Saudi production laid bare

Posted by Euan Mearns on March 19, 2007 - 10:00am in The Oil Drum: Europe

A couple of weeks ago I made a comment saying that we needed data on producing wells and drilling history in order to further analyse Saudi oil production. In answer to my wish Kyle posted a comment with this link to the OPEC Annual Statistical Bulletin which contains all this information - well almost.

So is Saudi production about to nosedive?Background

This is the fourth article on Saudi Arabia in this recent series on The Oil Drum. Stuart Staniford set the ball rolling with his post:

Saudi Arabian oil declines 8% in 2006I responded with:

Saudi Arabia and that $1000 betTo which Stuart replied with:

A nosedive toward the desertThere's nothing like a good controversy to stimulate research. But where does the truth lie?

Stuart's position Oil production peaked in Saudi Arabia in 2005. Recent sharp declines in production are involuntary and Saudi Arabia has switched from swing producer to supply constrained producer.

My position Sharp falls in Saudi production since April 2006 are in part voluntary achieved by retiring wells. I say "in part voluntary" because it seems likely that the Saudis will welcome the chance to rest wells with high water cut or low reservoir pressure. When called upon to do so, I believe Saudi Arabia will increase future production through bringing wells out of retirement and a rolling program of drilling new wells.This post looks in detail at the drilling and production record of Saudi Aramco since 1980.

Summary

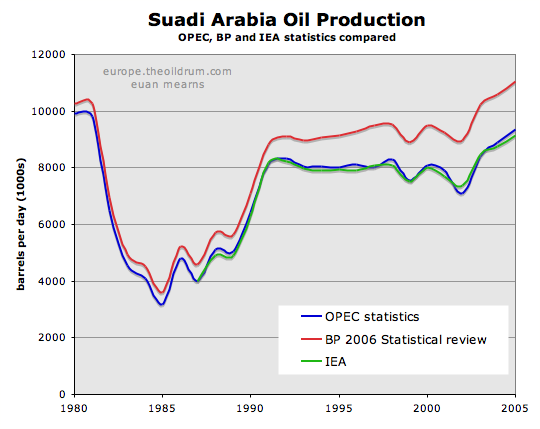

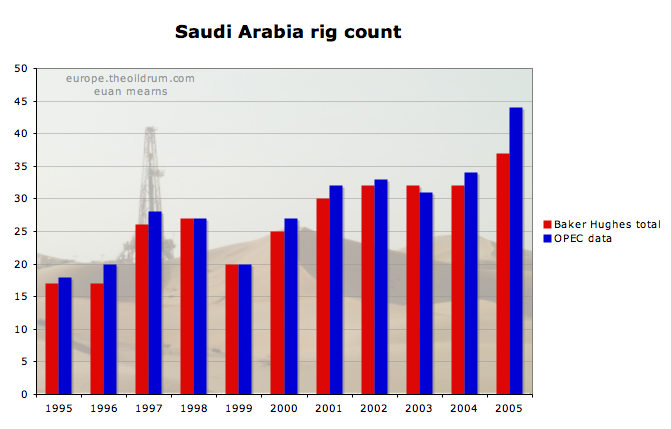

- Cross checking OPEC production and rig count data with International Energy Agency (IEA) and Baker Hughes data shows excellent agreement suggesting there is no reason to doubt the reliability of the OPEC data source.

- In 2005, Saudi Arabia had 1923 producing wells that on average produced 5740 barrels oil per day per well. This is astonishing high well productivity for an area that has been producing oil for over 50 years.

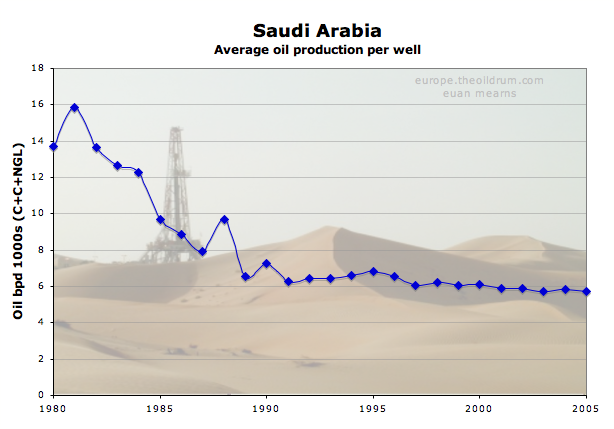

- The average well productivity has drifted down from just above 6000 bpd in 1991 to just below 6000 bpd in 2005 (Figure 1). There is no sign of a looming productivity crisis in these data and it would appear that increasing production may be achieved quite simply by drilling more wells.

- The data provide insight into Saudi Aramco reservoir and resource management in relation to their roll as swing producer. In the past, production has been reduced by retiring production wells and raised again by bringing wells out of retirement. All the while, Aramco have a rolling program of drilling new wells thereby increasing the total number of wells that are available for production.

- In my post of 7th March I suggested that the most likely explanation for falling Saudi production since April 2006 was voluntary restraint executed through a program of resting wells with high water cut or low pressure. The data presented here contain no evidence of a pending production crisis and voluntary restraint is still considered to be the most likely explanation for recent falls in Saudi production.

Data

The OPEC Annual Statistical Bulletin provides access to many data tables pertaining to OPEC and global oil and gas production. Click on the Oil and Gas Data tab to access Tables 36 and 37 which are the source of data presented in this post. Amongst other things these tables provide information on "The number of producing wells" in Saudi Arabia from 1980 to 2005 and the number of wells drilled each year.

As is often the case, not all the data you may wish to have is provided. In the drilling statistics, wells by type (oil, gas, dry and other) are specified for 1980 to 1991 and for 2002 and 2003 but for the other years only a total number is provided which slightly obscures the oil well drilling history. Furthermore, the producing wells are not broken out by oil or gas which adds marginal uncertainty to the data presentation.

The production data used in this post is that taken from the 1986 BP statistical review. These production figures are for crude oil, condensate and natural gas liquids (C+C+NGL). In the OPEC drilling data, I have combined the number of gas wells and oil wells. This meshes with the BP data - as a growing amount of liquids production in Saudi Arabia is from NGL that is produced from gas wells. This adds marginal uncertainty to the data analysis but does not prejudice the validity of the overall conclusions.

One data anomaly, deemed to be a data error, is present in the 1985 producing wells (table T37) where a figure of 731 is recorded. 1985 was the production nadir for Saudi and this figure is highly anomalous compared with the adjacent years. It has been arbitrarily changed to 371 to bring the data in line.

Data reliablity

A number of commentators are sceptical about the accuracy and reliability of information produced by OPEC. I have therefore conducted a couple of cross checks between the OPEC data with other sources. In the charts below, the OPEC production data for Saudi Arabia is compared with BP and IEA data and information on Saudi rig counts are cross checked with Baker Hughes international rig count.

Figure 2 Saudi Arabian oil production. OPEC (Table T38), BP and IEA sources compared. The OPEC data is "Crude oil" and shows excellent agreement with the IEA data which is crude + condensate (C+C). The BP data includes natural gas liquids (NGL) which explains why this data tracks well above the C+C. Note how the contrbution from NGL has grow in importance since 1990. Click to enlarge (applies to all charts). Figure 3 The number of active rigs in Saudi Arabia. OPEC (Table T35) compared with Baker Hughes (oil+gas+miscellaneous). The agreement is generally excellent apart from 2005 where the OPEC count is significantly higher than Baker Hughes. Note how the total rig count has been rising steadily since 1995, suggesting that the Saudis have been winding up their oil and gas activities steadily for the last decade. In general terms there is excellent agreement between the OPEC data and other sources and I see no reason to doubt the validity of the drilling and well data provided by OPEC.

Producing wells and production

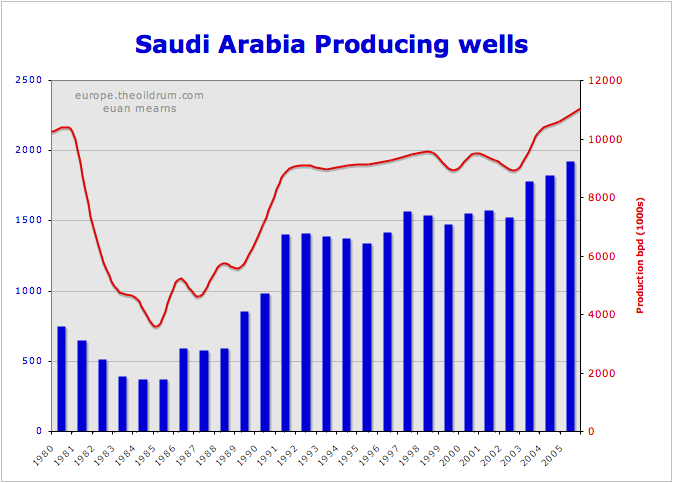

There is a close correspondence between the numbers of producing wells and oil production (Figure 4). But as discussed below, the correlation between these two variables is complex and masks a story of shifting reservoir management strategy, global supply and demand, swing production and geological constraints.

In broad terms, the number of producing wells was reduced from 1980 to 1985 in order to cut back production and constrain global oil supply at a time production was building in the North Sea, the North Slope (Alaska) and other areas. In this period, new wells were still being drilled and the reduction was achieved by mothballing wells and production capacity. Following the 1985 production low, wells were brought out of retirement and from 1985 to 1991, production was built back towards 10 million bpd.

Note how production dips in 1990 and 2002 correspond with dips in the number of producing wells. These are voluntary reductions in production brought about by retiring wells that may be brought out of retirement to boost future production as needs dictate.

In 2003 there was a surge in global demand and the Saudis helped meet that demand by drilling more oil wells that year (Figure 5) and by retiring fewer wells (Figure 6) resulting in significant jump in the number of producing wells (Figure 4).

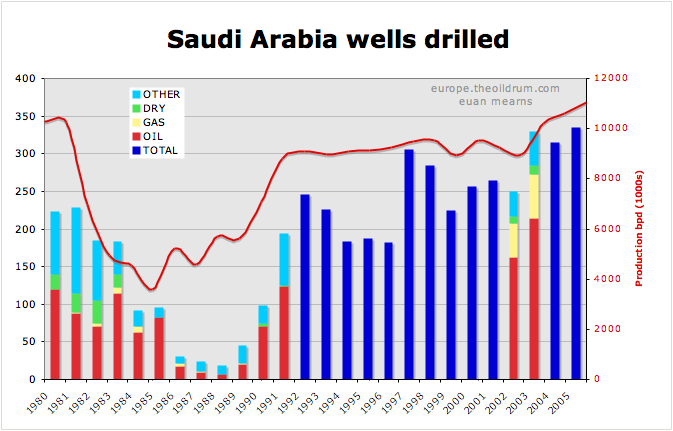

Drilling history

Figure 5 provides some fascinating insight into the workings of Saudi Aramco. In the period 1980 to 1985 production was cut from 10 to 4 million barrels per day through a program of well retirements discussed above and yet they continued to drill new oil wells at a rate of around 100 per year throughout this period. It was only in 1986 that drilling activity was cut back (oil price crash) and the drilling low point of 1988 is offset by 3 years from the production low point of 1985.

The overall level of drilling activity has been rising since 1991 (GW1) and it is a great pity that we do not have the breakdown by well type for most of this period. By 2002-2003 it can be seen that the number of oil wells being drilled each year had approximately doubled from the pre-1985 era and that there has been a substantial increase in the number of gas wells drilled. The rising number of oil wells drilled combined with more or less flat production in the period 1991 to 2003 is a sure fire sign that the average productivity of new wells is falling. This is perfectly natural, not surprising and does not signal an immediate crisis. The average productivity of new wells will most likely continue to fall. For example the Khurais development has target production of 1.2 million bpd using 300 wells. This suggests a minimum target well productivity of around 4000 bpd as some of the wells will be water injectors.

Well retirement pattern

What is meant by well retirement?

Saudi Arabia, as the biggest producer in the OPEC swing production cartel, have a long history of raising and lowering production to suit market needs. Part of the mechanism used to achieve this control is to shut down production in perfectly good wells. The other mechanism for lowering production is to choke back producers (lower production). Production may then be raised at will by re-instating retired wells, opening the chokes on restricted wells and drilling new wells. Saudi ability to raise production will be dependent upon the inventory of retired wells available to them at any point in time and to the capacity of production facilities. In his comment here, Kyle suggested that the Saudis may be retiring wells that were producing at 4000 bpd. This would be unheard off in the OECD and in most other OPEC countries. In my post of 7th March I suggested that the Saudis may elect to retire wells with high water cuts or low reservoir pressure. Resting such wells is good reservoir management practice. It must also be noted, however, that some wells that are retired may eventually be abandoned if their productivity is no longer profitable or if they have become obsolete.

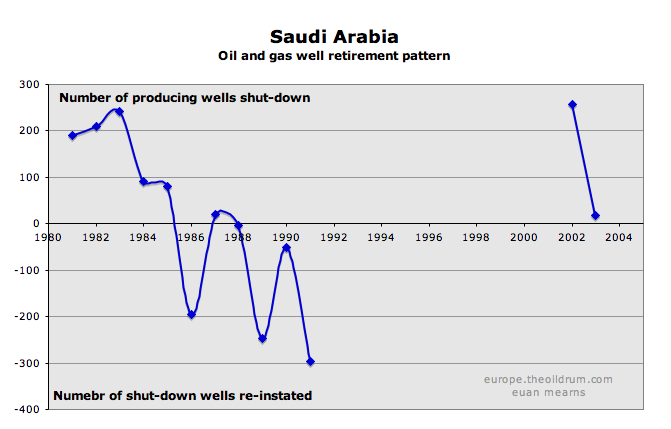

Combining the data shown in Figures 4 and 5 enables an estimate to be made of the number of producing wells that are shut down each year.

number of retired wells = number of wells drilled - YOY change in productive wellsThis pattern is shown in Figure 6 and in Figure 7 the cumulative tally of retired wells is stacked on the producing well tally.

In the period 1980 to 1991 the Saudis essentially went through a cycle of retiring wells and then bringing those wells out of retirement (whilst continuing to drill new wells all the time). The peak cumulative tally was reached in 1985 (the production nadir) when the Saudis had mothballed 814 wells! By 1991, when all production was required during GW1 the tally of mothballed wells had fallen back to just 40.

So what might the current tally of mothballed wells in Saudi Arabia be? The paucity of data since 1991 makes this impossible to say. However, in 2002 a staggering 257 wells were mothballed. In 2003, which was the first year of the recent production surge, the Saudis still had capacity to mothball or abandon 18 wells. The production increase that year was achieved by adding 214 new oil wells and not shutting down a large number of older wells to compensate.

The period 2004 to 2005 I imagine may replicate the pattern of 2003, where new production was added by simply drilling wells without retiring older wells. If there was any production shortfall then the Saudis will have had 257 wells rested in 2002 to fall back upon. 2006 saw the commissioning of the Haradh III project, although this only has 32 production wells. Haradh III was a high profile mega project development but the number of producing wells is not hugely significant compared with the annual drilling program (unless of course a trilateral is counted as 3 wells).

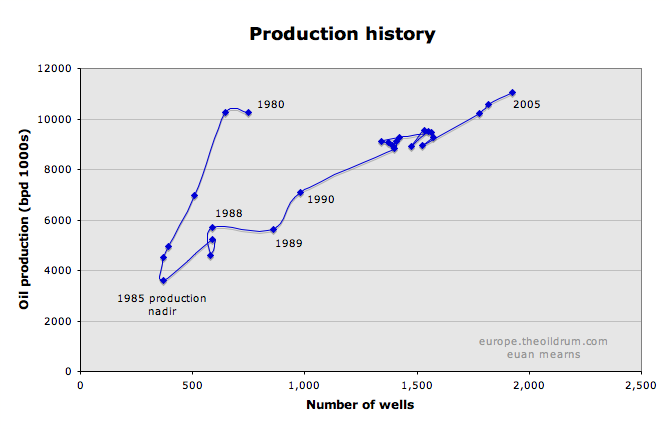

Production history

Saudi Arabian average daily production per year is plotted against the number of producing wells in Figure 8. This provides fascinating insight into Saudi reservoir management practice. From 1981 to 1985 production did nose dive from over 10 to below 4 million bpd through a program of planned well retirement. Then in 1985 Saudi policy was changed in order to maintain market share, production was raised and the oil price collapsed in 1986.

Between 1988 and 1989 production was held constant even though the number of producing wells was raised from 590 to 858. This would seem to signal a new approach to reservoir management with lowered flow rates and production sustained from a larger number of wells. The constant trend of 6000 bpd per well was established in 1989 and it would almost seem that this has been a target well productivity for the Saudis since then.

The great knot of data points at around 9 million bpd represents the "plateau years" of production from 1991 to 2002. Then in 2003, with rising global demand and falling production in the North Sea and other areas, the Saudis were called upon to ramp up production which was achieved with relative ease by simply adding more wells through drilling and reducing the well retirement rate.

That $2000 bet

So where does this leave Saudi oil production, peak oil and the end of the world as we know it? Regular readers of The OIl Drum may think I have become a cornucopian. I assure you not at all, I'm simply looking at data and drawing reasonable conclusions.

Saudi ability to sustain and grow production is dependent upon the availability of new good quality mega projects to develop and the cupboard in this respect is beginning to look rather bare. Khurais due on by 2009, some off shore field developments and further development of gas resources (NGL) should provide sufficient resources to sustain production, and perhaps modest growth, for a few years at least. And as Stuart pointed out the Saudis will likely have a huge number of smaller fields to develop, though I very much doubt many of those will be brought on stream by 2008.

Hubbert linearisation suggests that Saudi Arabia is in the vicinity of 50% depletion of their ultimate recoverable developed reserves. Declining Saudi production therefore is probably only a few years away.

In his last post Stuart raised the stakes on his wager to $2000. So let's have a reminder what that wager was:

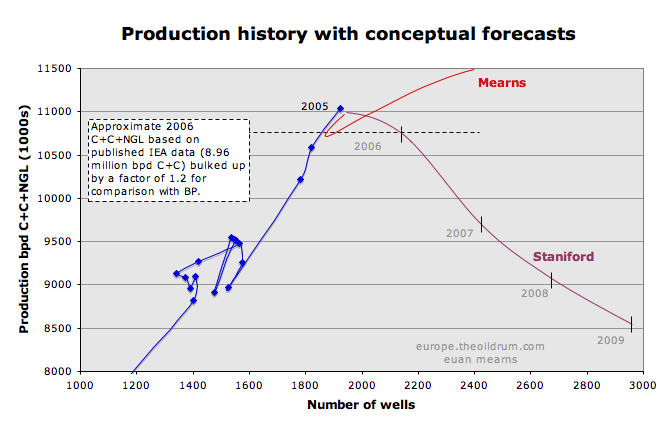

I'll bet $1000 (now $2000) with the first person who cares to take me up on it that the international oil agencies will never report sustained Saudi production of crude+condensate of 10.7 million barrels or more.

In BP currency of C+C+NGL that equates to around 12.8 million bpd. Figure 9 shows the fundamental difference between my position and Stuart's and also illustrates why I'm not about to take on Stuart's bet. Stuart has called a peak in Saudi production in 2005 and no matter how many wells they now drill, he forecasts that production will continue to slide in a manner similar to that shown. My position is that recent falls in Saudi production reflect voluntary restraint achieved by retiring wells and that production may rise again in the future, dependent upon global demand picking up.

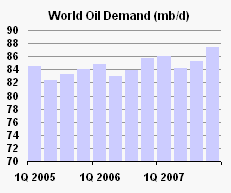

So what difference does this make for global energy markets? A look at the oil demand forecast for 2007 from the IEA gives some insight.

The IEA are forecasting demand to rise strongly by around 3 million bpd between the second and fourth quarters. Saudi Arabia would normally be the main country called upon to meet this increased demand. If Saudi production falls instead by around 1 million barrels per day, as modelled by Stuart, then a supply crunch and energy crisis will likely unfold. According to my view, Saudi Arabia, together with other OPEC countries will raise production to meet this demand challenge. We will see another squeeze on reserved capacity, higher prices and demand destruction, essentially repeating the cycle of 2005 / 2006. Every squeeze such as this will bring us one step closer to peak oil which I still see as 2012±3 years.

Forget ye not the diggs, the reddits, and the linkfarms!

The average production per well, since Saudi production is 100% under secondary recovery, shares an inverse relationship with the stability of the production stream. Anyone who has been in this business for any time would rather have 10,000 wells making 100 bopd than 10 wells making 100,000 bopd under waterflood. This is especially true of Saudi since most of their developed oil is of low viscosity and individual well breakthrough is a dramatic, career ending event.

In addition, anybody who knows anything would also rather have 10 MMBOPD at 90% water (Russia) than 10 MMBOPD at 20% water (Saudi). Ten million a day at 20% water is 1.2 MMBOPD at 90% water, capeche??

The ballgame in Saudi Arabia is Ain Dar/Shedgum and Uthmaniyah areas of Ghawar. They represent 50% of every production curve that gets thrown up here 3 times per day. By Saudi's (Saleri's ) own admission, they are 70% depleted. I have graphics of a fractional flow curve overlain with Saleri's pie chart of the Ain Dar/Shedgum reserves to show how aggressive their reserve forecasts are. Even still, Saleri tacitly provides a 60 Bbbl reserve estimate for Ghawar at 1/1/04 and the most I can come up with from the individual areas is 30.

P.S. The reason the HL for Texas in 1960 is 20 billion barrels low is that secondary recovery was not widespread at that time. The 20 billion barrel shift is probably pretty close to the waterflood oil displaced in the state of texas. Saudi HL is a waterflood case. No such shift expected.

I need someone to post some graphs (not charts those are marketing) or teach me an easy way how.

Drill or Be Drilled

The reason the HL for Texas in 1960 is 20 billion barrels low is that secondary recovery was not widespread at that time.

No, that isn't why. Those are rationalizations that people are offering to explain the data, but I am about to show that this is not the case. I am working on this essay right now. I don't want to give too much away, but I will say that the HL has a predisposition for underpredicting URR. In fact, in some of the idealized cases I have plotted, the HL is underpredicting URR by more than 90%!

Knock yourself out.

I question the ability of the daily oil production curve manipulated in any manner to accurately predict ultimate recovery anywho. By the time it works nobody cares anyways.

The key lies in the pore volume.... So+Sw+Sg=1. Hubbert knew this better than anyone. And those answers are out there if you look hard enough.

And the Saudi's have an Sw problem in their principal producing areas.

"The key lies in the pore volume.... So+Sw+Sg=1"

"the Saudi's have an Sw problem in their principal producing areas"

Fractional Flow, I would greatly appreciate if you could explain to the uninitiated what So, Sw and Sg are. #

Also, what is the "Sw problem" and is this publically available information or something you have come across in a professional capacity?

many thanks

So= Oil Saturation, % pore volume occupied by oil

Sw= Water Saturation, % pore volume occupied by water

Sg= Gas Saturation, % pore volume occupied by gas.

1= So + Sw + Sg

whether your talking about 1 ft3 or the total of Ghawar

for Ghawar, always operated above bubble point so Sg=0

So

1= So + Sw

And for Ain Dar Shedgum Soi= .85 (initial oil saturation)

Sor= .21 (residual oil saturation)

And the pore volume is 105 Bbbls.

The Field has recovered (1/1/04) 27 billion barrels and the oil shrinks 34% from the reservoir to the stock tank so the current oil saturation is

So= . 85- 27*1.34/105= 50.5 %

and the current (1/1/04) water saturation is

Sw= 1-.505= 49.5%

And at 2 MMBOPD, the water saturation is increasing about 1% year or it is now about 53%....

Producing the field by drilling horizontal wells in the top or shutting in high water cut wells doesn't change any of this....

and this is a problem

Thanks, as I suspected, the explanation has led to more questions....

Is "pore volume" the same as "oil originally in place"? For Ain Dar/Shedgum am I correct you are saying that is 105 billion barrels? Where did you get the 105 billion barrel number and are there similar numbers for other parts of Ghawar (and indeed all other Saudi fields)?

When you talk about shrinkage, are you talking about "non-recoverable reserves"? IE a 34% shrinkage implies that of the 105 billion "pore volume", shrinkage will be 34%, or approx 36 billion barrels. Which in turn would mean that recoverable reserves would be approx 69 billion abrrels, of which 27 billion barrels have already been produced?

As Sw increases, I assume there is a knock-on detrimental effect on daily oil production capacity. Is there any way to quantify this?

thanks again.

Pore Volume is not OOIP.

OOIP= Pore Volume * Initial Oil Saturation/ Formation Volume Factor

(Boi)

Yes I am saying that is the Pore Volume for Ain Dar/ Shedgum.

I am not aware of other numbers... except 38 billion for Haradh... but

Uthmaniyah is unknown. Let's stick to Ghawar for now.

Shrinkage is the loss of volume in the oil due to the dissolved gas an

is expressed in the formation volume factor. For Ghawar, it requires

1.34 barrels of oil in the ground to make a barrel of oil in the stock

tank after the gas evolves.

If you have Saleri's 2005 CSIS presentation, he presents a pie chart of

the reserve classifications for Ain Dar/ Shedgum and 17.1 billion

barrels is contingent resources. Any reservoir engineer assumes that

this is residual oil to waterflood. You then have everything you need

from that pie chart to derive the residual oil saturation, the initial

oil saturation, the current oil saturation..... and there is only one

pore volume which makes it work it is approximately 105 Bbbls.

Yes there is a technique to calculate water cut behavior as a function

of water saturation and hence oil producing rate it is called the

fractional flow curve.

I can only speak for myself, but it appears to me that you have a core competence (reservoir engineer?) that I have not seen before on TOD and believe you could add a lot of technical colour to some of the discussisons that take place here. I am certainly fascinated by your numbers and apparent expertise with regards to Ghawar fields and would love to see you expound further on this, perhaps with a full length post?

Could you give us some background on what you have done professionally?

Thanks again.

What he said.

Perfect Leanan

:-)

I agree. But Fractional_Flow needs to append a translation at the top or bottom of his work so that mere mortals can at least understand the gist of what he's talking about.

Thanks.

I am a reservoir engineer and oil company owner who has done nothing but waterflood work for essentially 21 years.

I have an MSPE from Stanford. I am running a reservoir simulator simultaneous to answering your post right now. Although I run reservoir simulations, I am a back of the envelope kinda guy. You have to know what makes the simulator do what it does... a good simulation hand knows what the answer will be before he makes the run.

Saleri's presentation is actually the holy grail. There are also 2 aramco spe papers from 2005 that would scare the crap out of you if you know what you are looking at.

This is the most onerous, pandering statement in the entirety of the peak oil debate.

Bye for now.

Interesting bio, thanks for sharing.

Any chance of a link to the Saleri presentation or the Aramco SPE "crap expellent" papers? Alternatively, and appreciating that your time is precious and that you have a company to run, an insight into what these papers discuss.....

Pushing my luck now, I know, but I am sure it is worth the effort....

I believe that the article being refered to is to be found here and was the debate between Matt Simmons and the ARAMCO folk at CSIS in 2004.

HO

Saleri preso here:

Saleri preso

From a thoughtful and detailed critique of Simmons by petroleum engineers:

Simmons critique

The critique includes a caution against generalizing SPE papers to the whole of Saudi production. To paraphrase: "SPE papers represent technical challenges, not a survey of overall practice or operations."

CW

Global peak: 2007 - 2010

Global decline rate, Post peak: 2%

Economic response: Severe global recession, ~5 years, then slow recovery

Simmons critique-

Simmmons technical editors killed him.

The whole bubble point/reservoir pressure dew point think- he couldn't have missed the mark any further.

The critique is a bunch of drivel that doesn't get any closer to the actual problem- which is 4 MMBOPD at Ain Dar/Shedgum and Uthmaniyah resting on the precipice.

What is? What Euan wrote?

No- I am sorry.

This is the text from Saleri in reference to Ain Dar/Shedgum

I got locked up on a cut and paste and had to go.

"Well, compare that with the reality. The reality is you're producing two million barrels and probably going to be producing two million barrels for a few more decades at very modest water cuts. So obviously your reserves are much much higher than 40 percent. That's the explanation for the type of reserves we're carrying which again are very conservative on the basis of actual field performance.""

Thanks for the clarification.

I thought he meant his reference to the Saudi's own work being the "holy grail," as in pandering to the Saudis themselves. But I'm probably wrong.

Cool.

So I have a question for you. The only reason I believe in HL is that the concept is similar to statistical thermodynamics.

The equations of classical thermo dynamics and the physical interpretation are completely bogus but correct. The reason it works turns out to be because of statistical thermodynamics and the fact that the quantum properties measured by thermodynamics average to a bulk number. Classical physics fails miserably when the number of quantum states is small so a statistical population cannot be built.

A laser for example even though its population dynamics are statistical the small number of states result in a quantum phenomena unlike a regular light bulb.

You should be able to do a similar analysis connecting the real geology to a ensemble and thence to statistics.

The problem is to make this connection you have to really know what your doing. Its one of those cases where the result is obvious and beautiful but knowing how to set up the equations requires brilliance and a deep understanding of the problem.

The only reason I believe in HL is that the concept is similar to statistical thermodynamics.

Let me ask you a hypothetical question. Give it some thought. If I show a case in which the only information that we know is an oil production rate, and that it increases by some increment every year, what do you think the HL is going to look like? Would you begin to have doubts if, when fed this information, it actually predicts a URR and a % Qt?

To reiterate, we have a rate that increments upward every year. What will the HL show?

How is that? I observe an asymptotic function that never intersects the x axis.

I do have strong reservations about the information content in a period of flat production, though.

How is that? I observe an asymptotic function that never intersects the x axis.

That's true when you run the production out to infinity. But if you stop and then extrapolate - say 20 years into your production - you do indeed predict some weird stuff. The problem is one someone mentioned on the other thread: We are attempting to linearize a non-linear function.

That's not quite it, I don't think.

The HL method is making an Ansatz (assumption) about an underlying functional form of oil production over time which is an essentially empirical one, but one with some support.

If you have production increasing every year, then you are still on the exponential upgrowth phase of a logistic curve and therefore the fit is indeterminate on distinguishing a HL based logistic production curve (which peaks later) or one which continues upward.

In this case the HL method is not suitable because in a Bayesian sense, many curves are compatible with data observed so far.

A logistic production curve of course has an functional form of an exponential at the beginning, so this degeneracy is not surprising.

Now the fact that in some regimes a fit to the HL Ansatz is unstable or not precise does not mean that the same is true in other regimes, namely fitting a curve with data which have peaked. Here, that instability/degeneracy/large Bayesian posterior uncertainty which would be present in the "early growth" circumstance would not be present now if we believe world oil production to be reasonably well goverened by the logistic model.

The fact presently is that the world production of conventional oil has peaked roughly 18 months ago.

A number of explanations which explained the prior world false peak (early 80's) are not tenable this time:

* There are few very large involuntary shut-ins (Tanker Wars)

* economic growth during this period has been strong

* oil prices are sustained and high

Only the supposed Saudi voluntary shut-in (which is reasonable but uncertain) can be a mitigating factor.

Even though the HL is unrealiable in some circumstances, it does not necessarily follow that it is unreliable in all circumstances and this is where people are talking past one another perhaps.

The flaws can be:

1) mathematical fitting problems

2) non-economic non-geological disruptions

3) fundamental flaw of underlying Ansatz to describe real data

In some limited circumstances of subsets, in the absence of (1) and (2), then the real data tend to be compatible with (3), which is why it was proposed to begin with.

An interesting exercise:

Suppose one were to "back out" a decent guesstimate for how much additional, and voluntarily waived, production potential the Saudis had at any time recently, and added that as "virtual production" to the world production curve, "as if" they were producing all out.

What would a HL estimate for a peak and ultimate reserves in that circumstance? I'd take that as a reasonable 'optimistic but not delusional' upper bound for peak oil. Who has the models ready to go here?

My wild ass guess: 2015-2020.

The connection to statistical mechanics is essentially not to concentrate too narrowly to the individual particles, which can react unpredictably, but instead look at the collection of particles as a whole, which tend to follow a statistical average.

But I think you know this.

In a way, I find it kind of pointless to ponder the dynamics of a few oil regions in Saudi Arabia when we have the statistics of the rest of the world and historical data to consider. In other words, a few extra energetic particles won't sway it too much one way or another.

I agree the only reason that KSA stands out is because they have made what many believe to be outrageous claims.

I'm sure you could find someone today with mathematical skill and if you gave them the HL theory and various blind data sets and let them calculate they probably would reasonably predict the same peak date for KSA as we have.

The troubling aspect is one of the cornerstones of the oil society seems to have literaly told the lie of the century.

Increasing QT.

The whole point of the model is that production does not increase every year it peaks. So HL has some predictive power pre-peak certainly open to debate. Next post peak it seems pretty good until you get into the long tail where production is constrained by the nature of the recovery method. Water handling nitrogen handling steam etc. Enough oil is left in the ground from primary and secondary extraction that given enough money you can produce the fields for a long time at low production rates and EROI using advanced methods.

I've said a few times you have to bracket the HL using other information if you don't accept this then you can prove HL is wrong all day long. Since it is a empirical model the connections between HL and the real geology are complex at best.

And finally if you read my post about stat thermo all I'm saying is that the real geology can be treated in the same manner as stat thermo treated using statistical methods to derive higher order equations that describe the bulk this can be extended to groups of fields etc. It would be nice to have a solution developed from first principals but for now the logistic curve is good enough. We know from other processes that the bulk behavior is statistical.

To use another example consider a pile of sand the forces that effect a pile of sand vs a bucket of water are quite different and operate on different scales. But they both average to overall fluid equations for flow. HL is simply a proxy for these unknown fluid equations which are themselves only valid withing a given range.

Now with all that said if the bracketing of HL is simply to contrived then I'd say drop it. If a reasonable set of methods can be used to bracket HL then its useful.

I don't know what your going to write by my interest is in HL applied within say +/- 20% of peak. I could care less about its behavior outside this range. On the front side the data may be too noisy on the backside you have obviously peaked so you don't need HL nor does it apply as production moves to technically constrained.

The trick and the part your rejecting is that you have to have other information to determine if you think your within 20% or so of the peak. And even after this you need additional information to narrow down the actual peak year.

Now if someone comes up with the equivalent of stat thermo for the problem and can derive the real equations from first principals I'd drop HL in a heartbeat but I suspect they won't be all that different. Without this HL is the only method we have does not result in parameter explosion and bias.

I've said several times that most people modeling peak oil get sucked into the long tail region where a lot of oil will be produced at low flow rates. Just about everyone that starts doubting HL seems to focus on this region. We do have a lot more oil to produce and advanced methods may increase URR but its not going to change the fact that post peak we will consistently have demand exceed supply and thats all that matters. Once the economics of oil change the party is over.

So I could care less about 75% of the oil left to produce its the first 25% or even 10% post peak thats useful the rest is irrelevant since the geopolitical/social issues will determine if this oil is produced and what it is used for. Basically once we have a supply/demand wedge develop greater than say 4mbpd forget about the models since above ground factors will control oil production.

The whole point of the model is that production does not increase every year it peaks.

Yet I will show you it calling peak even as production is increasing.

The trick and the part your rejecting is that you have to have other information to determine if you think your within 20% or so of the peak.

No. I have debated this other information plenty of times. I have repeatedly addressed the Saudi cuts last year. That is "other information."

Without this HL is the only method we have does not result in parameter explosion and bias.

You might change your mind after my next essay. It may turn out that we just don't have a working model. If I am using a model to make decisions, and it only works part of the time - and I can't tell when it is actually working - then that is no better than having no model at all.

I look forward to your contributions.

I have no problem throwing HL out if it makes sense to do so.

For now we lack a better model and I'm not yet convinced HL is

useless.

With that said a model like HL should work if producing oil behaves in the same way as heat fluid dynamics etc where bulk properties arise from intrinsic micro physical constraints.

I don't agree with the multi-parameter macro models simply because we don't have enough information. The bottom up approaches however seem to make sense except its hard to justify the decline rates used and they don't predict URR.

They do give us a good idea of production rates.

In any case we will see.

Yet I will show you it calling peak even as production is increasing.

Robert: of course you can make up contrived fake data that would throw HL off. That does not disprove HL for real data.

Memmel's point is that in the real world, for a large enough region, due to statistical aggregation, real data usually tends to behave like Hubbert's curve.

I'm not sure this holds for Saudi Arabia though, due to so much of their output coming from one huge field. But perhaps that's still OK, since one field is not one well, and Ghawar is large and varied enough that it conforms to some statistical trends. Like the East Texas field.

To be exact its a empirical proxy for the real equation that could be derived from first principals "in theory".

Without the real statistical equation derived in a manner similar to how thermodynamics is derived from quantum mechanics via statistical thermodynamics its ...

Good enough :)

Statistical mechanics is used to derive bulk properties from molecular models - including "classical" molecular models.

I understand your analogy, but quantum mechanics at the molecular level is not required for statistical mechanics to apply.

I suspect that if such a technique were used, the "fixed" parameters would be critical, and depend on information that no one will agree on, like URR, etc. If the model got at all complex, the math probably would become intractable... so you would do what the stat mech people do... run simulations.

One reason in one post I said "in theory" you can calculate this. I don't think its as intractable as you claim. And it does descend to the quantum level because the wetting of a porous hydrophilic surface by a hydrophophic long chain hydrocarbon is a quantum event.

I think its doable since in chemistry we have a theory about a very similar process used to separate chemicals in chromography. Its called theoretical plates. Note the theory part is prominent in its name.

http://en.wikipedia.org/wiki/Theoretical_plate

A theory for oil extraction would be similar. A key point of this theory is that two things remain close to constants

regardless of how you change the parameters.

1.) The time it takes for a particular chemical to elute i.e

its peak.

2.) The overall volume i.e URR is a constant.

The curve can be sharper with a higher peak or broader but the time is basically a constant and the total volume is a constant.

I know this theory well or better used too. I'd expect and basic theory of oil extraction to end up with the same basic result. If you produce a region close to its natural rate you will peak at a certain time and next the URR is basically a constant.

All your doing by being a swing producer is flattening the peak over a few more years and the use of advanced extraction just makes the peak sharper. KSA has used both approaches in addition to secondary water drive on the fields. In fact in my opinion the two factors of using horizontal wells and secondary water drive makes the swing producer argument mute its lost in the noise compared to the other two effects.

With my understanding of Theoretical Plates I'm happy to be quite stubborn about the peak date and total URR being practically constants I cannot see anything changing this since it can't be altered in chromatography.

HL fits as a approximate model for oil extraction related to theoretical plates and it is trying to measure the two conditions that are known to be constant from a similar theory chromatography.

Even better the theoretical plate model fails in about the same places where HL fails for basically the same reasons.

Now with that said the theoretical plate model is not the right model for oil extraction but a similar model is needed and it will behave in a similar fashion.

In fact I would have to assume that a model like the chromatographic one has been developed for oil any chemist that works in the oil industry would see the equivalence in about ten seconds. The first time I read anything about a real oil reservoir I said hey that's just like our chromatographic columns. Someone in the field should be able to dredge up a reference this is too obvious.

Agian I think its premature to throw out HL.

Robert: of course you can make up contrived fake data that would throw HL off. That does not disprove HL for real data.

I am not talking about feeding it just random data. I am talking about feeding it specific trends and seeing how it behaves. For instance, if I feed it a consistently increasing production rate, and yet it predicts an imminent peak, we have a problem. Would you disagree?

Robert,

I think you have to make sure you don't apply the HL model too early. In your hypothetical case, you are applying it too early because your production rate is still "consistently increasing." You need to wait until the data settles down, i.e. probably until some point at which production is continuing to increase, but at a steadily decreasing rate. (From what you've described about your hypothetical model, it will never exhibit this behavior and therefore never produce a valid HL.) Khebab and others have some good rules of thumb for this.

I had occasion to pull out Beyond Oil a couple of days ago to find a passage for Asebius, and I just ran across another passage which indicates that Deffeyes had the same question of Hubbert's 1956 prediction:

From Beyond Oil, Chapter 2 - Where Oil Came From: The Hubbert Outlook, pp 29-30.

That sounds about right. He would still need to be aware of discovery in the region and have some idea on how much of the discovered areas had been produced. But yes I'm saying once it settles down you should have a good number.

My rule of thumb is within 20% of peak but decline but sustained production is enough or it seems to have been enough for Hubbert.

THank you thank you.

I can't understand how people, Peak Oil Cognizant people talk about how much oil will be produced in 2015 - 2025 or something as if it will be business as usual. Those who aren't getting any will just sit down and say "Darn It".

As you said, After it Peaks AND ALL the PLAYERS KNOW it has PEAKED... Game over. The masks will come off, and true raw emotions will prevail I am afraid.

It will be like ten guys all oiled up and trying to be the first one to climb a greased pole. Each hand that grabs for that nigerian sweet crude will have to run the gauntlet.

BTW and I think you know this in chemistry we have the theoretical plate model to normalize chromatography.

http://teaching.shu.ac.uk/hwb/chemistry/tutorials/chrom/chrom1.htm

A similar sort of model should hold for oil extraction.

A couple of comments on that:

I understood that the logistics model was originally observed to follow the behavior of a single oil well, and then on that basis, was predicted to describe the behavior of fields (countries, the world...). This logic is reversed from the stat. thermo analogy.

Also, one could ask if any oil-producing region is a large enough ensemble to average out the differences. In particular, KSA has Ghawar which is the elephant in the field, unless it is argued that it behaves as the statistical average.

On a related note, you state (further down) that HL is not a physical model, and that is strictly correct in that one doesn't derive it from first principles. However, it relates the production rate to the total produced relative to how much was there originally, and one could see how this could arise from real physical parameters (pressures etc.).

Not sure about reversed :) Historically we had thermo first then figured out why it worked much later.

The right statistical model for Oil fields needs to include or derive from the field geometry factors and should include at least some way to model changing well technology. HL does neither actually thats why its really a empirical model semi derived from real data. My point is that I don't see how HL is all that different from the "real" statistical model done from first principals since using real production data tends to take into account these factors. If and this is a big if you feel you have interpreted the data correctly. I'd hesitate to make any real connection between HL and physical production.

The macro relation of produced OIP in place and production rate could be fitted to any Gaussian like distribution so the correlation is weak. We could easily find another macro model that works better than HL but I don't think considering the noise in the data it makes a big difference.

How to say this ...

From first principles we know something like HL will result if we modeled the system correctly and the data has a lot of error so why not just use HL ?

My point of contention if any with Robert is that such a model does and must exist I'm not overly concerned that we have not developed the exact model since it does not change the ramifications of peak oil and the bottom up methods tend to agree within the error range with HL. Picking the exact year of peak is simply and art if we are right then fine if not no biggie we can't confirm world peak until we know the world decline rate is hight enough that we will never bring projects online fast enough to recover. This is at the minimum two years after peak. I've said a few times that even then it will be controversial but its important to build a strong case that peak is behind us. HL may or may not be useful for this case. Post peak its seems pretty good so I'd say its useful.

To repeat myself its the decline rates that come out of HL that I like foremost and the URR estimate of what I call easy oil second which is the oil recovered from beginning production till say 20% post peak or the stuff we can get at high production rates.

Not overall URR which I have zero interest in KSA may be producing 1mpd in 100 years for all I know I don't see how that effects us today.

memmel,

I did not completely follow this and several of your other posts about the analogy between HL and thermodynamics, but it sure reminded me of some Central Limit Theorem discussions here on TOD a while back. See

Predicting US Production with Gaussians

Yes Guassian would probably work also. Several different curves have been used. In general we don't have a strong reason to choose one method over the other. In this case the data has enough error that the detailed shape of the curve is probably not all that important. If someone comes up with good reasons for using another model and it is in agreement with the data from known regions that are in decline switching models is probably the easiest thing we can do :)

The point I've come down to is pretty simple regardless of the shape of the curve the date of the peak and URR are pretty much constants. How you produce the fields and other factors are simply changing the shape of the curve but the total URR i.e the area under the curve and the position of the peak are fixed.

A simple triangle might even give good results.

I might add that if you think about it picking the peak year is not that onerous its basically picking the peak date within 1-2% if the field is produced for 50-70 years.

Now picking the peak month ....

Man, I LOVE THIS SITE!!

You never know who is going to post some really pertinent details about the oil business. And for Peak Oil as in all else, the devil is in the details.

Thanks for sharing your expertise Fractional_Flow.

(addressed to fractional flow) i can agree that a fundamental understanding of reservoir engineering is more useful than the results from a simulations study. however, if you already know the results, aren't you wasting your time running the model ?

Hi f - welcome to the board...

If you have Saleri's 2005 CSIS presentation, he presents a pie chart of the reserve classifications for Ain Dar/ Shedgum and 17.1 billion barrels is contingent resources. Any reservoir engineer assumes that this is residual oil to waterflood.

Nice analysis, but if it has a weak point then this is it. I don't think you'll find "contingent resources" defined in either the SEC or the SPE definitions - which of course is just what Saleri wants, as most of the scribblers in his audience would be arts graduate scum (economics at best). What happens to your calculations if you assume a more conventional waterflood RF? I won't start an argument by suggesting a number myself...

Cheers,

PUD

I'm totally comfortable with the analysis.

SPE 93439 "Water Management in North Ain Dar, Saudi Arabia"

Here, Aramco twins an injection well lost due to mechanical failure and cuts a sponge core as well as carbon/oxygen logs the Arab D to result in a residual oil saturation to waterflood of 21%.

It all matches with a pore volume of 105 (it's actually 109.. I'm sorry about the round down) but I did this quite a while ago.

And if you look at Saleri OOIP for Ain Dar/Shedgum, and use the 109 and an 85% Soi and 1.34 Boi, it all matches.

Can someone translate this ?

Was er sagte, war, dass wir in der tiefen Scheiße sind.

Damn near made more sense to me :)

Actually from my chemistry degree we do similar stuff to perform separations. A oil field has a lot in common with HPLC. High Pressure Liquid Chromatography. But we actually want breakthrough while the goal with oil is to not let the system separate or fractionate. It seems everything I was taught to try to do in chemistry is wrong for oil.

As a chemist I'd probably de-pressurize the reservoir let the gas bubble out first then extract then oil with a strong water drive causing the oil components to fractionate. Completely and utterly wrong :)

He said we're in the deep shit.

That's what I thought he said. :-(

Guys-

I'm sorry but here goes.

Poster Lucky_Underdog questioned my assumption that 17.1 billion barrels of "contingent resources" provided by Saleri in May 2005 CSIS is the Waterflood Residual oil.

He rightly but tacitly asserts that no one in their right mind would have the balls to call any type of actual field reserves right up to that limit. Which is actually the point of this whole discussion.

THe waterflood residual oil is the oil left behind in the rock due to the trapping by interfacial tension forces by the water.... it is unrecoverable by any practical pressure differential you can put across the rock... even a core in the lab. By the process of waterflooding.

I provided as proof for this assumption an SPE paper in which Aramco drilled a well right next to an injector which they had to abandon for a mechanical failure. They did state of the art diagnostic analyses on the pay zone in this well to derive the fact that 21% of the pore volume contained oil. Which is the residual oil saturation by definition. Which is what Saleri calls contingent resources when you apply it to a 109 billion barrel pore volume. Aramco sees everything else as possibly recoverable, indeed almost 85% of everything else is proven. Which is actually quite ludicrous and takes very big balls. Which was the original premise of this discussion.

It may come to pass that 85% of the available mobile waterflood oil is recovered... as of 1/1/04 over 50% of the available mobile waterflood oil was recovered. But I think Lucky will agree a lot of that will come above 90% water.

Any chance you'd write an article about this for us? I think this deserves a thread of its own.

This is my point about Ghawar, Cantarell, Burgan and Daqing being on their way to where East Texas is now--1.2 mbpd of water per day, with a 1% oil cut.

Like East Texas, these fields will practically never quit producing, but their production, compared to the flush production, will in time be just a small fraction of their peak sustained production.

If, as I believe, Ghawar is in decline or crashing, every single field that is, or was, producing one mbpd or more is in decline or crashing.

The only new one mbpd and larger field on the horizon is Kashagan, which--at best--won't hit peak production until some time after 2020.

FF, First of all, Some KICK ASS stuff there.

2nd if I understand you, what we have left is that patena coating of oil on the sand particles (a soap bubble thickness), that you can NEVER actually get out, across miles and miles of sand.

It adds up to 17 billion barrels or something.

Basically, they are running their production of stained oil across their whole field and running up to 85%ish of what was originally there?

Again,

It's not a Peak Oil Crest,

Not a Peak Oil Cliff,

It's a Peak Oil Bluff.

WOW

kaufst du diese Schätzung... 105?

Wirklich sagte er, dass die Zahl unten von 109 - nicht wirklich eine Schätzung rund gemacht wurde

Keine Ahnung.

No notion???

Come on .

We have a model. A model that is probably peer reviewed and found in any number of reservoir textbooks.

The parameters have been explained and the data has been pulled from established sources. It's a plug and chug operation.

And you have "no notion"?

You either dispute the model's relationships or you dispute the data... WHICH?

You should not bang Hubbert's model as subjective without addressing this.

That's not a model, it's a mathematical identity

This deserves a cogent keypost.

I bet the data Cheney gets from the Saudis is based on the fractional flow curve.

No notion???

First thing, while “no notion” may the literal translation that you get from a translation program, Germans use it in exactly the same way that we shrug our shoulders and say “No idea.” That would be the colloquial meaning.

You either dispute the model's relationships or you dispute the data... WHICH?

I don't know anything about this model, and don't have time to investigate right now as I am busy with something else. So I don't dispute either. I just don't know, which is what I said. I don't believe in reading a couple of references and then responding to claims I haven't seen before. I know there are some who have no problem developing instant expertise by reading a few sites, but that's not my style. It would take more time than I have right now to investigate. Furthermore, the issue here is something that I have never disputed: Whether Ghawar is close to peaking.

The Saudis themselves have acknowledged that it is close to 50% depleted. So that has never been the issue for me. The issues are: 1). How long?; and 2). What other production do they have to be developed?

You should not bang Hubbert's model as subjective without addressing this.

This is not Hubbert's model, now is it? Whether FF is correct or not has no bearing on whether the HL model works, nor any bearing on my position at all. That’s why I can shrug my shoulders, say “No idea”, and not feel the need to go grab some instant expertise to address his claims. One thing I do know, is that his claim from why the HL didn’t work in the case of Texas is wrong. I will address this in the essay I am working on.

This is not Hubbert's model, now is it? Whether FF is correct or not has no bearing on whether the HL model works, nor any bearing on my position at all.

I understand .

Entschuldigen Sie mich. Tief ist nicht genug.

Heres the link to SPE 93439 "Water Management in North Ain Dar, Saudi Arabia"

http://freeoil.1111mb.com/spe/spe93439.pdf

HL is not by any means a physical model so I can't see how you

can claim it does not handle certain physical aspects. It was never intended too. Its purely a empirical observation with the requirement that the fields be developed and produced close to their maximum rate.

As far as URR predictions as long as the URR predicted by HL is true say 35% after peak the amount of oil recovered in the long tail both does not follow the assumptions of HL and is not that important for why you would do a HL analysis.

I've said a few times that I'd consider the URR from HL as the URR for easy oil. Which is all I care about the amount of oil that can be extracted at great expense is irrelevant to the world and especially irrelevant to the NOC's ask Libya. I could care less about 40% of the oil recoverable post world peak only the 20% near the peak.

KSA may well be capable of producing 4-6 mbpd for decades but it does not matter at that point we are either riding electric trains to work or were dead.

Non-expert remark here: I haven't seen anyone mention the case of using the negative case of HL. Envision an oil province in which 'other' indicators lead us to believe that peak will occur at X point of time + or - a margin of error. If HL on this province did not show peak within this margin, using any set of normally used sets of data points, would this not be a fairly convincing negative case? Or is a situation like this simply unlikely to occur?

Generally you can always construct a HL plot that gives the right answer. Along of course with any number that give the wrong answer. Asserting you have the right one is based on information not included in the model and maybe not known at the time you constructed the model. As Robert mentioned this is because we are attempting to linearize a non-linear function.

This is what is driving Robert crazy.

WT is stating that models that correctly predicted the decline of Texas and the Lower 48 can be mapped to models of KSA and show a decline in the near future. WT is using this mapping as proof. Robert disagrees. I think the secondary evidence enforces WT claim even though the claim itself may not be provable. So I'm ok with using previous HL analysis of other regions that declined as predicted as constraints on new regions. I might add even though no one has done it you should be able to mix production from any number of regions and run HL's on the mixed and individual regions and get the same basic answer. In fact Russia is done this way it really should not be treated as a single region.

But HL should be if I remember my algebra commutative and additive ?

This means you can take the North Sea Lower 48 and Alaska add them together and construct a HL plot that should give the same answer as each region taken alone.

"But HL should be if I remember my algebra commutative and additive ?"

No. Consider computing HL on crude + condensates + whale oil. Whale oil followed a lovely Hubbert curve in the mid-1800s -- you would have been screaming "peak", when in fact peak C+C+W wasn't for another 150 years.

OK silly example, but the point is that HL is only going to work well for roughly-well-behaved production vs. time functions, e.g. monotonic rise to peak, then monotonic fall after peak, with noise that doesn't swamp the signal (HL makes me uneasy for countries like Russia for this reason). It should work well enough if you're combining two or more production functions that peak at about the same time, or at least overlap enough that their sum looks roughly-well-behaved, so it's probably legit for "world peak oil", but it's not additive in an algebraic sense.

peace,

lilnev

Right ...,

Thats what I meant :)

Semi-additive ? :)

New math terms for HL just to drive Robert crazy.

By god we will make it work even if we have to change the laws of addition :)

Would you care to comment on the dual porosity / permeability system I undersatnd exists in Ghawar and how the Sw problem you refer to relates to these dual / multiple systems?

We don't have to make it any more complex than it is to be concerned.

The principal concern I have with regard to the natural fractural is the crest is all that's left and Ain Dar/ Shedgum. And anybody would recognize that the stress and therefore fracturing if a problem, would be most severe here.

"The principal concern I have with regard to the natural fractural is the crest is all that's left and Ain Dar/ Shedgum. And anybody would recognize that the stress and therefore fracturing if a problem, would be most severe here."

This sounds ominous, but unfortunately I haven't a clue what you're saying. How would yoou explain your statement to a layman (such as myself), please?

Think of the reservoir as a curved rock arch. Curvature is strongest at the crest (the pointy bit at the top) so this is where the rock is most highly strained. So this is where fracturing is most likely to occur. Natural fractures are generally bad news in a waterflood because water runs along them and arrives at the production wells sooner than you'd like.

At this stage I don't think it's going to make much difference - even without natural fracturing, the it's-all-over look is all over. Plus the matrix (unfractured rock) permeability is pretty high, which tends to mitigate the effect of the fractures (allows the waterflood in the matrix to "keep up" with the fractures). Plus I've never heard fracture flow invoked as an important mechanism in the Arab/Minagish/Zubair Cretaceous limestones of East Arabia (not to be confused with the Eocene Asmari Limestone of Iran, which has completely different characteristics).

curvature may be greatest at the top of this particular reservoir, however it is not generally the case. flexure (or curvature) is greatest where the rate of change of dip is greatest (first derivative of dip). this can occur around the flank of the structure. Puerto Chicito field in the San Juan basin for example.

On March 8, 1956, at a meeting of the American Petroleum Institute in San Antonio, Texas, M. King Hubbert, in the preprinted version of his prepared remarks, had the following statement,

As more and more people are learning, Lower 48 oil production, as predicted by Dr. Hubbert, peaked in 1970, and it has fallen fairly steadily since 1970.

Note that cumulative post-1970 Lower 48 crude oil production has been 99% of what the HL model predicted it would be, using only production data through 1970 to construct the model.

If we focus solely on the Texas HL plot, the post-1957 data are clearly consistent with a URR estimate in the vicinity of 60 Gb.

In any case, we had three predictions for lower crude oil production, most likely in 2006, based on the HL method: Deffeyes/World; Brown/Saudi Arabia and Khebab/Mexico. Result? Three crude oil production declines.

But that was just three simultaneous "coincidences," like the 99% correlation between the post-1970 HL model (using only data through 1970 go construct the model) and post-1970 cumulative Lower 48 production.

http://lifeaftertheoilcrash.net/

Dude, only 24 of 44 of the top oil producers in confirmed permanent decline? No problem right? Where's the market's magic hand?

Saudi Arabia is about to do a oil production belly flop due to their implementation of "advanced techniques" - the decline WILL be steep, and the only real question is are we up shit creek without a paddle NOW or in a few years? That's not even mentioning runaway global scorching and oil exports dwindling faster than cash at a tittie bar.

There you have it, and as I thought. Good work, Robert.

The simple fact that issues Robert is currently investigating are not well known---they should be fully understood---shows that the HL method is not robust. It's an early-stage tool, and a good idea worth pursuing. But it's not a predictive tool in the state it's currently in.

Dunno I think its more and issue of defining how its been used. A lot of external parameters not included in the model are used to deduce the correctness of a particular HL plot.

This filtering has been ad hoc as far as I know. The question is can it be made rigorous and if so does HL retain predictive powers.

See my other posts why I think its a proxy for the right model and close enough. I don't believe Robert will be able to show HL does not work simply because I think that a correct model similar to HL exists and can be derived from first principals.

Until/If we get a better model developed from physical constraints HL serves a purpose. With that said Roberts work could easily be the key to determining a better model so I don't discount it in the least.

And finally if we do get it I expect the new model and HL to be in pretty good agreement.

"Captain! Is that an iceberg straight ahead?"

"Depends on how you define iceberg, and what methodology you're using to detect said iceberg."

"Damn it, Ensign, is it or isn't it?"

"Well, we really shouldn't jump to conclusions. As you know, we do not have certainty to within twenty decimal places. I much prefer to see if we hit the iceberg after we pass it."

"Ensign, you are retarded."

These analogies suggesting that it doesn’t matter whether the Titanic sinks in 2 hours or 4 hours, or that the only thing that matters is that we are hitting the iceberg, are an incredible display of intellectual shallowness. Of course it matters when it sinks. Of course it matters when you are going to die. After all, you are going to die some day, right? Does it matter to you whether it is today, next week, or 10 years from now? Or does the fact that you are going to die render the timing completely irrelevant to you? From responses such as yours, I am left to wonder.

What more time gives us is at least the opportunity to become a little more prepared. It doesn’t mean we will use the opportunity, but at least time gives that to us. We may have some lifeboats on the way that can rescue a few. If you are convinced that we will sink in 2 hours, and you jump in 2 hours, it might have mattered to you that we didn’t actually sink for 4 hours, and that a few lifeboats arrived in 3 hours.

It is very important to know how much time we have, and it is important that we don’t burn up our credibility in confidently arguing that peak is now, if it isn’t 5 years from now. This will become painfully obvious to some of you if production turns up and we set new production records. I think the point might finally reach even the dullest of minds.

Of course I have to make the obligatory statement that this doesn’t mean I think we should delay action. Of course I have made my position on that clear numerous times.

"What more time gives us is at least the opportunity to become a little more prepared. It doesn’t mean we will use the opportunity, but at least time gives that to us."

Robert, I would like to think that you are correct, but I see little evidence of it. I doubt many people will change livestyles until they are forced to by price.

And as for "losing credibility," what difference does it make? What I mean by this is, once we peak and decline, everyone will (presumably) know, which may feed our individual egos by being proven right, and may improve your personal employment chances, but I'm not sure what practical value it has on a larger level.

IMHO, a lot of people still won't believe that we are in a true resource constraint. They will blame it on those crooks at Big Oil and those evil foreign countries that won't give us their oil. They have been told for so long that there is plenty of oil and we will never run out -- and they have accepted it on faith without giving it any real thought. Many people think cheap gasoline is our birthright. Please pass the Koolaid.

And frankly, I'll likely will be one of those "I told you so" jerks. After all of the flack and utter dismissal I've experienced regarding the subject of peak oil, there isn't much else to say once they see the light. I've had people compare peak oil to the year 2000 doomers. Yeah, right. Peak oil is the same thing as, "the world is going to end because the computer clocks won't roll over correctly." Sorry, the data is out there -- enough so that any thinking person should be concerned and investigating/preparing. The only exceptions would be those that don't have access to the internet since our media does an overall lousy job of covering the subject.

Hi Jim,

And thank you to everyone for this discussion.

re: "I doubt many people will change livestyles until they are forced to by price."

Some Qs:

My take on what Robert is saying in regard to time is - having some time to do something is good. What we do is another (I would say crucial) issue, of course. That's the first part of what he's saying, as I understand it. (Second part in a minute.)

Instead of taking your point above as a reason why time *doesn't* matter, I'd say this could be a starting point for some mitigation planning. It does matter.

Or, let me put it this way: What *if* it *does" matter?

For example, okay, let's assume "I doubt many people will change livestyles until they are forced to by price." Good assessment.

1) So, what next? What is the next step? Yes, price will "force" change. Okay. (AT least we've identified something that will force change.)

Can we envision policies, which put into place the price changes - (do you mean on gasoline, by the way? or, something else?)- that might have the desired effect?

2) And, (working a bit backwards), what *is* that desired effect?

I'm asking for your thoughts on this, with as much sincerity as I possibly can.

By "policies" I mean both gov't. policies of any kind...

And I also mean...are there any other actors or "stakeholders" who might be able to influence *"price"* in the desired direction? If so, how?

3) What is the end result of the direction of "price force"? What is the exact "lifestyle change" you are speaking about here? Can you talk about it? Can you describe it? Is there a positive version - (or a "least bad")- version that might result if "price forcing" is done in advance, as opposed to post-peak?

Part II: If I may be so bold as to continue w. my interpretation of Robert's point.

"Credibility" is good to have, if one wants to take positive action in the time allowed. Wouldn't you say?

4) "...everyone will (presumably) know..."

Well, I'm not at all sure. It's difficult to understand the implications of "peak" (for all kinds of reasons - emotional, education-wise, and who knows what else...). I'm not sure this will change post-peak.

In any case, it seems to me that the point of what Kjell Aleklett and many others say- (and devote their lives to)- is to "warn the world".

People who know, who understand, are in a position to act in a positive fashion. Who else possibly can?

It seems that means "us". To begin with. And the credibility "issue" is to establish a basis for there to be more of "us".

The easiest way to post images is to upload them to a free image hosting service, such as ImageShack.us or Flickr. Make sure it's one that allows "hot linking" (linking directly to images - Blogger, for example, does not allow it).

You can then post them here, by linking to them using the HTML img tag.

<img src="your image url">

thanks

this is a test

You are using the BBcode tags. This board uses plain HTML.

<img src="http://img122.imageshack.us/img122/903/aindarshedgumfractionalok4.th.png">

Gives you this:

Hit preview to see how it will look before you post.

Key got cropped - what do those two fw curves refer to? With and without gravity? (I assume that's why you quoted permeability in the graph title).

Given that fw at breakthrough is about 80% for either curve, giving a surface watercut in the mid-80s, way below even the worst claims of the pessimists, doesn't that tell us that they're probably flooding the thing out one row at a time, so the curve by itself gives us no real information about the overall state of the reservoir?

I see that you were right about "contingent resources" being Sorw, though. I'd expect to be fired for cause if I tried to pull something like that.

Sorry for the image quality.

fw res and surface Honapour correlation carbonate intermediate wettability 220 md.

Look at this image and tell me what you see as abandonment Sw if you can.. it looks like .65 to .66 to me.

The bottom line is Saleri is giving essentially 100% of the oil behind the flood front as reserves.... with no detriment for efficiency. I don't think you can slice it any other way.

Not to mention that I see breakthrough fw above 90%... but the tangent on this wide a mobile saturation is a difficult point to capture. Reasonable men of good conscience can differ on this.

This is the ideal water flood. A coarsening upward sequence with the oil viscosity less than the water with purely downdip injection. But the collapse will be abrupt.

Thanks for your questions.

I've put it this way: Ghawar, Cantarell, Burgan and Daqing are well on their way to (or beyond) where Prudhoe Bay is now (75% water cut) and ultimately to where East Texas is now (99% water cut, i.e., watered out).

But the collapse will be abrupt.

Boy, when I just read that, it came with a THUD.

Once every so often, you read something, even if it is something you have read before, but this time... This time, the hairs stood up on the back of my neck.

Thank You FF for that. I even heard Beethoven's 5th in my head.

JC

OK, then...if what FF says is all true...collapse will be abrupt...what the hell is keeping the lid on everything right now?

Markets are not going nuts...price of crude is dropping (although gasoline is edging up...strange)...DOW is setting records.

I am playing devil's advocate here, but what is it going to take to see through the cracks here?

FF...stop talking formulas for a moment and tell how KSA is keeping lid on this?

Lol.

The concept of a collapse in the Ghawar has been related here for many moons. That it is using the same EOR techniques as the Yibal should have raised alarm bells for anyone with any sense of reasoning. Check out the history of the Yibal if you really want to see the hairs stand up on the back of your neck. Just imagine the same collapse in the Ghawar.

You people never have been very adept at listening. I appreciate FF dropping a nice load of sweet, sweet, sci-talk to make you hapless geeks get all gooey and drop your defenses and perhaps start to believe what was oh so obvious two years ago.

So, if that is what it takes, my hat is off to you FF.

Is there a single history of Yibal? Or better yet does there exist an archived debate of the field's ongoing performance and subsequent decline. Something like this?

peter

Its a combination of poor field management and lack of water flood as you say. This oil is being extracted now. The problem in a sense with Texas is technology was not applied smoothly to production since the technology was developed to extract this bypassed oil in the first place. I'd say Russia is in a similar situation with basically two waves of technology pre and post Soviet Union plus of course the collapse period.

In the case of Texas these problems where rectified post peak so it did not effect the date of peak all that much instead it lead to a later increasing URR in the tail if the technology had been applied earlier before peak then the Texas URR would have been higher and the peak higher not sure it would have been much later. The HL URR is increasingly low as you pour more and more resources into extracting the remaining oil at lower and lower URR. Recovery factors creep up but the production rate is technology bound not geology and generally low. My example is a well that 90% watered out its constrained by the water handling abilities.

Hi f,

In addition, anybody who knows anything would also rather have 10 MMBOPD at 90% water (Russia) than 10 MMBOPD at 20% water (Saudi). Ten million a day at 20% water is 1.2 MMBOPD at 90% water, capeche??

So when did Russia ever produce 100MMstb/d dry oil? That liquid production rate is the result of several decades of incremental installation of pumps and treatment plants. As you know perfectly well, I'm sure. Though I'll concede the larger point that nasty surprises are a lot more likely in Saudiya than in Russia. There's a lot less spare capacity in the oilfield equipment business than there was five years ago...

I agree. I did well testing in Ghawar from 1982-87. The only way you could get a well that produced 6,000 on average would be to average in the water injectors. The average well in shedgum produced 18mbd through a 1 7/8 choke.

Fractional_Flow,

If Saudi Arabia is at 53% water cut and climbing at 1% per year. How many years until cliff. What was Oman's water cut before the cliff?

'...that production may rise again in the future, dependent upon global demand picking up.'

And that is the crux, isn't it? To the extent I have a forecast about the next decade, it fits into the data presented here - Saudi production will remain flat, but their 'productive capacity' will be on par with the North Sea's productive capacity in British oil production forecasting today - that is, a number based on what is politically desired (like Reagan/Bush era USGS reserve numbers), not reality.

A plateau based more on economic than geologic conditions is looking ever more likely, though one subject to some serious disruptions.

The one thing lacking in your information, though, are numbers related to the quality of the oil now being produced, however. A fairly minor point, in the broad picture painted here, but having to construct a refinery's facilities to handle the oil from one of KSA's remaining megafields is not really an encouraging sign of having that much in reserve.

Nice one Euan. A solid plausible contribution.