Drumbeat: March 18, 2013

Posted by Leanan on March 18, 2013 - 9:39am

Days of Promise Fade for Ethanol

MACON, Mo. — Five years ago, rural America was giddy for ethanol.Backed by government subsidies and mandates, hundreds of ethanol plants rose among the golden fields of the Corn Belt, bringing jobs and business to small towns, providing farmers with a new market for their crops and generating billions of dollars in revenue for the producers of this corn-based fuel blend.

Those days of promise and prosperity are vanishing.

Nearly 10 percent of the nation’s ethanol plants have stopped production over the past year, in part because the drought that has ravaged much of the nation’s crops pushed commodity prices so high that ethanol has become too expensive to produce.

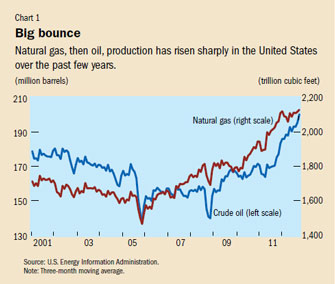

A strong rebound in gas and then oil production in the United States over the past few years has taken markets and policymakers by surprise. As a result, natural gas prices in the United States are at a 20-year low after adjusting for inflation, while light sweet crude oil from the landlocked production areas in the U.S. Midwest is selling at an unusually large discount from international benchmark prices.

The surge in production is largely the result of the new ability of producers to extract oil and gas from unconventional geological formations—so-called shale rock and tight rock or sand formations. The revolution in production occurred first in natural gas and more recently in oil.

It is already widely accepted that the availability of shale gas resources has fundamentally changed the outlook for natural gas as a source of energy. Prospects for unconventional shale and tight oil production are more uncertain though. Could its development foreshadow a long-term decline in oil prices, as happened during the mid- to late 1970s after the 1973 Middle East war triggered a surge in oil production? Conversely, are there risks that the revolution will not last? Moreover, how will it alter the macroeconomic effects of sharp changes in oil prices (so-called oil shocks) on the U.S. and other economies?

Naimi says oil price at $100/barrel 'seems reasonable'

Dubai (Platts) - Saudi Arabian oil minister Ali Naimi said Monday that the price of oil at $100/barrel seemed "reasonable" and would not deter economic growth in Asia while reiterating the kingdom's commitment to maintaining spare oil production capacity for the sake of market stability."Over the past 15 years, it is clear that oil prices have fluctuated more than at any time in history," Naimi told the Credit Suisse Asia Pacific conference in Hong Kong.

WTI Drops From 3-Week High on Cyprus; Libya Pipeline Shut

West Texas Intermediate crude fell from the highest price in three weeks as an unprecedented levy on bank savings in Cyprus threatened to worsen Europe’s debt crisis. Libya shut an oil pipeline after protests.Futures slipped as much as 1.4 percent in New York, dropping for the first time in three days. Cyprus bowed to demands by euro-area finance ministers to raise 5.8 billion euros ($7.6 billion) by taking a piece of every bank account, sending the euro tumbling and sparking public outrage. The closing of the Waha Oil Co. pipe after a strike by truck drivers cut Libyan crude output by 120,000 barrels a day, according to Oil Minister Abdulbari al-Arusi.

Saudi Arabia, Iraq Raise January Oil Shimpents Slightly

Saudi Arabia and Iraq raised crude oil exports in January for the first time in three months, as demand from Asian countries climbed, according to the Joint Organisations Data Initiative.The Saudi kingdom shipped 7.09 million barrels a day, up 30,000 barrels a day from December, data posted today on the initiative’s website showed. Exports in January were 5.5 percent lower than the same month last year, according to JODI.

U.S. Natural Gas Rises to 17-Month High Amid Cold Weather Demand

U.S. natural gas futures rose to their highest in almost 17 months as colder-than-normal weather boosted demand.The low temperature in New York City will remain below the 30-year average for at least 8 days, according to CustomWeather Inc. Below-normal temperatures in northern states over the next five days will spread across the East from March 20 through March 29, Commodity Weather Group LLC said March 15.

Pemex’s Proven Reserves Gain for Second Year After Discoveries

Petroleos Mexicanos, the state- owned company, posted a gain in its proven reserves for a second year, supported by discoveries in the Gulf of Mexico and onshore.Mexico’s reserves rose 0.4 percent to 13.868 billion barrels as of Jan. 1 from 13.81 billion a year earlier, Mexican President Enrique Pena Nieto said today on the 75th anniversary of the state-owned company. Last year, reserves rose 0.1 percent, the first gain in more than a decade.

Statoil Starts Production From Skuld Field in Norwegian Sea

Norwegian oil and gas major Statoil ASA (STO) said Monday that with its partners Eni S.p.A. (E) and Petoro, it has started production from the Skuld field at Norne in the Norwegian Sea.

Libya’s Waha Oil Output Cut by 120,000 Barrels a Day, Arusi Says

Waha Oil Co.’s pipeline in Libya was shut because of a strike at its Gialo field resulting in a cut in the country’s crude output by 120,000 barrels a day, Oil Minister Abdulbari al-Arusi said.The protest is continuing today at the Gialo field, which feeds crude into a pipeline that runs to the Es Sider export terminal, Abduljalil Mayuf, spokesman of Arabian Gulf Oil Co., a unit of National Oil Corp., said by phone from the eastern city of Benghazi.

Statoil reports new gas discovery in Tanzania

Gas exploration off Tanzania has yielded good results for Statoil. On Monday morning, the company reports that it has made a major new discovery. This is the third in one year.“The success in Block 2 is the result of an ambitious and successful drilling campaign. We have so far completed five wells within 15 months and will continue with further wells later this year,” says Tim Dodson, executive vice president for Exploration in Statoil.

Russia Adopts Texas Drilling to Revive Soviet Oil Fields

Fracking isn’t just for shale. In Russia, producers are importing techniques from the U.S. to squeeze billions of dollars of extra oil from Soviet-era fields.TNK-BP, Russia’s third-largest producer, will use hydraulic fracturing combined with horizontal drilling in almost half the wells it sinks this year, a sixfold increase in just two years, the company said. OAO Rosneft, OAO Lukoil and OAO Gazprom Neft have similar plans.

Russia tax breaks for shale, offshore oil seen on Jan.1

(Reuters) - Russian tax breaks for shale and offshore oil, to unlock millions of barrels, will come in to force on Jan. 1 2014, a Finance Ministry official said on Monday.The tight oil tax package will make Russia one of the few countries to incentivise the production of energy resources from shale and other 'tight' rock.

UK should use shale gas to cut emissions, report says

The UK should use natural gas, including from "fracking", to help cut carbon by replacing coal for power supplies over the next few years, a report has suggested.But it would be risky to assume gas prices will be low in the coming years or that the UK has extensive supplies of shale gas which is extracted through the controversial process of fracking, the study said.

Saudi Arabia to Drill Seven Shale Gas Test Wells, Al-Naimi Says

Saudi Arabia, the world’s biggest oil exporter, will drill about seven test wells for shale gas this year, according to Oil Minister Ali Al-Naimi.“We know where the areas are,” Al-Naimi said at a conference in Hong Kong today, referring to the country’s shale gas deposits. “We have rough estimates of over 600 trillion cubic feet of unconventional and shale gas so the potential is very huge and we plan to exploit it.”

Chesapeake Energy to Sell $2.3 Billion of Senior Notes

Chesapeake Energy Corp. intends to offer $2.3 billion of senior notes to help fund a tender offer for roughly $938 million in outstanding senior notes.

TNK-BP Billionaires Plan Global Oil, Telecom Deals After Sale

With $14 billion from selling out of TNK-BP, Mikhail Fridman and German Khan’s Alfa Group is planning to return to the oil industry and expand worldwide, according to Stan Polovets, chief executive officer of the Alfa- Access-Renova Consortium, which owned the Russian oil venture 50:50 with BP Plc.

Iran launches destroyer, a made-in-Iran guided-missile ship

Tehran - Iran launched a domestically built destroyer in the Caspian Sea on Sunday, its first deployment of a major warship in the oil-rich region, state TV reported.

Oil import from Iran slashed by 27%

India may slash import of crude oil from Iran by as much as 27 per cent this fiscal because US and European sanctions have made it difficult to ship oil from the Persian Gulf nation.

No favours for Scotland on energy, warns UK energy minister

UK Energy and climate secretary Ed Davey has thrown down the gauntlet to advocates of Scottish independence, warning that it would place Scotland in direct competition with Norway and Ireland to provide the cheapest electricity supply to the UK.

Dow Chemical to build specialty plants on U.S. Gulf Coast

(Reuters) - Dow Chemical Co said it plans to build several specialty material production plants on the U.S. Gulf Coast to take advantage of cheap shale-derived natural gas.Margins in Dow's performance plastics business have been squeezed in Europe and Asia as the company uses more-expensive crude oil-derived naphtha to make some plastics in these regions.

Saudi Aramco, Dow Venture Begins Bond Sale for Chemicals Complex

Sadara Chemical Co., a joint venture of Saudi Arabian Oil Co. and Dow Chemical Co. (DOW), started selling an Islamic bond that may raise at least $1.4 billion to fund construction of a chemicals complex.The sale of floating-rate securities in Saudi riyals is open only to Saudi nationals and institutions and will have a tenor of about 16 years, the Dhahran-based company said in an e- mailed statement today. Investors will receive a payment every six months equivalent to the six-month Saudi Interbank Offered Rate plus a margin to be decided later.

California Fracking Fight Has $25 Billion Taxes at Stake

California’s reputation for environmental protection may be jeopardized by the lure of a $25 billion tax windfall that depends on how the state permits oil companies to take advantage of vast deposits lying two miles beneath its golden hills.The Monterey Shale formation running through the center of the state may hold 15.4 billion barrels of oil -- equivalent to five years of U.S. petroleum imports, according to a state report. Releasing it requires drillers to smash the rock by forcing millions of gallons of water and chemicals underground, a technique known as fracking.

Eastern Cape to be South Africa’s energy hub, says Peters

THE Eastern Cape is on track to become South Africa’s energy hub, as national power utility Eskom plans its first nuclear plant in the region at Thyspunt, near Cape St Francis, Energy Minister Dipuo Peters said on Monday.Speaking at the Nuclear Africa conference in Johannesburg, Ms Peters said the government was willing to implement a nuclear energy programme with the urgency it deserved.

European Car-Efficiency Rule Would Cut Fuel Bill by 25%

A European Union plan to tighten emissions standards on cars would cut auto-fuel costs by almost a quarter in 2030, according to a report e-mailed by a group promoting policies to reduce carbon emissions in the region.Fuel bills would fall 57 billion euros ($75 billion) from a projected cost of 245 billion euros in 2030, said the European Climate Foundation, which contributed to the report prepared by Cambridge Econometrics and Ricardo-AEA. Producing fuel-efficient vehicles would add 22 billion euros of capital costs, it said.

Via Mark Thoma, a new paper in Vox on the effects of increased rail service, making clever use of natural experiments created by changes in German ownership and regulation. The results aren’t that surprising — more frequent rail service sharply reduces pollution and other costs associated with driving — but it’s good to have this kind of solid work to back our intuition.

Congestion Pricing Is a Force Multiplier for Transit

Writing up a cool paper on the positive externalities of mass transit, Paul Krugman describes transit investment as a kind of useful second-best policy: "the right answer is to get the incentives right, and charge large fees for driving in congestion."That's correct, but I also think it's important for transit fans to see that congestion fees are a kind of force multiplier for transit.

Some conservatives had a different description for Twu and his map. “High-speed rail supporter Alfred Twu has gotten a lot of attention for having boldly drawn a map of where he thinks high-speed trains should go,” wrote Randal O’Toole of the libertarian Cato Institute. “Twu’s map is even more absurd than Obama’s plan,” he wrote, describing the map, and high-speed rail in general, as a “ridiculous fantasy.”O’Toole’s reaction demonstrated one of the principal reasons why American high-speed rail has been mostly stymied: One person’s beautiful vision of the future is another’s terrifying government boondoggle. The Obama plan to use $8 billion in stimulus money as a carrot to get states to invest in high-speed rail went down in flames two years ago. It failed largely because Republican governors in states such as Florida rejected federal funds. But if there were some way to get beyond partisan politics and legal battles over right-of-way issues, what would an ideally efficient map of an American high-speed rail system actually look like?

Abu Dhabi Boosts Solar Power 10-Fold With Shams Plant in Desert

Abu Dhabi, the largest sheikhdom in the United Arab Emirates, is making a 10-fold boost in its capacity to generate electricity from the sun by starting the Shams 1 solar plant with partners Total SA and Abengoa SA.Masdar, the state-owned renewable energy company, will supply 100 megawatts of electricity from the Middle East’s largest facility using concentrated solar technology, Chief Executive Officer Sultan al Jaber said today at the plant’s inauguration in the inland desert west of the U.A.E.’s capital, also called Abu Dhabi.

Suntech Said to Get Default Notice on $541 Million Unpaid Bonds

The trustee administering $541 million in bonds from Suntech Power Holdings Co. Ltd. sent the solar company a notice of default yesterday as the deadline to redeem the notes passed, a person familiar with the matter said.The move allows bondholders to sue the Chinese company in U.S. courts, according to the person, who asked not to be named because the information hasn’t become public. A default would be the first by a mainland Chinese company. Suntech said holders of 63 percent of the bonds agreed to delay exercising their rights for two months until May 15.

Gas Thieves and Gas Defenders in the 1973-4 Oil Crisis

Like all of the Documerica photographs of the shortage—images of shuttered stations, lines of cars, and reluctant pedestrians and cyclists—this one provokes questions about citizens’ behavior toward each other in a crisis. Was it as “Mad Max” out there as this photo would imply?Citizen-on-citizen gasoline thefts like the ones this man feared seem to have been more common in some areas of the country than others. The Los Angeles Times — the newspaper of record of car-dependent Southern California — reported in February 1974 that gas siphoning, in which criminals used a tube to get gas out of a parked car, was rampant. A policeman thought that most of the perpetrators were juveniles: “These young people are going to drive and they are determined to get the gas somehow.”

Micro-Apartments in the Big City: A Trend Builds

Imagine waking in a 15-by-15-foot apartment that still manages to have everything you need. The bed collapses into the wall, and a breakfast table extends down from the back of the bed once it’s tucked away. Instead of closets, look overhead to nooks suspended from the ceiling. Company coming? Get out the stools that stack like nesting dolls in an ottoman.Micro-apartments, in some cases smaller than college dorm rooms, are cropping up in North American cities as urban planners experiment with new types of housing to accommodate growing numbers of single professionals, students, and the elderly. Single-person households made up 26.7 percent of the U.S. total in 2010, vs. 17.6 percent in 1970, according to Census Bureau data. In cities, the proportion is often higher: In New York, it’s about 33 percent. And these boîtes aren’t just for singles. The idea is to be more efficient and eventually to offer cheaper rents.

Man-made desert lake: Ecological paradise or disaster?

The lake is an industrial byproduct of the desalination system used to meet the UAE's water needs. With few sources of fresh water in the region, the country has relied on desalinating seawater for domestic use -- a technology that has been essential to the country's growth, according to advocates."Desalination started here 50 years ago," said Corrado Sommariva, president of the International Desalination Association. "There wouldn't be any development of the industry or society if there was no desalination."

The waste water is treated and just over half reused for industrial purposes, according Mohamed Al Madfaei, executive director at the Abu Dhabi Environmental Agency.

But the other 45% of recycled waste water was simply discharged at sea or released on to the land, where it had been pushing up groundwater levels, and eventually resulted in the creation of Lake Zakher.

Pentagon weapons-maker finds method for cheap, clean water

(Reuters) - A defense contractor better known for building jet fighters and lethal missiles says it has found a way to slash the amount of energy needed to remove salt from seawater, potentially making it vastly cheaper to produce clean water at a time when scarcity has become a global security issue.

Tornado debris study could lead to better warnings

Knowing where the debris is likely to fall could help protect the public if a tornado were to strike a hazardous site and suck up toxic biological or radioactive debris, Knox said."We need to get enough understanding so we can get fairly reasonable predictions of where the stuff goes," said John Snow, a professor of meteorology and dean emeritus at the University of Oklahoma who studied tornado debris in the 1990s. Knox's study builds on research done by Snow and others.

Though nuclear reactors are designed to withstand the force of tornadoes, radioactive materials such as fuel rods are often stored nearby, Snow said. A direct hit on such material is one of many catastrophic scenarios involving tornado-blown debris.

A Green Pope? Many Wonder If Environmental Activism Will Continue

The Catholic Church got a new pope on Wednesday — Pope Francis, who has taken his new name from the patron saint of animals and the environment. But will the man formerly known as Cardinal Jorge Mario Bergoglio of Argentina live up to the ideals of his 13th-century Italian namesake?

Earth Hour Is a Colossal Waste of Time—And Energy

The organizers say that they are providing a way to demonstrate one’s desire to “do something” about global warming. But the reality is that Earth Hour teaches all the wrong lessens, and it actually increases CO2 emissions. Its vain symbolism reveals exactly what is wrong with today’s feel-good environmentalism.Earth Hour teaches us that tackling global warming is easy. Yet, by switching off the lights, all we are doing is making it harder to see.

Resilient agriculture, water reservoirs crucial for Pakistan - scientists

LAHORE, Pakistan (AlertNet) – Leading climate scientists in Pakistan have called for the development of high-temperature-tolerant, climate-resilient, genetically modified crops and the construction of huge water reservoirs to mitigate the effects of climate change.Speaking after the launch of Pakistan’s National Climate Change Policy (NCCP) last month, Ashfaq Ahmad Chattha warned that rising temperatures due to climate change were leading to reduced water supplies and affecting crop production.

Inuits worried as they confront new realities

The rapid melting of the Arctic sea ice has rejuvenated interests in the region, ranging from oil and gas and mineral exploration to the possibility of shorter sea routes and increased tourism. But all this poses fresh challenges to the survival of the Inuit and other indigenous people who live there.While some speakers at The Arctic Summit held by The Economist on March 12 seemed to favour the line that the local people needed money just as anyone else and would welcome the chance to blow it up on fast cars and gizmos, a more studied view was put forth by Aqqaluk Lynge, chair of the Inuit Circumpolar Council, who was quite firm that “We don’t want the fate of the North American indigenous people.”

Will be interested in Alan's comments on the Train Fanatasy posting.

It would seem to me that there is a fallacy involved in the analysis provided. If the high speed line is built, populations will shift to access points. Also, there is an implied statement that it is somehow sustainable to continue airline and roadway supports as these systems become increasingly out priced relative to their utility.

Craig

In the West, the proposed north-south lines follow the existing population concentrations: the West Coast and the front ranges of the Rockies. The east-west lines running out of LA are problematic in terms of populations shifting there: lack of water is going to be a severe constraint. Historically, east-west routes across the West have been more for the purpose of connecting the West Coast to the eastern half of the country than anything else.

I'm always amused by maps that draw high-speed rail heading west out of Denver. No one in their right mind is going to try building through the Rockies along that route. Getting I-70 west from Denver added to the interstate system took US Army insistence and every political favor the State of Colorado could call in. It was the last piece of the original interstate system finished, and at by far the highest cost per mile. A practical northern route is going to go farther north and cross the Continental Divide over the South Pass in Wyoming.

If high speed is 220 mph, then it won't get built. That speed requires a new roadbed built to high-speed rail specifications with no grade-crossing roadways.

Besides, high-speed rail is roughly equivalent to air travel over longer distances in terms of energy used per passenger mile when you add in all the embedded energy costs and full costs of railway and terminal operations.

High speed will require elevated structure with high speed elevated over low speed (mostly freight but w/local transit) in any event, at least in my opinion. It would seem to me that the biggest difference would have to be the type of energy used. For instance, in most long distance (trans-desert, for example) solar and wind would be fairly abundent. Sufficiently so that the use of solar panels, which would add the benefit of shading the rails) might give way to additional power input into the diversified grid in the new energy paradigm.

The real problem from an energy perspective is having sufficient resources to get the thing built in the first place.

The next serious problem would be service and maintenance, plus of course protection against terrorist attacks.

Craig

It is so symptomatic of our delusions that we will waste our very limited resources on high speed rail as opposed to simply building out standard rail. What an accomplishment and huge benefit it would be if only we could recover some of the rail system we had in the 1950's, only electrified. But, no, we believe our time is so precious thanks to delusions of productivity, that we must go fast!

In reality, as our economy tanks huge portions of the population will have nothing BUT time to spend. We cannot afford to conserve TIME, we need to conserve ENERGY.

Same symptom in the UK. We need the same answers you do. Ironically (?) gradual electrification was preferred UK government policy until after the financial crash. One guesses these 'schemes' are trying to talk-up the economy? Goodness knows what the 'business plan' could be. And this is supposed to be a private 'commercial' initiative in the USA?

I wonder also about our current (UK government) attempt to get EDF (state-controlled French utility) to build some nuclear power stations here, other consortai having withdrawn from the bidding. EDF are holding out for government guaranteed returns over the next 40 years!

Two difficulties, Twilight, in returning to the 1950's. First, we have lost most of the lines. What is left is pretty much devoted to heavy freight traffic; scheduling passenger rail between those trains involves putting the passengers on side lines as freight move unrestricted. And, there is a good reason, since stopping freight for people involves both excess wear in braking and excess fuel in regaining lost speed.

That is why I believe that people and light freight could move above the heavy trains on existing traction. In places, it may be necessary to detour from the same line in order to have more gradual curves for the mag-lev (or whatever h.s. system is adopted). Both freight and elevated lines would be using electric power.

Even if we decided that we didn't need to go quite so fast, some varient of this would be required to allow freight and passenger lines to co-exist.

One other thing - back in the day, accidents frequently involved freight/passenger line mix-ups. Some of these would be avoided due to use of modern computer systems, and yet should such occur the lighter rolling stock would suffer the greater damage.

The only lines on which speed is important, even given our delusions, are long distance passenger and light freight. And whilst Europe considers 100 miles a long distance, we consider this a commute. Taking trains off diesel, moving passengers onto trains from autos, and substituting fast rail for air would all help... and all cry out for the need for a new energy infrastructure to supply electric power to our transportation grid.

Craig

I understand the infrastructure we lost, which is why I said reclaiming what we had would be challenge aplenty. But trying to go fast only adds enormously to the cost - not a linear function I am sure. There is no need to go faster than trains did in their heyday, ever, no matter what the distance. Our time is not that valuable, and will only be worth less as we go.

In effect, it was only the amplification effect of fossil fossil fuels that made it seem like our time was worth so much. Without that, then a couple of hours or a couple of days makes little difference.

I agree that high speed should not be important, but passenger trains do need to move faster than freight trains and stay on schedule. During the golden age of rail travel, the railways also had a lot of high priority freight that either went on cars included with a passenger train or on a higher speed freight train. Today the high priority stuff goes by truck or plane and the railways are largely just moving freight that doesn't need to get to its destination quickly. However there is one current example of a high speed freight service -- the Railex refrigerated trains that move fresh produce across the country in 5 days. As truck/plane transport gets more expensive I'm sure we'll see more high speed freight trains deployed to capture that market. Well, if the railways are going to accommodate high speed freight trains then they may as well get some additional revenue by running passenger trains on their tracks too!

To use a local example, passenger service in the Montreal-Ottawa-Toronto corridor has been been improved by the construction of additional track in areas prone to congestion. Passenger trains generally don't have dedicated track, but instances where a passenger train gets stuck waiting for a freight train to clear the track have been greatly reduced. Service frequency has also been increased -- the current schedule shows seven trains a day on weekdays from Ottawa to Toronto. This isn't high speed rail -- the fastest train (with minimal stops) does the trip in 4 hours but clearly the more frequent service and fewer delays are attracting more business.

A view from China:

The high-speed trains here leave every 30-45 minutes.

The regular trains leave every 1-3 hours.

The high-speed trains cost 2.5 times more, and are 3 times faster from point-to-point.

And the subway system runs trains every 3-6 minutes.

Station stops are around 50 seconds, there are two drivers in the front cab, and speeds max out at 65 km/h.

Have people move more or less once to where they can do/get/offer most things locally and by foot/human-power. Negligible wait times, speeds, and energy and infrastructure investments. ;)

Separation is more important than speed. OTOH, unless the speed comes with a huge cost offset, then "as fast as is practical" is not a bad thing. Even in the good old days, speed was an important element.

You are correct though, that speed for its own sake is probably demeaning to the human psyche.

There is also the consideration that much of our travel today is not really necessary or imortant. Visits to one's family are high on most people's lists. Business travel can be largely avoided through teleconferencing. It is ego more than business need that drives much of the long distance travel taking place today. That and high level perks for the upper mamagement...

I still think that we need to ramp up as quickly as possible. Otherwise we may see our travel even more limited that what we are discussing.

Craig

I vividly remember 1950s trips involving a Union Pacific Dome car

http://en.wikipedia.org/wiki/Dome_car

Funny, later flying over that same route left no such memories. The Earth seems so unimportant at 30 thousand feet.

James Howard Kunstler has long argued for the build-out of conventional passenger rail service rather than attempting the high capital cost of high speed rail. The America 2050 website has some interesting concepts, and the optimum solution may lie within what the America 2050 site calls its TransAmerica Network, essential an expansion of Amtrak-style service along conventional rail routes where the higher speed (up to 110 mph) service build-out isn't practical.

As air flights become too expensive for the average family, a tightly integrated bus-rail network will become more appealing, especially if gas-rationing or some similar restriction limits long distance driving. Such a system will require some type of service at the end of the bus or rail, such as a Zip Car or other rental option. Public transit alone just cannot support the intercity market.

Intercity rail works best where a number of cities are linked together. We tend to look at intercity travel in terms of the airline model: large city to large city, but smaller communities actually seem to generate more trips per capita on services like Amtrak. The "sweet spot" distance of 150-600 miles is correct, but that doesn't need to be the length of the train schedule itself. It is the number of unique city interchanges on the train route that is critical. The more unique city to city combinations without a transfer, the more traffic is generated. Don't forget that many of our American cities originated as service stops on rail routes, and the spacing between them is not accidental.

There is a lot of lessons to be relearned in reading railroad histories and skimming the old Official Guides of the Railways and Steamships. We did a lot of traveling in the USA and Canada long before limited-access highways or airlines were available. As several others have mentioned, we may have to settle for slower speeds in order to afford travel at all.

I guess I was kind of thinking the renewables, when they can scale up, would allow at least a reasonable amount of energy to be provided on an ongoing basis. I'm assuming they will be able to produces some fairly large fraction of the current electricity we are generating, and that electric would become the primary energy mode into the future.

If those assumptions are correct, we should see a gradual transition to an all-electric paradigm. So electrified rail, be it passenger or freight, would be what would get built out. From what Alan is saying that looks to be the idea in France, at any rate. Again, my assumption is renewable electric would be scaled to handle industrial manufacturing too. So the infrastructure for the rail systems would be generated in this way too - rails, ties, catenary, wire, body, the whole nine yards - manufactured in electrically driven plants near to rail lines.

The rail-centric model worked well for a century in the U.S. Once the price of fossils go high enough I think we'll manually tear up suburbia for materials, or reconfigure it to be rail-oriented. It worked well in Los Angeles back in the day. And Chicago. A quick Google Earth scan shows about 80% of the Chicago, North Shore, and Milwaukee right-of-way to be intact. It's mostly a bike path now. There are even a couple of surviving stations (Kenosha and Dempster St). There's even a fair amount of the track still extant, under the pavement. The rail is still plainly visible in the parking lot next to the Kenosha Station.

The North Shore Electroliners reached speeds of 90 mph. More than fast enough for now. If we want high speed you do need elevation, but again it seems to me all based on renewables being able to deliver on their promise. The Germans certainly seem to think they can. Quite a few folks here seem to think so too. At some point, with sufficient energy, one ought to be able to synthesize a moderate amount of hydrocarbon fuel for the really critical applications (er, ah, industrial food comes to mind).

Set all this up in a blended electric grid paradigm - decentralized for small installations (homes, apartments, small businesses) and centralized for larger buildings and industry, and I think it could work.

The total energy per capita in the U.S. I think, is on a declining trend. If the energy use goes down, and the renewables go up, we should reach some equilibrium point.

No?

RE; 'Renewables Delivering on their promise' .. part of the key to that will be not making inaccurate assumptions or presumptions about what those promises are or should be.

Part of the plan by Ed Tennyson and I is 90 mph EMU in the Washington DC area.

http://oilfreedc.blogspot.com/2012/07/emus-90-mph-from-rockville-to-crys...

At the end is an interesting bit of history :-)

Overall, Ed (one of the original DC Metro planners, 1962-63) think we can almost triple passenger-miles while reducing the operating subsidy below current levels.

Best Hopes,

Alan

A more general problem with intercity train, either high speed or the 90 mph type, is that it can't compete with intercity buses. Intercity buses, especially the fast-growing curbside buses, are cheaper than train, have much more frequent schedules, and serve many more departure-destination pairs. The curbside buses allow passengers to locate the departure points, make reservations, pay for tickets, etc., all from smartphones. They have no terminal costs or costs of personnel to sell tickets.

The Motor Coach Metamorphosis

2012 Year-in-Review of Intercity Bus Service in the United States

January 6, 2013

Joseph P. Schwieterman1, Brian Antolin2, Paige Largent3, and Marisa Schulz4

1Director, Chaddick Institute and Professor, School of Public Service

2Research Associate, LeBow College of Business, Drexel University, Philadelphia

3Research Associate, Chaddick Institute 4Assistant Director, Chaddick Institute

Well Greyhound really messed up some bus service when it bought out Jefferson. No more service to Canada via Winnipeg, Greyhound just kicked it to the curb. I had to buy a car after 11 years without. Any new expansions or improvements between Texas and Minnesota in bus service, please post.

Greyhound has gone so far as to dump people off of the bus at a layover in Des Moines, Iowa in sub-zero (F) weather for hours but not allow into terminal. Standard operating procedure for some buses into Fargo ND also, bus into garage, passengers left outside.

Not to mention the Border Patrol coming onto buses and saying in english, who here isn't American. (Hattiesburg MS). Moi with maple leaf socks, IAM Canadian hat and a Canadian t-shirt was passed over. I was all set to engage them in Espanol, and possibly end with "No habla espanol? O pobrecito, mi corazon sangre." But no, they just walked up to one individual and pulled him off.

Buses worse in 90's than 80's, even worse in 2000's and still getting worse in my experience.

Greyhound may be getting worse. But that's not what Merrill's talking about. He's talking about Megabus and Bolt. They're the ones with no terminals. They offer fares as low as $1, with free wi-fi and other perks. They're attracting an entirely different clientele than the traditional Greyhound bus.

As for the border crossing...that's just as obnoxious on a train, or even in a car. That's not the buses' fault.

Hattiesburg, MS isn't on the border. Appears BP just boarded the bus on demand. They could do that to Bolt or Megabus as well. We live in an ever tightening police state.

They can also do it on a train.

And we all know what rights we give up when we fly.

Hattiesburg MS in 2007 was one flattened city at the time I was traveling and had only so far rebuilt the casinos. The US was not sending obnoxious crude armed carcasian racists at the time onto AmTrak. Real turnoff to bus travel that is. But ya know, the direct flights from Canada to Hattiesburg MS area petered out, the casino junkets to there just didn't take off. Had to do something with the people trained at the airport with nothing to do.

And NO - it is not as obnoxious crossing the borders in a car. US citizen, I notice a much more polite entrance into Canada most times. Trust me, there is a large difference in reception how you enter into the US from Canada.

I have seen them do racist things to people of colour and their spouses and children repeatedly when traveling by bus at the Emerson ND border crossing and read in the Winnipeg Free Press when they put a active service US Army Col. MD - Iraq war veteran surgeon in plastic hand cuffs. They did this in front of his agoraphobic mother who was feeling quite trapped in the little glass room. His only crime was being an African-American.

It was always much less intensive flying into the US than taking the bus. And the last 5 times in a vehicle I "own", well, smooth as silk.

With the new "laws" giving carte blanche to those armed brown shirt Homeland whatever stopping trains, buses, and autos anywhere within 160 km of the Atlantic and Pacific oceans, Gulf of Mexico and the Canadian and Mexican borders, expect more harrasment and more effort being put especially into stopping buses.

No, it will be a real turn off to riding the bus in those areas.

I have studied TOD (Transit Orientated Development) and what type of rail creates it.

Metro (subway or elevated) seems to have the strongest pull, followed by streetcar, Light Rail and commuter rail in that order.

Commuter rail TOD pull is weak. The Long Island Railroad carries about 1 million people every work day, yet few stations have any TOD around then.

MARC offers 120 mph service from Baltimore to Washington DC for $7 with frequent service (including Express), yet there is only one condo/apartment building around the main Baltimore train station and none at other stops.

OTOH, Metro has transformative impacts around their stations.

Even in Japan and the EU, with HSR, few take trips by rail over 800 km (500 miles). The "Sweet spot" is trips under 500 km (300 miles).

PS: I am digesting the recent announcements for Paris. By 2030, 90% of Parisians will live within 2 km of a train station. Cost 26.5 + 7 + 2 billion euros. THAT will have an impact !

Alan

Just a note: CNN and CNN/Money (links above) seem to be down for now. It ain't Leanans fault ;-/

I think it's just you. They are working fine for me.

Been reading this article:

Cyprus bailout threatens to backfire

This has caused a huge run on the banks. Not sure why the EU insisted on this. The article says something about concern over money-laundering, but I'm not sure how this tax is supposed to address that.

The article calls the proposal "An unprecedented tax on bank deposits...", which it isn't. Taxes on wealth have been around for a long time and property taxes are the best example. When I was younger, the State of Georgia used to levy a so-called "intangible tax" on financial assets and I recall that also included money in a bank account. Florida also once levied an intangible tax, but it was repealed in 2007. It may be a "new" idea in the EU, but that's only because people have short memories...

E. Swanson

Black Dog, I am sorry you feel that way but my opinion varies. If there is a tax in place on Bank deposits and I put my money in the bank anyway "my bad" however, in this case the money has been placed in the bank and then the government says in effect well we need 6 per cent of your savings so we will help ourselves. That is robbery. Maybe you will be fine with the idea but I worry that that is the first step and next governments will decide that retirement accounts have a lot of money so we will just take 40 per cent of that to pay for our next whatever. Stealing is too tempting to be allowed even or especially by governments.

OK, you put your money in bank which gives you 11% interest rate, in other countries of the Euro zone you get 1%, then the bank is in trouble and you complain that you have to pay 7% in order that I give money to save 93% of your savings? You are a clown. :-)

Hint: The alternative would have been that the banks on Cyprus run out of business and you may have faced a 100% loss. What do you choose?

What happened to the 100,000 Euro deposit insurance? If banks in Cyprus were reckless why were the deposits in those banks insured? Why were the banks not reigned in before there was a crisis?

In this case the bond holders and stock holders should take the loss and the ECB should bail out the depositors up to the 100,000 Euro limit.

Thanks, I guess that explains it. (11%? Holy guacamole. That about ten times what you'd get in the U.S.)

It doesn't explain why unelected IMF, ECB and Eu officials are willing to risk bank runs and falling markets in other EU countries over a measly 10 billion euros when other countries have been 'bailed out' at levels much higher. It's been suggested that the banksters responsible were also taking advantage of the high returns available in Cyprus (would have been stupid not to), until recently.

It would be interesting to know if the recent Flight To Safety began before this 'levy' plan was revealed.

After Cyprus, eurozone risks transmission failure and running out of road

The EU PTB must either be desperate, stupid, or corrupt to squander what little trust is left in EU markets and risk contagion at this point. I think it goes much deeper than elections in Germany... but maybe it's just me.

Are more well off EU countries laying the groundwork for a disolution of the Euro?

Although it remains pretty in-transparent of who demands what and who pressures whom how, it does seem that Germany and the Eurozone mostly demands a total amount of contribution from a country, not so much specifics of how to achieve that. Those are mostly up to the individual countries as long as they are plausible.

E.g. in the current situation, both the EZB and German government and IMF claim they demanded a contribution of 5.8 billion from the Cypriot financial industry, it was then the Cypriot government who decided to tax all accounts, as limiting it to accounts over 100.000Eur would have asked, in their opinion, too much from the rich. If that is true, then it is the Cypriot government to blame for the breach of the bank guarantees, not the EU (although they could have possibly prevented it). Hence, they also have no objection if that part of the deal get augmented by protecting 100% of the first e.g. 25000 Euro, as long as the total amount of contributions stay the same.

Likewise, I would be highly surprised if the EU or German government would object if Greece decided to take more money from e.g. wealthy ship owners and therefore cut social security less as long as the total amount stays convincingly the same. So again, the social imbalance of austerity measures is at least partially imposed by local politicians, not the EU.

Leanan, our MSM (I live in Belgium, EU), say something like: "The other bailouts were mainly financed by German taxpayers. But since a lot of money on the Cypriotic banks originates from Russian Nouveau Riches, German taxpayers are not willing to spend money to support them."

Eventually now my friends do understand why I don't have money on a bank; just enough for daily life.

To be clear the 11% is for non residents only, residents get a mere 7%. That is for a 5yr deposit over 150k

Most 30-183 day rates are in the 3-4% range. It's safe to say the floating rate is even lower.

http://cyprusbank.org.ua/index/0-8

For comparison of other EZ deposit rates

http://europe.deposits.org/

So it's close to the same rates as Italy, Portugal and Romania, significantly less then Ukraine and believe it or not RUssia.

Otherwise the money for the bailout would come from the 'thin air' just like any other loan, so it's not as if the rest of the EZ will see their tax rates go up, just to keep the Cyprus banks afloat.

Yes, but to assume that you get much more interest than others without higher risk is a little bit strange for me.

BTW Strictly speaking it was/is not about the insolvency of one bank but of the Cypriotic government. The Austrian TV (ORF) brought an interesting article on this issue on their site:

http://www.orf.at/stories/2172417/2172412/

According to the ORF Anastasiades (Cyprus' president) fought hard to limit the losses of the rich investors to 10%, i.e. he sold his poorer citizen. The model of the ECB (Jörg Asmussen) was to guarantee the 100.000 EUR and let only richer investors (Russians, Brits) pay.

The 100.000 EUR guarantee is only for bank insolvencies, not for a national insolvencies, therefore, it was and still is an gift, nothing mandatory.

According the ORF Cyprus with only 1 million citizen has 30 billion EUR in accounts of people with 100.000 EUR or less and 38 billion EUR of richer investors (Russians, Brits). The 6 billion would have meant around 15% losses for the rich investors.

how about, the bank goes bankrupt, the bank executives, management, and pals, go to prison, the remains of the bank audited and as much of where the money went that can be found, it is used to satisfy the bankruptcy according to already established contracts which indicate precedence of creditors, and the next time everyone, including depositors, is more careful with what he does and how much of a free ride he expects?

And if the depositors through the bank or the bank has paid for deposit insurance, this time around, make good on that promise, and perhaps the scrutiny or the premiums on such insurance goes up next time to reflect the risk? perhaps with more diligence the risk won't be 'party til the money is gone and get bailed out' but 'responsibly manage what is in your custody or risk being sued or going to prison' ?

you know, like in the old days?

(and how about the only involvement of the government in ANY of this is the operation of uncorrupt courts as a civilized venue for these matters of contract law to be settled?)

that's what i'd choose.

Except, my friend, that there would perforce be government involved in the "go to prison" part! And, rightly so!

I recognize a true Libertarian view here.

The danger is not recognizing that there are laws necessary where you demand enforcement; denying government power to create those laws is problematic. Also, while granting civil remedies in court is an excellent goal, in fact you would see the laws bent to the will of the Wealthy so that access to those theoretically uncorrupt courts would be limited to those who have resources.

The sad fact is that Libertarianism, whilst a wonderful theory, struggles against the evil influence of wealth on those lucky enough to have such. And don't give me that crap about hard work, savings, etc. The owners would never really allow anyone else to enter their holy orders.

Craig

I don't understand how anyone with any decency can justify an outright confiscation of nearly 10% of depositors money. The depositors did not use any leverage and did not create the financial crisis. Why are they being punished? This move is not only illegal but also abysmally stupid because it has shattered confidence in the banks. Now everyone who is not dim witted understands that the 100 Euro bill in your pocket is worth 10% more than 100 Euros in a bank account. People will now hide their wealth which is not good for the economy at all.

Taxing 6%-10% of deposits is clearly a bad solution. But then the situation in Cyprus, the EU (and other countries like the US) seems pretty dire and unsustainable. All "solutions" to this crisis are necessarily going to be terrible. The only question is who is going to loose how much money and which is the least terrible solution?

So what are the alternatives? The Dept in many countries are totally unsustainable, so something has to give.

1) Inflation: One way is to inflate dept away. With record low interest on savings in many countries and a non negligable inflation. E.g. the UK has an inflation of nearly 3% while savings interests are more like 1%. So in 4 - 5 years you have lost more than the 6% of wealth that they are now taxing. In addition, inflation doesn't only hit savings, but all income. So this hits low income people much more which everyone claims they are so concerned about than taking a small part of savings.

2) Burden all of the dept on the tax payer. At a bailout of 17 billion euros, that is the equivalent of about 17.000 Eur per Cypriot. So unless the "small saver" has more than 200.000 Eur of savings they loose more this way, and those who have that in savings can likely afford to pay some to save their country. Furthermore, given how austerity has so far handled, most of the savings have come from social security. My guess is that taking that money from the poor is going to be much more painful than taking it from those with savings.

3) Letting the country go bankrupt: That is pretty uncontrollable and will again likely hit the low to middle class much more than loosing 6% of savings.

4) Have the European tax payer pay for the losses: Well, that might be nice for Cypruss and Greece, but the rest of Europe (and the US and other countries who are participating through the IMF) don't directly fancy that solution and have to come up with that money (see solution 2).

5) Let the banks go bankrupt. Although this imho really should be part of the solution, it isn't going to solve the problems alone. Particularly if as Rockman said, most "investments" into a bank come from savings rather than "traditional" investments. In that case letting the banks go bankrupt isn't enough and savers would again likely loose at least the amount they are going to loose.

6) Stick your head into the sand and hope to borrow more money indefinitely: Well, that is kind of the solution governments have tried the last decade or two. However, unless you find ever more savers who are willing to lend you money to finance this ponzi schema, this won't work and is exactly the reason we are in this mess now.

So given the alternatives, loosing only 6 - 10% of saving might really be one of the least terrible solution and shares the pain relatively fairly. On top one has to remember, that the 6 billion envisioned in this depositor tax is only about a third of total money necessary. So 2/3s is still coming from other solutions.

On top, if all of the people get an immediate overt hit (rather the long drawn out stealthy hit in inflation), perhaps it will teach voters that in a democracy they are responsible for the actions of government and start voting for long term responsible politicians, and taking the short term easy route of increasing dept and no reforms is going to hurt them rather directly!

Everyone needs to realize that given the current situation and the failure to solve the problems over the last couple of decades everyone is going to have to take large losses in some form or another and nothing is totally safe. No stocks, no back deposits, no gold no nothing. If you start from that premises many solutions look a lot less dire and acceptable.

" All "solutions" to this crisis are necessarily going to be terrible." In a nutshell.

Steve from VA left a pretty spot-on comment over at TAE:

The idea that inflation simply takes money from people is not correct. Monetary inflation should not be confused with supply shortages that produce higher prices, as TOD has devoted itself to with respect to oil. Monetary inflation raises the price of everything, including, in fact especially including, labor. (1) Inflation does have costs, not always equally bourn, so that when a nation inflates its currency the value of that currency is reduced with respect to those of other nations so its citizens pay more for imported goods and services. For a nation like Cyprus this would be a pretty large percentage of costs since they import much of what they import. On the other hand this is a fairly smooth and fair way to reduce imports and increase exports and hence balance a nation's trade. Cyprus' problem is that it can't inflate its currency because it is under the Euro which is acting sort of like a gold standard strangling its economy.

It appears that modern economies require about 3% inflation to operate smoothly and inflation below that promotes inequality with the financial crises that go with excessive inequality. From 1873 until about 1896 the US had one "panic" after another as deflation drove debtors under. The accident of gold finds in South Africa, Australia, and Alaska got us out from under the "cross of gold" that was strangling us.

(1) One can make the argument that if wages are not rising there is no inflation.

EXplain to those of us living on our savings what, exactly, cost increases are if not inflation.

They are the consequence of natural resource scarcity. But since labor isn't scarce anymore the cost of it does not rise commensurately.

This is why I am not expecting hyperinflation. Without rising wages, there's a limit to how much prices can rise. And wages aren't rising.

"Without rising wages, there's a limit to how much prices can rise. And wages aren't rising."

I had this discussion with my dad last week while talking about housing. There should be no rebound happening in housing right now because income is not rebounding - it's just another bubble essentially. The DrHousingBubble blog has done a few posts showing the entry of investment capital into the housing market. With CD's and savings accounts paying zilch, capital is chasing anything that moves (like the stock markets).

With the potential for minimum wage to be raised it'll be interesting to see how that balances if it happens. Whether it will go into de-leveraging and paying off debt or if it'll go into the fuel tank. Regardless, the US is getting dangerously imbalanced...as bad as the Tea Party is we haven't started voting in actual neo-nazis yet, but with all of the gun-nutters running around in a tizzy it seems like it won't take much more before something breaks.

I think housing is, in part, shifting back to being less of an investment that is bought and sold every 5 years to a more traditional status, a more permanent home where folks plan to stay. Many of my ancestors lived in the same place for decades, often their whole adult lives. "Home" has a different inherent value than "house" or "property". I know many fellow baby boomers that are looking for the place where they plan to stay (until they can't), perhaps a place worthy of being passed on to their kids. People are willing to pay a premium for such a spot, compared to bidders who plan to sell in a few years. I expect this is why areas such as Portland and Asheville didn't see such drastic declines in prices and were early to recover. Parts of Colorado also held up well. People with money are hunkering down more. I, for one, am totally unconcerned with resale value. Most everything I have is in this place, so it would take a lot of money to get us to even consider selling.

Low interest rates are also having an effect. Take the above 'stay put' meme and toss in a 30 year fixed rate at 3.25% for perhaps the rest of the buyer's life, people are willing to spend more up front.

I have a friend that moved to Portland - he said it was basically like someone took Asheville and multiplied it by a few times. They both have similar cultures and oddly enough vie for "Beer City USA" every year. Asheville has a lot of second home/retirement and cash activity that kept it pretty inflated through the crash (to my detriment - if prices had reached pre-boom levels I could actually afford something) which makes it a bit unique compared to most places.

"Low interest rates are also having an effect. Take the above 'stay put' meme and toss in a 30 year fixed rate at 3.25% for perhaps the rest of the buyer's life, people are willing to spend more up front."

That's the source of the problem - the easy money. But it only works once, not for very long, and leaves no good way out. The boom it creates drives the price of houses up, then once prices are up, even the easy money can't drive it further because housing prices must be supported by income. Its just a trick that allows a set level of income to leverage itself higher.

For example if someone is paying $200,000 over the course of a loan, at rate A% they'll have $100,000 to put towards the house and 100,000 in interest. At rate B% they'll have $150,000 towards the house and $50,000 in interest. The person, going from rate A to rate B now has an extra $50,000 to try to out-bid someone else in getting a house originally worth $100,000...and during the boom, this is exactly what happened. So now the house is "$150,000" up from "$100,000" a rise in 50%. This basically out of thin air instantly creates $50,000 which goes into the economy. That money is free to stimulate the economy and did - but it did so in a violent way, as money does when suddenly poured in and it's a One-and-Done proposition. Just as money can be created out of thin air by a decrease in interest, it can be destroyed by rising rate...but this doesn't happen until the point of sale (or "Mark to Market"), so it has a chance of slowly working its way out of the system. This is taking the form of short sales and foreclosures - but the banks are pacing these out in what's come to be known as "Shadow Inventory." Homes that are either in foreclosure and not being marketed, or homes that are delinquent in payments and not being foreclosed upon. There are still plenty out there. There are many who are still "underwater" as well...I saw a blurb recently...

http://articles.latimes.com/2012/sep/12/business/la-fi-mo-underwater-bor...

All it will take is the slightest rise in rates and those people will be working the rest of their lives just to get even on those houses to be able to sell.

But yes - on the other side, there was a fellow on CNBC just yesterday that said that IF you're going to stay in a house more than 7 years and get a 30 year fixed-rate mortgage, considering maintenance and closing costs and such, buying a house will be cheaper than renting. The break-even was less in some places than others...but if you have to/want to move all it takes is a shift in those rates and you're underwater big time - because mountains of available leverage will disappear instantly.

But I do have to agree with the comment below:

All bets are off.

Many homes getting purchased now are from cash investors, the rest are majority government-backed low down-payment loans, and this is all after that absurd $8,000 giveaway that suckered a bunch of folks into the 2009-10 mini-rebound-bubble. They certainly have more rabbits in their hat than I would have guessed.

But a 30 year mortgage...that's a hell of a long commitment to a series of payments when in 2-10 years we'll likely be seeing huge contractions in the economy, or at the very least, large displacements in resources.

I have been constantly surprised and amazed at how long this thing has been strung out presumably because of the crack dealers at the FED. Although what you say seems true, I would not be a nickel on it coming true any time soon.

The time-honored solution of European sovereigns over-indebted to bankers and merchants has been to execute or exile the bankers and merchants.

There are no "good" solutions but they picked the worst possible solution. The right thing to do is to let the bond holders take the loss (they risked their capital) while protecting the first 100,000 Euro in deposits. Now confidence has been shattered and everyone knows deposit insurance means nothing.

Right, and by definition shattering the illusion is the worst of all possible errors - because illusion is all that is left.

suyog - I haven't seen the numbers to back it up but have heard stories that the Cyprus banks have gotten very little bond money and that most of the investments were made with the depositors' cash. IOW the depositors are the de facto bond owners. And just like bond holders they took the risk (whether they realized it or not) to make the above average returns they were getting. If that's anywhere close to being correct then it would seem reasonable that they share in any loses just as their shared in the gains. As we say it Texas: You make your bets and takes your chances...stop whining.

Of course, that whole story might be exaggerated to help out the real debt owners

Give me a break. People keep their money in the bank because they don't want to take a risk. They rely on deposit insurance to protect their money. If the bank management wants to make risky bets the regulators are supposed to prevent that. If the bank's liabilities exceed its assets the regulators are supposed to take over the bank, return the depositors money, fire the management and pay the bond holders and stock holders (in that order) if there is any equity left. Or they could find a bigger bank to take over the failed bank. Either way, depositor money (up to the insurance limit) is sacred and should be protected.

"As we say it Texas: You make your bets and takes your chances...stop whining."

I'm very sure that wouldn't be accepted as an explanation if the same thing happened in Texas!

If you’re getting 6X to 8X the interest on your account that other banks ar paying and you don’t think your money is at any risk then most Texans would say you’re a dang fool and deserve what you get. LOL. Like I said: Texans don’t have much patience with folks who make bad bets and then whine about losing the bet. You’re suppose to take it like a man…even if you’re a woman. Actually Texas women typically do tend to take it better than the men.

If the banks in your country (Texas) are all paying that same rate and you put your money in a bank outside your country that's paying 1/6th to 1/8th the rate, Texans would say it's YOU who are the dang fool. I wouldn't want to be the person who gets to tell a Texan he was a dang fool for putting his money in a Texas bank only to have 10% taken off the top!

penury - "...next governments will decide that retirement accounts have a lot of money so we will just take..." Actually since the last time I looked at the rules the US govt already does that ability. On some retirement accounts if you don't withdraw a minimum amount (which will be taxed as income) the feds will assess a penalty and take it out for you. At least they are nice enough to wait until you die before taking a big chunk of your savings from you via inheritance tax.

It's only a matter of time until Congress decides that the income in Roth IRAs should be taxable upon withdrawal.

"It's only a matter of time until Congress decides that the income in Roth IRAs should be taxable upon withdrawal."

Agreed. Especially since the traditional IRA already let you put in after-tax (non-deductable) contributions. Letting income go untaxed is so unlike the government.

I think the 401K will go down at the same time. I don't know if they will terminate them completely, (you have to roll it over into the IRA) or whether they just cut off new contributions which would be easier politically and let the program wither away. (Wall Street will shriek somewhat less this way than if they terminate the program instantly). There was a paper out a few months ago that said the 401k program did not significantly increase the rate of savings, and it's costing the government a lot in tax revenue. ($142 billion per year according to one source I found.)

The regular IRA may survive. It was intended for those who are not covered by a retirement plan at work, and the tax deduction phases out at middle-class income levels.

No need to upset people that way, just switch from an income to a consumption tax.

The federal and state governments tax wealth in bank accounts upon the owner's death. It's called the estate tax. Some states also charge an inheritance tax. Taxing property is nothing new.

Seizing your property and retrospectively creating a law to justify it is though.

Hmmmm... that sounds vaguely familiar. Something to do with the history of the 'New World'. Something about colonial law and policy....

Merrill, Rockman and all: If you own a home, or any other real estate, you pay a pretty stiff property tax.

If you rent, you pay someone else's property tax (built into the rent).

The only taxes that fairly represent ability to pay are income tax and VAT. VAT goes into the price of goods sold, so it is regressive to the extent it is levied on necessaries. Income taxes can be, and usually are, graduated, and nominally at least progressive. Wealthy folks soon get ahold of the basic tax laws and intall loopholes to avoid such.

Excise taxes and exit taxes try to tax the other guy, but rarely work out very well.

So long as we have governments, we will have taxes of some sort. The thing we who live in nominal democracies need to do is to better determine what we need, and enact taxes as fair as possible to pay for those things. Meanwhile, greed will continue unabated and unabashedly to do violence to the best of all intents.

Best wishes for fair taxes.

Craig

I think the current estate tax only applies to estates over $5 million.

That's the federal exemption -- state exemptions vary. It may be a progressive tax, but it is still a tax levied on savings and checking account balances.

Most states, including all I have lived in, have effectively no estate tax.

Federal tax allows all of your savings, investments,, etc., to go to your spouse untaxed. You each have a 5 Mil lifetime exclusion, plus a per donee exemption from gift taxes each year that increases by a COLA. Roughly $12K/yr (probably higher now).

If you cannot get enough of your riches to your kids, and support your wife on that, I do NOT feel sorry for you!

To me, better to tax me after I die than while I am alive. I would shift as much as possible to the Estate Tax sector.

Also, I would tax the bejesus out of investment transactions! Buy and hold! Also, I would end the concept of long term gains. Gains is gains.

Just a few thoughts as the Cypriots vote down their 'opportunity' to volunteer.

One more aside: I voted for Prop. 13! Would vote to end real estate taxes on residential property every time.

Craig

The talking head on Deutsche Welle last night used the term "Black Swan" when discussing the possible consequences of Cyprus.

PO talk will slowly creep into the lexicon because, increasingly, our common cliches, myths and justifications no longer speak to current contradictions and a future dangers. Watch the language, changes there forshadow changes in public consciousness.

One reason offered for this approach was that the Cyprus banks, unlike many other EU banks, have relatively little bonds out. They run their investments mainly off of the depositors' money. I suppose that's the logic: the depositors are the de facto bond owners and thus, like any other bond holder, have to pay the piper when the bill comes due. It sounds as though the Cyprus banks were offering much better rates han other EU banks. So again the logic: depositors were taking a chance by going with risker investments by the banks to capture a better return. IOW you make your bets and have to accept your share of the losses.

But it was offered that a lot of money, especially Russian/drug money, sits in those banks. It was postulated that this money might not run away from the Cyprus banks too fast: the new fee is just the cost of doing business now. And business is still doing OK.

Rockman, the reason why it was done matters not and a bank account is not an investment it's private property stored at a bank. Also bank deposits below 100k are covered by a deposit insurance, so there should be no risk attached to putting your money in the bank because it is guaranteed safe by the government. The money has been confiscated. It's not a tax, levy or anything else but theft.

The bond of trust has been broken everywhere. Private property is no longer safe from the technocrats and can be taken away at will, justified by retrospectively created laws. What's the point of saving the banks if everything is destroyed in the process?

Burgundy et al – Details matter and they are difficult to run down now. First, what are the banking regs in Cyprus? Are they anything like US regs? Is there govt deposit insurance? Few details yet but I get the sense that a Cyprus bank is run differently and those folks knew it. Second, if (and it’s a big IF) some depositors were getting 10%+ interest on the account while most other EU banks were paying 1% to 2% are you going to assume there’s no risk involved? If so then you would have been a prime Bernie Madoff investor. And, IF I understand correctly many of the Cyprus banks refused to cooperate with international money laundering investigations and was rather well known by the public. That should have been one more red flag the depositors should have considered.

Again lots of IF’s but I’ve see very few documented facts presented here. Lots of assumptions, including mine, but few details.

Even your reference is confusing. In almost the same breath it says the tax won’t be legislated by the Cyprus govt but by other EU countries and then says it hasn’t been enacted yet and won’t be until the Cyprus parliament votes for it. So which is it? Exactly how will those countries remove any of those deposits w/o the cooperation of the Cyprus govt?

"Is there govt deposit insurance?"

Yeah, Rock. That's what makes this such a trust buster:

http://www.npr.org/blogs/money/2013/03/18/174619914/where-the-bank-reall...

Suggest you read the last two paragraphs at the link, then follow the rabit hole link to 'shadow banking system'; $52 trillon (with a T) outside regulated banking systems, but "capital ventures, securities markets, pension and mutual funds, all dependent and highly leveraged.

The same could be applied to the big US banks too. Your own bank is probably up to it's eyeballs in money laundering, they all are because if they weren't they'd be out of business (eg. todays news: HSBC faces new money laundering claims in Argentina). The flows of black money in the global economy are huge and if IIRC are equivalent to being the third largest economy.

So scapegoating the victim for putting their money in their local high street bank in a government guaranteed deposit insured account because they should have know it was crooked really doesn't wash. As it also applies to everyone on the planet with a bank account. Do you deserve to lose 7% of your money simply because you put it in a bank for safekeeping? You must surely know your bank is probably up to no good and likely insolvent just like all the other banks.

Clearing my cache fixed it... strange.

As for the Cyprus debacle, perhaps the EU is testing the waters, using little old Cyprus. If things are as bad in Europe as folks like TAE are saying, they may be running out of options... or is Naomi Klein's Shock Doctrine coming to pass?

I'm not gonna get too wacked out of shape by this Cyprus thing. IMHO a few fools concocted a dumb trial balloon, which is just not gonna fly. There may be runs on other peripheral country banks as a result. However (I'm assuming this will get chucked out before they get their hands on the loot), once its been proven to be totally politically unworkable, the deposits are probably safer, -they will have to find some other turnips to squeeze blood from.

The Cyprus thing tells people in Eurozone countries which might be forced to accept a 'bailout' from the ECB, "take all your money out of the bank the day before each long weekend". (They always do this kind of thing on long weekends.) That's several times a year.

If those banks are forced to hold 100% reserves, they will be unwilling to lend. This Cyprus thing could have a very depressing effect on investment, and therefore on economic activity in general, and that will flow through to the other Eurozone countries and countries that want to export to them.

Not the end of the world, true. Just a ratcheting up of the perpetual low-grade depression we're already in.

All round, an awesome day's work.

Anybody in EU with an iota of sense will now pull most of their money out of the banking system.

If I was in EU and had significant amount of money in the bank, I will use it to pay off my debt and if there is anything left after that stuff it in the mattress or buy gold or some other hard asset with it. It is now clear that the oligarchs will do whatever it takes - including outright confiscation - to save the banksters.

After Cyprus, only fools will keep significant amount of money in the bank. They simply cannot be trusted with your money.

Would you advise the same for those of us in these united states?

I think in the short term the US will benefit from the EU crisis as scared capital flees to the perceived safe haven (LOL) in the US. But I don't see our financial system surviving past 2017. Governments desperate for revenue will get increasingly tyrannical. I think paying off your debts and using your savings to buy hard assets and gold is a good idea no matter where you live.

So in a follow the money scenario, who is the winner here?

This appears to be result of political miscalculation rather than deliberate planning.

The reasoning is that Merkel's coalition needs a small party called the FDP which is getting hammered by its voters for supporting bailouts (however reluctantly). It's in danger of falling below the 5% threshold for representation in the Bundestag at the coming elections.

Germany also wants Finland's support in Brussels, and the Finnish Minister of Finance has been vociferously demanding an end to bailouts.

So...the ECB said to the Cypriot president, "since you have no bond-holders, your large depositors are going to have to take a 'haircut'". Anastasiades wants to hold onto the Russian Oligarch banking business, and figured that anything over 10% would cause them to go elsewhere. So the small Cypriot savers had to share the pain.

Being a politician in something the equivalent of Hoboken, he didn't realise the effect that breaking the 100% deposit guarantee would have internationally.

The ECB didn't help matters by saying repeatedly, "this is not a precedent." Everyone interprets that as apophasis - affirming something by appearing to deny it.

So, to save a 9% political party and therefore a ruling coalition, we get a situation in which the general public's confidence in the worlds banking systems has taken a huge hit.

Let's see if I understand the situation in Cyprus from reading Rush to ATMs in Cyprus on EU bailout tax (CNN, March 16, 2013) and Cyprus shuts banks as bailout backfires (CNN Money, March 18, 2013).

The banks in Cyprus are decimated by losses on Greek debt.

In June 2012, the former president, Demetris Christofia, a communist, asks the EU for a bailout of the banks in Cyprus.

The EU responds with a plan that Christofia rejects causing negotiations to stall.

There is an election. The new president of Cyprus, Nicos Anastasiades, a conservative, agrees to the EU's terms and sends the proposal to parliament for ratification on Friday or Saturday (March 16, 2013).

On Saturday the people of Cyprus hear the news and began withdrawing funds from ATM's.

On Sunday, March 17, 2013, the government of Cyprus announces that the banks in Cyprus will not reopen until next Thursday, March 21, 2013, while parliament considers the bill, thus preventing depositors from withdrawing their funds creating a bank run.

The annual GDP of Cyprus is €18 billion making the bail out (proposed loan?) a sizable fraction of their GDP.

The debt of Cyprus is about 87% of GDP (€15.7 billion).

Unemployment in Cyprus was 12% in 2012 and is forecast to rise to over 14% in 2014.

The International Monetary Fund is expected to contribute to the deal, that is, getting a loan from and making a deal with the devil.

Cypriot banks have large volumes of international deposits. Russian businesses might have $19 billion in deposits.

The conditions of the EU proposal are:

1. The EU provides a loan of €10 billion to Cyprus?