OPEC says, "Don't Count on Us" for More Supply

Posted by Gail the Actuary on December 19, 2011 - 11:34am

This post appears in ASPO-USA's December 19th Newsletter.

The results of OPEC’s latest meeting to set oil production quotas were announced this morning. Instead of production targets for individual countries, a group production ceiling of 30 million barrels a day was set. This amount is a bit less than OPEC produced in November 2011 (actual 30.367 mbd), according to its reckoning, and less than it would have produced most of 2011, if Libyan production had stayed on line, based on the amounts shown in its November Oil Market Report.

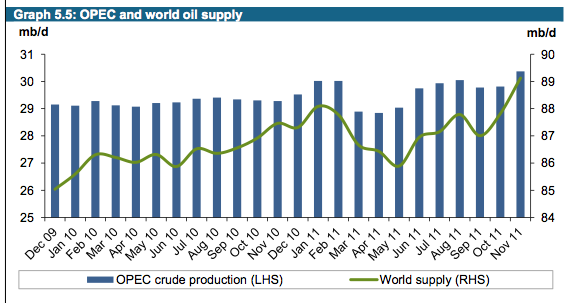

A recent history of oil production from the November Oil Market Report, both for OPEC and in total, is shown in Figure 1.

According to a Platts report of the meeting, Venezuelan Oil Minister Rafael Ramirez told reporters, “We are going to reduce the level of production of each country to make space for Libya.” That is not what people want to hear–Brent oil price is still over $100 barrel, even with what seems to be record production for both the world and OPEC, based on Figure 1.

The same Platts report also says, “OPEC on Tuesday said it expected demand for OPEC crude next year to average 30.09 million b/d.” Thus, the new production cap is slightly less than what OPEC sees as demand going forward.

It should be noted that the new limit includes Iraq in addition to the “regular” OPEC countries. Thus, the agreement says that if Iraq increases its production, other OPEC countries will reduce their production to keep total production to 30 million barrels a day.

All of this comes shortly after Saudi Arabia announced that it has halted plans to increase capacity to 15 million barrels a day by 2020. I wrote about this in a recent post. Saudi Arabia claims to have 12 million barrels a day in capacity now, but there is little evidence that it can actually produce this amount of oil. Saudi Arabia recently boasted that it would increase oil production above 10 million barrels a day, to help offset the drop in Libyan oil production, but amounts reported by the OPEC Oil Market Report and the EIA report of monthly oil production are still under this amount. The highest Saudi oil production reported by the EIA is 9.94 million barrels a day in August 2011.

There would seem to be several reasons for applying an overall cap to OPEC production:

1. OPEC needs/wants high oil prices. They certainly don’t want the price of oil to fall by very much, if they are to have enough funds to pay for all their social programs. So holding production down is in their best interests. An overall cap provides as direct a way as possible of keeping overall production down.

2. It is not clear that most OPEC members have any spare capacity. Saudi Arabia may, in fact, need to “rest” its wells after pushing production to its recent high of 9.94 million barrels a day in oil production. Writing the agreement as an overall cap gives Saudi Arabia “cover” for resting its wells, as needed.

3. This approach is at least theoretically easier to administer. One or two or three countries can make a change in production, if desired, to bring total oil production down to the desired level, if others raise their production.

4. This approach gives a framework for future agreements that can be helpful if Iraq’s oil production should actually increase by very much. Iraq’s production is in effect pulled back in under the agreement.

5. This approach provides great “cover” if one or more OPEC countries experiences a decline in oil production. There is no need for embarrassment if an individual country should experience declining production, since a country can simply blame the result on a need to keep overall production within the selected limit, and thus “save face”. A country with very high stated reserves might be especially embarrassed by an unexplained decline in production, since this might also suggest that the stated reserves were inaccurate.

Why the Market Discounts the New Cap

I am aware that the price of oil dropped after the announcement of the new 30 million barrel a day cap. The view underlying this decline is that the new cap is similar to the individual country caps, and likely to be exceeded if circumstances are right. Furthermore, the 30 million barrel a day cap is similar to what OPEC has recently been producing, so there is no expectation of a cut in production at this time.

It seems to me, though, that OPEC is gradually changing from an association whose primary purpose is to hold down production, to an association of mostly aging oil countries who need to cover up the fact that their oil production may not be able to keep up much longer. The new methodology works much better, if part of the purpose is to cover up the reason for declining production of a few countries.

Figure 2 is a graph I showed in a recent post. It shows Middle Eastern and North African (MENA) oil production as a percentage of world oil production.

The countries included in MENA are not the same as OPEC, but there is a large overlap with the older OPEC members. Figure 2 shows that this group has not raised production relative to world production by very much, even when oil prices were high, suggesting that they have little capacity to do so.

As the very old wells in MENA countries age further, declining production can be expected to be an increasing problem, adding to the need for countries to “save face” as production declines, as mentioned in Point 5 above.

Conclusion

It will take a while to see how the new cap works out in practice. The important effect may not be in the next three months, but over the longer term, especially if Iraq’s production increases.

Both EIA and IEA are expecting that OPEC will provide the majority of future increases in world oil production. If my interpretation is right, OPEC is suggesting that they will decide how much, if any, increase in production will be allowed through to the rest of the world–that is, assuming that the increase in OPEC production is really there in the first place, and not offset by other OPEC declines.

My expectation is that oil price will really depend on how well the world economy is doing. The world economy is threatening to slip into recession now. If it does, prices may go down. If it does not, and OPEC indeed keeps its production capped at 30 million barrels a day, we should expect higher oil prices ahead.

In any new agreement, the real question is how the agreement is administered in practice. I have suggested one way the new agreement may be used. It will be interesting to see what actually happens.

This post originally appeared on Our Finite World.

http://www.youtube.com/watch?v=O2reaZDEUJQ

OPEC is feeling Fine and Mellow:

http://www.youtube.com/watch?v=YKqxG09wlIA

First off, I wonder, is it a 2.5 ye. avr. with an oil spout of 3/10 to cover the Saudi cap?

This is impractical;

I'll explain:

When the Saudis, or the Venezuelan chair-holders, decide to everest in a united Saudi Oil Agreement,

the Libyans are automatically left out of the loop.

That would force a 3.0 ye. AVR. of 20% the current OIL supply globally.

OPEC makes 40 gallons per rig, per mgt, (or megatons) but the rest of the world, get's about 10 barrels, mil, from the rig.

Forcing- an oil degradation, IF, OPEC, doesn't hire more EXECS, from Over-Seas, as stations from their Corp. Off,.

Where-ever.

NOT very good, unless, 30 gallons are rigged, reversing to the EST, as suggested, 30.09gal./m/day. (MBD)

Opposed, to a, very humbling, 25dmd (drones per million gallons, apprx. 25 gallons (MBD) per day).

WOW. How disconcer(t)ing. Do we need more illegal work?

Or, do we hire by officious ability?

DAWDLING, i'd say, to say the least.

"Venezuela is one of the world's largest exporters of crude oil and the largest in the Western Hemisphere. The oil sector is of central importance to the Venezuelan economy. As a founding member of the Organization of the Petroleum Exporting Countries (OPEC), Venezuela is an important player in the global oil market."

From the EIA website. 'Interesting,' hmm.

Thanks, Gail. I loved Figure 1, how the scale on both sides is the same, the colors, and the line/bar combo; it is a very clear and eye pleasing graphic.

I think most of us here at TOD were waiting for the Saudis to admit what we all knew, that they will never produce 15 MBPD; I doubt they will ever reach 12 MBPD.

The new 30 MBPD OPEC production goal is very interesting for many reasons. First, from now on there will be no individual quotas; this will make OPEC meetings an easier affair because there is less to negotiate. Second, Iraq was thrown in. It is anyone's guess what will happen in Iraq, but they have the improbable to be realized potential to increase production significantly and adds uncertainty. Third, it helps SA to safe face after the previous(worst ever) OPEC meeting. Fourth, it is so much closer to the true actual production than the previous one. Fifth, how will they use this new system in the future.

I agree completely with your conclusions. The purpose of this change is to fudge, confuse, and hide their declining production capacity.

I wrote another post about the Saudis putting off an increase to 15 MBPD capacity beyond 2020, also for ASPO-USA. I call that post, Saudi Arabia - Headed for a Downfall. I don't think that post will run on The Oil Drum.

Thanks, I had already read it.

That statement is in conflict with al-Husseini's statement:

Saudi Aramco’s Drilling to Jump 12% Next Year, Ex-Official Says

http://www.businessweek.com/news/2011-12-22/saudi-aramco-s-drilling-to-j...

It seems to me that OPEC has simply acknowledged to the world that it no longer has any real purpose. For 50 years it has acted as a cartel restricting production by it's members to maximise overall revenue. It no longer needs to play this role as natural production limitations now mean that now the world simply cannot be flooded with cheap oil.

OPEC no longer has it's fundermental role to play so it will progressively (probably over the next few years) fade into obscurity. Unless of course it adopts a new raison d'etre.

Well done once again Gail.

thanks Gail.

Took me some time to understand your figure 1. But then I found that OPEC is not a very large part of world production, and that the plot just compares the variation of OPEC to that of the more stable world production. All in all the variation of world production was not much more than by 1% of the total. That leaves me a bit surprised as to the large spikes in the oil prices.

What I don't understand in the story is why OPEC would even want to hide any weakness in their supply .. as any uncertainty would drive up prices, which should be good for them, or not? Would the urge of Saoudi Arabia to brag about their big macho fields be larger than a fear of over-promising, or even profiting from higher prices due to more reasonable predictions?

The Saudis have been worried in the past that any doubts in the West regarding the reliability of the Kingdom as an energy supplier would translate into an escalation in the implementation of alternative energy technologies. The Saudis have more confidence in (and fear of) the West's technical abilities than is warranted.

The Saudi oil chief (whose name escapes me) has said, on several occasions, that they want to keep the oil price high enough that they make money, but not so high that other countries develop alternatives to oil.

In my opinion, Saudi and/or OPEC admitting that they "weakness" in their supply is the single thing that would spur a serious take up of oil alternatives in the western countries. Paying high prices for oil is one thing, but the prospect of a serious oil supply decline is quite another.

If it was revealed that things are really bad, we would see western governments doing all sorts of things to avoid being dependent on a declining/unreliable supply.

Of course, they should be doing that today, but as long as the supply is "stable" then the easiest political path is BAU rather than pushing the panic button.

Figure 1 is really a figure I copied out of an OPEC report. This graph is a little confusing to me too, since OPEC and world so that they seem to be at the same level (if one ignores the two different axes). I would probably show a tall graph, with world up at the top, and OPEC only a third of the way up, so it isn't so confusing.

Regarding why OPEC would try to hide any weakness in their supply, you have to remember that quite a few OPEC countries have little other than oil. Saudi Arabia is the biggest user of desalination in the world, since it doesn't even have water. Without water, it is pretty much impossible to grow food. Before oil was discovered, countries had much less population, and very much less wealth--in the extreme case, just what could be generated from a few oases in the desert. The rulers in these countries want to be seen as being in charge of what happens to oil supply. The US pretty much hid the US decline in oil production in 1970. I would not expect it to be different there (except that it would be a lot harder to hide).

I don't think the issue of other countries building or not building alternatives is really an issue. Alternatives don't work very well--for example, biofuels can substitute for only a small % of fuel, unless they are chemically identical to petroleum products, and most aren't. The also aren't very scalable. Talking about alternatives as if they truly provided another way of fueling vehicles makes people think that the current situation isn't too problematic, so that BAU can continue a while longer.

Electric vehicles (hybrids, PHEVs, EREVs, pure EVs) scale extremely well.

The only thing slowing them is everyone's lack of recognition of the enormous hidden costs of oil: security (trillion dollar oil wars, homeland security, really bad war movies, etc, etc); economic (oil shocks, trade deficits, etc, etc); pollution, etc.

That lack of recognition is largely caused by disinformation and the wholesale purchase of our elected representatives by the oil industry, of course.

Eh? Firstly, as Darwinian points out, OPEC data is crude, and World is 'total liquids', so this skews the portion of the total that OPEC represents. At about 30 mbd, I'd call that more than 'not a very large part' of even the near 90 mbd shown most recently for the world. But of the more like 75 mbd world total crude oil, OPEC is certainly a significant chunk thereof.

More puzzling to me, however, is this:

World total liquids in the graph vary from 85 mbd to just over 89 mbd. This is a variation of about 5%. OPEC's output is more stable during the period shown.

Capping production is a distracter. The key is export levels. If OPEC's domestic consumption continues to rise, less oil will be exported thus keeping prices high. By keeping production level at 30MBPD combined with its increasing domestic consumption, OPEC is saying less oil will be available for purchase in 2012, which ought to keep oil price on its slow, steady rise. And of course no mention of any intent to replace Iranian exports should they be removed from the market for whatever reason.

I am not sure we are talking about a slow steady rise. Oil price has really been rising pretty quickly, since about 2003.

Thank you Gail.

The media response to oil prices has changed. Nobody seems much concerned by high prices anymore and, just as with the Euro crisis and the banking crisis, and the general economic malaise, the world is living from day to day and hoping for a miracle. Christmas is the new big thing because it gives everyone a forced break.

OPEC has been clever and given a media impression that it has increased production limits while in reality it has slightly decreased them. They have, on occasion, been pumping at slightly above 30 million barrels, and it was a real strain and couldn’t be continued it seems. This global figure can, for a while, disguise falling Saudi production, which will allow the mega rich borrowed time to organise themselves more bolt holes. When it is finally publically acknowledged that Saudi oil production is declining I can’t begin to predict anything that might happen in the money markets: all guesses are off.

I believe 2012 will be the year when the energy crisis is seen for what it is and the world’s economy becomes irreversibly destabilised. I wish I had my own bolt hole.

It gives certainty to the global markets in negating Iraq. Even if Iraq did get all its ducks in a row and increase production at the rate they claim they could, OPEC would just reduce other production to limit supply.

Thus the message to markets is - even if GFC II hits tomorrow, even if Iraq pulls an elephant out of the top hat, that oil price isn't to go south.

IIRC Non-OPEC is pretty stable, short term, which mean they expect prices to be equally stable and growth in one area to be met by reductions in others.

Short term price maintenance it seems.

I can imagine the economy really going south in 2012, but I am less convinced that people will make the connection with our energy problem. The connection will probably be with the Euro failure, and all of the debt defaults, and some other problem of the day.

Sorry. Should not have used "slow." This site's documentation of historical oil prices and production clearly refutes "slow" as proper and suggest meteoric as better. A graph I found interesting displays oil price and the # of futures contracts. But it appears the metioric rise in price has stalled again, thus OPEC's announcement of a production level without saying its purpose is to ensure a price basis of $100/bbl.

Re: Saudi Net Oil Exports

Here is what BP shows for Saudi production, consumption and net exports for 2005 to 2010 (total petroleum liquids, mbpd), versus annual Brent crude oil prices (EIA):

Production - Consumption = Net Exports

2005: 11.1 - 2.0 = 9.1 & $55

2006: 10.9 - 2.1 = 8.8 & $65

2007: 10.5 - 2.2 = 8.3 & $72

2008: 10.8 - 2.4 = 8.4 & $97

2009: 9.9 - 2.6 = 7.3 & $62

2010: 10.0 - 2.8 = 7.2 & $80

The EIA is showing average Saudi total liquids production of 11.0 mbpd for 2011, through August. Let’s assume that the EIA shows them matching the 2005 rate of 11.1 mbpd for all of 2011, and let’s assume that consumption continues to increase at the 2005 to 2010 rate. This would put Saudi 2011 consumption at 3 mbpd, resulting in 2011 net oil exports of about 8.1 mbpd, versus an average Brent price of about $111 for 2011.

However, while the BP and EIA data were virtually identical for 2005, we have recently seen a significant discrepancy between the two data bases, with BP’s total liquids number for 2010 only being about 95% of the EIA’s number. Given the discrepancy between the JODI and EIA data bases for 2010, I am more inclined to use the BP numbers. Applying a 95% correction factor would give us the following estimate for 2011:

2011: 10.5* - 3.0* = 7.5* & $111*

*Estimated

In any case, it seems likely that annual Saudi net oil exports for 2011 will be somewhere between 7.5 and 8.1 mpbd, versus an annual Brent price of about $111, versus net exports of 8.4 mbpd and an annual oil price of $97 in 2008 and versus net exports of 9.1 mbpd and an annual oil price of $55 in 2005.

Saudi Arabia has almost certainly shown--for only the second time since 2005--a year over year increase in net exports. However, although annual global oil prices doubled from 2005 to 2011, Saudi net oil exports in 2011 were probably 1.0 to 1.6 mbpd below their 2005 level.

Regarding Global Net Exports* of oil (GNE), if we extrapolate the 2005 to 2010 rates of change in exporting countries' production and consumption and in Chindia's net oil imports, the supply of (net) exported oil available to importers other than China & India would fall from 40 mbpd in 2005 to about 21 mbpd in 2020:

*GNE = net exports from top 33 net oil exporters in 2005, BP + Minor EIA data, total petroleum liquids; ANE = GNE less Chindia's net imports

2005: 11.1 - 2.0 = 9.1 & $55 ....... 9.1 x 55 = 500.55

2006: 10.9 - 2.1 = 8.8 & $65 ...... 8.8 x 65 = 572.00

2007: 10.5 - 2.2 = 8.3 & $72 ...... 8.3 x 72 = 597.60

2008: 10.8 - 2.4 = 8.4 & $97 ...... 8.4 x 97 = 814.80

2009: 9.9 - 2.6 = 7.3 & $62 ........ 7.3 x 62 = 452.60

2010: 10.0 - 2.8 = 7.2 & $80 ...... 7.2 x 80 = 576.00

2011: 10.5 - 3.0 = 7.5 & $111....... 7.5 x 111 = 832.00* (million $/day avg.)

While not accounting for production costs, etc., 2011 looks like a pretty good year for the House of Saud, despite relatively lower average production. While I understand that these are somewhat rough estimates, one can see why KSA may not be especially motivated to increase production at this point.

It also seems a very strange time for them to announce that they are not doing the investment needed to raise capacity to 15 MBD in 2020. When times are good, should be the time they should be investing. But I think they have essentially spent all of the additional funds on social programs, and probably locked themselves into high social program spending in the future.

They could be sandbagging, holding their cards so to speak. This would be culturally consistent, as we well know.

"When times are good, should be the time they should be investing."

Unless they don't have the oil to fill the new pipelines.

Unless they could fill the pipelines, but not keep them filled long enough to pay them off.

Unless (looking at the profit numbers above) they have decided a steady income for a longer time is better than a higher profit for a shorter time.

There are plenty of unlesses to explain a lack of desire to expand capacity.

It is curious that they showed a massive increase in net oil exports from 2002 to 2005, in response to rising oil prices, but then a far different pattern after 2005, in response to generally rising oil prices. Saudi net oil exports, horizontal scale, versus annual US oil prices:

Given the Arab Spring happenings, I think the Saudis will finally allow women to drive. Imagine what that will do to the amount of oil internally consumed. I wonder how much longer non-US/Canada Western Hemisphere oil will be sold outside of that bloc given the impressive growth rate in economic activity and coordination.

It is curious that they showed a massive increase in net oil exports from 2002 to 2005, in response to rising oil prices, but then a far different pattern after 2005, in response to generally rising oil prices.

Perhaps they've realized that they could increase profits, while increasing their own consumption somewhat and keeping production fairly flat. Seems like the smart thing to do (and that's what I get from your numbers). This would be consistent with statements the King made a while back about preserving some of their production for the future (something like that; can't seem to find it now). Why go all out when they seem to be doing well meeting their internal goals. I'm not suggesting that they could increase production a lot, but the line they are walking may not be as fine as some have suggested, and there's no sense at this point in forcing these old fields into giving up the goo.

As always, many thanks for your efforts.

Note that Figure 1 shows world oil supply as all liquids and OPEC oil production as crude only. It would be nice if both figures were in the same product allowing us to make a better comparison as to the increase and decline of each product over the months and years.

Ron P.

Thanks for pointing that out. As I pointed out, it is not my graph--it's OPEC's.

I didn't have any source of OPEC's view of their monthly production figures (except for months that happened to be shown on charts), so it was difficult to make my own version of the graph.

It is humorous to think that OPEC could actually agree on anything. Saudi probably told them that they were reducing production because they know the more oil in the ground, the more they are worth in the long run.

So we peaked in 1978, then another peak around 2007 after 30 years.. There is no telling how much the OPEC countries are leaving in the ground with their mismanaged state oil companies. They are not following a pure open market system within their own countries and to surmise what is really happening in them is rarely going to be accurate. They have to balance revenues and keeping their people happy or face the consequences.

Look at Iran. In 1980 production was at 1.5 million per day, by 2005 peaked at 4 million and has been on decline due to mismanagement. They have found billions in new fields, but can they produce them? Seems like today, the answer is no, but there will be a time where they get organized enough to do it, or hire the right people.

Venezuela is another example. They keep finding more and more oil, but mismanagement just leaves it sitting in the ground for another day.

Iraq, what is their true potential? They have over 100 billion in reserves...

There are a lot of reasons for individual opec countries declines and a lot of it is not due to field depletion.

Saudi Arabia's state oil company manages its wells extremely carefully. Iraq and Iran's wells suffered badly during their 8 years war (with the US supplying arms to both sides). Iran has faced Western sanctions for decades which has crippled their oil and refinery industries. Venezuala is a more mixed case. They nationalised their oil industry and the international oil companies lost heavily, and are very cautious about returning, leaving the NOC to mis-manage their conventional wells, and fail to develop their unconventional ones.

OPEC may be little more than a talking shop these days, but they have little reason to give Western customers an easy ride, after the ways we have treated them.

And if you beleive Iraq has 100B barrels, then I have just the bridge you have always dreamed of owning...

Your version of the story sounds a little closer to correct.

Ralph - All valid points. But I've decided to become a constant "pouncher" on one subject: proven oil reserves and their relationship to PO. I fully accept that 100 billion number so send me a brochure about that bridge. LOL. Now that I've settled the issue of how much oil Iraq has I'll let someone else tell us how much Iraq will be producing in 12 months...5 years...20 years. After all, PO is all about production rates and not reserves.

I've studied hundreds of fields in great detail over the last 36 years. Even when I could prove with 100% confidence the URR of a reservoir that number had no relationship to production rate. I've analyzed reservoirs that contained URR of similar magnitude with some producing less than 50 bopd total from all its wells and others producing 10,000+ bopd. URR implies absolutely nothing about prodction rate nor profitability. I've done dozens of field acquisitions and no one ever paid much attention to the amount of proven reserves. The valuations were based solely on cash flow projections. And those projections are based upon production rates. And thus cash flow stands as a valid surrogate for PO analysis.

Rockman, at what point do you extend your knowledge beyond the known, into the unknown? While being absolutely positive of something prior to acquiring it makes perfect sense for a normal businessman, it doesn't work as well for an exploring geologist. Hubbert, in 1956, list tens of billions of barrels which hadn't even been discovered (let alone assigned a URR or had a single barrel of production) in his forecasts of future production rate. Basically, he made it all up. If Rockman had been sitting beside him while he did it, would you have been insisting he couldn't make such a projection, what with no fields discovered, no fields delineated, no fields economic? Rockman, he MADE THEM UP. It sounds as though you frown on such behavior, even though (ultimately) Hubbert was proven correct for all those fields, about which nothing was known.

ObiWan - Knowledge = KNOWN. Unknown = not known = not knowledge. I've had exploration geologists blow smoke up my butt for 36 years. But that's not a criticism, mind you...that's their job. As a matter of definition an exploration project is one that lacks sufficient PROOF there are reserves present. And an exploratory well is about prospect specific reserve potential...not some grand universal concept like Hubbert was dealing with. But remember Hubbert wasn't focusing on URR but production rates. And as I'll continue to point out those two metrics are completely unrelated at a reservoir level. The grander the scope of the projection the easier it is to wave one's arm. That doesn't mean that projection is wrong but that it can't be proven/disproven by drilling even a few hundred wells...it will take many thousands drilled over many decades.

But I'm not sure what you mean by his "making it all up". He simply plotted US production rate. And then projected when he thought that curve would peak. You can duplicate his work exactly today. And don't be confused like other folks: Hubbert did not project nor predict what the down slope of the curve would look like. In fact, if you read his original work, he says it's not predictable. But what he did predict was that once US production reached the peak rate it would never reach that level again. And so far he's been completely correct. We might have come to a plateau at the moment but that that's a far cry from getting back to 1970's production rates.

I don't frown on such behavior...I just don't assign very little practical value to it for what me and the rest of the oil patch does on a day to day basis. Hubbert's model didn't cause one well to be drilled...now did it prevent one well from being drilled. I've got 3 exploration wells drilling right now and in not in one case did Hubbert's model come into play. Nor did it play a role in any of the other hundreds of wells I've been involved with during my career. But works like Hubbert's would be very critical in affecting govt policies. Of course, that assume the govt would understand and act upon such information. And, of course, no govt would IMHO. Jimmy Carter made a weak attempt and was laughed out of office.

Back to the single most important curve we all want to see today: max global oil production rate for the next 50 years. Essentially what Hubbert did with US production. That's a matter deserving the greatest of attention. But whether there are 100 billion bo left to produce or 2 trillion bo is of no interest to me...at all. How much oil is left in the ground will have no impact on me or future generations. How long it will take for that oil to reach the surface is the critical factor...perhaps as a matter of life and death for a great many folks.

Hubbert was the ultimate exploration geologist. And he was right. How much of what he did would you have considered "blowing smoke up your butt", based on your claim that only production matters? Hubbert had ZERO production from those tens of billions of barrels of non-reserves, non-producing oil fields in the US.

If I showed up and told you I was going to make tens of billions of barrels of oil from...nothing....how does that fit into your world view that things don't matter if they aren't producing?

Ubi - Every word out of an exploration geologist's mouth is potential butt smoke. LOL. Again, I say that with great respect...it is their job. And if you said you had a billion bbl prospect...BIG BUTT SMOKE! Which isn't to say I wouldn't drill it. But until I have it behind a string of casing it's only words. And words don't fill my gas tank. Find your billion bbl field, drill enough confirmation wells, do some well testing and modeling and then, AND ONLY THEN, I'll generate a future production rate projection. Only then is your billion bbl field worth discussing with respect to PO IMHO.

A CEO of one of my companies said this of Jim Bob Moffit...a very well known big time explorationist (typically drilling with someone elses's money): "Jim Bob is one hell of a wildcatter. By the time he finishes explaining why the last well you drilled with him was a dry hole you're all ginned up to drill the next well."

BTW that CEO's company went belly up a few years later. And today 30 years later Jim Bob is still one hell of a wildcatter. Two years ago he made what might be one of the biggest non-DW discoveries (Davie Jones Field) in the US in decades. And probably did it using someone else's money. Also BTW: that same CEO had a joint venture with another famous local wildcatter...Sandy. Drilled 18 exploration wells...all dry holes. And Sandy's senior guys retired millionaires as a result. Yep...Sandy could hurl butt smoke like few others. LOL.

You didn't answer my question. Hubbert, using your analogy, blew billions of barrels of smoke up someones butt, made it up whole cloth, a process you appear to disparage pretty regularly. His entire theory was based on these butt-smoke barrels, and yet you accept what he did as a valid method of prediction, while discounting the very process he did it by. And you would have been wrong, because those billions of butt-smoke barrels turned out to exist.

Obi - Exactly: blowing butt smoke is exactly how you do exploration or project future discoveries. By definition an exploratory target (and any future projection of such discoveries) is unproven. If there were solid evidence showing the reserves were there it would be a development well and not a wildcat. No one every got a wildcat drilled by emphasizing the likelyhood it was going to be a drill hole. That's why I always tease exploration geologists who present economics that show something like a 23.5 rate of rate. Point 5? You sure it's not point 8? A wildcatter can't prove there are any reserves there at all and he wants me to buy a ROR computed to one decimal place. LOL.

I don't disparage the butt smoke at all. It's an absolute necessity in the exploration game. But I do acknowledge it for what it is: a story of greaty potential riches with zero proof that you won't lose all your investment drilling that well. That's how I get away with teasing westexas: without crazy wildcatters like him we development/production types wouldn't have a job.

So it sounds as though you are advocating blowing smoke as a perfectly legitimate means of developing oil and gas prospects, regardless of economic considerations? Yet you insist economic conditions are only what matter in your world? So would you venture that Hubbert was the world's best smoke blower? Except, of course, that the oil he blew smoke about was actually discovered, developed and produced.

So how much smoke blowing will generate the next 20 billion barrels in the US do you think?

Hubbert basically made two "If, then" statements in 1956: If Lower 48 URR are about 150 Gb, the Lower 48 peaks in 1966; If Lower 48 URR are about 200 Gb, the Lower 48 peaks in 1971. Note that fifty billion barrels of recoverable reserves postponed the projected peak by five years.

Rock, After reading K.deffeye awhile ago lost sight of the fact that rate of production determines PO. Now you're making me aware how the more impressive his projection was. But weren't known reserves (URR?) important in the projection? CLearly, ROP is going to be constrained in a bakken but you also must know that a new mega field of easier oil isn't going to pop from an overlooked area.

mac - URR is only important in one aspect: it indicates how long a field will produce at a certain flow rate projection. Again, I know it seems a contradiction but a big URR doesn't mean high flow rates. The field I mentioned earlier actually exists just south of San Antonio: 2.3 million bbl of proven recoverable oil. But the entire field is doing only 50 bopd...about 1 bopd per well. Granted an extreme example but real none the less. Yes: will produce for 100 years. But I can show you many fields with 2 or 3 million bbls of recoverable oil that are producing a couple of thousand bbls of oil/day. So two fields with 3 million bbls URR and one produces at 40X the rate of the other. And, as you say, PO is about rate.

So when someone says a field, a trend or a country has XX billion bbls of proven oil reserves what can you assume about the impact of those reserves on PO? Absolutely nothing based on just that number alone. Again, why I don't spend any of my limited supply of remaining brain cells debating those numbers. LOL

Reserves are not URR. Cumulative production + reserves aren't usually even URR, until you plug the last well in the field and it dies. And even then, it can be revived.

Yes! We need to keep increasing our use of non-renewable resources at exponential rates in a finite system. That will lead us to bliss.

We humans are so silly and primitive.

Anyway, the way we humans need to learn to think is in terms of levels of sustainability and how the closer we are to balance the longer things can continue with less possibility for disruptive collapse.

Or... We can rise our middle fingers and tell our children to have fun, which is what we are doing now. "Hey, science will find an answer for you guys. Good luck!"...

Or we can choose to live childfree and get sterilized.

Well, it's a question of burning it now vs. burning it later. If we burn it now, then individuals and families get "rich" while society in the long run suffers. If we burn it later, society might be better off, but the ability of people to make money would be reduced. In the early 80s we made the decision that we would burn everything as fast as we possibly could.

So then the question of inheritance. Not all kids will suffer, especially if they get a huge inheritance from their parents, who got rich. Or witness the phenomenon of young adults moving back in with their parents. In effect, there's not enough energy left for them to have an income to afford to live by themselves in a new home. Instead, they are living off the energy embedded in the construction of the old home, which is especially useful if it's owned outright and if their parents still have some income, even if it's social security.

The real question, then, is how well the system stays together. We'll muddle through until some breaking point occurs and then it's game over for our currencies, and that's when people will only begin to inherit hard assets.

That's exactly the problem. Do they have 100 billion? How much is in the Orinco belt? A trillion?

Who knows?

These countries will eventually need to pay for the expertise to get it out of the ground or go broke, and maybe then we will see what is really going on.

Russia is an interesting example of this. They needed to get production up and fields going that were in serious decline. A number of other fields were too complex or they did not have technology to exploit, so they call the big oil companies to come in and voila, they are at near record production levels.

The usual state vs. capitalism problems exist there, but they have been successful.

Will it last? It depends on if they find new fields, or technology opens up a new extraction method. (Horizontal Drilling, Hydraulic Fracturing, 4-d modeling, Subsalt Analysis)

Until the Earth looks like a bee colony or if anyone has ever seen images of the Comstock load or Ophir mine in Nevada, we cannot claim the end is near. That mine went through a few phases of the end is near to only be born again with even greater production, until they hollowed out an entire mountain(or hill) with nothing left to grind up.

I think that price goes up with the new, more elaborate extraction techniques. It is the high price that will bring down the economy. We will always have plenty of very high priced oil, that virtually no one can afford. People will not recognize that oil is behind the financial problems (just as they do not now).

Gail - Rare is it that I get to pounch on you. The price of oil hasn't gone up due to "more elaborate extraction methods". The use of more expensive methods has inceased because the price of oil has risen significantly. Every one of those expensive extraction techniques has been around a minimum of 20 years....some over 40 years. I drilled and frac'd my first Eagle Ford well about 25 years ago...with poor economic results. Then again, oil was selling for less than $20/bbl. Had it been selling for $100/bbl at that time I would have drilled more EF wells.

Of course, I know you understand this better than most. But it was just your wording that caught my eye. Everyone in the oil patch wishes they could demand a price for their production based upon what they've spent. Unfortunately the free market doesn't allow it. The crude buyers don't care if I spent $10/bbl or $200/bbl to get my production out of the ground: they'll only pay what the market forces will allow.

High prices enable the more expensive drilling techniques to be used. Fracking now is taken to a whole new level (at least cost-wise) compared to what it was 50 years ago. I probably didn't say things in quite the right order, but without high oil prices, a lot of newer oil production would shut down.

I don't quite understand why fracked gas production has kept on as long as it has, with current prices, except that the big oil companies have no other way of "replacing their reserves," and they have enough $$ to hang on until gas prices go higher.

Isn't there some "use it or lose it" criteria? Rockman will know if there is. If the companies need to be working the field to keep their leases, a few marginally uneconomic wells should not be a problem. Sort of like the homestead farmers having to farm their claims to keep them. Even if the land was marginal and they lost money on the crop, it was cheaper than having to buy the land with cash. So with leases. A bird in hand and all that?

Knowledgable comments gratefully accepted and solicited.

Craig

Use it or lose it is definitely a problem with natural gas. I see it as a big reason why US natural gas production is higher than what the system can currently use, depressing prices. Once storage areas are filled, there is little place for excess natural gas to go, and the price drops to $0. (I think I remember a negative price once.)

I don't think use it or lose it is as much a problem with oil, because oil is traded more in an international market, and there is a shortage in that international market. But I think some Canadian producers have produced at oil at prices lower than they wanted, because they had already committed investment funds and had staff on hand, even though there was a Cushing bottle neck. So there can be kind of a problem there too.

zap - Leases expiring could be contributing to continued efforts. Besides having 100's of $millions invested in those leases there's another incentive: those leases represent some booked value. By letting a lease expire undrilled they also have to reduce the book value of the company by whatever was assigned to those leases. Essentially a double whammy...no drilling and a write down of assets. If the public company estimated they would break even and not make one penny profit by drilling a lease it would still be very worthwhile to do so. I've seen companies pay leases rentals on properties they had no intention of drilling just to delay the write down. The problem with the shale gas leases is that the boom caused those rental fees to be as high as the original lease bonus and thus too expensive to renew.

It may be that those totaling the production costs associated with frack rigs and horizontal drilling, in comparison with traditional methods, are overlooking in the drop in dry hole costs. They don't miss much any more with horizontal+frack. It appears the improved hit rate is saving a lot of money.

Oil is not behind the financial problem. Complete disregard for living within our limits is the problem. We do not need big cars, big houses, big yards! We do not need our houses to be heated at 72deg, we do not need A/C, but we DEMAND it. Did we need to spend 1trillion or whatever it was in Iraq? No wonder we are broke. Isn't that our deficit?

And the banks, credit card companies, and government want to bleed every last drop out of the blind consumer.

Oil is just providing the straw that is breaking the bank, because everyone has already spent to the limit. It was far cheaper than it should have been for a very long time, and probably still is.

And because we have been feeding this engine for the past 30 years, it's going to take a lot of friction to get it to change. We still haven't reached that point yet. Look at Europe looking for more money from ECB and IMF(What the hell!), so they don't default from stupidity. Look at the United States unable to pass a simple tax break to small business.

Goverments trying to keep status quo, citizens trying to keep status quo, it's not working anymore.

What fed the engine of commerce was low oil prices, and now what is causing the friction is the high price. The higher it goes the more friction, causing a reduction in the speed of that engine. That's the concern of peak oilers, that we are either on a long descent or will suddenly hit a threshold, an economic collapse due to high oil prices. That was the point of Gail's analysis.

I like your answer!

In my Miami Beach condo, the A/C unit is a need not an option. The heat, humidity, and air circulation are so bad, you get mold and mildew all over if the A/C breaks down. On the other hand a heater is a luxury for me; my condo unit never goes under 68F in winter.

This is a good post, indeed a great job. You must have done good research for the work, i appreciate your efforts. I am looking for more updates from your side. Thanks

IMO, too conspiratorial. Maybe that is what you were going for ?

Couldn't you just say "Saudi Arabia's name plate capacity is 12 million barrels per day". Is there evidence that SA can't actually produce this amount ?

More conspiracy theroy.

I believe SA stated they could offset the loss in Libyan oil production with a low sulfur, intermediate gravity oil blend suitable for European refineries. SA also claims they didn't get any takers for the blend. What SA didn't say is what were the terms of their offer.

TOD complains of not being taken seriously. Maybe there is a reason.

Just because you're paranoid doesn't mean they aren't out to get you.

http://www.votf.org/votfblog/just-because-youre-paranoid-doesnt-mean-the...

There usually is. Unidirectional claims, studies and conclusions are rarely helpful, unlikely to be correct, and relatively easy to spot. Anyone remember NoseDive Towards the Desert? Which wasn't? How about the grand pronunciations of peak oil in 2008? Followed by 90 million barrels of liquids just this past month, according to Stuart?

http://earlywarn.blogspot.com/2011/12/iea-90mbd-of-liquid-fuel-in-novemb...

To be taken seriously, it seems to me that both sides of the issue must be examined with equal amounts of objective analysis. And those who provide such analysis must be given more consideration than the type of name calling Yergin seems to generate. We are all aware of what it represents to repeat the same experiment, over and over again, expecting a different result.

As noted up the thread, I estimate that 2011 Saudi net oil exports will be between 1.0 and 1.6 mbpd below their 2005 annual net export rate of 9.1 mbpd (total petroleum liquids, BP).

Using the lower estimate of 2011 net exports, 7.5 mbpd, Saudi Arabia would approach zero net oil exports in about 16 years, around 2027. Using the higher estimate of 2011 net exports, 8.1 mbpd, Saudi Arabia would approach zero net oil exports in about 19 years, around 2030 (in both cases extrapolating the 2005 to estimated 2011 rate of increase in the ratio (C/P) of Saudi consumption to production of total petroleum liquids). At the 2005 to 2010 rate of change in the C/P ratio, Saudi Arabia would have approached zero net oil exports by the end of 2024. So, the slope of the projected Saudi net export decline has changed slightly.

A rough rule of thumb* suggests that the Saudis would have shipped half of their post-2005 Cumulative Net Exports (CNE) by the end of 2012, based on the 2010 estimate, and they will have shipped half of their post-2005 CNE by the end of 2014, based on the most optimistic 2011 estimate.

Regarding the monthly preliminary global IEA total liquids data (inclusive of low net energy biofuels, and which can be affected by inventory changes, and which are subject to later adjustments), I think that the annual data are much more meaningful. It's also helpful to look at some "Gap" charts.

Five annual "Gap" charts follow, showing the gaps between where we would have been at the 2002 to 2005 rates of increase, versus the actual data in 2010 (common vertical scale):

EIA Total Liquids (including biofuels):

BP Total Petroleum Liquids:

http://i1095.photobucket.com/albums/i475/westexas/Slide06.jpg

EIA Crude + Condensate:

Global Net Oil Exports (GNE, BP & Minor EIA data, Total Petroleum Liquids):

http://i1095.photobucket.com/albums/i475/westexas/Slide07.jpg

Available Net Exports (GNE less Chindia’s net imports):

I would particularly note the difference between the first chart, total liquids, and the last chart, Available Net Exports (ANE).

Two GNE & ANE scenarios:

0.1%/year Production Decline (2010 to 2020), Top 33 Net Oil Exporters:

http://i1095.photobucket.com/albums/i475/westexas/Slide10-1.jpg

1.0%/year Production Decline (2010 to 2020), Top 33 Net Oil Exporters:

http://i1095.photobucket.com/albums/i475/westexas/Slide11.jpg

CERA, et al tend to focus on the total liquids data while ignoring the GNE & ANE data. Since Yergin is now calling for less than a one percent per year rate of increase in total liquids productive "capacity," which is similar to what we saw from 2005 to 2010 in the EIA total liquids data (+0.5%year), it seems to me that Yergin is, almost certainly without realizing it, in effect predicting a continued decline in GNE & ANE:

http://www.energybulletin.net/stories/2011-10-24/daniel-yergin-massively...

Daniel Yergin Massively Reduced His Energy Estimates

*(Half of post-peak CNE tend to be shipped about one third of the way into a net export decline). In other words, relatively high initial post-peak net export volumes are disguising a very high post-peak depletion rate, the depletion rate being the rate at which post-2005 CNE are being shipped. Based on the most optimistic 2011 estimate for Saudi net exports, I estimate that the 2005 to 2011 post-2005 CNE depletion rate for Saudi Arabia is about 8%/year.

Some CNE comparisons: http://i1095.photobucket.com/albums/i475/westexas/Slide1-8.jpg

I have been talking about financial connections to oil supply, and I find I am taken quite seriously. My posts are on a quite a few web sites, not just The Oil Drum. Forexpros.com now has one of my posts on its front page.

You have to expect a range of different views. Some turn out to be right; some wrong. The financial views have held up.

Saudi Arabia may, in fact, need to “rest” its wells after pushing production to its recent high of 9.94 million barrels a day in oil production.

Below is a diagram showing what probably is happening to Saudi Arabia's oil wells - it's called "water coning". The constraining factor is that they can't maintain high production rates for any great length of time because coning will occur and the wells will start to produce 100% water.

Bottom line: They don't really have the productive capacity they claim they have. If they produce at high rates for too long, their wells will "go to water".

Watching the picture it seems most of the oil is left to produce and the only problem is with the well. Do they use these kind of pictures to sell horizontal wells?

karl - Exactly the tool used to sell a hz well. When you produce a vert well too fast you develop a low pressure sink around the well and that causes the water to move upwards much faster than it would naturally. A hz well can produce 5X the rate of a vert well but because the pressure draw down is extended over thousands of feet instead of less than 100' you don't create that big pressure sink.

As far as oil left behind, it's not uncommon for as much as 50% of the original oil in place to be left behind due to the normal encroachment of water. Even high recovery reservoirs can leave 30% behind. Cone a well and you can abandon it and drill a replacement well nearby. But if you've already depleted to a fair degree there may not be enough residual oil to justify economically a redrill.

I think I got it. You drill a horizontal well and since you work with exploration you sell it to someone else.

karl - I've had my fling wildcatting from time to time but I'm a career reservoir/production/operations geologist. Selling production has never been my thing: essentially eliminating my job. But these days that's the plan: cash up and head to the house permanently.

Nice pic Rocky. And for folks who aren't too familiar with reservoir mechanics, I've seldon seen "resting a well" reverse the damage done by coning. In fact I've seen companies spend large sums of capex trying various procedures and chemicals to fix coning. And with very little to no success. Once the water saturation in the rock gets high enough it's ability to flow oil diminishes greatly. The ability of oil or water to flow through is a function of it's saturation. Almost all water drive reservoirs have water in the pores with the oil. But as long as the water fills less than 30% of the pore space it will flow 100% oil. But once the water sat gets high (above 60% or so) it might not flow any oil even though 30% or more of the pore space is filled with oil.

I've seen first hand 250 bopd wells turn to 100% water in less than a month due to coning. And after 36 years I've never see one coned well returned to anywhere close to original production rate. Sorta like telling you're sweetie those new jeans make her butt look big: there ain't no good road back...you just shut your mouth shut and suffer the consequences.

Below is a link to an image of a non-aqueous phase liquid (NAPL; e.g., crude oil) at or below residual saturation in an otherwise water-saturated porous media. The image shows the fluids only; the media would fill the spherical empty spaces. Residual saturation is the saturation at which the continuous (connected) NAPL becomes disconnected and is immobilized by capillarity.

http://www.uni-saarland.de/fak7/seemann/group/kamal.html

As ROCKMAN and Rocky have iterated, this is difficult to reverse.

My doctoral research involved using injected tracers to determine the saturation of NAPLs in porous media, including chlorinated solvents and petroleum products. Although the application was for environmental remediation of aquifers, the idea originated in the oil patch as a method for measuring the oil saturation in a producing formation as a function of time.

Disclosure: that is not me in the photo in the weblink.

The Saudis probably have permanently damaged the oil reservoir in Ghawar by overproducing it. They can "rest the wells" all they want, but the oil that has been bypassed by the water is stranded and they are never going to be able to get it out.

If they had been prudent they would have produced it at a much lower rate in the interests of maximizing ultimate recovery, but that would have limited them to about half of what they like to tell the world is their maximum productive capacity.

(Never say never - they probably could recover a lot of the stranded oil with some kind of solvent flood, but it would probably take centuries of time and trillions of dollars to do it. Something for your great-grandchildren to look forward to.)

Yeah, and Saudi Aramco has been producing 'oil stained brine' in Ghawar since at least 2007. What I'm wondering is when did SA install the 500 million bpd water production and processing facilities ?

Saudi Aramco has used a gigacell reservoir model with 46 years of history to match. Wouldn't you suspect that SA knows how much they can produce ?

Absolutely. Plus they can afford to hire the best. And do.

Thats what Simmons claimed was supposed to be happening as well. More than half a decade ago. So how many more times can Saudi Arabia produce more than people think they can? They have already done it what, 3 or 4 times? 1979 was certainly a good year. 2005? 2011? Do I hear once more? Four times? Six?

And someone really needs to present some perspective, say, with the Wilmington field in California before they can claim that the Saudis have "water" problems. There are problems, and then there are problems. I'll take the Saudi problems any day of the week over Wilmington, if given the choice.

Matt Simmons' book on Saudi was published in 2005. The BP (total petroleum liquids) data base showed that at the 2002 to 2005 rate of increase in production, the Saudis would have been producing about 16 mbpd in 2010. Of course, the annual data have shown that all post-2005 annual production numbers have (so far) been below the 2005 rate of 11.1 mbpd.

2011 will of course be pretty close, depending on what kind of discrepancy that we see between the EIA and BP data sets. Note that the cumulative shortfall between what the Saudis would have produced at their 2005 annual rate, versus what they actually produced, in 2006 to 2010 inclusive, was about 1.2 Gb. The cumulative shortfall between what the Saudis would have (net) exported at their 2005 annual rate and what they actually net exported, in 2006 to 2010 inclusive, was about 2 Gb.

As noted up the thread, I estimate that 2011 Saudi net exports will be between 1.0 and 1.6 mbpd below their 2005 annual rate, and I estimate that the Saudis will have probably shipped about half of their post-2005 Cumulative Net Exports (CNE) by the end of 2014.

I don't think even Simmons was incapable enough to project linear increases from short time frames of Saudi production increases. One look at Saudi production rates and their peaks in production going back 40 years should be enough to give anyone pause, applying any version of peak oil bells, logistics, linears, or any other trend fitting exercise to production rates which aren't related to the ultimate amount of oil actually available.

When was the last time that they showed six straight years of lower net oil exports, relative to a prior index year, versus annual oil prices all exceeding the annual price during the index year, with five of the six years showing year over year increases in oil prices?

In other words, the BP data base shows Saudi net oil exports of 9.1 mbpd in 2005, versus a Brent price of $55. So, 2005 is our index year.

2006 to 2011 inclusive annual net exports are all below the 2005 net export rate. Annual oil prices for 2006 to 2011 inclusive are all higher than the 2005 level, with five of the six years showing year over year increases in oil prices. Brent is going to average about $111 for 2011--twice what we saw in 2005--and I estimate that 2011 Saudi net oil exports are going to be 1.0 to 1.6 mbpd below their 2005 rate. This is in marked contrast to the very rapid increase in Saudi net oil exports from 2002 to 2005, in response to rising oil prices.

Have we seen this 2005 to 2011 pattern before?

And when was Matt's book published?

Just a total blue-sky thought here: I've wondered if KSA could be lying about their increased domestic oil consumption to help hide their decline in total production.

The 8%/yr decline figure that has been hypothesized (for their biggest few fields, was it?) rings very possible to me. If that's true then they're offsetting it with other production increases more effectively than Matt Simmons would have thought possible in 2004. KSA's recent rising domestic consumption figures strike me as being pretty convenient for someone who might be trying to hide falling production.

It's just a theory. I have no evidence. I'm not informed enough to know if these ideas are plausible.

Oil did feed the engine, but who spent themselves silly without any foresight of a bump in the road.

EVERYONE step forward.

You would think after 4000 years of civilization, someone would look at what can possibly change in the future.

Less rain? Disease? Higher Costs? Wars?

It's not like we haven't see the rise and fall of civilizations throughout history.

Yes, but they weren't as ingenious in "how" they wasted their resources and polluted. So it doesn't count ;p

If you use the in- prefix as used in the word insoluble, I'd agree with that. :)

Expectations can drive production, just as demand can. The real problem as Peak Oil continues is that we are now seeing new, and yes better, ways to extract oil from existing wells. Also, new, and again better, ways to extract from what was previously uneconomical plays such as Athabaska oil sands and Bakkan shale fields. All of this is done accompanied by great noise from the media, noise generated by press releases and spin machines ginned up to promote all of the latest ‘finds.’

Now we are told that we can become energy independent; we are promised a virtually unceasing and everlasting flow of oil to prop up our ailing economy. What it looks to me like is that what has happened is that we have no greater reserves, but we have found a way to use them up faster. If that is true, then the downside of the Hubbert curve will be sharply steeper; more the cliff than the hill.

The danger from this phenomenon is that we will have far less time to react, to change, and to plan a viable means to survival. It is not clear, even now, that we have sufficient time to ‘save’ most of civilization. Most of the TOD must-reads seem to believe we are past that already. What we need is a rational assessment from someone who is a scientist, or at least sufficiently educated and known in energy and climate circles to be appreciated, to apply in depth analysis, using available and verifiable data and techniques to determine what needs to be done, what can be done, and how long we have before it is too late, if it is not already. So far I have not seen that on TOD, or anywhere else for that matter. Instead we are relying on a few popular writers whose works are easily derided as mere vehicles for making money for the authors.

I am not sure what peer reviewed journals might be appropriate to the task. Something that is accepted both in respected Oil & Gas journals, and in climate journals and resources publications might do the job. When PO is reduced to a truly scientific endeavor, instead of being seen as a purely opinions blog, perhaps we will be seen in a different light.

Another reason that TOD is not ‘taken seriously’ is that should the MSN and the PTB take us seriously, and actually publish the truth, they fear that it would create an economic nightmare. Probably not a general panic in the population, but certainly those with skin in the game would suddenly be aware that they could suffer enormous losses. And, for a politician, admitting the truth would be the end of his career. Thus, shooting the messenger (TOD) is the easy way out.

All in all, my opinion (this being TOD and all) is that we will see no organized action taken until the problem is inescapable and impacting everyone in a tragically obvious manner. At which time, after a year or two of chucking and jiving about budget restraints, taxes and popular policy, a Congressional committee will be appointed to investigate it. As conditions deteriorate, that committee will report to POTUS that we need to do something, and all of the big contractors will view it as the new way to get richer. As contractors’ lobbiests talk to the various Congresspeople (remember, SCOTUS has determined that money is free speech, and free speech is protected, yada yada), conditions will deteriorate, until it is obviously far too late, at which time it all ends.

And it cannot begin again in any way near the same numbers of people, or types of activity. It will evolve into something new, and hopefully as a species we will be there, and it will be better than the last effusion of hubris that we are finishing up now.

Best hopes for shorter rants.

Craig

edit: I started to simply say that we will know oil has truly peaked when OPEC abandons the silliness of quotas and gives carte blanche to all to pump what they want.

zap - "I am not sure what peer reviewed journals might be appropriate to the task." And that's exactly the problem. Almost none of the ridiculous statements have gone through peer review. And for good reason IMHO: most of the authors know they would have their work thrown back into their faces and told to go sit in the corner. LOL.

But we have tons of peer review work that support the positions on TOD. The problem is that they almost always tend to be too technical for the MSM (and most everyone else) to deal with. So whose words get out to the public? Obvious who ever the MSM picks and for whatever reasons they chose. Could the Rockman get a national platform to preach his own brand of "truth"? Not likely but even if I did I couldn't: I work for a man who, although he wouldn't disagree with anything I would say, likes his privacy and wouldn't want the attention my blabbering would bring. And what about my cohorts who aren't similarly restricted? Sure...if they worked for a company that paid them to put out press releases. But guess what: those companies that do pay such folks don't want the type of press releases the likes of me would produce. So in a way those press release are peer reviewed....reviewed by a very select group of folks with a specific agenda. And thus allow only statements that support their positions.

But if I hit it big and became independently wealth I would give it a try. Would probably have to work my way up the food chain. Maybe start with Howard Stern and other rabble rousers who like sticking their fingers into the establishment's eye. Of course, this would propel me into super hero status and would require the addition of a trusty side kick. At the moment I'm thinking westexas or Penelope Cruz...each for their own obvious reason.

Not sure if you'd be superhero or villian. What we are saying is not well received. Don't know if you have experienced it or not, but though they readily admit that I have far greater knowledge (as little as I do have) than they, most, but not all, of my family do not receive it, deny it, and in general through hissy fits about it. All the usual junk comes back to me: "They" will find a way. "They" will find more oil. We can't run out of oil (even when I explain that running out is not the problem), can we? etc., etc., etc., ad nauseum.

And, especially right now, I understand your perplexity at not being able to be as public as you might like. I can't even say for whom I work... And, like you, being somewhat practical, I do what needs to be done and try to make some difference.

Keep up the good work. Let me know when you "hit it big." I'll do likewise, and maybe if I do I can subsidize Rockman on Peak Oil!

Craig

zap - In case I never mentioned it before: TOD is the only place I discuss PO. Re: my cohorts...there's nothing to discuss...we've understood if for decades. And with re: to the non-oil patch types? That falls into the category of trying to teach pigs to roller skate: it just frustrates you and p*sses the pigs off. So why bother?

Sure. Everyone else was claiming peak oil in 2008, including this one from TOD...

http://www.theoildrum.com/node/5177

matched up against data like this...

http://earlywarn.blogspot.com/2011/12/iea-90mbd-of-liquid-fuel-in-novemb...

and the question becomes obvious, is 15 million barrels or so big enough of a miss that all the peer reviewed nonsense in the world won't distract from the actual reality of what has happened?

Obi, Makes one wonder, But I'm focusing on the big sea of blue where there is a 5 yr plateau. If we have a euro induced recession this will probably be a short term maximum but as far as i'm concerned if 20 yrs from now this level hasn't been surpassed before sliding down then it is peak. Although, To me it's interesting how the oil patch has ramped up (about 9m oil) since the mortgage bubble and sustains it. makes one wonder if another ramp up is not possible. (but personally I think oil patch is on steroids)

http://www.theoildrum.com/node/8729#comment-859013

And a "What If" scenario, to-wit, what if we are on a crude oil plateau similar to the North Sea?

(North Sea in blue, Global in black, different vertical scales)

Rockie and Rockie Jr

How would you answer questions like:

Penelope Wiles: I am a part of the feminists against drilling F.A.D. and I wanted to ask you why you can't see that the drilling for oil represents the use of phallic instruments to rape mother earth and leave us dependent on your cruel products.

Rockman: I'll leave this one for you Westexas!

Westexas: ... Thanks!

Michael Jones: I'm from Minnesota and I wanted to ask you why the unpatriotic bastards from Alberta are sending the oil from the Oil sands out of the United States and to China when people in America are desperate for that oil.

Rockman: Next caller.

Penelope Cruz: When I hear you talking about hydrological horizontal well drilling it makes me feel so hot. I hear you can propagate your fractures throughout the geological body...

Rockman: Stay on the line it's time for some messages from our sponsor the Yergin foundation, I'll continue this discussion off air.

Westexas: I'll take this caller, you hold the line Rockman and chat to Mac from Arizona about the chances of finding oil on his 2000 acre ranch. Besides I'm a better frack'er than you. :-P

Rockman: It looks like Mac got cut off and I'll be free to talk to Penelope now, how about you get the refreshments, Westexas?

S - good questions. For Penelope: do you use any hydrocarbon products to maintain your life style? If so then you're part of the gang bang. If not whose phone did you borrow to make this call? Michael: just like the US oil patch the Canadian oil patch ain't your momma. Grow a set and start taking care of your own problems. Penelope: propogate THIS gal. Halliburton has spent many $millions trying to learn how to propagate fractures more than a few 100'. And i still have my doubts about their abilities. Mac: I hate to think how much time I've wasted standing on some dusty road answering such question from other mineral owners. The simple answer: down't order that new pickup until the first mail box money shows up.

After peak oil comes peak denial. People will deny the truth even when it is painfully obvious and will cover up the truth with disinformation, fuzzy numbers, scape goats and ad hominem attacks on people who dare speak the truth. But denial will decline when even that is not enough to prevent the truth from being blocked out. At which point denial turns to anger... Society will go through the five classic steps of grief.

The issue of what is ahead escapes the understanding of a lot of folks writing journal articles (and potential peer reviewers), because it crosses too many fields. The issue isn't that there isn't enough oil; it is that it becomes too expensive for the economy to afford. The economy cannot be expected to slide downward nicely as oil supply is reduced. It more likely will have big drops, as whole systems fail. For example, if banks are closed, other businesses cannot pay their workers. There is no way a peer reviewed journal wants to touch this.

Gail's appearance on Russia Today:

http://www.youtube.com/watch?v=koIWYZCOe7k

That is a link to my interview on the Keiser Report, with respect to my post The 65 Year Debt Bubble.

Thanks Gail. Have you come across an adjusted net energy oil graph? I say this because if they aren't subtracting the increased energy to get to, say, 90 mb/d or 100 mb/d, then the graph is less useful as time goes on. OPEC is happy with $100 oil to keep their people happy, until it causes the next recession. I can't see how we'll ever have sustained growth without high oil prices putting us back into recession. Peak Oil is a %$&***...

MrEnergyCzar

I don't think I have.

I think there are several related problems:

1. It takes more energy to get oil out.

2. There needs to be a bigger up front investment, and more delay, to get the oil out. All of this has to be financed somehow.

3. Minerals such as copper, phosphorus, silver, and uranium are found in ores of lower and lower quality, so require more oil for extraction.

All of these combined to make the issue even bigger.

US imports of Saudi crude are down more than 50% from its 2003 peak, now ~10% of total US consumption. And some of that crude is refined, turned around and exported, now that the US is net exporter of refined petroleum products.

http://www.eia.gov/dnav/pet/hist_chart/MCRIMUSSA2a.jpg

Canadian production has been backing Saudi Arabian, Mexican, and Venezuelan production out of the US market since it has a distinct cost advantage at this point in time, in addition to which Mexican and Venezuelan production rates have been falling while Canadian production rates have been rising as new oil sands plants come on line.

Given the lower purchase cost of Canadian oil, it is economic for Midwestern US refineries to process it and export the refined products to Europe and Asia since they have lower feedstock costs than European and Asian refineries. At the same time they have surplus capacity since US consumption has fallen due to demand destruction caused by high prices.

Bottom line: It's pretty lucrative to be a Midwestern US refinery these days, not so great to be a US consumer.

How's that? US average price per gallon gasoline, 12/19/2011: $3.229

http://205.254.135.7/petroleum/gasdiesel/

Anyone interested in a better understanding of the oil situation in Saudi Arabia could always go over to youtube and see the videos, "The Oil Kingdom" parts one and two, from December 7th, 2008. This will require about a half hour of your time, to get "updated" on information, that has been widely available to the general public for OVER THREE YEARS!!!

Had these videos been viewed by the relevant parties, I doubt if most of these comments would ever have been written, let alone the article itself. Education about the true state of the world's oil situation can be likened to an oil pipe. What you get out of it, depends entirely upon what you put into it. Therefore, it's up to each individual to take the responsibility to educate themselves by locating all the relevant sources of information, that are so easily available on the Internet. There is no excuse for such ignorance, if you have an Internet connection to use.

I don't think so. The vast majority of these posters have read 'Twilight', bought it hook, line and sinker. Here are the links you refered to:

Part I:

http://www.cbsnews.com/video/watch/?id=4653109n

Part II:

http://www.youtube.com/watch?v=D1t4ue-WmlU

I noticed CBS didn't pass up the opportunity to villanize Iran, though.

If they could get past 'they are lying', there would be hope. It seems conspiracy is, Oh so sexy.

I bought a copy of 'Twilight' not too long ago. It cost me the grand sum of $0.19 plus S & H, it was well worth the price. I'm not so sure about the shipping costs, though. The conclusions, which most of TOD seems to be hung-up on, were as bogus as Madoff.

Yes,the book "TWILIGHT" is the source of the present day massive misunderstanding of Saudi oil Reserves by the Peak Oil believers. Conspiracy theories are a great sell, and once bought, never seem to go away.

In relation to some recent comments of mine about the Bakken, here are two (somewhat boring) videos also at youtube that will perhaps give some of the disbelievers some sense of proportion regarding the actual amounts of oil being produced there, these days.

Bakken Shale Drilling Activity 2010 (6:56)

- A time lapse video with some nice background music.

Bakken Oil Train 2011 (4:24)

- Showing a Bakken oil train pulling out of the station. The folks at TOD just don't seem to realize that oil production is rising so fast there, that there's not enough pipeline capacity to carry it to market. That's why trains are now used, even though it costs more to move oil by train. That's also why so many Bakken oil companies are presently SLOWING down their production. The oil economics are such, that it's much better to just leave it in the ground until the pipelines are built.

You guys are too funny. Thanks so much for the needed levity.

Did you bother to view the videos? It's well known that you can lead a horse to water, but you can't make it drink. This website is clearly running on ignorance. Ignorance is not stupidity. It is simply not knowing. People's comments, your latest included, certainly reveal why. Incorrect input will inevitably result in incorrect conclusions. To properly educate yourself, just follow the directions I'm giving you. The choice is yours,...education or ignorance.

I got Twilight at the library. I paid more to read it than it was worth. Who would have thought Simmons was such an optimist, in between pimping oil fear to sell some stocks to pension funds. Just goes to show that accountants aren't worth spit as petroleum engineers.

Yes, when looking for actual information...watch videos. Matched only in their accuracy by blogs on the topic I imagine....

Calling Simmons a crook won't make his controversial 2003 "Twilight" predictions wrong.

His book barely had time to make paperback before he was being proven correct.

Which predictions have been proven correct ?

Apparently, this one.

Simmons, M., Twilight in the Desert (New Jersey, John Wiley and Sons Inc., 2005 ), p.354: