Oil Watch: Drill Baby Drill

Posted by Euan Mearns on January 30, 2013 - 11:36am

Executive Summary

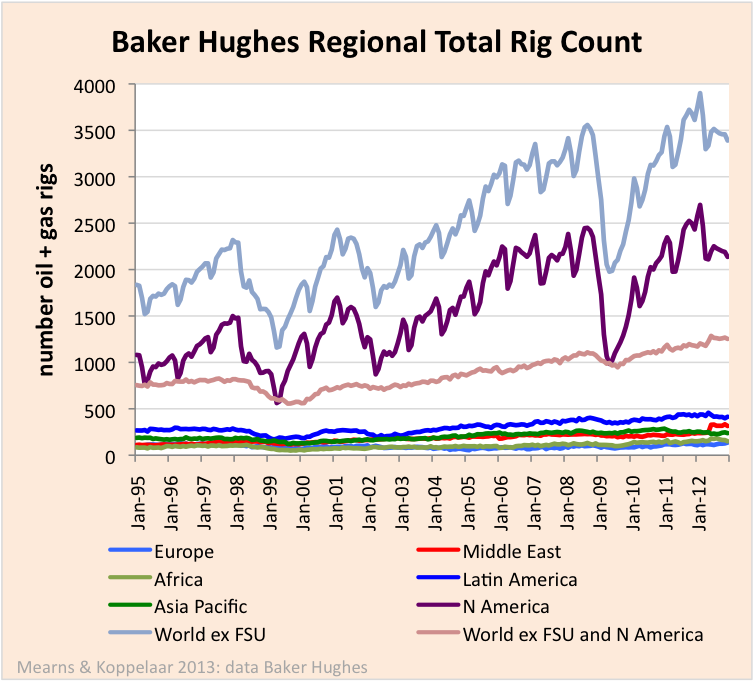

In January 1995 there was a total of 1738 oil and gas rigs drilling globally (excluding the former Soviet Union (FSU). By February 2012 that number had more than doubled to 3850. Global C+C+NGL production grew from 68 to 84 million bpd (24%) over the same period.

Global drilling for oil and gas is dominated by North America, in particular the USA. In January 1995 there were 737 oil and gas rigs drilling in the USA, 42% of the world total. By October 2011 this figure had grown to 2010 rigs, 55% of the world total.

Proportionally, the USA has increased it's drilling effort compared to the rest of the world and currently benefits from lower oil prices, significantly lower natural gas prices and higher economic growth than many OECD peers.

Does the rest of the world need to wake up and to drill baby drill?

Figure 1 Global oil, gas and total rig counts from Baker Hughes compared with global crude+condensate+NGL production from the EIA. Note that Baker Hughes does not include data for the FSU.

The overall structure of the global rig count data is controlled by North America. The fall in drilling activity in 1998 was due to chronic low oil prices less than $10 / barrel; the fall in 2001 was due to recession in wake of the dot com bust and the fall in 2008 was due to the financial crash. The annual cyclicity in the data comes from Canada, where drilling is reduced during the Spring thaw. The near term peak of 3850 rigs was in February 2012 and it remains to be seen how the fall in drilling activity since then pans out. It is possible this is linked to a realisation that drilling shale is not profitable. The huge switch from gas to oil drilling post-2009 is discussed below the fold.

Oil Watch posts are joint with Rembrandt Koppelaar.

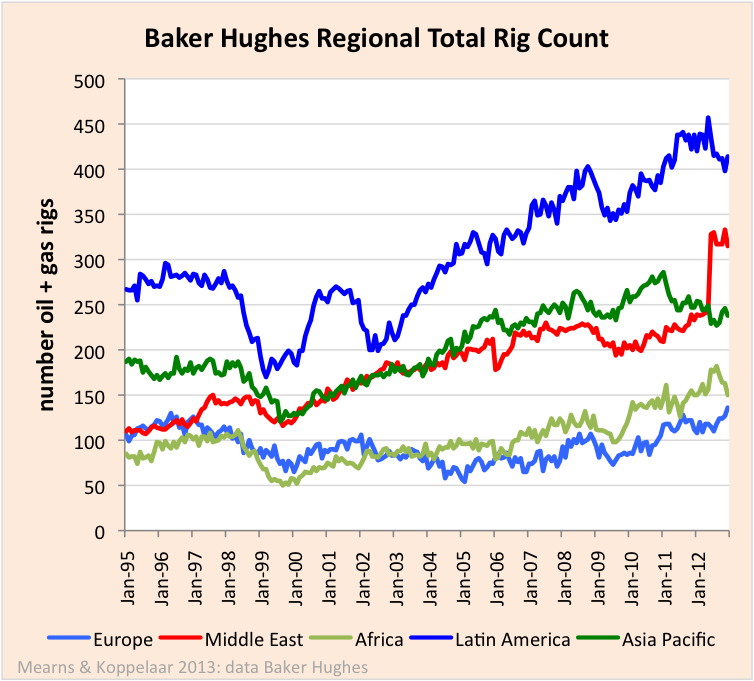

Figure 2 shows how the structure of the global rig count is controlled by N America. In Dec 2012 N America accounted for 64% of the global total. Drilling in N America is also much more volatile than in the rest of the world, hence N America dominates the structure of the global data. The detail for the other regions is shown in Figure 3.

After N America, Latin America (that includes Mexico) leads the drilling charts (Figure 3). The overall structure is similar to N America. Rig count has grown by 55% since Jan 1995 from 267 to 414 rigs in Dec 2012.

The Middle East shows a major increase in rigs by 186% from 110 rigs in Jan 1995 to 315 rigs in Dec 2012. The amazing thing about The Middle East is that they were able to sustain 20 million bpd production in 1995 with only a handful of rigs drilling wells. In 2005 the production world changed as depletion of reserves in aging supergiants meant that a higher level of drilling was required to maintain production (see Figure 7 for Saudi Arabia). The step down in the data in June 2005 is due to cessation of reports from Iran and the step up in June 2012 is due to the beginning of reports from Iraq. Note that Egypt and Sudan are included with the Middle East by Baker Hughes and these countries have been deducted from the Middle East statistics and included with Africa in this report.

The rig count for the Asia Pacific shows a marginal increase of 27% from 187 rigs in Jan 1995 to 238 rigs in Dec 2012 (Figure 3). The peak number was 286 in Jan 2011 and the decline since then most likely reflects redeployment of rigs to other regions that are presumably viewed more favorably.

The rig count for Africa has grown by 76% from 85 rigs in Jan 1995 to 150 in Dec 2012. Whilst this is a steady increase it is still a very low level of drilling activity for such a vast and locally oil and gas rich continent.

The rig count for Europe is essentially flat over the period though shows signs of rising towards the end of 2012. This is due in part to a rise in land rigs drilling in Turkey but the North Sea also shows a small uptick.

Since the year 2000, significantly more of the world's rigs were engaged in drilling for gas than for oil (Figure 1) but since 2009 this has changed dramatically with gas drilling continuing to decline and rigs being reassigned to drilling for oil to the point that 76% of rigs are now engaged in drilling for oil. This whole pattern is dominated by a switch from drilling for shale gas to shale oil in the USA as discussed below. Up until 2009 there were significantly more rigs drilling for oil in the rest of the world than there was in North America (Figure 4) but since then oil drilling has shot up in North America so that there is now significantly more rigs drilling for oil in North America than in the rest of the world.

Every now and then we stumble upon a statistic that is difficult to comprehend. Global gas drilling statistics is one of these. In mid 2008, 88% of all gas drilling in the world (ex FSU) was taking place in N America. As already discussed, since 2009 there has been a major re-deployment of rigs to drill oil instead of gas (Figure 5). It is difficult to understand what is going on in the psyche of the rest of the world. Can we not be bothered to drill for vital fuel? Or is this linked to the geopolitical location of reserves in countries with national energy corporations? Perhaps a bit of both.

With the USA dominating global drilling, it is of course worthwhile to take a closer look at the drilling and production statistics for that country (Figure 6). The "drill baby drill" frenzy reached a peak of 2002 rigs in September 2008 when the financial crash took control of events. This peak was narrowly passed with 2010 rigs operating in October 2011, but since then operational drilling has declined significantly. Figure 6 shows how oil has been prioritised over gas since 2009. Gas rigs peaked at 1589 in August 2008 and have since declined to 423 rigs in December 2012, but over this period gas production has continued to rise as a backlog of wells drilled have been brought onstream and hooked up to the distribution network. It seems likely, however, that oil wells will be brought on straight away, and for example, associated gas in the Bakken is simply flared. The shale oil drilling frenzy has produced around a 1 million bpd contribution to US and global oil production. But this has taken around 55% of the global drilling effort (see summary at top).

Oil drilling has recently turned down in the USA (Figure 6). If shale oil production was to continue rising into the future, we would expect to see the rig number continuing to go up. It remains to be seen if the recent downturn in US oil drilling is temporary and what reasons lie behind this reversal.

Finally, it is worth taking a look at Saudi Arabia (Figure 7). The number of rigs operating in the Kingdom reached a record high of 88 in October 2012 and there has to be a message in that statistic in itself. The split was 58 oil and 30 gas. But Saudi Arabia continues to produce around 11.7 million bpd on a slowly rising bumpy plateau with a relatively tiny number of operational rigs. The production world changed in Saudi Arabia in 2005 when the drilling rig count more than doubled, drilling new wells to combat declines from legacy assets like Ghawar. Like the USA, there has been a recent prioritistaion of oil drilling over gas. With Brent crude trading at over $113 / barrel it is quite clear that the world's major producers are working flat out to meet demand.

Data Limitations

Baker Hughes provide a service to the global community by publishing their extensive rig count database. However, like many complex sets of statistics, the data has a number of limitations as follows:

1. The main limitation of the Baker Hughes rig count is the omission of data from the FSU.

2. The count misses the drilling activity of large fixed offshore platforms some of which are continuously engaged in drilling oil and gas production and exploration wells.

3. The "International" data is reported monthly from January 1995, which is the datum used in this report. North American data is reported weekly and has been transformed to monthly averages using an XL macro. The US weekly data begins in July 1987 while the Canadian weekly data does not begin until March 1998. There is monthly data for Canada going back to 1964 but this is for total rigs, not broken out by oil and gas.From Baker Hughes Baker Hughes has issued the rotary rig counts as a service to the petroleum industry since 1944, when Hughes Tool Company began weekly counts of U.S. and Canadian drilling activity. Hughes initiated the monthly international rig count in 1975. The North American rig count is released weekly at noon central time on the last day of the work week. The international rig count is released on the fifth working day of each month.

The Baker Hughes Rig Counts are an important business barometer for the drilling industry and its suppliers. When drilling rigs are active, they consume products and services produced by the oil service industry. The active rig count acts as a leading indicator of demand for products used in drilling, completing, producing and processing hydrocarbons.

Baker Hughes Rig Counts are published by major newspapers and trade publications, are referred to frequently by journalists, economists, security analysts and government officials, and are included in many industry statistical reports. Because they have been compiled consistently for 60 years, Baker Hughes Rig Counts also are useful in historical analysis of the industry.

From a North American view point the relative inactivity of drilling in the rest of the world may be baffling. However, it is probably worth repeating some background factors often mentioned on the Drum that have to affect the business of getting out there and drilling. Firstly in much of the world the land owners have no, or limited, rights to sub-surface minerals. So there is little financial incentive to open up land to development, other than for fees they may manage to negotiate in return for granting access rights and surface damage/compensation. Secondly there just isn't a cohort of skilled drillers, engineers, and their specialized rigs and services, idling nearby and waiting to be called upon. Mobilizing such a task force requires negotiating a plethora of hurdles including politics, customs, taxes, corruption, visas, supply lines and, sadly more frequently, civil or national unrest or terrorism.

The result is that to drill you have to be prepared to commit serious capital and time in your investment. A few million dollars and some enthusiastic geos with a hunch are not enough.

It would be interesting to get FSU figures. That is an area where they do have the skills and the service sector and they have a huge back-catalogue of onshore drilling.

In addition to o-t's informative post I'll toss out another huge distinction between the US and most of the world: the number of oil and gas operators. Here's a list of just the largest 50 US companies (http://www.petrostrategies.org/Links/Biggest_US_Based_Oil_and_Gas_Compan...). Most won't have to go far down the list before they see names they've never seen before. Beyond that list there are many hundreds of smaller companies most of which, after 38 years in the oil patch, even I’ve never heard of. Having access to privately owned leases is one thing but unless there are enough companies to pursue them it won't happen. In addition there are hundreds of other companies in the process that will never drill a single well but play a vital role in the process. These companies generate drilling projects and sell them to operators. Other companies focus of taking mineral leases which they never intend to drill but will later sell to operators. And both groups of companies do this with their own capital at risk.

And there's much more to the dynamics than the number of operators. The US has a huge service industry sector that's responsible for 99% of the physical drilling activity. True for not only the small independents but the majors also. A Deep Water GOM drill rig may have 140 souls on board for a major oil company and it wouldn’t be uncommon for only a couple of them to be employees of the operator. Same holds true for the onshore support system. The operator may have a dozen or two hands assigned to that well but there can easily be 3 or 4 times that many involved with the service companies.

Without the service companies we couldn’t drill a single well in this country…not even the mighty ExxonMobil. Besides supplying the personnel the service companies took over research and technology development from the Big Oil more than 30 years ago. It’s Halliburton, Baker Hughes et al that are responsible for what’s being accomplished with a drill bit today. And that’s fortunate for the rest of the world: these service companies supply those foreign operators with the required support to get their job done. And beyond the technology there is the financial side of the process. US service companies have amassed (and financed) $trillions in equipment. Oil companies can finance their drilling efforts or fund the infrastructure. But they lost the ability to do both long ago.

Bottom line: IMHO regardless of how high oil/NG prices go or what new trends/technologies are discovered the rest of the world will never approach the productivity of the US oil patch.

The late Matt Simmons use to warn of an aging workforce in the oil industry and that young folks were not entering into the field as much....is this true?

Non expert question here ...

To what extend are drilling rigs "standardized", that is all about the same size ?

Or are there some used for drilling "big holes" and other for small ones ?

Yves - Let's just focus on onshore drilling. No standards at all given the very wide range of wells drilled. I’ve drilled 1,200’ deep shale wells in KY with a 10’ mast mounted on the back of a 10 ton truck with the entire operation handled by just two hands. I’ve drilled 24,000’ deep wells in S La. that required a rig with a 120’ tall derrick with the capability of lifting a 800,000# string of casing. And that rig took 36 18-wheelers to transport it to my location. Besides lifting capacity the pumps used to circulate the drilling mud can be huge. Or non-existent as for my KY wells which circulated only air and not drilling mud.

I guess the easiest analogy would be airplanes: compare a one-man glider to a military transport that can haul a tank or a space shuttle. About the only commonality is that all planes fly and all rigs drill holes in the ground.

Also anothe tidbit: don't get confused when you see folks throw around stats by the number of "oil rigs" driling vs. "gas rigs". We don't have different rigs. The distinction is whether we permit for NG or oil. The same rig I just used to drill my oil prospect moved onto another location for a different operator to drill a gas well.

Rock - thanks a lot for the info. But we can still consider these statistics based on number of rigs to be meaningful ?

And for instance does a rig for a new well in a conventional field (say in Saudi Arabia) tend to be bigger than a rig for one of the many shale oil or gas wells ?

Yves – As far as I’m concerned the rig count just indicates how many rigs were being drilled that month…nothing else. It implies nothing about how many well were drilled that month nor how many wells were added to the production stream. One rig in Karnes County, Texas, takes 30 days to drill an Eagle Ford well that comes on at 500 bopd. My well in Victoria County took 10 days to drill and comes on at 40 bopd. Both rigs add one to the rig count. And a 3rd rig in Aransas County that month was a dry hole that took 4 months to drill. And that same month a rig in the KSA drills a well that took 3 months and comes on at 5,000 bopd. But that rig drilled a horizontal well in Ghawar Fld and didn’t really add much additional reserves…just increased the recovery rate. A Deep Water rig was drilling that month and has been drilling for 6 months and we don’t yet know the results of that effort. But maybe it yields a well that will do 20,000 bopd. But won’t start producing for 2 years while they finish the drilling phase and then have to build out the production facilities.

So there’s 5 rigs added to the count for that month and if all I told you was 5 rigs were drilling during that 30 day period what would that tell you? It would tell you that 5 rigs were drilling that month…nothing else. Now think of 4,000 rigs drilling worldwide that month. That’s 4,000 wells you know nothing about other then they well drilling during at least during a portion of that month. There are rigs drilling today that will finish their well in less than 30 days. There are rigs that will take 6 months to drill their well. So you have two rigs that each add one well to the monthly rig count. Yet one will drill 12 wells in the next year and the other only two. And those two well might add 5,000 bopd to global production. Or nothing at all.

But y-o-y changes? Today there are X% rigs drilling in the US compared to Jan 2012. Does that mean there will be X% wells drilled in 2013? Don’t know…we haven’t gotten thru 2013 yet. Rig count may increase…or decrease. And if we end up drilling the same number of wells in 2013 as we did in 2012 will we add the same amount of production as we did in 2012? Don’t know…maybe more…maybe less. All depends on what we can’t know until it happens.

So again the rig count for Jan 2013 only tells you who many rigs are drilling during that month. Nothing about future well counts or production. If that number is higher than the rig count during Jan 2012 we might drill more wells during 2013…or fewer. Those 2013 wells, regardless of how many are drilled, might add more to the US production rate than the wells drilled during 2012. Or less production. Remember my story about a joint venture I watched over about 30 years ago: drilled 18 exploration wells in 2 years. All dry holes. In 2 years in the mid 80’s I drilled 25 exploration wells and made 23 completions.

Trust me: I can sling stats around all day long and intentionally mislead almost anyone. Except Ron, of course. LOL.

Speaking of well counts; A trusted friend told me that his contact had just signed a contract for 1,000 well pads near Minot, ND. Sounds extremely high to me but if true, would indicate the trend within the Bakken for the next year.

Anyone have related info?

On another note, Montana's legislature is now in session. Evidently the oil drilling fever has migrated to the politicians and they want some of the action. So much for renewables or efficiency.

JB

MTED - I often sign long term contracts with some of my vendors. But the details vary a good bit. Just a guess but I suspect that contract just locks in a price and no legal commitment to build all of those 1,000 pads. Location builders tend to work on a relatively small margin. The company I often utilize to build my locations will take my signed contract and use it as collateral for a loan. Even getting a count on current drill permits doesn't mean ever one will eventually get drilled. Drill permits tend to be very cheap and for one reason or another I've had a number of dril permits that never resulted in a well being drilled.

The best example I give give of big expectations not being met is Devon drilling the E Texas shales back in '08. They had 18 rigs drilling that summer. The geologists told my drilling dept. to sign up every rig they could no matter the cost. And then came the bust in NG prices later that year. In early '09 Devon released 14 of those 18 rigs and paid a $40 million penalty. Yep: paid $40 million to NOT DRILL WELLS. As we often say in the oil patch: there's the plan and then there's what actually happens.

Why would it be, o' fountainhead of rhetoric, that operators worldwide add much additional reserves with each additional well, but Ghawar is an exception ?

What is it about Ghawar that makes this true ? Is it that Ghawar is a tank, and all other reservoirs worldwide are made up of anisotropic rock units ?

c - If I understand you correctly then yes: Ghawar Fld is fundamentally different than the new fractured shale plays and reservoirs like the Bakken. The biggest difference is that the Ghawar Fld has been producing for decades and the shale “fields” haven’t. In fact, the shale “fields” are not fields but trends. New horizontal shale wells are tapping areas of the formation that have never been produced because of the very limited drainage areas of reservoir. Hz wells are drilled in the shales for a very different reason then they are drilled in Ghawar et al. This is due to the second big difference: the nature of the porosity in conventional fields like Ghawar and the unconventional reservoirs like the shales. The situation doesn’t really have much to do with anisotropy: the property of being directionally dependent, as opposed to isotropy, which implies identical properties in all directions. All rocks are anisotropic to some degree. Shales tend to be just so much more. What distinguishes the shale plays from the conventional fields like Ghawar is the nature of fracture producing. The "matrix porosity" (the actually rock and not the fractures) of shales are not producible to any meaningful extent where as the matrix of the conventional reservoirs like Ghawar is the primary source of the production. That's the real meaning of the distinction beteen a conventional and unconventional reservoir IMHO. Not so much the type of rock. They are very rare but there have been are fractured reservoirs that produced oil from igneous granite rocks in California. A higly unconventional reservoir to say the least.

It’s also not 100% correct to say that hz wells in Ghawar Fld aren’t adding some new recoverable reserves. But it might amount to a very small incremental increase. Increased recovery rate is the primary goal. I’m about to begin a hz drilling program in some very old and nearly depleted conventional oil fields in Texas. If very successful I might increase URR from 50% to 55%. Profitable for sure but not a game changer

No, I was refering to Ghawar compared to other conventional reservoirs.

Saudi Aramco thinks they are drilling a relatively low permeability oil saturated zone above a high permeability watered-out zone i.e increased recovery(reserves).

Application of Multivariate Methods to Optimize Development of Thin Oil Zones in a Mature Carbonate Reservoir

http://www.saudiaramco.com/content/dam/Publications/Journal%20of%20Techn...

Applied to Ghawar field, that would amount to 9 gb increased reserves.

I have recently been working in Bangladesh and it illustrates some of the issues mentioned here. They have recently embarked upon a drilling programme to try and support their stalling gas production. The few (less than 5 I would guess) domestic state-owned rigs are not capable of drilling the new, often deeper and more complex targets, so they have contracted a foreign company to bring in bigger rigs and all the associated service components.

The programme started several years ago, and a despite a Polish company being selected 2 years ago, they 'backed out'. Now Gazprom, the Russian giant, is taking over. Bangladesh "subsequently passed a law that bypasses the tender process, and prevents deals inked under the new law from being challenged in courts."

http://www.thefinancialexpress-bd.com/index.php?ref=MjBfMDFfMjRfMTNfMV8y...

In a nutshell after several years of studies, international tendering, multiple cross-committee reviews and subsequent drafting of new laws, Bangladesh may be in a position to drill several mcuh needed deep wells by the end of 2013... It is not easy!

In a 'separate' development, the Bangladeshi Prime Minister visited Russia this month and is said to have agreed to purchase a number of fighter planes and other weapons.

http://www.countercurrents.org/custer270113.htm

Now what was the question? Ah yes, why don't they drill more wells in the rest of the world? Well, if you have the time, and the influence, and you are prepared to broaden your remit just a little beyond the oil patch we may make some progress!

What kind of water depth?! It's been a couple of years, but I recall they had very limited offshore experience and that was really near shore shelf... that could be um interesting...

These wells are all planned for onshore. The offshore activity is still very limited but there are efforts to increase interest in the offshore. Maritime boundary disputes have been partially settled (disputes with India and Burma) and the government has recently offered more favourable production terms for foreign investors/IOCs.

Hi, i just noticed this:

> 1995=total 1738 oil and gas rigs drilling globally

> By 2012 = total 3850 oil and gas rigs drilling globally

> Global C+C+NGL production grew from 68 to 84 million bpd over the same period.

am I right then in extrapolating the following:

in 1995 = 1738 rigs pulled out 39,125.43 thousand Brl/day / rig on average

in 2012 = 3850 rigs pulled out 21,818.81 thousand Brl/day / rig on average

if this is right (i assume it is) is this a indicator of very serious problems down the line re: keeping pace with peak oil etc...?

v - You're heading in the right direction but the number you're trying to estimate is difficult. Those 3850 rigs didn't add 84 million bo. Most of that oil was being produced before those rigs drilled. One can try to estimate the increase in production per rig drilling but still rather inaccurate: how much was due to new wells and how much from old wells being produced at a higher rate? Or did the older wells decrease in production? And of the new wells drilled how many discovered new reserves and how many drilled into existing proved reservoirs to just increase rates without significantly adding reserves? Also one rig that might have drilled wells that resulted in 10,000 new bbls of oil per day and another might have added only 500 bopd. And the consider a Deep Water rig: it might spend 2 years of continuoue drilling yet the new production of, lets say 300,000 bopd, won't start for 12 months after the last well was drilled: takes time to put all that production equipment together.

Concerning Saudi Rig Counts You wrote:

However: Saudi Aramco’s Rig Count to Reach Record, Analyst Says Bloomberg

And: Saudi Aramco plans record rig count this year -sources

You say they had a record of 88 at the end of October and the first link says they had 133 at the end of December. That is a gain of 45 between October and December. That just don't seem reasonable.

At any rate they plan to have between 163 and 170 rigs by the end of 2013. Seems like they are saying "Drill Baby Drill". I wonder what brought all that on? ;-)

Ron P.

If nothing else it may just be reinforcing how difficult it can be to get reliable stats in this business!

Interesting information Ron. Don't know how to explain it. According to BH there were just 78 operational rigs in December 2012 in KSA. Perhaps Sadad is counting fixed offshore installations as well?

I know Saudi has hundreds of offshore wells and platforms but no fixed offshore drilling rigs. Anyway Sadad al-Husseini said 98 of the rigs were working onshore and 35 offshore. So I would think he was counting drilling rigs and not something else. Perhaps Saudi has rigs that belong to ARAMCO that Baker Hughes was not counting.

But the fact that they intend to add 30 rigs this year should tell us something.

Ron P.

The thing that gets me is, even if the higher estimates are correct, why is it that the KSA have only a couple hundred (tops) rigs vs. the U.S.'s 2,000+? It certainly can't be due to a huge difference in drilling technology. Are we mostly just drilling dry holes? Is it possible the EIA's optimistic reserve estimates are right after all?

The KSA fields are typically massive, and most have been exceptionally easy to produce from (good porosity and permeability, continuous reservoirs etc). The production on a well-by-well basis is gold-standard. The result is that they can (or they could historically) get million barrel plus production from a field with only a hundred or so wells. These stats will change in due course as the KSA bring into production less productive fields and continue to tap into more difficult reservoir sections in mature fields. So one factor is that the geology is, on average, much more conducive to oil production in the KSA compared to the average field in the US. When you have a well that can produce at 10,000 bbl/day compared to one only producing 10 bbl/day you don't need to drill so much.

Secondly all drilling is controlled by the national oil company. Nobody else gets a chance to drill. Whether they want to or not.

Thanks. The fact that the KSA has not up til now even *needed* to tap into "less productive fields" (unlike the U.S.) combined with Aramco's highly conservative approach to drilling tells me that they may in fact have a whole lot more oil in reserve than many here believe. Even if it's expensive lower EROEI oil, that may push the global peak date further into the future.

Monbiot may have been right after all ("there's enough [oil] to fry us all").

Not necessarily...I think it was in "Twilight In The Desert" that Matt Simmons described the "Super Straw" effect of horizontal drilling and the sudden stop when the waterflood reaches them. The basic premise is that the horizontal wells allow production to keep running right up to the point that the water reaches them such that they do not gradually increase in water-cut but simply flood out when it reaches them. The "Super Straw" also means that you've not increased the percentage of recovery - only increased the extraction rate. So with horizontal wells everything can look peachy right up until the day that everything comes to a screeching halt.

It's like zipping down the road on "E"...the car is still running so everything seems fine and hey - you haven't had to tap into that 1/2 gallon Jerry Can in the trunk yet so everything's fine, right? Might as well assume you have a full tank since you haven't had to resort to the jerry can.

I can see how you would have that outlook if your knowledge is based on 'Twilight'. In the interest of dispelling the myth:

Integrated Water Management and Reservoir Surveillance Strategies Employed in a Carbonate Field in Saudi Arabia: Review and Results

http://www.saudiaramco.com/content/www/en/home.html#news%257C%252Fen%252...

This is the 21st century, they(SA) have cellular phones, they have cable TV, they have the internet, they have giga cell reservoir models with 60 plus years of history to match. I doubt Saudi Aramco will just sit by and let the rising water drown them. I doubt Saudi Aramco will fly down the road without a fuel guage.

It's the rest of the world that can't look at Saudi Arabia's fuel gauge - they know what's going on (and won't tell anyone else) and it looks like they're getting "mentally prepared" so-to-speak to pull out the jerrycan by drilling the sub-par fields. The rest of the world sees production holding, so assumes that everything is still fine and assumes the tank is full.

Right, that is the reason they are searching desperately in the Red Sea, looking under two kilometers of water and 7,000 feet of salt.

Aramco boosts drilling in seismically tough Red Sea

And are injecting CO2 into Ghawar in hopes of teasing a little more oil out of that old giant.

Saudis Announce 2013 CO2 Injection Plan For Ghawar - But Insist KSA "Does Not Need" Large-Scale EOR

Of course they are not doing it for the oil, they are doing it to help combat Global Warming. Yeah right!

Ron P.

Apparently you are asserting that pilot CO2 injection in Ghawar is evidence of desperation ? Is that correct ?

Saudi Aramco's stated objective all along has been to 'maximize hydrocarbon recovery'. That is rational. Testing CO2 injection in a pilot project in the world's largest field is also: - rational. Equating pilot CO2 injection in Ghawar to desperation is: - not rational.

Of course they are testing CO2 injection with the expectation of recovering additional oil, carbon capture is a desirable side effect. What is irrational about that ?

Just found this. Baker Hughes says Saudi was to increase its rig count to 118 in 2011.

Saudi Arabia Increasing Rig Count 28%, Baker Hughes CEO Says

But back then it was also to keep spare capacity at a comfortable level. ;-)

Correct me if I'm wrong, Euan, but I think both the Russians and

the Chinese have large rig fleets, numbering many hundreds up to 1000

rigs. Your numbers don't include either country, thus skewing the global

results somewhat.

Yes, North America is the big dog, but there's tons of drilling happening

in the FSU and in China. Indeed, perhaps the drilling effort in Eurasia nearly rivals

that in North America?

The latest BP energy outlook has a graph for onshore oil and gas rigs for 2011 (page 24). It shows around 1500 rigs for China and 1100 for FSU.

Rudall, yep I point out in article that FSU is not included. BH do include offshore rigs for China, oversight for my part that they do not include onshore rigs.

Stoney, thanks for pointer to BP energy outlook.

CNPC Drilling Rigs

Russia Drilling Rigs

Россия (Russia) СНГ(FSU)

I seriously doubted your numbers when I read them and started to post saying they sounded ridiculous. But after googling it, I was shocked to find that your numbers were also reported elsewhere and just might be correct.

Obama says the U.S. has a “record number of oil rigs" and "more working oil and gas rigs than the rest of the world” The Truth-O-Meter Says:

Apparently this is the report he is talking about. It is obviously a computer generated translation because some of it just don't make any sense.

Developments in world oil rig manufacturing

Okay, but what does all this tell us? Russian production rose 1.3% this year, about the same as China. Russiais expected to drop by 100 kb/d this year, according to most analysis. All this tells me that they are both drilling like crazy without increasing their production very much.

Ron P.

Is there a source to track well count instead of rig count?

Rig count used to be a reasonable indicator of the number of wells drilled, but rig efficiency and the type of wells being drilled has changed so much over the last 10 years that I don't think you can compare rig counts in 2003 to those in 2013 and arrive at any valid conclusions.

As a very rough example, the gas rig in 2003 was about 800. Today it is 400. I am not sure that means that we are drilling 50% fewer gas wells in 2013 than 2003.

IHS is a leading data broker on well data - I have seen claims that they have 70% plus well spots of wells drilled in their databases. But you have to pay for access. In Europe land and North sea well spot data (surface locations) can be down loaded free, so you can get stats on UK, Norway, Netherlands etc. These public data sets may also give you well spud dates or completion dates.

It seems folks ignore an critical oil-drilling subsidy here in the USA, our sophisticated rural infrastructure. We have a legacy of 100 years of very inexpensive petroleum that built (and still maintains) a highly efficient rural/back country industrial network of roads, fuel and electrical transmission lines, very heavy equipment, and associated personal-support structures (gas stations, convenience stores, hotels, heavy equipment/truck yards, etc.) Does the rest of the world have such a capacity? Do other place have their own Kern Country/Pennsylvania stripper cultures? (in the geological sense of the word :) )

It seems that our ability to extract the last drop might not be shared by other nations. We can measure and hedge our investment and drilling strategies, fine-tune JIT drilling operations, and make money on 50/bpd. I suspect few other nations will have the ability to net energy or make money on their own tight-shale. Rig count is a measure of desperation here in the USA.

ANewLand – I can’t toss out a stat for average production per well in other regions such as the KS. Maybe Ron can. But I’m sure those numbers are huge compared to the average US well. 50 bopd? Try less than 10 bpd…that’s the current US average. I know a few operators, due to the uniqueness of their reservoirs, are making a very nice cash flow/profit from wells making just 1 or 2 bopd.

The big difference between the US oil patch and the rest of the world (basically the NOC’s) is sweat equity and low overhead. One of the operators I mentioned above is netting around $400k/yr from his little 1 -2 bopd wells. And that because he pays no one other than himself to produce those well. And when he does need an extra pair of hands he brings his wife out to work. Really. I asked him once what it cost him to replace the down hole pump on one of his little well. He said $673.52. The man runs a tight ship. As I said the other day guys like this squeeze a nickel so that they make the buffalo poop.

As I said the other day guys like this squeeze a nickel so that they make the buffalo poop.

Well ROCK you made me shuffle though a 3/4 full

1 lb.12 oz. coffee can of 'silver.' Low and behold I did find one buffalo on a 2005 nickle. Some of the 2004 nickles commemerated the first exploration of the Bakken country --well they have a picture of one of the two boats the Lewis and Clark expedition 'sailed' upriver looking for the NW passage. And low and behold you can update your idiom, allow for inflation and squeeze buffalo poop out of a quarter if you happen to have a 2005 Kansas, 2006 North Dakota or a 2010 Yellowstone/Wyoming commemerative, the hind end of one of the bison on the last one is actually conveniently off coin to ease the collection process?-)I imagine if I actually had a real 1 lb. coffee can of 'silver' I might have found an old buffalo nickle--but I've raised a teenage son with poker nights since the days either of those was common.?-)

How does the Buffalo Guy get his oil to town? I assume it is not by buckboard? Perhaps a truck once a week/month to drain his holding tank? Or a small collection pipeline system? Would a similar independent mom-and pop operation be possible in other less developed places? How about in centralized societies/economies? Would similar minimally productive reserves be bothered with?

yeah, so basically the US is anomalous, yet its condition dominates the global resource discussion, both here and especially in the MSM....

ANewLand - Oil is typically hauled off a lease once a month if the volume is small. Otherwise they haul when the tanks get full. Only the largest fields have oil pipelines moving the production to the sales terminals.

Mom & pops in other countries? Not very easily done. For one thing the "mom & pop" tag tends to make them sound rather unsophisticated. In reality they tend to be the most skilled workers in the oil patch when it comes to squeezing profits out of low producing wells. And typically they do the physical work themselves since the cost to hire others to do it destroys much/all of the profit. And where did they get this ability? Commonly by working decades for bigger companies. And then there’s the question of capitalization. Most M&P operators are producing old worn out fields they bought from the bigger companies. Don’t have the financial capability to buy the old production you have no M&P sector.

And when they need to hire a service company to work on their wells? There are small M&P service companies that will work for them at doable prices. You don’t have that sector overseas in the vast majority of countries. There you hire Schlumberger, Halliburton, et al. And they don’t work cheap.

And in nearly all cases in the US the M&P operators are producing from privately owned mineral leases from wells drilled by private companies. In most of the rest of the world oil production is from govt owned mineral leases and from wells drilled by the govt’s national oil company. And NOC’s don’t have much incentive to sell their producing wells to anyone…tends to undermine the value of those workers to the govt. IOW they don’t want to sell their jobs. OTOH the NOC’s typically don’t have the manpower to deal with the more marginal production. This may change in time for such countries as the KSA when the average production per well is closer to 500 bopd than 5,000 bopd. But the challenge when will be where will they get those extra workers.

Yes: the US is very unique with respect to oil field operations compare to the rest of the world. Again I won’t try to guess what the average well produces per day in the rest of the world. But I have no doubt it’s much greater than the average of less than 10 bopd in the US.

I ask these questions because I have this thesis alluded to in my first comment; as the US declines down the energy slope less energy will be available to produce energy. Thus the high-hanging fruit (stranded fields, other remote resources) will become less attractive to harvest (rather than more profitable).

Those 10bpd strippers depend on a rather complex rural infrastructure built when oil was cheap, subsidy of sorts. In the USA country life is more, not less, dependent on JIT fossil fuel deliveries. I continue to maintain a rather jaundiced view of American 'country life.' The guys who hunt/fish have ATV's, truck/trailer rigs, but still mostly shop at supermarkets. Someday rural oil-field workers won't have the luxury to live rural. Takes too much diesel fuel. This process actually began decades ago as bridge/tunnel/pipeline/transmission repair has languished. Just as the Empty Quarter or Siberia is too expensive to strip, so too will rural PA once the convenience stores shut down.

ANewLand - I’m gonna guess you don’t live in rural Texas where many of the M&P companies exist. I'll use that nice husband/wife I know who are producing a bunch of shallow wells at around 1 bopd per well. On an average day he might drive around their lease maybe 5 or 10 miles and checks his wells. If there are no problems he’s back at the house in a couple of hours…done for the day. Once a month the oil buyer shows up with his tanker and in a couple of hours hauls off that month’s production. Done for the day. And maybe once every week or two he and his wife drive 60 miles r/t to shop at Wal-Mart and the grocery. OTOH I drive 50 miles r/t every day to the office and when I go to one of my drilling wells in La. I’ll drive 600+ miles r/t. Then add the huge amount of energy I use to drill new wells compared to the scant little electricity he uses to produce his wells. Which one of us do you think can handle high energy costs/low availability better?

Trust me: if I’m still alive when the TSHTF really bad I’ve already have it set up to relocate to the country. And if I’m not around my 13 yo daughter is already set up. She doesn’t need the Houston water works to function like I do: she has her own water well. Need some meat: shoot a deer/wild pig or just slaughter one of her steers. Local grocery didn’t get veggies delivered this week: just pick some out her garden. Need to visit an neighbor and have no gasoline: ride her horse. Need protection from the zombie hordes roaming the streets like in Houston? No problem: with vigilant and well-armed neighbors watching the few roads in that won’t be much of a problem. No electricity like all the rest of us? Use the hand pump on the water well. But she will still sweat her butt of in August just like the rest of us. But at least a few solar panels she can run a fan. I’ve grew up without air condition and survived just fine…so would she.

The M&P stripper operators don’t depend on anything other than what they have on their lease. Not sure what complex infrastructure you’re referring to. The well pumps oil into a steel tank and a truck swings by to haul it to a buyer’s depot. The only other infrastructure they need is either electricity or some diesel…neither of which I would describe as “complex rural infrastructure”. And some actually fuel their production operations with NG they produce on their lease so other than the oil tanker showing up once a month they don’t need anything else. As far as rural convenience stores shutting down I don’t know how it is where you live but for some years now they have been proliferating in the rural areas of Texas and La. that I visit. And not just little stores: more and more Wal-Mart’s pushing into small towns and even into undeveloped rural areas not in town sites. One Wal-Mart I often stop when heading to S Texas is the country 15 miles from the nearest town. Yes: on two sides of it butt up against cattle pastures.

And let’s not forget that if THSHTF really bad due to energy shortages the assets the M&P companies own/control become even more valuable. There aren’t many other sectors in the economy you can say that about. If the price of diesel goes to $20/gallon as a result of oil going to $200/bbl the only folks who might be able to afford to buy much of it will be the M&P companies that are selling oil...at $200/bbl. Please don’t take this as an insult but it seems as though you have very little firsthand knowledge of either rural life (at least in Texas and La.) or how small oil operators function. If wrong I apologies. But I’ve dealt with M&P operators for 30 years and have spent a good bit of time in those rural communities and if I could swap places today I would do so without hesitation.

Rockman - I won't argue with you regarding rural M&P oil producers, especially those in TX & LA - lord knows I know better than to dispute you regarding such things. But I will suggest that ANL makes a valid point regarding the hinterlands in general. I live in such a place in VA, and grew up in one in northern NY. Of the latter, an ex's uncle from NC, upon visiting my homeland once remarked something along the lines of, "Folks think we got rednecks down South, but they ain't nothin' compared t' them boys ya' got up thar". The local term is 'woodchucks'. Anyway, the point is that the ATV ridin', deer shootin', Walmart (an hour away) shoppin' good ol' boys from both North and South haven't a clue what's coming at them. And when things get bad, yes, I'd much rather be far out than in some city, but the deer will be gone the first year. Few know how to grow food, and it'll get harder as the weather gets ever weirder. Apart from you oil patch folks, those who are driving F-250's a hundred miles each way to construction jobs or whatever job, are going to be in a world of hurt as fuel prices go up, wages stagnate, jobs disappear, and the price of food and other necessities go ever upward, if those things can be found at all. Resource scarcity bodes ill for all but perhaps a handful who sit directly on those final scarce goodies. And they, of course, will be literally 'under the gun'.

clifman - I agree with you in general. But the conversation wasn't about your typical red neck but the folks that run the M&P companies. You can't run such operations (at least not for long) if you have mush between your ears. I know it may not sound very nice but I know where there are folks out in the country that will never be able to hang on to what they have when times get tough. One of them owns the property between my ex and her sister. And when the day comes they lose it when times get bad I'll buy it for more than what anyone else would pay but still get it dirt cheap. I don't wish those folks such trouble but they are doing it to themselves. For instance he bought that classic big p/u that he didn't really need. A truck he paid more for than their house trailer is worth.

Deer are already thinned out too much. But ferrow hogs are out of control. Most of the locals sell their deer permits to city hunters for way too much money and then trap the pigs for their protein source. A few years ago the pigs got so bad in the adjacent county farmers were hiring folks to come in and clean them out.

Think about it: if I own some small wells netting me $200,000/yr when TSHTF really bad, 30% of the county unemployed and many city folks are having problems keeping their homes warm and food on the table every night just how bad are you going to feel for me? I meant it when I said I was very envious of SOME of those country folks.

From last one year Oil Drum is on my daily reading list. And, I learned lot from you people

1. Based on the above information, its clearly shows that US will be responsible for flooding the market with oil and gas and dependency of US on others countries will be reduced to 1/3rd, But, what about declining wells, is there any paper or article which care about the declining rate of wells ?

2. US is supplying the market with extra energy but where is the demand ? They are cutting down on gas but above stats shows their increasing production of crude, not sure if energy industry is ready for US as major producer ?

3. INDIA growth rate is bottoming out to 6 % in 2013, So again where is the demand ?

4.I think year 2013 will be a cheap oil year i:e price of Brent will be below 100 $, if I am wrong please correct me ?

Where's the demand? Well China is building & buying an awful lot of cars these days. I assume they plan on driving them.

But it is not all about demand. Depletion never sleeps and although the USA has boosted production, there is a lot of depletion going on elsewhere. And every since the world proved that it could (kinda) run on $100/barrel oil, the Saudis seem happy to keep the price around there. Their production has dropped a bit lately, I suspect they are intentionally cutting back on production a little bit to keep the price up. Why produce more at $80/barrel when you can produce a little less for $100/barrel?

I think we will largely be on a plateau this year. But that is just a WAG that is certainly wrong. There will be some unforeseen war, terrorist attack, technology break-through, discovery, field peaking, etc. There always is.

Gulatiakshay – Welcome. Sounds like is a good place for you to get caught up on some of the facts. It may take a bit of time but be patient…it will be worth it. If I make some incorrect assumptions about your knowledge base don’t hesitate to say so.

1 The US isn’t flooding any market with oil...not even in the US itself. The US is one of the largest oil consumers on the planet and imports a significant amount of that oil from other countries…mostly Canada, Mexico and Venezuela. Actually the US is not adding to the market but draining it: the US population is only 5% of the global count yet we consume about 25% of the oil produced on the planet.

2 Yes…US oil production has been increasing the last few years. But the US has been one of the top 3 oil producing countries on the planet since the beginning of oil/NG production. In fact at one time the US produced much more oil per day that all of OPEC. In fact at one time the regulatory body in Texas controlled the price of oil by limiting how much companies in Texas could produce on any given. Yes: Saudi Arabia has produced a lot of oil since the beginning. But the US has recovered 50% more oil than the Saudis since the beginning.

3 India’s growth rate may be slowing but a 6% growth rates still strikes me as rather high.

4 You…possibly wrong about future oil prices? Welcome to the club, buddy. LOL. If you’ve read some of my posts you know I try to avoid such predictions. I make enough mistakes about matters that think I understand well. And Brent prices? Currently it is 3.3% higher than a year ago and 10.1% higher than 6 months ago. Latest posting shows the current price is $114.73/bbl

The US will be responsible for flooding the market with oil only in the wet dreams of Fox TV pundits. The US is still the world's largest net oil importer. It has been stepping up its production in North Dakota and Texas quite substantially, but these are old oil formations that companies have known about for half a century or more. They are only being drilled now because the oil price has become high enough to pay for the wells. At some point the companies will run out of new places to drill wells, and then the drilling will stop.

Which brings us to the second point: The decline rate on these new "shale oil" wells is extremely steep - typically 70% in the first 2 years of production. Companies don't mind because they plan to recover their investment in 6 months to 2 years. However, when they stop drilling, the Red Queen will stop running and the overall decline rate will be quite steep. You won't see anything in the mainstream media discussing this because the oil companies don't want to talk about it, and the pundits get most of their information from oil company press releases.

I think that the most accurate assessment of the global situation is that net oil importing OECD countries like the US are gradually being forced out of the global market for exported oil as the developing countries, led by China, have consumed an increasing share of a declining post-2005 volume of Global Net Exports of oil (GNE*).

Our data base shows that the ratio of GNE to Chindia's Net Imports of oil (CNI) fell from 11.0 in 2002 to 5.3 in 2011, and the rate of decline in the ratio has accelerated in recent years, falling from 8.9 in 2005 to 5.3 in 2011. At the 2005 to 2011 rate of decline in the GNE/CNI ratio, in only 18 years the Chinidia region alone (China + India) would theoretically consume 100% of GNE:

Available Net Exports (GNE Less Chindia’s Net Imports):

(2002-2005 rate of change: +4.4%/year; 2005-2011 rate of change: -2.2%year)

Note that the GNE/CNI ratio fell from 2002 to 2005 because the rate of increase in CNI exceeded the rate of increase in GNE.

Rising US oil crude oil production (to a level well below our 1970 peak rate) certainly helps, but it's a near certainty that we finished 2012 with the highest overall decline rate from existing wellbores in US history, and I have a hard time believing that thousands and thousands wellbores quickly headed toward stripper well status--10 bpd or less--will make a material long term difference in the global net export situation.

I think that the US is temporarily in a better position supply wise, but ever increasing decline rates in existing wellbores will catch up with us sooner or later.

In any case, I don't think that an average American consumer, who is not directly or indirectly employed in the domestic oil business, is in a better position, since the fact remains that the global (Brent) price of oil is averaged $112 in 2012, versus $25 in 2002.

And while WTI prices are certainly lower than global prices, the WTI price is really only relevant to Mid-continent producers and refiners. Based on the WTI crack spread versus Brent crack spread (the gross profit from refining a barrel of WTI is about $13-$15 higher than the gross profit from refining a barrel of Brent), US consumers (even in areas where refiners pay WTI prices) are very much exposed to global crude oil prices. Basically, Mid-continent refiners are paying WTI prices for crude, but largely charging Brent based prices for refined products.

In my opinion, net oil importing OECD countries have gone increasingly into debt, from real creditors and accommodative central banks, trying to keep their "Wants" based economies going, as the developing countries, led by China, have consumed an increasing share of declining volume of post-2005 Global Net Exports of oil. The GNE/CNI ratio versus global public debt, through 2011 (Economist Magazine):

*Top 33 net exporters in 2005, BP + Minor EIA data, total petroleum liquids

Euan

Some good points have been raised in this discussion prompted by your rig count post.

So... give us an Anglo reality check, please. How many land rigs are available in the UK? You guys

had or have shale gas hopes, as I understand it, so are there 5 or 10 rigs available that could be

mobilized to fly the Union Jack and drill in Derbyshire or whatever the hell you call your prospective

locations? Offshore.... likewise, how many rigs are rotating, searching for Maggie Thatcher's leftovers?

One of the classic Jack Nicholson flicks, Five Easy Pieces, features a guy working as a rig hand, at least until

he gets into a fight and gets fired. I wonder if that type of blue-collar cultural icon, the roughneck, has an

English analogy?

Randy, BH do provide a land / offshore split. UK currently has zero land rigs drilling, looking back through the data the max has been 4 land rigs - maybe we could borrow some of yours;-) UK currently has about 20 rigs drilling off shore.

Across Europe there are 77 land rigs drilling, with 26 of these in Turkey where there was an upsurge in drilling activity 3 years ago - I assume this is targeting shale but have not heard anything about this.

Chart shows Maggie's dreams going down the tubes.

UK roughnecks work 2 weeks offshore then get a 3 week vacation. Many of them live in Spain.

Yes, if I lived in the UK I would be quite concerned - certainly much more than most Brits appear to be.

Two decades of easy living on the strength of the North Sea oil fields is coming to a rather rapid end. The UK really needs a backup plan to deal with its energy needs when the oil runs out, and I don't see any sign of one.

In Canada our backup plan is quite simple - as our conventional oil runs out we bring our oil sands on production and produce more oil than ever before. In the UK it's not so simple. I have some friends and relatives working in the UK oil industry, but they're just there for a good time, not a long time. They don't intend to stay. They haven't taken out UK citizenship or even sold their houses in Canada.

By contrast, there are a lot of UK petroleum engineers and geologists who have houses and residency status here in Canada. They're generally working somewhere in places like West Africa, but like to have a place to run to if things blow up there.

Rocky - My cohort who drilled with me offshore Africa is a Brit with his residence on the slopes of Whistler. Once I asked about his oil field opportunities in England...he just laughed.

"...as our conventional oil runs out we bring our oil sands on production and produce more oil than ever before." And continue to gouge the US consumer with your high prices and hurt our domestic oil patch by dumping your cheap crude on us. Wait a second...does that make sense? Yes, it does, you greedy bastard! LOL.

You know if you helped me get Canadian citizenship I could become a greedy bastard too and stop harassing you. Just a thought.

There is always a backup 'plan.' In the mid 19th century the UK's backup plan for totally potato dependent Ireland sent a whole lot of Irish to N. America and had about a million starve to death when the blight hit. You still have the queen on your money in Canada and Australia, I'm sure you won't mind if your fellow commonwealthers just move in next door in mass to share the bounty. The US wouldn't be a particularly popular destination for those accustomed to cradle to grave health care.

Seriously, somehow the UK needs to take what resources it has available and get its people heating systems more efficient. Heat pumps have to make sense in a maritime climate and well designed insulation upgrades just have so much payback so fast it is ridiculous how little has been done there (and in the US for that matter).

During the Irish Potato Famine the UK didn't have a backup plan - their plan was BAU, and that plan didn't work. That seems to be the default plan for the North Sea oil decline, too.

The population of Ireland is still only half of what it was just before the Potato Famine hit. The fundamental problem was that Ireland's thin soils and cold, wet climate were perfect for potatoes and nothing else. Without potatoes they couldn't feed 8 million people. They had no money to buy food and the British weren't keen on feeding an extra 4 million of them, so the choice was emigrate or die. There now are about 10 times as many descendants of people who left Ireland living outside of Ireland as there are people left in Ireland.

Interestingly, the first wave of immigrants hit Canada first because the Irish had the unfettered right to move to a fellow British Empire country, whereas the US had immigration controls. The Canadian lumber ships coming back empty from Britain made room in the holds for masses of Irish at phenomenally low rates. In many cases their landlords paid for their passage because they didn't want to see them starve to death in their little cottages, and they didn't have the money to feed them for long. Toronto at the time had about 10,000 people, when suddenly one summer 20,000 Irish immigrants showed up, most of them starving and sick with various plagues. It was a traumatic year for everybody concerned, but they managed to cope. Montreal had even more. The descendants of those Irish are still there.

Canada was in some ways a good place for all Irish because the Protestants moved to Protestant Ontario and became staunch British supporters, and the Catholics moved to Catholic Quebec and became French Canadians. Many old French Canadian families now have Irish surnames, as do many old established Ontario families. However, they no longer spoke the same language so they couldn't argue with each other anymore.

Later, the US opened up its borders to Irish immigrants and eased the pressure on Canada, so many Americans think the Irish waves hitting Boston and New York were somehow unique. They weren't. Canada is full of emigrants from all kinds of wars, revolutions, and famines all over the world. Economic migrants are easier to deal with because they usually come with useful skills.

Good summary. There were some convoluted routes to the 'western' US through Canada if memory serves. Seems some island in the St. Lawrence River was site of a whole lot of Irish refugee misery. Last winter [edit] or the winter before (seems like Dave was travelling in Africa at the time)[/edit] I read The Great Hunger which does an admirable job of presenting best available facts and figures. The author's aristocratic voice does come through but she does write well. Can't remember her name at the moment.

Yes, the island is Grosse Isle, Quebec. It was the main quarantine station for Irish immigrants coming into Canada, and many of them contracted typhus.

Most of the ships arriving from Ireland (the "coffin ships") also carried disease, and the authorities simply couldn't cope - if they looked healthy they just moved them through as fast as possible. Many of the immigrants who were passed on through Grosse Isle developed typhus further upriver, and in later years workers found a mass grave with 6,000 Irish bodies in Montreal. Toronto was similarly affected and thousands of Irish died there as well.

At least half of the Irish immigrants who arrived in Canada continued on to the US. Canada couldn't legally keep them out, and once they had landed in Canada it was a simple matter to walk across the border into the US and avoid all the authorities. Boston was a popular destination.

I am a little suspicious about the effeciency of natural gas fired electricity to run a heat pump. If inefficency of heat generated electricity from any fuel start to match the efficiency gain of the heat pump it will just create a lot of extra work. If the waste heat from electricity generation is used it will however make sense.

Insulation will of course make sense.

There of course are other ways to generate electricity besides gas and coal, but unfortuanately I'm not seeing too much jumping up and down about the next generation of nuclear at the moment--too costly? still too risky? or just not able to compete right now with FF that passes a great part of its cost to 'the future?'

They might build a GE Prism fast breeder soon, China is working on a thorium unit. Countries are installing AP1000 reactors, but it will be a while.

Some scenarios:

NG CC powerplants 50-60% electricity; electric heat pump with ground source (COP 4): 200-240% heat compared to direct burning of NG.

NG power plant 35% electricity: electric heat pump with ground source (COP 4): 120-140% heat compared to direct burning.

If you can use the waste heat, too: ~180% of direct burning.

NG is used in gas heat pumps (COP 1.5 - 2.0): 150-200% heat, however you save power plants.

With air source heat pumps you have often only a COP of 2.5, then a NG heater is from a primary energy POV not really worse, esp. when you then cook with NG.

Well as you might guess from my name above I am a result of the great Irish diaspora from the famine. But I would have to say from the perspective of my country, New Zealand, Australia doesn't look like much of a bolthole as Climate Change unfolds. Hot and dry to hotter and dryer? Water issues are already massive there. Huge and contentious FF desal plant just built in Melbourne. Of course solar has a bright potential there but Big Coal runs the place....

NZ does look like a better bet, it's as pluvial as Australia isn't, a food exporter many times over (yes currently using imported FF inputs but that can step down in crisis as it only uses 4% of the total) and already generates 80% electricity renewably. (50%Hydro, 30%Geo + Wind- no subsidies, these stack up here)

But still we are insanely living in a 20C BAU mindset here, government building highways like crazy and promoting a fantasy 'Drill, Baby, Drill' policy, handing el cheapo leases for largely nonexistent FF (it increasingly seems) to Anadarko and TAG amoung others. Petrobras has just pulled out. We've been fracking for years thanks to the involvement of North American companies: There is no NOC.

Elections late 2014 look likely to return a Labour/Green coalition which will make for a big change to the fantasists currently in charge. How much of a change I think will depend on the state of the world come mid next year. The way the MSM discourse is right now is not helpful to getting us on the right track, and believe me if the 4.5 million souls here on islands the size of Britain and many natural resources can't sort it out, then I hate to think how it's going to be for the rest of the world as we face resource depletion and a cooking atmos...?

Patrick in NZ

Yes, indeed, and I am speaking from these islands parked a little off the coast of N Europe (60 plus million of us in a bunch of cities set in a small farming area that works out at about 4 persons per ploughable acre). Shame about the N Sea and all that coal we don't have anymore. See Rune & Euan's numbers and comment.

Even more behind the times up here. Quite a lot of us in England at least think we are going to leave Europe, build a few high-speed rail lines and a new airport and get back to the 'good times'. Meanwhile almost all our housing could be described as energy inefficient 'legacy', even the stuff built in the last 20 years.

Phil

Yes I have lived in the UK and am very fond of the place but becoming increasingly concerned about the debate there. Frankly if you allow the NIMBYS to prevent development of your not inconsiderable wind resource you'll be going down like Captain Scott the Antarctic; death by foolish prejudice.

On the rail investment debate, my understanding is that HS2, while expensive, means that you can avoid expanding London's airports at all through the happy transformation of existing regional airports effectively being shifted closer to that market with the high speed trains. With Birmingham [IIRC] only an hour away by train then that effectively becomes another London field. I have spent more time getting from Heathrow to central London than that! So while to spend Billions on both those investments [especially Foster's nutty Thames Estuary Airport scheme] would be crazy with rail you get a whole lot of advantages with a lot less risk than betting on the continued expansion of the carbon intensive FF dependant airline sector.

Electric rail is a way better gamble and happily removes any need for the other. Of course you also need to get smarter about how you generate those electrons... including as i say above getting a hell of a lot less squeamish with your views....

Euan,

thanks for sharing.

Your chart shows crude oil balance. How would it look if natural gas was shown? and coal?

U.K. presently imports about 50% of its natural gas consumption on an annual basis.

Presently U.K. imports 60%-70% of its coal consumption.

U.K. now imports about 50% of its primary energy consumption.

- Rune

Rune, we got wind and sh*t loads of Hot Air!

The UK has never had much onshore activity so the dominance of the offshore business has a)generally kept the crews out of sight of the public b) been less labour intensive. You do get some of that roughneck culture in the support centres of Aberdeen and a few of the other eastern ports, but nothing like the US or Canada.

I've said this before: you need to be very careful about trusting the Baker Hughes rig count as it is used internally within the company for budgeting and forecasting. Managers are not above distorting the figures to make their operations and market share figures look better.

Rudall asked me to post this chart to further the debate about shale.....

According to the Oil and Gas Journal, 43,669 wells were drilled in the U.S. in 2012. Next year, they

forecast about 42,100 wells will be drilled, even with a smaller rig count. So, yes, we are drilling more wells

per rig per year than we used to.

We can lend/lease a few to Britain if need be.

A frenetic drilling pace can lead to growth in shale gas and growth in tight oil. Those are realities, which then morph through

media massage and industry pr into "a century of gas" and "energy independence," respectively.

But the soundbites neglect to fully encapsulate the frightful physics of nano porosity.

Shales are demonstrably real. We need to get our head around that. But in a longer

time frame they may be doomed to disappoint, see the chart above that Euan posted.

Shales may offer more in the short term than they can deliver in the long. But if you throw enough rigs and money

at them you can get the largest and most rapid infusion of new energy in American history. They are a frickin miracle, but may also be a

fleeting one.

And as I noted up the thread, for an average US consumer not directly or indirectly employed in the US oil industry, the fact remains that global supply & demand factors, especially in regard to the export market, pushed the average annual price of Brent from $25 in 2002 to $112 in 2012.

Yes. And as I noted upthread in response to Rockman (& ANewLand), things are only going to continue to get worse for said average US consumer, whether they are urban, rural, or (deity forbid) suburban. Your ELP remains amongst the best advice out there- get thee out of the discretionary side of the economy.

But if you throw enough rigs and money

at them you can get the largest and most rapid infusion of new energy in American history. They are a frickin miracle, but may also be a

fleeting one.

????? Are you sure about that ?????

You need to gauge that energy infusion against the country's total energy budget, gross additions only tells a fraction of the story.

rudall - You might want to check the stats on the late 70's and early 80's oil boom in he US. At the peak had more than twice as many rigs drilling (4,600+) as we have today. Many $billions spent. And then check out what US production did during and immediately after. Trust me: it wil be very sobering.

Aw, c'mon Rock, you exaggerate. Peak rigs was 4530 in week 52 of 1981 - according to BH. But seriously, TKS for the heads up. Post on US rig count v oil production 1949 to 2012 is on the way.

Euan - Fading memories I suppose. Especially of such insane times. I've mentioned before about watching over a JV that drilled 18 exploration wells during that boom period. And drilled 18 dry holes in a row. Some of the crap that got drilled back then makes the current shale plays look like solid gold.

Euan - Another point comes to mind: I'll repeat a statement that I'm sure has confused a few folks: the late 70's drilling boom did more to damage the US oil patch than any other event I've seen during my 38 year. But there is a possiblity of seeing another such event in the near future. Of course it's difficult to imagine oil prices dropping that low to create such a repeat. OTOH in early '08 no one was predicting the collapse of NG prices we saw just 12 months later. A collapse that is still very much with us 4 YEARS LATER. IMHO the only thing predictable in the oil patch is that it's unpredictable. Might be difficult for some folks to accept but I have about 100 years of oil patch history back that statement up.

Lend/lease

It's about time we got around to a WWII mindset in the energy arena!

/sarc (only sort of...)

Cliffman

I would hold the sarc. That is exactly is what is needed; a war footing like the UK in WWII. I have often thought that right now the whole world is acting like Britain in the 1930s; thinking we are making deals with Hitler [resource depletion and AGW] and a whole lot of the population saying 'it'll be all right' [ignorists] and others acting like collaborators [denialists]. But that's just human nature. And it should be balanced by what was achieved when shit got real.

Humans are amazingly adaptable and resourceful but pretty much only when we absolutely have to be. We'll deal and deny and ignore right up to the last minute. Let's hope it's not too late this time. It would help if we were clearer about what the enemy is. I mean if only the great US of A stopped chasing the great chimera of our age: Islamic terrorism, with the enormous diversion of resources and attention that that entails, and faced up to the much more real and actually existential threats right in front of us. But hell we're all doin' it, like most things in this age it's just more visible and bigger in the Imperial capital..... Now excuse me while I drive to the shops in my German SUV one more time for a coffee in a disposable cup.... [actually not, but most of the rest of my country are on this stinking hot day...]

Yeah, Patrick, I agree completely. The (sort of) sarc tag was because while I think we need a WWII footing to even begin to address what we face, we are not doing it, and the lend/lease of drilling rigs to spread the 'drill, baby, drill' meme across the pond is not the sort of WWII emulation that is actually needed.

Problem is that 'the last minute' will indeed be 'too late this time', as we have global predicaments, not local or regional problems.

And I like your use of the word chimera wrt Islamic terrorism. It is simply the latest boogey man being held up to distract and divert the masses from the continual siphoning of public resources into the coffers of the money barons.

Actually the "psyche of the rest of the world" makes total sense to me.

Given that fossil reserves are finite and will eventually be exhausted, why would any country want to go on a frenzy of production and quickly exhaust precious limited reserves while also depressing prices by increasing supply?

Shale oil and gas will almost definitely be worth much more in coming decades, so what incentive is there to "Drill, Baby, Drill" from a nationalist perspective, except for pure short-term expediency and "damn the future" disregard for future generations?? Better to let the "grasshopper" countries exhaust their reserves and sell irreplaceable national patrimony for a pittance. Future generations will believe that drilling the US like a pin-cushion to depletion in such a short time was an unconscionable theft from the future, but luckily most of us will be dead and immune to their scorn.

Keeping fossil fuels in the ground pays an "interest rate" (if you look at the increase in value over time) that dwarfs almost any other investment. Sure there are blips in the curve, like the US shale gas boom, but overall slope of the curve is obvious.

And of course this ignores the elephant in the room, climate change. How does an article discuss production rates for fossil fuels and not even mention human-caused climate change, the most fundamental geophysical fact of our time?

Well stated comment. And this 'what incentive is there to "Drill, Baby, Drill" from a nationalist perspective, except for pure short-term expediency and "damn the future" disregard for future generations??' is of course a

question that answers itself.

but luckily most of us will be dead and immune to their scorn. Although I have no progeny of my own, I feel now and deeply the scorn of those future generations...

Clifman – let me make a somewhat harsh statement but I think most will get the point. “Although I have no progeny of my own, I feel now and deeply the scorn of those future generations...”. Fair enough point but let me ask an unfair question: do you care more about those unborn children then the ones alive today? Kinda like the old joke: “Are you still beating your wife?” There really isn’t a good answer. Some third world countries with energy resources are using that income to help their children today. Do you want those countries to deprive the current generation of what they are getting now for the sake of children yet born? Of course it’s unfortunate that in many of those countries very little of that income is being spread to those with the greatest needs. But if such countries were to suffer a loss of income by voluntarily reducing FF production which ends of the economy will likely take the brunt of the hit: the wealthiest or the poorest?

So maybe we go for some balance between the needs of current and future generations. But that brings up another sad reality that many who want to “save something for future generations” don’t bring into the conversation: how are those unborn generations going to deal with the energy/climate situation? Are they going to be good stewards for their future unborn generations or on they going to burn more coal faster than ever in order to keep their current BAU going as best as possible.