Drumbeat: June 25, 2012

Posted by Leanan on June 25, 2012 - 10:07am

Oil economists predict growth until 2030

“We think that oil demand will peak by 2030 and decline thereafter,” said chief analyst at Statoil, Eirik Wærness.Statoil presented its annual forecast for global economics and energy markets - Energy Perspectives 2012, Thursday.

According to Mr Wærness, who penned the report with analyst Kyrre M Knudsen and chief economist Klaus Mohn, Statoil expects a yearly growth of around 1 million barrels a day towards the 2020s. Demand will fall slightly during that decade, before leveling off around 2030.

The three believe lower economic growth, higher efficiency and increased use of electricity and gas will be the drivers causing demand for oil to decline after 2030.

From the deepest waters of the Gulf of Mexico to the prairies of North Dakota, and many places in between, the production of oil and gas in the United States has greatly increased over recent years through the industry’s ability to access heretofore inaccessible and unaffordable "unconventional oil." Using new technology and financed by the rising prices of oil since the mid-2000s, national oil production has risen over the past four years from 4.95 million barrels a day (mb/d) to 5.7. The Energy Department projects 7 mb/d by 2020, while other experts claim production could eventually be 10 million, which would put the United States in the league with Saudi Arabia.With this increased production, a growing number of people (especially from the oil industry, Wall Street, and the Republican Party) have loudly proclaimed the end of peak oil, dismissing it as a myth that has now been dispelled. We’re not running out of oil, they insist.

But peak oil is not about the end of oil. Geologically speaking, that will never happen. Rather, peak oil is about the end of the cheap, abundant, easy to extract oil, the "sweet" crude that has been the bedrock of our industrial civilization, and the basis of the economic growth we’ve come to take for granted. This older oil still accounts for 75 percent of our daily consumption, but has been disappearing at the rate of 3-4 mb/d each year, and will be largely gone in 20 years. As older fields dry up, newer ones are not being discovered. In 20 years, cheap oil will be largely gone.

I used to worry about peak oil but not so much now. The thing that is going to get our civilization first is the 30 plus year old leverage bubble bursting. The tech bubble and and housing bubbles were just sub bubbles of the over all leverage bubble and this is nothing new. Nicole Foss explains at from about 13:00 to 19:00 in the video below.

Oil Trades Below $80 for a Third Day on Economic Outlook

Oil traded below $80 a barrel for a third day in New York amid concern that Europe’s debt crisis will curb demand for fuels.Futures slid as much as 1.2 percent as George Soros warned that a failure by European Union leaders meeting this week to produce drastic measures could spell the demise of the bloc’s shared currency. Developed economies are running into the limits of monetary policy, the Bank for International Settlements said in its annual report yesterday. Oil earlier rose as much as 1.2 percent after Tropical Storm Debby approached oil and gas installations in the Gulf of Mexico.

(CNN) -- U.S. gasoline prices have dropped by nearly 15 cents a gallon since early June as crude oil continues to fall on global economic fears, the latest Lundberg Survey reported Sunday.A gallon of regular gasoline dropped to an average of $3.48 per gallon in the continental United States. That's down 14.6 cents from the last biweekly Lundberg Survey, which canvasses about 2,500 filling stations across the Lower 48.

Oil Prices to Weaken Further, Providing ‘Stimulus’ for Consumers: Survey

Oil prices are set to soften further this week after data showed a slowdown in business activity from Europe to the U.S. and China reflecting continued deterioration in the global economy, according to CNBC's weekly survey of oil market sentiment. Middle East tensions and the U.S. hurricane season may limit the declines.

Tropical Storm Debby Weakens in Gulf Off Florida

Tropical Storm Debby weakened in the Gulf of Mexico off the Florida Panhandle after shifting away from oil- and natural gas-production areas where Anadarko Petroleum Corp., BP Plc and rivals halted output.

Gas boom set to inflame growth

AUSTRALIA'S natural gas boom threatens to set off a new round of interest rate rises, pushing economic growth above the level with which the Reserve Bank is comfortable.An analysis commissioned by the industry finds that by 2016 investment in liquefied natural gas will add 2.2 per cent to gross domestic product growth.

High Oil Prices Cut the Cost of Natural Gas

There’s an unprecedented price gap in the energy patch. Oil has traded above $100 a barrel since February, while natural gas prices have dropped below $2 per million British thermal units—from $4.85 in June of last year. A divergence like this “has never happened before,” says Duane Grubert, an energy analyst with Susquehanna Financial Group. The last time natural gas prices were this low, in 2002, oil was at $20 a barrel.In a departure from their traditional relationship, high oil prices are helping keep gas prices down. Natural gas producers are cutting production in hopes of bringing down supplies and therefore increasing prices. The industrywide gas rig count fell by 23 last week, to 624, the lowest in 10 years, according to driller Baker Hughes. Yet production keeps growing. It is projected to average 69.2 billion cubic feet per day in 2012, up from an average 66.2 billion cubic feet per day last year, according to the Energy Information Administration. And supplies keep growing. The EIA predicts natural gas in storage will reach a record 4.1 trillion cubic feet by October, compared with 2.5 trillion cubic feet now.

Saudi Aramco Said to From Venture Firm on Drilling Tech

Saudi Arabian Oil Co., the world’s largest crude exporter, is forming a venture capital company to invest in international startups developing new drilling technologies, a person with knowledge of the plan said.Saudi Aramco, as the state-owned producer is known, wants to adopt the latest techniques and expertise for boosting output at older oil fields and fracturing rocks in underground reservoirs to speed the extraction of crude, the person said, declining to be identified because the project is confidential. The investment company will start operating soon, the person said, without specifying a date or indicating how much money it would have to invest.

OPEC Could Collapse As Shale Gas Pops Peak Oil Myth

The Organization of Petroleum Exporting Countries, which in its heyday could trigger global economic crises by turning off the oil taps, faces an uncertain future as the shale oil revolution transforms the energy business.

Saudi Arabia seeks Red Sea energy resources

Despite holding the fourth-largest reserves of natural gas, Saudi Arabia is short of gas supply and Saudi Aramco has embarked on an ambitious programme to boost gas production by a third in the five years to 2015.Added production is desperately needed to maintain the drive towards industrial expansion, which is based on the petrochemicals sector and associated downstream industries. Petrochemicals rely heavily on gas as a feedstock, while a growing industrial base requires electricity to power it.

Saudi Arabia currently burns growing volumes of crude oil to feed its demand for power and natural gas is a preferable alternative. It is cleaner burning and also frees up higher-value crude for export.

Bahrain Banagas Reviewing Local Gas Prices, Alwatan Says

Bahrain’s National Gas Co., known as Banagas, is reviewing prices of natural gas sold locally to industrial companies, Alwatan newspaper said, citing chief executive officer Mohamed bin Khalifa Al Khalifa.Banagas is awaiting the results of a study it’s undertaking with an international consultancy firm to determine the new pricing structure, the Bahraini daily quoted Al Khalifa as saying.

China's Sinopec eyes shale gas assets in US

It is a good time for Chinese companies to buy into US natural gas projects given the low international natural gas prices, experts said, after media reported that the head of China's largest energy company paid a visit to the US to talk about a possible gas shale assets acquisition, Global Times reported.

Norway Oil Workers Shut Platforms as Mediation Talks Fail

Norwegian offshore workers shut two platforms after mediated talks on pensions and wages failed, curtailing output in Europe’s second-largest crude and natural gas producer.A government-led mediation was unable to bridge a divide over pensions with the labor unions, Industry Energy, Safe and Lederene, the Norwegian Oil Industry Association said today in an e-mailed statement. The talks had pushed past a midnight deadline before a strike was called.

Pertamina Workers Step Up Demonstrations at West Java Refinery

Thousands of workers at a Pertamina’s refinery in Balongan, Indramayu district in West Java rallied in protest of the Indonesian state oil and gas company’s outsourcing of labor, and general worker welfare at its facilities on Monday.The action, which was the third demonstration this week, ultimately turned chaotic when demonstrators tried to break through the gates at the refinery, according to reports from BeritaSatu.

Coal-Plant Plunge Threatens Billions in Pollution Spend

The coal-fired power industry in the U.S. is facing the biggest plunge in asset values in a decade, risking billions of dollars in pollution-control spending by utilities such as Exelon Corp. and American Electric Power Co.An indication of how much new emissions rules and cheaper natural gas have hammered the value of coal-burning generation will come when Exelon announces the results of the first big sale of U.S. coal-fired power plants in four years.

Chesapeake and rival plotted to suppress land prices

GAYLORD, MICHIGAN (Reuters) - Under the direction of CEO Aubrey McClendon, Chesapeake Energy Corp. plotted with its top competitor to suppress land prices in one of America’s most promising oil and gas plays, a Reuters investigation has found.In emails between Chesapeake and Encana Corp, Canada’s largest natural gas company, the rivals repeatedly discussed how to avoid bidding against each other in a public land auction in Michigan two years ago and in at least nine prospective deals with private land owners here.

JPMorgan Shuns Chesapeake Business That Goldman Courts

JPMorgan Chase & Co. and Goldman Sachs Group Inc. compete for banking and trading business from almost all of the world’s largest companies, with one notable exception: Chesapeake Energy Corp., the second biggest U.S. gas producer now facing a cash-flow shortage.For more than a decade, JPMorgan bankers have declined to do business with Chesapeake and its chief executive officer, Aubrey McClendon, 52, said people with knowledge of the matter. In contrast, Goldman Sachs, which once loaned money to McClendon against his wine collection, recently helped arrange a $4 billion loan for Oklahoma City-based Chesapeake and is advising on its efforts to sell assets.

Oil Stocks Biggest Losers With Valuations Lowest Since 2009

At a time of record fuel demand, bountiful oil and natural gas, and expanding economies, no stocks are doing worse in the world than energy producers from BP Plc to Hess Corp.The MSCI World Energy Index has declined 9.6 percent this year, more than any other group, according to data compiled by Bloomberg. The gauge has climbed 45 percent since equities bottomed in 2009, less than any industry with earnings tied to economic growth. In the U.S., the stocks are at the cheapest levels relative to the Standard & Poor’s 500 Index since 2009.

Is now a buying opportunity for oil stocks?

Oil and gas stocks are getting clobbered this year as the price of crude oil falls. But is this creating a huge buying opportunity for investors?

Egypt's incoming leader Morsi calls for peace, unity

CAIRO – Thousands of Egyptians on Sunday celebrated the presidential victory of the Muslim Brotherhood's Mohammed Morsi in the place where their democracy began —Tahrir Square.

Report: 33 Syrian army members defect to Turkey

(CNN) -- Syrian President Bashar al-Assad's military may have more cracks in its armor as dozens more soldiers, including a general and two colonels, have defected across the border, Turkish media reported Monday.The 33 army defectors entered Turkey and were sent to a camp in southern Hatay province, the Anadolu news agency said, citing authorities.

Syria rejects Turkey claims on downed jet

(CNN) -- Syria raised the stakes Monday in a war of words with Turkey over the shooting down of a Turkish fighter jet by Syria, an incident that threatens to draw in NATO.

EU says to implement sanctions against Iran on July 1 as planned

Brussels (Platts) - The EU's sanctions against Iran -- including a ban on oil imports and a ban on the provision of insurance for tankers shipping Iranian oil -- will come into force as planned on July 1, the EU's foreign affairs chief Catherine Ashton said Monday.In a statement ahead of talks between EU foreign ministers in Luxembourg, Ashton said there would be no review of the already agreed sanctions.

Oil imports from Iran to dry up over reinsurance

Iranian oil imports to Korea are highly likely to stop starting next month.Despite expectations that Korea would negotiate with EU officials for exemptions to some of the union’s sanctions on Iran, the attempt failed yesterday, according to sources within the Korean government.

The European Union decided to stand firm on its decision to prohibit reinsurance contracts on oil ships delivering Iranian oil starting next month.

S.Korea reports sharp fall in Iran oil imports

South Korea's May imports of Iranian crude oil fell 39.5 percent from a year earlier to 3.96 million barrels as it cuts shipments in line with a US sanctions drive, figures showed Monday.Imports from January to May dropped 15.7 percent from the same period last year, according to the preliminary figures from the state Korea National Oil Corporation.

India allows use of Iran ships for oil imports

(Reuters) - India has allowed state refiners to import Iranian oil, with Tehran arranging shipping and insurance, from July 1, keeping purchases of over 200,000 barrels per day (bpd) flowing after European sanctions hit insurance for the cargoes, government and industry sources said.

Report: Venezuela supplied Iran with F-16 to prepare for possible strike

Venezuela has transferred at least one F-16 fighter to Iran in an attempt to help it calibrate its air defenses, in preparation for a possible Israeli or U.S. strike on its nuclear facilities, Haaretz quoted Spanish newspaper ABC as reporting.ABC, one of the three largest Spanish dailies and aligned with the ruling rightist party, wrote that the transfer, in 2006, was supervised by one of Venezuelan president Hugo Chavez's closest aides. The paper's Washington correspondent, Emili J. Blasco, said the story was based on both sources in Venezuela's air force and classified documents, following a tip- off by a non-Western intelligence agency.

Agency: Iran swaps first liquid gas shipment

Azerbaijan, Baku - The first sea shipment of liquid gas from a Caspian Sea littoral state has been offloaded by Iran as part of its program for swapping petroleum products.

Libya seeks to boost crude oil production

Libya is seeking to boost its oil production by a third to two million barrels a day by year-end, surpassing last year's pre-conflict level, Libyan ambassador to Washington Ali Aujali says. How fast Libya returns to pre-war levels or surpasses them "depends also on the oil companies, how fast they are returning" to restart or expand operations, Aujali said, speaking at a Bloomberg Government breakfast in Washington on Wednesday. Beyond oil, Libya is eager for American investment in tourism, health care and education, he said.

Nigeria: Oil spills drench and sicken delta communities

WARRI, Nigeria— When he was a child, Tonye Emmanuel Isenah saw men in the Niger Delta who were 70 and even 80 years old. But these days, he said, people just don’t live that long.Isenah is now the deputy leader of the state assembly in Bayelsa State, part of Nigeria’s oil rich Niger Delta region — a land that for decades has suffered annual devastating oil spills. Experts say the yearly spills are each comparable to the Exxon Valdez spill. And the environmental degradation is causing the local people to become ill and die at earlier ages.

Ikea won’t tell where it gets its wood — and Congress is about to give it a pass

Particleboard might not be as physically off-putting as pink slime, but the source of its contents can be as hard to trace as the source of an E. coli outbreak. And while the materials in an Ikea dresser won’t make consumers physically sick, the purchaser of these products might well feel queasy. Right now, there’s no way of knowing whether or not that chest of drawers or flimsy bookshelf contains wood from old-growth or illegally logged forests — in other words, whether the product is implicated in deforestation, climate change, and drug smuggling.

Malaysia Haze Points to a Regional Problem

KUALA LUMPUR, Malaysia — For much of the year, the Petronas Towers, the world’s tallest twin buildings, are gleaming landmarks visible far from the city center here. But last weekend, the 88-story structures were shrouded in a smoky haze that prompted doctors to warn people with respiratory problems to wear masks.The haze, attributed mostly to fires burning on the Indonesian island of Sumatra, has become a recurring summer blight, engulfing parts of Malaysia, Thailand, Brunei and Singapore, and leaving a litany of health and economic costs in its wake.

Progress on the Sidelines as Rio Conference Ends

But while the summit meeting’s 283-paragraph agreement, called “The Future We Want,” lacks enforceable commitments on climate change and other global challenges, the outcome reflects big power shifts around the world. These include a new assertiveness by developing nations in international forums and the growing capacity of grass-roots organizations and corporations to mold effective environmental action without the blessing of governments.

The Battle Over Climate Science

Climate scientists routinely face death threats, hate mail, nuisance lawsuits and political attacks. How much worse can it get?

California sea levels to rise 5-plus feet this century, study says

Sea levels along the California coast are expected to rise up to 1 foot in 20 years, 2 feet by 2050 and as much as 5-1/2 feet by the end of the century, climbing slightly more than the global average and increasing the risk of flooding and storm damage, a new study says.That's because much of California is sinking, extending the reach of a sea that is warming and expanding because of climate change, according to a report by a committee of scientists released Friday by the National Research Council.

Study: Sea rise faster on East Coast than rest of globe

WASHINGTON (AP) – From Cape Hatteras, N.C., to just north of Boston, sea levels are rising much faster than they are around the globe, putting one of the world's most costly coasts in danger of flooding, government researchers report.U.S. Geological Survey scientists call the 600-mile swath a "hot spot" for climbing sea levels caused by global warming. Along the region, the Atlantic Ocean is rising at an annual rate three times to four times faster than the global average since 1990, according to the study published Sunday in the journal Nature Climate Change.

Lloyd’s Details ‘Growing Impact of Climate Change’ as UN Meets

Lloyd’s has published a roundup of the environmental issues inherent in as the world grows warmer. The recently concluded Rio +20 Conference was an attempt – 20 years after the first conference – “to try to reach agreement on sustainable growth, controlling world emissions and managing the growing impact of climate change,” Lloyd’s explained. How well the 3000+ delegates did, or didn’t, accomplish these tasks future generations will learn.Here is a summary of the environmental issues Lloyd’s selected as the most significant ones threatening the planet:

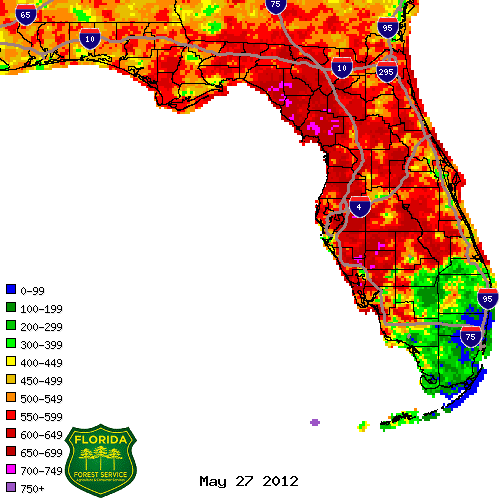

Re: Tropical Storm Debby Weakens in Gulf Off Florida

This morning's projected path suggests that Debby won't come ashore until Friday. In the mean time, the result will be lots of rain with 10-15 inches expected and up to 25 inches in isolated areas. Who needs sea level rise when that much rain falls from the sky? Add to that will be the storm surge over a large area of northwestern Florida. It's interesting that the Bloomberg story understates the amount of rain projected by the National Hurricane Center. Nothing to worry about, move along...

E. Swanson

At least it'll help with the drought zones in the area. Lots of watermelons, soy, cotton, etc. grown there.

Replenish the resivoirs yes it will help. But if the farmers are like he ones here on the plains that much rain coupled with maybe some hail, that simply destroys crops.

Go short on Florida crops?

The 11 AM EDT projected path from the NHC now shows a turn toward the East-northeast, heading toward the Atlantic (eventually). They still think Debby won't make landfall until Thursday. Your experience may differ...

E. Swanson

Reporting from central Florida. All I can say is that we've gotten a TON of rain in the last few days. Honestly, though, in Florida you don't even take notice unless it's at least a category 3. Severe thunderstorms are an every-day part of life down here.

I dunno, looks like this might be an extreme event even for Florida.

Over here on the Space Coast, I have yet to receive 1 inch from Debbie.

What a difference a month makes.

For Australian readers

25/6/2012

10 Mouse clicks to calculate Australian crude oil depletion of 83 %

http://crudeoilpeak.info/10-mouse-clicks-to-calculate-australian-crude-o...

Petrol hit a many-month low of $1.20 per litre in Melbourne today ... happy motoring is here again!

Regarding Bubbles and the Collapse, above: While this video is over a year old (posted April 2011), it's value remains as it describes the process of slow deterioration of the systems that massive amounts of fossil fuels have enabled. All of the bubbles we've seen to date have formed atop a wave of oil, and will burst as the wave breaks.

Too bad Ron Beasley couldn't get Stoneleigh's name right :-/

Typo - fixed

This story from up top, tells me more than anything about Saudi reserves..

http://www.thenational.ae/thenationalconversation/industry-insights/ener...

If you really had 267b bbls and were producing only 3.65b/yr (10m/d) then why would you not wait for 20-30 years until technologies for viewing what's down there were better?

To me they are getting desperate, to explore there, especially when there are claimed to be so many desert areas not yet explored.

Greed?

The late "Buzz" Ivanhoe in one of his Hubbert Center Newsletters gave the number of oil fields in the US in 1989 at 31,385. Rest of the world combined? 9,779. Given this imbalance I don't find it surprising that the Saudis might be interested in doing a bit of wildcatting on the rest of their territory.

http://hubbert.mines.edu/news/Ivanhoe_02-4.pdf

That imbalance, quite obviously, no longer exists. If the US is the most oil surveyed nation in the world, Saudi Arabia is likely a close second. They are now looking for oil in what would one of the most expensive places in the world to produce oil:

Aramco boosts drilling in seismically tough Red Sea

And it looks like just looking for oil in such a place can be quite expensive also. From the link up top that Hide Away referred to:

To drill a lot of dry holes, and keep drilling in such a place has a ring of desperation to it.

Ron P.

Well, I don't know about rankings of nations by surveying; couldn't even tell you which state leads in the US. I had another link to a source showing which nation had the most wells, but neglected to write it down. Ivanhoe also provided a breakdown of field sizes by continent and major nations in this newsletter, if you're interested. He has US/Russia/Canada for field population. KSA has no doubt been surveyed a great deal, but a lot of it is basement rock that isn't worth looking at.

The exploration is bread-and-butter deepwater, according to this item from early last year: Saudi Aramco to invest $25 billion in Red Sea oil and gas | 2B1stconsulting. About 4 times their onshore costs, but not as expensive as UDW or unconventional. They're employing contractors who have worked in these more challenging environments, of course. Also there's a ref to shallow water work; not sure if that's going on in the Red Sea as well as in the Arabian Sea or Persian Gulf.

Bear in mind that companies were wildcatting on the North Slope in the 1960s, when the price per barrel had been stuck at ca. $2 for decades and oil was turning up under every other rock; discoveries hadn't peaked. That certainly wasn't fueled by any sort of mad scramble for production at all costs.

"The unique “Landowner mineral rights” is the reason why the U.S./48 is the most thoroughly drilled nation in the world, with 3X the number of oil fields (1989=31,385) as in all the rest of the world combined (1989=9,779)."

The term "Fields" here is intresting. Could one of our resident experts speak to the term and why it seems how the U.S. defines a field or survey and the rest of the world uses the definition may be the reason for the huge imbalance. Does the number of fields really matter or is it the total quality and quantity in the field?

Nothing wrong with Saudis or anyone else doing a little exploration, just think the imbalance number may be a bit deceiving.

Badger – I can’t tell you how “fields” are defined in other countries but in the US it’s fairly simple. If an oil/NG reservoir is penetrated by a well and doesn’t fall within the relatively tight geographic boundary of an existing field it will be named as a new field. How tight is tight? Maybe less than 1,000’ away.

Regardless of the methodology counting fields is of zero relevance IMHO. A single field in Texas may have produced 300 million bbls of oil from 400 wells. Another field produced 20,000 bo from one well. Both fields would count as one in that stat. In the 80’s I made 21 new field discoveries. But 20 of those new fields consisted of a single NG well that produced very modest amount of value. Last year I drilled a 17,000' well in SW Louisian for $9 milion. Found one reservoir and gave it a new field name. That one well will drain all the NG. It is and always will be a one-well field, I could also list many dozens of individual oil fields in Texas and Louisiana that never recovered enough reserves to pay back the development costs. Yes: there are many “fields” in the US that produced so little oil they lost money.

The critical difference re: field count between the US and other countries is the combination of privately owner mineral rights and the small independent operators in the US. I suspect the number has fallen but the last time I saw the stat the Saudis were averaging about 5,000 bopd per well. The average oil well in the US is doing less than 10 bopd. That stat along should indicate the futility of using field count as an indication of anything IMHO. There are thousands of oil fields in the US that the Saudis would never have developed. And many more still producing that the NOC’s would have abandoned long ago that small US companies are still producing today. I can point to one trend in Texas where the average well is producing less tha 5 bopd with 98%+ of the production being water. And those operators are making a very sweet profit even with the recently fallen oil price. I know a very nice husband and wife who are making over $400,000/year from their little wells averaging less than 1 bopd. It's all about sweat equity. The sweat is all theirs as is all the profit.

The term "field" is somewhat ambiguous. According to the Schlumberger Oilfield Dictionary a field is:

and an oil field is:

Each government regulatory agency will have a more exact definition, and it vary somewhat from agency to agency.

Oil fields vary drastically in size, and the main reason the US has so many more fields than other countries is that it has drilled so many more wells than other countries. The vast majority of oil fields are very small, and the US has found an awful lot of them, but the majority of the world's oil is contained a few big oil fields, most of which are in the Middle East.

Rocky – “Typically, the term implies an economic size.” And typically Blue gets it right. But this time Texas messes them up. When a new field is discovered one must give it a name acceptable to the TRRC before you allowed to produce the well. The TRRC requires no proof of profitability. How bad can this go? Two years ago drilled a new field discovery. Filed the paper work with the TRRC along with the new field name. Unfortunately the well pressure depleted in 37 days. Didn’t make enough to pay for the cement let alone the entire well. Yet for ever and ever this will be a field on the books. And it will add the same in the field count stats just like the great East Texas multi-billion bbl field.

I could have padded my resume back in the 80’s by pointing out the 22 new fields I discovered in less than 3 years. But I would make the point that 21 of those discoveries were one-well fields. Wouldn’t have been a lie to not qualify that effort. Just dishonorable. But the really fun part: I got to make up a lot of field names. Named them after my dog, my engineer and two girl friends at the time. And one to tease an ornery land owner: had a big blue sign hanging on his gate for all the neighbors (who disliked him more than me) to laugh at. Fluffy Field. Ass Hole Field would have been funnier but the TRRC does have its standards. LOL.

Oh...just remembered a story. Was told the Piceance Basin in the Rockies was originally named the Piss Ant Basin by the surveyors. But the USGS cleaned it up. Was also told piceance was the French name for the piss ant. Never have checked that out.

I don't think you would be able to name an oil field after your dog in Alberta, and I don't think they like one-well oil fields either. Most likely the government would tell you what to call your field. Typically it's based on the name of the nearest town or geographical feature.

BTW, Piceance originates from the Ute Indians. It means "land of tall grass."

Rocky - "I don't think you would be able to name an oil field after your dog in Alberta". Of course not...what else would you expect from a bunch of socialistic commies who take every opportunity to crush an individual's rights. There is a good reason the Texas flag has only one star in it, ya know. I still find comfort when I think of Missy Field and my long gone little mutt. The long gone girl friends...not so much. At least it's better than having their names tattooed on my butt.

Grass lands, eh? Na...I stick with the misinformation I was given...makes for a better story.

Re: OPEC Could Collapse As Shale Gas Pops Peak Oil Myth

Given the strong implication that the heyday of OPEC, according to the article, is over, are we to assume that they mean that OPEC turning off the taps in the present would not trigger an economical crisis at the same or larger scope than that of the oil crises of past? Or, to use a more extreme example, Saudi Arabia falling into civil war would only be a blip on the radar? Saudi Arabia is part of OPEC, right?

???

The article is buggered right from the title: ..."Shale Gas Pops Peak Oil Myth"??,,, goes on to talk about shale oil. Then there's this:

The article also touts our "100 year supply" of natural gas. Really?

Shale Gas Reality Begins to Dawn

At some point, I predict we'll find that even bullsh@t is virtually finite. That's when the real fun starts...

Apart from the universe and human stupidity, only bullsh*t is infinite. And I'm not sure about the universe...

-Einstein.

And I am pretty sure he was wrong about the Universe.

Tepco ex-executives get golden parachute

Good to see Japan is following the America's lead. At Mr Shimizu's level, the consequences for epic failure are... public bailouts followed by an even better job!

Wow, Mother Nature is beating the heck out of Peak Oil. Corn prices up over 7% today while oil prices are down over 1%. The correlation is broken -- wish I had time to graph this. Ethanol was being killed off already so this current weather pattern is going to really put a dent in production.

Corn prices set 4-month high as crop outlook dims

I don't think the correlation is broken at all. You have to take the average of *what the ethanol plant actually paid* over about 2 years for both corn and natural gas, and then what they get paid for DDGs to know if the correlation is broken. Let's also not forget electricity as an input as well... most of the ethanol plants have really good deals on electricity from excess capacity from coal plants and wind turbines holding the price down.

And to figure out what they ethanol plant paid per bushel, you probably have to look in their annual report. They are hedged to beat hell, and the only people getting beat up are the commodity speculators. The ethanol plants probably locked in supply contracts when corn was $5.20/bushel, and now whomever took the other side of that trade is the one getting beat up. I'm going to bet the other side is food processors and feedlots, and they will just push the price on to the consumer.

Ethanol plants " are hedged to beat hell"

How about elaborating on this? The grain trade business is not one where you know exactly where your commodity will be coming from, due to weather, pests, or maybe financial constaints of local growers. The couple farmers I know that grow and sell wheat, corn and soybeans never sell the crop until the growing seasson is well along or maybe even not until after harvesting.

Should the grain elevators not be able to supply the contract, who makes up the loss?

I don't understand how hedging can work well with grains. Maybe you can explain better. I think ethanol plants are more at the mercy of periodic price changes than you portray.

The grain trade business more or less invented hedging long ago for the exact reasons you cited. There is too much risk involved in growing, selling, buying, and milling grain, so they invented all kinds of financial instruments to hedge the risks.

The oil industry has similar problems, so once the agricultural industry developed the concepts, the oil industry adopted them and used them to hedge the risks in oil trading.

Based on the ethanol plants that I have dealt with my guess is that you are overstating the amount of hedging that they do- specially with respect to the duration of the hedges. For many of the operators the cashflow associated with margin on futures (if prices should fall) is more than they can handle.

Plus by definition -hedging implies that they have a fixed price ethanol sales contract on the other side. If they didn't they would be speculating not hedging. If so those fixed price contracts could have been entered into at any time. I don't think the gas blenders have a better crystal ball than anybody else to have picked the bottom of the corn market.

The price of oil and corn became correlated as ethanol refinery capacity grew which means the price of corn was driven by the price of oil. What you are discussing has nothing to do with commodity price relationships but pertains to ethanol profitability. Ethanol is not currently profitable.

Corn Price Increases Tell a Story About Why Commodity Prices Are Rising

ethanol margins

the 2007 Renewable fuels Standard already requires gasoline blenders to use renewable fuels equal 9.23% of their gasoline sales. This is almost right up against the blend wall of 10%. Consequently, at this point conventional gasoline prices have very little impact on the price of ethanol either way- if gasoline prices fell blenders would still be required to purchase minimum ethanol volumes and if they rose there is not a lot more that they could purchase given the blend wall. Whether the EPA allows E15 or not I don't believe it will make a lot of difference in the short term since I think there will be great consumer resistance to purchase E15 for conventional engines given all the stories about it damaging engines.

The impact of oil prices on ethanol demand could be more pronounced overseas where they are not running into the problem of the blend wall.

Corn prices extend rally as yield hopes tumble

Rising prices ignite Sudan street protests

Last Pinta giant tortoise Lonesome George dies

Really sad...one more species lost.

Yes, it is very sad. Nice gallery of a fascinating and magnificent creature.

"The last word in ignorance is the man who says of an animal or plant, 'What good is it?' If the land mechanism as a whole is good, then every part is good, whether we understand it or not. If the biota, in the course of aeons, has built something we like but do not understand, then who but a fool would discard seemingly useless parts? To keep every cog and wheel is the first precaution of intelligent tinkering." - Aldo Leopold

Regarding the talk about the oil spills in the Nigerian delta: How much of those leaks are caused by people cutting up holes in the pipes to steal the oil? I can't imagine such a thing could go un, without heavy spillage.

Nigeria Leads in Crude Oil Theft - Jonathan

Goodluck with that :-0

New Report: 80% renewables in US by 2050 (with addtional cost at 25 - 50/MWh above projected future costs of conventional generation)

NREL has a new report that may interest some on the site. At 850 pages, it's a bit of a slog, but looks at technical feasibility for high renewables in the US given current technology availability and limits. It's titled: "Renewable Electricity Futures Study" (4 volumes).

http://www.nrel.gov/analysis/re_futures/

MIT Tech Review has a summary of report, "The U.S. Could Run on 80-Percent Renewable Electricity by 2050." Looking mainly from a standpoint of technological feasibility (and current technology), NREL concludes US could receive 50% of it's electricity from solar and wind (intermittent renewables), and the remaining (up to 80% renewables) from biomass, hydroelectric, and conventional geothermal by 2050 (non-intermittent renewables). In addition, they estimate total cost for 80% portfolio target would add about 2.5 to 5 cents "per kilowatt hour on top of what electricity prices would have been using conventional power production." One of the more import concerns in the report is the integration and management of intermittent energy sources (50% from solar and wind). They estimate this can be done reliably with a diversity of combined approaches: storage up to 10% of generating capacity, geographically distributed resources (which are varied in the US), T&D investment, smart-grid communications, flexible conventional generation, changes in power system operations, and demand-response.

Perhaps it's worth adding that other recent studies are also being modeled and proposed along the same lines, looking at technological feasibility, costs, policy, and R&D opportunities for a high renewables generation mix (with emphasis on new strategic opportunities, change in public attitudes, declining future costs, and policy reform as major factors in bringing about change in conventional generation, subsidy, and pollution outcomes).

http://dx.doi.org/10.1126/science.1208365

http://dx.doi.org/10.1016/j.enpol.2012.03.011

http://www.technologyreview.com/featured-story/428145/the-great-german-e...

NREL has a handy interactive graphic highlighting possible breakdown for resource and technology mix to 2050.

http://rpm.nrel.gov/refhighre/expansion/expansion.html

From Apendix A: Cost, Environmental, and Social Implications of High-Penetration...

Or you may prefer Kunstler's version (referring to last weekend's Aspen Environment Forum):

Or how about a simplified take on both of the above, "Eat, drink, and be merry, my friends, for tomorrow we die."

To me the message of the above report is the exact opposite of "for tomorrow we die".

If the report had said that a renewable replacement for fossil-generated electricity was technically or financially impractical, then given what we know about the eventual exhaustion of finite fossil fuels "tomorrow we die" would have been reasonable summary

To the contrary, this report (which I posted a link to yesterday), says that very high renewables percentages are technically and financially practical. Contrary to Ghung's quote from Kunstler "There is not even a dim apprehension that many of the aforementioned vexations originate in technology itself, and its blowbacks", the section that Ghung chooses to quote from is titled " Cost, Environmental, and Social Implications of High-Penetration" and that section is explicitly about the impacts of renewable technologies.

Any reasonable person knows that renewables will have many impacts, but the relevant question is how those impacts compare with other options (oil sands, fracking, coal-burning, wood harvesting, etc.) because those environmentally devastating processes are in full swing today.

Along the lines of report above the following link indicates that increasing wind turbine size dramatically reduces environmental impact per kWh. Makes sense since swept area increases as the square of radius, so power output grows much faster as turbine size grows than material consumption in towers and blades).

http://pubs.acs.org/doi/abs/10.1021/es204108n?journalCode=esthag

"...that section is explicitly about the impacts of renewable technologies."

Which is why I countered. The impacts of the technologies cannot be divorced from the immense amount of capital, resources, and environmental costs involved in implementing them,, and diverting current wasteful, discretionary uses of these resources will be necessary and difficult, especially in our current political environment. As one who has personally adopted and promoted renewables for many years, I'm also trying to be a realist.

The additional cost of new generation is marginal (it's merely the excess cost above replacement cost). We replace all our generation sources every 40 to 60 years. NREL projects BAU costs for electricity in the range of 10 cents/kWh. The high cost with 80% renewables is 15 cents/kWh. Does this really signal to you that all hope is lost, and the sky is falling?

"Does this really signal to you that all hope is lost, and the sky is falling?"

Throw in a little global warming; sea level rise; increasing population of a clueless, disconnected species; growth and waste based BAU; credit/debt implosions; peaking oil and numerous other resources, depleted environment-fresh water-soil-oceans; social divisions/unrest;;; all essentially concurrent, well, sort of. I'll leave out asteroids, super volcanoes, and and CMEs. We're busy enough rotting in our own wastes. Beyond that, I'm pretty much an optimist.

I have little hope for hyper-complex, top-down solutions. Keepin' it local. That said, I admire your stance. Go for it.

"Beyond that, I'm pretty much an optimist".

Nearly ruined a good keyboard with tea, there ;) Likewise. I think the only solutions, if they can be called solutions, are local.

Q: "NREL projects BAU costs for electricity in the range of 10 cents/kWh. The high cost with 80% renewables is 15 cents/kWh. Does this really signal to you that all hope is lost, and the sky is falling?"

A: "Throw in a little global warming; sea level rise; increasing population of a clueless, disconnected species; growth and waste based BAU; credit/debt implosions; peaking oil and numerous other resources, depleted environment-fresh water-soil-oceans; social divisions/unrest;;; all essentially concurrent, well, sort of. I'll leave out asteroids, super volcanoes, and and CMEs."

Now That's a straw-man argument!

But, it turns out that at the beginning of that whole conversation is another straw-man in that its presence implied that it has something to do with the report: "It's a very odd mix of hard-headed science and the most dismaying sort of crypto-religious faith in happy endings...". Those words are taken from a description of an unrelated live event:

Clusterf**k Nation

Rocky Mountain High

http://kunstler.com/blog/2012/06/rocky-mountain-high.html

"The techno-narcissism flowed like a melted Slurpee this torrid weekend at the annual Aspen Environment Forum where scores of scientists, media figures, authors, professors, and policy wonks convened to settle the world's hash..."

Here's another: "The whole report pretty much ignores Agriculture, Mining and Heavy Transport because they are outside the electricity high users. Ignoring them makes the whole report useless, yet it is worse than that."

The Oil Drum | Drumbeat: June 22, 2012

http://www.theoildrum.com/node/9277/901543

The Oil Drum | Drumbeat: June 16, 2012

http://www.theoildrum.com/node/9268/900458

The report is about electricity. Agriculture, mining, and heavy transport are outside the intent of the report.

Just composting all the straw-men presented here directly into fertilizer and gas would make for a brighter energy future!

The prompt appearance of so many authoritative-sounding dismissals backed by -zero- technical references is a flag.

The report seems to tweek the pro-nuclear and anti-cornucopian camps.

Here is another conversation:

http://www.reddit.com/r/science/comments/v6pqo/dept_of_energy_finds_rene...

http://www.democraticunderground.com/112718362

Kalimanku,

You have to be kidding. We are at or very near peak oil, yet the assumptions in this report expect many of the renewables to get cheaper or remain the same in cost. I have exposed several of the assumptions in the report that are clearly incorrect, yet you keep saying it is a straw man argument.

As we go down the backslope of peak oil, costs are going to rise. If you have the same demand, yet a limited supply then price will rise. With oil the only way price will not rise on the downslope after the peak is if economies are collapsing. Even in a cornucopian world you need to factor in the reality of rising prices, for mining and heavy transport as they are needed to build the renewables in the first place. Agriculture is also vitally important as there is likely to be a disproportionate amount of liquid fuels allocated there in the future.

The report also uses assumptions of 2.5% GDP growth and 0.9% population growth, yet instead of using actual electricity consumption growth over the last 20 years, chooses to use a different number that works better, an EIA projection (showing much reduced electricity growth).

Please take a closer look at the numbers in the assumptions and compare them to the reality of what is actually happening.

"We are at or very near peak oil"

What is the time-frame? Consider that economic vigor and oil price/demand modulate each-other into an endless undulating plateau within which final discoveries and process changes occur.

"expect many of the renewables to get cheaper"

What has the trend been?

This would probably be a good time to set about installing the first wave of renewable energy sources.

What the report seems to offer is that there is enough sunshine and wind available within every locally interconnected patch of surface to supply some good part of the energy that might be used there. This is what anyone who has played with living with solar panels soon finds out. Wind takes it to a whole new level. Present-day common wind-turbines do not scale down to household size while maintaining any real efficiency: They are best mounted high and being large... so they would serve larger areas. This strongly invokes the connectivity, the power grid, and storage requirements if the turbine output is taken directly as electricity.

Beyond that is, yes, an invitation to endless guessing.

"The report also uses assumptions of 2.5% GDP growth and 0.9% population growth"

Well, why stop there? In keeping with the theme of trying to embed the report within speculations about a larger system analysis over a period of four decades, the more likely specter of world-wide economic chaos and inevitable wars and population devastating plagues, crop failures, and famine of the next warming half century could be invoked.

What is to be gained by dismissing the report?

What is to be gained by accepting the report?

The report is issued so that everything seems OK. Current BAU can continue without any problems to current politicians.

Please read between the lines of why these types of reports are commisioned in the first place.

O.K., I'll go first, then...

Reading the report undermines the meme that renewables are a myth.

< Rant >

Everything is OK. The banks are much better off than before... and bigger, too! The well-to-do are doing well. Current BAU can continue without any problems to current corporations and their little sock-puppets: Everyone else comprises an absolutely digestible, interchangeable, and disposable pool of labor and consumption. Like Vanderbilt said "The public be d*mned!". Their welfare matters only ultimately in their active numbers contributing to the scale of returns.

< End of Rant >

I do not believe that there is going to be a mass migration away from the technologically enabled state of human existence until that state is no longer enabled or no longer necessary. Technology enables novel levels of population density and is necessary to their maintenance. When the yield from that technology fades, the population declines until it can be maintained without it. The technology of selectively breed corn and hand-dug extensive irrigation systems enabled and maintained dense populations in the past. To walk away into the jungle from such a system en-mass is to die. The simple cornucopian idea might have been anhydrous ammonia fertilizer. Today, it can be made from wind, water, and air. What use would denying mention of such, if then accomplished, technology serve?

I've got no idea what your real question is here, but I will attempt an answer of the following..

I agree. The numbers shown on this site, especially from people like Westexas with the ELM, show that current "technologically enabled state of human existence" will not be possible due to energy constraints.

The simple fact is that renewables require a lot of energy to build in the first place, a simple fact that is often overlooked. To ramp up renewables magnitudes of order higher than present forces increases in production of glass, aluminium, concrete, steel, silver, copper, tellerium, lithium, etc. To vastly increase the supply of these raw materials, requires a vast increase in the energy used in there creation.

EVERY study on renewables overlooks this simple catch 22 and focuses on current price trend instead. There is a vast difference between using 6% of a worlds output of a resource pa and 120% of the worlds output pa, yet everything in the 'renewable future', from cornucopian sources, would have us believe there is no difference.(silver for PV BTW with a 20X increase in production, but still not enough).

You have overlooked several of us informing you there are ways around your perceived problems: using less material per panel, substitutions, concentrated PV and increased efficiency. Your assumption that PV manufacturing will not adapt creates a flawed projection. If peak oil continues to create a recessionary global economy, then expect electricity demand to decrease as well as demand for glass. Fewer homes built and fewer cars manufactured means less glass needed for those uses.

Remember Dolores Garcia's version of the Limits to Growth model, New World Model – EROEI issues August 24, 2009. The scenario with the best outcome was a concerted effort to deploy renewable energy now. In her model a renewable energy build-out did not fizzle from resource constraints. Rather civilization starts having problems next century due to loss of arable land.

I keep hearing things like 'substitution' except I dont see these coming onto the market. In regard to silver..

from here..

http://www.firstmajestic.com/s/SilverUses.asp

What you are forgetting to add is that investment dollars will also dry up, plus the ability of people and corporations to pay for renewables.

The concept of renewables only work during periods of healthy economies and global growth, providing the funding to make it happen. The catch 22 is that this type of world is one of increasing materials and energy use, to the point that we will always be chasing our tails.

The concept of renewables only work during periods of healthy economies and global growth, providing the funding to make it happen. The catch 22 is that this type of world is one of increasing materials and energy use, to the point that we will always be chasing our tails.

And yet, the system up until the widespread use of oil was all based on renewables.

Eric,

'The system' used a bit of coal before oil during the industrial revolution and I would not call that a renewable.

The population prior to the IR was an order of magnitude less than today. Using the same type of renewables with todays population would lead to decimation of the natural world in a very short period of time, then collapse.

We are talking about todays renewables, PV and giant concrete and steel wind turbines producing electricity, but you knew that.

Yes, substitutes are coming into the market. The "there is no substitute for silver" meme is being pumped by the silver industry.

NAOM

I think it has also been picked-up by the desperate pro-nuclear and fossil-fuel bobble-heads. Another one is that there is a shortage of the ability to make glass... even though there is no shortage of glass being installed or planned. Also offered is an inability to make the metal and concrete for wind turbines! This one seems particularly strained, since there is never a projected shortage of concrete and steel to build fleets of nuclear reactors.

KalimankuDenku,

You have this totally wrong. There is no shortage of these materials, nor has anyone claimed there is one. What I have continually stated is that there needs to be a massive increase in production of them, which of course will take a massive increase in energy use to do so. Yet all the proclaimers of renewables talk about using LESS energy in the future.

It doesn't work having a society using less energy while trying to vastly increase the production of a whole range of base materials. A question I often ask, is who misses out on their energy use to make renewables possible?

BTW, I do not like being linked in with pro-nuclear. I am very much against it because there is no way to keep it safe as Fukushima proved. Plus there is no possibility of keeping reactors safe in a shooting war.

Sorry for confusing you with pro-nuclear, Hide_away. I apologize and hope you will accept my apology.

Yes, it will take energy to make the infrastructure that gathers renewable energies. There are immense energies flowing through the existing system.

Really, the question still stands. What is the vision that drives your responses? So far, the only revelations have been when some part of it gets stepped-on or poked at... a sort of puzzle in a box. What is this model of the future and the path to it?

No problems.

The way society is going is a race to the edge of the cliff then freefall, I cannot see it happening any other way. The current economic system relies on growth, or it collapses. Every time I look at the numbers in detail, instead of just glossing over the headlines of 'good news', I see us running into resource constraints, especially oil in the near term.

Civilizations have collapsed in the past and I see plenty of evidence ours will go the same way. I also believe that because of modern technology and complexity our current civilization can collapse much faster than previous examples. If food does not get to the cities, how far off is anarchy?

My responses are an attempt to draw out some shred of hope that can be backed up by real numbers of what is happening, not a wish list. We have had 40 years for preparation of resource constraints, yet mannaged to squander that time, now we have a few years if we are lucky, yet our economies are completely unprepared. Egypt and Greece are the canaries, there is no money for investment in anything there. The environment is likely to suffer a huge assault as the population there grabs whatever wood they need for cooking and heating, and everything that can possibly be eaten is.

Everyone expects answers, sometimes problems have no solutions.

OK...

Within that context, one can make the observation that the world is not uniform. The future is like a contest. Some groups will have made better moves than others... while also benefiting from a better setting. It is not a single unbroken expanse of yeast.

From the report...

NAOM, what type of panels are you talking about? How much are they? What is the life span, efficiency etc?

Google is your friend ;) {winking smiley} You can find plenty about it in just a few minutes as I did.

:) {smiley}

NAOM

Q: "What is to be gained by dismissing the report?"

A: "What is to be gained by accepting the report?... I've got no idea what your real question is here"

So, the question still stands:

What is to be gained by dismissing the report?

The essay that begins "The simple fact is that renewables require a lot of energy to build..." implies savings.

Two wars fought on credit and a gambling debt assumed from the financial industry contravene the very concept of savings. It would be better to invest in hard assets. I fully understand that there is a difference in these forms of capital. I also understand that in the end-game of a civilization, the remaining capital is gambled away:

1) The founders of a civilization invest.

2) The next generations live on the return from that investment.

3) The following ones consume the capital itself.

4) The last gamble away what's left.

In America, the founders wiped-away the indigenous peoples and made roads, distribution, factories, mines, logging operations, fisheries, and farms.

The next generations ran those and lived on the returns. The trees and fish and soil became money.

The following ones pocketed money by letting the infrastructure decay and selling the factories.

The concepts of savings and investment are both out of step at this point. Investment at least sequesters some capital away from the high-level looters.

It isn't putting up strawmen to attempt to consider the environment in which a proposed process must occur.

"The report is about electricity. Agriculture, mining, and heavy transport are outside the intent of the report."

...but will absolutely affect it's implementation, as will the other things I mentioned. I agree that, like many things we've done, it is presented as a noble cause (one I could easily embrace), like so many other noble causes we've embarked upon. Yet here we are... in a huge mess of our own making. The first rule of RE, one I consider scalable: REDUCE THY CONSUMPTION.

This all applies equally well to making chocolate shakes in thirty years.

Absolutely. If chocolate shakes are important enough, I'll beat and flog any proposal to make them in 30 years and see what it's weaknesses are. That's what the anti-chocolate-shake folks are going to do. Too bad someone didn't put the Solyndra thing through this process before so much damage was done (and so many dollars pissed away).

BTW: I wouldn't count on consuming too many chocolate shakes in thirty years.

I think that a large part of the failure of Solyndra was the economic downturn and the problems with the financial system after 2007. Not to mention the fact that China went into PV production in a big way about the same time and undercut prices. Solyndra wasn't the only US based solar company to go out of business, for example, there was also Evergreen Solar, which pioneered a way to make low cost PV cells. They had just finished a new plant in Massachusetts with considerable support from local government, but still hit the wall because of financial problems. Then too, the Europeans, especially Germany, cut their solar subsidies, which had been a great stimulus for the entire PV industry. I'm

wouldn't benot surprised to hear that Evergreen's new plant was bought at auction by some Chinese company.In other words, it probably doesn't matter what the technical merits of the chocolate-shake debate are, if the economic and political side of the discussion turns against chocolate-shake consumption because of problems with too much obesity (or what ever)...

E. Swanson

After reading this Wikipedia page on Solyndra I think Eric is largely right, However, I think that a large part of the failure of Solyndra was that it was a dumb idea. I distinctly remember being at InterSolar 2011 in San Francisco last year and seeing what IIRC was Solyndra displaying their product, a cylindrical PV cell that could capture light from all directions in a given plane. Again IIRC the idea was to capture light reflected from behind and the side of the modules. I remember thinking to myself, "What a dumb idea. Increase complexity of manufacturing to solve a problem that does not exist".

As far as I know, existing modules do an excellent job of generating electricity from sunlight falling on their surfaces and little to no light passes through them so, there is usually no light reflecting from behind them. In addition, the solar PV installation course I had done a year before, spent a good deal of time outlining how to create conditions for the best exposure to sunlight, for as long as possible during the day. As far as I'm concerned the Solyndra idea was as way to waste good PV material going after marginal light. Much better to just lay the darned things flat and point them as close to directly at the sun as possible! If I could have a few words with whoever thought it was a good idea to support Solyndra with government money, I'm pretty sure I could make them feel rather silly.

Alan from the islands

There were a couple of potentially good points about the tubes. One was that their system was supposedly lighter, and that might mean that flat roofs with marginal load bearing capacity could host their solution whereas tradition panels were alleged to be too heavy. The second was that the curve of power versus time of day is flatter with the solyndra system versus flat panels. The real kicker would (maybe maybe maybe) have been if the cyllinders allowed cheaper construction, by piggy backing on the florescent tube industry. But, even given those gee wizzes, I still that it was an odd idea -nit worthy of throwing so many eggs at.

It never seemed like a great idea to me but I don't think the shape killed them, it was the fact that silicon prices dropped like a rock. The thin-film revolution didn't quite happen because silicon-based PV suddenly dropped heavily.

Ice cream of the future, now!

http://www.youtube.com/watch?v=ApWALFBqHL8

Too bad someone didn't put the Solyndra thing through this process before so much damage was done (and so many dollars p*ssed away).

Solyndra, 500 million dollars

http://en.wikipedia.org/wiki/Solyndra

Hobbit movie, 500 million dollars

http://gotchamovies.com/news/the-hobbit-budget-tops-500-million-most-exp...

http://en.wikipedia.org/wiki/List_of_most_expensive_films

F-35, priceless

http://en.wikipedia.org/wiki/Lockheed_Martin_F-35_Lightning_II

The noise machine is really really hard to talk over. Elsewhere around here, there is much reflected noise about how renewables are bankrupting Ontario.

I had posted this a few weeks back

The Jet That Ate the Pentagon

Just astonishing

But we need a hyper-sonic stealth jet plane because terrorists in caves can easily knock down F-16s. ;-)

unfortunately I do not think that this story is going to go away/get a lot better.

unfortunately almost all people and their elected representatives do not hold the DoD's feet to the fire to show requirements traceability to fundamental first-case desired effects. For those who might log on and cry foul and say 'yes they do'...I got news for ya, they do not do it well at all...if one looks clear to the left of the acquisition chart/process the first fundamental flubs are in what used to be called the capabilities-based (gaps) analysis and the functional need analyses. To many golden calf unchallengeable fundamental assumptions.

I wonder what will be done about the sequester?

The military contractors are not stupid. They make sure that component makers are spread out into almost every district of every state. That way every Congressman can proclaim to be protecting jobs when the keep an expensive weapon system that we don't need.

Peak Military bang-for-the buck.

Inflation in the 'military economy' is rampant.

Of course the first question is what and how much of 'it' do we need...to produce what desired effects?

A workmate told me yesterday that the first Gerald Ford-class carrier (the Ford) is estimated as requirement some $14 to initially field...cost of air wing and 50-year O&M extra.

The Ford class is slated to replace the Nimitz-class...all ten of them...The one-of-a-kind Enterprise will also retire by 2015 or earlier (nuclear carrier #11).

I think the great steaming MIC dinosaur is starting to collapse under its own weight.

I've only had a chance to skim the report so far, but some of the assumptions, particularly for the Eastern Interconnect portion of the US grid, strike me as unreasonable. Perhaps after I've had a chance to dig into it in more detail I'll feel differently.

Here is what I wrote the other day in a drumbeat about this report...

It looks like my initial assesment of this report being waved around as evidence is already coming true. The assumptions are garbage and do not reflect reality.

Read the section on storage for a real laugh, if you can laugh at a report whose conclusions are in no way supported by the evidence offered.

They have 'shown' that the objectives can be achieved, if you close your eyes and wish really hard, and simply assume that all the difficult bits will be magiced away by the God of 'technological progress'

So far:

"The claims are grandiose, but the document fails to back them up."

"...conclusions are in no way supported by the evidence offered."

"...They do a nice headline though."

http://www.theoildrum.com/node/9277/901543

http://www.theoildrum.com/node/9268/900458

"Read the section on storage for a real laugh"

O.K.

http://www.nrel.gov/docs/fy12osti/52409-2.pdf

Here's part of the introduction:

Energy storage is used in electric grids in the United States and worldwide. It is dominated by pumped-storage hydropower (PSH), with about 20 GW deployed in the United States and more than 127 GW deployed worldwide (EIA 2008; Ingram 2010). In the United States, PSH was built largely in response to market conditions in the 1970s, including high oil and natural gas prices, regulatory restrictions on plants burning oil and gas, dependence on low-efficiency steam plants for peaking power, and anticipated “build-out” of a largely inflexible nuclear fleet (Denholm et al. 2010). In addition to PSH, a single, 110-MW compressed air energy storage (CAES) facility has been constructed in the United States (EPRI/DOE 2003). CAES is described in Section 12.3.2.3.

Deployment of storage in the United States over the past two decades has been limited by low natural gas prices, availability of high-efficiency and flexible gas turbines, and limited cost reductions in storage technologies. In addition, the regulatory treatment of storage, costly licensing and permitting, challenges with storage valuation, as well as utility risk aversion (including market uncertainty) have also limited storage development (EAC 2008). Figure 12-1 shows the installations of bulk energy storage in the United States.

--Following this, there are descriptions of the storage systems that have been installed.--

"if you close your eyes and wish really hard...(for the) God of 'technological progress'"

12.3.3 Technologies Not Included in RE Futures Scenario Analysis

The following technologies offer substantial potential benefits in many applications, but were not included in the Renewable Electricity Futures modeling as they either provide services not explicitly evaluated in the analysis or have not yet been significantly commercialized in grid storage applications.

12.3.3.1 Flywheels

12.3.3.2 Capacitors

12.3.3.3 Superconducting Magnetic Energy Storage

12.3.3.4 High-Power Batteries

12.3.3.5 Electric Vehicles and the Role of Vehicle-to-Grid

12.3.3.6 Hydrogen Energy Storage and Fuel Production

--It looks like they actually throw out a lot of technological progress that has not yet been proven in large applications in the US. The Role of Vehicle-to-Grid is an operational reality elsewhere in the world.--

In addition to EV's, there are end-user Heat and Cool storage strategies which can go far towards moderating both grid storage concerns, as well as offering those users more resilience in how and when they need to buy energy to keep homes and businesses well supplied.

Meanwhile, it seems like the Nuclear power advocates are the ones fervently dreaming that such a beast can be reasonably managed as its fleet steadily ages and as our economy and climate rankle under newly acknowledged hardships.

Ah yes, the home thermal storage the Canadians were talking about here. That one isn't even mentioned in the report. Rather than grasping at straws, as the authoritative sounding dismissive comments without references portray it, the report limits itself to the most mundane means of energy storage.

Yeah . . . it is very low-tech but such heat/cool storage technologies can be very effective when combined with a smart grid. Generate lots of ice overnight when there is excess capacity and used that ice to help cool buildings on very hot peak energy days.

From my email inbox:

And it can all be found here: ANNUAL ENERGY OUTLOOK 2012

So far I have only looked at: A1 Total Energy Supply and Disposition Demand. They have US Crude + Condensate production peaking in 2020 at 14.40 quadrillion BTU, verses 12.35 quadrillion btu in 2012. They have US imports of crude oil peaking in 2010 at 20.14 quadrillion btu.

They do not have total energy production peaking at all, going from 78.47 in 2012 to 94.67 quadrillion btu in 2035. However they do have total energy imports going from 29.56 in 2009, the first year on the chart, declining every year until it hits 24.69 quadrillion btu in 2036.

Ron P.

Adam Sieminski? Interesting. He was Deutsche Bank's chief energy economist for a number of years. Apparently he was appointed to EIA Administrator earlier this year. He is known as a sharp analyst, although he could not have had much influence on this AEO -- it was well in production when he showed up.

FOR ALL – Re: the "end of PO" BS above I teased Ghung the other day about ignoring such fools and their endless string of straw man arguments. But as I sit here in my lounger recovering from a bad reaction to a med procedure this morning I have some time to waste. As most here understand the PO discussion centers of global PO. Obviously US PO occurred about 40 years ago. No debate there…numbers are available to everyone. And despite the recent rise in US production primarily due to higher prices (and not to new tech/trends with the exception of DW GOM) we are still producing around 60% of our peak. The Energy Dept can predict any amount of growth they want but those will only be proven right or wrong in the rear view mirror. Their words prove nothing today IMHO.

Even the author can’t get the definition of PO correct: ”… peak oil is about the end of the cheap, abundant, easy to extract oil, the "sweet" crude that has been the bedrock of our industrial civilization…”. Most on TOD understand that neither the quality nor the price of oil are part of the definition. Unfortunately most of the J6P’s out there won’t catch the more subtle points of the argument and all they’ll take away is that “we have plenty of oil”. And even many of those politicians who do appreciate the reality of the situation don’t want to be the messenger bearing bad news and thus fall into disfavor with the voters.

The inmates have control of the asylum. As I’ve pointed out before: it doesn’t pay to try to teach pigs to roller skate: it only frustrates you and pisses the pigs off.

Too true, your comment reminded me of this article I read earlier today on business insider:

North America Is Poised For Huge Natural Gas Shock (Business Insider)

Much of the information provided in the article is sound (although granted some is a little dubious) but just read the comments that accompany the article. Various insults have been thrown around and many even question the competency of the writer and most ironic of all, one claims it is a propaganda speech that is given to increase stock prices of shale oil. It is a clear case of the pigs being pissed off when you try to teach them to roller skate.

I am the author. I used to be an editor here. My focus was largely on herding behaviour in markets and the need to take a contrarian stance. I stand by my prediction that natural gas prices are set to rise sharply in the coming years.

The original article appeared at The Automatic Earth. Business Insider frequently carries our work.

I agree with the overall thrust of your article that prices are too low, by too low I mean the price is unable to cover the cost of production and therefore the industry is not sustainable. There is a lot of hype and it has a general gold rush vibe to it with the main beneficiaries of this hype being the lease holders and the oil service companies that provide the infrastructure necessary for the fracking.

However the main contention I have with the article you posted and the reason I added dubious statement to my previous comment is because of the suggestion that market prices are mainly the result of the perception of a gas glut. I think the main driving force in the low price is the relative oversupply in the market which will correct in time. Also I have my doubts the most important point (at least for the companies drilling the wells) is EROEI. I think cash-flow or more precisely the lack of it is the most pressing matter as is the need to increase year on year reserves to please the investors on Wall Street and maintain stock prices. This need for cash-flow and reserves increases is what is driving these companies to the ground and not the poor EROEI returns. I think that point could have been stressed a bit more.

Still, the article was good and besides even if you had presented those facts it would not have changed the comments you received. People will believe what they want to believe and anything that challenges this notion will be attacked with great vigor. It will be interesting to see how people will react once the supply crunch is well and truly felt. I get the feeling those critics will suddenly change their tune and pretend they saw this bust coming years ago.

Rockman which article are you referring?

It can't be Is Peak Oil Dead? In that Tim Stevenson sucks in the cornicopian with the first 2 paragraphs and then slams them with reality.

Edit: Don't answer that, I think I see the one your referring.

That is a great article. As you mention he does a good job of drawing in the cornucopians. I like the part blockquoted below on EROEI, which I think more than any other aspect of oil is what the cornucopians fail to comprehend. They think unconventional sources simply means more oil, ah, but it means much more expensive and environmentally damaging oil.

That 6:1 ratio for a complx society is a scary thought, we are already ~10:1 and with the new supplies coming online in the 4:1 range it will not take long at all to drop to 6:1.

I think it depends on the kind of energy return you need. If Alberta oil sand is 5:1 then it's below that threshold. But I think we could be sustained by that for a while because most of that 20%-in that is needed to produce the 100%-out is just used for heat and they could easily take that from the produced bitumen rather than external natural gas as is done today.

Other low EROEI sources like deepwater oil etc. have a more complex re-routing of the 20% back to provide the 100% out, like for example powering all the drilling equipment and offshore platforms, etc. That would not be so easily accommodated by burning some of the produced oil, so that would likely not work below that 6:1 figure.