Drumbeat: March 25, 2013

Posted by Leanan on March 25, 2013 - 10:09am

WE will need fossil fuels like oil and gas for the foreseeable future. So there’s really little choice (sigh). We have to press ahead with fracking for natural gas. We must approve the Keystone XL pipeline to get Canadian oil.This mantra, repeated on TV ads and in political debates, is punctuated with a tinge of inevitability and regret. But, increasingly, scientific research and the experience of other countries should prompt us to ask: To what extent will we really “need” fossil fuel in the years to come? To what extent is it a choice?

As renewable energy gets cheaper and machines and buildings become more energy efficient, a number of countries that two decades ago ran on a fuel mix much like America’s are successfully dialing down their fossil fuel habits. Thirteen countries got more than 30 percent of their electricity from renewable energy in 2011, according to the Paris-based International Energy Agency, and many are aiming still higher.

Could we? Should we?

Every time supplies of oil and gas get tight, the rising price that comes with scarcity creates incentives and the “invisible hand” does the rest. What is certain, however, is that the fossil energy era is far from over. Just as the stone-age did not end when there were no more stones, the oil and gas era will not end when we run out. It will end when technology develops an alternative that is abundant and just as affordable.

WTI Crude Rises to One-Month High; Brent Spread Narrows

West Texas Intermediate crude rose to the highest in a month as Cyprus agreed on an international bailout, allaying concern that Europe’s debt crisis will worsen. WTI narrowed its discount to Brent to the least since July.

U.S. Gasoline Prices Fall to $3.7074 in Lundberg Survey

The average price for regular gasoline at U.S. pumps fell 3.2 cents a gallon in the past two weeks to $3.7074 cents, according to Lundberg Survey Inc.

Around $100 a barrel is good oil price - Saudi's Naimi

Oil prices at around $100 a barrel are reasonable for both consumers and producers, OPEC heavyweight Saudi Arabia's oil minister said on Monday, again highlighting the top crude exporter's preferred oil price.

Vehicle Miles Driven: Population-Adjusted Numbers Hit Yet Another Post-Crisis Low

Clearly, when we adjust for population growth, the Miles-Driven metric takes on a much darker look. The nominal 39-month dip that began in May 1979 grows to 61 months, slightly more than five years. The trough was a 6% decline from the previous peak.The population-adjusted all-time high dates from June 2005. That's 90 months — over seven years ago. The latest data is 8.59% below the 2005 peak, a new post-Financial Crisis low. Our adjusted miles driven based on the 16-and-older age cohort is about where we were as a nation in March of 1995.

Better route planning cuts fuel use in freight sector

(Reuters) - U.S. distributors and freight hauliers have held down diesel consumption even as their business recovers from recession by making thousands of small changes to their operations.Improved driver training, restrictions on idling and careful route planning to reduce deadheads (where vehicles travel empty) are all reducing consumption of expensive diesel while helping companies promote their green credentials.

How to drive down the cost of petrol and diesel

How many trips do you make each week in an empty car?By arranging to travel with three other colleagues who live relatively close (sometimes called a car pool) you could drive just one out of every four days, significantly reducing the wear and tear on your car, as well as fuel and parking costs.

Hedge Funds Most Bearish Ever on Copper, Favor Gold: Commodities

Hedge funds are making the biggest bet against copper on record as global inventories expand to a nine-year high, while concern that Europe’s debt crisis will spread spurred the biggest gain in gold bets since 2008.

Iraq to Fall Short of 2014 Target for Oil Output, Lawmaker Says

Iraq, the second-largest producer in OPEC, won’t reach its target of pumping 4.5 million barrels of oil a day by next year and plans to announce revised production goals in April, senior government officials said.The country will fall short of its target partly as a result of bureaucratic hurdles and the lack of an energy law, Adnan al-Janabi, chairman of the Iraqi parliament’s oil and energy committee, said today at a conference in Dubai. A draft energy law is “stuck” because of political disputes and won’t be passed soon, al-Janabi said.

Russia, China find compromise on gas deal after 15 year standoff

MOSCOW (Reuters) - China has accepted an olive branch from Russia's Gazprom after years of tough talks which had failed to yield a deal on gas supplies, though the main point of conflict - price - remains.

Russia Lets China Into Arctic Oil Rush as Energy Giants Embrace

Russia’s decision to give China a share of prized Arctic exploration licenses as part of a “breakthrough” deal signals how the world’s largest oil and gas producer and the biggest energy consumer are redrawing the global energy map.

Nigerian oil auditors welcomes passage of energy bill through Senate

Lagos (Platts) - Nigeria Extractive Industries Transparency Initiative (NEITI) Monday welcomed the passage of the Petroleum Industry Bill to the committee stage of the Senate, reiterating that the bill will boost the agency's efforts to create transparency in oil acreage awards and management of oil revenues.

Sinopec Joins China Peers in Posting Lower Full-Year Profits

China Petroleum & Chemical Corp., Asia’s biggest refiner, joined PetroChina Co. in posting lower 2012 profits, as the nation’s largest energy companies look to overseas growth to counter the impact of price controls at home.

Oil industry success due to tax system, says Norway MP

Conservative (H) MP Siri Meling believes current tax scheme legislation has been crucial to oil companies daring to invest in innovation.

Sitting on too much money, Norway risks going off course

Middle East-style oil wealth combined with a generous Nordic welfare model is slowly throttling big chunks of Norway’s economy, threatening western Europe’s biggest success story.On the surface, Norway is the envy of the world: growth is strong, per capita GDP has exceeded $100,000 and the nation sits on a $700 billion rainy day cash reserve, or $140,000 per man, woman and child.

But it may just be too much money as Norwegians, more keen on leisure and family life are working less and less.

Lebanon urged to privatise more

Lebanon risks going the way of Greece and Cyprus because of the lack of privatisation, warns a senior government official.High public spending, conflict of interests and a constrained economy affected by the Syrian crisis is fuelling problems that could lead to chaos, especially after Najib Miqati's resignation as prime minister on Saturday.

Mursi warning stirs fears in Egypt opposition

(Reuters) - Egyptian President Mohamed Mursi threatened on Sunday to take unspecified steps to "protect this nation" after violent demonstrations against his Muslim Brotherhood, using vague but severe language that the opposition said heralded a crackdown.

Syrian rebels bombard central Damascus, army artillery hits back

BEIRUT (Reuters) - Syrian rebels fired dozens of mortar bombs into central Damascus on Monday, hitting a high-security area within a kilometer (less than a mile) of President Bashar al-Assad's residence, residents and a security source said.The military retaliated with artillery fire from Mount Qasioun, overlooking the Syrian capital. "I've heard dozens of regime shells so far, pounding rebels," one resident said.

Kerry Visits Iraq in Push to Halt Iran Flights Aiding Syria

John Kerry, the first secretary of state to visit Iraq in four years, urged Prime Minister Nouri al-Maliki to stop Iran from using Iraqi airspace to fly arms and fighters to Syria’s military, arguing that if Iraq wants a say in Syria’s future, it must help end the bloody conflict there.

Australia PM appoints new resources minister in reshuffle

CANBERRA (Reuters) - Australia's prime minister appointed Gary Gray, a former adviser to the country's largest oil and gas firm Woodside Petroleum, as resources minister on Monday in a cabinet reshuffle forced by a string of ministerial resignations.

Centrica buys U.S. LNG in 20-year deal as U.K. output wanes

Centrica Plc, the U.K.’s largest household energy supplier, signed a 20-year deal to import natural gas from the U.S., securing supplies as production from British North Sea fields decline.

US shale gas to heat British homes within five years

Nearly 2m homes in the UK will be heated by shale gas from the US within five years, under a deal agreed on Monday that is likely to be the first time major exports of the controversial energy source are used in the UK.The US government has kept a tight rein on exports since the shale gas boom started more than five years ago. But the deal struck by energy company Centrica marks the start of a new era in gas use in the UK, because it opens up the market to cheap supplies from the US, as North Sea gas fields run out and pipelines to Europe remain expensive.

Canada’s pipeline preacher will not slow down

OTTAWA—Stephen Harper’s pipeline preacher has not lost any of his zeal.Joe Oliver takes to his pulpit daily, spraying statistics and “fact-based” arguments at his opponents, refusing to be slowed by recent heart surgery, perhaps the loudest and most determined environmental protest ever mounted on both sides of the border or native leaders who promise a long, hot summer followed by potentially years of court challenges.

For Obama, Keystone decision is a study in symbolism

The Keystone XL pipeline taking more of Canada’s oil sands oil to refineries with the required capacity on the U.S. Gulf Coast seems in serious jeopardy. Oil sands are atop the “kill list” of some prominent climate activists. The New York Times is now urging President Barack Obama to deny Keystone’s entry into the United States. And Tom Steyer, a California billionaire, is reportedly willing to use his wealth to punish pro-pipeline politicians. They expect a presidential veto to be an important symbolic victory in the larger fight against global climate change.

In Ohio, the fog begins to lift over the Utica shale

NEW YORK (Reuters) - Shares of Gulfport Energy were in free fall last spring, dropping 55 percent in four months, until the oil and gas producer announced it had drilled its first three wells in the Utica shale formation in Ohio.The Oklahoma-based company's value has since more than doubled, bolstered by a series of company production updates on those and a handful of other new wells located in what many believe to be the next frontier in America's oil and gas revolution.

Asia starts to lead way on clean energy

Australia's neighbours in Asia - especially China - are emerging as the countries best placed to prosper from moves to cut greenhouse gas emissions, an international study has found.In their second study of the ''low carbon competitiveness'' of the world's largest economies, multinational GE and the Climate Institute found the momentum for action on climate change had shifted from Europe and the United States towards emerging Asian economies.

World landmarks go dark for Earth Hour

Iconic landmarks and skylines were plunged into darkness on Saturday as the "Earth Hour" switch-off of lights around the world got under way to raise awareness of climate change.Sydney kicked off the event at 8.30 pm (0930 GMT), cutting lights to cheers and applause from a small crowd who had gathered to see the skyline dim and Sydney Opera House turn a deep green to symbolise renewable energy.

Organisers expect hundreds of millions of people across more than 150 countries to turn off their lights for 60 minutes on Saturday night -- at 8:30 pm local time -- in a symbolic show of support for the planet.

PROMISES, PROMISES: Hopes on climate change action may fall short again in Obama’s new term

The issue:Slowing the buildup of greenhouse gases responsible for warming the planet is one of the biggest challenges the United States and President Barack Obama face. The effects of rising global temperatures are widespread and costly: more severe storms, rising seas, species extinctions, and changes in weather patterns that will alter food production and the spread of disease.

Politically, the stakes are huge.

What Drought? Just Don’t Tread on Our Green Grass

In big Texas cities, the state’s water shortage can seem like someone else’s problem.Drought has been in the news a long time, but rates haven’t gone up. Water still comes out when you turn on the tap. The golf courses are still green, and so are the lawns.

Prof Sir John Beddington warns of floods, droughts and storms

The government's chief scientist has said that there is already enough CO2 in the atmosphere for there to be more floods and droughts over the next 25 years.Prof Sir John Beddington said there was a "need for urgency" in tackling climate change.

Why Russian doomsday climate predictions may prove prophetic

Climate change was back in the spotlight for the Russian media last week, with doomsday-style predictions of more extreme weather events, rapidly warming Arctic and growing global average temperatures.

Commentary: Texas and Eagle Ford – Where the Action Is

Jean Laherrere has the Bakken peaking in 2013 and Roger Blanchard has Eagle Ford peaking in 2014. If either of these guys are close then the dream of American energy independence is about to turn into a nightmare.

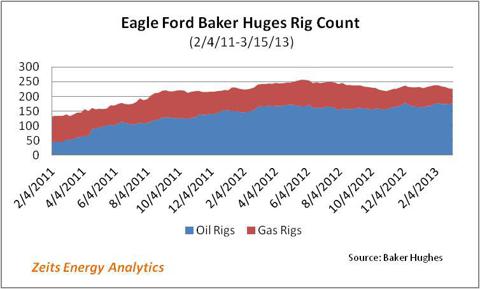

Figure II

In this article Roger also brings up an interesting point about the difference between what the EIA says Texas is producing and what the Texas RR Commission says Texas is producing. That difference was 0 in 2008, -1,000 bp/d/d in 2009, 4,000 bp/d in 2010, 52,000 bp/d in 2011 but a whopping 354,000 kb/d in 2012. What gives?

Ron P.

This fitted curve is really just one scenario and should be interpreted with caution. I've only looked at a few production histories at the region level, but I would expect a plateau of at least a few years, rather than the big drop off he shows. OTOH, he acknowledges using EIA's generous 330 Gb ultimate recovery -- if that value turns out to be smaller the decline could be pretty steep.

Again, recognizing that Blanchard doesn't intend for this curve to be a rigorous projection, I feel skeptical about curves that show a sharp drop off. It appears that a plateau can persist in part due to the peak oil dynamic: at peak, production costs begin to escalate (increasing investment meets lower throughput). If those costs can translate to market prices, more marginal wells are brought on as the most lucrative/productive wells decline. It's not sustainable, of course, but it keeps things going for a few years...

Well I also expect the decline to not be nearly as steep as Roger shows here, but rather steep nevertheless. And I do not expect a plateau. Looking at histories at histories from conventional fields will not give you a clue as to how steep the decline will be here. There are no histories of shale production at this level. The Bakken and Eagle Ford are the very first ones.

And from the rest of your post it seems obvious that you are comparing Eagle Ford to conventional wells in conventional fields. This is impossible since each well pulls oil from its own private little reservoir, created by fracking, and not from a large reservoir with many wells. And each well has a decline rate of from 40 to over 60 percent the very first year.

Ron P.

It's a fair point, that I have conventional fields close to mind since we don't have much else to go from (i.e., some good production data on individuals wells, but short history at a regional level). As such it is just a hunch on my part that we'll see a plateau of a few years.

I have seen so many headlines of the variety "Wow the Energy Boom in the US is Permanent and Powerful!!" and I recall that just a few years ago (way back in 2006 or 2007 and the years leading up to them) I would see headlines "Wow the Housing Boom in the US is Permanent and Powerful!"

It is pretty easy to draw conclusions, therefore, and even to see, through the mists, how the situation now also tumbles into a crash....(hopefully slow)

We need (and indeed we have) continuing failures in the financial world, including Europe. Currency problems, debt crises, ongoing structural deleveraging. Discontinuities pile up......and finally there is just no wherewithal to pay the people who would love to drill if only they could.

And then it is possible to imagine things getting rather quiet, I mean the machines we are so used to. Not all of them, not all at once....slowly, little by little, and everywhere, however.

It is already happening, of course. But you already knew that, didn't you?

Google "in the beginning was the plan"

NAOM

I am thinking this discrepency that Blanchard is concerned about is the same discrepency that Westexas was concerned with a while back, and he may want to comment, but I believe he finally concluded that the difference is due to (1) differences in what each considers "crude oil" , and (2) slow reporting by the RRC (the RRC numbers actually increase with time as late reporters are added).

Roger found a Texas RRC data source for condensate, so he is comparing apples to apples, and I suspect that most of the RRC/EIA discrepancy is due to production data that the RRC has on wells which have not yet been assigned a RRC number.

Here is an interesting RRC question: Since the RRC has clearly been schnookered by most of the oil companies in the Eagle Ford who reported their production as crude when in fact it was condensate--will they require them to change their reporting, and if so, will they require them to go back and change their reports for the last few years? And will there be any penalties levied? (I know that Texans like to think the RRC is the last word in oil production reporting, but in the case of Eagle Ford, self reporting seems to have been more akin to self serving).

And of course, the whole thing brings up the question of: how much credance can you give to any of this data, EIA data included, when most of it is self reporting?

Elmo – No one snookered the TRRC. It determines whether a liquid hydrocarbon is classified as oil or condensate…not the companies. Essential whether the liquid hydrocarbons produced from a well are classified as oil or condensate isn’t determined by the gravity of that liquid but by the classification of the well. Two wells may produce a liquid hydrocarbon of the save gravity but if one well is classified as an oil well then tit’s liquid production is classified as oil. If it’s a gas well then it’s classified as condensate. From an official TRRC hearing:

“There is no statewide rule with a specific definition of “crude petroleum oil”, apart from the explanation of what shall not be construed as “crude petroleum oil.” According to the Texas Natural Resources Code § 86.002(1) “ ‘Oil’ means crude petroleum oil.” If a well produces less than one barrel of oil per 100,000 cubic feet of gas the Commission classifies it as a gas well. If the well produces more than one barrel of oil per 100,000 cubic feet of gas the Commission classifies it as an oil well and the gas produced from it is considered casing head gas under Rule 79.”

And to cloud the issue more: BTW a PVT is a pressure vs. volume vs. temp analysis:

“If a well fails the requirements on Form G-5 to be considered a gas well, an operator may present evidence from a PVT (pressure, volume, temperature) test conducted on the produced hydrocarbons. If the PVT test shows that the hydrocarbons in a reservoir at that time comprise more than 100,000 cubic feet of gas per barrel of hydrocarbon liquid, the Commission may administratively classify the well as a gas well for a certain period of time. If, due to pressure depletion, the reservoir later contains less than 100,000 cubic feet of gas per barrel of liquid, the Commission will administratively reclassify the well as an oil well.” So for part of a well’s life it’s producing condensate but years later it’s producing oil…in the eyes of the TRRC.

The Eagle Ford wells are classified as either oil or gas wells depending on the gas/oil ratio. While some wells may be classified as oil wells and thus their production counted as “oil” they may have the same gravity as wells classified as gas wells and thus producing condensate. Understanding how the TRRC works is not simple. There are consulting companies in Austin make a good living helping even experienced operators to work their way through the TRRC regs. The classification of a well as an oil well vs. a NG well is not a trivial matter. It has very significant implications I won’t go into right now. Understand that 70% of EOG's EFS production may be classified at condensate but another operator's EFS wells may only be producing 30% condensate and 70% "oil". All depends on how those wells are classified.

Hey Rockman--great, your post showed up again.

In any case, thanks for replying—I was hoping you would. Please understand that I don’t have a dog in this fight, only trying to understand the oil patch. And sometimes you only learn by asking a question, and sometimes the sharper the question, the more you learn. ;-)

If you read the RBN article, you know that EOG commissioned a study by IHS, (which as I understand it has the largest oil field data base in the world) and that study (which EOG presented at their earnings conference call) looked at 10 of the largest oil companies producing in the Eagle Ford and concluded that 7 of the 10 weren’t producing oil at all, they were only producing condensate (and with EOG being one of the 3 that were only producing oil, which of course is what they wanted the world to know).

The conclusion from the study was that 70% of the liquid being produced in the Eagle Ford is condensate (to the right of the API 45 line) rather than oil. Yet at the same time the RRC has been reporting that only 18% of those liquids are condensate.

Is this discrepancy important? I don’t know. As you said, “The classification of a well as an oil well vs. a NG well is not a trivial matter. It has very significant implications”. And as the RBN article says , “If the IHS study that EOG presented last week is accurate then the volume of condensate on its way to the Gulf will overwhelm existing refining capacity sooner rather than later”.

And off course, if investors found out that their oil company wasn’t getting the high bucks for crude they were lead to believe was the case, but only getting lower bucks for condensate, they might be less inclined to buy more stock.

Me, I don’t really care, since I have to assume that the producers know what they are producing and the refiners know what they are buying, and as for the average American, he doesn’t seems to give a damn either way. Meanwhile, Peak Oil is almost here and nothing is going to change that.

Elmo – And here’s the root cause of the confusion: 30 API liquid hydrocarbons is oil. And so is 55 API liquid hydrocarbon. It’s all oil regardless of how the liquid hydrocarbon is classified. Different gravities, different sales price and different energy content. But the same can be said for liquid hydrocarbon at the other end of the spectrum say at 15 API. But it’s all oil in a general sense. The problem could be resolved by simply calling all the production LH…liquid hydrocarbon. But that doesn’t roll of the tongue as easy as oil or condensate. And there's no need to point out that the lighter LH’s sell for less than the middle grade LH’s because there are heavy oils that sell for less than the lighter oil. And there are even middle grade oils that sell for less than some light oils due to high deductions for sulfur and other problems.

Though there’s a rough correlation the distinction, in the eyes of some like the TRRC, is based upon the classification of a well and not the gravity of the oil. All well and fine for IHS to say X% of companies are producing condensate but the question is how do they define a company’s production of liquid hydrocarbon? If it uses different methodology then the TRRC you’ll always have two stats that differ from each other. I suspect some fols are comparing apples to oranges and don't realize it. For instance a well producing 48 API liquid will be classified as oil if the TRRC regs classify that well as an oil well based upon the gas/oil ratio. If another well producing the identical 48 API liquid is classified as a gas well then its production will be accounted for in the TRRC stats as condensate. But it is true that many wells producing light liquids tend to be classified as gas wells and thus accounted as condensate. But not all of them. But I gather that IHS classifies all LH production above 45 API as condensate. The TRRC doesn't.

There’s also another complication when characterizing past and future trends in the EFS. There is an oil window and a separate gas window in the EFS. The difference is spatial but that also includes a depth variation. In general the deep EFS reservoirs tend to be gassier and thus more likely to be classified as gas/condensate by the TRRC. The oil window tends to be shallower (i.e. not as hot). But there are exceptions.

As far as valuing a company’s stock based upon what price they are getting for the liquid hydrocarbons that’s a poor metric IMHO. Company A may be selling all its oil production at a higher oil price while Company B is selling all its condensate production at a lower price. But Company A goes insolvent due to bad management decisions and the stock would be used for toilet paper. And the stock of Company B doubles in 12 months because they were lucky enough to lease a sweet spot. In the oil patch a company’s profitability has never been determined solely by what price it sells its production for. The key has always been and always will be is what they spent to get it out of the ground. Selling $80 condensate that cost you $60 to develop is good. Selling oil for $100 that cost you $110 to develop is baddddddddd. LOL.

“…and as for the average American, he doesn’t seem to give a damn either way.” And to a degree that doesn’t matter. We are likely trending towards a lighter gravity LH over time. The energy content and gasoline/diesel yields will shift. But it’s all still oil. PO, be it Peak 30 API or peak 55 API, doesn't really matter a great deal in the Big Picture IMHO. It's still a peak in our ability to produce motor fuels. As the day progresses I will try to research more details on the condensate/oil distinction by the different players.

I once read that there is more heat energy than chemical energy in produced oil.

A 2-part question:

How hot is this stuff when it reaches the surface?

With the interest in hot-rock geothermal (eg in Australia) could the two industries get together and either share oil heat or "dry" wells?

Bryan

There is definitely not more heat energy than chemical energy in produced oil.

One bbl of oil is ~6e9 J.

Taking a bbl of oil from 300 C (very good geothermal resource) to 0 C (basically impossible in a real power cycle, but makes the math easy) is

Q = m*Cp*DelT = 300 lbs * 1000 J/lbs C * 300 C = 1e8 J (rounding up)

So it's more than an order of magnitude difference, even with some generous assumptions.

What you may have read is that the rock from which the oil was extracted has more heat energy than the oil contained within it. That may be true, but effectively mining the heat is a tough proposition.

Hello Rockman,

For my laymans mind surely if its liquid at room temp (68F ) and 1 atmosphere when extracted then would that help in classify it as oil - after all a gas is a gas...

And for the other end of the scale for tar I think some kind of viscosity measure , hmm, tars vary a lot

but perhaps above 400C to make them liquid ?

call them waxes if above 45C they are liquid

tough I think

Forbin

Condensate is defined as hydrocarbons which are in the gaseous state under reservoir conditions, but condense to liquids under atmospheric conditions.

This means that, chemically speaking, condensate is a liquid the same as oil under atmospheric conditions, and the phase only differed under reservoir conditions. The only fundamental difference at the surface is its origin - condensate comes from gas wells, oil comes from oil wells. The difference is a bit arbitrary, but normally government regulators tell oil companies which type of well they have, not vice versa. It's a legal rather than a production issue.

From a practical standpoint, condensate is usually a less dense, less viscous liquid than oil, but some crude oils are nearly as light as some condensates. However, from the oil refinery perspective, the product mix they can get out of condensate will be different from that of most oil, so they will pay a different price depending on market conditions.

At the moment, as a result of the increased production from the Eagle Ford and other condensate-rich gas plays there is too much condensate on the US market, and as a result it is getting a lower price than oil. Fortunately for producers there is a strong demand from Canada for condensate to dilute heavy oil and bitumen to allow it to flow though pipelines, so much of the condensate is being exported to Canada, and immediately reimported as diluted bitumen (dilbit).

Thanks, Guy, for the best job of explaining condensate yet, at least in TOD. Appreciate it! The side comment on dilbit was informative and interesting as well. This is the sort of thing that makes TOD the best site for energy information I have found.

Craig

And my point is that if we back out condensate from the C+C measurement, it appears that the the global supply of "Black Gold, Texas Tea*" in 2012 was probably flat to down, versus 2005, despite a doubling in global crude oil prices.

*e.g., the surface seep that Jed Clampett found, i.e., 45 or lower API crude

Jed hasn't done so well ever since Drysdale's recommendation of Greek bonds as a way to recover from his Reno housing development investments. Especially since he canned Drysdale and moved his money to Cyprus.

Hi Ron,

The difference between the Railroad Commission's numbers and the EIA is because smaller producers often report late and sometimes there are corrections that take time to process. The EIA avoids this by surveying the larger companies that produce about 80 to 90 % of total output and then assuming that the proportion produced by thes companies has not changed when doing their estimates. If you look back about 18 months the EIA and RRC numbers match very closely, but the most recent production is probably closer to the EIA numbers (unless the proportion of total output by the surveyed companies has changed significantly.) To estimate Eagle Ford output you need to adjust the RRC numbers by assuming that the ratio of Eagle Ford to total statewide production is similar to the RRC reported numbers and then adjust by the ratio between the RRC statewide numbers and the EIA estimates.

As a simple example using round numbers, if Eagle ford output was 400 kB/d and statewide production was 1600 kB/d according to the RRC of TX, but the EIA data suggests 2000 kB/d for TX, then the appropriate estimate for the Eagle Ford would be 500 kB/d. Bottom line, the RRC numbers for recent production will tend to understate the actual output.

DC

Ron et al – When I see such a chart I don’t see the decline of an oil field predicted. I primarily see a prediction of future drilling activity. And obvious such a prediction will be heavily influenced by price expectations. Some folks say PO is wrong because no one predicted the uptick from the shales. Of course not: how many folks were predicting $100 oil back when it was selling for less than half that amount? Same thing with the shale gas play: we all knew that NG was there and knew how to get it out. But there was little interest until NG prices started to boom.

Back to the chart. If I asked you to model Eagle Ford oil production in 2015 AND stipulated that oil would drop to $40/bbl tomorrow I suspect your projection would be very different than if you modeled with oil rising to $120/bbl tomorrow and holding there for the next 5 years. But the chart is a combination of two trends: the additional production from wells yet drilled and the declining production of existing wells. Wells coming on in the last year would skew that number up high. But wells drilled 3 or 4 years ago would be contributing little due to those well-known high decline rates. But the older wells would contribute low volume but low decline rate steady base.

Consider the boundary limit of such a chart. If no more EFS wells were drilled tomorrow then you would see a very sharp drop off over 2 or 3 years and then a rather low decline rate period. OTOH if oil jumped to $120/bbl tomorrow they would be trying to drill even more EFS wells then they did in the last 12 months. But again there’s another obvious boundary limit: regardless of how high oil prices get there are a limited number of EFS locations that can be drilled. As pointed out before the horizontal drilling and frac’ng of the Austin Chalk in Texas was the hottest play in the country back in the early 90s’s. But you don’t hear much about it now even with the higher oil prices: the great majority of the viable locations have been drilled.

So the chart: how accurate it proves to be in the next few years will depend more on drilling activity than individual well decline rates. A better way to imagine the dynamic IMHO is to think of the EFS as thousands of potential individual fields that, once drilled, have a very high decline rate. How high the production from this trend of fields goes and how long it stays there will depend on how quickly new fields (wells) are developed.

Rockman, of course economics, that is the price of crude oil, will have everything to do with future oil drilling and production. But when we are making predictions they must all be made with the caveat that they only apply if oil prices stay pretty close to what they are today. If the bottom falls out of oil prices, because the economy collapses, then decline rates will be a lot steeper. On the other hand, if prices go even higher then that will make more marginal fields economical and we will either see production rise or decline rates slowed considerably.

On the other hand there is just no way to get around geological constraints. So there is a limit to what price changes can actually do.

Looking at the chart again, the decline rate Roger Blanchard predicts is not really that steep. Those little diamonds on the chart are years, not months. He says the Eagle Ford will be at 600,000 barrels per day when it peaks in 2014. Then three years later, in 2017, it will still be at 500,000 barrels per day. That is only about a 6 percent decline. This is shale, I expect the decline rate to be a lot higher than that, especially if they start pulling rigs out.

Ron P.

Does the action of the Federal Reserve have any influence on the price of oil? Seems to me that when they pull back their buying of mortgage backed securities there will be a big fall in the price of oil. But maybe they can keep doing what they are doing until they want...at least that is what they tell us..."everything is just fine you just sit back and leave the flying to us"

Sparky: When the Fed stops purchasing securities (mortgage backed and/or the QE purchases), the cost of money will go up. That means interest rates rise, bond values fall, and what is left of the banking industry drops into the hole thus created.

At least that is my opinion... and that the Fed cannot, for that reason, stop. Especially the QE part. I mean, if the Fed isn't buying Treasuries for no interest at all, then the auction will turn to people who will demand interest commensurate with risk. You could at that time see value of the dollar drop, prices rise, and inflation take off.

Or not. Given the present situation it is as likely to fall in either direction, IMO. And, neither particulary pleasant.

Craig

Hi Ron,

As I mentioned upthread, the RRCT (Railroad Commission of Texas) numbers need to be adjusted upwards, especially for recent months. If we assume the EIA numbers are better estimates than recent estimates by the RRCT we get the following for the Eagle Ford:

Note that the output in Dec 2012 is close to the peak in Mr. Blanchard’s chart in 2014. As Rockman points out, (and you agree), the future will depend both on the future price of oil, the rate that new wells are drilled and completed (which will be influenced by the price of oil), and by how productive the new wells are (which is a function of how large the sweet spots are). If we want to create a future scenario, we need to explicitly state our assumptions about how we think these factors will develop over time.

I have recently updated a future scenario for the Eagle Ford (crude only) with the following assumptions:

-Real oil prices will rise by about 12 % per year (they will roughly triple over a 10 year period)

-The average well profile of new wells will remain the same for 2 more years (until Jan 2015) and will then decrease by 1 % per month, this results in wells starting production in Jan 2020 producing roughly half the output of wells starting production in Jan 2015 and earlier over similar time frames (i.e. 5 year cumulative output 204,000 b vs 117,000 b).

-The rate that new wells are added increases from 139 new wells per month in Jan 2013 to 187 new wells/month in Jan 2015 (an increase of 2 wells per month over 24 months) this acceleration continues out to Jan 2018 (258 new wells/month) then slows to half (increase by 1 extra well per month), the peak is reached in Feb 2019 at 1.3 MMb/d with 17817 wells producing and it is assumed the trend is completely drilled up at 40000 wells in Dec 2026.

Just a different take from Roger Blanchard.

Note that the first chart is C+C and the second is crude only (I was unsure how to model the condensate production.)

Also the cumulative output from April 2009 to July 2051 is about 7 billion barrels.

DC

I repeat - please don't re-post comments that are blocked by the spam filter. They'll only be blocked again.

And don't edit comments that have been blocked, then approved by a mod. That only gets them blocked again.

Has there been a change in what type of comments are "prefered", or are the preferences just more enforced now?

The spam filter is new. We got attacked by spammers last week. It was unmanageable. Like, 10 spam comments for every real one. Super G purged 70,000 accounts and blocked new people from registering, and that solved the problem temporarily. The spam filter is so we can open up to new registrations again. But it's got problems of its own.

Is it possible to set up a test to clear new account registrations?

Probably wouldn't want to make it too onerous as to drive everyone off. Do spammers have the ability to jump a hurdle like this?

Sorry Leanan,

I wasn't aware of the new moderation. Are all comments now moderated or only comments with links? I will be sure not to re-post in the future while my comment is being moderated, I realized my mistake after the fact. Thanks for all you do.

DC

Near as I can tell, the spam filter tries to block comments that likely to be spam, personal attacks, "low quality," or obscene/profane. It looks like comments with images or a lot of links are the ones that tend to get caught in the filter.

Originally, comments that were filtered were deleted. Super G changed the settings so they are hidden, giving me the option of un-hiding them if they are not spam. He's trying to lower the aggressiveness of the filtering, because it's catching a lot of legitimate comments.

Not sure if your package can do it, but I'd suggest a whitelist of known contributors (eg the usual suspects), which don't get blocked. That way the only ones that go via the algorithm are those from new posters - increasing the spam/signal ratio of blocked posts.

Easiest way of populating that would be to take everyone with a first posting date at least two years in the past, and add them to the whitelist.

I guess I got cought by the ""low quality," or obscene/profane" last week during a discussion of UK gas storage level and politicans going the pond I could not resist and posted a link to a diver going into an icy pond.

DC, I think your chart and predictions are wildly optimistic. Eagle Ford, like the Bakken, is already showing signs of slowing down. Two out of the last four months show a declines. And where do you get the data that says new wells will increase at the rate of two per month for the next two years? Or for that matter why do you think the average profile of new wells will remain the same for the next two years, and after that only decline at 1 percent per month? Are they two years away from drilling all the sweet spots in Eagle Ford?

And looking at your chart, it looks like the current number of wells to be about 300. Is that right? The Bakken already has over 5,000 wells. If Eagle Ford is producing that much oil from so few wells, then there is something fundamentally different between the Bakken and Eagle Ford.

Ron P.

The current number of wells is around 2000, but that is only an estimate, there is not an easy way to track the number of wells in the Eagle Ford. I have looked at the data for the eagle ford for individual wells and there has not been a pronounced decrease in new well productivity from 2010 to 2011.

My modelling work on the Bakken suggested that holding the "average well" profile constant from Jan 2008 to Dec 2012, yields a model which agrees well with the data from NDDMR. The eagle ford trend started to ramp up in 2010 and by now we are 2 years into development, in the Bakken case 4 years of a steady well profile worked well so I assumed 4 years might work for the Eagle Ford as well, Dec 2014 is the 4 year point for the Eagle Ford and that was the basis of leaving the well profile unchanged until Jan 2015.

The 1 % per month works out to about 12 % per year, Rune Likvern's analysis shows about a 20 % decline in the well profile over 1 year, so the estimate is somewhat optimistic as I have the well profile declining less aggressively than in the Bakken.

The two well increase per month is simply a guess, there is no future data I can point to, if you find some it would be interesting however ;). In the case of the Bakken if we start in Dec 2010 at 2064 wells and add 3 wells to the 48 new wells of that month for every month after for 24 months we get 4041 wells after 24 months, which is less than the 5062 wells in Dec 2012. So at a similar level of development (about 2000 wells) I have added 2 new wells per month in the Eagle Ford rather than the 3 wells per month seen in the Bakken (and the three wells is actually too low, we end up a 1000 wells short.) So either I am wildly optimistic or maybe wildly conservative, I think it is about right.

Based only on area and a well spacing similar to that proposed by James Mason in his article about the Bakken, the Eagle Ford might allow 60000 wells, I used 40000 to be conservative, but the peak is reached at only 17,800 wells, I have no idea what number will be reached.

I would point out that anyone proposing that the Bakken would reach 669 kb/day two years ago would have been considered wildly optimistic, and I would have agreed.

Time will tell if my scenario proves to be too optimistic, too conservative, or not too far off.

DC

No, no, no, it did not work that way at all. All those new wells were added suddenly, in one month. Bakken additional wells jumped from 60 to 159 in one month. From June 11 to July 11.

I label them "New Wells' because that is what I thought they were. But no, that number, 159, is simply new wells minus wells in the Bakken shut down that month. And they have been shutting down wells at a rate of perhaps 50 per month. So it is likely the number of wells jumped, in July 11, by more than 150. And notice that the number jumped to 192 in March 12 and May 12 but has since declined to just 113 in January of this year.

Bakken additional wells per month. (New wells minus wells shut down.)

So there never has been a smooth additional number of wells added per month in the Bakken, and I doubt that there has been, or ever will be, in the Eagle Ford either.

As I said, your Eagle Ford production estimation is wildly optimistic.

And a gradual 2 per month increase won't work for Eagle Ford either. In fact the Eagle Ford rig count has been decreasing.

(click to enlarge)

Ron P.

Hi Ron,

You are correct that the Bakken did not ramp up smoothly. My point was that we do not know what the future will look like.

I will attempt to lay this out more clearly. We know in late 2010 there were about 2000 wells producing in the Bakken, and in late 2012 there were about 5000. Now let us imagine that we do not have the number of wells for every month between (which is exactly the case for the Eagle Ford). I propose that in such a situation we assume a smooth ramp up because we don't have any data, if we had done so for the Bakken we would have needed about 2 extra "additional" wells per month. I would be interested in where you get 50 wells being shut down each month. We only have data on the number of producing wells, you are correct that there are some wells shut down every month, but we can only guess how many that is.

I agree there will not be smooth ramp up, it does not really matter, it is the trend that is important.

The trend I have proposed for the Eagle Ford is very similar to the trend we have seen in the Bakken, the smoothness is of little consequence and has little effect on overall production. Does the trend seem wildly optimistic, is there some reason the Eagle Ford could not repeat what has already been accomplished in the Bakken? It seems to me that Texas is all about oil and that it would be easier there, also the winters are a little milder so 12 months of production may be easier to accomplish.

Note that in Jan 2005 there were 188 wells producing in the Bakken, there was a short term peak in number of producing wells in Aug 1994 at 256 producing wells so at least 68 wells were shut down over this period (some new wells may have been added as well, hard to know how many). For simplicity let's assume no new wells were added (prices too low maybe). Let us also assume older wells will tend to be shut down as they deplete.

In Aug 1984 there were 68 producing wells and in Aug 1994 there were 256, an increase of 188 producing wells, of the 68 old wells from 1984 at least 57 had been added since Aug 1979 when there were 14 producing wells so by Jan 2005 if these 68 wells were producing they were 20 to 25 years old (they were probably shut down over the Aug 1994 and Jan 2005 period at the age of 15 to 20 years). This leaves the 188 wells from Jan 2005 which probably were between 11 and 21 years old (started production between Sept 1984 and Aug 1994). If these wells were being shut down at 50 wells/month, it would not make much sense, maybe you meant 50 wells per year, but it has been 8 years since Jan 2005 so if we assume the same number shut down per year we would get about 24 old wells shut down per year or 2 per month.

Another way to approach this is to assume on average that wells get shut down after 15 years. The chart below adjusts the delta prod wells (change in # of producing wells each month) by increasing the delta prod wells by the delta prod wells from 15 years earlier if it is a positive change. I am assuming these wells are shut sown after 15 years on average and a new well must be added to replace it (if the number of producing wells is unchanged). I also show the linear trend from Jan 2008 to Dec 2012. Finally I add the linear increase in delta producing wells by 2 per month (as in my wildly optimistic Eagle Ford scenario), this is labelled as

"+2 wells/mo". Note that I agree with you about starting at 48 in Dec 2010 and instead start at 94 (on the linear trendline) and increase by 2 each month, this still falls at 4872 producing wells in Dec 2012, well short of the 5044 wells from NDDMR.

On the rig counts, the oil rigs are the important part of that chart and they have been flat since Feb 2012 with little effect on output, note that the oil rig count tripled in 2011, it may fall in the future or it may rise, time will tell us.

Edited to add what follows:

Just for kicks, I updated my Eagle Ford Scenario so that it is only "mildly optimistic" ;)

DC

DC - According to my DrillingInfo data base there have been 3,842 Eagle Ford completions since June 2008 when the boom began. Those wells were drilled on 2,793 leases. Production in Texas is reported by lease and not by the well. Thru Jan 2013 those leases have produced 257.3 million bbls of C+C and 711.6 bcf according to the data derived from production reports submitted to the TRRC. But understand the DI data base charts the liquid hydrocarbon production as “oil”…it doesn’t break it out into oil and condensate. The spam filter blocked some of my response yesterday so in case you missed the main point: As far as the TRRC goes the distinction between oil and condensate isn’t based upon the gravity or composition of the liquid hydrocarbons. If the TRRC classifies a well as a gas well all the liquids from that well are classified as condensate. If it’s classified as an oil well then all the liquids are classified as oil. The distinction between and oil well and gas well is based upon the GOR…gas/oil ratio. And that may be the GOR at atmospheric conditions or, if an operator makes a special application, at reservoir pressure conditions.

So if a well is producing 300 bbls of 40 API liquids and it’s classified as a gas well then 300 bbls per day of CONDENSATE is reported. If a well making 300 bbls of 40 API liquids is classified as an oil well then 300 bbls per day of OIL production is reported. The classification of a well as an oil or NG produce has huge impact on the different regulatory rules on unitization, well spacing, royalty distribution, etc., etc. Just to make it more complicated the reservoir pressures can change significantly over time and it’s possible for a gas well to be reclassified as an oil well after producing a number of years. So in the records the well may have X thousands of bbls of condensate produced during the first portion of its life an Y thousands of bbls of oil produced over the last portion of its life. And this is where confusion may come in from different reporting agencies. If one group is looking only looking at Eagle Ford condensate production as reported by the TRRC then they are missing Eagle Ford oil production. The GOR varies greatly across the trend. The deeper wells tend to be classified as gas wells and the shallower ones as oil wells. Thus you’ll see references to the EFS ”oil window”.

In a few days I’ll be able to give some indication of any changes in the production character of wells (leases, actually) over time. The best metric available would be the cumulative production over the first 12 months. Thus this stat will be only for those leases coming on line in Jan 2012 and earlier. Again, leases and not wells. If a lease started producing on 1 Jan but multiple wells were drilled during the next 11 months the later wells will not have contributed for a full 12 months.

The reason Texas long ago required operators to just report lease production and not by well was practicality. Several wells may be producing into the same oil tanks on the lease. So typically oil production was never measured per well. As an operator it’s critical for us to know how individual wells are doing so we’ll periodically catch samples from all the producing wells and then allocate the total production per well. But those numbers aren’t given to the TRRC.

Hi Rockman,

Thank you for that information. Are those completions only oil wells or does it include both oil and gas, if it is both do you have the gas/oil breakdown for number of completions? Also do you know how many of those completions are producing? I noticed that there are often leases which are on the schedule but are not producing yet.

I realize that only the leases get reported and that there are often several wells per lease, this makes modelling difficult, one can get an idea of the number of wells per lease by using the map viewer and putting in the lease ID# and district #, then you can dig further and find when the wells were completed, but it is a huge pain and that was the source of my "there is not an easy way to find the number of wells". I tried to determine an "average well profile" by focussing on thos leases with a single well in eagle ford 2 and on multiple well leases that had several wells completed at about the same time, but there is too much guesswork when wells get added later so those leases I did not use.

The problem with the 12 month metric that you use is that for those leases that have new wells come on line over the 12 month period (at say 6 months and 9 months along with the initial wells at month 1) will look better than they would if we were looking at a lease with only wells producing for a full 12 months. I am not sure there is a good way around this problem without a lot of work. For 136 wells from 125 leases in the Eagle Ford 2 field I get an average of 109,174 barrels of oil for the first 12 months of production, the wells started production between August 2010 and Jan 2012.

For condensate vs oil I used what the RRCT gives in various fields of the Eagle Ford Trend. In my model I used crude only because I was not sure how to deal with condensate.

DC

Rockman,

I have discovered some of the answers to my questions at http://www.rrc.state.tx.us/eagleford/

As of 3/29/2013, the Map shows (click twice to enlarge it) well completions and drilling permits as of March 7, 2013 in the Eagle Ford play(it is updated monthly). Currently we have 5458 permits (both oil and gas), 2874 oil completions on schedule, and 1073 gas well completions on schedule. Note that sometimes a lease is on the schedule (lease # is reported for a field) but is not yet producing, so not all of these wells are producing. When we look at data from the online production query for oil leases in the Eagleville fields of district 1 and 2, we tend to find 75 to 80 % of leases on the schedule for any given month are not producing any oil. So for March 7 we are likely have about 2230 producing oil wells in the Eagle Ford.

Also at the Eagle Ford info page we find that there were 1262 producing oil leases at the end of 2012 in the Eagle Ford, so the average oil lease has about 2230/1262= 1.77 wells, at the end of 2012, this number will change over time, this makes attempt to model what is happening quite tricky.

DC

There was a story on Saturday's WaPo that the US Senate had passed a bill in support of the Keystone XL pipeline project.

Senate endorses construction of Keystone XL oil pipeline from Canada to Texas

There was a mention of this vote in Saturday's Drumbeat, but no comments about it. The vote was "nonbinding", but it did pass 62-37 with some support from the Democrats...

E. Swanson

Dog – “They expect a presidential veto to be an important symbolic victory in the larger fight against global climate change.” So for the moment we have two symbolic “victories” to focus on: The victory against global climate change by the POTUS not signing the permit (so far) and the victory of Canadian oil sand producers to export more oil to the US during 2012, on President Obama’s watch, than ever before in history.

So, wonder whose symbolic victory is more powerful? Even more important: which one will still exist a year from now? And there are some other more than symbolic victories the MSM hasn’t been focusing upon. Like more than 400 “victorious” drilling permits in the offshore GOM fed leases since the BP oil spill. And like the more than 15 “victorious” current oil production projects in the GOM approved by the POTUS. And like the “victorious” offering of 100 million acres of offshore leases by the PTUS in the last 12 months. And like the “victorious” increase of US coal exports that haven't been blocked by the POTUS. And, last but not least, the “victorious” success of the other 98% of the Keystone PL that doesn’t require approval from the POTUS.

Just adding up those few victories and comparing them to the environmentalists’ victory on that one very short section of Keystone it looks like a rather one-sided battle of the presidential symbols. Honestly, I am sympathetic with the plight of the environmentalists even if I don’t agree with every one of their positions. Today all they have are a few mostly symbolic victories that will be short lived IMHO. And I'm sure their chances of other successes will decline even more as we stumble down the PO path. It looks like Goliath vs. David. But all David has is a symbolic sling. And I strongly suspect the POTUS will take even that one away from him in the coming months.

The Senate and the President have spoken loud and clear. They have no intention of doing anything to stop or slow down fossil fuel production. I agree there are no victories for those who care about carbon, symbolic or otherwise.

Meanwhile, back in the real world: Scientists link frozen spring to dramatic Arctic sea ice loss http://www.guardian.co.uk/environment/2013/mar/25/frozen-spring-arctic-s...

In the UK many people's attitude to "Global Warming" is "Bring it on, I'm all in favour of a Mediterranean climate in [insert name of home town]". A lot of these do not even question the science, i.e. they're prepared to believe that it is anthropegenic, but don't care...

Recently, I've been asking individuals whether their attitude would change if the science showed that Global Warming (or Climate Change as I prefer to refer to it) would generally mean wetter summers and colder winters, with only the occasional short-lived heat wave. Almost 100% said this would change their attitude towards the issue...

I can only hope that a lot of people read the article.....

There gas storage is almost empty and the weather is cold so it make sense for the moment.

Don't worry about us being out of NG just yet; the big boat from Quatar has arrived.

This is the nexus between climate change and peak oil. So far, peak oil is primarily driving us to use dirtier fossil fuels with decreasing returns on investment. Instead of moving toward renewables full throttle, we are putting the accelerator to the floor for deep water and oil sands, following the path of least resistance. We're not very good at adding the externalities into our economic calculus, choosing the least monetary cost today without considering the future environmental, long-term economic, and health costs.

Hi Rockman,

I know that you are sympathetic to the ends that many environmentalists seek, but are quite dubious about the means in many cases (Keystone XL for example).

I think your assessment is spot on. My hope is that rising oil prices, followed by rising natural gas prices, and eventually rising coal prices coupled with pollution enforcement on old coal electrical generation will allow market forces to turn things in the right direction.

This is probably an overly optimistic scenario, but if prices rise enough then public transport, electric cars, wind power, solar power, and a better grid (more HVDC transmission) all start to make sense from an economic perspective. I think this will require a tripling or maybe more in the real price of oil, natural gas, and coal. Maybe in 10 years or so we will be there (note that real price of Brent crude roughly tripled from 2002 to 2012.)

DC

Talk today on the BBC that us Brits are going to buy Nat gas from the States - no mention of price either

can it be done ?

will we be able to afford the pipeline over the Atlantic ? ;-)

( shipping terminal and compression ,storage tanks , none build so far ?? )

why not just build a tunnel - A Transatlantic Tunnel, Hurrah! http://en.wikipedia.org/wiki/Tunnel_Through_the_Deeps

Aye perchance a time to sleep and dream ......

Gas ELM anyone - sister web site "the Gas Tank " oops perhaps that doesn't work so well for Amerikans ! "the methane burp": dunno , help me out here guys !

Forbin

Would seem to be a logical place to export some of the US LNG. I'm surprised it's taken this long for it to start to make traction. Maybe the brits are finally realizing they're in deep trouble WRT to natural gas? Now it seems they've all ticked off the Russians, so they better have a backup plan in place.

I believe they already have import terminals over there, I doubt there'd be much additional infrastructure to be added.

Edit: looks like this is the reference -

http://gcaptain.com/energy-firm-signs-20-year-import/

A 20-year supply deal, starting 5 years in the future? I will be interested to see how this holds up....

Well LNG facilities take a number of years to build, so it makes sense. I think he was referring to the hope that the pricing arbitrage that exists today will *hopefully* exist 5 years from now. Naturally 5 years ago they were almost certainly singing a different tune regarding US exports, so time will tell.

Yes, we already import LNG from Qatar so we're well set up for imports...

But!

Will there be any shale gas to spare in the US in 2018 when this starts? Let alone 20 years down the line?

I see much here on depletion rates...

And won't export push US LNG prices up?

Centrica press release here: http://www.centrica.com/index.asp?pageid=1041&newsid=2693&goback=%2Egmr_...

At the bottom of the release are the pricing details, based on Free On Board at the Sabine Pass facility.

The price is $3.00 + (115% x Henry Hub NG price). Last price for 2018 NG at Henry Hub was $4.76 per mmbtu. Using an exchange rate of 1.52 for $/£ (I can't find a rate for 2018, so I used the spot rate), the price Centrica/Cheniere have agreed is approximately 56 pence per therm ($8.50/mmbtu) FOB Sabine Pass.

I guess shipping and regasification would cost in the region of 6 pence / therm (anyone with more accurate numbers please feel free to chime in - I've used 3.5 p/therm [$0.53/mmbtu] for freight and 2.5 p/therm [$0.38/mmbtu]for regas).

Total cost to Centrica delivered at the NBP in the UK would therefore (at today's prices) theoretically be in the region of 62 pence/therm ($9.40/mmbtu), which looks relatively cheap compared to the 2018 NBP forward price of roughly 65.50 pence/therm ($9.95/mmbtu).

Of course, if Centrica wanted to "lock in" all the various elements (Henry Hub, NBP, £/$ rate, etc) for even just the first year of the term, I'd expect them to have to take a pretty significant hair-cut on the UK pricing and to pay a reasonable hefty premium for the Henry Hub pricing....

What is the ratio between metric tonnes and cu feet ? I suspect that this is <<1% of US methane production.

Alan

It's not a huge deal - just over 91 BCF/year (using 1,000 btus per cu foot). Roughly 0.5% of US production if I got all my numbers right....

1 metric tonne equals about 48,700 cu feet. http://www.bp.com/conversionfactors.jsp.

1.0 Metric Ton = 46.7 Mcf

Meanwhile, the EIA shows that US dry monthly natural gas production has basically been flat, generally between 1.9 and 2.0 TCF per month, since early 2011.

That's only because it's really cheap, though. If prices go up, so will production, for a while anyway.

That's why you get a 20 year firm contract if you're an exporter...who cares what the prices are, you still get paid the same whether you load 10 ships a month or 10 ships a year.

Talking of the Utica shales in Ohio, does anyone have some hard information on the Utica shales in the St. Lawrence valley, in Anticosti and and Gaspesia (all in the province of Quebec). Citizens are promised untold riches, but I've seen no numbers at all for the St. Lawrence Valley shales (supposedly gas rich), for the Anticosti shales (the current estimate of 30 billions of barrels looks like a wild guess based on rock morphology, they cannot even tell if it's gas or oil) and the Haldimand #4 well, about to be drilled close to downtown Gaspé even though the city actually opposes the projet, is trying to tap a meagre 8 million barrels reservoir. Hardly a tight oil revolution.

Does anyone know about the real potential of the area? My feeling now is that oil companies promise a lot more than they can deliver in an effort to get subsidies or to lift some environmental rules. You know, the old «it's a small sacrifice for a huge return» hoax.

From Stuart Staniford's blog: Why Did Saudi Arabia Reduce Oil Production?

While watching some old ASPO videos over the weekend, I think I may have stumbled upon the answer to Stuart's question. Some of the reduction may have been due to natural decline but most of it was likely intentional but for a very important reason. It was what Robert Hirsch calls "Oil Exporting Whithholding Scenario". His explanation starts at about 21:26 into this video: Robert Hirsch - Peak Oil: Exploring the Risk Factors ASPO 2007

Saudi is now realizing that their production is finite and will soon start to seriously decline, along with the rest of the world, they have decided to deliberately cut production in order to save it for their own future use. They realize that they must export oil for revenue to run their country but also must ration what they have left. It will be a delicate balance, export enough to support their budget but save enough to run their country for a few years into the future as well.

And if this is the case, and I believe it is, Saudi oil production is not likely to increase in the future. In fact it will likely continue decline further as they must cut production even further in order to maintain this delicate balance.

Ron P.

Of course, a better question is, "Why did Saudi net oil exports fall for seven straight years (relative to 2005), as global annual crude oil prices doubled?"

The Saudi ECI ratio (ratio of total petroleum liquids production to liquids consumption), through 2011:

The above extrapolation suggests that Saudi Arabia, through 2011, had already shipped about 38% of their post-2005 CNE (Cumulative Net Exports), but there is a critically important point about this extrapolation.

The above extrapolation assumes a slight, but perpetual, increase in production, since it is based on the 2005 to 2011 production rate of change (11.0 to 11.2 mbpd). An inevitable production decline, even with a reduction in the rate of increase in consumption, means that the 38% post-2005 CNE depletion estimate is probably too optimistic.

I still think Saudi Arabia has some aces in the hole to stem the export declines. Declines will continue but the current trend will be less steep because of measures such as:

1) More refineries will be built to handle the crappy heavy-sour crude that they have. They are not selling much of it because most of the refineries are built to handle better quality oil. But as the price of oil continues to go up, eventually people will build refineries to handle the heavy-sour crude because it will be sold at a good discount from the high-grade oil.

2) Saudi Arabia can phase out the current ridiculous oil subsidies that encourage wasteful domestic usage of gasoline/diesel. People will drive less, buy more efficient cars, use public transport, etc. . . . like the rest of the world is doing.

3) They can stop burning so much valuable crude oil to create electricity. With the reduced prices of solar & wind systems, it is crazy for them to burn up crude that they could be exporting just to create electricity. Raise electricity prices and move to non-oil based generation systems like everyone else. Nukes, solar, wind, natural gas, etc.

And when we see them start doing these things . . . then we know they are starting to sweat.

speculawyer, is Saudi Arabia subsidizing the price of electricity like they are with gasoline?

Electricity is very heavily subsidized in KSA.

And power outages in August are not acceptable.

Alan

Spec, nothing happens very fast in Saudi Arabia. All the stuff you are talking about is either already happening or will not happen at all. The oil Saudi is producing right now is not really crappy, most of is is quite light. It is the stuff from Manifa that will come on line in about a year, more or less, that is really crappy. However two new refineries will soon be completed and both will be able to handle the oil from Manifa.

They are looking at Solar, Wind and Nuclear but it will be years before they have anything along these lines comes on line. I doubt if they will ever have nuclear power. Their hope right now is more gas. They are drilling like crazy for gas and that will likely lower their internal crude consumption somewhat.

But they don't have anything coming down the pike that can slow declines down. In fact I think they are seeing rising decline rates right now and that is why they are cutting back. And those decline rates can only rise as water starts to hit those new horizontal infill wells that they started drilling about a decade ago to stem their 8% decline rate. They say they got it down almost to 2% but that could not possibly last. All they were doing is pulling the oil out faster, dramatically increasing their depletion rate.

Ron P.

Oh I agree things happen slow there . . . and that is why I say that when you see these things happening, you'll know they are starting to sweat.

But all of those things WILL happen . . . it is only a matter of time. They will procrastinate though, like all humans do. But when push comes to shove . . . well, Iran did it.

They've been searching for gas for over a decade now. And they even invited all the IOCs to come in and help with that (something they won't do with oil). But I don't think they've had enough success with gas alone such that they'll need to do solar, wind, nukes, etc.

Not quite the KSA, but the UAE just provisioned the worlds largest solar thermal plant:

http://www.reuters.com/article/2013/03/17/us-uae-solar-idUSBRE92G08B2013...

The KSA has a long term plan for renewables (mostly solar), aiming for 24GW by 2020 and 52GW by 2032.

http://cleantechnica.com/2013/02/25/saudi-arabia-reveals-plans-for-54-gw...

An interesting pic on oil and gas reserves (in USD) per capita :

Thanks. This goes to my graph collection.

The UK, at #44, does not look too good.

Alan

What happens to them if the price of oil falls a lot to say about $40 a barrel.

Spec,disagree with you on all three .

1.You can't build a refinery with a click of your fingers . It takes years and most important (like NG pipelines) a continuous sure shot supply source over the next minimum 10 years . The only people who are ever going to build a refinery to process the real crap quality of crude oil coming in the future will be the Saudi's and no one else.

2. Cut subsidies ? You might as well cut off the head of King Abdullah and the House of Saud.

3.Solar and wind to replace oil for electric generation ; the problems associated with both the sources and exra problems in a desert environment have been often posted on this forum .They can assist but cannot be the solution .

They are already sweating , I am looking to see when do they start pissing in their pants .

China will build refineries to process very low quality crude. Perhaps the Indians as well.

Alan

Chinese maybe ??? Indians no chance .The refineries(owned by the state) are in a bad economic state due to the subsidy policy of the govt as they have to bear the major brunt . They have enough problems maintaining cash flow for day to day operations .Forget about new refineries . As to the private sector , the only big world player is Reliance but most of their operation is export based .Maybe rpt maybe they tweak their operation to process the crap stuff if Saudi or other make a buy back agreement .All other private refiners are minnows.

I was thinking of Reliance as "maybe India".

Alan

Not true. MRPL processes about 400kbopd, Reliance processes 1.2mbopd. If you take the total refining capacity in India it's about 12mbopd. So it's clear that Public Sector refineries dominate the picture. As far as subsidies go, they are going slowly. There is no subsidy on gasoline and for diesel subsidies are slowly coming down. I think you need to wait and watch this sector.

Sort of like a pre-emptive ELM effect...

Further increasing the Saudi trade surplus by pumping more only increases their problem with what to do with the excess petrodollars. There are few assets available to them which would appreciate faster than reserves in the ground. Depositing more petrodollars in accounts at Cyprus-like banks would be a bad idea.

Besides, as cost of extraction goes up, they need to get increased prices for current production in order to protect their profit margin per barrel. They can influence prices so long as Iraq, Iran, and Venezuela can't make up the difference when the Saudi's cut.

They started raising the price spread for del to the US back in Jul/12.

Sure enough, imports started declining.From 1.7m bl/da in Aug to 1.0m bl/da by Dec/12.

At the same time they lowered the spread for their far east customers.What didn't go to the US, went east.

The spread is a good indicator of how much oil they want you to buy!

In Jan/13 they brought forward the start-up date to late 2013 from 2017 for Manifia.

Despite lower prod, they said they were maintaining exports by del 200m bl/da from inventories.

From these last two statements,I'd say they are having prob in their fields.

They will prob increase prod(400-500?) this summer for their own power plants.

Good trading to everyone.

EM

If you are correct, I give them a great deal of credit for caring about the future just a little bit. More than I can say about this country.

Husbanding.

...or trying to avoid their Arab Spring; keep their heads and Rolls Royces as long as possible. The House of Saud is a one ring circus.

The top story "Life After Oil and Gas" is the standard media misleading trick. It quickly morphs from do we need fossil fuels to talking about the percentage of renewables in electricity supply in some select countries.

Some inconvenient facts are that the world had primary energy use of 143,000 Twh in 2008 from here...

http://en.wikipedia.org/wiki/World_energy_consumption

Fossil fuels provided over 81%. Nuclear, hydro and biomass most of the rest.

New renewables constitute ~3% of electricity production or about 607 Twh.

The growth rate of both wind and solar has fallen recently, due to the winding back of incentives from governments around the world.

Wiki is hopelessly out of date, yet the numbers seem to hold from those presented here..

http://yearbook.enerdata.net/electricity-domestic-consumption-data-by-re...

World primary energy use has been growing at ~2%pa since 1990. The renewables make up about 12.7% of the total, the same percentage as 1990. The largest component of renewables are biomass (mainly wood for heating) and hydro-electricity.

The current declining growth rate of new renewables in the context of high oil prices is precisely the wrong direction to make predictions of them "saving us".

Yes, they really should be given some big posters such as below to put on their office walls maybe :

http://www.iea.org/stats/pdf_graphs/29TPES.pdf

It's all a bit wooly. Talking about oil, gas, fossil fuels and electricity. Not so much oil used for electricity these days. I don't have exact figures but electricity is only about 25-30% of energy use, so if you had 30% of electricity produced by renewables, ceretis paribus, you would be reducing FF use by maybe 20% given a 50% conversion efficiency of FF to electricity, which may be on the high side, but close enough for this commentor.

So we have an article proclaiming we don't need FF, then with some back of the envelope calculations, quickly realise it's all just hot air.

As an aside, EROEI's being what they are, the production of renewables requires an upfront EI, which seems to require an increase in power generation, and in 20-30 years again ceretis paribus we would likely need to be burning more FF then we are now even if renewabls were 30% of the mix. Simply because of the required growth in energy production/consumption.

So yes we do need FF to have some kind of BAU, where a house is a constant temperature all year round, and homeowners clubs force residents to use electric clothes dries, another example of the madness on planet stupid.

Prof Sir John Beddington warns of floods, droughts and storms

I saw his interview on BBC this morning. Basically the presenter played down his warnings and made him look alarmist. When in fact Sir John was already presenting the facts in a low key and measured way. I think most people will miss the message completely which is a shame because what he was trying to rely really is alarming.

It's the shortened timescale that alarmed me a couple of weeks ago and the wide ranging effects it was going to have on us. Basically I think we'll be in deep trouble by 2020 if not before. What's happening in the UK right now is quite amazing (snow, blizzards, cold, flooding).

Sounds about right.

A farmer I saw on TV this evening who was pulling the few sheep remaining alive from a big drift said that his dad (77) could not remember a Spring event like this. Ruinous. He also mentioned while he got his breath that this time last year he was in shorts and the sheep were trying to get shade under the trees.