Saudi Arabia and Gas Prices

Posted by Stuart Staniford on May 24, 2007 - 7:47am

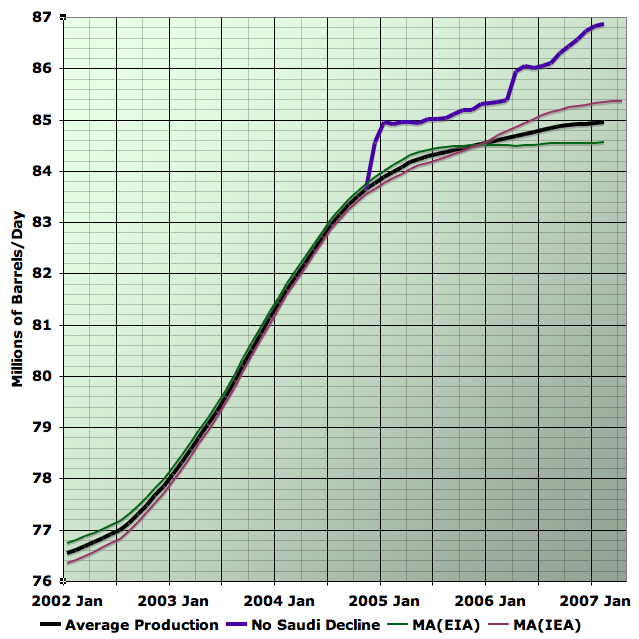

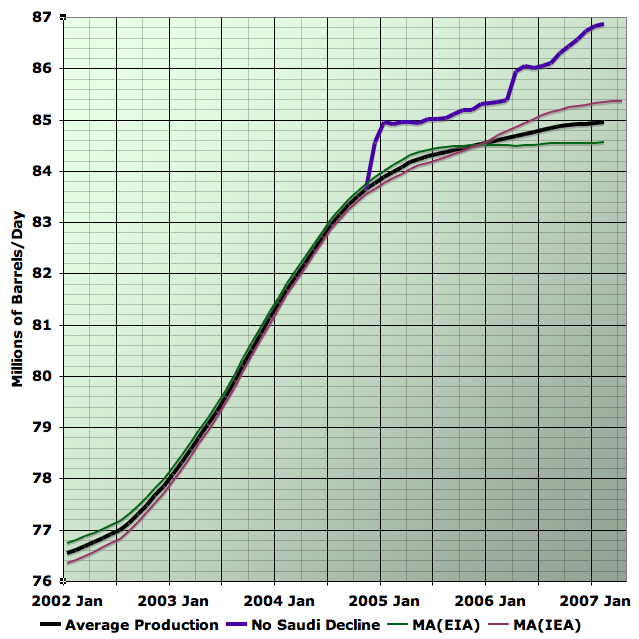

Let me start by providing the latest available data on Saudi oil production:

The core issue under discussion is that production is off by about 1 million barrels per day since Q3 of 2004, despite the addition of new projects with a rated capacity of about 1 million barrels per day (the Qatif/Abu Safah redevelopment which was supposed to create 690kbd of additional crude+condensate capacity, and the Haradh III development which should have added 300kbd of crude production capacity).

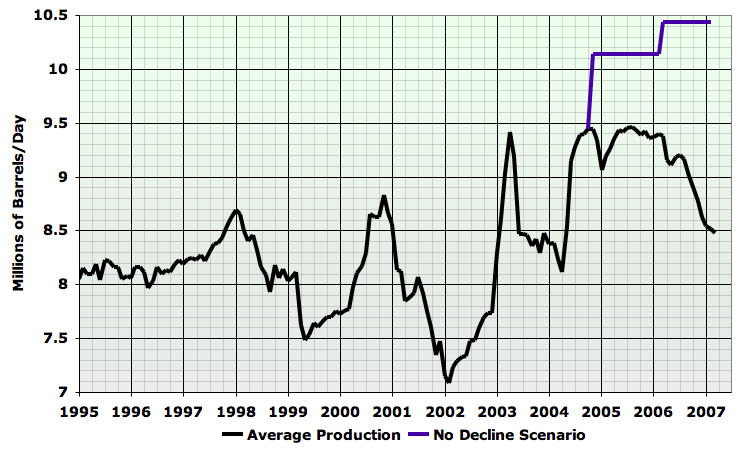

If we imagine that all fields had been on the same plateau as in Q3 2004 to the present day, and we further add in the new projects (dating approximate), we would have had a picture like the purple curve in this next graph:

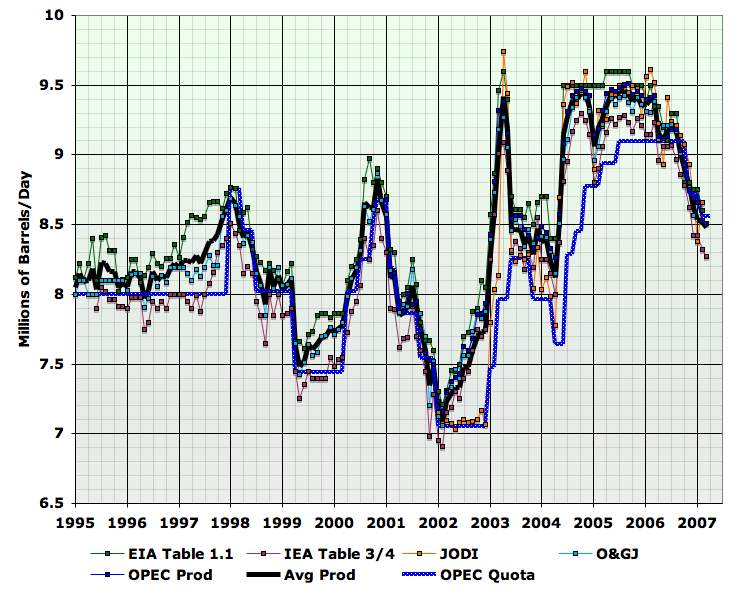

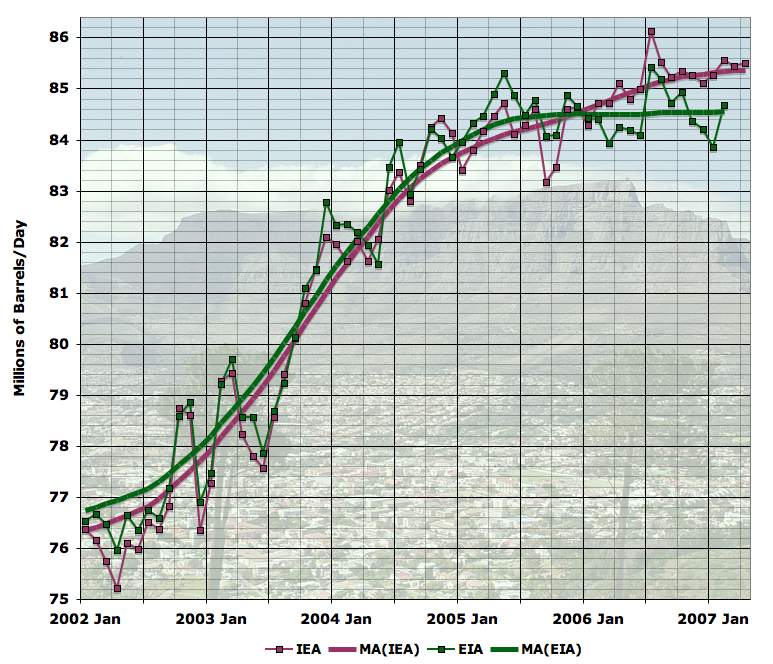

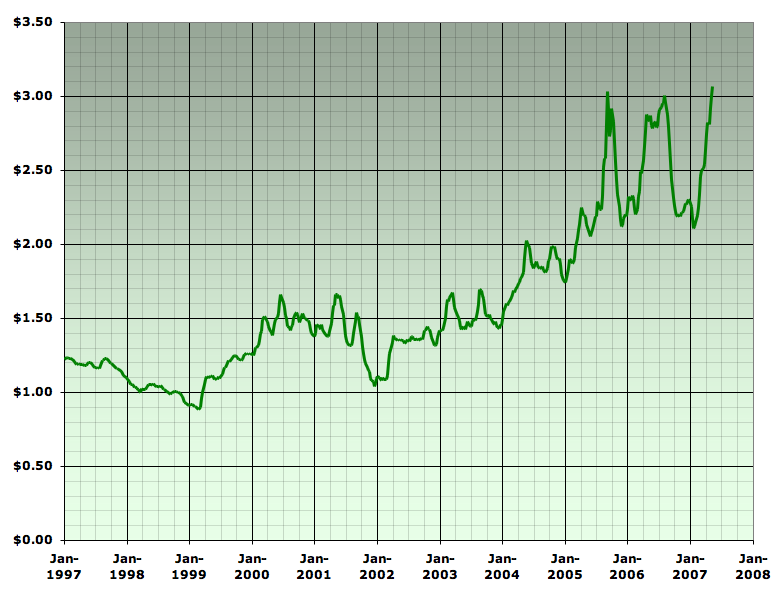

This situation is one factor playing into the global production curve. Total global oil supply during the economic recovery following the 2000 tech crash recession looks like this:

(These are "total liquids" figures - ie they include natural gas liquids, coal-to-liquids, biofuels, refinery gains, etc, in addition to crude and condensate). If you believe the EIA, total global oil supply has been essentially flat for the last couple of years, despite rising prices. If you prefer the IEA's figures, then production has been growing but in an anomalously slow way compared to historical growth rates.

If we add onto the average of the two moving average curves above the difference between actual Saudi production and the hypothetical "no decline" scenario, we get this picture:

Clearly, that would have been a rather different last few years in the global oil markets. But how much of the run up of gas prices can we attribute to this cause?

Firstly, just how much has the price of gas gone up since 2004?

Well, in late 2004 it was around $1.90, and now it's about $3.05. So we have around $1.15 of increase to explain or about a 60% increase in the price.

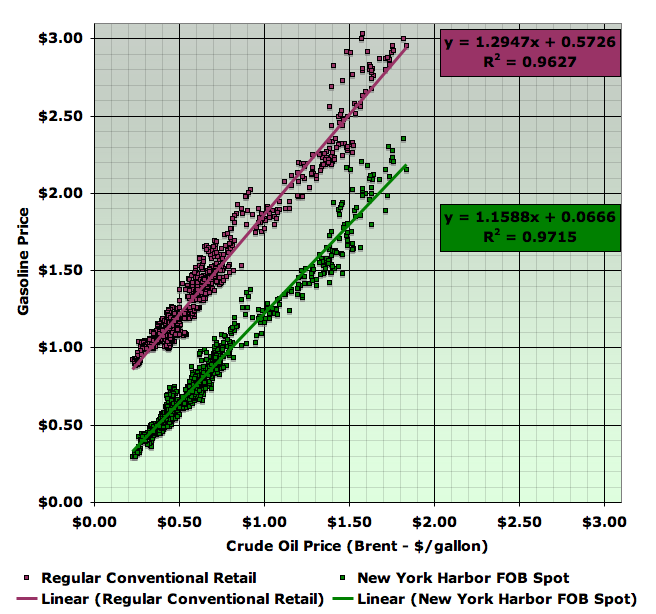

The next thing to understand is that there is generally an extremely strong relationship between the price of gasoline and the price of oil:

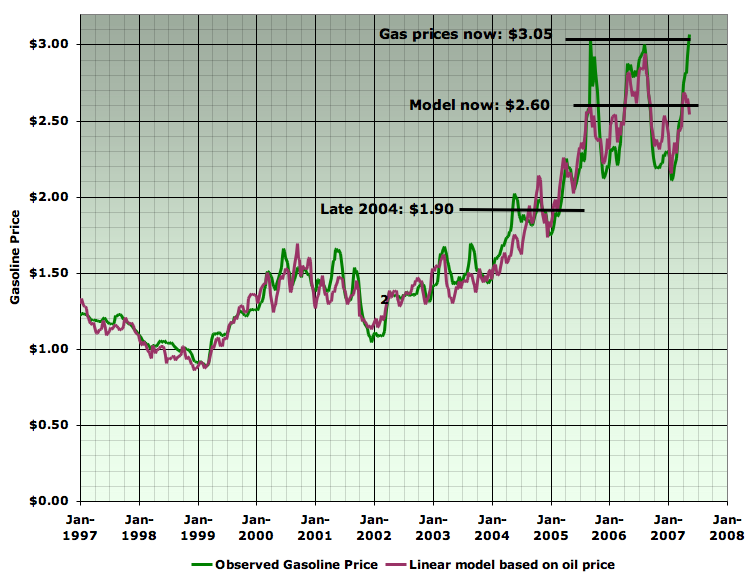

The R2 of 96% at the retail level says that 96% of the variance of gas prices (since 1991) is explained by this simple straight line model applied to oil prices. This makes sense - refiners have to include the cost of crude in the price they charge their customers, and both they are the distributors and retailers probably begin their pricing model by tacking a fixed percentage onto whatever crude costs them. While there is some residual effect that we can attribute to varying refinery/distributor/retailer margins - which are erratically seasonal - clearly if you know the oil price, you usually know most of what you need to know to get close to the current price of gas. Let's look at the time series of gas prices together with the results of the linear model above (which just knows about the oil price, and nothing else):

As you can see, although generally this model does pretty well, right now we are in an anomalous period where gas prices have gone significantly higher than oil prices alone would suggest. Likely this is due to the refining tightness discussed elsewhere. So on the graph above, we can attribute about $0.45 of the rise since late 2004 to downstream margins (most of which is very recent and probably fairly transient till BP finishes repairs), but about $0.70 is due just to crude costs.

So then the question is whether 2mbpd in missing Saudi oil production is enough to account for the $0.70 increase that can reasonably be attributed to crude, rather than refinery tightness. Well, that's a $0.70/$1.90 ~ 35% increase. Given a gasoline price elasticity of -0.05 during the period of interest, it would only take a 35/20 = 1.75% reduction in global gasoline supplies to do the job. Since the missing Saudi production is 2/84 = 2.4% of global oil supply, it would appear that, had this not happened, we would have had little or none of the 35% crude-based increase in gasoline prices since 2004.

(Note that I'm not arguing this is the only thing going on in world oil markets. However, I'm suggesting the thought experiment of keeping everything else exactly as it it occurred, and just adding back in the missing 2mbd of Saudi production. It appears in that hypothetical world, we wouldn't have had the crude oil increases that led to most of the recent gas price increases).

One might argue that the world couldn't have refined the extra oil, had Saudi Aramco produced it (thereby causing much larger violations of the historical relationship between oil and gasoline prices). Global refinery utilization data is poor enough to make this a difficult argument to evaluate. However, since they keep reducing their deliveries below contracted volumes to their customers, this doesn't seem the likeliest explanation:

May 14 (Bloomberg) -- Saudi Aramco, the world's largest state oil company, will cut Arab Light crude oil exports to Asia for the first time in at least three months as part of an overall supply reduction to the region.(Note that the production declines actually began at least 12 months before the OPEC quota cut, and earlier than that if one counts the failure of the Qatif megaproject to increase top line production).The Dhahran, Saudi Arabia-based oil producer will lower shipments starting in June, said three refinery officials who received notices and asked not to be identified because of confidentiality agreements. The producer has been reducing Arab Medium and Arab Heavy sales by between 9 percent and 10 percent of total contracted volumes.

Saudi Aramco's supply cuts in the past few months were focused on its Arab Heavy grade that mostly yields fuel oil during processing. Saudi Arabia is lowering exports to comply with 1.7 million-barrel-a-day production cuts agreed last year by the Organization of Petroleum Exporting Countries.

The company has trimmed shipments below contract levels since November. Saudi Aramco lowered exports to Asian refiners in April by an average 9 percent, and the cuts this month and in June are more than the 7 percent reduction in March shipments.

It's the eighth month that Saudi Aramco has reduced exports to Asia.

Finally, for the record, I don't want to suggest that gasoline price increases are all bad. I personally am in favor of high gas prices to promote conservation of precious remaining oil, moves to make the vehicle fleet more efficient and reduced carbon emissions. But if you feel differently about high gas prices, you might want to pay close attention to what Saudi Arabia is doing.

Recent Oil Drum articles on Saudi Arabia:

Stuart Staniford

- Depletion Levels in Ghawar

- The Status of North Ghawar

- Further Saudi Arabia Discussions

- Water in the Gas Tank

- A Nosedive Toward the Desert

- Saudi Arabian oil declines 8% in 2006

by Euan Mearns

- Ghawar reserves update and revisions (1)

- GHAWAR: an estimate of remaining oil reserves and production decline (Part 2 - results)

- GHAWAR: an estimate of remaining oil reserves and production decline (Part 1 - background and methodology)

- Saudi production laid bare

- Saudi Arabia and that $1000 bet

by Heading Out

- Simple mathematics - The Saudi reserves, GOSPs and water injection

- Of Oil Supply trains and a thought on Ain Dar

So on the graph above, we can attribute about $0.45 of the rise since late 2004 to downstream margins (most of which is very recent and probably fairly transient till BP finishes repairs), but about $0.70 is due just to crude costs.

Agree with your analysis, and I think it's a good one. I know what you mean by the preceding statement, but I would say it somewhat differently. Margins don't dictate the price. The price dictates margins. So you can attribute $0.45 to tight capacity, which has boosted downstream margins.

I was working on a gasoline price post, but you may have covered most of the bases here. One thing I was going to hit upon was the influence of a weaker dollar on imports.

Nicely done.

Nice that we're in agreement for once :-)

Superb work as usual Stuart.

Also agree with Robert's point about the weak US dollar. Downunder we are a long way below our record petrol prices due to the strong Kiwi dollar. I haven't even heard anyone mentioning petrol prices for nearly a year. Increasing deaths of teenagers due to street racing is a bigger concern.

Nobody here even knows that Americans are currently complaining about their "high" petrol prices. If they did, they would be disgusted, as NZ prices are much higher, and nobody complains.

Well, the Dollar might be falling, but from the Euro's perspective, it's more like the Euro is rising..

That's Euro compared to yen(blue) and dollar(barchart) for the past 2 years.

Now for the past 5 Months:

By the way, the graphs are inverted to get the right effect..

Here in Munich, we're also getting record gasoline prices, but that seems to have been the case for the past 35 years (mostly because of rising tax levels), so nobody really squeals about it.

---

My grandfather pumped oil with an engine-house,

my father pumped oil with a 20 lb. electric motor,

can't I just pump it online?

If I calculated that right, a gallon of regular costs $7.17 here.

(1 ltr. = 1.39Euro)

Diesel is about 0.2Euro cheaper.

By the way, the chart above is in %:

Top chart 95%-120% (inverse, of course)

Bottom: 97.5%-105%

Americans have both the "right" and the physiology to squeal.

Actually its sad how jaded Americans have become we are not the same people we where 20-30 years ago. I think the passing of the generations that went through the depression and WWII has been a real blow to our country. Whats left is a bunch of squealies.

I couldn't agree more. What has happened to America is one of the central tragedies of the modern era. Henry Miller saw it coming before world war 2. Now the process is more or less complete. "Shithoarders & Individualists" as JIm Morrison put it.

Matt

Wow, I guess since I'm a relatively young'un I never heard that "Shithoarders & Individualists" quote, but that is absolutely brilliant. That alone is a great ultra-condensed liberal take on what is wrong with the world. Heroin junkies say profound things now and again. Lenny Bruce was an exception who said profound things all the time...

Me likey when TOD goes all out USA Today on us and has nice, shiny pictures! Our editor Staniford is seriously rocking it these days. Excellent post.

____________________________________

TOD: On the rise during the descent.

It's on American Prayer. The Doors did it in the 70's by setting some spoken word tapes of his to music. Get it. Morrison was more a redneck boozer than anything else. He was a guy who basically ate himself up over our culture. A martyr suicide.

Matt

I can't believe the situation in NZ appears to be so much different to Oz where our dollar is also strong? Record in Melbourne last year was about $1.44 and today we got to $1.39.

Do you the know the figures for comparison in NZ?

cheers

Phil.

We're running about $1.55 here in Auckland at the moment.

The latest govt budget sets a new 10c/litre petrol tax on sales within the Auckland region to fund Auckland specific transport projects: finishing the motorway system :), electrification of the pathetic rail system, etc...

Nice link for current prices, and comparisons as well as breakdown of price components for NZ from the Ministry of Economic Development:

International and Domestic Petrol and Diesel Price Comparisons:

http://www.med.govt.nz/templates/ContentTopicSummary____20094.aspx

Also, shows some nice graphs giving an indication of the price incl/excl. tax for OECD by quarter (in $NZD of course)

The last swing producer is running out - we are starting to move to true just in time delivery, so to speak, as the last player in the shell game folds.

Storage has lost its role as a 'producer.'

This is meant in a broad sense, not a narrow technical one - for example, what is Aramco's Saudi based storage capacity? Estimates seem to range widely. But at this point, I would guess that Saudi Arabia has played its last ace.

Reality trumps.

Indeed. I seem to remember that, in order to avoid a major shortfall with respect to demand, Saudi Arabia needs to greatly increase its shipments in May/June... The trimming of its deliveries to Asia would seem to indicate the opposite.

Are we getting a clear picture that they can't deliver, yet?

Ace's graphs seem to show a significant difference between projected demand and supply in October 2007, if I remember correctly. But , I don't know whether supply means a producer producing the oil or a producer delivering the oil. If the latter, then I guess that we would need to see greater production significantly before the final part of the year,

Peter.

I agree the official start of peak effect season is a bit later starting this fall and next winter. We are being a bit myopic looking at the coming summer. We may have spot shortages but if so its because of the failure of the market not peak oil. So price alone will ensure that the US market is well supplied this summer. If you look forward however I think you will see that next summer regardless of price the US will not get the oil/gasoline it demands and thats when the fireworks really start.

My pond model indicates a spike in prices in the fall and early winter when historically prices have dropped if the signal is not obliterated by hurricanes we will see real peak oil effects as early as this fall.

Since this is the last summer that I think we will have a fairly normal US summer driving season my suggestion is too enjoy it. I'm not saying be flagrant but I've for example driven less that 300 miles this year I feel I've done my part and its not my fault that the rest of America is full of idiots. By changing my lifestyle I will be able to afford to take a few trips each year regardless of price if gas is available. I feel that real conservation should also have

at least a small rewards part. Next my trip is four adults

and three small kids in one mini van for 500 miles. So I feel even this extravagance is reasonable. If we had good

reasonably priced rail I would have been much happier to do a train trip :) But the cost of train tickets makes it much cheaper to move this many people via car and my actual energy usage may be lower.

Next summer shortages will proabably result in unplanned overnight stays in gas stations.

After that ...

I think I found the answer to Jevons Paradox.

By making a scarce resource a luxury item not a necessity your fairly immune to price increases once the resource depletes.

Next your conservation allows others to over consume putting them at a disadvantage once depletion kicks in. So by being frugal you set the Hummer driver up for a devastating fall once the resource begins to decline your enemies are weakened by playing the game wrong.

This does imply that conservation alone is not sufficient if the resource is still a necessity so buying a hybrid is a good thing but if you still must have gasoline then you have not fully beaten the system only if its a true luxury do you win the Jevons Paradox game. In a sense the only way to win at Jevons Paradox is to quit playing the game. I'd say this has profound implications for how we handle peak oil. Since partial "solutions" like ethanol are not real since they don't beat Jevons Paradox since the amount of ethanol we can produce is finite you will simply have the economy grow or shrink until it consumes 100% of the available resource then financial inequality will ensure that the wealthier people get more and more of the resource.

So moving to renewable does absolutely no good unless the population/consumption is well below the capacity of the renewable resource otherwise market forces will lead to consolidation. This is simply another way to say the only way to win is to not play the game.

So lets say to be safe you need to fix demand at 1/3 of the renewable capacity of the resource. For our current way of life this is fairly draconian but you can see that it ensures basically a endless supply if you stay within the constraints. Efficiency gains and real conservation would be a huge growth area in fact short term use of the extra capacity to implement more efficient future use makes sense.

So this is a even stronger argument. If your day to day usage is fixed at 1/3 of the total available and if up to and additional 1/3 of the resource is reserved for implementing efficiency gains your actually get real long term growth until the system is practically perfect. At that

point if desired the 1/3 restriction could be weakened but I'd think that it would be so ingrained its impossible to change. So growth would then continue by harnessing 1/3's of other resource bases. So using 1/3 of a renewable resource has seems to provide balance.

Its interesting that before fertilizers became widely available this is about the ratio that was used for agriculture for thousands of years.

The difference between gasoline and ethanol.

With gasoline eventually only the very rich will drive.

With ethanol eventually only the rich will eat.

If they survive the "above ground factors". :-)

But I agree, the only way you can win this game is not to play. Taking a bite here and there is not playing because you are not committed or addicted.

The question might be: Will the rich survive?

What is rich?

Dollars?

Gold?

Land?

Buildings?

Look at the Fall of the Roman Empire. Southern Britain is liberally scattered with the remains of quite exquisite Roman villas, and more than its fair share of hoards of gold and silver coinage etc. It is true throughout western Europe. The people abandoned the villas, or for some reason they fell into disuse. The hoarded gold suggest buried with a desire to return some day. They never returned to reclaim the hoards.

I think that when a civilisation crashes, it affects all levels. For sure, those at the top of the pyramid may last longer, but ultimately, the pyramid collapses bringing down all levels. Except , possibly by DNA, who now can claim lineage to the Romans or the Romano-British?

None. There is no lineage of family names back to this period. Only spurious attempts linking dark age rulers with Rome - and these 'bloodlines' are nothing more than spin to cement and reinforce a local victor.

The point of being rich is to ensure your DNA succeeds.

The lack of Roman names suggests none made it. Even the rich. Sure, the DNA made it into the pool, but the pride of the continuation of a family name did not. Thats suggests loss of power, loss of control

It goes further: After the Norman Conquest, all Anglo Saxon Aristocracy disappeared as well.

So the elite of Romano British society failed at the bottleneck in the 6th Century, and the Anglo Saxon Aristocracy failed at the bottleneck of 1066...

The Anglo Saxon peasantry survived. They were useful.

We even speak English rather than Norman French. One historian subscribes that this is because Wet nurses and other household staff were Anglo Saxon rather than Norman.

So perhaps it is not a given that the current elite will survive over the long term.

I think this has a lot more to do with Romans having a modern trade dependent civilization and that they may have not followed the 1/3 rules outlined above assuming instead that they produced food to the limit of sustainability or slightly beyond then yes they would have failed. So they broke this extended ELP two different ways. They where dependent on trade to support core parts of their lifestyle and they did not follow the one third rule. The sheer destruction during the dark ages coupled with the black death thence finding the new world before we again hit the maximum or renewable resources and concentration of power scenario is the only reason we are not living through the fall of the second Roman Empire now.

Some people that think a return to renewable is some sort of glorious new age I suspect they will be sadly mistaken unless we practice these 1/3 rules.

This article suggest that Romans where the Americans of the day and food the equivalent of the SUV of the time period.

http://resourcesforhistory.com/Roman_Food_in_Britain.htm

To my knowledge none of the empires ever practiced 1/3 ELP.

I think a lot of the primitive societies did but they also seemed too have practiced extensive low grade warfare to keep populations in line on top of the natural diseases.

So at least in the past we have little indication of a peaceful way to practice 1/3 ELP but modern birth control offers a route for us to eventually consider it even the simple and effective latex condoms of today are enough.

Hopefully we will have effective male contraceptives before TSHTF for real.

Dear Memmel.

My posting is not much concerned with why a civilisation may collapse, but more regarding the aftermath.

A common assumption is that the elite of any given civilisation survive.

After all, the rich exist to ensure they pass on the DNA that they posess

(...I wonder if they realise that they exist only as draught horses for a primitive ribo-nucleic acid...)

Anyway.

I suggest that the rich, in a collapsing society are no safer, and perhaps at greater risk, than the poor in that collapsing society.

There are no Ceasars, no Arthurs, not even any Godwynsons or Hardradersons, nor Tostigsons or Tostigdottirs.

I humbly suggest that collapsing societies take the elites down as well.

At least by the parameters that elites judge themselves. And that is the continuation of both the familial line and the bloodline. (they are not the same: Mummy's baby , Daddys maybe...)

There will be no Cheneysons or Jennasdottirs in future times. If lucky, they will survive in the common DNA blend.

Any assumption that the elite will survive and outlast this civilisation as an elite is at best, fragile. They may hang on for a while, but somebody will screw it up for them.

There is some serious doubt about the contiuation of the lineage of an English medieval kings line. A small dark line suddenly produced a six foot red-gold haired child. Quite possibly a connection between a Queen and an English bowman while in France.

The tall, red-blond complexion survived through the late Plantegenets, Henry VIII, and into Elisabeth I.

Compare the painting of Richard III with his brother Edward

As I said:

Mummys baby, Daddys maybe...

Sometimes you just gotta laugh

The Bush and Cheney dynasties may end up with Blackwater Mercenary Bastards... Pretty much the equivalent of a Hundred Years War Lucky Archer.

Who knows these things?

As for the Romans: They broke their own rules: You cannot hope to feed an Empire if it doesnt produce something in return.

And you cannot defend an Empire's interests if the elite are exempt by birth and wealth from military service.

Longer term I agree. Generally the rich stay rich by controlling the system that they in effect design. When the rules change few of the former elite make it through to be the new powers that be. So yes long term I agree that the power brokers of today will not make it genetically. However we will live for hundreds of years affected by the decisions made by todays and yesterdays elite. So their legacy will live for a long time if only as curses.

Hi Memmel, its an interesting line of speculation, but I question that the Romans were based on trade. They had a slave-based economy, and their conquest system with looting and tribute paid the troops. Eventually, they ran out of areas worth conquering and their warfare turned internal. The empire fell apart without constant conquests, which were increasingly unweildy to administer. Thats without considering yhe abandonment of Roman pagan virtue and philosophy for the outlandish oriental religeon christianity with its totalitarian worldview.

Gasoline and oil have replaced slavery in our society. their ability to do work is unparelled. As we deplete our slaves-oil run machinery, our American attempt at world domination will fall apart. The illegal immigrants that we are importing faster than we can assimilate will overwhelm our society, just as the Goths and Vandals overwhelmed Gaul and the western Roman Empire.

Hadrian's wall in Britain was what resulted when the exponential expansion of Imperial Rome stopped on its northwest fringes. It didn't bankrupt Rome, but it marked where the expansion failed. The Roman Legions stopped relying on expansion to pay their saleries, but instead local taxes.And soon the warlords became petty kings, the Angles and Saxons overwhelmed the Britans. Stopping expansion killed the traditional Roman model.

Maybe history, if anyone literate and philosophical survives, will reguard our insane wall on the Mexican border and our stupid NAFTA highway as the high water mark of the Industrial West. So, if you are inclined, bury your hoard and go on a last driving vacation.

I like your analogy also. It goes to show how you run a expansionist based economy on renewable resources :)

You make some very good points and this is probably the main reason for the fall of Rome.

I think we are in agreement that the core problem is expansion stopped the slave/oil spigot began to run dry. Wealth concentrated into the hands of a few and society collapsed.

The parallel with todays society is uncanny to say the least. To me the problem is when wealth creation stumbles the natural ability of the rich to concentrate wealth effectively wrecks the society in short order only the continuous flow of wealth can keep the wealthy from destroying their own society in their ravenous quest for infinite wealth.

Note the fact that they where limited to a renewable resources so their decline was generally only from the stopping of expansion this could explain the long time that it took them to decline they did not drift far into overshoot on the resource side. While we are far from equilibrium. But the key is once resource growth stops and declines we can no longer support our ruling class and they in effect strip the wealth from the rest of society to satiate their needs.

Needless to say we can effectively do nothing until this diseased wealthy class destroys itself.

This does indicate the close correlation between the peak in monetary excess and peak export resources at first wealth is pumped in in and attempt to expand the resource base when this fails it is turned to concentration of power at the expense of all else. If you look at numerous countries that have a vast class of poor and a small elite class they are in general also the same countries that have a fixed economic system with no real growth generally its export of some resource or natural products. So to me the ties are quite powerful. Next almost all of these countries have had major financial problems that stop once power is concentrated and more important exports are stabilized.

Of course these countries are unstable to external influences such as invasion etc.

Thanks for your post.

I really hope that computers survive and esp the Oildrum website it will be a great resource for future historians.

I wonder if writings exist from Roman times that showed they knew that they where heading for destruction. You have to think they carried out the same discussions we do today.

I found this.

http://www.amazon.com/Sidonius-Apollinaris-Fall-Rome-407-485/dp/0198144725

Don't know much about it though.

And this.

http://en.wikipedia.org/wiki/Sidonius_Apollinaris

Funny, I don't see "our society" as anything different from the society that the folks standing at the home depot looking for day labor are part of. Where do people get your sense of boundaries, your sense of "us" and your sense of "them"?

I look at the Guatamallan guy looking for work on the corner and I don't have a sense that he is different from me. That could be me, and I want a society in which, if that were me, I wouldn't be treated as if I didn't have a right to be here.

Last time I checked those "illegal" immigrants pretty much came here of their own volition, and weren't imported by anyone.

Don't disagree I used to live in Vietnam and although money was a big differentiator trust me I've no us or them mentality.

I've also lived in the Holly Springs Mississippi which is a third world country inside the US. The problem is abject poverty like in Vietnam and Mississippi is a different beast.

I don't know how to describe it you have to experience real true raw poverty like this. Its not us or them but it is why the Guatemalan risked everything to stand on a street corner in the US for work. So I assure you I don't fear the loss of the American lifestyle crap but this intense poverty is not good for anyone.

Read my post again, I said "If they survive...."

One never knows how it will play out.

If it really collapses very quick then "rich" is anyone that has something the mob wants or needs, whether they can see it or someone informed them.

The most logical scenario in the US at the beginning is that "green zones" may develop in major cities.

No one can really predict it, the rich are usually not very good at street survival but on the other side then can buy the last chopper off the rooftop so to speak.

I think the biggest obstacle is that the best laid plans never survive first contact and this makes it questionable in my mind to commit to a specific plan in advance. There are a good number of basic precautions that can be in place all the time.

If it turns into a end of the world scenario, then who cares, take as many of the fu(kers as you can and save the last round for yourself.

Hi Mudlogger,

Good point about the collapse of the rich at the end of the Roman Empire. I would have to do a bit of research to figure out if your take on the Norman Conquest is accurate, though. The way I understand it, some nobility was pushed north to Scottland and/or fled to Norse ties, changed loyalties etc.. (See Thomas Becket, Henry II.'s Chancellor), where they tended to marry back into the nobility of the region. Maybe this take is somewhat wrong, ...

... but actually I wanted to comment on "French", Anglo-Saxon and the "English" language.

The "French" language spoken on the English Court died out for a number of reasons, even during the 100-Years-War, when the English/Norse nobility was claiming power over most of France. The biggest reason was that the dialect in London was quite different than that spoken on the Seine. It was probably very backwards and "embarassing". (see Chaucer's description of the prioress) Otherwise there is no reason for a society NOT to have a two-class language system.

English, meaning "Middle English" spoken from ca. 1300-1450 was no longer Anglo-Saxon. It was more of a creole - a mix between Anglo-Saxon and French. We eat "pork" (French for pig: porc) but still have swine and sows (the Germanic) in the barn.

English was NOT the language of the original wet nurse (although closer to it).

It was also NOT the language of the Norman French, although sentence structure is closer here than to the Anglo-Saxon.

But I agree:

Long live the Peasantry!

Long live White Trash!

Cheers from Munich,

Dom (an Appalatian hillbilly from the Ohian Foothills..)

----

My grandfather pumped oil with an engine-house,

my father pumped oil with a 20 lb. electric motor,

can't I just pump it online?

Perhaps I should have referred to it as Engelsc or old english.

Some did escape to Scotland after the Norman ethnic cleansing of North of the river Humber. ('The Harrying of the North').

And some made it back home to Scandinavia since by that time, the North English were Anglo-Norse.

Some actually made it to Aberdeenshire (as it now is) and settled, speaking a dialect known as Engelsc.

As for the wet-nurse theory. It is not mine, just apassing comment.

The world is a turning place...

At least in the Southern US the wet nurse theory holds. The southern English dialect I speak was heavily influenced by words and speech patterns from the African slaves and later servants. This strong bond is one reason that as racism receded in both South Africa and the Southern US you did not have as hard a time getting people to integrate as outsiders thought. Racism is learned behavior and generally does not take deep roots until your much older. I think if your interested in and example of cultural collision the more recent American slavery period is useful. Note that in general in the southern US the ratio of African to European ancestry is about 50/50. As a personal note I was raised as a young child by some old Sharecroppers their grand parents where slaves so only their parents were born free and even then only slightly after the end of the American civil war.

So a fairly direct effect of both slavery and the civil war was present in the south into the 1970's. Only after my generation did the chain break. My children for example will be disconnected in the same way from WWII and it will look to them like ancient history. It seems too take about four generations for a horrific event to leave the culture.

The freedom marches of the 1960's are not that disconnected generation wise from the civil war in fact its the first point at which both African and European descent Americans lived outside the shadow so to speak of the civil war.

Hopefully this gives you some idea how major events reverberate through societies for 100 years or more.

Next it looks like the fall of the Roman Empire was just as messy Americans tend to view it as a quick event.

'... to quit playing the game' as a solution to Jevon's paradox is exactly why Cheney describes conservation as a personal virtue.

It is also one reason the United States seems so resistant to change - essentially, it is the leading society which has arisen out of the oil age, much the same way Britain was the leading society which arose out of the coal age.

America would have to become something different, with wrenching changes, if it decided to stop playing the oil game.

Just watching how the price of gas has become a leading topic has been interesting - for non-Americans in industrial countries, a rising price of gas means walking more, or using a bicycle - in Germany, most people have a working one, after all, and the bike paths cover most routes, and riding in traffic isn't generally life threatening.

To a certain extent, Europe (in aggregate) is already following your suggestion - walking home from the store this evening, a TGV passed me - the high speed rail nets are slowly merging here, for example.

Keeping America in gasoline is a cheap price for stability, even if only in the short term - Europeans have a very long tradition of enjoying their comforts as long as possible, without undue concern. And Germans, at least, still think bicycling to a local lake to swim on a 90° day is better than driving a car to an air-conditioned mall.

Not that anyone is actually earning any money from those swimmers (except the ice cream sellers - generally Italians who also make their own ice cream). To be a bit cheeky - as a number of them swim without clothes, you can easily see that enjoyment can be stripped bare, so to speak.

If very lucky, maybe Americans can learn how to enjoy such basic pleasures - no credit card required, just time to feel the sun and water.

>still don't understand why it doesn't matter when you burn the oil and gas. Like coal, it seems like the later we did it the better.

Europe will fair no better that the US will. Those that beleve Europe will survive over other nations are in denial.

1. Europe's population is dependant upon unsustainable entitlement programs. Its workforce is aging as fewer Europeans elected to have children. The lack of a young workforce will result in a collapse of its entitlement programs (especially in a economy that is more dependant on manual labor to produce goods and services).

2. Europe has little domestic energy resources. Already its facing a near crisis as its become dependant on energy exports from Russia. Europeans will still need energy to run trains, heat thier homes, and put food on the table.

3. Europes very large population presents some major challeges. Could Europe even maintain required food production without the use of fossil fuels and petrochemicals for agriculture? Population size is dependant on the available of food to feed it. Oil and Gas provide a means to more than quadrupling crop yeilds will cutting the land use devoted to agraculture in half. Land that was once valuable and fertial farm land is now occupied be dwellings (homes, apt. buildings, factories and offices).

4. Europe's largest industrial states are depend on exports. When true global fuel shortages appear consumers worldwide will cut consumption, wether its BMW's, Phillips TVs or Wines and Cheeses.

An internal transportation system alone does not sustain an empire.

To answer quickly -

1. Since most people here think a growing population is a major problem in terms of resource depletion/sustainability, a stable or declining population is not considered a sign of problems, but a ray of hope over the long term. As for entitlement programs - yes, it is true, Europeans feel that universal health care is a mark of a decent and well functioning society, for example.

2. Germany is developing a non-fuel energy economy - just getting started, true, but getting started is the first step.

3. German agriculture has been attempting to significantly reduce its use of petrochemicals - in part, because petrochemicals seem to have long term effects which are themselves a growing problem in terms of soil. Generally, however, Europe doesn't suffer sprawl in the American sense - the small farmland plot I own cost something like 1 euro a square meter - land zoned for a house currently cost something like 500 euros - the distance between the two is about a kilometer. And when a new area is built, at least in Germany, the community is required to compensate by turning some other parcel into either agricultural or 'natural' land - the town I live in has planted over 500 cherry trees in its orchard to compensate for some new housing areas.

4. 'Empire'? What many people seem to not understand is that Europe existed before oil age, and will be able to exist afterwards. Will Mercedes be a big employer in the region? No, not really, but does this mean that the train system will stop functioning, or the barges no longer use the Rhine? At some point, sure - everything ends. I tend to be a non-doomer, except in terms of the U.S. - Europe will survive, but you are right - it won't be exporting much, and a lot of people in Germany will live like they did 50 years ago - tending land, heating one room with wood, and otherwise spending their time locally.

I can't imagine that in America's suburbia, though.

My perspective is not about business as usual - that won't be the case - but about basic infrastructure. Can Germany, for example, move food from productive land in Eastern Germany? - much was left pretty untended by the socialist system in terms of fertilzer and pesticides - it is in pretty good shape, actually - another reason Germans are trying to cut back on such things, since comparing and contrasting was pretty eye opening.

On the other hand, will climate change cause massive problems? Certainly likely.

In other words, will Europe be able to maintain itself at an 1890s level without total collapse? Possibly. Can America?

Most import is peak oil is a social problem. European society can I believe more easily deal with peak oil than America. They will and have made the right choices. Next most people that take care of themselves can work and contribute well into their 70's I suspect that Europeans will value the contribution of their aging population even if it means allowing them to work part time. Aging should not be considered another type of disability that needs to be addressed. By just working part time esp at tasks the elderly did not get to do in their younger years they could easily contribute enough to cover their own basic costs. I can think of a thousands of jobs that older people can perform well.

In closing any attempt to constrain the overshoot condition in a human manner entails dealing with a large aging population so its a problem that must and I think can be solved.

In other words, will Europe be able to maintain itself at an 1890s level without total collapse? Possibly.

Yes---if and only if all of Europe, and not just France, accepts nuclear fission to replace the coal which drove the civilization of 1890 (at a far smaller population).

Can America?

Enormous parts of suburbia? No.

In other words, will Europe be able to maintain itself at an 1890s level without total collapse? Possibly.

Yes---if and only if all of Europe, and not just France, accepts nuclear fission to replace the coal which drove the civilization of 1890 (at a far smaller population).

Can America?

Enormous parts of suburbia in hot areas? No.

Re "In other words, will Europe be able to maintain itself at an 1890s level without total collapse? Possibly."

To put things in perspective:

In Denmark- north Europe year 1650-1800 the rural society = 95% of society worked with a barley harvest of 5-7 fold - the 5 fold was without manure- and the 7 was with farm manure. I have book "Alexander the Great and the Logistics of the Macedonian Army" citing annual harvests rates of 12-15 fold in the old Babylonic (Iraq)river valleys 500 BC as well as along the Nile with annual floods. So these are possibly the max/min biomass/ food harvest rates possible in a "primitive" setup without fertilizers and pesticides.

Today studies has shown that Denmark could produce 240 PJ annually- for 5.5 million people- from wind, biomass, solar etc.- without nuclear and without fossil energy. This translates into 30 % of present energy use and approximately to 1 ton of oil energy= 6 barrels oil energy per person per year sustainably and "forever".

While this is probably too optimistic, it also shows that we are not doomed but rather that we have to make do with much less and use energy much more efficient. Finally, the fewer we are the better.

kind regards/And1

It may be time to start explaining that nitrogen based fertilizers and pesticides etc are going to be with us for a long time. If we can make electricity we can make fertilizer so assumptions that we will live in a world without chemical fertilizers are false. We may choose to not use them or they may be expensive and thus used sparingly but they will still be available and probably not much more expensive than today.

By that I mean less than 5 times today's cost. Obviously with nuclear power we effectively have as much fertilizer as needed. And we still have plenty of NG/oil left for petrochemical products if we stop burning it as fuel.

I think water/powering irrigation pumps is a far bigger factor in world food production. But Europe should be able to maintain a high level of food production. Also of course the directed use of farm machinery for some tasks such as harvesting makes a big difference. You can easily only use electric/biomass powered farm equipment for planting and harvesting and still get a great EROI. Put it this way the EROI of a horse and a tractor are at worst the same but I suspect the tractor has a far higher EROI used judiciously.

Next of course the tractors themselves could easily be shared amongst a number of farmers we are still very wasteful and redundant with farm equipment.

>We may choose to not use them or they may be expensive and thus used sparingly but they will still be available and probably not much more expensive than today.

You can bet on it that they will be far more expensive. FWIW: Making Fertializer, Pesticides and other critical chemicals using electricity is terribly inefficient. Nitrates and and Pesticides can be produced using pyrolysis much more efficiently then using electricity.

>Obviously with nuclear power we effectively have as much fertilizer as needed.

Ahem. Where does Europe get most of this Nuclear Fuel?

>And we still have plenty of NG/oil left for petrochemical products if we stop burning it as fuel.

Same goes for NG and Oil, Do you believe that Exporters will freely trade NG,Oil and Uranium in the future as they do today? Consider the possibly that NG, Oil and Uranium, become issues of national security and gov'ts will tightly control exports. Assuming that Europe is only able to import a tiny fraction of current energy imports. What's Plan B?

>In Denmark- north Europe year 1650-1800 the rural society = 95% of society worked with a barley harvest of 5-7 fold - the 5 fold was without manure- and the 7 was with farm manure.

What was the population of Denmark and the rest of Europe during that time, and what is the population level today? Your comparing Apples and Oranges.

Back then the majority of the people were directly involved with agraculture. People grew up on rural farms and few people traveled beyond more than a few dozen miles from where they were born. Today, few people are directly involved in agraculture and lack the necessary skills. Most now live in cities and rely on industrialize farming to feed them.

What's likely to happen is that as energy resources deplete unemployment will soar as the export machine comes to a grinding halt. Gov'ts will gravitate towards even greater socialism to deal with rising unemployment and declining energy resources (as they have done in the past). Farms and other basic resources will be nationalized for the greater good, leading to a form of totaliarism as Gov'ts reach for tighter control over strategic resources (food, energy, etc) and reduce personal freedoms in order to reduce crime and other social issues. Gov't will opt for quantity over qualify for food production which foods will be of lower nutrietional valuble leading to rise of malnutrietion and associated diseases.

I also suspect that there could be the potential for war in situations where one European state has a bumper crop and another has a severe crop failure. Nations will be less likely to share food and other strategic resources if food and energy production destablizes.

>Today studies has shown that Denmark could produce 240 PJ annually- for 5.5 million people- from wind, biomass, solar etc.- without nuclear and without fossil energy. This translates into 30 % of present energy use and approximately to 1 ton of oil energy= 6 barrels oil energy per person per year sustainably and "forever".

I very much doubt sufficient sustainable energy and food resources will support anywhere near these current population levels. If it was true then they would need to import far less fossil fuels.

Countries will also need to produce far more food than they currently consume because occasional acts of nature (droughts, cold snaps, investations, blights, etc) will impact crop yields. In the past, Europe faced crop failures that caused starvation and they'll happen again. When the majority of the population was living in rural region, social stresses were less of a problem. Large Cities are much more difficult to control during crisises.

Even if Europe was somehow able to meet domestic consumption, other parts of the world will not. If an act of natural event occurs, and it cuts food production significantly, then you'll have a problem without adquite reserves.

>I have book "Alexander the Great and the Logistics of the Macedonian Army" citing annual harvests rates of 12-15 fold in the old Babylonic (Iraq)river valleys 500 BC as well as along the Nile with annual floods. So these are possibly the max/min biomass/ food harvest rates possible in a "primitive" setup without fertilizers and pesticides.

That was when the populations were very small (compared with today's population). Egyptions and Babylonians only farmed the fertial flood plain and there was a natural balance between the little amount of fertial land and the population. Today, farming occurs many miles from flood plains and countries like Iraq and Eygpt have tapped into the deep aquifers belows the desert sands to irrigate crops. The available land in the fertile flood plains is no longer enough to feed the masses of today. This can be said of Europe. In addition, industrialization has polluted much of European rivers (Especially in the former Soviet block) and the contaiminated flood plains are probably unsuitable for growing crops.

>Finally, the fewer we are the better.

Getting there is the real problem. Most People refuse to lie down and die or go quitely in the night. In the past crisis always lead to riots, revolts and chaos. I would expect this will hold true in the future.

memmel said,

"In a sense the only way to win at Jevons Paradox is to quit playing the game."

BY JOVE, I THINK HE'S GOT IT! :-O

Excellent, EXACTLY on point memmel! :-)

And this is why, I assert, that the with each passing day, more and more thinkers, technicians and "doers" are moving to solar in some form, and some form of solar hydrogen.

At the end of the day, it is the only base that overcomes the problem of "death by 1000 conversions".

With solar, increased consumption of the energy does not decrease the supply! ONLY wind, solar, and in certain locations, tide and geothermal can say this (and even geothermal can pressure can be dropped if too many wells are added too close together)

Solar is the only alternative with a potential base of power in BTU or Kw that is large enough to last for centuries into the future.

Solar can be converted with ever improving efficiency with in most cases, a one or two step conversion:

Solar to heat

Solar to electricity

Solar to electricity to hydrogen

and in certain experimental systems, solar to hydrogen direct in the panel with water and light only flowing, skipping the electric step

Even at the current stage of development, solar is showing more promise than many alternatives have been able to after billions of dollars and and years of work (ethanol, switchgrass, celluostic alcohol, even bio butanol, and tar sands and oil shale, and certainly cleaner and much, much more efficient than GTL or CTL)

Solar has been endorsed and the radical nature of the solution understood by giants such as Edison, Tesla, Buckminster Fuller and Alvin Toffler, among many others.

Even the ethanol and biofuel sceptics Patzik and Pimentel of Cornell see potential in the development of solar and solar to hydrogen far exceeding the possibilities of ethanol.

memmels view is,

"So lets say to be safe you need to fix demand at 1/3 of the renewable capacity of the resource. For our current way of life this is fairly draconian but you can see that it ensures basically a endless supply if you stay within the constraints."

With solar, this is easily possible. Some have argued endlessly that we should go thermal solar, others say PV solar. We will of course go both!

Some have argued whether we should use solar to charge batteries, or should use it to produce hydrogen. We will of course do both!

Some have argued whether the collectors should be on individual homes and farms, or should be on large industrial and retail roof space, or combined at a large "solar farm" owned by the utilities. It will of course be all of the above.

Some have asked whether we should produce power by wind, by solar, or by nuclear, or be efficient in our use of remaining fossil fuels.

As Matthew Simmons once said several years ago, "The argument is not the renewables vs. the fossil fuels....we will need them all."

But the great underlying FACT about the true renewables (in fact, this can almost be considered definitional of a true renewable energy) is that no matter how much is consumed, the volume on the Earth DOES NOT go down.

Sunlight, wind can say it. Nuclear can't, bio-fuels can't, fossil fuels can't.

And for the theorists of EROEI, (I confess here to having doubts about the way EROEI is often used, but it is the EROEI argument that pushed me to the solar option as much as anything else), the EROEI of oil and gas, even if there is a lot of it left in the world, is only going to go down. The EROEI of the renewables, the true renewables that is, is only going to go up. At some point, the two lines will have to cross, and from that point on, a person will be paying a penalty to get to use the fossil fuels. Think of that: Paying a penalty to get to use the dirtier fuel. Paying a penalty to get to undermine the nations balance of payments and national security. Paying a penalty to help our nations enemies. Paying a penelty to get to use oil and gas that the poor of the world still need until they can make the transition.

The paradigm shift is coming much faster than most realize. We are at about with solar energy and solar to hydrogen where the home computer industry was in 1975. Some home builts, kit builts, tinkers working on formats. But the money crowd is getting interested. Nations are starting to see it as a potential national industry. Even strategic thinkers are starting to see the geo political advantage of it.

This is starting to look like the industry of the next third of a century plus. What choices will you and your children make to be on the right side of a revolution?

If you had known for certain what was coming in the cmputer, software, and internet revolution back in the early 1970's, can you think of at least 1000 ways in which you could have made millions?

If you know now that the renewable and solar age are the industry of growth for the rest of our lives, if we are over 35, and for the rest of our career no matter what age we are, can you think of ways to be on the wealth creating, winning side?

Knock off the thoughts of going to the retreat to learn how to plow with donkeys, folks, there is a better future than that awaiting us! :-)

And for pete's sake stop wasting time acting as apologists for the oil companies! They have the money to defend themselves, and beside, in the great scheme of things, like sailing schooners, steam engines and stage coach lines before them, their day of growth and glory has come and is beginning to go.

Allow them a peaceful decline and demise. The oil industry has, and I know this line will get me in trouble, but in my view, it has given us so much. Not just technology, but an aesthetic, a look and feel that has been priceless.

The renewable age is beginning to give us a new look and feel. We are in for a fascinating time! I only wish I were in my twenties again, to be back at the front of this wave, back in the shops and the technical colleges....it is going to be some great time for great talant!

I will shorten what memmel said:

"In a sense the only way to win is to quit playing the game."

The old game, that is! We have been playing against the house, and we know the house sets the wheel so that the house wins.

Quit playing the OLD game. Start playing the new game. It still has a straight wheel and unmarked cards! :-)

Roger Conner Jr.

Remember, we are only one cubic mile from freedom

Gentlemen, it's about time that some of you just caught your breath and re-read the stuff which came out of the Club of Rome in the mid-'60s. There was a lot of Malthusian thinking based on cheap commodities and the consequent high consumption growth rates. The market then stepped in and we went thru a couple of price spike-collapse cycles in '73 and '80. It has been ever thus with commodities. That is, price spikes result in higher production, alternative supplies and conservation.

One cannot forget that new technologies improve the supply and demand sides of the equation. We are getting into areas we never dreamed we could drill: deeper waters and smaller reservoirs. Also, recovery factors for existing reservoirs have increased because of directional drilling. New technologies have also increased our efficiency of use and has the ability to do much more. Who doesn't have more house insulation these days? We have to choice to buy and can certainly make more efficient vehicles.

At the same time, refineries will be expanded and upgraded to make more efficient use of crude oil. At the present time, US refineries convert ~ 75-80% of crude to clean products. Refineries in Europe and the Far East make closer to 50-65% of clean products. If those yields were improved by 10% that would amount to another 8 million barrels per day of clean products, wiping out about 5 years of annuall demand growth without requiring another drop of crude oil production. What was lacking for the last 15 years was refinery profitability to fund this expansion. The existing refineries are now plenty profitable and many expansion projects are now underway. It will take a few years, but the market will balance supply/demand again.

I seem to remember that, in order to avoid a major shortfall with respect to demand, Saudi Arabia needs to greatly increase its shipments in May/June.

With crude piling up in the U.S., it is no longer clear that this is the case. I would also note that the last time I looked at total OECD inventories, they were also pretty healthy, after dropping earlier. If this is still the case, the market - as far as inventories that are transparent - appears to be adequately supplied at this time.

I previously have said we would know something by summer, but we have to start pulling some crude inventories before Saudi is going to be called upon for more production.

But I wonder - where are the Koreans making up their shortfall? Between China, Japan. and the U.S., the Koreans are easily squeezed - and to no one's perceived disadvantage except the Koreans, who are the disadvantaged.

This is the point about Saudi storage - I assume that everyone who isn't an oil producer is trying to keep their inventories as high as possible - at this point, empty storage is not necessarily measured in dollar and cents. The Saudis may have fairly extensive storage, based on security concerns, not simply economic ones.

There is a market for all the oil produced currently - and as oil production declines, that market will remain in force. What is happening is the allocation of that dwindling supply.

And the awareness of that fact. Peak oil is no longer a boutique concern of the next decade.

It has essentially arrived, regardless of a few thousand barrels here or there.

And when I say storage, it is in a broad sense - tanker cargoes and the speed of the tankers reach port is certainly a way to manipulate noticeable amounts of oil - remember the Houston fog which no one but government agencies seemed to see?

Maybe the tanker games are over, with the cargoes they carry now representing maximum production without the stretched out storage buffer, especially with a certain tension in the air concerning Iran.

Just speculation, of course - but with demand reamining stubbornly high, including China's SPR, and India's desire to at least be able to withstand minor oil shortfalls/shocks, reality begins to overrule the games being played. memmel had some fascinating speculation on how the Saudis have been shuffling their wells, so to speak - and how that is now likely coming to a close, as the water front simply reduces the number of wells available.

This is not a prediction about price, or the fact that the oil industry works by a different set of frameworks than most people seem to understand, including a price crash, which could occur even in the face of declining production.

I just think that the reality will set in over the next period of time - the amount of oil available will never be higher than now.

Fascinating discussion,all

When you mention "allocation", you raise the matter of how can the US unilaterally cut its demand, and thus imports, as some remedy for PO? The unilateral cut will simply be slurped by others, yielding no lessening of overall depletion rates.

Any US cut of its imports must be accompanied by a mechanism preventing others picking up what was left on the dock, or in the well. This perhaps is accomplished by having KSA cut back production and begin putting its buyers "on allocation", in essence forcing all importers to cut imports.

Thi KSA allocation regimen can be joint US-KSA move, with unnamed others, as quiet prerequisute to mandated consumer cutbacks. This scenario would predict that soon the US/others will publicly acknowledge PO and mandate cuts in consumption. All done without mention of PO until exporter have already cut their production.

The economics and shocks willalready have gradiently been imposed.

Fascinating discussion,all

When you mention "allocation", you raise the matter of how can the US unilaterally cut its demand, and thus imports, as some remedy for PO? The unilateral cut will simply be slurped by others, yielding no lessening of overall depletion rates.

Any US cut of its imports must be accompanied by a mechanism preventing others picking up what was left on the dock, or in the well. This perhaps is accomplished by having KSA cut back production and begin putting its buyers "on allocation", in essence forcing all importers to cut imports.

Thi KSA allocation regimen can be joint US-KSA move, with unnamed others, as quiet prerequisute to mandated consumer cutbacks. This scenario would predict that soon the US/others will publicly acknowledge PO and mandate cuts in consumption. All done without mention of PO until exporters have already cut their production.

The economics and shocks will already have gradiently been imposed.

I like your line of reasoning. The US even if only to protect its military capability needs to go on a oil diet. This scenario represents a way to do it in a politically correct manner. Your right that regardless of evil plots or lack of them if the US government is peak oil aware it has to at least partially wean Americans of oil or we will have collapse. I think that plans are afoot to ensure a few are at the top of the heap but they still require the existence of the heap.

So this makes a lot of sense thanks. Of course it only makes matters worse in the third world but I think they have been written off.

Hi Robert,

Do you have a more recent source for OECD inventory?

The May 11 Oil Market report, they are still showing 2 straight quarters of approx. 1MMBPD draw.

Overall, the OECD inventory is still healthy (above average), but still drawing.

Something must be triggering this extended draw, and it doesn't prove anything...just asks the question why?

EIA Projection: http://www.eia.doe.gov/emeu/steo/pub/gifs/Slide25.gif

I wonder what a chart of crude oil inventories in non-OECD countries would look like?

Note that Brent is getting close to $72, only $2 below its post-5/05 monthly high.

I have noted that the EIA's projections are not known for being particularly accurate. If that projection does come to pass, then we will find out if Saudi can produce more. Until then, it's just another EIA projection.

And OPEC crude this week is within 30 cents of where it was this week last year. And yet Saudi has made lots and lots of cuts.

This time last year prices of oil included huge post-Katrina "hurricane" premium (and we must remember, that not only the premium was oversized, but after that hurricane season of 2006 didn't happen at all, which affected current prices as well)

So to look at the supply-demand part of the oil prices and compare them with last year's, we will have to wait till the end of the 2007 Hurricane season (and only if it will be not catastrophic like 2005)

From the EIA short term energy outlook:

Average monthly Brent spot crude oil price in the 20 months prior to 5/05: $38

Average (and median) monthly Brent spot crude oil price since 5/05: $62, within a range of $54 to $74. Currently in the $71 to $72 range (about 33% above the post-5/05 monthly low price).

Mathematically, based on HL, the world is now where the Lower 48 was in the 1970-1972 time frame, and like the Lower 48 in the Seventies, the world is responding to higher prices with lower crude oil production. The cumulative shortfall between what the world would have produced at the 5/05 rate and what we actually produced is on the order of 500 mb (EIA, crude + condensate).

Average monthly Brent spot crude oil price in the 20 months prior to 5/05: $38

Average (and median) monthly Brent spot crude oil price since 5/05: $62, within a range of $54 to $74. Currently in the $71 to $72 range (about 33% above the post-5/05 monthly low price).

No argument there, but if spare capacity is shrinking - regardless of whether production has peaked - you will see the same. And I don't think anyone would suggest that we don't have much less spare capacity today than 5 years ago.

It seems that a lot of the refineries in the third world are of the simple variety so they are not in competition for the flows of heavy sour crude but only light sweet crude. I think the pricing pressure is coming from the peak of light sweet beginning to be felt. As the worlds crude supply becomes heavier and sour the effect on countries that don't have the means to upgrade refineries to handle heavy sour crudes will be interesting to say the least. To me this implies that over the next few years at least the pricing pressure will be between light sweet crude and importing gasoline made from heavy sour crudes at complex refineries. So the crack spread will probably widen for some time. The inability of much of the world to pay for refinery upgrades will probably keep the heavy sour grades at a fairly reasonable price for some time. I think the sulfur is also a big issue for refiners since you can't run high sulfur crudes in general through a simple refinery you can run heavier crude at a lower yield. Robert might comment.

So the refining problem is I think more of a peak light sweet crude issue then anything else. Its much easier and cheaper to refine light sweet crudes and if we had not peaked in light sweet we would not have this refining bottle neck we see today. This differential will not close but it will drive the price of light sweet and refined gasoline to the same value minus a minimal refining cost. Needless to say owning a simple refinery will not be a winner in the near future.

So the focus for now is on light sweet and simple vs complex refining and more troublesome the location of these simple refineries. My opinion is that a lot of the third world is going to hit the wall very quickly especially since they have the double burden of simple refineries and subsidies.

In a year or two once the dust settles it will be a complex refinery heavy sour bidding war. This early destruction of a lot of the third world demand will give the wealthier countries additional breathing room to keep the SUV's rolling.

memmel...I've been arguing this point for awhile now...that the refining issues we are seeing are a result of contrained light, sweet crude availability, but Robert keeps showing me stats that say the inputs to refineries has not changed in 10 years, so the evidence is not there or the stats Robert is looking at don't tell the picture.

The idea you state, however, makes a lot of intuitive sense to me.

Its third world refineries that are getting hammered and running shortages. Asia is a big place and we are assuming that the cuts KSA are making are effecting only the wealthy nations. I don't know their contracts but they could well be reneging on favorable contracts with a number of the poorer nations. Until we understand the situation with light sweet and worldwide simple refineries I think Stuarts current work is not correct. Also note that given the timing of the peak of light sweet now is exactly when it should become a huge issue.

Every thing can be readily explained by the loss of 1mbpd or more of light sweet crude and it fits the current situation better some of this is of course Ghawar but thats just part of the problem.

So in this scenario, where there is a problem finding enough light, sweet crude to run through the simple refineries, there might be more pressure to obtain imports of finished product and subsequent bidding wars on this product from countries/companies that can supply the finished product?

Right.

So I think Stuart is correct on the amount of missing oil i.e 1-2 mbpd but its light sweet gone missing from a variety of sources not just KSA. So I don't agree with the KSA part of the analysis. Technically you could say they are telling the partial truth but a lot of the oil they produce is heavier and sour so the situation is they are seeing the spread on light sweet and think they can tighten it by dropping heavy sour production and the markets that can handle heavy sour are probably well supplied. Now they have been dropping supplies of the lighter sweet crudes i.e Ghawar lately and this jive with production from northern Ghawar declining as part of the light sweet problem.

The important thing is KSA if Northern Ghawar is in decline can do nothing about peak light sweet they are not really relevant to the light/sweet/simple refinery part of peak oil.

Outside of course if they manage to starve the world of heavy sour with cuts and thus this adds into the gasoline shortage by starving the complex refineries. But I don't think this is the case yet its unclear if the Asian refiners are actually short heavy sour crudes.

I think Robert is closer to correct on this situation than Stuarts current post. If KSA has managed to cause a shortage of heavy sour on top of the problems with light sweet we would be at much higher price points then we are seeing now.

The light sweet problems will probably push gas into 4 dollars per gallon then it will zoom to close to about 8 a gallon next summer if no hurricanes unless we have at least a few third world economies crater this summer late fall. If we get the hurricane strikes predicted then I'm certain a fairly wealthy third world country will soon cease to exist as a functional economy. In short we are getting time when the losers of the demand destruction game I model as musical chairs and Russian roulette start showing up. The

Someone has to go down soon. Since the poorest countries use little fuel demand destruction in them is not enough. We really need 1mbpd of light sweet freed for the rest of the market this means a fairly large third world economy is toast. So the price will rise until this happens. I can't see general conservation as a solution anymore.

The total amount of "missing" Saudi production that I am referring to is the difference between Q3 2004 production (and the very similar 2005 plateau) and production today, plus the fact that two new megaprojects (Qatif/Abu Safar, and Haradh III) came on stream and did not increase production. So something else must have declined or been turned off to offset those increases. That is 1mbd + 690kbd + 300kbd, and it's quite hard to add those together and come up very far from 2mbd.

We really need 1mbpd of light sweet freed for the rest of the market this means a fairly large third world economy is toast.

Memmel, do you know which countries in the world consume more than 1 million barrels per day?

I found this.

http://www.nationmaster.com/graph/ene_oil_con-energy-oil-consumption

Taiwan is right at this number.

So thats why I'm saying it will be a fairly big economy that goes down.

A lot of countries are at 200kbd so this is the effective destruction of 5 countries in the world like Israel or Vietnam.

Or Egypt and Malaysia for example at around 500kb each.

I think this puts the effect of just losing 1mbpd in production in perspective. So once we are down 3-4 the world

is toast. Thats 30-40 small countries without one drop of oil.

Anyone that thinks our modern society is going to last long after peak oil is sadly mistaken we basically have at most a few more years before TSHTF.

The only reason we are still stumbling now is because of storage some conservation etc. But I see a cliff coming up fast.

Just to add if you look at the small countries at 1,000kbd i.e Samoa for example its hundreds without oil.

To avert this US demand would have to decrease by almost 1mbd

and about the same for the EU and Japan. I cannot see the US/EU/Japan voluntarily dropping 4 mbpd.

The money wrench is subsidies used by many countries so the burning question is who is running out of money. And how high will oil/gasoline prices have to go until these subsidies fail and thus the economies behind them. I think its too late for most countries to gradually decrease subsidies since we are talking about and event that started this summer and round one will end next year.

http://money.cnn.com/2007/05/04/news/economy/gas_demand/

I don't have a comprehensive list of countries with subsidies. But we really should build a list of these countries and focus on ones that are not oil exporters and have serious account imbalances now and further only have simple refining capacity. The first victims of peak oil will be on this list and they better add up to 1mbpd or so in consumption.

You need to look at all these issues together.

Interesting that our pals Columbia dropped subsidies in 2002.

Maybe they were passed a tip ? I'd love to see countries that buddied up to Washington over the last few years then quickly dropped subsidies.

One more post this is a great article on the issue.

http://rru.worldbank.org/documents/publicpolicyjournal/310Bacon_Kojima.pdf

I found more info

http://peakoildebunked.blogspot.com/2005/10/120-gasoline-subsidies.html

I've actually found the peak oil debunked site useful

for info supporting peak oil.

Big pdf!

http://www.gtz.de/de/dokumente/en_International_Fuel_Prices_2005.pdf

Egypt looks like a potential trouble spot in Africa

I'd watch them carefully.

Bolivia,Ecuador,Columbia,Mexico and Suriname in the Americas.

Myanmar, North Korea, Pakistan,Indonesia,Jordan,Yemen,Syria Bangladesh, Vietnam and the Philippines for Asia probably missed a few here.

But you can combine this with the consumption numbers and

see that we will have problems fairly quickly.

I was correct to look at South Wast Asia. I left off countries with reasonable exports of oil.

Note the tinderbox of countries with little oil in the ME with subsidies and south Asia.

I would be surprised if we don't see problems out of one of these countries on the list or in the big report.

But this is enough info I think to put together the list

of countries at risk.

The price spread 10 year ago, between Tapis Light Crude (44 Gravity) and Mayan Heavy Crude (22 Gravity) was about $5.50.

Currently, the price spread is $21.

I listened to an investor presentation today by one of my favorite CanRoys a company called Baytex. They are a heavy oil producer in Alberta and have sold their oil to Frontier a U.S. refiner with refineries in Wyoming and up the road from me in El Dorado KS.. Baytex has priced their heavy oil (lloyd blend) to Frontier via a longterm contract at 71% of the WTI their 5 year contract will expire this December and they are anticipating a significant improvement in the differential against the WTI.

Reason?

The Lloyd Blend Market is now (2007)tracking at the lowest differential to WTI in years

Why?

Pipelines flows have been changed so that Canadian Heavy Oil is now flowing to the Gulf Coast which has 6 million barrel a day refining capacity for Heavy Oil. How Come? Canadian Heavy is displacing Mexican and Venezulean Heavy oils that are no longer available to Gulf refiners for reasons well known to all Drummers. For those Drummers with a couple extra deterioating greenbacks Baytex is currently yielding +9.5% in Canadian Dollars.

Presentation can be accessed thru their website:

NYSE Symbol: BTE

http://www.baytex.ab.ca/main/

First, the differentials between light & heavy crudes are almost entirely a function of the product price spreads. That is, when the difference between gasoline and residual fuel is $5/b (like it used to be 5-8 years ago) this diff'l will be low. Today when this gasoline-resid is $50-80/b, then the sweet-sour crude oil diff'l will also be huge. The factor which would indicate a shortage of sweet crude would be some observable difference in the refining margins for sweet and sour crudes. There is some indication of lower margins for sweet crudes, but not a huge issue. The market allocates crude pretty well to those who are willing to pay for it. in the longer term, those higher margins for sour crudes attract investments so the market arbitrages the refining values and margins pretty well.

The simplest possible refinery is a fractionating column (common to every refinery ever built AFAIK). This will work on every crude in existence, light or heavy, sweet or sour. You will be able to get natural gasoline (naptha), kerosene, and fuel oils. For heavy sour crudes your products will have high sulfur and you will get less of the lights and more asphalt.

If you want to get rid of the sulfur, get higher yields, or get modern gasoline blends then you have to start adding complexity.