Drumbeat: December 21, 2012

Posted by Leanan on December 21, 2012 - 10:51am

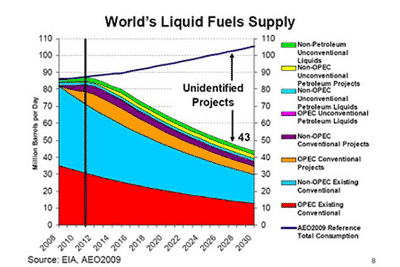

The one chart about oil's future everyone should see

The chart shows that by 2030 world output of oil and other liquid fuels from current fields is expected to drop to 43 million barrels per day (mbpd), some 62 million barrels below projected demand of 105 mbpd. (Though prepared in 2009, the chart takes into account known projects expected to be producing by 2012.) This drop is consistent with the observed decline in the worldwide rate of production from existing fields of about 4 percent per year. Certainly, there will be more projects identified in the 18 years ahead. And, many people will say that we already have a large new resource of tight oil (often mistakenly referred to as shale oil) which can be extracted through hydraulic fracturing or fracking. But even if the optimists are correct--and there can be no guarantee that they will be--this source of oil will only add 3 to 4 million barrels of daily production. What Sweetnam's chart tells us is that we must find and bring into production the equivalent of five new Saudi Arabias between now and 2030 in order to meet expected demand even if the volume of tight oil reaches its maximum projected output. (The Saudis currently produce about 11.7 mbpd of oil and other liquids.)

Oil Declines Most in Two Weeks on U.S. Budget Delay

Oil declined the most in more than two weeks because of concern that U.S. lawmakers may fail to avert spending cuts and tax increases that threaten the economy of the world’s biggest crude consumer.West Texas Intermediate dropped as much as 1.6 percent, paring a second weekly gain, after House Speaker John Boehner scrapped a plan to allow higher tax rates on annual income above $1 million, throwing talks on budget issues known as the fiscal cliff into turmoil. Oil rose a fifth day yesterday, the longest rally since September, after government data showed the U.S. economy grew at a 3.1 percent annual rate in the third quarter, higher than a previous estimate of 2.7 percent.

Oil marketers ask: who will buy my crude?

(Reuters) - Marketing production is more associated with technology and entertainment than grubby industrial raw materials like oil. But marketing is set to become more important as the oil market moves into surplus and struggles with an increasingly diverse range of crudes.Crude marketers need to convince refiners their oil is worth paying a premium for and to undertake expensive investments to be able to process it.

Outlining its strategy to investors in October, Continental Resources, one of the leading producers in North Dakota's Bakken, devoted a third of its presentation to the importance of improving the marketing of its output to secure more recognition of its quality and achieve higher prices.

Iraq ups its selling game on path to oil's top tier

LONDON (Reuters) - Iraq is sharpening a push to sell its swelling crude output and sit at oil's top table with Saudi Arabia, sweetening terms for contract buyers next year, its customers say.Iraqi Oil Minister Abdul-Kareem Luaibi held court to oil executives in Vienna's Hotel Imperial last week on the sidelines of an OPEC meeting. Some buyers have said they were concerned by higher prices and variable quality.

OPEC Exports Drop After Winter Demand Peak, Oil Movements Says

The Organization of Petroleum Exporting Countries will cut crude exports by 2.6 percent as demand during the northern hemisphere winter begins to slacken, according to tanker tracker Oil Movements.The group that supplies about 40 percent of the world’s oil will export 24.1 million barrels a day in the four weeks to Jan. 5, down 640,000 barrels a day from the previous period, the researcher said in an e-mailed report today. The figures exclude Angola and Ecuador.

Iran Talks in Early 2013 to Boost Oil Risk Premium, SocGen Says

International talks early next year over Iran’s nuclear program will probably renew focus on the issue and bolster a risk premium in oil prices, according to Societe Generale SA.The U.S. is trying to bring Iran back to the negotiating table in the first quarter, before Israel’s alleged deadline for a resolution or military confrontation with Iran in the late spring or summer, Michael Wittner, the New York-based head of commodities research for the bank, said in an e-mailed note.

The Peak Oil Crisis: Chaos in the Middle East

Nearly everywhere one looks in the Middle East these days, troubles are growing and new wounds are opening that seem unlikely to heal in the foreseeable future. Now all this would be academic except that most of the world’s readily exploitable oil comes from the region. Despite the hype of “energy independence” the world’s advanced economies would quickly grind to a halt without a steady flow of Middle Eastern oil. If one looks at all the ongoing hostilities and growing animosities in the region as a whole, it is difficult to conclude there will not be major disruptions in oil exports within the next five to ten years.

Copper, oil targeted by wary investors for 2013

LONDON (Reuters) - Investors, stung by losses in commodity investments this year and last, are warily preparing to put money into oil and industrial metals in 2013 if recovery takes hold in the global economy and especially in top raw materials consumer China.Some fund managers have already upped allocations to copper, closely correlated with world industrial output, while others are waiting for more signs that demand is gearing up and macro-economic roadblocks are being removed.

Fincantieri to Buy STX OSV to Add Oil-Rig Support Vessels

Fincantieri SpA agreed to buy a controlling stake in STX OSV Holdings Ltd. (SOH), the world’s biggest maker of oil-rig support vessels, for 455 million euros ($600 million) as rising energy demand stokes offshore drilling.

Russian anger at energy law blocks EU summit progress

(Reuters) - Russian anger at an EU energy law blocked progress at talks between Russian President Vladimir Putin and European Union leaders on Friday.Putin, on his first visit to Brussels since his re-election as president in May, was greeted by four topless women, protesting against civil rights curbs in Russia and shouting "Putin, go to hell". They were bundled away by police.

Relations between the 27-nation bloc and Russia, its main external supplier of energy and a key trading partner, have long been poisoned by rows over gas pipelines.

Belarus says secures more Russian oil supply, seeks $2 bln loan

(Reuters) - Belarus has secured an increase in Russian crude supplies next year and asked Moscow for a $2 billion loan to upgrade its ageing industrial assets, Belarussian President Alexander Lukashenko said on Friday.

Russia’s Gazprom to buy the whole of Kyrgyzstan’s state gas company

BISHKEK, Kyrgyzstan — Kyrgyzstan’s state-owned natural gas company says it is to be sold in its entirety to Russian energy giant Gazprom.

World Bank tribunal accepts Repsol complaint over YPF takeover

(Reuters) - The World Bank's arbitration body started moving ahead this week on a complaint by Spanish oil major Repsol over Argentina's expropriation of its controlling stake in energy company YPF.

Burning pipeline fire sign of Nigeria's woes

IJE ODODO, Nigeria (AP) -- The gasoline pipeline burns unstopped near a village close to Nigeria's sprawling megacity of Lagos, shooting flames into the air as leaking fuel muddies the ground. All around it, the ground is littered with plastic jerry-cans, used by those who hacked into the line to steal the fuel within.The pipeline explosion here in Ije Ododo shows the ongoing problems oil-rich Nigeria faces. While the nation's politicians and businessmen have long profited from the country's production of roughly 2 million barrels of oil a day, many Nigerians remain desperately poor and take dangerous risks to try and earn a living.

Canada’s October Economy Grew 0.1% on Oil Production

Canada’s economy expanded for the first time in three months in October as increases in oil and gas production countered manufacturing declines.

Statoil to create 700 jobs in North Sea development

Statoil is to invest £4.3bn in a North Sea oil field, bringing hundreds of jobs to the north east of Scotland.

A career in energy sector can still be a pretty cool pursuit

Nasa engineers staring at unemployment found second careers in the energy industry after the Space Shuttle programme closed down this year, reminding those who are listening, not enough it would seem, that trying to extract oil and gas from thousands of feet under the ground in far remote hostile exotic environments is still a pretty cool pursuit.

Buru Searching for More Australian Oil After Share Price Doubles

Buru Energy Ltd., the second-best performer on Australia’s energy index this year, is targeting as many as 20 oil prospects in the country’s northwest, seeking to repeat the first major discovery in the area since the 1980s.Buru plans to drill two to four oil wells in 2013 in the onshore Canning Basin, more than 2,000 kilometers (1,240 miles) north of Perth, and to start full production at the Ungani find by the end of the year, Eric Streitberg, executive director of the Perth-based company, said in a phone interview yesterday.

Eni, Anadarko Plan World’s Second-Largest LNG Plant in Africa

Eni SpA and Anadarko Petroleum Corp. agreed to build the world’s second-largest liquefied natural gas plant in Mozambique to start exporting fuel in 2018.Italy’s largest oil company and Anadarko will coordinate development of gas fields and cooperate in the construction of the plant in the Cabo Delgado province of northern Mozambique, which could have an eventual capacity of about 50 million tons a year, The Woodlands, Texas-based company said today in a statement. That would make it the largest LNG plant outside Qatar, the world’s biggest exporter of the fuel.

NYSE Cedes Autonomy to 12-Year-Old Market

The owner of the New York Stock Exchange, whose trading floor helped fuel Warren Buffett’s fortune and financed industries from shipping to semiconductors, is about to be bought by a 12-year-old energy market operator founded with money from a legal settlement.IntercontinentalExchange Inc. agreed to buy NYSE Euronext for $8.2 billion in cash and stock after its own shares surged fivefold since going public in 2006. Chief Executive Officer Jeffrey Sprecher will lead the combined company that includes the biggest U.S. equity market company and second-largest European futures exchange, with NYSE’s Duncan Niederauer relegated to president, according to a statement yesterday.

Caribou and Oil Companies to Share Alaska Petroleum Reserve

An Interior Department plan for the National Petroleum Reserve – Alaska calls for half of its 23 million acres to be set aside for wildlife conservation, wilderness and recreation and for the rest to be opened to potential oil and gas development.The plan, announced on Wednesday, allows for construction of pipelines across the reserve to carry oil and gas from the Beaufort and Chukchi Seas off Alaska’s North Slope to the current Trans-Alaska oil pipeline. Shell began exploratory drilling off the coast this year but stopped before reaching oil-bearing zones because of weather and equipment problems.

Obama Expels BP, Record Number of Firms From Contracting

The Obama administration has temporarily barred more than 3,800 contractors from winning new federal work so far in 2012, the most on record.BP Plc made the U.S. government’s blacklist last month after being suspended for its role in the biggest oil spill in the nation’s history. A Booz Allen Hamilton Holding Corp. unit in Texas was banned for about nine weeks after it hired a former government employee who shared sensitive information about a pending technology project.

Car salesmen sell the sizzle, not the steak, so it's understandable why there are thousands of Nissan Leafs gathering dust across U.S. lots. The all-electric, bug-shaped car is the proud vision of Nissan CEO Carlos Ghosn's, who predicted U.S. Leaf sales would double to 20,000 in 2012.The sales target proved wildly optimistic. In fact, Leaf sales were actually down 16% from 2011 as of October, and even after the Leaf's recent glitzy ad campaign, there's no way Nissan gets even close to Ghosn's sales goal.

Is nuclear power necessary for solving climate change?

The relative costs and benefits of nuclear energy have been the subject of heated debate in recent years thanks to a combination of factors, including the need to cut carbon emissions and the 2011 accident at Fukushima, Japan. Critics argue that nuclear is not only dangerous but also unnecessary for tackling climate change; supporters claim the risks are small and that abandoning nuclear would make an already huge challenge even harder and more expensive.

Concentrated solar power with thermal energy storage can help utilities' bottom line, study shows

(Phys.org)—The storage capacity of concentrating solar power (CSP) can add significant value to a utility company's optimal mix of energy sources, a new report by the U.S. Department of Energy's National Renewable Energy Laboratory (NREL) suggests.The report found that CSP with a six-hour storage capacity can lower peak net loads when the sun isn't shining, enough to add $35.80 per megawatt hour to the capacity and operational value of the utility, compared to photovoltaic (PV) solar power alone, and even higher extra value when compared to CSP without storage. The net load is the normal load minus variable renewables such as photovoltaic and wind.

First Large Solar Plants Without Subsidy Sought in Spain

Solar developers in Spain are trying to build Europe’s first large-scale plants to sell electricity at market prices, taking advantage of a crash in equipment costs and some of the continent’s highest levels of sunlight.Builders have sought permits to connect 37.5 gigawatts of utility-sized projects to Red Electrica Corp. SA (REE)’s transmission grid, company spokeswoman Susana Moreno said. While demand studies show that’s far more new generation than the country needs, the first few plants could set a commercial precedent.

Why Renters Use More Electricity

Why do people buy inefficient refrigerators and clothes washers when spending a little more for an efficient one would save them money over time through lower electricity or water bills? There are a variety of reasons, but one that is persistently cited is that people are not necessarily buying these appliances for themselves. Often the buyer is a landlord, and the user is a tenant who does not make the choice but faces the consequences because he receives the energy bill.

Industry Seen Winning as EPA Weighs Weaker Boiler Rules

The U.S. Environmental Protection Agency is expected to release new pollution caps for industrial boilers and cement plants, as it bows to industry pressure to delay their effective date and ease some standards, according to environmental and business groups.A handful of regulations set to be released today are being watched by paper companies, chemical makers and other manufacturers for signs that the agency has agreed to their request for additional time to comply. The rules are among the most broadly applicable clean-air standards issued under President Barack Obama.

Power Company Loses Some of Its Appetite for Coal

WASHINGTON — Coal took another serious hit Wednesday — in the heart of coal country.American Electric Power, or A.E.P., the nation’s biggest consumer of coal, announced that it would shut its coal-burning boilers at the Big Sandy electric power plant near Louisa, Ky., a 1,100-megawatt facility that since the early 1960s has been burning coal that was mined locally.

U.S. Reopens Waters Off New England for Fishing

Regulators on Thursday voted to reopen about 5,000 square miles of protected waters off the coast of New England to new applications from commercial fishing interests. The move drew concern from environmental advocates and praise from fishermen who hope access to the waters will boost the ailing industry.

Global Warming, Peak Oil, Economic Chaos

The chief villain contributing to global warming through increased concentrations of anthropogenic greenhouse gases is carbon-dioxide, originating from the burning of fossil fuels such as oil. Despite a minority’s pedagogic insistence to the contrary, the World’s top petroleum geologists are already suggesting that its worldwide production may peak (hence “peak oil”) as soon as 2020, and thereafter decline. Many authorities predict this will result in economic chaos, so completing a troika harness for the apocalyptic horsemen.The logic of this scenario becomes more starkly apparent when we delve into the reliance society places on oil, which extends far wider than just its fuel applications. During the 150 years since it was first mined in Pennsylvania, the many products developed from refining crude oil have become inextricably woven into the fabric of people’s lives, most critically those inhabiting what are conventionally term the “developed” nations.

In a Lime Plaster Job, a Leonardo Moment

“In the space of a generation or two, they basically completely got rid of lime,” Ryan said. “And so now, if you talk to a mason or a plasterer, they don’t even know that you can just use lime.”The other reason Portland Cement has largely replaced lime, he said, is that it cures stronger and faster, allowing for the design of larger structures that can be built more quickly and cheaply.

“You can’t make a freeway overpass out of lime,” Ryan said. “You wouldn’t really pour a foundation for your house out of lime.” Where it excels, he said, is as a plaster.

“When you think about all the buildings in Europe, or anywhere where it’s old and they have that really beautiful patina charm, it’s all lime,” he said.

At the same time, Ryan said, lime performs the impressive feat of sucking carbon dioxide out of the atmosphere, which works against climate change.

$1,200 a Pound, Truffles Suffer in the Heat

Black truffles and other types of truffles are becoming scarcer, and some scientists say it is because of the effects of global climate change on the fungus’s Mediterranean habitat. One wholesaler says prices have risen tenfold over the last dozen years.

Utilities benefit in state carbon market

Most businesses say California's new cap-and-trade program, designed to curb greenhouse gas emissions, is a job killer that will suck billions of dollars out of the economy.But you won't hear too many protests from some of the biggest businesses of all: California's electric utilities.

From SMUD to Southern California Edison, the state's utilities have been placed in a special class that effectively cushions companies and their ratepayers from the cost of reducing carbon emissions.

Edison Snafu Skews Demand in First California Carbon Permit Sale

California, the world’s ninth- largest economy, has Edison International (EIX) to thank for selling all of its carbon permits in the state’s first auction. The company unintentionally bid for twice as many allowances as were for sale.Edison, owner of the state’s second-biggest power utility, submitted a proposal in the wrong format and offered to buy 21 times more allowances than it wanted on Nov. 14, documents obtained by Bloomberg show.

Fewer Americans Say Their Actions Can Slow Climate Change

Americans may be buying more compact fluorescent light bulbs these days, but they are less likely to set their thermostats low during the winter than they were four years ago and have less confidence that their actions will help to curb global warming, according to a new survey.

World Not Prepared for Extreme Events Like Sandy, Expert Says

"We thought about the risks and never in my wildest dreams would I have considered a storm of this magnitude and the impacts that it had on us," she said.But afterward, moving was never an option. The family is now focused on rebuilding and helping their neighbors do the same. Her husband, Tom Fox, has received funding on behalf of residents on their block for an environmentally friendly demonstration project called Rebuilding Breezy Green.

The Foxes bought their home intending to retire there; she is 53 and he is 65. But after Hurricane Sandy, they saw how the older residents of the community had to rely on family members or volunteers to rebuild for them, the Foxes realized they may not be able to stay in the home they love as they age.

Met Office sees 2013 likely to be one of warmest on record

LONDON (Reuters) - Global temperatures are forecast to be 0.57 degrees above the long-term average next year, making 2013 one of the warmest years on record, Britain's Met Office said on Thursday."It is very likely that 2013 will be one of the warmest 10 years in the record which goes back to 1850, and it is likely to be warmer than 2012," the Met Office said in its annual forecast for the coming year.

2012 another record-setter, fits climate forecasts

WASHINGTON, D.C. — As 2012 began, winter in the U.S. went AWOL. Spring and summer arrived early with wildfires, blistering heat and drought. And fall hit the eastern third of the country with the ferocity of Superstorm Sandy.This past year’s weather was deadly, costly and record-breaking everywhere, but especially in the United States.

If that sounds familiar, it should. The previous year also was one for the record books.

Drought, icemelt, superstorms ... a review of 2012's environmental news

The Guardian's environment team pick their biggest moments of what was a tumultuous year for nature and green politics.

I'm going to bet they will be using a lot of fossil fuel to do that rebuilding...

Even without finding, extracting and burning five new Saudi Arabias worth of oil in the next 27 years, according to currently existing scientific consensus we have already burned more than enough fossil fuels to make events such as Hurricane Sandy a lot more common than in the past.

Rinse and repeat in an infinite loop!

Russian Roulette, anyone?

"Russian Roulette, anyone?"

Playing Russian Roulette, one has a five out of six chance of getting lucky. It's a stretch for me to give 50/50 odds at this point.

Then you might like this App! Sheesh, the things one finds on the internet...

http://lh4.ggpht.com/FTJ9r-HzkioRSkrgqXdT_twmTcEB7rJ18LmpBmQTNfHleraaXL-...

BTW it's not 5 new Saudi Arabias in the next 27 years... 2030 is only 17 years away. Rockman, dig faster!

I would like to know, just out of pure curiosity, when the moving becomes an option? Because... How long will it take to rebuild? Will they manage in one year?

And if they do and next Sandy-lookalike comes along destroying their rebuilt home, will they decide -again- to rebuild? What about increased monsterstorm occurence..?

How many "rebuild and bust" cycles will it take for them to reconsider? Just asking...

Some villages here were flooded two years in a row. Some houses washed away, not a pretty sight... :(

Those people are asking the state for money to rebuild, but without changing anything about the stream. No dikes, no anything, rebuilding on the same place.

Is it just [blind] faith that disaster [hopefully] won't happen twice in the same place, although it did? Or just pure ignorance? When Mom Nature tells you twice: "you are doing it wrong!" and you decide to ignore the warning, well... no wonder the stream suddenly flows through your living room!

Don't get me wrong, I understand that people are emotionally attached to places they spend most of their lives. But when experts say floods will become a new norm and villagers get angry at them, shooting the messenger (sometimes almost literally!), then it's getting hard to find sympathy for them, cuz "you are doing it to yourself".

On the positive note, our government is very slow in helping its citizens, so people still didn't get the money to rebuild, therefore the second flood didn't destroy their new homes. At least sometimes a slow government is a good thing... from a certain POV, of course. :P

So, I'd like to know what's the limit, how many rebuilds to leave the coast to [rising] sea? (Not particularly from you, Fred. :D My question is to whom it may concern. :P)

/end of rant O:-)

A few years ago here in Sonoma County the feds finally said enough to people using govt flood insurance to rebuild in the Russian River flood plain. Now you see a lot of houses built up from the ground but I don't think they can get any flood insurance at all.

Yes, people are irrational. If we were not, we would have seriously started tackling global warming 30-40 years ago, when the National Academies of Sciences first warned the US government (and the world) that uncontrolled CO2 emissions imposed a serious risk.

We will pay the price for not heeding the warnings.

Has anyone even found 1 Saudi Arabia's worth yet, let alone 5?

NAOM

At 4% decline, the world has 'found' 1(one) Saudi Arabia in a little over 3 yrs(from ye 2011). Rough calculation - 2011 Production 83.6 million bpd. Using 4% decline per year, as quoted in the article, decline = 3.34 million bpd per year. Saudi Arabia produced 11.1 million bpd in 2011. 11.1/3.34 = 3.3 yrs.

I know the NYT is a propaganda mouthpiece for the FIRE economy, so I shouldn't be surprised by their hit-piece on renters in today's Drumbeat. I really liked their NYT-picked comment that grossly exaggerates how much each $ of energy savings raises a house's value.

I will say that I've lived in a one bedroom apartment for the past eight years with an older refrigerator, microwave, stove, and toaster as my only major appliances. Most of my lights are CFLs or LEDs. During that time my electric bill has ranged between $30 and $60. Meanwhile, the homeowners I know are constantly bemoaning their bills that exceed $100, $200, $300, or even more money.

I will say that the landlord wastes a fair amount of heating oil running the boiler too much because they don't seem to realize how much heat the heavy walls trap.

But again, the NYT is a FIRE controlled propaganda organ, so I shouldn't be surprised they are trying to keep those house prices inflated!

I thought I was fairly well-up on my acronyms, but what's FIRE?

Economy based on Finance, Insurance, and Real Estate.

Finance, Insurance, Real Estate = FIRE

Wolverine is reading this one way. The other way to read it is as another indictment of private ownership of shared housing complexes, or at least of the lack of regulation of such and the lack of tenants' power. Slumlording is bad enough in itself, but also "incentivizes" energy waste. I'm a renter, and it is a very valid point. Indeed, I've seen apartments that still have 1950s water and kitchen fixtures in them.

They (many states) have standards that rental housing is required to meet, when it comes to things like water leaks, mold, pests or lead paint. I believe they should similarly enact energy standards for rental housing. Along with that, the state should help the landlords with financing for the required energy efficiency improvements - to be paid back from the savings - the landlord would raise the rents to recoup the investment, but by less than the utility savings the renters would then enjoy.

The standards do exist, but in most places enforcement tends to be spotty. There are several wear issues involving the steam pipes in the walls around my apartment that I simply can't do anything about. I'm not a plumber or an HVAC guy. However, I am certainly not expecting much sympathy from my landlord when we conduct the move out inspection.

I would frame the NYT a little differently, while maybe it's just a word choice issue.. but they, very much like NPR, are simply describing the world they know and think is 'the way to be'.. They are in and amongst the monied classes, and while the breadbasket and Red States see them as East Coast socialists.. the REAL east coast socialists see them as the UMC.. the Upper-Middle Class, which has a certain level of Noblesse-Oblige towards the disenfranchised and the other fine folks in steerage, storeclerkery and the slums, but their paycheck is still dependent upon seeing the world that the Economists and the Fund Managers have laid out for them to understand.

I am a landlord, and I provide heat and hot water to my 4 humble units, so I have a very clear incentive to optimise the way that is provided, and how well the buildings can hold onto it, to keep the costs down.. I also can get various benefits and refunds from buying Energy Star Appliances, even if those only really benefit the Tenants costs in overall costs.. but they do also help my apartments look better to those who are looking for a place. Nonetheless, I know many Landlords are hardly able to get to the kinds of Efficiency and Weatherization levels that I aspire to.. much like most of the society. Any working people in the middle classes are often doing a lot just to survive these days.. I just finished my last day at LL Bean, doing seasonal 'Peak' work, tho' I didn't see any "LEANAN" Monograms pass through my Emroidery Machine, sorry to say.. but the folks around me are just as 'uniquely American', trying to hang onto a few decent positions to keep that final nostril up above the waves.. ('Millimeters of FreeBeard', I think it could be called).

I was grateful that they asked us all to observe a very nice little moment of Silence there on the Sewing Floor this morning for the Sandy Hook Families. They do what they can.. Maine is lucky to have a couple durable companies still sticking around.. we used to push a lot more thread up here in Lobsterland..

As the Captain said in 'DAS BOOT' ..

"You have to have good men. Good men, all of them." (Adapting gender as needed)

As a life-long reader of the NYT, I think you hit the nail on the head. The whole thing, the Iron Triangle, or FIRE, or whatever you want to call it, is simply systemic - given the rules of the game, our anarchist capitalism, globalization, and whatnot, well, this is just how it works out.

BTW, did you happen to see any "sgage" items coming through your embroidering station? :-) Anyway, I will wait until a few days after Christmas before I cash in my LL Bean gift cards. I do need a few things as winter comes on...

re: "sgage".. Believe me, I would have checked it out with you immediately! .. but their usual 5 or 6 sewing people (I originally wrote 'Sewers'.. ahem!) blossoms up to about 50-60 of us during the Holiday Peak period.. so they could have hit other machines. We saw some interesting text flying by.. and you get to read into all the TLA's to keep your mind traipsing along.. one day, I had IDF and PLO, only a few bags apart. So close, yet worlds apart!

Keep those calls and letters coming- Order before midnight tonight!

(TLA = 'Three-Lettered Acronym' in uber-clever internet jangle!)

"one day, I had IDF and PLO, only a few bags apart. So close, yet worlds apart!"

Wow, what a juxtaposition...

Good ol' Beans. I am mostly a Vermonter, but I live with a Maine lady (Mainiac?) these last 20-something years, and have made a few pilgrimages to Freeport :-) A couple of friends of ours were models in the catalog back in the 90's.

Don't know how it is up your way, but here in central NH we had 4 inches of snow followed by a day of rain and temps in the 40's, and it's a slush-pit. Ol' Leon knew these conditions well, I expect...

All wind and wet today.. the snow from Tues. is a distant memory.

I do wish Beans had remained truly an 'outfitter' in spirit.. maybe out of need they'll come back to their roots.. too much plastic now.

I have been a Beans customer for so long. The household I grew up in always had Beans catalogs lying around. Talking 1960's here. I've always been an "outdoorsman" and backpacker and what have you, and the Beans catalog was my wish book, really.

I know what you mean re: plastic. They could start with zippers. I've had the zipper on my jacket replaced 3 times (for free, I must add). But the darn plastic zippers just fail in a year or two...

Best hopes for Beans coming back to their roots!

I totally agree that NYC lives in its own economic and cultural bubble. I would argue that this bubble effect is even worse in the Versailles-on-the-Potomac known as Washington DC.

What I don't understand about my landlord is that they could pay a one-time fee for an energy efficiency study to vastly reduce their bill for running the boiler in this building. They could study how much heat this place traps and realize that they could probably satisfy NY heat laws while running the boiler at a much lower duty cycle.

As a landlord and a renter (no typo) I'd like to add that a lot of the things metioned above boil down to specifics.

For example, depending on where you rent out a place you may have to count on fridges and stoves, windscreens and even doors disapearing when tenants move out. This is not an incentive to put in anything but the cheapest appliance you can find.

That said, there is something to be said to make a rental place as fancy as is reasonable because it allows to you attract a certain type of tennant. On a pure dollar/cents basis it usually does not make sense (unless you go really high end) but it tends to give you fewer tenant problems.

with respect to not upgrading heat, it may be lack of knowledge or simply a horizon issue - if the the break even period for upgrading the furnace is 4 years but s/he intends to sell the building in less than that it makes no sense to go through the hassle and expense. savings are never quite that you think they'll be and there generally are a number of expenses which you only become aware of during installation. For example if you upgrade to a condensing boiler you now also need new pumps, manifold and a new venting system. don't count on those items showing up on the quote.

Lastle, chances are that whoever buys the building won't pay a premium for a better heating system.

rgds

WeekendPeak

"The one chart on oils future everyone should see"

The only thing that I can come up with, that makes sense beyond denial, is an underlying childishness if that is even the right word for why we cannot deal effectively with our future. I just get a sense playing in a sandbox, with very real consequences.

When I was a child in the early 60's, Disneyland CA had a ride called "Autotopia" basically go carts on a track. We Americans built autotopia on a grand scale. I think of this every time I drive anymore. Drive to McDonalds - a food stop in autotopia. Drive around in circles - nascar. Drive around for pleasure or to explore- the "-topia".

Some kids in the sandbox get more toys for themselves by making sure the rest of us get to play and are willing to use force to make sure it stays the way it is, like it is just a game to be won, even if the consequences kill us all, including themselves. I think we are collectively defective.

further to:

"The one chart about oil's future everyone should see"

This is such a great visual. It says it all plus the need for 5 equiv. KSA potentials. Now, if this projection could be superimposed on GW ramifications and the need to further cut back one could see that the next year or two surely must be the last few where it is even possible to keep head in sand and not pay attention.

Warming question regarding yesterday's plethora of depressing posts and the chart that predicts the state of droughts from resilience.org and re-posted on TOD.

Question:

I didn't see or read from TOD posties where the melting caps and particularly the Greenland sheet actually cools the northern hemisphere due to increased cold melt water. It seemed that all of the posts automatically assumed desertification relentlessly marches northwards and even hinted that the Pacific Northwest would be drier! Is it not the case that when the north Atlantic cools off the elevator would actually slow, current dynamics change, and a regime of long cold and wet + snowy winters will increase in northern Europe, with huge swings in dynamic weather events across the northern hemisphere, worldwide?

I have seen so many different models, but I am open to the idea that different feedbacks will sneak up on us. Renewed mountain glaciation seems more than likely at higher latitudes with increased precipitation.

Opinions, my learned compadres?

Paulo

Paulo,

The World Bank sponsored a peer reviewed report which indicated:

(Why a 4°C Warmer World Must Be Avoided, emphasis added). The uncertainties are not good at all, and the focus needs to be on one thing and one thing only: stop using fossil fuels in any manner which increases green house gases in the atmosphere.

I assume this is a typo on your part. It is the North Atlantic that cools, not the Northern Hemisphere. The Northern Hemisphere, along with the Southern Hemisphere, just keeps on getting warmer. But not all the North Atlantic cools, only the small part that the melt water dumps into and the rest of the Gulf Stream that it feeds. The rest of the North Atlantic gets warmer right along with the rest of the world's oceans.

After all, if the Northern Hemisphere got colder, the ice sheet and glaciers would not melt.

Ron P.

Ron,

It was a typo. Trying to squeeze in some comments before work started. However, even though I meant North Atlantic, the fact that the ocean is such an influencing effect....moderating where I live on the Pacific...I can see that the effect of the cooling water will cool the onshore land/weather thus bringing more grey days, colder summers, larger snowfalls.

My son and our families live on a river, just up from the estuary and our elevation is maybe 20' above high tide? We have a profound interest in rising water levels, but compared to the major coastal cities our future problems are small, indeed.

Putting the last touches on a furling design for my windmill, and also we drive small older vehicles and try to limit our use of FF; the small things individuals can do including insulation, bulb changes, etc...the whole situation is so out of our control it seems so futile. What effect can we have compared to a new Chinese coal plant or a new freeway in Houston? It makes me want to say, "screw it".

Regards....Paulo

A few thousand cubic kilometers per year of ice melt (its a few hundred now), turns out not to me not much compared to the world wide heat budget. And the fact that the melting ice (or melted out ground) absorbs more sunlight pushes things the other way. I think the albedo effect overwhelms the heat of fusion effect.

"I think the albedo effect overwhelms the heat of fusion effect."

Yes, that's why we see the polar amplification effect.

"The Northern Hemisphere, along with the Southern Hemisphere, just keeps on getting warmer."

Not entirely. If you look at NOAA's Land & Ocean Temperature Percentiles Jan-Nov 2012 temperature map you can see that most of Alaska is cooler than average.

As I write, the temperature at the Fairbanks airport is -42 degrees F. The high cost of heating oil has driven the conversion to wood heat and this, along with the intense cold and the absence of air circulation has resulted in significant air pollution in Fairbanks. Quoting from the Alaska Dispatch:

'Toxic air quality poses community health crisis in Fairbanks, Alaska

"Sometimes I feel like our days of living in (Fairbanks) are numbered. We're going to be forced to move away from family and friends. This environment is beautiful, but it's toxic" -- Suzanne Fenner, newly asthmatic after years in polluted air.'

Wanting to get away from fossil fuels I have used wood for heating and cooking for three decades. After reading this I decided personal action was needed. So I quit feeding wood into the the stove and turned on the oil fired heater.

Douglas

Douglas, there are lots of places that, this year, are cooler than average, and lots of places that, this year, are warmer than average. Overall the Northern Hemisphere just keeps getting warmer. That is climate and what we have is climate change. The weather, however, is something entirely different. That varies from place to place from time to time.

Ron P.

ffdjim,

I saw a documentary recently where they interviewed the Mayor of Barrow, AK. He said that the October average temperature there was 27 degrees above zero.

I agree that a decline or shutdown of the THC is a strong possibility. Most of the model work I've seen suggest that this will happen. One author claimed that this will mitigate the warming in Europe, reducing the impact of AGW on that region. However, that conclusion was based on a model which did not include changes in sea-ice. If the sea-ice extent continues to decline going forward, the Nordic Seas will be exposed to inflow of more low salinity surface water from the Arctic Ocean during the summer half of the year. In winter, sea-ice may become more mobile as thinner ice can break up and move more easily, thus increasing the flow thru the Fram Strait.

I think we are already experiencing some decline in the THC, although the measurements I've seen are not showing it, perhaps due to limitations in the RAPID program's data gathering system. There's data which shows periodic variation in the strength of the THC, but such measurements have only recently begun and there's no long term data available for comparison. Furthermore, the location of the sinking may change as the sinking has been associated with the sea-ice edge, which now has moved further into the Arctic Ocean as the minimum extent has declined...

E. Swanson

Yep. What he ^^^ said.

Personally, I think this whole period of history will necessitate a radical transcendence of human consciousness, a major "growing up" period that will result in at least a significant segment of the population leaning to appreciate the connection we all share, with each other as well as the earth and ecosystem. Either that, or we're going to whirl right down the drain. I'm fairly optimistic.

Absolutely! Seven billion people running half cocked on obsessive greed extravaganzas of the most self-involved kind, are quickly moving towards a state of dramatic change, being forced upon us due to a lack of ability to (as you put it):

That which is out of balance is always forced (at some juncture) to change to a state of balance. But what a mess it will be on the way there!

I could not agree more, and you said it quite well. I look around me though and think people have completely lost their way. Is it the ability to think or the ability to feel, or both, I don't know. Perhaps the American Indians had it, I'm not sure, but looking around I think they were about as close as we have come. Ironically we called them savages.

I too am optimistic. I just wonder how many generations will it take to purge our collective narcissism.

Same here. Tried to respond cleverly but kept coming up with quotes that cut thru optimism/pessimism axis:

But quoting quotes is an impotent way to respond to reality. I prefer doing something not just talking about it. Sort of like Greer's idea (forget where he got it): Learn one thing, give up one thing, save one thing. Hard to do this everyday (LOL) but try weekly. Folks have been noticing.

I like to say: just show up and you'll learn something new every damn day. Not sure where I got that from, so it could be original, but not bloody likely. Anyway, the thing that really boggles my mind is what are we going to do with all those dead bodies? If drought turns all the world into Egypt, then I can foresee a great mummification. I'm sure the smells will be strong for awhile, and will probably contribute to yet another positive feedback to global warming and runaway nonlinear climate change, but what if it rains instead? Bloat, bloat, bloat. Then there could be some serious pestilence and groundwater pollution for the "lucky" survivors to dodge. But color me an optimist, also, as life will go on, I'm sure. Bacterial life, that is.

"...quotes that cut thru optimism/pessimism axis:"

And you are right about actions. Focusing on what we do not want leaves us engaged and somewhat controlled by the negative. To focus on what can be, which is better by conscious choice, is all positive.

On a positive note; I very positive something bad will happen. Those in power will not realize the necessary adjustment.

Re: the chart showing the required new production to compensate for declining production – “What Sweetnam's chart tells us is that we must find and bring into production…blah, blah, blah”. Throughout my 37 year career I’ve sat in meetings with more management teams than I can remember who built their biz plans around goals and not capabilities. I’ve seen proposals to spend $millions in overhead and tens of $millions in drilling budgets to chase targets in trends where it was statistically impossible to find such reserves. And when the plan appears to be failing? Many won’t believe it but this is completely true: after reviewing a failed 2 years of drilling the CEO (who had no tech background in geology/engineering) reviewed the operations and came to an amazing solution to fix the company: the successful wells weren’t too bad but when the dry holes were factored in we were losing money big time. His obvious solution: focus on the type of projects that worked and avoid the ones that drilled up dry. Kinda how you can easily make money in the stock market: buy low…sell high. The company went bankrupt a few years later after spending $550 million to find $60 million in reserves. They had convinced themselves we could find bigger reserves in some trends that were bigger than had been found in those trends in the previous 30 years.

And that's the same sense I get from that chart. There's no sense that the opportunities needed to meet the projections actually exist. Essentially goals based on needs instead of capabilities. As I’ve said many time exploration geologists like westexas have to maintain a high level of optimism. Otherwise how can he wake up every morning and chase such elusive targets? But he’ll base that optimism on the historic facts in a trend. I would be more than glad to give this chart a fair judgment. All they need do is tell me exactly what trends they base those expectations upon and the stats that back them up. For instance onshore conventional oil: not once since oil rates peaked in 1971 have we been able to stop the decline in US production for a significant period on time as the chart predicts in the near future. Occasional upswings like we're currently seeing. But the chart projects the a constant replacement for our declining fields for decades ahead. The last time we saw anything approaching that ability was more than 40 years ago. And during those 40 years we've had huge improvements in exploration and engineering tools to assist us in the effort as well as periods of high oil/NG prices. Yet we've haven't seen that long term growth the chart is predicting. So back to the simple question: if the tech, prices and $trillions of capex spent in the US for the last 40 years hasn't done it for conventional oil production why the expectation it will happen year after year for the next few decades?

I'm beginning to hear more and more stories about US companies cutting back drilling, even for oil targets--because of out of control costs.

And this is a corollary to the whole Red Queen process, right? To keep increasing production with increasingly smaller plays, you have to apply more rigs, manpower, etc. and the increased call on those resources raises their cost (econ 101, supply and demand). Because the plays are inherently smaller and tougher to exploit (in tight oil for example) the break-even price per bbl is more sensitive to cost and similarly escalates. WTI under $90/bbl puts a lot of pressure on these operations.

Just imagine how much worse will that situation will get if we go into a recession, which will cause oil prices to drop further reducing incentive for exploration. Last evening I saw on tv news that if we go over the fiscal cliff, the CBO projects the 1st qtr. of 2013 to slip into recession to the tune of, get this, -3.9%!

This fits with Nate Hagens assertion that the only thing keeping the economy growing at a meager 2% is govt. spending via debt increases (against capitol). So even if there is an attempt to reign in spending and raise taxes to reduce deficits, it won't be enough to balance the budget and we'll still have a recessionary first quarter.

Then there's the debt ceiling fight ahead in feb/march in which the House plans to sqeeze the numbers some more in the direction of a balanced budget. Not that it isn't a noble idea, but with the situation as is, it seems like fiscal suicide. But maybe better to do it now than later.

Daunting to say the least!

RMan: i understand that your question is really rhetorical, so you can understand my answer is mainly hyperbole. In the U.S. all projections must indicate improvement. GDP must always increase by at least 2 per cent, the stock market must always go up. Sales must always increase, employment must always show improvement. Government spending must always increase, no reality will be allowed to dispel the euphoria of a constantly improving non-negotiable way of life.USA USA USA

penury - Great job of capturing the motives behind such projections. It's easy to understand why public oils would push them: who would buy a ticket on the Titanic if there were a reasonable expectation of the potential tragedy. It’s more difficult to understand why politicians resist the reality. Certainly some are intellectually unable to grasp the situation. But not all of them. Maybe despite the fact that many want to present themselves as saviors here to save us perhaps the smarter ones realize there aren’t easy solutions and don’t want to provide the unpleasant answers.

Even the predicted production from identified sources can be optimistic.

I have spent this morning trying to evaluate a property for a client. It's not a big field -- it produced about 2,000 barrels per day of genuine old-fashioned (but somewhat heavy) crude oil in October, from 34 wells -- but one of the top names in petroleum engineering reviewed the field back in January and forecast an average production of 2,500 barrels per day for 2012, rising to 4,000 barrels per day in 2015 before starting to decline.

They were 22% high in their one year forecast. What do you think the chances are of hitting 4,000 barrels per day in 2015?

Ird - I've heard that story a hundred times. "...but one of the top names in petroleum engineering reviewed the field...". Through out me career I've been constanly slammed for not being optimistic enough. Yet on those occasions when I've missed the target my estimate has usually been too high. Most managements I've dealt want to be mislead. That way they can tell their superiors that good times are ahead. And if it doesn't happen they blame the staff for being wrong. After stepping into that trap a couple of times I learned my lesson.

Hello,

I have released a new version of Sokath (0.5.3). The biggest changes are:

- Updated production data- and added Export Land Model results of United States, United Kingdom and China

- Implemented floating point number visualization for all panels

You can download the tool for free over here: http://sokath.sourceforge.net/

Below you see the graps about the production and ELM results of US, UK and China.

=================

United States

=================

=================

United Kingdom

=================

=================

China

=================

Thanks. Some graphs have legends - cool. Some graphs (eg UK production) have no legend - not so cool...

Dialup = Ouch!

The graphs are actually very well-optimized for the web. All of them together are smaller than many single images that others here have posted.

About 43Kb each looks like. With 15 of them and at 21,600 baud page load times for this drumbeat will be in excess of 300 seconds when I'm at home.

When I was on dial-up (until about a year ago) I browsed with images not loaded by default. Any images I wanted to see I right-clicked on.

Now there's an idea, thanks.

I still do that on many sites, even though my connection is very fast. For Firefox users, I highly recommend ImgLikeOpera. Like the name says, it adds Opera's image-handling functionality to Firefox. You can set it so that images are never loaded, always loaded, or loaded only if they're already in your cache, and easily switch between the various options. You can right-click to load an image that was blocked, if you want to see it. You can set different rules for different web sites.

Dialup = Ouch, truly, with TOD. I went to ISDN a year ago. Lovely!

But TOD is the most inefficient user of HTML on the net. I have said it before, and I'll say it now: a lot of the HTML used on TOD can be discarded at great benefit to the bandwidth and no or very little inconvenience to the user.

For example, a few minutes before posting this I pasted the source code for this page into a spreadsheet and sorted into HTML and content (not counting images).

Result:

HTML: 170,244 characters.

Content: 100,191 characters (i.e. only 37%)

Could be discarded:

I have never used the "Subthread | Parent subthread | Comments top" or "Reply in new window | Start new thread" links. I doubt others use them, and they could be discarded. Most of the functionality is available in other ways.

If you want to go to the top, ctrl-home; to the bottom, ctrl-end; reply in new window (I prefer tabs) "Reply" - right-click - "Open link in new tab" (using Firefox); start new thread, ctrl-end - "Post a comment".

Easy-peasy. Save yourself a ton of bandwidth. More content, fewer useless links = more readable page.

I have emailed Tech Support at TOD on this and other issues. Never even the courtesy of a reply.

Dialup? You mean we have members outside the realm of maximum BAU? The horror! Don't even tell me you're not in the OECD, or even worse, burst my bubble and prove that the light of progress has not reached all corners of the city on the hill.

Seriously though, if you want support, I think those links point to nowhere, you have to bug Leanan directly- but I doubt there is time/money/expertise available for a site upgrade of the magnitude you are suggesting in a world of decline (but then I'm no sysadmin either).

Desert

I don't even have dialup. I go to McDonald's or Subway to use their free wi-fi. Out in the extreme sticks where I live, dialup is too undependable, phone line dsl unavailable, and satellite very expensive and not within my poverty level budget.

Please do not bug me about things like this. I have nothing to do with the tech side of TOD. I have neither the rights nor the knowledge to make changes to the web site. That's all SuperG's realm. He does read the e-mails sent to the support address, but he doesn't have time to respond to all of them. Basically, he deals with urgent stuff. Other stuff he considers for major upgrades of the site, which happen very rarely. He's doing this in his spare time, and he's not being paid, so adjust your expectations accordingly.

I use the "Subthread" links occasionally, and use "Reply in new window" most times I comment. I know there are other workarounds, but that extra HTML is relatively minor. 37% content is far better than the average web page these days, I believe.

I read TOD on dialup for years, until one year ago (when DSL finally became available to my corner of the second largest town in Vermont). It was no problem, as long as I kept images from loading automatically.

I agree that "we" (on TOD, EB, etc) should keep the pages usable for the most people on the planet as possible, and that means keeping out excessive HTML fluff. EB was pretty good at that, with a slow erosion in recent years, and the new Resilience.org is less good in that sense. I get the feeling that young web designers have never even heard the word "bandwidth", or else think that the spectrum of bandwidths out there range from 4G to Goggle's gigabit. :-)

When it comes to bandwidth, the rule is: "build it and they will come". In other words, any amount of bandwidth will be filled with superfluous use. The current trend is video-on-demand, which is insanely wasteful of bandwidth to my old mind. (I'm sticking to DVDs by mail, 2 per month.)

Why is this important? Because bandwidth is the true physical cost of the internet. That (and massive servers) is where massive material and energy inputs are harnessed, invisible to the typical "user" who thinks that their Mac Mini is oh so light on the planet. And all this infrastructure is mostly paid for by advertising. If and when the advertising money dries up as the economy keeps sliding, people may be shocked as they are asked to pay for "streaming" by the byte - as is already the growing trend in the parallel world of wireless "mobile" data.

Excuse me, but where in the world do you live if you still discuss dialup and ISDN? I didn't think that was still comercially avilable.

Many in the US still use dialup. It is something like 1/4 of the people who access this site. It's especially common in rural areas, where broadband is often not available, but some just like to save money and so stick with dial-up.

In my part of the woods here in Scotts Valley California it is 12500 meters of wire from my house to the phone switch. DSL is limited to about 5,500 meters, and POP here is only 24k baud at best. Cable, ha ha, they won't run 2000 meters of cable for one connection. I have set up a WiFi link up to a mountain top about 8km away that allows me a “blinding” 250k bps. I obviously do not get good streaming video : ).

Regarding the plots for China's oil and gasoline demand: Current demand for oil is a little over 10 mmbpd, but when will the slope decline or go to zero, meaning no increase? Charts show only 10mmbpd max on vertical scale so I suppose no prediction is made.

I would guess before 2020 China's imports will stagnate and decline there after, besides domestic production decline starting well before that. Reason for my prediction is a continuation of US domestic production decline by 2015 and significant KSA production decline before 2020. Less oil on global market will mean less oil for China in particular, regardless of their foreign energy investments. If the global economy enters another recession led by US lack of growth, then all will happen sooner as US drill rigs are sidelined by low oil prices.

Money Printing for Beginners (and Experts)

How the global monetary system works, why it is about to collapse with hyperinflation as the likely outcome, and why the western countries running huge trade deficits (USA and UK) are in deep trouble when the SDR gets redefined.

If I were in the UK, I would plan to get out ASAP. When the Pound is dropped out of the SDR and the financial system collapses, what productive assets will that country retain? Its oil production is tanking, it has no coal left, and as far as I know it has no significant gas deposits. 50 million people crammed into a cold unproductive island... yikes. I don't know what y'all are going to do.

At least the US has lots of coal and gas left, even though its oil production is declining. It's also the breadbasket of the world with a much lower population density. It should be able to limp along for a few more decades, but the UK? Uggh. Malthusian Collapse, here we come.

Well, if that starts to happen (not saying it will or won't), it may provide a useful wake up call for people in other "developed" nations that something is going seriously wrong with finance/energy/resources/food. On the other hand, I already feel that way about Greece, and most folks seem to think "that can't happen over here". I guess we'll see.

It is true the U.S. has oil but without the Ponzi credit issuing scheme functioning correctly can the U.S. afford to produce the oil? I rather doubt that we can. The global economic collapse is coming and it will shatter the normalcy bias that is so prevalent in the world today. The end of easy credit will be the end of BAU.

Just caught President Obama's fiscal cliff / Christmas break speech. In closing he said the words "Call me a hopeless optimist..."

Haha! Good one :-)

Weird, I read "...Christmas bleak speech."

I read the paper. It has some useful information but it misses a

very important fact-- banks must turn a profit!!. They have done

this for centuries by charging interest on loans. This requires

an ever expanding level of debt to service the pre-existing debt.

Lately the interest rates have been forced down resulting in banks and

other financial institutions to search elsewhere for profits. This is the

driving force behind the derivatives market. The huge notational

value of the total derivatives market ( guesstimated at about 1 quadrillion dollars)

requires every form/type of account to be leveraged as collateral in

support of the market. This includes but is not limited to all segragated

accounts (including loans) held by everyone!

At a leverage ratio of 10/1 about 100 trillion dollars of collateral

Is needed to support the total derivatives market! The derivatives

market must keep expanding for the banks, hedge funds, insurance

companies, pension funds and others to stay profitable!!

There will be no "banking regulation" that separates commercial

banks from investments banks and/or prevents the use of "segragated accounts"

as collateral for derivatives! Any attempt to do so would result in the

immeadiate "margin call" on all the collateral!!! That is why there

are all the "exceptions" to the "Volker" rule (also known as rule 24)

in the Dodd/Frank banking bill being granted!!

The banks run the world!!!!'

Botched stem cell facelift leaves woman with bones growing in her EYES

Ewwwwwwwww.

As they say, "if it worked we wouldn't call it high-tech".

Love it!

«Plus ça change, plus c'est la même chose» or, in English, "Haven't we been down this road before?"

From April, 1982, the BBC Horizon's Whatever Happened to the Energy Crisis?

See: http://www.youtube.com/watch?v=5QvI7rPz36A

Cheers,

Paul

Nissan CEO Carlos Ghosn's, who predicted U.S. Leaf sales would double to 20,000 in 2012.

Leaf sales have certainly been disappointing. So I'm going to posit a few reasons why:

1) The sales forecasts were always too optimistic. EVs are expensive and do have range limits and that does not get many people interested. Yes they are cheaper to fuel buy people just don't take that into consideration . . . hence all our appliances being horribly inefficient unless the DoE forces regulations on them.

2) It overpromised and under delivered. They talked about 100 mile range. But that was with a ridiculously lenient Japanese standard. The EPA 73 mile range rating was more accurate and much smaller than 100 miles.

3) Expensive and then the price went up higher. It was released with a $32K price tag and got bumped up to $35.2K the next year. Ouch.

4) The PHEV model worked better for American consumers. The Volt sales have been better . . . at time twice as high as the Leaf sales. The Ford C-Max Energi and (wimpy) Plug-In Prius have also both sold better than the Leaf.

Of course, I have sympathy for Nissan. It is just not easy to build an inexpensive pure EV. But they are trying. And right now there are places with a $9775 off MSRP!:

http://www.nissansunnyvale.com/new-inventory/index.htm?listingConfigId=a...

So you can get one for less than $20K after counting that year-end discount, the Fed Tax-credit, and the California rebate. Hopefully the US-built Leaf will be significantly cheaper than the current $35.2K base price. That just does not go over well with consumers.

This is what concerns me about the recent hype, speculating that the US will overtake Saudi Arabia as the world's leading "oil" producer. Instead of hearing a narrative that implies that the higher price of EVs will be a worthwhile investment as liquid fuels become scarce or more expensive, we are hearing a narrative that suggests that spending the extra money on an EV is unwise since we'll soon all be swimming in oil. If I didn't know better, I would say that discouraging any thoughts of substitution or conservation is the exact motivation for this recent surge in optimistic news.

Truth be told, I don't know better and one result is that, all the pure EV players save one (Tesla) are facing bankruptcy.

Alan from the islands

I think thats secondary to "pumping up the (oil) stock prices". Although both contribute to the same goal, a thirstier fleet also helps to maintain oil demand. When multiple arguments all point the same way, selling an idea gets a lot easier.

Where is a view on people and the overall economic outlook? I don't see how anyone with a 'different' product like a fairly premium EV could be expected to see such a boost in sales in these surroundings.. no matter what people have said is recovering, I'd say it's clear to a great many consumers that we're generally suspended on fingernails at this point.

Even my somewhat mainstream wife is saying 'everything is going to change.. this system is falling apart' .. how would a sizable chunk of car buyers be expected to go for a dice-roll in that case? WE need a new car at this point, and she knows the arguments.. but an EV probably won't be the call.

I'd love to build a Pedelec Velo with Snow Tires.. but even then, I don't think I could make it legal here for the time being.

Each of those 'opportunity jumps' often have to get grabbed when the stars are lined up for you .. and the stars seem quite the mess so far. But I did manage to get the heat pump this year...

We've had a Leaf for over a year now (as well as a Volt). We like both of them. We recently drove the Leaf on a 70-mile round trip and got back with an indicated 18 miles remaining; much of the trip was highway, which gets lower mileage. I find the Leaf gets 4.2 miles/KWH or 140 mpg energy equivalent.

With a Leaf (or Volt), for less than the cost of 3 years' gasoline for an average gasoline car, you can buy solar panels the will power the Leaf for the same number of miles per year for the rest of your life.

I saw an article recently that said EV mileage varies greatly with driver style. It claims older drivers often do a lot better. I can imagine the average motorhead automobile reviewer type uses a pretty heavy foot on the accelerator and brake, and doesn't plan ahead for long even gentle braking and such. I imagine nearly anyone on the TOD list instinctively hypermiles.

One of the many beautiful things about a Prius is that with the right technique it actually can be driven quite aggressively with minimal impact to mileage. I'm a field engineer and therefore do a ton of driving to sites, and I'm usually running late. I can absolutely flog the Prius and still average around 44-45mpg, whereas if I baby it it will get around 49-50. Never been able to sustain more than 50 for any great length of time even on medium-speed highways, but that may be because it's an '05 with some age on the battery.

"EV mileage varies greatly with driver style."

A young friend of mine is involved with an entrepreneurial house doing electric vehicle development. When working on battery charge controllers, the need arises to discharge the battery. If the resistive power-burning load-banks are not available, then he will take the vehicle out and drive it flat. He has developed the art of, the habits for, driving an electric vehicle flat as quickly as possible.

It is butt-ugly

http://tctechcrunch2011.files.wordpress.com/2010/08/nissan-leaf-6.jpg

http://files.conceptcarz.com/img/Nissan/Nissan-Leaf_EV-Image-04-1024.jpg

http://www.automobilesreview.com/img/nissan-leaf-tokyo-2009/nissan-leaf-...

http://media.ed.edmunds-media.com/nissan/leaf/2012/oem/2012_nissan_leaf_...

Yeah, we irrational humans find looks mighty important.

If you want to sell something you need to find a market that wants to buy it. You are right that humans are irrational. Who else are you going to sell to, however, yeast?

http://www.blogcdn.com/www.autoblog.com/media/2009/08/bread-f1-car-large...

Article with a nice graph of the spread between the prices of Brent and WTI crude oil.

...But as a collapse person, I found the graph of U.S. Increase In Real GDP Per Dollar to be the most interesting.

http://www.businessinsider.com/the-most-important-charts-of-2012-2012-12...

Regarding the 'Chart Everyone Should See' above:

I went to the CSM Web site and clicked on the chart, then magnified the image using the FireFox '+' key, filling the screen, then used a straightedge to examine the depicted Delta between the anticipated consumption and the predicted consumption.

According to this chart, prepared in 2009, consumption is roughly flat in the few years up through 2012, then we see a detectable Delta in 2013, and a rather noticeable one in 2014, with the Delta much worse on out.

Undoubtedly this consumption fall-off will occur at some point....but this chart looks very much like a chart posted frequently in the years prior to 2010, depicting a production/consumption roll-off in 2010.

This prediction will come true one of these years...but I hesitate to predict the noticeable consumption roll-off occurs by the end of 2013.

Before I get a fusillade of anger sent my way...I am in firmly the 'PO camp'...but continued 'hard downslope' predictions that don't come true add gasoline to the anti-PO/forever cornocopian fires.

I wouldn't take that chart as an exact prediction of the end of the plateau, etc. The main point of it is that, over the somewhat longer term (a mere 20 years) it predicts the need for "a few Saudi Arabias" of demand to be magically supplied by faith-based "unidentified projects" (UFPs (tm)). Guaranteed, 'cause the universe owes us cheap fuel. /sarc

From the link:

You should post the EIA and tell them to get their act together.

Ron P.

http://www.eia.gov/forecasts/steo/query/

Select: International Crude Oil and Liquid Fuels

Select: Consumption

Select: Total World Liquid Fuels Consumption

Select: Submit Query

On the next pasge, select the graph icon

The resulting graph I see depicts a small, nut noticeable, increase in total liquids consumption through 2013.

Here is an outlook to 2030:

http://www.eia.gov/oiaf/aeo/otheranalysis/aeo_2009analysispapers/pdf/tab...

Here is an outlook through 2035:

http://www.eia.gov/neic/speeches/newell_aeo_liquids.pdf

Here are the assumptions for AEO2012:

http://www.eia.gov/forecasts/aeo/assumptions/

This is the assumptions PDF (this seems to address U.S. only, so I may be mixing apples and oranges):

http://www.eia.gov/forecasts/aeo/assumptions/pdf/0554%282012%29.pdf

I read the description of their high-level model architecture, said "Great, but its all about the assumptions", then looked at assumptions for supply, and saw reserves numbers coming from other sources such as USGS and others. I also saw 'percentage improvement' factors listed for things such as oil recovery rates etc.

In sum, if I assume that the model 'processes the data right', However, I wonder mightily if the model 'processes the right data'.

The problem is sparse data on OIP and recovery factors, and probably a big dose of Setec Astromomy.

Of course, those proposing counter data to the EIA projections are making their own assumptions.

The PO tribe will be proven correct wrt to the advent of permanent, continued supply declines...the 64 Gazillion dollar question is: When?

It's always suspect when a graph shows a large inflection point right after time=now...

Ulan Baskaw and Metrognomicon, the inflection point goes up, not down! The EIA said, in 2009, that by 2013 existing production would start to decline. It will. In fact it was already in steep decline when that projection was made. The graph clearly shows that. They said that new conventional projects would keep production flat to slightly up. It did. The EIA was correct in that respect.

Now, beginning in 2013, according to the EIA, unidentified projects would keep production going up. It might and it might not.

But stop blaming Curt Kobb and TOD posters for making projections that so clearly belong to the EIA. If the EIA has changed their projections since 2009 then that is no surprise. They seem to change them every year.

Ron P.

Ron P,

I understand the nature of the graph...what it is trying to portray.

Note that I am not 'blaming' Kurt Cobb or TOD denizens for creating the graph...however, I am leery of the effect of many folk wholeheartedly embracing and promoting the graph as 'the prediction'.

At this point I would not be surprised that, come this time next year, we do not see the Delta depicted in the graph. Maybe we won't even see the depicted Delta in the graph come this time in 2015.

We all know the time will come when all the 'last ditch' liquid fuel production efforts fail to offset the declines in the C&C oil production flow.

2015...20120...2035...all can be considered as 'tomorrow' in the context of Human history. We are inside lead-time away to optimally react to this eventuality. Maybe if most folks would have grokked the information presented by the Club of Rome decades ago...and implemented strict population controls, accelerated alt energy development and efficiency tech, changed land use and building use patterns...

Objective consensus in analysis of PO is impossible....the subject is far too supercharged/radioactive...the idea of 'finite' and 'endless growth is impossible' is alien to too many minds, especially those in power. Even given that some of the top dogs/captains of industry/government/etc. understand the concept of 'finite', they cannot topple the confidence game house of cards...perhaps they are happy to get theirs while they are still alive, and pray to the great deity 'Cornopcopia' that technological breakthroughs will rescue their progeny.

At any rate, I would take the graph in question with more than a few grains of salt...I clearly remember the 'After 2009 (then 2010) the production cliff arrivith' charts that were excitedly promoted.

Edit:

Ah, perhaps the Energy Data Crowdsourcing effort described by Rembrandt (see article on TOD right now) may help with the data sparsity problem.

But...then again, proprietary and national security considerations may prevent the collection and posting of certain data.

No, no, no, Ulan, you still don't understand the graph at all. And it is obvious that you do not understand what the graph is trying to portray. The graph was created by the EIA. The colored portion of the chart is what the EIA says will happen to current production between now and 2030.

There is nothing controversial about that portion of the chart. You obviously think there is. No, both Peak Oilers and the EIA can agree on that portion of the chart. They just looked at the current decline rates and extrapolated them out to 2030. It is as simple as that.

The controversial part of the chart is the white part, the unidentified projects part. The EIA says this will likely happen and we peak oilers say it is highly unlikely that this will happen. But obviously there will be some unidentified projects take place and the decline will not be nearly as great as if there were none. If there were none, then the actual decline would look just like the decline of the colored portion of the chart. But no one is making that claim, not the EIA, not Kurt Cobb and not peak oilers who post on TOD.

I hope that makes it clear because both you and Ulan seem to think this chart predicts some kind of drop off beginning in 2013. It predicts nothing of the sort. The colored portion predicts business as usual, the normal decline will continue, nothing more.

It would indeed be strange if the colored portion did not turn down. That would mean the normal decline suddenly stopped. And that would be news indeed.

Ron P.

I think we agree, perhaps I have not expressed myself well.

If I understand your words correctly, you think that the future oil production will be somewhere between the tops of the colored bars, a line representing the production of current fields, with the expected rate of decline, and the production from as yet unknown/undeclared fields, with their expected rate of decline, added to the expected current field production, as represented by the black line.

I would agree that there is a high probability that the future oil production lies between these two lines.

My interpretation of the estimates of some TODsters is that the actual production will be considerably closer to the colored bar tops than the black line. I do not refute that thinking, nor do I support it, as I do not have the raw data...in fact, some of the data may be unknown until future dates.

I am in complete agreement that the colored portion must decline, as that is the only behavior that complies with the known science and engineering, understanding of geology, etc.

I may be mistaken, but one of the other EIA document I scanned seemed to show 2030-ish production predictions of a magnitude comparable to those at present. This would imply a graph where the top of the black line started at the top of the colored portion in 2012 and maintained its magnitude until ~ 2030. In plain text, presently unknown sources would 'fill in' for the decline rate of presently known production.

The EIA documents I scanned did not depict any proof why this would be the case...so it all looks like guesswork to me...unless the EIA (or the USGS or the other sources the EIA points to) reveals their math/science justifying their claim.

Again...I not not what the truth of the matter is. Perhaps no one on Earth knows.