The OPEC meeting - How much will production really increase?

Posted by Rembrandt on June 8, 2011 - 11:25am

The Organization of the Petroleum Exporting Countries (OPEC) will meet today, June 8 in Vienna to talk about increasing oil production. Preliminary news reports are hinting at Kuwait and Saudi Arabia pushing for a 1.5 million barrels per day increase in production to cool off oil prices. West Texas Intermediate oil is currently a little below $100 a barrel, but most other blends are above $100 per barrel. Iran, Venezuela, and Iraq oppose the increase.

The increase appears to be based on an attempt by OPEC to re-balance supply with demand for OPEC crude. The latest OPEC Monthly Oil Market Report (May 2011) (PDF) indicates that demand for OPEC crude oil will average 29.9 million b/d in 2011. An increase in production by 1.5 million b/d would raise production from April's 28.8 to 30.3 million barrels per day,assuming that the statements made by OPEC are about production increases, and not about rising the quota level - something that is not at all clear.

*Update: OPEC has been unable to reach an agreement due to which production quota will not change. Saudi Arabia has announced that it will likely raise production regardless of the decision. “It was one of the worst meetings we’ve ever had..We were unable to reach an agreement” Saudi Arabian Oil Minister Ali al-Naimi said as representatives of the 12-member group left the meeting in Vienna after five hours of talks. (Bloomberg)

As usual with preliminary news statements from OPEC, the only certainty comes from Saudi Arabia. The country has announced a minimum 500.000 b/d increase in production, and probably hopes that the other countries will fill the remainder.

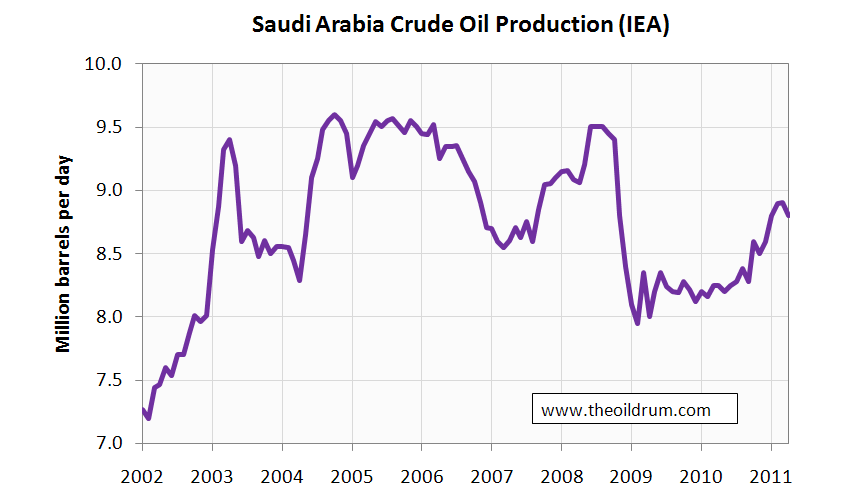

"The Gulf official said Saudi production was likely to average 9.5-9.7 million bpd in June. A Reuters estimate put output at 8.95 million bpd in May.

Saudi output was last as high in the middle of 2008 after oil prices set a record $147 a barrel, shortly before recession sent prices crashing (Reuters)."

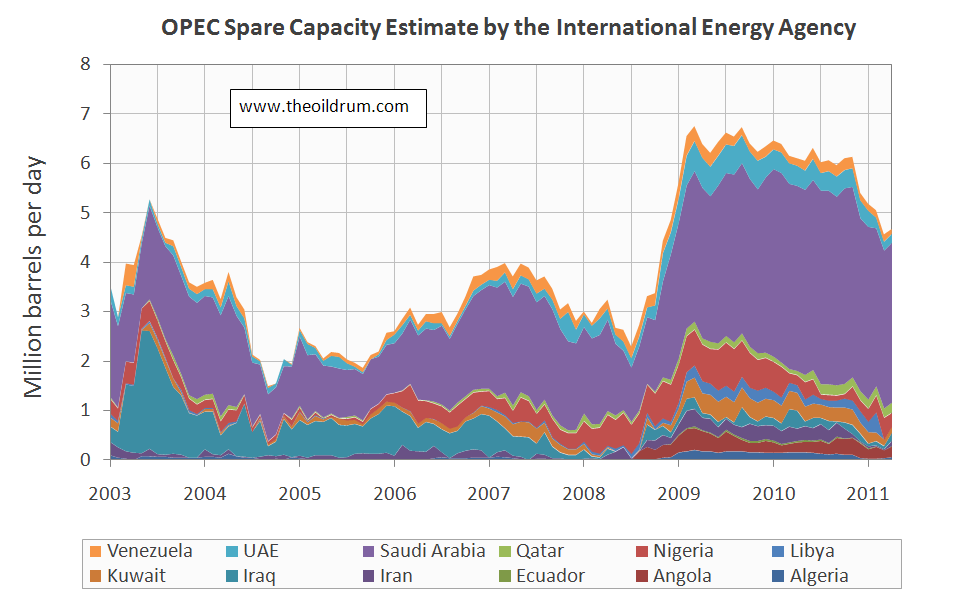

If Saudi Arabia raises its production by only 500.000 barrels a day, it is not clear where the remainder of the 1.5 million barrels would come from, because other OPEC countries seem to have little spare capacity. According to recent IEA estimates, spare capacity outside of Saudi Arabia amounts to only a small portion of the total, shown in figure 1.

Figure 1 - OPEC Spare Capacity as Estimated by the International Energy Agency in million barrels per day, from January 2003 to April 2011.(Click for Large Version)

Figure 2 - Saudi Arabia Crude Oil Production in million barrels per day from January 2002 to April 2011. Source of data: International Energy Agency (Click for Large Version)

According to Reuters, only half of the 500.000 b/d mentioned in the news may go to production as the other part is needed for diesel power plants in Saudi Arabia now the summer air conditioning season has started. In addition, production is needed for internal refining to fill a drop in oil product stocks.

"The extra Saudi supply won't all go for export. Direct crude burn at power plants to fuel summer air conditioning and higher refinery throughput for the return to service after maintenance of the Red Sea Rabigh refinery will soak up at least half the increment, Middle East analysts estimate (Reuters)."

In recent months the turmoil in Libya caused oil production there to almost grind to a halt, decreasing from 1.6 million b/d in January 2011 to 200,000 b/d in April according to the International Energy Agency. This decline wasn't offset by any other producer. As a result, world oil production declined from 87.6 to 85.9 between January and April of this year, a decline of 1.7 million b/d. Of this amount, 82% was due to Libya's decline. So far OPEC has failed to fill this gap, which raises questions as to how much capacity of the types of crude oil that the market requires does OPEC really have. The type of oil that Libya produces is high quality sweet crude with very little sulfur, while Saudi Arabia's extra capacity is known to be more heavy and sulfurous.

Figure 3 - World crude Oil Production and estimated Production Capacity, from January 2003 to April 2011. Data includes all liquids except biofuels. Source of data: International Energy Agency (Click for Large Version)

Figure 4 - OPEC Crude Oil Production and estimated Production Capacity, from January 2003 to April 2011. Data does not include Natural Gas Liquids. Source of data: International Energy Agency (Click for Large Version)

There is also a question as to whether the 1.5 million barrel a day increase under discussion is really an increase in production, or if it mostly reflects a desire to bring quotas (referred to as targets previously in this post) into line with actual production. It may be that the planned increase will have little real production impact, and will mostly remove part of this gap.

If OPEC does indeed increase production by 1.5 million b/d, it would significantly decrease estimated spare capacity to around 2.5 million b/d, a level last seen before September 2008 when the global financial crisis fully unfolded. If such a decrease in spare capacity should occur, the capacity tightness by itself might prevent a decrease in oil price of the desired amount.

As Ron pointed out earlier and Sam confirmed, the JODI data for Saudi Arabia crude oil is almost 10% less than the EIA numbers. Algeria and Qatar are between 40%-50% less. This contributes to a real discrepancy in the total numbers. I summed it up here:

http://www.dailykos.com/story/2011/06/07/982757/-We-are-in-the-middle-of...

At one point EIA and JODI were fairly close with regard to totals. Any thoughts about this recent divergence?

I have another post coming up on this probably next week that will provide good forum for more discussion.

It would be edifying to see some of our TOD stalwarts look at doing articles in context of the Hirsch Report, and Heinberg's call for action to actually get into the paradigm shift needed. We KNOW we are in the time of preparation for "Plan B" as Matthew Simmons put it.

The "AOL Travel Staff" post for June 8, 2011, 1030 AM shows Article: "Solar-Powered Rail Tunnel Connects Paris With Amsterdam" -

"Europe's first high-speed international trains to use solar panel generated electricity were introduced Monday. The trains link Paris and Amsterdam." The article does not mention windmill, tidal and /or other renewable electricity sources that could be part of operating electric railways -freight & passenger- without Diesel fuel.

Many authorities seem to shy away from robust commentary about significant action plans for American transition to the Peak Oil era and beyond, taking the position the job is too big to do anything but hunker down and wait for the inevitable collapse of the oil based economy. "Petrocollapse" is the term used by Jan Lundberg. James H. Kunstler likes "The Long Emergency" as a descriptor of what's in store for America. Must that be our fate?

It seems we in North America, particularly the USA have the ways and means to take the necessary action to retrofit agriculture, manufacturing and transport for effective transition to ever depleting oil supply, over the next several decades. We are aware of airplanes going down because pilots got engrossed in events in the cockpit not necessarily life threatening, but causing the aircraft to stall or dive because of inattention to "Flying The Damn Plane"!

Gail Tverberg has written on the railway component for TOD, and it would be encouraging to know the other contributors had "learned the territory" on railway subject. It is not really about being a railroad fan, just the simple idea of understanding that railway can & should be part of the post- Peak Oil world. And, comfortable with idea renewable inventory can be scaled to match railways expanded in capacity & reach, and grown in step with a program to rebuild dormant rail branch lines.

The car culture is certainly able to keep the headlines: However, we need vast effort on railways to Guarantee Societal & Commercial Cohesion considering limits on resources of all kinds. TOD has the eyes and ears of thousands of responsible leaders in politics and the corporate world; please spend more time on action plan...

Several weeks ago when Ron brought this up, I decided to contact the EIA and ask. I shared the response from Gary Long with Ron who checked the links and reported back that Long's links made no sense.

If anyone has other contacts at the EIA (and has nothing better to do), I suggest a second fishing expedition. You might catch a whopper.

About EIA-JODI differences.

In Argentina, where I am from, the difference comes from this.

JODI Database takes the number of Crude only.

EIA takes the number of Crude + Condensate + Stripped Gasoline ("Gasolina Estabilizada" in the database of the Secretaría de Energía).

Neither EIA nor JODI substracts the crude that the enterprises consume themself.

No that is not correct. JODI is Crude + Condensate and the EIA data is also Crude + Condensate. No stripped gasoline is included, or any other refined product for that matter. I don't know what stripped gasoline is unless you mean condensate. Condensate is like gasoline, you can actually burn it in a car. Knocks though.

The Joint Oil Data Initiative

International Energy Statistics Crude oil including Lease Condensate.

The above link gives you the EIA's database for crude + condensate only.

I have no idea what you mean by "enterprises" here. If you mean what the country consumes internally then of course not. That is what the ELM is all about.

Both JODI and the EIA are supposed to be the exact same data, Crude + Condensate. The OPEC Oil Market Report however is Crude Only.

Ron P.

He might be comparing the JODI data to that published by the governments own data and think the crude values match more closely?

Sorry, my fault.

I was comparing EIA and JODI data with the source: Secretaría de Energía (Department of Energy) of Argentina.

Some information come out of Oil Company's Affidavits.

Other information comes from the tables compiled by the Secretaría de Energía

What do I see? JODI data fits exactly with Oil Company's Affidavits (except some months that may be subjetc to future revisions). Then you can see three series with dotted lines that correspond to Crude, Crude+Condensate and Crude+Condensate+Gasolina Estabilizada (Stripped Gasoline). EIA data is over the last concept. I think the difference comes from the oil that is consumed by the oil company itself at the site of extraction. But this is only my best guess.

I don't think so. Oil companies do not consume crude oil at the site of extraction. They may consume gasoline or diesel but never Crude. Anyway there is nothing consumed in most fields. The pressure pushes the oil up. Of course there are water injection pumps, but they are mostly electric I think.

I have never heard of "stripped gasoline". That is not a term that any of the reporting agencies uses to my knowledge, either the EIA, IEA, JODI or OPEC's OMR. I assume they are talking about condensate, which is almost like gasoline without any additives. But if that is the case why would they use both terms?

Anyway I googled the term "Stripped Gasoline" and got several Spanish definitions. Apparently that is a common Spanish term. The only English pages that used the term were all about refineries. Apparently it is a term used by refinery people but never oil producers, in English anyway. I still think it is just condensate. Perhaps Spanish speaking people have two terms for two different kinds of condensate?

Ron P.

"E l condensate produced in the primary separation of gas and gasoline from a mechanical refrigeration unit in a column is stabilized by heat stabilization fund to a vapor pressure compatible with non-pressurized storage tanks. The product is called condensed and / or gasoline stabilized. DARNELL has provided numerous liquid stabilization units:"

It does look like condensate. And it might come from nat gas or associated gas. http://www.darnell.com.ar/pages/espanol/d_e.html

Is this in any way related to the new crude oil holding tank vapor recovery technology being used in the oil production realm? I had previously known about the vapor recovery units they are implementing on service station pumps, but this form of vapor recovery is supposedly capable of reducing methane more so than any other GHG, which is big because Methane is by far the biggest contributor to global warming. Interesting stuff.

The stock tank vapor recovery unit (VRU) is not exactly new. They have been used in the oil industry since at least 1952. They became more common after natural gas became marketed as a commodity in its own right, rather than as a by-product of oil production. The modern concern with greenhouse gas emissions has resulted in them becoming mandatory rather than optional in many jurisdictions.

It's very hard to find clear information, but here it goes...

In Argentina the Secretaría de Energía uses these terms:

Stripped gasoline (Gasolina Estabilizada) is a liquid of natural gas of the type C5, C6, and C7 (althoug C8 may be include).

Condensate (Condensado) referes to a liquid of more than C8.

Maybe in other parts of the world these concepts are the same, or under the same category.

And about the oil company own consumption... the tables showed by the Secretaría de Energía name it exactly "consumo en yacimiento" (consumption at the field).

I think maybe some differences between EIA and JODI might come from different concepts, even different languages.

No, they are both supposed to be measuring exactly the same thing, Crude + Condensate. The difference comes from the way they compile their data as well as their sources. JODI is supposed to get their data directly from the source. From the JODI link I posted above:

In other words they submit a questionnaire to each country and report what is reported to them. If nothing is reported they just post a zero for that country, or for the month they do not respond. Anyway that link is very good. Everyone interested in how JODI gathers their data should read it.

The EIA however does things a little different. They take their data directly from the producers when it is available. But when a nation does not report to the EIA or does not publish their production numbers then the EIA just guesses. And their guesses are often higher than those reported to JODI except in a very few cases, Venezuela in particular.

Ron P.

Jeff Rubin's Explanation: "Forget OPEC: Russia is Key" - http://www.jeffrubinssmallerworld.com/2011/06/08/forget-opec-russia-is-key/

Russia has not exactly been flooding the global net oil export market, with a 2007 to 2010 four year average net export rate of about 7.3 mbpd. Annual Russian net oil exports (BP, except for 2010):

2007: 7.3 mbpd

2008: 7.1

2009: 7.3

2010: 7.4*

* EIA data

Basically flat Russian net oil exports from 2007 to 2010 are in marked contrast to the rapid increase in net exports from 2002 to 2007, when Russian net oil exports increased at about 7%/year. Having said that, I expected that the slight 2008 decline would continue into 2009 & 2010. But given the advanced stage of depletion in the older Russian oil fields, when the production decline (and net export decline) does resume, it could be pretty sharp.

Wasn't there some report, some quarters ago, where the Russians were needing to invest a trillion bucks to offset their upcoming 12%/yr decline? Haven't heard much about that lately.

I just don't remember seeing that report. Got a link?

Ron P.

Here is something:

http://en.rian.ru/analysis/20110311/162958488.html

JB

Ron,

Here's something - a former thread on the Russian stuff.

http://www.theoildrum.com/node/7088

(I may be confused, but I probably began with this thread so for what it's worth)

It looks like BP has revised some of the prior data points. In any case, they are currently showing Russian net oil exports at 7.1 mbpd for both 2009 and 2010. The revised data for Russian net oil exports (BP):

2007: 7.1 mbpd

2008: 6.9

2009: 7.1

2010: 7.1

Here's a simple model I would like to run by the group. Assumptions: All OPEC export oil = $110/bbl; total OPEC exports = 28.8 million bopd; KSA share of OPEC exports = 31%; increasing OPEC exports to 30.3 million bopd lowers oil prices to $90/bbl.

If such events happen the non-KSA OPEC members would see revenue drop $65.6 billion/month to $56.4 billion/month. But if non-KSA OPEC decreased production 1.5 million bopd and thus oil prices stay at $110/bbl their revenue would be $60.6 billion/month (19. 9 million bopd down to 18.4 million bopd).

So by cutting production, and thus preserving more of their dwindling asset, they can increase their revenue by around $4 billion/month over what it would be if they didn't cut production rates. Forget about WWJD...what would you do if you ran the non-KSA OPEC? Maintain production levels of you declining asset and see you income drop about $9 billion/month (based on $90/bb) or reduce your production by the amount (1.5 million bopd) that the KSA increases it production and see an income reduction of just $4 billion/month? And by doing so also preserves over ONE HALF BILLION BBLS PER YEAR of your precious asset that you can sell later at a higher price. Losing market share, in the short term, isn't all that painful if you can maintain a higher price for your product's smaller market share.

Based on this simple model the real question IMHO isn't what the KSA can or will do to increase exports but what will the rest of the exporters decide to do. Folks might not think a drop in price from $110 to $90 per bbl isn't significant but notice how much more incentive there is for non-KSA exporters to reduce production if prices were to drop even lower.

Just wanted to add a side comment. The price of peace can not be denominated in monetary terms. Just as incomes from oil exports, can not be explained in economic terms alone. Sure, they would gain more money, by cutting production. But, what would they LOSE geo-politically?

Sitting atop an oil field, is a rather dangerous thing to do. More so if your the person who decides the flow rates, from it, and that choice will effect grain production worldwide. And the less grains you have, the more unrest and higher world food prices you get. And so the more governments who wish for stability, must "encourage" you, to produce more crude... in any and all, ways possible.

I would imply that what your asking, has left the relm of economics,

and entered the world of geo-politics.

BW - True but OTOH many of these countries placate their locals by subsidizing their lives. Losing income in both the short and long term isn't going to necessarially 'buy peace' either. We tend to focus on the pain coming down the PO road for us consumers. Might be time to start thinking about how the exporting countries will deal with decreased production/revenue. The ME seems a tad unstable today. Imagine what it will be like when those govt's have half of today's revenue to appease their locals. It might be quit a few years down the road but what if Iraq or the KSA become the new "Lybia's"?

That's a great point. Ive been thinking about that same thing in food terms IE: Now that the gov of Egypt fell, what happens to wheat purchasing power? That's an utterly fantastic, happy and fun new angle to ponder! .... Thanks... :P

Don't forget that last year the Russian wheat crop failed and they banned exports. This had a knock on for Egypt, which has to import the majority of its grain, and the cost of food rocketed. The same is true throughout the middle east and popular unrest is to a large degree driven by shortages and an increasingly unaffordable cost of living, and this in countries where the economies are at best stagnant and unproductive anyway. Add in the burgeoning increase in populations over the last few decades and you have the perfect tinderbox for revolt.

What I've read indictes this years wheat production will be at least below average. Possibly outright bad. And due to climate change I suspect that will be an anual occurance as soon as 5 years into the future.

Imagine what it will be like when those govt's have half of today's revenue to appease their locals.

http://english.aljazeera.net/news/middleeast/2011/06/2011695741630402.html

Looks like we get to watch that now. I get a bad feeling when I read about the US using drones in Yemen to take out the terrorists. Oh yeah, and we are providing eavesdropping services to the governemnts of KSA and Yemen. Is there a better recipe for turning mildly unhappy people into extremists? Hmmm...what's Yemen, about 25 million people? How far are they from KSA? Or Somalia?

Yemen boarders on Saudi and the Saudis are building a 1,000 miles wall, cum fence with all the bells and whistles, and have been doing so for 10 years. Religious affiliations about 50-50 Sunni

Shiite split. When they run out of oil which they will and have no money to pay for the food to feed the burgeoning population where 50% are under 18, then the Saudis could end up as toast. Somalia is just a short ferry ride over the red sea.

Rockman -- you need to also consider that the varoius countries have different costs of production. If the cost of production in SA is 50% of the current price, then a 10% drop results in 20% less net revenue. If the cost ofproduction in non-SA is 60% of the current price, then a 10% drop results in a 25% less net revenue for them.

So if the cost of production outside of SA is higher, they have even more incentive to keep production down and leave oil in the ground until they can pump it at higher profit.

All I have to say is--Yeeeeah! Rembrandt's back! With graphs!

I guess, for all the reasons that have been discussed here lately about EIA funding and what not, that we can't expect monthly updates again any time soon, but to see a nice clean set of graphs under that handle is still something of a consolation.

OK, enough with the cheer leading. No I'm back to my pesky, annoying self.

It is my understanding that the most recent data in almost any of these graphs is open to considerable revision. I wonder if we should put ranges of possible error or possible future adjustment over the most recent monthly figures to show that these data have a different status as far as their solidity goes than some of the earlier historical data?

By the way, I thought the last paragraph was particularly subtle and insightful (oops, back to cheer leading '-).

Falling Saudi, OPEC and Global production. Peak oil or weakening demand? I suspect the latter and suspect that major OECD economies are already heading back into recession caused by high energy prices and that Chindia is slowing down. OPEC increasing supply at this juncture seems rather irrelevant since demand, and prices, are probably already on the way down.

Given that SA clearly couldn't offset the Libyan oil that went off line, it seems extremely unlikely that they can now increase production two months later. I view all official OPEC (and especially SA) announcements as purely political, and designed to manage the market, with the content of the statement bearing no correlation with either physical reality or SA's actual oil policy.

However, if they anticipate a global easing of demand due to the return of recession, and hence a fall in the market price, it makes sense to claim they are actually increasing production even if they don't (because they can't). Then they can claim that they are still a functioning cartel, and are actively managing the price of oil, whilst in reality all they are doing is to continue pumping flat out. We all know on this site that official OPEC production figures are accurate as a Madoff tax return.

Smoke and mirrors.

Good points. As rising prices knocks down ("destroys") demand, it will always be possible to point to this diminished demand and say, "Look, demand is down so that's why oil producers aren't cranking out oil at higher levels."

That's why it seems likely to me that there will be those that claim it is all on the demand side all the way down the slope.

You mean like this?

So did OPEC and other oil exporting countries choose to put oil importing countries on the post-2005 supply/demand/price roller coaster, or did they have no choice?

They clearly chose to dramatically increase net oil exports from 2002 to 2005, in response to rising annual oil prices, but if they chose to restrict net oil exports after 2005, in response to generally rising annual oil prices (relative to 2005), why did they choose to restrict net oil exports?

Here is what we show for global net oil exports* (GNE) from 2002 to 2009:

2002: 39 mbpd

2003: 42

2004: 45

2005: 46

From 2002 to 2005, GNE increased at about 5%/year. At this rate of increase, GNE would be at about 59 mbpd in 2010, but that is not what happened.

2006: 46

2007: 45

2008: 45

2009: 43

2010: 44**

*Net oil exporters with 100,000 bpd or more of net oil exports in 2005 (BP + Minor EIA data)

**Estimated

My explanation is that Peaks Happen. Note the 1972 to 1982 Texas production response to generally rising annual oil prices and note the 1999 to 2009 North Sea production response to generally rising annual oil prices: (Annual oil prices on vertical scales, C+C production on horizontal scales):

Incidentally, a reasonable guesstimate is that in the past five years, 2006 to 2010 inclusive, globally we may have burned through about one-fifth of the entire post-2005 supply of global Cumulative Net Exports (CNE).

What's with that 46 MB/D GNE? I qouted those digits in a post here a few weeks ago and got bashed, GNE was only 42 MB/D. It was down in that thread we discussed JODI/IEA divergances. Sorry I don't remember who questioned that data but it was one of the regulars around here. So what is it, 42 or 46? And who says so?

We looked at oil exporters that were (net) exporting 100,000 bpd or more in 2005. We principally used the BP data set and subtracted domestic consumption from their numbers for total petroleum production. We used some EIA data for consumption in some of the smaller oil exporting countries. In any case, we came up with 46 mbpd for 2005 and 2006 for GNE.

Ah, yes, Wes...

If my quick math app is correct, that means we have 20 years left! Since I am 68, I could possibly make it to the end.

Damn!

Craig

In some cases, we can get a reasonable estimate of years of net oil exports left by extrapolating the rate of increase in the Consumption (C) to Production (P) ratio. I extrapolated the 2005 to 2009 rate of increase in the C/P ratio for GNE (net oil exporters with 100,000 bpd or more of net oil exports in 2005) to come with an approximate estimate of 50 years of net oil exports left, after 2005. A rough rule of thumb is that about half of post-peak CNE (Cumulative Net Exports) are shipped about one-third of the way into the net export decline period, which would put the global "Half LIfe" point for post-2005 CNE at about 2022. Here are the numbers for "Export Land" and for three actual case histories:

Fully agree with you. Add to that the fact that proven oil reserves increased by 6 billion bbls in 2010 and there is no indication that we are close to peak oil. This number is likely to be even higher in 2011 - Exxon even discovered 700 million bbls in the gulf today.

You are on the right scent, EM. The danger now is that China implodes; they do not, at least yet, have sufficient consumption to maintain. And, the US no longer has the borrowing power to consume anyway near what Chindia are producing.

Methinks local agriculture is the next boom.

Too bad the US wasted the stimulus on roadways instead of energy and mass transit. Ah, well... like you said. Demand, and prices, are probably already on the way down.

Craig

OPEC is expected to raise quotas. This is quotas and not actual production. Everyone, with the possible exception of Saudi Arabia, are already producing flat out. Saudi does have some heavy sour stuff that they could put on the market.

The rhetoric that comes out of this meeting will be far more interesting than any actual production changes.

Breaking News: Melissa Francis of CNBC is in Vienna. She just announced that the meeting has broken up with no decision on anything. She said some members have just left. I think there was some disagreement, probably some shouting going on.

Ron P.

WTI jumped a dollar on the news. No OPEC increase announced.

WTI Crude oil: Bouncing sharply higher as OPEC stalls on decision

Brent jumped $2.

http://www.bbc.co.uk/news/business/market_data/commodities/143908/intrad...

Still smoke and mirrors.

The meeting broke up with some members storming out, getting in their cars and driving off. Obviously there were some really pissed off people at this meeting.

This is the beginning of the end of OPEC. Everything revolves around Saudi Arabia. They are the only one with any spare capacity and really the only one that matters. The rest of OPEC realizes this and they don't like it. Many must be asking themselves: What's the point? Indeed, what it the point?

Ron P.

From google news.

Top three stories on OPEC giving 3 completely different accounts of the same event.

What a wonderful media service we have.

I saw the conflicting news as they rolled over the computer screen. Right now i have this feeling we saw an event that no one will remember in a month, but will go down in the history books whenthey get written in 20 years.

Kind of like Fukushima. This is becoming an interesting year.

I was always going to be an interesting year. Chris Screbowski in London has been predicting an oil crunch in 2011 for around 5 years. We all thought the GFC would delay it by a year or two; and maybe it still will, but as you say: 2011 is shaping up as an interesting year.

On my blog (in Swedish) I made a catastrophy prognosis for this year in January. My bet was this year would be a middle year on the intrestometer between 2010 and 2012. But I hedged that food supply is a worry and could cause problems in some parts of the year. Understatment Of the Year 2011 goes to: ME!

Although things turned out worse than I expected on almost all accounts as early as in march, I still believe 2011 will be a calm year compared to 2010 and 2011. Unless crops totaly go bonkers this summer.

I still believe (as I have since 2009) the oil crunch will start squeezing us in 2012. It apears the oil prices is reining in growth to such a degree competition for oil will not grow fast enough for a crunch this year. My two pence.

Meh! No big deal. That always happens when three blind men encounter a white elephant in the room... They are sure it's pink! Hmm, or is that when they see an invisible unicorn?! Same old sh!t, different flies.

I wonder how soon markets will figure out that OPEC really doesn't have oil to give. Not raising oil quotas when oil prices are as high as they are sounds like they don't have additional production available--especially when they did not raise production for the Libya outage, in a useful manner.

Never. This would require a 180 deg change of mindset. Even though technically markets (through price) already acknowledge this, it is another thing altogether for it to become open discussion in government, the media and the markets. Meantime they will continue to blame OPEC, wars, Chavez, Chindia, anything really that provides the handiest explanation for the current condition. Today that is OPEC.

Blaming the jews got worn out in the midevial ages. Now we blame spculators instead.

Currently on the CNBC ticker.

Saudi Oil Minister: Demand on OPEC Will Exceed Supply by 1.5 Million Barrels a Day By Year-End (Story Developing)

Maybe oil demand will exceed supply. More likely, oil prices go up a bit more, world economies will not be able handle high oil prices, economies will skid, many debt defaults will occur, and credit will tighten. Oil prices will go down and oil production will go down. (This drop in production may end up corresponding to "peak oil".)

It seems to me that if oil demand exceeds supply, it doesn't happen for long. Financial things happen to fix the situation.

I said this on the daily thread but I have to say it again. Demand and supply are both functions of price. So if some KSA guy said demand will exceed supply it is at a particular price. At the price a free market sets demand will equal supply. That is the price will go up until enough demand is no longer interested at that price and demand equals supply.

OPEC isn't a very good simulation of a free market, because (1) they've got a partial monopoly, and (2) they can in effect hold substantial inventory by leaving it in the ground. Even so, the price will adjust.

Ok but see, that's the whole discussion of "excess supply". Until recently, your scenario wasn't valid because KSA actually hard-set the price by how much of their potential supply they were willing to hold off the market. Question is, are they still doing that, and if so, why at such a high price which will damage their foreign investments (including 10% of all DJIA listed stocks)? Why, if they are still in control, were they willing to hard-set the price at $25 ten years ago but now want it above $100? Are they still in control of the world price? Doesn't look like it.

This is why I prefer to substitute the word "competition" with "demand" in most context. IE: When competition for oil increases but supply stay flat, price increases untill demand is reduced to the level of supply.

Demand is a curve.

Ed, I would agree with you. I know I just voted "no" on accepting a proposed guest post that was talking about demand exceeding supply. It doesn't work that way.

There are really two balances for inadequate oil supply though. One is higher price. But the problem is that the higher price disrupts the system further, and the second balance is contraction of the economy (recession, layoffs, debt defaults, lower credit availability). With a contracted economy, less oil is demanded (also less natural gas, less electricity, and fewer employees). The contracted economy becomes a real problem for governments, because they cannot collect enough taxes, given the lower number of workers employed and the lower value of homes. At the same time, governments need to pay out more in unemployment and social benefits.

The fact that this contraction is really the balance for inadequate oil supply is the reason behind the world's current economic problems, in my view.

Exactly right, Gail. Demand will fall. Debt will continue to wind down. Capital will diminish. Eventually, there will be insufficient capital to invest in industries to employ all of the people looking for work. And, there will not be enough oil to keep things running. Oil price will drop, of course, along with everything else, when there is diminished demand for the product.

The real danger here is that, as deflation destroys the economies, the landed aristocracy of super wealthy debt holders gets laws passed reinstituting debtors prisons, which will become your basic slave labor camps. Ownership of people may make a big comeback. The spin will be interesting to read as propaganda mills begin to grind it out.

I mean, when the only 'cheap' energy left is animal power, what are we but... well... animals?

Craig

You mean livestock and as you say we have been bought and sold before, probably will be again.

we wont really have debtor prisons. Not while there are nukes.

It isn't a random occurance that China is modernizing there military at the same time we will be going through a scarcity in oil.

That is the oldest reason there ever was to go to war, resources.

The real danger is that BAU continues until the first ICBM's start streaking through the sky.

PooBah

Yesterday

Crude Oil Futures Rise Amid Concern That OPEC Spare Capacity Will Tighten

Today

Oil Futures Climb On OPEC’s Refusal To Increase Production

Idiots.

Alright,I know, I'm putting my neck on the block ... do it fast..

There is no such thing as a gap in supply and demand, ever... Oil-trade is an auction and therein lies the answer.Period.

To clarify and enhance this my claim it's easier to look at that concept 50 years into the future --- will there be a 80 mbd supply / demand gap at that time, when 'oil is gone for good'?

We will not have 0 bbls/day production in 50 years time. In fact we'll probably have a higher production than today. In 2010 reserves increased by 6 billion barrels. In 2011 the number may be higher. Oil production will keep increasing for the foreseeable future.

Your same source for that data, BP, faithfully recorded Venezuela's 38.7 bbo jump in 2009, which was Hugo's way of hollering "Tar! Get your heavy tar! Excellenté ROI on your investment! Sorry about all that nationalization of assets stuff!" to all the IOCs he stabbed in the back when prices were high and revenues were strong. So, just 6 years of bona fide gains in P1 like 2010 will perhaps absolve BP of any accusations of being non-rigorous in this department.

/giggle

Please giggle! I will laugh loudly (again) when oil production (again) fails to collapse as ACE and co are predicting.

Oil has been on a plateau since 2005. Actually crude oil peaked in 2006 and net exports peaked in 2005. But most of us here on TOD have been saying that we will likely fall off the plateau sometime around mid 2012. But as far as net oil exports go, we have already fell off that plateau. Actually there was no plateau but we are well post net oil exports peak.

ACE is not a company, he is one person. You are one person who thinks oil production has been increasing. You, as one person, are just as wrong as ACE, who is also one person.

Ron P.

NM, You and your cornucopians need to get behind my model of oil production. It has a URR of 2800 Billion barrels of oil and yet has a peak at 2008, only a couple of years difference.

In case you missed it I will repeat. An additional 50% recoverable oil is added to the conventional Peak Oil estimate for URR and the peak barely moves. As everyone now seems to agree, it is all about the flow. We can't find it fast enough to keep up, we can't extract it fast enough to keep up, and dispersion and diminishing returns models exactly what is happening.

SO TRUE Web,

What people cannot grasp is calculus. We are all on a treadmill and the speed is getting turned up to the point that our muscles are not physically capable of holding on. That is where the oil industry is today on Planet Earth. They are losing the calculus, since fighting entropy requires more and more resources to be deployed to replace the old faithful megasites that are going going gone. One failure in a MENA country or two puts a huge stress on the system. Even if they deploy all that new cheap FED bankrolled capital oil and gas can make $200/bbl oil. However few will be able to afford it and the economy will sag. Reality will sink in for the cornucopians. We have had zero statistically significant growth for 5 years. Maybe after 10 years of no growth they will catch on.

+1

'Cept the "catch on" part. :(

"sustainability is just one problem among many, and we are the better at solving problems the stronger our economy—so we need to use up resources fast to get rich fast so that we can afford to address the problems caused by us using up resources fast." -- Thomas Fischbacher

Nordic_mist,

I would agree with you, if oil prices could rise indefinitely--say $1,000 barrel. At that point, we could extract almost anything, but we likely would be using more energy to extract the oil than the oil really has. Experience says that economies would have crashed as well--we just can't spend that much more for oil and have the rest of the economy continue as it has in the past. Once a big share of our resources start going into oil production, it leaves little for other things we need--healthcare, education, copper production, you name it.

Real costs for extracting oil have already risen to the point where they are either unmanageable or close to unmanageable for economies to handle. We are reaching this problem today--it is hard to see how it will not get worse.

Does OPEC really matter?

This is a very good video. It pretty well sums up everything that happened in Vienna today.

Then later there was this video: Worst Meeting Ever"

Ron P.

The KSA spokesperson says the market will not see any shortage. That KSA and the three GCC(?) countries will increase by 1.5mbpd. Who are the GCC? Do we believe this guy?

Gulf Cooperation Council [GCC]

Saudi Arabia and its Sunni Muslim dominated client states.

I'm not sure it's correct to call them client states. The GCC is in some ways a smokescreen; some of these countries really don't like each other at all, but for world consumption a polite face of unity is always shown.

It's not quite right to call them Sunni. First of all, Oman has its own variety of Islam, which is strictly speaking neither Sunni nor Shi'ite. Second, Bahrain is ruled by a Sunni monarchy, but the majority of the population is Shi'ite. The common denominator is that they are all Arab monarchies. They have underlined that point recently by deciding to admit Morocco & Jordan. Every Arab monarchy is now in the "Gulf" Co-operation Council. The powerhouse behind them all is "Saudi" Arabia, a State so reactionary that it is named after its ruling family.

It is also necessary to realise that "Saudi" Arabia does not act in what we might imagine to be the "national interest". It acts in the interests of the House of Saud. The monarchy needs to be protected against its subjects, so it needs a supply of arms. Just as it supports the other Arab monarchies, out of fear that a revolution in one would be an example for the subject of the others, so it seeks the support of the dominant world power, the United States. The House of Saud, therefore, while not being a US puppet, is a good deal more solicitous of US interests than a more nationalist regime of, say, an Islamic Republic of Arabia might be.

Once upon a time, the United States prided itself on supporting republican & democratic forms of government. Uncle Sam & the House of Saud, however, seem to be joined at the hip. It is for this reason that Barack Obama's advocacy for democracy in North Africa & West Asia will come to little. The monarchies need Uncle Sam and Uncle Sam needs the monarchies - especially the House of Saud.

"Once upon a time, the United States prided itself on supporting republican & democratic forms of government."

I remember anti-communist, I remember anti-fascist. Republican and democratic? I'll try to remember a time like that.

That depends of when one was born. In the 19th Century, the US pursued a pretty consistent anti-colonial and republican policy. The Spanish-American War torpedoed that consistency (it being hard to be anti-colonial whilst simultaneously prosecuting a murderous colonial war in the Philippines), but even as late as the 1950s & 60s, the US was supporting independence for the colonies of the old European empires. It also, until the Cold War, supported democracy, but in the late 1940s decided to align itself with the most violent of the anti-communists across what would become the Third World. Syngman Rhee, Chiang Kai-Shek, General Suharto, the Shah of Iran, General Pinochet, Mobutu Sese Seko, mass murderers every one, have driven the memory of an earlier, more progressive US policy into the mists of time. What remained was only hypocritical rhetoric. There's an old proverb, though, that hypocrisy is the tribute that vice pays to virtue.

GCC is basicly the EU of the Arabian peninsula. They have hade issues such as a common currency and army up on the table. The difference with the EU is they never manage to agree on much...

OPEC was founded as a cartel with the main purpose of restricting suppy of oil so as to boost prices. If all OPEC members are now producing flat out, then OPEC is irrelevant.

I think if I were an OPEC country I'd be a price hawk and try to lower production so as to boost oil prices much higher. True, this would put the world into a Greater Depression, but if production is reduced enough oil prices can still increase. In this case, OPEC countries would produce less, but due to the higher oil prices might be able to maintain their net oil income. This course of action would have the huge advantage to OPEC countries of making their oil last longer.

But OPEC is weak. They do not have the consensus to behave as a true cartel anymore. With the oligopoly power of OPEC fading away to nothingness, countries will tend to continue flat-out maximum production of oil, even though it is in their long-term self-interest to reduce production so as to make oil income last more years.

Is this starting to sound like the Texas Railroad Commission in 1971?

sf - So true but nothing good last forever. LOL

Naimi : Dont call Opec a cartel !

Reporter: What should we call it then ?

Naimi : An organization !!

lol

Who wrote that transcript? It reads like a 2nd grader's Tweet.

OPEC Stands Pat on Oil Output - WSJ.com

So soft demand will precipitate an emergency meeting? How does that work?

Maybe they're just making this stuff up, all of this baloney about arguments that lead to papers using terms like "acrimonious" or "tension-filled." Certainly it rattle markets in a big way, for a day or two anyway.

Mmm, hasn't that been the case for about 20 years now?

If OPEC wanted to stabilize OPEC output they should decrease output by 10% per year for the next five years. Then they would be in a position to produce at that level consistently for the next 25 years. Subtracting internal use there might not be much for export but production would be predictable.

It seems to me that the KSA behavior is irrational for a seller. Unless someone has a gun to the head of the seller.

Rational to me would be to produce slower giving better final recovery fraction and making the income stream last longer. KSA talked about not increasing production to leave some for the grandchildren. Whatever happened to that idea?

Well, I'd think that someone has a gun to their head. And, no, I'm not talking about the US, although, they may also have.

Looking at Rembrandt's wonderful graphs it really does look like the world is bumping along at some sort of limit of production. World economies are likewise unable to rise and seem to be suffocating under the invisible lid called energy limitation. Amoebas dividing in a jar spring to mind.

OPEC won't agree to increase extraction because they can't, and anyway, as has been said, it isn't in their interest. That the KSA shows willing to 'help' is of course a useful ruse aimed quite possibly at mollifying western public opinion.

This appears to be it then, Peak Oil and peak industrial production dancing a minuet together.

It would be irrational if the House of Saud were acting in the "national interests". In reality, though, King Abdullah & his extended family act in the knowledge that they depend on the support of the United States for their continued tenure in power. They have, as a matter of policy, kept the population in a state of mediaeval social backwardness even as their material comfort has increased. As a result, their social base is risibly small and they could be knocked off by a determined force of a few thousand, provided it could split the officer corps of the military.

Absolute monarchy is a very weak hold on power in this day & age. The House of Saud needs all the outside help it can get. Thus its behaviour.

Perhaps things are changing . . . but the conventional wisdom is that the Saudi leaders are more progressive than the Saudi people. If the Saudi people ran things, it would be even more medieval.

Yes, that is the conventional wisdom. The Sauds are urbane, worldly, hypocritical and utterly corrupt. Their subjects are effectively infants, with backward views only possible because they have no connection to political power. If they came to power, they would grow up fast, since they would learn the consequences of their views and have to think things through for the first time.

Look at Iran. A revolution brought the Ayatollahs to power in 1979, because a majority of the people had not broken from the mediaeval world view of traditional life (though it was a close run thing - they were helped by the criminal disunity of the Left). Now, however, the clergy are detested and nobody goes to the mosque any more. The people are still Muslim, but they have broken from religious fundamentalism. The Ayatollahs only cling to power through brute force and fraud.

If the House of Saud were overthrown, I expect a similar process would take place in the Islamic Republic of Arabia.

I would contend with this article's quoting of EIA as an alleged authority on OPECs so-called 'spare capacity'.

Several organisations which happen to harbour far more clever people than the run-down IEA, such as Goldman Sachs, have put the number at 'below 2 mbpd'. And this back was in April.

Saudi Arabia are now saying there is a need to add another 1.5 mb/d onto the market by the end of this year. They may indeed have a little left. Perhaps a million barrels, perhaps 1.5 even.

But let's assume they can meet this demand, which is unlikely given their record for the last decade, but even if this comes to fruition; what happens in 2012? Who will add the other 1.5-2 mb/d in extra supply? And 2013? And so forth?

Lastly, I would also echo what someone else said about these OPEC statements being political. That's exactly what they are. Saudi Arabia and other OPEC countries are notorious liars. Let's judge them by their actions. On every occassion in the last 5 years they have failed to step up to the plate. In 2008 and even more shockingly in 2011. Libya is the textbook example of the very situation where you need to release the oil from your spare capacity, if you have one that is. Saudi Arabia failed to do this. Is it a coincidence that this happened at the same time as world production plateaued?

Despite all this, IEA, however, still claims Saudi Arabia alone have 3+ mb/d in spare capacity.

And by quoting them, apparently this does article too.

KSA have never produced 10 million barrels a day. I live under the asumption that that is the hard roof they can not penetrate. So their true maximum spare capacity is simply 10 million bpd minus what they produce today. Not enough to save the world economy.

2/3/2011

WikiLeaks cable from Riyadh implied Saudis could pump only 9.8 mb/d in 2011

http://crudeoilpeak.info/wikileaks-cable-from-riyadh-implied-saudis-coul...

9/6/2011

A disunited OPEC can't control upward trend of oil prices

http://crudeoilpeak.info/a-disunited-opec-cant-control-upward-trend-of-o...

Arab Spring and social unrest behind drive for higher oil prices. Analyst sees $120 ahead short term:

http://www.bloomberg.com/video/70670868/

The reason KSA cannot increase production may be political.

Venezuela and Iran both seem to be having great problems maintaining production, Libya's in a civil war and Iraq seems to be struggling, all together ~40% of OPEC.

OPEC is their business and they need to keep their partners happy.

http://www.npr.org/2011/06/08/137065443/opec-decides-not-to-increase-oil...

Venezuela and Iran have been diverting investment away from oil production for years to social programs and their anti-Western politics keeps many investors away. This is more likely the reason they are having production problems than peaking of oil reserves there, even though these fields are getting quite old.

OPEC is not a business, it is a Cartel, or as the Saudi Oil Minister prefers, an organization. And of course Saudi would prefer that everyone be happy but that will not and has not kept them from producing every barrel the desire to produce. Everyone is producing more than their quota and Saudi is the biggest violator.

Of course Venezuela and Iran, along with a few others, are mismanaging their oil reserves but Venezuela peaked in 1970 and Iran peaked in 1974 long before either of the current regimes came to power. Venezuela is currently producing almost 1.5 mb/d below their peak and Iran is producing about 2 mb/d below their peak. There is not a snowball's chance in hell that either of these countries will ever reach their prior peaks again.

Mismanagement, along with war and political upheaval is just part of the equation. There always has been and always will be mismanagement, war and politics. Production peaks, not reserves. I don't know that OPEC has peaked but I would bet that they have, or did in in 2008 as both JODI and OPEC's own Oil Market Report confirms.

Ron P.

Production Increase is No long Term Solution

In President Obama's Blueprint for a Secure Energy Future (March 2011), he recommended expanded drilling and development of one million electrically powered vehicles to maintain reasonable gasoline prices. That will not achieve stable gasoline prices because United States oil reserves are declining, new reserves are uncertain and one million vehicles is a small percentage of the total vehicle fleet.

Gasoline prices are likely to increase because the United States is now importing nearly 60 percent of its crude oil needs. In 11 years that figure will rise to 100 percent without massive oil discoveries and/or a significant decline in production due to an economic depression. This situation was totally ignored by President Obama and will lead to:

• U.S. economy and trade balance will become far worse than it is now

• OPEC will exert even more influence over U.S. policy

• U.S. transportation and manufacturing will be at risk

Dr. Jeffrey Everson

www.JHEversonConsultimg.com

jeff@JHEversonConsulting.com

I have some news for you, Doctor. "The United States... importing ... 100% of its oil in 11 years". We've been discussing stripper wells in another thread. The US will certainly still be producing oil in 11 years. Maybe not offshore so much or in Alaska, but we'll still have thousands of producing wells on the continent.

In fact, read what that Westexas guy has to say. We may in the not too distant future be producing 100% of the oil we consume and importing none!

Otherwise your points seem valid. Obama hasn't ignored production though, he has done a number of things to facilitate drilling and mining.

What Westexas is saying is that many of the oil exporting countries will be consuming 100% of their own oil in the not-too-distant future, leaving none left for them to export.

However, that doesn't apply to Canada. Canada has been slowly but steadily increasing its production from the oil sands, while its own domestic consumption has been flat to declining. As a result, Canada is now by far the largest supplier of imported oil to the US market.

So, while imports from other countries (e.g. Saudi Arabia, Mexico, and Venezuela) will probably decline, imports from Canada will probably continue to increase, assuming the Chinese don't outbid Americans for it. I suspect the Chinese will get a big share of it eventually, because they have been buying up Canadian oil reserves enthusiastically in recent years.

There is a diversity of opinion here. I am more of the opinion that the fraction oil imported to the US will only increase. With much of it highly expensive Canadian and Venezuelan tar sand oil at $150 per barrel.

Jeffrey, the drum is about sharing opinions so I will give you mine.

One cannot import oil that is not available.

Oil price has just increased 5-fold in less than a decade, if that is not enough support for domestic production, nothing the tax payer could provide, would be. Absolutely no need for corporate welfare directed as the lucky and the wealthy.

There is plenty of capital in the US and few investment opportunities. The fracking business looks decent if Oil remains above a $100/barrel and I think some increase in US production is likely.

As Oil will almost certainly remain above $100/barrel, consequently, absent recession, demand destruction will continue. If a recession occurs demand will plummet and if a depression occurs, well, a man without energy walks.

What we need is a massive expansion of US support for green energy. Some will say wind and solar are not profitable. Fortunately, once built they will deliver energy with very little maintenance for a long time even for the new owners of the bankrupt firms. It is not Obama that is the problem, but a certain tea whipped party that has lost all grip with reality.

So two countries that hate the USA . . . and Iraq.

That "liberation" sure brought them to our side, didn't it? :-/

Does OPEC even matter anymore? By what I understand pretty much all of OPEC is producing as much as their infrastructure will allow except Saudia Arabia. And Saudi Arabia doesn't even have as much spare capacity as they claim. And much of their spare capacity is heavy sour that many can't use.

Basically . . . if the OPEC nations are virtually all producing full tilt and its members cheat if they don't like the plan . . . what does OPEC even mean these days?

Sorry folk, but this week the Texas Rail Road Commission will not be forcing its constituency to follow productions rules. The country is well supplied. The world is well supplied. It's all good.

sb - Actually all the TRRC regs are in full force including the allowable law which sets the production level of all oil wells in Texas. The TRRC meets every month and sets the allowable for the next 30 days. This law has never been repealed. For about 40 years the allowable has been set at 100%. But if the TRRC decides to set it at 50% next month they can.

So again, to be fair, I should remind folks: DON'T MESS WITH TEXAS. And if you really tick us off we might stop exporting Blue Bell ice cream. The horror...the horror.

On a serios note: Iraq. According to various estimates this is the country with the greatest potential to increase production ON A GEOLOGIC BASIS. Obviosly whether Iraq adds 2 million bod or 12 million bopd the above ground factors will likely set the rate. And thus anyone can predict what ever level of increase they want but none can be taken with any credibiity IMHO. Consider unpredictable events we've seen in the ME as of late. As PO effects increase and the US reduces/increases its presence in the region it difficult to imagine a new age of stabilty coming about.

The Alberta Energy Resources Conservation Board (ERCB) sets a similar allowable for oil wells in Alberta. It has been set at 100% for most of the last 40 years as well.

However, there was a really nasty incident in 1980 when the Canadian federal government introduced an export tax on oil, with the intention of using the money to subsidize oil imports into Eastern Canada. The Alberta government took exception to it and the ERCB cut the allowable. That reduced exports to the US and increase imports into Eastern Canada, and the result was that the export tax no longer covered the import subsidies. Ultimately it cost the federal government several billion dollars in lost revenues, and increased the federal debt substantially. It took them decades to pay off the losses.

The ensuing kerfuffle also cost the Liberal government nearly all their support in Western Canada. The Liberals haven't really recovered politically in the ensuing 30 years, and they fell to third place in the last election. The current Conservative Prime Minister is from Alberta, with considerable support from permanently P.O.'d Westerners, and much to the horror of Easterners. "Don't mess with Texas" is a good rule, but "Don't mess with Alberta" is also prudent in the Canadian context.

There seems to be a common east vs west pattern here. A cyclic shift in the polarization of sunlight as each day passes?

Interesting Rocky. Although it's difficult to imagine the TRRC making a simiar move. Especially with the loss of revenue to the small indepedent companies and reduced tax income. But you never say never...especially when it comes to Texas politics. But given all the potential political tipping points ahead we'll just wait and see.