Naked Oil

Posted by Gail the Actuary on January 11, 2012 - 12:03pm

This is a guest post by Chris Cook, former compliance and market supervision director of the International Petroleum Exchange.

All is not as it appears in the global oil markets, which have become entirely dysfunctional and no longer fit for its purpose, in my view. I believe that the market price is about to collapse as it did in 2008, and that this will mark the end of an era in which the market has been run by and on behalf of trading and financial intermediaries.

In this post I forecast the imminent death of the crude oil market and I identify the killers; the re-birth of the global market in crude oil in new form will be the subject of another post.

Global Oil Pricing

The “Brent Complex” is aptly named, being an increasingly baroque collection of contracts relating to North Sea crude oil, originally based upon the Shell “Brent” quality crude oil contract that originated in the 1980s.

It now consists of physical and forward BFOE (the Brent, Forties, Oseberg and Ekofisk fields) contracts in North Sea crude oil; and the key ICE Europe BFOE futures contract, which is not a deliverable contract and is purely a financial bet based upon the price in the BFOE forward market.

There is also a whole plethora of other ‘over the counter’ (OTC) contracts involving not only BFOE, but also a huge transatlantic “arbitrage” market between the BFOE contract and the US West Texas Intermediate (WTI) contract originated by NYMEX, but cloned by ICE Europe.

North Sea crude oil production has been in secular decline for many years, and even though the North Sea crude oil benchmark contract was extended from the Brent quality to become BFOE, there are now only about 60 cargoes each of 600,000 barrels of BFOE quality crude oil (and as low as 50 when maintenance is under way) delivered out of the North Sea each month, worth at current prices about $4 billion.

It is the ‘Dated’ or spot price of these cargoes – as reported by the oil price reporting service Platts in the ‘Platts Window’– that is the benchmark for global oil prices either directly (about 60%) or indirectly, through BFOE/WTI arbitrage for most of the rest.

It will be seen that traders of the scale of the oil majors and sovereign oil companies do not really have to put much money at risk by their standards in order to acquire enough cargoes to move or support the global market price via the BFOE market.

Indeed, the evolution of the BFOE market has been a response to declining production and the fact that traders could not resist manipulating the market by buying up contracts and “squeezing” those who had sold forward oil they did not have, causing them very substantial losses. The fewer cargoes produced, the easier the underlying market is to manipulate.

As a very knowledgeable insider puts it….

The Platts window is the most abused market mechanism in the world.

But since all of this short term ‘micro’ manipulation or trading (choose your language) has been going on among consenting adults in a wholesale market inaccessible to the man in the street, it is pretty much a zero sum game, and for many years the UK regulators responsible for it – ie the Financial Services Authority and its predecessor - have essentially ignored it, with a “light touch” wholesale market regime.

If the history of commodity markets shows us anything, it is that if producers can manipulate or support prices then they will, and there are many examples of which the classic cases are the 1985 tin crisis, and Yasuo Hamanaka’s 10-year manipulation of the copper market on behalf of Sumitomo Corporation.

When I gave evidence to the UK Parliament’s Treasury Select Committee three years ago at the time of the last crude oil bubble, I recommended a major transatlantic regulatory investigation into the operation of the Brent Complex and in particular in respect of the relationship between financial investors and producers, and the role of intermediaries in that relationship.

I also proposed root and branch reform of global energy market architecture, which in my view can only come from producer nations and consumer nations collectively, because intermediary turkeys will not vote for Christmas.

A Meme is Born

In the early 1990s, Goldman Sachs created a new way of investing in commodities. The Goldman Sachs Commodity Index (GSCI) enabled investment in a basket of commodities – of which oil and oil products was the greatest component – and the new GSCI fund invested by buying futures contracts in the relevant commodity markets which were 'rolled over' from month to month.

The genius dash of marketing fairy dust that was sprinkled on this concept was to call investment in the fund a ‘hedge against inflation’. Investors in the fund were able to offload the perceived risk of holding dollars and instead take on the risk of holding commodities.

The smartest kids on the block were not slow to realise that the GSCI – which was structurally ‘long’ of commodity markets – was taking a long term position which was precisely the opposite of a commodity producer who is structurally ‘short’ of commodities because they routinely sell futures contracts in order to insure themselves against a fall in the dollar price; ie commodity producers are offloading the risk of owning commodities, and taking on the risk of holding dollars.

So, in 1995 a marriage was arranged.

BP and Goldman Sachs get Married

From 1995 to 2007 BP and Goldman Sachs were joined at the head, having the same chairman – the Irish former head of the World Trade Organisation, Peter Sutherland. From 1999 until he fell from grace in 2007 through revelations about his private life, BP’s CEO Lord Browne was also on the Goldman Sachs board.

The outcome of the relationship was that BP were in a position, if they were so minded, to obtain interest-free funding via Goldman Sachs, from GSCI investors through the simple expedient of a sale and repurchase agreement - ie BP could sell title to oil with an agreement to buy back the oil later at an agreed price.

The outcome would be a financial ‘lease’ of oil by BP to GSCI investors and the monetisation of part of BP’s oil inventory. Such agreements in relation to bilateral physical oil transactions are typically concluded privately, and are invisible to the organised markets. However, any risk management contracts which an intermediary such as Goldman Sachs may enter into as a counter-party to both a fund and a producer are visible on the futures exchanges.

Due to the invisibility of the change of ownership of inventory ‘information asymmetry’ is created where some market participants are in possession of key market information which others do not have. This ownership by investors of inventory in the custody of a producer has been termed ‘Dark Inventory’

I must make quite clear at this point that only BP and Goldman Sachs know whether they actually did create Dark Inventory by leasing oil in this way, and readers must make up their own minds on that. But I do know that in their shoes, what I would have done, particularly bearing in mind that such commodity leasing is a perfectly legitimate financing stratagem that has been in routine use in the precious metals and base metal markets for a very long time indeed.

Planet Hype

The ‘inflation hedging’ meme gradually gained traction and a new breed of Exchange Traded Funds (ETFs) and structured investment products were created to invest in commodities. In 2005, Shell entered quite transparently into a relationship with ETF Securities which enabled them to cut out as middlemen both investment banks and the futures market casinos, and with them the substantial rent both collect.

Other investment banks also started to offer similar products and a bandwagon began to roll. From 2005 to 2008, we therefore saw an increasing flood of dollars into the oil market, and this was accompanied by the most shameless and often completely misleading hype, and led to a bubble in the price.

There was (and still is) no piece of news which cannot be interpreted as a reason to buy crude oil. The classic case was US environmental restrictions on oil products, which led to restricted supply, and to price increases in oil products. Now, anyone would think that reduced refinery throughput will reduce the demand for crude oil and should logically lead to a fall in crude oil prices.

But on Planet Hype faulty economic logic – the view that higher product prices are necessarily associated with higher crude oil prices – was instead used as justification for the higher crude oil prices which resulted from the financial buying of crude oil attracted by the hype.

You couldn’t make it up: but unfortunately, they could, and they did.

More worrying than mere hype was that a very significant amount of oil inventory had actually changed hands from producers to investors. Only those directly involved were aware that below the visible part of the oil market iceberg lurked massive unseen ‘Dark Inventory’.

Greedy Speculators and Hoarding

The pervasive narrative among people and politicians, and which is spread by a campaigning press, is of ‘greedy speculators’ who are ‘hoarding’ commodities and ‘gouging’ consumers in search of a transaction profit.

There is no better example of this meme than the UK’s Daily Mail scoop on 20th November 2009.

Here we saw pictures of shoals of some 54 shark-like tankers loaded with oil and lurking off the UK coast with millions of barrels of ‘hoarded’ crude oil, some of them having been there since April 2009. The Mail’s story was that these tankers were full of hoarded oil whose greedy owners were waiting for prices to rise before gouging the public.

The reality was rather different.

The motivation of the investors involved was not greed but fear. The Fed had been busily printing another trillion in QE dollars to buy securities and the sellers, and other investors aimed not to make a dollar profit but rather to avoid a dollar loss.

So they poured $ billions into oil index funds and similar products and the oil leases/loans which accommodated these funds’ financial purchases of oil had the effect of raising forward prices and of depressing the spot price, thereby creating what is known as a market ‘in contango’.

When the forward price is high enough in a contango market, what happens is that traders will borrow money to buy crude oil now, and sell the oil at the higher price in the future. Provided the contango is high enough, they will cover interest costs and the cost of chartering and insuring the vessel and its cargo, and lock in a profit for the trader at the end.

This is exactly what traders did through the summer of 2009, until the winter demand by refineries for crude oil and a reduction in the flow of QE dollars into the market combined to see the stored oil gradually delivered to refineries and the sharks depart the UK shores.

The point is that the widely held perception of high oil prices being the fault of hoarders and greedy speculators is – apart from very short term ‘spikes’ in the price - entirely misconceived. And even when speculators do dabble in oil markets, they are almost always pillaged by traders and investment banks with much better market information, which is probably what is happening right now.

The Bubble Bursts

In 2008 there was an influx of genuine speculators in search of short term transaction profit. The motivation of inflation hedgers, on the other hand, is the avoidance of loss, which leads to different market behaviour and the perverse outcome that they have been responsible for causing the very inflation they sought to avoid.

The price eventually reached levels at which demand for products began to be affected and shrewd market observers began to position themselves for the inevitable bursting of the obvious bubble. But those market traders and speculators who correctly diagnosed that the price would collapse were unaware of the existence of the Dark Inventory of pre-sold oil sitting invisibly like an iceberg under the water.

Traders who had sold off-exchange Brent/BFOE contracts or deliverable WTI contracts found themselves ‘squeezed’ because title to the crude oil which they thought would be available at a cheaper price to fulfil their contractual commitment had been ‘pre-sold’ to financial investors. This meant that they had to scramble to buy oil at a higher price than they had expected.

The price spiked to $147 per barrel, and then declined over several months all the way to $35 per barrel or so, as many of the index fund investors pulled their money out of the market in late 2008 and joined a stampede to the safety of US Treasury Bills. What was happening here was that the Dark Inventory which had been created flooded back into the market, and overwhelmed the market’s capacity to absorb it.

Convergence and Futures Pricing

The oil market price is – by definition – the price at which title to dollars is exchanged for title to crude oil.

But there is very considerable debate among economists about the effect of derivative contracts on this spot market price, and whether it is the case that the futures market converges on the physical market price or vice versa.

Now, in the case of a deliverable exchange futures contract, a price is set for delivery of a standardised quantity of a particular specification of a commodity at a particular location within a specified period of time. If that contract is held open until the expiry date and time then there will indeed be a spot delivery and payment against documents at the original price. in accordance with the exchange’s contractual terms.

But the key point is that this futures contract will not be held open to the expiry date at the original price unless the physical market price – which is set by physical supply and demand – is actually at that price at that specific point in time. If the physical price is lower or higher, then the futures contract will be closed out through a matching purchase or sale and a profit or loss will be taken.

I managed the International Petroleum Exchange’s Gas Oil contract for six years, which was deliverable in North West Europe, and the final minutes of trading before contract expiry were Europe’s greatest game of ‘chicken’.

Moreover, no IPE broker in his right mind would dream (because the broker was responsible to the London Clearing House for defaults) of letting a financial investor with no capability of making or taking delivery hold a position into the last month before delivery. And if a broker was not in his right mind, it was my job to act under the exchange rules to ensure such positions were liquidated.

In other markets, the ability to own physical commodities – eg through ownership of warehouse warrants – is much more straightforward for investors. But the logistics of oil and oil products are such that financial investors are simply incapable of participating in the physical market. In my view, the use of position limits for financial investors in crude oil and oil products is of little or no use if the clearing house, exchange, and brokers are doing their job.

Finally, now that the US WTI contract is just the tail on the Brent/BFOE physical market dog, this discussion has moved on, since the ICE Brent/BFOE futures contract is in fact settled in cash against an index based on trading in the BFOE forward market, with no physical delivery. It is simply a straightforward financial bet in relation to the routinely manipulated underlying BFOE physical market price - ie, the question of convergence does not arise.

Anything but Dollars

With interest rates at zero per cent, and with the Federal Reserve Bank printing dollars through QE, a tidal wave of money flowed into equity and commodity markets purely as an alternative to the dollar, and they did so through a proliferation of funds set up by banks.

Note here that the beauty of such funds for the banks is that it is the investors who take the market risk, not the banks, and the marketing and operation of funds has become a very profitable use of scarce bank capital.

So a flood of financial purchasers of oil were looking for producers willing and able to sell or lease oil to them.

Producers in Pain

Producing nations who had massively expanded their spending in line with a perceived ‘sellers’ market’ paradigm where they had the whip hand, were badly hurt by the 2008 price collapse and OPEC took action to restrict production.

But might some OPEC members or other producing nations have gone further than this?

What is clear is that the price rose swiftly in 2009 and then remained roughly in a range between $70 and $90 per barrel until early 2011 when twin shocks hit the oil market. Firstly, there was the supply shock in Libya which saw 1.5m bbl per day of top quality crude oil leave the market, and secondly, the demand shock of Fukushima, which saw a dramatic switch from nuclear to carbon-fuelled energy.

My thesis is that Shell directly, and others indirectly, were not the only ones leasing oil to funds. I believe that it is probable that the US and Saudis/GCC reached – with the help of the best financial brains money can rent – a geo-political understanding with the aim that the oil price is firstly capped at an upper level which does not lead to politically embarrassing high US gasoline prices; and secondly, collared at a level which provides a satisfactory level of Saudi/GCC oil revenues.

The QE Pump Stops

In June 2011, the QE pump which had been keeping commodity and equity markets inflated and correlated stopped, and price levels began to decline. Consumer demand – as opposed to financial demand – for commodities had also been affected not only by high prices, but by reduced demand from developed nations for finished goods. In September 2011, more than $9bn of index fund money pulled out of the markets for the safe haven of T-bills.

What happened as a result was that the regular rolling over of oil leases, and the free dollar funding for producers of their oil inventory ceased. So the leased oil returned to the ownership of the producers, while the dollars returned to the ownership of the funds.

Since the ‘repurchases’ were no longer occurring, the forward oil price fell below the current price, and this ‘backwardation’ was misinterpreted by market traders and speculators. They believed that the backwardation was – as it usually is - a sign that current demand was high and increasing relative to forward demand, whereas in this false market the current demand is unchanged but the forward demand is decreasing.

As in 2008, speculators and traders were again suckered too soon into the market, and this led to profits at their expense to those with asymmetric information, and a ‘pop’ upwards in the price as they were forced to close speculative short positions. My information is that a major oil market trader was successfully able to ‘squeeze’ the Brent/BFOE market on at least two occasions in late 2011 precisely because they were aware of the true situation of inventory ownership, and the rest of the market was not.

As an insider puts it……

You can’t have proper price discovery when half of the inventory is being sold elsewhere at a different price. On exchange physical doesn’t even exist. Futures are converging to physical, but only the physical which is visible for Platts assessment.

….pointing out that transactions in respect of physical ownership of oil do not take place on an exchange, and that there is effectively a ‘two tier’ market. Only a proportion of spot or physical Brent/BFOE transactions therefore actually form the basis of the Platts assessment of the global benchmark oil price.

Enter Iran

In my view, there is little or no chance of military action against Iran, and having been to Iran five times in recent years, and as recently as two months ago, there is much I could write on this subject.

While financial sanctions have been pretty smart, and increasingly effective so far, the medium and long term effect of the proposed EU oil embargo – which will in fact affect only a pretty minimal and easily accommodated amount of demand which is evaporating anyway – is more apparent than real.

While there would undoubtedly be a short term price rise – cheered on by the usual suspects – in the medium and long term the embargo will act to reduce oil prices. This is because Iran will necessarily have to sell oil at below market price to China and others, and since the market is over-supplied, particularly in Europe, this will undercut market prices generally.

Mexico has routinely hedged oil production for years, and Qatar – who are very shrewd operators – began to do the same in November 2011 since they expect the price to fall this year. In the short term the Iran ‘crisis’ is in my view being hyped for all it is worth to entice yet more unwary speculators into the oil market so that other producers may sell their production forward at high prices while they last before the inevitable and imminent collapse.

Current Position

If you believe the investment banks – who all have oil funds to sell to the credulous – Far Eastern demand is holding up, supplies are tight, and stocks are low, so prices are set to rise to maybe $120 or above in 2012, even in the absence of fisticuffs involving Iran.

I take a different view. I see real demand – as opposed to financial demand and stock-piling, such as in the copper market – declining in 2012 as the financial crisis continues at best, and deepens at worst, particularly in the EU. Stocks are low because bank financing of stock is disappearing as banks retrench, and it makes no sense for traders to hold stocks if forward prices are lower than today’s price.

As for supplies, US crude oil production is probably higher, and consumption lower, than widely appreciated. Elsewhere, there is plenty of oil available now that much of the Dark Inventory has been liquidated, and this liquidation was probably why in November 2011 we saw the highest Saudi monthly deliveries in 30 years.

Finally, we see North Sea oil being shipped – for the first time since 2008 – half way around the world to find Far East buyers. We also see Petroplus, a major independent Swiss refiner, crippled by inflated crude oil prices, and shutting down three refineries because demand for its products has disappeared, and it can no longer finance crude oil purchases now that banks have pulled its credit lines.

In my world, refineries closed due to reduced demand for their products imply a reduction in demand for crude oil: but not, apparently, on the Planet Hype of investment banks with funds to sell.

History does not repeat itself, but it does rhyme, and my forecast is that the crude oil price will fall dramatically during the first half of 2012, possibly as low as $45 to $55 per barrel.

Then What?

As the price collapses we will see producer nations generally and OPEC in particular once again going into panic mode, and genuinely cutting production. We will also see the next great regulatory scandal where a legion of risk-averse retail investors who have lost most or all of their investment will not be pleased to hear that they were warned on Page 5, paragraph (b); clause (iv) of their customer agreement that markets could go down as well as up.

At this point, I hope and expect that consumer and producer nations might finally get their heads together and agree that whereas the former seeks a stable low price, and the latter a stable high price, they actually have an interest – even if intermediaries do not – in agreeing a formula for a stable fair price.

We can’t solve 21st century problems with 20th century solutions and I shall address the subject of a resilient global energy market architecture in my next post.

And what does Goldman Sachs say?

Goldman sees massive upside risk in oil prices

They have a history of hyping the price then liquidating their position. Superspike and all that.

EDIT: I wouldn't discount this thesis out of hand

@Undertow

I rest my case. :-)

If the squid is hyping something you can bet they are reducing their exposure to it.

It's always helpful to look at the global supply data, but let's take a quick look at Saudi data. Note that at Saudi Arabia's 2002 to 2005 rate of increase in net oil exports (BP), they would have (net) exported about 13 mbpd in 2010, versus the actual 2010 net export level of 7.2 mbpd (versus 9.1 mbpd in 2005). While it appears that Saudi Arabia, for only the second time since 2005, has shown a year over year increase in net oil exports in 2011, I estimate that their 2011 net exports will be between 1.0 and 1.6 mbpd below their 2005 rate.

As noted below, we saw a doubling in global crude oil prices from 2002 to 2005, corresponding to a massive increase in Saudi net oil exports.

But then in response to the doubling in global crude oil prices from 2005 to 2011, we have seen a substantial decline in Saudi net oil exports, relative to 2005.

Could the post-2005 decline in Saudi net oil exports be completely voluntary? Possibly, but there is always the simplest explanation, to-wit, that Saudi Arabia, like the prior swing producer, Texas, is not immune from the laws of physics.

A Review of Annual Brent Crude Oil Prices Versus Global Production & Net Export Data

Here is a link to EIA data showing annual Brent prices, which is a good indicator of global crude oil prices:

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=RBRTE&f=A

Here are the annual Brent crude oil prices from 2005 on, along with the rates of change relative to 2005:

2005: $55,

2006: $65, +17%/year

2007: $72, +13%/year

2008: $97, +19%/year

2009: $62, + 3%/year

2010: $80, + 8%/year

2011: $111, +12%/year

The 2011 annual Brent price is about twice the 2005 annual price, and it is the highest annual crude oil price ever, up 26% over the annual 2010 price, and up 14% from the annual 2008 price.

Note that we have had two price doublings since 2002, from $25 in 2002 to $55 in 2005, and then from $55 in 2005 to $111 in 2011.

In response to the first price doubling, we did of course see a substantial increase across the board in total liquids production (inclusive of biofuels), in total petroleum liquids, in crude + condensate, and in Global Net Exports (GNE) and in Available Net Exports (ANE). Note that the rates of increase in GNE and in ANE exceeded the rates of increase in the production numbers (which is what our model predicted would happen).

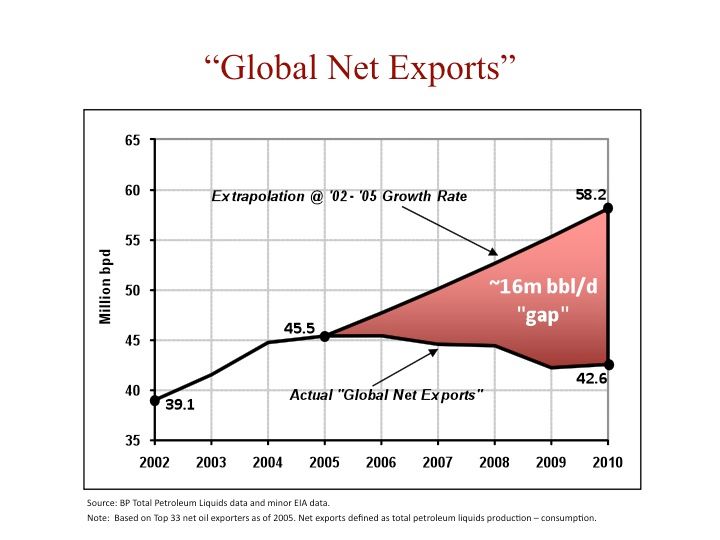

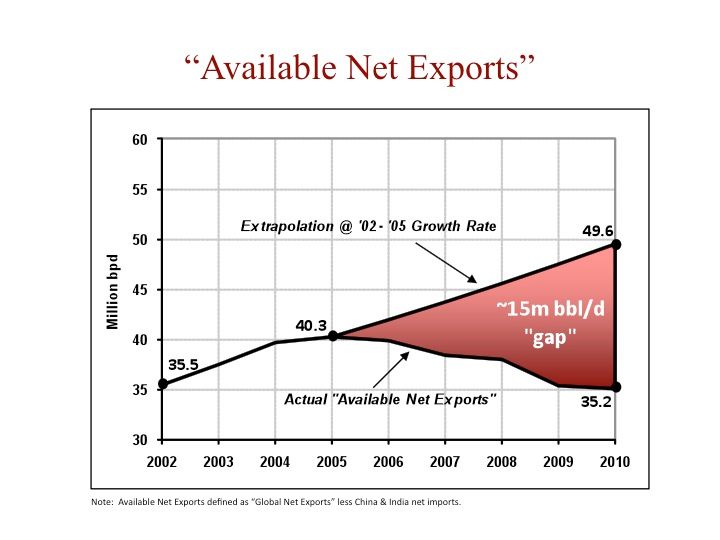

In response to the second price doubling, we have seen a very slow rate of increase in total liquids production (up 0.5%/year from 2005 to 2010), virtually flat total petroleum liquids and and virtually flat C+C production (through 2010), and a 1.3%/year and 2.8%/year respective decline rate in GNE & ANE (through 2010). Note that we saw declines in the GNE & ANE numbers , versus flat to very slowly increasing production numbers (which is what our model predicted would happen).

I estimate that the ANE decline rate will accelerate to between 5%/year and 8%/year from 2010 to 2020. Note that at China & India's (Chindia's) combined rate of increase in their in their net oil imports as a percentage of Global Net Exports from 2005 to 2010, the Chindia region alone would consume 100% of Global Net Exports in about 19 years.

I estimate that the current CANE (Cumulative Available Net Exports, post-2005) depletion rate could be on the order of about 8%/year (versus a 2005 to 2010 2.8%/year rate of decline in the volume of ANE). The CANE depletion rate would be the rate that we are consuming the cumulative post-2005 supply of global net exports available to importers other than China & India. Based on a simple model and based on actual case histories, note that it is common for the initial depletion rate to exceed the initial annual rate of decline in net exports.

In round numbers, I estimate that the remaining cumulative supply of (net) exported oil available to importers other than China & India is falling at an annual rate that is about three times the rate that the annual volume of (net) exported oil available to importers other than China & India is falling.

Think of it this way. Let's assume you have $100,000 in the bank and you withdraw $10,000 the first year, $9,000 the second year, $8,000 the third year and $7,000 the fourth year. The rate of decline in annual withdrawals is 12%/year, but the cash balance in the account is falling at 27%/year.

Here are the observed rates of change for key liquids measurements for 2002 to 2005 and for 2005 to 2010 respectively (respectively corresponding to first Brent crude price doubling and to most of second Brent crude price doubling):

Production/Export Measurement: 2002 to 2005 rate of change, 2005 to 2010 rate of change (change between the two)

Total Liquids (EIA, Including Biofuels): +3.1%/year, +0.5%/year (84% reduction in rate of increase)

Total Petroleum Liquids (BP): +2.9%/year, +0.15%/year (95% reduction in rate of increase)

Crude + Condensate (EIA): +3.1%/year, +0.08%/year (97% reduction in rate of increase)

GNE (BP + Minor EIA data, top 33 net oil exporters): +5.2%/year, -1.3%/year (shifted from increasing GNE to declining GNE)

ANE (GNE less Chindia's combined net oil imports): +4.2%/year, -2.8%/year (shifted from increasing ANE to declining ANE)

Five annual "Gap" charts follow, showing the gaps between where we would have been at the 2002 to 2005 rates of increase, versus the actual data in 2010 (common vertical scale):

EIA Total Liquids (including biofuels):

http://i1095.photobucket.com/albums/i475/westexas/Slide1-18.jpg

BP Total Petroleum Liquids:

http://i1095.photobucket.com/albums/i475/westexas/Slide06.jpg

EIA Crude + Condensate:

http://i1095.photobucket.com/albums/i475/westexas/Slide05.jpg

Global Net Oil Exports (GNE, BP & Minor EIA data, Total Petroleum Liquids):

Available Net Exports (GNE less Chindia’s net imports):

I would particularly note the difference between the first chart, total liquids, and the last chart, Available Net Exports (ANE).

Two GNE & ANE scenarios:

0.1%/year Production Decline (2010 to 2020), Top 33 Net Oil Exporters:

http://i1095.photobucket.com/albums/i475/westexas/Slide10-1.jpg

1.0%/year Production Decline (2010 to 2020), Top 33 Net Oil Exporters:

http://i1095.photobucket.com/albums/i475/westexas/Slide11.jpg

CERA, et al tend to focus on the total liquids data while ignoring the GNE & ANE data. Since Yergin is now calling for less than a one percent per year rate of increase in total liquids productive "capacity," which is similar to what we saw from 2005 to 2010 in the EIA total liquids data (+0.5%year), it seems to me that Yergin is, almost certainly without realizing it, in effect predicting a continued decline in GNE & ANE:

http://www.energybulletin.net/stories/2011-10-24/daniel-yergin-massively...

What about countries which have floating prices for their oil now? For instance would you consider Nigeria to be a net exporter or net importer when they export all their oil and import refined product at a floating international price? I think the idea of net exporter vs importer is too simplistic because I think it doesn't take into account the countries which have a floating price and can experience the same demand destruction as net importers and I see sales of oil in those countries as being sales of convenience with many of the oil producers willing and able to sell on the international market if the producers themselves are privately held or publicly held companies. Maybe net exports better represents those countries where the state has both a fixed price locally and ownership of oil production than say a country like Canada which exports crude produced by independent companies.

Well. thats as clear as mud.

Isn't this the oil accordion explanation on steroids?

I am looking forward to your second post

I take it the GCC is http://www.gcc-sg.org/eng/ ?

midi - I'm with you. There's a reason no one should ever listen to a geologist talk about oil trading. We may good at finding the grease but that's about it. I sent the post to an engineer who does understand the market and also works for a international financial company. Asked for his bottom line thoughts about the proposition presented here. I'll let you know what he thinks.

I don't discount it and I wish to understand the operation of these financial instruments more...

I suspect the poster is right in that they are not fit for purpose.

Since a crash is almost guaranteed shortly, you don't need insider knowledge to see that oil will fall again in price. $55 is a good enough guess I suppose.

What i do want to know is what that crash will reveal about the true state of world oil supplies (for instance whether $80ish is really a minimum now for getting oil out of the ground).

You people still do not understand the difference between money and energy. Who cares what the price is, what you should be worried about is availability.

You see, you all have done a fantastic job at achieving one hundred percent dependance on a mission critical resource. Now you all TRADE it in a "free market" using debt-based money, all while giving the keys to the mine safe to the economists. If it weren't so tragic it would be hilarious in its obvious greed. The "price fluctuations" are going to kill millions if not start a war. And , really, it's not the price its the availability. Much like starving or wounding an animal you will find out the difference between money and energy.

I think we all get that...

You may get it, but I don't think "we all get that". Behaviour needs to change as an example and it has not.

For instance, you all are looking at energy availability in terms of "markets" or "money". That's bad and you better figger out why soon.

well even the OP suggests something must be done

Lets see what he has to say......

For me a reason why this is important is when talking to folks re: Peak Oil, and export limitations, how many times do we hear "it's just the speculators manipulating prices". I would like to know how much truth is in that response? I always assumed speculation played a very minor role, and I believe that is true. However, it would be awesome to be able to know how much of price spiking is based on speculation or actual demand.

Paulo

"Behaviour needs to change as an example and it has not."

Sure, whatever. Another oar put in concerning behavior changes. Usually such musings reflect pre-existing religious, philosophical, or esthetic preferences having at best very limited relationship to the subject matter. So frog-march people out to farmettes. No, frog-march them in to jampacked towns. Run the economy with interminable "meetings" of starry-eyed local committees who feel that everything comes from fairy dust and unicorn horns. No, have state bureaucrats micromanage everyone and everything from hundreds or thousands of km away. No, go back to "simpler" tribal times. And so on upon tiresome and-so-on.

So with respect to the subjects at hand, what specific behavior changes do you feel would bring about your favored hypothetical Utopia?

The only meaningful policy remains volume based taxes (which is much more in line with the free market than subsidies things)

And this to push products towards better efficiency (not necessarily through breaking new technology, more like lighter, smaller, less powerful vehicles)

Of course could only work with a clear associated message.

Much probably way too late anyway, also true ..

Even though it is still the most meaningful policy

Aloha PaulS,

There is quite a delicious irony in your sarcasm, since any of the options you mention will likely work better than the way things are going now. I'd rather trust in "fairy dust and unicorn horns" than Goldman Sachs.

...achieving one hundred percent dependance on a mission critical resource.

Isn't that a redundant statement?

Kinda, but heres the subtle difference:

Air is a "mission critical resource" because it is your genetic mission to take another breath, but really you are one hundred percent dependent on it to survive.

Petroleum, on the other hand, is only a "mission critical resource" for the very reason that we ALLOWED ourselves to become "one hundred percent dependent" on it. In reality, we could do one hundred percent without as has been proven countless times.

Clear as mud? which could be argued as being a "mission critical resource" that we are "one hundred percent dependent on"

Clear as mud? Yes. Minor point? Maybe, maybe not.

Oxygen is mission critical because of how our metabolism evolved. The lack of options is what makes it a mission critical resource. (Stating we're 100% dependent on it adds nothing.)

Applying this thinking to civilization gets muddy. Since, as you imply, we have options proven countless times. Of course, what options remain depend on how our fling with oil affected the top soil, etc.

It might be clearer to say that petroleum is mission critical for modernity, a recent and specific version of industrial civilization. Industrial civilization itself existed pre-petroleum, as did other forms of civil society. Modernity (e.g., a consumerist version of industrial society) flourished on cheap and abundant crude oil. We'll descent out of that version soon. We, here, seem to disagree mainly about the rate of descent (and what landings are possible short of demise).

doesn't "Stoneleigh" from the AutomaticEarth blog predict deflation as well?

Several comentators on TAE predict it, and they can make a good economic case for it, particularly given that QE1 & 2 have NOT been as inflationary as they should, under ordinary modeling.

I suppose we will see, won't we?

Craig

Thanks Chris for a fascinating article. It's almost too much information for those who don't live in a the world of finance but the perspective from your catbird seat is highly valuable.

I do have some questions, though.

1) You wrote:

As I understand it, the phrase "dark inventory ... flooded back into the market" refers to financial inventory, not any inventory of physical oil. From my simple minded supply/demand perspective this seems unnecessarily convoluted. I would describe the situation as "economic dislocation resulted in decreased demand which caused prices to drop". Yes, financial shenanigans exacerbated the short term price swings but on a yearly averaged basis it seems that normal supply/demand considerations would account for what happened.

The determination of cause and effect often depends on what time scale one is asking a question. On a minute-by-minute basis the price of oil is determined by traders. On a decade-by-decade basis, however, it is undoubtedly determined by global supply and demand. On what time scale do you think your "dark inventory" thesis is important? It looks like month-to-month to me.

2) Related to the above, you suggest that prices could drop as low as "$45 to $55" per barrel, presumably an intra-session low. Would you care to wager a guess as to what the annual average price might be in 2012? Although daily prices are important for markets and politicians, anyone making long term plans (5-10 years) for family, business or government policy needs to be more concerned with the annual average prices.

Thanks for your input.

Jon

PS__ Readers can check out current and historical oil futures chains at the Market Futures databrowser. We also created a movie of these plots that goes from July, 2009 until March, 2011. We could extend it to the present if there were sufficient interest.

I am struggling here too on this "flood of oil"

there must be some physical oil in storage that was transformed into these financial instruments? I can see how "in effect" the speculators in these products can cheat and be on both sides of the deal at expiration but I can't see why they need to expire at all

Unless the oil is physically released?

Jonathan Callahan

We are indeed talking about financial inventory here.

The economic interest in the oil has become detached from the oil itself, so that the oil has literally been monetised.

Dark Inventory is very much a factor on a short to medium time horizon which may keep commodity prices and even equity prices (not just oil prices) financialised and inflated wherever it deployed.

As I have written on the Oil Drum before I see two trend lines in oil prices - both of them rising (because I subscribe to the peak oil thesis).

The upper boundary trend price is the 'seller's market' at which demand is destroyed: the lower boundary trend price is a buyer's market, at which production is locked in/destroyed.

In a perfect world, sellers, who desire a stable (ideally increasing) high price and buyers, who desire a stable (ideally decreasing) low price, would aim to agree a formula for a stable and equitable (inevitably increasing) 'fair' price.

But for the middlemen who intermediate buyers and sellers, Stability is Death, and so they will always tend to cause volatility. Financial middlemen also enable buyers and sellers to finance or fund stocks, and to manage price risks from price volatility through using debt and derivatives.

Note also that if producers CAN hold prices at the 'upper bound' - because financing and funding of inventory is available - then they WILL.

I think we will see the price collapse within Q1 and Q2, and attempts will then be made to resuscitate the price as before.

Now, in the long term the oil price can, and for the sake of the planet IMHO should, be at the level which destroys demand.

But for the next year or two at least - absent a new settlement and market architecture - I see desperate producers pumping as much as they can. I also see a world in pretty deep recession if not depression which will keep 'real' demand low, and I see no appetite for the sort of financial demand necessary to fund the maintenance of the price above the 'lower bound' trend line.

"Monetization" of energy or any other mission critical resource seals your fate. You need to learn the difference between money and energy, they are not interchangeable.

Perhaps some one could discuss hypothecation in the crude markets?

if you open a line of credit on these GSCI things or even a standard contract(s) I guess you are on your way....

Sorry I am a bit stupid.... Still not getting this

Q1 Dark inventory=real physical oil in storage somewhere?

yes or no?

Yes.

And mainly where producers store it for free - in the ground.

that infers to me dark inventory release is dark spare production capacity... which represents a massive global conspiracy.

ie to control the price there needs to be hidden production capacity [of significance] that can control the price

the mystery swing producer... if the contracts expire without the oil actually be released onto the market then the investment vehicle/bank fails

or if production capacity has to diverted from other consumer streams the price goes up on the spot market.

that strikes me as unlikely.

mididoctors

The price is affected because market players mistake financial demand for real demand.

There are no games going on with production. What we are seeing is games with different types of financial claims over production.

And not just in the oil market. every organised market has been financialised in this way, as I wrote here.

It's just that the oil market is the one I know best.

they are massive idiots then.... how can they conflate the two?

why would they go down to the floor and buy oil they don't need?

moreover if the financial futures are just casino bets WGsAF? ATEOTD its a bubble that is open to attack by someone taking a bet going short.... is this your insight into Goldman Sachs position..hype and dump

what if they took out insurance on the contracts failing if the oil is called in for real and/or start a sell off? that would be armageddon if the capacity doesn't exist!

That is what speculators do. They buy stuff on the come, hoping they can sell the promise of delivery for a greater price than they promised to pay. It is claimed that Goldman acts as an enabler of fraud.

yeah but not on the expiration date day... and since this happens once per month its hard to believe speculators have hiked the price up by the amounts claimed.

the only way for them to speculate long term is to hoard

as for these financial GSCI derivatives and such I.... as a hypothetical oil trader should just ignore AFAICS

Of course that's what speculators do. They also sell stuff they don't need. Every contract has two sides, a long side and a short side. And just as many speculators are on the short side as there are speculators on the long side. They watch the fundamentals and try to guess which way the price of oil will move. If they guess wrong they lose.

I find it truly amazing that some people believe speculators can drive up prices and keep them there when the demand is not there? That is absolutely impossible! Speculators can cause swings in the futures market, both up and down but the price always follows the line of supply and demand.

Picture a water skier being towed by a boat. The skier can swing way to the left of the boat then way to the right but the general direction of the skier must be the same as the general direction of the boat. The skier is like the speculators and the boat is the fundamentals. The price of oil must follow the fundamentals, supply and demand, but the speculators can cause short term swings but they can never cause long term price changes.

It is just ludicrous to think that speculators can cause the price to rise and stay high when the demand to keep prices up is just not there. High prices cause demand destruction. The US uses almost three million barrels per day less than we used in 2005. High prices have knocked over 10 percent off the consumption of oil in the US. Speculators had not one damn thing to do with it.

Ron P.

Ron P

Correct. Speculators had nothing to do with it.

That is my point.

It is ludicrous to say that speculators (let's call them active investors in search of transaction profit) can do any more than spike the price temporarily.

This is why I - and, I now see, also Mike Masters in June 2009 - are saying that it is not speculators (who are being pillaged by the casino in a less than zero sum game) but passive and risk averse investors avoiding loss who are the problem.

These investors are funding producers ability to support prices, and are killing every market in which they participate by distorting the pricing mechanism through taking medium and long term positions, which can be - and are - maintained for years.

Best Regards

Chris Cook

but how can these medium and long term positions effect the pit price on the day .. especially if they are rolled over and no oil appears?

I still do not understand how the paper oil effects the spot price

I just do not understand

I go and buy up a whole bunch of long term positions and push those positions up in price..you've been contangoed... at expiration if the demand isn't there I lose my shirt

or

if I roll over in some cash contract off the floor because the original seller buys it back no one knows and its as thou the oil never existed ...... the money is just kept in stasis hovering on the edge of a cliff...

or am I wrong?

Midi, on average over half of all contracts traded are for the near term contract, especially early in the life of that contract as "near term". When that contract has only a few days to run, then contracts will begin to move to the next month. Check it out at: Light Crude Oil. That contract (February) has less than 10 days to run but volume is still over four times higher than the next contract (March), though March open interest is now higher.

But look down at the far out months, the ones some folks claim pushes the price higher. They have very little volume. These contracts have virtually no effect on near term prices. Only the nearest term contract, and near expiration the second to near term contract, has any effect on the price of oil. The near term contract is the only one ever quoted and the only one used as any kind of benchmark.

The far out contract prices are simply ignored, except by some paper traders of course. Some traders specialize in arbitrage and try to hedge one contract against another. And of course hedgers constantly watch the far out contracts because these are the only contracts they buy or sell. They are hedging themselves to guarantee a fair price in the future. But true hedgers make up only a very tiny fraction of all trades.

Note: So called "Hedge Funds" have nothing to do with actually hedging the future price of oil. They call themselves "Hedge Funds" because they buy and sell several different commodities. If they lose money in one they may hope to make it up in another. That is their "hedge". True hedgers are actually producers or consumers of oil like refineries or dealers in the physical product.

Ron P.

thats roughly my understanding as well

This sounds correct to me and always seems to put someone on bottom and someone on top. So hope your the guy on top.

Chris:

I think the Hunt brothers' speculative gambit back in the 70's, trying to corner the market in silver, is illustrative of this point. NO matter what they do to price on a temporary basis, if production continues the price will drop to what it costs to produce and make a profit. Temporarily higher, maybe, but long term it won't work with active commodities.

What will, and does, drive price is cost of production, coupled with demand. If COP exceeds demand price, production ceases. There can come a point where price is so high that there is no demand whatever. No oil will be produced beyond that point.

For those who wonder, the pharmaceutical and lubrication uses will enable a bit of production to continue, at a very high price. Only the 1% of the 1% will be able to burn petrol in an ICE, or for heating purposes at that time. And that, strictly speaking, is what peak oil is really about. Not that we run out, for there will be oil remaining. It will simple be far too expensive to continue to use it as we do today.

Craig

So the idea is that firms or countries that have credible oil wells simply claim that they are pumping oil at a flow rate that is greater than the engineering measurement true flow rate and claim that this extra oil is in storage in a secure undisclosed location. Then it leases this 'oil in storage' to Goldman and Goldman uses this lease as its working capital for its index fund.

The next step is to do the same thing with the gold that is dissolved in sea water. Claim that one has developed a method to extracting from seawater* and that one is busy working the process and putting the resulting bullion in an undisclosed vault. If this is believed, we really could return to the gold standard, for as long as the belief in this magic spell lasts.

*Of course the process for extraction is being kept secret because it is a 'proprietary' innovation.

Another idea: Perhaps the numbers for internal oil consumption in export land countries are inflated as well as the production numbers, and the truth is that both are smaller than reported by the same amount. This offers cover for claiming that they have oil in storage somewhere when, in fact, they do not.

Who is auditing the internal consumption numbers? Maybe the populace in these countries is not using as much oil as the rulers claim. Maybe the numbers are being invented to support a story. If so, I can't see how this will end well.

The Thirties case history is interesting. It appears that global demand fell only one year, in 1930, rising thereafter. Annual US crude oil prices fell to $1.80 in 1931 (down from $3.70 in 1929), and generally rose until 1937, hitting $2.60 in 1937, before declining to $1.90 in 1938.

There were reportedly three million more cars on the road in the US in 1937, versus 1929. And of course, China is to our current predicament as the US was to the Thirties, with the difference being that hundreds of millions of consumers in developing countries want to buy, and in many cases can buy, cars now--and of course we are now looking at declining Global Net Exports of oil, versus rising exports in the Thirties.

Oil Price Data Source: Global Financial Data

Chris,

Thank you for that clarification. The idea that there is an overall price trend and that middlemen profit from swings between the upper and lower bounds makes perfect sense.

I think your vision of desperate producers and a world in deep recession is a very likely outcome. There is no doubt that a deep recession will reduce 'real' demand in OECD nations but I am also open to the possibility that the economic return per barrel consumed in developing nations will limit the reduction in demand globally. I think it is quite plausible that growth in non-OECD demand will outpace any declines in OECD demand thus keeping upward pressure on oil prices on an annual averaged basis.

Volatility is the new normal.

Jon

Chris, in compiling weather forecasts these days, I'm quite sure that UK MET office forecasters sit in a darkened room with their supercomputers and forget that it would be a good idea to look out the window before issuing their forecast. I wonder if you may also be guilty of being too absorbed by your model and have overlooked a very obvious fact in your analysis - demand for liquid fuel is at a record high (chart from Stuart Staniford at Early Warn)

http://earlywarn.blogspot.com/2011/12/iea-90mbd-of-liquid-fuel-in-novemb...

I spent most of last year expecting the bottom to fall out of the markets - as happened in 2008, but have been overwhelmingly impressed by the determination of OECD governments to keep the system afloat - first sign of trouble and we will have QE3. And so without a market crash, and for so long as global economy continues to grow in aggregate, I don't see oil prices crashing as a result of a speculative bubble in oil prices bursting.

Volatility has virtually abandoned the oil price, and we have stability arguably in the pink spot that will keep producers very happy without crippling OECD economies - though high energy prices are a major drag. The inflationary impact will shortly fall out of the equation since most of the price rise was over by March 2011.

Of course, some of us round these parts think that an observed 2005 to 2010 average volumetric decline of one mbpd per year in the volume of Global Net Exports available to importers other than China & India might be a contributing factor to the doubling in annual Brent crude prices that we saw from 2005 to 2011.

If we assume basically flat production by the top 33 net oil exporters, and if we extrapolate the China, India & Top 33 Net Oil Exporters' 2005 to 2010 rates of change in consumption, then for every two barrels of oil that non-Chindia importers (net) imported in 2005, they would have to make do with one barrel in 2020.

I think the emphasis on demand vs consumption need to be set against the point the OP makes about the market being "pressurised" and at the margins to start with

this manipulation of price and extreme price volatility in the medium term interrupted by the present short term "price stability" are in a way symptoms of systemic failure in the market to address peak production...

IE these games in the markets are only possible because the price moves massively at the margins irrespective of the geological fundamentals..even if the price plummets to $20 a barrel it matters not.

hence unfit for purpose

thats if I understand the argument correctly

Think of it this way

The markets don't work

because the short term price is never correctly translated into a realistic long term price. In no small part because the feedback into the short term price by the longs is being manipulated by a conspiracy...in so many words.

Or annual Brent crude oil prices doubled from 2005 to 2011 because of an ongoing decline in GNE & ANE, in contrast to the rapid increase in same from 2002 to 2005, i.e., rising oil prices in response to declining volumes of (net) exported oil. But maybe I tend to simplify things too much.

I think in essence this is what he is saying

the price is not simply an analog of daily oil production vs demand and its easier to manipulate at the margin

when its really tight everyone is swing producer including ragtag guerrillas in the Niger delta....

what has occurred since 2000 perception wise is a redefining of tight production where a million barrels per day more or less sends the price all over the shop

I'm confused. From this graph we see Crude + Condensate well about "The Peak(s)" of 2005 and 2008. Will somebody enlighten us to why we see C+C approaching 90 MB/day instead of going into the "Post Peak" decline? Is this just more hype to hide the "Dark Inventory" to wipe naive investors out from a rigged financial shorting game?

You are looking at monthly total liquids data (subject to revision), inclusive of low net energy biofuels. Here is the annual EIA total liquids chart through 2010:

Here is the annual EIA C+C chart:

But as noted up the thread, we have seen multimillion barrel per day declines in GNE & ANE, which are measured in terms of total petroleum liquids.

Euan

In my view, and for the reasons given, the collapse is already under way. Irrespective of physical demand for yer actual black stuff the VALUE of the oil - the economic interest, if you like - has ALREADY been dumped and if I am correct, then nothing other than a significant and sustained supply shock can now temporarily stop the collapse in price.

My take on the high November Saudi deliveries is that they were merely delivering Dark Inventory of pre-sold crude into the market and they will have since been selling futures as fast as they can to unwary speculators to lock in the price during what they probably expect to be a temporary collapse, like the last one.

Do not mistake the trading of paper oil (and futures are NOT paper oil but claims over mainly paper oil) for physical supply and demand, which changes relatively slowly, but with the odd de-stabilising shock like Libya's crude falling out of the market - and of course flooding back in as fast as the engineers and the Vitols and Trafiguras of this world can facilitate it.

I believe the Chinese oil demand - as it is for copper and for almost everything else - is as a stockpile against future use, and of course a hedge against dollar inflation. They will quite happily hoover up all the Iranian oil they can lay their hands on but they will be looking for the cheapest price going.

As For QE3 it will not IMHO happen, since Bernanke knows (or at least believes, because his thesis was on the subject) that further US QE will see T-Bill rates go negative, money market funds will 'break the buck' and all hell will break loose.

Chris, it is a fascinating article, as much because I understand so little of it, and don't really understand your reply here;-) Its like we are from different worlds speaking a different language. For example, when you say:

Where is the evidence for this? Do you have charts or tables? ICE Brent front month is currently $112.5 - around the mean of the narrow trading range of the past 10 months. I just don't see any evidence of NET dumping. The futures market is originally constructed to allow producers to hedge price and currency fluctuations, and for every winner in the game there is an equal and opposite loser.

And when you say:

Bunds went negative this week - investors happy to pay Bundesbank to look after their money - but for opposite reasons to those you cite for the FED. Why will excessive demand for Bucks break them?

I live in a world of declining N Sea, Mexican, N Slope production, rampant Chindia demand and static supply since 2005.

In your main article you say:

EH?! surely it is high price that reduces demand leading to lower refinery throughput? and I think you say this...

Demand for oil is in decline in the OECD who are losing mkt share to Chindia where, I imagine refineries are working flat out. As pointed out in my lead comment, demand for liquid fuel IS at an all time high (by volume).

Concerning refinery throughput and demand, think about the interaction between oil price and the economy. With no peak oil, when consumer demand for oil exceeds supply, suppliers make more oil, everyone is happy.

With peak oil, when consumers demand more oil, supply can't keep up, price rises, this causes an economic recession. Demand goes down, prices plummet. With prices low, the economy starts to recover, demand goes back up, eventually demand exceeds supply and the cycle repeats.

Peak oil produces what Eric Janszen calls the "peak-cheap-oil" cycle (something he forecast in his 2010 book and perhaps earlier on his website iTulip.com). The current price spike would be the second period of the cycle which will continue indefinitely unless, as the author of this article suggests, steps are taken to smooth things out. The overall trend of price will be up whether the cycle continues or steps are taken to stabilize price (and the overall economic trend will be cyclical recessions amounting to a deepening depression).

EDIT:

By the way, I know that's not exactly what this author is saying, but that's what I'm hearing! (although I wouldn't say when the price spike will end and suddenly decline, it could very well be later than this article is predicting).

Euan Mearns

I am talking about the exit from the market of index funds and ETFs, and possibly one of the factors in this exit was the realisation by investors - thanks to the MF Global insolvency - that even though they had managed to offload dollar risk in favour of commodity risk, they still had the counter-party risk of the fund issuer.

So they have decided they prefer to have the Fed and/or Treasury as a counter-party instead.

$9 billion exited the markets in September and undoubtedly a lot more since. These were exactly the players who exited the market in Q2 2008.

As I said, when this 'inflation hedging' money exits the market it leads to false signals which lure in unwary speculators and traders. Coupled with the Iran noise, the market is in my view currently at an Oil-e-Coyote point.

Further QE would mean further demand for T-Bills, and in the same way that demand for Bunds has seen rates go negative, so T-Bill rates would go negative.

Have a read of FT Alphaville on the subject - they've convinced me.

Finally, let's think of what's going on as rather like the opaque creation by producers of oil vouchers redeemable in payment for oil.

It doesn't matter what the physical supply and demand for oil is: if a batch of oil vouchers finds its way to refiners then they don't need dollars to pay for oil supplied by the issuer.

The price of oil in dollars will fall until new dollar buyers emerge and this equalises selling in dollars with buying in dollars and stops the fall.

Conversely, when a producer is creating and selling vouchers (lending his oil and creating dark inventory) then he does not need to sell as much oil for dollars, and the 'real' dollar demand for oil will increase the dollar oil price - as it did.

Well I bought some Brent ETFs back in The Fall of 2010 and became extremely pissed off when their rise did in no way reflect the rise in Brent in the following months. These were underwritten by Shell physical. Now I was told the reason for this was market in contango and every month when the contract rolled there was attrition! WTF? Now i do believe that markets can be and are being rigged in a disgraceful way to line the pockets of the market makers. But I don't believe this activity is influencing the direction of the market.

And the oil price did not flinch in September - look out the window and see if folks are still driving their cars! And when these players exited the market in 2Q 2008 the oil price continued to soar. Now this may have been a leading indicator of trouble to come with banks raising liquidity. But the oil price crashed in 2008 as a result of a banking crisis, a freezing over of global trade and a fall in demand for oil of 2 mmbpd. It didn't crash as the result of institutions liquidating balanced positions in paper oil 3 months before.

If the European banking crisis is not resolved, then sure we may see a rerun of 2008. But if it is resolved then I and many other observers see oil prices stabalising in current range - $100 to 130 - which is high enough to underpin plateau oil production for a while at least.

The flight to T Bills and Bunds at present has more to do with failing confidence in banks and the €. If the FED prints again, then this is designed to keep the party going on FIAT vapor and funds will flow back to oil and gold that will both rise relative to $US.

But to be clear, no doubt oil price and industrial civilisation will crash if there is a major financial dislocation. Back in 2008 no one saw it coming. Today everyone sees it coming - including Mervyn King - and are doing all they humanly can to prevent this calamity from happening.

Euan Mearns

Your experience of ETFs demonstrates the reflexivity at work.

The very presence of yours and other passive/inflation hedging funds in the market created the very contango which gradually ate away your investment.

Re 2008 ...ooops....I meant second half, not Q2 - no-one was liquidating then.....so no, the price didn't crash because of index fund liquidations.

The bubble was one of several across markets and prices generally collapsed in the meltdown after the oil price was 'spiked' by manipulation/speculation (depends on if you believe Semgroup were goosed by Goldman)

But the depth of the fall was undoubtedly exacerbated by the exit of index fund money in the second half of 2008, mainly in September and October as I recall.

Mike Masters' CFTC testimony is interesting bearing in mind when he made it (June 2009).

Not only did Masters say that 2008 represented a classic bubble and crash, he also warned presciently that another bubble was on the way (pages 2 & 3), and was particularly scathing (pages 25 onwards) about the effect of 'passive' (ie index funds and ETFs) long term investors on markets.

Re the situation now, the effect of 'passive' index money pulling out is not an immediate crash, because of the structure of the market and the delivery cycle of forward contracts involved in oil leasing.

The effect is - as described in my article - to 'pop' the market price as speculators sell forward without knowledge of 'Dark Inventory' and are then forced to cover their positions. We have just finished mopping up after that, and speculators/traders are licking their wounds and pretty much staying on the sidelines.

Re the economic situation, I think that the € will struggle on for a little while yet.

But if it does, I disagree with you and other observers re oil market prices, which - as I wrote - will, absent a large supply shock, head down sooner rather than later.

More QE might boost physical gold - but I think that the ETF era is pretty much on its last legs, and shows all the signs of being the next great regulatory disaster. I don't see QE3 money boosting oil prices again.

Hi Chris, thanks for the email and link to FT Alphaville that is pasted below. The oil price in Euros is interesting but note the following: 1) if you deflate the numbers they are probably still below the 2008 peak; 2) the € is very strong in the periphery and very weak in Germany causing a boom in that country (that has come to a halt now) 3) Germany is rapidly expanding use of renewables and energy efficiency gains - it is a dynamic system.

http://ftalphaville.ft.com/blog/2012/01/09/823191/euro-crisis-brent-oil-...

I have been waiting for oil price to crash for 12 months but instead it has plateaued - up today on Iran sanctions. I've run a series of posts following this (2 links below) and would reiterate that the negative impact of oil price is two fold 1) inflation and 2) erosion of disposable income and as already noted the inflationary part is about to fallout of equation. Inflation falling in China will now lead to easing of monetary policy.

http://www.theoildrum.com/node/8645

http://www.theoildrum.com/node/8483

Euan... according to the Bank Participation Report, the U.S. Bank Commercials are not betting that the EURO is going to die anytime soon. Not only have they increased their EURO FX long contracts almost 50,000 since October, they have liquidated 675,000 of the Short 3 Month Euro-Dollar contracts:

what if its all nonsense.

what if the money can not be used as a measure of where money is going because its a burst bubble. What if we are just watching the money flow from one part of a broken engine into another part as thou that was a safe haven... but in reality its just because there is nowhere left to go.

Middoctors... I actually agree with you. It is all nonsense in the end. Unfortunately, the monetary authorities have two alternatives here:

1) PRINT

2) DIE

So, they will continue to print. Many analysts are forecasting future paths of the US Dollar and U.S. deficits well into 2020. I see no way for the system to continue this long without some serious changes in the monetary system.

I am completely surprised at the lack of understanding of money by those who are highly educated and who should know better. Those praying and hoping their paper wealth will make it through it all... have my deepest sympathy.

Right, because fiat money is, in the end, political. If money is not natural (gold), then it's political.

The debt is evaporating and is being replaced with fiat.

The way to play the game going forward is to get as much fiat as you can, and continuously convert it into harder assets. That's all you can do, at least that's all I see. Either taking on debt, or lending, is extremely risky in this environment. "Neither a borrower nor a lender be." In my opinion, the world's bond markets are the most dysfunctional of all (which is saying something), and that's where the final endpoint will be. The sheeple are being herded there, as they exit "risky" assets only to find themselves in the cauldron of Treasury positions as the door shuts them in.

Bonds are not cash! There is no such thing as a cash equivalent, either you have cash or you don't. An FDIC insured account is practically the same thing, as without this the entire banking and payment system fails. The bond market, on the other hand, can fail without the payment system failing. So ultimately, a bank account is safer than even government bonds. I don't understand why people argue otherwise. If the banks don't work, that's the ultimate sign of collapse, and I don't think it will quite come to that yet.

You can either survive with cash, gold, and real assets, or you can die with bonds. Your choice.

Euan,

Another way to look at this is that a market that is working is volatile, with lots of new knowledge and tweaks in underlying market drivers moving the price in a chaotic way. If you see stability in the market, then you've seen the market decouple from basic drivers (attractors), even if you don't know what they are or why.

Such behaviour tends to result in 'drift' until the market is captured by a new attractor (set of drivers).

Now that WTI graph in the top right over previous months has tended towards a step pattern, day on day, with stability during the trading day. That suggests to me that the market is being set outside the US, and that normal OECD demand drivers on price aren't really playing.

The other half of this is to realise that the entire financial market is made of fraudsters and cheats - all looking to 'do over' each other to make money. They might have paid for laws that don't make their behaviour strictly criminal - but as we would know it, they're all crooks and without a moral scruple.

The market needs volatility to make money, no matter what the producers or consumers want. Therefore any market that gets stable is a problem. In addition, they don't want to get taken to the cleaners the same way twice. If the op is correct, and fraudulent games are being played to try to make large sums - that requires there is a mug willing to play. These crooks know when they are being defrauded.

Whilst there might be a hidden decline in demand that is about to knock the bottom out of the (fraudulent) market - I'm not so sure. Recessions are built on belief and so far that belief has been positive. A shock is needed to move it.

Thus I'm much more worried that the stability you talk about is going to be upset because the hidden game is changing, the market number is decoupled, and that is exactly the moment when a new crook with a new plan can get it caught by a new attactor (one that makes them trillions).

An oil price decline can't really precede an obvious recession (no matter what the op implies) so I think a spike is on the cards first, bringing that necessary volatility that can then make someone very rich.

In short, its quiet, too quiet.

Well here's what we are looking at (chart from the FT). I guess my use of the word volatility was rather loose. The large - scale price changes, rise fall and then rise again are gone for present with almost 12 months of stability. But the small-scale fluctuations are still there. I've always taken the view that speculative variance is reflected by some of this small - scale fluctuation. I do not agree that the overall structure of the chart is controlled by the financials preferring to believe this is more linked to OPEC spare capacity, the supply - demand dynamic, the need for Chindia to out bid OECD to create flow of supplies from west to east and above all the responsiveness of Saudi Arabia to shifts in the market - where they do a fantastic job but sometimes get wrong footed and need to scurry to find rigs.

I'd tend to agree with you that with Iran being squeezed out of market, their customers are going to be looking for oil else where and that upwards pressure is currently more likely. I have given up trying to forecast the oil price. In the period 2003 to 2007 i was very good at it - previous year + 20%. But since, it has become a game of trying to guess what will happen to global banking system.

http://www.theoildrum.com/files/Screen%20shot%202011-12-13%20at%208-1.35...

Beautiful graph!

I know nothing.

I observe that, over the interval that the left side scale covers 1/7th of the data range, 75mbpd-85mbpd, the right side scale covers a 5X data range, $25/b - $125/b, and is adjusted for inflation. This 35:1 difference in the scales is what makes the curves seem to nest so nicely. I also have not heard of any huge investment, any vast renovation having to be made to maintain this level of oil production. It seems the price represented is quite disconnected from both the value of the currency and the availability of the product.

Drop by 1/2? Rise by 2X? Sure, why not.

The system is irrational.

________________________________

Capitalism is great, as long as it is not for anything you really need:

Healthcare - U.S. primary healthcare insurance industry

Electricity - Enron

A house - mortgage fraud disaster

Food - junk food

Education - student-loan industry

Information - corporate media

Culture - video games

Retirement - 401K

I am still not clear how the monetisation of part of BP’s oil inventory actually distorts the spot price..

am I right this occurs because the genuine expiration of these long investments releases a flood of oil into the spot market?

if there is spare oil to control the price then the only thing that can stop the ongoing creation of rolled over futures without delivery (off the exchange floor so to speak) is above ground storage?

this takes me back to santelli pointing out that the distortions are in the future price.. not the spot price

http://youtu.be/6oGAX1g60HU

What will happen is that market players sell BFOE/Brent forward physical contracts, and OilCo buys them.

The market players sold because they believed the price will fall, in the expectation that they can buy back similar contracts cheaper in this 'over the counter' market and make a profit.

The problem is that OilCo already owns some or all of the inventory/rights to production available, and this means that the hapless seller finds himself 'squeezed'. He therefore has to buy the spot oil necessary to fulfil his forward sale contract from the only seller - ie Oilco.

And the spot price 'pops' upwards (and is distorted) as a result.

this can really only happen in the short term as the loser knows he will lose

ie its a one shot effect. and it only happens to the speculators going short

if I just want oil in my back yard?

mididoctors

A lot of traders and speculators are nursing their wounds, and keeping out of the oil market and other similarly financialised zombie markets until they see a trend they can follow.

And yet, and yet:

Financial oil has almost constantly in contango for the past few years. I buy December 2012 contracts at Price X, and by the time December 2012 rolls around, it is underwater. In my limited experience buying and selling these things, it has not worked exactly the way you say-- and that is why the ETF's are getting murdered. If buying spot oil pops the price, then the physical price moves up, allowing the financial price to clear out at a higher level. But that hasn't been happening.

My small mind is missing something here.