Whither Oil Prices?

Posted by Dave Cohen on September 18, 2006 - 1:09am

Since early August, oil prices have fallen considerably. From the EIA's latest This Week in Petroleum.

Oil Prices Continue to DropLet's examine the EIA's timely question. Combined with the Jack-2 Test Well, the dropping prices have served as fodder for those debunking peak oil claims.In the last 5 weeks, since August 7, oil prices, both for crude oil and petroleum products, have dropped substantially. The price of West Texas Intermediate (WTI) crude oil has fallen from $77 per barrel to below $64 per barrel. Retail gasoline prices have dropped 42 cents per gallon to $2.62 as of September 11, while retail diesel fuel prices, at $2.86 per gallon, are now about 20 cents per gallon lower than they were 5 weeks ago. Will the declines continue, or will they begin to level off and possibly increase later this year?

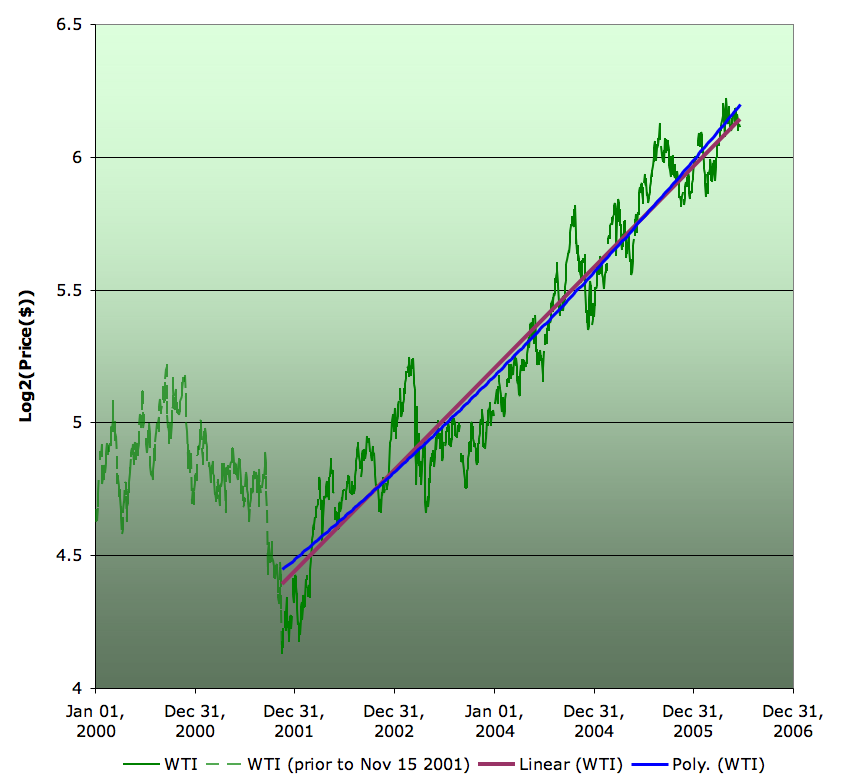

Log (base 2) of West Texas Intermediate spot price in nominal US dollars Jan 2000-Jun 20th, 2006, together with linear and quadratic fits to the data from Nov 15th, 2001 onwards (the low before the recent price run-up). On this scale, 4 is $16, 5 is $32, and 6 is $64. Graph is not zero-scaled.

Figure 1 -- Click to Enlarge

I have taken the start of the price rise as November 15th 2001 which is when prices bottomed out after the tech crash and the events of 9/11. To that price rise I fit both a linear trend, and a quadratic. To the extent the price was curving up in a bubblicious manner, we would expect the quadratic to depart markedly from the straight line. It elects not to do so - the two are very close. Thus we see that although there is considerable volatility in the price (and the pattern of that is worth further analysis in the future) the price rise is very much exponential in nature. So I take this as further evidence that we do not have a self-reinforcing bubble.It is natural to ask whether we are witnessing the bursting of an oil price bubble. Was Stuart wrong?At least not yet.

[editor's note, by Dave Cohen] I should add that if Stuart was wrong, so was I.

On the other hand, prices have been subject to "considerable volatility" in recent years so the current bearish oil market may simply be an exaggerated extension of that trend. James Hamilton of Econbrowser has an interesting analysis of what's happening now. Here's his take on things in Gasoline prices will fall even more published on September 13th.

So what is going on? I've argued that speculation in oil has in part been driven by the asymmetric payoff structure in a tight market. With limited excess capacity, any supply disruption had the potential to produce quite a spike up in prices, and that possibility may have been regarded as sufficient compensation to speculators for the risk of a price decline that would be expected to occur if none of those events took place. But we're now operating on the flip side of that same calculation-- hurricanes have so far failed to disrupt this season's production of oil from the Gulf of Mexico and the conflict with Iran seems to be playing out as an awkward standoff. The absence of bad news means prices had to drop.Indeed, the optimists are out in force because of the "absence of bad news".Furthermore, there is some evidence that petroleum demand is finally starting to be tamed, which is of course one way to create more excess production capacity in the world oil market. My concern here is that the incipient economic slowdown may be the most important factor responsible for declining petroleum demand. And to the extent that's the story, the oil price declines are not exclusively a harbinger of good economic news.

"Prices have just begun to drop," said Michael C. Lynch, of Amherst, an oil-industry analyst who heads Strategic Energy & Economic Research Inc. with clients ranging from the U.S. Department of Energy to Aramco, Saudi Arabia's national oil company.Hamilton's remarks bring together many of the factors said to be affecting current prices.Growing supplies of oil and oil products, coupled with weak demand, which is the response to the past year's high prices, have been reducing the price of crude oil, he said. From its current price of about $67 a barrel, Lynch said he thinks "it will stabilize in the low 40s within the next year."

- easing global demand—see Oil Trades Near Five-Month Low After IEA Lowers Demand Forecast

- perceived lower risk premiums—see Oil rebounds after six-day slide, Iran risk ebbs

- weak hurricane activity—see Oil Price Increases in New York, Remains Near Six-Month Low

No doubt analysts like Lynch would argue that we are arriving at the end of a speculative bubble. Hamilton's view sees continued volatility based on "the asymmetric payoff structure in a tight market." As he points out, there has been no new supply easing spare capacity concerns, a point reinforced by continuing bad news out of Iraq and Nigeria. Instead, decreased demand is "one way to create more excess production capacity in the world oil market."

Three other considerations must be added to these analyses. First, OPEC decided not to cut production quotas at their recent meeting. Second, inventories have been higher than normal this year although there was an unexpected drop in crude stocks just last week. Last but not least, oil prices are undergoing a seasonal adjustment—though the change seems to have arrived a bit early this year.

Figure 2 -- Click to Enlarge

Prices have fallen from their risk-induced high of $78/barrel (Israeli/Hezbollah war) to just above $63/barrel as of this writing. A quick glimpse at Figure 2 reveals that after the risk-induced high (hurricanes) of $70/barrel in 2005, prices subsequently fell to about $57/barrel. In 2004, prices reached $55/barrel in late summer before falling to about $42/barrel in October. However, the current drop of about $15/barrel exceeds both prior years by $2/barrel—and October isn't here yet.

Getting back to the original question, it is apparent that the answer is not straightforward; predicting future oil prices never is! In the shorter term, prices could easily fall precipitously down to the $50s or even the $40s before the late year seasonal rise kicks in. There seems little reason to expect the great volatility of past years to end any time soon. While things are quiet now on the risk premium front, underlying conditions defining the uncertain geopolitical situation have not changed. However, if global demand continues to ease, prices may not bounce back to expected levels in the high $60s or $70s.

The optimistic Michael Lynch sees prices stabilizing in the low $40s within the next year. That's not even the lowball estimate. In Business Week's story Oil: A Bubble, Not a Spike?, analyst Tim Evans believes "the crude rally isn't justified by fundamentals and expects prices to 'fall hard' soon to $26 to $30 a barrel", thus reflecting the bubble view of reality.

Evans, a senior analyst at IFR Energy Services, a division of Thomson Financial, thinks that the current run-up in oil prices is much like the Internet bubble of the late '90s. While other analysts are calling for crude to hit upward of $100 per barrel in the next few years, he believes the bubble will burst in the next several months, bringing prices back down into the upper-$20s range.[Recently, Evans said], we saw the highest level of commercial crude oil inventory in the U.S. since June, 2002. Then, we were trading in the range of $26 to $30 per barrel. The current physical fundamentals, not even projecting to a greater surplus down the road, are consistent with a $26 to $30 price.

But were this to happen, is it good news? Since there is no supply-side relief, stable prices (which would be an anomaly given recent trends) in the low $40s or below that would necessarily reflect steep declines in demand—perhaps even recession in some OECD nations. Otherwise, market supply & demand fundamentals do not appear to support such a pricing prediction. Furthermore, OPEC regards $60/barrel as a new baseline. From Oil Gains on Foiled U.S. Embassy Attack, OPEC Price Vigilance:

Members of the Organization of Petroleum Exporting Countries, which pumps 40 percent of the world's oil, decided yesterday to keep production quotas unchanged. The group wants prices to stay above $60 a barrel, Iranian Oil Minister Kazem Vaziri-Hamaneh told reporters today in Vienna, speaking through a translator,OPEC will probably implement production cuts if prices fall much below $60/barrel in an already tight market. Earlier this year, Venezuela was calling for such cuts.``The price we favor is not below $60'' a barrel, for OPEC's basket oil price, Vaziri-Hamaneh said. ``Supply is more than demand and stocks are at a very high level, and because of these two factors, prices are very fragile.''

Oil pared early gains today as the International Energy Agency cut global oil demand estimates for 2006 and 2007, spurred by a slowdown in the U.S., the world's largest energy consumer.

Finally, should oil prices fall precipitously from recent levels, the effect on new investment to increase global production could be disastrous. Marginal per barrel costs for new E&P is increasing into the $25 to mid $30s range. Prices in the low $40s leave little room for desired large returns on investment. Low prices discourage exploitation of the higher risk, high cost projects that now dominate the oil production scene. The position of analysts like Lynch seems to carry with it an inherent contradiction: low prices and increasing supply. In addition, high price volatility also discourages investment. No one on the upstream supply side wants to see great fluctuations in price.

Whither oil prices? There is still no convincing evidence that oil prices have been bubbly over the last few years but there is no fully convincing explanation for the steepness of the current price decline either—lack of bad news doesn't seem to be the whole story. The short-term group psychology of the current market must be playing some role. Here's an interesting story for all to read as we conclude this essay—Oil and XOI Corrections, written September 15th.

Fundamentals take years to change at best. It is inconceivable that the world oil market changed fundamentally since the latest 17% slump in oil started a little over a month ago. If fundamentals cannot change that fast then they still remain very bullish. So the recent correction based on speculators getting worried about a geopolitical/hurricane lull is a psychology-driven technical event. And such countertrend moves rarely last for long since sentiment changes so rapidly.This view is not inconsistent with Hamilton's but merely adds another dimension to it.

The future oil price can not be known but all of the considerations discussed here will play some role going forward.

However, the numerator of the price ratio, the mythical US dollar, has an entirely different nature than a barrel of oil. US dollars are an imaginary invention that largely exist as data bits on computers. Banks have mechanisms for creating dollars at will with essentially infinite $RO$I. JP Morgan just reported a growth of $5.5 trillion in their derivatives in the last quarter. This represents roughly half the GDP of the whole US. The exact value of the derivatives market is unknown, but certainly exceeds hundreds of trillions of dollars. Of note, these electronic dollars can be destroyed as fast as they were created. Likewise last year the Economist reported the OECD homeowners had accrued $30 trillion in home equity gains during the current housing bubble. This is equal to the aggregate GDP of all the OECD nations. This virtual money is also subject to vanishing into thin air.

So looking to predict a future oil price ratio, one must divide an imaginary and highly volatile dollar unit by a physical entity. Good luck with that. However, I agree with the Austrians that central banks exist to inflate the money supply, and they do that more often than not.

"Dollars" are just a noise that we humans make and that Mother Nature pays no heed to. We can crunch the dollar numbers to any unbounded value we choose. It is not absurd to talk about a googleplex of dollars as reported within the depths of some bank's computer whereas one could not rationally do the same thing for barrels of sweet crude. The physical world is bounded. Human hubris is not.

If printing more money really works, then let's just do this: we'll design a nice, new $1 billion bill. Then we'll print up 6.5 billion of them and give one to every person on the planet. Then everyone will be rich!!

It is meaningless to say that money is fictional. Are numbers not real?

It would be more accurate to say that that money and energy represent different dimensions, one physical (the world of things, processes and 3 dimensional space), one mental (the world where things and 3d space is represented). These distinct dimensions are not seperate - but they intersect in known and mysterious ways.

But then again, humans lie. :-)

It's from the Forbes article on Michael Lynch:

http://www.forbes.com/home/forbes/2006/1002/098.html

Peak oil is about production capacity, and production capacity is extremely insensitive to short term pricing. The Gulf of Mexico Lower Tertiary Play will not start producing oil before 2009 if oil is $35/bbl or $135/bbl. The same is true for almost all of the projects on Chris Skrebowski's Mega-projects list. Most of those projects were justified on oil forecasts considerably less than $40/bbl and they will go forward in all cases, absent a worldwide economic contraction.

To be honest, most of the major oil companies would be happy for oil to move back to $50/bbl (or even $40/bbl) and stay there. Such a scenario takes them out of the political spotlight, it puts downward pressure on the cost of services and supplies, and it takes power and money out of the holders of the resources (governments of nation states) and puts it back in the hands of those who have the capability to extract the resource.

Sometimes it seems that we are watching the daily fluctuations of temperature in NYC and trying to make statements about global warming.

http://www.forbes.com/business/feeds/afx/2006/09/15/afx3019146.html

BEIJING (XFN-ASIA) - China imported 95.8 mln tons of crude oil in the first eight months, up 15.3 pct year-on-year, with 11.82 mln tons in August alone, the General Administration of Customs said in a statement.

The imports of oil products rose 25.7 pct year-on-year to 25.75 mln tons from January to August, with 3.78 mln tons in August.

I have worked on Wall Street for nearly 20 years. A former boss once said:

"a - fill in the blank with stock, bond, commodity - will keep going up till it stops going up, and it will keep going down until it stops going down". And "they always go up farther than you thought possible, and down farther than you thought possible". If do not trade for a living, this statements might seem simplistically obvious. When you have a great deal of money on the line... they can eat a hole in your stomach.

At the moment the short term trend is down, even though we had a couple of days of pause. As a trader, I would not reach for the falling knife, so i must believe that prices are headed lower. Prognosticating a price point of the bottom? Ha! These are always made by economists who do not a penny of their own money in the game.

All these people who put their life saving into speculative houses over the last couple of years. Reading the headlines today must be a nightmare for them.

"massive imports"? I reviewed the import data (for the U.S.) at the EIA website and the "massive imports" are actually down, year oover year for the first 6 months of 2006 from 2005. If I am missing something please let me know. Any help would be appreciated

My feeling is that oil prices are down on a combination of expectations of lower demand (partially because of lower economic growth expectations) and reduction in the role of financial intermediaries/risk premium. Could all change soon, who knows.

Of course world Oil prices should not be down because of US imorts, unless of course, the tanker inventory world wide can't find a home... but that is the line coming from a number of Oil market analysts and advisors... US inventories have only 3 components (when you lump crude, distillate, and gasoline together) domestic production, imports, and consumption. Production is down, imorts are down, consumption is... down? Must be if inventories are up year over year

It is my contention that in the same way, the other primary trading banks (Goldman Sachs, etc),are holding similarly massive derivative positions in the gold and oil markets on behalf of the Federal Reserve System, and can move the daily price at will by buying / selling these instruments. The idea that the oil markets are too big to be controlled in this way does not hold if you look at the size of these derivative positions (Trillions!!).

Remember that these markets are decoupled from the physical commodities, since for the most part the traders dont actually take possession of the physical - they just take their profit and move on to the next trade. There is a lot more oil trading in derivatives than there is actual oil existing in the world. The same with gold. Once the paper trades outweigh the physical trades 10 to 1, the price decouples from the actual physical demand / supply, and voila.

Also agree that the markets are decoupled from reality (there is a case for saying that many derivative markets are decoupled from fiction, too).

I have a complaint about $ bills: they are too small and not sufficiently absorbent for the role they are being prepared for: toilet paper.

(Don't tell me you don't know how to use the shells?...)

- stop reporting M3

- declare that companies working in partnership with the government can keep secret books

- put a Goldman Sachs guy in charge of the treasury

- stop reporting committment of traders

VOILA! The US government can print money and give it to their strategic trading partners to be used in manipulating the market. NOW PERFECTLY LEGAL! If the traders lose several billion, no problem, just print more money. Market manipulation for political purposes is the goal, not trading profits. It works until a foreign power declares the practice to be bullshit. Then the US dollar becomes nonconvertible, like the Zimbabwe dollar.Serioiusly, I have wondered and after reading your post, I am really wondering now.

"3 put a Goldman Sachs guy in charge of the treasury

"

Correction;

3 put a Goldman Sachs guy in charge of the treasury AGAIN.

Put another way, a futures contract obligates the holder to buy or sell the commodity at that price at a particular future time. Big financial interests may be able to temporarily shift the futures price away from what the spot price will be, but that just puts them on the hook to pay the difference when the contract closes.

This means that any such manipulation is basically an offer to give money away. If you're convinced that futures prices are artificially being held down, here's your chance to get rich. You can invest a few thousand in an options contract and make many times your investment. Reinvest your winnings and in a few years, you can be sitting on millions.

Basically what you're saying, when you adopt this conspiracy theory, is that these companies are willing to give away their wealth to anyone who sees the truth of what they are doing. If whatever secret, hidden information gets out that clued you into the true situation, then everybody would want a cut of this money fountain. So this kind of manipulation can only work as long as most people are not aware that it is happening. It must be well hidden and well disguised. But then, how did you find out about it?

Just the awareness that virtually unlimited pockets could be used to 'protect' certain markets from too sudden moves in the 'wrong' direction skews the ways traders bet on markets. That's the beauty of the PPT (plunge protection team) 99% of the time just the knowledge of its very existence is all that is needed, only very rarely is real intervention required.

You could posit that funds that see it in their best interests to push oil prices higher most of the time (because that raises the value of the much-larger positions they hold in oil company shares, by increasing the value of those companies' oil reserves), could choose to push prices lower right before the November elections, hoping it will help out the Republicans. Republicans tend to be more eager to pass the sort of corporate welfare that can make fund managers rich beyond the dreams of avarice.

This theory can't be proven of course, unless one of the big funds goes bankrupt and we suddenly get access to their emails, as happened with Enron so it can only remain a theory. It may be paranoid, but it's not tin-foil hat territory, not when you have a long history including ...

- During Calfornia's energy crisis, allegations that Enron was gaming the market were scoffed at. Those charges, as we all well know, later turned out to be true. The Federal Energy Commission went on to hire Enron's lawyer, a woman who scribbled this note to her client: "Answer questions, say nothing. Answer questions, finger others." Enron invested a few million in George W. Bush and reaped billions in return. Nice business!

- Senator Ted Stevens, the Republican head of the Senate Energy and Commerce Committee refused to require energy company CEOs to testify under oath last year -- thus freeing them up to lie. Why did they want to lie about Dick Cheney's Energy task force, do you think?

- The Department of Energy asking the National Petroleum Council to investigate Peak Oil claims, and NPC is headed up by former ExxonMobil CEO "Don't Rock the Boat" Lee Raymond to run the investigation. You know -- that same Exxon that says Peak Oil is not a problem. And yes, Lee Raymond was one of the oil CEOs who lied to the Senate.

I could go on, but there's only so much time. All this doesn't mean there aren't real economic reasons for oil prices to go up and down -- but there could be other forces at work as well. I don't know that the oil markets are being manipulated ... I just suspect it.http://en.wikipedia.org/wiki/Plunge_Protection_Team

I think this 41 page PDF from Sprott Asset Management answers that question:

http://sprott.com/pdf/pressrelease/TheVisibleHand.pdf

"Given the available information, we do not believe there can be any doubt that the U.S. government has intervened to support the stock market. Too much credible information

exists to deny this. ... These markets have been interfered with on numerous occasions."

Generally it's much easier to influence a market by massaging information, so as to influence others to take a position. And even then it has to be done infrequently. Like in poker. If you always bluff then people learn to expect it.

This shows that they are both reacting to the same publicly available information. And in reality the Fed often does exactly what the market expects it to do, either because it agrees with the market, or because it isn't willing to risk defying the market.

However, the system is not without some usefulness in the here and now. The price of oil, or any widely traded, highly visible commodity or financial instrument, is in part a reflection of the average emotion and broad understanding among a world of players. Clearly some players have more input (bigger pockets) than others, in this group-think we call market pricing, for all that, the price is a useful reflection of what the world thinks.

Speaking about the price of oil, the intraday chart on Friday is a possible reversal day; doesn't mean oil is headed right back up, but it may try to stage an attempt at a rally. Whether that holds and a series of higher highs and higher lows is established (a change in trend from down to up) is for the future to determine.

It is true that derivitive securities whip the underlying commodity in one of the few true cases of the tail wagging the dog... but this is not down in concert. Goldman is at war with Morgan, who is under attack from Bear Stearns, etc ... for every buyer of ANY security, there is a seller... only one of them gets to be right. There is no altruism in ths industry... no self respecting Wall streeter would take a bullet for another!

http://msnbc.msn.com/id/14823087/

Isn't there some quantum currency theory in which virtual dollars and virtual antidollars are continuously created and destroyed at a furious pace as part of the fabric of the economic universe?

The risk that we face going forward is that which is stated and implied in the article: as prices plummet, and they may go very low if and when current projects come online, the incentive to increase investment in infrastructure and research and development of new fields will fall off significantly.

Major projects like the new Gulf of Mexico exploration will immediately become unprofitable, along with many of the tar sands programs. This doesn't even touch on the need for basic infrastructure improvements that will go unfinished.

Herein is the big rub: if prices begin to fall significantly below $55 - $60 per barrel, we're going to continue to sell ourselves short in the long-run. The 'spike' we've seen this past year will rear its ugly head sometime in the near future and most likely be far worse (assuming investment slows and/or stops).

If current exploration projects are put on hold or cancelled - what does this mean as the 'slack' in the system evaporates and the infrastructure continues to deteriorate?

or whale bone:

You're great

The government, who at high levels are aware that oil is finite, should put a floor on fossil fuel prices, to mitigate the volatility ahead - look at the price graphs that Khebab posted - at any point in time during those roller coasters, could someone from either camp (the whale bone doomers and cornucopians) argued that they were right?

Europe has been on a path toward a better, sustainable energy mix for many years now. The U.S. has just guzzled oil. I don't know what will happen to the world economy as oil becomes more pricey, but the U.S. is going to be in big trouble for certain. (I'm disregarding the assertion of doomers that everything is going to completely collapse)

In the Goldbug world he is a guru. Look him up in google and you will see most references are within a small circle of gold bug outfits, such as Financial Sense.

I'm not saying this is good or bad. Just letting you know.

Someone should write a story on Gold Bugs and Peak Oil. It would be fun and informative.

http://www.puplava.com/aboutus/managementteam/contentCollection/02/managerImage/Puplava_Mary.jpg

Jim Puplava has been well ahead of most financial folks in his awareness of peak oil and regularly has long interviews with the likes of Matt Simmons (who's due back for another in a couple of weeks), Richard Heinberg, Matt Savinar. It's a very good site for some interesting perspectives and analysis of peak oil and related issues. I'd say that oil and energy gets probably 5x as much coverage as gold in their broadcasts. Well worth listening IMO. For those who don't know the place: http://www.financialsense.com/index.html

I agree that Goldbugs and doomers were first to point out peak oil, but am not sure how mucg credit to give for it. I'd say about half points because much was luck. A broken clock is right twice a day. A doomer is likely to spot problems ahead of an optimist.

Gold bugs and sellers of gold are always saying the world is coming to an end, so that people will but their safe haven (www.safehaven.com). If we survive peak oil, it is safe to guess that the gold bugs may be the first to spot the next potential crisis. However they may also spot and promote 3-4 other non-crisises first.

You can say that I mean he is not an "insider". I can say I am merely holding him to the standard of other who have public, transparent record of their investment results.

If you'd like to listen to their previous interview etc mp3s you'll find the 2006 ones and links to prior years, here:

http://www.financialsense.com/asktheexpert/2006.html

There's lots of oil and energy related interviews (virtually all the well known gloomier ones and the occasional near cornucopian too!) from mid 2003 onwards.

Simply put, if there were no physical limits to growth, the gold bugs' cause would be harmful to prosperity.

Hardcore goldbugs (www.gata.org) denounce that the financial establishment have been carrying on a covert manipulation of the price of gold for some time. Sure they have! And it had the same objective as the 1933 gold confiscation and the London Gold Pool of the 60's: keeping the public away from using precious metals as monetary stores of value, so as to ensure the effectiveness of central banks' monetary policies to stimulate aggregate demand (consumption plus investment) and thus "foster maximum sustainable growth in output and employment" Bernanke, February 07, 2006, as quoted in.

Basically, during the upward way to Hubbert's Peak recessions (including the Depression) were caused by lack of demand (the exception being the 70's after the oil shocks, which can be viewed as a drill of Hubbert's Peak) for which the fast cure was printing money. As Krugman more or less says in "The return of depression economics": "Recessions are caused by people chasing too little scrip. The solution is to print more scrip." It follows that, if people are chasing a currency that cannot be printed, there is no solution. (Actually there is no fast solution. Even without any stimulus the US would have gotten out of the Great Depression in the long run. The problem was that for FDR any run longer than 4 years was just too long.)

To explain in a more technical way why it is necessary to keep the public away from precious metals in order to ensure the effectiveness of monetary policy to stimulate demand, we have to touch the concept of "dollarization": the substitution of a country's currency by that of another country (usually the US dollar, more recently also the Euro) for one or more of the functions of money (first for store of value, then also for medium of exchange). Basically, as a Latin American (or Balkan, or FSU) government started to irresponsibly print pesos (or whatever), the public started to shift their savings to dollars (or Marks, in the case of Croatia e.g.), kept mostly outside the financial system ("under the mattress"). Then they started using dollars for big transactions (like buying houses or cars). That process advanced to different degrees in different countries, and exhibits hysteresis. With a high degree of dollarization, monetary policy loses all effectiveness in stimulating demand: additional injected liquidity just serves to raise the exchange rate. In other words, any excess peso people have in their pocket is used to buy dollars (or euros). In a very dollarized economy, Fisher's Velocity of circulation depends not only on the interest rate, but also, and mainly, on the expected devaluation, the degree of dollarization of the economy, and the elasticity of substitution between currencies. It can become a very volatile variable.

Now, the key concept is: precious metals are to the dollar (and euro, etc.) what the dollar (and euro, etc.) is to the peso. If OECD citizens started shifting their savings to gold, the Central Banks would no longer be able to stimulate demand by monetary policy. So "metallization" (coining that word for the shifting of savings to metal-denominated assets, metallization being to OECD fiat currencies what dollarization is to pesos) was unacceptable, because it meant monetary policy would be useless to fight recessions, which up to now were always caused by lack of demand. So, if governments and central bankers did not try to keep the public away from gold, they were not Keynesians (loosely defining Keynesian policies as those actively seeking to achieve economic growth rates close to sustainable potential, particularly - and at the very least - trying to minimize the depth and length of recessions). And, after the miserable failure of the London Gold Pool, if they did not do it in a covert way, they were incompetent. So GATA has been right all the way in that there was a manipulation, and anyone with a basic understanding of monetary theory could have deduced there must have been one.

Therefore, if there were no Hubbert's Peak (or more generally no physical "limits to growth"), the need to keep the public away from precious metals as monetary stores of value would persist for ever, and gold bugs could fairly be regarded as the foremost enemies of prosperity.

But after PO the "limits to growth" (actually the "enforcement of negative growth rates") in economic output will not be the consequence of insufficient demand but of a relentless physical constraint from Nature, namely the decline in the production rate of fossil fuels. Stimulating aggregate demand with monetary policy will not be able to increase output at all, as no monetary stimulus can reverse the decline of an oil field, and no monetary stimulus will be necessary to increase exploration efforts since the price of fossil fuels will be high enough to do the job by itself. Therefore, there will be no harm to the system in allowing the investing public to escape from fiat currencies and park their savings in gold or silver, since there will be no benefit to the system in stimulating their consumption of goods (and there could possibly be some harm in that: when a pub is running short of beer, they wouldn't turn on the heater to make people more thirsty).

An excerpt of the aborted essay:

Incompatibility between a PM-based monetary system and the (unsustainable) growth potential of the XX century.

Taking from DeLong (1998) the figures for world GDP in constant dollars for a select set of years (in index numbers relative to 1500 A.D.), and from Butler, M. (2000) the cumulative gold and silver production figures (explained in detail for silver in Butler, M. (1999)) up to those same years (in billions of ounces, with those for silver divided by 15 to normalize its value to gold), we have:

Date World Cumul. Cumul. Cum.Ag Cumul. Cum.PM IAAIR

GDP Au Ag /15 PM /GDP %

1500 100 0.30 4.1 0.27 0.57 5.70

1800 299 0.45 7.4 0.49 0.94 3.14 -0.2

1900 943 0.81 13.2 0.88 1.69 1.79 -0.56

1950 2472 1.99 23.2 1.55 3.54 1.43 -0.45

1975 7720 2.97 30 * 2 * 4.97* 0.64* -3.16

2000 17590 4.34 40.9* 2.73* 7.07* 0.4 * -1.86

The cumulative figures above refer to mined amounts. To assess the amount of metal that could be effectively available for monetary use one should substract the fraction lost or used in dissipative industrial uses. For gold, that fraction is fairly constant and around 10%. For silver, that fraction became greater and greater after ever-increasing industrial uses started to be found for the white metal around 1942, the year when the supply/demand deficit started, as documented in Zurbuchen (2006). Consequently, the effectively available amounts for silver and overall PM for 1975 and 2000 were much lower than those in the table (marked with ""), as was the effective PM/GDP ratio.

It should also be noted that the GDP figures above are not adjusted to take into account the "new kinds of goods" after 1800, and thus, in the view of some authors (including DeLong) could grossly understate the rate of economic growth over the past two centuries.

Having thus made clear that the case depicted by the above table is extremely conservative, we can now calculate the Implied Average Anual Inflation Rate (IAAIR) for the periods considered, assumming a PM-based monetary system without fractional reserve banking (i.e. with M1 = M0 = total amount of monetary gold and silver). The method is:

IAAIR(1950-1975) = [(0.64 / 1.43) *

(1/25)] - 1 = -0,0316 = -3.16%If only gold had been used as monetary metal, the case would have been:

IAAIR(1950-1975) = [(0.385 / 0.805) ** (1/25)] - 1 = -0,0291 = -2.91%

It is clear that an average annual deflation rate of 3% would have been incompatible with the unprecedented economic growth rates the world (particularly the OECD countries) experienced between 1950 and 1973. And trying to alleviate the monetary constraint resorting to fractional reserve banking to expand M1 versus M0 would have led to an extremely unstable financial and economic system, as explained in section I.I. Consequently, the only way that mankind was able to achieve such unheard-of economic growth rates was by implementing a fiat monetary system. (What was required was a fiat monetary system, not necessarily one using fractional reserve banking.)

As a final purely speculative question: was that good in the end? In other words, wouldn't have been better for the world to have kept the gold standard and experienced much lower economic growth rates? Perhaps an answer to this question is implied in the words of Matthew Simmons in an interview with Jim Puplava at

http://www.financialsense.com/transcriptions/Simmons.html

"we've effectively built a world economy on the illusion that Middle East oil would last forever at inexpensive cost."

From wikipedia:

Those plastic buggy whips are just not the same though.

http://crudethoughts.blogspot.com/2006/06/commodity-bubble.html

Mark Folsom

One example is inventory build. As oil price rises, users quite naturally hedge their future needs by building inventory, the thesis. Eventually the market notices the inventory build and sells oil in response - the antithesis. Eventually, however, after a number of cycles of this movement the market begins to understand that higher inventory levels are an integral part of rising oil prices and that selling against an inventory build is a losing proposition, since the price continually recovers. Thus the market begins to accept the fact that inventory builds are consistent with tighting supplies and rising prices.

Of course this synthesis may become a thesis which spawns its own antithesis: namely an increase in speculative inventory builds (as contrasted with strategic inventory builds such as the US SPR) as speculators become convinced that inventory buildups do not cause price declines. After some period of speculative build, a synthisis occurs: that the market re-learns the need to correct the price in the face of speculative builds.

The inventory issues are in the early stage of working themselves out I believe.

Another dialectic relates to hoarding by exporting countries. The old thesis was that prices alway revert to the mean, so there is no reason not to sell as much oil as you can produce to convert it to investible cash ASAP. The antithesis, which has begun to evolve, is that oil will generally become pricier with time, so it is optimal to withhold production and reduce exports to maximize cash flow by selling oil later at higher prices. The synthesis is that rapid increases in oil prices yield economic recessions, substantial efforts by oil importers to develop alternative energy sources and new conservation technologies - all of which reduce oil demand sufficiently to lower prices. Recognition of this should moderate the hoarding behavior of exporters.

These new dialectics - and others - are all spawned by the background understanding of Peak Oil phenomenon, whether the peak has occured or not at this time. They are part of the reasons for surges and pullbacks in oil prices around a rising trend line.

Anyway, that's how I see it.

It's almost a given that as soon as a Newspaper reports a stock or commodity as doing well it's time to short it.

I agree that higher inventory holdings are a logical response to higher prices and volatility, and to potential supply disruptions. And that the markets are in the early stages of adjusting to accommodate that recognition. I wonder when China will be buying to fill its new SPR facilities?

In part the significant retracement in commodities (15% in the CRB index over the last few months) is more an indicator of future reduction in demand due to an impending global slowdown and imminent US recession. The Fed cohorts are doing their bit to keep stocks up, the big (political) question is whether they will succeed in that until after the mid term elections, it's looking 50 / 50 to me ATM. When they cease or fail expect a similar 15% initial correction in stock prices. The significant difference between stocks and commodities is that commodity prices will recover but stocks will continue going down as the Fed liquidity sluice-gates open in the futile attempt to avert this recession. They virtually succeeded in flooding their way through the 2001 attempted recession, that very success stored up more pain for this coming one.

Sorry for that digression, back to oil...

We are at an interesting price point. Round the turn of 2005/6 there was quite a struggle around the $62 to $65 level, eventually resolved conclusively to the upside at the end of March 2006, this area may well provide resistance to further declines. The lower bound of the trendline is currently just above $65 so has been broken conclusively to the downside, unless the price corrects up pretty smart-ish (roughly by end of Wednesday next once we have next US reserves data) further declines in oil price should be expected.

This commentary posted yesterday is worth a read, the following quote is taken from it:

http://www.financialsense.com/editorials/pearce/2006/0914.html

All the hyped news has been negative for the oil price in the last few weeks, the less hyped news less so. None of the basics have changed apart from the Israel / Lebanon situation being more stable, that was never worth more than a +$10 premium so the price probably overshot on the upside by a $couple and has possibly overshot similarly on the downside.

This hurricane season has thankfully conspired to turn all but one Atlantic hurricane out to sea and that pattern looks set to continue for the next week at least. I think a fair part of the hurricane premium has been taken out of prices.

There is an important resistence at about $56, if that breaks then $50-ish is possible. I personally expect the price to bounce back up, probably from current level (50%), else from $60 (20%) or $56 (20%), with a 10% chance for it falling through to $50-$52. If it is going to continue down then that should happen soon, pauses of a couple of days would be a buy signal for me.

There is still a fair chance of oil touching $83 to $85 in 2006 but the probability has reduced to about 35%. Note that is a 3.5x higher probability than oil dropping below $56 IMO.

The predictions from likes of Michael Lynch give me great confidence in mine ;-)) $40 oil won't happen without 10% (official stats) US unemployment. OPEC will take oil off the market if oversupply looks to push oil below about $55.

Yes, there is a contradiction between positions like Evans' and Lynch's and reality: once much of the cheap oil is gone, cheap oil prices cannot be maintained for more than brief periods. For now I would say cheap is below $65 (non-US-recession mode) and $55 (US recession mode).

For the next 5 years' prices I'll refer you to an answer I gave earlier today:

http://www.theoildrum.com/comments/2006/9/11/231845/209/131#131

But now we've broken it. We went from $78 down to $63 so far. If we'd followed the pattern we would have done more like $85 down to $70, to match the previous year's high.

So my guess is that this pattern was just a coincidence and doesn't offer much predictive value for what will happen over the next few months.

And how do you check if you are right?--this kind of history is non-repeatable. I mean, whatever the result, you come up smiling like a rose.

Thirty-five percent chance of oil be at $85 by the end of 2006? How can you be wrong? Or right, for that matter?

How I check if I am right? I keep a record of my guesses and decisions. I've taken to posting some online as a discipline, here and there, and sometimes on a blog. I gave myself a 'score' of 30% for my 2005 predictions here:

http://theslide.blogspot.com/2006/01/2005-predictions-assessed.html

I can give you some black / white predictions that I would bet on by end of 2006:

Oil to make a new high in 2006: currently no but significant probability of that being wrong

Oil to drop below $55.50: no, I would currently offer odds of 5:1 on this

DJIA to make a new high in 2006: yes, very briefly in the next 2 weeks, but...

DJIA to close 2006 below 10,500: yes

Gold (spot) to drop below $520: no

Gold to make new high (>$720): no, not until late Q1 2007 barring significantly bad geopolitical events

You may have others, I'd give an answer and quote my estimated probability of that being correct.

My guess yearend prices...

WTIC next month oil: $69 (note, this will be up 10% on yearend 2005)

DJIA: 10,280 (close to flat yoy)

Gold, spot: $640 (up over 20% yoy)

Fed funds rate: 5.25%, with a 30% probability of 5.0% or lower, 5% probability of 5.50% or higher

I'd say there are three broad ways to think about a past prediction:

(1) assume that you've learned that it was right or wrong

(2) forget about it, and make a new prediction

(3) realize you'll never know

The old saw that the market rewards you when you are right, but doesn't care if you are right for the right reason, can be extended. That's the way the whole world works. We don't want to be sucked in, and mis-trained, by thinking we were necessarily right for the right reason.

And of course sometimes we make the odds allocation correctly, but suffer from the long odds rolling in that day. Just because you are right, that doesn't mean you are going to win.

You work your prediction until it is something meaningful - i.e. the sum of all probablities equals one, then bet on it. For oil it could work like this:

One year prediction

$85 = 35%

$75 = 40%

65$ = 25%

(85*.35)+(75*.4)+(65*.25)

Your expected value for oil is $75. If the current future price is $65, you buy one year forwards. If you make money, you are right.

The history books tell us that the denial of 95% of Japan's source of oil lead, in part, to WWII. Germany lost, in part, from a lack of resources, including oil. The play for hegemony over Iraq is a failure. It would be unwise to compound this error with further military threats or actions. If the aforementioned published facts get confirmed by other sources and are "in the news" oil should go up sooner than otherwise

Most interestingly, this $17 drop from the high is nowhere near replicated in the long dated contracts. The Dec 2009 contract peaked at $75 in July and has dropped to $68 - a decline of only $7.

If market participants were really unworried about Peak Oil and supplies going forward, a sell off would have been accentuated in the back months, which it has not been.

Oil correction looks overdone

If the selloff continues, however, I believe that the long-dated contracts will start to come down as well. The long-dated contracts seem to be filtered versions of the front-month contract, i.e. they eventually follow it, but much more sluggishly.

Ask me a question about the weather, and I talk about oil exports.

In July, the Russian government did the largest IPO in Russian history, for Rosneft.

Does that give them a financial incentive to pump up oil production reports, so that they can do a "Pump and dump?"

Which is easier to fudge--oil production reports or oil export numbers?

"I'm going with $57 a barrel by mid-November."

http://tinyurl.com/e5zw2

Where is the line forming to kiss SelfAggrandizedTrader's feet? He made the call...

==AC

The other part is that November is coming up. I don't know what levers are available to the administration -- is it possible to draw down reserves (SPR is it?) quietly? Is it possible for the large oil companies to do some of this? This is something that could be done for more than just political reasons: it could also be a play to allow re-entry into the market for some at a lower price. Sheer speculation on my part.

What will be interesting to see is what happens will the economy really does cool. It's only just started in my opinion. I see no pleasant way out of the housing bubble. If demand drops more quickly that production declines, how much drop in price will there be? It might be cheaper to work off inventories than produce more, keeping prices level or even increasing them -- especially when it is clear to everyone that peak has passed. At that point it might be that the ups and downs are only in the rate of increase, not in the levels themselves. We'll see.

Really, Really Cheap Oil - Gasoline for $2? Michael Lynch says those good old days are just around the corner (free forbes.com registration required)

This is a relatively long article in the latest issue of Forbes. Looks like the author got the definition of peak oil just a tad wrong. I recommend signing up for forbes.com and reading the article in its entirety. It's the most I've ever read about Michael Lynch.

Yet he still has got it completely wrong.

Here is what I figure the addition of the Gulf of Mexico find does for future production. (from)

I'd like to bludgeon Lynch over the head with this graph.

Well, actually scary graph ...

Actually, not so scary....take your little hand, lay it over about 1987 to covering the years out from there leaving 1987 and earlier visible....and you can see the backside of hell!

It was all over right there folks, but....well....actually, it wasn't...if you were a young whipprsnapper snorting coke down at Studio 54, you didn't care, and it payed not to, because it was a temporary mirage....and now your an aging geezer, and how many barrels above the big collapse?

It just tells you to BE CAREFUL, looks can be decieving, depending on which part of the chart you choose to use....(by the way, those are hstorical numbers, not "projections", and they still create one helll of an optical illusion don't they? :-)

Roger Conner known to you as ThatsItImout

Because they won't respond to baits (re Dave), they don't need to, you are not their intended audience.

And their intended audience doesn't give a hoot about you Peak Oil pranksters!

So says Grima Wormtongue (Michael C. Lynch):

"New supply, coming online from all corners of the world, is more than ample to satisfy growth in demand and sufficient even to withstand an embargo against Iran."

replies Saruman (President Bush):

"TO WAAAARRRRRR"

there will be no dawn for men...

Triff ..

http://theoildrum.com/story/2006/7/29/15449/2233#2

My meta-point is twofold: that the future is hard to predict (duh!); and (more importantly) that people tend to be over-confident in their predictions. It is that second point which our overall failure on this poll drives home.

The oil price has now almost completely discounted any hurricane related disruption this season; about 90% discounted any serious Iran conflict or Iran oil supply disruption.

Will the 2006 yearend price be higher or lower than the current $63? Higher, with a 90% probability.

and I'll be doing just such a poll tomorrow. :)

I learned recently that Lee Raymond happened to graduate with a PhD from what is now one of the top Chemical Engineering programs at the University of Minnesota. They should revoke his diploma with statements like that.

Web hubble...what you are missing is an ability to multiply. Multiply that new Jack 2 well by about 10,000. Maybe 100,000...worldwide.

When have the pessimists ever been right about energy?

And he was right.

King Hubbert was right about US peaking in 1970.

Also, see here our Transport Minister's speech this week linking peak oil and climate change as greater challenges than muslim threat(PDF warning 4MB):

http://www.ministers.wa.gov.au/mactiernan/docs/speeches/STEP%20Final.pdf

"Today our civilisation is facing two extreme and

paradoxically interrelated challenges: neither of which

has received the focus from world leaders that the

other challenge - global terrorism - has; although the

consequences of these are at least as threatening and

probably much greater."

Note the drop in our Perth river streamflows over winter by 60% over the past 5 years, from the long-term averages- we are going to be stuffed if climate change keeps going in this direction in the SW corner of Australia.

As Jean Laherrere would probably opine, oil price in 2007 will be somewhere between $10/bbl and $200/bbl. Bets anyone?

Take names, make notes

The voices that are saying that oil will be $20 next year are probably close to the political forces that are holding prices down for political gain (November election). When this price control is lifted, we will better know who we can trust with honest reporting.

QUESTION: Did Oil Prices Stay Too High Too Long This Time?

There is now a creeping suspicion entering the minds of some astute observers:

Did Oil Prices Stay Too High Too Long This Time? And did they do so at just the wrong time?

What does that mean?

Well, think of it this way: As of 1999, no one even looked at the fuel mileage sticker on new cars when they bought. The fuel was givaway, so who cared?

Polls during that period showed fuel economy 12th or 13th on th list of priorities behind such things as style, orignality and performance, and "interior comforts".

The Toyota Hybrid was considered as odd as a vintage Hudson Hornet.

Cars with 10 and 12 cyliner engines (even 10 cylinder Diesels!) were coming out the factory doors, being sold new and used to even upper middle class folks, and no one payed attention to the possibility of overkill. There were 16 and 24 cylinder cars on drawing boards.

SUV's were the bread and butter of the auto trade, and trucks were getting as big as locomotives, and in fact, were sold on that basis.

Now, a half decade later, things have changed. The question is, have they changed long enough. The auto and energy production/consumption business are long lead time industries in both cases, and now, turning back the clock may be impossible. The advent of new technology and communication makes this even more of a fast moving, irreversable situation.

Recall, that this is the first real long duration fuel crisis we have had in the internet era. In the 1970's, there were alternatives, but almost no one except for the technical reader understood them, and even then, cross information between industries was almost unknown. The Briggs&Stratton Hybrid Car is an example. This was a full gas electric plug in hybrid car, built in 1981, that was seen by almost NO ONE. Technicians in other industries never got the chance to "tweak" it in their imagination, and on their Texas Instrument scientific calculator (the biggest computer tool they had then), so there could be no cross polination of ideas. Today, it's different.

Likewise, the demise of the SUV has been fast and furious. Ford Motor Company is racing GM to bankruptcy, as Fords golden cow SUV and truck line are being bled out of existance, along with most of the company. Even if Ford now survives, they will be a shodow of their former self for many years, maybe forever. Turning something like this around is so rare it is called a business miracle. The fuel price is not all that is working against them. The boomers are getting old, and even their kids are getting older. The needed SUV to carry the kids on vacations and outings is no more. The old folks don't like climbing several feet to get into and out of their truck. Older folks are now looking at something low, safe and comfortable. A luxury hybrid perhaps? Security, they realize, is not looking like a military truck, but may be in fuel efficiency and flexibility. Even if gas had stayed cheap, the sales of SUV's would already be dropping like a stone.

But the BIG news is this: The cat was allowed to get out of the bag.

With the internet, every new development in plug hybrid, hydraulic hybrid drive, advanced lithium ion batteries, thin film solar panels collapsing in price as oil and gas stayed high in price, every development was traded among the technicians, the venture capitalists and the prospective customers.

Now, even if gasoline prices drop, people know something they did not know before: Much of the new technology is market ready, cleaner, quieter and more secure and simple than the current bootstrapped overcomplex thing we call the internal combustion automobile. Sure, a fossil fuel engine (and it doesn't have to be gasoline, they now know that, it can be a wild combination of fuels, gasoline, Diesel, natural gas, LPG, ethanol, bio-fuel, recycled methane, on and on), but back to point, a fossil fuel engine may be needed, or wanted, as range extender, climate control prime mover, or performance enhancer, but it will not have to be the primary power.

The public knows that if power density to weight and life cycle charges have tripled and mulitply by that again by triple in battery cordless power tools, then it is purely the market forces and the effort that will put them in cars, boats, motercycles, and lawn mowers. The power source? The grid, and distributed generation are now beginnning to finally make their move.

The paradigm has shifted. The "trajectory" has changed. The big "Mo" is slipping away from the oil industry. It is easy to say, "solar panels are too high...", but what about when they are not? What OTHER charge can you bring against them, that cannot be brought against crude oil in spade fulls?

Likewise, batteries, windmills, geo-thermal heat pumps, LPG and nat gas micro plants, and on and on.

The oil industry and suppliers, both independent and nationally owned, have always known when to hold um', and known when to fold um'.

This time, they may have miscalled their hand. This time, they may have waited too long to fold. This time, the cat is out of the bag, and given the communications now available (it really is a new age) may be able to stay out.

The "peakers" and the new agers may be right, but for reasons completely different than what they expected.

By choice and by popular demand, the oil age may be nearing the end.

Roger Conner ThatsItImout

A couple of small comments (not necessarily related to the above post!):

Trouble is, buying any new car makes no economic sense: the moment you drive it off the dealer's lot, bingo, the value depreciates on average by about 30% ...unless you plan to keep the auto for 15+ years or till it returns to dust.

People are so not buying Civic Hybrids that in Los Angeles you can't get them for MSRP; almost all dealers are $500-$2000 above.

Regular Civics are selling for their usual price of a bit under their (significantly lower) MSRP. And they're selling quite well.

I think the reality is that at least some people are actually quite foresighted individually about the future.

Consider also that a non-hybrid Civic is one of the most fuel efficient cars that people ordinarily buy anyway. And that a computation of "fuel cost saved by hybrid" always has in it a component of fuel price. Only if you assume that the fuel price stays the same over that life is it valid. If you have a very efficient vehicle, it's like owning a "call option" on the price of fuel over the long run; you have less sensitivity to upside shocks and that's worth something.

Consider also that many hybrid buyers probably have to drive many miles, and 100k miles on a Civic is not at all the lifetime of such a car (more like 200k).

I bet many HC Hybrid drivers previously weren't coming from old Honda Civics, but perhaps SUVs and less efficient cars.

Folks, Detroit has been selling "irrational" ever since Alfred P. Sloan developed the idea of a staircase of nameplates for social climbers from Chevy to Cadillac. General Motors most of all has spent 80 years culturally manipulating Americans into wanting the kinds of cars it can best mass-produce, until those Americans in turn allowed their country to be rebuilt into a place that fit the cars. The rise & fall of the tail fin is a classic case of nurturing an irrational taste into an absolute necessity through media brainwashing, until everyone gets sick of it and Detroit comes up with a new fad.

God save Detroit if everyone out there got rational enough to realize that a car is a tool, not a lifestyle, and a 4-cylinder Hyundai with a 10/100,000 warranty is the perfect tool. If we want entertainment we can wait 'til we get home to our Grand Theft Auto games.

How do you invest for the future when energy markets are this crazy? A lot of farmers who invested in ethanol co-ops might be facing bankruptcy.

Subsidised corn ethanol production is medium term iffy IMO, any calculations beyond the current year are speculation. But most currently existing plants are economic at below $40 oil plus subsidies.

Why would fuel prices keep dropping? Have you not heard of 'peak oil'? ;)

Pretty ugly ...

The ethanol producers have a another problem, and it's big...natural gas.

Ahhh, but natural gas has come down you say, and your right, but has it come down enough....recalll that it raced upward even higher than crude oil so compared to history, (when many of the ethanol projections were laid out) natural gas is still high. I have sen some projections from as late as 2001 projecting overal nat gas averages of $2.50 to $3.50 per mm/btu to make these projects make sense, and even then, it was thin margin all the way.

Either way, we know this: The corn growers have went to Washington themselves on several occasions making the ironic argument that the ehtannol industry cannot survive without cheap and reliabel natural gas (!!!), think of that logic! In other words, as long as a non-renewable, clean, petroleum/fossil fuel that we will soon be trying to import by way of LNG we are in such dire straights for it stay cheap, we can make a non-petroleum, "renewable" "homegrown" fuel from it!, that is well....not really so cheap! ;-O

Trying to extract moonbeams from cucumbers would seem a short order compared to this logic! :-)

Roger Conner known to you as ThatsItImout

However, IMO, soon it will be China, Europe and the US bidding against each other instead bidding against areas like Africa.

A month ago I came across this article.

It says, "Consumption of gasoline in Belgium dropped 15% in the first 4 months of 2006 compared to same period 2005".

Since Belgium cannot be considered as a poor country, you need to adjust your theory (most likely poorer countries reducing their consumption).

"The era of easy, cheap oil appears to be drawing to a close. As chronic oil shortages become more widespread, the historic relationship between oil futures and short-term price moves may end as the price of oil begins a relentless march higher - especially as measured in U. S. dollars."

The best areas to look for elucidation of COT data are the currency and precious metals markets, they are the ones with the most debate and analysis, sniff around and you will find.

Dammit, that could be the most equivocal post I have ever made, sorry.

One thing that occurred to me while I was asleep was that many of the UK based small to medium cap oil cos (20 to 70,000 bopd) stopped hedging a couple of years ago. Prior to that they would hedge up to half of their production, now they have been running un-hedged. Does the reduction in spread on the large trader short ratio (LTSR) then mean greater market certainty - back in Dec 03 many of the commercials were sure that price would rise?

I wonder if this shows in the volume of hedge / future contracts pre and post Dec 03? Is volatility on the LTSR a pointer to uncertainty among the commercials? If so, do you know where we find that info?

This is supposedy introduced in the interest of transparency but to my mind makes reading accounts much more opaque. Why would they do that?

I think Treeman has hit the nail on the head: "As the percentage of crude production from expensive sources ( Tar sands, Heavy sour, ultra deep water) rises, the floor for crude prices rises. Get the price down to where the production from these sources is not economic and you quickly get into supply problems."

A lively discussion. Thanks to all.

Which means the oil companies have to become believers in peak oil since they must weather the gyrations in the market and keep on working on non-conventional sources assured that depletion will inorexably cause prices to rise.

Whats funny is most people figured the price floor was around sixty and prices could drop but now that the market moves as normal everyone proclaims the end of peak oil.

Not to mention a whole not of Americans are out of money.

Watch what they do not what they say.

Oil was undervalued for years. $50 oil is just catching up to inflation. Measure the oil price in something other than paper dollars, and $50 oil is a very reasonable price. The loss of purchasing power of the dollar in the past 10 years is staggering. What Walmart sells being the exception.

My comment above about "10,000" and "100,000" was refering to oil wells. Not oil fields. I Believe I have read that the Jack 2 field is 250 miles long. Not being an oil expert, I can't guesstimate on how many wells will be used to tap it. Let's just say many.

I remember stumbling across peakoil.com or some such site in early 2004 where a poster made the outlandish statement that oil could be $50 by the end of the year.

I was shocked, because I was already concerned with the current $30-something oil, and had been assured by the media that oil would soon return to $10-$15 a barrel after the deadenders in Iraq were cleaned up.

We have a small ranch. It's very difficult to make ends meet, and the prospect of $50 oil was not a good thing to contemplate. Now we pay an extra $4,000 a year for increased fuel costs, which is a lot for us.

Sure, the value of the ranch has skyrocketed (for now) but this is a homestead ranch that will never be sold. And we never, ever, EVER, borrow money from the bank. It's an old family policy left over from The Great Depression.

What's absolutely killing farmers and ranchers right now is not so much the price of fuel, but the cost of parts for machinery. It's outrageous! If this kind of inflation in parts continues, farmers are definitely going back to draft horses.

There are signs that US real estate is turning down and will impact the US economy. I wonder what the US would be like now had it not been for the recent cheapness of globalisation and chinese production?

Small farm economics is constantly changing. If you can't stand the heat, get out of the kitchen...and out of farming.

But I doubt if we'll continue to grow a big surplus of food for the suburban population. I guess they'll just have to start backyard gardens and can their own vegetables.

thanks,

Sid

People don't drill just to break even.

The $63 barrel of oil you are talking about is WTI or similar. It is the best and most expensive oil around (with a few exceptions). Heavier oils are trading much (20%) cheaper.

The most expensive and confusing step in the process of bring the crude to market is refining. It is confusing in part because it costs more to refine cheap oil then expensive oil. So your $63 a barrel WTI may have a refining margin that is much lower than a heavy, sour crude. Also, you can't (practically) convert a barrel of oil to gasoline alone. Different crudes slates in different refining configurations can produce a fairly broad assortment of products (gas, diesel, kerosene, fuel oil, etc.)

I believe global complex refining margins have been running in the range of $9 per barrel, although this is an average figure.

Financial market skullduggery is undefined and hence unanswerable. Are you refering to an additional premium people are willing to pay to make sure they get the oil they need at a predictable price? Or is it people who hold futures contracts but don't take delivery (like may TOD readers).

If you think people should be compensated for bearing risk, then there may not actually be very much skullduggery at all.

There is no right, or known answer for how much of the price of oil is financial in nature and how much of that is good/bad or producer profits versus intermediary profits.

The Foundation for Taxpayer and Consumer Rights recently put out a good study on gas pricing that makes a strong case for price gouging, particularly by refiners in the West. Access the full report here:

http://www.consumerwatchdog.org/energy/rp/6399.pdf

Here are the main findings:

The data from 2006 is off tho a slow start compared to 2005 but recent weekly comparisons between "now" and a year ago have shown strong recent increases. What that looks like for the year is still till early to tell.

This premise is not true.

First, OECD inventories, which includes the US, are at a ten-year low even though consumption is at a ten-year high. In addition, OECD inventories are down one day's cover per the EIA, my guess is 50-60mmb.

SEcond, even looking at just US inventories, which is all the market does look at, inventories are only even with last year, not up, because 12mmb loaned from the SPR has not been repaid, and will not be at least until after the election.

There is no demand destruction in sight. Chinese imports of crude and products are up 17% yoy, probably in part because price controls have been partially lifted, raising prices but allowing consumers to fill their new cars... and, speaking of which, sales are up 50% yoy (now there's a boom, and one foretelling a future boom in crude demand). Meanwhile, US consumption is up, if only 1%. So far, current prices are not high enough to depress demand. Has anybody been out on the freeways lately?

IMO buyers will return, hedgies will reverse, the golden fifties will not return, and we will soon march smartly back to the top of the three-year trend, 80+, before year end. Actually, 80 is a bargain - just ask Simmons.