Iran - Possible Implications of an Oil Embargo

Posted by Euan Mearns on December 6, 2011 - 6:30am

Does Thursday's announcement that the EU is considering to ban oil imports from Iran epitomise the draining of power from west to east? The big winners here will be China and India, who do not fear rising Iranian influence and who will gladly soak up any additional oil exports they may have to offer. However, ending this small dependency upon Iranian oil imports in Europe (Figure 2) does clear the way for military action without the need to ponder the immediate consequences on oil imports.

Figure 1 Iran displays export land traits where growing domestic consumption is eating into the oil available for export that has been declining slowly since 2003. Data from BP. Y-axis is barrels per day (1000s). Balance = production less consumption which is a proxy for net exports. Production = crude+condensate+NGL whilst consumption may include refinery "gains" and bio-fuel. In many countries there is also an active two-way trade in crude and refined products.

In a week where the UK embassy in Iran was overrun and the two countries are breaking off diplomatic ties, on the back of heightened concern about Iran's nuclear weapons program and an unexplained explosion at an Iranian missile launching site, the EU has decided to flex its muscles and to ban Iranian oil imports. The big winners here are the other countries importing oil from Iran - Japan, China, India and South Korea. Does the EU really believe that in today's extremely tight oil market that oil sanctions against Iran will worry them in the least?

Figure 2 Table from a worthy article on Iranian oil and demographics posted on Crude Oil Peak details the countries importing oil from Iran in 2008. The four EU countries to be affected by any embargo will be Italy, Spain, Greece and France. Given that Greece and Spain are already in recession and that Italy and France are heading in that direction, it seems likely that their oil consumption will already be on the wane and that losing these relatively small amounts of Iranian imports will have little consequence.

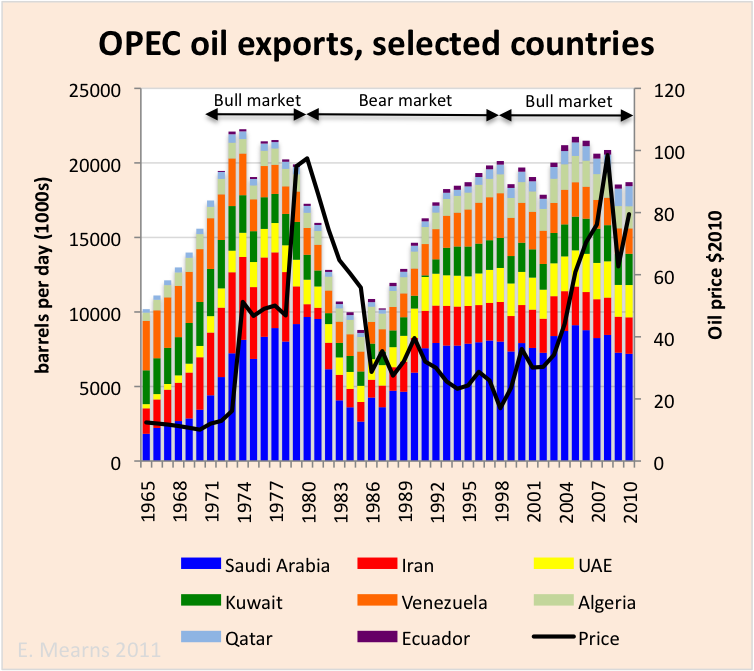

Figure 3 OPEC net exports (production consumption balance from BP) showing the importance of The Gulf states.

With the risks of armed conflict against Iran increasing with every week that passes it is important to grasp what this may mean for global oil markets. Two end points seem to exist. The first is where "the West", i.e. NATO or some other looser alliance ± Israel launches a cruise missile attack (conventional) against Iran's nuclear facilities. destroying them. In that eventuality Iran, with current leadership, would be unlikely to ever again export oil to "the West", but since at that point The West will not be importing any oil from Iran this would not matter.

Figure 4 Iranian oil infrastructure, setting in the Arabian or Persian Gulf and the linch pin location of The Straights of Hormuz. Map from Wikipedia.

The second more extreme scenario is that armed conflict spreads, compromising oil exports through the Straights of Hormuz. Oil exports from Saudi Arabia, Kuwait, The United Arab Emirates (UAE), Qatar, Iraq and Iran all pass through Hormuz. Data is not available for Iraq, but exports from Saudi, Kuwait, UAE and Qatar stood at around 12,805,000 bpd in 2010. The global net export market stood at around 35,173,000 and so these 4 countries alone account for around 36.4% of the global export market (excluding Iraq and Iran). Should these exports cease, albeit temporarily, the oil price will go through the roof, causing severe trauma to the global economy, including China.

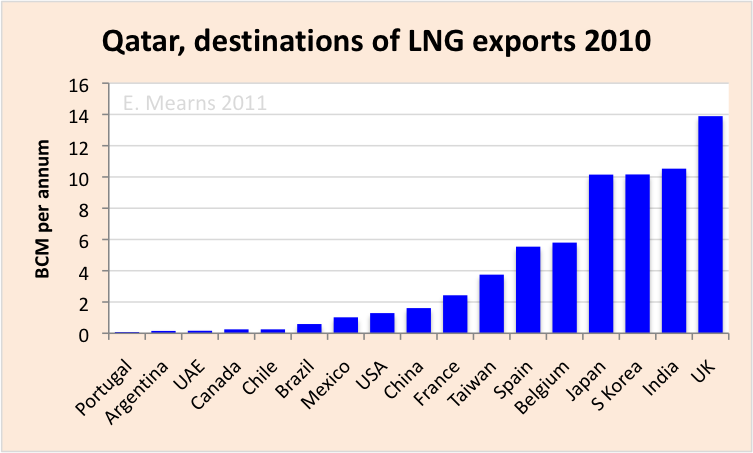

In addition, there are significant liquefied natural gas exports from Qatar that pass through Hormuz on a daily basis. According to BP, Qatar exported around 96 BCM of gas in 2010 (Figure 5) to the countries shown in Figure 6. In Europe, the UK, Spain, and Belgium would be most affected by disruption to LNG supplies from the Gulf whilst in Asia, India, S Korea, and Japan would be most affected. This highlights the increasingly exposed nature of OECD energy supplies where electricity supplies may be threatened by armed conflicts on the other side of the world.

Anyone else think the *concentration* of oil infrastructure might look a little... seductive to a certain kind of mind?

Especially since that concentration happens to be in some of the less rugged terrain.

I don't buy the basic argument of this post -- it will STILL matter if Iran's supply to India etc is cut off, because those countries will seek their supply elsewhere, in competition with the U.S.A..

The only implication of an embargo is pigs will fly. Because no nation will cut off it's own oil supply, and everyone understands the oil market is global, not local. The whole premise of this post is a waste of time.

You obviously don't read the posts here very often or you would know that a large portion of the worlds oil is bought under contract with NOC. for example China has entered into contracts with Venezuela to obtain crude in exchange for helping develop oil fields in Hugo Chavez' domain. That oil and oil from many other countries is not traded, though still exported.

The European users of Iran's oil will have to go farther and pay more for oil bought on market. So even if the embargo against Iran does not cause a direct shortage it will cause price increases.

I find the whole concept of long term mechanized warfare inside oil exporting countries something to be careful of, like holding a loaded gun pointed at your own foot. It seems so obvious of a blow hard, arrogant position. I suspect the tipping point will be - Go ahead shoot yourself in the foot. Which leads me to the bigger concern which is the adultness of world leaders.

Five year rates of change in net oil exports for top 33 net oil exporters in 2005 (what I define as Global Net Exports or GNE), as they collectively showed about a 3 mbpd decline in net oil exports from 2005 to 2010, from about 46 mbpd to about 43 mbpd (BP +minor EIA data):

My ballpark guesstimate is that these 33 net oil exporters will have collectively shipped about half of their post-2005 Cumulative Net Exports (CNE) by the end of 2020, 10 years hence--and at Chindia's 2005 to 2010 rate of increase in their combined net oil imports as a percentage of GNE, the Chindia region alone would consume 100% of GNE in about 19 years.

Euan,

I take it that you don't consider high oil prices a likely outcome of an embargo by the EU, since oil participates in a world market. Iran is trying to pass around this story, though.

Could there be a temporary oil price spike from an embargo, as things even out, similar to what happens with a closure of the Straight of Hormuz?

Gail, I guess the way I see things is that 500,000 bpd is such a small amount that it can get lost in the noise of falling consumption due to recession in most of the affected countries. But OECD will lose another slice of export market to the East.

This assumption ignores the idea that oil prices are set at the margins. If supply meets demand, everything is fine. The moment it doesn't, the price will spike. A recession follows almost every price spike in oil. Since 2008, another spike won't be just an inconvenience. It will be a disaster. Imagine bond rates going up 5 points, massive defaults, more job losses. There is no wiggle room in the global oil markets.

The EU may have announced that they were considering it, but it seems that the fruits of their considerations were, no, no way, not a chance in hell - just couched in more appropriate language; broadly speaking, there's as much chance of the EU enacting an oil embargo as there is of the US fulfilling the Bush administration's announcement of a manned mission to Mars by 2020.

I realise that you may be being slightly snarky here, but given that the EU currently imports about 500kbpd from Iran - where's the "spare" oil to replace that going to come from? If it's from Kuwait/UAE/Saudi on the basis of swapping destinations, then the EU nations have achieved NOTHING in the event of a conflict - the oil will still be blocked or disrupted, with the worst case scenario being oil loading infrastructure in smoking ruins. So this supply conundrum will have to be addressed via competing with the US for supplies from Algeria, Nigeria, Angola, Russia.

See reply to Gail - I really don't think 500,000 bpd is enough to worry about, especially in countries where demand for oil is likely falling.

It seems that Iran really is developing nuclear weapons and I don't think there is any chance that the west, especially Israel, will allow that to go to completion. And so this presents an awful dilemma.

Euan

Well, I think that we can propose a reasonable test for that assumption.

Will the IEA coordinate another emergency stock release over the winter? If yes, then I would assert that the 500kbpd is irreplaceable via current production, and no amount of swapping deckchairs will alter that.

As an addendum to my comments, I'd also note that apart from the much-reduced level of Libyan exports, there are at least 4 oil/energy market pressure points that are currently in play:

The EU has already embargoed Syrian exports, so at a guess it's already 100kbpd light from that source alone - and I can't imagine that Syrian production/exports are a thriving business given the current levels of civil unrest.

The Yemen clusterfuck has, likewise, impacted both production and exports. Recent reporting suggests that local refineries are down due to oil pipeline damage, and I would imagine that this is sucking in product from Saudi/Oman to cover.

The Sudan-South Sudan spat is building momentum - supply impacts as yet unknown.

The repeated sabotage of the Egyptian natural gas pipeline is constraining supplies to both Jordan and Israel, who are having to cover by increasing imports of oil for electricity generation purposes.

Whilst taken in isolation these aren't especially significant, taken together they're probably contributing to at least an additional 250-350kbpd of uncertain/lost supply.

I'd also note that the EIA import by destination data showed a dramatic reduction in Nigerian imports into the US in September ( about 400kbpd ); if this is repeated in October and November, it would suggest that the EU response to CURRENT supply issues is to compete for Atlantic basin production.

What about Libyan Oil. Does it factor in all this?

http://www.bloomberg.com/news/2011-12-07/total-sees-libya-output-at-1-5-...

I've no doubt that Libyan oil exports will come back - but take a look at the EIA's cod-analysis at this weeks' TWIP,as a corrective to the over-optimistic assessments in the Bloomberg report

It's not inconceivable that Libya will return to the pre-conflict level of exports in 2013 or 2014 - but there's an awful lot that can go wrong in the interim, especially with large numbers of armed militias hanging around the place.

Iran may well be developing nuclear weapons, but that doesn't necessarily mean a disaster. Have a look at a map, they are surrounded by US forces and Israel has threatened to attack them on a number of occasions. Is it any wonder they want nukes? It will certainly alter the balance of power if they do get them, but that doesn't mean they will necessarily use them. US foreign policy since WW2 has been an unmitigated disaster in the region and the people living there have suffered accordingly.

Maybe instead of ramping up pressure things would be better if the West; and the US in particular, took a more conciliatory approach. A nuclear armed Iran can be contained, just like all the other nuclear powers elsewhere. It is the contant meddling and the constant pressure that keeps that odious Tehran government in power. If the pressure were lifted the "Arab spring" might stretch and become a "Persian spring". And Iran might then become a friendlier more open country on better terms with the rest of the world.

Just an idea. Current policy isn't working and has never worked. And continuing to do something that evidently doesn't work is madness. Also, an attack on Iran will close Hormuz and possibly destroy much of the energy infrastructure in the Gulf. Then the global economy really will be a very deep depression for a very long time.

I agree that attacking Iran isn't a good idea, but if war with Iran arrives, it won't be because it was a good idea, and it might not even be completely intentional. The US has been increasing covert operations inside Iran recently, and something might go wrong. Plus, for many years now there's been a significant faction in the US that wants to go to war with Iran, I'm not quite sure why.

US military industrial complex spends serious money marketing the perceived need for ever increasing expenditures for military hardware. Iran is good for business.

I am also baffled by US foreign policy as an American. I have no clue what the West would gain from attacking Iran except another bloody quagmire which would drain the US treasury and gain the enmity of the many. The justification of Iran gaining nuclear weapons seems such a flimsy reason for an attack. The preparation for attack is a reason for Iran to develop nuclear weapons. Iran has a fearful, reactive regime. I do not see much overt aggression or territorial ambition. Certainly there is saber rattling toward Israel and covert operations and support of Syria. None of this seems like a justification for attack, more a justification for containment. American foreign policy has been aggressive since World War II, but the belligerence has increased in the last 25 years with 2 full-scale Iraq wars, a half-hearted war in Afghanistan which has ramped up. A small-scale police action in response to 911 would be all that was justified in my mind.

I've been to Iran five times now in the last seven years, most recently a month ago when I was a plenary speaker on Transition through Gas at an oil ministry sponsored academic conference.

I spoke after the OPEC and Gas OPEC (GECF) Secretary Generals and before Iran's vice president. During the rest of my stay I met quite a few of the energy sector decision makers, not least the Oil Minister, who is both action oriented and commercially aware, which is a rare combination among the few decision makers.

Firstly, there is not IMHO the slightest threat from Iran: what we are seeing is a battle between two conservative factions for control of the oil and gas complex during a privatisation phase. The last (minimal) vestige of theocracy ended in 2009. It's uncannily like Russia was a dozen years ago.

Re nukes, I'd be surprised if they weren't seeking the capacity and knowledge to build a bomb, but I very much doubt whether they are dumb enough to actually do so, when not doing so is a very valuable negotiating card to play.

Secondly, the financial sanctions are a minor inconvenience for the elite and a serious inconvenience for the business community and the man on the street. Oil sanctions are completely bonkers, and would give China a windfall and also greatly benefit the very factions the West most wants to hit. ie those who control the China relationship and unofficial channels, and guess who it was who made a mess on the British Ambassador's carpet?

In my view, in a 'Suez Moment' in or around 2007, the Chinese forced the US to agree to get out of Iraq, and to leave Iran alone. Energy security is as important for the Chinese as it is to the US, and I believe they threatened to pull the economic rug on the US at that point.

Since then it's all been noise, which suits the Israelis as they continue to create realities on the ground; and also suits Iranian factions playing the nationalist card; and finally has helped the investment banks to keep the crude oil bubble hyped up and inflated with dollars borrowed interest-free from 'inflation hedging' funds who are blithely causing the very inflation they wish to avoid.

I can say with authority that Iran very much wishes to take the politics out of energy and are aiming to engage in what is being termed 'Energy Diplomacy'. In the first instance they have agreed an initiative, which I originated, to develop the natural gas market.

I also originated the almost mythical Iran Oil Bourse ten years ago (although I advised them to create a Middle Eastern benchmark, not an Iranian one,). One of the hottest topics raised with me last month - including in TV interviews - was the future of that initiative.

I confidently expect - in the absence of further QE (which the Fed dare not do since they fear it will trigger debt deflation) or a very substantial cut in production by OPEC - a rapid fall in the oil price in the next one to three months similar to or possibly even more dramatic than the last oil price bubble collapse in 2008.

At that point it will get interesting.

I agree that if swapping destinations is all that occurs then the embargo essentially achieves nothing. However, if we put that aside and the embargo does have the effect of reducing imports to Europe, then it could be a way of "enforcing" austerity on the Southern European countries. Therefore, the "embargo" is really a cover for explaining reduced standards of living in those countries who cannot afford oil at today's prices while providing political cover to TPTB so as to try to quell internal rebellion.

Firstly thank you to Euan for this informative post which has finally pulled me out of lurking mode. On reading this two things immediately spring to mind:

(1) Greece, it has been reported that Greece has been forced to buy directly from Iran due to credit issues with other suppliers. http://www.reuters.com/article/2011/11/11/us-greece-iran-oil-idUSTRE7AA3...

(2) Italy, Italy’s refiners need light sweet crude & have had source elsewhere due to cut in Libyan production of same.

So my question here particularly in relation to point 2 is what type oil does Iran mostly export?

Tremain, afraid I can't help you here other than to say I suspect Iran produces and exports a large range of crude quality - which is the case in most large producers.

I don't see it happening.

And Iran will get the bomb. After all, almost anyone can make one, you just need the materials.

With Pakistan to the East, Israel to the West, Russia to the North, and the US covering the South, why not join the club?

Especially when you have good missile technology.

Iran is planning to reduce crude oil exports and replace them with exports of refined products. At least that is the cover story. So in future just looking at crude exports may not tell the whole story of what is going on.

http://www.youtube.com/watch?v=pUHh8UeEb-I

Iran is trying to improve it's auto industry which is the largest in the Middle East:

http://www.youtube.com/watch?v=4yaDRPksXN0

If successful, car numbers may grow faster within Iran thereby further reducing oil exports as domestic use increases.

There is often talk about "shutting down" the Straits of Hormuz and impeding supply. What happens if Iran simply decides to point missiles at Saudi tankers?

Let's bear in mind that aircraft carriers are highly vulnerable to the right kind of missiles and IIRC, Iran has them, which is why the U.S. had to "refloat" their fleet during war simulations a few years ago.

This, and given Iran's natural defences, is why I worry that any war will necessarily involve nukes... and how exactly is Israel not going to get involved in this?

To paraphrase something I distantly remember: "Russian politicians are smart, the stupid ones are all dead, and one problem with the Cold War was that they assumed American actions were basically malevolent -- because they couldn't possibly be that stupid."

I'm not sure if it would be just the closing of the straight. I would expect many attacks against installations on the southern side. Even a relativly short conflict would then cause problems for years to come. Add to that arming every hot head in the area and telling them to attack installations and interests would add yet another layer.

NAOM

If a war breaks out in the area of the Straits, the panic factor alone will be enough to give the world economy a heart attack.

If it lasts very long, it is almost certain to disrupt shipping and very likely to disrupt production.

But a war sure would suit a lot of politicians in a lot of places.

There's nothing like a war to divert attention from current problems and refocus it elsewhere;and of course there are a lot of people who can get what they want by no other means.

This is aligned with my thinking. The situation in Iran is very serious indeed. Nothing like a spike in oil prices up to $200 and the following mayhem to deflect attention and blame away from the current mayhem in the markets - especially the European bond markets.

OFM,

Wars only serve as a distraction if victory is assured and there is a minimum of impact at home (witness Maggie Thatcher and the Falklands). No guarantee, however, that even a successful war will translate into votes (witness Bush '41 and the first Gulf War). However, if the outcome is ambivalent and/or it lasts more than a few weeks (witness Vietnam and Iraq) it can lead to endless domestic grief.

Since an attack on Iran would cause mayhem on the international markets without any concomitant guarantee of a quick fix, politicians peering at the election cycle would be ill-advised to stir this hornet's nest. This is one situation where any thoughtful analyst can anticipate any number of blow backs.

IMHO, an attack against Iran, if it comes about, will not be undertaken for domestic purposes, even if peering into some form of economic Armageddon. The culprit is realpolitik and the maneuvering of geopolitical chess players.

The prized audience will not be the television viewers in Chicago or Albuquerque or even London or Jerusalem. Instead it would be a lesson plan for diplomats, intended especially for foreign ministries in places like Moscow, Beijing, and Riyadh.

That's the way the very wise and modest Gandalf sees it anyhow;-)

I agree that war won't be undertaken for domestic purposes. I fear that war may be closer than we think. (http://www.theatlantic.com/international/archive/2011/12/has-a-war-with-...)

Western public opinion is being softened up as Iran is more and more portrayed as a pariah state that will have to be taken out before it goes critical. Meaningless sanctions will only increase western economic hardship, but this will be portrayed as the fault of Iran, and any other country that dares to strike its own furrow. Any military action at all anywhere near Hormuz will spike oil prices through the roof and lead very quickly to increased economic hardship here in the west; the perfect opportunity to go for Iran’s oilfields.

The public will be got onside by the puppet media but the result will be the final end of western world hegemony. Expect social meltdown and the flight of those with real money to South America and Australasia.

Has a War With Iran Already Begun? Probably, but we may not know the details until further down the road. A bit like the $7.7 trillion bailout to the banks in 2008 - part of a mentality that says, "a blind and deaf lion (public) poses less danger to the ring-master and the clowns."

Obama is a president who likes conducting policy under wraps - out of sight - with shiny paper and a bow on top. Except what's inside doesn't smell too good.

To rehash an older article:

The secrecy-loving mind of the U.S. journalist

If a major conflagration breaks out in the Middle East, it won't be a matter of the West stumbling into it. That's the way it will be presented in some newscasts, but the US administration will enter into the fracas with its eyes wide open. That it will fail to tell the people is a different problem. We live in an era where deception no longer carries the moral opprobrium it once did. That's to our detriment. The lies will hurt us most in the end.

Good morning Priest,

Your reasoning is as good as mine no doubt; and there are so many things that could happen at random that any one "most likely" scenario might be quickly eclipsed by another.

In terms of a war being politically useful, I agree wholeheartedly if the time frame under consideration is the medium to long term; but in the short term, such a a war might be judged to be useful to a politician seeking election or relection.

And then there are the priests-or madmen if you prefer-of the world.

Evidently there are a scads of them who are eager to see a bloody fight and the sooner the better, and unfortunately they seem to be in charge of the (mis)education of millions of young men with little to lose but glory and perhaps property to be gained.

There are also a lot of very rich and powerful individuals and corporations in favor of war-seeing it as an opportunity to enrich themselves at little or no risk, as losing does not enter into their thinking.

I agree wholeheartedly with you about the hypocrisy of O Bama in respect to transparency and govt.

I felt the same way about the Clintons wrapping themselves in the trappings of Thomas Jefferson-whose philosophy of government could hardly have been farther from their own.

The big lie rules, and the few who are smart enough to realize this truth are too few and too isolated to do anything about it.

Ignorance can be fixed, but doing so is like sweeping back the tide, a never ending unwinnable job , and the vast mass of people will forever be ignorant.

You can't fix stupid, and unfortunately most people are stupid enough that they wish to be well informed about football and celebrities but not serious matters such as survival.

Hapless for the rest of us, they're precisely the people who may push the whole edifice over the cliff, since their calculations ignore blow back risks. Corporations are like people in that they see harm's way affecting others not themselves. Perhaps if the very rich and powerful had a better footing in the day to day they would be more inclined to act as a brake not an accelerator, but alas, object lessons are not their strength. Nobody likes to admit they can "lose".

Priests, madmen, prophets, shamans all share a common fate, alluded to in the story of Cassandra: each looks in from the outside and tries to warn. Risky business. They 'stone the prophets'. For what it's worth, that usually happens just before the powerful get swept away by the forces breaking in on them - by sword, penury, or exile. Even the mighty are not immune from war and distress. Willful ignorance comes with a price.

As I said before, I suspect the map of the Middle East will look very different in a generation or two. The boundaries drawn up the victors of the First World War are as moveable as the desert sand. The West is vulnerable and it is less envied and feared as before. Meddling is no longer automatically beneficial for the meddler.

Sir Edmund Grey was not off the mark when he said in 1914: "The lamps are going out all over Europe. We shall not see them lit again in our time". Europe was never the same again. Will happen again if someone is stupid enough to light the Middle Eastern powder keg. Last time, America, one step removed from the conflict, was waiting in the wings to take over where western Europe left off. That scenario will not repeat itself.

mac - You know me to be just as blood thristy as any Texan and willing to send our brightest/bravest into harm's way if there's a good reason. After all, that's why God created Marines: to help fill that line at St. Peter's Gate. LOL. But: "...but in the short term, such a a war might be judged to be useful to a politician seeking election or relection." I'm not sure how that might play out these days. After the terrible human and monetary losses we've suffered in recent decades on such military adventures the politicans will have to do a lot more than wave flags and give brave speeches to get me to sign off. And I suspect a great many more folks will need even more justification. And given the likely immediate economic disruptions we would suffer I doubt any patriotic chatter will make the America public very receptive even if there's an initial knee jerk supportive reaction.

I like your style Rock!

You're right-a lot of politicians , especially including our own, will probably see a war as a political loser.

But some around the margins in smaller countries may see this differently.They may see it as an opportunity to gain in power and influence while raking in some loot or acquiring some territory.

I hope that there will be no war, but I try to separate my hopes from my thinking.

Speaking as an armchair historian and hardcore realist observer of human nature, I believe war in the Middle East is a virtual certainty.The only real questions in my mind are precisely when and precisely why such a war will break out.It could be tomorrow, or it could be a decade.

Some good thinkers here believe such wars are unwinnable, but that imo depends on the definition of victory.

The oil of the Middle East is flowing freely in world markets.

So long as we maintain our presence there , it will continue to flow.

Now a lot of us believe that the enormous American presence there is a mistake and a waste of colossal proportions, and I understand their pov very well indeed.I would believe the same thing , except for one pesky little detail:

I do NOT believe that oil would be freely flowing in world markets if we weren't "over there" right now.Our economy imo would collapse just about overnight if were were to pull out our ground based forces and recall our Navy to home ports.

We may not be able to "slap them silly" as I put it recently in respect to trouble maskers in the area ;Hiesenberg for one maintains that we can't.

I maintain that we can, in effect, easily do so well enough to keep a lot of potential trouble makers in line.Not many two bit dictators and strong men really want to go to bed tonight wondering if tonight is the night we launch a cruise missile with their own name on it.

And while we can't easily occupy and pacify a country like Iraq or Afghanistan (maybe we can't accomplish this goal at all) we can certainly make any such country wish they had kept whatever serious military hardware they possess within their borders and out of sight if they were to mobilize and go aviking.

Nobody is going to send an armored column across any border over there if Uncle Sam says "No".If they do, only a few minor elements of it can be expected to return home with tails well tucked between legs.

I believe the people at the top of the heap in the Pentagon and around DC-in Congress and in the White House-regardless of current election results- are as a practical matter willing to define victory as MAINTAINING THE FREE FLOW OF THAT OIL on a day to day momth to month year to year basis.

The troops over there can be looked upon more as cops than as invaders in a useful and legitimate sense, even though they are also obviously invaders and mostly unwelcome.

Cops on the streets in any city anywhere are never demobilized-they are there much more to PREVENT trouble than to stop it once started.It takes a dozen or more to do that for each one it takes to keep trouble at bay before it gets out of hand.

When the oil is gone, the troops can come home.Not before.We will keep them there no matter what, so long as we are able to do so, no matter the expense.

We have no other viable choice in the short or medium term.

.

mac - yep...I was just thinking in terms of US politicians. In some countries war might be a chosen method to maintain control of the populace. I agree about our presence have some effect in keeping the oil flowing but difficult to estimate the real value vs. the negatives. You seen my thoughts before about a MADOR protocol developing between us and China. The Mutually Assured Distribution Of Resources seems a likely development IMHO. The US and China will be able to exert a lot of pressure especially if they do so in a cooperative manner. I've seen reports that China is planning a carrier force...a proven method of exerting influence around the globe. When things start getting very tight it will be interesting to see how many of our "allies:" were willing to p*ss on to get what oil remains. China will be able to enforce their rights. And so will we...in theory. We all know that somewhere down the road someone will have to give up their imported oil. The high bidders would be the obvious winners. But in some cases it may take more than a fat check book. That's where a carrier and a Marine (US or Chinese) expeditionary force could come in handy.

There has been a lot of lies already about the Iranian nuclear ambitions. Just like the ones about Irak. The latest is implicating a russian "Expert', whose expertise was in diamond manufacture. One might suspect an urge to get control of the Iranian oil.

A little humor:

http://www.videofunder.com/view/klnd5923h/iran-so-far-away-andy-samberg-...

There is clearly nothing to worry about. GOP front-runner Newt Gingrich said all we had to do is drill a little more and we could make up for all of the reduced exports from Iran.

Oh you may think that is crazy. But that is only after he's had time to calm down. In 2009, he suggest that we should sabotage Iran's oil infrastructure.

http://thinkprogress.org/politics/2009/07/13/50472/gingrich-iran-policy/

I'm really struck by that first chart. Since the revolution in 1979 Iranian oil production never reached half of the pre-revolution rate? The shape of the curve doesn't suggest to me that they have experienced massive depletion, rather that they have been constrained by something, such as a loss of technical talent or disruption by outsiders.

That may complicate what is really going on. I have wondered for a long time if the lost production, whatever the reason is driving their nuclear push. Either they really want to replace the lost energy source with nuclear and the sabre rattling in the west is all lies or, perhaps, they fear that without a nuclear umbrella they will be subject to even more internal interference by a hostile west.

Bloody war with Iraq for at least 8 years did not help. Sanctions from the West kept out modern technology and Western investment. Poor reserve management probably damaged existing wells. Ideological anti-Western doctrine did the rest.

Iran probably could expand production somewhat, but not back to the 70s peak.

Shame, because the Iranian people are mostly cultured, well educated and peaceful.

Euan,

Thanks for your interesting post. I wonder why you kept, so prudently, Iraq and Iran out of your calculations on the impact on world oil exports.

Here follow my updated comments in Energy Resources, four days ago, on the impacts of the closure of the Hormuz Strait:

As per the BP Statistic Yearbook 2011 (Oil Inter-are movements), which include Iran and Iraq approximate production

Oil imports in China: 6 Mbpd

Oil Imports in China from Persian Gulf: 2.3 Mbpd direct and perhaps 3 Mbpd

induced

Oil dependence of China from the Persian Gulf: 38-50%

Oil imports in Europe: 12 Mbpd

Oil Imports in Europe from Persian Gulf: 2.3 Mbpd direct and perhaps 2.5 Mbpd

induced

Oil dependence of Europe from the Persian Gulf: 19-21%

(Spain being much more dependent, in a 30%)

Oil imports in USA: 11.6 Mbpd

Oil Imports in USA from Persian Gulf: 1.7 Mbpd

Oil dependence of USA from the Persian Gulf: 15%

With all Japan would be in a hara-kiri position:

Oil imports in Japan: 4.6 Mbpd

Oil Imports in Japan from Persian Gulf: 3.6 Mbpd direct

Oil dependence of Japan from the Persian Gulf: 78%

What I have excluded here is the natural gas shipments that will also be cut, if the Hormuz Strait closes. South Korea, will be one of the most affected countries, in a 43% of its total gas demand. Japan will be affected in a 22% of its total consumption. Spain, as you have mentioned, with close to 17% of its gas consumption, coming from Middle East in LNG tankers. India, a 18%. China, in this case, only with a 2% of its total consumption.

With a shortage caused by the Hormuz Strait closure for several months, for instance, Japan could even probably have serious difficulties even to maintain its about 50 operative nuclear power plants, many of them still stopped, after the earthquake and subsequent tsunami, but needed to maintain with lots of electricity and liquid fuels supplies from outside. The strategic reserves of the countries amount to about 90-120 days of real storage capacity. If Hormuz Strait is closed by tens of thousand of submarine mines, that can not be swept or cleared for many months; if missiles or rockets or fast speed suicide boats sink a certain number of oil super tankers or LNG tankers in the region, the supply problems will extend very much in time, due to the replacement long periods.

In a global emergency situation, the US could apparently (only apparently)

survive. Europe will, most likely fall on its knees. China plummets. Japan

disappears.

So, perhaps we can understand now better why Chinese are sending clear signals

to USA and Europe about entering into a WWIII, if necessary. The clue is "to

defend Iran". The reality is to avoid its own full collapse, if the USA and

Israel dare to attack Iran and provoking a natural reaction of a Persian Gulf

shut down perhaps for many more months than strategic reserves may accept. And

for those who have still a little common sense, they should understand and make

understand their falcons and dirty financial lobbies, overflying the Congress

and the Senate, that China has a great capability to harm anyone and of course,

to die by killing.

At this point in time, I am not very much impressed by the assumption than oil prices will skyrocket, because this is assuming that market economy will still be in BAU mode. Much on the contrary, I guess that market economy will immediately be replaced by war economy, where process have little to do in securing supplies.

But the USA will commit a big mistake if they believe that because they still hold the only operative global fleet around the globe, they may be able to capture and redirect even oil flows now directed to other countries (detrimental to those countries), to minimize or reduce to zero (initially) its 15% oil

shortage, if the Persian Gulf is closed for more than 3 months.

At least 3 countries with atomic weapons could retaliate, if they see that the USA provokes its complete collapse. Others, with no atomic weapons could harm a lot to the today apparently secured energy routes and sources.

It is also a potential scenario that Chinese could perhaps tighten themselves as

much ass a 50% in its oil consumption (still a heavy coal based country) that

we, comfortable Europeans or North Americans, sofa and remote control trained, will never accept.

Beware of idiots and stupid people with financial strength and narrow minded

economicist views and monkeys playing in the war rooms. My suggestion is to try to resist to the strategy of tension, mounted by a minority. The recent shot down of an US stealth unmanned plane inside Iran, is one of the best examples on how to play with stupidities.

I wonder what type of narrow-minded, short sighted politics and strategies our Western leaders play. I recall the plan to build some 20 nuclear power plants in Iran, during the Sha of Persia period. That was decided, in a moment when Iran had much more oil and gas than today and much less internal consumption, but apparently, all the main potential suppliers and contractors (Germany, France the USA) were very happy. What if Khomeini had arrived to power a decade later, with about 10 or 15 of these plants already operative? What the Western powers would have done? To bomb them all? How do we select when a nuclear civil project in a developing country is with or is secure? Why on Earth the nuclear lobby has been selling to us for decades, that civil and military use of nuclear power were hermetic compartments and when Iranians start with its civil nuclear program, we suddenly discover that everybody was pissing in the swimming pool and some of them even from the diving board and that the line between civil and military nuclear applications is so tiny? Do we take decisions just because the leaders in charge are our soabs in this very moment? How to secure that the leaders in one country will continue being friends of the technology providers (we, the good guys) for the time the plutonium (24,600 years semi disintegration period) in their possession semi-disintegrate?

The excuses of Iran diverting enriched uranium from civil use to military use is a pure alibi of the need to go for the before last (only before than Venezuela) of the important producing/exporting countries that still challenges the decisions on what to do with their own oil, in a dwindling world oil and gas supplies, specially in the export capacity of the producers and more specially in the low cost, high EROEI, high quality fuels.

This time, with the planet in its limits, the war as an exit to the problems is

not a choice any longer; it is not an option. We have only the option to power

down voluntarily. Call it power down, not recession.

I have thought for a while that it is a myth that the US can successfully use force to maintain oil imports to the US--because of the vulnerability of supertankers to everything from submarines to sabotage. Note the recent consumption trends for China, India, the top 33 net oil exporters and the US from 2002 to 2010, as annual Brent crude oil prices rose at an average rate of 15%/year:

If we extrapolate the 2005 to 2010 rates of change in Global Net Exports of oil and in Chindia's net oil imports, for every two barrels of oil that non-Chindia countries (net) imported in 2005, the non-Chindia importers would have to make do with one barrel in 2020.

Indeed. This was the result of a single suicide bomber in the straits less than 2 years ago.

http://www.aljazeera.com/news/middleeast/2010/08/20108683953783853.html

That was the result of a rubber dinghy filled with crude home made explosives. Now imagine what the same dinghy fitted with

an armour piercing RPG or similar

All tankers are just extremely big sitting ducks in the water, even the simplest of rockets/speed boats packed with some shaped HE charge can blow em apart. BTW how many super-sized tankers exist in the world ? Any numbers.

Given the world's dependence on them, I'd say we are not looking at a very bright future.

Who is going to insure cargo and ships in the Gulf if war breaks out? The value of the cargo in a big tanker exceeds the value of the tanker.

Who is going to take the risk on $300,000,000 worth of oil?

My guess is that the US will step in and insure the oil in those tankers and then the owners will sabotage them to get the insurance.

According to Wikipedia,

http://en.wikipedia.org/wiki/Tanker_(ship)

the big ducks are more or less as follows:

At nearly 380 vessels in the size range 279,000 Dead Weight Tons (DWT) to 320,000 DWT, these are by far the most popular size range among the larger Very Large Crude Carriers (VLCCs). Only seven vessels are larger than this, and approximately 90 between 220,000 DWT and 279,000 DWT.

So, they do not need to be massively successful.

So give or take 500 missiles. To have redundancy let's have 500 X 4 or 2000 anti-ship missiles to bring the world to it's knees. Excellent

If the soldier using it can get close enough, it won't take an antiship missile to sink oil tankers.

The ones that are used on battle fields to attack tanks are quite good enough to do the job, although it might take three or more of them, as tankers are compartmentalized.

Anybody who can can get within a mile or maybe even two or three miles of a tanker in a small fast boat can take the tanker out with the kind of missiles used against tanks and aircraft. Tankers aren't armored at all.They ARE loaded with highly flammable oil about half the time.

But something tells me that antiship missiles are not in short supply in the Middle East in any case.

Pedro Prieto--

I was wondering when someone on this thread would notice that a real Iran war (as opposed to the current stealth war) would take Saudi oil off-line indefinitely.

Good point! Good post!

--Gaianne

Hi Pedro,

Well spoken,

The only Item nobody seems to mention is that Bashir Nuclear plant is now operative if it gets bombed we have another Fukushima scale release of radiation. Better check the way the wind is blowing. ( at least when the Isralies bomed Iranian reactor it had not been fueled)

The whole of Gulf could be Nuclear radation no go area. How long does it take to Decontaminate a supertanker full of oil ?

Ugh. People like John Bolton would look at that and see "USA wins!" That analysis would seem to make the crazy war mongers MORE LIKELY to attack, not less likely.

I've always thought that if the USA launches a serious strike against Iran, Iran will retaliate by launching a massive strike against the Saudi oil fields, oil ports, refineries, etc. that are all located just across the gulf on Saudi Arabia's eastern shore. That would send oil prices into the stratosphere causing the world economy to meltdown. And what hurts Americans more than money? (That would also increase the value of Iranian oil . . . if they could manage to produce it.)

There are much talk about the Iranian nuclear program, and the possibility of nuclear attacks from Iran, but there are not many words written or spoken about the new Iranian oil bourse just started to sell crude oil and other oil products in a basket of other currencies than the dollar.

The new Iranian oil bourse placed at Kish Island could become a much bigger threat to the United States than any nuclear facility today. Anything that can divert from the dollar hegemony in the oil trading, making the dollar a world reserve currency, will be taken seriously in Washington.

Saddam offered his oil in Euro prior to the invasion in 2003, and Gadaffi was about to start oil trade in gold dinars prior to the Nato attack, and if the Iranians get this oil bourse going with China and Russia as big customers maybe that will provoke a new Nato attack against Iran. Of course based on the Nuclear threat since the world probably have been hammered with nuclear stories by the media at that point.

Personally I think that the only thing stopping Washington from the attack so far is the possibility of nuclear technology in Iran, and the fact that any attack will drive the oil prices sky high making life in America and Europe even harder than it is today.

There are no way I can see the Iranians attack anyone in the next years, but they are well aware of what happens to those trying to destroy the dollar as the world reserve currency. Therefore it is in Irans best interest to look as a big threat to keep any attacks away in the near future while trying to establish this new oil bourse at Kish Island.

I don't know what the influence of Iran oil sold in any other currency could be to the worlds power balance, but maybe someone in here can give a good overview, or will have more insights on this oil bourse.

Some info for those interested:

http://tehrantimes.com/economy-and-business/1748-1st-oil-shipment-sold-o...

http://oilprice.com/Energy/Crude-Oil/Iran-Opens-Oil-Bourse-Harbinger-of-...

Eddi

I was interviewed five years ago by Chris Vernon concerning the Iran Oil Bourse

Interview re Iran Oil Bourse

since it was my idea in the first place......

....it's simply a spot exchange and pretty irrelevant in the scheme of things.

I was interviewed by TV over there a few weeks ago on how it might be developed, and also had a couple of meetings with the Oil Ministry.

This whole Saddam/Iran Oil Bourse meme is completely misconceived IMHO but of course you can't ask Saddam on here.

Thank you for your info, and a very interesting interview.

I really like the idea of peeling out all the speculations and get down to basic trade between two parties.

I also found it interesting to read the comments, and see that back in 2006 some people were sure that this bourse was not going to happen at all... showing how hard it is to predict the future for all of us.

I like to thing that you are correct about this Saddam/Gadaffi/Iran Oil Bourse being completely misconceived, but in my world I try to be an observer mostly, and as an observer I find it pretty hard to discredit the fact that everyone who puts out a threat to the petrodollar finds himself in deep trouble quite fast.

I can also personally agree that this Iranian Exchange will not destroy the dollar in any way alone, but It seems that Washington are political engaged to take down any threat to the dollar, big or small. Maybe to send a message to stay away of such thinking? I dont know, but it looks clear that these threats are taken as a act of war.

As an observer it is obvious for me that either Gadaffi or Iran would/will attack the western world in any way. If a war starts the attacker will again be USA, of course to defend itself from potential nuclear attacks if you ask the media. For me this is just a big game, and in that game anyone who threatens the dollar seems to be punished.

Why is that, since as you mention, this will not threaten the dollar on its own, but maybe the fear in Washington is that tradings with other currencies can evolve and be a factor later on? I dont have any good answers, and this is all just speculations anyway.

Also I will mention that even if this is small in the big picture, the fact that oil is traded in dollar make every country to have dollar reserves to be able to get the oil, and in these hard times for the United States I think they are dependant on that fact.

Again, thanks for the link and good information on the background and function of the oil bourse.

Rib,

In effect, the Busher nuclear power plant is already fully loaded. And it is true that probably in this event most of the Middle East would have to be declared no go area for a long time. The worst of the nuclear effects is not a conventional explosion of a 1 GW nuclear power plant (Chernobyl or Fukushima, for instance) or the 1 Megaton explosion of a nuclear warhead. The worst of them all is the combination of a nuclear 1 Megaton blast on a 1 GW nuclear power plant (See catastrophic releases of radioctivity A. Fetter y Kosta Tipis, Scientific American June 1981)

And the problem of bombing when the wind is blowing Eastwards in Iran, for instance (in the case of Israel, to avoid the atomic cloud) is a mistake, because the radioactive releases will last for a long time and the wind changes directions almost every day.

Israelis bombed the Osirak plant in Iraq (Tammuz), only after few days the French took away some nuclear materials, despite the anger of the Iraqis, who feared what was going to happen. French must have been warned by Israelis few days before. An Israeli fighter was shot down by Iraqis days before the real bombing, but nothing appeared in the Western media. It was only announced in Iraq, and sounded very strange, because they were in a war against Iran, not Israel. But Khomeini did severe instructions not to bomb civilian targets (the first months of the war), neither the nuclear power plant. He was much more respectful with its evil enemy than Israelis, even he had been provoked and harassed by the Iraqis first. And apparently the Israelis had noticed that Iraqis were piling up anti aircraft batteries and missiles around the Osirak plant and besides, raising captive balloons (like in London in the II WW) around the plant, fixed with steel wires hanging very high (500 m.), so that in these days the fighters, to be accuarate (not like today with shot and go missiles from long distances or programmed Tomahawks, guided by satelite), had to fly low until reaching the target, also to escape from the missiles range.

And the main problem will not be decontaminating an oil super tanker from radiation.

It is if Iranians manage to sink just 100 of the 500 big oil tankers moving most of the world oil flow. The ballistic missiles are relatively easy to intercept with these costly shields. What is a little bit more difficult to prevent is the deployment of tens of thousands of submarine mines in the Hormuz Strait (3 Km both ways navigation lanes) and to prevent for every super tanker the sea level flying land to sea missiles or fast boats fully loaded with explosives or even torpedoes from the coast.

Eddi is also right when he notices that the main harm to the USA is the trading with oil in currencies other than the dollar. This is really painful for the US, and more likely what cost the life of Saddam and Kaddafi.

I mentioned this in the drumbeat but it fits here . . .

Oil at $150 Becomes Biggest Options Bet on Iran

http://finance.yahoo.com/news/oil-150-becomes-biggest-options-142650324....

Even if nothing happens with Iran, such a position may pay off if there is an oil crunch due to increased Chinese demand and continued weak supply.