Russian Car Sales & Net Oil Exports

Posted by Sam Foucher on June 9, 2007 - 10:46am

This a guest post by Jeffrey J. Brown (westexas)

The following story about booming Russian car sales is a perfect example of the “Export Land” Model, where rising domestic consumption in exporting countries can overwhelm increases in oil production, resulting in lower net oil exports.

As I warned in January, 2006 (see my article, “Net Oil Exports Revisited”), net oil exports by all of the top three net oil exporters (Saudi Arabia, Russia and Norway) fell from 2005 to 2006 (EIA data). Based on the following article, since 2002, foreign car sales in Russia have been increasing at the rate of about 50% per year (doubling about every 1.4 years). I wonder what effect this is having on gasoline consumption in Russia?

Incidentally, my Net Oil Exports article appears to be quite popular on the web. Out of about 1.8 million listings for Net Oil Exports on Google, the article is consistently in the top five, and it is generally #1. (I should point out that I built on work done by Matt Simmons and Kenneth Deffeyes, et al, using "Khebab's" graphs.)

THE VIEW FROM EUROPE

Russian car boom catches eye of Japan, Germany

By JOCHEN LEGEWIE

Excerpt:

Oil boom's impact

All in all, the maximum output capacities of plants operated or planned by overseas automakers is approaching 1 million cars per year. Clearly, something is up in mother Russia.

To put matters simply, Russia is experiencing a good old-fashioned oil boom. Its deepening ties with European energy suppliers, along with rising prices of crude oil and other resources, has created a steady stream of revenue. Having gone through a major economic crisis as recently as 1998, the country has made a complete about face and is now prudently stockpiling funds for future rainy days.

It has also been generous with its citizens. Income tax in Russia is levied at an across-the-board rate of 13 percent, making it the lowest of the major industrialized nations. Combined with extremely low utility costs, as well as pent-up demand for goods after decades of state rule, and the deepening thirst for cars comes as no surprise.

Furthermore, car ownership in Russia is still at a relatively low level of less than 20 percent. Compare that with Germany, where it's over 50 percent, or Japan, which has 44 percent. And the average age of a car in Russia is approaching 10 years, which means many car owners will soon be looking for a replacement. All of these factors add up to a steeply growing market, especially for foreign makes.

In 2002, only 112,000 foreign cars were sold in Russia. This year, the VDA is forecasting that 1,350,000 foreign vehicles will be sold — a 12-fold increase. Conversely, sales of Russian-produced cars have been on a steady decline, from 857,000 in 2002 to a forecast of 750,000 in 2007.

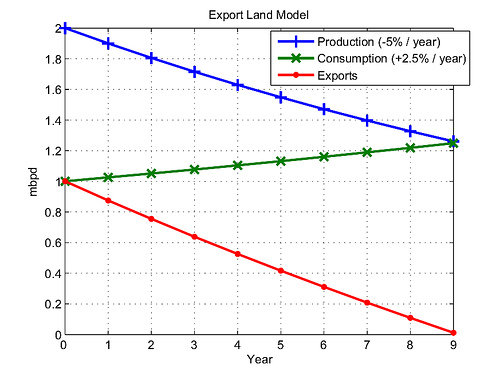

The following graph shows a hypothetical oil exporting country where a 5% annual decline rate in oil production and a 2.5% annual rate of increase in domestic oil consumption results in a 50% decline in net oil exports in 4.5 years (a decline rate of 16% per year).

As production actually starts declining, many exporting countries will show double digit declines in net exports. For example, from January, 2006 to April, 2007, Mexican oil exports declined 18%, a decline rate of 16% per year, on a month to month basis.

In my opinion, because of the Export Land Model, the ongoing decline in world crude oil production, relative to May, 2005, will look more like a crash from the point of view of importing countries.

Based on our mathematical models (Hubbert Linearization), Russia, at least their mature basins, is at about the same stage of depletion as the United States, in the vicinity of 85% depleted. This suggests that when Russian oil production turns down again (no later than next year, in my opinion), it will be a very sharp decline, resulting in a probably catastrophic decline in Russian oil exports.

I tend to boldly go where other prognosticators are afraid (or more likely, too smart) to go, but since I am in the oil exploration business in a highly mature province, I am wrong most of the time, so what the heck.

I think that Russia will probably show declining oil production this year, no later than next year. Based on EIA data, Russian crude oil production has basically been flat since October, 2006. With rapidly increasing domestic consumption, this means declining oil exports. Note that when the Russians report higher oil exports, they always use comparisons to early 2006.

What if Russia shut down the pipeline in the following story because of problems with net export capacity?

http://jamestown.org/edm/article.php?article_id=2372212

RUSSIAN OIL PIPELINE SHUTOFF TO LITHUANIA: WIDER RAMIFICATIONS

By Vladimir Socor

Wednesday, June 6, 2007

Yeah, and why should Russia sell off their precious oil recources at all. Russia has paid of its debts. Oil is now THE strategic recource to keep in order to maintain its superpower status and its economy hummering. When PO is apparent to the whole world, i wouldn´t be surprised if Russia stops exporting oil.

Then really TSHTF and TEOTWAKI fulfills.

Acutally, being a major natural gas supplier to Europe may give them even more leverage.

Westexas,

As usual, a very useful analysis. Can you create a table for the top 10 exporters showing the rate at which their exports are declining or increasing as the case may be?

At what rate are exports declining for Saudi Arabia, Russia, Venezuela, Nigeria, Canada and Norway?

Also, what fraction of the total exports come from the top 10 exporters?

Thanks in advance.

I am working on an outline of a paper for the Top 10 Net Oil Exporters, that Khebab and I are going to do, possibly for ASPO Houston this fall.

I think that the top 10 account for 75% to 80% of total net exports.

Note that Russia showed an increase in production from 2005 to 2006, but a decline in exports, because increased domestic consumption.

In general, once an exporter starts showing lower production, in most cases I expect them to show double digit declines (on a month to month basis), e.g., the 18% decline in Mexican exports, from 1/06 to 4/07.

Do we know where the overall production numbers come from for countries such as KSA and Russia. Exports can I assume be tracked easily but can we trust the total production numbers ?

For example Russian production could well have declined this year but they could have had enough internal storage coupled with straining any excess capacity to meet internal demand.

In general its not clear that the production capacity is utilized 100% year around thus its possible to increase production for a year or two before you start showing declines via drawing down storage without accounting for it and stressing the system.

Noting that Russia seems to suffer numerous problems with production like the US seems to have with refining stressing the system as above will lead to a increased incidence of above ground factors. And if this is coupled with outright fudging of the numbers and shell games you could easily be in a bit worse shape then reported.

Since your stating a 50% decrease in five years situations like I'm proposing that in effect hide the first year or more of decline are not insignificant.

Export Land Model:

http://www.theoildrum.com/files/240076673_494160e1a0.jpg

There is some really interesting math here that I want to explore with Khebab (guess which one of us will be doing the heavy mental work).

In any case, if you look at the above graph, the decline per year for the first four years is about 16% or so. However, decline rate for the next four years is far greater--around 37% per year.

When we look at a normal bell shaped curve, where production starts declining, say at 5% per year, we have a long gradual "tail" of production, because as annual production declines, 5% represents a lesser and lesser amount of volumetric decline per year.

However, with the Export Land model, we have one dependent variable, net exports, and two independent variables, production and consumption that can both work against net exports--rapidly pulling net exports down to zero, with no "gradual tail." What would be interesting would be to model this for various combinations of decline rates and consumption rates.

In general, my guess is that once a region's exports start declining from peak exports, the first 50% decline in exports will be less than half the decline rate that we see for the remaining 50% decline in exports (relative to peak exports), or the final decline rate will be more than twice as great as the initial decline rate.

We can probably refer to the first 50%, relative to Peak Exports, as Phase One, with Phase Two being the decline of the second 50%, relative to Peak Exports.

This scenario is precisely what we saw in the UK, peak net exports to zero in about six or seven years.

If we apply this model to Mexico, they will be down to 50% of peak exports by about 7/1/10. I bet that the annual decline rate from there will be in the 30% to 40% range.

All of this implies that net oil exports will be a rapidly diminishing factor in the world economy as time goes on, especially in four or five years.

The one problem with Export land is I can't see exports dropping by 50% without a fundamental change in the economics of oil.

I was sent this link in a email by a reader.

http://www.hubbertpeak.com/reynolds/MineralEconomy.htm

This shows the exponential increase in prices soon after the peak in production.

The key graph is here.

http://www.hubbertpeak.com/reynolds/images/a2f2.gif

Note at about 20% or so post peak price effectively takes the market to a different level.

So I don't see the simple export land model holding past a 25% decline in oil exports at most.

In my response I used this example.

Your in a huge theater filled with thousands of people the film has just reach the middle point and best part. You smell smoke and leave notifying the management on the way out. They do nothing and only a short time later many people smell the smoke and panic as they try to reach the exits killing hundreds in the crush. Thousands are killed as the theater burns to the ground.

The point is that even though the greatest loss of life is from the fire i.e effectively no exports the system fundamentally changes far earlier with very few exiting in a controlled manner.

I think the above is a good simple explanation for the converging negative events we face GW Peak Oil Credit Bubble etc etc. Its going to go with a bang when it goes.

I've guesstimated the critical point is when we are down about 4mbd from peak this is when everyone smells the smoke.

I see no reason for any sort of orderly power down once its clear we are post peak. I'm claiming for oil it will actually start at about 5% from world peak production.

Looking at the graph your see this is exactly when the price starts heading for the stratosphere. So I think that for export land the simple model fails and goes over to the one described in the paper once your 5% or so off peak.

This if may calculations are right is in 2008 or 2009 at the latest so we probably only have a year or two at most before we begin to see this phase change when everyone knows every year their will be less oil.

I've yet to see anyone effectively argue these models are wrong. Since you never have enough time I'd love to see it be 2010 or later but I don't think so.

An interesting question that raises a corollary.

How far can a society adjust down their oil consumption and still function ?

The most extreme example I found was Switzerland in 1945. After the end of a six year, 100% oil embargo, the average Swiss used 1/400th the oil used by the average American today. In other words, the average Swiss got by for the entire year with less oil than the average American uses in a day !

Yet they had a functioning Western industrial democracy with a decent quality of life, if stressed.

France is building an infrastructure that mimics, in several ways, the Swiss infrastructure. A cohesive and fairly comprehensive non-oil transportation system (that relies on local non-FF electricity) in parallel to the popular oil based one.

If today's oil imports into Switzerland and France were cut in half over a short period (months ?) it would be tough, but they could adapt (barely) and continue to function. With more time to adjust (small lead acid EVs, more urban rail that stretches out, re-localization, abandoning some exurbs and suburbs, complete replacement of oil heating, etc. they could cut back 90+% IMHO and still function.

The United States is, of course, not doing this.

Best Hopes for Non-oil Transportation,

Alan

memmel and Alan,

My biggest concern is the population has shifted to suburbia. As a kid most moms canned and raised a garden. Rarely does this happen today. The summer close of school was adjusted for harvest if in dire need so kids could harvest crops/work in fields.

This economy we have is so far removed from that.

Memmel, unfortunatly you bring up the second part - what happens....

I think the biggest thing in America will be for lack of a better word a shear effect. We don't have a very large class of people living in extreme poverty in America as is common in many countries that are what I consider economically bound. These are countries that are effectively controlled by a elite upper class Mexico and don't have a social welfare net. Mexico is a example but in general outside of Japan/US/EU most countries have a substantial class of people that are not just poor but what we call in the South dirt poor. In the US some illegal immigrants call into this category but we still manage to provide decent health care social services etc even for this class.

I think the first thing to go in the US will be this social safety net which is what separates the first from the second and third worlds. The reason is that taxes/government will be forced to either start a tax increase spiral or cut services and tax revenue dries up as more income is diverted to gasoline/transportation. And they cannot increase taxes on gasoline the time for this is long past. So the first thing we will see is a tax crunch that start to rip out this safety net. Next of course more and more families will slid down the slippery slope towards poverty a lot of course is because of their own greed but the result is the same. This dropping standard of living feeds into dropping taxes ...

This has not happened in America since the 1930's but what it is is a depression and what it means is that if you lose you job etc over the next few years the bottom may be a long way down. The example of people working together to lower everyones consumption works but the easiest is to have say one and ten Americans fall into absolute poverty and no longer consume basically any gasoline then 2 in 10 etc.

Eventually we will cut gasoline usage by say 50% simply because 50% of Americans now live in extreme poverty.

I think we will get electric rail and trams etc but they will be used to ferry our new class of desperate workers willing to work basically for food not some sort of Swiss dream. West Texas's ELP does not have to be done in a dignified manner the social effects of ELP applied brutally by the free market can significant and harmful. We have a choice how we practice ELP but we have to ELP.

This is how I think demand destruction will play out in America. The key is that by dropping a increasing percentage of Americans into abject poverty we can reduce consumption without changing the lifestyles of those that still have money. Obviously its also a breeding ground for political activism which will actually help people reduce services more. In general what this means is the New Deal will be repealed as we head into the next great depression. The irony does not escape me.

To reply to my own post :)

I think Detroit is ground zero for the rise of this class of deeply impoverished people. Its got all the right or more correctly wrong conditions. Its highly dependent on the sale of large automobiles for its economy and its tax base is heavily eroded. Soon government services will state being scaled back and of course I expect failure of the big automakers. This will leave a large population of retired people in Detroit with no pensions or retirement and a escalating unmet need for social services. So overall I think Detroit will be the model for whats coming for the rest of America. If I'm right it would be good if its possible to get a graph of gasoline consumption in the Detroit area. If you have the info post and email me.

I'd like to watch it like I watch Asphalt prices as another canary for the coal mine. Googling Detroit and gasoline does not work for obvious reasons.

Oh the things that occur to one in the shower.

IIRC Putin has been supplying Iran with nuclear experts for their program. What if he is taking advantage of the Iranians by putting them in a position to take a fall? He indirectly eggs the US into attacking Iran to stop them 'getting the bomb' which unleashes hell in the middle east and essentially stops all oil exports from that region.

Suddenly Mother Russia, sitting on what he believes to be vast reserves of resources in the form of Oil and Gas, is in a key position to become the prime power in the northen hemisphere by supplying the energy that keeps the economies of Europe running. At the same time he gets the pleasure of watching the USA die the death of a thousand cuts as it tries to control an uncontrollable situation in the ME to maintain its supply of oil. Payback is, as they say, a bitch.

Sounds like something out of a Tom Clancy novel or a James Bond film. But then I find that real life seems like one long bad dream these days.

Re: The "Bidding War" for declining crude oil exports

While OECD oil inventories have fallen from their highs last year, they are still at adequate levels, although the EIA is warning that we will drop to the bottom of the five year range this year, especially in terms of Days of Supply: http://www.eia.doe.gov/emeu/steo/pub/gifs/Slide25.gif

However, focusing on OECD inventories, as an indication of what is going on in the entire world, is like asserting that no one went hungry in the US in the Thirties, based on surveys of the top half of incomes earners.

Consider a map of OECD versus non-OECD countries:

http://en.wikipedia.org/wiki/Image:OECD-memberstates.png

We don’t have to look hard for reports of forced energy conservation in poorer regions. Leanan has posted countless stories. I think that one of the best is the following WSJ article in 2006. IMO, inventory levels in OECD countries are okay, because of forced energy conservation in areas like Africa, but the pattern that I expect to see is forced energy conservation moving up the food chain.

Published on 18 Nov 2006 by Wall St Journal. Archived on 23 Nov 2006.

As Fuel Prices Soar, A Country Unravels

by Chip Cummins

Conakry, Guinea

A story of problems with forced energy conservation at the margins, in a OECD country:

http://online.wsj.com

Running on Empty

On a Road to Nowhere

An Alaskan village asks a scary question:

What happens when oil is too expensive to use?

By RUSSELL GOLD

June 9, 2007; Page A1

Excerpt:

I live in northern Sweden at the same latitude as Alaska. I heat our house with wood. Now its cheap, and we have abundant wood recources in a region with a scarce population.

But i wonder what will happen when oil is in shortage? How can we harvest and transport the wood?? It sure won´t be cheap anymoore.

We certainly are in uncharted waters.

Living in southern Sweden, and also heating with wood (call it really, really efficient biofuels if you want).

To harvest and transport around 2000 kWh of firewood (a solid cube of 1x1x1 meter), you need to use around 2 liters of fossil fuels, or 20 kWh of energy. And this number is declining due to developments in forestry.

It will always be profitable to harvest firewood, as long as there is any oil left. Yes, it will become more expensive, but it will remain the cheapest source of energy here in Sweden. No matter how expensive oil will be, it will always be cheaper than heating with electricity-based methods, as the electricity price follows the price of oil over time.

Anyway, for household needs you will eventually harvest with a manual saw or axe, and pull the wood home with a horse or a human-powered cart, as been done in the past. No worries. Just make sure you own some forest within manual distance. I do.

Do you think 10 million Swedes can all move to firewood use? Trees don't grow all that quickly at these latitudes.

We are 9 millions. I don´t know, but during for example WWII

we had mostly firewood use(if i recall it right) without a problem. But then we where about 6 million inhabitants.

Precent times i certainly believe that we in northern Sweden, with a scarce population, have no problems what so ever with wood recources. How it would play out in for example Stockholm area today i am unsure about, but during the war Stockholm made it with wood as i recall it(but with a smaller population, and houses prepared for wood burning). Nowadays houses in urban areas are not prepared for wood burning.

The annual growth of forest in Sweden is around 80 million solid cubic meters, or approx 9 cubic meters (at least 18000 kWh or 1800 liters of gasoline or 450 gallons) per capita. We are nine million people.

Today Sweden derives it's energy from the following sources (off the top of my hat): 20% nuclear, 20% hydro, 40% oil (almost entirely transportation) and 20% other (including biofuels, industry heat recycling, burning waste - almost no landfills anymore).

Less than 10% of the forest growth goes to biofuels, the rest is refined using hydro and nuclear power into paper pulp, paper or processed timber (two by fours etc) and exported. We export our energy surpluses (a significant portion of the nuclear and hydro goes into the paper industry or metals (primarly iron/steel)) as refined raw materials, which pay a lot better than wood pellets or firewood.

There would be no problem increasing the biofuel portion of the forestry if need be, but it would kill off quite a few jobs in the paper industry. This illustrates that the immediate effects of peak oil, at least in Sweden, will be economic. About 250 000 people are employed in the automotive service sector (tires, workshops, gasoline stations, roadside restaurants etc etc) or automotive industry (Volvo/Ford and Saab/GM). If driving would decrease by 50%, 50% of those jobs would be lost, which would be a significant part of the workforce.

If push comes to shove you could run the entire diesel fleet of harvesters, carriers, tractors and trucks on wood chip gasified producer air. Did it in the past (WW2), could definetly do it again.

Myself, I'm a net energy producer, I sell more energy as firewood than our household and farm consume, including electricity and all fossil fuels even private use (but excluding emergy in bought equipment which is a bit difficult to calculate. Emergy in our own improvments and maintainance of forest, fields and structures is included though). Firewood pay better for the primary producer than selling lumber as paper pulp material, and most Swedish small houses have at least a wood stove as backup, and 400 000 houses heat with wood furnace coupled to watertanks. No problem finding buyers for firewood.

We heat our entire 2000 sq ft house using a single american Vermont Castings wooden stove, but then the house have been properly insulated in recent years, even though it was originaly built 100 years ago.

Sweden could be self-sufficient in energy, but it would require sacrifices, and walls towards the rest of Europe. However, we're members of the European Union, which has stated that all member states should share their energy resources, so we will be in the shit with the rest of them. At least peacefully, as we've dismantled most of our military anyway so we wouldn't be able to keep it to ourself anyways.

At least the climate keeps most people away, but global warming may change that and there goes the advantage of our sparsely populated country...

I have been to Kotzebue one summer many years ago. I remember it as being totally flat without any trees within perhaps tens of miles. We flew in low on Alaskan Airways and it was all lakes and tundra as far as one could see. It is very different from Sweden at a similar latitude. I have been to Northern Norway and the trees near Harstad, for example, grow to only around one meter in height. Also, they are all bent over in the prevailing wind direction. Quite miserable.

That has nothing in common with the vast Swedish softwood forests. Ever been to the forest districts of Canada?

Sweden is covered by dense pine and spruce forest, with the exception of "fjällen", ie the mountains to the north of Sweden. Towards the south hardwood becomes more and more common.

Hej Cornucopia

Jag håller med om allt du skriver. Själv är jag äldre, och kommer inte att orka med att hugga, transportera, och hantera större mängder ved. Men jag räknar kallt med att det inte skall vara några problem även ifall du inte har egen skog. Det finns gott om skog i närheten, och gott om folk som kommer att vara fattiga, och som kommer att kunna leverera ved till oss som har pengar och kan betala för oss.

Kenneth

Som norrlänning har du antagligen rätt, Kenneth. Kan vara svårare i de mer välbefolkade delarna av södra Sverige.

Thanks, and as well for the article Running on Empty

On a Road to Nowhere

Would anyone care to comment on the storage of wind produced hydrogen/oxygen in those northern areas? It seems to me that the direct use, of stored hydrogen and oxygen from wind, as heat and possibly lighting (gas) would be efficient. What would be the problems?

The pond shrinks but not evenly or fairly.

Swede the usual comment about woods efficiency is that it heats you twice once when you cut it and once when you burn it. Hows that for cold comfort?

Thanks CrystalRadio, you are conforting me with positive thoughts.

Westexas; thanks for yet another interesting article, but I would just like to comment re:your continuing use of Guinea as a example of an African state in PO demise. African states suffer from a multitude of problems and I think the rush to apportion PO effects to particular instances has to be done with a degree of care. For example here is a piece from Oct 2004 which deals with Guinea's severe problems in the period 2003-2004:

http://www.afrol.com/articles/14446

As you will see the country was even in 2003 having severe problems with power outages etc (and as I recall oil prices were only just then starting their main ascent). The causes of these problems as described in the article were (and still are as far as I can see) multiple. There seems to be a tendancy to rush to 'doomerish' conclusion as regards PO and Africa, but Africa has never been a simple place to analyse.

Your keypost seems a little incomplete. Yes, an extra million vehicles can be expected to raise domestic consumption. Can we try to put some numbers on that? What are the average km driven in Russia, what is the average kilometerage (can't we just conquer the world and get rid of this evil metric system?) of the vehicles they are buying, how many barrels per year does that add to their consumption, assuming the rest is constant or increasing at some known rate, how will that affect exports given flat production.

Well,

Let's see, let me check my schedule.

I have to go pick up dog up at the vet. I have to pick my wife up at the airport. I have to pay some bills. I have two drilling rigs running. One of them may have over 60' of net oil pay at a depth of 1,200'--possibly somewhat over-pressured. We have to decide whether to drill to a deeper, somewhat depleted zone, and perhaps risk lost circulation, which would drop the hydrostatic pressures on our shallow pay zone, possibly causing a blowout, and perhaps an oil fire. Then I have to pick locations for about six new wellbores. Other than that, I have plenty of time.

Don't drill the second hole. If there is no expectation of a different non connected payzone compared to the first one don't risk it. The result is you end up with slower output, and a longer output.

This takes advantage of hedging against the high price of drilling (almost reaching the 1980's peak cost), and the high price of crude will further increase profits.

If you drill, your oil will most assuradly be priced at a much higher level, and that well will fall out of production first IF oil prices fall.

Summary, don't drill to take advantage of HIGH drilling costs and HIGH oil prices and to reduce risk to the well. You can always go back to the oil site and redrill.

As long as you are producing from one payzone, your lease holds for all of the others. Produce from one well unless the second well will hold more lease acreage long term.

My 2 cents,

Alan

Alan, that's incorrect. Depth limitations are dependent on the lease terms. If a major oil company assigns some acreage, it may be limited to only one objective zone, and the same with large rich landowners. The Sate of Texas, a very large mineral owner in the Permian Basin, limits their leases to 100' below the deepest depth drilled

Everything is negotiable on an oil and gas lease except the names and the land description.

ooo this i did not know.

Very interesting. I would also assume there are clauses in the contracts to take away rights for specific depths if drilling is not done in a time period, as to facilitate the resource extraction....

then it becomes a matter of, is the exploration really worth passing up to someone else, because one would give up his advantage by drilling and learning what is there to exploit!

very tricky!

An Oil & Gas Lease is a simply a contract between the mineral owner and the oil company that specifies the terms under which the oil company can explore for and produce oil and gas.

In the "Good Old Days," one producing well would hold the entire lease, inclusive of all depths, and the lease typically was only two pages. And a lot of acreage is being held under old leases. Newer leases tend to be much more complex, routinely running to more than 20 pages in length.

Gilgamesh, different companies have different economic parameters. As an example, large integrated oil companies have specialists on the payroll, office buildings, lawyers, lobbyists, accountants and retirees. For a well to be even marginally profitable, the company has to make more than say, 10 bbls a day, and they must have at least 200/bbl a day in production that is fairly close to this well.

A small independent may have just a few full time employees and own very little in capital goods-a computer or two and a pick-up. Every service is contracted for and the costs assigned to a particular well. They may use a contract operating service, or even just a few money raisers who invest OPM (other people's money) in participation in a few people's wells. Their costs are so much lower that a 10bbl a day well with a decent reserves-say 30,000 bbl, will pay them 800% in a few years!

The big integrated companies know this, so if they own some acreage that appears marginal or unprofitable to them, they sell it, sometimes retaining a piece of the well. This is called a farm-out. Sometimes they just sell the production when it has dropped to marginal rates for them.

I work mostly for small independents on a contract basis, buying oil leases. These guys either don't have a landman, or their landman doesn't have time to do all that needs to be done, so they contract out land services.

Not every company wants to get huge, go public and deal with all the regulatory nonsense and hype. There is no right or wrong way to be in the oil business, its all what suits you. I prefer to generate deals and sell them, retaining an interest in the property. I've worked for a couple of companies who wanted to build up reserves and float stock, then be taken over by a larger company. And its all working for energy independence. Its fun and a good living.

But, don't delude yourself that we are going to drill out of the peak oil mess. About 2/3rds of the world production is from Giant and Supergiant fields. And we are not finding enough of them, a point that has been belabored many times. The fields that are left to be discovered are mostly expensive to drill, expensive to produce or have geopolitical risk so large as to be impractical. Chevron still hasn't made a decision to exploit the Wilcox Trend well at Jack 2. Nobody's rushing to buy a concession in Iraq (that's a conjecture). Even prospects in the eastern Gulf of Mexico,offshore California or Alaska on the Wildlife Refuge are too hot for operators in the US.

The operator is going to shut down early. The risk of a losing circulation was really pretty low, but "low" is not zero, so we are going to log the well and see how many feet of net pay we have in the shallow zone.

BTW, I have been telling my Oil Patch friends that what we have seen so far--in terms of oil and gas prices and drilling activity--IMO is just a small trembler, before the "New Madrid" type economic earthquake that is going to shake the country and the world. IMO, we are about to see an absolute desperate search for energy.

I continue to advise anyone who will listen to downsize now in an expectation of much higher food and energy prices in the years ahead. To use a modified version of a phrase from academia, I also think that we are headed toward a period of something approaching "Produce or perish," i.e., I advise you to "Cut thy spending and get thee to the non-discretionary side of the economy."

sounds good to me.

i've always been of the mind to be one of the 'providers' for the world. I've got a brain and would prefer to use it to keep several thousand other people alive through food/energy production rather than having to work with what I am given by the food/energy industry.

Jeffery, Any thoughts to the time frame for "New Madrid". 2008-2010?

Thanks, D

Never heard of "New Madrid". But found it on Wikipedia.

In regard to oil production, we have seen regional examples of peak production, despite higher prices and "improved technology" and we have seen regions go from exporters to importers: http://www.theoildrum.com/uploads/28/Data_4weeks.png

The difference is that Saudi Arabia and the world are now where Texas and the Lower 48 were at in the early Seventies.

As I noted up the thread, IMO what we have seen so far are just the tremblers before the big economic earthquake. The big earthquake occurs when oil and petroleum product import dependent economies like the US have to face the reality of declining total petroleum exports. And I think that we are in the early stages, with most of the pain being felt in poorer regions. 2008-2010 is probably a good estimate of when things get "interesting." Matt Simmons is predicting $200 oil in 2010, in constant 2005 dollars.

Imagine, if you will, the Mew Madrid Earthquake as a symbol for an economic earthquake. From the article on the New Madrid Earthquake:

GreenMan, do you want to give it a try?

The Russian numbers might be hard to get (I don't speak Russian, so change that to impossible). But why not pick another European country and use those numbers as a proxy?

I would expect per capita travel to be fairly small. The cities are going to be pretty dense because of mass transit. It will take a while before they start building sprawl.

Perhaps a year ago, I posted a WSJ story on Russian sprawl. Few statistics, mostly anecdotes. Two lane country roads clogged with commuters with hour+ commutes outside Moscow.

Best Hopes that the WSJ was exaggerating,

Alan

My wifes Russian/Ukrainian,

On our annual trips out to Odessa, (top of the Black Sea)over the last 7 years the rate of development, number cars, shops and new building, is marked. I'd say the number of cars (new are mostly imports) on the road has doubled in that time. Most of these cars are small by American standards, I guess the fleet probably averages 30 to 40 mpg US (though there's even the odd Hummer to be seen)

However, Illichevsk, the Odessa port town, is actually a model of what Jim Kunstler would describe as new urbanism. The vast majority live in flats, and the town/city are compact, with most walking to a myriad of small shops, cafes and markets, with a supermarket only being built in the last two years -in the town centre. Communal parks, numerous cafes and a pleasant sea front. There's been some disparaging commentaries equating such urban living as left inspired. Whilst this is the origin of older developments, the present Ukraine is more capitalist than any other European country, and the housing bubble is at least as pronounced.

Odessa twenty miles away by car or frequent mini-bus, is well served by trolley buses and trams, though they're getting a bit old in the tooth, and I noticed some lines being taken out.

The trains and train line from Odessa to Kiev, are also somewhat rickety, underfunded, 12 hours overnight to travel 300miles to Kiev, not in the TGV league. Or 6 and a half hours by car on single and dual carrageway roads.

The electricity and water supplies have always been a bit flakey. Russian gas supplies and drought are probably the biggest threats to the countries well being.

Records

I was in Moscow last June. From what I saw: No exaggeration. Actually, I was pretty stunned at the change from my previous trip. Everyone in Russia who makes a little money wants a flat in Moscow. Everyone who lives in Moscow wants a Dacha. Not sure what life in Ekaterinberg is like.

Jeff

I also do not speak Russian.

I suppose that the real issue is really Russian domestic consumption (growth) estimates. In that sense the number of automobiles sold is really just an anecdote, albeit one that could be used in an essay to illustrate a consumption estimate.

If we doubt the consumption estimates, we could try to do a bottom-up analysis based on auto sales, but would we have any reason to suspect that mileage and miles driven estimates were any more reliable? I suppose by contrasting them with European estimates, for a start.

http://www.minprom.gov.ru/eng/ministry/statistics/0

Anyone know who "CCD FEC" is?

They also split out the Defense Ministry in the next paragraph. Perhaps there are a number of items that would have to be added to come up with what we might think of as "domestic consumption". It is hard enough to puzzle out what the EIA means with its statistics.

This looks like a slippery slope to a bottomless pit, which can't be good.

http://en.mirros.ru/economics/tnk/

http://www.riatec.ru/en/

Looks like the good info is published in MinTop magazine, a mere $2930 per year ($244.10 per issue!), according to Amazon.

Cheap!! Sign me up for two!

One way to estimate would be to get the numbers of new cars each year. Plus numbers for gasoline usage per year. Get gasoline per car, times those 1 million new cars.

If that data had not been 2002 numbers and had been 2005 or 2006 that would have been enough for a SWAG.

Another wild guess would be to assume VMT per car would be some fraction of the current US, take the 30 - 40 estimate for MPG. Assume 6,000 miles per year(1/2 US). Assume cars are bought at random through the year, giving 1/2 the yearly mileage the first year.

1e6 new cars * 3,000 miles / 30 MPG = 100 e6 more gallons of gasoline per year.

.27 million more per day. Double that the next year. (and that would be in line with the 2.5% increase in consumption numbers quoted above.)

http://www.indexmundi.com/russia/oil_consumption.html

I have no idea how reliable that site is. They claim to get their data from the cia factbook, which does in fact list:

Oil - consumption:

2.5 million bbl/day (2005 est.)

https://www.cia.gov/library/publications/the-world-factbook/print/rs.html

WT,

ELM, ELP -- what happened to ELN?

There is one solution to the ELM problem: bomb the offending countries into the stone age. I'm sure Iraqi consumption is way below what it would have been. And of course the Iranians are just as guilty, greedily consuming the hydrocarbons nature mistakenly placed beneath her soil. Norway shouldn't be a problem, but Russia could be tricky. But we've got our best and brightest working on it, so nothing to worry about there.

this type of demand destruction is probably not nessisary... people in the poorer countries will probably starve to death or die by some infectious agent first. (people will die in 1st world countries too, but in lower proportion to the total popluation)

remember in lots of the oil producing nations unemployment is super super high. discontent breeds rapidly in such situations.

nukes also destroy infrastructure. i'm pretty sure noone has neutron bombs though so we are probably safe.

by the time any of these bombing runs actually take place, there will not be much oil left anyways, and the internet/radio/tv will probably not be working so noone will hear about it.

I'm pretty sure noone has neutron bombs though so we are probably safe

Israel (many reports) stole our neutron bomb plans and built dozens of them (perhaps half or a third of the arsenal "according to reports"). It suits their strategic interests if ever they do nuke someone.

And if some future US Administration "cut a deal" with oil exporters ...

Alan

Neutron bombs are thermo nuclear devices as well. They have a huge bang and cause as much destruction as a similiar sized nuke.

The only difference is they also release a lot of radiation. This is useful for taking out tanks crews that would normaly be protected from the heat/shockwave.

The were developed as a way to stop russian armored divisions in Europe. A smallish nutron bomb could take out the crews while it would take a much larger regular nuke to disable the tanks physicaly.

The common idea that a neutron bomb kills people and leaves buildings intact is just myth.

I'm not sure why Israel would need neutron bombs. Are they worried about an Iranian tank invasion?

good to know that it wont be used on civilian populations

I guess we will skip every other letter. The next one would be ELR. Economize, Localize and Run (as in oil patch guys running for their lives from angry soccer moms).

How about MYIR? (Make Yourself Indispensible to the Rich)

Or OTOG (Outrun The Other Guy).

As in the old joke about the two lawyers encountering a bear in the woods.

One lawyer stops and gets his running shoes out of his bag and starts putting them on.

The other lawyer says, "Don't be crazy. You can't outrun the bear."

The first lawyer replies, "I just have to outrun you."

Funny. Why must it be two lawyers, and not two oil engineers or geologists?

Geologists and engineers would be at work, instead of walking in the woods.

The Export Land Model has long struck me as the most intractable problem of all for the US and other importers Post PO.

Once efficiency gains reach there limits, what are importers to do about declining level of imports?

They can bid up the price, but then they are only transfering their wealth to other nations who will use that wealth to further consume the many comforts of oil.

It seems the attempted colonization of the Export Land is the only eventual coarse.

But then what will America have become?

Skylar: IMHO, it might not be as bad for the USA as it first appears. One could relabel the Alberta tar sands as North American tar sands, as it is one totally integrated energy market. I would expect the investment to really ramp up going forward. CTL will also come on stream. The bottom line is, the products will be more expensive but so much is literally pissed away currently that IMO it is still not certain that a calamity will unfold (at least within the next 10 years).

>>One could relabel the Alberta tar sands as North American tar sands,<<

But that is the very definition of "colonization."

The point is that importers such as the US will be very reluctant to transfer their wealth to other peoples. They'd rather expropriate that wealth.

Skylar: The plan is for the USA/Canada/Mexico label to be rendered effectively meaningless. Currently Canada/USA is one integrated energy market for oil and gasoline, which means that whichever citizen of either country has the money can purchase the product. Rather than colonization, I would label the integration as globalization, which is in effect separating the planet into two teams ("countries")with competing interests, the top 1% financially (approx 65 million

humans) and the bottom 99%.

>>The plan is for the USA/Canada/Mexico label to be rendered effectively meaningless. Currently Canada/USA is one integrated energy market for oil and gasoline, which means that whichever citizen of either country has the money can purchase the product...<<<

Well, I guess I mostly agree with that, but don't discount the cultural, tribal & racial disparities; and all the resentments that that may entail.

I'm not so sure it won't be worse than we think. America's true FF use is masked by the fact that we have exported so much manufacturing including all the plastics in so many modern devices from computers to coffee makers.

It looks like the great unwinding to me.

Brian, I'll suggest that a rapid movement towards conservation will be "a calamity" to large numbers of Americans who are deeply in debt and will lose their jobs at least temporarily.

Consider the amount of economic activity around TV and newspaper advertising of cars, car manufacturing, new and used car sales, car repair, car tires and accessories, road construction, etc. Even if these soon-to-be-unemployed people had the skills to grow food and build electic trolleys, it would take a good while to tool up for those new jobs.

For the US to have a non-calamatous transition, we would have had to start when Jimmy Carter told us to. The tar sands are a drop in the bucket to US oil consumption; Dubbya and Dick know that, that's why we're in Iraq. They made a desperate gamble to keep this teetering edifice from collapsing.

Errol in Miami

skylar writes "They can bid up the price, but then they are only transfering their wealth to other nations who will use that wealth to further consume the many comforts of oil."

A feed back loop that I see coming as well. At the time we need to build Alan's rail we will be shipping $ somewhere else.

I sit back and look (increduously) at where we are headed. At the tire store the TV was on in the waiting room and there was CNN with a pathetic news special on Paris Hilton complete with pictures of her house. There was a woman staring intently, god knows what she was thinking, because she was stuck waiting as well.

The oil exporting countries with exception of a few in equatorial Africa are awash in cash from higher oil prices. Many of these countries, like Russia described in this post by westexas, have growing economies that benefit the average citizen who goes out and buys a car with the increased wages. This increased car ownership is happening in Venezuela, Mexico, Saudia Arabia, UAE, Russia, Iran, and many other places. Some of these countries are trying to boost tourism and expanding their airlines and tourist destinations to also use more oil domestically. United Arab Emerits is one such place doing the latter on a grand scale.

As the economies and populations of the oil exporters grow, so will their domestic oil consumption, expecially where gasoline is heavily subsidized. The "Land Export Model" that westexas has descibed should be the major energy discussion of oil importing nations, especially the US. Even if world production of oil continues to grow slightly for a few more years (unlikely), the world's "tradable" oil will decline due to faster rising consumption within the oil exporting nations. The near term threat is decreasing exports which will happen even if world oil production peak and decline is a few years off.

How much refinery capacity do Russia and these other countries have? Do Russia (and other exporting countries) have plans for expanding refinery capacity that are in line with projected/expected internal demand for products, especially gasoline.

How much is world wide refinery capacity expected to grow in the near future? Is this growth expected to keep up with expected demand for products?

These questions are to a large degree prompted by the tightness displayed in the US gasoline market. Is there or could a corresponding tightness develop on a global scale?

In pure economic terms, with no consideration given to political borders and internal political considerations, one would think that there are energy producers and energy consumers, without consideration to where they live.

Now, domestic consumers in exporting countries do have an economic advantage over more distant consumers (lower transportation cost), but if a distant consumer is willing to outbid, inclusive of the higher transportation costs, a domestic consumer, in pure economic terms the energy should flow to the high bidder.

But that is not how the real world works. Again, look at Mexico, where exports are down 18% from 1/06. As a relatively poor country, if oil were going solely to the high bidders, they should have seen a minimal decline in exports. In other words, it seems to me that the Mexican case history tends to support the Export Land Model.

I think that world export capacity is a huge and rapidly growing problem.

Russia has some undeveloped multi-billion barrel oil reserves in East Siberia. There are several articles about pipeline projects to get the oil to market either to the Pacific, or China or both. Russia was planning to build a new refinery in East Siberia also. I read one article that the Russian West Siberian reserves are mature and exports to Europe might be lessened going forward. Russia may expect to find more Arctic oil. A large Caspian field was discovered last year, and the Pacific shelf has attracted some exploration interest. Undeveloped natural gas , condensate, and heavy oil fields existed in large quantities.

You can make very similar arguments for the US Lower 48 and Total US, inclusive of Alaska. BTW, when Hubbert did his initial work on the Lower 48, a one-third increase in estimated URR only delayed the expected peak by five years.

We don't stop finding new fields when a region peaks. However, what we can't do is to offset the declines from the older larger fields, and the Russians themselves have started making public statements to the effect that Eastern Siberian reserves may not come on line fast enough to offset the declines from older fields.

Russia's absolute peak was in the 1980's on a broad plateau centered on 1984. They produced from just below 11 mbpd to just above 11 mbpd for five years on both sides of 1984 (1979-1983 and 1985-1989, all inclusive).

Russia's post-1984 cumulative oil production, through 2004, was 95% of what the HL model predicted it would be, using only production data through 1984 to generate the model. (Post-1970 cumulative Lower 48 production was 99% of what the HL model predicted, using only data through 1970 to generate the model.)

The recent rebound in Russian production was largely just making up for what was not produced after collapse of the Soviet Union. Russia has now "caught up" to where they should be, based on the HL model, and Russian production has basically been on a plateau since October 2006.

Since the Russians showed lower exports, year over year from 2005 to 2006, with rising production, I would expect that flat production equals an even sharper drop in exports--thus my question about the shutdown of the pipeline that I referenced above.

The bottom line, as I outlined above, is that IMO we will see a catastrophic decline in Russian oil exports, probably starting this year, no later than next year.

Remember - energy is just one input

This is key

In other words, china is an energy importer, the US is an energy importer, japan is an energy importer and Haiti is an energy importer. all things being equal, who is worse off?

that is, assuming all importers have an equal access to

supply...

japan is the most efficient user of energy in the world, with a 3X ratio over the US of GDP output per barrel of input. they learned the hard way, but they also learned smart

you have to take the economy as a whole, competitiveness, productivity, debt levels, innovation, which are reflected in currency value.

the US is a large complex economy, very flexible and adaptive, with good resilience - as has been shown by 9/11, the dot com crash, and other shocks . will people suffer - no question - in mississippi etc - they are suffering now,

and lack of energy is not the reason.

japan shows what can be done. we are a long way from there,

and there is much more that can be done

"Necessity is the Mother" as they say

we have not hit the stone wall yet - the mental stone wall of mass realization - when we do there will be lots of innovation, and changes in behavior

as Matt Simmons says - he thinks this will be the number one news story in 2010. right now it is way down the list

From the point of view of an oil exporter, which country provides you the best "stuff" for your oil? China, Japan, the US or Haiti?

In other words, how do you get the maximum economic benefit from delivering BTU's to importers?

As a nation where the majority of us live off the discretionary income of other Americans, how competitive are we with Japan and China in regard to the "stuff" we can trade for oil?

I think this will wind up being a very important question, and I'm afraid the US as it now exists the answer may be "not very", except perhaps for exporting food. But there may be problems with that, too.

And at the point it becomes obvious the US has little to trade, whence the US dollar's value?

Our main tradable skill in the future may be threatening to nuke other nations. Which could be problematic in its own right.

Hey you guys don't be so defeatist, I just made a purchase on line to a US company for a Grain Mill this afternoon..

http://www.aaoobfoods.com/foodprocessing.htm#top

A little more upbeat Okay? or I'll begin selling This Must Be Mordor Or TOD tee shirts.

Boeing is in the process of blowing Airbus out of the water with the 787 (some parts made in Japan and Italy).

There will be a need for some air travel regardless of oil prices. If one makes an aircraft that uses 20% less fuel (and 40% less maintenance) than any flying now, there will be a market for it. Add similar technology replacements for the 737 and 777.

Microsoft and Apple will still have market share IMHO.

And "Hollywood" was a major exporter in the Great Depression and continues to be one today.

With a collapsing dollar, some industry will return to take advantage of cheap American labor.

Best (?) Hopes for American Industry and Exports,

Alan

Poly: You are correct- in the future Americans will live like Japanese- which is a major psychological problem for most Americans. There aren't that many Japanese with a 4000 square foot house doing an 80 mile round trip commute five days a week.

instead its a 200 sq foot house doing a 100 mile round trip on the fast, electrified transit system

WRT the commutes, there aren't all that many Americans doing 80 mile round trips either. On the whole, Japanese commutes take far more time than North American commutes. OTOH urban car commutes are fairly uncommon, which probably accounts for the much longer commute time, as even in Japan, trains and buses often involve a fair amount of time-consuming walking and waiting - although train services, especially, are very punctual, not sloppy and shiftless as in the USA, where nothing much beyond, presumably, overbearing self-esteem, is required of drivers and maintenance workers. (And if one wants to argue based on the few well-publicized ultracommuters, one must also consider the Shinkansen ultracommuters of Japan.)

It may be a long time before "Americans live like Japanese", since population densities in Japan - in those areas where most people actually live - are unimaginably high to Americans. Even in New York City, the only thing that matches Tokyo for sheer incessant press of numbers is the Lexington Avenue subway - and then only during the rush hours, as at other times the crowd on the Lex is a bit thinner and there may be something of a wait.

If America matched Japan for population density, the train-vs-car numbers would match Japan much more closely, as they begin to do in New York. But most Americans don't live that way. And the sort of massive, multi-tens-of-trillions investment needed to herd nearly everyone into megacities in such a radical manner will not be forthcoming. Should the doomer-porn version of PO transpire, the money will simply never exist; in all other cases, few will rush to embrace such a lifestyle or pay such a heavy cost.

Please note that the "money" did not exist in Japan either, for them to become what they are today. They did it out of necessity, not riches.

Agree though that the US will not fully duplicate Japan - the geography is fundamentally different giving rise to a somewhat different set of issues and methods of resolution. Additionally, sociologically the differences are sufficient to make the Japanese lifestyle unlikely.

However, I do expect the the US will continue to adopt measures to make emulate some key elements of Asian lifestyles - out of necessity if not by choice. This includes greater use of trains, more efficient automobiles, and smaller residences.

Again, it is necessity that drives us.

A false choice !

Several overlooked points.

The most relevant is the recent French tram building spree. I have cataloged (THANKS Google :-) French cities and towns over 100,000 population.

Four do not have a tram and no plans in process for one. (Limoges has electric trolley buses), four towns have unfinanced plans in process and one is under construction (another opened earlier this year).

EVERY OTHER FRENCH CITY AND TOWN OVER 100,000 HAS URBAN RAIL !

And several under 100,000 have trams as well. I found it interesting that French towns (with the well known French bureaucracy) can go from financial decision to ribbon cutting in 3 to 4 years. Lyon built two tram lines from a vague route plan to opening in 3 years 5 months.

Grenoble has a population of 157,500 (metropolitan area 400,000 to 515,000 depending on definition). Each day 120,000 people travel on the system – 75,000 on line A and 45,000 on line B – and the system has been described by Francois-Xavier Perrin, director general of operator TAG, as "a fantastic tool to revive our city and to modernise the city's public transport at the same time."

There are also even more ambitious plans for a 50km tram-train network, modelled on Karlsruhe, Germany, using existing tram and some SNCF heavy rail lines and involving extending the system south, east and northwards.

A modern industrial democracy CAN massively retrofit Urban Rail not only into cities, but also towns. There are discussions in France about building trams in even smaller towns. Mulhouse (pop 112,000) opened their first tram line in 2006 and has plans for three tram lines (branching into neighboring villages of 5,000 and 10,000) by 2012.

Another point.

We cannot retrofit our country

With massive help from gov't policies, the USA did dramatically alter our Urban form in just twenty or so years. Between 1950 to 1970 we trashed almost EVERY prime commercial property in the nation (aka downtowns) and a good percentage of our well built established neighborhoods.

Unlike pre-WW II, most new construction is shoddy and designed to last just 20 years before major repairs are required (a couple of decades ago the standard was 30 years). So we, as a society, can either rebuild McMansions or build smaller, better quality housing that is more energy efficient (internally and externally).

About 30% of Americans WANT to live in TOD today, Satisfy this unmeant market demand and then "see what happens". Hopefully, Gov;t policies will help in the death of suburbia as they once helped to kill inner cities (turn about is fair play).

Two blocks from me is the type of development that we can afford. The front half of a parking lot is having a duplex built on it. 26' wide, 50' long, 2 stories, 2 units. 1.5 blocks from a streetcar stop, a neighborhood grocer two doors down. It will sell in the middle class range.

Best Hopes for Urban Rail and TOD, because we will not have a choice in the medium run,

Alan

A new factor is that some customers are saying 'we don't want your stinkin' exports': example Australian LNG and the Malibu terminal. Combine that with new found ways of using the NG at home such as gas-to-liquids or converting diesel trucks to run on compressed natural gas (CNG). The same goes for yellowcake exports. When/if Canada and Australia get the low carbon message they could retain perhaps half of their production for use in domestic reactors. The CIA is right to worry about 'resource nationalism' hurting the US.

I am Australian. I have been arguing for some time that we should be scaling back our energy exports: Coal because of Global Warming, Natural Gas because of its value (we need it) and uranium because there are no adequate solutions for very long term waste storage.

I do not regard this as resource nationalism. We are entitled to use our resources as we see fit. They do not belong to the US and if we refuse to sell them to the US, such refusal is not a hostile act.

The fact that the US and Europe have plundered and squandered the ample resources they were gifted does not mean that if Russia, Australia or any place else refuses to sell them oil or gas that the US has a right to them. The invasion of Iraq was for oil. Lets hope the US cannot do that anymore.

"In 2002, only 112,000 foreign cars were sold in Russia."

I suspect that the this is the official number but the real number is higher. When I lived in Poland in 1999 I knew a guy who had 3 BMWs stolen in one year - the assumption was that they all went to Russia or Ukraine. I've certainly seen plenty of foreign cars in Russia.

As for what their future oil consumption will be like, I visited 5 different cities in Russia this year and it looks to me like they are moving from an urban to a suburban lifestyle. Don't forget, people in the US used to live in cities and use public transit until they had the option to do otherwise - and low and behold they moved en mass to a suburban lifestyle. Western Europe managed to moderate this trend - through very high petrol taxes, urban planning, etc. But knowing what I do of the Russians I would expect them to follow the American example - the one thing that might hold them back is their congested roads. The question is, can Putin or his successor manage to build lots of new roads?

I grew up in St. Petersburg, Russia, and while visiting there in September of last year I was shocked by the number of new SUV's on the streets. I even saw several H2 Hummers, which I've never seen in Russia before, even though I travel there almost every year. They look ridiculous in a Russian city (the lanes are more narrow than in the US), but more and more people buy them...

Regardless of where the Russian oil production goes from here, this consumption orgy does not bode well for the exports. A ride through the city that used to take less than an hour in late 1990's now takes two hours... traffic jams everywhere! Thank god there is plenty of light rail, plus the deepest subway network in the world (should come in handy in case of a nuclear gift exchange, assuming you can get to a metro station fast).

On the other hand, most Russian cities over 200K population still have very robust electrified mass transit systems in place (usually light rail and/or electric trolley buses). Those can be used to cut back on oil consumption when oil is $200/barrel.

WT, I've got one question about this predicted drop is exports. What is the effect of price difference? IOW, if the export market is willing to pay an extra 10-20 dollars per barrel won't the oil go across the border regardless? Are the producers in Russia really that beholden to their own consumers? Will the government mandate keeping the oil at home?

Your thoughts please.

Roy

Russia collects an oil export tax, a MAJOR source of revenue.

The domestic price is the world price - export tax - transportation costs.

As oil prices trend upward, so does the export tax. As long as export revenues and export taxes are going up, I see little concern in Russia over domestic consumption. And revenues can go up on declining volume.

Putin cares more about the Moscow taxidrivers than he does American SUV drivers.

Best Hopes for Conservation and Non-Oil Transportation,

Alan

WT

first a big thank you for your perseverance with your message here on the oildrum.

a big factor adding to the internal growth [ & re your export land declines] is money supply expansion. i have noted u pointing this out lately.for russia estimates are in the 45% + range.this is i guess them learning to play our financial game + no. 1 producer of crude.i think this speeds up the global economy endgame.bodes ill with all the threats currently going on.

thanks again for elp & export land & hubbert's analysis extrapolated to the world. unfortunately i think u are a bit of an optimist, impact wise. thanks again!

I talked about internal demand in exporting countries versus external demand in importing countries up the thread somewhere.

In pure economic terms, the oil should go to the high bidder, inclusive of the higher transportation costs to get the oil to the importers. However, in the real world that is less likely.

I think that we will see two phases in "Export Land," after production starts falling. In Phase One, income will go up faster than production and exports are falling, because of rapid price increases. In Phase Two, income will decline because the price increases can't offset the decline in production and exports.

In Phase Two, there will be efforts made to curtail domestic consumption (Iran may be entering Phase Two), but it will be very difficult to accomplish. For example, Iran's efforts to curtail the consumption of price subsidized gasoline are being met with considerable resistance.

After Phase One a comlete breakdown of the fiat money system may take place. I live in Germany and we are already standing at the brink cause of our debt, demography and globalisation. 200 € per barrel will ruin our economy. As a result of this development, there may be a Phase One B with falling prices (Deflation).

makes sense.

we have put $ pressures on iran that have helped force them to move into phase 2. they appear to be having $ problems.iran also knows preparing for hardship[war shortages] is best done in stages to avert revolution.

my point about the money printing is this is being done world wide[as u have noted in drumbeats] so this $ endgame speeds up within exporters because they can print at higher rates & 'get away with it'. i think war &/or financial crisis will lead the PO crisis [in the media] as it will be more acceptable.

added to above.

This is in essence [WT] your Iron Triangle[i left out this contribution of yours] following it's typical pattern of decisions.

A year or so ago I read an article about Lexus sales in St Peterburg. They have sold not a single IS (Small car) but alot SUV-s and large limousines. It is russian mentality, they have to show off. In Estonia (neighbour) we have russians who drive at least a 5 series BMW and are living in rental one-room flats....

"As I warned in January, 2006 (see my article, “Net Oil Exports Revisited”)"

The net oil exports, written in Jan 2006, was referencing When Does Hubbert Linearization Work? (via Hubbert Linearization Analysis of the Top Three Net Oil Exporters)

Since this was written in 2005, with data referenced from 2004, is there any plans to re-run some models of a) total production from exporters, and b) total net exports from these exporters, as the "current" information linked to on this site is more than 2 years old in places.

Andrew

Khebab and I are going to do an article on the top 10 net oil exporters.