What The Oil Drum Meant

Posted by Stuart Staniford on August 28, 2013 - 11:43pm

The popular peak oil blog The Oil Drum (TOD) began in early 2005. I joined as a contributor in mid 2005, later becoming an editor, and I left the site in early 2008. TOD continued in the meantime, at least up until now when the current editors have decided to transition to an archival format. They don't feel the quality and quantity of post submissions justify continuing. They asked a number of us old-timers to comment on the significance of TOD, and these are my reflections.

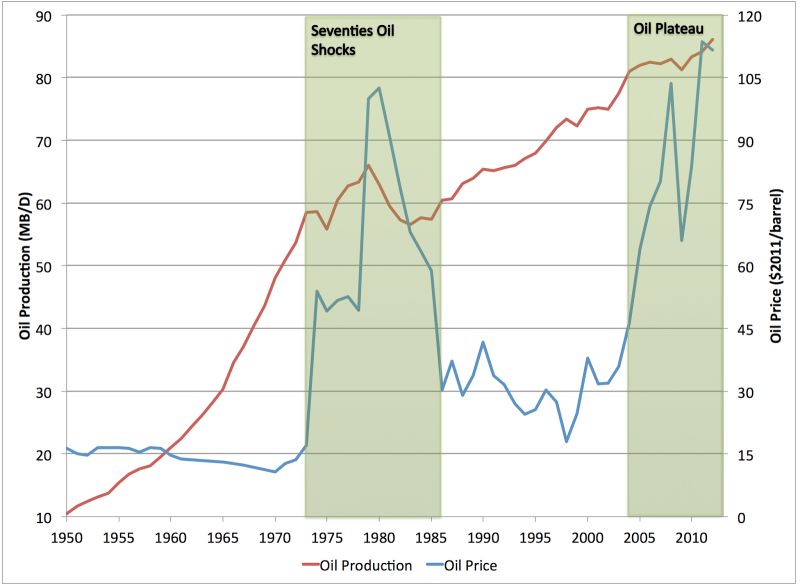

I start with the chart above. It shows, from 1950-2012, world oil production annually (red curve, left scale), and real oil prices annually (blue curve, right scale). I show in green boxes two regions of major disruption, and between them two regions of relatively calm behavior (in white).

The orderly region from 1950 to 1973 was characterized by very rapid growth in oil production that was achieved at very modest oil prices (around $20/barrel in 2011 dollars).

Then in 1973 came the Arab oil embargo, followed in 1979 by the Iranian revolution and then the Iraq-Iran war. These events caused a series of sharp but relatively short-lived contractions in the global oil supply. The result was huge price increases, and a permanent change in the way the world used oil.

After the dust settled in the mid eighties, oil production resumed growing fairly steadily, but never again at the frenetic pace of before the seventies - from now on society was more concerned with fuel efficiency and grew oil consumption more slowly. Prices fell into the $30 range, and remained there, give or take, for the next couple of decades. This was the second period of stability in the oil markets since WWII.

Then, in late 2004, global oil production largely stopped growing and entered a rough plateau. Prices began to shoot up, reaching well over $100/barrel within a few years, and largely staying there to this day (making allowance for a sharp downward fluctuation during the great recession).

There sprang up a large debate about the meaning of these events. The Oil Drum in particular I believe came to function as a central node in this debate, and one of the best places to hear a range of views that were based on a close analysis of the available data. The reason TOD is now coming to a close is that the need for this particular debate is over, at least for the time being. The data have spoken.

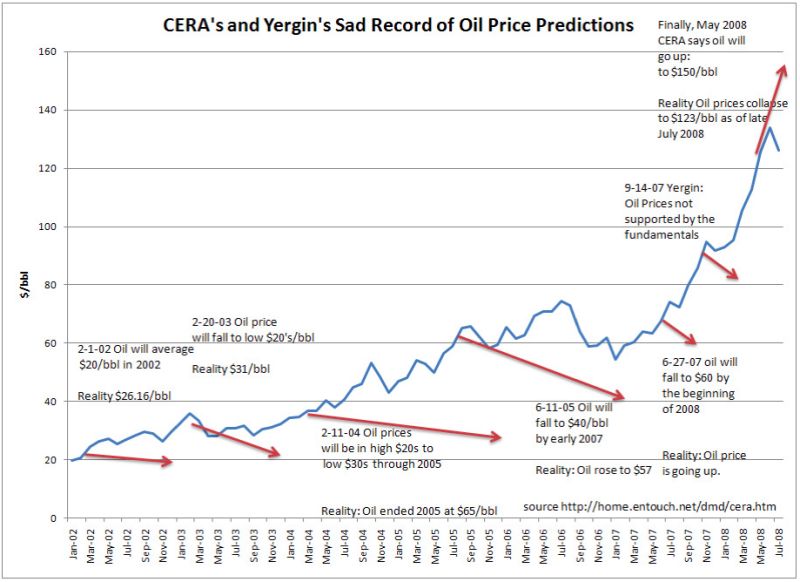

One extreme in this debate was what came to be known as cornucopians, epitomized by Daniel Yergin of the consultancy CERA. He made a long series of predictions that oil production would resume growing and prices would fall any day now. This was most famously satirized in a graph by Glenn Morton:

Obviously, this didn't happen. Oil production has not risen rapidly, and prices have not returned anywhere close to the pre-2004 idea of normal.

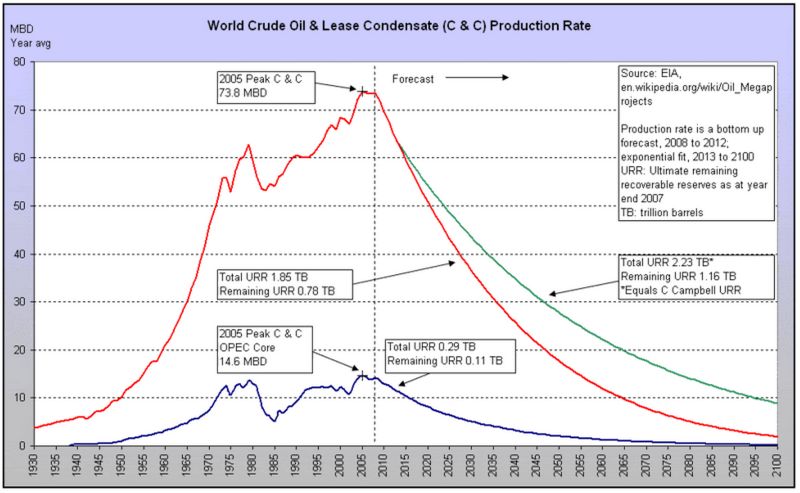

Another extreme in the debate were "doomers" who believed that global oil production would begin to fall very rapidly, very soon, because peak oil was upon us. "We're all gonna die" was the logical implication. One such forecaster was TOD contributor Ace who produced a series of forecasts like this one which showed oil production beginning a precipitous decline as of the date of the forecast:

The same piece forecast oil prices to rise rapidly and steadily and pass $200/barrel by the end of 2012. That didn't happen either.

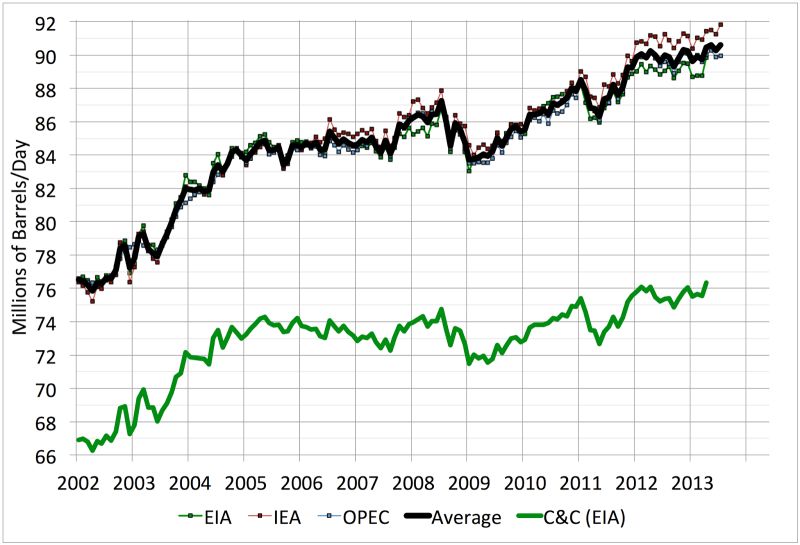

I'm not sure anyone predicted the last eight years perfectly (including me). Still, on the whole, the various "moderates" in the debate came closest. What has actually occurred can best be seen in this graph which shows monthly oil production from a variety of data sources from 2002 onward:

The green curve is the EIA's estimate of the production of "crude and condensate" - C&C - which is a fairly narrow definition of oil that largely measures liquid hydrocarbons that flow out of the ground. The other curves show various estimates of "all liquids", which adds things like biofuels and "natural gas liquids" - compounds like propane and butane removed from natural gas production. These aren't really oil, but can substitute for it to varying degrees and so are often counted with it.

The crude-and-condensate curve is bumpy, but does slope upward slightly. The all liquids curve slopes up more, reflecting the fact that global natural gas production has increased steadily. High oil prices and government policies also induced a biofuel boom after 2005.

Thus we seem to live in a world in which, although traditional sources of oil are declining in many places, high oil prices (around $100-$120) are able to bring out enough low quality sources of hydrocarbon to offset this decline and just a bit more. Examples include oil fracced from very tight rocks in North Dakota, and tar sands production in Canada. These sources are difficult enough to bring on line that prices have not crashed, but are sufficient to prevent global oil production from actually declining. Clearly, we have not passed peak oil yet, and it's not at all clear when we will.

In the meantime, the situation has gotten quite dull. I compile graphs of oil production every month, and it's gotten somewhat akin to watching paint dry; every month, it's pretty much flat, and I tire of saying the same things over and over again.

On the other hand, we certainly don't live in the pre-2004 world any more. Oil prices are high, and there seems little prospect that they will ever fall below $100/barrel for any sustained period. If for no other reason, Saudi Arabia needs an oil price somewhere around there to balance its budget, and they are always in a position to force the price to stay above that threshold by modest decreases in their production.

Furthermore, the situation remains very vulnerable to disruption. Whereas in the eighties and nineties there was large amounts of spare capacity in oil production, nowadays there is little, and perhaps almost none. Any disruption in any sizeable oil producer will cause a large price spike - as we saw in 2011 when a revolution in Libya, which produced less than 2% of the world's oil, caused a sizeable price spike.

As I write, Libya, Tunisia, Egypt, Syria, Lebanon, Iraq, and Iran are all subject to varying degrees of economic and political turmoil. We in the west are apparently about to bomb the Syrian government, as an interesting experiment to see what that does to the stability of the Middle East.

I assume at some point a large oil producer will descend into turmoil and then there will be a large price spike, and that may kick the global oil market out of the current meta-stable state. However, there is no telling when that might happen. In the mean time, oil production slowly creeps upward, and oil prices are around $100-$120.

One final point worth making: while global oil production has not peaked, oil consumption by the developed OECD countries almost certainly has. Since China, India, the Middle East, etc are all growing their consumption rapidly, and global supply is almost stagnant, OECD consumption must decline, and it has been:

I do not expect OECD consumption of oil to surpass its 2005 peak.

Thanks for the work and education Stuart. The decline in OECD consumption has been too little commented on in all circles. Especially since its happened accompanied stagnation or recession in the OECD economies, Greece biggest downturn, biggest downturn in oil use. While any place outside the OECD economies that still "grow" have also seen rise in oil use, that remains the model of development we know.

Well here we are the end of cheap oil, the rides just begun, the world as is doesn't work well on $100 oil, the numbers are clear, even if no one quite had it pegged how it would start showing. The OECD numbers are clear.

Stuart, why did you leave the site in 2008?

I am not certain where I will spend the majority of my oily time after TOD closes. But I do plan to follow the Monthly Oil Supply Update from Early Warning. In April 2013 Stuart Staniford started graphing All Liquids and C+C separately. It might be interesting to discuss the controversies regarding the inclusion of biofuels, natural gas liquids and refinery gains as "oil supply". To what extent is there double counting and inclusion of items with reduced or zero energy content in the all liquids category? As Staniford notes: " Which is better to consider is a matter of debate, but now we don't have to choose - we can see both at a glance."

http://earlywarn.blogspot.com/2013/04/monthly-oil-supply-update.html

Stuart, thanks for this summarizing posting as well as for all your valuable postings before. I agree that although much has been written about peak oil the overall picture is still far from being clear. And I think that a really holistic and realistic model that includes all information about supply and demand (including efficiency measures and alternatives als well as „demand destruction“) still hasn’t been created. This is one reason why I am about to launch a website that is supposed to connect the dots between the maze of information that has been published so far in a structured manner, using a wiki approach.

Another reason for this website is to create a textbook and knowledge database about peak oil (and the topics related to it) and also provide a one-stop-shop with ready-to-use arguments for future discussions about energy.

At present this website is still in its very beginning, but those who are interested may already have a look and are encouraged to participate.

The site is called WikiPeaks.

Good luck with your effort, Drillo. I look forward to participating.

I read that top graph as prices rise -> economy shrinks -> demand shrinks -> prices fall.

The only thing stopping the economy shrinking right now is Bernanke printing money. If going into debt is borrowing from the future, the US has burned the next decade's oil (WAG) and that is the only thing keeping consumption up. The drop will come when the US national debt stops increasing, or other countries lose faith in the dollar.

In '73-'74, the start of the seventies oil shocks, I was living in Britain. It was a terrible time in the West. Doom and gloom like you won't believe. Britain went on the 3-day week to save power, the coal miners were always on strike, the government fell.

October '73 was also the time of the Yom Kippur War. Are we headed for war in the Middle East today? It looks awfully likely.

I would not be surprised if a new TOD in fifty years' time were to look back, they would see a double peak -- the seventies oil shocks, and today -- followed by a steep fall and a slow rise to $1,000 oil in 2060.

It's very hard to dispute the basic logic of the "rising prices, shrinking economy, falling demand, falling price argument."

It fits the facts quite well so far.

But at some future time the available supply might contract fast enough that the available supply is inadequate to prevent sharp price increases even in the face of declining demand.

I have argued here in the past that as a farmer, I would gladly pay 20 dollars a gallon for diesel before I would buy a horse or mule- at least so long as i can keep a tractor running.

Of course the typical owner of a large car would find himself on a motor scooter or a bicycle at such a price if he could still afford one, most likely having lost his job.

After following and participating in the peak oil debate here for some time, mostly as a doomer, but sometimes as a devil's advocate for technology coming too the rescue, I have come to believe that most of us , doomer and cornucopian alike, have gone wrong- and are still wrong- if we are still in either camp- in respect to what will happen in the short to medium term.

I think the biggest reason well informed doomers have gone wrong is that they simply didn't believe the world economy could support hundred dollar oil, and didn't even seriously consider the possibility. It is obvious that the better informed doomer element knew all about the various kinds of unconventional oil from day one, but they didn't anticipate unconventional oil coming to market SOON ENOUGH , if ever, to offset the decline of conventional oil.

I am not inclined to be so generous or lenient with the cornucopians. As i see it, it is very likely that conventional oil is still going to decline a lot faster than unconventional oil can be ramped up, as evidenced by the historical record of the industry. Further more, the cornucopians are employing smoke and mirrors to make their arguments, constantly moving the goal posts and changing the definitions used to suit their own agenda.

Only a dimwit would ever truly give credence to the idea that biofuels are OIL- although they are indeed Oil SUBSTITUTES.

Claiming that peak demand has done away with peak oil is an equally absurd dodge that would not win a debate even in a junior high school competition.

I am impressed with WHT's work in the way a kid is impressed with anything big and and impressive but I must admit I can't make heads nor tails out of it, lacking any serious training in math and statistics and programming.

But unless I missed it, neither he nor anybody else has ever disproven THE CENTRAL POINT of Hubberts Work- which is that any oil field peaks and declines, period. I have read a good bit about Hubbert, including some of his own words, and i can say with confidence that he did not say much about the shape of the decline in any particular oil field, province or country, and did not rule out temporary increases in production from the discovery of new fields, or for that matter, the introduction of new technology.

When the historical record has run a little longer, i firmly believe he will be proven right, in principle- new fields and new technology cannot forever increase production, although there many be temporary upturns as when the North Slope came into production. The long term graph is still going to be more or less bell shaped.

And that holds for the US, as well as for the whole planet.

Personally I expected high oil prices to break the back of the economy, and the economy is certainly in a lot of trouble, for a lot of reasons including oil prices.

But it has proven to be more resilient than I expected- for now at least.

And the Invisible hand so scorned by some of us is doing a pretty good job of allowing those of us with sense enough to read the writing on the wall to personally transition away from oil.

Our brains are programmed to think short term, since we evolved having to solve short term problems. Hence we are so predisposed to expect things to happen quickly we forget that a decade or two, in terms of history, is the equivalent to a week or two , or a month or two, in the life of an individual.

I'm still a long term doomer, but for now, I think there will be oil enough - and OIL SUBSTITUTES ENOUgH-to keep Old man BAU's joints greased and his fires lit for the easily forseeable future- another decade maybe..

"...they simply didn't believe the world economy could support hundred dollar oil..."

I'm not so sure it is, Mac. It's clear that other parts of the economy are being sacrificed to pay for 'hundred dollar oil', or vain attempts at inferior substitution; similar to an addict selling things or not paying bills to support his addiction. Some of these things are considered discretionary by those who do the sacrificing; not so discretionary for those who make their livings in those sectors, or planned to retire on the surplus they thought they had produced.

It seems these 'surpluses' are being targeted to provide the illusion that we, collectively, haven't overshot our resource base. Prices creeping up relative to incomes, pension funds disappearing, increasing costs of necessary services; how much of this is due to our perceived need to support the increasing costs of our oil addiction? I, for one, can't call this 'resilience'. It's triage.

hi Ghung,

I basically agree with you- I'm pretty sure the world economy can't deal with hundred dollar oil over the long term.

But expensive oil hasn't actually k o'ed us yet because accounting trickery has postponed our having to pay the piper- so far- for the most part.

And we are also still living off of real assets built with formerly cheap energy ranging from houses to highways .

When these existing assets are worn out, we won't be able to replace most of them in an energy and resources constrained economic environment.

I know a lot of people personally who are already really hurting due to high oil prices- people who are not quite able to make ends meet any more from paycheck to paycheck because it costs them so much more to get to work, and because the day to day necessities ranging from food too electricity are constantly going up- in considerable part because of high oil and energy prices .

And when people in this situation lose their jobs- it's a catastrophe for them.

I might add that most of our jobs problems in this part of the w country are due to outsourcing.

So far as I am concerned, so called free trade has been a disaster for the working class people of this country.

We are already supporting tens of millions of people on public assistance of one sort or another who used to manufacture clothing, furniture , other consumer goods, heavy equipment, etc,

This situation is going to get a whole lot worse .

In the end, I believe most people able to think for themselves are going to conclude that "free trade ' has been a disaster.The idea is fine, the principle is fine, but the actual execution is fatally flawed and has resulted in the impoverishment of tens of millions of people who formerly were able to make a living and pay taxes.

The chickens are coming home to roost now.

The biggest and baddest chicken of them all, for the time being, is Obama care.

Unless the republicans, whole are wholly owned and operated by biz banks and big biz, are able to repeal it before it takes effect, it is going to turn millions of former working class conservative people into (gasp, hiss!!!) socialist welfare democrat voting bums within the next year when they get some badly needed medical care they would have otherwise done without.

All I can say is they shouda seen it coming and thought a little more about the long term consequences of their policies and a little less about the short term profits.

I am personally middle class myself in terms of my education and living standard, but my heart is with the working class, where my roots are.

OFM - First off, great to see you posting here again in TOD's final hour...

Yes, 'free trade' has been a disaster for the US working class. It's been a rousing success, however, for those who wrote the 'agreements'. 'Free trade'/globalization etc. was only ever intended by its designers to rachet up the siphoning of wealth from the poor to the already wealthy. Mission accomplished and ongoing. The only 'free' thing about is has been corporations free to exploit the workers of the world to the maximum extent in a viscious race to the lowest wages. And also to make them free to destroy the environment as rapaciously as possible, by making themselves as immune as possible to any meaningful regulatory oversight.

But I don't follow what you're saying about Obamacare. Howzit going to make working class conservatives into socialist welfare democrats? For those (like myself) who earn loo little to afford anything offered by this for-profit 'health care system' we have in the US, all I see is an effort as above to force siphoning of the poor's wages into the hands of the wealthy insurance cos. It ain't socialism, it's profiteering, pure & simple. Can you explain what you see differently better?

Thanks.

Hi Clifman,

It's simple enough, although I deliberately stated my argument in a a somewhat unconventional way.

A few million people are going to get the medical care they are in desperate need of, early next year, because with Obama care in effect , the doctors and hospitals aren't going to be able to turn them away any more.

And a considerable portion of these people are as well as their families are going to be very grateful indeed. Quite a few of them will vote for democrats in the future.

Most people who are not working class themselves simply have no real idea how working class conservatives think.

We look at doctors, lawyers, bankers, and just about all well to do people as being the functional equivalent of highway robbers- except we can't call the law on them, we just have to pay them a week or two's wages for a few minutes work .

But we also hate the democrats because from our pov- being WORKING working class people as opposed to business owners, every time we turn around, we see somebody collecting freebies and bennies which we are paying for with our own sweat and blood.The vast majority of the time, we aren't qualified to collect, because we do have a few assets. You simply can't have any idea how maddening it is to hear about "welfare bums" collecting more than we make in rent subsidies food stamps, and various other welfare benefits.

Obama care will be the first major program that will be of significant help to working age poor people across the board, without making them eat their pride by applying for a welfare benefit such as free school lunches.Social Security and Medicare is for old folks of course.

It's a brilliant strategic move on the part of the democrats, because once implemented, the people who aren't insured now will be- , and once they have seen the bill for a major illness taken carte of, instead of their being bankrupted, they are going to see the light.

Poor people aren't going to pay any more taxes- they aren't getting paid enough to pay any now, except consumption taxes, for all intents and purposes, and the FICA s deduction.

And as for the people who are opposed to Obama care- well, they generally would't vote for a democrat under any circumstance anyway.

I have a relative who did pretty well as a contractor, who retired just at the peak , while things were good, who is not yet old enough for medicare.

He had some savings, until he had a stroke a year ago.

He is and has always been a rabid republican, but you should hear him pee and moan about having to pay out just about his last dime for a couple off weeks in intensive care, a medevac ride, etc. plus his follow up treatments.

I'm thinking altogether about 300 grand. It took him fifteen or twenty years years to save what the medical industry charged him for a half a dozen people for two weeks.

Now if he had been "hard up", he would have likely gotten about a quarter of the care he got, since the hospital would have had to eat the bill. He would have lived, more than likely, but as a cripple, rather than as a filly functional healthy man.

When I explained to him that since he no longer had any income, Obama care would probably have paid most of the bill, the effect on him was as if I had hit him hard in the solar plexus- he never said a word for a long time.

So - working class conservatives morphing into "socialist welfare bums" is a clumsy attempt at humor .

They will feel entitled to their new medical bennies after a little while, rather than ashamed .

The chickens that are coming home are the chickens of the fat cats who are now having to face up to the fact that their strategy exporting the jobs of the working class has backfired on them, and backfired big time.

It had to of course, eventually.

Medical care in this country is irrevocably on the way to becoming a publicly financed right, rather than a privilege that must be paid for-assuming Obama care stands.

And since the working class isn't making enough money to pay very much if anything in income in taxes, the burden will be placed on the business/ professional class and on corporations.

Obama care will morph into a western european type system within a few years.

Obama care will return a lot more to the working poor than it collects from them in taxes ssince they pay mostly only consumption taxes.

And when it morphs into a western European type system, we as a society will be way better off, since Europeans typical get as good or better care, across the board, as we do, for about half the money.

I'm still a conservative, and i still believe in free markets- but we have not had a free market in health care for a long long time.

.

Our health care system as it is currently constituted is a disaster for every body in the country except the people who own it and the people actually employed in it.

No boby paying for health care in this country is getting fair value for their money.

It's so screwed up it is simply impossible to fix it- except by something as drastic as socializing it.

A realist understands that things can only get so bad before the poor people take to the streets .

I would rather seen socialized medicine than a revolution. Doubly so since Europe has proven they can do it better and for half the money.

And no, socialized medicine is not a source of current European woes- not at all.Socialized medicine is actually one of the foundations of such economic success as they have had for the last half century.

If govt v can do it for half there, I'm willing to give it a try here, given the clusterxxxx medical care is in this country now.

As always, please overlook my one finger typing and poor eyesight.

Brilliant OFM, I concur. Maybe because I'm a European? God bless America, the USA is slowly joining civilization :)

thanks, JN

the picture i painted above is the one i see wearing ny thickest and darkest pair of pink glasses, with the sun of the democratic party focused on the plan.

In actuality, when i remove my glasses, it is immediately obvious that the legislation as written is a clusterfxxk of the first order, becausee it is going to result in an enormous in crease in the cost for tens of millions of people.

I hope it is not true, but it appears to be a fact that a lot of people be forced to pay a very substantial part of their income for a policy- enough to ruin them, even after any subsidy they may or may not receive.

There will be recall petitions galore when the typical working class person finds out just how much such a policy is going to cost in most or maybe nearly all places. Nobody is hiring full time since part timers will have to bear their own premiums, etc.

I think the odds of repeal- once the general public once understands what is going on- are better than fifty percent.

The intentions were good, but the execution has been a tragic joke.

I called both my federal senators, one a demo rat, the other a repug lithan ,and the federal govt site dealing with this thing without being able to get even a ball park estimate of how much a subsidy a person with a given income might get .

And it is only a month from enactment!!!

What I find incomprehensible are the people who think that any job that doesn't require an advanced education shouldn't pay anymore than minimum wage. There was nothing wrong with someone who only had a high school education earning enough money to support a family at a manufacturing job.

Free trade does make both countries wealthier but clearly the benefits do not flow evenly across society. As you say, free trade has been a disaster because it has impoverished millions of people. Ironically, acquiring a higher education is no longer a guarantee of a good career. A significant percentage of college/university graduates are either unable to find work or are working at jobs that don't require the level of education they have. With a growing surplus of highly educated people, you can be sure that corporations will be trying to ratchet down salaries on those jobs too!

My impression is that the system does more to keep middle class people happy than to help the people at the bottom. This could be because

1. public sector workers are middle class and generally unionized. Politicians will usually go to great lengths to avoid public sector strikes as they get blamed for the inconvenience to the public.

2. middle class people are more likely to vote, donate to a political party or volunteer to work for a political party than people at the bottom.

3. people self identify as being middle class even if their income is too low.

Helping the people at the bottom would be the moral thing to do but it apparently isn't good politics!

I submitted a final post to TOD and then followed up, but haven't heard back yet. I never did have a direct pipeline to any of the TOD establishment.

This last one is on the Bakken and I did try to tone it down and let the intuition take over from the math. We will see what happens.

I doubt that farmers will have to pay that much. When the economics dictate, farmers will go back to producing all their own fuel on the farm. It won't be hay and oats for draft animals and cord wood for heating like the past, but biofuels to continue to fuel IC tractors and trucks, home and barn heating/cooling, crop drying, etc...

When the net profit from their acres is less for food crops than home made fuel production, farmers will switch over to home made fuel. (Baring Government intervention)

I suspect that the switch by farmers to home made biofuels will happen long before petroleum fuels become unavailable.

My 2 cents worth.

Jon, I would like to think that you are right, but I have second thoughts every time I need to fix or build something around our homestead. It always seem to involve ordering something or a trip to one of our local stores.

Our technology is just too complex and too efficient. Parts must be exact. It seems that old fashion ingenuity will not keep our modern technology running like it could with older technology. Without a fully functioning global supply chain we will need to go back to older technology that will include a lot of manual labor. It is hard to beat manual technologies that always work and can be relied on when you need it.

Of course it is possible to manufacture enough biofuel to run farms- and the trucks necessary to deliver the goods to and from, with a big n boost in train freight to help.

But we aren't ever going to run the economy on biofuel.

Not any economy recognizable as BAU any way.

Biofuels might conceivably be ramped up enough to fuel essential services vehicles such as a few cop cars, ambulances, delivery trucks, etc, - especially since most of the smaller essential vehicles could be battery powered, or hybrids.

I'm sure there will be enough conventional fuels produced to keep essential services supplied for the foreseeable future, and I agree that farmers may find it more economical to produce their own biodiesel (assuming methanol availability), perhaps as regional co-ops or somesuch. Of course, those who determine what 'essential sevices' are will be including themselves in that category. As for the very wealthy, the cost of fuel is a tiny percent of their income. Unless there's a major financial meltdown, dragging them down with the rest of us (or pitchfork brigades), they'll have the means to establish themselves as 'essential'. Me? I'm making other plans.

Climate change is more likely to cause major agricultural disruptions than fuel availability, IMO. If things ain't growing, no need for fuel, though I'm expecting a confluence of all of the above in the not-too-distant future.

Methanol is an easy renewable, during destructive distillation of wood the cellulose becomes charcoal and the lignin produces methanol. See http://www.cd3wd.com/cd3wd_40/cd3wd/apprtech/b23ale/en/B30_8.HTM

Biodiesel is a convenient fuel but I suspect running a tractor on pure methanol would give a higher EROEI, since the lipid-alcohol to ester reaction is exothermic and additional energy must be supplied to recover any excess methanol (if that is not to be totally wasted by venting).

I have to count myself in the camp of those a bit surprised at how resilient BAU has been.

A Drumbeat or so ago Leanan and someone else basically said something to the effect that JMG's "Catabolic Collapse"/Stairstep decline scenario has basically been validated. To that I have to say Yes&No...just like the "future is here, but not widely distributed" comment it seems that Collapse might be Catabolic style in aggregate, but will probably not be homogenized very well. Already we've seen a number of MENA nations "spring" - more likely due to resource constraints than some goofball idea of "freedom." Parts of Europe are being sacrificed, namely Greece, Ireland, Spain, Portugal, and Italy.

The Collapse seems to be here - just not widely distributed.

The people in the US which Chris Hedges talks about in "Capitalism's Sacrifice Zones" are part of it, the PIIGS are part of it, and Syria, Libya, Iraq, etc are part of it.

I still think the numbers pencil out that PV, wind, alternate transportation, re-development, and very importantly a controlled population descent could happen and we could find balance again...but the chance of that, though non-zero, is extra-ordinarily slim. We are where we are for a reason (human nature) and we could have turned this boat around 40 years ago and been in so much better a position than we are now - but it didn't happen.

I think this is where my mind is these days as well. BAU seems to have some serious staying power, so we'll probably bumble along for a while. In the meantime we should probably push for renewables, educate anyone we can get through to...and if we buy enough time, and that time is spent well - there might be a world left to inhabit.

When I bought my 1st new car in 1993, 91 octane unleaded was right at US$1/gallon.

That same grade of fuel has been at or over US$4/gallon, for the past year or so.

There has been volatility, but the overall trend has been "up-up-and-away!", in my opinion.

Long time lurker-- just wanted to thank all of the authors of this blog. I learned a tremendous amount.

Thanks for the all the good articles that stimulated thought and my armchair conclusion is the world oil supply is on the same page as a family that bought their house on two incomes and if one loses a job?????

Stuart

Thank you for your work over the years. Excellent.

It might seem that the 'nothing happening' plateau is dull and going nowhere in the PO story. For those of us looking for a good site to migrate to, I propose that, currently, nothing even comes close to TOD. However, when a shock or two hits that will change pretty quickly inmho. The real story will have to be covered by those who actually know what is going on, and not by Yergin interviews on MM.

See you all then.

Paulo

My view has been that this plateau has represented a new normal. The economy and the users of oil have become sufficiently responsive to price signals that demand can be driven out of the system by relatively small twitches in the headline oil price.

The interesting question is how much of the demand is this elastic at this general price level. Already we have pushed out quite a few million barrels of demand that would have been there. As we reach the end of that tranche, we should expect to see more extreme price spikes as the price has to tweak more and more to have the same effect.

The boring plateau is a stage. Eventually it gets not boring as the price/demand/supply decline kicks in.

"this plateau has represented a new normal"

Yep, except the plateau is very general... The rich will continue to get richer, the poor poorer. It sucks to think about, so drink up and enjoy the party while it lasts.

So long to the TOD community, best wishes.

Matt Blain

Melb, Australia

5yrs 44wks

+1 I would just like to add.....

To me I was always a undulating plateau kind of guy. Our current production levels do not surprise me as much as the price (I thought it would be higher). The doomer side of me leans towards the unease I feel that the falling return and dropping productivity is going unaddressed by the socio-political dialogue. The problem is just being kicked further and furthr down the road while resources are burnt maintaining the status quo.

The chief culprit from my perspective is the entrenched power of the financial elites who for want of a better shorthand are just screwing us all again.

So long to the TOD community, best wishes.

Bozzer

Hackney London England

7 years 32 weeks

The other interesting question is long-term elasticity - there are commercial consumers, like UPS, that are quietly working on alternatives to diesel, and PHEVs and EVs are getting more numerous and cheaper.

It's going to be an interesting fight between depletion and transition away from oil...

Hi Nick,

re: "transition away from oil..."

"Transition" can only work if and only if overall growth (esp. economic growth) ceases. "The fight" is not between depletion and transition.

Unless all oil extraction/production/delivery ceases tomorrow, depletion continues - no matter what. And "transition" requires both something to undertake the transition with (energy, labor, materials, time) and something to transition to...

Why does economic growth need to cease? If we stop using oil, and use renewable power instead, growth is unrelated.

Renewable power (and the remaining FF) will certainly power a transition. Heck, our problem is too much FF, not too little.

One of the greatest climate related posts of Stuart was in January 2007

Greenland, or why you might care about ice physics

http://www.theoildrum.com/story/2005/12/9/31522/5910

This was the first time I heard about NASA climatologist James Hansen. Many of his articles and 3 years later I met him when he did a lecture in Sydney Uni in March 2010. He said:

In Q&A I predicted that peak oil will weaken the economy to such an extent that no adequate action can be taken to reduce CO2 emissions and I thought at the time that this would be around the end of the decade. But the problem is coming earlier. Already the 1st phase of peak oil has increased prices in such a way that even in a wealthy country like Australia this has become a issue. And that is why around 50% or more of the electorate here will now vote for a global warming denier (Tony Abbott from the Liberals) at the 7th September election. He will abolish the recently introduced carbon tax and also a mining tax.

So we have quite similar developments with peak oil and global warming. In both cases the public seems to have lost interest.

It is still a mystery to me why TOD is going into archive mode now that things are converging in the Middle East. On my website http://crudeoilpeak.info/ I never run out of topics.

Thanks for your work as well, Matt. I follow your blog, Stuart's, Summers, Rapier...it's a fixation of mine to see how the "paint's drying."

Perhaps this is an inopportune moment for TOD to close up shop, but then again it's been a long haul for all involved, and contributions had dwindled to a trickle. Perhaps some other blog will regain its cachet? Whatever cachet is good for. And any more it's a simple matter to just follow different sites to see what people are talking about today. Maybe big blogs like TOD have run their course.

Or maybe TOD didn't do enough in the way of solicitation? As you say there's always something or another in the world of resource limits to analyze.

I do think you have a point there on big blogs. I personally tend to avoid multi-voice blogs (all of them, not just TOD), since invariably there's one or a few people I want to hear, and then others I'm not so interested to follow.

The Production Plateau Vs. CNE (Cumulative Net Exports) Depletion for the Six Country Case History (Indonesia, UK, Egypt, Vietnam, Argentina, Malaysia)

These are the six major net oil exporters (exporters with at least 100,000 bpd of net exports) that, insofar as I know, have approached zero net oil exports, or became net importers, since 1980, with the exception of China. The Six Countries showed about a six year production plateau from 1995 to 2000 inclusive, with an absolute peak in 1998 (BP, total petroleum liquids).

Note that by the time that they hit their combined absolute production peak in 1998, they had already depleted about half of their combined post-1992 CNE:

1995 was clearly an inflection point for Six Country production, in much the same way that 2005 was clearly an inflection point for various global and regional production numbers. In order to compare the Six Country case history to current production values, I defined 1995 and 2005 as “Index Years.”

The following chart shows normalized ECI ratios (ECI = Export Capacity Index, ratio of total petroleum liquids production to liquids consumption) for the Six Country case history, for Global Net Exports of oil (GNE*), for Available Net Exports (ANE, or GNE less Chindia’s Net Imports, or CNI) and for Saudi Arabia. Note that for ANE we use the ratio of GNE to CNI. The Index Year is set equal to 100% (1995 for Six Country case history, 2005 otherwise):

The following chart shows normalized estimated remaining post-Index Year CNE by year for the same four data sets, based on the post-Index Year rates of change in the ECI type ratios:

These charts are through 2011 (for current global and regional data), and I am working on updating the charts to incorporate 2012 annual data, but note that the estimate on the chart for remaining Six Country post-Index Year CNE, 39%, was too high.

The actual Six Country remaining post-1995 CNE value turned out to be 25% at the end of 2001 (Index Year + Six Years), or they shipped 75% of post-1995 CNE as production fell by only 6% in six years, an actual post-1995 CNE depletion rate of 23%/year, versus a production decline rate of 1.0%/year.

My premise is that the current “Undulating Plateau” in key global production numbers is largely an illusion. In my opinion, we are only maintaining something resembling Business As Usual because of sky high rates of depletion in post-2005 Global and Available CNE (Cumulative Net Exports).

Jeffrey J. Brown

Link to my paper on the ECI concept:

http://peak-oil.org/2013/02/commentary-the-export-capacity-index/

And two graphs that compare the declining GNE/CNI ratio (as defined above) to annual Brent crude oil prices and to total global public debt (through 2011):

Because of our rising reliance on EIA data for net export calculations, I’ve switched over to solely using EIA data, and the EIA data show that the GNE/CNI ratio fell from 12.0 in 2002 to 9.5 in 2005 (a -7.8%/year rate of change) and from 9.5 in 2005 to 5.0 in 2012 (-9.2%/year rate of change). At a GNE/CNI ratio of 1.0, China and India alone would theoretically consume 100% of Global Net Exports of oil (GNE).

At the 2005 to 2012 rate of decline in the GNE/CNI ratio, the ratio would theoretically hit 1.0 around the year 2030, in 17 years.

If we look solely at the 2005 to 2012 rate of decline in the ratio of GNE to China's Net Imports, China alone would theoretically consume 100% of GNE in 19 years, around the year 2032.

Brent averaged $112 in 2012, and global public debt showed another large increase in 2012 (Economist Magazine).

I think that developed net oil importing countries are desperately trying to keep their “Wants” based economies going, via deficit spending, financed by real creditors and by accommodative central banks, based on the premise that high oil price are temporary, and they will soon once again enjoy significantly increasing rates of increase in the production of lower priced crude oil.

In my opinion, the reality is that, at least through 2012, developed net oil importing countries like the US were gradually being forced out of the global market for exported oil, via price rationing, as the developing countries, led by China, consumed an increasing share of a post-2005 declining volume of Global Net Exports of oil.

And every month, there are 6-7 million more people on the planet, 6-7 million more mouths to feed, 6-7 million more poor workers clamoring for the middle-class lifestyle...

And every month, a greater portion of that flat 'production' curve comes from biofuels/NGPLs/other liquids less energy dense than oil.

And every month a greater portion comes from tar sands/fracking/deep water and other hard to extract sources meaning the EROEI of the total goes down.

Put all those together and we have a clearly declining net energy per capita that puts the kaibosh on the infinite growth paradigm that the global economy is based on.

A little more interesting than drying paint, but one has to peel back a layer or two to see it all.

That was the value of TOD.

(Will it be onions or the lack of other layer peeling that shall bring a tear to my eye come Sept? Perhaps we should start a new TOD, 'The Onion of Doom' to keep peeling back those layers...)

Oil Supply Disruptions 2013

BlueTwilight is posting news articles about significant disruptions in oil production around the world to correlate changes in EIA production data with those disruptions.

http://www.theplanetbeat.com/content/oil-supply-disruptions-2013

Stuart, great summary of our situation. However, I think you made a typo in your next to last paragraph. You wrote:

I presume that you meant consumption, not production in that sentence...

E. Swanson

You are correct - I will fix.

Thank you for all your work Stuart. I was drawn into The Oil Drum by your early work on HL and exploring ways of forecasting future oil production. I thought your work on Saudi Arabia was first rate!

Oil peaked first. Natural gas and coal have not yet peaked. We are seeing some substitution of natural gas and coal into oil. Even conventional oil production is being supported by steel at low prices. The second fossil peak, natural gas, will be much harder to overcome. Also, depletion of oil fields continues. We still need 5 new Saudi Arabia's to offset declines in existing fields. Shale oil is a nice 30 billion barrels, but where will the other 1500 billion barrels of reserves come from to support 5 Saudi's worth of production?

When looking at the OECD charts, what seems clear is that individual transport using oil has peaked and is being pushed into decline. Those countries that are still mostly using oil for commercial purposes, and have a large domestic energy supply, are able to grow demand. But no one else. I think The End of Suburbia is still a correct analysis of peak oil. And if you have the misfortune to live in Greece then peak oil has arrived in doomer form. The edges of the network are undergoing contraction. Back in the US toward the middle, we still can enjoy the illusion that edge decay will not reach us.

The stories of peak oil are going to now shift into how rising oil prices are putting pressure on other industries. Rising cost for oil causes rising costs for iron mining, causes rising cost for oil drilling, causes rising cost for iron mining, and we roll over the Limits to Growth. Cities unable to pave roads. Auto companies and airlines running without profit. Translating peak oil into everyday impacts.

"Back in the US toward the middle, we still can enjoy the illusion that edge decay will not reach us."

Interesting observation, since those of us paying attention are witness to the decline of places like Detroit and Gary, Indiana, while Phoenix and Vegas are leading the "real estate recovery". Go figure.

I suppose that when the Bakken boom goes bust, those who've benefited the most will move back to somewhere less sustainable like Phoenix or Florida, leaving North Dakota feeling like it's been gang-raped and dumped in a foul ditch, left wondering what happened, with their steers, some coal, and maybe a few stripper wells. They'll go back to what they know, and to a population density that makes sense for what's left of their environment.

Of course, it's all a nonsensical mis-allocation of resources that we can no longer afford, made possible by mass delusion. Perhaps Greece is fortunate in winning the race to the bottom in their part of the world. Vegas is going to make one helluva ghost town someday, while the Greeks will likely have adapted to their new reality, again. The core will be rotting from within for a long time, too big to bail out; too many claims on too few resources.

I enjoyed your work a lot, Stuart. In the end I think our viewpoints were pretty closely aligned. Your blog will continue to be a regular stop for me. All the best.

It may be debatable to call Ace anymore a doomer than Laherrere. After all, the graph by Ace shown above does plot a profile with a 2.23 trillion barrel URR, which is about the same number as Laherrere uses for the crude oil URR. If he calculated the area under the curve correctly, it is the same cumulative as Laherrere, with perhaps just a different glide path.

In terms of how the future unfolds, I hope that the conventional crude oil production statistics continues to be tracked. Eventually, the amount of creative bookkeeping they can do with refinery gains and classifying condensates will become exhausted.

They've been factoring in refinery processing gains for the all liquids numbers forever, so if it's pulling a fast one it's one that has some history behind it. Not sure which condensate you're referring to but the ones in C+C used to be called "natural gasoline" or "casinghead gasoline" owing to the very minimal processing needed to turn them into market ready transportation fuel, so to my way of thinking they are relevant to the discussion at hand. The butane/propane/propylene we're currently awash in is more of a mixed blessing, agreed, but only the uninformed get worked up about the majestic heights of the AL liquid number, instead of focusing on the relevant metric of C+C.

The amount of RFG and other ingredients as a % of the total AL has been growing since 1980, the earliest year we have from the EIA, too.

Very sad to think of our wonderful, informative and stimulating TOD site going dark next week.

To quote Samuel Johnson, the death of TOD "has crushed the spirits of the People and eclipsed the gaiety of nations".

Sad indeed!!

Yet there is something heroic about this darkening, too. Despite all the fascinating contributors and amazing posts, the benefits have been judged to be not worth it.

How many enterprises really are honest enough to examine themselves and say the same thing?

Maybe this honesty is partly because the people involved know that this discourse, PO discourse, has seeped into the mainstream (although sometimes phrased differently) and is therefore being taken care of by the mainstream media now. As well as being addressed by many capable bloggers...

TOD voluntarily cuts its CO2 emissions and provides an example of "do without".

And sends a message indirectly to its many TODers---step away from your computer and build a good life offline too, because ultimately life is lived offline. And will be increasingly lived offline as economies get worse.

An alternative measure is the time it takes for a given investment in energy production equipment to repay the energy that was used to create the asset.

Power satellites constructed with a hypothetical space elevator could have an energy repayment time measured in a few days.

How so? It takes about 15 kWh to lift a kg to GEO using an elevator. Five kg is the estimated mass to produce a kW of power on the ground. So a 75 kWh investment will pay back at a kWh per hour. So the investment repays it's lift cost in three days, no more than six days accounting for the energy in the power satellite parts.

Laser powered rockets are about 8% efficient. A more detailed analysis calculated the energy payback time at 53 days.

Peak upfront investment to reach 100 GW of new power plants per year came in at $60 B, 8 years start to break even, and a ten year ROI of 500%. Shame the oil drum is shutting down and I can't post the details.

Leanan, are we going to get a final post titled "peak oil websites run by our contributors" so we don't have to trawl over the last 2 months of drumbeats to find links to where people are going to be?

cheers,

Marco.

Goodbye The Oil Drum and thanks for all the wonderful and truthful information you have given me all these years. I want to say that I appreciate all those information that I have received. I will remember you always... Until the oil runs out then I would go into survival mode and forget about you.

Leanan just posted on Drumbeat that there's a backlog of key posts, so they'll likely keep coming for at least another week (Sept 6-7), and commenting will be held open for a week after the last posts.

Goody!

FWIW - I can be found at my blog http://earlywarn.blogspot.com. Best wishes to all!

Just wanted to pass on my thanks for all the great articles posted here the past several years. It is with regrets that I say goodbye and all my best to everyone who supported this site.

And thank you, Stuart, for this last article.

In the category of wisheful thinking, if the editors ever change their minds, I'd be glad to pay an annual subsription fee to make keep this site alive.

WVhybrid

ASPO-USA is launching a plausible replacement (check out the 8/30 Drumbeat thread), and ASPO-USA could certainly use some financial support in order to keep the website going. You can easily sign up for a recurring monthly donation. I have been a $50 per month contributor for about a year.

Dennis Coyne and Jeffery Brown aka westexas have chimed in off and on lately at peakoil.com, which is now the dean of peak oil forums it seems. Actually it predates TOD by a year or so. Before that was energyresources or whatever it was called at Yahoo I suppose.

Before TOD and peakoil.c there were active energy discussions on Prodigy, the USENET, a yuku site which later split into two low volume sites (both still in existence), and several Yahoo Groups. The Yahoo groups were originally on Onelist which was purchased by Yahoo. Some of the Yahoo Groups were weird. The Yahoo EnergyResources Group is still active and is probably open to new members. Posts often take two or more days to appear.. There is also a new Yahoo Group which was designed for TOD registrants. Thus far it does not have active discussion.

Prodigy was active throughout the 90's but was a Y2K casualty.The posts were not archived. During the late 90's the USENET included some wild arguments between Jay Hanson and various cornucopians including Michael C Lynch (mclynch) and the famous Stanford computer guru John McCarthy. Some of these posts may still be archived.

Link related to above comment

http://dir.groups.yahoo.com/group/energyresources/message/67525

I think the discussion parts of Usenet (not the binary parts) are pretty well archived at groups.google.com

"There is also a new Yahoo Group which was designed for TOD registrants. Thus far it does not have active discussion."

TODRegistry Yahoo Group is really a place for folks to park their contact info and stay in touch rather than a discussion group. Since TOD is still active, most folks are still commenting here, though I have hopes for some of the new startups. ASPO's "The Energy X-change" may be my goto place, though I plan to focus more on my backlog of chores at home and getting our kids more focused on their plan B. Some of them are getting pretty far out on a BAU limb.

What's interesting is that Parkman Whaling, the investment banking firm in Houston, recently funded Ultra Tech Frac Services to the tune of $21.3 million.

Stuart. The point is a good one but follow the thought.

basically the geopolitics [the big above ground factor] overlays the depletion rate thing. Eventually a big player or region will get hit by some above ground issue and spark a biggy we may not recover from at the perception level and kickstats a new paradigm in the zeitgeist.

Though setting up this scenario where marginal [or not so marginal] effects swing the economy off track is the end in itself. IE the plateau is a precarious position for the world "system" of civilisation to travel on. The range of influences that can effect us is broad and in the world tediously bogged down in day to day concerns which may never be associated with an underlying problem of resource depletion highlights why May 2005 can still be considered "it". With all things being being equal above ground events that occur in a world of plateau C+C are not the same as those that occur on the growth side of the hump.

A rebellion in libya in the 1990's is not the same as one in the 21st century

I have been a reader of the oil drum for many years and would like to express my sincere appreciation to all those who have put so much effort into making it the source of some of the most interesting and informative resources on the internet. Stuart's post is a good example of the kind of intelligent comment that will be greatly missed.

For what it's worth, what the Oil Drum meant to me was a sharp change in world view, a thorough appreciation of the ability for decent discussion to occur on the Web and greater appreciation of just how complicated human society really is.

It's been the most intellectually stimulating endeavour I've ever encountered. Everything from soup to nuts was touch on here, because of course, energy touches on essentially everything humans do.

I'll miss this place and I hope it comes back or a successor site equally good, arises in its place soon.

Thanks to all for their insights and shared wisdom. The group here represents the best that humankind has to offer in the realm of discourse.

I too have learnt so much here and will miss it enormously. Including the Drumbeats which were always varied and interesting and a wonderful timesaver for us all.

Stuarts's summary gets to the core of what interests me most. The big shifts behind our daily conditions, the underlying issues that generates the noise of the markets and politics but that they also conceal. And it seems to me that Stuart's opening chart clearly shows the things are certain to get very interesting indeed, the only questions being when, exactly, and how in detail.

There are always above ground issues in this globally extracted and traded vital resource that underpins every detail of our lives in the west and increasingly the rest of the world. So the key issue is surely about how much wriggle room does the current and future supply/demand balance offer to absorb the certain outages and upsets from human interactions?

It is clear that unconventional oil cannot have the impact that the North Sea, Cantarell, Alaskan fields had in the eighties that bought the west another two decades of Motordom and sprawl and global hegemony. The unexpected access to US fracked oil plus the demand destruction there and in Europe look to have bought this system years not decades. Not least because the developing world is willing and able to buy any surplus product available but also because the volumes (US) and rate (Canada) are simple insufficient to change the global supply situation no matter how meaningful they are locally.

Viewing all this at some distance from North America it is interesting to note how both the best and the worse analysis is centred there (TOD v Fox) so a near term moment of real significance will be (and I think it has begun) when the mainstream discovers that fracked oil will not make the US independent from imports and even more important when that production begins to decline. Real anger is my guess, a sense of betrayal, especially if matched, as is surely likely, with pain at the pump.

The tone of the discussion could change very very quickly,and price movements may become very volatile.

I hope TOD can be resuscitated when the inevitable 'non-boring' times reappear. But until then: Thank you all so much.