Tech Talk - Conclusions on the Chinese Energy Situation

Posted by Heading Out on September 23, 2012 - 4:56am

Although energy policy has not been a significant issue in the current political debate over who should be the next president of the United States, this has not been a particularly good month for that future. In August, the Alaskan pipeline pumped an average of 399 kbd from the North Slope. As winter approaches, that number needs to be above 350 kbd to ensure that there are no solids built-up within the pipe, and each year the numbers fall a little closer to that limit.

Just this past week, Shell announced that they will not complete any wells in the Chuchki Sea this year, but will only partially drill a number of wells, and leave completion until next year. This despite the fact that the Arctic ice acreage fell to the lowest level in 33 years, the time over which these measurements have been made. Further, over in Russia, the promised development of the Shtokman field, postponed several times in the past, has again been put back on the shelf. The arrival of increasing quantities of shale gas, and the loss of the market to China have reduced the need for these supplies in the short term. At the same time, the Russian government is again seeking support from Western companies for developments in East Siberia and offshore. They are apparently still courting BP.

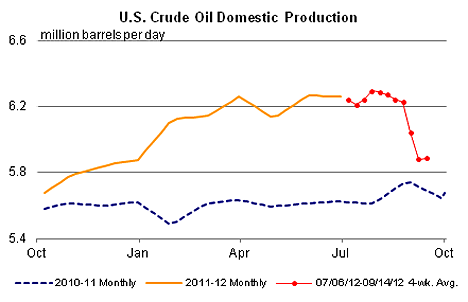

Overall, US crude production has stabilized, following the impacts of Hurricane Isaac, but is not following the steadily upward production path that folks such as Wood Mackenzie anticipated. That would require that the curve continue upward at a gain of around 0.5 mbd/year, which would be around the overall average for the gain this past year, but as a continuing slope, passing through the current apparent plateau.

It is this halt in the increase in oil production that is perhaps of the most concern to China (as well as the rest of us). While it can be shown that China has been able to provide for its future intermediate-term demand for natural gas and coal, they must have less confidence in their ability to sustain their growing demand for oil. The presumptive reason for that lack of confidence should come from a realistic assessment of their growth in demand relative to the supply and demand scenarios for the rest of the world, Figure 1 playing some part in that realistic analysis.

The disagreements between China and Japan over island ownership in the China Sea is continuing to roil the waters. While the issue is nominally over who owns the Diaoyu/Senkaku Islands, the aggressive position that China is taking not only here, but also with other nations that border on the South China Sea show no signs of diminishing. Following a meeting between Secretary of Defense Panetta and the Japanese Foreign Minister Koichiro Gemba, the Japanese have stated that the US recognizes that the disputed islands fall within the purview of the U.S.-Japan security treaty. China, in response, is sending hundreds of fishing boats into the region, as well as official government ships that will monitor events.

“We will send monitoring ships in waves, and have them remain around the Diaoyu Islands at all times to display our will to defend our sovereignty,” the Chinese official said.

The official added that the Fisheries Bureau will also work closely with the State Oceanic Administration.

According to the Fisheries Bureau, as of Sept. 19 more than 700 Chinese fishing boats were operating within 127 nautical miles, or 235 kilometers, of the Senkakus. Of these, 23 were within 60 nautical miles, or 111 km.

The official said commercial fishing boats will enter waters close to the islands at a time to be decided “based on the situation,” indicating that it will depend on Japan’s response.

We are coming to the end of the period where increases in global demand for oil could be met by developing new reserves, or by expanding the production from older fields. Yet, while driving across America this past week, the amount of investment being made in repairing the interstate highway system, and expanding the number of lanes bringing cars into the cities shows that there is continuing commitment to automobile and truck transport in the USA. (And as an aside, there appeared to be more trucks on the road than I remember seeing in the past 3 or 4 years).

With a slow but significant re-growth in the American economy, certainly helped by the low price of natural gas, there remains a serious lack of viable alternative fuels to replace oil for use in transportation. Thus the demand for oil in America and Europe will continue to be sustained. It will continue to rise in those countries such as Brazil, Russia, China and India where automobile use has yet to fill the potential market. For the next few years, Brazil and Russia can probably meet demand from their increased use of internal supplies, albeit by reducing exports. India and China, and their ilk, cannot.

Conflict over resources is, of course, not by any means new. Maschner and Reedy-Maschner have documented such conflicts in the Pacific Northwest during early arrivals of native peoples from Siberia, and conflict and warfare (as evidenced from skeletal remains) is pervasive throughout human history, from some of the earliest of times. (Stone weapon points found in mastodon skeletal remains are also found associated with some early human skeletal remains, showing that the tools were likely causes of the death of both).

The problem, however, that comes in the future is not just that the more powerful nations of the planet will need more crude oil resources than they can provide for their peoples on their own. It will become more difficult to identify places where it is practical to carry out an invasion that will then provide the needed volumes for a given country. Evidence of recent conflicts (Iraq is a prime example) show that conflict makes resource recovery more difficult and delays levels of production that might be achieved if the conflict did not occur.

Perhaps the Chinese use of fishing fleets is an attempt to achieve its goals without going to physical war. If so, it is unfortunate that the locations in which it can be deployed are likely to be few. Yet, at a time when most of the rest of the world appears unwilling to face the coming limitation on a vital resource, or to recognize that a problem might even exist, the Chinese awareness of the situation and their pro-active positioning of themselves to assure reserves ahead of other nations is beginning to be a greater concern.

200 years from now, our descendants will curse us for burning oil at a fantastic rate. We will need it to produce so many valuable products, for example, syringes to prevent pandemics.

Instead of treating the problem like a drug user needs therapy, we are more like drug lords that fight over turf with guns and violence. We are a world of drug addicts racing toward a cliff.

Please pass the aircraft carrier, sprinkled with some 18 year olds.

Thanks HO.

To get some kind of further perspective I used exportbrowser to get an approximate picture of energy in million tonnes of oil equivalent. http://mazamascience.com/OilExport/

China as of 2010/11 uses about 2200 mtoe, most of that from indigenous coal, with significant imports of oil (over half of oil use being from imports) and we see the beginnings of significant NG imports.

Coal circa 1800 mtoe consumption/production

oil ~500 mtoe (production ~200 mtoe)

NG ~120 mtoe (production ~95 mtoe)

You say elsewhere that China plans to treble NG use by 2020, and I presume therefore that the vast majority of any increase of that size must come from imports (Uzbekistan and Turkmenistan and Russia through existing pipelines)?

NG is still essentially about pipelines, and presumably distribution within China is going to need new pipelines. It is difficult to imagine them replicating retail distribution infrastructure that we see in the USA or Europe? Collection from shale NG fields, if these prove successful, cannot be a trivial project either, as we see currently in the USA, where today the 'unconventional' dual oil/NG wells commonly flare-off their NG.

Phil

Phil -” It is difficult to imagine them replicating retail distribution infrastructure that we see in the USA or Europe”. That makes sense. I see the same dynamics with telephone com: cheaper/faster to install towers than lay millions of miles of hard lines to every home. Seems more like to transmit NG sources energy via electricity production. Of course, that assumes the can upgrade that system sufficiently. Shale gas may require building new e- plants in the hale plays and exporting energy that way. But they’ll still have the expense of local gathering systems. But given their cheap source of labor and local built equipment they might make a go of that with mobile LNG/CNG plants.

Rockman

Yes, different cost structures make for different development.

And different legacy infrastructures are part of the picture; though these can cut both ways.

Here in Britain in very recent times we use far more LNG than in the past. Ocean terminals receive direct from the exporter's terminal by super large boat and then the LNG goes straight into our national gas-grid which already connects with almost all our 23M homes, as well as with e-power plant and industry. (Large point-storage for LNG for any length of time is prohibitively costly I am told.)

On the other hand, we have a long industrial legacy that makes any kind of 'upgrade', even to a lower running cost solution, cost an arm and a leg especially if costs are loaded upfront. Even rapid-payback innovations tend to make only low penetration unless they are like NG e-power plant, which were low cost to build, were suited to long term contracts and could ride on the back of existing infrastructure and in their case added much needed flexibility to e-generation.

Just now though 'policy' and 'vested interest' are in a tangle. It happened in the past with much of our industry - mechanisation of farming and coal mining being but two. They call it "path-dependence" these days!

Phil

phil - Thanks. I knew England had occsion problems with NG supplies but didn't relize it was piped to so many homes. BTW did you know we sent a shipload of LNG from a facility about 50 miles from my home in Texas to England some months ago. I think there's a 20 year supply contract in place. You're welcome. LOL.

Rockman

Amazing what can be a profitable deal ;) !

British North Sea N-gas supply still dropping like a stone - and the Norwegians have a lot of other customers.

My UK energy-academic friend has a slogan: "insulate - insulate - insulate".

What's a little LNG among friends? :)

phil - I don't know if the Brits have a way out of the deal but the price is benchmarked to the Henry Hub index with a built in profit margin for Chenier. NG is cheap at HH today...I doubt it will be several years from now. I just wish we could ship 1000X as much to them...we need to get rid of a lot of NG to get prices back up.

The introduction of North Sea natural gas made a huge improvement in British air quality. The killer smogs of old were caused by burning soft coal for heating. However, now that North Sea natural gas production is in steep decline, Britain has a serious problem.

When I was doing some consulting for the oil industry there, I noticed that insulation seemed a foreign concept to Brits. If they insulated their houses to Canadian standards - a minimum of 6 inches (150 mm) of fiberglass insulation in the walls, 4 inches(100 mm) in the basement, and 12 inches (300 mm) in the roof, plus 97% efficient furnaces - they would not only be a lot cheaper to heat, they would be a lot more comfortable, too. I have known Brits to be astonished how comfortable Canadian houses are at 40 degrees below zero. Well, we know it gets cold in Canada, it's not a surprise to anybody, and we build our houses for the climate. The British? I don't know what they were thinking. They keep a stiff upper lip, but it is caused by the cold drafts freezing their faces.

Rocky

‘Notorious’ could better sum it up.

Legacy has a lot to do with it.

When I was a kid and the country was about broke and the empire gone or going, the majority were working class.

They were not paid well, and lived in especially poor housing.

(Durham miners lived in Victorian 'minimal' housing and I guess had a purchasing power perhaps like a Chinese miner today: except for the 'free-coal'.)

We cooked on coal-gas and burned the residual coke in boilers for hot water and heated one or two rooms with open coal fires.

You are right - a temperature inversion could kill a lot of people with coal smoke, and did.

The smoke reduction actually happened before N Sea gas - a number of provisions including off-peak electric heating.

Sounds expensive?

It was; especially considering the low incomes of the majority.

A massive housing programme post WWII built a lot of new housing but we never heard of insulation.

A decade later we were putting in 3 inches of glass fibre over the ceilings under the roof.

New housing was nowhere near Canadian standards even into the 90s IIRC.

Not got a clue; or not enough spare cash up front within the social structure to make the investment? Both I guess. Legacy perhaps of a once profitable empire, but not designed to transfer easily and make the best of changed realities.

North Sea gas 'piggy-backed' on the old town coal gas infrastructure. Laid down a few trunk pipelines and hey-presto! North Sea gas seemed a good idea while it lasted

Phil

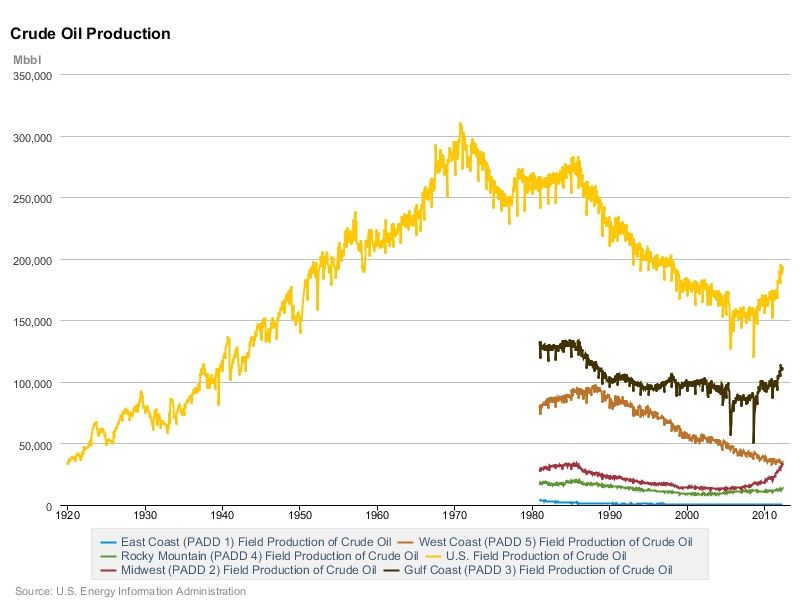

About the US production of crude oil, below taken from EIA site per "padd" :

Same without total US :

It looks like padd3 (gulf coast inland and GOM offshore) is as much if not more responsible for the increase as the Bakken, but I seem to remember reading here that GOM offshore was decreasing, so is the increase in padd3 more inland ? Is it also "tight oil" or conventional ?

Breakdown for Padd3 :

So it is indeed more Texas which increases more than offshore (and this includes Texas "near shore" right ?)

Padd2 (North Dakota) and Texas :

Padd2 details :

By the way these EIA data browsing tools are great, for sure the equivalent not publicly available for KSA or China

And overall historical pic :

Anybody knows where does the "major" increase in Texas production (more than the North Dakota one) comes from ?

Just additional efforts on existing fields due to barrel price, something else ?

The MOL (minimum operating volume) problem for the Alaskan pipeline (TAPS) is vastly overstated (presumably by the oil companies - they snookered Gail on this one).

Solution to pumping only 300,000 b/day in winter ?

Burn a small amount of the plentiful natural gas and preheat the oil to be injected into the pipeline by 10 to 15 C during the winter.

Best Hopes for the multi-million dollar consulting fee,

Alan

Alan, what in your opinion is the MOL.

http://www.eia.gov/todayinenergy/detail.cfm?id=7970

With more winter preheating and additional heating when the pipeline goes by the North Star oil refinery outside Fairbanks (plus some selected insulation), I can see (SWAG) 150,000 b/day flowing to Valdez.

The goal is to keep the oil at +1 C (and electrical heat or crude oil burning heat could also be added in some sections of pipeline).

At that point, sending the entire pipeline through an expanded refinery for "light refining", and shipping some selected semi-refined products south by rail thru Fairbanks and dewatered lighter products south by pipeline starts to become an option.

And then North Slope oil production also starts to become absorbed by the domestic Alaskan market demand, and deliveries to Valdez are no longer a major issue.

Best Hopes for the Check in the Mail,

Alan

The water entrained with the oil is not distilled. Actually pretty heavily contaminated with the saturation ppm of every hydrocarbon in the oil. This should drop the phase change to -2 C or lower.

I thought I read something here recently on TOD about Shell's production plans from the Chukchi Sea. Can't seem to find it right now, but as I recall they are planning to produce the liquids and reinject the gas to maintain reservoir pressure and permeability. Wasn't there was some speculation about Shell building a pipeline along the coast to meet up with TAPS?

That's assuming Shell finds something there that is commercially viable. Having worked for a company that spent billions of dollars drilling wells on the Canadian side of the (disputed) imaginary dotted line across the ocean, came up empty, and no longer exists, I'm not holding my breath waiting for it to happen.

I thought that was Exxon's plan for the much litigated Point Thompson leases...it certainly would seem, at the very least, premature for Shell to be saying what they were going to do with the sub Arctic Ocean hydrocarbons they've yet to find, though arrogant might be a better way to describe that sort of talk if indeed Shell has engaged in such.

I believe they were required to come up with a production plan as one of the requirements from Alaska. IIRC, if they were to produce the oil and gas together it would severely limit the URR due to lowered reservoir pressure, which somehow would lead to greatly decreased permeability. They weren't going to be allowed to leave that much in the ground, so they had to cough up for a rack of whopping big compressors to reinject the gas.

They had to pony up for the compressors already for just the exploration wells? Well I did find Shell's Revised Outer Continental Shelf Lease Exploration Plan Chukchi Sea, Alaska WARNING 9.95 MB PDF but it does seem to be loading fairly fast on my relatively slow DSL connection. I'll have a look see at it in a bit.

Once correction to my first reply. Thomson not Thompson is the correct spelling of the field I was refering to.

With more winter preheating and additional heating when the pipeline goes by the North Star oil refinery outside Fairbanks (plus some selected insulation), I can see (SWAG) 150,000 b/day flowing to Valdez.

While your general premise flies (aside from the fact that it is the Koch boys Flint Hills refinery in North Pole that adds the lions share of heat to TAPS...unfortunately it has to burn oil to do that as precious little natural gas has found its way to Fairbanks up to now but that could change) it ignores the potential for an emergency shutdown of the already cold flow lasting too long... not a pretty picture and something that almost happened a couple years ago when the flow was still over 600,000 bpd.

But Great Bear likes what it has found so far. Too early to say how the numbers will actually pencil in...but...they are drilling in the North Slope pipeline corridor...

Now for that eventual

At that point, sending the entire pipeline through an expanded refinery for "light refining", and shipping some selected semi-refined products south by rail thru Fairbanks

Until I read Duncan's suggestion in the second article linked above I've heard almost zero talk (other than when I've brought it up myself) of rail from Arctic Ocean to the interior in the last couple decades--if you read my first linked article you might wince a bit at how we now are planning to get 7 bcf a year of LNG here from there. It all seems to hinge on immediate rate of return and rail lines have even higher up front cost than gas pipelines I believe.

If the pipeline freezes up due to large leak and required extended shut down, then just wait for summer. Free solar heat - the oil is not going anywhere. Not good for financials though.

Rail through the Brooks Range seems possible only with large scale tunneling - $$$ and time.

Rail into the foothills of the Brooks Range seems quite feasible. Run a pipeline to that point IMHO.

Alan

I'm guessing this would be a messier situation than you envision as you sit on the flat lands just off the always warm Gulf of Mexico.

380 of the 800 miles of TAPS are buried. The ground around the buried sections can freeze pretty deep every winter--it is just not permafrost which means it does thaw every year eventually. An above ground pipe full of oil sitting in the twenty to sixty below with only a few inches of insulation around it will achieve average ambient air temperature after only some several days and that oil will conduct that cold to oil in the somewhat warmer underground sections which will then conduct the cold to the earth around them.

Now consider that in relatively balmy Fairbanks just a few years back the official high temperature only got above zero F one day during all of February and March. Lots and lots of time for the above ground sections to pipe deep cold to the buried sections and freeze wider and wider swaths of earth around them. Not so very much time to get the above ground sections to transfer the short season of summer heat to those swaths.

There are only 71 gate valves that block the pipe's flow in either direction. The pipeline crosses over 900 rivers and streams, 70 of which crossing are considered significant, and only 13 of the significant crossings are bridged, the rest are buried (originally placed in open trenchs) Believe me, we really, really, really don't want to see the oil to stop flowing for any length of time.

[edit add]

I've a bit of familiarity of what the earth near buried and raised sections of the pipeline can be as one of the many, many, transitions between the two designs is less than a half mile from my house, the basement of which I dug out myself and the 9 foot deep water line to which I keep resistance heated over half the year. The well casing conducts enough cold to freeze the heat taped line (at the pitless) some springs anyway!!!

What was TAPS going to do, even back in the days of 2 million b/day flowing, if, say an earthquake severed the line in several places and the oil sat and got cold ?

I can think of several plausible ways for the pipeline to stay shut down for days. Starting out hotter may give the oil another day or two to chill, but not much more.

Alan

Things got touchy during the January 2011 shutdown. Restart came after 84 hours, the second longest shutdown in TAPS history.

In November 2002 the surface rupture of a 7.9 magnitude slip of the Denali fault passed beneath the pipeline. TAPS was designed to handle that and functioned as designed (1.86MB pdf). Not sure how well the Valdez terminal would have held up to a tsunami like the one that washed away the much of the town's waterfront when the 9.2 magnitude 1964 subduction quake with and epicenter 65 miles from Valdez let loose--but that is a different design issue.

So far the earthquake engineering has proved adequate, and slip fault events bigger than the 2002 one are fairly rare, 1906 San Francisco being the last North American one that was larger. So the short answer to your question, the design is intended to avoid rupture by earthquake events of magnitude which are expected to occur in the corridor every 200-300 years. Not a bulletproof guarantee but no different than the way we build anything else.

And speaking of bullets, a drunk hunter not long out of jail put a .338 round through the pipe in 2001 while the US was in the process of invading Afghanistan. That October shutdown lasted 79 hours and 40 minutes. The shooter got 16 years. I got the thrill of having the weapons array on the bottom of a helicopter swivel my way as the pilot checked me out while I was traversing a remote part of the Valdez marine terminal construction project I was working on just after the pipeline restart. Don't know how good an idea it is to have that sort of firepower flying around an oil terminal--that was my second thought at the time--but the military presence was noticeable around the terminal in the early days of the Afghanistan war.

One thing no one disputes, the lower oil flow resulting in colder oil reduces the size of the window for a manageable emergency winter shutdown.

For the US, it is more of an issue to keep the oil exporters in the dollar sphere than to seize oil thru invasion. As long as US dollars are accepted as payment for oil and the dollars are recycled back to the US, the US will be first in line to receive oil exports.

For China, it is becoming increasingly costly to remain in the dollar sphere and recycle dollars back to the US. At some point, China will need to move away from the dollar and towards more bilateral trade. To me, the dispute with Japan seems more of a sideshow to distract attention and US resources from the far more important game that is being played with Iran.