Tech Talk - Global Crude Oil and Iran

Posted by Heading Out on October 28, 2012 - 7:35am

There has been a stir in energy news lately as folks have begun to extrapolate the growth in American oil and gas production to the point that they predict the United States may out-produce Saudi Arabia, in terms of total hydrocarbon production. Of course, in some cases, it is North American oil independence that is featured rather than that of the USA. The reason for this generalization is that by broadening the geography so the region also includes Canadian and Mexican production, then US imports from those countries magically disappear (which does not mean that they don’t have to be paid for. The US imported around 2.5 mbd from Canada and 1 mbd from Mexico in July). The stories also don’t dwell on the comparison of apples and apples. Consider the following quote from NPR. It is the easily missed sentence at the end of the first paragraph that is critical.

In 2011 the U.S. produced 5.66 million barrels of crude oil a day, according to the Department of Energy's Energy Information Administration. By next year the agency projects that will increase 21 percent to 6.85 million barrels a day. Add in things like natural gas liquids, biofuels and processing gains at refineries and that number increases.

"By 2013, we'll probably be a little over 11 million barrels a day," says EIA administrator Adam Sieminski. "That puts you pretty close to Saudi Arabia's" production of more than 11 million barrels a day, he says.

It might be pertinent to note that some of the crude produced in the Kingdom of Saudi Arabia (KSA) will be refined in the US, providing refinery gains here, and further distorting the comparison. Ah, well!

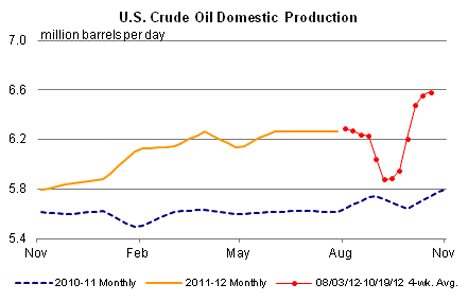

The current production gain in the US has resumed after a short plateau, although the gains following the shut-ins for Hurricane Isaac seem to be leveling off.

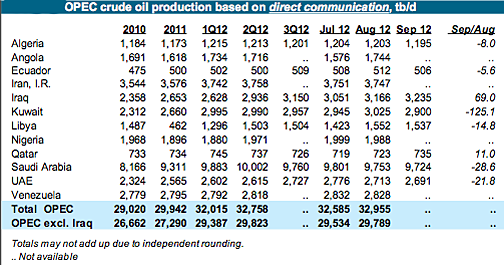

The information in the October Monthly Oil Market Report from OPEC show that crude oil production from KSA is running at 9.85 mbd, as reported by other sources.

Figure 2. Reported production from the OPEC nations through September 2012, as reported by others (OPEC MOMR)

When one looks at the production that KSA itself is reporting, the numbers are slightly reduced.

While the comparison of the two levels of crude suggest that the US has a long way to go in matching KSA crude production, the two sets of figures also point to the answer to another question.

Looking at the figures for Iran, it is clear the sanctions that have been imposed on this nation by the West are having a serious impact. Not only is this seen in the fall in oil production, likely around 1 mbd, but in the more consequential cut to exports this fall is reflected in a $7 billion reduction in income. Iran has just started to admit that this bite in their export market is hurting production. And it is only now that they recognize that this will further fall, though they are also threatening to carry this drop to its ultimate conclusion, and to stop exports entirely. An immediate impact would fall on Turkey, which has cut oil imports from Iran by about 20%, but which has a six month exemption from the full impact of the sanctions. It is currently importing around 200 kbd of crude. Some of that oil's value is apparently returning to Iran as gold bullion, which can be easier to spend.

However, the primary question might well be: if world oil markets are so tight, why hasn't taking a million barrels out of production had a more significant impact? And the answer to this comes in part because of the increase in production from KSA (note that a year ago the country was producing around 500 kbd less than it currently is), and also from the gains in production from the United States (as shown in Figure 1).

Further, given that the global economy, though regenerating from the depths of recession, is still not operating at levels sufficient to bring unemployment to more normal levels, overall demand also remains below what it might be.

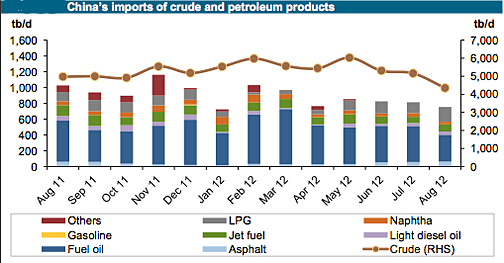

Since we live in a global economy, the problems of Europe and America are reflected in a reduced demand for goods from China and other Asian countries, which impacts the energy demand from factories. China has been taking some 40% of the Iranian export. OPEC has noted that Chinese demand has declined, and that part of this decline stems from an 18% reduction in imports from Iran. Interestingly, this was partially made up through an increase in imports from Iraq.

One of the threats that Iran has made is that it will shut down its exports completely. The country was initially exporting some 2.3 mbd before sanctions occurred, and sanctions have dropped this already to around 860 kbd. Of this, 200 kbd are going to Turkey, but this is a country with pipeline connections that give it options. There is a pipeline running from Iraq, the Kirkuk- Ceyhan connection which carries 300 kbd, and was briefly damaged by fire in August; and more famously, there is the Baku-Tiblisi-Ceyhan pipeline from the Caspian. This can carry 1 mbd of crude, and having run 190 mb through September this year, it is running not quite full.

In short, as with the suggestions mentioned the other week that Iran might seek to challenge Qatar in going into the natural gas LNG market, the threat this week is that it might shut off exports of crude seems to be likely geared only for domestic consumption.

The global demand at present is not such that the Iranian supply is critical to ensuring a balance in an acceptable price between supply and demand. It would seem that the global economy would need to regenerate further, and for North American and KSA to reach some form of current peak in production against that potential of rising demand before this balance is threatened. But in consolation to Iran, resting oilfields can sometimes help in terms of their longer-term production (as KSA has practiced for years).

It's all very well talking about barrels of oil but is anyone looking at the impact of falling energy returns? EOR, non-conventionals etc. all require a lot more energy in per unit of energy produced. Is anyone else surprised that this side of peak oil doesn't seem to be biting yet? Or is it being hidden using some financial wizardry?

Well, the effect of EOR on production will depend on the cost of the energy input relative to the price of the output. That's not always proportional to the physical input-output relation. In the long run, or maybe even the medium run, it'll catch up, but that could take a while.

As I noted on the Drumbeat yesterday regarding Jonathan Fahey's AP report last week, the EIA prediction of roughly 11 million barrels a day by 2013 includes all liquids, not just crude. The corresponding EIA production data for 2011 shows 9.88 million barrels a day production. Thus, there won't be a large jump from the crude production of 5.66 million barrels per day in 2011 to the vastly larger EIA production rate, as

presentedsuggested in the NPR report.EDIT: An increase in liquids due to increased natural gas production has also added to the total in recent years. Given the current low market prices for natural gas, one would conclude that production of natural gas may decline in the immediate future, which will tend to reduce the production of liquids from that source. Should this scenario transpire, it will be more difficult for total US production to continue the recent increasing trend...

E. Swanson

While the price of natural gas condensate remains high, they probably will not cut back on the development and production of wet natural gas wells. Natural gas condensate is refined into gasoline. A high price for gasoline will continue to encourage the production of NG condensate. Expect them to cut back on dry natural gas wells.

Regarding Iranian production: isn't it possible or even likely that oil exported for gold or some kind of barter agreement does not show up in the statistics?

Why would Iran report exports that circumvent sanctions? There are stories, about Iran exporting for gold involving 3rd parties.

The sanctions are not UN ones and thus busting them is not illegal accoring to international law. The sanctions are ones decided by the US & the EU and being forced on other countries through control of the international financial system. The result of the sanctions will therefore be to make Iran more dependent on exports to countries which are not affected by the reach of US financial power. China comes immediately to mind as a candidate. India might perhaps also develop a closer relationship.

Refinery gain is essentially volume gain due to the addition of hydrogen, right?

If we're using low-value hydrogen (from nat gas), we're basically converting nat gas into oil? That seems like a legitimate addition to oil volumes...

Or more commonly from cracking larger molecules--denser fractions of oil--into smaller molecules (less dense fractions). The lower density accounts for the greater volume: that is the gain. There is no change in mass.

What are the relative percentage shares of hydrogenation and cracking?

For what is called refinery gain, 0/100. No mass (hydrogen) is added.

How could you not add hydrogen? eg C16H34 is cracked into C8H18 + C8H18.

Depends on the molecule. The newly formed molecules can have double bonds. And many refining processes might hydrogenate the smaller molecules, and also produce denser, lower-hydrogen, higher-carbon substances like coke. Hydrogen can be concentrated from heavier into gasoline-weight fractions, but there is also an even higher-carbon residue. There is no net gain in mass.

Most refineries use a very significant amount of hydrogen as an input.

Wouldn't that hydrogen show up as extra mass?

When mass is added of whatever element the product is not counted as refinery gain. It would be budgeted differently. If you're interested, an excellent book on this subject, and more, is Oil 101 by Morgan Downey.

How would increases in volume and mass due to hydrogenation be budgeted?

Perhaps it'd be more accurate to post refinery gains from Saudi Arabian (or from any other exporting nation) oil as part of that nation's production, despite being refined here in the US. That would account more accurately for the real volume of fuel which originates in each country.

Why do you Hate Our Freedom*?

*(to distort statistics to fit the current BAU narrative of choice)

Maybe the energy industry needs a Bill James or two to reshuffle some well-known numbers. To change the focus of the picture, so to speak.

Earlier news from October:

The Central Bank of Iran (CBI) reported the inflation rate for the twelve-month period ending in Sharivar 1391 (23 September 2012) was at 24 percent.

http://www.uskowioniran.com/2012/10/inflation-at-24-cbi.html

Tehran’s foreign currency exchange shops have halted the sale of the dollar, Mehr News Agency reported on Monday. Under pressure from the government, the exchange shops were to sell the dollar at 28,500 rials, well below the 35,500 rate traded prior to last Wednesday’s disturbances and the closure of Tehran Grand Bazaar.

http://www.uskowioniran.com/2012/10/foreign-currency-exchange-halted.html

From my website:

in this article:

24/9/2012

Minesweeping exercise near Saudi oil hub

http://crudeoilpeak.info/minesweeping-exercise-near-saudi-oil-hub

The above article also has a CBS news link to former US Ambassador to Israel, Indyk, predicting war in 2013