Twenty (Important) Concepts I Wasn't Taught in Business School - Part I

Posted by nate hagens on September 20, 2013 - 12:27am

Twenty-one years ago I received an MBA with Honors from the University of Chicago. The world became my oyster. Or so it seemed. For many years I achieved status in the metrics popular in our day ~ large paychecks, nice cars, travel to exotic places, girlfriend(s), novelty, and perhaps most importantly, respect for being a 'successful' member of society. But it turns out my financial career, shortlived as it was, occurred at the tail end of an era ~ where financial markers would increasingly decouple from the reality they were created to represent. My skill of being able to create more digits out of some digits, (or at least being able to sell that likelihood), allowed me to succeed in a "turbo" financial system that would moonshot over the next 20 years. For a short time I was in the 1% (and still am relative to 'all humans who have ever lived'). Being in the 1% afforded me an opportunity to dig a little deeper in what was really going on (because I quit, and had time to read and think about things for 10 years). It turns out the logic underpinning the financial system, and therefore my career, was based on some core flawed assumptions that had 'worked' in the short run but have since become outdated, putting societies at significant risks.

Around 30% of matriculating undergraduate college students today choose a business major, yet 'doing business' without knowledge of biology, ecology, and physics entirely circumvents first principles of how our world really works ~ my too long but also too short summary of the important things I wasn't taught in business school is below.

The Blind men and the Elephant, by Rudyard Kipling

Business as usual as we know it, with economics as its guide and financial metrics as its scorecard, is in its death throes. The below essay is going to appear critical of finance and the nations (world's) business schools. But it is too, critical, of our entire educational system. However, physicists, plumbers and plowmen do not have the same pull with respect to our cultural goals and narrative that financial folk do - as such an examination of the central assumptions driving society is long overdue. But before I point out what I didn't learn in MBA school, I want to be fair - I did learn things of ‘value’ for the waters I would swim in the future: statistics, regression, how to professionally present and to facilitate meetings, and some useful marketing concepts. Of course, like any 20 something student, 1/2 of the value of graduate school is learning to interact with the group of people that will be your peers, and the relationships and contacts that develop. Plus the placement office was very helpful in getting us jobs as well.

The culture at Salomon Brothers impressed me the most and I landed in their Private Investment Department, where we were basically stockbrokers for the uber-rich - as a trainee I wasn't allowed to call on anyone worth less than $50 million (in 1993). After Salomon shut our department down I went to a similar job at Lehman Brothers. At Lehman I increasingly felt like a high paid car salesmen and after 2 years quit to go work for a client, develop trading algorithms on commodities and eventually started my own small fund. But increasingly, instead of trading or trying to grow my business I found myself reading about oil, history, evolution and ecological issues. It really bothered me that 'externalities' were not priced into our goods or profits. One day, on a hike, it struck me that what I was doing felt spiritually hollow and despite it ‘paying the bills’ I began to realize I was more interested in learning about how the world worked and maybe doing something about improving it. In 2002 I gave my clients their money back, embarked on basically a 2 year hiking trip with my dog, and a car full of books. Eventually I would obtain a PhD in Natural Resources, but like many of you my real degree was obtained on this site, interacting with the many and varied people I met and continue to call friends and mentors. I am continuing to work on, or at least think about, making the near and long term future better, despite the tall odds, while living on a small farm in Wisconsin. More on this below.

In the years that have passed, modern society has become a crazy mélange of angst, uncertainty and worry. Many of us intuitively recognize that we’ve constructed a ginormous Rube Goldberg machine which for a number of reasons may not continue to crank out goods and services for the next 30-40 years. We blame this and that demographic for our declining prospects – the Republicans, the environmentalists, the greedy rich, the lazy poor, the immigrants, the liberals, etc. We blame this and that country or political system – evil socialists, heartless capitalists, Chinese, Syrians, Europeans, etc. We watch TV and internet about the latest ‘news’ influencing our world yet are not entirely confident of the connections. But underlying all this back and forth are some first principles, which are only taught piecemeal in our schools, if at all. Below is a short list of 20 principles underpinning today’s global ‘commerce’. I should note, if I was a 25 year old starting business school, eager to get a high paying job in two short years, I wouldn’t believe what follows below, even if I had time or interest to read it, which I probably wouldn't.

20. Economic 'laws' were created during and based on a non-repeatable period of human history

"I found a flaw. I was shocked because I'd been going for 40 years or more with very considerable evidence that it was working exceptionally well." Alan Greenspan testimony to Congress, Oct 2011

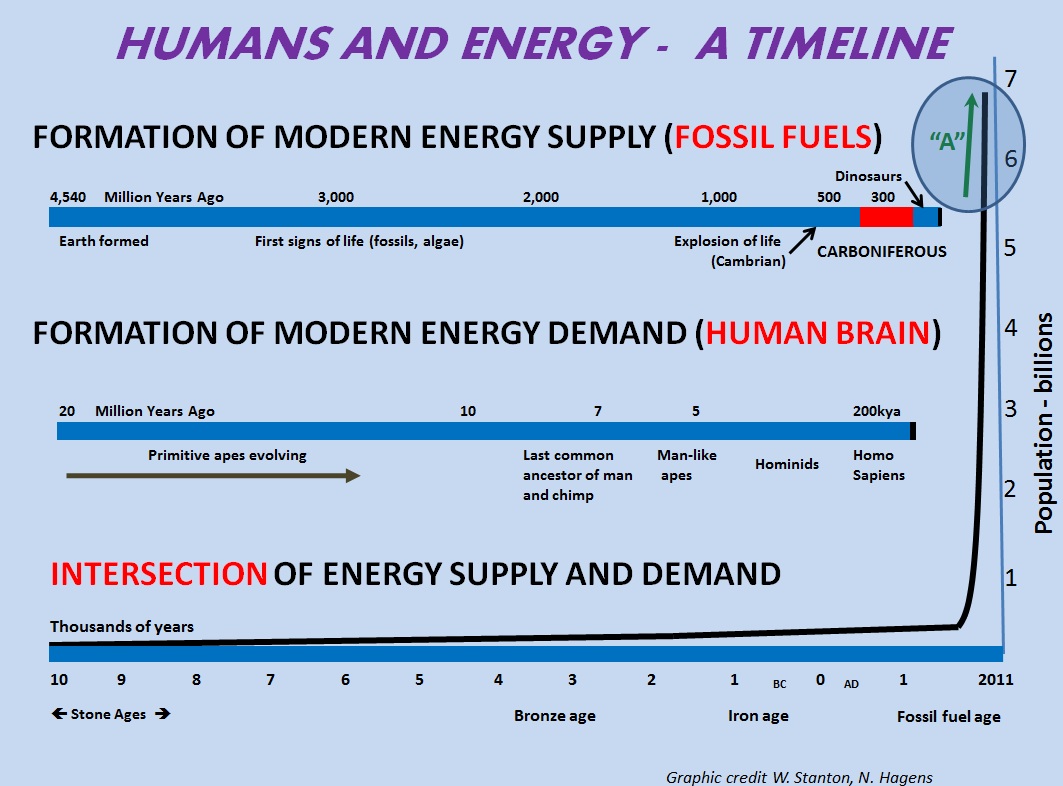

The above graphic shows a three-tiered time history of our planet, starting with the top black line being geologic time. The tiny black sliver on the far right, is enlarged in the second line, and the sliver on its far right is again enlarged on the bottom line, where the last 12,000 years are shown. We, both our environment, and ourselves, are products of this evolutionary history. Our true wealth originates from energy, natural resources and ecosystem services, developed over geologic time. Our true behavioral drivers are a product of our brains being sculpted and honed by 'what worked' in all 3 eras of this graph (but mostly the top 2). The dark line on the bottom is human population, but just as well could be economic output or fossil fuel use, as they have been highly correlated over this period.

The economic ‘theories’ underpinning our current society developed exclusively during the short period labeled 'A' on the graph, on a planet still ecologically empty of human systems and when increasing amounts of extraordinarily powerful fossil energy was applied to an expanding global economic system. For decades our human economies seemed to follow a pattern of growth interrupted by brief recession and resumption to growth. This has made it seem, for all intents and purposes, that growth of both the economy and aggregate individual wealth was something akin to a natural law –it is certainly taught that way in business schools. The reality is that our human trajectory –both past and future - is not a straight line but more like a polynomial - long straight stretches, up and down, with some wavy periods in the middle, and ultimately capped. Our present culture, our institutions, and all of our assumptions about the future were developed during a long 'upward sloping' stretch. Since this straight line period has gone on longer than the average human lifetime, our biological focus on the present over the future and past makes it difficult to imagine that the underlying truth is something else.

Evidence based science in fields like biology and physics has been marginalized during this long period of 'correlation=causation'. This oversight is not only ubiquitous in finance and economics but present in much of the social sciences, which over the past 2 generations have largely conflated proximate and ultimate explanations for individuals and societies. In nature geese fly south for the winter and north in the spring. They do this based on neurotransmitter signals honed over evolutionary time that contributed to their survival, both as individuals and as a species. "Flying north in spring" is a proximate explanation. "Neuro-chemical cues to maximize food/energy intake per effort contributing to survival" is an 'ultimate' explanation. In business school I was taught, 'markets go north' because of invention, technology and profits, an explanation which seemed incomplete to me even though it has appeared to be valid for most of my life. Social sciences have made great explanations of WHAT our behavior is, but the descriptions of WHY we are what we are and HOW we have accomplished a vast and impressive industrial civilization are still on the far fringes of mainstream science. Economics (and its subset of finance) is currently the social science leading our culture and institutions forward, even if now only by inertia.

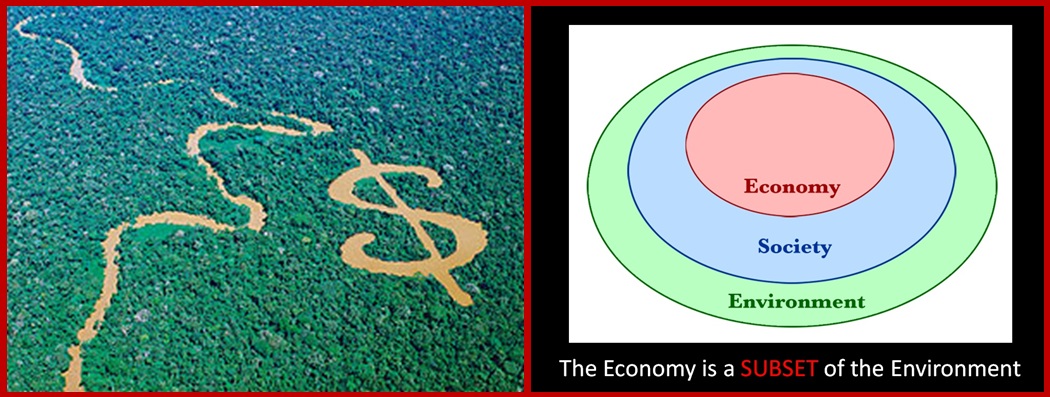

19. The economy is a subset of the environment, not vice versa

If people destroy something replaceable made by mankind, they are called vandals; if they destroy something irreplaceable made by God, they are called developers.

Joseph Wood Krutch

When you have to classify the very capacity of the Earth to support life as an "externality", then it is time to rethink your theory. --Herman Daly--

Standard economic and financial texts explain that our natural environment is only a subset of a larger human economy. A less anthropocentric (and more accurate) description however, is that human economies are only a subset of our natural environment. Though this may seem obvious, currently anything not influencing market prices remains outside of our economic system, and thus only actively 'valued' by government mandates or by some individuals, not by the cultural system as a whole. A landmark study in NATURE showed that the total value of 'ecosystem services' -those essential processes provided to humans by our environment like: clean air, hydrologic cycles, biodiversity, etc. if translated to dollar terms, were valued between 100-300% of Global GNP. Yet the market takes them for granted and does not ascribe value to them at all!!! Part of reason is that the negative impacts from market externalities aren't immediate, and with our steep discount rates (see below), the near term 'benefits' of GDP outweigh 'abstract' costs at some unknown future date.

Mankind's social conquest of earth has brought with it some uncomfortable 'externalities'. We are undergoing a 6th great extinction, which is no wonder given that humans and our livestock now outweigh wild animals by almost 50:1. Our one species is appropriating over 30% of the Net Primary Productivity of the planet. (One can ask, how can we use 30% of sunlight yet have 50x the weight of the other vertebrates and the answer, as we will see below, is our consumption of fossil carbon). A short list of deleterious impacts not incorporated into prices/costs includes: air pollution, water pollution, industrial animal production, overfishing (90% of pellagic fishes (tuna) in ocean are gone), nuclear waste, biodiversity loss, and antibiotic resistance. Perhaps the most ominous is the threat of climate change and ocean acidification, where humans, via burning large amounts of fossil carbon, are impacting global biogeochemical systems in profound and long-lasting ways.

Since GDP, profits and 'stuff' are how we currently measure success, these 'externalities' only measurement is the sense of loss, foreboding and angst by people paying attention. Such loss is currently not quantified by decision makers. In the past, only when there was a ‘smoking gun’ e.g. in the case of chlorofluorocarbons, DDT, unleaded gasoline, did society organize and require rules and regulations for the externalities, but these examples, as serious as they were, were not anathema to the entire human economy.

18. Energy is almost everything

Without natural resources life itself is impossible. From birth to death, natural resources, transformed for human use, feed, clothe, shelter, and transport us. Upon them we depend for every material necessity, comfort, convenience, and protection in our lives. Without abundant resources prosperity is out of reach.

— Gifford Pinchot Breaking New Ground (1998), 505.

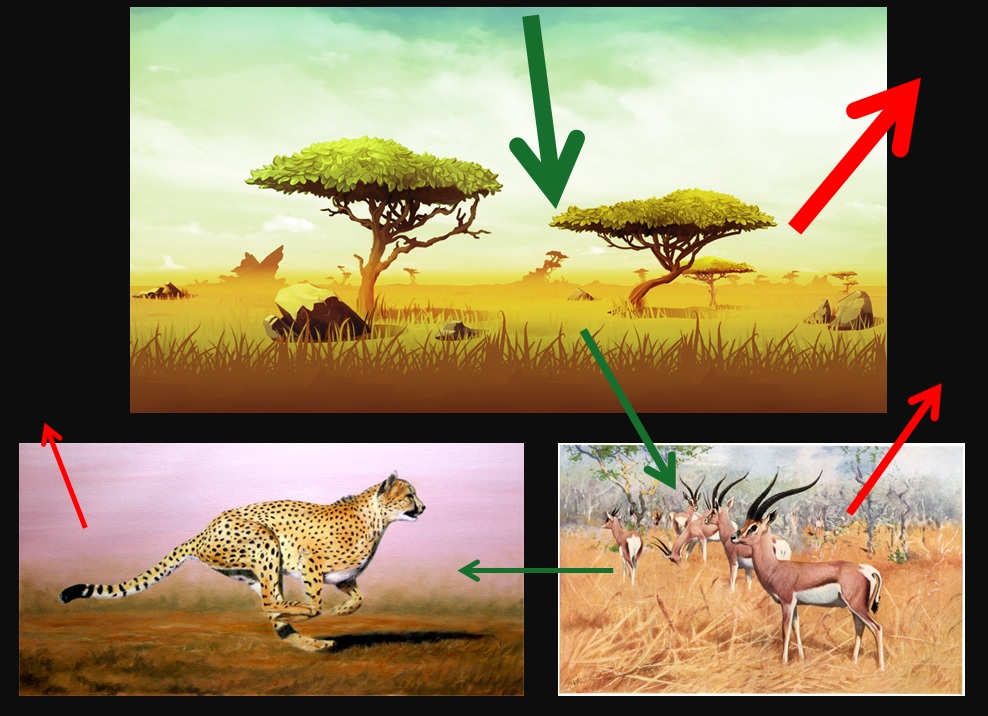

In nature, everything runs on energy. The suns rays combine with soil and water and CO2 to grow plants (primary productivity). Animals eat the plants. Other animals eat the animals. At each stage of this process there is an energy input, an energy output and waste heat (2nd law of thermodynamics). But at the bottom is always an energy input. Nothing can live without it. Similarly, man and his systems are part of nature. Our trajectory from using sources like biomass and draft animals, to wind and water power, to fossil fuels and electricity has enabled large increases in per capita output because of increases in the quantity of fuel available to produce non-energy goods. This transition to higher energy gain fuels also enabled social and economic diversification as less of our available energy was needed for the energy securing process, thereby diverting more energy towards non-extractive activities. The bottom of the human trophic pyramid is energy, about 90% of which is currently in the form of fossil carbon. Every single good, service or transaction that contributes to our GDP requires some energy input as a prerequisite. There are no exceptions. No matter how we choose to make a cup, whether from wood, or coconut, or glass or steel or plastic, energy is required in the process. Without primary energy, there would be no technology, or food, or medicine, or microwaves, or air conditioners, or cars, or internet, or anything.

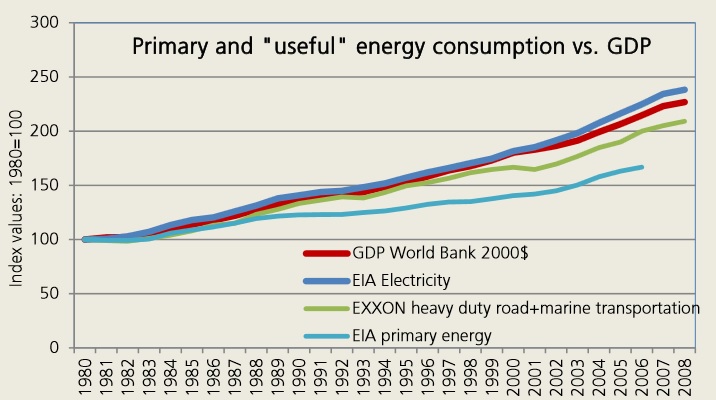

A long term graph of human output (GDP) is one highly correlated with primary energy use. For a while (1950s to 1990s) improvements in efficiency, especially in natural gas plants, complemented energy use as a driver of GDP, but most of these have declined to now have only minor contributions. Since 2000, 96% of our GDP can be explained by 'more energy' being used. (For more data and explanation on this, please see "Green Growth - An Oxymoron"). Some resource economists have claimed that the relationship between energy and the economy decoupled starting in the 1970s, but what happened was just an outsourcing of the 'heavy lifting' of industrial processes to cheaper locations. If one includes energy transfers embedded in finished goods and imports there isn’t a single country in the world that shows a disconnect between energy use and GDP. Energy it turns out, not dollars, is what we have to budget and spend. Quite simply, energy is the ability to do work. How much work, we'll see below.

17. Cheap energy, not technology, has been the main driver of wealth and productivity

The chemical potential energy available from the burning of things (e.g. wood) is rather astounding when compared with the energy which we supply our bodies in the form of food, and the fossil fuels of coal, oil, and natural gas burn even hotter while also being much easier to store and transport. We quickly learned that using some of this heat to perform work would transform what we could accomplish in massive ways. One barrel of oil, priced at just over $100 boasts 5,700,000 BTUs or work potential of 1700kWhs. At an average of .60 kWh per work day, to generate this amount of 'labor', an average human would have to work 2833 days, or 11 working years. At the average hourly US wage rate, this is almost $500,000 of labor can be substituted by the latent energy in one barrel of oil that costs us $100. Unbeknownst to most stock and bond researchers on Wall Street, this is the real ‘Trade’.

The vast majority of our industrial processes and activities are the result of this ‘Trade’. We applied large amounts of extremely cheap fossil carbon to tasks humans used to do manually. And we invented many many more. Each time it was an extremely inefficient trade from the perspective of energy (much more energy used) but even more extremely profitable from the perspective of human society. For instance, depending on the boundaries, driving a car on a paved road uses 50-100 times the energy of a human walking, but gets us to where we are going 10 times faster. The ‘Trade’ is largely responsible for some combination of: higher wages, higher profits, lower priced goods and more people. The average american today consumes ~60 barrel of oil equivalents of fossil carbon annually, a 'subsidy' from ancient plants and geologic processes amounting to ~600 years of their own human labor, before conversion. Even with 7 billion people, each human kWh is supported by over 90kWh of fossil labor, and in OECD nations about 4-5 times this much.

Technology acts as an enabler, both by inventing new and creative ways to convert primary energy into (useful?) activities and goods for human consumption and, occasionally, by making us use or extract primary energy in more efficient ways. Even such services that appear independent of energy, are not so- for example, using computers, iPhones, etc in aggregate comprise about 10% of our energy use, when the servers etc are included. Technology can create GDP without adding to energy use by using energy more efficiently but:

a) much of the large theoretical movements towards energy efficiency have already occurred and

b) energy saved is often used elsewhere in the system to build consumption demand, requiring more and more primary energy (Jevons paradox, rebound effect). Technological improvement thus does increase efficiency, but higher levels of resource consumption and a larger scale of resource extraction offset this advantage.

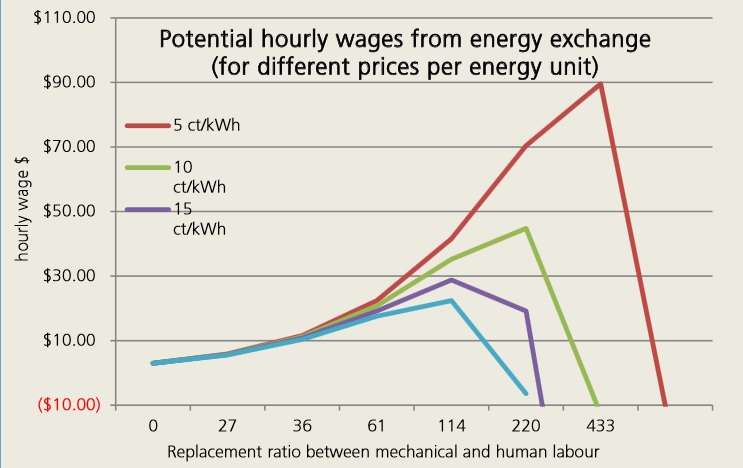

Despite the power in the Trade, its benefits can be readily reversed. Firstly, if we add very large amounts of primary energy, even if it is inexpensive, the wage increases/benefits start to decline. But more importantly, and has been happening in the past decade or so, as energy prices increase, so too do the benefits of the “Trade” start to wane. The graph to the right (source, page 18) shows that as the price of energy doubles or triples the benefits of this 'Trade' quickly recede. This is especially true for energy intensive transportation, like air travel, and for highly energy intensive processes, like aluminum smelting, cement manufacture- fully 30% of US industry falls into this category. The ensuing reduction in 'salary' from large energy price increases can only partially be offset by efficiency measures or lean manufacturing moves, because the whole 'Trade' was predicated on large amounts of very cheap energy. This is why the mainstream media touting increased oil production or the growth rate in solar/wind is missing the larger point - what matters are the benefits derived at the various cost points of energy extraction/harnessing. Even with large amounts of gross energy, if it is too costly, it is much less helpful or worse, the infrastructure, trade arrangements and expectations built upon continued $40 oil and $0.05kWh electricity will have to be changed. Basically, the benefits to human societies from the mammoth bank account we found underground are almost indistinguishable from magic. Yet we have managed, over time, to conflate the Magic with the Wizard.

16. Energy is special, is non-substitutable in the production function, and has an upward sloping long term cost curve

"Oil is a renewable resource, with no intrinsic value over and above its marginal cost... There is no original stock or store of wealth to be doled out on any special criterion... Capital markets are equipped to handle oil depletion...It is all a matter of money", M.A. Adelman, Professor of Economics, MIT Source

Physics informs us that energy is necessary for economic production and, therefore growth. However, economic texts do not even mention energy as a factor that either constrains or enables economic growth. Standard financial theory (Solows exogenous growth model, Cobb Douglas function) posits that capital and labor combine to create economic products, and that energy is just one generic commodity input into the production function - fully substitutable the way that designer jeans, or earrings or sushi are. The truth is that every single transaction that creates something of value in our global economy requires an energy input first. Capital, labor and conversions are ALL dependent on energy. For instance, the intro text by Frank and Bernanke (2d ed., 2004, p. 48) offers explanations for increased productivity: …increased quantity of capital per worker, increased # of workers, and, "perhaps the most important,...improvements in knowledge and technology." Nowhere in standard economic literature is there even a hint that the "improvement" in technology they refer to has, historically, been directly linked to the progression of displacing solar-powered human and animal muscle with larger and larger quantities of energy from oil, coal, and gas. Though energy is central (in that even more difficult ore grades require more overburden to extract, requiring more diesel fuel, etc), energy is not the only key limiter – other minerals and metals are finite and deteriorating in quality and cannot be (easily) replaced.

Since energy seemed the same as any other commodity economic models assumed that energy and resources would follow the same decreasing cost curve we have come to expect from gadgets like toasters and coffee cups, where the technology, outsourcing of parts to their lowest cost countries, and efficiencies of scale have generally formed a declining cost over time. For a while, energy too followed this curve, but given that high quality resources are finite, and require high quality processed resources themselves to extract and refine, eventually the cost curve of energy and other key minerals and ores, begins to rise again. This 'dual view' of energy vs regular everyday products is a key failing in economic texts. But for most of the past 60-70 years however this omission was perhaps understandable, as there WAS a continuing supply of cheap energy so its worth seemed to be just the dollar price of it. For most, this is still the dominant worldview – dollars are more important than energy.

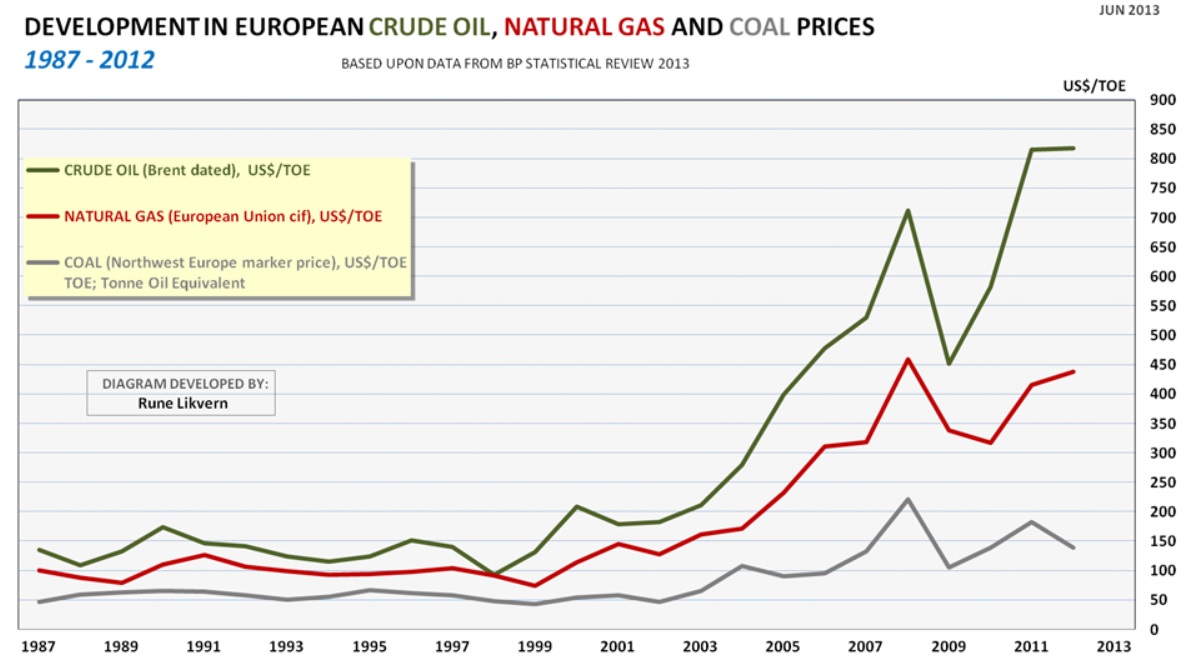

Historical cost curves for oil, coal and natural gas for Europe - Graph source: Rune Likvern Click to enlarge

15. Energy has costs in energy terms, which can differ significantly than dollar signals

“It is appropriate to conclude that, as long as the sun shines brightly on our fair planet, the appropriate estimate for the drag on the economy from increasing entropy is zero. William Nordhaus

“ The laws of economics are like the laws of engineering. There's only one set of laws and they work everywhere. One of the things I've learned in my time at the World Bank is that whenever anybody says "But economics works differently here", they're about to say something dumb. Lawrence H. Summers

“ ... the world can, in effect, get along without natural resources ... at some finite cost, production can be freed of dependence on exhaustible resources altogether.... Nobel Laureate Robert Solow

In nature, animals expend energy (muscle calories) in order to access energy (prey). The return on this ‘investment’ is a central evolutionary process bearing on metabolism, mating, strength and survival. Those organisms that have high energy returns in turn have surplus to withstand the various hurdles found in nature. So it is in the human system where the amount of energy that society has ‘to spend’ is that left over after the energy and resources needed to harvest and distribute that energy are accounted for. Finite resources typically follow a 'best first' concept of resource extraction. As we moved from surface exploration based on seeps to seismic surveys showing buried anticlines, to deep-water and subsalt reservoir exploration, and finally to hydro-fracturing of tight oil formations , the return per unit of energy input declined from over 100:1 to something under 10:1. To economists and decision makers only the dollar cost and gross production mattered during this period, as after all, more dollars would ‘create’ more energy flowing through our economies. Net energy can peak and decline while gross energy continues to rise, and indeed can go to zero when there is still plenty of gross resource remaining. Everything we do will become more expensive if we cannot reduce the energy consumption of specific processes faster than prices grow. Yet, financial texts continue to view economic activity as a function of infinite money creation rather than a function of capped energy stocks and finite energy flows.

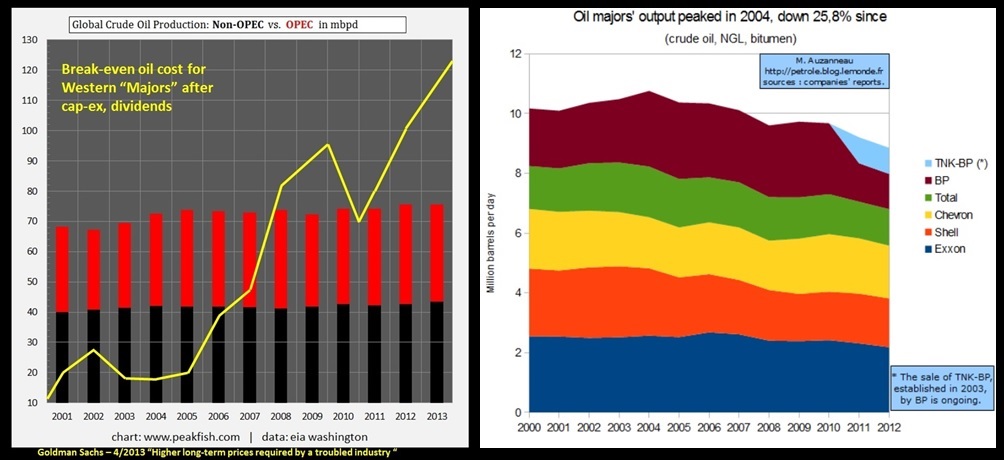

Left chart - western Majors price needed for cash flow break even in yellow, overlayed on OPEC vs non-OPEC crude oil production. Source IEA, Goldman Sach 4/13 report 'Higher long term prices required for troubled industry'. Right curve total oil production from Western Majors - source

Irrespective of the dollar price tag, it requires about 245 kilojoules to lift 5kg of oil 5 km out of the ground. Similar biophysical costs apply to every energy extraction/harnessing technology we have - but they are all parsed into financial terms for convenience. After all, isn't it dollars (euros, yen, renminbi) that our system is trying to optimize? But these physical input requirements will not vary whether the number of digits in the worlds banking system increases or shrinks or goes away. Though fossil fuels are our primary source of wealth, they were created a long time ago, and in drawing down their bounty we have not needed to pay the price of their generation, only their extraction. And, despite enormous amounts of sunlight hitting the earth everyday, real (and significant) resources need to be expended in order to harness and convert the sunlight into forms and at places where it can be used.

There is an enormous difference between ‘gross’ and ‘net’ which manifests in financial sphere via costs. Irrespective of our choice of nominal statistic measuring GDP (wampum or dollars or digits or gold), an increasing % of them will be allocated to the energy sector. If our objective is just to increase GDP, we can just keep growing gross energy by locating and exploiting deeper and deeper pockets of fossil hydrocarbons, but eventually our entire food, healthcare, entertainment infrastructure will be to provide for a giant mining operation. Few media outlets (none actually) handicap the new surge in gross USA oil production by a)capex requirements going up faster than oil prices, b) the enormous increase in diesel use in the shale plays and c) the higher API gravity oil (42 for Bakken, 55 for Eagleford) which exaggerate energy content per barrel between 3.5% and 10.7%. Under current trends, the implications of energy depletion is we will move from energy costing less than 5% of our economy to 10-15% or more. In addition to the obvious problems this will create, we will be using lower quality energy as well. As oil has become more expensive, we are increasingly going towards coal and wood to replace it. Already, in countries with a large drop in ability to afford (e.g. Greece) are cutting down forests to heat their homes in winter.

Net energy is what societies should be focused on, and most don’t even know what it is.

14. Money/financial instruments are just markers for real capital

Some material things make my life more enjoyable; many, however, would not. I like having an expensive private plane, but owning a half-dozen homes would be a burden. Too often, a vast collection of possessions ends up possessing its owner. The asset I most value, aside from health, is interesting, diverse, and long-standing friends. Warren Buffet - The Giving Pledge

Growing a big bank account is like fat storage for animals – but it’s not, because it’s only a marker for fat – its caloric benefit stored for the future is intertwined with a sociocultural system linked to monetary and credit marker. In business school, (and on Wall St.) we were taught that stocks going up ~10% a year over the long run was something akin to a natural law. The truth turns out to be something quite different. Stocks and bonds are themselves ‘derivatives’ of primary capital - energy and natural resources – which combine with technology to produce secondary capital - tractors, houses, tools, etc. Money and financial instruments are thus tertiary capital, with no intrinsic value – it’s the social system and what if confers that has value and this system is based on natural, built, social and human capital. And, our current system of ‘claims’ (what people think they own) has largely decoupled from underlying ‘real capital’.

13. Our money is created by commercial banks out of thin air (deposits and loans are created at same time)

Though societies require ‘energy’, individuals require money in order to transact in the things energy provides. What is money anyways? I certainly didn't learn in business school (or any school for that matter). Quite simply, money is a claim on a certain amount of energy. When our economic engine kicked into gear in the early 1900s, money (not energy or resources) was the limiting factor. We had so much wealth in our natural resource bank account that we needed ways of turbocharging the broader economy so productive ventures could be undertaken by anyone with skill, products or ambition. It was around this time that banks came into existence - to increase the flow of money to match the productive output of our economies only made sense - too little money and we couldn't produce the 'power' needed by a hungry world. Creditworthy individuals/businesses could now obtain loans from commercial banks who were required to keep a small portion of their assets on reserve with a central bank. And it worked fabulously well. Correlation=causation and all that.

We were taught to view credit creation as a series of consecutive bank "intermediations", where some initial deposit rippled through the banking system and via a multiplier, created additional money. E.g. banks are unable to create credit themselves, but are just passing on some wealth already created. This is true for about 5% of money coming into existence. The reality for 95%+ of money creation is profoundly different. The standard concept of lending describes a transfer of an existing commodity to its exclusive use somewhere else. However, this new credit extended by banks does not remove purchasing power or claims on resources from anywhere else in the economy. Since banks are capital constrained, not reserve constrained they lend when (ostensibly) creditworthy customers have demand for loans, not when they have excess reserves. As such the ‘fractional reserve banking’ system taught in textbooks and demonized on the blogosphere is not the proper description. I didn't learn this until 2007 or so. Banks do not lend money, they create it. And this is why the focus on government debt is a red herring. All of our financial claims are debt relative to natural resources.

**(Edit - This new paper by Bank of England states precisely what I did just above -banks are not just intermediaries as taught in textbooks)

12. Debt is a non-neutral intertemporal transfer

The left graph, shows the disconnect between GDP and aggregate, non-financial debt. In every single year since 1965 we have grown our debt more than we have grown our GDP. The right graph shows the inverse - how much GDP we receive for each new dollar of debt - declining debt productivity. Source: FED Z.1 2013, NBER

(Note: I use the terms credit and debt interchangeably, though creditor and debtor are opposites)

Of the broad aggregate money in existence in the US of around $60 trillion, only about $1 trillion is physical currency. The rest can be considered, ‘debt’, a claim of some sort (corporate, household, municipal, government, etc.) If cash is a claim on energy and resources, adding debt (from a position of no debt) becomes a claim on future energy and resources. In financial textbooks, debt is an economically neutral concept, neither bad nor good, but just an exchange of time preference between two parties on when they choose to consume. (* we were taught in corporate finance, because of the deductibility of interest, choosing debt over equity is preferred in situations with taxes – but in the real world, when capital markets are open and credit is flowing, if a CEO has choice between financing a project with equity or debt, he/she will almost always prefer debt. And so they do.) However, there are several things that happen when we issue debt/credit that cause the impact of the convention to be much different than in the textbooks:

1) While we are issuing debt (especially on a full planet) the best and easiest to find energy and resources deplete making energy (and therefore other things) generally more expensive for the creditor than the debtor. People that choose to save are ‘outcompeted’ by people who choose to consume by taking on debt. At SOME point in the future SOME creditors will get less, or nothing. (the question now is ‘when’ and ‘who’)

2) We increasingly have to issue more debt to keep up with the declining benefit of the “Trade”, lest aggregate demand plunge.

3) Over time we consume more rather than adding productive investment capacity. This lowers debt productivity over time (debt productivity is how much GDP we get for an additional $ of debt, or the ratio of GDP growth relative to debt growth). If an additional dollar of debt created a dollar of GDP, or anything close, it would be more or less like the textbooks claim – a tradeoff in the temporal preferences of the creditor and debtor. And, when debt productivity is high, we are transforming and extending wealth into different forms of future wealth (energy into productive factories etc). But when debt productivity is low (or approaching zero as is the case now), new debt is really just an exchange of wealth for income. This is happening now in all nations of the world to varying degrees. E.g. since 2008, G7 nations have added 1 trillion in nominal GDP, but at a cost of increasing debt by $18 trillion – and this doesn’t include off balance sheet guarantees.

Debt can thus be viewed two ways – 1) from a wealth inequality perspective, for every debtor there is a creditor – a zero sum game, 2) all claims (debts) are relative to the energy and natural resources required to a) service them and b) pay off the principle. (So, think 2 Italians: Gini and Ponzi.)

11. Energy measured in energy terms is the cost of capital

The cost of finite natural resources measured in energy terms is our real cost of capital. In the short and intermediate run, dollars function as energy, as we can use them to contract and pay for anything we want, including energy and energy production. They SEEM like the limiters. But in the long run, accelerating credit creation obscures the engine of the whole enterprise - the ‘burning of the energy’. Credit cannot create energy, but it does allow continued energy extraction and much (needed) higher prices than were credit unavailable. At some point in the past 40 years we crossed a threshold of 'not enough money' in the system to 'not enough cheap energy' in the system, which in turn necessitated even more money. After this point, new credit increasingly added gross energy masking declines in our true cost of capital (net energy/EROI). Though its hard to imagine, if society had disallowed debt circa 1975 (e.g. required banks to have 100% Tier 2 capital and reserves) OR if we had some natural resource tether – like gold – to our money supply since then, global oil production and GDP would likely have peaked 20-30 years ago (and we’d have a lot more of the sub 50$ tranche left). As such, focus on oil and gas production numbers isn't too helpful without incorporating credit forecasts and integrating affordability for societies at different price tranches.

An example might make this clearer: imagine 3,000 helicopters each dropped a billion dollars of cash in different communities across the country (that’s $3 Trillion ). Citizens that get there first would stuff their backpacks and become millionaires overnight, lots of others would have significant spending money, a larger number would get a few random hundreds stuck in fences, or cracks, and a large % of the population, not near the dropzone, would get nothing. The net effect of this would be to drive up energy use as the new rich would buy cars and take trips and generally consume more. EROI of the nations oil fields wouldn’t change, but oil companies would get a higher price for the now harder to find oil because the economy would be stronger, despite the fact that those $3 trillion came from thin air (or next to it). So, debt went up, GDP went up, oil prices went up, EROI stayed the same, a few people got richer, and a large % of people got little to nothing. This is pretty much what is happening today in the developed world.

Natural systems can perhaps grow 2-3% per year (standing forests in USA increase their volume by 2.6% per year). This can be increased via technology, extraction of principle (fossil carbon), debt, or some combination. If via technology, we are accessing energy we might not have been able to access in the future. If we use debt, we are diverting energy that would have been accessible in the future to today by increasing its affordability via handouts/guarantees and increasing the price that energy producers receive for it. In this fashion debt functions similarly to technology in oil extraction. Neither one is 'bad', but both favor immediate consumption on an assumption they will be repeated in continued iterations in the future.

Debt temporarily makes gross energy feel like net energy as a larger amount of energy is burned despite higher prices, lower wages and profits. Gross energy also adds to GDP, as the $80+ per barrel oil extraction costs in e.g. Bakken Shale ends up being spent in Williston and surrounding areas (this would be a different case if the oil were produced in Canada, or Saudi Arabia). But over time, as debt increases gross energy and net energy stays constant or declines, a larger % of our economy becomes involved in the energy sector. Already we have college graduates trained in biology, or accounting, or hotel management, working on oil rigs. In the future, important processes and parts of non-energy infrastructure will become too expensive to continue. Even more concerning is that, faced with higher costs, energy companies increasingly follow the societal trend towards using debt to pull production forward in time (e.g. Chesapeake, Statoil). In this environment, we can expect total capital expenditure to keep pace with total revenue every year, and net cash flow become negative as debt rises.

In the last 10 years the global credit market has grown at 12% per year allowing GDP growth of only 3.5% and increasing global crude oil production less than 1% annually. We're so used to running on various treadmills that the landscape doesn't look all too scary. But since 2008, despite energies fundamental role in economic growth, it is access to credit that is supporting our economies, in a surreal, permanent, Faustian bargain sort of way. As long as interest rates (govt borrowing costs) are low and market participants accept it, this can go on for quite a long time, all the while burning through the next higher cost tranche of extractable carbon fuel in turn getting reduced benefits from the "Trade" creating other societal pressures.

Society runs on energy, but thinks it runs on money. In such a scenario, there will be some paradoxical results from the end of cheap (to extract) oil. Instead of higher prices, the global economy will first lose the ability to continue to service both the principal and the interest on the large amounts of newly created money/debt, and we will then probably first face deflation. Under this scenario, the casualty will not be higher and higher prices to consumers that most in peak oil community expect, but rather the high and medium cost producers gradually going out of business due to market prices significantly below extraction costs. Peak oil will come about from the high cost tranches of production gradually disappearing.

I don't expect the government takeover of the credit mechanism to stop, but if it does, both oil production and oil prices will be quite a bit lower. In the long run it's all about the energy. For the foreseeable future, it's mostly about the credit

But why do we want energy and money anyways?

Continued in Part II

Very interesting article. I look forward to the rest of the article.

How far away from south central Minnesota are you in Wisconsin?

nice article...I read a book recently about the civil war Return to cold mountain I think...there was a part about how important a dog was to warning if marauders came on the property. I see it you see why can't the rest of the country and world see the flaws in the system...I guess it is just as well..the fear that comes will be untenable.... "We have nothing to fear but fear itself"

I have a huge library on all things related to our overshoot. When pressed to choose only one item to educate a (smart) newbie I usually return to your "Navigating a Room Full of Elephants". Now I have this excellent article to elaborate on your talk.

Sincere thanks for all your amazing contributions on TOD and best wishes for your future.

P.S. I hope you have found time to read Varki's Denial. I have finished my third reading and am relishing the deeper understanding of the insanity that surrounds us.

Rob M

Wonderful stuff. Some websites out there would charge a high membership fee to read analysis even half this well digested & presented. What a nice closing gift to the TOD readership. As archives go, this site will have a lot of nuggets worth mining.

Total agreement!

This one piece , freely given, is worth a hundred times more than a free lifetime subscription to every business publication in the entire country.

The only problem with it- which is on no way whatsoever Nate's fault- is that well over ninety percent of us lack the prerequisite knowledge needed to truly understand it and to FEEL it in our gut, in such as way that we will act on it , in our lives day to day, and in the voting booth.

If we send the link to our friends ,families, and coworkers, only a small fraction of the small fraction that actually read it will be able to comprehend it.

I will point out that I just condemned our educational system in the comments of the Bartlett post in the harshest polite language i could come up with in the few minutes i spent composing that comment.

I just had an old friend (since the seventies) leave after a few days few minutes ago.Career teacher of business education , graduate of a respectable university, a lifelong liberal democrat.

He's a great guy, with his heart in the right place, and in his retirement he is doing significant volunteer work for one of our greatest natural treasures, Shenandoah National Park.

This is a man who keeps his car radio on NPR, and he reads the Washington Post- used to any way, on a daily basis.

He believes in global warming, but he has accepted GW on faith- He has basically zero knowledge of physics and chemistry chemistry, and almost none of geology or any other hard science.

Since he has no real understanding of the problem of GW , any harebrained scheme thought up by anybody with a suit and a spreadsheet will look like a possible solution to him, if the man in the suit has a a rep for making money, or a suitably impressive diploma on his wall.

I just found out to my utter astonishment- which unfortunately I was not able to completely conceal- that he didn't know who cracked the DNA problem.

He freaking didn't know who Crick and Watson are.

Incidentally, his wife teaches English in a very snooty high dollar private school now, but she worked in public schools for almost forty years..

I'm perfectly sure she knows even less science than he does.

Between the two of them, they have probably had well over ten thousand kids , maybe as many as twenty thousand, pass thru their classrooms.

Nate, I would drive five hundred miles to stand in line to shake your hand.

I wouldn't say that about more than a handful of people in the whole world.

Mac

I wanted to reply to your long comment over at Jerome's last post.

In addition to thanks to Nate & Jerome and all; THANK YOU. ;)

best wishes with the apples & nuts and all

Phil H

Mac, I concur 100% And, if word got out it would be a very long line.

This (series) post is the most important, and the most impressive of the many many post in TOD. And done now - at the end.

I am glad, and at the same time sad. Glad to have the chance to see that at least one someone agrees with all of what has become almost a rant on my part, is sufficiently educated to present the facts in a straight forward and understandable way, and, praise God, is a Chicago MBA!!!!

But that should surprise no one. There is no more passionate preacher than the converted.

Thanks for your many posts. When shaking Nate's hand, I hope yours would be nearby to shake as well.

Craig

OFMac- and all

Just returned to TOD and amazed by the latest valuable contributions. I will read over the next month.

Note: The concepts of "discovery" and "patents" are terribly flawed /biased by potential personal benefits, including $ and power/control to manipulate and dominate.

"Edison's" electric light, "Bell Labs'" transistor, "Bell's" telephone, "Watson/Crick's" DNA helix, "Xerox'" copier, "Manhattan project's" Abomb, "Teller's" Hbomb, etc all were dependent on the work product of others who are rarely acknowledged and sometimes almost unknown and even actually unknown. All the while, legal maneuvers, theft,bribery and murder were often the inconvenient backstory to who was officially credited.

Best to all who contributed to TOD and/or read and learned. I raise a toast to the best there is in Mankind. As each makes an exit, may they return in a new ,expanded edition.

.

I agree that our patent system is in dire need of an overhaul- mostly because of the ill influences brought about by our having way too many lawyers and too much corporate money buying influence, and corrupting the intent of the system.

My own wag is that probably half , maybe more, of all the patents issued each year for the last five years or should not have been granted, because they simply aren't new inventions in any real sense of the word real.

But I do believe we need a patent system- otherwise tech progress would be much slower, because applied research and development of new discoveries would be slowed considerably.

Business men, especially small businessmen, would be reluctant to spend their limited capital introducing new tech to the public, knowing that without patent protection , any other company with the wherewithal to do so could jump immediately into the new market- without having gone to the expense of demonstrating and proving out the new tech.

Marijuana for instance is well proven to be a great natural medicine- but no pharmaceutical company will develop the potential, because there is no way to patent the result- and with hop patent, no way to sell enough of the new med, for enough money, to pay for the r and d. Testing a drug for safety and efficacy costs tens of millions of dollars.

There is imo another fault with the system that has come about with changing times. I think that things are changing so fast these days that patents should expire in no more than eight to ten years from either the issue date, or maybe fr4om the f date of first commercial use.

Having said all this, I also agree that a whole heck of a lot of scientists and inventors have been denied the just fruits of their labor, mostly by by scurrilous employers and lawyers in their employ. i also agree that women and "people of color" have been denied intellectual credit and monetary compensation simply because they weren't male and white- or the 'right ' other color, depending on their country- on many occasions.

But in terms of the larger debate about the future of the human species, and the future of the rest of the biosphere, credit or the lack thereof is pretty small potatoes. The world is not a fair place.

Totally agree with you, Greenish.

best

Phil H

Reading all these replies- it seems that the saying about the internet is true- people just go online to read what they already believe. Peak Oil has become a vast echo chamber. There isn't a single real question being raised here- just affirmations- like church.

Nate's post makes no acknowledgement of the abilities of humans to discover new things about nature which allow them to unlock additional energy sources (and the price mechanism which drives this effort). Its as if humans were just some species of rodent trying to survive in a rain forest that is dying. It is a world without intelligence- just simple entropy and draining supplies of resources.

There is a very hidden bias in all PO writings- that man is essentially a dumb passive creature who awaits his doom like a cow. That all scientific discoveries of any value have been already found out and there is nothing else to consider but how fast things will collapse. It is a world devoid of intelligence- populated by brutes who have no idea of what they are doing (but somehow were intelligent enough to create all the technological devices around us). PO doom is based on the singular paradoxical notion that people were once amazingly smart enough to create a high tech world and then, all at once, - everybody collectively loses their brains.

people just go online to read what they already believe.

Don't confuse the readers with the writers - for every person writing something that they haven't really thought out, there are another 10 people lurking and reading, and learning. Some of them aren't writing, because they know that they have something to learn....

That's generally true.

It certainly seems to have honked YOU off not to read what you already believe.

I offered congratulations on a nicely-written essay. They fell somewhat short of "hallelujah".

I don't actually see you asking any questions, for that matter; seemingly just making truculent assertions about human exceptionalism. If you don't often see such congratulations for the stuff you write - which I can believe - you perhaps shouldn't begrudge them to those who put in the effort to be original.

Dude, did you actually read it?

The gist of your comment seems basically religious; you're seemingly fluffed by the fact that the essay and many of the comments are based on referenced science and good observation. Since you responded downstream of my comment, I'll note that I think there's some tasty irony in your invoking "man's intelligence" to distinguish Nate's stuff from yours.

The good news for you is that the site's closing down, and there's no shortage of sites which assume that humans are magical beings who will always be saved from reality by their exceptional cleverness. Get thee there, and be blessed!

I too have had somewhat similar thoughts, but I would not put it so bluntly. I also think it would be foolish to dismiss PO and other limits because man is intelligent and can fix anything. Predicting behavior and phenomenon in the future is a risky business and doubly so with intelligent participants involved, but assuming that technology will come to the rescue is in itself a risky assumption.

Our technology is now so complicated that it is well beyond comprehension of any of us. In fact the only way that we can manage it at all is incrementally by building upon the works of all those who have come before us along with depending upon a fully functional supply chain.

This means among other things that if the current machine stops for any length of time, it will be difficult, if not impossible, to restart it. Even simple tools and machines are not so simple if you have to build from scratch without a fully functioning and working supply chain. And don't think that you can easily revert to a previous technology. You won't have that supply chain either.

IMO there are also inherent limits in our ability to continue to incrementally build upon the existing works. Based on my experience with software, at some point the system becomes so complicated that additional modifications are no longer worth the effort. In software this typically means that major and costly architectural surgery is necessary. In practicable terms this often means that you have painted yourself into a corner with no way out.

Nature is the final arbiter of what is possible and what is not. The hidden assumption on this forum is that the society we created with fossil fuels is not possible without. That may or may not be the case, but for me at least, it is a real question, the most important one of our times.

Also, it is indeed possible that some technological breakthrough will solve our problems. But it is very hard to write something intelligent about the likelihood of such an event. It more or less boils down to faith. On the other hand, lots of intelligent things can be said about a world where no such breakthrough occurs. IMHO Nate's piece is in this latter category.

The "hidden bias" that "that man is essentially a dumb passive creature who awaits his doom like a cow" is a coupled strawman. I've seen very few hidden biases, especially on TOD; they've all been aired out here at some point, and it has been pointed out many times that humans are neither dumb nor passive.

Humans have been quite clever in their aggressive exploitation of virtually any environmental opportunity for wealth and growth. Our species has been historically consistent in this behavior. Those who have a bias that our cleverness will suddenly be diverted towards considering the long-term negative consequences of our exploitations are at a distinct disadvantage if the past is a good indicator of our future behavior, toward each other and the planet. Virtually all of our problems began as solutions, most of our wars have been for resources, and we have a habit of being reactionary when crisis forces our hand. I, for one, am not so naive as to believe that we'll suddenly change this behavior, come together as a species and discontinue our degradations of our environment. Oil was just our latest, greatest opportunity to do so at an unprecedented scale.

"Also, it is indeed possible that some technological breakthrough will solve our problems."

The problem isn't our technology; it's us. Humans are exceptional alright; exceptionally adept at deluding themselves into thinking someone else will cleverly solve their collective predicaments in a way that doesn't involve burning things, creating an ever-growing waste stream and trampling on anything that gets in their way. How's that working out so far?

I dont think the above essay said anything about the future. It used neutral language to state that energy is the basis for GDP and wealth. Did Nate say there won't or can't be new breakthroughs? I think it is clear that IF we get a new very cheap energy technology with sufficient returns that growth could continue for a while (assuming it is ok for environment).

And I think it is very clear (to most that have researched it that is) that we could have a meaningful society without fossil fuels, but it wouldnt have remotely as much consumption or peoples that it does now. The other aspect not mentioned, perhaps in Part II is 'time' - how many decades would we need to effectively transition to even a 50/50 mix? I don't know. I agree with the poster above that the problem is us. We are not satisfied unless we have growth. Our institutions were not designed to manage decline - and look around you - decline is already here, its just not evenly distributed

It used neutral language to state that energy is the basis for GDP and wealth.

The language was seemingly neutral especially if one has an underlying feeling that 'we are all going to hell in a basket.'

I'll bring up one little example from the essay

We are undergoing 6th great extinction, which is no wonder given that humans and our livestock now outweigh wild animals by almost 50:1. [my emphasis]

I drug up the pdf linked but haven't went through it entirely. From a glance it appears Nate's phrase 'wild animals' refers to only to land mammals, possibly birds were included I haven't had time to look that closely.

Using the term 'wild animals' the way Nate did shows a bias, it becomes a loaded term. Last I read the total masses of ants and of humans on this planet were within an order of magnitude of being equal. There are a whole lot of other insect species out there and fish and crustaceans and on and on. A reader might say well insects aren't animals. Well then are they plants? Nate was playing fast and loose when he with his readers emotions with that line, it's 'pitch' not science.

The definition 1. of animals in Webste's New World College Dictionary fourth editionany of a kingdom (Animalia) of eukaryotes generally characterized by a multicellular body, the ability to move quickly and obtain food, specialized sense organs, and sexual reproduction.

"Well we all knew Nate was talking about our fury warm blooded 'landlubbing' kin" the reader might respond. Well yes if the reader is a member of the church 'doom is upon us' they likely would know exactly what Nate was talking about this instant the loaded term 'wild animals' was dropped. If they were trying to sort things out in the science based framework Nate claims to be following they likely were left scratching their heads and might not have read a word farther.

That is just one very easy to dissect instance of a deep underlying bias in this essay. There's is substance in it but seperating the tares from the oats is no mean task.

I got that data from Bill Gates blog, where he linked to Vaclav Smils 'Harvesting the Biosphere'. Its wild vertebrates. Not insects (invertebrates).

With a little googling you can see that human population increased 16% from 2000 and livestock is up 25%. Assuming wild vertebrates are flat (unlikely), wild animals - all of them - are less than 2% of the total living weight on Earth- humans and our farmed animals are 98.5%. If it doesn't concern you that humans and our chattel are almost 50x the weight of all wild vertebrates, well then we just share different philosophies. I swear. The Crusades of 21st century will not be between Christians and Muslims but between businessmen and ecologists. When I heard that stat for the first time about 98.5% of dry biomass weight it felt like I had been punched in the gut. But the fact that someone (you) are quibbling about definition of animals and vertebrates when I linked to the source, kind of sheds light on how this 50:1 happened to begin with. I don't blame anyone, and don't think we planned it this way, but when faced with such facts to push them away is probably natural. Cognitive dissonance and all that

And I do not think we are going to hell in a handbasket. But I do think the drivers of growth -cheap energy and available credit are waning, and our institutions and political body are asleep. Part II is about biology, wants vs needs, GDP, and what its all for. I'll be curious what you think about that side of it

So you get the data from Bill Gates blog, why does your link takes right us to Vaclav's paper where one has to go through quite a bit find the numbers? Did you go through the paper and work out the numbers yourself? If you did kudos, otherwise there is good reason I feel like I'm on a used car lot or in the pews on Sunday morning (always felt the same to me) right now?

You do misread me though, I became extremely concerned about human impact on the biospher 22 years before you were Salamon trainee stint-elborated on in my reply to Phil. Of course I don't have the fervor of a recent convert anymore.

Yes I went thru the data. But to be honest I first thought wild vertebrates included whales, fish etc but Smils data are only land vertebrates. Still.

Yes, a pickle. And both an interesting and profound time to be alive

Yes, a pickle. And both an interesting and profound time to be alive

We are in agreement on that most certainly but do have a somewhat different set of experiences on which we have built our world view. I've a good idea of where you are coming from though but not having really been up there where the levers are being pulled it is likely my picture is missing a tad of refinement a possibly a key insight or few. You may also feel you've a very good handle on where I'm coming from, but not having truly scraped from the bottom after choosing your work path you likely are missing some key insights critical to my world view as well.

And though it is even less important than the 'aminal quibbles' we been discussing, thinking on it I realized your Salomon Bros. time came only 21 years after my epiphany--I hate to spread misinformation ?-)

My oil supply epiphany was much more recent. Christmas Eve Day 2004. It had to do with multiple big low pressure systems spinning off from the Gulf of Alaska, snow shutting down every artery into our isolated regional hub for days and the first type vehicle that came streaming down a freshly opened highway from the far reaches of the road system. I'll give you a hint, the rigs were long, tubular and empty.

When I heard that stat for the first time about 98.5% of dry biomass weight it felt like I had been punched in the gut. But the fact that someone (you) are quibbling about definition of animals and vertebrates when I linked to the source, kind of sheds light on how this 50:1 happened to begin with.

I had not time to respond to this yesterday but I do find your surprise incredulous.

How would you not suspect the balance was not something like that. Even in your relatively wooded state with fair size wooded and riverine patches interspersed with much of the tilled and pastured land you only have a deer population of 600,000 give or take, and you have something like 20-40,000 bear. The rodents might outweigh the bear and deer or not but just Milwaukee's people, cats and dogs could well outweigh all of the above. Last time I heard there were still a good number of dairy cows in the state and Milwaukee proper has less than 20% of the people.

It's just not a big surprise if you've been walking through this world with the blinders off, though it might help if you read something like National Geographic for 20-50 years and watched a bit of TV keeping a bit of a world grid program always running in the 'back of your brain.' Where would you expect this gigantic undomesticated vertebrate population to outweigh us and our pets and livestock?

Asia? lets see two countries with over a billion people long farming all the best land leaving only the steep mountains, deserts, boreal forest and permafrost underlain tundra as major wild habitat swaths--none those habitats support large wild vertebrate density

Europe? the best habitat long farmed with lots of big cities

North America? with coast to coast industrial farms--with the big wild swaths like Asia's not able to support much wild vertebrate population density

Africa? with its burgeoning cities and agricultural and logging pressuring the edges of all major reserves.

South America? a quick look shows 390 million people for less than 8 million square miles--no contest their either and lots of beef cattle

Australia? if it can support much life its a city, farm or a sheep or cattle ranch

Antarctica?

So again why was that such a punch in the gut, weren't your eyes open as you flew and drove across the country? My moves from the city kept me at the edges where wild 'animal' populations were on the high side, but when I moved from the upper Great Lakes to the Rocky Mountains I saw endless farms and cattle ranches not endless bison herds. I don't doubt I live in the only state where wild vertebrates might outweigh humans and their domestic livestock--though with all of our dogs it might be a push. Why do you think I scraped a living along the edge so long--I liked being where it was wilder. But in the end I found it best living here in the suburban bush of Alaska's second largest city where there is no doubt the we and our domestic animals far outweigh the wild stock.

edit on:

[by the way Nate, thank you for all your efforts posting and replying here and through the years. Your work always fosters lively discussion and at least a few commenters punch at your post's weak sections about every time. This time, before this bracketed section, my 'contribution' is ~2400 words. Certainly not as widely read as your key post and lacking in documentation (not going to fight the spam filter) but 2400 words is a significant reply to 6200 word essay. TOD is not all about rubber stamping the 'preachers' as some on this page have claimed. Thanks again to all that have kept TOD going. It has been a great run.]

Err... Luke

Nate actually wrote: "Our one species is appropriating over 30% of the Net Primary Productivity of the planet. (One can ask, how can we use 30% of sunlight yet have 50x the weight of the other vertebrates and the answer, as we will see below, is our consumption of fossil carbon)" - my emphasis.

The point about "sunlight" might have been qualified by the term "photosynthesis". We now comprise a large set of of our own simplified ecosystems and prior ecosystems have become heavily constrained. 'We' are very much a 'world-sized' event, on a par perhaps with the great glaciation events, but as Nate goes on to point out, we are having a disproportionate effect on the oceans.

I was the only commenter who might be described as 'Hallelujah', perhaps embarrassingly so. But Greenish had made clear points and I had no need to repeat them. I responded because I have witnessed the development of analysis on TOD and found this article a useful summary to end with. More 'thanks' on my part, than 'Hallelujah'.

Phil

Phil, thanks for making a comment I was going to make. Luke's unnecessarily-snide remarks are seemingly based on his ignoring the word "vertebrates", thus creating an issue to complain about.

Nate actually wrote: "Our one species is appropriating over 30% of the Net Primary Productivity of the planet. (One can ask, how can we use 30% of sunlight yet have 50x the weight of the other vertebrates and the answer, as we will see below, is our consumption of fossil carbon)" - my emphasis.

But he used the term 'wild animals' first. That is pitch as is the use of the term 'sunlight' instead of photosynthesis which I didn't want to go into as my first reply was already too long. It's intent is to work the emotions, it certainly worked in my case as I had forgotten he used vertebrates later--I did manage to actually read through this entire piece of Nate's by the way. There was not need for the 'wild animal' sentence whatsoever in a science based approach now was there? 'Pitch' by its nature is insidious and pitch does permeate all Nate writes. Though it probably is unavoidable if you are trying to sell any kind of change.

My position does appear to be misread. Years back I posted here what was my epiphany moment on man's global impact. My moment was on Labor Day or Memorial Day 1972--I'd probabaly could sort out the day combing thourh old National Graphic Magazines, they had input to a different part of the 'vision.' I had a 'vision' in which I saw the earth systems more or less as sand on pans of an old fashioned beam balance. There was a huge, huge, huge constant stream sand of input hitting the fulcrum of the balance and dividing equally between the pans where it hit the respective piles and then mostly fell off into the void--that represented sunlight. For ages man scurried around moving grains of sand on the balance pans and even between the balance pans without altering the balance a jot, the steady stream of sand was just so huge. But then we started whittling away at one side of the fulcrum moving the point just so slightly. The stream of sand no longer hit the pans equally. Things changed rapidly after that. Yes very a simple picture, easy to shred as ridiculously so. But it has power in its simplicity and gives the sun it's rightful place in the order of things.

I stand by my final statement

That is just one very easy to dissect instance of a deep underlying bias in this essay. There's is substance in it but separating the tares from the oats is no mean task.

Hey Luke, I respect your point of view. However even if there is some bias in Nate's post the underlying facts are unassailable! Humans are having a major impact on our life support systems and the ecosphere. Things simply can not continue on our present path for long.

Do me a favor take 23 minutes of your life to listen to this highly biased plea from E.O.Willson

http://www.ted.com/talks/e_o_wilson_on_saving_life_on_earth.html

Guess what I'm biased too and I even admit to having an agenda!!! I'm willing to use every trick I know of to help push things along in certain direction. Hint that direction is orthogonal to the current path that the vast majority of humans are pursuing! I'm more in Nate's camp on this!

Cheers!

Fred

I believe it was E.O. Wilson's piece in Nat Geo a while back that stuck the ant mass number in my brain, which jumped right back and screamed out as I read Nate's 'wild animal' sentence. My sometimes 3G connection makes the linked video painful to attempt to watch, is text available. OK got through it, its a plea for getting a better handle on what is here before it isn't.

Our path is not going to be redirected by rational forward planning all that much, but rather by reacting to the pressures around us--that is what every other species does here--watch the unfolding battle around the Obama EPA's modest new CO2 limits for power plants if you think otherwise. If our actions redirect the suns energy so as to slide us off the landscape that is how it will be, unless of course we are 'the chosen ones who reflect the perfection' and therefore 'the perfection' just won't let that happen--a dangerous point of view and one I know you don't hold. It looks very much like being a generalist is that path through this extinction, but that may be an illusion as the generalists might rely on tiny vulnerable specialists for their own survival.

Do what you can, mostly we can only try to more or less protect some bioreserves and encourage more biodiversity friendly tech. I don't see that falling ERoEI of fossil fuels is going to suddenly alter our planet dominating course. Burning FF the last couple centuries appears to have allowed us to reach a critical mass of interconnected brains, one which will allow us to redirect energy for our species use until the landscape is finally so changed that it says 'no more.' That of course could happen suddenly if some of the little critters interacted with us in just the 'right' way--but I'm not going to hope for that either. Some change was going to race down upon the current balance eventually, we appear to be the eventually no sénse in taking it to personal. The big system doesn't 'care' unless of course we are 'the chosen ones.'

Do what you can but don't expect peak oil to be the savior. In the meantime I just might work on that 'mosquito burger' you mentioned to me a few years back?-)

I agree Luke!

Though a few of us may be able to set off a few strategic and preventive control avalanches here and there...

There are a few solitary individuals out there doing what they can. But you are right there are no guarantees going forward.

Cheers!

Fred

Good luck to you and greenish on your avalanche control. Regardless how big we try and see things we are always more than a little myopic. The law of unintended consequences can be and very often is very unforgiving.

Well as I said here some time ago, our best hope may be that the intergalactic cable crowd finds our show too darned entertaining to let it go off the air any time soon--pretty chancy way forward though, relying on thumbs up from the arena crowd. Especially from an imaginary one ?-)

Humans will always try to do the best they can with what they've got. But if the speed or scale of events is too large, being smart won't help you.

It's easy to say afterwards you should have anticipated e.g. the height of the tsunami, but you have to balance the possibility of an event versus the cost of providing for it.

Take food grains: knowing that the climate is becoming unpredictable, how much grain should be in storage, where should it be stored, and who should pay for it? Unless you helpfully dream about seven fat cows and seven lean cows, you are going to have to guess, and maybe look stupid in the future as it rots away or runs short.

The closer the world comes to hitting physical limits, the more we resemble grains of sand on a sandpile that has reached criticality. There will be landslides, we know that for certain. But the individual grains can't control where or how big they will be.

Take Fukushima. If the wind had blown in a different direction they would have had to evacuate Tokyo. What the ripple effects would have been I don't know. Certainly devastating for Japan, and maybe for the rest of the world as well. For all we know there is a butterfly flapping its wings in the Amazon right now that will trigger the big one. What will it be and are we prepared for it?

This is a very popular criticism and it does have some merit to it. But first let me point out that, like those that you are criticizing, you make the same mistake in assuming what you already believe. Nate's post DOES acknowledge advancement and innovation in areas of efficiency. But he points out that much of the efficiency gains have already been harvested and that we are hitting diminishing returns. And this is somewhat true. However, I do believe there is a massive amount of waste out there that we can eliminate. The way we design homes is insane. We put almost zero effort into designing them to reduce energy usage. It is like all the aerodynamically stupid cars of the 60's and 90's . . . efficiency didn't matter because gasoline was so cheap.

But onto your general thesis . . . that science and innovation will save us. Again, the same principle applies . . . diminishing returns. Science and engineering do produce new things all the time. But except for a few areas such as digital electronics and bio-engineering . . . progress has slowed down a lot. We largely now understand the physics of the world. And although there are chances at some revolutionary breakthroughs such as harnessing nuclear fusion or massive solar PV efficiency increases, there just are no new energy sources to tap. When was the last time a truly new source of energy was introduced? I'd say over 50 years ago when nuclear fission hit the scene. Since then there have been no new sources of energy introduced. If science and engineering is going to save us . . . why hasn't it? From 2000 to 2007 oil shot from under $20/barrel to over $100/barrel. Where is our savior? The best we got was pressure-washing oil-stained dirt in Canada and hydrofracturing small deposits of oil trapped in shale. That's not gonna power the flying cars we all want.

We are going to keep discovering and innovating. And those innovations will help us a lot. But we've hit diminishing returns. And worse, the burning of ever more fossil fuels is now back-firing against us with climate change. So, no, we haven't forgot about innovation and discovery . . . we just acknowledge its limits. There is a small chance that something truly revolutionary will be created . . . but most likely, the innovation will just slow the problem of PO.

Argghh.. Why a good discussion sprouts here on the last tick of the clock! Science and engineering works on projects that are funded, and TPTB have different priorities than us (i.e. are not PO-aware or want to happily continue BAU) or quite possibly see lower-hanging fruit in some other venue. My business for many years has been custom embedded systems, and I can't recall a single customer making a business decision on the basis of oil depletion or climate change.

There's lots of innovation going on, sure, and lots of technologists would love to jump on a new bandwagon. Someone has to create the crisis first. Sadly I don't see that happening by accident.

For example, there are all these new cool switching power supply chips that convert one voltage to another at very high efficiency. Does anyone use them? Not if they cost a penny more than the older chips. Save money by consuming less power? Sure, but only if some entity - UL, CE, etc. - mandates lower power usage. I think engineers love to make products more efficient, just like a marketeer yearns to polish the company image, but lets be clear: the CFO calls the shots, and the bottom line is profit.

What we need is an economic imperative, clear enough to justify an Apollo-scale project. Then, you'll see lots of innovation, and quickly.

Solar photovoltaic, as something beyond hyperexpensive space applications, certainly is younger than a half century. Only now is it becoming generally economic.

The biggest potential I see ( not yet economic) is "hot rock" Hydrofrac hot rocks, pump water down and get hot water/steam back. Heat exchange to alcohol mix (customized for ground water temperature recovered from hot rock) and run alcohol steam through a turbine.

Other working fluids may work better than alcohol, but I know alcohols will operate well in creating high pressure steam below 125 C.

Best Hopes,

Alan

And, of course, practical wind powered generation is less than 40 years old.

And "safe"* steam power - the kind that drives the turbines that drive the dynamos is less than a century old.

*Safe - as in one doesn't see reports in the news about exploding boilers like one used to see.

he points out that much of the efficiency gains have already been harvested

That's not even a little bit true. The average US vehicle uses about 900 watt-hours per km - this could be reduced to 120 whrs with a Nissan Leaf, and a Leaf's efficiency could easily be doubled in turn. That's a 93% reduction!