Countdown to $100 Oil - High Energy Prices Suppressing Growth?

Posted by Euan Mearns on November 30, 2011 - 11:43am

This is the fifth post in the series following the oil price, markets and general health of the global economy, examining the simple theory that OECD recession may result from annual average oil price exceeding $100 / bbl.

The annual average price (AAP) of Brent went through $100 on around 16th August 2011 and the AAP stood at $108 on 22nd November. The AAP high point in the 2008 price spike was $104.8 on 9th October that year, and so $108 expensive dollars sets a new record. This is a short post updating readers with developments including speculation about why a weak world economy can now sustain record high oil prices.

Figure 1 Data for Brent from the EIA, 1 year moving average roughly equals 5 trading days per week divided by 7 days per week = 261 days. FTSE 100 data from Yahoo. Back in 2007 – 09, the top of the London FTSE 100 index was 6731 on 12th October 2007 (1). The top of the oil price spike was $143.95 on 3rd July 2008, 8 months after the market top (2). Both oil price and markets had declined substantially by the time the Lehman induced crash came in October 2008. The recent high in the FTSE 100 was 6091 on 8th February 2011 (3). The top of the recent oil price spike was $126.64 on 2nd May 2011, 3 months after the market top (4). Data at 22nd November.

In his autumn budget statement, UK Finance Minister George Osborne recognised that high energy prices were one of three factors suppressing growth in the UK:

And in addition to the Eurozone crisis, the OBR (Office for Budget Responsibility) give two further reasons for the weaker forecasts.

First, what they call the “external inflation shock”, “the result of unexpected rises in energy prices and global agricultural commodity prices”.

Their analysis is that this explains the slowdown in growth in Britain over the past 18 months.

The day after delivering this statement, Osborne participated in coordinated action with other central banks to pump even more liquidity into the global financial system sending commodity prices sharply higher. The political and economic elite do not seem to have grasped as yet the links between their economic growth policies and high energy prices that suppress that growth.

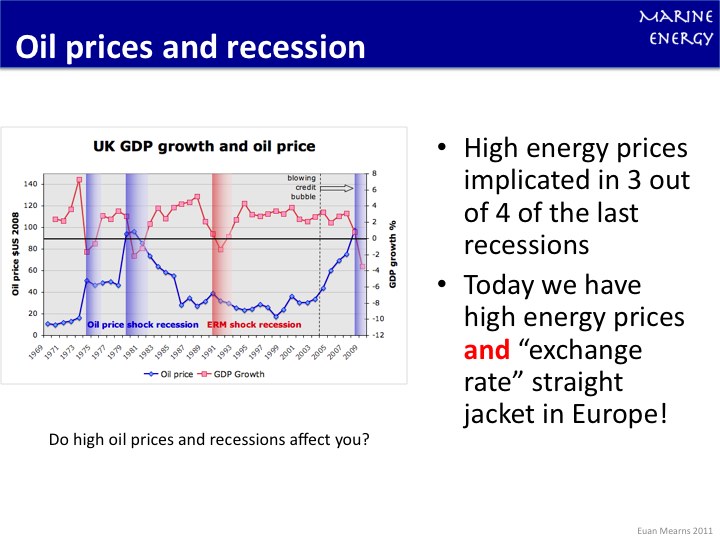

Despite the fact that most commodity prices are now in retreat, Brent oil prices remain stubbornly high at over $100. The historical precedent for high oil prices and recession in the UK is illustrated in the slide below, used in a lecture to first year undergraduates at The University of Aberdeen a couple of weeks ago.

Figure 2 The relationship between oil prices and recession in the UK. Note that countries in the Euro Zone periphery are contending with high energy prices, high interest rates, high € exchange rate and cuts to public spending at present. What chance recovery?

Three out of the last four UK recessions are associated (not necessarily caused by) spikes in oil price. The fourth was caused by the UK's membership of the Exchange Rate Mechanism (ERM) that preceded the € whereby countries pegged their exchange rate to a basket of European currencies (i.e. the Deutshmark) by adjusting fiscal regimes and interest rates. Defending this policy by ever higher interest rates led to the humiliating exit of the UK from this mechanism on what has become known as Black Friday. Norman Lamont (then Finance Minister) was humiliated and George Soros made a killing and became famous. The UK entered a sharp recession that ended when devaluation and a lowering of interest rates made our economy competitive once again. There is a message in there for the EZ countries. Germany is currently basking in the warm glow of a low exchange rate, boosting exports and growth while much of the European periphery is being barbecued, not just by a strong currency and rising interest rates but at the same time near record high oil prices. Something has to give - and will do quite soon!

And so to a look at a range of reasons for stubborn high oil prices:

1) Whilst is appears that a new AAP has been set, adjusting the previous peak of $104.8 from October 2008 for three years of inflation at 3% per annum provides an adjusted value of $115 in today's money. Thus prices must strengthen considerably from here to match the 2008 peak.

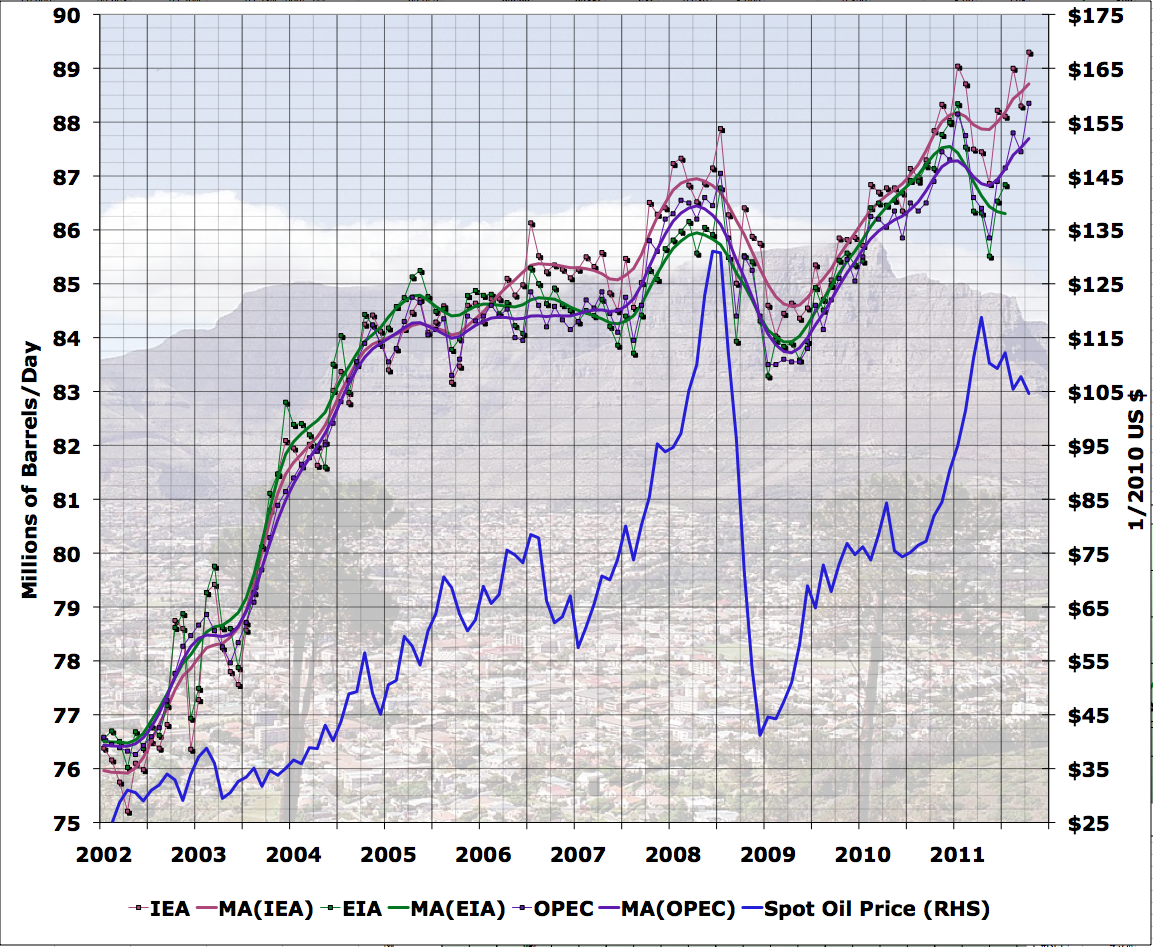

2) Global all liquids demand remains strong as this chart from Stuart Staniford at Early Warn shows. Thus while news abounds on weak growth in Europe and risk of double dip recession rises, it appears that these troubles have not yet affected oil demand at the global scale. Is Europe about to lose more share of the global oil market?

Figure 3 Global all liquids hit a new high in October 2011 suggesting that global demand is still strong despite near record high AAP for Brent. All liquids = crude+condensate+NGL+refinery gains+bio fuel. Chart from Early Warn.

3) The Arab Spring has turned to the Arab Fall and tensions in Syria, Iran, Egypt and Pakistan combined with continued unrest across the MENA region may continue to provide a risk premium for oil while other commodity prices fall.

4) The proximity of the back side of Hubbert's peak in crude oil means that the oil market is tight causing relentless pressure on price.

5) The theory that high oil prices lead to recession in the OECD may be incorrect.

I am not yet ready to declare a link between high oil / energy prices and recession as dead and my continued perception is that these persistent high oil prices are suppressing growth throughout the OECD and that it is this absence of growth that is in part responsible for the inability of certain European nations to service their debts. The unsustainable high nature of these debts is of course a major part of the problem too combined with the fiscal structure of the € zone that forbids participation of the European Central Bank in primary bond markets. Even if the € crisis is "solved" I believe we will see the peripheral EZ countries limping on with low or negative growth, burdened by high energy prices.

"oil is too expensive to support growth and at lower prices supplies will not be sufficient to support meaningful growth."

Rune Likvern

Earlier posts in this series

Oil prices and recession June 1 2011

Countdown to $100 oil - a date with history? July 11 2011

Countdown to $100 Oil - Deja Vu? August 26 2011

Countdown to $100 Oil - No Normal Recession October 17 2011

Regarding monthly total liquids data (which are subject to revision and which can be affected by inventory changes), some perspective: Five annual "Yergin Gap" charts follow, showing the gaps between where we would have been at the 2002 to 2005 rates of increase, versus the actual data in 2010 (common vertical scale):

EIA Total Liquids (including biofuels):

http://i1095.photobucket.com/albums/i475/westexas/Slide1-18.jpg

BP Total Petroleum Liquids:

http://i1095.photobucket.com/albums/i475/westexas/Slide06.jpg

EIA Crude + Condensate:

http://i1095.photobucket.com/albums/i475/westexas/Slide05.jpg

Global Net Oil Exports* (GNE, BP & Minor EIA data, Total Petroleum Liquids):

http://i1095.photobucket.com/albums/i475/westexas/Slide07.jpg

Available Net Exports (GNE less Chindia’s net imports):

http://i1095.photobucket.com/albums/i475/westexas/Slide08.jpg

I would particularly note the difference between the first chart, total liquids, and the last chart, Available Net Exports (ANE). At the 2005 to 2010 rate of increase in Chindia's combined net oil imports, as a percentage of GNE, the Chindia region would consume 100% of GNE in only 19 years. Apparently, there are 196 countries in the world. If we assume about a half dozen inconsequential net oil exporters, in addition to the top 33 net oil exporters that we have analyzed, that leaves about 157 net oil importing countries. As noted above, at their 2005 to 2010 rate of increase in net exports, as a percentage of GNE, in 19 years the Chindia region would consume 100% of GNE, leaving nothing for the other 155 net oil importers.

Normalized oil consumption, 2002 to 2010, for China, India, Top 33 net oil exporters and the US, as the annual Brent price increased at an average rate of 15%/year:

Note that CERA, et al tend to focus on the total liquids data while ignoring the GNE & ANE data. Since Daniel Yergin, co-founder of CERA, is now calling for less than a one percent per year rate of increase in total liquids productive "capacity," which is similar to what we saw from 2005 to 2010 in the EIA total liquids data (+0.5%year), it seems to me that Yergin is, almost certainly without realizing it, in effect predicting a continued decline in GNE & ANE:

http://www.energybulletin.net/stories/2011-10-24/daniel-yergin-massively...

Daniel Yergin Massively Reduced His Energy Estimates

*Production less consumption, top 33 net oil exporters in 2005, BP + Minor EIA data, captures 99%+ of total net exports

westtexas - I'm putting together a powerpoint for a presentation I'm doing about PO, carbon pricing and the possible effects on urban land use (its a bit esoteric, but is for a university audience, not a general one). I'd love to, with your permission, use these slides to illustrate that the predicament we face goes beyond total production.

Feel free to use the slides. If you need anything further, shoot me an email. I have some forward looking GNE & ANE slides, showing a couple of "What if" scenarios.

Jeffrey Brown

Great (on both counts!! I'll send you that email this evening.

Perhaps you can try this instead of your powerpoint presentation.

http://www.ted.com/talks/john_bohannon_dance_vs_powerpoint_a_modest_prop...

Excellent. What a fantastic alternative to death-by-Powerpoint. Thank you.

Hi TODers!

TOD authors and editors prefer that article comments relate directly to the MAIN article topic. Please review the Readers Guidelines at http://www.theoildrum.com/special/guidelines

Other energy topic comments are always welcome in the current Drumbeat thread, basically the TOD open forum.

Best regards,

Kate

Is that a question ?

Known for quite some time already, no ?..

"Essentiellement la richesse est énergie : l'énergie et la base et la fin de la production"

http://iiscn.wordpress.com/2011/05/06/bataille-et-lenergie/

Time to go look back into the "physiocrats" also, maybe :

http://en.wikipedia.org/wiki/Physiocrat

And when is the US putting itself a sizeable volume based gas tax just out of its own purely selfish survival interests ?

Or are wars and mercenaries the only planned mitigation direction ?

FOR ALL

Perhaps the discussion should avoid the tag "causing recessions". Multiple factors could coincide with any recession. Even the definition of recession is debated by some.

But the effect on growth seems rather straight forward. Not sure how that link can be denied. I doubt anyone one would disagree that there would be a significant positive impact on growth if oil fell to $40/bbl next week. Or am I wrong? The magnitude of the impact and the associated feedback loops can be discussed endlessly, of course. But, conversely, when oil prices jumped from $40/bbl in 2004-5 it would be difficult to argue that it didn’t have a significant negative impact on growth.

The more pressing question would seem to be how the world economies cope with what appears to be long term higher energy prices. In theory alt development would be the way to go. But if the economies can't maintain BAU then how do they fund alts? It would seem logical that even more capex has to be drawn away from the now diminished BAU expendatures. And if the alts don't afford a profit margin competative with all the other BAU efforts why would we expect private investments to move that direction? The govt could provide capital support but they are also faced with a problem supporting its existing BAU. Conservation is offered as a possible way to go. And there's certainly a lot of "fat" the US could trim. But it's still a zero sum gaim: a significnt portion of society depends on that fat to support themselves. In the end, someone has to give up even more than they have already.

Anyone have some "volunteers" in mind?

RockMan, To be honest I've been surprised that the global economy has not yet sagged under the recent price spike but believe the impact is working its way through the system and that a European recession at least is likely unavoidable now. USA seems to be in better shape, maybe you guys are better at Capitalism - but maybe your cheaper nat gas prices are helping too. Of course the powers at be are doing all they can to avert the disaster of a double dip.

You are correct to point out multiple causes for any recession - two successive quarters of negative GDP growth in the UK. It may be argued that I don't have a lot new to say in this post - and that's true, but one reason to keep the series going is to hammer a message home. And it is encouraging for me at least to note now that our Finance Minister recognises high energy prices as an important factor in holding back that all elusive growth. 3 to 4% growth per annum "solves" Europe's debt crisis, for a while at least.

The interesting thing is that recognising and acknowledging the problem, what you do about it. Recent action by George Osborne has included a £10 billion tax raid on North Sea oil production, in his statement yesterday he deferred a 3p per liter tax rise on gasoline and today the new liquidity splurge. All this is designed to penalise the energy producers and to stimulate consumption - both lines of action sending energy prices higher, the exact opposite of what is wanted. I understand the political imperatives of these actions, but at some point the cycle needs to be broken.

There is no simple solution - as you know - but as a starting point the OECD (and the USA in particular) needs to aggressively attack energy waste with the aim of getting energy consumption down. Power stations, home heat and cooling, automobiles - all need to be much, much more efficient. Moving onto replacement forms of energy I think this needs to be completely rethought in how it is presented to the public.

I still like the writing of Charles Eisenstein....

Peak Oil, Peak Debt, and the Concentration of Power

http://www.theoildrum.com/node/8350

.... where I believe it is possible to run society on renewables, its just that society will be very different to the one we have today. Some would argue better, others would argue worse. Believing that transitioning to renewables will somehow be easy, simple and cheap is I believe naive. I think transitioning from the time of plenty to the time of less will be a very painful process for OECD societies.

Bleeding Britain:

http://krugman.blogs.nytimes.com/2011/11/30/bleeding-britain/

The snag I see in this is that it might never be possible to "print" enough money to satisfy Krugman, or at least not without causing Weimar II or postwar Hungary. 1020 pengo for a loaf of bread, anyone? The pols are going to have to make up their minds (if they have any) about whether to pursue enough growth to satisfy Krugman's concerns in the manner Krugman would (implicitly) deal with them, i.e. by running up debt without limit and paying it off with growth, or whether to please the greens and the climate-treaty-ites by phasing out BAU so hastily as to have a huge depressionary effect (didn't someone mention that one can't print oil?) They're only pols, so they'd like to have it both ways, but maybe they can't and they'll eventually have to toss at least one set of lobbyists off the bus. And if physical considerations eventually make it impossible to have it Krugman's way, well... that's another angle.

I dare say Krugman may be more conversant with PO than you are with economics. According to him, and I think he's right, inflation is not a major concern at this point. On the other hand, you argue that increased economic activity will not lead to growth, since there's not enough energy for it. Fair enough. So what if you borrowed a lot of money and put a lot of people to work, as PK wishes, but you put them to work entirely on alt energy and efficiency projects? His main point, as I take it, is that we have MILLIONS of Americans sitting around doing basically nothing, and surely we could put them to work doing something useful?

New jobs for those millions in the USA and in other countries with high unemployment tend to require more energy on the whole, even if those jobs would be in alt energy and efficiency. Unless the new jobs were able to create enough new alt energy sources or create enough extra efficiency to offset the energy requirements of creating and sustaining those new jobs, then more energy would be required on the whole. If a business model where creating a lot of new jobs in alt energy and in improving efficiency were easily doable and profitable, then one would have expected the markets to have already beaten a path to their door for the clear benefits in doing that, just as in the case of a proverbial better mouse trap design. Build a better mousetrap, and the world will beat a path to your door.

Since oil production appears to have either peaked or plateaued, one would expect that all of the existing oil production is somewhat spoken for or dedicated already to the existing jobs already in place. It's not an official dedication, but it is likely a zero sum game. A "push in" in one place will result in a "pop out" in another. Creating new jobs in one place could take away jobs in another (which kind of explains how offshoring has affected many countries that formerly had low unemployment but now have high unemployment).

The business/governing model for new job creation may need to adjust to reflect the zero sum game, where more manual labor is relied upon, and where more people are put to work, but where the energy input remains constant or even decreases over time.

My other comment to this article about a worldwide drive 55, etc. could help to free up some energy for new jobs, but it is not along the lines of new job creation that would be directly involved in alt energy and in efficiency. In general, more alt energy (with beneficial EROEI) and more efficiency are good things and they help to free up the current energy flows already in place to support new jobs and existing jobs.

We need a new kind of economy rather than adjustments to the 'old-school' model John D. Rockefeller and Standard Oil Corp. left us with.

Instead of the waste-based regime dependent upon consumption what is needed is a conservation-based economy that rewards thrift and the increase in capital quality.

Today's narrative is very simple: our economic distress is the result of high labor costs rather than high energy costs.

Following this narrative, the cure has been to substitute petroleum/electric machines for humans and follow other strategies to reduce labor costs: zero-interest rate policies, banning labor unions, offshoring jobs, substituting credit access for wages, allowing unrestricted immigration, cutting worker benefits, cutting taxes to managers, automation, etc.

The incorrect narrative means the cure -- primarily automation and offshoring -- IS the disease.

Keep in mind, billions are working w/ desperation around the world around the clock to prevent a depression, so there should be no surprise there has been no collapse. Rather more surprising if there had been one!

Another thing is that rationing is taking place by shrinking credit/deleveraging which is slower than rationing by collapse/demand destruction. For instance, UK is experiencing 'fuel poverty'

Greece, Portugal, Ireland and the rest of the EU is becoming car- free as they lose access to credit. If they fall out of the Eurozone their replacement currencies will not be acceptable to oil exporters (who can sell to hard-currency China and India). Eventually the ongoing deflation will render the entire EU car free as members either have worthless money or their export industries lose customers.

A final thing is that Peak Oil only exists in the context of vehicle use/waste of petroleum. Auto burn has been the priority use for petrol. This has shouldered aside other potential uses that would add a higher value to petroleum. Right now the alternative uses for petroleum do not require the volume of material: lubricants, chemical feedstocks, asphalt. Remove the cars and there is no peak oil 'problem'. We have enough petrol for lubricant use for 100k years.

Enjoy your oil can.

Actually running existing US Green Transit (i.e. Rail, buses, vans with biking and walking) could bring major energy savings almost immediately at very little cost. Just to take the example I know best - the whole

New Jersey Transit system of commuter rail, light rail, buses and shuttles provides 365 million trips for an operating cost of only

$300 Million which is now, due to Gov Christie cuts, almost entirely borne by transit riders. When you consider that just 1 highway bypass cost $78 Million this is a pittance especially compared with $7 Billion

being wasted on new highway lanes in New Jersey.

Most of these Rail systems do not run on weekends and have horrible frequency on even weekday off-peak service. They are totally oriented towards commuting to New York City and back even though 50% of New Jersey lives within a few miles of a train station. Just running the trains every 30 minutes and supplying connecting shuttles or bikeways for the last mile would get literally thousands of cars off the road as well as saving thousands of gallons of gasoline.

New Jersey is more densely populated than China and surely easily capable of getting to the existing European level of using only 33% per capita oil usage it does now.

And this is not limited to New Jersey.

Despite all the wonderful claims about the "vast United States" in fact according to the US Federal Highway Administration 79% of Americans live in urbanized areas which could easily use Green Transit. In fact back in May, the Brookings Institute did an amazing

2 year study of census data, jobs and transit systems which found that

70% of working age Americans live only 3/4th mile from a transit stop!

For the New York metropolitan area the figure is 90%!

Yet only 30% could get to a job even during peak hours with the most

frequent transit in less than 90 minutes. This is due to the lack of connections, infrequent service, lack of local/express service, and lack of shuttles or other means for the last mile.

This is hardly impossible to fix nor requires huge outlays of energy.

It does not even require building anything to get the first benefits.

Simply hire people to run existing peak hour train capacity around the clock and all week long, take Govt vehicles for personal use of

people like the NJ Transit Director and use them for shuttles, hire

drivers to drive those existing Govt vehicles.

In fact how about conscripting military vehicles into the task instead of wasting them on fruitless endless Resource Wars for Oil?

Right away without any investment except for jobs for the unemployed and a minimal amount of energy redirected from personal use to public

transit huge energy savings could be made.

Those savings could then be invested in the next steps of bringing back into service already existing trunk lines which could easily double capacity and the reach of already running Rail lines.

Across the USA there are 233,000 miles of Rail just waiting to be

summoned back to service.

It is time to stop the highway madness and just do it!

The only problem with putting those millions back to work is that the system is then set up to encourange them to put their new discretionary income to work buying up a bunch of resource intensive stuff. If employing millions in alt energy and other well intentioned programs only serves as another hit of "we must have growth at all costs" drug then it's destined to be a failure. At this point it's pretty much the case that governments & business are just stringing together increasingly outlandish and unsustainable "solutions" to give the "markets" a sugar high for a while.

A real stab at a "solution" would be to go ahead and put those millions to work on alt energy, level with the masses as to our dire predicament, and start instituting programs that try to lead to a somewhat (not likely) orderly power down and reorganization of basics such as food supply and power distribution. Really this would be more of a "resolution" and a painful one at that, rather than a "solution". Of course we all know this will never happen willingly - our "can do" attitude doesn't deal well with resolutions - we need them all wrapped up in tidy packages of solutions, where nobody has to sacrifice.

The system is so broken and BAU so entrenched that we're to the point where "outside the box thinking" just allows change in a small cell within the larger BAU box - with very limited opportunity to break out of this much larger box. In the long term - resource wise - it may be that it's better to have people sitting around doing nothing IF they can't fundamentally change their priorities and / or the system in which they currently exist...

Maybe it's better in some larger sense to have people sitting around doing nothing--but I'm not convinced. It is very, very hard for unemployed people and their families. Anyway, I was mainly responding to the inflation argument, which seems to me wrongheaded. Putting people back to work may be wrong, but it's not because we'd have to print money to do so. Peak oil is a huge problem right now. Inflation is not.

Why a smart man like Mr. Krugman cares a whit about Britain eludes me. But then he's in denial about Peak Oil like most others.

He cares about Britain because they took the complete opposite route from what he recommended -- austerity instead of massive stimulus. He certainly wants to believe that Britain would have been better off trying to stimulate their economy through deficit spending.

The UK has implemented cuts - for the 99%. The banking class are still seeing double-digit income rises.

The austerity has not caused an manufacturing/export led recovery, in fact we are re-entering recession, because of stubbornly high energy prices, and the collapse of our European export markets. Unemployment is rising rapidly, I expect to add to the number personally in the next few days... forecast tax income is sharply down on previous expectation and the net government debt is still growing and accelerating. Even the Tory government is pinning hopes of bringing it under control on the return to 3% GDP growth in 3 years time.

We have economic collapse delayed, not prevented. Maybe, if most of Europe goes under first, the energy prices will come down far enough to see us round the corner for another decade.

This week the chancellor announced yet another cut in the state pension (rise in starting age) and public sector pay raise cap of 1% (on top of a 2 year freeze) and a stimulus package of oil powered transport infrastructure investment funded from the private sector pension contingency fund.

I'm not betting my savings on that working.

What is the alternative to austerity? There is growing proof that we have reached the limits of growth. Deficit financed stimulus spending operates on the assumption that you can stimulate the economy into growing faster, thereby enabling the budget to be balanced. If we have reached the limits of growth, stimulus spending only results in more debt and even more pain further down the road. The inability of the economy to keep growing also has a pretty negative impact on pensions. The pension plan model where a worker invests a small portion of their earnings into a pension fund that than grows consistently at a rate several percentage points higher than the inflation rate only works as long as we have continuous economic growth.

Austerity was a very effective cure for our economic problems in Canada back in the 1990's, but that was at a time when the rest of the world economy, especially our major trading partner the US was in good shape. These days it isn't going to magically fix anyones economy.

When I look at the country like Britain I don't see any way they can avoid a drop in the standard of living. You have a large population for your size, little natural resources and need to spend an increasing amount of money to import energy. You are better off taking the hit now than trying to kick the can down the road.

My provincial government (Ontario, Canada) is very much wedded to the idea of stimulus spending to avoid inflecting any significant amount of pain on anyone. They consistently run $16 billion deficits and have accumulated twice the amount of debt per capita as any other province in Canada. Like Britain the prospects for growth in our manufacturing/finance based economy are poor and we are resource poor in comparison to our western provinces. The growth projections that our government uses are completely unrealistic. It just means that when we reach the point that our provincial government cannot borrow anymore, things are going to get pretty ugly. We would be much better off to try to balance our budget now rather than continuing to dig ourselves into a deeper hole.

I think that we are seeing cognitive dissonance on a global scale. Government officials generally refuse to acknowledge resource limits. It's as if, once the Titanic hit the iceberg, the officers resumed the voyage, and ignored reports of flooding.

It may be that many government officials understand the situation but don't want to do something that would threaten their chances of being reelected. I remember years before the financial meltdown someone commenting that if the changes that society needed were to be implemented, political leaders were going to have to be prepared to spend their political capital after getting elected. It seems that few leaders are willing to do that.

Maybe the solution is term limits for all politicians. If a politician knows they cannot run for office again they may be more inclined to support a needed but unpopular reform.

I know that the US president can only serve for two terms but given the amount of power that exists in Congress and the Senate that isn't sufficient.

@jstewart: "There is growing proof that we have reached the limits of growth. Deficit financed stimulus spending operates on the assumption that you can stimulate the economy into growing faster"

It does look like we may have reached the limits of growth, but that does not mean that it's a good idea to have 10% of our able-bodied people (or in Spain 25%) sitting around eating cheetos and feeling miserable. It sucks for them and it's not great for us. Rather than calling it "deficit spending" let's call it "making sure everyone's doing something useful." The 99% are increasingly screwed, and I think we should try to help.

I agree that unemployment is a huge problem, especially among young people. The solution cannot involve more deficit spending though as that is unsustainable in an economy with little or no growth. The OWS movement represents a first effort by people to rejig the system. Unfortunately, the OWS movement has given a lot of people the idea that the needs of the 99% can be satisfied just by taxing the 1%. I don't believe that is the case. To properly provide for everyone in society will require taking away income from the middle class (oops, that's me!). It will also require a lowering of expectations of the type of work that people will be doing. The idea that everyone with at least two brain cells should be able to get a university degree and a nice well paid office job where you don't get your hands dirty is no longer tenable.

I used to be annoyed at people who only thought in terms of redistributing the econonmic pie because running a more open market would enable the pie to grow. It's an entirely different situation when that pie cannot get larger and may in fact shrink in size.

One way to "create" jobs would be to stop immigration (except for a small number of highly educated/skilled people or people with a lot of capital to invest) and to encourage non-citizen workers to leave. I am surprised this has not happened already. Of course this doesn't solve the problem but reduces the pain and buys you some time.

In the case of the US, I am puzzled that all discussion of immigration revolves around illegal immigrants. Meanwhile, a large number of legal immigrants continue to come despite the continuing high unemployment rate.

In Canada we actually had more immigrants in 2010 than we had had in many many years. However, there are some signs that the government is moving towards changing the immigration system. There is more focus on bringing in skilled immigrants with skills that are in demand. A two year moratorium on accepting applications for family reunification has been put in place while the federal government consults with the provinces on what to do. In the meantime, the number of immigrants admitted under family reunification will be increased to try to clear the backlog of applications. So I am hopeful that we are heading in the direction of reducing the number of immigrants we admit.

I am puzzled too. With a real unemployment rate that is close to 20% I thought they would have shut down immigration by now (with the exceptions listed above).

A modification of the Keynes Lenin quote: There is no subtler, no surer means of over-turning the existing basis of society than to raise the price of energy. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

I think we are seeing the slow strangulation of the economy, but it is so subtle and intertwined, that it will take historians to pinpoint it.

+ 10

Believing that transitioning to renewables will somehow be easy, simple and cheap is I believe naive.

That baffles me. Hybrids like the Prius and EREVs like the Chevy Volt are better vehicles in every way: cheaper life cycle costs, better performance (acceleration and handling....well, at least for the Volt...), quieter, cleaner. Renewables are at least as well geographically distributed as oil!

That also suggests that somehow oil (as well as NG and coal) has been easy, simple and cheap. Hasn't the recent multi-trillion dollar oil war started to disabuse us of this notion??

Euan,

The 'time' factor in our energy use will have to slow. To slow our lives down, to wait. Wait until the next tomato season. Wait until we can be in a certain location to pick something up. To slow the rate at which heat escapes our buildings, or the rate we replace vehicles.

How much energy gets consumed supplying our 'wants' quickly?

I do not like nor advocate the idea of everyone wearing gray wool coats and living in boxy gray buildings, but surely there must be some room to reduce our energy consumption and still have a very comfortable life. Frivolousness will have to go (WT's ELP and get on the non discretionary side of the economy). The best advise I have heard to date.

(simplifying)The BIG obstacle is those who lent money foolishly believe they can demand repayment and it will therefor "happen". Lenders want to get paid in full and with money that has value. Unfortunately we let the financial people deregulate their industry and we are being asked (forced) to pay for their greed and incompetence.

"But it's still a zero sum gaim"

This zero sum game "mantra" is so overblown ...

A no growth economy is still :

- same number of cars produced as previous year

- same number of wheat or corn tons grown and consumed as previous year

- same number of Kwh produced and consumed as previous year

- same number of sun rays reaching the earth as previous year (more or less)

- same number of barrels extracted and burnt as previous year

etc

In other words still primarily a notion of flows, and not this "the economy is growing, shrinking, or whatever"

And in the end, the "what" is produced is of course of prime importance independently of the amount of money it represents.

And to influence this "what", without having to define it in anyway, volume based fossile fuels taxes are for sure the best policy, in fact most probably the only valid one.

However in a no growth economy the population keeps growing. No jobs for new people added to the population. New technology keeps saving more labor, putting more people out of work. No jobs for the newly disenfranchised. (Meaning the Luddites are finally right.) And "no growth" means people taking out loans to start new businesses mostly fail. Banks make loans expecting growth. Growth pays interest on loans.

The end of growth is the beginning of collapse.

Ron P.

Not sure about all that.

The energy growth destroyed a lot of jobs, lower energy also means more maintenance, more recycling, more people involved in agriculture, etc.

As to ""no growth" means people taking out loans to start new businesses mostly fail."

Not even sure about that one, no growth can also mean that new business failing and the one succeeding end up in a kind of balance (and same for the bank loans). Could be compared to what is done with venture capitalists in high tech for instance. On the other hand bringing financial role back to "investment judgment"(and away from derivatives of derivatives) could also make sense.

But for sure some serious turmoil ahead yes.

One thing for sure, the only way to push for a less fossile intensive OPEX economy is through volume based taxes.

And many things are possible without even major innovations : cars can get lighter less powerfull very easily, two houses at 20 or 22°C it's the same thing, except one can be insulated consuming not much, one not consuming a lot.

And the knowledge economy also, if the "everything should be free on the net or fed by commercials for "real" products" dogma was questionned ... A book is a publication, a web site also, and whatever is said the contents on the web is quite far from what it could potentially be.

But for sure the kind of Alzheimer twittering facebooking frenzy isn't really headed in that direction...

I agree totally with Darwinian.

If only we could stop growing more of us, and instead adapt to fewer people, there might still be a rise in productivity, combined with a different and less damaging - I would hope - form of 'growth'.

Unfortunately, here in Britain at least, every political imperative seems to encourage the growth of people; benefits for having more children, subsidised housing for women who have children without any support mechanisms of their own, encouraging more housing, even when tens of thousands of houses stand empty, more railways, more roads, promises of yet better healthcare... promises all taken out against the expectation of growth.

At the same time even the government pundits tell us we are going to have practically no economic growth in the foreseeable future and that inflation is rising at above 5%. And government workers in tens of thousands are being sacked and told to find work in a non-growing private sector. Lewis Carroll would have understood the logic but it’s harder for the rest of us who find living in 'wonderland' increasingly fraught.

Westexas and his analogy of the crew of the Titanic refusing to acknowledge the iceberg or the water seems perfectly apposite to me.

With all the monetary interventions I would have to say the effect of inflation on any given commodity is impossible to determine. M2 is up 10% yoy. Governments are busy shoving 10lbs of monetary crap into a 5lb bag. How much of the overflow is going into the nominal price of oil? Anyone's guess.

I think high oil prices will suppress growth, but the effect is a bit more subtle than one might think.

Any given supply chains for goods and services is dependent on:

1) money

2) energy (particularly oil)

3) other supply chains

One part of almost all supply chains is transportation, which is critically dependent on ONE power source (i.e. cheap oil). Even continued oil production depends on a supply chain of cheap oil.

As oil gets more expensive, these supply chains become more expensive to maintain. Eventually some supply chains simply stop (e.g. car parts from Japan), which in turn effects other supply chains (trucks are not built, or built very slowly) and so on.

Once started, the cascade effects spread. I expect the economy to tank rather rapidly after the next price spikes, followed by supply shortages of coal, mechanical parts, food, fuel and so on.

Like trying to drain blood to cure a plague victim. Every theory of how the world works hits the rocks at some point. Neo-classical Economics dismisses non-monetary factors as unimportant and Peak Oil will be a sharp rock in the big reef of Limits that the theory founders upon. From the wreckage a new whole will be created to sail into the uncharted (but much more limit aware) future.

For those just joining us there is very solid evidence linking oil prices and recessions in the US. Good post by James Hamilton and lots of linkshere. Since the US gets 40% of its energy from oil, that is logical.

Euan, I think your theory of cheap nat gas in the US is helping. The US uses the energy from nat gas, coal, etc to create goods to pay for the oil. If those energy sources are cheap, it allows some higher oil prices. Murphy and Hall did some work with the cost of all energy sources. It might be worth looking into.

Euan/Jon - I'm not very knowledgeable of macroeconomics so I like to keep it simple. To Euan's point about collapse not happening very fast: perhaps each economy has a number of buffers. Not just energy buffers like the SPR. Some painful buffers: depleting personal savings and unemployment that reduces costs for businesses. Other buffers in between: govt borrowing and selling down inventory at below cost in order to maintain cash flow.

Many have been in the same place personally: unemployed but maintaining BAU to some degree. Outwardly your position may not look that bad. But if your personal buffers (savings, conservation, help from family members/friends) run out at the same time the collapse could be staggering.

That seems to be THE question for all the folks trying to predict the future: how do you measure the endurance of the multiple buffers and their effective life spans? And those metrics have to be balanced with a less than static energy/commodity environment. One example that comes to mind: was the subprime mortgage play an initial buffer that helped offset rising energy prices? That might explain what could have been something of a multiplier effect: either development (high energy costs and subprime melt down) could be rated as (-1) each but combined they equaled (-4).

What would be the next significant buffer to fail: govt borrowing, personal savings depletion, a spike in unemployment, future collapse of financial institutions? Again, as a simple geologist it’s taxing enough to come up with the questions. I’ll leave it to the TOD smarty pants to come up with the answers.

I'm pretty convinced that the world economy is stuck in a trap based on oil prices. Any time there is a whiff of growth, the oil price shoots up and strangles that economic growth.

This situation is going to make things difficult for all high level politicians. Come election time, either the economy will be crappy such that people will want to vote out the leader based on the economy or the economy will be showing some growth but the oil prices will be high such that people will want to vote out the leader based on oil prices. Obama will have a tough re-election fight. And who ever wins will have a tough time making the people happy.

The situation is difficult and there are no easy solutions.

. For me its back to front. It's not the price. Its the net energy growth or relative lack of it. the money goes up and down bouncing around the inside of a system that can not expand at a rate to satisfy the financial metrics. The price is a signal it has trouble expanding rather than the cause of said a lack of growth.... yes there's a feedback thing in there somewhere. But the boundaries are drawn by the access too the energy.

Its easy to get lost in the detail... I think

if that is [I am]wrong then it follows that a major restructuring of finance should be able to liberate more power[literally].

I think what we need is a major restructuring of energy efficiency and what we use energy for. If we double energy efficiency then maybe we get a doubling of price and that brings on a whole raft of new possibilities. And if we get much smarter in the way we use energy - create more wealth per unit energy used then that may lead to a restructuring of finance.

I'm beginning to think this may take decades of adjustments. We may see a major price reset in the next year or two (or week or two) but I doubt we will emerge from that with infinite wisdom.

At some point population and population structure needs to be addressed to address the demographic problems facing OECD and other countries. We just had a hundred years party. Now comes the hundred year hang over.

I decode that as rationing. Which works for me.

How do you sell it?

95% of TOD wouldn't countenance it

How about a World Wide drive 55, or even 45? Forward looking statements about valid economic and energy concerns coordinated by all the major governments might get buy in from the world population. A worldwide drive 55 wouldn't even be an official rationing, though effectively it would reduce consumption just like an official rationing scenario would. That would free up energy to support employment and production in other vital and critical areas. Major governments could even put out a coordinated statement strongly recommending heating and cooling reductions to save energy but not actually requiring them for a while until really necessary. The slight inconvenience of a 68 degree home or workplace in the winter, or a 80 degree home or workplace in the summer might be welcomed, a little reluctantly, by the masses as long as they can see that almost everyone in the world is trying to do their parts. Avoiding an official rationing scenario would probably be beneficial to consumer sentiment, and anything that helps to keep more people out of austerity would also be beneficial.

On the face of it sound ideas [still a difficult sell]

You have to constrain consumption at the boarders of teh economy or its jevons 2.0

You have to shrink the overall availability...ie a energy production cap, otherwise what is the point?

OTOH If production becomes physically limited, seems likely.... then Jevons is less of a issue and your suggestions start to make sense. Maybe, but equality requires deeper mandating and a removal of up to now perceived freedoms[too consume]. Your last point is key. It has to be seen as fair. In WW2 rationing was disliked but tolerated because it was seen as [in the most part] ubiquitous.

I was interested in how RR the other day posted about how the doomer scenarios had lost traction. I am starting to move in the other direction. Which I find surprising. I was a peak-lite kind of guy but now I think politics and ideologies are going to throw a rather nasty curveball into the mix, and paradoxically propelled by the non-materialization of what are in hindsight some rather juvenile doomer scenarios . I sense a terrible political power vacuum forming in the abyss created by the failure of the markets.

The thing to note about the oil price is not the level it reaches prior to stalling the markets, it is the fact the volatility in the price switches us on and off every other week between a notion of market re-stabilisation and systemic failure. No one can credibly join the dots in the market. And everyone is looking around for an answer and bizarrely the "most" credible solutions are stop gap ideas still based around the market, Buffet, shale gas and the like.

These solutions "seem" to weave practicality and a new incarnation of market ideology. This austrian school stuff is everywhere. Despite being the same animal. I think we have been committed to this "game changer" gas thing. A new horizon we will all be sold is just around the corner. In the mean time the ground beneath our feet turns to quicksand. The initial round of competition of ideas on what to do is over and has I think been won for the time being by a combination of deep market ideology and unconventional fossil fuel development.

There is strong evidence that production has already reached the limit, so Jevons would seem a mute point. Peak conventional oil has been accepted as having occurred several years ago, so yes the suggestion to free up energy for more jobs by reducing global speed limits starts to make a lot of sense. So far, a self evident and successful government/business policy that results in the macro creation of jobs hasn't seemed to materialize as evidenced by the high unemployment and austerity policies being pushed in so many places and at so many levels (city, county, state, country, and corporate). If USA, Russia, China, England, Germany, France, etc., ... all come out at once and say drive 55, 50, or 45, and that it will help things to get better on a macroeconomic level, it gets easier for people to buy in and to be more optimistic too.

I am not against the idea you understand.

Yes I understood. And I also understand that getting buy in from any consortium of governments up front might not be easily done. Maybe if one or two governments were to take the drive 55 initiative by themselves, etc, and put out press releases supportive of the wisdom and benefits to be gained from a wider adoption of that policy by other countries, maybe it could snowball to most countries then.

hasn't spain already done something like this?

They did, when Libya went off-line. The speed limit reduction was reversed 3 months later. It was claimed to be a modest success.

Or maybe not. During the 55mph period in the USA, the European countries generally did not lower their speed limits much if at all. Europeans visiting here, and suddenly contemplating distances and open spaces utterly unknown to them back home, in any day-to-day practical sense, tended to treat it, more often than not, as just the sort of risible, sick joke that only "crazy Americans" would undertake given those circumstances. (I suspect that many Americans associate it with what they might see as a whiny and ineffectual Jimmy Carter, even though it was instituted under Richard Nixon...)

IIRC during the 73 crisis the speed limit was dropped to 50mph in the UK

http://en.wikipedia.org/wiki/Road_speed_limits_in_the_United_Kingdom#197...

Since I never saw my father drive faster than 50mph ever, I'm not sure if I remember this limit or not.

He sold his car last year, aged 89.

The other "crazy American" idea is that of everybody driving PU's and SUV's for their single passenger commutes.

The problem is not the speed limit, it is the vehicles being used. A Prius at 75 mph is still far more fuel efficient than an F-150 at 55, as is almost any passenger car, from subcompact to midsize.

I see more comments from Euros about the ridiculous number of oversized vehicles driven with one person in them, than about anything else - and rightly so, IMO.

The only the way the large vehicles are efficient is if they are either full of people and/or cargo, or sitting in the driveway, unused.

If everyone was driving vehicles with Euro diesel type efficiency, so much oil would be saved that you could raise the speed limit and still be way ahead.

Before thinking of worldwide regulations, how about the US taking care of itself and of its own survival a bit ?

Like a $2 tax a gallon at least, that would still put it behind most OECD countries regarding volume based gas taxes.

And it works : European fossile fuel use per capita around half US one.

Note : the excuse"but we are a big country" doesn't fly, a times 2 more efficient car is a times two more efficient car, whatever the number of miles driven.

The only valid excuse is : but our "defense" budget is our current gas tax, which indeed is true more or less.

And again this is purely selfish self interest based : lowering trade deficit, pushing products adaptation

Yes, taxing is smart especially if there is still a lot efficiency to gained. If the US halves oil use they'll be more resillient to higher prices and they'll be able to use existing sources twice as long. Start now, there is a lot to be gained.

If we double energy efficiency then maybe we get a doubling of price

How about if we just kick the oil addiction? Replace ICEs with EVs, replace longhaul trucks with trains, then electric trains and electric short-haul trucks, for instance?

"This situation is going to make things difficult for all high level politicians."

Expect the Obama camp to attempt a nice stimulus package (not called that, of course) to get a short term boost in economic activity and an equal and opposite effort to not let that happen by the GOP. The GOP wants the economy to be failing come election time and will do anything (or, more precisely, do nothing) to prevent it.

The US political system is obviously unable to handle the coming global economic crisis and will most likely be torn apart by angry citizens. To be replaced by what, is the unsettling question.

As far as I see it we have reached peak conventional oil, and recent all liquids growth comes from defining more and more energy sources as 'oil'. Tar sands is reasonable, NGL is marginal, as it can only substitute for some fractions of conventional crude, (as witness the growing shortages of diesel fuel) and biofuels are downright fraudulent, as they are biological, with barely positive net fossil energy supply, low energy density and actually reduce the energy content (by volume) of the final product.

In fact, the net energy of the global oil supply is probably now in decline, and the world economy is rebalancing to reflect this reality, with oil efficient economies growing and inefficient ones (The OECD) in sharp decline. The US situation is partially balanced by cheap NG, the SPR, and huge military, political and economic inertia.

Europe is heading rapidly for financial meltdown, and the Euro is on death row. The UK is now also heading into double dip recession, a fact even the Tory government recognises, and has just announced further welfare spending cuts to fund a 'stimulus' package of about $30B of - you guessed it - new roads and airports. And it has cut the tax on petrol.

Mainly agreed. Peak in conventional crude is close or passed. Some NGls are OK. Temperate bio-fuels are principally secondary and not primary energy. Refinery gains are simply volume and not energy expansion of the refined stock.

Petrol tax has been deferred, not reduced. But overall the package of measures with roads etc is symptomatic of denial. The problem is recognised but the means to fix it elusive.

Osborne does get a degree of sympathy. He can't just stand up and say we are going to abandon the growth mantra and our FF based economies. But he could fund £50 billion worth of CHP and renewable heat instead of roads and airports.

In Scotland (where the Sun seldom shines in any case) we are now fitting solar panels on N facing roofs! I kid you not. One of the vendors phoned me yesterday (sales call) and when I explained that what they were doing with government subsidies was disgraceful I was told that simply daylight was adequate for PV systems, direct sunlight did not matter. Any comments or charts?

ROFLMAO. I don't have a light meter handy and it's not sunny anyway, so I'm unable to make a precise direct comparison on the spot. However, on a cloudy day one might get 1/6 or less, possibly much less, of the sunny-day output - and even that much only if it's a rather high quality panel (high shunt resistance); polycrystalline panels, especially older ones, may well show a uselessly low terminal voltage. I'd expect even less from scattered skylight since it's normally quite dim - and also because it's blue, which is poorly utilized both because most of the energy per photon goes to waste given the small Si bandgap, and because blue photons are poorly absorbed (in the useful mode) in the first place. Given the number of south-facing locations that don't have panels, it seems to be, well, let's be honest, quite an incredibly stupid form of investment, but then again what can you ever expect from government?

The bottom line: maybe those same governments and sales people will soon be flogging solar panels for use in moonlight?

Well, some people here report that solar panel output goes up when clouds pass so it would be interesting to see what the output is. Also, someone reported a solar panel that output 2A in moonlight.

NAOM

My 400 watt (nameplate) 3 panel system with 24 volt battery back-up, on a south facing roof of 1 in 3 pitch has just this month been unable to keep a 13 watt CFL lighted for 5 hours per day.

I live near Seattle.

Valentin Sofware have two online handy calculators for working out total yeild for PV an Solar thermal on an anual basis.

http://www.valentin.de/en

You can vary the inputs. I have found them to be reasonably accurate you can also download trial versions of their sotware . North facing give an anual drop off ~55% over due south with little or no out output from Aug-March . Solar thermal grants were not eligble here if they were not between east round to west as yield was too poor

Is that really the case ???

What the f*** is David MacKay doing ?

I mean, his book is most probably the most realistic, to the point, accurate source regarding energy aspects these days.

If anything the tax on petrol should be increased of course.

For sure a lot of transparency also has to be put in budget usage, but overall the direction should be : increase taxes on fossile fuels and maybe some other raw materials, reduce taxes on work.

(and increase taxes on top revenus and capital revenus, if there is a way to close the tax heavens revolving doors ...)

And have "economists" say under a gun if necessary, that they don't understand anything, and that their "science" is completely rotten since XIXth century at least in considering capital value of raw material as zero (Friedmann and Marx being in perfect agreement on this one by the way)

OK some of the money is to be spent on railways, and it was a cancelled tax rise, not a tax cut. But the rest on oil powered transport systems.

David MacKay must be a very frustrated man. By taking the Queen's shilling, he is effectively neutered. He cannot express opinions on government policy outside of officially approved government channels.

But he isn't anymore an adviser in Cameron government no ?

I'd prefer to see MacKay engaging more in how we get through to 2020 as opposed to the focus on 2050. I think it is also the case that advisors give advice that is taken or left by political masters.

I have a question that has been puzzling me for some time.

It seems that most of us think that oil prices are constrained by demand in such a way that oil cannot rise above a certain price range before so called "demand destruction " causes the sale of oil to fall off so sharply that the price collapses back to (temporarily ) affordable levels.

This seems entirely reasonable to me.

However, some claim or speculate that the highest possible price that can't be very much if at all beyond perhaps one hundred to one hundred fifty dollars per barrel in constant money.Some would argue that even one hundred dollars is to high , and that the economy will therefore shrink.

It is easy to see that potential producers whose estimated costs will continue to be potential rather than actual producers so long as prices remain in this range.

It is also easy to see that existing fields will be produced even if prices fall way off, since the day to day costs are minor in relation to the sunk costs of developing such existing fields, and less than the value of the oil produced, thereby generating some cash even if there is no actual profit earned.

But I simply don't see any reason WHY oil prices CANNOT rise considerably higher than a hundred fifty per barrel in constant at some future time.

I have remarked that regardless of my overall financial situation, I will gladly pay twenty dollars per gallon for diesel before I will do without;in terms of utility, that diesel in priceless to me.

Now even in a world economy that has crashed, there will still be plenty of purchasing power-nowhere near enough to pay this kind of money for eighty million barrels a day of course.

But there might be enough remaining demand to pay two hundred constant dollars-or even three hundred- for say thirty million barrels.

And thirty million might be all that can be produced within the foreseeable future for a number of reasons.

I can easily visualize a number of scenarios where that is all that is available, these scenarios involving a combination of depletion,, national policies forbidding export of more than minimal amounts, and political turmoil up to and including war.

We must remember that as we cut consumption, every gallon becomes more valuable than the last.

What I'm looking for is a counterargument that "feels" airtight.

I don't believe demand destruction has been proven to trump the increasing utility of smaller quantities of oil, although so far it seems that way-but so far, we still have lots of producers who are making huge profits, and can keep on producing even if prices crash.

This situation will not last forever.Such producers will become fewer as old developed field fields deplete, and new fields are obviously more expensive to develop.

It looks to me as if at some point in time ,possibly not to far off, the price of oil can rise even in the face of a declining economy.

I'm looking at the mid to long term in posing this question.The conventional wisdom seems to explain the short term very well.

At the top of the thread, I showed normalized oil consumption for China, India, the top 33 net oil exporters and for the US, from 2002 to 2010, as annual Brent prices rose at about 15%/year.

WT,I have been following your comments and I'm convinced that someday you can -if you want to- be on the biggest talk show on tv saying "I told you so" years ago.

I don't suppose prices can rise THAT fast for another decade.

But who knows?

It would be unreasonable of me to put you on the spot demanding a price prediction for say the year 2021.

Still, there are others here who are either pros or semipros, and some of them may be willing to speculate.

Of course as an amateur I can prophesy like Deets the Texas Ranger in Lonesome Dove.He prophesied "hot and dry " in respect to Texas weather.

I can prophesy high and scarce easily enough myself, even though my oil expertise is basically limited to what I have learned here on TOD.;-)

Front page WSJ story yesterday: “U.S. Nears Milestone: Net Fuel Exporter”

http://online.wsj.com/article/SB1000142405297020344170457706867048830624...

For 2011, it appears that the US is on track to be net exporter of refined petroleum products, on the order of about 0.2 mbpd. Although the WSJ reporters did note, several paragraphs into the story, that the US remains the world’s largest net oil importer, in both terms of crude oil and total petroleum liquids, I suspect that many casual readers will conclude that the US is now a net oil exporter.

We have of course seen increasing US oil (and gas) production. If we look at the pre-hurricane production data in 2004, versus 2010, US total petroleum liquids production rose from 7.2 mbpd in 2004 to 7.5 mbpd in 2010, an increase of 0.3 mbpd (BP). Note that BP does not count biofuels and refinery gains in the production numbers.

Over the same time frame, 2004 to 2010, US consumption fell from 20.7 mbpd to 19.1 mbpd, a decline of 1.6 mbpd. Based on the BP data, US net oil imports fell from 13.5 mbpd in 2004 to 11.6 mbpd in 2010, a decline of 1.9 mbpd. Declining consumption resulted in 84% of the 2004 to 2010 decline in US net oil imports.

Therefore, the primary contributor to the US becoming a net exporter of refined products and the primary contributor to the decline in US net oil imports is declining consumption in the US, as the US and many other developed countries have been forced, post-2005, to take a declining share of a falling volume of Global Net Exports (GNE), which are calculated in terms of Total Petroleum Liquids.

So, the WSJ reporters are taking a symptom of Peak Exports, i.e., declining US oil consumption, and presenting it as a positive story.

There are apparently 196 countries in the world. If we assume about a half dozen inconsequential net oil exporters, in addition to the top 33 net oil exporters that we studied, that leaves about 157 net oil importing countries. So, if we extrapolate current trends, just two of these net oil importers, China & India, would consume 100% of the global supply of (net) exported oil in only 19 years, leaving nothing for the other 155 current net oil importing countries.

I continue to be mystified that this factual statement is not the #1 story in the world.

Here is an interesting comment from a blogger on The Oil Drum (tye454):

“ . . . the government and banks are going to pull every trick or lie or cheat that they're able to, because the alternative is their very own destruction.”

I suspect that this is one of the primary reasons that we will probably never get most government officials, members of the MSM, etc. to actually acknowledge the reality of Peak Oil/Peak Exports. It is of course related to the famous Upton Sinclair quote, "It is difficult to get a man to understand something when his job depends on not understanding it."

I think that we are seeing cognitive dissonance on a global scale. Government officials, the MSM etc. generally refuse to acknowledge resource limits. It's as if, once the Titanic hit the iceberg, the officers resumed the voyage, and ignored reports of flooding.

Truly impressive this one ...

(and also got it quoted to me in a non oil related forum where I mentioned peak oil ...)

But somehow, seems to me all the comments on MSM articles are a quite good medium to pass the message, and not only on oil or energy articles, also on financial crisis articles like "did you know the basic reason of the crisis is the oil production peak ? Did you know all oil shocks led to recessions and we are in the "mother of all oil shock" stuff like that, or bare simple facts US peak 1970, north sea 2000, Mexico 2005, things like that.

More or less peak oil forums become kind of "closed group therapy stuff", simple messages in comments with one or two links if possible also efficient most probably.

And I find the picture a bit different in France : several key guys already mentioned it (politics or industry), also in other countries Sweden I think it is rather official.

In fact what is behind all this, is the lie by ommission regarding the US having been through its peak in 1970 (41 years ago already), much more than global peak aspects even.

And for sure much tougher for the US than for a country that almost never had any to begin with, and with always the "hopes" regarding new plays shale oil and the like (besides having been at the origin of oil usage and expension).

But each year makes this lie by ommission tougher to get around.

Too bad James Akins not there anymore, could have put this straight maybe.

the WSJ reporters are taking a symptom of Peak Exports, i.e., declining US oil consumption, and presenting it as a positive story.

It is a positive story. The US is becoming more efficient, cutting out low-value oil use, and finding substitutes for oil. This is good news. And, it is a bit of good news that the US can cover all of it's refining needs.

OTOH, I agree that the story is misleading - most readers will come away thinking that the US is an oil exporter.

apologies to the editor for the veering from topic here but I just got back to town and a couple points Nick attempted to address a couple weeks ago needed addressing and this looked to be the only open thread Nick is monitoring.

how do you develop the mine completely electric?

Two things 1. we were discussing copper mines not coal, copper mines do not produce fuel for an on site power plant and are generally very remote 2. the electric hauler in your linked picture was driving on a road, the building of which for the foreseeable future will be relegated to ice rigs. Incredible amounts of gravel must be mined, crushed and hauled to build 50-100 mile long remote roads.

Hard wiring it all would be possible, but that creates a greater demand for copper.

Aluminum would work just fine.

no doubt aluminum does just fine for larger lines (larger being relative to standard house wiring) but making more aluminum requires more electricity. Electric motors will continue to require copper, more motors more copper. Last I heard an industry analyst said we would need another half dozen mines the size of Pebble before 2030 to meet copper demand.

The issue is not whether it is possible to electrify a huge chunk of transportation, mining and heavy construction that is now fully fossil fuel dependent but rather whether it will be done in a timely fashion before constricted oil supplies push up system costs beyond what economic critical activity levels can handle. Because coal delivers power to invested dollar more quickly than other sources do it will likely remain the big go to fuel source in the push to electrify. I don't see that as a particularly happy scenario.

copper mines do not produce fuel for an on site power plant

I could be wrong, but I think few coal mines get their power from on-site coal generation.

are generally very remote

Powder River strip mines are pretty far from civilization. Chilean copper mines are pretty well industrialized.

road, the building of which for the foreseeable future will be relegated to ice rigs

Or EREV rigs, with swappable batteries.

Incredible amounts of gravel must be mined, crushed and hauled to build 50-100 mile long remote roads.

Tracked (or wheeled) haulers don't operate over long distances - they're typically internal to the mine, right? Long distance transport will be rail, mostly.

aluminum does just fine for larger lines (larger being relative to standard house wiring)

Aluminium does just fine for house wiring, as long as you're moderately careful with your terminations.

making more aluminum requires more electricity.

True. But, we don't have a shortage of electricity.

Electric motors will continue to require copper

Electric motors can be built with aluminium:

http://en.wikipedia.org/wiki/Electric_motor

The issue is...whether it is possible to electrify a huge chunk of transportation, mining and heavy construction...before constricted oil supplies push up system costs beyond what economic critical activity levels can handle.

Sure.

First, it can be done reasonably quickly - the bottleneck will be ramping up battery production. Personal transportation is 50% of oil consumption in the US, and 50% of miles come from vehicles less than 6-6.5 years old.

2nd, oil supplies aren't dropping quickly: Aleklett projects that world liquid fuel supply will only drop by 11% by 2030.

Because coal delivers power to invested dollar more quickly than other sources do it will likely remain the big go to fuel source in the push to electrify.

New coal plants in the US are large, take longer to build than windpower, and have large pollution control costs (just for "criterion" pollutants, like sulfur and mercury). In an uncertain political climate (pun intended) they have a high risk component for investors. Their overall cost is such that cost per kWh is really very comparable to that of windpower.

---------------------------------------

The bottom line for mining is that it's a relatively small percentage of oil consumption, and if necessary it can outbid other uses for a very long time, more than long enough to transition to a new infrastructure.

OFM,

I do not post often, but wanted to mention that I enjoy your posts. You are very modest with your "I am no expert", which may be true, but you offer many of the most insightful comments on the Oil Drum. I have some knowledge of physics (BS) and economics (MA), but also am not an expert. The price of oil could certainly rise as you suggest and possibly reach an equilibrium at say $200 (in 2008 dollars) at some point in the future with a lower total output (like the 30 mbd you suggested). The question that arises is what the US economy would look like if it was only using 7 mbd instead of 20 mbd. Clearly we would be driving less, would be less apt to buy large SUVs, more likely to walk or ride a bike, or a bus and so forth. We might change indoor temps (65 winter and 80 summer). It is very unlikely that BAU would continue and we will likely collapse especially without some prior planning and action to mitigate our energy decline. The severity of the collapse seems dependent on how quickly we move from 20 to 7 mbd. Hopefully we will begin to realize that more roads and bridges are not as good a social investment as low carbon energy sources. We could also use significant R and D into the transition from fossil fuels to wind, solar, nuclear, hydro with natural gas as our main transition fuel as oil depletes. This all needs to happen while focusing on efficiency as EM points out upthread.

DC

As someone with an MA in economics you should post more often. We love to get the academic view once in awhile.

Sure we could do with less. We could drive less, we would consume less goods and services. Yes we could cut the fat and live very frugal on perhaps less than half what we consume now. But everyone seems to completely overlook the consequences of such frugality by the public. And those consequences were not mentioned in your post either. If we cut to half what we consume today then people producing that half would be unemployed. It probably would not be half the workforce but it would be close.

People are employed producing or servicing the fat we would cut. And if all those people were unemployed it could very easily have a snowball effect. If the employed cut by half their consumption then the unemployed would have to cut their consumption to the bone. States would be hard pressed to pay unemployment insurance. They would have to cut their budget, laying off necessary workers. Then when their unemployment insurance ran out, or the states went bankrupt, things could get really bad.

But people who talk about what we could do without never seem to think about all those people employed producing the things we would do without. That's thinking the problem through half way.

Ron P.

You mean people in China? I don't think stuff gets made outside China these days. Seriously though even most consumer goods manufactured outside China will have components that were manufactured in China - it's almost a certainty.

I hate to put a damper on globalisation but it's about time we started making stuff again! balance that HUUUUUUUGE trade deficit......oh dear I only half though that through. thatt means my new 50in flatscreen would have cost me 586% more than it actually did.....dang I knew there was a catch...

Marco.

On the whole, it is likely that we will either drive less and consume less either in a planned and somewhat voluntary method, or forced to by definition as a result of depleting resources and due to the downstream physical limitations that resource depletion causes. I suspect that with a zero sum game, that any energy freed up due to policies that reduce consumption in some areas will readily flow to other areas that will benefit from them and that might help to reduce unemployment in ways. Running the world engine at redline until a proverbial piston is thrown should be avoided. A governor on the engine that keeps it stable is a good investment, even though that governor introduces a speed limitation and we desire to go faster. Yes, there will likely be some job dislocations in some areas of the economy by reducing consumption in planned ways. But likely no worse than existing job dislocations due to credit and debt issues. The credit and debt issues just might be in reality a downstream effect to the already existing resource depletion pressures or even soon to be expected resource depletions.

I am reminded of a scene in the movie "The Outlaw Josey Wales" where granny realizes she has a predicament and is not happy to be riding with the notorious Josey Wales who just saved them from a raiding party. The Indian Chief succinctly asks Granny :

Ron,

You make an excellent point, a reduction in consumption reduces income ceteris paribus. I was not suggesting that all consumption would be reduced I was focused on energy consumption, particularly fossil fuels (especially coal and oil). Let us assume that total demand does not change, but that people spend the money saved on energy at restaurants, on a more efficient car, a bicycle, or shoes.

People could change their preferences so that money spent on transportation and coal power plants are spent on other goods and services. To move us away from higher carbon energy these might be building energy efficiency measures, wind turbines, solar energy (of all types pv, csp, dhw and passive heat), HVDC transmission placed so that intermittant energy sources can complement each other more easily, R+D on next generation nuclear, renewable energy, and energy efficiency, and building out nuclear, especially newer systems (see latest GE/Hitachi design).