Tech Talk - Future Natural Gas Production from Western Siberia

Posted by Heading Out on February 27, 2012 - 11:24am

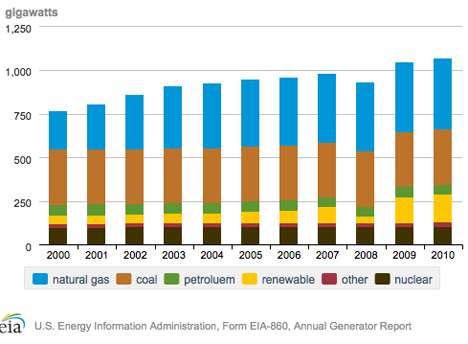

The bitterly cold weather in parts of Europe over the past few weeks has had an impact on power consumption. Russia saw the highest demand yet for electricity at 156.96 Gigawatts, while at the same time reducing the volumes of natural gas that it is supplying to Europe. To put the Russian power level in perspective, while there has been an increase in power generated from natural gas in the United States, the capacity to generate more than 1,000 GW still relies considerably on coal and nuclear power, although renewable sources are becoming more prominent.

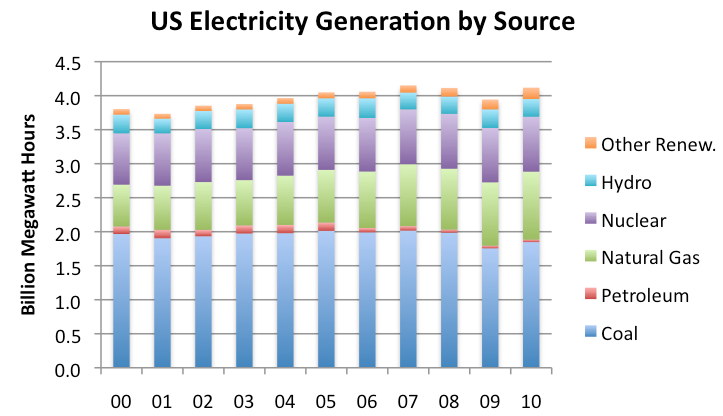

The above plot, however, shows capacity rather than actual contribution, and I am grateful to Gail, who took the time to develop a plot of actual use that shows how the different sources actually contribute. I am putting in both, since each addresses a different point in comparison with Russian production.

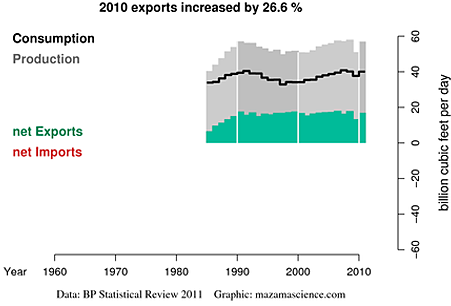

In contrast to the US, some 56.2% of the total energy in Russia comes from natural gas; oil produces some 18.3%, coal 14.4%, nuclear power is 5.3%, and hydropower is at 5.6%. This high demand for natural gas is compounded by the sales which Russia makes to Europe, where it provides about 25% of the market supply, down from the 27% levels a couple of years ago. And Gazprom is further marketing its product to India (through LNG sales) as well as to China, where it will now be in competition with natural gas piped from Turkmenistan (which used to have Gazprom as its only customer). (note that the identifier has been corrected to reflect that this is total energy not just electrical.)

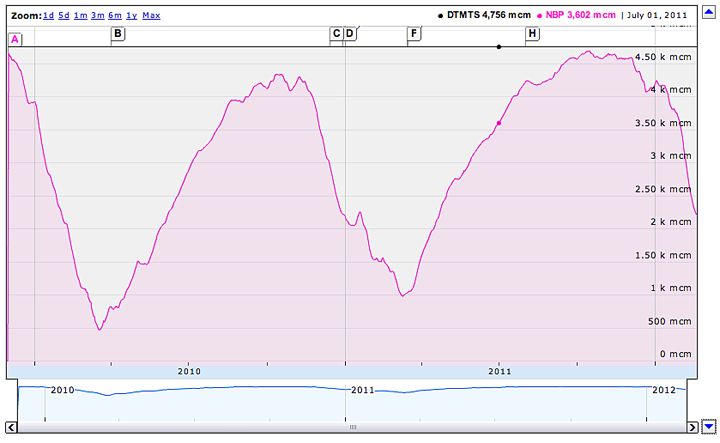

Natural gas is more often supplied on demand rather than from large storage facilities. So when local demand in Russia recently rose due to the severe cold spell, there was less available for Europe, and supply fell, for example, by 30% in Italy. Though having been that route before, European nations have learned to keep some reserve available for these situations. Gazprom has also seen the need for more storage, and now plans on investing some 2-300 million euros to double the volume available in gas reservoirs around Europe. During the peak cold spell, Europe was using around 17 bcf per day up 20% from the average demand during 2011.

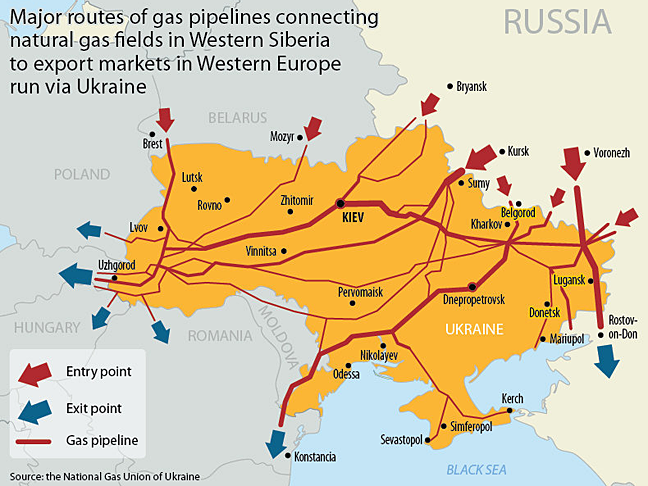

The problems that Gazprom faces are two-fold: the first is to produce the gas, and then the second is to ensure that the customer has enough available when needed. And at the moment (to address the latter problem first) one of the critical issues is that the gas must pass through Ukraine.

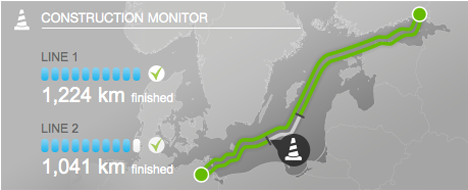

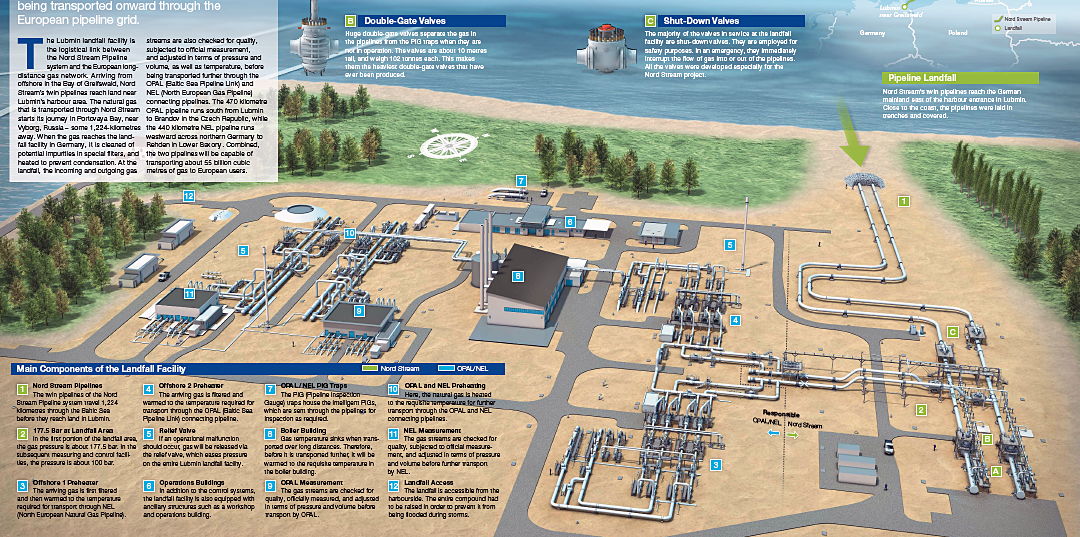

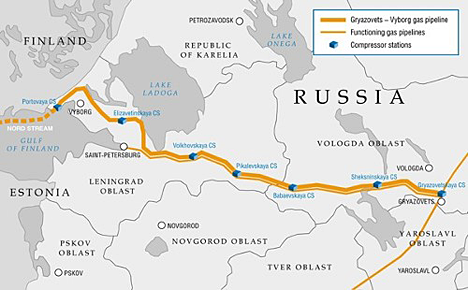

Unfortunately, Ukraine and Russia have an uncomfortable history in regard to the passage of natural gas through the country, and because of the cold this year, this is no different, with disputes over volumes contracted for and used still continuing. However, the Nord Stream pipeline has now completed the first pipeline to Germany, bypassing Ukraine. The second lacks only one section and will be installed this year. The twin pipelines will carry the equivalent of 5.3 bcf/day into Lubmin in Northern Germany, with delivery from Portovaya Bay in Russia already flowing through the first pipeline, starting on 8 November, 2011.

The Russian end of the pipeline connects into the Gryazovets-Vyborg pipeline, which brings the gas from the producing fields.

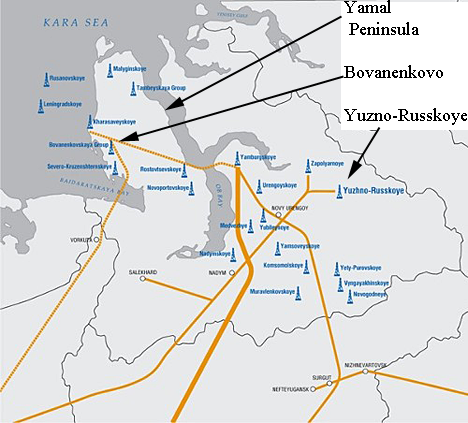

The gas that comes through the pipeline is from Novy Urengoy in Western Siberia, where some 74% of Russian natural gas is being produced, at present. This is where the Yuzhno-Russkoye gas field is located, with current estimated reserves of 21 Tcf of natural gas. The gas is currently coming from some 142 wells spread over an area of 424 sq miles, with the field producing 2.6 bcf a day. The gas field came on line in 2007 and it takes 10 days for the gas to make the trip.

It should be noted that the pipelines going up into the Yamal Pensinsula are still being developed and the gas fields of that region are not therefore fully available, though drilling is taking place.

There are a number of fields in the Peninsula that are still to be fully developed, including Bovanenkovo, and these will provide some of the reserves that Russia will need as their main producing fields start to run down. There has been some considerable progress, however, since the last time I tried to find evidence of activity in the field.

It is one of 11 natural gas and 15 oil and gas condensate fields in the Peninsula, with aggregate reserves, for just the three largest fields (Bovanenkovo, Kharasavey and Novoportovskoye) of 208 Tcf of natural gas, 730 million barrels of condensate, and 1.6 billion barrels of oil. At present, the first 1.5 bcf/day production is scheduled to begin operation in the 3rd quarter of this year. A railroad is being connected into the region in order to maintain supplies and provide equipment for further construction.

With the growing prospects of additional natural gas from Yamal, and with further facilities being built in Europe for storage to get through inclement weather, it does appear that Russia will be able to supply Western Europe with natural gas for at least the next 30 years that they are predicting. Although should demand rise, as it well might with the closure of nuclear and coal-fired power stations, then the reserves will be drawn down considerably faster. At present, the current storage has only been run down by about 48% of that available, according to Gas Infrastructure Europe.

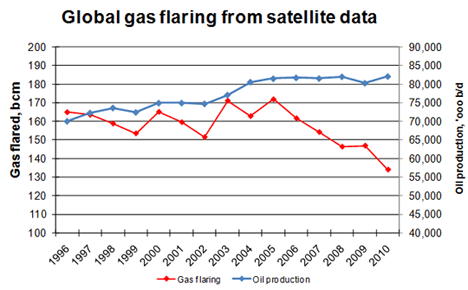

This is while Russia is still flaring considerable volumes of natural gas that cannot be otherwise used. And while the trend is going down (by about 15%) it still has a way to go. There just aren’t that many folk in Siberia that appreciate the slightly warmer air that is being generated. And while that part of the news is good, the failure to date of the Polish trials to find commercial reserves of natural gas in domestic shale deposits may mean that Gazprom’s market will continue, since the presence of as much as 187 Tcf of natural gas in the Polish shales does not do anyone any good if it cannot be viably recovered.

I thought the Russian electricity generation mix being 18% oil sounded odd so I followed the link. The article seems to indicate that the numbers you grabbed for electricity mix are actually total energy. The mix given for electricity is: "Gas accounts for approximately 47 percent of electricity generated in Russia. Coal accounts for 18 percent, hydropower for 17 percent, and nuclear energy for 16 percent."

That seems correct.

Do we now know for sure that oil provides only a trivial amount of electricity in Russia and is mostly only used for emergency generation, as it is in some other countries? You are correct in noting that the linked article says

Eyeballing databrowser suggests that is about right.

Again I see the same quote as you for Russian electricity. The article says

Can the author correct his text?

It appears that in 2010 Russia flared about 5% of gas production, or about 1/4 of global flaring.

What happens when the 30 years is up? The Germans seem reckless increasing their dependence on Russian gas and big price rises seem inevitable. As with Ukraine disputes over pricing may see the Russians threaten to turn off the tap.

My guess is that 'range anxiety' will set in well before, say just a decade from now.

Hi HO,

Thank you for an extremely interesting post. It seems that the Russian gas coming to Western Europe is traveling a lot further than gas usually does in the US. My impression is that the pressurizing and pumping equipment in a natural gas pipeline is powered by natural gas. Is this correct? If so, do you have any sense of what fraction of the Russian gas is consumed in sending it to Western Europe?

Thanks,

Dave

Dave:

your assumption about the power costs for transportation of the gas, and where it comes from, is right. I'd have to dig a little to get the actual numbers on the power needs for individual pipelines, though they are generally available for each of the major ones. For example the compressor station to drive the gas through the Nord Stream pipeline, which is some 1200 km long, is provided by 6 x 52 MWh and 2 x 27 MWh pumping stations.

Cheers

HO

Note that some pipeline compressors are driven by grid-electricity (I serve a few) but this is the exception, not the rule. It is more common for smaller pipelines, where grid power is available without upgrades and maintenance makes up a bigger part of gas turbine compressor cost.

Hi HO,

Thank you for the information. Presumably it should be MW instead of MWh.

Dave

"Although should demand rise, as it well might with the closure of nuclear and coal-fired power stations, then the reserves will be drawn down considerably faster."

Interesting comment. My theory is that the current producers prefer to sell their gas as fast as possible because that is what produces current income. As is the case for many, they have little thought for what might happen 10, 20 or 30 years from now.

That being said, I wonder how much Gazprom related money is being spent to support the irrational efforts to shut down German nuclear power stations in order to open up more markets for gas.

Every large German reactor that was shut down used to be producing as much energy for the European grid as natural gas fired power plants consuming about 200 million cubic feet per day. When Merkel ordered the immediate closure of 8 power plants in reaction to an earthquake and tsunami, neither of which are risks in Germany, she essentially increased Gazprom's sales opportunities by 1.6 BCF per day. When all 17 German nuclear plants are shutdown, the reduction in output will be roughly equivalent to the increased gas supply from Nordstream.

In a startling coincidence, the man who initially negotiated the deal to shut down German nuclear plants by 2020 - former Chancellor Schroeder - has been working for Gazprom on the Nordstream project ever since he left office.

Rod Adams

Publisher, Atomic Insights

Or they will make their electrical energy production facilities more efficient.

Besides building up renewable capacity, Germany can and most likely will deploy more Combined Cycle Gas Turbine plants, which are 60 to 65% more efficient than the old single stage power plants.

Germany 2020 RE industry forecast.

Germany plans multi-billion euro power plant revamp.

Florida is quickly modernizing it's power plants. Tearing down old Bunker oil/NG steam plants and replacing them with modern GW+ sized CCGT NG/Diesel fuel tech.

In each case, they will use the existing pipelines and gas flows, but produce much more electricity from that fuel source.

If Russia, Ukraine and the rest of the EU went down the same path the NG problem would probably cease to be of concern.

Replacing an existing 40% efficient NG-electric steam turbine with once-thru cooling with a 60% efficient combined cycle plant (efficiencies are selected for ease of calculation) has 3 different boundary conditions (gas supply, power grid, and cooling requirement). If you use the same amount of gas, you produce 50% more power and require 2/3rds as much cooling. If you produce the same amount of power, you use 2/3rds as much gas, and require 4/9ths as much cooling. If you use the same amount of cooling, you use 50% more gas, and produce 2.25X the power.

Russian CCGT plants:

2 x 450 MW Severo-Zapad CHP in Sankt-Petersburg

2 x 450 MW CHP-2 in Kaliningrad

2 x 220 MW CHP-1 in Tyumen

2 x 450 MW CHP-27 in Moscow

1 x 450 MW CHP-21 in Moscow

1 x 325 MW PP in Ivanovo

160 MW CHP in Sochi

2 x 121 MW Mezhdunarodnaya CHP in Moscow

1 x 400 MW PP in Shatura

1 x 420 MW CHP in Krasnodar

1 x 230 MW CHP-3 in Chelyabinsk

Publisher, Atomic Insights

in his own words:

link