Drumbeat: April 13, 2012

Posted by Leanan on April 13, 2012 - 9:32am

How OPEC clouds the issue of oil production

How much oil does OPEC produce? It is a simple question, but the answer has been complicated after the cartel started this month to publish two different sets of data.According to its monthly oil market report, OPEC either produced about 31.2 million barrels a day in February, or a much higher 32.1 million b/d. The difference in the two estimates is equal to twice the production of its smallest member -- Ecuador.

The dispute about the true level of production is not merely an internal matter for the cartel that controls 40 per cent of the world’s oil supplies. It complicates policymaking and contributes to instability in oil markets as traders are unsure about supply.

Indian Oil Chairman: Seeking INR7.67/Liter Increase In Gasoline Prices

NEW DELHI – Indian Oil Corp. (530965.BY) wants to raise gasoline prices by INR7.67 a liter to make up for its sales losses, the chairman of the country's biggest refining and fuel marketing company by sales said Friday.Indian Oil and two other state-run fuel retailers--Hindustan Petroleum Corp. (500104.BY) and Bharat Petroleum Corp. (500547.BY)--are incurring sales losses totaling INR500 million ($9.7 million) a day from gasoline sales, R.S. Butola told reporters.

Tensions between West and Iran not the main factor in future oil prices

Iran's confrontation with the West has been a worthy headline-grabber for months, but it is mundane economic realities that will set the tone for oil markets in the months ahead.

Syrians take to the streets amid a fragile cease-fire

(CNN) -- Syrians poured into the streets after Friday prayers, chanting and raising opposition flags in a major test of a fragile cease-fire implemented a day earlier to end a bloody government crackdown."God we have no one to ask for help but you," they chanted. "Down with Assad!"

Eni SpA pipeline attacked in Nigeria's oil delta

LAGOS, Nigeria—Gunmen attacked a pipeline early Friday morning belonging to Eni SpA in Nigeria's oil-rich and restive southern delta, the Italian oil firm said, as the main militant group in the region claimed responsibility for the assault.Eni said engineers had begun examining the damage on the pipeline near Clough Creek in Bayelsa state, the home of Nigerian President Goodluck Jonathan. The company did not say how much oil had been spilled in the attack, nor how much of its oil production had been affected.

Spain gas demand drops further, coal used more

MADRID (Reuters) - Spanish gas demand extended a year-long slump in March, gas grid manager Enagas said on Friday, as coal continued to grab a larger share of the country's generating mix.A year-on-year fall of 9.0 percent in March followed a jump of 11 percent in February when demand rose to cope with unusually cold weather.

Russia's Novatek mulls bid for Cypriot gas

MONTREAL - Novatek, Russia's largest independent natural gas producer, is considering applying for a license to explore for gas offshore from Cyprus when Nicosia opens a second round of bidding for its exclusive economic zone (EEZ) later this year.

Lithuania eyes LNG imports from Norway

(Reuters) - Lithuania, which plans a floating liquefied natural gas (LNG) import terminal by end-2014, is considering imports from Norway, the energy ministry said on Friday.

Unlike the rest of the world right now, Russia isn't scrambling to develop its shale gas assets. The country is the world's second-largest natural-gas producer, and its production story affects much of the world and many of our investments.

China power giant inks $2.4-bln India project

HONG KONG/NEW DELHI (Reuters) - Power Construction Corporation of China has signed a $2.4 billion contract to build the second phase of a massive coal-fired power complex in southern India to help meet soaring local demand for electricity, the firm said on Friday.China has been playing an active role in power project construction overseas, particularly in developing countries, taking advantage of state financing as well as experience and technology acquired through three decades of economic boom.

Russia To Prepare Offshore Tax Breaks By October -Report

MOSCOW – Russia's government will prepare tax changes for offshore oil and gas projects by October, the Interfax news agency reports Friday citing the country's Deputy Finance Minister Sergei Shatalov.

China extends energy levy to projects with foreign firms

(Reuters) - China has extended a charge on oil and gas production to cover cooperation projects between foreign and Chinese companies from those run solely by domestic firms, as it tries to smooth levies for all oil and gas producers.

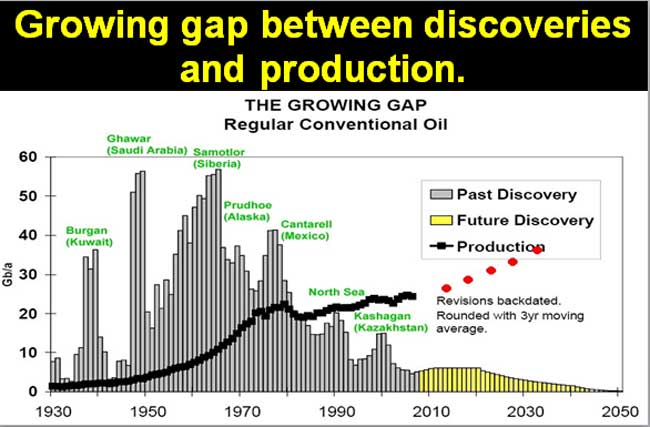

Supply Chain Graphic of the Week: Another View of Peak Oil

The picture it paints is not a good one. First, look how few new reserves are being discovered, versus the huge oil field finds in the 1950-80 period (gray bars, versus small expected future finds in the yellow bars).You can also see in the black line how production levels, despite rising overall global demand, have been flat-lining in recent years: just what you would expect with nearing Peak Oil.

Texas Oil Commissioner talks about possible 4 million barrels of oil per day in 2016 from Texas

If Texas delivers the increases that the commissioner is talking about and North Dakota continues its trend and the other oil shale areas increase as well then it is very plausible that the US could become the #1 crude oil producer. It can also mean that there will be a new peak in US oil production which runs counter to the peak oil theme of it peaked in the US and will peak for the world and never get back to those levels.

While We Dither On Oil, It’s Drill, Beijing, Drill

A Chinese oil company is now the world’s top producer. While we sleep and watch pump prices rise, China, India and even Cuba seek supplies the world over, including drilling off the Florida coast.

The War at the End of the US Dollar

US politicians are clamoring for war with Iran, the third largest oil exporter in the world. Iran refuses to sell its oil for US dollars. If Iranian oil were traded in US dollars, it would moderate the US dollar price of crude oil and ease pressure on the US economy, as well as extend the world reserve currency status of the US dollar and give the US economic leverage over consumers of Iranian oil, which include China and India.

Cheap Natural Gas Won't Destroy The Nuclear Power Industry

Natural gas prices are now below $2 per 1,000 cubic feet, the lowest they've been in over a decade. What's this mean for the energy industry - specifically nuclear power?

With the price of a gallon of gasoline in the United States now at $5 — and climbing — CNBC’s Rick Santelli is making it his personal mission to demonstrate to the world that cars can easily be converted to run on natural gas. Santelli is best known for starting the Tea Party movement with his famous rant about being forced to pay for his neighbors’ mortgage. If Santelli is right about natural gas, he may start an even more powerful trend. Natural gas is in abundant supply in the United States, and the U.S. is the world’s lowest-cost producer. Lured by the promise of fueling their vehicles at a fraction of the cost of using gasoline, Santelli is sure to have a lot of followers.

Taste testers enlisted to sample fish exposed to Scottish gas leak

China launches oil spill response vessels

NANNING (Xinhua) -- China has put the country's first oil spill response vessels (OSRV) into use, a move to strengthen emergency response capabilities in case of oil spill accidents.

Scotland's government has brought in a team of taste testers to ensure the safety of fish potentially affected by an ongoing gas leak emanating from a North Sea oil platform owned by French multinational oil and gas company Total S.A.The government brought to the Marine Scotland Science organization "specially trained sensory testers" who tasted seven species of fish found near the gas leak.

Could Solar Power Boost Saudi Oil Exports?

How often have we heard that installing renewable energy sources like wind and solar power will improve US energy security and reduce oil imports? There are other reasons for promoting these technologies, but this one has little substance, because we generate less than 1% of our electricity from oil. Ironically, this logic looks much more relevant to the part of the world with the largest oil reserves and that accounts for the lion's share of global oil exports, the Middle East. This week's Economist reports that Saudi Arabia generates 65% of its power from oil, and the impact on its oil exports could grow dramatically as the country's population and economy expand. Other Gulf producers have similar profiles. The Saudi government's strategy to increase its use of nuclear and renewable energy could pay big dividends in preserving oil for exports, though the volumes freed up by such means wouldn't be cheap.

Melting Arctic is nothing but good news for the mining industry: Lloyd’s/Chatham House

The melting ice cap in the Arctic sea could open up access to immense mineral reserves, attracting billions of dollars in investment, but also bringing with it unique risks and challenges, says Lloyd’s/Chatham House latest Risk Insight report.While the London-based think-tank estimates that investments over US$100 billion are expected in the region over the next decade, it also warns about the potential environmental damages from oil drilling in the far north.

Climate change said to threaten Asia's 'Rice Bowl'

BANGKOK (UPI) -- Catastrophic flood-drought cycles could threaten Asia's rice production and pose a significant threat to millions of people across the region, researchers say.Rapid climate change and its potential to intensify Southeast Asia's droughts and floods could affect Asia's "Rice Bowl" and lead to millions in crop damages, climate specialists and agricultural scientists warned.

Mexico to introduce radical climate law

Mexico is set to become the second country worldwide to begin legislating against climate change, as its House of Representatives passed a climate law.If passed by the Mexican Senate, the General Law on Climate Change will require the whole country to reduce its carbon by 50% by 2050.

Japan Greenhouse Gas Emissions Rose 4.2% on Recovering Economy

Japan’s greenhouse gas emissions for the year ended March 2011 rose 4.2 percent as the economy recovered from the 2008 financial crisis, the Environment Ministry said today, exceeding a previous estimate.

Philippines deploys second ship in China standoff

The Philippines deployed a second vessel to tiny islands in the South China Sea on Thursday in a bid to protect its sovereignty in an increasingly tense territorial standoff with China.Authorities said a coast guard boat joined the Philippines' biggest warship at Scarborough Shoal, where two Chinese surveillance vessels were protecting a group of Chinese fishermen from being arrested.

Oil Halts Two-Day Advance on China Growth Slowdown, Naimi Pledge

Oil halted a two-day advance in New York after China’s economy grew at the slowest pace in 11 quarters and Saudi Arabia’s oil minister said the kingdom is determined to see lower prices.Futures fell as much as 0.8 percent after government data today showed China’s gross domestic product expanded 8.1 percent from a year earlier in the first quarter, after an 8.9 percent gain in the final three months of 2011. Industrial output rose at a faster pace in March, while retail sales growth accelerated. Saudi Arabia, the world’s biggest crude exporter, considers prices too high and is working toward damping them, Minister Ali al-Naimi said today.

Consumer Prices in U.S. Probably Rose at Slower Pace

The cost of living in the U.S. probably rose at a slower pace in March as the run-up in energy prices lost steam, economists said before a report today.The consumer-price index increased 0.3 percent last month after rising 0.4 percent in February, according to the median forecast of 80 economists surveyed by Bloomberg News. So-called core prices, which exclude volatile food and energy costs, may have climbed 0.2 percent.

Why gas prices may have peaked

NEW YORK (CNNMoney) -- After one of the fastest and steepest runups in recent memory, it's possible gasoline prices may have peaked.Retail gas prices fell more than half a cent Friday to a nationwide average just above $3.90 a gallon, according to AAA, continuing a decline started late last week that has shaved almost 4 cents off the price of gas.

The decline mirrors a moderate drop in crude oil prices, which account for roughly 70% of the cost of gas.

Turkey could seek NATO's help to deal with Syria

ANKARA, Turkey (AP) — Turkey said it could seek NATO's help in case the Syrian troops violate its borders again.Prime Minister Recep Tayyip Erdogan said Wednesday that "NATO has responsibilities to protect the Turkish border according to Article 5." He was referring to the article in the alliance's treaty stating that an attack against one NATO member shall be considered an attack against all members.

Iranians Decry Double Standard Before Nuclear Talks

For nations seeking to restrict Iran’s pursuit of nuclear technology, Vida Asgari has a question: if others can do it, why not us?“Why should only powerful countries have it?” said Asgari, a 44-year-old sales assistant in a Tehran bookshop. “If it’s peaceful, it’s our right and we should stand up for it.”

Spain summons Argentine ambassador in energy dispute, warns country against becoming "pariah"

MADRID - Spain warned Argentina Friday it risks becoming "an international pariah" if it tries to wrest control of energy company Repsol's majority stake in its South American YPF unit, raising tensions between the two nations and sending Repsol's shares plunging.Spanish Foreign Minister Jose Manuel Garcia-Margallo summoned Argentina's Ambassador Carlo Antonio Bettini to convey Spain's "concern" over possible nationalization of YPF, which represents 42 per cent of Repsol's total reserves, estimated at 2.1 billion barrels of crude.

EU tells Argentina to respect investor rights in Repsol spat

The European Union has urged Argentina today to respect the rights of foreign investments as it voiced concern over reported plans to nationalise a unit of Spanish oil firm Repsol.The European Commission, the EU's executive arm, said its delegation in Buenos Aires had expressed its concerns directly to the Argentine government.

Argentine Governor Rejects News Report on YPF Takeover Plan

The governor of Argentina’s Jujuy province rejected a media report that said the government plans to send Congress a bill authorizing it to take a 50.01 percent stake in YPF SA (YPFD), the country’s biggest energy company.“Everything is under review,” Eduardo Fellner told reporters last night provincial governors met President Cristina Fernandez de Kirchner in Buenos Aires. “There is no legal proposal yet, there are just press rumors.”

LNG Export Plant Verges on U.S. Approval Amid Shale Glut

Cheniere Energy Inc. (LNG), the natural gas importer that lost $1.2 billion in a decade, is poised to become the sole U.S. exporter of fuel from the shale bonanza that’s turned the nation into the world’s biggest gas producer.The government may decide as soon as next week on Cheniere’s request to build a $10 billion Louisiana plant that would be the largest in the U.S. to liquefy gas and load it onto ocean-going tankers.

Ask Matt: What are some ways to invest in natural gas?

Increasingly, municipal bus systems, for instance, are turning to natural gas as a way to power their fleets. And more shipping and transportation companies, too, are using natural gas.But despite the interest in natural gas as a fuel, the plans to use it have failed to catch on in any widespread way. And prices of natural gas tell the story.

Catskill Mountains town bans natural gas fracking

OLIVE, N.Y. (AP) - The Town of Olive in the Catskill Mountains is the latest community in New York to ban to natural gas drilling using high-volume hydraulic fracturing.More than 50 New York communities have enacted so-called fracking bans at the urging of residents who say the potential benefits aren't enough to risk polluting water supplies and endangering public health.

Shell Confident It’s Not Source of Gulf of Mexico Sheen

Royal Dutch Shell Plc (RDSA), Europe’s largest oil company, said an oil sheen between two of its platforms in the Gulf of Mexico is dissipating, and the company is trying to determine where it came from.The sheen, estimated at about six barrels that covered 10 square miles, has broken up, the Hague-based company said in an e-mailed statement. Shell said in an earlier statement that an inspection found “no sign of leaks” and “no well control issues” from its operations in the area.

Nuclear Halt in South Korea Seen Boosting Coal

South Korea may expand record imports of power-station coal as a nuclear-plant failure that was hidden for a month stokes opposition to atomic energy a year after Japan’s Fukushima disaster.

Edano May Visit Fukui With Message Japan Reactors Safe

Yukio Edano, the government official who steered Japan through the early days of the Fukushima crisis, may visit western Japan in the coming week with the message nuclear plants in the area are safe.In the latest step to get the nation’s reactors running again before power demand peaks in summer, the industry minister will likely focus on winning over local authorities in Fukui prefecture to allow the restart of two Kansai Electric Power Co. reactors at the Ohi plant, about 95 kilometers (59 miles) northeast of Osaka.

Dr. Chu on Profits, Horse Manure and Other Forces of Technological Change

Steven Chu, the secretary of energy, is optimistic about the future of renewable energy.“The clean tech industry is making great strides,” he said on Wednesday at the New York Times Energy for Tomorrow conference in New York. Technologies like battery storage have vastly improved, solar efficiency is improving and electric cars are just at the beginning of their development.

And despite the political partisanship in Washington, he said, “there are people on the other side of the aisle that recognize the economic opportunity.”

Drought expands throughout USA

Still reeling from last year's devastating drought that led to at least $10 billion in agricultural losses across Texas and the South, the nation is enduring another unusually parched year.A mostly dry, mild winter has put nearly 61% of the lower 48 states in "abnormally dry" or drought conditions, according to the U.S. Drought Monitor, a weekly federal tracking of drought. That's the highest percentage of dry or drought conditions since September 2007, when 61.5% of the country was listed in those categories.

E.P.A. Weighs Texas Plan to Cut Haze in National Parks

The Environmental Protection Agency wants cleaner air at national parks across the country, including Guadalupe Mountains and Big Bend in Texas. By November, it is supposed to complete a plan that could regulate emissions from dozens of Texas’ industrial plants, with the goal of reducing haze at parks. Texas officials who would execute the plan are not seeking any new controls, and the electric power industry, unusually, is taking the prospect of a new E.P.A. rule in stride.

Worry About U.S. Water, Air Pollution at Historical Lows

PRINCETON, NJ -- Americans currently express record-low concern about both air pollution and pollution of drinking water. Thirty-six percent say they worry a great deal about air pollution and 48% about pollution of drinking water. Both figures are down more than 20 percentage points from the year 2000.

Oilsands company reducing greenhouse gases and saving money

In the wake of new data confirming a rise in greenhouse gas emissions from Alberta's oilsands sector, one Canadian company, Cenovus, says it's turning the corner in efforts to reduce heat-trapping gases released for each barrel of oil produced from their operations.

David Suzuki Foundation wags finger at Alberta, Sask.

The rest of Canada is leading the way in fighting climate change, argues the David Suzuki Foundation, but Alberta and Saskatchewan are lagging far behind.According to a report released Wednesday, the rest of Canada — with Ontario, Quebec and B.C. being rated as “very good” — are “leaders” in greenhouse-gas reduction.

Signs Europe Bending on Airline Carbon Fee

ISTANBUL — The European Union, heading for a trade war over a new toll on the greenhouse gas emissions of international airlines using European airspace, has been warned that the measure could wreck the prospects for global action on climate change.

Drastic changes needed to curb most potent greenhouse gas

Meat consumption in the developed world needs to be cut by 50 per cent per person by 2050 if we are to meet the most aggressive strategy, set out by the Intergovernmental Panel on Climate Change (IPCC), to reduce one of the most important greenhouse gases, nitrous oxide (N2O).

Rising Pacific seas linked to climate change: Study

SYDNEY - Sea levels in the southwest Pacific started rising drastically in the 1880s, with a notable peak in the 1990s thought to be linked to human-induced climate change, according to a new study.

Painting roofs white is as green as taking cars off the roads for 50 years, says study

Painting roofs white and using light-coloured materials to surface roads and pavements would not only make cities cooler in summer, it would save the same amount of carbon as taking all the cars in the world off the roads for 50 years, a study has found.

A reminder to Oil Drum readers who might be interested:

The Age of Limits Conference will be taking place Memorial Day Weekend at Four Quarters, which is around 100 miles away from Washington, DC.

http://www.ageoflimits.org

"For 50 years serious thinkers have questioned the assumptions of our global industrial culture and its prospects over the longer term. In recent decades they have succeeded in bringing at least some of the core science into popular discussion, notably petroleum depletion and especially climate change. Through these years proposals have been made outlining the governmental policies that would be necessary to begin “solving” these problems. Sadly, we can now see through the course of events, or rather non-events, that the window of opportunity is closing, if not already closed. We are now confronted not by a problem, but by a predicament; one which has no solution, but only adaptations and mitigation's.

Environmental Degradation and Resource Depletion.

Global Population Growth and Demographics.

Rentier Debt and Growth Based Finance. Global Climate Change.

A world now reaching The Limits of Growth on a Finite Earth.

·In-Depth Conversations With Gail Tverberg, Thomas Whipple, John Michael Greer, Carolyn Baker, Dmitry Orlov, and others being confirmed.

The Age of Limits directly addresses our developing understanding of the core issues relating to the emerging decline of the western industrialized model and the practical adaptations and preparations that apply on the personal, family and local levels.

This is not intended to be a conference in the usual sense of presentations to a passive audience. We will instead foster “Weekend Community” through the creation of physical spaces that encourage attendees meeting and exchanging with each other and with our presenters... in a very natural and beautiful setting."

More information available on Age of Limits website.

Feel free to spread the word to those who might be interested!

Any hope that such a conference will grace the west coast one day? I live in BC and would attend as far south as Oregon...Califfolks could head north.

Thanks...Paulo

Well, if you want one on the West Coast, feel free to take the initiative to organize one! That's the best way to insure one will happen.

This is planned to be an inexpensive conference. I am not sure if registration is $75 or $85 now (it varies by date), but it is much lower than for most other conferences. One option for housing is camping on site. There is a small fee for that.

Also, for those wishing to attend who are car-free, a ride board will likely be posted sometime, so people can carpool.

Yes, the price for the entire weekend conference is $85 if one is registered before May 19th. After that it's $95. Meal plan options are additional: Brunch and dinner, either omnivore or herbivore options, available each day for $9.50/each meal.

And it's not all "Doom n' gloom"! There will be music and dancing too in the evening.

Anyway, please spread the word to individuals, groups, or networks who might be interested. We're trying to publicize the conference more.

From Worry About U.S. Water, Air Pollution at Historical Lows, above:

I've long been of the opinion that folks will focus on things they consider necessary as opposed to worrying about doing the most sensible things for a sustainable future; discounting the future while maintaining the present. It makes sense in a way, but insures that, collectively, we will keep consuming, profiting, and burning stuff at the expense of the climate and environment. I know few people who, while acknowledging that these problems exist, are willing to sacrifice their lifestyles other than making token (and not very meaningful) changes. Others simply don't have much wiggle room. Either way, folks seem to give preserving what they have now priority over what could be. I expect this will continue as more people get nearer to their subsistance levels. They certainly aren't going to paint their roofs white, at least until they're roasting in their homes..

The message of the article seems to be 'What you can't see won't Poll well..' - and I know, it's a Gallup Article.. but is it unreasonable of me to want to see some clear comparisons between what people believe or 'worry about', and what we've actually measured, where Pollution and Environmental toxins actually stand?

In this case, I know that compared to the mid seventies, we've seen some astonishing improvements in River Water quality.. but that's not to say that there aren't just scads of NEW pollutants that are also in the mix, as we live in more contact with Phthalates and other Plastic Compounds and Additives than ever before? (Phthalates have recently been fingered for possible links to Elderly Onset of Diabetes, I heard.. tho causality still not proven beyond doubt..) http://diabetes.webmd.com/news/20120412/phthalates-may-double-diabetes-risk

I need to hear a little more comparative fact behind these stories on 'perception', I must say.

People stop caring about what's happening to their environment if they have difficulties making ends meet, the only exception to this are aborigines who derive their existence from their natural surroundings. They still retain what I'd like to call an umbilical cord to nature. Sadly their numbers have been declining for almost two centuries now.

Best hopes for environmental activism from poor people.

Ghung,

Maybe I should have posted my comment downthread on painting your roof white and the link here. Roofs don't last forever, even replacing old or leaking roofs with white would help. Given a roof life expectancy of 25 yrs, that's a lot of reflection that could be added.

Air and water quality are both much better than they used to be in the late 1960's. Now we are way up the cost-benefit curve. A small incremental increase in air or water quality comes with a large price tag. At some point it is time to say good enough, and stop. Then you should expect to drop into maintenance mode, keeping an eye out for things like Bis-phenol A that were either overlooked because of diffuse and indirect effects, or for things are new.

"At some point it is time to say good enough, and stop."

Unfortunately, I think too many are willing to say it's time to Stop not because the problems aren't costly anymore, but when we aren't able to see the sludge on the rivers edges.

We have energy and mfg industries who are still fighting to keep us from listing their effluents as pollutants.. knowing that they'll have much better luck with the exhausts that we can't see with our own eyes.

http://www.thefloridacurrent.com/article.cfm?id=27201279

+1

Beyond that, people get used to degraded conditions so they don't recognize how bad they are, and people increasingly don't spend time in the outdoors anyways. This is actually a constant refrain of environmentalists - heck, New York City was once known for oysters... What we see is NOT what it once was.

Frankly, as I commute by bike in traffic, I think people mostly just don't notice because they aren't exposed to it as obviously as they could be. On a bike, it is very obvious that cars, trucks, and buses are pumping out nasty gases, much more so than even from the sidewalk. Aside from that, noise and light pollution are an issue - on days when it rains and I take the bus, I can't help but notice how loud traffic is... And of course, most of us probably can't see the milky way anymore. Even cities used to be much less bright.

There may be enough value in some of this, enough to excuse some pollution, but we're not anywhere near where it once was or where it could be. I am not so sure all of this is quite worth it. The modern world comes at what price? What are we actually getting for what we have lost?

There was an article in the last DB that reported wheat was over supplied and prices would be falling. That article was really stupid since they were actually projecting 2012/2013 supply. I guess they will never learn that Mother Nature has the final say in food supply.

Foreign wheat supplies down slightly

...not to mention: Drought expands throughout USA, though looking at the map in the link, it seems that many wheat producing areas aren't in a drought situation (yet).

True, but there IS a 'severe drought' blotch right in the middle of the corn belt--southern MN and northern Iowa. They seem to have gotten some rain just in the last few hours, though.

The big picture is pretty impressive/depressing, though--nearly two-thirds of the country in some form of extreme dryness or drought. It is the spreading patches of long term drought that I find most worrying--basically these are places that are on their way to becoming deserts, or at least much dryer ecosystems than they had been.

I wonder if we will see the patches between the midwest and the east connect up eventually, so that everything but a thinning slice in the middle of the country will soon be in some form of drought.

I posted a link yesterday to a new PBS series. The first episode titled "Food Machine" (seemingly renamed Food Nation), has segments on wheat and corn production. Many corn growers have quadrupled their production using circular fields and irrigation. One guy said that he doesn't consider himself a farmer like his grandfather was. He's an input/output manager.

Another large-scale farmer in California's central valley said that water was 50% of his costs; much more than fertilizers, pesticides, fuel or labor. There are some great aerial shots of how farming has changed over several decades, mainly due to technology and increased inputs. The show gave me a real sense of how complex and vulnerable our food systems are, and little hope that we can feed everyone using local and organic methods, even though there is a lot of "fat" in the system.

I am sure that a big part of water costs are energy costs. If there is enough water available, it is just pumping it, but that can be uphill and some distance. If not, desalination may be the only choice, and that is energy intensive as well.

If California is having nuclear electricity problems, it seems like the need for such pumping could add to electricity woes.

Here's a pdf, including a table of prices paid per acre foot by farmers in the central valley for irrigation water, by source. A little dated, but I doubt they've dropped; looks like it could add up quickly. I imagine the farmer was refering to his total costs, including electricity and equipment. It's a bit alarming if water alone is 50% of his costs.

But wouldn't it be more alarming if his total costs were half of his costs?

Also might be of interest:

For those that Netflix, I noticed last night that many TED talks are now available to be watched via streaming, including a series on food.

Ghung-

\

Excellent series. It was on PBS here this past week. Really gives the viewer a look at how its all connected. The scale of things is just massive. I like how they don't take a side on any issues, they just report how it works.

I thought it leads the viewer to get a good perspective without getting bogged down in details or taking sides. The segment on restaurants and "cravability" may make folks think a bit about where their favorite grub comes from, and the complex systems required to bring them their next blooming onion or pizza. The idea that thousands of acres are devoted to one specific onion for one restaurant chain, to be served as a 2000 calorie snack, is a bit crazy to me ("must be exactly 3 1/2 inches, no more, no less").

The drought patch is there, but I don't think it's at this stage a cause for concern. Certainly, it isn't priced much today. I'm wondering about this year's picture for the east, and SE. It's been a rainless spring for many, and quite fire prone.

Wheat is the lowest water user of grains, called the Desert Rose. In the northwest, it's headed bumper. Overrall, there might bee some yield reductions to moisture stress, but no alarms as of yet. Many cattlemen are switching to wheat over corn, the nutritionists say it won't affect gain. I don't know, to me the "tailpipe" of those cows is still just as wet, if not more so on the switch.

We've had a smallish forest fire in Gilead Maine a week or so back.. DURING SPRING RUNOFF SEASON!

Some flukes are to be expected from year to year.. but yeesh!

Jeff Masters mentioned record sea surface temperatures in the GOM in March and carrying over in April. He was saying that will help bring rain to the plains this weekend. It looks like that will carry up to my town where I am really worried about no moisture for the 200+ trees I have planted this spring. I think we will be back to flooding before you know it but I have been wrong before.

The North Texas panhandle and area south and east are major winter wheat producers.

Latest is 36% of Texas winter wheat crop is poor or very poor.

And is bad drought.

Alan

http://www.independent.co.uk/news/business/news/opec-studying-plan-to-bo...

April, 2004: Opec studying plan to boost oil price band by a third

(Saudi's Naimi determined to maintain $22 to $28 price band)

April 28, 2004

Annual Saudi Net Oil Exports* (BP) Vs Annual Brent Crude Oil Prices:

http://i1095.photobucket.com/albums/i475/westexas/Slide1-21.jpg

*2011 estimated at 7.8 mbpd, versus 2005 rate of 9.1 mbpd

http://www.reuters.com/article/2012/04/13/us-saudi-oil-idUSBRE83C06X2012...

April, 2012: Saudi's Naimi says determined to bring down oil prices

April 13, 2012

As I have previously noted, Saudi Arabia tried very hard from 2002 to 2005 to bring down oil prices, as annual Brent prices doubled from $25 in 2002 to $55 in 2005, but then we have the 2005 to 2011 annual data, as annual Brent prices doubled again, from $55 in 2005 to $111 in 2011.

Minister Ali Al-Naimi

al-Husseini said much the same thing:

Based on the 2005 to 2010 annual data for the top 33 net oil exporters in 2005 (we don't have the annual BP data yet for 2011), the decline in Saudi net oil exports from 2005 to 2010 (a decline of 1.9 mbpd, from 9.1 in 2005 to 7.2 in 2010), was two-thirds of the combined net export decline from the top 33 net oil exporters (a decline of 2.9 mbpd).

Let me put it this way. If Saudi Arabia were the sole source of global net oil exports, the 2005 to 2010 decline in global net oil exports (GNE*) would have been 21%, instead of 6.4%. Or if Saudi Arabia had simply maintained their 2005 net export rate of 9.1 mbpd, the 2005 to 2010 decline in GNE would have been only about 2%.

*Top 33 net oil exporters in 2005, total petroleum liquids, BP + Minor EIA data

And the really, really scary part of "Net Export Math" is depletion:

A look at Consumption to Production ratios:

http://www.theoildrum.com/node/9110#comment-886600

Given the rapid fraying of relations between Iran and its allies and Saudi/GCC nations, I see the demise of OPEC occuring within the year. Admittedly, OPEC no longer has the clout it had just a decade ago, but I still think its demise will have a negative impact on oil markets. Hopefully, someone else will chime-in with their thoughts.

OPEC is already dead, like a lot of things it lives on zombie style spilling out useless noise.

As an evil speculator, I can tell you OPEC doesn't matter. They are like a press secretary that gets shoved in front of the cameras to sell people on BS. The markets know what's up, and called their bluff. Price remains high. Production remains flat.

I guess Joules=Watts=carbon emissions now.

The innumeracy is bad enough, but the unit incompatability in the comparisons is wrenchingly bad.

Gosh, r4ndom, are you positing that reducing use of energy in most of its forms doesn't translate to reduced emissions, or are you just picking nits? Just askin'...

I agree with their conclusion, but it's like watching a 3 year old read. Even if they occasionally blurt out the correct word it is quite clear they have no idea what they are doing.

"...it's like watching a 3 year old read."

Perhaps the author understands the intended audience better than you do ;-)

Sorry to pick nits, but a 3 year old is in fact perfectly capable of both reading and understanding the written word. It is easy to underestimate what a child is capable of, but it's still a mistake. I believe that the kids of today are the ones who will have the easiest time making the transition away from oil while the older generation will be paralyzed with a lack of understanding, not knowing what to do. That 3 year old sitting on my couch reading to her sister might be helping her family gather food in a few short years.

He explains it all in the second to last paragraph:

"Albedo is measured on a scale of zero to one, where 1.0 is totally reflective and zero absorbs all sunlight."

And just so everyone else can follow this post, Percentage is measured on a scale of 0 to 100, where 100 is highest.

I thought there was a recent study that concluded that painting roofs white was NOT all that great of a strategy. Don't have the link handy, though. Does anyone else remember what I'm talking about?

I think it depends on the strategy.

Choosing white roofing and paving up front pays off, but the energy involved in doing it over is more than you stand to save in a reasonable amount of time.

If your town has a lot of solar driven cooling demand it should help reduce the need for cooling. The total area is too small compared to the surface of the planet to provide more that a drop in the bucket in terms of directly cooling the planet -but any energy savings will help matters.

I would be concerned about the effect of attic moisture. Current designs expect hot attics to create drying air circulation. [One could of course add ventilation fans]

d- I think the study you were thinking of is Urban 'Heat Island' Effect Is a Small Part of Global Warming; White Roofs Don't Reduce It

Thanks, S. That's the one. You're the best.

So how do we square the two apparently contradictory findings of these two studies?

They do reduce GW, just not by enough to be a big deal.

Different assumptions and different analytical envelopes.

vs.

Ah, so percent is the same as joules is the same as watts?

In the quote they explicitly compare power to energy, like I said the unit conformity gets even worse in the full article.

I was pointing out that he uses one paragraph to define a unit that - although potentially useful - is not even used in the article.

They did sortof refer to it, increase the citywide (albedo) by .1...

I saw a similar study yesterday and was going to comment on it.

Although painting roofs white isn't going to change ocean acidity, and the cost effectiveness is debated as a governmental solution, it still reflects heat back. And as a personal solution, it could be a big help. Paint your roofs white. It's more than a feel good exercise.

We took this step at the ranch several years ago. Large 60x80 barn, 40x40 shop/equipment shed, various outblgs, sheds, my wife balked at our 25x45 house. She wanted her green roof. An added bonus is how much cooler they are in summer. If you have metal roofs, it's really quite easy, and long lasting. For galvanized roofs, wash with a 50% grocery store vinegar solution first. We used a back pack sprayer. It helps create a bonding surface. Then paint. We used a quality white solid house stain, it's holding up excellent. The only drawback has been that the roofs don't shed snow quite as easily, but they still shed when it's deep, or it warms a little.

Edit:

Global warming scientists foresee Sun-reflecting cities

http://news.yahoo.com/global-warming-scientists-foresee-sun-reflecting-c...

This ceramic-based roof paint reflects and insulates, according to claims. Trucking companies use this stuff to keep down refrigeration costs, IIRC.

Have we considered this from a complete impact picture, including the environmental and energy impacts of producing the paint, disposing of the excess/waste. etc? What about the lost heat absorption in the winter? There are also these things called "shade trees" - you plant them and the grow all by themselves, and in the summer they get these things called "leaves" that block a lot of the light from hitting your roof..........

So easy to fall into the trap that everything which is wrong has a solution that involves buying something produced by modern industrial manufacturing. It was not all that long ago that people did not have fossil fuels, and they came up with other solutions such as shade trees and open sleeping porches. The future won't be an exact copy of the past, but that doesn't mean we should toss out the good ideas.

The picture to paint is how much CO2 we are adding.

Shade trees are great, if you live in an area with sufficient summer moisture and can wait 20 years. In the meantime, as long as you have to replace that leaky roof, make it white.

Although the benefit of having a white roof would be a cooler building, all of the longwave radiation that is bounce off the roof does not necessarily get reflected back into space. It can get absorbed by things like black soot in the lower atmosphere.

Best hopes for simple solutions - I wish this were it.

At least half of it would escape to space, so it is net cooling. It means the property and its envorns is a bit cooler than it would be otherwise, which might also reduce water demand of gardening.

Wonder if it's possible to design just the roofing material as a passive system that over the course of the year changes it's reflectivity. For places like most of the U.S., the surface would be highly reflective when the sun was high in the sky in the summer months and would become less relective when the sun was lower in the sky, fall into winter. Whole homes are already designed for this, but retrofitting is usally not cost effective.

I read something once several years ago, the Chinese had invented a paint that was dark color cold, and reflective when warm. But, I haven't heard anything since. It should certainly be doable -remember those liquid crystal thermometers? But, you want the paint to be both cheap, and long lasting, and those requirements might be show stoppers.

If you are right white roofs are a no-brainer in most warm climates.

It would be interesting to see a google map of climate zones and recommended applications (deciduous trees vs. white roof) for a particular zone. I guess one factor to consider would be ratio of annual heating degree days to cooling degree days. If cooling needs are greater than heating you go with a white roof. If not, plant shade trees.

Mediterranean architecture traditionally goes with white walls and roofs, so on reflection I don't think the original article is exactly news.

Incidentally. Longwave refers to the thermal reradiation (heat), shortwave refers to visible and near infrared (the solar input). Generall you can as a rule of thumb guess that about half of the energy absorbed by shortwave, will be reradiated longwave. The longwave has a tougher time getting through the atmosphere (that observation is the basis of the greenhouse effect).

But it isn't being absorbed by the bilding reducing the need for nergy intensive fans and A/C.

NAOM

BTW In one of my old posts I had the results of a simple test I did with 4 tiles. There was a big advantage with white. If anyone has good search-fu to find it or I may try and repeat it tomorrow.

i guess in the north (where i am) it would probably be more reasonable to paint the roof black...

You might want to run the numbers. Since there isn't much sunlight to absorn during the cold season, its weighting should be smaller than during summer. And if the roof is covered by snow, those days roof color doesn't matter. Actually snow is temporary extra insulation, if a white roof allows it to stay longer on your roof, that might cut heating needs!

Re: Texas Oil Commissioner talks about possible 4 million barrels of oil per day in 2016 from Texas (uptop)

*Texas Railroad Commission (Texas RRC). When oil production was first regulated in the Thirties in Texas, my understanding is that oil was primarily transported by rail, so it made sense that the Texas RRC would regulate oil.

So, the Texas RRC, which sums the output from Texas oil leases, shows a production rate of 1.15 mbpd for February, while the EIA shows a production rate of 1.67 mbpd for January, which is 45% more than what the Texas RRC shows for February (I wonder what the January data showed). I suppose that the difference could be condensate, but I thought that both agencies counted condensate. I'll see if I can get an answer from the RRC.

Incidentally, if the most recent data from state agencies are a few weeks to months old, how does the EIA estimate weekly US crude oil production?

wt - As far as I can tell the TRRC counts condensate as oil. They do have a seperate category for NGL's but not condensate oil. I can't understand the variance either. As you know there's only once source of productuion numbers for Texas: those reported by the companies to the TRRC. We don't report our production to anyone else. EIA can post any numbers they want but they have no other source then the numbers the TRRC has. Maybe it's just some accounting misfit. But it seems to be a rather large one.

Maybe, just MAYBE, Texas can stop being an oil importer !

http://205.254.135.7/state/seds/hf.jsp?incfile=sep_use/total/use_tot_TXc...

In trillion BTUs

Not Much Hope for Drill, Baby, Drill,

Alan

1 barrel of #2 diesel = 5.8 million BTUs

1 barrel gasoline = 5.25 million BTUs

It's a week old, but here's a Financial post article to let you know you can all relax now.

http://opinion.financialpost.com/2012/03/30/lawrence-solomon-a-world-awa...

As more data comes in regarding liquid fuels, I'm beginning to have doubts about projections by folks like Hirsch and Skrebowski who are both saying that the global liquids pseudo-plateau we're on will only last us another ~3 years at the most, after which global production decline will set in.

Is this still likely? I like to re-check my beliefs periodically, and I'm wondering whether my previous assumption that sometime around the middle of this decade the long downward slide begins. If that's not the case, and the plateau will continue for much longer (say another decade) then that changes the energy picture dramatically, because that gives us ample time to do a transition. (Not that we will, but my assumption so far has been that a transition is impossible because we don't have the time.)

I should add: I know the net export math might get us even if production stays flat for a decade. Though that assumes that these exporting nations and Chindia will continue their growth trajectories, which isn't a foregone conclusion. It seems they're headed for slower growth as their economies mature.

I would like to share your optimism, but I wonder if the world economic system, in which the vast majority of the countries are ludicrously broke, can continue to borrow money from the future much longer. $120 oil is draining all of those countries of any possibility of recovery. If the plateau continues I lose hope for the world economy. It probably will not collapse overnight, but a long term collapse is baked into the cake.

I simply don't see how the world economy can survive another decade of a plateau. The signs are everywhere - it is unraveling. This is what peak oil looks like.

I would guess that some won't survive - but what do I care (in the US) about some poor African Country that gets more poor and more people starve...I get to use the oil they were consuming :) Yeah that was mean, and purposely so, but it's ultimately the truth for those of us in rich nations. The US is living the dream with the reserve currency. We'll be ok until that gig is up. How it ends I have no idea, frankly I can't believe that other countries haven't banded together to try and move oil away from dollars in order to steal consumption from the US.

Actually, what the data show is that the developing countries are outbidding the developed oil importing countries for access to declining supply of Global Net Exports of oil (GNE).

Yes I've been watching the EIA data for quite a while and really don't understand it. Personally I see no signs that we're really using that much less oil, there certainly aren't any shortages of gas around here or any less traffic. At least no reduction thats been noticeable. The only difference I've noticed is that instead of building 10 new housing developments at a time, they're only building 6. I wish they wouldn't build any, but seems peak oil hasn't been able to pull that one off yet. I think when push comes to shove, and if there are ever real shortages, the US will be able to outbid many other countries on earth if not only due to the fact that it's bought and sold in dollars. But frankly right now it seems like we really just don't need the oil that much.

Normalized oil consumption for China, India, Top 33 net oil exporting countries and the US for 2002 to 2010 (BP), as annual global crude oil prices rose from $25 in 2002 to $111 in 2011, with one year over year decline along the way, in 2009:

Looking at new home construction since 1959 (US Census data) the peak year in the US was 1972 with 2,356,600 units. This includes apartments, condos, duplexes, etc., in addition to single family detached dwellings. We only reached two million annual new homes again twice, once in 1978 and again in 2005 with the housing bubble. The bottom was 2009 with 554,000 that year. In 2011 it was 608,800; about 70 percent of those were single family units. Source: http://www.census.gov/construction/nrc/pdf/startsan.pdf

Regarding vehicle miles of travel, the annual rate of growth back in the 1980's was four percent. That dropped to 2.5 percent in the 1990's and down to one percent per year in the 2000s. The peak vehicular mobility was reached in 2007. Since then, the annual vehicle miles of travel in the US has been dropping and is now down a total of 3.2 percent from its 12-month moving peak in January of 2008. (This is from the Federal Highway Administration based on four thousand permanent traffic counting stations nationwide.) That is not enough for the average driver to notice, but my job requires me to look at historic traffic trends, and it shows up in almost every location.

Public transit ridership is up nationwide; there were 21 standees on my city bus yesterday afternoon. Amtrak and Greyhound riderships are both up about 50 percent since a decade ago. In my metro area (mid-South) much of the new development is all mid-town to the fringe of downtown. The change since the peak in conventional oil around 2006 and the start of the recession is obvious.

Ty said: "The US is living the dream with the reserve currency. We'll be ok until that gig is up. How it ends I have no idea, ..."

- link up top: The War at the End of the US Dollar

It almost looks like I would have written that article. If I knew what I was talking about and wasn't an engineer and could actually write coherently, that is.

That's quite the article.

To me, it points out that it is meaningless for Americans to try and have any conversation or debate about America, or the world, at all... based upon what Americans are allowed to "know". The information we are given has no history, background, context, depth, or comparatives. Gaining these requires the quest of an academic, a life's devotion, to make clear what has been purposely obscured.

Page 7:

"In the face of the most severe economic decline since the Great Depression, the US federal government embarked on a $700 billion economic stimulus plan, despite the fact that tax revenues were falling. In addition to an initial $800 billion bailout package, government sponsored entities Fannie Mae and Freddie Mac were taken into receivership, making the US federal government liable for roughly $5 trillion of mortgage debt. In 2009, the total liabilities of the federal government were estimated to be as high as $23.7 trillion by then Special Inspector General for the Troubled Asset Relief Program (Sigtarp), Neil Barofsky. As a result, US federal government debt increased sharply and, in 2011, the US credit rating was downgraded for the first time in history."

This is the fiscal conservative view. Taken at face value, the devaluation was inevitable. So, was the whole "congress can't agree on raising the debt ceiling" brinksmanship episode... just theater? Just a way to make the inexorable decline to a ratings downgrade more palatable? So it could be blamed on, effectively, threatening the lenders with refusing to pay it back... out of sheer, slap-stick, of-the-moment incompetence? Or have I constructed a false argument?

You know, that's very perceptive. I've been in a lot of different countries, notably the overrated Himalayan tourist trap of Nepal, and the nearly mythical mountain kingdom of Bhutan (where you can't get in unless you pay $200/day, in advance, for a guided tour. They check at the airport, and they are VERY organized, in a Buddhist kind of way.)

US news is very fact-free. You can get a better picture of what is happening in the world in Bhutan, and people do because they get BBC World Service, Al Jazeera, Russian Television (RT) and CNN using satellite TV - even nomadic yak herders, living at an altitude which no cow and few humans can tolerate, get satellite TV and have iPhones to communicate with the yak cheese vendors in Thimphu.

This was brought clearly in focus for me when I was mountain biking in Utah. I was living in a house full of medical professionals when an outbreak of some kind of nasty flu broke out in Mexico. There were six channels on TV, and all were completely focused on this flu outbreak with a "Thousands of people are going to die" message. The medical professionals watching with me were saying, "Well, thousands of people die of the flu EVERY year - so what's the difference?" They were more concerned I was going to undercook the burgers on the BBQ, because that could be really serious.

We also picked up a former US Special Forces dude at the side of the road wearing a life jacket and holding a paddle (from which we deduced he was a whitewater canoeist, which we also are) and drove him back to his truck at the put-in point in Colorado. Despite the fact he had served in the jungles of Central America, he had no idea whatsoever what was going on there. He just ran around in the trees with an assault rifle. My wife, who worked for a while in the hospitals in the jungles of Central America, training the local people, tried to explain it all to him, but there was a huge cultural gap between him and them. I tried to explain that the Chinese were holding trillions of dollars in US cash in reserves and were basically supporting the American dollar for their own political reasons, but that was lost on him, too.

Rocky – Pointed the same to someone after I got stateside from my Africa trip. Told them about all the Al Jazeera I watched. They asked how much propaganda/editorials were included. I told them very little if any. Just facts presented in a fairly neutral manner. And lots of facts at that. Compare that to this “hot” MSM story: for the third day they talked about the cow that escaped from a slaughter house and was running thru urban streets. This morning they had an in depth interview with a fellow that ran an animal rescue facility that has adopted that cow.

Thank goodness there was nothing else more important going on in the world.

Re that flu outbreak, all that MSM fuss about it badly damaged many people's livelihoods down here. Few MSM outlets bothered to fact check those stories. That there was an election going on in the area and politicians were blowing it up to show how they would deal with it and make things better. Few people end up in hospital unless they are very ill so the stats taken were highly distorted, flu cases weren't recognised until they were already very ill which boosted the mortality rate. The many who self medicated at home were never counted. The resulting plunge in tourist numbers really hammered the town.

NAOM

I can very easily imagine a coalition of former allies and rivals deciding to "Vote the USA off the island".

Much easier with GWB, Santorum or Gingrich in charge and the US acting irresponsibly.

Create a "Eurodollar" currency, using dollars already outside the USA. If the US wants some Eurodollars (all ours are inside the USA) they will create some for our gold reserves. Else pay for imports with exports.

A good strategy for other nations to gain more time to get off oil.

Alan

Maybe not? Fear of military retaliation......

I just have this feeling in my gut that the plateau (or slow rise for all liquids) will go on for an awefully long time, far longer than most people expect. I completely disagree with the shark-fin theory. It's one reason I'm far less of a doomer than I used to be. I now get much more concerned about things like drought and extreme heat than I do about oil. Gasoline prices are more of a curiosity than anything else. $4/gal just doesn't seem to be that big of a deal to people around here anymore. I'm also more interested in the event horizon for the world central banks and debt...but that's like watching a mystery movie and not real-life at this point.

That's what I've been feeling too, but it's just a feeling. What I'm hoping is that folks who know the data and the fields and upcoming projects and so on can square the data we're seeing come out with projections like Hirsch's and Skrebowski's.

Basically I don't want to just go off of gut feelings, but rather am hoping that eminent peak oilers step back and recalculate their projections. Maybe they're still right. Maybe not. But either way I'd be interested in the quantitative result.

A look at Consumption to Production ratios in former and current oil exporting countries:

http://www.theoildrum.com/node/9110#comment-886600

One of the key characteristics of net export declines is that an initially (relatively) low net export decline rate tends to obscure a very high post-peak Cumulative Net Export (CNE) depletion rate. For example, three years into a 12 year net export decline period, Indonesia had shown a post-peak net export decline rate of 7.9%/year, but only three years into the decline they had already shipped 42% of post-peak CNE, a three year depletion rate of 18%/year.

As noted in the above link, the entire post-2005 cumulative supply of global net oil exports (GNE) that are available to importers other than China & India may have already fallen by about 35%, in only the five year period from 2005 to 2010, a five year post-2005 depletion rate of 8.6%/year.

ty - I agree with you about a prolonged plateau with a more gradual decline over decades. OTOH that plateau represents oil prodction rate...not the cost of energy/economic stability. Between ELM and growth in consumer countries the per capital amount of energy may show a more significant decline rate. But still not a shark fin IMHO.

As far as the poorer countries (i.e. Africa) I'll share a very recent observation. I just spent 2 weeks in a small west Africa country. Less resources than most countries over there...no oil...no exports to speak of at all. A little bit of tourism. But they do have an abundance of native fruits and veggies. And an ocean full of tasty and cheap sea food. And fairly cheap rice. No obesity problems for sure but didn't see any walking skeletons either. Everybody walks. If they have a few pennies they might grab a taxi. One pitch by a coastal resort caught my eye: "24 Hour Electricity".

If their energy costs were to double it would make life a tad more uncomfortable for sure. And if energy costs double in the US? Gasoline $8/gallon? The electric bill at the factory your neighbor works at doubles? Your AC costs twice as much to run this August as last year? I suspect the suffering (at least the perceived suffering) would be much greater here than that small Africa country. And I have no doubt our unemployment rate would rise much higher than many if not most undeveloped economies.

However, a shark fin decline will only be apparent once it occurs, should it. Meaning, we could go another 2-5 years of pseudo plateau then suddenly supplies drop sharply. Once it does everyone will say ah yes, the shark fin decline we all talked about. That's why regardless of month to month analysis, how this situation plays out is still unknown.

Hell I got my monthly electric bill yesterday and the kwh rate actually *dropped* by 10%, so out of control electricity costs are the last thing on my mind these days. My rates have dropped almost 25% from their peak in 2007-2008.

I guess I just think there's a lot of room for the US to steal oil usage from marginal countries without having the price double. If there's one thing I can count on, it's for the US government to figure out some sort of way to leverage its dollar hegemony to procure/steal resources from other countries as necessary. Right now it doesn't seem necessary, but if there were shortages, I'd pick the US to win a fight over Botswana.

Someday if the debt situation gets out of control I think it could get ugly, who knows when that is though.

I've noticed this, too - electricity prices are dropping, due to cheap natural gas. I've seen articles about it from across the country, in my news trawls.

I wish the PUCs would make them invest that in renewable sources instead of lowering bills. Because those bills are just going to go back up when the gas glut goes away and then people are going to scream when prices go up.

Well you can't expect people to believe that the current gas glut is going to go away when they keep seeing ads from the American Gas Association claiming that America has a 100 year supply of gas. The AGA can be trusted, right??

Well if you don't believe the evil American Gas Association, Obama is saying it too.

They're gonna sell it right out from under ya:

LNG Export Plant Verges on U.S. Approval Amid Shale Glut

http://www.bloomberg.com/news/2012-04-12/lng-export-plant-verges-on-u-s-...

Citizens can kiss any benefit to them goodby. The only thing left for them will be the mess.

...just like in Nigeria.

But think of the proft$.

NAOM

And when they go back up, the meme, that it is due to expensive hippy power (renewables), not to the changing NG fortunes, will be pushed relentlessly.

ty - "I guess I just think there's a lot of room for the US to steal oil usage from marginal countries without having the price double." Today US refiners are importing oil, making fuel and exporting a good bit of it to foreign buyers. And why are the refiners doing this instead of selling those products domestically? Easy answer: those fireign buyers are willing and able to pay more than US consumers. I don't know who the buyers are but they are "stealing our fuel" (from your view point) by their willingness to pay more, aren't they? Venezuelan oil that once went to Gulf Coast refiners is being shipped to China today. After Kinder-Morgan spends $5 billion to expand (by 500,000 bopd) their pipeline from the oil sands to the west coast of Canada, China will have the opportunity to buy oil that was formally exported to the US. The buyer for that oil will be the importing country that can outbid the other. That might be the US...might be China. Time will tell.

Right now most of the west African oil is going to the EU and China. "I'd pick the US to win a fight over Botswana." Very little of that oil is going to Botswana. And if we did snatch all the Botswana imports away from them I doubt the 15,000 bopd they currently import will lower our gasoline prices very much. The way the situation has developing for the last 10 years it looks like we're becoming more of an oil snatching victim then perp.

And when they finish the NG pipeline and LNG export facility that was recently approved in Oregon maybe we'll start seeing some of our abundant NG resources snatched away by China and Japan. Again, only time will tell. But Chenier just signed a 20 year contract to export $400+ million/year of US NG to the UK. Sounds like another snatching in progress. And we're being outbid by that financial powerhouse...England? Makes me imagine being mugged by a 70 you man in a wheel chair. But maybe that's just me. LOL.

I understand what you are saying Rock, but what I'm actually observing on the ground so far is that whatever oil these other countries are snatching from us right now doesn't really seem to be doing all that much damage. We're obviously not yet at some MOL requirement to maintain a functionaing economy, yet. So we can afford to give up that oil without having to give up much else in terms of quality of life (trimming the fat?). Eventually if and when it gets to the point that we really can't afford to give up any additional oil because shortages will occur or society will break down, my money is on the US finding a way to get that oil back. Since we only have to run faster than the slowest zebra, I'm sure we can muscle it out of some impoverished African nation(s). Botswana was the first one that came to my mind but it could be any number of them.

I also think all of that hinges on the US being able to pay for it in dollars (debt, aka US govnt funding). And the only way that's happening is if oil is sold in dollars...so as long as oil is sold in dollars I think we are ok. That's why peak oil ina nd of itself doesn't scare me anymore. I'm more scared of peak dollar. But so far I haven't seen much other than bluster from a couple nations talking about lessening its role. Maybe there's more behind the scenes, I'll never know until it's too late anyway. I think if China and Russia both got together and did their oil dealings outside of the dollar then it would be game on. And it would be quite fitting that Russia would want to do just that given how it went down between the US and the USSR. But so far...I just don't see it.

And yes, I'm doing my best to export all the LNG to Asia for you. But it'll be 2016-2018 before any of that stuff finally comes online...if in the case of Cheniere it ever happens (had to get that dig in there).

ty - I've never been much of the "end of life as we know it" type either. As far as the muscle to snatch oil from the impoverished nations it reminds of the old joke about why Dillinger robbed banks: "Because that's where the money is". But I do serious believe in my MADOR model: the Mutually Assured Distribution Of Resources. And who will be the "Mutual" parties involved? Certainly not Botswana. And not dozens of other small importers. OTOH they don't have much oil to snatch in the first place. All of Botswana's import would supply us with 1/10 of 1% of US consumption. I assume the mutual parties will be the US and China ultimately. Who'll be there from the start with these two countries and then be pushed to curb as supplies get tighter remains to be seen. Today half of the oil from Equatorial Guinea goes to the EU and the other half to the US. Maybe someday we'll make the dictator of EG an offer he can't refuse. Or maybe we'll decide it's time to "export democracy" to the folks of EG.

Initially I expect political and economic means will be employed just as they are today. But what happens if/when the day comes the US can't outbid Japan or England for the oil we need? How far will the US citizens be willing to see their economy degrade before we try more "forceful" methods to secure energy? I (and much of the world) certainly hope we've adjusted our ways long before that option gets to the table. But hoping won't change whatever the future has in store.

Gunboat diplomacy might work for the US in the Americas, but that's probably going to be the limit of their reach.

Let's roll forward our scenario to a point when exports are obviously difficult to come by, the US petrodollar is faltering on high debt and the US can't fulfil its 5-10 Mbpd oil imports habit from global markets. So they start sending some ships to various areas to 'press their case'. The country in question says "the price is X, you want, you pay"; and the US says "we want it at x, or we'll spread some democracy". Now this country isn't going to want less income, and the current customers aren't going to want to lose - so what do they do?

Well other than sending their ships, they might arrange for a US bound oil carrier to meet an accident.

Global traffic in oil is very vulnerable to limitation. Underwater, surface and air all give multiple avenues of attack, and a tanker is a big target. Enforcing an embargo is well within the scope of countries concerned, and protection of those tankers would actually be quite hard. Couple that with some other economic warfare against a US that we've already agreed can't pay its way, and the military option gets spiked.

Hence why I think the US needs to be acting now to live within the means of its backyard. Strong arming Canadians is much more credible than trying to grab the middle east.

The tanker war in the 1980's demonstrated that oil tankers are resilient to attack due to their size and compartmentalized design. A cruse missile piercing the hull and exploding in a tank of oil without oxygen creates no fire. A single sea mine does not sink a big ship.

When crude oil exports become scarce, most countries currently exporting crude oil will be crumbling. The U.S. will likely be importing crude oil only from Canada, producing 5 to 6 Mb/d of crude oil domestically, producing ~1 Mb/d of ethanol from corn and natural gas and producing jet fuel from cooking oil or other biomass. Unemployment will be higher than today. U.S. vehicles might have an average fuel economy of 50 miles/gallon of gasoline, the average vehicle distance traveled will be about 5,000 miles/year and most long distance freight will be hauled by trains instead of semitrailer trucks traveling on Interstate highways. Corporate automobile fleets will typically be powered by natural gas. There will be a glut of unused oil tankers and container ships. The U.S.'s wasteful fuel consumption in transportation will be purged from the system, but its economy will probably still be above the minimum operating level for crude oil. If not yet overthrown, then Saudi Arabia will probably be exporting crude oil to China.

When crude oil exports become scarce, the U.S. will not care about crude oil in the Middle East. The concern might be over imports of natural gas or other resources. The American middle class will not be able to compete with the greater efficiency and higher valued uses of crude oil in other countries until U.S. consumption is at the same level of importance. Thus, I think the U.S. will be living within its means on crude oil before 2040.

And since the 1980s, tankers have moved to double hull designs - even more resistant to attack,

Best Hopes for No "Experiments" with double hull tankers,

Alan

Yes, I kind of wonder about the sinkability of monstrous double-hulled Ultra-Large Crude Carriers (ULCCs) compared to US destroyers, which are kind of fragile.

You fire a cruise missile at them, it goes through the side, explodes, and under anaerobic conditions the crude oil extinguishes the fire. You fire another cruise missile at it, and the same thing happens. The ULCC continues on its way, dribbling a small portion of its crude oil contents into the sea through the holes in the side. Once they are clear, the crew goes down the side with a few boards, some nails and a hammer, and patches the holes.

Hopefully we won't find out if that is what really would happen, but you never know.

Oil is not always sold in dollars. It is priced in dollars, but can be, and often is, transacted in whatever currency or medium of exchange is agreed upon by the two parties.

There is no difference between oil and any other tradable good. Most transactions are done in dollars as it is the dominant currency and most easily exchangeable. There is absolutely no reason why a transaction couldn't be done in Euros, Yuan, or barter.

I don't know who the buyers are but they are "stealing our fuel" (from your view point) by their willingness to pay more, aren't they?

The biggest recipients of US refinery products, as of January, 2012 ( U.S. Imports by Country of Origin) are:

Mexico 531,000 bpd

Canada 294,000 bpd

Netherlands 271,000 bpd

Chile 142,000 bpd

Panama 127,000 bpd

Brazil 110,000 bpd

China 101,000 bpd

Note that the first two countries on the list are two of the three biggest suppliers of crude oil to the US (Canada 2,459,000 bpd, Mexico 995,000 bpd) and Canada is the biggest supplier of refined products to the US (549,000 bpd), while Mexico shipped fewer products to the US (119,000 bpd). The Netherlands doesn't ship any crude oil to the US, but it shipped 119,000 bpd of refined products.

The conclusion I would draw that there is a very heavy oil and product trade within the Americas, which is heavily biased toward crude imports into the US. The trade with the Netherlands is probably European refineries buying diesel fuel from the US and selling gasoline to the US. Other than that, the US is just disposing of its surplus refinery products to other countries after the decline in domestic consumption.

Interestingly, the US imported 445,000 bpd of refined products from Russia in January, which made it second only to Canada as a product supplier. What's that all about?

Sounds like the imperial wealth pump (as described in Greer's recent series) is not running properly any more. Instead of pumping the wealth to the US it's sending it somewhere else. Which is exactly how I expect things to play out over time - gradually and increasingly we'll be less able to get the share of the good stuff we've had, and built our society and infrastructure around.

Rockman- I am glad that you brought up the question of 24 hour electricity. There are some who believe that the absence of 24hour on demand electricity is the end of the universe as we know it. From personal experience - when I travel to India and there is no power for significant periods of time it causes in me nowhere near the anxiety that a short power outages does in the US. I think it is all about expectations. The biggest rap against renewable energy is its intermittent nature. My guess when faced with no electricity or intermittent electricity people will figure out a way to manage.

I think one problem in the U.S ( and probably accounts for why it is the capital of doomerism) is that life has been very kind even when we have been at war. Think of German society which even under the stress of daily bombing didn't collapse into the kind of anarchism that doomers predict will happen with the end of BAU. There is a reason why human beings are the dominant species- we are adaptable.

It's all relative; India's economy wasn't built around lots of virtually uninteruptable electricity, or 20 mb/day of oil. In the US, our people may (or may not) be adaptable, but our systems, not so easily. It's our per capita consumption that makes us vulnerable; much of it required under current conditions.

I've solved much of this issue at home, but not without time, costs, and sacrificing some things we took for granted. I also threw out a lot of things and started from scratch. Parts of India also have problems related to basic sanitation, lack of refrigeration, etc., problems they know how to deal with. Tell Americans that they'll have to live like most folks in India, and see how they react. Tell your big grocery chain in the US that they won't have power for their huge refrigeration systems, or that they'll need to install backups of some sort, and see what happens to food prices...

Over half of the population in India is employed in agriculture/food production. Compare that to around 2.5% in the US..

Ghung - Wished I had save the photo: an Indian chap sitting on a stationary bike peddling away powerering a small generator from one of the wheels. Had a lap top balanced on the handle bars.

Human Power Machine for XO Laptop from OLPC Afghanistan

http://www.youtube.com/watch?v=kTHilzbuORE

OLPC Afghanistan

http://www.youtube.com/watch?v=1hctg-mDAkY

_____________________________________

http://www.youtube.com/watch?v=L5AzbDJ7KYI