Saudi Arabia and that $1000 bet

Posted by Euan Mearns on March 7, 2007 - 11:00am in The Oil Drum: Europe

First of all congratulations to Stuart for busting some records with his post "Saudi Arabian oil declines 8% in 2006" published on 2nd March. I was unavailable to comment that day but feel there are several cautionary observations that need to be made before jumping to any conclusion about the end of the oil age. If Stuart is right, and he may be, then the consequences may be dire.

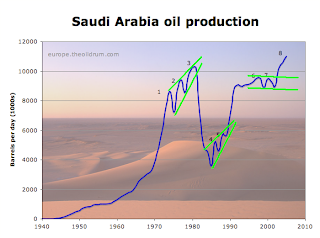

In the last decade, monthly Saudi Arabian oil production has undergone cyclic decline on 4 occasions - 1998, 2001, 2003 and 2006. So how can anyone be sure that the present production decline signals a terminal slide in Saudi production?

Monthly oil production for Saudi Arabia reported by the International Energy Agency (eia) believed to be crude oil+condensate (C+C).

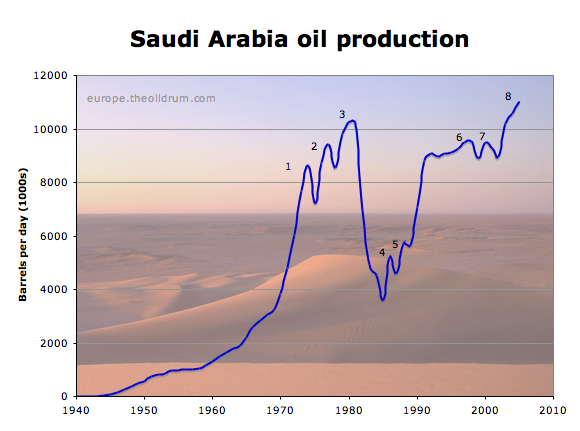

Annual oil production for Saudi Arabia C+C+NGL. From 1965 the data are from the BP statistical review.

The annual average production data from BP show that since 1970 there have been 8 peaks in Saudi oil production followed by decline. (note that BP quote crude + condensate + natural gas liquids (C+C+NGL) while the eia data are C+C). There is no disputing that the declines following peaks 1 to 7 were caused by voluntary restraint, Saudi Arabia playing the roll of swing producer. The big question is whether recent declines from peak number 8 are voluntary or not?

Stuart is arguing that at the beginning of 2005, Saudi Arabia switched from swing producer to a supply constrained producer and the main lines of his argument are:

"They have never had declining production in the face of high and rising prices before. And they have never had supply side events show through in the production profile before" (from email correspondence)

So lets examine these two cornerstones of Stuart's argument.

Oil Price

According to the Energy Information Agency (eia), the decline in Saudi production began in April 2006. The oil price was indeed still rising at this time and did not peak until June 2006. But since June 2006 both oil price and Saudi production have been falling. The June 2006 oil price peak was the final spurt of a speculative boom fuelled by rising demand for oil, a narrowing of spare productive capacity and international tension over Iran, Iraq, North Korea to name but a few tense areas.

High oil prices worked their magic, dampened demand growth and stimulated a global exploration and production effort with the oil industry working flat out, everywhere. There is no shortage of oil throughout the OECD. US and European inventories remain high.

Faced with this scenario, it seems plausible to me that Saudi Arabia and other OPEC countries have cut production in order to support prices at the $60 level which does not seem to present any problem to the developed world economies. That is what the Saudis say they have done and I can see no evidence or reason to doubt it.

Supply Side Events

So what about Stuart's assertion that commissioning of the Haradh gas oil separation plant (GOSP) is recognisable as a 300 kbpd blip on the decline curve. Whilst I am not entirely convinced by this chart, produced by averaging three of four data sources, I am happy to accept the possibility that it may be a valid observation and offer an alternative explanation.

Falling Saudi Arabian oil production, monthly averages from three sources - the US EIA, the OECD iea and JODI. From Staniford "Saudi Arabian oil declines 8% in 2006"

The Saudis have to run their oil production on different planning time scales. The planning and construction of the Haradh 3 GOSP probably took several years and of course, once complete it was immediately commissioned. At the same time the Saudis claimed they were cutting production in response to flat world demand for oil. They have done this many times before and it seems likely that inefficient production from wells with high water cut and from low permeability reservoirs would be shut down (see below). There is no conflict between the Saudis cutting production from inefficient wells simultaneous with new, dry oil production being brought on stream. The 300 kbpd blip, if valid, may therefore reflect new production coming on at a time of voluntary restraint. Mothballed wells add to the Saudi's reserve capacity.

The Smoking Gun

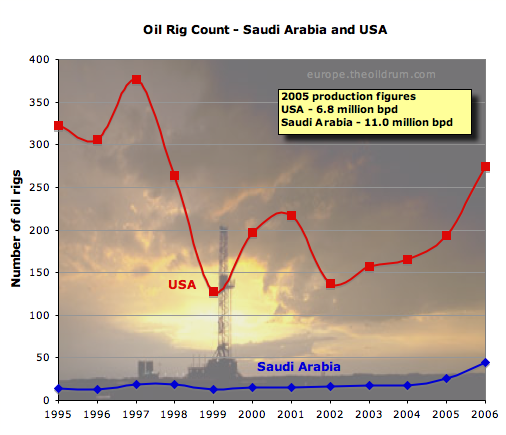

There has been much debate about the increase in the number of oil drilling rigs operating in Saudi Arabia which are up from around 17 in 2004 to over 50 in 2006. The fact that oil production has actually fallen whilst the number of rigs has increased in seen by many as a sign of crisis.

Saudi oil rig count compared with variations in the US rig count, believed to be onshore and offshore rigs. Whilst the relative growth in Saudi rigs is high (approximate 3 fold increase) this is starting from a very low baseline and the absolute rise of around 40 rigs over two years is trivial compared to the production volumes. International rig count and US rig count from Baker Hughes.

Another way of looking at this however, is that Saudi Arabia maintained oil production capacity of over 9 million bpd for many years with only 17 drilling rigs. The recent increase is very modest in absolute terms. The additional rigs may be drilling new developments such as Khurais, reported to be using 23 rigs, which are not yet on stream. But even when these new developments come on, Saudi production may not necessarily rise - because the market is currently satiated.

The Quality of Saudi Reservoirs

Most of the oil reservoirs in the Middle East are limestone and the quality of those reservoirs is highly variable. Without going into detail, Saudi reservoirs have two significant problems which are both related to permeability (the ease with which fluids may fow through the rock).

Low permeability reservoirs - not surprisingly, the Saudis developed their best (high permeability) reservoirs first and are now having to fall back upon the second tier, lower permeability assets. The problem is amply demonstrated in Ghawar where the north end of the field has fabulous reservoir quality, average permeability over 500 mD, whilst the south end of the field (which still contains a lot of oil) has poor reservoir quality with average permeability under 70 mD (see below). The low permeability reservoirs produce more slowly and require a larger number of wells (hence the increase in drilling rigs?). Saudi reservoir engineers will welcome the opportunity to rest the low permeability reservoirs to allow pressure to rebound as described by Matthew Simmons on p171 of Twilight in the Dessert.

High permeability streaks - also known as super-K horizons. These lead to injected water flooding producers prematurely and unpredictably giving rise to the much-publicised problems associated with water flooding and reservoir management. Again, reservoir and petroleum engineers would welcome any opportunity to trade wells with high water cut for new dry oil production.

Wells mothballed on grounds of high water cut or low reservoir pressure will benefit from the rest and when production is resumed, as needs require, they will for a short while perform much better than prior to shutdown.

| average porosity | average permeability | |

|---|---|---|

| Ain Dar | 19% | 617mD |

| Shedgum | 19% | 639mD |

| Uthmaniyah | 18% | 220mD |

| Hawiyah | 17% | 68mD |

| Haradh | 14% | 52mD |

A balanced perspective

I am trying to bring some balance to the debate on Saudi oil production. On the one hand, Saudi Aramco and the eia are forecasting "forever rising" production whilst Matthew Simmons now joined by Stuart are forecasting rapid and terminal decline in Saudi oil production. As is often the case, reality probably lies somewhere between these two extremes.- There is little doubt that Saudi oil production has fallen steadily since April 2006. The fact that this can be measured in four different ways means very little. It would be surprising if the different agencies were not in general agreement with each other.

- In my opinion, there is no hard evidence to support that this fall in production is involuntary.

- Similarly, there is no hard evidence to prove it is voluntary. But given the long history of Saudi Arabia acting as global swing producer, in my opinion, hard evidence would be required to prove that this had ceased to be the case. Such evidence may include: 1) falling global oil production 2) escalating oil prices and 3) falling OECD inventories. Right now, none of these tests are satisfied.

- Saudi petroleum engineers would welcome the opportunity to rest wells with low reservoir pressure or high water cuts and their is no conflict is substituting this type of inefficient production for dry oil production from new projects.

- I am in total agreement that Saudi oil production is entering a new era. In the past, over 9 million barrels per day could be achieved with relative ease. Their best assets are mature and may be in decline. In the future, much greater effort will probably be required to sustain production over 9 million barrels per day.

That $1000 bet

I'll bet $1000 with the first person who cares to take me up on it that the international oil agencies will never report sustained Saudi production of crude+condensate of 10.7 million barrels or more. Stuart Staniford, 2nd March 2007

High stakes and long odds! If Stuart was so confident that Saudi production was heading south for good then he would not have set the bar so high.

Forget ye not the reddits and the diggs, nor the link farms. This is a debate that needs to get as many eyes as possible...let's help Euan get readers!

Can someone please disprove this one? Show me the pipeline is officially in use or really isn't in use so I can relax.

The Saudi-Iraq pipeline

This says it was repaired and ready to go in 2002.

http://www.menewsline.com/stories/2002/june/06_18_3.html

Something is not right here. The above article says it was repaired and ready to go in 2002. Yet in 2003 there appears to have been a media campaign to state that the pipeline was unusable as it had not been touched since since 1990 when it was closed and had massive corrosion.

http://www.gasandoil.com/goc/news/ntm34663.htm

Is this one of those things you don't want to touch or you'll die like in "Syriana"?

Is it possible that stolen Iraqi Oil is being pumped to and laundered through Saudi Arabia?

My personal bet is that Kuwait is Iraq's laundry. Both based on some interesting photo interpretation from a retired Air Force colonel, and the fact that Kuwait and Iraq 'share' an oil region.

This doesn't mean that Kuwait has to have a monopoly, of course - supporting the invisible hand that runs our affairs is part of what makes the Bush League tick.

Would be very ironic. First, provoke an invasion..

Only one complaint with this theory, though: Why would Kuwait be dropping their reserves numbers, either officially or unofficially?

Reserves are one thing, oil/cash flow another.

Here is how my theory goes -

1. Kuwait is on par with Saudi Arabia in terms of its American connection - without KSA's Mecca hole card

2. After Iraq's invasion. Kuwait's infrastructure was rebuilt - and the people doing the rebuilding certainly had a longer term perspective than just the next quarterly report (remember, Bush I was in charge - and just by coincidence, a second Bush is now in charge, courtesy of several Bush I Supreme Court appointees).

3. According to international law, you just can't invade and steal a nation's resources - not that Bush II cares that much about laws, as we've seen, but there are still some constraints - notice the unsuccessful Chavez regime change.

4. After having overbuilt Kuwait's exporting infrastructure while no one was really paying attention, pointing out that the Iraqis are to blame for a drop in their exports is simple, as it certainly contains an element of truth.

5. Everybody except the Iraqis splits the cash, and drives off into the sunset. The invisible hand at work.

Actually, this is the sort of theory which could be proven to a degree - there are enough physical elements which can be checked. For example, if Kuwait had facilities to load 4 tankers a day before the Iraqi invasion, and they were rebuilt with the capacity to load 8 afterwards - or if the tanker loads from Kuwait increased measurably after the U.S. invasion. Or rig activity on the border between the two countries.

This also leads to a certain amount of speculation about reserves - perhaps the Kuwaitis were also counting on an oil bonanza to allow them to keep up the pretense that their reserves were still large, with production to match. But then, the amount of Iraqi oil to plunder was less than planned on - reality seems to be a real weak point in much of the Bush League's planning, in my opinion (ah, roses - the smell of victory). This information would be much harder to confirm, obviously.

"This information would be much harder to confirm, obviously"

I found rig count data back to 1998.

Don't see any obvious anomolies - unless, of course, the rigs have been moved to the iraqi border.

Or it was directly after GWI - anyone with better/longer data?

One of the things to keep in mind is that the Saudi King was replaced in August 2005. The policies in place before August 2005 are not indicative of the policies in place post August 2005. Specifically, the concept of what is the fair price for a barrel of oil. In August 2005 the Saudi's view of the fair price of oil moved from $25 to $60.

The same man was in charge after August 2005 as was before August 2005. Crown prince Abdullah took over when King Fahd became incapacitated by a stroke in 1995. When the King died in 2005, Crown Prince Abdullah simply took the title as king. But he had been in power already for ten years.

No power changed hands in August 1995. Power remained in the same hands as it was before the king died.

Ron Patterson

Beng the guy who has the most influence while the king is incapacitated is not the same as being "The King".

Ever notice that people don’t trot out their articles when the data contradict their prediction? But since the data support the prediction, here it is again.

http://www.energybulletin.net/16459.html

Published on 24 May 2006 by GraphOilogy. Archived on 25 May 2006.

Texas and US Lower 48 oil production as a model for Saudi Arabia and the world

by Jeffrey J. Brown & "Khebab"

Texas, like Saudi Arabia, produced at less than capacity for long periods of time, thus the following plot, based on the assumption that Saudi Arabia was likely to start declining at the same stage of depletion at which Texas started declining.

Texas, in 1972, relative to Saudi Arabia, in 2005:

http://static.flickr.com/55/145186318_27a012448e_o.png

In regard to oil prices, the average monthly Brent spot crude price was $38 in the 20 months prior to 5/05, versus $62 in the 20 months after 5/05 (within a range of $54 to $74). And of course, 5/05 was the highest crude + condensate production so far (EIA). The cumulative shortfall in what we would have produced at the 5/05 rate and what we actually produced is on the order of 366 million barrels of crude + condensate (through 12/06). BTW, I would put the most recent Saudi peak at 9.6 mbpd, in 9/05.

In my opinion, we have seen some reduced demand, primarily in poorer regions like Africa, because of a physical inability to buy energy. I think that $62 has been sufficient, so far, to balance reduced demand against lower supply. But I suspect that we are about to start a new round of bidding for declining production--and especially declining exports.

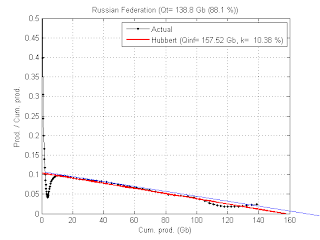

In regard to the HL model, to expect to see sustained rising production from the 60% of Qt mark, which is where Saudi Arabia currently is, is to expect to see that which we have never seen, insofar as I know, in any large producing province (60 Gb or more).

In fact, Saudi Arabia is right between the 50% mark at which the North Sea peaked, and the 70% mark, where the North Sea is currently. No one (outside CERA at least) questions the reality of the North Sea decline, so why is the Saudi decline so shocking?

While it is true that the Texas HL plot was quite noisy prior to the peak, we can get an accurate HL plot for Texas now, and the Saudi HL plot has been quite consistent. The infamous “dogleg” in the last three or four years of Saudi data was also seen right before the Texas peak.

Also, on an annual basis, the 2005 to 2006 decline in Saudi production of 4.3% (C+C) is quite close to the long term Texas decline rate of about 4%.

One thing that puzzles me is why were Iraq, Russia and “Other” able to find buyers for a total increase of about 900,00 bpd (12/05 to 12/06, C+C), but Saudi Arabia had to cut their production by about 700,000 bpd?

WT: I added this comment late to the exchange you had with RR, in response to RR, on the orginal Staniford thread:

http://www.theoildrum.com/comment/reply/2325/165766

Gregor

There are many ways to make an analysis.

I prefer charts.

If Saudi oil production were a stock, we could easily find a "rising wedge", which is very bearish for production.

Top beginning Jan. '98

Bottom beginning Jan. '02

If I knew how to upload the pic...

Graphs of the market measure human reactions in group situations. A chart of production is about geology, not human reactions (though there may be some recession/geopolitics embedded in the graph). If geology follows a graph, it would be something like a hubbert graph - not a 'rising wedge'.

Technical analysis in the market doesnt work anyways. Most people that look at charts dont make money doing so but recognize a certain pattern that worked in the past or they read about in some technical analysis book. They remember the times it worked and selectively forget about the times it didnt.

Any market chart pattern can turn into any other chart pattern and usually does.

Well, I think Geology determines where 50% is - the point at which the absolute top is reached. Not HOW we get there. Not HOW we leave there.

If you look at the oil production graph of the WORLD, you will notice that it followed a bell shape until 1974. And then?

It formed a left shoulder:-)

And did it then return to the bell curve?

No.

Why? Price restrictions, political restrictions, infrastructure restrictions. This has NOTHING to do with geology. This is what you call "human reaction" (hate to mention it, but it would concur to CERA's above ground factors).

I happen to see all this on a chart, just like I called September 2003 as the start of the oil bull market. Why? Because of the price chart (in combination wiht the fundamentals of PO and Chinese demand and especially because of the sustained price pressure after GWII was quickly "won"). My father, an old oil man, didn't believe me.

I am not going to defend chart techniques, which is more of an art than a science or whatever.

BUT I would refuse right now to BET on Stuart's conclusion that SA has maxed out because I need a confirmation from the chart - a rising wedge can break in both directions, and it has not broken yet. It is approaching its lower support line.

For what it's worth..

"They remember the times it worked.."

The problem with a lot of chart technic is that it is best seen in the rear view mirror. Sound familiar?

Besides, let's just test the hypothesis. Here's the chart:

As a trader, I would not bet on SA's fall until the line at the bottom is broken. I have a fundamental idea (call me Stuart, convinced that production has peaked) but wait for a market "signal" to make the trade..

Now, how about historical information in a field that is very humanly driven (factor "human reaction")? I'm using a much greater time frame, basically comparing apples with oranges in the two charts:

Like I said, for what it's worth..

Westtexas, I suppose many of us are quite familiar with your HL analyses, which seem to me helpful and informative. I have a few problems relying on HL analyses for SA.

1) We don't have sufficient data to say SA's Qt is what you say it is.

2) HL is not perfectly predictive. I recall one HL analysis where the predicted Qt was quite short of actual because the line trended up at a point.

In order of importance, 1) is more important that 2), and 2) injects sufficient uncertainty, for me, to prevent saying anything definitive about future Saudi capacity.

HL error is non-linear post peak its pratically nill +/- 5% at most and this is from intrinsic production issues. Leading up to the peak I'm guessing its less than 10% if your within 5% of the peak. Once more I remind Mr Rapier he promised a post on HL error.

Multi peak scenarios have their own peak issues leading to a systematic error when depending on how you convolve the peaks.

Probably a simple retreat to taking the area under the curve and constructing a total simple area is the easiest and close enough.

One thing thats not been brought out but should is the production decreases we see are generally short lived and don't actually effect the final date of peak production all that much within the error of HL analysis. The shift in a production period spanning decades is on the order of years well withing the +-5% that I think HL has.

Right now we are in the pivotal point that is either a few years post peak or a few years pre-peak so lots of room for discussion.

I have noticed that recently as peak has become a stronger possibility that we have lost sight of the fact that these few years really don't effect the final result all that much. Its a matter of peak now or before 2015 in the big picture it does not matter. Even if production increases base demand if oil was cheap is already greater than supply so the era of cheap oil is already in the rear view mirror.

We are now concerned when real shortages will develop.

Then of course the EROI peak which I think will be far worse.

Once more I remind Mr Rapier he promised a post on HL error.

As you might guess, I have had a lot going on, an inconsistent Internet connection, and frankly this has been of low priority for me. I also haven't decided the best way to approach the problem. I could start in 2000 and generate a year by year HL of Saudi (or Texas in 1960) and show how they change over time. Do you think this would suffice? It would give a series of data points that have bounced around, giving us a standard deviation for a particular time period.

Suggestions are welcome, but I can't say when I will get around to it. I have several other things I am working on, but I do agree that this would be an interesting analysis to present.

I'd say you need to show when error is bad say 20%

and work back from their I don't know what year that is

or the time scale but thats enough for some cool results.

Once you show error drops under 20% and the error bars on the years of peak drop thats enough.

I think we can safely determine when we are 20% post peak for texas. I think that everyone here figures we are less than this now for the world.

I just don't know what the resulting error spread in years is.

But running Texas/ lower 48 through this analysis will give us a excellent handle on how well we understand peak oil and we have the North Sea as a test.

In any case I think if you do this you can be 100% confident in predicting peak oil for the world within this range.

You push that we must know the right answer my response is we have enough data to be confident about the world peak within a error range. Yes it means the public will need to understand error but we have almost 100% confidence in the numbers.

In any case backing off to a 20% error range for a known case makes good sense. Initially maybe go higher but you get the drift early on HL has like 500% error bars.

memmel, you are exactly right that the position of Saudi/world production

Memmel, I believe that you are exactly right that the timing of the determination of the peak is impossible to determine with the data we have available and the important thing to notice is that the era of inexpensive crude is over. Its the unanswerable arguement for the Cornucopians.

Let them keep redefining the definition of crude to include kerogen (oil shales) and bitumen (tar sands) so that their reserve figures are preposterous, and include ethanol and buidiesel in the oil production figures. The public could care less about the number of barrels per day, but they damn sure notice a nickle bobble in price at the pump.

Hi m,

re: "Then of course the EROI peak which I think will be far worse."

Is there any way to get an analytical handle on this? Has anyone applied the methods that exist to looking at the situation we face?

I assume that you are referring to the UK plot, which showed an initial P/Q intercept of 30%. The problem with this is that there is no example of a large producing region showing anything remotely close to a long term 30% P/Q intercept. Most of them are between 5% and 10%. The only two outliers that I know about are the UK and Iran, which are around 13%.

The "Early Peak" UK HL plot is just an example of doing the HL plot too early in the data set.

The overall North Sea peaked at the same stage of depletion as the Lower 48, Mexico and apparently the world. Russia also hit a plateau at 50% of Qt.

I'd like to see a longer term chart comparing Texas and SA oil production. Did Texas have the kinds of ups and downs that SA shows when we go back to the 1960s as in the charts in the main post? Your chart overlaying SA and Texas production only takes SA back to the 1990s, where there are no peaks visible. If you're going to claim the two are comparable, let's see more data.

Euan - Dumb questions, from your post...

average porosity

19(%) vrs 14(%)

19 is 135% more than 14

average permeability

617 vs 52

617 is 1,186% more than 52

These two figures are extreemly different, and I assume permeability must be the most important one for rapid extraction. hence which field gets developed first is because of this. Is this correct?

Never mind the words should make this obvious.

If you were to compare KSA with Texas are the #'s similiar? Can the decline rates be similiar?

Does this even matter in regards to HL?

Like I said dumb questions...

Never mind (reread and think!) self answering questions.

:) I think I will go outside now. thanks

D

The distinction is that the reservoir rock in the "good" sectors offers essentially zero resistance to fluid flow. To put it in handwaving terms, there don't exist any rigs capable of drilling wells with an internal diameter big enough to take everything that the reservoir could throw at them. Whereas the hydraulic resistance of the reservoir in the "poor" areas is appreciable, i.e. you'd need to take it into account to figure a precise estimate of well flowrate. It's still a pretty damn good reservoir.

Looking at the table that Euan cited, the reservoir quality in even the "poor" areas should be enough to allow flowrates of over 10,000 barrels per day per well - possibly MUCH higher. That would be a regular cased and perforated well, or maybe even a barefoot completion in this competent limestone; nothing especially fancy, certainly not a bottle-brush.

Any "normal" oil company would gladly give its gonads for a clear run at something like Haradh.

In Ag there are terms relating to water content in soil. Between 100% dry soil(oven dried) and 100% wet soil(field capacity) there are other important conditions. Microscopically held water can exist, > oven dried, but is not available to the plants as it is held to tightly by the soil particles. Between field capacity with 0% air and microscopically held is "available water" for plants. (Generally most plants need some air around thier roots but that is besides the point).

Can I assume that oil is similiar in that there will be a film of oil left on these rocks when "available oil" is removed?

This "steaming" process, can or do they incorporate some sort of "detergent" to cut the oil loose?

If you check the link to Greg Croft you''l see that water satuartion levels of around 11% are quoted. That means that 11% of the pore volume is filled with water and the remaining 89% with oil.

Limestone reservoirs are often viewed as oil wet, i.e. it is oil that wets the carbonate matrix. During production you hope to recover 30 to 50% of the oil in place, the produced oil gets replaced with aquifer or injected water.

A lot of the oil gets left behind and incraesing the recovery of that residual oil has been the focus of much research over the years. The problem is that with water saturation over 50%, the oil gets discontinuous in the reservoir and cannot flow.

Thank you both for answering.

Obviously oil is like alot of other things - part education, part art, and luck never hurts.

Euan, Thanks for the additional educated perspective.

RE inventories: It has been mentioned, on occasion, how crude inventories can be a contra-indicator of crude scarcity. If a refiner has spare tankage and anticipates higher prices in the future (contango) he would tend to fill the tanks to the max, whereas in a market that anticipates lower prices (higher supply at the oil field) he would be relaxed about leaving a few tanks empty. Do you think this may play a part in how we read these tea leaves?

Ah, I see Gregor's post above which addresses these issues. Thanks Gregor.

Great data in this story by Stuart:

http://www.theoildrum.com/story/2006/1/28/01820/6609

He describes a slowing North American economy:

Oil consumption tends to decline along with GDP. I'm sure that KSA observed the same economic trends as Stuart and made a decision to remove production from the market and seek to maintain pricing.

As for the bet, we need Stuart to clarify what period of time is represented by "sustained" Saudi production. Euan, if you were to take Stuart up on his bet, I'll take a quarter tranche from you. Maybe RR will take another quarter tranche and then we just need a final fourth party. Note that the bet stipulates an infinite future so we can wait forever for KSA to report that 10.7 million barrels.

Of course this also means we wait forever to collect from Stuart :-)

Cheers!

Mr. account:

You have forgotten one caveat in the current state of energy consumption/production in today's "global" economy; that would be China. Their economy has grown such that they now are the second largest oil importer behind the US at about 4 million barrels per day. Their oil consumption has been growing by 10 to 15% per year for several years. Even if the world economy slows, they will still import huge amounts of oil for their economic engine that the government is controlling.

Even if its exports fall, China's GDP may not fall as fast as the US or EU because of that $1.1 trillion in cash that the banks of China can use to help keep that engine running at near full throttle.

Mr Train:

My conjecture would be as follows -

1) KSA observed possible economic decline in OECD and made decision to reduce production to protect price.

2) OECD decline was not as weak as expected plus there was additional take up from the Chinese economy as you have stated.

3) Both of the above factors resulted in rising prices in the face of pre-planned declining KSA production.

4) Price rise was exacerbated by speculators entering market. This diverted production to inventory, created problems for non-speculative buyers and triggered a speculative bubble which is now in the process of unwinding.

In addition to not having factual data on KSA fundamentals, we also lack factual data on fundamentals of Chinese economy. We also need to take into account the relatively long lag times between action and result in a fairly complex global production system.

Cheers!

Maybe RR will take another quarter tranche and then we just need a final fourth party. Note that the bet stipulates an infinite future so we can wait forever for KSA to report that 10.7 million barrels.

There are several factors at play here. No doubt there are existing fields that are depleting. So that is a major factor. They also have fields that they are developing. My guess is that they are trying to forecast demand and develop fields as demand warrants it. But, the longer it takes demand to pick up, the more depletion they have had to contend with. So, it is not just a matter of "Can they do it?" If they believed 10 years ago that demand right now from them would require 10.7 million barrels a day, they could have accelerated their existing projects and they could have done it.

As it is, I am in agreement that Ghawar is close to peaking, and when it does they will have a struggle pushing production up. Bottom line: Could they have done it in 2007 if they had started planning 10 years ago? Yes, I think so. Given the situation now, will they be able to do it in the next 5 years? I wouldn't take that bet.

What I do say though is that if the country is in terminal decline they shouldn't be able to increase their production from here. My prediction is that they will. I think that's what is meant by setting the bar high. Stuart is suggesting that they have peaked, but wants them to demonstrate something far above today's production levels. If they really have peaked, 9 million bpd should suffice to win the bet.

>As it is, I am in agreement that Ghawar is close to peaking, and when it does they will have a struggle pushing production up

Ghawar Peaked in 1981. Production is now leaving its multi-decade plateu and is very likely entering terminal decline. There is a big difference between "peaking" and "terminal decline".

Hypothetically, even if KSA was able to magically increase production it doesn't matter. All of the existing supergiants (except for one) are either in the high single digit or low double digit declines and it takes an awful lot of small field production just to offset those declines.

We have a situation where advanced technology has enabled us to maintance high production rates at the expense of much steeper declines in the future. Global there is very little effort focused on mitigation projects to prepare our infrastructure for a world with less oil and more expensive oil. We will soon be facing a severe economic recession (probably in the the next 12 to 18 months) which will will never crawl out of during my our your lifetime. Some of this will be related to energy, some do to economy imbalances that have been ongoing for decades.

That was precisely the bet I offered for precisely that reason. Then someone piped in effectively saying "well why don't you bet 10 for a *real* bet," entirely missing the point.

new account and Robert - I had considered wagering that we do see a monthly average 9.3 million bpd C+C (eia accounting) from Saudi Arabia before 2012 and would be happy to go $1000/4 on that basis.

Stuart - are you up for that?

Euan:

I'm in.

Robert's busy so we may not hear from him for a bit. And we still need someone to pick up the fourth tranche. Any fellow TODders willing to make life more interesting than it already is?

I expect we'll see "9.3 million bpd C+C (eia accounting) from Saudi Arabia before 2012", I expect they could burst up to that for a few months from storage if there was the market for it (Iran off-line?). But I doubt Stuart would go for it - that's a long way short of his 10.7 mbpd.

There is no hard evidence to support that this fall in production is involuntary

There is no hard evidence to prove it is voluntary

There is no "hard" evidence.

There is endless nonsense, however, and since I love that stuff, keep it up!

Bring it on!

Good article Euan, and it goes to show that with similar data a different conclusion can be reached - ergo it is not possible at this moment in time to make a declaration one way or another.

I am glad you brought up the rigs issue - the increase in SA in the past few years (often accompanied with the assertion that they are engaged in a drilling frenzy) is in my view wrongly used as a clinching piece of evidence. A quick examination of the Baker Hughes data shows that even such low level producers as India and Argentina still have more rigs in country than SA, and the former has shown a not dissimilar increase in rig utilisation. The comment is made 'ah yes but they are producing less with more rigs' - but as you point out, there need be no absolute correlation between the two anyway if the decision has been made to cut production to husband older resources, and ready newer fields to share the production burden.

Thus to my mind the rig issue in SA is:

a) Not as anywhere dramatic as some believe - absolute numbers are still tiny, compared to the US, or even some small producers

b) Another interpretation of the increase in rig numbers (response to higher prices, need to bring on back up fields) is just as valid as the one traditionally made

As I have stated previously, none of this makes any difference to me and where I am in my PO preparations, but it could make a deal of difference in terms of how TOD is viewed in the future.

Euan, calling the peak in KSA is really irrelevant here. My question to you is, are you worried about it? Is it a remote possibility? If so, do you think it prudent to start thinking about the future...planning for the inevitable?

Dragonfly - wrt to global peak, I've pinned my colours to 2012±3 years based on khebabs loglets / HL - so yes I think folks should be worrried. In calling Saudi decline, Staurt is more or less calling peak now. I see recent flat production and falling Saudi production as a reflection of demand and believe that when demand picks up (and or production continues to slide else where) that Saudi production will rise again - how high I don't know, but I would bet on over 9.3 million C+C for a short spurt.

I beleive (and this is only conjecture) that the Saudis will have a large number of wells shut in and that these may be brought on as required.

So, here we have two expert analysts saying that KSA peak is probably somewhere between now and 6 years from now. This precision can be debated by experts for awhile longer, but for those reading these posts that are not experts, it really indicates that it is time to do something...prepare on a personal-level, contact local/federal politicians, look at the world in a much different fashion.

Thanks Euan and Stuart for all the hard work, but it is looking more and more that CERA is wrong and there will be a more near term peak than a later term peak.

I know this is tiresome, but there is one area where we know we most definitely have not peaked, and that is with respect to the emissions of greeenhouse gases. Regardless of who is right about peak oil, this debate will continue for the next several years regardless of the true peak. And then there will be serveral more years of arguments about what caused the peak and whether we could have delayed the peak with even more aggressive drilling in every area of the world that has heretofore been considered "sensitive". Why, I am sure there are people, including in congress, who will argue that we can even return to the glory days of supply in the U.S.A.

There is one area where it is clear that we have to do something and that something is to reduce the burning of fossil fuels. Otherwise, we are just arguing with the addict about whether there is sufficient heroin to keep him from the horrors of withrawal.

Given the overwhelming and immediate need to cut the consumption of oil and all other fossil fuels, could it be that the debate about peak oil is counterproductive? If one engages in the debate with the likes of CERA, for example, the mind becomes focused on the idea that this debate is really important. Some would argue that it is important because we must convince people to compare for the deluge or, as it were, the absence of of the deluge, the abundance of oil and the continuation of Happy Motoring. But either way, you can't win. If there is peak oil, we are assured that oil sands, tar sands, ethanol, and coal liquids will save us. If there is not peak oil, we can continue our lifestyle for decases without a worry.

Given what the Chinese, the U.S. and others are doing to reduce their dependence upon oil, I almost wish the peak oil denialists had truly won the day. The Chinese, for example, don't worry their pretty little heads about the exact date or even decade when peak oil will arrive. They know their appetite is voracious and will be even more so; therefore, they pursue everything, every last btu they can extract out of anything to the ends of the earth. Meanwhile, the U.S. digs its own graves in the Middle East.

Coal production has really taken off this past 5 years and that is a worrying trend that I suspect will just get worse.

In Aberdeen our politicians are still dead keen on building more roads and extending the local airport. Its tough to get through to politicians. When you suggest there may not be enough fuel to put in the planes their eyes just glaze over.

Right on the mark, Dave. A further implication from the current state of evidence is this: a person who says SA's current decline is involuntary (not to mention irreversible) cannot even be proven to have been right---except in having guessed correctly (but then who cares)---if in fact the decline turns out to be such.

Alright, Dave has gone Postal now. I'm glad you don't know where I live. He only took his ball and went home to get his gun.

That's it in a nut shell - and I believe we need hard evidence before calling the terminal decline of Saudi Arabia as an oil producer.

Though I understand, and often support, the academic stance of requiring "hard evidence" for critical claims, I'm not sure that such a position is a good one in the case of world peak-oil. Factor in risk assessment. What are the potential outcomes for people world-wide post-peak? Perhaps waiting for concrete evidence in this case is an unwise decision. Sometimes survival depends on interpreting the best information available and then acting, even if there is significant uncertainty. I think that's what people like Staniford, West Texas, and Simmons are doing.

Close to my own personal opinion, what difference does it make really—peak oil in 2005, 2008 or 2013? Acting now to deal with this major problem is in our best interest. I like the idea of exploring the error bars in HL, discussed above, and coming up with an interval of years for peak that has a high degree of confidence. I hope to see something like that soon.

-best,

Wolf Read

I think your right that we ought not to get too hung up on certain details. And it does seem that Staurt's position and mine are not to distant in the grander scheme.

The precautionary principal is difficult to apply to pending disasters. A smoking volcano that may errupt in 5 days or 5 years - when do you evacuate?

WRT errors and HL - Khebab may be a better bet than Robert - he was talking about boot strapping the other week - so I'll make sure he gets the message.

WRT errors and HL - Khebab may be a better bet than Robert

I would say that he is probably in a better position short term to get this done. I won't be able to tackle it for a bit.

Hello grey

re: "...coming up with an interval of years for peak that has a high degree of confidence. I hope to see something like that soon."

Yes. Saying "we don't know" or "evidence inconclusive" is less than optimal, if "we" (or some of us, anyway) have the ability to make explicit a specified error range, and can specify any other qualifications (confidence level, assumptions or whatever.) Further, to specify multiple approaches (and any qualifications attached to them) would be the icing on the argument.

Even to agree on a form for this would be nice. I noticed, for example, Robert the other day said peak "could be" in 2013. So, is the best presentation in terms of dates? Or, something else?

It seems important...not only because it would encompass both Robert's and Jeffrey's concerns, but also in view of a human tendency to give the easiest (less stressful, perhaps) interpretation to a phrase like "inconclusive data".

(Re-stating, perhaps, the obvious.)

I don't see any "hard" evidence that we will ever get "hard" evidence.

Is it just me or did that post seem a little weird...

Hi Steve001,

Re: "just me". I have the impression Dave's been upset for a while. (At least, he seemed upset back when HO posted his "energy conference summary"). I don't think he means it the way it might come across if one hadn't been reading. (But you could ask him. Of course.) As best I can tell, it means kind of like..."we/you all are wasting your time and we'd better get to work."

The Staniford Post on KSR has now reached mention in the Wall Street Journal, in today's WSJ Energy Blog.

March 6, 2007, 5:06 pm

Blog Roll — Pondering Saudi Arabia’s Falling Production

Writing on his blog, The Cost of Energy, Lou Grinzo ponders the reasons for Saudi Arabia’s falling oil production last year, according to OPEC data (discussed at length in this Oil Drum post on Friday). “Clearly Saudi Arabian oil production is lower. The magic question is: Why?” he asks. “Have they hit peak production on enough of their fields that they’re…at their all-time peak? Or are they ‘merely’ at a local peak that can be overcome via enhanced oil recovery techniques…? Or is it simply that they really are telling the truth, and they’ve voluntarily cut production for one or more reasons?” He warns against jumping to conclusions about the development, which he sees many doing. “No self-congratulatory doomerism here,” he writes. “I’d rather stick with militant agnosticism, even if it’s more than a bit frustrating at times.”

Blogging

Blogs We’re Reading:

* The Cost of Energy

* The Energy Blog

* DeSmogBlog

* Rigzone

* Joel Makower

– Mark Gongloff

Comments (2) | Permalink | Trackbacks

Save & Share: Share on Facebook | Del.icio.us | Digg this | Email This

http://blogs.wsj.com/energy/

Gregor

A couple of things.

First off, remember that the WSJ blog is relatively new. We get more traffic from po.com and other outlets then from there (for now)--but, of course, Mark's blog has the potential to be influential. I look forward to seeing how Mark handles the controversial issues and integrating readerships.

I wish him much success. He could be a great ally in facilitating the discussion of our energy future.

Stuart has here what is known as a 'sucker bet'.

1. If the Saudis get their oil production over ten million barrels a day, he wins.

2. If the Saudis don't get their oil production over ten million barrels a day, he pays you off with a post hyperinflation aluminum alloy 1,000 dollar coin he got back in change at Starbucks.

Huh?

That's not how I read it...just the opposite.

If they get it over 10.7mbpd, Stuart loses and pays $1000.

Anything under 10.7mbpd, Stuart wins $1000.

It's a "buddy" bet. With no closing date "....by 2015" you will never have to pay, ever, even if he is right. He feels comfortable that he is correct, for he is the only one at risk.

Euan, great post.

According to EIA crude oil had so far nominal high endings in early August 2006.

………

Brent spot ended at $79,26 on August 09. 2006

WTI spot ended at $77,05 on August 07. 2006

……….

According to EIA STEO Mar 2007 the OECD Commercial Oil Stocks were building towards a high in early July 2006.

Looks like OECD was buying oil for storing while prices were high, and drawing them as prices cooled down.

……..

Further, EIA IPM March 2007 reported SA (C+C) at 9,300 Mb/d for Jul and Aug 2006 and down to 8,750 Mb/d in Dec 2006.

From Aug 2006 to Dec 2006 the remaining OPEC members reduced their production with 0,495 Mb/d.

SA having approx 30 % of OPEC production took 50 % of these cuts.

EIA STEO March 2007 lists SA production at 8,600 Mb/d for Feb 2007, down 0,700 Mb/d in six months. The same STEO indicates SA cuts of 0,158 Mb/d of the February 2007 OPEC cuts (0,500 Mb/d) which is close to the fraction of their production.

From May 2004 to Jun 2004 SA (C+C) jumped from 8,500 Mb/d to 9,500 Mb/d, which just temporarily helped cool down oil prices that then ran indecently high at $35 - $40/b.

For the same months all reported OPEC production increased 1,189 Mb/d, in other words SA alone stood for more than 80 % of the reported increased OPEC production.

The future SA production numbers will obviously become very interesting, but I got a feeling that SA production numbers also should be seen in relation to total OPEC production.

NGM2

High oil prices worked their magic, dampened demand growth and stimulated a global exploration and production effort with the oil industry working flat out, everywhere. There is no shortage of oil throughout the OECD. US and European inventories remain high.

How are you measuring Inventories? On an absolute, or days supply basis? Also, what do you mean by shortages? You use the word "shortage" as though that were relevant to a bull market in oil. Shortages means that some buyers cannot buy oil, that there's none available. The use of the word shortage, in the context you are using it, presents a false dilemma.

Also, how are you measuring the oil price? Front month contracts? You are rebutting the large question of KSR declines, and using front month oil price, to do so?

My response to a series of RR comments on the previous thread, regarding these issues of Price, Inventories, and the Futures Curve is here:

http://www.theoildrum.com/comment/reply/2325/165766

I must say, I am seeing a real dearth of mention of the crude oil futures curve, out to 2012, here at TOD. More than germane, it is central to any discussion of Peak Oil. Topical too given that the CFTC recently did a major study of participation, in the long end of the curve.

Gregor

If its possible to determine how many delivery contracts KSA needs to meet this summer ? This may mean that KSA is probably in a tight position to meet contracts for deliveries this summer. If we could find out or prove this is true it again points to KSA husbanding their resources to sell during the summer surge. It would be more evidence that KSA is doing everything they can to make it through this summer without having to admit to peaking.

I very much agree with your perspective. Can you give a link to the CFTC report - do you mean this one from 2005? Also, I would like to get data to make the graph of some index of the degree of backwardation vs contango over the last five years, but can't find this data publicly available - any suggestions?

Hi Stuart,

Below are links to the much anticipated CFTC report on changes in market participation in the long end, the out-years, of the Crude Oil Futures Curve. This was released on 06 FEB 2007. Both NYMEX and ICE have contracts now available out to DEC 2012. 2013s are due to be available soon, probably this month.

Also, I would like to get data to make the graph of some index of the degree of backwardation vs contango over the last five years, but can't find this data publicly available - any suggestions?

Don't I wish it, too. To be able to see over-time changes in the Term Structure of the crude oil futures curve generally entails a hefty payment to some data provider. I know for example that Bloomberg Terminal users have access to most historical data like this. NYMEX no doubt franchises this data out to resellers, like Bloomberg. I must say NYMEX has been very savvy and early to realize the value in all their data. But that's another story.

My personal view is that the steep backwardation that existed in the curve until, say, 2003, represented the confidence in Saudi Supply. As the back end of the curve has risen, obviously it's been a multi-factorial phenomenon. From investment flows, to addition of length--out to more distant years. In a way, CFTC conclusions are rather obvious: more participants equals more reliable pricing. But I am glad the study was done nevertheless.

PS: I recall that some investors in 2004, when Front Month was say at 40.00, were buying the long end for around 25.00. (these were probably the 2010's, at that time). Well, that free lunch is long gone, now. DEC 2012 NYMEX WTI is indicated at 65.87, and ICE Brent 2012 indicated at 64.50.

The action in the 2012's over the last year has been fascinating, to say the least. They rose in sympathetic volatility to last Summer's spike in front month, But throughout the Autumn, and notably during January 2007's smackdown, they showed much, much more resistance to falling. I know some heavy holders of the 2012 Brents, who have noticed all this and are of course quite pleased.

Best,

Gregor

CFTC Site:

http://www.cftc.gov/cftc/cftchome.htm

Press Release:

http://www.cftc.gov/opa/press07/opa5287-07.htm

Report:

http://www.cftc.gov/files/opa/press07/opamarketreportenergyfutures.pdf

Gregor,

You make an excellent point. Michele Markey, at Apache, had this to say in August 2006:

http://www.apachecorp.com/Explore/Explore_Features/20060828/Topic_Report...

"The market has placed a premium on future crude deliveries, which has encouraged storage builds as a hedge against higher prices and supply disruptions. It is important to consider that the U.S. has only 21 days of supply in commercial inventories."

Noting that Saudi Arabia needs from 0.5 to 1 MMBpd in new capacity each year just to offset the decline in existing fields and that world surplus production capacity has dropped significantly in recent years, she observed:

"Since the market can no longer rely on increased production from large producers when there is a supply disruption, the alternative is to build inventories. Larger inventories act as a form of insurance against disruptions. Also, during a rising price trend, it is cheaper to buy more crude now rather than later."

Perhaps Saudi Arabia is scrambling to build an insurance capacity by resting some high water wells until the market is screaming for supply. Isn't it just as likely that they are acting to avoid a catastrophic increase in the decline rate by 'voluntarily' taking a greater upfront hit? I defer to the experts.

In light of Robert Rapier's emphasis on arguing from the facts, I wondered the other day about his assertion that inventory levels were driving Saudi Arabia's production decisions. Since the OECD only accounted for 24% of the increased demand for oil from 2000 through 2005, it occured to me that if Robert's assertion was valid then the Saudis, being intelligent and experienced traders, must have some knowledge of stock levels in the non-OECD countries. Afterall these countries accounted for 76% of the growth in demand from 2000 to 2005, raising their share of world demand to 41% from 37.5% during those five years.

But it turns out that there is no data on world stocks.

It was while looking for this data that I came upon Ms. Markey's analysis. She had some comments about our knowledge of inventories:

"the greatest issue for crude oil inventories is the wide range of crude oil quality. Sudden drops in the supply of certain types of crude can reduce refinery inputs even though it would appear that ample supplies of crude exist. This is possibly the case with inventory levels today. There currently is no way to quantify what types of crude are in commercial U.S. storage. We do know that the U.S. Strategic Petroleum Reserve (SPR) contains 273.6 million barrels (MMBbls) of sweet crude and 414.3 MMBbls of sour crude. Another difficult issue is quantifying the maximum global or U.S. storage capacity. No information regarding individual storage facilities is publicly available. Also, secondary terminal storage and floating storage is highly variable. Information such as the recent storage constraints at Louisiana Offshore Oil Port (LOOP) for Mars production is usually anecdotal at best."

All in all, given the incompleteness and poor quality of information about inventories, it seems unlikely that the Saudi's would use it as the basis of their production decisions.

Since the OECD only accounted for 24% of the increased demand for oil from 2000 through 2005, it occured to me that if Robert's assertion was valid then the Saudis, being intelligent and experienced traders, must have some knowledge of stock levels in the non-OECD countries.

In fact they do. In defending their decision to reduce production, they have frequently cited very high inventories across SE Asia. What I have yet to see is anything but speculation that any country's inventories were ever in trouble - and we do know that over the vast majority of the time the Saudi's were making cuts that the price was falling.

So, if people are going to assert that perhaps other countries without readily available information had inventory issues, then they need to understand that this is just speculation. What I have provided is verifiable evidence. Having said that, I have no doubt that some poor countries were priced out of the market, but that also has the effect of reducing demand, which leads to the need to reduce supply.

My recollection is that futures have nearly always been lower, changing to higher shortly after I became interested in energy late 04/early 05. IMO this epochal change is why refiners now have a strong incentive to hold higher stocks than in the past, tho this is interpeted by many to mean the market is well supplied.

I have daily crude oil contracts data going back to 1983. It's in a binary format, and it would not be legal for me to give you a copy of it, but I could write a simple program if the specifications aren't too onerous.

I have actually looked at contango/backwardization in my past research. And as I recall, "near contract" periods of contango existed going way back. Some of these may be associated with ME conflict, etc.

I didn't see the comments before. I am at work now, so will keep my comments brief as I have a couple of others to answer as well. You wrote:

That said, the repetitious citation of Inventories on an Absolute, rather than a Days Supply basis, is something we see most often from people who don't understand the market. Robert Kaufmann's longer-term studies in this area, for example, are telling. Days Supply is the proper way to measure Inventories, not Absolute Supply.

Here is what I am saying, that I think is being missed. When the Saudi production cuts began, inventories were rising. When inventories are rising, it does not matter whether you have 1 days supply or 100 days supply on hand. That is an irrelevant metric. What is relevant is that the tanks you have physically on hand are increasing in volume, which means you are purchasing more than you need, and that if demand doesn't pick up that you will have to reduce your purchases.

That is a major reason that I think they were telling the truth when they said they didn't have buyers. I have worked in a refinery, and I know what happens when your inventories are rising. You don't say "Ah, but we have fewer days supply on hand."

But other countries seemed to be able to find buyers.

There was room in the tanks for their oil.

Why did full inventories only effect SA oil?

But other countries seemed to be able to find buyers.

I have addressed this before. It is not true. I have shown that Canada, for instance, was not producing all out as inventories were rising. But because KSA produces so much oil, an X% cut in KSA will be larger than an X% cut in other countries. So, it isn't that Saudi was the only country affected; it is just that the effects are more noticable with them.

Your position is just silly. The world produced a record amount of oil jul/aug, just as prices maxed out. Nobody disputes this... Only sa was cutting production; every other producer on the planet brought every barrel they could squeeze out of their fields in pursuit of the record high prices, and it was this high production that naturally led to high storage. And now, with prices at 60, a level apparently satisfactory to opec, sa is heroically cutting more, as other members welsh on their cuts.

Your position is just silly.

Let's see about that.

The world produced a record amount of oil jul/aug, just as prices maxed out. Nobody disputes this...

They don't? July/August were not records. Or do you mean the highest production from a July/August?. Anyway, if you bother to look at the country by country data, you will see that a lot of producers cut production over the same time as Saudi. The reason July/August were up over the previous years was that Russia and Iraq cranked it up. Nobody else.

Only sa was cutting production; every other producer on the planet brought every barrel they could squeeze out of their fields in pursuit of the record high prices, and it was this high production that naturally led to high storage.

Demand fell due to high prices. And it is not my "opinion" that not all producers were producing full out. I know that to be fact. If you think that's a silly position, well knock yourself out. But you better go back and recheck your "facts."

OPEC had been producing flat out for an extended time, were already producing every barrel they could during the period of peak prices. IMO, everybody except sa produced every barrel they could. As far as I can tell from what you have said, you think sa did not do what everybody else did, even as they said, and said repeatedly, that a) prices were too high, and b) there were no buyers for their oil... I see no basis for your position, but you are of course entitled to hold it.

IMO, everybody except sa produced every barrel they could.

Again, as I stated, my information is not an opinion. If you bothered to look up the country by country data, then you wouldn't be forced to venture this opinion either as the data contradict it.

I see no basis for your position...

Again, because you apparently can't be bothered to look at the country by country data. I have stated numerous times that Canada was not producing every barrel they could; serengeti reiterates that below. I don't know what else to tell you. The data define the basis of my position.

Hmm, Robert,

So why dont you link to the data, or display a graph...?

Hmm...

The OECD Inventories graph is at the site that Memmel mentioned on the weekend.

"Every"? You're guessing, and you're wrong. We cut production 15% in certain of our producing fields in Western Cda because pipelines were full. We were forced to truck production east to tap a pipeline carrying product to Chicago.

Sufficiently "every" that peak monthly production was set in jul, and nearly matched in aug, and not since... It is not surprising that infrastructure, including pipelines, were full during this singular event. I said every barrel they could produce, and this limit is not in all cases what the fields can produce but sometimes what their local infrastructure limits are.

I said every barrel they could produce, and this limit is not in all cases what the fields can produce but sometimes what their local infrastructure limits are.

Yet you insist on ignoring the fact that KSA has their own unique limits. They don't sell on the spot market; they have customers. If customer purchases were slowing down - and inventory data suggest that this was inevitable - then their production is going to slow down. Of course they have also stated that customer orders were slowing down.

The point is that in a contango market the richest will be oversupplied vs the losers. So I think your reading too much into the fact that the wealthiest countries are in contango.

We need to look at markets that are under supplied at a price point but this is harder to info to find.

Thus my push for asphalt markets in wealthy countries as a true indicator.

I'm hoping you may get a chance in your new role to meet some oil workers returning from SA and get some ground-level information directly that you can share with us. I keep hoping for someone currently working there or recently returned to participate in the discussion to the extent they can.

Gregor - your comments are noted. High spot prices, lead to high gasoline prices which IMO probably led many folks around the world to use less gas. Your average driver is not considering contango.

The slide in spot prices since June last year IMO most likely reflects a widening of capacity - caused by new production coming on (e.g. the huge Azeri - Chirag field in Azerbaijan) and / or a softening of demand - caused by aforementioned high prices - what other way is there of looking at this?

WRT futures in contango - I agree entirely that future supplies will get ever tighter and less secure. The main point I am making in this post is that I beleive Saudi production will rise again with rising demand.

To me the sum of your argument rests on the assumption that KSA has reduced production by shutting in wells that have high water content.

I agree with the concept that they probably pump from regions and fields with lower water cut esp new fields brought online in preference to watered out regions.

But I don't see how this argument means ghawar or at least the northern half is in decline. One piece of evidence that could clarify maybe is quality ratio of the oil they have shipped last year. If its tending toward grades that are not produced from ghawar the then their is a good chance ghawar is declining.

So the bottom line is that its a safe bet that wells were shut in that have high water cut. By resting these wells they can offer a brief surge this summer bringing them back online. Also I suspect they are filling or have filled all the tank storage they have in preparation for a summer surge. My opinion was that any additional production would come from tanks this summer. But I'm fine with the concept that some wells that had a high water cut can be rested and produce at a higher rate for a short period of time this is a known solution.

All this points out is that KSA is preparing for a mini surge to head off high oil prices this summer or probably more realistic to take advantage of higher prices this summer.

Thus since I believe they are declining and they have chosen a fairly reasonable way to manage their dwindling resources.

They cut back production rest wells and fill tank storage while demand is relatively low as demand picks up in the summer they surge the rested wells and empty the tanks at the highest yearly price. As they decline the floor price rises higher but they get the best returns with this model.

This of course means KSA believes that the world has peaked thus they are safe in following this course.

Next year of course we will see the same pattern but with a more constrained oil supply and lower surge peaks.

The important point is that if KSA thinks it can get away with managing its production to sell oil at the highest price each year this means they believe the world has reached peak production.

I agree that their production cuts may have not been 100% because of decline but if its 80% and they can increase production for a short time in the summer they stand to make a lot more money. Only if they believe that the rest of the world cannot undercut them and is decline.

If this is the case we will see that after the summer surge if we have the peak prices in the fall I've predicted KSA will not be able to increase production. Nor will they be able to increase next winter but they will have to husband their resource to surge once a year in summer. And with that I can't see them maintaining a higher production rate for more than 90 days since draw downs from their tank farms would be a big part of the supposed production increase.

If my hypothesis is correct then their is a good chance that KSA will increase its tank storage capacity. This can be used to level production shortfalls.

They are in fact doing this for china

http://www.tmcnet.com/usubmit/2006/01/23/1308516.htm

I can find no information on if more farms are being built inside KSA. But even the work with china points out that they may feel they cannot meet peak demand anymore and must use large tank farms too try and bridge production/demand gaps.

Also its not clear that the storage is needed depending on their true capacity. So a negative does may not mean much but I can't see any reason for them to increase storage internally since they are probably restricted by the export terminals.

In short I do not see that the argument presented here proves anything in fact it furthers the case that KSA is probably declining and has changed to the model that makes the most sense which is to husband their production so they can surge it at the periods of highest prices. It does say that the surge will not just be from tank farm draws but also from temporary increases from some well that are still producing but shut in. This makes sense. How does it prove they are not in decline and also again more telling that they are safe playing this game since they believe the world is in decline ?

But I contend that they can only do this now once a year and each year the surge will be lower and the base production rate will be lower. And more telling they will not be able to handle increased fall or winter demand with increased production. This trick will work this summer but 2008 is iffy and I doubt that its worthwhile by 2009. It basically a one shot strategy for the first and maybe second year post peak. Notice that the decision to increase the SPR and china 's tank storage will help later as full production for the entire year is needed to meet demand. After that ...

There seems to be quite a fixation here on looking at the raw production numbers in bbl's, be they of "C+C", "All Liquids", etc. which, beyond a certain point does not seem too helpful.

I say this because it seems to me that what is really of "real world" significance is not how many barrels of flamable liquid are being produced, but how much net chemical potential energy is being made available.

By tracking only the barrels of output, and not subtracting the barrels of fuel invested in the whole petroleum industry [treating them as an "externality", and thus ignoring them] it seems to me that with every month that passes these graphs, accurate though they may be in one sense are giving a more and more optimistically distorted picture;

Drilling in exotic locations uses more fuel, recovery measures from old wells uses more fuel, extracting upgrading the greasy sand of Canada, shipping a greater fraction of the total around the world in tankers as more countries become importers, feeding the increasingly bloated "financialization tail" of the industry i.e. the oil speculators and associatied camp followers, "Stabalizing" the oil producing regions via military and other interventions, yada yada, yada, all these things are getting more energy expensive by leaps and bounds.

Anyone got any idea what a graph of "net liquid fossil fuel energy extracted" would look like? I'd be amazed if such a graph did not show a clear peak some decades ago...

It is a factor. And it is important for deep offshore drilling oil sand and ethanol. Which is what is supposed to save us in the future. But right now most production is coming from wells and fields developed using cheap oil. The bigger factor right now is increased consumption in producing countries WT export land model. Your concerns will rise and become dominate later down the peak oil curve post peak. I think they are valid just the effects will not be important till we are well past peak oil.

Obviously they show that post peak we will have a second crash that might be even stronger in total energy or EROI. In fact their is a good chance that this EROI peak will be harder and have bigger effects than the absolute peak in Oil.

Just we are not at that point yet but yes peak EROI follows with a vengeance after peak oil. But peak EROI will give us something to talk about once peak oil is obvious.

Just we are not at that point yet but yes peak EROI follows with a vengeance after peak oil. But peak EROI will give us something to talk about once peak oil is obvious.

I like the way you think.

The points been oft-made, especially in the context of the global production curve, and I don't think anyone disagrees. But we don't have any data with which to construct a "net liquid fuels" measure.

And to repeat its importance is post peak since we will be using the results of equipment and infrastructure developed with cheap oil until well after peak oil is obvious.

I think peak EROI will be harder on us than peak oil but its not a issue just yet.

When we start growing corn with tractors created using a majority of inputs based on corn ethanol thats when real problems develop. Peak EROI is a nasty feedback loop.

"When we start growing corn with tractors created using a majority of inputs based on corn ethanol..."

The point you describe, Memmel, is way, way down the eroi slope. We have obviously passed peak eroi in the liquid fuel trade. Just the increasing presence of tar pit extracts, subsidized crop derivatives, and ultra deep water oil in the all liquids barrel pays testimony to this reality.

I need to collect my thoughts on peak EROI I just grokked it in this discussion. Right now I'm scared shitless on the concept. But I have realized that high tech civilization is a energy junkie and we have to admit to it.

Let me think but peak EROI is a strange attractor for sure.

http://en.wikipedia.org/wiki/Strange_attractor#Strange_attractor

To explain a bit more beyond peak EROI we have the next peak which is peak quality even with recycling the stores of high grade raw materials decrease. So its nested set of strange attractors. Fore example if we choose coal the uranium the input of ore virgin ore decreases and creating a new EROI drop.

Their is no way out of this except fusion and moving beyond earth but this just increases the period of the before the next attractor cycle.

High tech is eventually doomed as of right now.

This means we are intrinsically screwed as long as wealth is material regardless of the technological level.

This means that duh

http://en.wikipedia.org/wiki/Kurt_G%C3%B6del

Godel ensures that high tech civilizations must collapse since they operate on a inverted Godel plane.

Complexity tends towards a inverted Godel plane since a species cannot have zero members at zero it goes extinct.

Only inflation from increased energy usage delays this final collapse.

Thus complexity results in black hole of zero, a species cannot escape. I might add that evolution offers a mini escape but the inverted Godel plane rules all.

Inverted Godel Darwinisim is born :)

I'm a smart bastard but I don't know how we can escape this.

Maybe just knowing the problem results in a solution that un-inverts the Godel N dimensional plane say one of the inverted inverted infinities expand. I.e. big bang.

Thus the trick answer is if you figure out the question it results in the answer.

Anyway I'll be long dead before we have to solve this.

memmel,

Usually I understand you but maybe you shouldn't have taken that hit of acid before the last post.

No kidding. Now, if he'd shared it, the rest of us might have a clue.

Memmel:

Wittgenstein argues against the existence of a "private language." Your post proves the accuracy of his assertion.

Can you rephrase or explain "inverted Godel Darwinisim?"

[chuckle] see cid yama above.

Two things to note:

If you'd mind restating yourself in a form that makes sense, memmel, perhaps we could get somewhere.

Via Google Search

In 1931, the Czech-born mathematician Kurt Gödel demonstrated that within any given branch of mathematics, there would always be some propositions that couldn't be proven either true or false using the rules and axioms ... of that mathematical branch itself. You might be able to prove every conceivable statement about numbers within a system by going outside the system in order to come up with new rules and axioms, but by doing so you'll only create a larger system with its own unprovable statements. The implication is that all logical system of any complexity are, by definition, incomplete; each of them contains, at any given time, more true statements than it can possibly prove according to its own defining set of rules.

Gödel's Theorem has been used to argue that a computer can never be as smart as a human being because the extent of its knowledge is limited by a fixed set of axioms, whereas people can discover unexpected truths ... It plays a part in modern linguistic theories, which emphasize the power of language to come up with new ways to express ideas. And it has been taken to imply that you'll never entirely understand yourself, since your mind, like any other closed system, can only be sure of what it knows about itself by relying on what it knows about itself.

Does this mean that Memmel is another genius like that professor fellow played by Gladiator in the movies?

I suppose you mean actor Russel Crowe? http://imdb.com/name/nm0000128/

And the movie you were referring to is "A beautiful mind"?

J. Dähn

Yes, I'm familiar with Godel's incompleteness theorems. None of which have anything to do with planes, inverted or otherwise.

Godel focuses on the fact that mathematical truth is possible outside of any set of theorems. Other stuff can exist outside also I call them impossibilities. These are statements for which a theorem makes no sense since you can't create axioms.

For example assume you have a square in a 2 dimensional world