The IEA SPR release: open thread

Posted by Euan Mearns on June 24, 2011 - 11:00am

Drowning in debt, the OECD did have one little nest egg tucked away in the form of strategic petroleum reserves (SPR). Yesterday the International Energy Agency (IEA), an OECD organisation, decided to raid these meagre savings in order to try and keep the global growth party alive. The recognition that high oil and energy prices were threatening a weak and faltering recovery is an admission by the OECD that high oil prices were threatening recession.

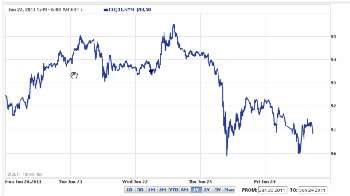

The decision yesterday to release 60 million barrels from strategic reserves over a 30 day period sent already weak and falling oil prices through the floor with Brent futures down 8% at one point. This represents 4% of total OECD public stocks of crude oil and refined products that totals 1547 million barrels.

Many believe that the $900 billion of quantitative easing in the USA has underpinned the most recent commodities spike. Ask the question where the global economy would be right now without QE? Rising demand colliding with inelastic supply is the technical cause of high and volatile oil prices. The logical solution is to boost supply and reduce demand. Yesterday's action by the IEA is designed to do the exact opposite of that since the aim is to reduce price. This will boost demand and hurt high cost oil producers in the OECD.

My own view on the OECD economies is that anaemic growth in many countries has likely already turned negative mirrored by already falling oil prices. Higher taxes, reduced public spending and the burden of high energy prices lie at the heart of this problem. But there seems no way out. OECD consumers also face the ever present risk of higher interest rates which must rise some day when buyers of government bonds demand higher rents for growing risk of default. Countries like the UK require strong economic growth to repair their public balance sheets to avoid the risk of default. This growth requires growing supplies of cheap energy. 60 million barrels of oil, 18 hours of global consumption, is the latest sticking plaster to be rolled out.

This is an open thread to gather opinion on yesterday's move by the IEA.

I think the SPR release was done to help fix the economic problems that many OECD members have. I wrote a post about this on Our Finite World about this called Release of Oil from the SPR – Desperately Trying to Fix the Economy.

Great post and graphs, Gail. Desperation seems to be an apt description when one looks at the economic/energy/political situation systemically, and, as I posted yesterday, this has all of the hallmarks of a Hail Mary pass. Since the home team is down by multiple scores, one can only deduce that the design is to save face. I can't believe these folks actually think that they can salvage the growth game. The playing field is in tatters, the rules corrupted, and the officials have lost any sense of fairness. Expect a new game soon, with different rules, played in the dark for most.

The fans have already started rioting in the streets.

Obama's trying to get re-elected.

I don't know why, I wouldn't want to be Capt. of the Titanic as it's sinking. Hubris, I guess....

If so, it seems like pretty bad timing. Is he going to keep releasing oil for the next year and more? Do all those other countries releasing oil reserves want that desperately to help fix an American election?

As Gail and others have said, this seems to benefit the EU most notably at this point.

I guess I was wrong. I am reading Gail's piece right now "Release of Oil from the SPR – Desperately Trying to Fix the Economy."

It's not bad timing at all. You're forgetting about the time lags between oil price changes and effects in the rest of the economy. The idea isn't to have low oil prices for the election, it's to have a stronger economy a month or so before the election. The best they can hope for at this point is an economy not in recession next summer, and if you want to head off a recession, this is a pretty good time to do it.

Right now, we're all waiting for Qaddafi to give it up. The Europeans in particular really want the guy gone. But the loss of Libyan oil is increasing Brent prices, so it effects everyone. The question isn't why the Europeans would want to help the US President, the question is why the Europeans would want to help the Europeans. Each actor from the OECD releasing oil has their own reasons, both political and economic, to want to release now. But in all cases they're most likely thinking of it as a temporary measure until Qaddafi's gone.

By the end of the summer, they're thinking Qaddafi will be gone, we'll be through the high demand period, maybe the Saudis will have come through with more supply, and demand will be lower due to slower economies, so prices will be lower of their own accord. Even if those don't happen, we'll have had a month of lower prices that will act as a stimulus, which the US and Eurozone economies could use now.

Excellent connect-the-dots summary.

Not much stimulus out of 18 hours of world consumption.

What do 'they' do for an encore?

The Europeans do indeed have their own reasons; high prices lead to hostile motorists. Preemptive pandering is the name of the game. Easing the threat of road closures and strikes in tense times makes sense.

If drivers are riotous in China, why not Spain?

http://www.zerohedge.com/article/china-inflation-and-wage-protests-sprea...

"why" Money and power. Which are good to have in good times and even better to have in bad times.

Maybe he's operating onn the greater fool theory. If he loses, we will get a much greater fool imposed on us. So in that sense, I'm hoping he's successful, cause the alternatives appear stark raving crazy.

I believe it was Kunstler who said the U.S. would eventually elect lunatics. Sadly, it seems more true everyday.

So who will be the Caligula to Obama's Tiberius?

Tiberius? that was a long time ago. bush/clinton/bush/obama is more like a repeating sequence of nero and caligula, with an occasional aspiration, perhaps to imitating a carcalla from time to time. One might be more likely to consider eisenhower as tiberius..

of course, the analogy, which works rather well in the big picture, does not translate

so well for this kind of thing, the sequence is not the same and there's not reason it

should be. Keep focused on the big picture, though, and it's like you have the script right in front of you, reading along.

Desperate is the right word, Gail. More of such attempts will follow.

The Saudis can't pump more to offset Libyan losses, as shown in graphs of my post on the recent OPEC meeting

9/6/2011

A disunited OPEC can't control upward trend of oil prices

http://crudeoilpeak.info/a-disunited-opec-cant-control-upward-trend-of-o...

And look at the oil production profiles in Libya, by Richard Miller from the Energy Institute, with some calculations on cumulative production and producable oil until 2040

24/6/2011

War overshadows peak oil in Libya

http://crudeoilpeak.info/war-overshadows-peak-oil-in-libya

I agree with what you've written.

Why kick the can down the road? To sweep Lybia under the rug? To preserve Saudi Arabia's ability to (possibly) bluff? To keep Iran from benefiting from the Lybia spike? To make the next spike worse by hampering investment and leaving the US without an SPR? Ech..

Great post all-around. And always good to hear "if high cost oil is what sinks the economy, high cost green energy is of very little help." Of course it's nothing new, but it's one of those things that needs to be repeated constantly lest people (me, at least) forget and go off into a fantasy-world.

Thanks!

Then perhaps trying to live in a fantasy economy, that depends on cheap, no longer available, energy to function, is the real problem!

Assuming we all stop being delusional, we might finally build an economy that is based on the realities of the physical limits we must live with.

May the captains of the current economy go down with the ship and hopefully a few of us can take to the lifeboats... Oh, and if you don't want to pull your weight by manning the oars, and if you try to sneak a bit more than your fair ration of the drinking water, the rest of us will be forced to toss you to the sharks. Hopefully they won't get indigestion.

Yes, we know that we are running out of oil but we must use more oil to grow the economy which will use even more oil that we are running out of. The primary problem with our economy right now is that it does not provide sufficient employment and, for millions of people, it does not provide enough money to, you know, live. We have had continued growth in manufactured goods but, at the same time, we have had decreases in employment. Producing even more goods will not solve the problem because manufacturers have found a way to decouple manufacturing from employment.

The only "solution" on offer is even lower taxes and massive decreases in spending to somehow free up the animal spirits of the capitalist economy to do what it is clearly not doing right now. But nothing is being done, not even that, because our government is frozen in place, paying 535 congress persons to do nothing.

So, in spite of all this, the only action being taken is this desperate action of providing more oil for an economy that clearly will not need the oil after congress gets through with it.

It would seem that virtually no one gets the fact that this economy's ability to provide decent jobs for a middle class economy is virtually dead.

As you imply, the ship is going down and the current political system and level of deep thought is not equipped to provide most people a decent standard of living. If one believes that this economy cannot be successful without continued, increased injections of oil, then it truly has reached the terminal stage of utter desperation and hopelessness.

With this release of oil, the President has, in effect announced that America is doomed going forward. This would only not be true if he truly believes that oil production is headed upward and we are just in a little temporary rough patch that we can paper over with an SPR release.

Bingo.

Many have been saying this for years, but we are disparaged, labeled as negative and even unpatriotic.

Even here on TOD, a site which leans toward a certain rational doomer position, there are those whose attitude is "America, love it or leave it."

One caveat is that I don't know what Obama believes. I also don't trust him to tell the truth even though I voted for him. I recently read the book Griftopia and it appears Obama flat out lied about what he was going to do with the health care bill. He also failed to follow through on climate change. God knows what will result from these negotiations with the Republicans on the debt ceiling. He also didn't have the courtesy to come out and personally explain to the American people what the hell is he is doing with this SPR release. He seems to be in hiding, like Bush, in that he seldom does press conferences.

Being from IL. I took it upon myself to re-name President O'bama, O'Bummer. He shall be

known only as O'bummer with his many failures to date.

"Obama flat out lied about..."

Keeping in mind that, like Bush/Gore a few years back who competed in their campaigns over who would spend the massive Clinton Surplus better, Obama's campaign started out in a pretty decent economy (to all appearances). It was well into the primaries before things turned ugly, and the economy was pretty much in free-fall while he was being sworn in.

As the circumstances had entirely changed, some change in priorities was only responsible.

Most of the current economic problems of the US would be solved if we returned to the tax structure before Reagan. We have a deficiency of demand. Long term problems are more intractable and another issue.

Markets oscillate between fear and greed. Maybe that is true for populations of people or other creatures too. During times of fear, it is a fight for survival, negative things keep happening, endless problems occur, cascading failures, costs that can't be covered. During times of greed, it is the opposite: easy money, food everywhere, everyone greedily expanding.

We as living creatures are incapable of living without being at one extreme or another, I fear.

Maybe if we transition off oil after many years we might have a more stable pattern. Not now.

http://af.reuters.com/article/energyOilNews/idAFN0124677220110601?pageNu...

This link is to an article about salt carverns at the SPR needing to be emptied, because they not longer meet the specs. I remember a local article in a South Louisiana news paper explaining the either the administration could sell oil in the open market or they could rent cavern space from private land holders locally. I know the numbers from the article doesn't match up but there may have been more problems at the caverns than they previously knew about.

If this release was needed for due to the caverns needing to be emptied for structural reasons, Obama is very slick for taking credit for it although he should have anounced it a couple of months ago.

Hi Gail, I think this release is only about economics. However, I think this is a ploy to sell hard assets for dollars giving the treasury cash to extend beyond the debt ceiling Aug. 2 self defined deadline.

Why would the DOE sell Louisiana/Texas sweet crude (which is a small fraction of SPR)at 112$ barrel, when spot sweet prices are already 92$ a barrel? This makes little energy policy sense and only short term bankruptcy sense. Any thoughts on this?

Some OPEC members are unhappy

However, China is happy. Buying opportunity.

The Dark Side of the OECD Oil Inventory Release

From the WSJ:

Wow. Tanaka says this is just to fill a gap while we wait for KSA to pump more, of course. That spare capacity that takes, uh, 30 days to come online by definition, right? That, and/or they're all waiting for QKaddaffffi to keel over. Would be quite something for this to devolve into a market intervention no-holds-barred cage match.

One of the unintended consequences of using 60 million barrels of reserves might be China's adding 60 million of oil to their reserves as their crude oil import needs expand.

I think that this represents the governments latest efforts at price control for oil. I think that other efforts are being made surreptitiously; however, price controls in the face of a shortage can only lead to one thing:more shortages, and more exports overseas where people can get higher prices. This will lead to an acceleration of our net oil import drop.

This is what price controls have accomplished so far:

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WTTNTUS2&f=W

less energy in this econonomy means continued slowing.

The only true solutions to the current crisis are either PERMANENTLY increased production, or massively decreased amount of oil use. I'm afraid that the second option is coming whether we like it or not.

I can't see how releasing 60 million barrels will have any substantial positive effect on OECD economies. Oil prices will temporarily drop, exploration will slow down somewhat, and Americans will take the opportunity to buy a new gas guzzler. Then what happens after the 60 million barrels have been burned up? Oil prices will rise, exploration companies will have lost a bit of momentum, consumers who bought a guzzler will have second thoughts, and the economies will tank again. The governments will then be forced to release another 60 million barrels. It's kind of like quantative easing, you can't live without it, yet you know you can't continue doing it.

Worse, oil prices may rise faster than before, like pulling back on a length of elastic when the other end is still moving away from you then letting go. At the very least the markets are going to really jig up and down as people try to make a profit off of it.

This is an appalling idea and highlights just how totally out of other ideas the governments are. Even when they "know" what needs doing. They aren't even backing it up with a another plan. It's just this sat on its own with a sprinkling of magical hope that something good will happen within the next couple of months.

Many people do not know the difference between the geological term for reserves and the more limited definition used to describe what is in storage, as in the strategic petroleum reserves.

Lots of discussion here The Oil ConunDrum

Joe Romm (Climate Progress Blog)

http://thinkprogress.org/romm/2011/06/23/252032/breaking-u-s-and-allies-...

suggests that the revenue from releases from the SPR should be used to fund development of clean energy technologies, as well as energy efficiency programs. This seems a good idea. Is it correct to assume that the government will be selling the oil? 30 million bbl at $80 a bbl is $2.4 billion. Any idea what will be done with this money. Does current law prescribe what must be done with it? (Sorry about the clunky link)

General Fund. Drop in the bucket. Buy votes.

Remember the release is from a group of OECD countries not just USA. The money raised selling oil at $80 / bbl will be used to buy it back at $120 / bbl at some later date;-(

That was the use I was afraid of.

But smart individuals, and especially large institutions, should be able to see that this will mean large increases in gas prices in the not-too-distant future, and could use whatever savings the derive from the temporary lowering of prices to prep as much as they can for the oil constrained future that is looming.

Of course, this begs the question of whether there actually exists any such smart individuals or institutions!

As we slide down the other side of the production curve, we will never find the right moment to refill the SPR.

I think this is like printing money. Once you start, it becomes extremely difficult to stop. Likely this move will be repeated, then repeated again, until the SPR is completely drained.

This REEKS of panic, especially after the Bernank's charming performance couple days ago.

I completely agree with you. It does reek of panic.

It particularly comes across that way due to its announcement only 1 day after Bernanke closed the books on continuing QEII. Didn't take them long to find another way to try and stimulate the economy. However, what's to stop OPEC from reducing exports to OECD countries to raise price? The release of 60 mb may be all for naught.

It seems so counter-intuitive for Obama to be doing anything and everything he can to get re-elected via all these hail mary passes designed to keep the ship afloat just a little bit longer, and for what? Who in their right mind would want to be at the helm of the good ship lolli-pop when SHTF via this continued net energy decline that will only get worse?

Exactly. The only logical conclusion is that the leaders who want to helm this ship are not in their right mind.

Sobering, isn't it?

Interesting choice of analogy. This is Socrates, from The Republic, Book VI. He describes society as a mutinous ship, where power is what matters, rather than what to actually do with it:

"Him who is their partisan and cleverly aids them in their plot for getting the ship out of the captain's hands into their own whether by force or persuasion, they compliment with the name of sailor, pilot, able seaman, and abuse the other sort of man, whom they call a good-for-nothing; but that the true pilot must pay attention to the year and seasons and sky and stars and winds, and whatever else belongs to his art, if he intends to be really qualified for the command of a ship, and that he must and will be the steerer, whether other people like or not-the possibility of this union of authority with the steerer's art has never seriously entered into their thoughts or been made part of their calling. Now in vessels which are in a state of mutiny and by sailors who are mutineers, how will the true pilot be regarded? Will he not be called by them a prater, a star-gazer, a good-for-nothing?"

I'm sure peak oilers will find that Socrates' parable resonates. It's worthwhile to remember that the philosopher and his students, for their part, lived during the decline and disintegration of classical Athens. It's somewhat comforting: this kind of sobriety has quite a long and noble history.

- Resid the Undergrad

Or maybe they are betting that they'll be able to buy that oil back at $40 by the end of the year...

Yeh, you could be right.

yes it would seem so.....

My sarcometer went haywire on Romm's piece - I'm not absolutely sure he was being serious rather than ironic. I imagine the SPR release will temporarily reduce the price of virtual barrels, the ones all sides of the histrionically babbling commentariat seem to focus on.

Hate Econ 101 or not, that price signal will communicate, "we kicked those wicked speculators in the teeth, problem solved." As the broader public receives the signal, they will likely shift spending (relative to where it would have gone) by some amount that will utterly dwarf a measly $2.4 billion. And it will signal energy suppliers that "we don't need it."

As to where the money will really go, likely into the general fund, one way or another. Some will undoubtedly end up as "stimulus" highway projects. That is, "we" will build highways and reduce the flow of fuel in all but the very short run (relative to what it might have been.) Yup, push hard in opposing directions - sounds like typical government to me.)

"we kicked those wicked speculators in the teeth, problem solved."

The admittedly cynical perspective I took on this in a reply to Jon Freise below was that the admin has inside information that another major slide in the economy was inevitable. This means that oil prices will fall, probably dramatically.

If the admin can show that it took a dramatic move early on that they can point to and claim that it had a major effect in bringing down the price of gas, they can at least crow about that, even while the actual economy is in the toilet.

I'm not sure they're that smart, but who knows?

As I remember the news during the Clinton administration SPR withdrawals are not sold, they are loaned out with the expectation that they be returned at some defined time in the future. This works out great for refiners, they get loaner oil today at high prices then give back when prices are lower.

Depends on the circumstances. This is an outright sale, which has happened before but loans are far more common.

DOE stated 112$ a barrel for sale Aug.

I find the timing particularly interesting as we are far from the all time high reached in 2008. Previously releases have followed one off disasters or significant events:

(1) Iraq’s invasion of Kuwait in 1990/1991.

(2) In 2005 after Hurricane Katrina.

This time the reason given this time is the loss of Libyan production.

This is surely an admission that the Saudis have no spare capacity to speak of. The official reason for the timing is the upcoming driving season, but I also sense that there is something that they are not telling us perhaps some present or near future disruption that they are anticipating.

Link to IEA question & answer session: http://www.iea.org/files/faq.asp.

It does seem weird, you would think they would wait until just before the next election cycle to do this. Maybe they think that this is close enough.

I suspect it could be linked to the ending of QE in 7 days time. Also, who is to say that the exercise is not repeated to ease Obama back into office?

This is the 'Wag the Dog' explanation of why things happen.

In 1997, Clinton ordered air strikes on Al Qaeda and Republicans

jumped on that action as an attempt to distract the public from Monica Lewinsky.

http://articles.cnn.com/2004-03-23/politics/wag.dog_1_bin-president-clin...

"I suspect it could be linked to the ending of QE in 7 days time."

I think Euan hit the nail on the head. This is the next round of stimulus to keep the economy's head above water. With the GOP stonewalling everything else, I kinda admire the creativity and resourcefulness. Its a losing game in the end, but I don't know that I would do anything different if I were in the big chair. What are you going to do, just succumb to being the president that let Great Depression 2.0 happen? No you are going to fight.

If Obama had any brains he'd be trying to find ways to back away from the helm to let some other poor sucker ride the ship down. This won't be the Great Depression 2.0, it will be the Abyss 1.0

Yeah, probably. I should probably put my cynic hat on, but in the end I am a sucker for people who actually give a crap about the world and are willing to go down with the ship and fight to keep it afloat til the end. Like Ugo Bardi said in his post on stoic philosophy.

You mean, like the guy who has incinerated hundreds, if not thousands, of desperately poor innocent Third Worlders? The gods save us from people who give a crap.

"If Obama had any brains he'd be trying to find ways to back away from the helm to let some other poor sucker ride the ship down."

I have always felt that Obama was allowed to win to be just exactly that; the patsy, the fall-guy, the scape-goat, the poor sucker to ride the ship down.

The opposition party is taking actions that are explicitly intended to further ruin the economy so that Obama will not get elected. That is their goal but they do not have a clue as to how they would turn it around once they got the power. Some of them may think they actually have a solution but, if elected, they will find out that they do not have a solution.

There is an increasing probability that the U.S. and most of the developed world will crash and burn in early August. Most people still believe in the fundamental sanity of congress. I don't anymore but devoutly wish I am wrong.

Without war, collapse likely won't be as scary as people think. Bad yes, but things move on, they always do.

America is going to be a country running alot more slowly. It will take forever to get places, and the streets and highways will be empty.

Be glad! It will be alot quieter, and as long as you can muster a weekly trip to the grocery store, even if they only have water and bread, and even if you only have food stamps, you won't starve.

Time to stop and smell the roses, is the way I look at it.

War is the big question mark. Always.

The next global war can be expected to begin in the 2030s or thereabouts. The major combatants, such as the US, are likely to lose a significant fraction of their populations. And if the war involves genetically modified pathogens, the loss could be very high globally.

http://en.wikipedia.org/wiki/War_cycles

"War is the big question mark. Always."

But nobody has the technology to fight a war without oil anymore. Where are the pikes, the short-swords, the maces?

Predator drones use far less fuel than piloted aircraft, but they hardly cut it as weapons of a full scale war.

The creation, manufacture, and distribution of biological weapons requires relatively little oil. Nuclear war using the existing stockpile of weapons requires little incremental oil.

War requires lots of oil only when it is fought by transporting large quantities of high-explosive weapons to distant places, and when fighting it in a way that spends tremendous amounts of energy to minimize casualties.

Consider that Cambodia was able to kill about 1/3 its population using little oil.

The wars in eastern Congo, Rwanda, etc. have required little oil. If you chop someones hands off with a machete, they bleed to death.

"War requires lots of oil only when it is fought by transporting large quantities of high-explosive weapons to distant places, and when fighting it in a way that spends tremendous amounts of energy to minimize casualties."

Sad but true. Look at the US Civil War, no oil used at all, and WWI, very little oil but a fair bit of coal.

Yes, it needs to be emphasized that all regular policy options have been eliminated. Even if congress gets around to raise ceiling to preclude immediate Armageddom, there will be massive demand destruction anyway as a result of budget cuts. This is, of course, the Republican's plan to take back power. I don't think this oil stimulus will be nearly enough to be able to overcome the coming demand destruction. This is the man going over the cliff and grasping at flowers to avoid the abyss.

Natequist, thanks, The nattering nabobs of negativity were getting to me. Yeah, it is not much, but if Libyan oil does come online in 3 months it will have smoothed the transition. The recent drop in crude prices forwarded into decreased gas costs represent a considerable stimulus. Best to keep them there.

6/15 Its (OPEC) 33 economists pointed to the need for 2 million barrels per day (bpd) more oil in the third quarter and 1.5 million bpd in the last three months of the year.

"This shortage of 2 million barrels, if it materializes, in the third quarter and the fourth quarter, then the price will go up for sure," Badri told the Reuters Global Energy and Climate Summit.

http://www.reuters.com/article/2011/06/14/us-energy-summit-opec-idUSTRE7...

So...

SPR now equals ruffly 700 million bls.

At 30 mil bl per month, that works out to 23 more months.

But, we won't need to release on a regular schedule, just every time the price moves up an inch.

It seems like it would be a regular schedule. Each time we reach the end of the SPR release then the price will need to move back up an inch.

This SPR release is like a band aid stuck onto a compound fracture. Well, considering the negative signals being sent it's more like salt being dumped onto the wound.

The general tone of the post is that governments can't do anything

to turn around the situation. On the face of it this is false.

The SPR releases are bringing down prices and the stimulus saved the banks and the stock market is back to ~90% of what it was in a very short time.

People and systems need time to adjust and much pain is involved.

'Ah, but in the long run we're all DOOMED' saith the gloomers.

Certainly the world has changed a lot in 3 years but does change equal DOOM?

It does for those who refuse to change.

This forum also needs to change from a focus on doom to a focus on

rebirth. Too much pessimism is corrosive.

"It is not God's will merely that we should be happy, but that we should make ourselves happy"--Immanuel Kant

“God helps those who help themselves.” Benjamin Franklin

It's also God's will that we be good custodians of the gifts he gave us. This is clearly not what happened. We are the prodigal son who wasted our inheritance and has yet to repent.

The decline has stopped for now.

Malaise is the new normal. The eighties and nineties are gone for good. This malaise will continue until Terminal Decline...!

Then, it really starts getting bad.

"On the face of it this is"....true.

Majorian,

Tell me one thing the governments of the West have done in the past 30 years in order to really change the conversation, educate the people, and move to a more energy-sustainable future.

I have to agree, government does have the potential to prepare for the impact of peak oil, but lacks either the foresight or the will to do so.

But like an alcoholic, a person has to admit there is a problem before he or she can be helped.

So you believe that the banks have not recovered, that the price of oil has not fallen recently and the stock market hasn't risen since 2008?

The governments of the West have actually done a number of things to reduce energy intensity, promote renewables and a 'greener' lifestyle but it hasn't been enough. OTOH, the 'developing world'

has undermined the conversation, undoing many weak steps forward in the West.

To be honest I don't know how complete 'gloomers' such as yourself can 'change to the conversation'.

I believe that the banks have had their books cooked to make it look like they have recovered. I also believe that the fed has made the interest rates so low, that people are forced to move their money out of bonds into what is basically a giant ponzi scheme and that that they are manipulating the price of oil lower. But the facts still stand, we are paying an enormous amount of money for an ever decreasing supply of oil coming into this country.

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WTTNTUS2&f=W

http://cr4re.com/charts/charts.html?Trade#category=Trade&chart=TradeDefi...

I don't think that it is inevitable that we will hit a brick wall, but if we keep going the direction we have been, very bad things are about to happen.

I'm glad you are bringing this topic up Majorian even if I have a different take on it. We are currently trapped in a dualistic conversation between BAU-ers who refuse to see the problem (and convince the average American that there is enough oil to keep growth going for a hundred years, and if there isn't, technology will save us with no problem whatsoever) and the Kunstler-ite view that advocates for a "power down" strategy. If your goal is to convince the mainstream to shift the economy onto a sustainable energy basis, "power down" is about the worst message you could have. It goes against every human impulse to plan to power down. We need to power up, but in the right way. But many doomers just want to wallow in their doom, not fix anything. I am not including most Oil Drum-mers in this category, but the tendency towards learned hopelessness does come through.

I am waiting for an emergent movement with a realistic but positive message that addresses the problem clearly. The Transition movement is important and does great work, but it will never reach the masses. But then again, maybe the movement I'm hoping for can't exist, maybe its splitting too many hairs. Anyways, thats my thoughts.

The BAU-ers aren't credible even to themselves.

They spout capitalist 'happy-talk' but they know the party is over. They're pinning their hopes on neofeudalist 'Disaster Capitalism'. There are always winners and losers and if there are many more losers than winners then so be it.

It's a gambler's mindset.

In fact the great 20th century Golden Age was based on a rising standard of living for the masses. Everybody knows that's over--there aren't the resources left.

The great political struggle is between the doomed masses and an entrenched wealthy elite and the elite is clearly winning.

Our political system is not intended to address problems, our media is not intended to enlighten the public, and our economic system is not intended to raise the standard of living.

This is what the public needs to realize.

These are the things that must change.

An analogy might be to Europe's 16th century to 17th century.

It began with the theologically democratic impulse of the Reformation followed by the Counter-Reformation reaction. Quite early on the peasants and then the middle classes were defeated

and eventually the various princelings were defeated and converted to courtiers for absolute monarchs, with the occasional

reversal such as the English Civil War. What ended this dismal cycle was the Industrial Revolution.

There is nothing to prevent the whole world from being reduced to the living standard of Bangladesh or Somalia even though this is preventable.

Waiting?! Before you do what?

There are lots of emergent and fully emerged movements out there that will direct your energies usefully if they need directing. Google on any of these terms to find a few that motivate me: "environmental movement", "organic food", "simple living", "solar living", "feet first", "livable cities", "slow food" and on and on.

It's been said before but why not just "be the change you want to see" and motivate others by your good example.

I don't get this "waiting" thing.

Or Google "energyshortage" just to balance the equation. :-)

My feeling is that the simplest and most elegant solution to the problem is to reduce human population by 50% solely by the use of birth control, which could probably be accomplished in about a century.

This would involve changing the zeitgeist of almost every culture on the planet almost instantaneously through some innovative and as-yet-undeveloped combination of viral information dissemination, spirituality, psychology, and an appeal to shared values that would unite the most dissident anarchist with the most unrepentant and venal IMF free-market apologist.

As ludicrous as such a prospect might appear, it's starting to look more practical and civilized than the alternative, and has the advantage of not requiring much in the way of material instrumentality. It would preserve a substantial margin of our current way of life, and each nation's integrity and traditions could be preserved as well.

Life just isn't that much worse with two, one, or no kids in today's world. It's actually much less stressful.

While I'm not sure I agree that "power down" is the wrong message-- a shocking number of people loathe contemporary technology, and are becoming mentally unstable because it is being crammed down their throats-- I would concede that a "power flat" message has some advantages.

Please forgive the ravings of a visitor from the soft sciences, and thank you for your patience with my peculiar brand of idealism.

For my part I agree, and am cautiously optimistic since birthrates have been trending lower. I don't particularly want to have children myself. And being perhaps the most dissident anarchist who you mentioned, I guess you should direct your energies toward the apologists... But I do wonder what our population pyramids would look like after years of such a policy, and whether it's feasible for so few young to care for so many old.

- Resid the Undergrad

Just do not allow the old to live as long as they do in Japan.

See Russia as an example.

Alan

Do you really feel that when you get older that the world will better off without you?

In other words, how would you feel about this policy applied to you?

IOW......are you really serious?

I am talking about what the evolving social reality will be post-Peak Oil. Not what I want or hope for.

Some old people can still contribute, but they are a minority after age 72 or so.

Sometimes Reality Suxes,

Alan

In a wide variety of ways, I think that's deeply, deeply unrealistic.

-There's no reason for PO to cause the kind of deep poverty that would require: the minimum cost for keeping someone around is very low - perhaps $5k. It's very hard to imagine poverty deep enough to make aggressive euthanasia worth that kind of minimal savings.

-Most people over 72 can be enormously valuable - we just choose to put them on the shelf, which is a terrible practice.

-rates of disability are much lower among elders than they used to be.

-much of the remaining old-age disability is caused by over-eating and under-exercise, something that the kind of PO event you're envisioning will help reduce. Think of the improved health of the British during WWII.

-the only kind of age-related rationing that might make some kind of conceivable sense is a reduction in aggressive end-of-life medical care, which tends to have relatively little marginal value.

Good point about the pyramid. Fortunately, the idea of everyone living to 120 seems to have gone out of style with my father's generation.

Marjorian,

I don't want to "change to the conversation". I had hoped that the governments would have changed the conversation, but they haven't. Carter tried in the mid-70s, but nothing has been done since then.

The banks have been rescued by the Fed (which they own), the price of oil is TEN TIMES HIGHER than it was 10 years ago, and the stock market is where it was in January 2000 (give or take a few percent). Not exactly a basis for hope.

Yes, the governments of the West have done a few things on the margin, though much more so in Europe (eg look at miles/gallon for autos&trucks, or should I say "trucks"), but it's just so little given the scale of the problem.

I agree that change is underway and that buying time (aka kicking the can down the road) can give people a little more room to adapt to the new reality of higher energy prices. The one thing all governments want to avoid is sudden change so buying time by any means possible is highly valued. Longer term consequences are beyond the half-life of most terms in office and are therefore of secondary concern.

Successful politicians are experts at saying the right thing at the right time to change public perception and evoke certain public behaviors, e.g. voting them into office ... again. I see market manipulation at this level in a similar light -- affect sentiment, change behavior and buy more time. Often, the more surprising the move, the more substantial the impact it will have.

By driving down the price of oil a little, OECD governments are giving a warning shot to oil speculators: "We have the means and the will to reduce oil prices whenever we deem necessary. Get your money out of oil speculation and back into the productive side of the economy." If I'm correct we may see a call for additional sales of gold reserves at some point for similar reasons. Of course it will be sold to the public as fiscally prudent, non-debt income resulting from "smart investments" and "selling high" etc. Blah blah blah ... whatever. While partially true, those future comments will mask an ulterior motive to drive investors out of precious metals and into other parts of the economy.

At least in the US, with Quantitative Easing about to be removed and a new election cycle about to begin, the current administration needs to find substitute sources of money to inject into the economy to keep growth alive for a little bit longer. I believe that coralling investors into buying stocks and bonds as opposed to commodities futures is one way they hope to accomplish this.

Jon

Goldbuggery is a mental disease.

I saw Steve Forbes on Yahoo Finance arguing for the millionth time that now was the time to go back to the Gold Standard. All we had to do was to fix the price of gold at $1500 per oz. (locking in his capital gains) and the world would become heaven on earth.

So much for Gold as a currency!

The chutzpah of the Gold Bugs is breath-taking.

I disagree with Steve Forbes, both on his call for a gold standard, and for the price of $1500 per ounce, neither of which makes sense. IMO we should have both fiat currency, as well as freely circulating precious metals as an alternative for wealth preservation. Basically what we have now, but the fiat currency needs to be much better managed.

I'm investing in precious metals because they are the safest bet going forward. They are the only currency that is nobody else's liability, and they can't be manipulated as easily. 1 ounce of gold stays 1 ounce of gold, even though the price may fluctuate. Whereas, with fiat currency, you could lose all of your purchasing power very quickly.

Financial instruments don't look particularly good, and as we are finding out, oil is not a store of wealth, as it is manipulated by financiers and politicians. Moreover, economic depression will reduce the demand for oil, so the price is likely to be quite volatile.

Precious metals are the only store of wealth going forward.

In a world where all hell breaks loose, goes horribly pear shaped and tits up etc. etc:

Why would a cold, hard, metal that is essentially useless, other than in some industrial applications,jewelry and gold leaf on the domes of Statehouse Rotundas, be considered to be of great value any more?

Isn't that just BAU overvaluation of glittering objects which, has been, a large contributing factor in getting us into this mess in the first place?

Gold has always been valued for its innate appeal to our more primitive sensibilities. It will only lose this appeal once we evolve past that, and this evolution will require rational human genetic engineering. It's safe to say that gold will be valued for quite some time for reasons other than its industrial use. Whether $1500 is too much is anybody's guess, though... Some people are convinced that eventually the Fed will start inflationary policies to deal with deflation of the coming depression.

"To be born again," sang Gibreel Farishta tumbling from the heavens, "first you have to die."

--- The Satanic Verses

The SPR releases are bringing down prices and the stimulus saved the banks and the stock market is back to ~90% of what it was in a very short time.

Only in the very short term. We have had releases in the past; that didn't stop oil from going over $100 per barrel. What will happen is a short term price drop, and then it is as Euan says -- we can either buy it back at higher prices or run with less insurance in the SPR.

All in all a pretty stupid, short-sighted idea. And you have to love the comments at Joe Romm's blog. People are going "What are you smoking?" And Joe throws out one non-sequitor after another like "It won't impact prices in the long-run" and "We must sell off the SPR ASAP." I don't even think he believes it is a good idea; he is just towing the party line set by Schumer and Markey.

We're going to need the rest of this stuff if the rumors of Hugo Chávez having prostate cancer turn out to be fatal.

Prostate cancer is highly treatable. I would not worry.

I suspect you are too young to have seen many people die from prostate cancer:

What are the key statistics about prostate cancer?

May 22, 2011 – Prostate cancer is the second leading cause of cancer death in American men, behind only lung cancer. About 1 man in 36 will die of prostate ...

www.cancer.org/cancer/prostatecancer/.../prostate-cancer-key-statistics -

And as good old Wikipedia puts it:

"Prostate cancer tends to develop in men over the age of fifty and although it is one of the most prevalent types of cancer in men, many never have symptoms, undergo no therapy, and eventually die of other causes. This is because cancer of the prostate is, in most cases, slow-growing, symptom-free, and since men with the condition are older they often die of causes unrelated to the prostate cancer, such as heart/circulatory disease, pneumonia, other unconnected cancers, or old age. About 2/3 of cases are slow growing, the other third more aggressive and fast developing"

It's often said that you'll die with prostate cancer, not because of it.

From the IEA FAQ:

Months ago, the Saudis offered a "special blend" to replace the Libyan crude. It was not exactly a resounding market success. So how, in 30 days, will they come up with a new blend that does satisfy European refiners? Not from cranking up Ghawar of Khurais, which are both too heavy and sour in comparison. The composition of the "spare capacity" is important, as well as the time to market.

Edit: Of course, they could refill the SPR with heavy sour, and there was a report that the US and KSA had discussed this. But that still doesn't get the better stuff to Europe.

Yes, this is an admission that the Saudis can't pump more oil of the right grade.

But the main reason for the release is to chase speculators out of the market. They know quantitative easing must go on for years because there's no other way to fund all the insolvent nations and pay off their debt. Without manipulating commodity prices, they would quickly rise to levels that would kill of what little growth there is. It's a balancing act, and it will go on until large countries get their fiscals in order -- ok, that's never :)

This move makes perfect sense, if you believe that what the oil company top brass have been saying while testifying: That speculators are driving prices. Just check out Republican Investor (how can you not trust a source with that name?).

That story is widely about:

http://www.mcclatchydc.com/2011/05/13/v-print/114190/speculation-explain...

http://www.dailykos.com/story/2011/05/24/978918/-Finally:-CFTF-Charges-O...

Now if you believe oil's top brass is deliberatly lying to congress, well then this is a dumb move. I think the White House is calling their bluff.

If you get the API newsletters then you have been treated to some truly hysterical posts lately. First they scream it is the speculators that are driving up oil prices, then when the White house and congress threaten hedging (which has kept quite a few nat gas producers alive) they scream that speculation is essential to the proper functioning of the oil and gas markets. I love it "Oh, wait don't kill them! They are innocent! Didn't you know we were lying?"

There are a couple of other reasons to release from the SPR. The economy is going into a slide and that will pull oil down. 6 months from now may be a great time to buy oil if this is a repeat of 2008 (remember $30 oil?). Waiting to release until after the peak may have been timed to soften the depth of economic drop while still allowing the peak to drive behavior towards less oil use (government action to reduce oil use has been effectivly blocked in the US). Or it may have been because governments take time to react, and they are moving slowly.

There are quite a few Fed Reserve research papers tying oil prices to unemployment with an 18 month lag and that puts us at next November.

http://www.mitpressjournals.org/doi/abs/10.1162/003465398557708

Further, the oil companies defeated a cut in tax breaks. This is a way of knee capping their profits.

Thanks for the many (if grim) laughs about RI and API newsletters.

So you think this may actually be a very shrewd move?

If they know for certain that the economy is going in to a slump that will continue to drive oil and gas prices down, by releasing oil from SPR now, they can take credit for all the drop in oil prices, even if only a relatively small part of that is attributable to the release?

This may be too clever by half, but one has to assume that there are all sorts of games being played and signals being sent. Your last point seems particularly cogent. I still think that it's mostly about Europe, though.

Ding-ding-ding! We have a winner!!

Never forget that the prime directive for politicians is to get re-elected. And I don't for a minute think Obama and secretary Chu are dummies about the economy or peak oil. Obama is a consummate politician and he will at least be able to take credit for low gas prices even if the economy is in the ditch next year.

SA has announced it will produce more oil, but as Stuart points out on his blog, they actually dropped production after Libya, so maybe they don't have any. I think the economic drop is now locked in. As WestTexas keeps saying, oil prices are higher now (on average) than the start of 2008. I think governments are trying to keep the depth of the drop as shallow as possible.

The good news from my view is this says Obama (and the IEA) knows that oil and the economy are connected. The US was filling the SPR during the high price peak under Bush. We are light years ahead in understanding. (of course we could go light years back in 2012). Hey, they got it after 1 lesson. That is not bad! The IEA is starting to sound halfway realistic ("We should have starting changing 10 years ago"). The UK clearly "gets it" now.

We might get some skillful management of the recession. Interest rates are being held down. Check out Jeff Rubin's ASPO speech about how high oil prices turn into a housing crisis.

I am not saying the train wreck is avoidable. It isn't. And efforts to shift to a green economy are being blocked across the board. But the crash might be slowed in rate.

Hi Jon, good to see you tonight at the movie.

Do you have any idea of the timing of the 'train wreck'? Someone above said something about August of this year. 2012 seems a bit too...Mayan. Thoughts?

Thanks for the references and your comments. Just one observation, whilst it may be true that speculative activity in the oil futures market has increased greatly, and now represents the larger part of such activity rather than the minor part, isn't this likely to be the natural order of things when markets start becoming vulnerable and more chaotic? After all, if oil remains at a pretty constant price for years on end, how can speculators make much money out of it? Only those interested in securing oil and hedging changes in currency etc would be interested in a static market. So my point is not that speculators are causing the high and volatile prices, but that they are making use of the underlying supply/demand problem related to peaking / plateauing oil to make windfall profits. I doubt that many posting here would be suggesting that speculators are to blame, it's those who find it politically and economically convenient to deny oil and energy depletion issues that do this.

This whole move is like a diabetic going on a donut binge. It is a clear signal that world leaders, including Obama, are afraid to sit down with their people to have an honest conversation about the future of oil. It is a clear signal that, in a moment of panic, Obama has decided to jettison any pretense of dealing with our long range energy problems. In the short run, if he is very lucky, he might get a boost to the economy; in the longer run he is endangering a conservation, efficiency, and alternatives policy. I get it that he wants to be reelected but this kind of knee jerk reaction is why we will never do anything serious about the fundamental fact that we live on a finite planet with finite amounts of fossil fuels, other resources, and air in which to spew all the pollutants.

This is a clear declaration on Obama's part that he believes the American people are stupid and cannot be given the facts. To be fair, however, regardless of what he does, he will be attacked by Republicans and the American people do not possess the ability to rationally assess what is going on in the world.

Mommy and daddy have lost their jobs and have no prospects for another job. But don't worry, they've got three months of savings and a credit card.

You're right.

"This is a clear declaration on Obama's part that he believes the American people are stupid and cannot be given the facts."

I have always thought that Obama is an excellent judge of character.

You liberals can't make up your mind.

On the one hand, you want a Carter like president who levels with the American people regarding the energy situation, and proposes new ways forward.

On the other hand, you praise Obama for having nothing but disdain for the American people, and for making overtly political decisions merely to stay in power.

Conservatives jam that knife in your belly while staring at you in the face. Liberals stab you in the back and then run away.

People prefer the former. They always will.

Who is praising Obama? Certainly not me.

tstreet:

natequist implied that Obama was an excellent judge of character by having a low opinion of the American people and essentially misleading them.

I was merely pointing out that this seems rather contradictory to me: if a President were to say all the right things regarding our situation, natequist would be the first to praise him.

This type of behavior is actually very common amongst American liberals. They are very opportunistic and unprincipled. "Clintonian" if you will.

Obama is the same way, isn't he? All that matters is putting those rednecks in their place.

Go to dailykos and you'll hardly find a peep about this latest move. Heaven forbid they say anything negative about their wonderboy president.

Believe, me, I don't have a higher opinion of conservatives. But I call a spade a spade.

People prefer conservatives that jam the knife in their belly while staring them in the face.

Any links?

http://www.youtube.com/watch?v=h-HJ7_StDls

I love how we all think about politics knowing what we know. We still pick sides. LOL. No side will help.

One side favors the wealthy -- measures that strip wealth from the masses.

The other side is trying to grow the economy to keep a few more middle class jobs longer.

Neither side can win and both will fail. It is just about whether you like rich people to have more or more people to have about the same a little longer.

LOL. SPR would have been released by any President in Obama's shoes. Europe would experience a shortage this summer. Therefore, they needed to release too.

The cool part is the coordination of the SPR releases.

See coordination is the Tell in this poker game. The coordination tells producers and speculators the OECD can f--- with them still .LMAO

The human brain is in its primitive primate roots, inherently tribal.

We cannot help but to pick one tribe (the Demagogues) or the other (the Publicrats).

The one tribe neither side wants us to pick is Pangaea tribe.

[ i.mage.+]

Or that he loves power and will do anything to keep it.

Opposition party opposes, film at 11.

Asia joins global move to tap oil reserves

I guess China can buy Korean and Japanese oil.

The devil is in the details of these releases. According to this article, the Energy Department will offer all of the crude in one bid sale. The winning companies of whatever is sold would receive delivery by the end of August (wow!).

One question I would have is whether it is just a loan, as sales have been in the past. In this case, it would seem like the same companies would have to pay back what is purchased now, with what may be higher-priced oil later. If this is the case, not a whole lot may be sold.

So while the IEA says that it will take 30 days for new Saudi oil to reach the market, it will take over twice that for SPR oil to hit the market.

Maybe we need a DSPR (D for Dynamic)

I did find documents online related to the sale, but haven't read much of them.

Scribid - DOE Notice of Sale

SPR - General Rules about Sales

Bids seem to be due by June 29, and are calculated as % of the price of Luisiana Light Sweet Crude. This price seems to be about $109 now. Clearly Midwest markets that are oversupplied with WTI and heavy oils are not going to be much interested. Perhaps elsewhere? Depends on the terms, relative to other oil, it would seem. I imagining that they are expecting to sell the oil at a discount, and because of this, bring other prices down.

UPDATE 1-U.S. crude oil stocks drop as refinery rates soar says that midwest refinery utilization was 97.5%, so there is no room for SPG crude there.

East Coast utilization was 75.9%, and Gulf was 89.5%, so there is room for more inputs there.

You are right. We ran out of refinery capacity in 2006, and had to start importing massive amounts of refined products. Since then the net importation of refined products has dropped to almost zero, as the north sea production has declined. We will need to send the spr oil to europe, have it refined and then bring the products back here. The real problems are in Europe right now.

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WRPNTUS2&f=W

This makes no sense. How can it take so long? I thought the SPR was for use in emergency? Smacks of a ploy to unhinge the futures market and a political move rather than a move to bring fresh supply to market immediately to put in cars for driving season.

Drawdown Capability

Maximum drawdown capability - 4.4 million barrels per day

Time for oil to enter U.S. market - 13 days from Presidential decision

http://www.fe.doe.gov/programs/reserves/spr/spr-facts.html

This would then suggest that the world market is 'well supplied'.

No it means the terms of this sale are so bad that no one wants it. If I offer oil at $1000 per barrel and have no buyers that does not mean the world is well supplied.

Time will tell, of course. But Alan Drake speculated yesterday that the oil may not be replaced. That's the way I would bet, too. Proceeds will help patch up some cuts in the upcoming budget deal, and further liquidations will be evaluated. Start of a slippery slope, IMHO.

August is guaranteed delivery date. The sale document says every effort will be made to deliver in July where requested and possible.

Oil for delivery from SPR in August will hit the refinery in mid Sept to be refined to hit the pipelines by the end of Sept to early Oct. This will put the finished product into East Coast and Mid West terminals late Oct.

This release is for the winter season.

The question is why would the present admisistration want cheaper fuel for the winter ???

Silly season starts in Jan in Iowa.

I would want to know who has profited from front running the knowledge this release was going to occur. There is/was a contango going on now the ladders on the floating roofs are pointed straight down! The pipelines are pumping the bejeebers out of the tanks. They are getting rid of inventory to be able to fill with ? higher or lower cost oil?

My gut feeing, based simply on where I see the ladders on floating oil storage tanks, is the price of crude is heading lower. And this was happening before the release of the SPR oil.

Something is not passing the smell test!

Maybe it buys some time for a group [the House of Saud perhaps?] to finalise their security arrangements on their fortress in Uraguay..?

I do find it interesting that the Republicans are not screaming about this....but maybe I tuned it out. Of course another reason they may not be screaming is they are finally realizing the jig is up and its either admitting time or covering up time. The other angle is that it appears to be market manipulation for a mere 60 million barrels....I wonder who made money on that announcement...

Screaming would be irrational. They are complaining.

Gotta love the API:

What did Nero say as Rome Burned, "There is no supply emergency." That guy gets paid more than me too. LOL.

While heading into work this morning I was listening to a local right wing radio talk show host discuss the SPR release. He was calling this a political move by Obama, which I tend to agree with. He then said something that amazed me, and I quote, "30 million barrels is only a day and a half of US consumption." I was quite impressed until he went from that into a rant about drilling in ANWR, GOM, top of Mt. Rushmore, etc.

I can confirm that attitude from what I hear. Some of them know so many details, such as how ethanol doesn't have the necessary energy return, etc, but when it comes to facing some reality they stop short and just blame environmentalists. Everyone knows why they do this -- their audience would simply evaporate unless they could blame bogeymen.

Exactly. Same as right-wing congressional and senate campaigns. They've so demonized the centre-left to their (IMHO blind) constituency that they no longer dare agree with anything the centre-left might do.

Looks like the US got Saudi permission for the SPR release ...

Before Oil Move, a Secret U.S. Delegation to Saudi Arabia

I wonder if Saudi Arabia might be the key to this whole thing. My initial impression was that the release of emergency supplies was a vote of no confidence from the IEA regarding Saudi Arabia's ability to increase net oil exports, and that may be the case, but it also occurred to me that the release of emergency supplies may allow Saudi Arabia to claim that additional Saudi oil is not needed, given the release of emergency supplies. If Saudi Arabia can't materially increase their exports of oil, especially light/sweet oil, the release of emergency supplies would be a very convenient fig leaf for them.

Note that the five year numbers for Saudi Arabia don't look good regarding their future net export capacity. Their consumption to production ratio rose from 18% in 2005 to 28% in 2010 (BP). At this rate of increase in the ratio, they would approach a 100% C/P ratio (and thus zero net oil exports) in only 14 years, around 2024. And I am surprised that the BP data base showed another year over year decline in Saudi net oil exports, from 7.3 mbpd in 2009 to 7.2 mbpd in 2010 (versus 9.1 mbpd in 2005). So far, Saudi Arabia has shown year over year declines in net oil exports for four of the past five years.

Saudi Arabia is not –not – increasing its regular oil exports since that widely reported claim that they would increase output by 1 million bpd more than the level prior to that announcement. Even the IEA admitted yesterday they see KSA recently increasing output only by 500,000 bpd (but it was not clear over what time period). The Saudis may be reserving some of its extra output for itself to get through the summer cooling season. As best as I can determine exports from KSA have increased about 300,000 bpd starting on or about June 1, with 100,000 bpd of that going to Yemen for free.

Meanwhile oil tanker tracker reports indicate even with those extra exports (of 300,000 bpd) above, OPEC is still exporting 1.25 million bpd less than right about the start of February. The US has taken a disproportionate share of that export loss, and with ‘floating storage’ nowhere to be seen as it was in the summer of 2010, frankly the US was headed for oil shortages as soon as August.

Coincidentally the SPR is timed to be released in August. I’m not saying the many other factors mentioned here were not contributing factors to the release of oil reserves, but a prospective oil shortage is a powerful motivating factor.

At this point, I believe that KSA will now be excused by the media from delivering on its recent oil 1 million bpd increase in output pledge, just as it was from other hyperbolic pledges earlier in 2011.

But there seems no way out

- Euan Mearns (above)

May I suggest that there is "a way out". Reduce consumption (NOT increase it) and invest the "lost consumption" in long lived energy efficient and energy producing infrastructure.

Some sectors grow due to increased demand. More insulation, better windows and doors, solar or gas tankless hot water heaters on the residential front. Some measures may have long paybacks, but they still "pay back" and more in years beyond.

With consumption, nothing but trash is left for the future.

Factories can become more energy efficient, and provide a buffer for the future.

And massive infrastructure can be built with "lost consumption". Wind turbines, solar, electrified and expanded railroads, urban rail, a few billion for bike infrastructure, transit orientated development.

I have calculated that US trucks would have to buy diesel at 18 cents/gallon to compete with the fuel costs of electrified double stack rail. Transportation is one of the fundamental "Factors of Production". Permanently lower that cost# and source it domestically (hopefully renewably, even if it costs 20 cents/gallon), and the long term benefits will ripple through the economy.

Such a transformation would not be immediate. In the year of investment, only (average) six months of benefits. That first year, a $1 invested is little better than a $1 consumed. But in the second year, the benefits double and only minor operating costs (depending on type).

Best Hopes for Seeing Another Way,

Alan

# The marginal cost of rail capacity is lower than the average cost, the opposite of trucks and highways. Even excluding fuel costs, the more rail is used, the cheaper and faster it gets, with appropriate levels of infrastructure investment.

Absent ties (40 years expected for concrete ties), other fixed infrastructure will last a half century to over a century. A long term investment in energy efficiency.

Alan, all these attempts to keep this tattered ballon aloft simply delays the day that a new way of thinking can be introduced. We (the OECD) are insolvent and lack the means (cheap FF) to do the physical work required to move forward with the old model. IMO we need a major hiatus, a shock, and from that lower point, we can build.

I suggest that REDUCING consumption (absolutely doable in the OECD) and diverting the freed resources (minus depletion) to long lived energy efficient and energy producing infrastructure IS THE NEW MODEL.

Yes, it preserves much of the social and economic infrastructure of the past, but that seems to be an advantage.

More later,

Alan

May I suggest that there is "a way out". Reduce consumption (NOT increase it) and invest the "lost consumption" in long lived energy efficient and energy producing infrastructure.

Three reasons this won't happen:

1. Goes against the profit-seeking, plannned obsolescence mindset of America's Oligarchs, which won't be changing anytime soon, not even with an outright Depression. Wall Street will change its mind when you pry the last nickel out of their cold, dead hands. Ditto for prying the last Cheez Doodle out of Jim-Bob Sixpack's hands.

2. Jevon's Paradox (so eloquently illustrated in several earlier posts here).

3. Any reduction in U.S. consumption will be more than offset by the additional 70 million added to world population each year, many in "developing" countries that are driving hard to attain our high consumption wasteful lifestyle.

Logically, "solving" the problem of dwindling finite resources vs. exponentially growing population X consumption (before Mother Nature does it for us in a not-so-nice way) is absurdly simple. Practically and politically though, it's impossible. You will never be able to "teach" the unteachably, willfully ignorant masses who actively resist this information. It seems to be a genetic trait that ~98% of the population will always believe what they want to believe and live in an alternate reality of religion, mysticism, BAU, Culture War politics, and convenient scapegoats. They continue to be ruled over and manipulated by a tiny % of talented sociopaths who understand this mindset and exploit it mercilessly for personal advantage. In the U.S., these elite sociopaths have convinced the masses that the price of oil is high because of gay marriage, corporate capture of government is good, and that AGW is a liberal myth created by devious scientists scheming to get grant money.

Even worse, the drive to reproduce endlessly and consume without limits appears to be a universal genetic trait that no amount of education or convincing will ever be able to counter. But... not to worry, empirical reality has a way of imposing itself, despite all of humanity's tireless efforts to vanquish it. All TODers can do is prepare as best we can for our own futures and enjoy the show as it plays out.

It is evolution in action. Those that give up (have few children) loose. Yes, there maybe a die-off coming and those that have the most descendants have the best odds of having surviving descendants when it is all over. Yes that is over simplified if you have fewer but they are better provided for (in a mansion in Greenwich, Connecticut with a massive Swiss bank account protected by private security and then a layer of town, state and federal police) that could provide better odds.

Having a lot of direct descendants is the agenda of the gene. There is no particular reason for it to be the agenda of consciousness.

Humans are pretty fungible at this point, not a lot of variation in the genome. I didn't make any new humans, since the supply seems ample. Knowingly raising kids as some sort of lottery ticket cannon fodder to try getting one's cleft chin and hazel eyes through history's biggest dieoff would be beyond abusive.

Just my 2 cents...

When you look at the massive variability in behavior in dogs (ie. retriever vs. terrier), and then consider the variability in mental predilections in humans (ie. the "engineering mind" or Asperger's type people vs the artist) it seems obvious that what variation there is in the genome can cause big shifts in overall behavior. Imagine a world populated entirely by Aspies, or one in which they didn't exist.

Incidentally, I think that humanity's best long-term hope is genetic engineering... We are getting close to a $1000 full genome sequence, and we have the 1000 Genome Project. We also have rapid advances in gene synthesis to the point that anyone with $5000 can order a gene from a company and get a plasmid of your choice, of any sequence you desire.

The biggest obstacle to overcome is ethical, but someone will do it. Somebody always does...

Interesting take, but... what makes you think selfless philanthropists and rational do-gooders will be in charge of the genetic tinkering? Wouldn't the Oligarchs much prefer a world of stupid, submissive, trusting sheep? And for themselves (the ruling top 0.1%), they'd want even more evil, brilliant sociopaths for offspring. Or even better --genetically engineer *themselves* to be immortal.

"The marginal cost of rail capacity is lower than the average cost, the opposite of trucks and highways."

How does this work mathematically? Does it simply indicate that rail is below capacity? I'd certainly expect a big bump in marginal cost when a growing mode reaches capacity and needs a new increment of capital investment, but that would apply to any mode. So, as a broad-brush distinction between rails and highways ... huh??

The most dramatic example was earlier this month.

BNSF opened 5 miles of double track in Abo Canyon ($90 million investment) and increased capacity on their Southern Transcon line (2,217 miles - LA to Chicago) from 80 to 100 trains/day to 135 trains/day. Abo Canyon is a fairly steep section with many 40 mph curves and was quite a bottleneck when it was a single bi-directional track on June 1st.

This was the penultimate (one or two left) improvement of this vital line. And yes, almost $2 billion was spent before on improvements that have steadily raised both capacity and speed.

A decade ago, Southern TransCon capacity was 50-60 trains/day even with substantial sections of double track and average speeds almost 20 mph slower. The original cost would have been substantially more than the >$2 billion cost of improvements.

I wish I could derive a mathematical ratio, but individual cases vary too much.

Alan

The Louisiana DoT is spending $1.2 billion to expand traffic lanes on the Huey Long bridge from 4 lanes to 6 lanes. An example of highway vs. rail capacity increases.

BTW, faster is cheaper. Less rolling stock needed and less labor/train.

Apples and oranges? Clearing bottlenecks is indeed often a cost-effective way to raise capacity. But shouldn't we expect rebuilding an ancient (75-year-old) major, world-class river bridge to add lanes (or tracks for that matter) to be vastly more expensive than just blasting, grading, and laying an extra track (double-tracking) or extra lanes on the ground in the back of beyond? All the more so if said bridge has to be kept in service, and the shipping channel underneath has to be kept safe and open, during the rebuild? Wouldn't double-tracking a railroad bridge of the same size under the same constraints be expensive too?

This example seems merely to illustrate that rebuilding obsolete major river bridges is expensive. (So is rebuilding obsolete old houses.) Didn't we know that already?

One also wonders why they didn't simply build a new cable-stayed bridge, then demolish the old maintenance-intensive monster, a sensible approach that has sometimes been taken elsewhere on the Mississippi and its tributaries. Then again, maybe anything associated in any way with the Longs is doomed forever to be beyond rational explanation.

A number of incorrect assumptions.

75 years is hardly ancient for a rail bridge (and the Huey Long is a double track, unlimited weight rail bridge with road lanes cantilevered off it). At least another century left in it. With the rail approaches, almost 4 miles of heavy steel construction. A significant % of all US steel production in 1933 went into this one bridge.

MASSIVE supports on either bank of the Mississippi, as the supports anchor the bridge in the mud (no bedrock).

I am NOT an expert, but I cannot see a new cable stayed bridge as a viable alternative for rail + road loads. Simply too much. And what of the approaches ?

I suspect a modern bridge, built to 100.4% of specs would last no longer than the massively over built Huey Long. Both might be scrapped in 2140.

Maintenance is basically painting.

-------

The bridge does not need more capacity. It connects two suburbs and the draw on one side, the Avondale Shipyard (5,000 jobs + suppliers) closes just as the $1.2 billion is spent.

Better to let the bridge continue to be a bottleneck and reduce driving. One "benefit" is to enable more sprawl on the Westbank. In any case, the cost effectiveness of reducing the road bottleneck is two or three orders of magnitude less that reducing the rail bottleneck.

In fact the entire Southern Transcon upgrade, affecting 2,217 miles, is only about 50% more than the Huey Long upgrade. The rail line upgrade has three or more orders of magnitude benefit to society than the bridge widening.

Best Hopes for Rail Investments,

Alan

But the railroads are entirely monopoly private systems including the trackage and traffic control! While the highway and airways are public systems that anyone can use.

Until the Federal Government nationalizes the railroad trackage and traffic control systems into one public national system on which any and all private businesses that wish to operate railroad freight and passenger systems you will never get any real movement towards efficiently operated systems and particularly passenger rail systems that can compete with the road and air transportation systems.