Gasoline Prices – Part I: Immediate Causes

Posted by Robert Rapier on June 8, 2007 - 11:00am

Introduction

As of this writing in late May 2007, gasoline prices have increased by over $0.70 per gallon since March. This is great news if you bought gasoline futures in March, but bad news for most consumers, and the politicians that answer to them. If you knew where to look, there were early indications of trouble brewing last winter. By February to early March there were definite signs pointing toward an impending problem – over 2 months before this became a "crisis" in the view of the public. On March 9, 2007 I warned that gasoline supplies "could pose problems in the coming weeks" and "higher gasoline prices will be the norm rather than the exception in upcoming years." So, how did this situation happen?

In Part I, I will discuss the short term causes that have resulted in the current supply crunch, and explain what factors potentially signal higher prices. In Part II, I will address longer term factors and policy decisions that have contributed to the problem.

Gouging: The Lazy Man's Answer

A large portion of the population - including many politicians, judging from recent hearings into the matter - seem to believe that "price gouging" is the explanation for higher gas prices. This explanation reeks of an inability to actually understand the issues. Of course oil companies do seek to maximize profits, but they can't do so by merely raising the price of gasoline. That is done by the market, and if prices go up the companies earn more money. The cause of higher oil company profits is that oil and gasoline prices have gone up. But many have cause and effect mixed up. They believe that the cause of higher gasoline prices is "profiteering." If that were the case, the oil industry would not be cyclical.

People seem to understand that when the price of gold rises, gold mining companies make more money. And there doesn't seem to be a widespread misconception that the reason they are making more money is that they just decided to raise the price of gold. People understand that they can't do this. It is the same with oil companies and the price of gasoline. (I will address the issue of withholding supply in Part II).

The Role of OPEC

However, there is one caveat. OPEC does control enough of the world's oil production that they have historically managed oil supplies to maintain an oil "price band" that they view as fair. Only 5 years ago the average retail gasoline price was $1.35/gallon. At that time, the world average price for crude oil was $23.47/bbl. By 2006, crude oil had risen to $60.32 and gasoline to $2.57. Thus the retail price of gasoline had risen by $1.22/gallon. Oil, with 42 gallons in a barrel, had risen by $36.85, or $0.88/gallon. Given that a barrel of oil does not yield 100% finished products, we can attribute most - and potentially all - of the gasoline price increase from 2002 to 2006 to the increase in the price of oil.

2007 Adds a Twist

However, in 2007, the recent average U.S. retail gasoline price of $3.22 - $0.65 higher than in 2006 - coincided with a world crude oil price of $64/bbl. That is only $0.09/gallon higher than the 2006 price, so clearly this small increase in crude prices does not explain the recent gasoline price rise. So let's look at the short term factors behind the 2007 price run-up.

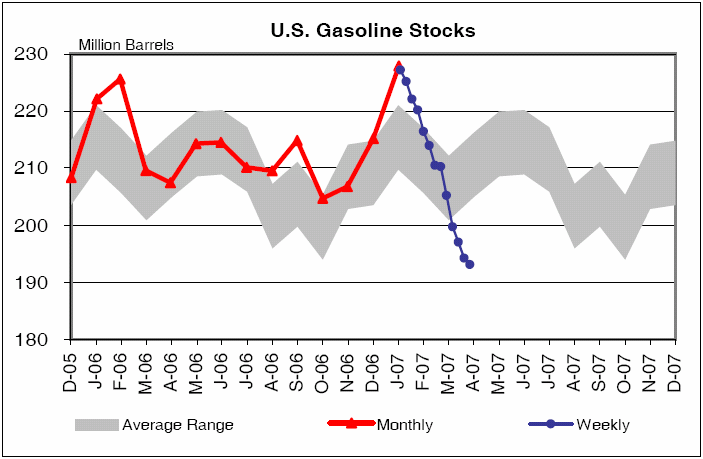

A graph extracted from the Weekly Petroleum Status Report published by the EIA (see the note at the end) gives a picture of the gasoline inventory situation over the past year:

Figure 1: U.S. Gasoline Inventories Through April 2007. Source: EIA

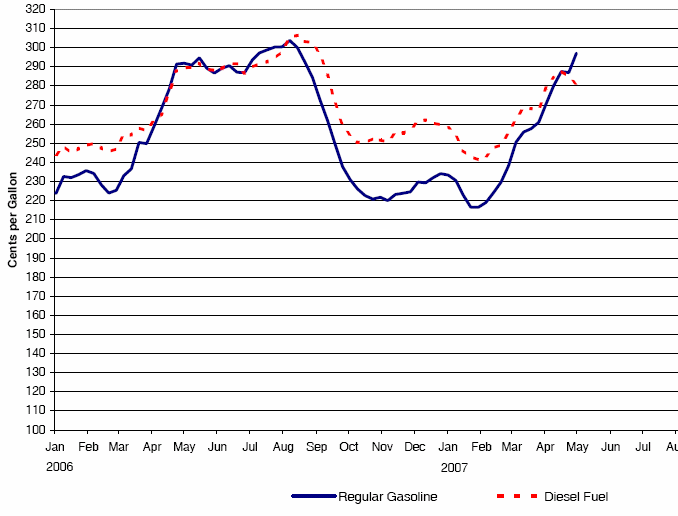

Compare that to the chart for retail gasoline (and diesel) price over the same time period:

Figure 2: U.S. Retail Gasoline Prices Through April 2007. Source: EIA

The relationship is clear. As gasoline supplies were rapidly pulled down, gasoline prices lagged at first, and then raced to catch up. It was apparent by February or March that the rate of descent was highly unusual, and sharply higher prices would be required to stop the plunge. On May 16, 2007 the EIA reported:

Gasoline inventories have recently been drawn down at a dramatic rate to bridge the gap between supply and demand. Over 12 consecutive weeks during February, March, and April, total gasoline inventories declined by a cumulative total of more than 34 million barrels (15 percent). This is the sharpest decline in gasoline inventories over a consecutive 12-week period in EIA’s recorded historical data.

So that answers the immediate question of why gasoline prices rose. The obvious follow-up is "What caused such a sharp decline in gasoline inventories?"

Reason 1: Record Winter Demand

Figure 2 shows that at the end of summer in 2006, gasoline prices plunged. This had two effects that ultimately resulted in the record high prices in the spring of 2007: Demand rose and gasoline imports fell. The plunge had the effect of spurring record demand starting in the fall of 2006 and continuing into the winter of 2007. Gasoline demand was regularly hitting 9.5 million barrels per day - an unprecedented level for fall or winter, and more typical of summer demand. While inventories were able to stay ahead of the demand until about January of 2007, when refineries (in the U.S and in Europe) started to take outages for annual maintenance, inventories started to plummet. Gasoline inventories do tend to drop every spring, but the lower gasoline prices resulted in a record-breaking inventory draw.

Reason 2: Lower Refinery Utilization

In the summer of 2005, crude oil inputs to refineries reached the level of 16.5 million barrels per day. Refinery utilization (the crude inputs/total refinery capacity) was as high as 98% on a weekly basis. But refineries have not matched those levels since Hurricane Katrina. Refinery inputs have only managed to reach 16 million barrels a day on two separate weeks since 2005, and have spent most of 2007 below 15 million barrels per day. Refinery utilization that was reaching 98% prior to Katrina has not been above 93.8% since.

One reason for this is that Hurricane Katrina resulted in the shut down of many refineries, which forced others to postpone their fall maintenance in order to keep the market supplied. Instead of stopping to do needed repairs, the refineries were instead asked to operate at full throttle. While this helped alleviate the immediate supply crunch, it also introduced a number of problems that have lingered. Imagine that your car is in bad need of a tune-up, but instead of taking it out of service, you decided to go out and run it at full speed for another 6 months or a year. That's what the refineries did, and they haven't yet fully recovered from lingering maintenance problems that resulted.

Another major factor that has had a ripple effect through U.S. refining was the BP explosion in Texas City on March 23rd, 2005 that cost 15 people their lives. Not only has production not been fully restored at this refinery - one of the 5 largest in the U.S. - but the subsequent investigation headed up by Former US Secretary of State James Baker pointed out numerous process safety issues in BP's operations. Furthermore, the investigation report noted that these safety issues were not limited to BP.

The impact of this is that it has resulted in a much more cautious approach to refinery operations. There is far less hesitation to shut down a refinery if there appears to be a problem, and that is what is happening. Refiners are taking a meticulous approach in their operations to prevent another Texas City - but at the price of reduced utilization.

On top of the Texas City incident, BP also had a recent fire at their Whiting, Indiana refinery - also one of the 5 largest in the U.S. This refinery has been running at half capacity since the March 22nd, 2007 blaze. While these unplanned outages are not limited to BP, because these two refineries are among the 5 biggest in the U.S., they have been a major contributor toward the spring gasoline supply crunch.

In Part II, I will go into more detail behind the longer-term refinery issues - such as failure to keep up with growing demand - that have contributed to the current situation.

Reason 3: Falling Gasoline Imports

The third factor that resulted in the rapid inventory drop is that gasoline imports fell. There are two reasons for this. First, as prices plunged in late 2006, the profit margins for European gasoline exporters plunged as well. This provided a disincentive for exporting gasoline to the U.S.

Second, between the summer and fall of 2006 the U.S. dollar fell by around 10% against the Euro and the British Pound. Since U.S. fuel imports are paid in dollars, the exporters are receiving less money unless the price rises to compensate. For example, Great Britain is currently the largest volume source of U.S. gasoline imports. In the summer of 2006, $1 was worth 0.55 British Pounds. If gasoline is $2 a gallon, a British exporter receives 1.10 British Pounds per gallon of gasoline sold in the U.S. By the fall of 2006, the exchange rate had dropped to 0.50 British Pounds per U.S. dollar. At the same $2 a gallon, a British exporter only received 1.0 Pounds per gallon of gasoline sold in the U.S. Because gasoline prices were falling as well, this provided a double disincentive for gasoline exporters.

Figure 3: U.S. Gasoline Imports 2005-2007. Source: EIA

As can be seen in Figure 3, gasoline imports fell in late 2006, and imports have remained consistently below the previous year's levels. Given that demand was at a record high, utilization in the U.S. was down, and imports were lower as well, it is not surprising that inventories were drawn down so rapidly, nor that the price reacted as it did. This year's gasoline situation was a perfect storm combining much greater demand with lower supplies. The outcome was inevitable: Record high gas prices.

Summary

Gasoline prices have risen for a number of factors. The cost of crude has gone up sharply in the past few years, adding about $1/gallon to the base cost of gasoline. In the fall of 2006, gasoline prices fell to their lowest levels in a year. This spurred record demand in the fall and winter of 2006, and discouraged gasoline imports (which were also discouraged by a weaker dollar). Those factors combined to draw down gasoline inventories in the spring of 2007 at the fastest rate in EIA history. When an inventory draw is that steep and persistent, gasoline prices must rise sharply to reign in demand and balance it with available supply.

Looking ahead, the supply/demand picture will likely remain very tight for years, although there will be occasional relief depending on the season. But it looks to be the rule, rather than the exception, that higher gasoline prices are here to stay. A return to sub-$2/gal gasoline appears highly unlikely (again, some seasonal exceptions are possible).

In Part II, I will look at longer term factors that have adversely impacted U.S. gasoline supplies.

Note: This Week in Petroleum

If you follow the petroleum markets, or you just want to know what is going on in the world of energy, the weekly reports from the Energy Information Administration (EIA) are invaluable. Each week the EIA releases a report detailing information on petroleum and product inventory levels, imports, prices, refinery utilization, etc.

Some links you may want to bookmark, if you want to be more informed about what’s happening in the world of energy, are: Text File of Highlights. This is the first report to come out. It is released at 10:30 a.m. EST each Wednesday. This is a text file that provides all of the important details, although without the graphics. The second is: This Week in Petroleum (TWIP). This is a comprehensive and graphical look at the trends and developments. The report is released at 1 p.m. EST each Wednesday. A more comprehensive view can be found in the Weekly Petroleum Status Report, also released each Wednesday at 1 p.m. EST.

Previous Essays on Gasoline Prices

Stuart Staniford

Robert Rapier

Thanks, Robert! I really admire your work and dedication. What effect do you think the tropical cyclone in the Arabian Sea is going to have on prices? I'm thinking it will be as bad as a western Gulf Hurricane. Do you know what proportion of crude is exported through the Arabian Sea?

It's amazing to me that the market doesn't seem to be reacting much to this. No, I don't know the proportion exported through the Arabian Sea, but it is not a trivial amount. This is going to be interesting, to say the least.

Someone suggested 25% of world crude:

http://www.powerswitch.org.uk/forum/viewtopic.php?t=4311&highlight=

Peter.

Folks, we would ask that you help us spread our authors' pieces around the internet as best you can--in comment boxes on other websites, whatever and however you can help. People need the information we discuss here.

We would also ask that, if you are so inclined, that you would take a moment and help our articles out on slashdot, reddit, digg, and the other link farms as well.

Thank you very much...!

Hi Robert,

I have taken the liberty of making bold with part of your statement:

That bit seems to imply future relief to that situation, are you looking to a decrease in demand? If so, how so? Or do you have some arcane knowledge of future increases in production?

Thanks.

That bit seems to imply future relief to that situation, are you looking to a decrease in demand? If so, how so? Or do you have some arcane knowledge of future increases in production?

No, I don't see any relief in sight. When I say "years", what I mean is as far as I can see.

That's also a relief, I thought for a while we would be seeing doomers jumping from windows, Nice to know it is still Buggered as Usual. ;>)

A large portion of the population - including many politicians, judging from recent hearings into the matter - seem to believe that "price gouging" is the explanation for higher gas prices. This explanation reeks of an inability to actually understand the issues. Of course oil companies do seek to maximize profits, but they can't do so by merely raising the price of gasoline. That is done by the market, and if prices go up the companies earn more money. The cause of higher oil company profits is that oil and gasoline prices have gone up. But many have cause and effect mixed up. They believe that the cause of higher gasoline prices is "profiteering." If that were the case, the oil industry would not be cyclical.

This is as succinct a description of pricing as I've ever seen. Very plainly stated.

But get ready for chaos.

"bad news for most consumers, and the politicians that answer to them"

figure of speech ?

almost un-fair nit-picking. if the politicians answered to us, it would be a very different world.

Who is us? Actually, the politicians do answer to the majority. In the Dem debates, most of the pols pandered to the fact that Americans only care about reducing gas prices and don't want to hear the truth about demand.

I don't see the relationship between price and inventory nor do I see any evidence of the substantially increased demand caused by the price drop mentioned here. If product is supplied to the market in the appropriate quantity, inventory isn't an issue until it impairs actual supply to the market. As long as the supply is adequate, prices shouldn't rise like this.

Now as to the gold markets, apparently you don't follow them because your analogy is inaccurate. The Central Banks of Europe and the US, regularly dishoard gold onto the market in order to suppress the price. The oil market works just the opposite. Market participants try to maximize their returns by selling surplus at higher prices in order to reap the reward of high prices and build supply in times of unfavorable prices. If the oil producers drive prices down by oversupply then they hold back, much as OPEC has done. Gold producers do not have a production setting cartel as do the oil producers. It's well known that OPEC has a substantial impact on oil prices through management of their marginal production. The gold producers hold no such cartel and therefore have no power to manage prices. In the gold markets the Central Banks hold years of total production and can dump a month of worldwide production to suppress the price anytime they need to, they are the cartel in that market. They clearly did this in February through May of this year and in May through June of last year.

Now back to the price of gasoline. In your inventory plot we see that inventories have dropped sharply preceding a price spike. However your data goes back a year and we don't see that kind of inventory draw down corresponding to last years substantial price rise of the same magnitude. The first question I would ask is why would inventory be a determinate of price since it clearly isn't supply to the market? Then secondly, who controls inventory? The answer to the second question would be the refiners and distributors who produce the domestic product and sell the imported product. The answer to the first question is not so clear since this inventory is fairly volatile, i.e. it is being produced to sell quickly or it goes bad. In other words a buildup of inventory isn't likely because of the volatility of the product. So gasoline production has to be just in time for the most part and it has been for years. Excess refinery capacity aside, we still haven't seen any shortages of product that would account for the prices we are currently paying. In economic terms, your argument for no price fixing doesn't hold water.

I don't see the relationship between price and inventory

I simply don't know what to say to that. You can't see that as inventories plunged, prices started to skyrocket? If you download the demand information from last winter, you will see that as prices fell, demand shattered all the previous winter records. Denying it doesn't change the facts.

As long as the supply is adequate, prices shouldn't rise like this.

Have you ever taken an economics course? You certainly have a bizarre view of pricing - that actual shortages must develop before prices respond.

The Central Banks of Europe and the US, regularly dishoard gold onto the market in order to suppress the price.

So then gold prices never spike up? Of course they do. And when they do, gold mining companies make more money. And they make more money because gold prices spiked, not because they raised the price of gold.

Excess refinery capacity aside, we still haven't seen any shortages of product that would account for the prices we are currently paying.

Again, I don't know what to say. Corn prices doubled in the past couple of years. There are no corn shortages to account for this. Are you suggesting that we have to have actual shortages to explain the price spike? Do you not understand that if the price hadn't spiked, we would be facing actual shortages right now? That's why the price spiked - to reign in demand and balance it with supply.

Robert, you had much the same reaction that I had and it doesn't take dropping the data into SAS to see how the tightness of supply is a leading indicator on gasoline prices. Last year the market responded to the perceived tightness of the oil supply

It seems the oil markets are now responding with front month WTI up $1.11/barrel and Brent Crude up $1.43/barrel as of this writing.

Arthur Robey

Oil, like rent is an inelastic commodity. In other words it responds sluggishly to increased price. You just have to pay your rent no matter how hard they slug you. Eventually you may be forced into a caravan. It is going to take a lot of weaning to get us off oil.

In other words, I am too stupid for words...............

Try reading my whole comment. If you desire to draw some kind of relationship between inventory and price it should hold at all times and your data clearly shows it doesn't. Correlation doesn't imply causation and I would bet that the level of correlation in those two graphs you presented is insignificant anyway.

As to gold prices spiking up, they are mostly crushed right after they have a good spike. As I told you, gold is a managed market by the Central Banks who have substantially more supply above ground than the miners.

Instead of saying you don't know what to say you might try to respond to my comments and questions with real answers.

This isn't correct, it's just wrong. You make a statement without the basis of any kind of relationship to justify it's correctness. What I know is that gasoline usage is up, not down and that prices are up right along with it. There has been no demand destruction due to price increases and so the prices have continued to increase. This is due to the fact that there is no supplier who has a surplus and can suppress the price. That is because there is a paucity of suppliers and as most people understand, that is what a lack of competition amounts to. It is exactly what a cartel does, limit competition to manage price. It's exactly how the banking system in the US operates. Why would you expect big oil to be different than big banking?

What you are doing in your post is calling the rest of us who don't agree with you stupid. You have posted a bunch of data that isn't connected and made a hand-waving argument as to why prices aren't fixed because your unconnected data explains the price rise completely. What you have failed to show is that prices are not fixed. Until you can do that, most people aren't going to believe you.

If you desire to draw some kind of relationship between inventory and price it should hold at all times and your data clearly shows it doesn't.

That’s completely false. Do you know what r-squared signifies? Do you understand that a relationship that holds at all times will have an r-squared of 1? Even the relationship between crude and gasoline doesn’t always apply. It gets cold in the winter in Maine. Yet that doesn’t hold “at all times.” Therefore it’s false? We can’t draw relationships? Again, you have some very bizarre notions.

As to gold prices spiking up, they are mostly crushed right after they have a good spike.

Right. I note this comment from you last year:

Had gold shortages developed to warrant such a price rise? Did gold mining companies profit from the spike? Did they actually raise the price? The vast majority of what you wrote is simply a red herring. So what if the banks try to control the price of gold? OPEC tries to control the price of oil. That doesn’t change the fact that when gasoline prices spike, oil companies make money as a result – not because they spiked gas prices.

This isn't correct, it's just wrong. You make a statement without the basis of any kind of relationship to justify it's correctness.

That you can’t see the relationship does not mean that everyone else can’t. Demand has been up all winter. Yet not until inventories started to plummet did the price start to rise. But there’s no relationship there. Nothing to see, move along.

What I know is that gasoline usage is up, not down and that prices are up right along with it. There has been no demand destruction due to price increases and so the prices have continued to increase.

Demand was up in the winter to record levels, yet prices were suppressed. Can you guess why? Hint: The relationship that you can’t see between inventories and price.

What you are doing in your post is calling the rest of us who don't agree with you stupid.

Well, so far, “the rest of us” is just you.

You have posted a bunch of data that isn't connected…

Let me ask you once more, since you didn’t answer the first time. Have you ever taken an economics course? You seem unable to understand that there WOULD be a relationship between inventory and price – especially when the inventory is racing toward the MOL (as it was).

What you have failed to show is that prices are not fixed. Until you can do that, most people aren't going to believe you.

Well, you are never going to convince the conspiracy nuts. I more or less write them off, because nothing you post is going to convince them that this isn’t all decided in a smoke-filled room between all the Big Oil CEOs.

In your own words.

So by your own admission, most people don't buy the oil company apologist arguments you are making here.

Of course I have but unfortunately economics isn't a science. It is a set of idealized speculations that don't work very well in the real world because things just aren't the way economists assume they are. Moreover, people don't behave the way economists say they should. For example, these high gas prices should have caused consumption to fall but they haven't. In fact consumption has risen right along with the price, please explain from that from your economics text book if you can.

Regarding my post on gold, I think you missed the point there. That was a post where I was predicting price completely on the basis of technical analysis which could care less about fundamentals. You are making all kinds of fundamental arguments here and ignoring technical arguments as well as collusion in determining the price. In fact you resort to name calling and throw up your hands because I don't find your arguments very compelling.

In the gasoline market the longs have to take delivery or pay a very high premium in the contango to avoid it. So in the gasoline market, longs are real consumers whereas in the gold market longs are simply speculators who factor any contango into their trading programs. Longs in the gold market rarely take delivery, the COMEX gold inventory is only about 10% of the open interest. Furthermore, as I have already pointed out, gasoline is very volatile. I think it has about a six month shelf life at best, gold lasts forever, the two products don't compare very well.

This is one of the great weaknesses of economics, it fails to distinguish between products. The only distinguishing characteristic is elasticity of demand but that doesn't even begin to cover the issue of volatility of the product itself. It also completely fails to account for what happens when a small group controls something that is vital to everyone's survival. This leads to exactly the kind of situation we find ourselves in now. The oil companies are making outlandish profits due to collusion at the expense of everyone else and yet not many people are cutting consumption as a result. The oil companies will continue to gouge until they can't.

Now you tell me what is to keep them from gouging, if you can.

So by your own admission, most people don't buy the oil company apologist arguments you are making here.

Ah, so you mean you, like the rest of the general public, do not understand how gasoline markets work. Technically, I should point out that “a large portion” doesn’t automatically imply “most”, so it isn’t by my own admission. But if you want to tell me that you are in the same boat as a large portion of the rest of the public in being unable to understand that the gasoline market is like the soybean market, yes, I would agree with that.

However, I would point out that I have found that most people, when presented with the actual data, do "buy" the arguments. Even the rabidly anti-oil FTCR has finally acknowledged that inventories drive price. They just say that oil companies are artificially driving inventories down. Their proof? None. They are like you and your collusion charges. You can't explain it any other way, and it can't, it just can't be what I have said. It can't. It must be collusion. So you close your eyes and say "I don't see a relationship." Of course most of the public have not seen the data, so they do have a better excuse than you do.

In fact consumption has risen right along with the price, please explain from that from your economics text book if you can.

The population is growing, more people are driving, and despite their complaints, the price really doesn’t hurt yet. It’s not that difficult. But at some point, it will stop growing if the price keeps rising.

Regarding my post on gold, I think you missed the point there.

No, I didn’t. The majority of what you have been writing about gold is simply not relevant. The facts are, gold prices do go up and down. Just like gas prices. And when they go up, gold mining companies see their stock price go up. You know that relationship, right? So, does that mean that gold companies raised gold prices? Or did the market?

You are making all kinds of fundamental arguments here and ignoring technical arguments as well as collusion in determining the price.

You have evidence of collusion? By all means, call the FTC! I mean, they have investigated these claims again and again, as have many state agencies. They didn’t find any. But you have uncovered some? Would you share it with us?

So in the gasoline market, longs are real consumers

Wow, I will have to tell that to some of the guys on here who buy gas futures and ask them where they actually store the gasoline. Seriously, you are digging yourself into a big credibility hole. In fact, the gas market behaves like the gold market or the corn market or the soybean market. If supply is falling in the face of strong demand, the price will go up. If it LOOKS like supply is falling, the price will go up. That’s just the way it works. Believe me or don’t believe me. I have sat in on many a price discussion regarding gasoline. We are looking at inventories to raise and lower prices. That’s not a guess or a speculation or a hunch. It is a fact.

The oil companies are making outlandish profits due to collusion

There you go again. Any time you want to post some proof of these charges, I think everyone would be happy to see it. So far, we have seen an enormous disconnect from you regarding how markets work, and a number of charges of collusion which government investigations never seem to uncover.

Also, what is an outlandish profit? Please define, and define gouging for me if you will.

Now you tell me what is to keep them from gouging, if you can.

Tell me how to measure gouging, and then we can visit that question. And tell me, when your friend did so well on your advice in the gold market, was that gouging? And was the profit outlandish? Why or why not?

What, you mean some guys who buy a few contracts on margin? They aren't the real players in the market and don't have any impact on price so why bring them up? Real buyers in quantity have to take delivery and they must have storage. The people you are talking about mean nothing in the scope of this discussion. You are the one digging yourself a credibility hole, not me.

Right now the difference between NYMEX unleaded and the pump price is about $1 or nearly a 50% markup. Now we are talking about already produced, finished product. You know what the markup is on bullion gold purchased from a dealer and spot gold is? Anywhere from 2-5% right now according to Kitco. What's the difference there?

You are the one digging yourself a credibility hole, not me.

I will let our posts speak for themselves.

Right now the difference between NYMEX unleaded and the pump price is about $1 or nearly a 50% markup.

Have you heard of the government? They get a very large cut of that. You knew that right? I mean, that would be really, really stupid to point out the difference between the NYMEX and the pump price, and not factor in that a very large portion of that goes to the state and federal government. Then, you have a little going toward transporting the fuel, and a little toward the retailer. And "poof", your 50% markup evaporated, right along with the rest of your credibility.

Fellow, I have been having fun with you, but I have to do some other things now. Besides, it is almost bedtime here in Scotland, and I want some others to have fun with you as well. But remember, I can spot a fake from a mile away.

Last I checked it was 18cpg federal and about 22cpg state average for a total of about $.40/gallon. So there is a $.60 per gallon premium from the spot market and that translates to a roughly 25% markup over the spot price. Still a far cry from 2-5% in gold. So what's the difference? Gold has to be shipped, in fact it has to be remelted and coined which costs something too. Better get to bed because your brain is getting too tired trying to avoid using real numbers in order to keep up with this discussion.

I don't mind slapping you around one more time before bed, so I shall.

Last I checked it was 18cpg federal and about 22cpg state average for a total of about $.40/gallon. So there is a $.60 per gallon premium from the spot market and that translates to a roughly 25% markup over the spot price.

So, in the blink of an eye, your 50% markup is down to 25%. You are a master back-pedaler. If you thought about it for a second, that should tell you something.

But let's investigate with some real numbers, instead of your approximations.

Today, unleaded on the NYMEX is $2.24. The retail price on the East Coast is $3.07 in the update released today. So, we have an $0.83 gap.

Gas taxes are a bit higher than you suggested. The average a few years ago was $0.42/gallon, but it's more now because many states have sales taxes, and taxes have gone up as the price of gas has gone up. The gas tax in New York is right at $0.50/gallon. It's over $0.50/gallon in California. But let's say for a moment that it still is an average of $0.42/gal. Now we only have a $0.41 gap. In the $0.41 gap we have the cost of the person buying the fuel (usually a jobber), the cost of transporting it (the pipeline gets a cut), and then the markup by the retailer. So those huge markups you think you have uncovered, just don't exist. You have a fantasy created in your mind, all because of an inability to grasp the obvious – low inventories mean high prices. (Now, had you gone a different direction and addressed refinery margins, you would have had a better argument. But you didn't).

a far cry from 2-5% in gold.

Now wait a second. First of all, you said gold had a big run up last year. Are you suggesting that someone was not making some big profits at that time? Because it seems to me that you are making a comparison of gold when the price is steady, to gasoline when the price has shot up. Let's compare to gold when the price shot up. Don't you think that would be a more accurate comparison?

Better get to bed because your brain is getting too tired trying to avoid using real numbers in order to keep up with this discussion.

You are so far over your head that it’s an embarrassment. But as studies have shown, the most incompetent severely overrate their abilities. Just review how our posts have played out - how many unanswered questions, unsubstantiated charges, and red herrings you threw out there - and it is clear that you tried to fake your way through the discussion. You might get away with that sort of crap on another board, but here, a lot of people know what they are talking about. You can’t fake your way around here for long.

Good night. You have been a riot. And you kept me up late, even though your arguments weren’t worth it. I will leave you to the meat grinder.

Actually Robert, I think it's *really* interesting to see how regular people think about this. Clearly WRS has given this a lot of thought. Whether or not his conclusions make sense to us, I bet most people out there who are convinced they are being ripped off would be cheering right along with him. I think this is a good opportunity to know your opponent.

Uh, it tells me I forgot to add in the taxes, big deal, there is still a large markup, it's about five to ten times as high as for gold so if all markets are the same, what's the difference?

As to the spike in gold last May, I believe there was a high a a $40 premium over spot which just demonstrated my point that there was a lack of supply but even $40 over spot at $725/oz was only 5% markup and that is the high end for gold.

I can't wait for you to post Part II so I can laugh some more. Really, I think I know who you are but Im not going to guess, suffice it to say, you are less than impressive except in your own mind.......

wrs - if I were you I would quit at half time while you are merely 6-0 down.

The tax issue is his first score and really it doesn't change the fact that the margins in the two markets are vastly different. The rest of what he is claiming as a victory is simply opinion and not fact. You agree with him but it doesn't make me wrong because I disagree with the two of you...............

Uh, it tells me I forgot to add in the taxes, big deal, there is still a large markup, it's about five to ten times as high as for gold so if all markets are the same, what's the difference?

That's not all you "forgot", but it highlights your sloppiness in looking at the numbers. Here's the irrefutable bottom line - the piece that puts an explanation point on your ignorance of oil and gas economics. Information on profits and sales is released with every quarterly and annual report. Oil companies make about 10 cents on a dollar of sales - not the 25 or 50% profits that you suggest. These numbers are in the audited annual reports, so it really renders all of your goofy speculation completely irrelevant.

If you want to claim a 25% profit (a bit lower than Microsoft's, I might add) then show me. The quarterly reports are public record. Why don't they match up with your assertions? I know why. Because you conveniently overlook a great deal of information in your "analyses." But the fact that the numbers don't match up tell us all we need to know about your ciphering.

Really, I think I know who you are but Im not going to guess...

You really crack me up. So, it isn't clear enough from my profile? Or is it part of the conspiracy in which I am really someone else?

you are less than impressive except in your own mind.......

Sometimes I wish the hundred or so people who e-mail me every day thought so. Would make my life less complicated.

This comment exposes your glaring ignorance of how businesses operate. The margin in a single product like gasoline is not reflective of the profit level for the entire business. I bet you don't even know what the margins are for any given Microsoft product do you? Maybe you aren't clear on the difference between an income statement and a press release, net income is what get's bandied about in a press release in order to make it appear they aren't gouging. However, that 10% margin you are referring to is based on after-tax income not pre-tax income and that is what a real margin computation is based upon. So the real margin for XOM last year was 18.6% not 10%, a whole lot closer to that 27% I came up with for gasoline.

Nonetheless, lets continue this to see what the specifics of the downstream business for XOM were last year as compared to previous years. The return on capital employed was 35% in 2006 year and 32% in 2005 but in 2002 it was 5%, in 2003 and 2004 it averaged 17%. I wonder what could have caused that massive increase in return for 2005 and 2006? It couldn't be the price of gasoline could it? Nah, that might make too much sense, it must have been some marvelous turnaround in the efficiency of all their refineries, stores and pumps, yeah that's it.

How about the total volume of product produced as a measure of the business and it's profit levels by comparison? Well from their annual report it appears that total product volume was down a little in 2006 as compared to the previous four years while margins and income were up, how about that? You know any other "highly competitive businesses" where that happens? Let me know if you do. Moving on to net earnings for downstream operations we can see that this year net earnings were 550% higher than in 2002 and 50% higher than in 2004 ON THE SAME SALES VOLUME. Golly what do you think could account for such a huge divergence in such a COMPETITIVE BUSINESS?.

You really should dig a little deeper into things yourself........

However, that 10% margin you are referring to is based on after-tax income not pre-tax income and that is what a real margin computation is based upon. So the real margin for XOM last year was 18.6% not 10%, a whole lot closer to that 27% I came up with for gasoline.

Your arguments have degenerated to the absurd. Does XOM pay taxes? Yes. So, how much money do those big gougers end up with – in their pockets? 10%. Not the 50% you suggested, nor the 27% you backpedaled to. Your gouging argument simply has no legs.

The return on capital employed was 35% in 2006 year and 32% in 2005 but in 2002 it was 5%, in 2003 and 2004 it averaged 17%. I wonder what could have caused that massive increase in return for 2005 and 2006? It couldn't be the price of gasoline could it?

First of all, you are the one who introduced your marvelous 50%, no wait it's 25%, but wait, it's even less markup, that is split between the jobber, the pipeline company, and the retailer. That was what I addressed by showing you that the markups can't possibly be what you say, because we have their income statements. (And according to this, ROCE for XOM in 2006 was 32% - which XOM claimed was 50% greater than other oil companies).

So, having lost that argument, you move on to ROCE. In 2002, many oil companies were losing money. Have you seen Paul Sankey's Senate testimony in which he explained this (which caused Ron Wyden to concede the point and stop asking why there hadn't been massive investments in capacity over the past 5 years)? Nobody is going to willingly risk billions of dollars for a 5% ROCE. So, comparing the ROCE today with that of 5 years ago is absolutely disingenuous, unless you think oil companies should be taking risks to provide you your gas without any rewards for their (very high) risks. And of course I guess you know that oil companies have lots of other costs besides capital? You know that, right? So they are not getting a 32% return on their money, if that’s what you think. Judging from your previous comments, though, it probably is what you think.

Furthermore – and here’s what I love about these ROCE discussions – can you give me the ROCE of various industries? An ROCE in a vacuum is meaningless. Let’s do some comparisons, shall we? (The ROCE proponent always gets stumped at this point).

Finally, I don’t know why I continue to have to explain this, but of course the reason profits are going up is because prices are going up. I never said otherwise. What I have said is that prices are not going up because oil companies can simply raise and lower them at will. And despite your protests and your inability to see very plain relationships, you haven’t demonstrated anything different.

The more posts you make, the more you expose yourself. You have absolutely no idea of what you are talking about. But look around you. Others have been trying to tell you the same thing.

Money has an article called Why no one's making more gas

Their answer is that long-term margins have not been good enough.

Too many people forget that times have not always been prosperous like they are right now. Although with supply and demand as tight as they are - and no relief on the horizon - I think this will be the new reality. That is primarily why I went to work for an oil company.

Absurd, you mean Exxon's own bragging is absurd? Of course I pointed out that this 10% measure you refer to is after tax profit which isn't the real margin. The real margin is made at the expense of the customer before taxes and after expenses (including management perks and compensation) it's part of the price the oil companies set. If they didn't have pricing power they would eat it but they don't, the consumer does. This is what a busines earns, taxable income that is distributed to bagholders, er I mean shareholders after taxes. The real margin is earned from what the customer is paying including state sales tax and excise tax. So the real margin is what it is, it's 18.6%, live with it. You have lost this argument. You are getting shriller and shriller with each post as you declare Im ignorant without basis.

Now let's consider the assertion that many companies in 2002 were losing money. Why don't you tell me which ones? Not Exxon/Mobil or Chevron/Texaco or Conoco/Philips or BP/Amoco or Shell, so which one was it? Now let's consider the assertion that this gasoline business which I know so little about is the most efficient and competitive market possible. Now if that is so, how is it that the domestic net income from refining of oil companies rose from an industry total of $1 Billion in 2002 to $18 Billion in 2005 without any increase in volume? How is it that the profit of Exxon/Mobil has increased %550 since 2002 on no increase in production volume?

Sorry, Robert. You lose, there is no way this can happen without industry collusion. Exxon/Mobil cannot raise prices unilaterally and if the other companies are earning similar profits to Exxon/Mobil (which they are) then they are complicit in the price hikes. That amounts to collusion, prove otherwise.

Just one more little tidbit about your precious MOL. The last time that inventories dipped close to MOL was back in 1995/1996 and guess what, prices were low like a buck per gallon and they stayed low. Wonder what was different? Well BP and Amoco as well as Exxon and Mobil as well as Conoco and Phillips as well as Chevron and Texaco were all separate companies. There was a lot more competition back then and no tacit collusion as there is today.

Game, set and match........................

Of course I pointed out that this 10% measure you refer to is after tax profit which isn't the real margin.

I am going to go ahead and wrap this up, because you couldn’t possibly lose this debate any worse than you have. So let’s tie up lose ends. First, you suggested that oil companies are gouging, and that there was a 50% mark-up on fuel. That went down and down and down. Now, we are down to 10% that actually goes into their pocket from $1 of sales. Your gouging argument went straight into the toilet. Many industries make far more than this. People in California sell houses and have a far greater profit margin.

You are getting shriller and shriller with each post as you declare Im ignorant without basis.

Without basis? I will let our posts speak to that assertion.

Sorry, Robert. You lose, there is no way this can happen without industry collusion.

Tell you what. When you find evidence of this assertion – one that has been investigated 30 times in recent memory without any evidence of wrongdoing – be sure and let us know, OK? Until then, they are just your idle ramblings.

Just one more little tidbit about your precious MOL. The last time that inventories dipped close to MOL was back in 1995/1996 and guess what, prices were low like a buck per gallon and they stayed low.

Can you really be this stupid, or is this an act? I mean, seriously? Your posts are comically absurd, and I get the impression that you think you are actually scoring points here. Your combination of ignorance and arrogance is sad.

OK, time for school 1 last time. The next time, I will send you a bill. Do you know what demand numbers were in 1995/1996? Do you know how much lower we are on a days of supply basis today? No, of course you don’t, or you wouldn’t have made that ignorant argument. MOL matters much more 1). Depending on the season (much more critical prior to the summer); and 2). As demand increases.

Game, set and match........................

Yes, that was the case 2 days ago. That fact just never penetrated your brain. Your backpedaling should have been a hint.

Robert, you are the arrogant one here. It is you that has the blog and holds himself out as an expert offering his expert opinion. I'm just a business owner that knows how to price products and what pricing power is. I can see that the oil companies have pricing power now because of consolidation resulting in a lack of competition. I am simply contradicting your fatuous assertion that inventory levels are a determinate of price. This inventory argument really doesn't apply to a just in time product with a short shelf life like gasoline where inventory must be minimized as a normal course of business. The only determinate of price right now is what oil companies can get people to pay. They hold all the cards now and it's clear there is tacit collusion. It's writ large on their balance sheets.

The way you keep harping on this mistake I made about the markup on the NYMEX unleaded is funny because I was comparing the markup on spot gold to the retail customer and you have never come back to that point.

Let's look at some of your mistakes, You said gasoline was just like gold

I said it's not and proved it. The markup on spot gold to the retail customer is A MAXIMUM OF 5% EVEN IN TIMES OF SHORT SUPPLY. For unleaded gasoline it appears to be about 27% right now (not the 50% I first claimed) so the two markets aren't even close but you said they were the same.

Instead of answering that you harped on me not including the excise taxes and you haven't stopped because it's the only mistake I have made.

Here is another mistake you made.

I checked this statement out and found it to be false. In fact the big companies all made money, just not nearly what they are today. Since I challenged you to prove it you have not responded to it. It seems to me if you know this to be the case you could just list the money losers off for me but you haven't. Your silence on that point speaks to your error. You still can't explain how such a competitive business can have such high margins.

You claimed in your most recent post

Have you checked the net margins for clothing retail where there is lot's of competition? It's about 5% or for the grocery busines it's less than 2%. Competitive industries are characterized by low margins, high margins are only possible in markets without competition. Here is an up to date list of net margins by industry. The average is 7.61%, the median is 6.84%. XOM's 10.8% net margin last year is greater than 75% of all the industries in the list. In fact if you look at the list and consider XOM to be integrated petroleum, then the profit margin there for that industry is 8.11% which is more than 60% of the industries in the list.

The thing that you really cannot explain away is that the downstream operations of all the refiners in this country have produced about the same amount of product for the last five years and yet their profits have increased on aggregate by 18 times. For XOM it's 550% since 2002. This doesn't happen in any other business and yet you would have us believe it's not collusion, yeah right. You claim it's a supply problem but if that is so, why isn't at least one oil company building a new refinery to take advantage of this wonderful under-supply situation? There are lot's of old refinery sites that are grandfathered in under EPA rules and can be used for new refineries. This is a well known fact but maybe you didn't know it. Why isn't at least one refiner going after those sites and building new refineries on them? Could it be that the industry wants the supply situation to remain what it is so that they can continue to make these outlandish margins? That would be collusion wouldn't it? Tacit yes and not illegal but collusion all the same.

You also haven't answered the question of why economic models aren't working for the oil business. You ask me if I took an economics course and I did. The economics text book would tell you that if the market is under-supplied and there are excess profits to be made that one or more participants will provide additional supply to take advantage of this. Surely one refiner would do this but what we see is a constant volume of product from the domestic refiners for the last five years. The economics model of supply and demand assumes that there is no collusion otherwise it doesn't work, it's not working now, what does that tell you, assuming you believe it's valid?

They have never proven active collusion but I am not claiming active collusion, I am talking about tacit collusion resulting from a lack of competition.

Sorry Robert, I have been very reasonable and reasoned in my arguments and you have failed to address them. What you have done in your ever shriller posts is attempt to dismiss me with name calling. Sorry, that works for grade schoolers but not for grownups............

Only a couple of things even worth commenting on here, because we are basically done. I just find it sad that you continue to want to mislead.

The markup on spot gold to the retail customer is A MAXIMUM OF 5% EVEN IN TIMES OF SHORT SUPPLY.

That is simply false. When gold prices run up, someone is making a lot more money without a lot more expense. It is exactly the same. Your 5% is a fabrication. You are being incredibly selective with your numbers in order to support your point. You also chose a very difficult year for oil as your baseline for what they should be making.

I checked this statement out and found it to be false. In fact the big companies all made money, just not nearly what they are today. Since I challenged you to prove it you have not responded to it.

I just ignored it, because it wasn’t worth looking them up. I personally know of several refineries that closed right around that time – precisely because they weren’t making any money. 2002 was the year margins began to turn up. And it is true that most oil companies were losing money at that time. You just don’t understand that the big ones don’t comprise “most.” But that's not the first time you have misinterpreted that word.

So just because I don’t respond to a particular claim you made, doesn’t mean that I have conceded a point. It may mean, as it did in this case, that I think you are merely wasting my time with trollish responses.

You claim it's a supply problem but if that is so, why isn't at least one oil company building a new refinery to take advantage of this wonderful under-supply situation?

This is why talking to you is such a waste. This point is so basic, and so well-known, that it is amazing that you would even ask it. Quiz: How much has refinery capacity increased in just the past 10 years? How many expansions are currently underway? Really, when you throw out PRATTs like that, what’s the point?

XOM's 10.8% net margin last year is greater than 75% of all the industries in the list.

If you want to tell yourself that this is gouging, by all means continue to do so. I am finished wasting my time on you. The New York Times is waiting for a call back. I have to tell them that some guy on TOD would recommend that they don’t talk to me, as I don’t know what I am talking about.

Really, I have become terribly bored with this. I don’t believe in wasting too much time trying to convince someone who is clearly only trying to waste my time with such gems as "Well, why aren't they building any new refineries?" If you really are puzzled by this, then your knowledge of this industry is at an even lower level than I thought. But I expound upon this in Part II.

Bet you don't buy gold, heaven forbid I say it's obvious on the outside chance you do but you can look at any number of sites to see what the current price of bullion coins is. For example, Kitco which is one of the highest is charging $708 for a one ounce gold eagle with spot gold at $670. That is a 5% markup. If you pick gold Maples you can get them for $704 also a 5% markup and a one ounce gold bar is $683.10 which is only a 2% markup. These are retail bullion gold prices. You don't have to buy 100oz which is the size of a single deliverable bar on the COMEX and currently would cost you $67,000.

Nope, it's a matter of inventory and two-way trading. Retail gold is dependent on people selling low because they are suckers. The dealer buys back at low prices and tries to sell at high prices but it take serious money and expertise to find the bottom so most of them operate on a low inventory basis and try to make money on small margin and decent volume.

I buy from a guy I have been doing business with since 1999 and I only pay about 2-3% markup with him. I pay attention to these markups to get an idea how short the physical market really is so Im not making this up. Even when gold was at $725 last year the markup wasn't more than 5%. Kitco used to be only about 3% but they have increased their markup over the years. You can look at Tulving as well to see how low the markups can be, this is a competitive market, unlike gasoline.

Prove it, link all the income statements for most of the companies or admit you are wrong. You have really gone out on the limb now claiming "most" were losing money. But even if some smaller regional refiners were being squeezed out by the bigger players Im not surprised. Still prove your statement or admit you were wrong. Now as to the big ones, they comprise "most" of the market which is one of my points here you seem to keep missing.

Im supposed to be impressed? What do I care, they are a rag anyhow. I just got asked to submit a paper to my professional organization without peer review because my past papers have all been well received. So what, I said no because I really don't have anything to say of value this year. It seems you didn't either in this commentary but that didn't stop you from putting something up anyway. That is the weakness of bloggers, they feel they must say something on a regular basis, just like editorialists in a newspaper. So what happens is most of what bloggers put out becomes drivel as a result of the triumph of quantity over quality. I have read your blog and I like it but this was an ill-conceived argument. You got your kudos from the sycophants that always tell you you are great but you are having trouble with real criticism and it shows.

My, I couldn't tell because you keep replying as though you aren't going to allow me to have the last word. Well let me tell you that I happen to know a guy that is going around and buying up those old refinery sites for an investment group so that they can flip them. So far they are losing their asses, I thought it was a good idea when he told me about it two years ago but now look, no new refineries.......

Finally, just one more point about astute investors and business people. They invest when there is blood on the streets. In a business that is cyclic it makes sense to buy up cheap assets of your competitors who are going out of business in tough times and then sell them in the high times. That is how to make money and the oil companies know this but the big ones are more interested in seeing the small ones go out of business and stay that way. The capacity expansions you are talking about are minor compared to what it would take to reduce prices by increasing supply with new refineries at this juncture.

For example, Kitco which is one of the highest is charging $708 for a one ounce gold eagle with spot gold at $670.

Your failure to understand is now understandable. You are focusing on the retailer. The retailer of gas doesn't make much markup either. The producer of gold makes a lot more money when price goes up. This is analogous to the oil company making a lot more money when oil or gas goes up.

Not trying to get the last word in (that goes 2 ways, you know), but I saw one more opportunity for you to actually learn something. Of course I have pointed this out numerous times, but I thought one more time wouldn't hurt.

It seems you didn't either in this commentary but that didn't stop you from putting something up anyway. That is the weakness of bloggers, they feel they must say something on a regular basis, just like editorialists in a newspaper.

Again, it would be nice if everyone else felt that way. I get far too many demands on my time right now. Maybe I can start referring people to you?

I was in a pretty big hurry this morning, but I want to close the book on a couple more items. If you then want the last word, have at it.

Prove it, link all the income statements for most of the companies or admit you are wrong.

This is ultimately a futile exercise and a waste of my time. I can spend hours digging up financial statements from numerous oil companies who were losing money at that time. And I will ultimately gather a list that will show that most companies were losing money. But then you will do what you always do, and start morphing your argument without admitting error. You will say “Yeah, but that’s not most of the volume” (even though those not losing money were making poor margins). So I will have spent several hours to what end? Waste of time. If the rest of the discussion had been more productive, it may have been worth the effort. But I can see when my time is being wasted. I will point out that Paul Sankey, in his testimony before the U.S. Senate, said exactly the same thing. Whether your personal burden of proof can be met is irrelevant, but I am not going to waste time trying to do it as it isn’t a quick exercise.

Im supposed to be impressed? What do I care, they are a rag anyhow.

Would you be more impressed by The Washington Post? Fortune? Rolling Stone? (That’s the one that actually impressed my wife). All have called seeking comments/intereviews on various aspects of the energy market.

But that doesn’t matter. Here’s what does. I get paid for my expertise in the oil and gas business. People in this business, who know this business, have recognized that I know what I am talking about. I am in Scotland because some people pretty high up the chain said “That guy knows his stuff.” I did not seek out this job, I was sought out for it. I have been sought out for many that I turned down. In the energy business. So, it is irrelevant whether you think I know what I am talking about. When others start to pay you - or call you to the legislature to testify - on the subject of energy issues, then you can claim that at least someone feels you know what you are talking about. As it is, you are just another over-confident Internet pseudo-expert (and I am being very generous with my usage of “expert”).

I just got asked to submit a paper to my professional organization without peer review because my past papers have all been well received.

Was it on the topic of energy? I didn’t think so. I just got asked to write a chapter for a book being edited by a professor whose name you would immediately recognize. It IS on energy.

You got your kudos from the sycophants that always tell you you are great but you are having trouble with real criticism and it shows.

My real kudos, as I have pointed out, come because I am paid for my opinion in this area. It was crystal clear from your first post that you are not.

Well let me tell you that I happen to know a guy that is going around and buying up those old refinery sites for an investment group so that they can flip them. So far they are losing their asses, I thought it was a good idea when he told me about it two years ago…

I bet you did. That’s why you are not an expert in this area. Every time the government talks about building new refineries, I laugh. So much naivety. Your sort of naivety is why our energy policy is in such a pitiful state. Too many people think oil companies should go out and risk billions building floating cities in the ocean – losing lives in the process – and make 5%. Sorry, I disagree.

In a business that is cyclic it makes sense to buy up cheap assets of your competitors who are going out of business in tough times and then sell them in the high times.

Sad. Very sad. You have no idea how many assets my own company has bought up in the past 2 or 3 years. But in the down cycle, they don’t have the cash to buy up cheap assets. They are spending all of their cash to keep the equipment running.

One final word on the issue of refineries losing money in 2002. Look back over the thread and see the number of times you have backpedaled, or simply dropped an argument. The tax issue was just one example, but it ultimately demonstrated why attempting to prove the issue of refineries losing money would have been futile. Your gouging argument was cut in half in one swoop, and you didn’t bat an eye. You didn’t say “OK, margins weren’t as high as I thought.” You stuck to the exact same argument, even as I continued to chip away at it. I showed you that the tax wasn’t the only problem – that taxes were higher than you said – that there were a number of people in that chain that had to be paid - and we finally chipped it down to 10% on sales that actually goes into the oil companies’ pockets. Yet you never conceded one inch – even in that case where your argument was demolished. Everyone but you saw that.

Now, if you want to have the last word, by all means do. Part II is coming up in a few days (will be on Financial Sense tomorrow) and then if you wish you can continue to demonstrate your ignorance.

I play basketball, I am great at backpedalling ;-). Now as to the excise tax issue, I admitted way back up there I left it out. What kills me is that you cannot either understand my point or you are purposely being obtuse.

Here is what I originally said:

I have bolded the key point which you are finally just now noticing because you were so excited about my oversight on the excise tax. The key point is that we are talking about the markup on a finished product. It is only 2-5% in gold and yet for gasoline it is 27% right now. Normally it isn't that high.

Now about gold miners and this erroneous statement:

Spikes really don't help gold miners because they don't carry inventory and their product takes a long time to produce in small quantities. It takes a ton of ore just to get a few grams of gold. So it takes several tons to get an ounce. Gold is very different from oil and gasoline. Furthermore, many of the big miners hedged their production years in advance by selling it forward at low prices back in the early part of this decade. Barrick is a good example of a company who is severely underwater in their hedge book as a result of that foolish practice. The only gold company that I am aware of that held on to gold in order to sell into spikes was GoldCorp and they only did that while Rob McEwen was the CEO, he left two years ago. They don't do that anymore.

With gasoline the big integrated oil companies benefit most from price spikes. They set the price to the distributors and thus to the retailers who are captive anyway. Franchisees are nothing but contract employees to the big oil company whose brand they sell. Those people don't get much at all from the spikes. With gold it's just the speculators that benefit and then the CBs/Bullion Banks usually step in and crush the price to make sure that gold stays under control. Gold miners make money if there is a steady long term rise in the price of gold. They usually don't get to take advantage of short term spikes like last May.

I don't know where you copied my post on gold from, I doubt I posted that here and since you refer to my posting on other boards you undoubtedly have read my posts elsewhere. If you do, then you know that I do follow the gold market closely and know quite a lot about it. You are incorrect in your analogy between gold and oil, they just aren't even close to the same and I have explained it in a number of different places on this thread and yet you keep trying to say they are the same.

OK, so you concede the point.

It was the only example and I did admit from the beginning that I left out the tax. It didn't change my argument one bit. It only took you about another 20 posts to figure out what I was saying since you couldn't drop it trying to score points with it.

Oil companies are just like any other business according to you. Walmart opens new stores every year in order to make 3.2% so your argument doesn't hold water. Let me give you another interesting statistic from XOM's 10-K that you might not be aware of. They spent $29.5B buying back stock and $7.6B was distributed to dividends for 2006, that is basically all their net income. How much was put into the downstream business? A paltry $2.7B with only $824M being spent in the US. Overall they only spent $19.9B on exploration and capital, they don't seem like they really want to find more oil and sell more gasoline do they? They would rather buy back stock than make money finding oil and selling gasoline, that's odd don't you think? Especially with the high margins they are making these days. Once again, that doesn't comport with economics texts.

On the other hand, Walmart is in a competitive business and their motto is Always Low Prices. They don't have a $28B cash position and they only bought back $5B in stock last year. They spent $15B on capital expansion which was greater than their net income of $11B. They are a good example of a business in a highly competitive market with all the margins squeezed to the lowest.

You might read this article in the Chronicle. It says refining profits are at record and mind blowing levels (gross refining margins of about 40% right now) and agrees that "it's a little hard to explain" but the really hilarious new excuse for not building refineries is get this.....

Like Bush's plan will ever be implemented. Maybe you should modify part II to include that argument for not building any new refineries........

There is so much that you just cannot explain away when presented with the facts that you just resort to telling me I don't know what I am talking about. I am sorry you have to do this but it's because you are trying to establish a position that isn't consistent with the facts.

Of course, a tentative explanation that can be tested against the real world is known as a "hypothesis". Those idealized speculations are known as theories and models, like in other sciences.

The fact that people don't always behave individually according to classical economic theory (i.e. "rationally") is creating the new branch of "behavioral economics." They've handed out a couple of Nobels for work in that field.

The explanation for your question about US demand is that the price elasticity of demand is known to have become quite steep for gas in the US recently. Elasticity is a concept that applies at all levels, so that different people have different demand curves for gasoline, and different countries have different demand curves, etc. Higher prices may only slow the rate of growth, or it may be that prices are only high enough to slow the rate of increase of growth for now.

If imports of gasoline to the US were reducing consumption in other countries, would that count as a shortage? We would be essentially out bidding people in other countries for fuel, so that prices would have to rise here and consumption would be reduced elsewhere. What's wrong with that description with regard to our current situation?

Sorry, my daughter got her degree in economics from the College of Liberal Arts, not the College of Natural Science or the College of Engineering.

Well show me the data that proves it's the case. The levels of imports during this winter's big draw on Robert's chart were less than a million barrels per week. It's only within the last couple of weeks that we have seen levels of imports that are on par with those of Katrina and Rita and those seem to be having a price moderating effect. I would have to say that probably your speculation is unfounded but since I am not part of the "in the know" crowd here I must be wrong.

Fact: Global production is flat.

Fact: Consumption is up in the US, China, and India.

Fact: Consumption is flat in Europe.

Fact: Consumption is down (demand destruction) in Africa, other parts of Asia, and South America.

Oil production has not increased yet demand from the most consuming of consumers has increased so something had to give somewhere. It just happened where you refuse to look.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

I'll stick with your last paragraph.

Would you say that "supply" includes inventories? I would guess from your statement "The first question I would ask is why would inventory be a determinate of price since it clearly isn't supply to the market?" that you don't consider inventory as part of supply. This is an uncommon definition of supply. It implies that until it is pumped into an auto tank, it doesn't exist.

Last year, there was a drop in inventories, notice the period from Feb-06 to Apr-06. There were also predictions of a hurricane season nearly as bad as the record '05 hurricane season. The prices rose because inventory was falling when there was an expectation of a need for significant inventory buffer.

I think that the argument you're making is that inventories are some kind of fiction, whereas Robert probably looks at the inventory level as an indicator that the futures market is strongly interested in. The goal of the industry is to provide just enough supply, but that requires an inventory as a buffer to get through demand spikes. Gasoline in storage facilities, pipelines, trucks, etc. doesn't go bad *that* fast.

Yes there was but it wasn't half as large as the drop in 06 but produced nearly the same price increase. Moreover, if you look at Sep/Oct 06 there was a nice draw down and yet prices continued to fall.

I didn't say this at all. I said as long as the supply at the pump isn't interrupted that prices shouldn't spike like they have. After all, it is the oil companies that set the price, it's their stores that put up the signs. The motorists don't choose the price they want to pay. If there was a lower price available they would choose it, of that there is no question. The problem for you oil company apologists is that you cannot accept the fact that oil companies set the price of gasoline. If that weren't the case I would be albe to go bargain on the price I wanted to pay form my gasoline now wouldn't I?

Yes there was but it wasn't half as large as the drop in 06 but produced nearly the same price increase. Moreover, if you look at Sep/Oct 06 there was a nice draw down and yet prices continued to fall.

Think that might have had something to do with how close we got to the MOL this year? Nah, couldn't be that we were getting close to the MOL and were at record low inventories right before peak driving season. I mean, that would just blow those conspiracies right out of the water, and we can’t have that. We must maintain that these issues are unrelated.

I would also point out that last year’s spike had much more to do with the rising price of crude, and that the drop wasn’t nearly as steep, nor nearly as close to MOLs. You may have seen Stuart’s essay demonstrating the relationship between crude and gas prices. Now, the r-squared wasn’t 1, but it was pretty high. But I know that 1 is your criterion for there being a relationship.

I said as long as the supply at the pump isn't interrupted that prices shouldn't spike like they have.

So, when gold prices spiked last year, was the supply interrupted?

After all, it is the oil companies that set the price, it's their stores that put up the signs.

Yes, and there is surely a complete disconnect from the NYMEX and the price that buyers are willing to pay - and what ends up on those signs. I guess the oil companies must consult tarot cards before changing those signs. Or they say "Hey, inventories are falling fast. Let's lower prices!"

If that weren't the case I would be albe to go bargain on the price I wanted to pay form my gasoline now wouldn't I?

So, I can do that with gold? Then I guess the gold mining companies ARE setting the price of gold.

You have a very muddled view of markets and supply/demand relationships. And your whole view of oil is completely contradicted by the fact that other markets behave in the same way with respect to supply/demand concerns, but the oil companies are "special" because they actually set the price of gasoline. Whatever.

You assume customers have any idea of MOL? What would it have to do with prices then? Unless the oil companies know what this level is and know that the closer they get to it the higher prices can go then what does it mean?

Yes of course it was. The shorts supply the longs and there weren't any new shorts coming to market until the G8 Central Banks had an emergency meeting the weekend of May 13-14 2006 and determined to "fix" the problems in the commodity markets. They sold something like 100 tons of gold in one month on the record and probably another 300 tons off the record. This fixed the shortage right up and caused a lot of speculators to cough up that which they thought was so valuable just a couple of months before. This of course cannot happen with gasoline, once it is used, it cannot be resold, like gold. You keep making ill-founded market comparisons, what's the point? Do you want to talk about gasoline or gold?

You assume customers have any idea of MOL?

What???? You are making no sense at all. The fact that gasoline is dropping toward the MOL with no sign of stopping means that refiners and marketers are going "Crap, we better raise the price a bit more before we run completely out." And traders are saying "Gasoline is in short supply, buy, buy, buy." It has nothing to do with whether customers know what an MOL is.

The shorts supply the longs and there weren't any new shorts coming to market until the G8 Central Banks had an emergency meeting the weekend of May 13-14 2006 and determined to "fix" the problems in the commodity markets.

I think you misunderstood the question. You said for gas prices to skyrocket that there should be physical shortages. What I want to know is where there were physical shortages of gold, not where there was a supply/demand imbalance. Please provide a link to these physical shortages that warranted an increase in the price of gold.

Do you want to talk about gasoline or gold?