The Energy Return on Investment Threshold

Posted by David Murphy on November 25, 2011 - 7:55am

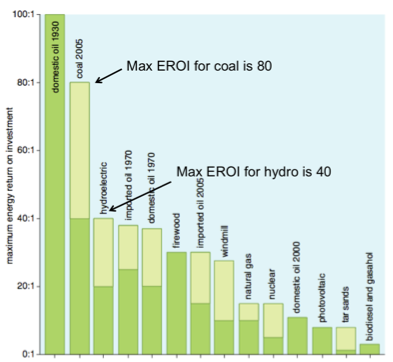

Hall and Day (2009) report that the EROI for coal might be as high as 80 and that for hydropower, EROI is 40. Does this mean that coal is twice as ‘good’ as hydro? The answer is no, and in this post I will discuss how this relates to the idea of an EROI Threshold.

The Net Energy Cliff

This post is based on a presentation that I gave at the recent ASPO conference on November 4th, 2011.

We must first realize that EROI is a somewhat theoretical concept; it is a unitless ratio that does not describe actual flows of energy. What society really cares about, and what is really used to grow economies around the world, are actual flows of energy. More precisely, the economy utilizes flows of net energy. What, if anything, can EROI tell us about the flow of net energy?

To understand how EROI influences the flow of net energy, we must first look at the equation for both net energy and EROI, which are:

Net Energy = Eout – Ein

EROI = Eout/Ein

If we solve the EROI equation for Ein and substitute it into the Net Energy equation, we get:

Net Energy = Eout*((EROI-1)/EROI)

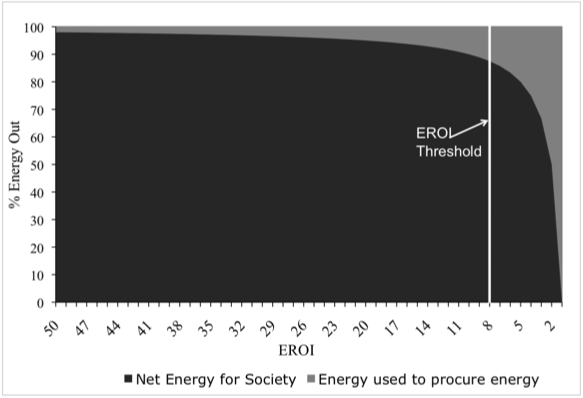

From this equation Mearns (2008) created the “Net Energy Cliff” graph. The net energy cliff figure relates the percent of energy delivered as net energy (y-axis, dark grey) and the percent of energy used to procure energy (y-axis, light grey) as a function of EROI (x-axis).

The Net Energy Cliff

The exponential relation between net energy and EROI creates what I am calling an EROI Threshold at roughly 8. Due to the asymptotic nature of the curve at high EROIs, there is little difference in the actual flow of net energy delivered from technologies that have EROIs above 8. The corollary is that extraction/conversion processes with EROIs below 8 result in vastly different flows of net energy.

For example, a drop in the EROI of oil extraction from 50 to 10 would result in a change in net energy flow from 98% (of the gross energy flow) to 90%. Yet, a drop in EROI from 10 to 2 would result in a net energy change from 90% to 50% of the gross energy flow.

This means that the relevance of EROI as a meaningful comparison of extraction/conversion technologies decreases as EROI increases. This is also the reason why I stated in the beginning of the article that coal, with an EROI of 80, is not twice as good as hydro, with an EROI of 40, because the actual difference in the flow of net energy between these two is very small. The truth is that they both deliver well over 90% net energy. What this threshold effect means is that, when substituting renewables for fossil fuels, it is less important to match EROIs (i.e. substituting coal for a renewable that also has an EROI of 80), and more important to focus simply on avoiding very low EROI technologies (EROI < 8).

Major Caveat to the EROI Threshold

There is one major caveat to this discussion. The logic behind the EROI Threshold only applies if the EROIs being compared are actually commensurable: i.e. that the EROI analyses utilize the same set of assumptions. This is often, however, not the case.

One significant difference between the EROIs calculated for fossil fuels and that for renewable technologies results from the intermittent nature of renewable energy. It is commonly thought that scaling renewable energy will require the adoption of some sort of storage system to account for times of over- and under-production. The EROI of wind or solar PV will surely decrease if we allocate the energy costs of those storage systems to the solar PV or wind conversion process. The question is whether this added energy cost will decrease the EROI of these systems below the EROI threshold, but to my knowledge, there are no peer-reviewed papers reporting EROI numbers that included these costs.

Bottom-Line

EROI is a useful metric for comparing across energy extraction/conversion technologies, or for comparing the extraction/conversion process of one resource over time. But as EROI increases, and especially as it increases much beyond 8, its relevance, as it pertains to net energy flows, fades. Furthermore, due to the aggregated nature of the EROI statistic, every analysis involves assumptions. It is important that those who use these EROI statistics understand what those assumptions are and what they indicate about the utility of the EROI statistic produced.

References

1.Hall, C.A.S.; Day, J.W., Revisiting the limits to growth after peak oil. American Scientist 2009, 97, 230-237.

2.Mearns, E. In The global energy crises and its role in the pending collapse of the global economy, Royal Society of Chemists, Aberdeen, Scotland, October 29th, 2008; Aberdeen, Scotland, 2008.

David, your value for hydro seams low. Gagnon got much higher values (110-220). Also, I would like to pint out that all those values are calculated around a system boundary. Value calculated by EOI-LCA tend to be much lower.

The hydro values do seem low when you consider some of the run-of-the-river hydro projects (no dam). There is very little energy input required to build these projects, and the energy output can be enormous.

I saw one in Bhutan that was 1000 megawatts, and they had room for another three like it downstream of the first. Of course, Bhutan is a semi-mythical mountain kingdom high in the Himalayas, a modern version of Shangri-La, so it has enough vertical drop in its rivers to make this work. Most places don't have similar mountains.

The EROI of the Niagara Falls hydro stations must also be enormous. Most people don't know there are hydro stations at Niagara Falls (producing 4400 megawatts of power), nor do they realize that they cut back the flow of the falls when the tourists aren't there. Between 50 and 75% of the flow of the Niagara River goes through the generating stations.

very interesting , thank you , anything below 8 ain't worth doing basically , a though came to mind that Medieval period Feudal system had the peasants giving 7/8 ths of their output to the lord , does this represent a EROI of 7 perhaps? I thinking of agriculture systems compared with our FF one

Forbin

That would be an EROEI of 8. If you consider no population growth, of course.

It is general admited that agrarian society have an EROI between 5 and 10. Note that part of the takes were used to build and maintain energy production/plundering system. Mill were often under the control of the landlord, while army is a way to extract resources with high embodied energy.

Do you have any sources for that?

If I recall correctly, during pioneer days in North America it required about 25% of the land to feed the horses needed to plow it. That would give an EROI of 4, not 8. So I think the guideline of 8 as a minimum is unrealistic. An EROI of 4 is perfectly acceptable if that is the best choice you have. It did require a lot of cheap land, though.

OTOH, I think the Roman system of using slaves was considerably worse. I doubt the EROI of slave-based farming was higher than 2, which may be one of the reasons for the collapse of the Roman Empire.

The barbarians had a much more efficient system of pastoral agriculture, although it only worked at a much lower population (easily achieved by killing a lot of the Romans).

Tainter cover this aspect very well. From my memory, he has calculated an EROI of 10 from the agricultural process, much more from conquest.

I must also point out that one must distinguish EROI from ERR. The grain used by the horse dont matter as much as the grain used by the farmer. Horse are like tar sand, a lot of tar sand is use to extract tar sand but from the outside this does not matter much.

In primitive agriculture, the only energy inputs and outputs were food energy. So, in primitive subsistence agriculture, the inputs and outputs are equal, and the EROEI was not much more than 1. Being a subsistence farmer in ancient times was not a lot of fun, his main objective was to live until he died, which was not a long time.

Civilization stepped up this rate, until in the late Middle Ages, with the introduction of metal plows and horses the EROEI may have reached 4. They still burned up 25% of their food to feed the horses, but it was a lot better than burning up 100% of their food to grow enough food to work hard enough to feed themselves.

And then the industrial revolution hit, and with the burning of coal for fuel and the use of machines for farming and manufacturing, the EROEI skyrocketed. The introduction of oil for fuel pushed it even higher.

But I don't think an EROEI of 10 for ancient agriculture can be justified. I think it was a lot lower than that.

The way you comes to ten is to calculate how much calorie you get from each calorie spent. It must be higher than one because, you need energy for the elderly and children, who cant feed themselves. You need spare calorie to build you house and make your clothe. Overall, you don't save much however. EROI is not use to calculate the net energy of the economy, just the energy flow in the energy production.

I don't think this is David's point. His point is that with EROEI above 8 ordinary people don't notice the difference that much. Below 8, energy becomes something everyone starts paying attention to.

Do you mean 7/8ths or 1/8th. If they gave 7/8ths to the lord that would leave them with only 1/8 of their crop to live on for one year. They would have starved.

Anyway you cannot figure EROI from just knowing what they gave away or kept. You must know their original investment. And since that was mostly labor, that would be rather difficult to calculate.

Ron P.

Actually you can. One can simply stipulate that the food surplus is the net energy, since we know that medieval peasants pretty much worked their butts off and didn't enjoy any luxuries. Thus 7/8 of the crop was what they (and their animals) needed to survive and produce next years' crop, and 1/8 was the net energy. Stuart Staniford has taken this logic further and argued that the EROEI of medieval society was between 1.1 and 1.6.

Now, if large amounts of other energy besides food was used - firewood, for example - that might throw the result off by some amount.

Wait a second! -- You mean tar sands might not be a good idea?!

...But, through the lens of the the coming economic collapse: There's also a complexity component to future US energy sources. i.e. Once the economy simplifies & localizes (via collapse), it's only energy sources that have relatively simple extraction techniques & infrastructure requirements, and that don't require complex supply lines that will be viable at all. (ex: mostly contemporary solar stuff -- firewood, grains & veggies, passive solar, draft animal, solar thermal, etc.)

That these will necessarily supply a significantly lower energy flow rate will not bother the architect(s) of the Thermodynamic Laws one bit. ...And the still-living earth is totally psyched about it.

Roman empire has collapses when its EROI dropped following the conquest of all valuable land. There EROI ended to about 10 following the collapse.

I fear that industrialization may well be a one-time event in human history because of the energy investment needed to harness the residual, more complex fossil fuel sources post-collapse. If we screw up now I think re-industrialization would be very difficult to achieve.

Provided the biosphere remains habitable, after several million years without significant extraction of them, fossil fuels would accumulate again. Geologic processes would slowly create more mineral deposits.

Yes, except that the timescale for that would be more on the scale of billions of years, not millions.

Would this also mean that it is important to take into account Odum's "transformity" (eg a BTU of Coal is not the same as a BTU of electricity) ratios at lower EROI's?

Yes, this is something important too. The EROI presented here are all calculated in primary energy. In the case of electricity to get a 3x factor due to the conversion of BTU to kWh. This improve the EROI of PV compare to it pure energy production. Technology providing EROI lower than 10 are problematic.

I believe Odum has actually put the ratio at 4 to 1 when comparing primary FF energy to electrical energy

Might be, it depend of the technology used.

I believe the extra unit was added to account for the energy used to build the thermal plant which has a conversion efficiency of about one third or so.

It also depends on what the electricity is used for. If it is for heating the transformity may be a less. For process work such as driving a motor, it is probably on the high side... so, it depends.

If it is for heating the transformity may be a less.

Could be a 4, with a heat pump.

Not really. Whether consumers use coal for the heat directly, or consume electricity generated by coal, does not affect the amount of coal (equivalent) that is used to get more coal. That is what principally affects the threshold.

What about with substitutions for coal fired generation such as Solar PV or Wind generated electricity. As we deplete our coal reserves and the EROI's are lower these other technologies might be substituted even more than they are now.

Not quite sure what you're trying to get at.

It's true that the things you're referring to affect EROEI calculations and definitions, in various fashions. But I don't see how it affects David's overall point that above a certain EROEI, comparisons become less significant. His point is that below an EROEI of about 8, everything that affects EROEI becomes more important.

The point is:

input of 1 units of coal and output of 10 units = E-ROI of 10.

input of 1 units of coal and output of 3.3 units of electricity = E-ROI of 10.

How? Because 3.3 units of electricity in an electric motor will dig up as much coal as 10 units of coal in a steam engine.

The point is:

All of these things indeed go into an accurate understanding of the EROEI of given technologies, but David's point in the keypost is a meta-analysis that operates above all that.

We know there is a lot of work going on today to compute the EROI's of various energy supplies such as coal, oil, natural gas, wind, solar PV, etc. David made a good point that the really critical area of this analysis is when the EROI is less than 8 to 1 because the net energy is much much less. Well, this is the same area that some of the renewable projects fall into and renewables often make electricity. So, when we are comparing low EROI renewables against the high EROI fossil fuels (that need to be transformed into electricity to do work) it makes sense to include the transformity in the analysis. For example, one could mistakenly write off some of the low EROI renewable projects as not being economic if the transformity is not considered.

That depends of the actual usage for electricity. If you waste it for direct heating, you'll need the same amount of energy then, lets say, fuel oil.

And coal, no matter how high the eroi is, might not work as well as gasoline/diesel/etc for truck and heavy machinery, which is needed in the extraction of oil and gas.

The total energy input include lots of energy type: oil, gas, electricity and others. In the case of oil or gas extraction, they can be conveniently factorised as oil or gas, since theses energy sources can be of use everywhere, which gives a perfect, i.e. accurate, EROI involving a single energy source.

I would like to see an eroi of the type, lets say:

EROI = coal output / (oil input + gas input + coal input)

And, we should replace the oil inputs and gas by their respective EROI factor (namely (1 + 1/(EROI-1)) * energy input). That is, if you have an oil EROI of 2, then you don't need 10 joules of oil input, but 20, since you will use 10 to extract 20 and then use that oil to extract coal.

That give us an interesting figure where some source a considered to have an high eroi, but since they relies on a generous eroi by other energy sources, their own eroi is good. However, give a worst eroi for the energy extraction of the inputs, and you end up with a bad eroi for theses.

Exemple:

Coal extraction EROI with oil and electricity = 10 TJ of coal output / (0.2 TJ oil + 0.02 TJ electricity)

Oil extraction EROI with oil = 40

Oil factor = 1 + 1/(40-1) =~ 1.025 = fo

Electricity conversion = ( 3 TJ * (1 + 1/(fc-1)) + 0.05 TJ * fo) / 1 TJ = fe

Coal extraction EROI with oil and electricity = 10 TJ / (0.205 TJ + 0.02 TJ * fe)) = fc

fc = 37.3406

So the EROI for coal would be, in energy alone, 45, but since electricity is much more valuable, we get 37.3406 assuming electricity and oil inputs. Everything is factorised as coal or self-sufficient energy sources (using their own EROI).

With changing oil EROI, labeled as x and using the latter assumptions, the Coal EROI would be:

We can see that coal extraction isn't that much dependent on oil EROI until it reaches a value lower then 10 or 20. Now, to make steel and heavy equipment we would need anthracite and others.

In conclusion, I feel the method, given the right values, is much more reliable as EROI because the result is a closed system, like on a drilling platform where you use gas to extract gas. Only here you need a coal mine, an oil well and a coal power plant to make the system closed.

Coal powered steam engines would work quite well in big trucks.

Much coal mining can only be done by electrical equipment, for safety reasons. Much mining, especially underground, has been electric for some time - here's a source of electrical mining equipment. Caterpillar manufactures 200-ton and above mining trucks with both drives. Caterpillar will produce mining trucks for every application—uphill, downhill, flat or extreme conditions — with electric as well as mechanical drive. Here's an electric earth moving truck. Here's an electric mobile strip mining machine, the largest tracked vehicle in the world at 13,500 tons.

to make steel and heavy equipment we would need anthracite and others.

Electricity can suffice for iron reduction/smelting.

In principle yes. But transformity doesn't necessarily lower the EROEI of fossil fuels (see Nick's post).

To repeat, I think it is the wrong interpretation of David's 'threshold' idea to think that EROEI sources below 8 are not economic. That's not his point.

I agree with your first and second points. However, I also believe that some of the lower EROI renewable projects may be viewed as un-sustainable because of their lower EROI's if transformity is not considered. This may be the right answer in some cases but I wanted to point out that we need to make sure we do consider transformity, where applicable, and especially in the low EROI cases in order to get a truer picture of what is going on.

I think that renewables' economic competitiveness with fossil fuels might be underestimated if transformity is not taken into account. Sustainability is another question, which David is not addressing in the keypost.

In any case, we are not really disagreeing on much of anything here.

When looking at storage and other 'backup' for renewables it is important to consider the also concepts outlined in this report from members of the IEEE Power and Energy Society on "Wind Power Myths Debunked" as there are other ways to at least partially address the storage issue using for example 'energy balancing' between geographic regions. http://www.ohiowind.org/PDFs/Wind%20Power%20Myths%20Debunked.pdf

I assume that the ow EROEI for tar sands is because large amounts of natural gas is currently used in the extraction and refining process. A lot of this NG is stranded from other markets, so I think a more representative measure would be the EROEI of the combined tar sands/NG operation, which would be somewhere between the figure for the two technologies separately .

Also, I wonder if we could estimate the minimum EROEI for industrial society overall that would be needed to sustain a given level of industrial technology. For example, I think we are already beyond the point where manned interplanetary travel is likely to occur, we simple do not have enough spare energy and never will have. At some point technologies will become too capital intensive to develop further - how many more generations of Moore's Law development of semiconductor technology can we sustain before the potential market return falls below the cost of development? Will we ever build a commercial fusion reactor even if we have the technology today to sustain a net energy positive fusion reactor core? If a solar storm took out half the GPS satellites would we have the funds to replace them? In the longer run, could we afford to replace processor fabrication plants?

Large scale renewable energy systems and adaptable power grids are as dependant on electronic control and communications as conventional power stations. In the long run will we need to employ third world level technology because we cannot sustain anything else?

Power for controls is actually very small when compared to the energy it is controlling.

It is important that we remember the non physics and non engineering sides of this issue.

There are always bigger envelopes, at least until you get to Greenish's "alien biologist " pov.

I fully recognize the implications of the fast drop off of useable and useful net energy at an eroi of around 8 or 10 after seeing this graph here for the first time-up until now, I didn't have any good idea just how high eroi must be to achieve stability if not sustainability of an industrial economy.

My hat is off to the author and the originators of this fundamental work.

The non engineering and non physics side-the human side-of this issue may play a far more important part in the short to medium term than expected.

A million tons of concrete and steel can be used to build a mega mall with high rise office and residential towers, or it can be used to build a hydro electric power station.

The first option will consume energy at a prodigous rate for either the life of the infrastructure, maybe fifty to a hundred years, or until the collapse of bau renders it worthless.

The second option will produce prodigious amounts of power times ten or a hundred or a thousand for at least a hundred years or so-and imo, for a lot longer with maintainence, at least at a reduced level of output.

At the personal level, we can either "invest" energy in a beer run in our oversized suvs , or we can invest energy in insulation and a a solar domestic hot water system. At the society level, we can invest in wind, solar, hydro, and maybe some biofuels-or football staduims and jumbo jets to fly road warriors and tourists around..

The thing to keep in mind is that in either case, the energy will be spent.It will not be conserved to any serious extent;we are naked apes, not Vulcans.

Arguments about the fundamental eroi of hydro or solar pv pale into insignificance when this is considered from a practical pov for the short to medium time frame.

Of course over the long term, eroi will rule as firmly and as harshly as the fundamental laws of physics.

In a couple more decades, basic engineering texts will probably have chapters devoted to the concept.

I think Ralph's point was more that the energy required to run an economy capable of producing those controls (the only kown example being the economy of the last n years) is huge. So, if we lose the ability to produce them, for whatever reason, we probably will never be able to produce them again,

Peter.

If we are going to have a power grid at all we will need something to control it. We are still using a lot of old electromechanical protective relays as described in the Applied Protective Relaying hand book by Westinghouse from years ago. http://www.amazon.com/Protective-Relaying-Wetinghouse-Electric-Corporati... However, these controls are clunky, use lots of materials to construct and consume a lot of energy. Some of these relays operate all of the time in the 'fail safe' mode so they can consume a lot of electricity. I think the newer electronic controls will be an improvement over these old electromechanical switches, etc. both from an energy and materials consumption standpoint. Adding intelligence such as sensors, advanced communications and coordinated control systems, and computers to our electrical grid infrastructure can substantially improve efficiency and reliability through enhanced situational awareness, reduced outages, and improved response to disturbances. It also enables flexible electricity pricing that will allow consumers to monitor and control their own energy usage and costs.

Yair...dunno..a new neighbour spent three hundred plus bucks on a you-beaut electronic sensor to shut down a little diesel pump when the tank overflows...and then he saw my jam tin on a piece of fishing line that fills up when my tank overflows and shuts off the Honda...it's even got a little hole in the bottom so the water drips out and a spring resets for the next start...effective, low-tech and cost nix.

Controls are getting just too complicated. Every effort should be made to reduce complexity.

Cheers.

You make a good point ..... However, ecological economist, Elinor Ostrom, recommends that we embrace complexity in order to be able to deal with the challenges of this complex world.

I'm not familiar with Ostrum, but it seems like she doesn't understand that decomplexifying should be the objective.

Antoinetta III

She was the first women to recieve the Nobel Prize in Economics (2009) for her work "Governing the Commons" and she also serves on the board of the Stockholm Resilience Center. http://www.stockholmresilience.org/aboutus.4.aeea46911a3127427980003326.... She is well informed about our our energy and environmental challenges.

Vision

The vision of the Stockholm Resilience Centre is a world where social-ecological systems are understood, governed and managed, to enhance human well-being and the capacity to deal with complexity and change, for the sustainable co-evolution of human civilizations with the biosphere.

Mission

The mission of Stockholm Resilience Centre is to advance research for governance and management of social-ecological systems to secure ecosystem services for human wellbeing and resilience for long-term sustainability. We apply and further develop the scientific advancements of this research within practice, policy, and in academic training.

http://www.stockholmresilience.org/aboutus/visionandmission.4.aeea46911a...

I don;t disagree that these things can improve "situational awareness" , but is this really necessary, or beneficial? The grid has been functioning reliably for decades. I would argue that the overall grid has been far more reliable than any computer software yet written.

All outages where I live (BC) are caused by weather events (or scheduled maintenance), and no amount of software, controls or complexity will change that one iota. Putting cables underground will, but at enormous cost that far exceeds the benefit.

When you add al these sensors and things, they have to be maintained, and upgraded more often than the grid they are controlling. Also, the grid operator can then become dependent on those control systems suppliers to "reprogram" stuff when needed. If those people are on the other side of the country, or world, or have gone out of business, then what?

Real world example - the Sky Train in Vancouver is a driverless transit system, that relies on automated controls, sensors, etc etc. But it still has people sitting in a room controlling that - instead of sitting in the drivers cabin. It costs twice as much per passenger mile to operate and maintain this system as Calgary spends on its train drivers. And when the Sky Train needs to change/update something, they have to get the specialist in from S. Korea - how reliable, really, is that?

As for time of day charging, that can and has been done for decades simply with two meters. For residential customers, adding complex systems to enable many rate options, and real time flexible pricing is pointless - you have all this cost so that homeowners can save 87c a day more than just by having peak and off peak. And that is only if they are constantly gaming system - what is the point?

In keeping with the EROEI theme of this post, I suggest we need more 80/20 solutions, complex things like the "smart grid" end up deliver 90% of the benefits, but for 50% of the cost, not 20. It is taking overall EROEI backwards.

The real savings in electricity are to be had by identifying and eliminating customer wastage, and shifting discretionary loads to off peak. We do not need to get real time electricity prices on our smart phones to do that.

Further real-world example - WMATA trains in Washington, DC. That system is highly automated, although since people sit in the drivers' cabs, it doesn't look it. But every now and then they run short on some exotic 1970s relay or other. Then the drivers actually have to drive the trains - with almost the same disastrous effect on schedule-keeping that's a perpetual everyday debacle with buses...

Yair...I know I always bring things back to the basics but some things realy erk me...For some months we have been enduring protracted road work on the main north/south route through Queensland.

Originaly they started off with the normal reversible stop/slow sign...simple cheap effective...we now have a solar powered traffic light unit mounted on a trailer with a remote and the operators are bored jitless sitting in a reclining camp chair and I suspect they go to sleep.

I understand the solar powered set up rents for two fifty bucks a day...this is progress?

You can be sure there is some concern in there about "safety", for the people having to stand by the road, and out in the sun etc.

That said, the traffic lights are sometimes needed when you still have one lane operation at night, and there is no work going on - then they are worth their cost.

Otherwise, its another example of how many employees want someone to spend money to make their job easier, almost redundant, but still keep their job.

That often contributes to declining EROEI

I can't imagine that they're renting the sign. Not unless they only do road projects for 2 weeks a year.

Yair...Nick the electronic signs are rented...as is the track-hoe and grader and the trucks and equipment on the projects.

Cheers

Good god! That's an expensive way to do things.

It is extremely difficult for a construction company to maintain a steady enough flow of work to justify the enormous capital expenditures involved in buying heavy machinery.

So it is common for a company to own only such machines as it can use very frequently and rent the rest.

On a small highway job a dump truck might be used almost every day, but a backhoe might be used only a couple of days out of the month.

So it's cheaper by far to rent one for that two days.

Rental rates are actually quite reasonable at the "wholesale " rates paid by contractors.

Even a one horse operator such as yours truly can get a nearly new hundred thousand dollar machine, delivered and picked up, for five hundred bucks for a day;I can get it for five to seven days for about nine hundred, and for a month for two grand.No expense except the operator, fuel, and grease.

No property tax, no expensive secure storage yard to park the machine, no mechanic on the payroll to look after it, no truck and driver needed to haul it around.

Otoh, I paid twenty grand for a big four wheel drive backhoe (older and well used) and use it only occasionally-four days rent at five hundred a day is two grand and a first approximation of a ten percent return on my twenty.

I only need to run it ten or twelve days a year to justify owning it, so long as I can afford to have the money tied up in it.

The only way to get reasonably close to full time use out of lots of heavy machines is for somebody to rent them out to lots of different users.

I loan my hoe out to trustworthy neighbors in exchange for the loan of equipment I don't own, such as a dump truck, or in exchange for skilled labor.

Yeh, I've found it is often cheaper to do a week's rental rather than two or three days for several items. Likewise month v weeks.

NAOM

That makes sense.

OTOH, the comment said "..For some months we have been enduring protracted road work on the main north/south route through Queensland."

So, that's a big job, for a long time.

"we now have a solar powered traffic light unit mounted on a trailer with a remote... rents for two fifty bucks a day"

That can't make sense.

Paul - I hear what you are saying and you make good points for the BAU case. However, if we are going to integrate a meaningful amount of intermittant renewable energy (widely distributed generation) into the grid, this will make things a lot more complicated (for VAR, power, frequency and voltage control) which will require more complicated monitoring and control capabilities. If we are just going to run our remaining fossil fuels into the ground using conventional large scale thermal plants then electromechanical protective relays will probably handle this just fine.

Can we include large office developments?

That cement is a bit of a waste.

The primary manufacture of the steel though could supply a useful low-energy mine for catabolism at a later stage I suppose?

I always get a chuckle from the logic that the NG may as well be used to process the tar sands because it stranded. The NG would not be stranded if a pipeline was built to connect to the pipeline system further south in Alberta.

I agree.

If they can get the tar oil to the market, they should be able to get the natural gas to the market.

In point of fact, there are pipelines in Northern Alberta to connect the gas fields to markets as far south as Southern California and Mexico. However, you have to realize that it costs energy to move natural gas down a pipeline - and not a small amount of energy. As things stand, it is more efficient to burn the gas in the oil sands plants, which after all are sitting right on top of the gas fields, rather than send it all the way to Southern California or Mexico.

I have a problem with the energy cliff/threshold idea, and Forbin articulates the thesis I don't agree with: "anything below 8 ain't worth doing basically".

Now, if you have an EROI 7 energy multiplying system that comes for free, then you can connect them serially, and get an EROI 49 system (and again). That is, very low EROI systems may be viable if the energy source is plentiful enough, the labor resource needed to create the system is low enough and the environmental impact is low enough.

Please fill us in on the details of such a system-I'm ready to buy in if it can be done.

It's easy to envision one, at least. For instance, a fully robotic wind power construction and deployment system that is (entirely/almost entirely/arbitrarily) self sufficient (can recycle and repair itself and its deployed wind towers) and gives surplus energy.

Nothing in what you've described is 'serially connected.'

You're right, I take that back, if I may. It's a matter of scale, and the cost of that scale.

Wasn't the "fully robotic wind power construction and deployment system" powered by wind energy?

Yes, but electrons don't smell, so it doesn't really matter. If you set up such a black box, you feed it from the grid with 10 units (you do need to provide it at least at startup), and after a while, it produces, say, 50 units to the grid, for a surplus of 40. If you disconnect it from grid input and just take the energy from the system itself isn't a big issue.

Anyway, if you build another such system (of equal size), you couldn't feed it with the 40 surplus and get 200 units to the grid. That's where my "serial connection" may lead thoughts down the wrong path. You need to scale the systems in size or in numbers to get the 200 surplus. It isn't a magic box that just multiplies whatever energy you feed it with.

Given that the wind power can produce oil, steel, and requirement to make robots then yes it is possible. You'll also have to factor lower EROI caused by transformation of electricity into oil/steel. Oil coming from theses will be much less efficient and with lower EROI.

However, the multiplication thing here is simply a question of time. An EROI of 10 in 1 year is better then an EROI of 30 on 10 years**.

**If your maximum energy output is fixed, then your system output is equal to the inverse of the EROI, no matter how much iteration you make. The better EROI become much more important. The system is always equal to the EROI, but if the maximum energy output isn't the limiting factor, you get get to very very high levels of energy output.

Actually, you don't need to make anything up to show that E-ROI isn't the most important thing - there are good historical examples - see my comment below.

David – A very interesting and logical approach. It parallels the economic aspects of oil/NG drilling. As discussed before the oil patch doesn’t consider EROI when making investment decisions…at least not directly. The actual fuel used to drill a well is not only a small fraction of the total costs but also represents a very small percentage of energy even from a marginally successful well. At the upper end it’s totally irrelevant. The difficult aspect of estimating EROI for a well is estimating the embedded energy in the equipment. And the additional problem of amortizing that energy across the number of wells eventually drilled.

In a similar way to your analysis our economic evaluation makes little difference at the upper end. Two exploratory wells may both cost $6 million but one has a target of $30 million net reserves and the other $60 million. Both are quit economic projects but one is not twice as good as the other. First, the $60 million may find $20 million worth or reserves…or none at all. Dry holes happen. This is why I tease exploration geologists about doing detailed economic analysis of the projects: all exploratory wells are great investments because the geologist is free to pump the reserves up since there is a lack of data…that’s why it’s called exploration.

I’m a career development/reservoir geologist. Economic analysis of these types of projects is more similar to your EROI threshold. The reserve targets tend to be much smaller than exploration goals. Thus energy input is more closely approaching energy output. This is why development projects must have a high probability of success: little room for error. And that has always been the balance: exploration is high risk/high potential yield and development is low risk/low potential.

But now we have major plays that fall between these two extremes: the fractured shale plays. Almost every fractured shale exploratory well is completed because it's nearly impossible to tell what it will produce from indications while drilling. When was the last time anyone reported a dry hole in the Eagle Ford or Marcellus? I’ve seen wells with excellent fracture indicators lose money. And wells with little or no indication of commercial quality produce huge profits. Every shale well completed will produce some hydrocarbons…the question is how much and how fast.

The shale plays are a statistical game. Success isn’t based upon what any one well discovered…despite the fact most of the public oils like to report their big wells (and tend to not put out press releases on the less impressive results). My very rough estimate is that some shale plays will, in general, fall not too far above your threshold. Which isn’t that bad for the public oils. Their primary goal is not high profits (and thus not high EROI). It’s the maintain/grow shareholder equity. As discussed many times Wall Street rewards reserve base growth while typically ignoring ROR. I drill only conventional reservoirs and generate 2 to 3 times the return than even the better Eagle Ford wells. But if my company were public Wall Street would have very little interest in us…we don’t care how much of our reserve base we replace. It’s all about $’s in/$’s out. Of course, we would like to increase our reserve base as much as possible...but not at the cost of ROR.

But in the end there is a factor that has a significant effect on the EROI threshold: oil path economics will kill a project long before the projected EROI gets too low. The total non-energy costs of drilling a well are much greater than the energy consumed. And it’s the total costs that determine what gets drilled. Perhaps not coincidentally I recently estimated the minimum limit for a project to pass economic muster would fall close to an EROI of 10. Though it’s difficult to equate ROR and EROI directly to each other, there is obviously a relationship. But that relationship is made even foggier when the shale plays are analyzed. In theory a public oil could break even (make no profit) on every shale well they drilled but as long as they increaed their reserve base y-o-y Wall Street would bid their stock price up. I suspect such an effort would produce a threshold below your EROI of 8.

From the data I got from the scientific literature money return on investment (MRN) is roughtly equal to the EROI divide by 6 to 12. Hence, anything beloy and EROI of 10, is unlikely to make some profit. As you point out, there is a social cost to a technology that is not factored in the classical LCA analysis. I start a research project on this topic but obviously, there is a lot of job to do.

Yvan - Could you put a ittle more meat on that bone? In the oil patch a return of 15-20% is considered very acceptable. Depending on how it's measured historically 10% ROR is the norm. That would equate to an EROI of 60-120. That seems more than a tad high. And a 1% ROR would be an EROI of 6-12. Now that would seem to fit closer to that threshold of 8.

I am not sure that you can equate ROR to EROI with a simple linear transformation. EOR is net income over revenu. Energy wise it would be ROR=(Money_recovered - f_m *Money_invested)/Money_recovered=1- f_m/EROI (f_m=6-12). Hence,

ROR-1=-f_m/EROI

EROI=f_m/(1-ROR)

Hence for a ROR of 15-20%

EROI=1.2 * f_m

But I think there is a temporal factor that is not taken into account. An easier way to do the calculation is that the economic payback time is longer by a factor f_m, compare to the EPT.

Yvan - I agree fully. I thought ou were supporting that 6/12 relationship. Whatever the relationship certainly not linear. Certainly to complex for a geologist to figure out. Temporal: yes...just the other day I wondered is some one could come up with a NPV equivelent for EROI.

I disagree. The oilsands, as RMG has frequently pointed out, have an operation EROEI of about 6:1. Add in external embedded energy and this would be lower still.

BUT at current oil prices, these operations are *highly* profitable, the factor EROI to MRN would need to be about 3 to reflect this reality.

This is, quite simply, because different energy sources, in different places (or even different times of day or year) can have *vastly* different monetary values. Oil is currently worth 6x more per BTU than NG, so turning one unit of NG into six of oil will have vastly different returns than turning oil into 6x oil.

Any paper that puts an arbitrary ratio of EROI to MRN is ignoring this fact.

Perhaps the people that wrote that scientific literature ought to have to decide which energy producers they will invest their retirement savings in, and then see if they think that arbitary ratio holds true.

Economics is not a science, but neither is business - the scientists need to recognise this.

I said the 6-12 is an average that I found in one of my research sbout energy efficiency, and is it close that to the average economy EROI. You are right the ratio is lower for the oil industry. Unless you have both energy and money flow, comparison is impossible to do in a strict way. Trust me this is a rare occurrence in the scientific literature. And your are right, you can cheat using NG to leverage.

As for the tar sand, the EROI (~3) is low but the EER (External energy ratio) is around 10 and it is mostly natural gaz, which makes them profitable.

Rockman,

Very intriguing comments. Can you email me this "I recently estimated the minimum limit for a project to pass economic muster would fall close to an EROI of 10."

My email is theoildrumeroi at gmail dot com

David, I have a bit of a quibble with your report, one I've offered before on TOD. I think that the use of the abbreviation "EROI" is seriously confusing. While you have clearly defined what you mean, so that we here on TOD understand the meaning, outside this rather small group, the market oriented world will assume that this means "Energy Return on Investment", as in, dollars invested. I think that the better abbreviation would be "EROEI", as we really need to be passing this message beyond the choir, so to speak. Among the comments already posted this morning, there appears to be a mixing of units, with dollar cost and energy cost being conflated. If the message is garbled at the onset, it will be even harder to deliver it to the world beyond those who already understand...

E. Swanson

Yep, EROI is seriously confusing since the default standard-english meaning of "energy return on investment" is something else entirely, and is a commonly used phrase. Worse, it is a phrase which is often use in the same discussions. It's as though in an alternate world both spaghetti and meatballs are called spaghetti. One comes from ground-up cow parts, one is pasta, but we call them both spaghetti because the Pope does. This causes no end of foulups in restaurants, on shopping lists, and in manufacturing.

Continuing to use EROI because previous academic papers did makes little sense, unless the intent is to prevent the broader public from ever understanding it. EROEI, ER/EI, or even "net energy" is at least not inherently confusing. I beat that drum for a couple years here, but even the academics bold enough to post on TOD will seemingly stick with EROI until it's pried from their cold dead hands.

I've never seen a discussion go very far before the acronym EROI causes confusion. Because it's confusing.

Until the marklar decide to marklar the marklar, marklar will marklar the same marklar.

'Net energy' is not the same as ER/EI, as David made clear in the keypost.

Perhaps the subject is inherently difficult for most people no matter what. Some time ago I removed 'emergy' from the Wikipedia page for EROEI, where it was offered as a synonym.

Yes, I was talking about clarity of concepts.... apparently not clearly enough. ER/EI is a dimensionless ratio while "net energy" is expressed in energy units. More importantly, the ratio conceptually establishes the nature of an absolute limit we and all life are up against. It's a deep realization most people never have; that the same limits which apply to the energy expenditure of polar bear foraging also apply to human civilization.

That's an important thing... which makes it a shame to use an inherently-confounding acronym and phrase to refer to it. Thus, one winds up talking about "net energy" instead, which is a similar concept and doesn't suffer from the terminology problem.

Among other things, I've been an activist who has introduced new concepts and terms into contemporary human culture, and it's an easy thing to do wrong... hence my heckling for more clarity.

I think that's just a THEORY... >;^)

A question. As a novice to The Oil Drum, please forgive me if the question has been answered previously.

Whenever I read about energy returned on energy invested, I think of an ordinary alkaline battery, such as might power a torch or a clock or whatever.

The old received information was that it took 50 times the energy to make that battery than the user gets out of it. Is that an EROEI of 1:50? Or is it properly shown as -50:1?

It seems to me that, to most people, EROEI is irrelevant; what is important is the energy at the point of use, no matter what it takes to get to that point (plus of course the final cost). So it only matters once we pass peak energy, and maybe not then to some!

David

A battery isn't a source of energy, it's a way to store energy provided from some other source. Our basic problem is that humanity discovered ways to recover and use the energy stored in fossil fuels. Fossil fuels are like your battery example, the original energy is provided by the sun and the storage is the result of geological processes. Like your battery, once the fossil fuels have been consumed, there won't be any easy way to replenish that energy source or use the devices which have been optimized for each fossil fuel type. The cost in money is just a comparison between your income and the amount of energy available for you to use. At some point in time, no matter how much green paper the average man has in his pocket, he won't be able to buy enough of those fossil fuels to power a car or heat a big house...

E. Swanson

"A battery isn't a source of energy, it's a way to store energy provided from some other source."

With respect, I understand that; but why does that affect my saying that 50 units of energy are required to produce 1, in other words, EROEI 1:50?

David

Right on. I have attacked the EROEI concept many, many times since I started commenting on TOD. All to little or no avail.

EROEI has some validity if the form of energy in is the same as the form of energy out. This is true of oil wells mostly.

But when the form of energy in is different from the form of energy out there is often a gain in utility that compensates for very low or even negative EROEI numbers as in the case of batteries that you cite.

This concept seems to be very hard for EROEI believers to grasp.

When different forms of energy are compared as in the chart shown, energy is taken to be concrete and measurable. It is not. All energy is not the same. Each form has its own utility which can in many cases make up for the loss of energy inputs of one form to produce the newer form.

Energy is an abstract noun. It is not concrete. As such, charts showing comparisons of different forms of energy are inherently fallacious. This fallacy is called reification:

From Wikipedia:

Well, let's try it this way: you may have a valid point in there somewhere - but one "definition" of insanity is repeating the same behavior over and over and expecting different results.

It seems as though energy, on any reasonable definition, is real enough even if different forms do indeed have different utility under different circumstances. It is certainly real enough to be precisely measurable, real enough for the societal "we" to measure precisely the losses when we convert it from one form to another, and even real enough to kill us outright if we get in its way under the right (i.e. wrong) circumstances.

Anyway, I intuitively suspect that buried in there somewhere is a valid point, but I'm at something of a loss to tease it out for sure. Maybe a paraphrase omitting the notion of "reification" might help, I dunno...

No, he doesn't really. His argument boils down to saying that because these issues are complex, we can't know anything at all about them. By that kind of logic, no one knows anything about anything. It's pure sophistry, especially the part about reification.

X has a valid point.

I don't have any trouble understanding it;his argument is based on the simple assumption that so long as some forms of enerGy are plentiful and therefore cheap, and it is economically feasible to convert energy from such a form to another that is scarce and therefore more expensive-AND also worth the extra expense-due to increased utility-then EROEI doesn't matter.

And as a matter of fact , it doesn't-from the pov of a businessman.

I must say that it also doesn't matter much in any respect, for now, and for some considerable time into the future, excepting the theoretical respect.This is because all the decisions that are being made, and are going to be made for some time, are going to be made on the basis of cost and utility;the overall situation is analogous to the INVESTMENT DECISION PROCESS in the oil and gas drilling business which Rockman so capably describes.

Now at some future time, it MAY be that enlightened leaders decide that oil for instance must be conserved for use as chemical feedstocks, rather than burned as fuel, because it will require more energy to manufacture these from other raw materials such as organic wastes.

But as a practical matter, if energy is wasted by so burning coal to manufacture lubricants, nobody will give a hoot-excepting by oddballs who hang out on websites such as this one.(My friends sometimes say I am so odd I am weird-way beyond simply eccentric.)

EROEI will become critically important from a practical pov at the same time as energy from oil, coal, and ng becomes scarce and unaffordable-scarce and unaffordable to the extent that we must run our civilization on renewables for the most part.

If I understand this article correctly, we are going to be in very deep doo doo at THAT POINT in time if renewables can't supply copious energy at an EROEI return of about eight or better.(I personally doubt if renewables are going to be up to the job.)

X is a business oriented guy.

He is not concerned with theoretical matters that have no immediate practical applications or implications.

His pov is similar to that of the people who invent or support ponzi schemes such as social security.The less mathematically literate ones may actually believe such systems are sustainable.The smarter ones, privately, admit that they expect to be properly composted before the bill comes due.

I have less than zero use for corn ethanol, except mixed with spring water in moderate quantities.It is a really desperately dumb way to extend gasoline supplies, for many reasons other than a scanty return on energy invested for energy out.

But again, looking at this from x's pov, I can't really be sure what the EROEI of corn ethanol is-or might be, at some future time, when industrial waste heat might be used to carry out the distillation, etc.

Assigning an energy value to the high protein livestock feed left over is a very tricky business in and of itself-the answers found will depend on numerous assumptions involving the embedded energy in other fungible feedstuffs, not to mention the basic question of whether we should even be eating animals raised in confinement

The weight of the actual PRACTICAL evidence is on his side-what we are actually DOING follows his reasoning precisely.

The theoretical evidence is on everybody elses side.

We will eventually have to face up to that theoretical evidence-but not for a while yet.

Bau will rule-until bau collapses.

X may be as wrong as wrong can get, but hos type are in control of the levers.

OFM,

I made a previous reply to your post, which for some reason disappeared, perhaps because I was not nice enough to X. This reply is not the same; the other one was better. This is the best I can do instead.

Sure it does. First of all, if the business man is a venture capitalist looking at the energy industry, he ought to be really interested in EROEI. It will help tell him which technologies are not worth investing in, if the net energy is negative and there is no other advantage. Secondly, studying EROEI is just another piece of information that may tell you things about the direction of costs and prices in your energy related industry. Is it the only thing to consider? No one ever said it was. Is it stupid or a waste of time to consider it? I don't think so. Changes in EROEI will affect industry in all sorts of ways, and its useful for any businessman to have a clue about what those might be.

No, you can't be sure, but you can make an educated guess using science. Or at least you can listen to those who make those estimates. And that might lead to better decisions if you happen to be considering whether to stay in the the ethanol business or not. If X does not realize that, I think that's unfortunate for him.

Well stated.

If EROEI was the only concern, then no one would bother with electricity (EROEI no better than 0.4), and yet we do. The concept is a boundary case, and is of academic interest. As a practical matter, it doesn't matter. Something else will shut you down first if you are Rockman, or you will do it anyway if you can convert something readily available (coal, wind, sunlight) to a more useful form (diesel, electricity).

These EROI work because original EROI is high enough from start. If the original EROI was low, the conversion factor will bring the price of the final product to uneconomic model.

As a practical matter, it is a factor (albiet not the only one) that determines your business success or failure. It certainly does matter.

If you understand why EROEI matters, you might realize you have a better chance of taking your capital and moving to a new business before you get shut down. If you do not understand why EROEI matters, it will just happen to you and you will be unprepared mentally and probably financially.

I have some difficulty understanding why anyone who posts on this site dedicated to 'energy and our future' does not think that EROEI has practical implications.

Eroei simply DOES NOT HAVE any practical implications from a businessman's pov when considered in a time frame used to make business decisions on an ongoing basis.

Businessmen compute profits and losses and returns on investments and calculate or estimate their risks in MONETARY terms.

Now of course they do consider whatever estimates are available respecting the future costs of various sources of energy-IN MONEY, not in ergs or calories or kilowatt hours-and the MONEY cost is adjusted up or down according to what they estimate the energy will be worth depending on its FORM.

So a businessman may estimate that ten years from now that a gallon of gasoline will be worth eight bucks before taxes and that coal containing an equal amount of energy is worth only a buck and a half.

He will not give a hoot whether energy is wasted in converting coal to gasoline-so long as it looks like there is money to be made doing it.

OF COURSE he will consider the possibility that the PRICE of coal and the OTHER INPUTS NEEDED manufacture synthetic gasolinemight increase to the point that the investment in a coal to liquids plant might not pay off.

But all these considerations will be made on the basis of prices and expenses in money rather than energy.

I have an older Ford F150 4x4 that I have set aside hoping to convert it to a woodburner someday when time permits.My research indicates that 10 kilos of good dry oak chips will take me about as far as a gallon of gasoline if I ever get her running on wood.

Anybody who wants some good dry oak can buy it from me for a hundred dollars a ton cash underground economy price picked up at my place cut to stove length.Chipping will be another forty bucks.

That 240 dollars worth of wood chips(which would probably cost twice as much at retail in the above ground economy) will take me about as far as a hundred gallons of gasoline, which will cost me about 350 bucks.

But considering how much trouble it is going to be to drive that Ford burning wood, I would much rather pay TWICE or even three times as much for gasoline, so long as I can get it and have the money to pay for it.

I could care less about the amount of energy embedded in the oak as compared to the gasoline;the gasoline has far far greater more utility as ice fuel-enough greater utility that I would gladly pay two or three or even more times as much for the MOTOR FUEL ENERGY EQUIVALENT amount of gasoline.

(Just starting up a wood burner takes fifteen minutes, and it must be serviced every five hundred miles or so; and the engine , which should last another hundred thousand miles on gasoline will probably not last more than twenty thousand burning wood.Refueling will probably take at least fifteen minutes.Half of the cargo box will be taken up by the wood gasifier and a chip supply adequate for a hundred mile trip.)

Eroei will become important -critically important-someday.It is a very useful metric, an invaluable metric, in computing the outer bounds of what is sustainable.

But businessmen are interested in profit and loss, not sustainability.

A coal to liquid plant might be built with a planned life span of thirty five years.

A business man will not likely look any farther ahead than that.Liquid fuel on an equivalent energy basis will probably be worth a LOT MORE thirty five years from now than coal.The decision to build or not to build will be based on relative prices, not energy content.

And how do they assess their likely monetary returns on investments that will take many years to pay themselves back? By considering the many real world factors that might affect their cash flow. EROEI is a real world factor that many would do well to put in their stack of considerations.

That depends if they are the type of businessmen who want to make a profit only this quarter, or for the rest of their lives. There is nothing inherently anti-sustainability about business. It is a moral choice for a businessperson to completely ignore sustainability. If businessmen had no obligations to consider sustainability, then we could say that there is nothing wrong with Ponzi schemes. But of course, there is something wrong with them.

Did you miss my response to your post upthread? I don't get the impression that you really thought about anything I said in that post, and if this last post was meant as a response, I don't think you made any new points in it.

Sorry JB

I see that we are talking past each other.

My contention is that business men DO look as far as possible into the future, in estimating costs and returns-certainly any company building an electric power plant must come to the conclusion that they will be able to operate it for quite a long time in order to make a profit overall-maybe for twenty or thirty years or more.It will probably take that long to pay off the loans!

Business men ARE interested in sustainability in a narrow sense of the word-meaning that the business model will last at least for the time frame under consideration.That would be forty years for a power plant designed to last for forty years.

I tend to use the word sustainable in a broader sense-meaning a practice is sustainable if and only if it can be practiced for an indefinitely long period of time, such as centuries or millenniums.

Slash and burn agriculture in a vast tropical jungle or rain forest would be sustainable if only five thousand humans were practicing it in a territory of a thousand square miles.The farmers would not need to return to any given spot for a century or longer-giving that spot plenty of time to recover.This could continue for thousands of years if nobody barged in and the locals didn't develop any new technologies

The kind of farming I do is sustainable in business terms;my business planning time frame is about two decades, which is as long as I expect to live, if I'm lucky, and as far ahead as I can see the future-thru a dark glass, dimly.Our little farm is well taken care of in just about every respect.But we are utterly dependent on petroleum products;we started mechanizing in the twenties, two decades before I was born, and the process was substantially complete by 1950 or so, even though my maternal grandfather owned one last pet mule until sometime in the nineties.

So we are not sustainably farming, in the true sense of the word.Whether we can continue our own little bau business for even another half century is extremely doubtful.

And I do recognize that EROEI has enormous , critical, grave implications for our society as a whole.It is not hard to understand that a barrel of oil produced in East Texas in the 1930's required only a trivial investment in drilling machinery and concrete and steel pipe and so forth, whereas a deep water well requires very large per barrel investment of equipment and materials.This necessarily means that we have less capital and for machinery and materials to supply ourselves with other goods and services-a thousand tons of concrete and steel buried thousands of feet deep in an oil well is a thousand tons less available to builds a bride or hospital of course.

I guess what I am really disputing is the meaning of the words we are using-sustainable, theoretical, and practical.

To me sustainably means indefinitely; practical means "bau" and theoretical -in this context- means "of academic interest only" because "bau" is the controlling paradigm.

Best, OFM

Fair enough OFM. If your point is that we are in a paradigm (BAU) where the vast majority of (business) people completely ignore EROEI, I can't dispute that. I just don't think it's a good paradigm for us all to be operating in, and I think that at least to a certain degree we can choose to think about things differently. I'd guess that probably you can agree with that.

In order to avoid fruitless arguments, I would simply take the EROEI for that battery to be approxmately 0.02. That is, in discharging it one gets back 2 units of energy for every 100 used in producing it.

This implies that batteries of that sort wouldn't be practical as primary energy sources, since any system relying on them as such would quickly grind to a halt with each recirculation being 2% of its predecessor. It follows that EROEI itself isn't a reason to manufacture and use them, so we might choose to think of them mainly in some other way - such as a convenient and expensive way to get a little useful energy to a spot where otherwise there would be none at all. (Some folks might take said choice to be a matter of dogma, but that's unnecessary - the alternatives are merely points of view.)

In reality, the lengthiest arguments will be over in-between cases - such as corn ethanol used as fuel, which might be seen as an energy source with EROEI a touch over 1.0, or instead as a Rube Goldberg way to convert natural gas or coal to liquid fuel. Arguing over whether corn ethanol is an energy source or an energy carrier is somewhat fruitless, often a matter of "spin" where the outcome depends on where one's bread is buttered. The real question is whether it is worth doing. In the right circumstances, 70 joules of liquid fuel may well be worth a great deal more than 100 joules of coal - but even then, using corn as an intermediate step could be far from optimal.

A mountain lion could hunt wild boar and get an EROI of 50 and meet all of its energy needs. The lion could also hunt antelope at an EROI of 25 and catch two antelope instead of one boar and still meet all of its energy needs, although it had to spend more time hunting. The lion could catch 20 rabbits at EROI of 10 and still meet all of its energy needs even though it would be hunting nearly all of the time. However it could not hunt mice with an EROI of 4 because it would not have the time to do all of the other things a lion must do to stay alive.

Declining overall EROI and declining oil imports will expand the energy procurement part of the economy and shrink other sectors. To maintain the existing level of complexity will require greater and greater draw down of lesser and lesser EROI resources. After it's determined that future delivery of energy and resources will not be forthcoming with interest - bills, notes and bonds will be defaulted on. We can try to meet energy contraction with conservation and expanded government risk guarantees for energy producers. Along this path many more things will become too expensive to produce and there won't be credit or cheaper Asian labor to make up for increasing costs of energy. The next likely target for economizing will be labor costs and associated expenses in the West.

Where does it stabilize? When ninety percent of the population are involved in producing food and energy and the automobile, colleges, and most medical care have withered on the vine?

Precisely, it's about time! And for human civilization, an EROI system of 4 might suffice, since it might not take that much of our precious time away, if the system is automated enough. (The lion is the system - humans create systems, and that's a big difference.) EROI and time may not be that linked, and for renewable resources, depletion is not an issue but environmental impact may be. I simply don't think EROI is that important.

But the "system" is already automated. Just think of "civilization" as an automated system for extracting energy from the environment to make more "civilization". This process has been going on for a long time. Early on, the EROI was low (hunting/gathering/subsistence agriculture), then with improved technology this was boosted to something like 100 (early coal and oil). This high EROI allowed a much bigger civilization, which in turn tried really hard, using the best available technology to extract more energy. The process is ongoing but EROI is falling because the process is intrinsically self-limiting. There is just no way around it because any EROI greater than unity implies exponential growth, which is not sustainable in a finite world.

And gets more so all the time. Which is why EROI matters less.

What, why? This makes no sense. Look at the lion/boar EROI example of Dopamine. The lion has a great EROI from hunting, and then use the surplus energy when lying around yawning. He won't grow exponentially.

The EROI of the lion hunting needs to be greater than one if the is allowed to do things like sleep have sex and rest. You could design a "better", more efficient lion that didn't need to sleep. What would be the result. The lion would be able to hunt more. The supply of antelope would fall as result. The lion would then seek to improve the EROI by making more automated hunting systems (lion cubs). After a few iterations, the lion population would crash.

You are basically arguing that humans are different and are not limited by resource constraints, that energy usage can increase to infinity. This is unlikely to be true.

Yes, the lion population would crash, but that would be the start of a convergence toward a new equilibrium in relation to its prey. And at equilibrium the EROI of the lion hunt would still be high, and the lion would still not grow exponentially.

No, I'm arguing humans, since they are building systems that have degrees of separation from themselves and their use of time and effort, are not (very much) limited by EROI. However, the systems are subject to resource constraints and environmental constraints.

A cheap low-EROI oil sands operation, for example, can fuel our civilisation only as long as the resource base isn't depleted or the climate doesn't kill us. A cheap low-EROI breeder operation, OTOH, may be infinitely sustainable since the fuel resource base is extremely large. (Ok, nuclear breeder EROI is likely to be high, but anyway, let's assume it isn't.)

Your premise in your last paragraph is that nuclear fission breeder operations (I will assume that means as the majority source for Humanity's energy consumption) will be cheap.

That premise is unproven.

I suppose we should first define 'cheap', including defining all costs involved.

A second point: You may wish to claim that your preferred process is 'sustainable for a long time' vice 'infinitely sustainable'.

Yes, it is, but nevertheless it will be. I won't try to convince anyone in this thread though - too off topic.

No, we don't, since external costs are insignificant. Or perhaps you mean that we should be careful to include external costs of alternatives when we compare to today's energy costs? In that case, it's a good point.

No, not really. Or perhaps I do, to avoid pointless arguments. I could be extremely conservative and say "millions of years" instead.

Do you recommend any books which outline the vision you advocate of large-scale breeder fission electric power reactors?

Also, do you recommend any web sites which outline the vision you advocate of large-scale breeder fission electric power reactors?

To your knowledge, have their been any key posts on TOD which outline the vision you advocate of large-scale breeder fission electric power reactors?

This are honest questions...you obviously are convinced of the potential success of this approach, and I like to read, and wish to read the same sources you have read.

I am looking for sources that provide adequate details.

I think many designs would do, including the traditional fast breeder. However, the somewhat hyped LFTR breeder seems to show most promise for economy and safety. I'm sure you've heard about it, and if you want to know more, you can always start at the wikipedia entry and then google.

I'm not very inclined to give you more than that, since I know that whatever I give you, you'll follow up with claims that the information is inadequate and provide some miscellaneous accusations to go along with that. You're on your own.

I have already read that Wikipedia article, as well as every other Wikipedia article for all the past, present, and future fission reactor designs listed there that I could find. I also have read numerous sources on Gen III, GEN IV, Gen V fission reactor designs in the past found using Google search.

Thank you for your time to provide your reply...but I can do fine without you!

I would think that to in all cases, EROI decreases to the minimum necessary to maintain equilibrium between the species and its resources. If a lion doubles it's efficiency in hunting, the population of prey will decrease until a the EROI decreases to its original value. In principle, the population of lions could fall in order to maintain the higher EROI (few lions, lots of prey), but that would require a conscious choice on the part of the lions to limit their population.

In any case, the EROI of lions is 1.0. The EROI of hunting is higher only because very artificial boundaries are set for calculating energy. The energy lions consume while resting/other activities is also necessary for their survival.

The the human civilisation also has an EROI of 1.

This article is about the extraction of energy from the environment to run machines, the lion hunting was someones analogy. But clearly EROI as defined in this article also has to converge to one in the long term. This is also clear from the first graph above.

You have to be cautious here, because the supply of rabbit might go down and probably not be sufficient. With higher consumption because of the lower EROI, the rabbit population may simply go down, increasing the EROI because of population changes, which will drive to further ressource depletion and so on until the EROI reach 1.

That means, the population of lions will be limited the the population of rabbits much more because of its lower EROI. A better EROI, such as the antelope, would put less strain its population since the lions would need less hunting.

In conclusion, the EROI is not necessarily a static value, it may depend of usage.

Secondly, lower EROI drive up the ressource depletion (or total utilisation in the case of a replenishable supply).

Does this analysis take into account 'entropic dissipation' of energy generation ? In other words do the EROI figures take into account the amount of energy required to remove the bi-products of energy production ? This could well prove critical if carbon capture technologies are taken into account. Also the energy cliff graph is my opinion doesn't seem all that alarmist.. all it is really saying is that if EROI drops below 8, then more GDP and resources are spent on acquiring energy resources rather than consuming or using the energy resources themselves.. not bad if unemployment stands at 9% - putting idle resources into play. Seems to suggest that current high unemployment is transitional from a consumer based economy to an energy based economy ? Important thing to consider on a Black Friday shopping day.

This EROEI issue seems to be plagued with difficulties, as Jeppen's comment and the rude reply to it illustrate.

For example, it's not obvious to me that 8 is a magic number that's OK, while 7 guarantees utter collapse. Nor is it obvious that as EROEI decreases there's any particular value at which the general flow diagram must suddenly be reconfigured to a new topology. Nor is it obvious to me that low-ish EROEI is intrinsically a problem; it would seem to depend on the labor intensity and the size of the primary supply.

It must surely be a tacit assumption - and one that probably needs to be made more explicit - that the input energy to an EROEI calculation must be, in some sense yet to be defined rigorously, economically (oh, the horror of that hated word) relevant. After all, in the real universe, the Earth only intercepts around 0.00000004% of the output of the sun, and we don't factor the 99.99999996% of wasted sunlight into EROEI since it's economically utterly irrelevant. No labor or other human input is required to produce it, it's simply there no matter what we do.

So, certainly, in principle, one could imagine a set of black boxes with an EROEI of 1.1, supplying 10TW for human use, but with a total energy flow of 110TW, 100TW of which circulates back internally to feed the harvesting/production process. Of course that probably couldn't function on tacitly-assumed horse-and-buggy technology since there wouldn't be any time for human beings to do the other things they need to do in order to live. OTOH, we don't live in Roman times any more; if our black boxes were highly automated, then we would indeed have time to do other things, so why not?