Is this the Economic stage of the Peak?

Posted by Heading Out on November 22, 2005 - 1:37am

Obviously Saudi Arabia was paying attention since, in an adjacent article Minister Ali Naimi is calling for a better roadmap for demand, since they do not want to invest in increasing production, at a time when it will not be needed.

Now the big question, of course, is how much depletion did the CGES build into their model ? And how much slippage?

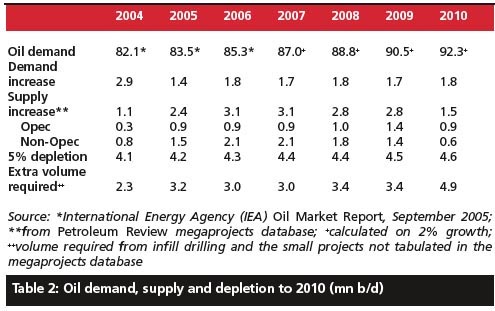

Since then at the ASPO-USA meeting he increased the OPEC production to 1.1 mbd and had the non-OPEC at 2.1 for a total of 3.2. But if one subtracts 5% depletion of 4.3 mbd the number comes out as minus 1.1 mbd and this is before we consider an increase in demand (the 1.1 mbd number that CGES projects).

In regard to supply there was an article in the OGJ that pointed out that even stripper well production is in decline in the US, even though the number increased.

IOGCC's annual study showed 397,362 marginal oil wells produced 311 million bbl in 2004, or an average of 2.14 b/d/well. During 2003, a total of 393,463 stripper wells produced 313.7 million bbl, or an average of 2.18 b/d/well.

It begins to look as though next year will be the one that starts to point out the seriousness of the depletion problem, even without the arrival of any more hurricanes. And since the balance may already be negative at today's prices, it may well be that at this time the amount that Saudi Arabia pumps will be related to price, and that this will integrate with demand destruction to bring us back into balance, but whether that is at more or less oil than is currently being produced will be the interesting story.

Oh, and a short P.S. Writing about logging yesterday, I had no clue that Schlumberger was going to announce a more effective logging package today.

We have quite high oil prices volatility and this makes the demand foreacasting very difficult. It is not very likely that we would now have an oil glut. There is also the natural gas problem. Oil may again become a rational alternative to gas there where gas prices are real high and no other fuels (coal) are not easily avalaible.

We could say that China has succeeded at least somewhat to curb oil consumption. But it is developing rapidly and this is more difficult than before. Even if China keeps the share of oil in its energy mix constant, a 10+ % economic growth means that the oil consumption rises. China has little domestic natural gas, so there are not many choices. The Chinese oil consumption has grown roughly at the same pace as GDP. Now, if Chinese domestic oil production (3.4 mbpd 2004) starts to decline this means increasing market demand and a decreasing supply.

More, the all important Chinese coal production growth seems to be slowing down somewhat from the present (10%) level. This would increase import demand, also for oil.

The article said that they plan to quadruple the size of their economy by 2020, while "only" doubling their use of coal. The article talked about solar and wind, but I have to think that oil is also a big part of their plans. No way can solar or wind provide that much energy.

China needs a lot more oil, that's for sure.

"Lu Jianhua, Director of Foreign Trade Department of the MOC, told the Asian Business Forum held recently, that it is unfair to blame China for rising international oil prices."

But really, China is feeling pinched. Check out the cited China Daily article.

I've asked a local (Argentina) financial analyst regarding current oil price and he says:

"The monetary policy of the USA is financing a level of expenditures higher than the current level of income. To sustain those expenditures it is necessary that a lot of the rest of the world's savings flows to USA.

This fact allows the current deficit, but is causing higher interest rates and/or US dollar devaluation every new cycle.

The deficit would require from USA higher savings, but such a thing would imply a greater effort, which is beyond the current administration because it doesn't have political support. That's way they're trying not to prevent American citizens from accessing credit.

The limit to all this is the level of risk that the States who hold currently depreciating USA bonds would able to accept.

As far as this deficit and the credit needed to sustain it continue to grow, the price of the commodities will rise above the level allowed in an balanced economic situation (i.e. no deficit).

Nowadays the vast majority of the prices (gold, grains, metals, oil, etc) are historically high. The only thing cheap is the US dollar."

What he is saying is that almost all commodities' prices are high, not only oil. So it's not enough to adjust by inflation, it is necessary to put all the other commodities in the equation.

What do you think?

Regards

Fernando

Since the U.S. enjoys the favor of being the World Reserve Currency, such deficits have been allowed to exist and grow. However, current U.S. spending is so large that the dollar is begining to become seriously devalued. Eventually countries will see that it is not in their best interest to use the dollar (Iraq, soon Iran). So far the Bush administration's answer has been to invade such a country. We shall see what happens as more countries decide to make the switch.

How long the world will continue financing this binge is another question. It is not really in Japan and China's best interest for their people to fabricate and send us their best stuff, but their governments don't have the political will to reform their economies, which would throw many of those currently making things for us into the street, so the situation will go - for a while.

For instance, here in Buenos Aires, I can have lunch at McDonalds, drink Pepsi, watch WB/Hallmark/HBO/ESPN/etc. on TV, pay with VISA, etc.

You can see the same thing in almost every nation on earth.

Where do all the royalties go? To the USA.

(1) The Bureau of Labor Statistics (BLS) which calculates the CPI, uses "hedonics." The purpose of hedonics is to to measure price changes of a CPI component at constant utility.

According to this methodology, for example, IT products are getting cheaper because the cost per floating point operation (FLOP) is decreasing. I would take issue with that approach though. For the longest time a solid desktop machine cost $2,000 or so, no matter what upgrades it included. Despite the increase in product quality, if you wanted a decent desktop, that is what you paid. OK, that is finally changing, but you get the point. Consumers (and the calculation of consumer welfare is what counts in a CONSUMER price index) had to pay the same amount for "a desktop computer that did solid basic calculations, word processing, and communications," but at that time, BLS used increasing product quality per dollar, to factor in price "deflation" in the computing sector. Price per flop is not the component that drives consumer expenditure; the price a consumer needs to pay for consumer goods is what we are interested in, or should be, when we calculate the CPI.

(2) The BLS calculations for owner-occupied housing prices are notoriously flawed. One would expect BLS to measure housing prices by monitoring home price transactions and deriving from them changes in the average price per square foot of residential space. (There is a separate component of the CPI for residential rentals; that is a different calculation.)

(3) According to a recent article in, I believe, Barron's Financial Weekly, the medical expense portion of the CPI does not count the employer-paid portion of health insurance. I would argue with this for two reasons. First, it would seem absurd to argue that health insurance in effect costs less because someone else pays for a portion of it. Second, we all pay for health insurance, either through our own outlays or from pass-through of employer-paid costs into consumer prices. We cannot say that because we are not laying out the funds directly, the cost of healthcare is less. Is the cost really going up as people lose insurance, or have to make higher co-payments? No, just more people are paying for it out-of-pocket.

I apologize for the length of this post but if you want to understand the CPI you must know that it is an index composed of subindices, each of which comprises a piece of the theoretical market basket of a representative consumer.

Now we can address the poster's main point. The US current account deficit does require that other countries finance it by purchasing US treasury securities (or buying US companies or hard assets, or something else priced in dollars). I'm not sure inflation is the big factor here. What matters to me is that we are exporting dollars in exchange for goods, and to the extent the quantity of US dollars exceeds the demand for things that are priced in dollars (at constant exchange rates) one would expect the dollar to be devalued (price of dollars in exchange of other currencies falls).

Now, if we denominate international trade of oil in dollars, oil producers will be loth to accept dollars (or at least hold them for any length of time) without some kind of compensation if they expect dollars to be devalued in the future. To the extent that the dollar is expected to fall, oil producers might try to raise prices, or get oil trade denominated in another currency, or at least a currency basket that is less heavily dollar weighted.

An increase in the price of gold shows that investors' preference for holding gold, which has a cost to hold in the vault, is increasing relative to their wishes to hold dollars, that pay interest. In my view that is a vote against the dollar. I would remind you, however, that the dollar is at the moment strengthening against other currencies. So maybe what investors are saying is that for the moment they would rather hold increasing amounts of gold, rather than the paper currencies of most countries.

Thanks for a very lucid critique of CPI and our account balance. A few additional questions you might like to comment on.

I am old fashioned and still believe that wealth is created by adding value to "things" through addition of work or energy. My examples are extraction of ores (and energy) from the ground, geometrically increasing seeds or food using the sun (farming), making complex items (clothing, toys, tools, machines, buildings, etc.) out of simple starting material (manufacturing).

These actions all convert simple items into more and/or more complex items using ingenuity and often energy of some type. The U.S. used to do this and sell more items (in aggregate) to other countries than it used internally. Currently we import most of these items. Especially oil energy. Our economy appears to me to be based more on transactions of money than creating wealth as I define above. In simplistic terms, we are a nation of middle men handling goods and taking a cut.

At the same time we have had this trend away from making things we are told that a lot of "wealth" has been created in the process. Obviously many people have personally benefited in dollars terms. My questions are; has the economy actually grown in terms of real wealth during this period? Are all the transactions that are occuring providing for the maintenance and building of our societal infrastructure the way it did 50 years ago? Or is there not enough money after all the accounting is done to put to those needs? Are we really creating wealth through the new just in time, off shore economy? What is the difference between wealth and a large bank account?

Any thoughts or comments appreciated as I go back and forth on these concepts in my own head.

It would seem intuitive that people would demand a reserve currency to make things simple, over and above obvious needs for one, and so proved late Yale economist James Triffin ("Triffin's paradox"). It is also true that since we can buy what we want, there is a temptation for reckless leadership to print more dollars without regard to fiscal soundness, or to keeping the dollar scarce enough for it to be desirable. Bush is now doing that.

I don't know what we should or shouldn't be producing, but I agree, a healthy manufacturing economy keeps well paid jobs and high skills here. Keeping many of the companies headquartered here keeps high level design and leadership skills here. I note Japan is no longer a low cost economy but they still have a vibrant auto industry, for example, even though they now outsource some of the manufacturing work. They are just more reluctant than we and they do consider the effect on the health of Japan when they do so. We are cavalierly letting go the production and productivity built up over centuries, as long as it appears that a free market is operating, and that American shareholders benefit. The rest of the world would seem to be agape as we do nothing to stop it from slipping through our fingers.

Does manufacturing matter?

Fernando

Thanks for replies and insights.

So it seems we need something tradeable other than dollars. In an ideal world dollars (or any hard sound currency) would substitute for goods or services exchanged. Trade deficits, national debt and inflation are the signs that we are trying to print our way to prosperity.

I think that you are exactly right. By picking and choosing which commodities are included in calculating inflation, the US maintains an artificially low inflation rate. This helps them with both international contracts (which are adjusted based on the US rate of inflation) and it also helps them with expenses (most US government salaries and entitlement programs are adjusted based on the published US inflation rate). So it is in the best interest of the US government to remove any rising prices from their inflation index.

This is the reason that no airlines are included in our Transportation Index - it would raise the index tremendously.

The method you propose is one that makes sense, and is fair. It also would force the US to acknowledge that we are having a very massive problem with inflation. That would mean that inflation adjustments would kick in and raise salaries for governement officials and increase payments for Medicare, Social Security and all other government programs. The price of oil (which is adjusted for inflation based on US numbers) would also rise.

We would see increases in expenses that would cripple the government, and since the only way they can get more money these days is to print more, then inflation would jump again. This is also the reason that the government (via the Federal Reserve) stopped reporting on the M3 money supply. They do not want anyone to know how many US dollars are floating in the world right now, and especially in the near future.

I think an argument could be made that we are seeing money entering the precious metals markets worldwide. Gold is approaching $500 and silver is up 20% from last year end, while bond sales are low or flat, even the new US 30 year option. The world stock markets are basically following the US, with most of them flat or with low single digit gains over the year. Real estate markets are in retreat everywhere but in the US, where they are flattening out.

So, it looks to me as if the only thing rising is gold and silver, which would imply money buying in at a fairly broad level...

"For longer than we had reason to expect, this country has been relatively immune to the violent swings in supply and demand of a finite commodity. I think most of us suspected we were living on borrowed time; and in fact, the volatility of the past year confirmed that."

http://www.greencarcongress.com/2005/11/ford_outlines_s.html#more

In another part of his speech, he's looking for R&D subsidies for auto companies. Does he believe, or is he justifying a bailout?

I think he is laying the groundwork for eventual bailout, specifically pension fund obligations, which are the first thing that gets abrogated when big companies hit troubled waters...

A final question, what will be a graph of oil prices for the last few years (at least since the euro was launched) if we choose euros instead of US dollars??

Regards

Fernando