Drumbeat: January 4, 2012

Posted by Leanan on January 4, 2012 - 10:35am

Violence erupts in Nigeria over petrol prices

Protesters furious over spiralling petrol prices started fires on a motorway and at least one person was killed in the unrest after Nigeria's government scrapped a subsidy that had kept fuel costs down for more than 20 years.One union leader described the government's hugely unpopular move as "immoral and politically suicidal" and urged Nigerians to resist "with everything they have". But yesterday's protest showed that, once unleashed, the pent-up anger of the masses could be hard to curtail.

'Searing anger' as Nigerians protest fuel price increase

(CNN) -- Car tires were set on fire and gas stations blockaded as hundreds of Nigerians took to the streets to protest the removal of fuel subsidies that saw the price of petrol more than double virtually overnight.Angry Nigerians chanted anti-government slogans and brandished placards in a largely peaceful protest Tuesday against the removal of government subsidies.

Crude Oil Falls From Near Eight-Month High on European Economic Concerns

Oil fell from its highest settlement in almost eight months on signs that Europe’s debt crisis may drag the region into a recession, curbing fuel consumption.West Texas Intermediate crude futures reversed gains as the euro dropped from near a one-week high against the dollar after European reports showed services and manufacturing output contracted and inflation slowed. German 10-year bonds stayed lower after the country sold additional securities. Oil rallied 4.2 percent yesterday as the head of Iran’s army warned the U.S. against sending an aircraft carrier back to the Persian Gulf.

OPEC oil output hits 3-year high

OPEC oil output rose in December to the highest since October 2008, mainly due to a further recovery in Libya's production, a Reuters survey found on Wednesday.Supply from all 12 members of the Organization of the Petroleum Exporting Countries averaged 30.74 million barrels per day last month, up from a revised 30.62 million bpd in November, the survey of sources at oil companies, OPEC officials and analysts found.

UK spot gas rises due to undersupplied system

LONDON (Reuters) - British prompt gas prices rose on Wednesday because supplies were short but gains were capped by stable Norwegian and North Sea production, while topped up inventories and warm weather flattened prices along the forward curve.

Raw Materials Seen Rebounding as Global Economy Skirts Slump: Commodities

Commodities may rebound from their first retreat in three years as developing economies shore up global growth, driving demand higher at a time when raw-material producers are already struggling to keep up.Precious metals will advance 27 percent or more, industrial metals at least 17 percent and grains 5 percent, according to the median estimates in a Bloomberg survey of 143 analysts, traders and investors. Nine of the 15 commodities covered by a similar survey a year earlier reached their predicted highs in 2011, with another five no more than 4 percent away.

U.S. to Iran: Warships to remain in Persian Gulf

WASHINGTON (AP) – The Obama administration on Tuesday brushed aside Iran's warning to keep U.S. aircraft carriers out of the Gulf, dismissing its threats as a consequence of hard-hitting American sanctions on the Iranian economy.Provoking a hostile start to what could prove a pivotal year for Iran, the country's army chief said American vessels were unwelcome in the Gulf, the strategic waterway that carries to market much of the oil pumped in the Middle East.

Iran oil standoff could mean higher gas prices

The standoff between Iran and the West in the Strait of Hormuz has more to do with your daily commute than you might realize. If investors are spooked by the angry rhetoric coming out of the Persian Gulf, it could drive up the price of a barrel of oil, which means pain at the pump for American drivers.

Iran’s Nuclear Fuel Rod Isn’t a Military Threat, U.S. Energy Analysts Say

Iran’s development of a nuclear fuel rod for medical research isn’t a milestone in a quest for atomic weapons, according to energy analysts in the U.S.

Turkey to seek U.S. waiver on Iran oil - energy official

ANKARA (Reuters) - Turkey will seek a waiver from the United States to exempt its biggest refiner Tupras from new U.S. sanctions on institutions that deal with Iran's central bank, a Turkish energy ministry official told Reuters on Wednesday.

South Korea Increases Oil Deal with Iran

South Korea has made an agreement to increase its oil business dealings with Iran and helping to sabotage U.S. economic sanctions against the Iranian Republic.

Kuwait protests at Iran step to develop gas field

DUBAI: Kuwait protested on Tuesday against Iran's intention to unilaterally develop a disputed offshore gas field in the Gulf unless an agreement is reached, Kuwait's state news agency KUNA reported.Iran said on Sunday it would launch full-scale unilateral development of the field if Kuwait does not respond to its offer of joint development.

Greece speeds up oil and gas exploration

Debt-stricken Greece, which currently has the least exploration for hydrocarbons in the region, is vowing to exploit its oil and gas reserves.

Enterprise Products, Genesis Energy To Build Gulf of Mexico Crude Oil Pipeline

DOW JONES NEWSWIRES - Enterprise Products Partners L.P. (EPD) and Genesis Energy L.P. (GEL) plan to build a crude oil gathering pipeline in the deepwater Gulf of Mexico for a consortium of six producers.

Kazakh state of emergency extended

Kazakh president Nursultan Nazarbayev has extended a state of emergency in the western oil city of Zhanaozen until the end of January.

Deepwater oil rig work takes a certain attitude

No one has issues with the money — but the long hours, isolation and danger? Sometimes.

Shell trying to plug second Nigeria leak

ABUJA (Reuters) - Royal Dutch Shell's operation in Nigeria is working to plug a leak caused by sabotage that shut its 70,000 barrel-per-day (bpd) Nembe Creek pipeline, the company said in a statement emailed to Reuters on Wednesday.The pipeline in the swampy creeks of the Niger Delta was shut down on December 24 but went unreported, eclipsed by a much bigger leak at Shell's offshore Bongo facility.

Appeals court in Ecuador upholds $18 billion decision against Chevron

QUITO, Ecuador — An appeals court in Ecuador upheld an $18 billion ruling against Chevron Corp. on Tuesday for oil pollution in the Amazon rain forest more than two decades ago.The ruling confirmed a February judgment in the case. The Ecuadorean plaintiffs said in a statement that the decision is based on scientific evidence presented at trial proving that waste had poisoned the water supply.

Deepwater liabilities make momma look small

BP and Halliburton are engaged in a war of words via filings to a New Orleans court. This resembles tit-for-tat schoolyard trash talking of the “Yo momma’s so fat” variety, though with more legal verbiage and higher financial stakes. The latest sally, from the energy major on Monday, reasserted its optimistic conviction that the oil services group could be liable for all the costs of the horrendous 2010 Gulf of Mexico oil spill. These have been estimated at between $40bn and $60bn.

CARACAS - Countries that have always depended on imported oil and gas, like Chile, Paraguay, Poland or Ukraine, and especially heavy consumers such as the United States and China, could become self-sufficient in natural gas in the near future and even start exporting it.

Energy Giants Undeterred by Quakes Seek Shale Growth Runway

Asian and European energy producers are spending billions of dollars to amass stakes in oil and natural-gas discoveries from Ohio to British Columbia even as earthquakes and tainted water threaten to stall the biggest drilling boom in at least two decades.

China approves shale gas as independent resource

(Reuters) - China has approved shale gas as an independent mining resource, a legal status that may allow smaller Chinese energy firms to develop the unconventional energy source, state media reported on Wednesday.The world's top energy user could hold shale gas reserves exceeding those of the United States, where a revolution in production techniques is overturning the country's dependence on imported gas.

Quakes could cause shift in support for fracking

COLUMBUS, Ohio — In Ohio, geographically and politically positioned to become a leading importer of wastewater from gas drilling, environmentalists and lawmakers opposed to the technique known as fracking are seizing on a series of small earthquakes as a signal to proceed with caution.

Proceed with caution in Alaska

The Arctic Ocean is much shallower than the Gulf of Mexico. Shell would drill in 160 feet of water or less, compared with the mile-deep water where BP was drilling in the Gulf. And well pressures off Alaska are just a third to a half what they are where BP drilled. If something did go horribly wrong, Shell would benefit from BP's experience.

As long as the Obama administration allows Royal Dutch Shell to push forward with plans to drill in the Arctic's Chukchi and Beaufort seas, the closer America's Arctic comes to a disaster that could eclipse the tragedy in the Gulf.

2011 Winning Strategies Still Look Good For 2012

Peak oil theory is still valid, even if energy companies manage to transition advanced natural gas drilling techniques to oil production. After all, peak oil does not hold that we are running out of oil, only that production becomes increasingly difficult and less productive as we tap the planet's reserves. Fracking oil shale or drilling miles into the ocean off the shores of Brazil is definitely much more resource-intensive than drilling in Saudi Arabia 50 years ago. Green energy remains insufficient to replace carbon fuels and Japan's nuclear incident may have set back that industry world-wide. A decade into the 21st century, 20th century energy is still the primary fuel of the global economy, thus peak oil remains an actionable investment thesis.

Breaking U.S. Dependence On Foreign Oil

We’ve heard the beating of the drum time and time again: “We must reduce our dependence on foreign oil.” It forces us into poor economic, political, diplomatic, and military choices. But, what are we really doing about it?

University of Alaska Fairbanks professor predicts spike in oil prices

FAIRBANKS — Gasoline prices in the $4-per-gallon range may be uncomfortably high for many Fairbanks residents, but Doug Reynolds believes prices in the years ahead could make these seem like the good old days.Reynolds, a professor of oil and energy economics at the University of Alaska Fairbanks, said he sees oil prices soaring in the next five to 10 years, “easily” reaching $200 per barrel or more.

Jeff Rubin: What do triple-digit oil prices mean for growth?

The real story behind triple-digit oil prices is not the threat of supply shocks, but the sheer, unrelenting rise in world oil demand. Already closing in on 90 million barrels a day, the quick rebound in world oil consumption to new record highs demonstrates the global economy can’t grow without burning greater amounts of oil.No matter how many rabbits the oil industry can pull out of its hat, be it tar sands from Alberta or shale oil from the Bakkens, supply just can’t seem to keep pace - at least not at the prices most consumers can afford to pay. That is the message that triple digit prices keeps telling us.

Correcting the Growth of Human History

Today, there is hardly a stock, bond, municipal plan, government budget, student loan, retirement program, housing development, business plan, political campaign, health care program or insurance company that doesn’t rely on growth. Everybody expects growth to resume…after we have put this crisis behind us.Growth is normal, they believe.

But what if it isn’t normal? What if it was a once-in-a-centi-millenium event, made possible by cheap energy?

We are now extracting the hardest to reach oil reserves and have hit or exceeded peak oil. Sorry folks, the North American dream of capitalism and consumerism is over. We can choose to continue supporting these destructive systems and support another dead end industry, or we can choose to start supporting each other in our communities.

In practice, sustainability is a moving target because it has to be tied to things like demand. What is sustainable at one level may not be at a higher level. It often does not engage a new paradigm. It simply extends an older and frequently decrepit one. But resilience puts us on a new track with an unlimited future, and that's where I prefer to be. All this has a practical business and CRM side.

If you run a business today or sit at the executive decision-making table, have you run this analysis? Do you know how reliant on oil and fossil fuels your business is across the board (transportation, packaging, formulation, etc.)? Have you projected your costs and profitability for when oil does reach $250?

What non-scientist Paul Krugman doesn’t understand about debt

Granted, the notion that America’s growth going forward is going to be limited by declining supplies of net energy — i.e. peak oil — isn’t yet a popular one. But as the work of economists like James Hamilton suggests, the price of oil has a powerful effect on our economy, and the explanatory power of energy supplies is indisputable for people with scientific — specifically biological — training.

Crisis of Leadership, Not Crisis of Capitalism

According to what I read, we face not just the worst recession since the 1930s, but a challenge to the West’s entire economic order. The Great Recession exposes the poverty of orthodox economics. It constitutes an ideological crisis. It shows that capitalism itself is “fundamentally” flawed. If all this were true, I’d be a lot more worried about the coming year than I am -- which is saying something.A new year’s corrective is in order. Reports of the death of capitalism are greatly exaggerated.

Report: Green economy to be determined by corporate control

As global corporations ready themselves for a post-petroleum world, a green economy will be centered on exploiting biomass (food and fiber crops, plant oils, algae, grasses, forest residues, etc.). Supporters of the post-petroleum future involve many of the world’s largest, and most powerful corporations and governments, all touting new technologies - including genomics, nanotechnology and synthetic biology - for transforming biomass into high-value products.

Honda sued over mileage in small claims court

TORRANCE, Calif. — A woman who expected her 2006 Honda Civic Hybrid to be her dream car wants Honda to pay for not delivering the high mileage it promised. But rather than joining other owners in a class-action lawsuit, she is going solo in small claims court, an unusual move that could offer a bigger payout if it doesn't backfire.

So far, battery cars coming up short

Add them all up, hybrids, plug-ins and pure battery-electric vehicles, or BEVs, and they accounted for little more than 2% of the U.S. automotive market last year. Remove conventional gas-electric models, such as the Toyota Prius and Ford Fusion Hybrid, from the equation and more advanced battery vehicles generated barely 20,000 sales.“I’d say they failed,” proclaims Joe Phillippi, chief analyst with AutoTrends Consulting.

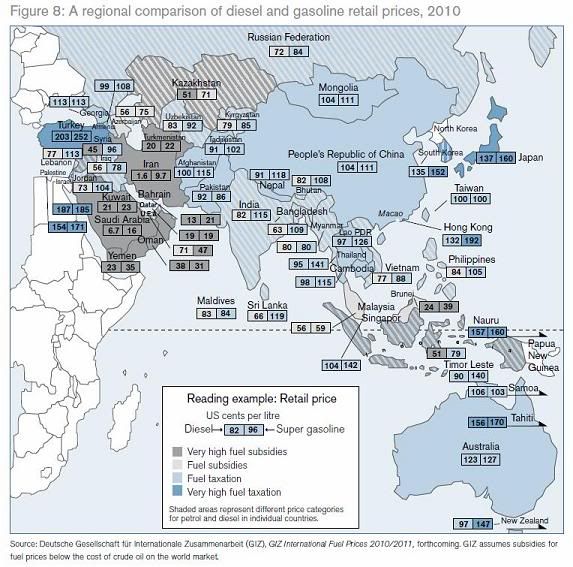

Subsidies on fuel slow biodiesel adoption, says Neutral Group

Biofuel and energy-efficient cars are making inroads in the Emirates but fuel subsidies are undermining the appeal of the "green drive".

Storehouses for Solar Energy Can Step In When the Sun Goes Down

If solar energy is eventually going to matter — that is, generate a significant portion of the nation’s electricity — the industry must overcome a major stumbling block, experts say: finding a way to store it for use when the sun isn’t shining.That challenge seems to be creating an opening for a different form of power, solar thermal, which makes electricity by using the sun’s heat to boil water. The water can be used to heat salt that stores the energy until later, when the sun dips and households power up their appliances and air-conditioning at peak demand hours in the summer.

The Convoluted Economics of Storing Energy

The economics of a plant that can store bulk amounts of energy are a bit arcane. At the simplest level, the idea is to gather the sun’s heat when it is available and save it until prices for electricity reach a peak. At the moment, though, prices peak when the sun is high in the sky, because that is when the demand for power, mostly for air-conditioning, is highest. Some experts think it will be years before the power system is so saturated with solar photovoltaics that thermal storage becomes worthwhile.

Geothermal Working Group- Final Report unveiled by the County of Hawai‘i

The report was sponsored by the County of Hawai‘i to evaluate geothermal energy as the primary source of baseload power for electricity on the Island of Hawai‘i. The report includes an analysis of technical data and expert testimony providing convincing rationale to develop local renewable energy plants and transition away from the county’s dependence on petroleum-fueled generators for baseload electricity. The report, which is currently being circulated within Hawai`i’s State Legislation, was developed as research to help support Hawai`i’s Clean Energy Initiative goals.

After 40-Year Battle, Train May Roll for Oahu

KAPOLEI, Hawaii — From the farmlands here on the western side of Oahu, the hotels of Honolulu and the bluffs of Diamond Head can be seen rising 20 miles in the distance. This is rural Hawaii: waves and coastline on one side, lush mountains on the other and barely a building or vehicle in sight.But sometime this spring, a $5.3 billion project is scheduled to rise from the Kapolei farmlands that offers powerful evidence of how much this island, a symbol of Pacific tranquillity, is changing. A 40-year battle to build a mass transit line appears to be nearing its end. Barring a court intervention, construction is to begin in March on a 20-mile rail line that will be elevated 40 feet in the air, barreling over farmland, commercial districts and parts of downtown Honolulu, and stretching from here to Waikiki.

EDF Reactor Extensions May Cost $65 Billion on Safety Review

Electricite de France SA (EDF) said the cost of extending nuclear reactor lives to 60 years could reach 50 billion euros ($65 billion) as safety measures ordered by regulators force the utility to accelerate investment.

Habitat goes green and saves new residents some green

NASHVILLE – Antonio and Christie Miller of Nashville can smile when they talk about their utility bills. So can Casey Greer.That's because they're residents of new Habitat for Humanity homes that were built to meet top energy-efficiency standards.

Is Southern California Finally Getting Serious About Its Water Crisis?

To quench the thirst of Southern California's some 20 million people, water must be imported from hundreds of miles away, across a daunting array of deserts, valleys and mountains. For decades, Angelenos have muttered a doomsday refrain: our water supply isn't sustainable, and we are going to have to get smarter about managing it — at some point. The obviousness of the problem, however, instilled a kind of panicked lassitude. The discussion became predictable: alarm would set in during times of drought, as authorities talked of restrictions and plans to boost local water sources. Then rainy years would follow, and L.A. and its surrounding cities would move on to other, supposedly more pressing issues. Through it all, the mentality remained the same: sprinklers outside city buildings and private homes continued to feed large lawns even while it was raining, using water brought from far away.Now authorities are once again saying the time has come for a change. They say they're going to follow through. Should we believe them?

Climate change means regional opportunity

Take a little Rorschach test for me: What do the words, climate change, peak oil and energy conservation mean to you?If you think like the U.S. Chamber of Commerce the alarm bells of regulation, taxation and invading greenies go off in your head. But, if you are like the leading businesses in Europe, it's visions of Pounds, Kroner and Euros dancing in your mind. What many here see as a threat to America's economic future is an economic as well as environmental imperative in Europe.

Will Fossil Fuel Companies Face Liability for Climate Change?

It is one thing to do your own research, but it is another to deliberately deceive people, contributing to widespread harm primarily to retain profits.

20 inches to disaster: U.S. coasts unprepared for higher seas

Let's say the rise in sea level that climate change will bring us -- from melting ice caps and expanding seas -- won't be "all that bad" by, oh, the year 2080. Maybe ... just half a meter (a little under 20 inches). We can deal with half a meter, right?Well, yeah -- if we're ready to "deal with" almost 50 percent more affected people and 73 percent more property losses from a typical Category 3 hurricane -- all because of the higher storm surge that'll come from that additional 20 inches of sea level. ("Storm surge," in case you don't know, describes the ocean water that a storm's winds bring ashore, in addition to what's usually there with normal tides.)

Saudis use more oil; exporter status threatened

Saudi is in a pickle. They need to keep electricity, water and gasoline prices very low to appease their public and keep from catching the "Arab Spring" flu. But doing so they are using more and more of their own oil.

Most of their water and electricity is produced by burning oil because they are short of natural gas though they are now trying desperately to bring more natural gas on line to help with the problem.

Ron P.

brevity is the soul of wit

You can sum up a news story like no other.

SA is planning a significant nuclear power program. I assume the intent of such a nuclear build is to reduce the internal demand for oil + gas to allow more product to be exported. Source:

So they are basically saying they will build 16 1 GW reactors over the next three years, with specs by March and first tender by end of 2012. If SA achieves this level of build out in five years' time, it would be a remarkable achievement. For a country with virtually no nuclear experience indigenously, I would say:

Ain't. Gonna. Happen.

If it does happen, SA consumers will still get first call on the oil that's freed up. IMHO, it is not realistic to expect nuclear power to make a substantial difference in SA net exports. But we shall see. They have put a timeline out that we can check against.

Let's hope those are Gen-IV MSR reactors that can burn waste from nations with mostly obsolete reactors like the U.S., France, Russia or Japan. If they can pull that off, the Saudis may have a winning long term strategy. If not, then as Ron says, ELM, rapid population growth and Arab Spring will probably bring about an end to the current regime --not a bad thing IMO.

They are not KEPCO is quoting for "Korean Standardized Nuclear Plant (KSNP) Gen 2 equipment. Areava was underbid on price for their EPR Gen 3+ unsuprisingly

http://www.kedo.org/lwr_reactor_model.asp

"The KSNP NSSS is a two-loop design and is a scaled down and updated version of the Combustion Engineering (CE) System 80 pressurized-water reactor design, which is based on the U.S. Nuclear Regulatory Commission-approved CE Standardized Safety Analysis Report (CESSAR-F). There are three nuclear power units in operation in the United States with System 80 nuclear steam supply systems (i.e., Palo Verde Units 1, 2 and 3). However, the thermal power for the KSNP was reduced and additional design improvements provided to obtain additional thermal margin for safety. Thus, each unit is rated at 1000 MWe rather than the 1300 MWe of the original System 80 design."

Kind of like buying a 1970's car design with modern fuel injection and airbags. Fine until you have a crash !

Yeah, Combustion Engineering was bought by ABB some 20 or so years ago.

Various sources suggest that Saudi generating capacity is about 30 GW faceplate, and that about 65% of that is oil-fired. If one GWh equals 564 barrels of oil, and you assume 35% thermal efficiency, then you get a maximum of about 750,000 bbl/day. Which would be about a third of their current consumption, eyeballing the chart at Mazama Science. Given growth in domestic demand outside of the electric sector, time to bring alternative electric generation online, and probable declines in production, then you're almost certainly right: no substantial difference in net exports.

In my opinion, the whole region should go nuclear, as long as no Fukushima-ish or Chernobyl-ish disasters are possible.

I also think the whole region should aggressively pursue as many other non FF solutions as will work in that part of the world.

OK, clashing definitions of 'few years' are at play here:

http://www.arabianbusiness.com/saudi-plans-first-tender-for-nuclear-plan...

I'd believe they could get it done by 2030 with a lot of discipline, focus, and of course capital. It still won't influence the net export picture much...

Good luck to them Steve,

Ron's (Darwinian) at the beginning of this thread gave me all the reasons I want to know why they wont. Let me add a few more there educational system is not going to supply the qualified workforce needed to complete such a task when 90% of Phd's awarded at there Universities are in religious studies, a religion by the way that frowns on any form of science, especially Darwin's theory of Evolution. When that most revered of Islamic scientists Big Mo said that mountains are set like teeth into the earth, we are all made from a clot of blood, and that the sun sinks into a muddy pool when it sets, then there goose is cooked. In Islam there are no shades of grey only black and white. They will need more than 20 years just to get over that sort of mental inertia. There population is predominantly young and sexually frustrated. The Hippies of the seventies could at least could go back too there squat and have a screw to release the tension, highly recommended . This lot are doomed for ever too gaze in rapture at women dressed in black bin liner bags and argue if she has sexy eyebrows or not.

Lets just for the fun of it run through a few more reasons why they will not succeed. There is a certain country in the Middle east who by the tenets of the Koran are doomed for extinction. Now I wouldn't put money on it that they are in complete agreement with this view.Pre-emptive strikes are there speciality, when they didn't or couldn't do it as in 1948 and 1973 they came very near to annihilation. A few well aimed cruise missiles that can enter the anal orifice of a jumping kangaroo at 2,000 miles, would to put it mildly put a crimp in any ones desires and needs for peaceful atomic energy.This could and would put back any building program for years.

Money the Saudi's have in plenty, but will they have it in 20 years time. I wont run through any anti Saudi scenarios, I will just give an historical example. Great Britain the country of my birth ran through its patrimony the result of 200 years of colonial exploitation in the space of a couple of years in the early 1940s Without that Platinum credit card, lend lease, thank you Uncle Sam, we would have been toast.

Now I ask a simple question, who will give the Saudi's credit when there sovereign funds are exhausted after a couple of years because some clowns in dresses and silly hats on the opposite side of the Gulf think wouldn't it be fun if we closed the Straits of Humuz fired a few rockets at there oil installations and started a campaign of blowing up oil pipe lines, because God told us to do it. No income no credit. I am certain the answer would be no one, especially if it took several years to get the oil back on line, during which time you had to feed and cloth 25 million people who hated your guts, while your economy was gutted and your own people starving because of the lack of oil. Triage would be the order of the day and the devil or Shaitan can take the hindmost.

Oh, by the way, before I forget, Happy New Year everyone

regards

Yorkshire Miner

I can't make a lot of sense out of your post, but I did run across this article a few days ago(haven't seen it posted):

U.S. to sell F-15 fighter jets to Saudi Arabia

http://www.bizjournals.com/dayton/news/2011/12/29/us-to-sell-f-15-fighte...

A month or two of oil revenue.

And just before 1492 Europe was a backwater and the Middle East was more advanced...

Warning to the U.S., beware of the rise of fundamentalism....

"Fundamentalists are no fun and they are mental"

Okay guys, you all seem to misunderstand what is needed to build nuclear power plant. All you need is money and Saudi has plenty of money.

I went to Saudi Arabia in 1980 to help build and commission what was then their largest gas/oil fired power plant. It was built by Dravo Utilities out of Pittsburgh with American engineers and almost all expat labor. Americans did the engineering and supplied the skilled labor. The grunt work was done by Filipinos, Pakistanis, Indians, and several other countries.

If they build a nuclear power plant it will be built by American engineers. No problem there.

Ron P.

I read in 2010 that a problem is the shortage of factories that can built special reinforced concrete that is needed for nuclear power plants. Maybe that has changed now.

I think you meant "cement" You don't get concrete from a factory;;;

I can't find the article that talks about the shortage of factories that make that. That is: shortage if the demand for nuclear power plants rises sharply as planned before the disaster in Japan.

So now the world is even more in dire straits. Lately show up articles that shale gas will be a game changer. Time will tell, but I recall some comments from ROCKMAN that cast doubt on that.

So, who can tell me: why is it okay for KSA to build a nuclear power plant, but not Iran?

I mean, the Wahabis are as bad as the Mullahs. Both are fundamentalist loonies who hate each other at least as much as they hate everyone else, and if you let both have them, at some time they will nuke each other!

But then, the Paks already seem prepared for that, so...

Let the games begin?

Craig

This is too easy. Because the Saudis are *our* fundamentalist loonies, silly! (at least they are as long as they keep selling us all the black stuff we need at a price we can afford)

http://4.bp.blogspot.com/_kJP7skqpG_I/SdzGt_nm7nI/AAAAAAAAAKI/Xm81bql4Al...

If Iran just wanted to build a nuclear power plant no one would care. It is the bomb they are worried about. We have people in Saudi Arabia. In fact, as I said, we would be the one building the nuclear power plant. Of course they could opt to have France build it. Anyway neither we or France would build them a bomb.

A Mullah is just an Islamic religious leader, like a priest or preacher. Though it is primarily a Shia term, it is sometimes used by the Sunni as well. I heard the term used very often when I was in Saudi Arabia. Of course I was in the Eastern Province which is mostly Shia. But even in the Eastern province everything was run by the Sunni. The Sunni have far more Wasta than the Shia anywhere in Saudi Arabia.

Ron P.

I estimate that 2011 Saudi net oil exports will be between 1.0 and 1.6 mbpd below their 2005 annual net export rate of 9.1 mbpd (total petroleum liquids, BP).

Using the lower estimate of 2011 net exports, 7.5 mbpd, Saudi Arabia would approach zero net oil exports in about 16 years, around 2027. Using the higher estimate of 2011 net exports, 8.1 mbpd, Saudi Arabia would approach zero net oil exports in about 19 years, around 2030 (in both cases extrapolating the 2005 to estimated 2011 rate of increase in the ratio (C/P) of Saudi consumption to production of total petroleum liquids). At the 2005 to 2010 rate of change in the C/P ratio, Saudi Arabia would have approached zero net oil exports by the end of 2024. So, the slope of the projected Saudi net export decline has changed slightly.

A rough rule of thumb* suggests that the Saudis will have shipped half of their post-2005 Cumulative Net Exports (CNE) by the end of 2012, based on the 2010 estimate, and they will have shipped half of their post-2005 CNE by the end of 2014, based on the most optimistic 2011 estimate.

*Half of post-peak CNE tend to be shipped about one third of the way into a net export decline. In other words, relatively high initial post-peak net export volumes are disguising a very high post-peak depletion rate, the depletion rate being the rate at which post-2005 CNE are being shipped. Based on the most optimistic 2011 estimate for Saudi net exports, I estimate that the 2005 to 2011 post-2005 CNE depletion rate for Saudi Arabia is about 8%/year. Some CNE comparisons: http://i1095.photobucket.com/albums/i475/westexas/Slide1-8.jpg

Nominations for the 2012 Bloggies are open: Best Science or Technology Weblog. TOD definitely deserves some noms.

Yeah Anthony Watts' site, http://wattsupwiththat.com/ has a couple of bloggies in this category. That's just not right!

Re: Deepwater liabilities make momma look small, up top:

Detailed visual analysis:

http://www.youtube.com/watch?v=kBQdTv7bspM&feature=related

Very interesting. Thanks for posting.

Not being in the industry (and not an engineer) I don't know how significant it was, but I found it interesting that part of the problem was loss of power, considering that that was also an issue with Fukushima disaster. If power had not been lost on the rig would it have made a difference?

It is pretty amazing to see how many backup rams, sheers, etc. were not able to contain the pressure. This reminds of the frequent discussions y'all were having at the time about how much harder it is drill as we move into deeper and deeper water.

I always appreciate my TOD education.

don't - If I understand the BOP that BP was using correctly it should function even if it lost rig power and even if it were separated completely from the rig. Of course, that's in theory. Just like in theory a parachute will open when you pull the cord. Unfortunately that's not always the case. BOP's are required to be functioned tested and certified by independent third parties every two weeks. Then again, I recall a report from Norway that someone posted back in the Macondo disaster days. I think they analyzed 16 cases of lost well control and found the BOP had malfunctioned, to some degree, 40% of the time. Didn't always lead to a blowout, pollution or death. But also didn't perform as well as theory predicted.

More importantly, the vast majority of drilling accidents I've seen firsthand were not caused simply by equipment failure but human error. There is only one guaranteed way to prevent another Macondo from happening: don't drill offshore. The new regs may reduce the possibility to a very small statistical chance but it's impossible to reduce it to zero. So the public/govt has to make a choice: stop drilling or accept at least a small part of the responsibility of any future accidents. No operator can truthfully promise they'll never have a blowout.

Rockman,

You are correct the all BOPs maintain enough stored energy to function once the electric power is lost. Hydraulic fluid is stored under pressure in accumulator bottles. The big finding in the BOP once it was analyzed, was the the fact of the drill pipe bending within the BOP and resting against the bore of the BOP. Shear rams are designed to self centre pipe in the well to a degree, but this pipe was hard up against the wall and it was pinched between the corners of the two closing rams, and therefore not cutting and sealing as per design. I am sure Cameron is doing some intensive R&D on this "little" design flaw as we speak.

While we are on this subject, it is interesting how little changes have undesired consequences.

1/ In the GOM it was illegal to discharge a product from the pits directly to the sea, but drilling fluids that did not produce a sheen, could be discharged. Therefore when the crew needed to dispose of the Loss Circulating material (LCM) they pumped it down hole, and due to insufficient pressure on the annular during a test the LCM blocked the kill line which stopped correct measurements being indicated on the drill floor.

2/ The diverter line, which is an emergency redirection of flow in the case of shallow formation gas, or in this case evacuation of the riser due to gas above the BOP, has always been a pre-selected option of port or starboard, depending on wind direction with a one button hit. But once again due to environmental concerns an extra option had been included on this rig which allowed the flow to be directed to the Mud Gas Separator (MGS). The MSG is designed to separate the mud and gas from a controlled well kill operation, and the degasser has a mud seal which can only hold 15 psi. In a controlled kill this is not usually a problem but it can be managed if you run close to the limits.

Now on the night the diverter was pre-selected to the MSG, in the panic the button was operated in this mode, instead of overboard. The gas flow over whelmed the MSG, blew the burst disc, which dumped onto the main deck, and was finally ingested by the engines.

Now I am all for not polluting the environment, but we also have to be very careful about unintended consequences as we change procedures, especially when it effects last line of defense safety equipment/procedures.

Pusher - Great details. As you say about unintended consequences: many here might not like to hear it but, IMHO, I doubt most of the new reg changes will reduce risks to any great degree and some might even make matters worse. You know how to drill a well as safely as possible...most experienced hands do. Whether they do or not is it is another question. I'm sure you've been overridden a number of times by management who "knew better" than you.

A small but long standing gripe about two nations divided by a common language

UK US

petrol gas

gas natural gas

crude oil petroleum

(belated) happy new year.

EDIT

(sorry for the bad formatting - just got distracted by the company boss who could find the on-button on her desktop pc)

I don't think it is dead or that anyone is seriously reporting on its death.

The problem is that nearly unregulated global capitalism does not require a "middle" class. That's why folks smell blood in the water, and it's their own blood.

Edit: Unless he's talking about end of growth, but even then, capitalist will make money off that. Just watch 'em.

One can get into all kinds of philosophical straightjackets, but capitalism is a fixture - it goes hand in hand with private property and will be around for as long as people can gain from labour and trade.

What's different in the past thirty years is the preponderance of the financial sector.

The banking sector, in particular, has soared to heights historically unknown. Usury is considered a grievous sin in all the major world religions and for a reason: it's highly manipulative and exploitative. Debt is a form of slavery. As John Ralston Saul so eloquently put it: "Bankers - pillars of society who are going to hell if there is a God and He has been accurately quoted."

The genius of the current crop of wizards at the top was that they convinced people at the bottom vice is virtue. Credit is liberating. Greed is good. Rich bonuses are a reward for services rendered.

The sham is up. Usury turned out to be the bogey-man it really is. The faithful have at least one consolation: the bankers are first in line for hell. The bigger question is whether justice can be brought to bear on this side of life's divide. If it can't, we're stuck with the consequences.

"The faithful have at least one consolation: the bankers are first in line for hell. The bigger question is whether justice can be brought to bear on this side of life's divide."

As a humble but persistent student of Collapsonomics (a term I prefer to 'doomerism") I am convinced that these hyper-capitalists, most anyway, will suffer justice in the near future. They exist in a highly specialized environment, one that is becoming inviable as a support system for their exploits.

It seems to me Ghung that the Hyper-capitalists as you call them are getting to look a lot like the French Aristocracy before the French revolution. Money has no power, if it doesn't and can't circulate,if the financial system suffers from a complete heart attack, instead of the partial heart attack of 2008 then they could easily end up resembling French toast.

They have more to lose. So they will lose more.

I wish that were true, but the way it's been throughout most of history is that those who have the least to lose, lose the most, while the oligarchs just tiptoe through the minefield unscathed (or rather are carried through on sedan chair by their unfortunate servants). The French and Russian Revolutions are notable precisely *because* they were so atypical.

The rich still lose a *lot* in a collapse, but they can afford parachutes for a soft landing so a greater percentage of them land on their feet.

Not sure if this is still true, but when I took business law the most an individual could charge another person, i.e. not a bank loan but a person to person loan, was 7%. It was called the usury law. However, banks can charge as much interest as they think they can get away with on credit cards.

I never could understand how the law would designate a certain max. % on a loan person to person, but not set a limit with the banks. Guess that's captitalism and how many people reach a point of becoming slaves to their debt.

But what about loans on homes in which the mortgage is now underwater? Again, slaves to the system. Walk away? In some cases the bank sues the person and because of new bankruptcy laws the person cannot get away from the courts decision and they become slaves to paying it off.

There are many ways to becoming a slave that just are not as obvious as they once were.

If I remember correctly, I read about a court case brought by a small lender charged with violating usury laws that resulted in the court throwing out the personal loan usury statue, this probably some twenty years or more ago.

The lender's attorney simply entered the as evidence the interest rates currently charged at that time on major credit cards, and asked the judge if all those banks should be charged too.The lender's rate was actually less than most of the cards.The lender was acqiuted, and allowed tp proceed with collection.

I am no lawyer, but I can say this for sure-I don't believe it is an accident that I cannot remember hearing usury mentioned in a newspaper or on the radio or in a business magazine for many years.

I guess it would embarrass to many bankers to mention the subject.

Actually that is wrong. The result was correct, but the reason was because of the Federal Due Process clause. The Court held that the state must honor the law of the Bank's home state (South Dakota, I think). Since then, banks have all added collection divisions incorporated in the states with the highest usury law.

Sometimes the law is an Ass.

Craig

Capitalism is not private property, nor is it gaining from labor. It is what exists when a society permits and encourages profit-making by business investors to serve as the society's top priority.

Meanwhile, that phenomenon cannot long exist without economic growth, which is needed to compensate for capitalism's strong tendency to automate and offshore the labor process.

If capitalism still exists in the year 2100, it will be a miracle. The planet cannot stand endless economic growth.

Capitalism is many things and can get twisted in points of semantics. Capitalism is about capital. As far as encouraging profit-making, I haven't heard of any system of labour and trade that hasn't had that built into it somewhere, somehow.

Michael, I agree with you. The growth model is not sustainable. Globalization built on consumers in the west and producers in the east is not sustainable. Real time deliveries are not sustainable.

Cheap transportation relies on cheap energy.

Cheap credit relies on cheap energy.

Any system built on cheap transportation and cheap credit is a disaster waiting to happen. Hence 2008. Particularly if it counts on growth as a magic fix. Hence 2012.

Over time, everything will change, including how we arrange capital.

Top priority? Why then do we have high corporate taxes and lots of regulation?

How long is "not long"? Capitalism has often survived with no problem without growth. For instance, Japans "lost decade". And as long as we can save labour by the techniques you mention, we can have growth by just letting the freed labour work.

..."we can have growth by just letting the freed labour work."

Work doing what?? Giving shopping carts at Walmart to grocery clerks from the Piggly Wiggly? Matters not. Your capitalist god is going down. It has overshot its resource base and fouled its nest. It's been chasing its tail for decades and is now eating it.

Did you catch the gaffe during the election final speeches, where Santorum said that WalMart did not outsource, and we needed more companies like WalMart? What a joke! Walmart started the outsourcing by purchasing foreign processed merchandise. The can't very well outsource thier clerks, or they would. They do pay them minimum wage, and they destroy all of the local businesses when they move in, thus destroying the retail tax base that was the link-pin of most small cities' revenues. Plus they drove down wages, eliminted jobs, and were the instigator of our race to the bottom!

Wonderful, Rick! We need more like that!

Craig

C'mon now. Rick has his fans. Google "santorum" and see what you get first:

...well, I'll let you try it ;-)

BTW: The Walmart in the next town just added 3 more isles of robo checkouts. One of them asked for my ID after I scanned a jar of Gulden's Spicy Brown Mustard...

"One of them asked for my ID after I scanned a jar of Gulden's Spicy Brown Mustard..."

You DID know, didn't you, that when mixed with Hellmans's Real Mayonnaise it produces a very powerful explosive? Hate to say it, but you are now on the no-fly list.

Does it have to be Mayo? Won't Miracle Whip work?

Craig

"Does it have to be Mayo? "

Yes. I can't tell you all the details - I'm in enough trouble as it is.

Warning TODers, don't do it! You may be left with an undesirable image that you can't get rid of. Especially if they keep talking about the "Santorum Surge" and coming from behind.

I know you probably can't help yourself, but don't say you weren't warned.

A little background for those faint o fheart. Moral of the story: Be careful who you piss off. One wonders how long before Rick gets outed.

Very interesting, thanks. I had more sympathy for him when I thought it was an unfortunate coincidence.

But thanks for the info. After a bunch of Republicans voluntarily calling themselves "Tea-baggers", it's hard to know if something is a gaffe, a lie, a spin, mis-direction, an attack or pablum.

It may work in his favor, though, since whoever beats him will have headlines reading "XXXX licks Santorum!"

I guess you can twist it (not you Santorum), since Walmart doesn't manufacture anything, but simply retails, its hard t offshore those retail jobs. -At least until we purchase checkout clerk Avatar's that can be run over the internet from Mumbai.

If you were worried about inflation, than Walmart was a bigtime hero, they put extreme price pressure on all their suppliers (which has of course led to a lot of outsourcing). So its a case of helping on the one hand (by pushing economic efficiency of its suppliers), and hurting us with the other "losing jobs to China". [Btw its been a few years since I've been in one]

After years of local resistance, we're finally getting a WalMart shoved down our throat. That's how it feels to me anyway. The only good news is they will be moving into a big empty place in The Mall, so at least nothing will get paved that isn't already paved, and it's not outside of town.

I've always called it MallWart. Did I call this to me?

Hey Water Weasal,

Are You In Eureka? That's what is going down here.

" In 1999 Eureka residents voted down Walmart’s bid to rezone an area of the waterfront for retail. By using the space left by Gottschalks, which is already zoned for retail, Walmart (or whoever) bypasses any zoning issues - which means the Eureka City Council and Eureka voters are also cut out of any further decision making."

http://www.northcoastjournal.com/news/2011/08/11/wheres-walmart/2/

Exactly. Well, Arcata, actually.

But I work walking distane from the mall, and sometimes get food at the Food Court for lunch.

Nice end run they did around the zoning laws.

"You underestimate my sneakiness!"

How are they doing an "end run around the zoning laws" by opening a retail store in area already zoned for retail in which apparently the previous tenant went out of business and left an unoccupied building? No offense, but the extent to which some people take their anti-Walmartism is amazing.

Its just a store... if you don't like the company, feel free to shop somewhere else. I have yet to visit a town/area where Walmart is the ONLY retailer and no other retail businesses exist, in fact, in most places I been, there are a cluster of other businesses of different types around the Walmart, or Target, or Costco, etc.

I called it an end run because they have tried to come here before, but because they were proposing a big new building, the community was able to say no. Now that they have found an unoccupied space, they can just move on in, no questions asked.

I have no personal experience with WallMart, having never been in one, but they have a bad reputation for draining the life force from small, local businesses. I guess we'll find out.

"...the community was able to say no..."

Oh, I get it, the end run wasn't around the zoning laws - the end run was around a small handful of loudmouthed crackpot busybodies (the so-called "community") with nothing better to do than order other people about capriciously and arbitrarily, in this case with respect to where they are or are not to shop.

Actually the Walmarts around where I live are slightly unpleasant to be in. Then again there are plenty of other places to shop, some (not all) of which charge reasonable prices - so what's the point in fussing?

Yes, I suppose we should just bow down to our Corporate Overlords. I'm sure they have our best interest at heart.

If you don't feel they give you a good deal, then don't shop there, and they will have less power. Market share is actually one of these things that the grass-roots decide by everyday action. This is, arguably, more democratic than voting about it - no need to oppress a minority and no need to wait for a vote.

This is true when genuine competition is still allowed --something that is becoming less and less common in many cartel and monopoly-dominated industries: healthcare (BlueCross/BlueShield is now a virtual monopoly in many Southern states), banking (BofA, Citigroup, JP Morgan Chase), retail (WalMart towns where locally owned shops have been decimated), cable (legal monopolies), wireless (AT&T, Verizon), etc. The trend of the last 30 years has been towards *more* concentration of power among fewer firms, not more competition or small businesses.

This seems to be a common critique among American liberals: "Yeah, yeah, a free market would be all well and good, but we don't have one and therefore we don't lose anything by destroying it." It's a bit like "Yeah, yeah, one should eat healthy food, but every once in a while, something unhealthy will slip by, so I could just eat whatever, whenever.

No, it's more like "Yeah, yeah, one should eat healthy food, but the only place that sells food near me is the gas station."

"Free market" is an extremely loaded and personal ideology sensitive term that means different things to different people.

To a working class libertarian it usually means "no regulations on most businesses, a weak central government", while to the privileged 1% it means "privatized profits, socialized losses, fat government no-bid contracts, and regulations that protect our monopolies & cartels from competition, and no economic safety net for most citizens".

To a liberal it might mean "regulations that serve to protect consumers from unecessary harm, fraud and deception, the environment from "the tragedy of the commons", and small businesses from Mafia-style cartels who don't want competition".

I strongly suspect my ideal concept of "free market" does not = yours.

I agree there is no universal definition, but I think the reasonable domain is much smaller than you portray it. Some of what you suggest, especially the 1% variation (that I don't agree the 1% want) is decidedly anti-free market. The definitions used by economic freedom indices are typically quite good.

IIRC youre is Sweden. I suspect if your local area has the balance off in one direction (in your case too much regulation), and you can't change it, then "less is always better" sounds attractive. OTOH, in the land of libertarians with insufficient regulation, the opposite state of affairs holds. It seems the political mind cannot comprehend the concept of just enough, but is attracted to the extremes, none or total.

I don't agree at all. Sweden is actually very free. We beat the US in 7 of 10 areas in the Heritage index. What draws us down to a somewhat worse average score are particularly bad stats in the remaining areas, i.e. taxes, government spending and labor law. Business regulation, trade regulation, property rights, monetary policies and so on are top notch, OTOH. They would be even freer if it were not for the EU membership.

I see our "extreme" libertarian policies as good, and your "extreme" libertarian policies as good. (They're not really extreme, but anyway.) I also compare with other countries - our neighbor Denmark, for instance, has high labour freedom with better results than Sweden.

Sure, some regulation may be good, but then it is "little and smart". Added volume and complexity is obviously bad, all else being equal. To my mind, Sweden does that better than the US. Our system and our mindset allows for more technocratic expert solutions than does yours, and also, unfortunately, for a bigger government. And we don't really do "pork-barrels".

Walmart makes a profit by literally engaging in wage theft. As in getting workers to put in work off the clock.

It's not just a matter of "don't shop there." Of course I don't. But honest retailers should not have to compete with a thief like Walmart.

That doesn't sound like theft to me. It's for workers to decide whether they think Walmart is the best option for them, all things considered. Unpaid time is quite common even in my own Sweden and the well paid R&D engineering line of work.

If your employer values the extra time you put in, then they will pay you for that time. If your employer does not pay you for your time, then they are sending you a message that they value your time as being worth nothing. This is basic economics, yes? A price signal? "We value your overtime but we aren't going to pay you" is a signal that actually they do not value your extra input at all.

If they DO secretly value it, but aren't prepraed to pay, then yes it is theft.

The employee gets a certain salary from the employer. The employee works a certain amount of time (including the "unpaid" overtime). The employee's time seems to be valued, by both parties, at the salary given divided by the total time put in.

There may be good reasons the employee and the employer understate the amount of hours worked, for example if they want to collude on ignoring minimum wage laws, or if wages are high and "sticky" for some other reason and unemployment has risen and the market wage has fallen. Or if the employee isn't as efficient as thought when the wage was set and thus needs to work a bit more to produce what's expected of him.

But your examples are still price signals. The "employee who isn't as efficient as thought," for instance; by squeezing more hours out of that employee for a given wage, then that's a signal that that employee's time is valued less than other employees, and that if s/he only works the set number of hours then they are being overpaid.

If you agree informally to give extra unpaid hours to your employer then you are admitting you are overpaid; if you disagree with that, then you should be selling your time/skills at the market value. Because otherwise it is theft. If it is common in Sweden, then it is a common form of theft, but that does not stop it from being theft. The only thing which stops it from being theft is if you give your consent to the idea that you are overpaid. Conversely, if you disagree that you are being overpaid, but you contribute unpaid hours anyway, then your time is being stolen.

In my workplace when I do extra hours I submit an overtime claim form. I get time and a half for it, ie 50% more pay. That's because any extra time is usually in high-value personal time, like evenings or weekends. I value that time more than normal 9-5 time, and therefore I ask for more money. My price signal is that I value my time, and I price it accordignly. Perhaps in Sweden evenings and weekends are low-value time? That's why you sell it for a price of zero? :-) Anyway my employer clearly values my time too, and values the projects I work on, because they cough up the extra money. So there's a price signal there too.

Salary-setting is an interesting part of price signal theory.

All of this thread ignores completely the reality that the employee has NO say. At one time unions were prevelent in the US and they helped quite a bit in establishing a strong middle class. Today they have been emasculated (beginning in 1981/2 with Reagan's destruction of PATCO, and continuing with anti union measures in Ohio, Wisconsin and elsewhere).

Which is why the 1 % want high unemployment (so long as it isn't their children or friends, eh?). that sets up the circumstances in which exploitation is possible and endemic.

How else would clothing manufacturers in US territories be able to hold young women in virtual slavery, requiring abortions if they become pregnant, etc.?

I agree that it is about price signals, but not about theft. But let's agree to disagree, as it seems Leanan is fed up with me. I disagree with the latest comments of Zaphod42 and r4ndom too, but I'll leave it at that.

You are making the assumption that the employee has a realistic choice.

In most cases for workers at the bottom the choice is "take what you are given or go hungry".

The one community I was in that was opposed, was in a very perifferal Rural environment. WallMart was attracted by the low land values. It would have generated a lot of traffic to/from the big city, and the local roads wouldn't have been up for the volume. At least respecting new bigbox locations there can be legitimate reasons other than protecting local merchants.

Walmart does a lot of store brand manufacturing using sweatshop labor outside the corporate umbrella. They are also famous for using front companies to purchase land and get permits without disclosing who they are. In one case, after several years working with them to provide utility power on one project, I was asked by a different company to provide info on another site. I asked them, and the people I was working with on the first project, and Walmart corporate (via a high-level channel) and they all lied and said it wasn't their project (even though I had good reason to need to know, and would happily have signed non-disclosure). The idiots had sent me documents which were word-for-word identical for the first project as part of the second project, so I knew they were lying, I just wanted to see if they'd tell me. Took them over a year to fess-up. When working with Wal-mart if you don't get it in writing it never happened. Companies have cultures and theirs is "screw everybody."

Yeah zaphod, but what you have to remember is the family that owns Walmart is getting super wealthier by the minute, which is what is most important to the Republican party. Remember, think in terms of the top 1/10th of 1% and eureka, you're there! The joy, the sheer beauty of returning to an era of serfs and land barons is just a few elections away. Go super pacs! snark

On the contrary, Walmart typically helps neighborhoods attract more businesses. They provide jobs, both in construction and as clerks, they provide tax revenues, competition, helps stabilize rough neighborhoods and, most importantly, provides greater purchasing power for those who need it the most. The positive externalities of such improved competition and efficiency far outweighs any negative externalities. (I won't mention that it helps the real poor, i.e. Chinese and others in countries where Walmart goods is being produced, since I guess you don't care.)

I know from my training in Economics that trade between two countries is mutually beneficial. That's the premise behind globalization. However, I have come to realize that the benefits of globalization are not evenly distributed. It certainly has not been beneficial to the tens of millions of people who lost their manufacturing jobs, or who have had their salaries reduced due to competition from Asian countries. Globalization is one of the factors that has led to a greater concentration of wealth at the top. We need a more even distribution of wealth and that will require doing more manufacturing in the developed nations and importing less from developing nations. It will mean a lower standard for those of us, including myself, who currently have relatively well paid jobs plus the benefit of being able to buy inexpensive imported goods.

Are you sure? These people might have been made redundant by automation instead, if not for off-shoring, and they have typically found other jobs with not-that-much lower pay. In all, I think the improved purchasing power more than compensates most would-be low-tier manufacturing workers.

In individual countries, yes. However, globalization has also led to a between-country convergence, leading to a drop in global GINI. This is extremely beneficial, and is already leading to re-shoring, where jobs are moving back to the West due to rising Chinese labour costs.

Why do we need a more even wealth distribution, and how could increased domestic manufacturing fix this? I would think manufacturing jobs brought back prematurely would not be that well paid. Burger flippers and others in the service sector will become even poorer, making the income distribution worse.

Most of all, it will mean a lower standard for those of you, not including yourself, who currently are unemployed or have low paying jobs, and who will lose the benefit of buying inexpensive imported goods.

It is a fact that inflation has been higher for rich people, something which isn't reflected in ordinary statistics on income and wealth distributions. The rich typically buy more expensive stuff, more often made in the West, sold with higher margins. What you suggest would be worse for low-paid workers, raising their inflation rate more than it would yours.

There would be fewer unemployed workers and higher wages if manufacturing returned to the US. This would offset higher prices. Your basic point about trade being beneficial to both countries is partially correct. In order for there to be optimal outcomes both labor and capital must be able to move freely between countries, this is much more the case for capital than labor.

Both these claims are incorrect. NAIRU doesn't improve by tariffs or other trade barriers. The statistics are clear on this. Wages absolutely gets worse by the increased prices, even if other nations don't retaliate with tariffs of their own.

The US has had the additional problem of running large trade deficits -- essentially the cost of importing goods has been subsidized by a net inflow of capital (borrowing). Economic theory focuses more on a balanced trade situation where each country produces goods they have a relative advantage at producing.

What we've lost in giving up manufacturing are jobs that were reasonably well paid but did not require a high level of education or skill. It's nice that more people are able to get a university education and a well paid professional career. Unfortunately, not everyone has the aptitude for doing that. As it happens, my son is one of those people. He currently has a manufacturing job assembling equipment. It's a great job for him as he works with his hands and doesn't get bored with the repetition. Unfortunately the company is most likely going to move their manufacturing to China later this year and he isn't likely to find similar work elsewhere. He definitely isn't university material. He'd like to learn a trade at community college, but even here many of the trades have bumped up their academic requirements (especially in regards to math).

It's debatable whether people at the bottom end of the salary scale benefit from being able to purchase cheaper manufactured goods. If someone lost a good manufacturing job and is now making minimum wage they are unquestionably worse off -- most of their income will go towards things like shelter, transportation and food, none of which have been made cheaper as a result of globalization. Being able to purchase inexpensive manufactured goods won't compensate for their loss of income. The other problem relates to the quality of goods. If you have a low income you want to buy items that are going to last a long time. Unfortunately, we've become a throw-away society so much of the manufactured goods on the market are not designed to last. You can certainly find expensive items that will last but it has become hard to find reasonably priced items that will last.

Globalization has given us more wealth on average, but there are a significant number of people in our society who have been hurt rather than helped by it.

There is a problem with sending green printed paper abroad and getting manufactured goods back?

Not really. They most definitely are. Everybody has clothes, TVs, phones, toys, most have cars and so on. Cheaper steel, rare earth metals and so on is stuff that, when used as inputs for other manufacturing, lowers the price of the end products. This affects the price of food by making agri equipment cheaper. For instance. Also, don't forget the Chinese are importing more and more, and that domestic R&D gets a push by increased global markets.

Sure, but someone who works in transportation or retail who once had minimum wage and now has a good job thanks to Chinese goods are better off. You're looking at a specific, transient case. Again, trade doesn't affect the number of jobs, and you'd be hard pressed to establish that it affects wage inequality very much either. Sure, if you're a blue collar worker that just lost a job, it's understandable that you'd be bitter, but overall, trade is unquestionably beneficial. It creates more pluses than minuses.

I don't really agree.

There are many more people helped than are hurt. The economy and its jobs are in constant motion, so there is always a bit of hurt in there. But overall, trade is good. The problem is merely that the transient and concentrated drawbacks are much more visible (and more easily attributable) than the more spread-out and long-run benefits.

I used to agree 100% with that. Now, I'm not so sure. In fact I think I'm more on the hurts more side now. But, I don't know how to reform things to get the best of both.

De-industrialization of the US has gone too far. The problem is that with consistently negative trade balances, we are getting by by selling off the ownership of the little productive caapcity we still have. I think we almost all sense the non-sustainability of the current situation. If we were specialized in say software, and they did manufacturing so the trade roughly balanced out, that would work. But we are selling our corps to foreign investors. That means the profits go overseas, and at best we become labour for their capital.

As I mentioned elsewhere, there is some signs of an re-shoring trend going on, as Chinese labour is getting ever-more expensive. Also, it's somewhat of a myth that the US has deindustrialised. Sure, the gap widened a little bit in the end of the 90-ies, but it's not that dramatic:

If they did we'd have a big problem that the economy only needs so many. I'd bet that so many is probably no more than a third of the jobs.

I college at work, had his son take electric lineman school. Only a few months of schooling. I don't know how he's doing, the job offer he had was rescinded because he had some traffic tickets on his record. I hope they don't all break that way (i.e. use the same disqualification criteria). Nevertheless there do exist semi-skilled jobs (electrician comes to mind), that require some training, but not needing years worth.

Electrician is NOT a SEMI-skilled job; most of the trades aren't and particularly not that one. Also, the ability to string Romex, twist wirenuts, and make-up receps does not make an electrician, anymore than the ability to solve algebraic equations makes a mathmetician. Making journeyman electrician typically requires about 3 years for the bright and technically inclined. One advantage is that typically the training is paid work. The intellectual demands of electrical work are greater than most degreed positions. I say that as a professional electrical engineer who worked as an electrician while going to university.

<< It is a fact that inflation has been higher for rich people, something which isn't reflected in ordinary statistics on income and wealth distributions. >>

Facts that are reflected in statistics are certainly not above suspicion.

However, I'm sure you will forgive me for being even more suspicious of facts that are not reflected in statistics.

I earn no money at my job, and have little disposable income. What are these inexpensive foreign goods that I am supposedly benefiting from? I would rather have health insurance that cost less than $800 per month.

I think my experience is pretty typical in the U.S.

This is not a fact. It is just random personal observation.

They are reflected in statistics, just not the ordinary inflation statistics you'll see.

I can't think of any physical goods that are not cheaper b/c of foreign competition.

I think some people are gonna react violently to this, but anyway: Insurance is losing money, on average, if you don't have access to information the insurance company doesn't. Better to save the money and pay out of pocket. If you have your government deregulate the health industry, it'll be cheaper too. Alternatively, of course, you could go the European way and try to force others to pay for you. However you cut it, however, limiting foreign trade will make you worse off in this regard as well. Less GDP will mean less resources for medicine and thus worse quality.

jeppen: You really hit the nail on the head with that last sentence. The reality is that, for the past 30 plus years, international corporations have been getting rich on wage arbitrage. I predicted what is happening back in the 70's. Anyone who saw that the Chinese, Indonesians, Indians, etc., were living on less than $700 a year could see that there must be an international leveling of wages. This is now taking place, with gut wrenching consequences in the U S of A. Not pleasant, and I don't know how to avoid it. As the poor in the third world rise, the middle class in America and Europe sink. More in American so far, but I think we will see that change soon.

Of course we know that the industrial age is wrapping up, and that this is not sustainable in any event. What is truly sad is that WalMart and the others have not paid even the poor in Chindia the value of their labor. They have instead exploited them, just as they no doubt will exploit the newly poor in America when transportation of foreign made goods becomes less affordable.

And, lest we forget, WalMart is simply following the tradition begun by K Mart years earlier, using the same model but doing a better job of it. And K Mart followed Sears Roebuck, who were notorious for their predatory practices years before that.

Where was it written, "There is nothing new under the Sun?"

(And, I do care. As much about the abject poverty that continues in those poor countries as for the harm being done here. Do you?)

Craig

Increased profits from outsourcing are quite short transients. The reason is that the competition follows, and price competition push profits toward the same equilibrium as always. Thus, the benefit is mainly transferred to consumers.

Yes, there is some leveling, and that's fantastic. I don't think it's very gut wrenching either, and the middle classes don't sink, but rise, albeit at a somewhat slower rate. However, this is setting us up for a real golden age, some of which we're seeing already. Think of this: We're at 6 billion mobile subscriptions around the world. Nigeria alone has some 150 million. Just the effect of everybody being able to communicate, and increasingly, having wikipedia at their fingertips, cannot be overstated. That US mobile subscriptions are as cheap as they are, and that 4G/LTE is already here, depends in large part on the fact that the markets of China, India and Africa enables equipment manufacturers to spread costs of development and achieve economies of scale. And China and India are catching up fast, and for every year with per-capita GDP growth close to double digits in these countries, their low-wage "advantages" are diminishing.

What does this mean? What is the value of their labor? What is exploitation? Is this anything more than rhethoric and arbitrary "good" levels of compensation and standards? I think the correct wage is the market wage. The Chinese have lifted hundreds of millions from absolute poverty this way (foreign direct investment), and large middle classes are growing from it. India is much more socialist and have held back, and they are lagging behind China because of this. They suffer from too little capitalism and economic freedom.

Yes, but rationally. And that's why I'm stressing that trade and globalization is good.

I think this is enough on this topic. You're not in the US, you probably haven't experienced how this political stuff has sucked all the air out of the room in so many Internet forums here.

There's plenty of other places where the same-old, same-old left vs. right stuff can be discussed. We'd like to cut down on the political rants here.

I would like to think of myself as anti-ranting, as I try to provide a science-based, constructive world-view to counter the typical rants of how badly everything is set up. But I'll shut up, no prob.

Leanan – None of Jeppen’s posts seemed the least bit like a rant to me. He is presenting a calm and methodical series of counterpoints to the frequently-expressed (and seldom moderated) attacks on free trade & capitalism that have become so commonplace on TOD. And he’s doing an impressive job of it, BTW. If readers dislike this differing viewpoint, they’re free to skip over his posts.

Jeppen, we don't have high corporate taxes and lots of regulation. The fact that so many people think we do is a sign of the power of corporate capital. Regulation, for that matter, is often an alternative to public, not-for-profit enterprise. Witness the recent "reform" of the medical-industrial complex. When it's more than that, it's often gutted (OSHA and FDA with 1/100th of the needed inspectors) or simply not enforced (Sherman Anti-trust Act; offshore drilling rules). It certainly is not any kind of serious constraint on doing business in the USA.

Meanwhile, corporate capitalism -- capitalism in which investors are permitted to form and maintain enterprises large enough to restrict price competition -- absolutely requires big government and, therefore, substantial taxation. Left to its own devices, the system is way too effective at its main goal -- sending the proceeds of economic and productivity growth to investors -- to be self-sustaining, without huge and increasing use of the state to counter the basic trend. That's the real secret to why no Republican is ever truly serious about shrinking government. Doing so means permanent Depression, which people won't long stand for.

"That's the real secret to why no Republican is ever truly serious about shrinking government. Doing so means permanent Depression, which people won't long stand for.

... The Republicans may not want the blame, but it may feel like 'permanent depression' for many. Limits...

So, the top priority of republicans is to maximize corporate profits, and they employ big government and high taxes, somewhat counterintuitively, to keep the profit level as high and as stable as possible? And smaller government and less regulation, despite all evidence to the contrary, would mean permanent depression? That's quite some conspiracy theory you've got there.

jeppen, the top priority of republicans is the same as Democrats: to acquire maximum power and wealth for themselves, which translates into protecting the interests of the 1%, who hold all the wealth and power, and are therefore the only "constituency" that matters. Everything else is a divide-and-conquer Culture War puppet show to distract the disenfranchised majority. No "conspiracy theories" necessary, just plain old fashioned realpolitik --follow the money.