Saudi Arabia's Reserve "Depletion Rates" provide Strong Evidence to Support Total Reserves of 175 Gb with only 65 Gb Remaining

Posted by Sam Foucher on April 20, 2007 - 11:05am

This a guest post by ace.

Summary

In Dr. Saleri’s Saudi Aramco presentation on Feb 24, 2004 to the CSIS in Washington, D.C., he stated that Our typical depletion rate is about two percent. However, Aramco’s definition of annual depletion rate is consistently calculated as annual production as a percentage of total reserves. Aramco’s calculation method will be confirmed by the examples below.

Data from the presentation is used to convert Aramco's depletion rates into conventional depletion rates which show that conventional maximum depletion rates forAin Dar/Shedgum, Abaiq and Berri are well above 5%/yr. In addition, Aramco's stated depletion rate for Shaybah shows that Aramco believes that Shaybah has up to 20 Gb total reserves.

In 2003, assume that Aramco could have produced at an average capacity of 9.5 Mb/day for the entire year. Production reached this level during the Iraq invasion in March 2003. The annual production is 3.5Gb (9.5Mb/d*365d*(1Gb/1000Mb)).

Aramco’s proved reserves are equal to the annual production divided by Aramco’s definition of annual depletion rate. Thus, total reserves are equal to 175Gb (3.5 Gb/2%), which is about half of their stated number of an extremely optimistic 359 Gb.

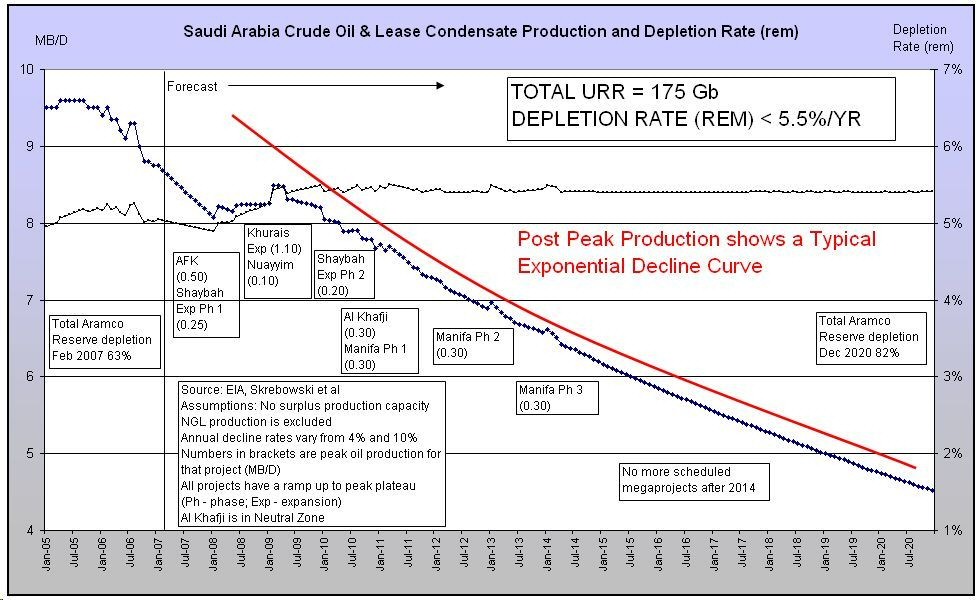

Finally, assuming that total reserves are 175 Gb and that these reserves are produced at a conventional depletion rate of below 5.5%/year, the oil production rate of Saudi Arabia is forecast to Dec 2020. This forecast shows that production follows an exponential decline curve down to 4.5 million barrels/day in Dec 2020 and that it is highly likely that the world's crude oil and lease condensate production has passed a peak of 74.2 million barrels/day on May 2005.

Definitions

Depletion rate (rem) = Common or conventional definition of depletion rate which is annual production as a percentage of remaining reserves (assumed to be the same as total reserves less cumulative oil reserves produced)

Depletion rate (tot) = Aramco’s definition of depletion rate which is annual production as a percentage of total reserves (assumed to be the same as initial proved reserves)

Reserves depletion = Cumulative reserves produced as a percentage of total reserves

URR

= Ultimate Recoverable Reserves or total reserves

Gb

= billion barrels

Mb

= million barrels

Saudi Aramco’s Depletion Rate Calculation Method

Dr. Saleri’s presentation shows Aramco’s calculation method for depletion rates. Figs 1, 3, 5 and 6 are sourced from this presentation.

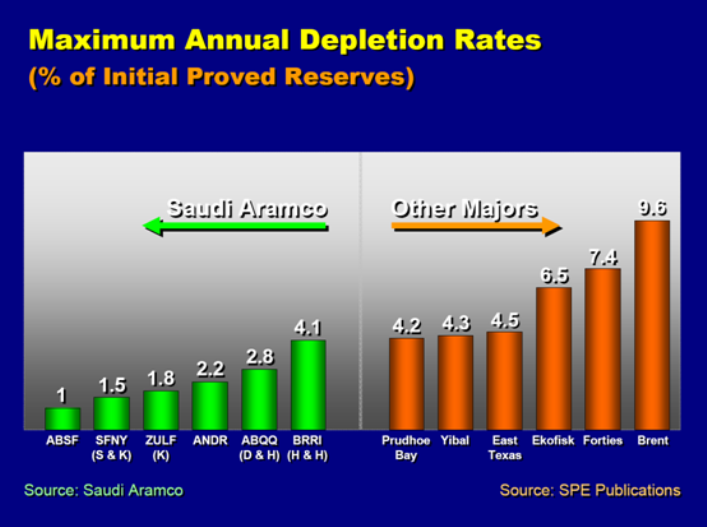

Fig 1 below states in the title that depletion rates are a “% of Initial Proved Reserves” which are the same as depletion rates (tot).

Fig 1 – Maximum Annual Depletion Rates (tot) – click to enlarge

To check this calculation, Prudhoe Bay’s maximum depletion rate (tot) of 4.2%/yr is verified. Here is a chart of Prudhoe Bay’s production profile. A total reserves (or Aramco’s term of initial reserves) figure of 13 Gb is used from this source as it is dated 2002 rather than the chart’s estimated reserves from 2001.

The maximum depletion rate (tot) is equal to the maximum annual production as a percentage of total reserves. Depletion rate (tot) = 0.55Gb(years 1980-87)/13 Gb = 4.2% which agrees with the depletion rate (tot) of 4.2% shown in Fig 1.

For comparison, in 1993, the depletion rate (rem) was much higher indicating that the Prudhoe Bay field was being produced aggressively. Annual production was less at 0.4 Gb and cumulative production was 8 Gb. Remaining reserves is total reserves of 13 Gb less cumulative of 8 Gb to give 5 Gb. Depletion rate (rem) = 0.4 Gb/5Gb = 8%/yr.

Fig 2 – Prudhoe Bay

Saudi Aramco’s Depletion Rates (rem) for Selected Fields

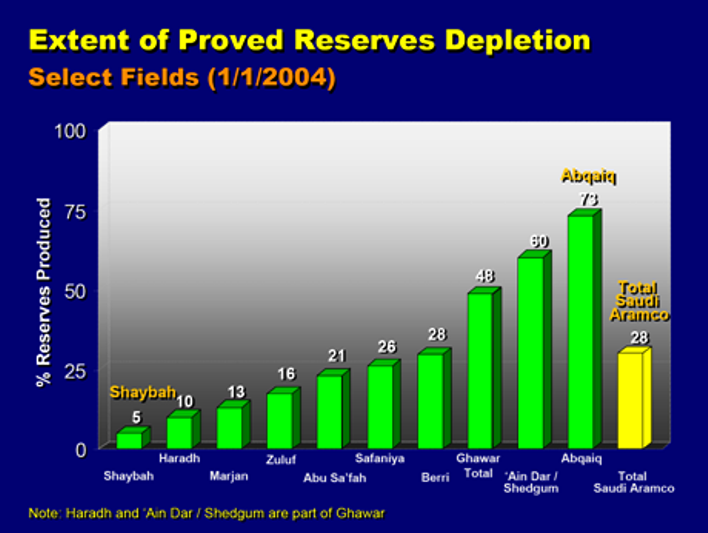

Fig 3 shows the reserves depletion of selected fields.

Abu Sa’fah has a reserves depletion of 21%. Fig 1 shows Abu Sa’fah (assumed to be ABSF) to have a maximum annual depletion rate (tot) of 1%. From the definitions above, reserves depletion is cumulative reserves produced as a percentage of total reserves. Depletion rate (tot) is annual production as a percentage of total reserves.

Depletion rate (rem)=annual production/(total reserves – cumulative reserves produced)=1%(total reserves)/(total reserves – 21%(total reserves)).

Abu Sa’fah maximum depletion rate (rem)

The total reserves variable cancels in the above equation resulting in the depletion rate (rem) = 1%/(100%-21%)=1.3%/yr for Abu Sa’fah, which is a low depletion rate (rem).

Applying the same formula to the other fields:

Safaniya maximum depletion rate (rem)

Depletion rate (rem) = 1.5%/(100%-26%)= 2.0%, still low.

Zuluf maximum depletion rate (rem)

Depletion rate (rem) = 1.8%/(100%-16%)= 2.1%.

Ain Dar/Shedgum maximum depletion rate (rem)

Depletion rate (rem) = 2.2%/(100%-60%)= 5.5%, this field is being pushed hard.

Abqaiq maximum depletion rate (rem)

Depletion rate (rem) = 2.8%/(100%-73%)= 10.4%, this is very high but this field has been producing since 1946.

Berri maximum depletion rate (rem)

Depletion rate (rem) = 4.1%/(100%-28%)= 5.7%, this field is being pushed hard.

As shown above, the maximum depletion rates (rem) range from 1.3% to 10.4% which is more realistic as supported by this statement for Middle East fields from this source . “Adopting a depletion rate for Iraq of 4-5%, which is well within good management practice for large fields”.

Fig 3 – Reserves Depletion – click to enlarge

Fig 4 below shows the actual depletion rate (rem) for Aramco, assuming total reserves of 175 Gb. The actual depletion rate (rem) is now between 4-5%. If the depletion rate (rem) is kept below a maximum of 5.5%, reflective of good reservoir management, then Aramco’s production will stay below 9 Mb/d and will continue to decline in order to keep the depletion rate (rem) below 5.5%, shown in Fig 7.

Shaybah Field Total Reserves

The figure below is also from Dr Saleri’s presentation. The depletion rate (tot) is given as 1%/yr with an optimistic production plateau of more than 50 years.

The annual production is 0.5 Mb/d*365d=182.5Mb/yr or about 0.18Gb/yr. Applying Aramco's depletion rate (tot) of 1%/yr gives total reserves=0.18Gb/1%=18Gb for Shaybah. This number appears very optimistic next to Colin Campbell’s figure of 6 Gb reserves for Shaybah, discovered in 1968, from his book “The Golden Century of Oil 1950-2050”.

However, this source agrees that Shaybah might have 18 Gb:

UAE: Saudi Border Oilfield

The UAE and Saudi Arabia are debating the ownership of the border oilfield at Shaybah, which contains nearly 1.5 per cent of the world's total crude resources. Discovered in 1968, the field straddles the UAE-Saudi border and is believed to be one of the world's largest onshore oilfields, with current estimated proven reserves of 15.7 billion barrels. Up until 25 December 2003, the field had yielded one billion barrels, however oil industry sources believe its recoverable oil potential could rise to 18 billion barrels in a few years with the deployment of new technology (such as horizontal drilling).

Fig 3 shows Shaybah’s reserves depletion to be only 5% to 1/1/2004. Given that Shaybah has produced (0.5 Mb/d*365d*5yr plus 0.2 Mb/d*365d, or 985 Mb) about 1 Gb to 1/1/2004, Shaybah’s total reserves using this calculation is the about 1Gb/5% or 20 Gb. At least, Aramco’s data shows consistent optimism within their presentation. I do not share their optimism and believe that Shaybah’s reserves are much lower than 18 Gb.

Saudi Aramco’s Real Reserves

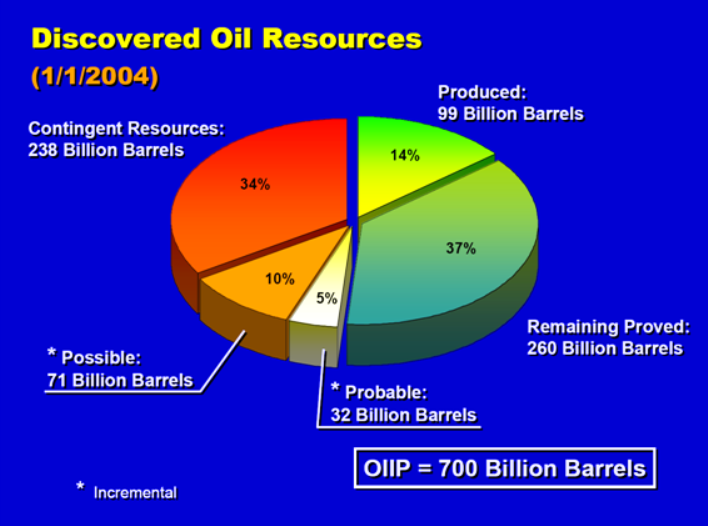

Fig 6 shows a pie chart for Aramco’s resources. Based on this chart, the total reserves are 260Gb+99Gb=359Gb. The reserve depletion is cumulative reserves produced divided by total reserves or 99/359 =28%, which is equal to the reserve depletion number of 28% in Fig 3. This shows that Aramco’s presentation data is consistent.

However, what is not consistent on Fig 3 is showing Ghawar’s depletion at 48% while Total Saudi Aramco is only 28%. Since Ghawar production has been a majority of Aramco’s total production, the depletion for Total Saudi Aramco should be at least 48%. If it is assumed that Aramco’s total reserves are 175Gb then the more realistic figure for reserves depletion for Total Saudi Aramco in Fig 3 should be 99/175=56%.

In 2007, the cumulative amount produced would be 99 Gb plus 11 Gb from Jan 2004 to Feb 2007 to give 110 Gb produced. The current reserves depletion is 110/175=63% which implies that future Aramco field production decline rates will accelerate to ensure that depletion rate (rem) are kept below 5%.

As the 260Gb reserves number is reported in BP’s annual statistics, and the BP reserves number is supposed to be remaining reserves, Aramco had no choice but to exaggerate their reserves upward to an enormous 359Gb! Note that in 1983 when Saudi Arabia nationalised its oil assets, BP stated reserves of 169 Gb for Saudi Arabia. This implies that a total reserves of 175 Gb is consistent with the 169 Gb number as no giant fields have been discovered in Saudi Arabia since Lawnah (only 1.2 Gb) in 1975.

Fig 6

– Saudi Aramco Discovered Oil

Resources – click to enlarge

A comment from Dr Saleri from his accompanying speech to the presentation was Our typical depletion rate is about two percent.

However, to be consistent with the presentation, that means that the Aramco depletion rate (tot) = 2%/yr. Assume that Aramco could have produced a “typical” 9.5 Mb/d in 2003. Fig 4 shows that a production level of 9.5 Mb/d was reached during the March 2003 Iraq invasion.

Annual production for 2003 equals 9.5 Mb/d*365d*(1 Gb/1000 Mb)=3.5Gb. Therefore, using this method, Aramco total reserves equals 3.5Gb/2%=175 Gb, which is about half of their stated number of 359 Gb.

Saudi Arabia Production Forecast

The actual production and depletion rates (rem) are shown in Fig 4 above. Fig 7 shows a forecast of production to Dec 2020. It is assumed that Aramco will continue to practice good reservoir management and consequently the depletion rate (rem) will not exceed 5.5%/year. If the depletion rate (rem) is kept lower than 5.5%, say at 4.5%/yr, then production rates would probably drop below 8 Mb/d in early 2008 and continue to decline.

The forecast shows clearly that Saudi Arabia having its reserves already 63% depleted must increase production decline rates to ensure that reservoirs are not damaged. Themegaprojects shown in the chart are too small to stop the exponential production decline. The reserves of the megaprojects' underlying fields are included in the total reserves of 175 Gb.

Furthermore, if the total reserves of Saudi Arabia are truly 175 Gb and Aramco's production is constrained by keeping the depletion rate (rem) under 5.5%, then the world's crude oil and lease condensate production is highly likely to already have passed a peak of 74.2 million barrels/day on May 2005.

Fig 7

– Saudi Arabia Forecast

Production Rates and Depletion Rates (rem) (EIA

actual lease condensate for Saudi Arabia is zero and forecast

lease

condensate assumed to be zero. Actual and forecast production

is crude

oil only.) – click to enlarge

Thanks Ace, great work.

Man, you just love to scare the hell out of me.

So, by the last graph...we can pretty much expect NET EXPORTS of Zero by 2020 (conservatively).

THAT's 13 years. Eeek! And assuming KSA doesn't decay into ANARCHY and FUNDAMENTALISM way before then.

Must find my happy place, now!

Great post, interesting to come up with a reserve estimate using sa values. GLad to see it got its own thread.

"However, what is not consistent on Fig 3 is showing Ghawar’s depletion at 48% while Total Saudi Aramco is only 28%. Since Ghawar production has been a majority of Aramco’s total production, the depletion for Total Saudi Aramco should be at least 48%."

This statement cannot be right - it implies that if ghawar's depletion was 100% sa would be 100% depleted. SA's 28% would be about right if ghawar contains about half of sa reserves, was produced first, and is about half depleted.

Your right the statement is wrong but your answer is I believe wrong its not that simple since its a weighted average. The correct answer is 56% as presented later. The simple statement although incorrect is "less" wrong than your 28% correction :)

He should say something like with Ghawar representing 50% of reserves and at a 48% depletion its unlikely that a total depletion of 28% is correct.

The real answer of course depends on how the rest of the fields where produced. If nothing but Ghawar was produced you would have a low depletion percentage in the teens.

Agreed. Tired of digging down to the bottom of a Drumbeat to look for Ace's posts. Thanks Khebab.

I don't see how the last graph implies anything of the sort. Even if KSA's production profile follows that graph, there is no way KSA will allow net exports to reach 0 for at least several decades. Domestic consumption will be curtailed well before oil exports dry up.

Other countries highly dependent on oil revenues will follow suit rather than see domestic consumption take up all their oil production. For this reason I think some are too pessimistic when making projections based on the 'export land' model.

I've broken down declining net oil exports in individual countries into Phase One and Phase Two--within the context of an overall decline in world oil exports.

In Phase One, cash flow is increasing, even as exports fall, because oil prices are rising faster than exports are falling.

In Phase Two, cash flow begins to stagnate or decline, because rising oil prices can't offset all of the decline in exports. At this point, I would expect to see some efforts to curtail domestic consumption, but by this time, net exports will have fallen quite a bit anyway.

The phase two situation is one reason I feel that overall production will decline at a acclerated pace as above ground factors lower production even more. Right now we are seeing above ground responses to peak oil take over one barrel off the market for each barrel lost to depletion. In time this will grow too 2:1 4:1 etc doubling at I figure between 2-5 years.

Your not including even more cash and oil that needs to be pumped into the oil industry itself because of skyrocketing production costs and declining EROI. I'd be surprised if any oil is produced in volatile regions of the world 6-7 years post peak much less the projected 50%.

This is the real reason for the Iraq war at any cost not just the depletion we are watching. A lot of places are going to go to zero quickly. It not about money its about having any oil. Very little of the remaing oil will be produced in our lifetimes if ever.

You scare the hell out of us normal persons, it seems that both TEOTWAKI and TSHTF fulfills.

Nothing surprising about what I'm saying if you hit peak oil world wide we face conditions that our ancestors use to face for thousands of years. They were not dumb people and our ability to make our recent technical leaps has a lot more to do with oil than some sort of superior intelligence. Periodic collapse of civilizations in the past plus a low energy base has a lot to do with the lack of a industrial civilization until we hit a triple play home run of the New World/Coal/Oil.

A lot of things had to come together to ignite our current civilization and we seem to forget this.

Civilizations die get over it.

Lets hope we can keep enough together to build a new better one for our children.

Mmmm, that typically takes what, 1000 years? Maybe

not such a bad thing.

Everything moves faster today :)

Seriously though we don't have the right economy to handle disruptions from oil supply problems. Everything has gone to just in time overseas production. It will unravel pretty quickly until we adjust to a older style of doing business with significant stocks of critical components. I hope and expect us to simply have serious problems with the random riot and burning slum.

In general we are in a far worse position today to deal with problems than we where even 10 years ago. I think you will be unpleasantly surprised at how fast things unravel. These last ten years of SUV's, McMansions and globalization probably increased the pain by a order of magnitude. Its like we have done everything in our power to make peak oil as painful as possible. The biggest unknown is that a lot of the people that will suffer demand destruction actually live in the same cities as the wealthy its unclear they will take dropping to a third world living standard peacefully.

Large parts of greater Los Angeles will burn for sure how this effects the rest of the US is unknown. On the east coast you have a number of the older poor cities that could potentially succumb to rioting. In the San Francisco area Oakland for example is likely to suffer riots. I think these demand destruction riots and resulting crashes in property values as people flee the effected regions will cause serious problems for the US.

I don't know Europe well enough but I'd expect Paris to have problems maybe other cities. They have good enough public transport that fuel costs are not as threatening there.

Back in the US we have a large enough concentration of poor in certain areas that depend on gasoline we are certain to have riots initiated at gas stations if they don't start for other reasons. Its hard to guess how the migration from these hot spot metropolitan areas will effect the US.

Certainly property value will plummet and business will leave the effected region the question is will it initiate a feedback mechanism causing further problems in itself. This is unknown. Near many of these poor regions is some of the most expensive property in the country so your looking at loosing a lot of wealth. America has never really had large regions that are no longer under the rule of law I'm sure we will contain the problems but at what cost ?

If your super rich and have a big house in Santa Monica I'd sell that puppy soon if you need the money. In general I'd not own anything near Compton that I could not afford to lose. Oakland I don't know well enough to guess where a riot could concentrate. Where I live in Orange County the city of Santa Anna is a potential flash enough of a concern I won't buy property in the area regardless of price. Its a double problem because its population contains a lot of illegal immigrant that work in the declining housing industry so the combo of peak oil and job loss without workers comp will make the region esp volatile. I'm sure a lot of the other poor areas in California have this same double impact situation from the collapsing housing industry and oil. Its a really bad time to have price spikes in gasoline in CA.

We have plenty of A*&Holes with Hummers in this area the chances of a Hummer being part of the cause of riots in orange county is very high.

In general worldwide riots by demanded destructed poor will be a big factor in how peak oil plays out. These riots are not the end of the world but it will fuel our downward decline. The collateral damage can easily push regions over the edge.

On the subject of riots/collateral damage, I remember a few weeks/months back where in Pakistan, people were attacking the local power utility station because of "load shedding" and blackouts.

This is the challenge going forward...people insist on blaming big oil for all their problems. So, you can easily see the leap to damaging refineries/pipelines etc.

It's the "if I can't have, no one can, rationale"

This was evident again last year(?) in the UK with the refinery blockade by truckers. It nearly caused a national disaster, and brought the country to its knees.

These gut reactions on the part of the public will likely be the death spiral of industrial civilisation.

That said, I am personally hoping for little green men to arrive and hand me the patent for Mr. Fusion. :P

I am a bit surprised that you think today's poor will be the only source of rioters.

Take today's low six figure income :whatever:, deprieve him (they riot more than her) of a job (even minimum wage, a house, all of his possessions & "savings" and even a place to sleep (except a squat in a foreclosed property). No social support before, he has developed just some minimal social network since TSHTF *like many Americans, he lacks that skill set.

I see him as a greater riot risk than today's poor.

Alan

First since their is a good chance that peak oil will help initiate a chronic recession of some other sort. A lot of these rioting poor will be former six figure incomes and hard working middle class. Economic problems will drive them into the poorer areas. Next the only reason I focused on the poor is that they are the ones who would suffer demand destruction first. In general its anyone who is living on the edge or past it regardless of income that has to work. A lot of Americans cannot suffer a few hundred dollar increase in expenses since they are in debt way over their heads. Persistent 5+ dollar a gallon gasoline coupled with attempt to use monetary inflation to hide uncontrollable rises in resource prices to keep the economy going will ensure widespread price inflation. When your customer prints the money he pays you with life is interesting.

The first people that are effected are the working poor who live with what I call the shiftless poor. And I grew up in Holly Springs Mississippi so I'm familiar with all the various forms of poverty its not just someones income.

I don't expect it to stay contained as you mention. But I would suspect the wealthier people would engage in marches and the like that will eventually be brutally put down.

One thing about suburbia its not a good place to have a old fashioned riot since the government offices are downtown you have to attack something. Suburbia either by accident or design is effective at limiting active political action.

jbunt

memmel

At first, I thought it was a typo (excusable) - (how this "effects" the rest of US) should be "affects"

then (people flee the "effected" regions) should be "affected"

then (business will leave the "effected" region) should be "affected"

and finally (A*&Holes with Hummers) shows your mindset

Why are so many posters likw you eager for peak oil? You guys want it SOOO BAAD!! You want the A*&Holes to be forced back to Walden Pond with you, where you think that everything in the world will then be right.

Well, according to this site, the A*&Holes with Hummers do not have a clue about peak oil - along with most other Amerians, so why call them that?

With respect to the Walden Pond that you desire, just look at New Orelans without power. That is what anyplace and everyplace in America will look like if there is not enough power.

All Walden Pond posters should identify themselves as such in their lead sentence.

I truly think you miss a major thread among many TOD posters (often American) - that is, the 'A*&Holes with Hummers' are going to destroy Walden Pond, along with anyone suggesting that doing so is just plain idiocy.

The other point is that many here also think what the 'A*&Holes with Hummers' believe, as compared to what they do, won't matter anyways - there will be less oil, regardless of what the 'A*&Holes with Hummers' want.

Very few people here think Walden Pond is an option - as a matter of fact, the number of such posters probably hovers around zero.

Maybe you should do some reading before writing something that seems to fit your pre-conceived notions. For example, this quote from memmel - 'These last ten years of SUV's, McMansions and globalization probably increased the pain by a order of magnitude. Its like we have done everything in our power to make peak oil as painful as possible. The biggest unknown is that a lot of the people that will suffer demand destruction actually live in the same cities as the wealthy its unclear they will take dropping to a third world living standard peacefully.

Large parts of greater Los Angeles will burn for sure how this effects the rest of the US is unknown. On the east coast you have a number of the older poor cities that could potentially succumb to rioting. In the San Francisco area Oakland for example is likely to suffer riots. I think these demand destruction riots and resulting crashes in property values as people flee the effected regions will cause serious problems for the US.'

Doesn't sound like Walden Pond to me.

The pond will shrink to the last bullfrog, pretty tough on us tadpoles.

sa is in phase 2 now - oil price down 20% from peak, production down 10%, exports down 13%? so gross revenue down 1/3 even as costs are rising fast, meaning net may be down 40% from last year's peak... and net per capita (even p/p, or per prince) down further. IMO their need for revenue will prohibit their ever voluntarily reducing production to save for the future, and opec has lost its raison d'etre... I am now convinced that all of sa cutbacks, meaning 80% of opec's, have been involuntary.

Groppe thinks there is substantial demand destruction remaining in third world still using oil for electrical power generation (eg senegal), and that current 60/b is high enough to hold prices around where they are now. He has a great record, but imo the transition from oil to ng/coal will be more difficult and slower in the third world today than in the US in the seventies because of the difficulty of transporting these alternate fuels to regions ill prepared to handle them combined with a lack of capital.

... my son will ride a camel; - there are not enough camels to go around, or grain to feed them... as in other places, there are too many sons...

Imagine that Wolfowitz has been diligently eliminating all birth control from world bank funded programs...

I don't think they have quite transitioned to phase two just yet. We have no indication of internal consumption constraints yet from KSA. Until you get pressure on internal consumption its hard to call a Phase II transition. Iran who has even more problems might not be phase 2 yet either. I assume Iran will cross over later this year or next. And KSA will cross over actually about the same time because of Ghawar. Mexico is a easier one to watch and they have not crossed yet either. Its interesting that Mexico Iran and KSA look like they will cross over into phase 2 at about the same time ensuring internal crisis will almost certainly effect exports. I assume Venezuela is later but Chavez is doing his best to get his country into phase 2 conditions as fast as possible. Back to Iran they threatened to cut gasoline subsidies but I've not seen that they have actually carried through yet.

http://www.weeklystandard.com/Content/Public/Articles/000/000/013/255wbn...

Iran will go before KSA for sure then probably Mexico then KSA. But it is a tight race.

"Mexico is a easier one to watch and they have not crossed yet either."

I don't pretend to understand how this might apply to the 'pahse I/phase II analysis, but if the chart is correct in this NYT story, just talking crude oil, 'export land' doesn't seem to be happening yet - in the last 4 years prod. has dropped while exports to US have held level, mas o menos. (Is Mexico shorting other customers?)

http://www.nytimes.com/2007/03/09/business/worldbusiness/09pemex.html?ex...

_________

Rex says, "Happy motoring!"

My understanding is exports have been dropping. I could well be wrong. If not then its internal demand that is being shorted.

Right now it looks like it still exports dropping.

http://www.rigzone.com/news/article.asp?a_id=40538

My opinion is that they will simply allow this to continue until the country goes bankrupt. I would be surprised if any country does anything to control internal demand until they are either bankrupt or exports drop to zero which ever comes first. In general I'd expect them to actually go bankrupt by the time the exports are about half what they are today.

So I'd expect financial conditions of the NCO/Governments to collapse before oil production. Of course this means little real investment in the oil infrastructure in the next few years further aggravating the situation. Sure you have a initial burst of investment when you first peak this happened in the US but once its clear that the decline cannot be averted by very expensive technical means this investment will dry up swiftly since it would require taking money away from internal government programs. If I'm right as early as next year Mexican investment in oil production will actually decline not increase then its a matter of riding the world oil price down to collapse. I think KSA is going down the same route I'd be surprised if the do any significant investments past the projects they are committed to now. So overall its simply a matter of when the price of oil internal demand and exports and dropping financial reserves result in these various countries going bankrupt.

Overall its a money game at that point. If I'm right these countries will finish projects the must and cancel the ones they can. Thats when you know the situation will play out as I've outlined.

Reports like this will abound

http://www.bloomberg.com/apps/news?pid=email_us&refer=news_index&sid=a2y...

These plans will not go through

http://goliath.ecnext.com/coms2/summary_0199-2828456_ITM

The problem is these NCO's cannot offer better terms because of their internal commitments and restrictions so they and their governments will fail well before geologic decline indicates the would.

You are forgetting Phase 2.1.

S.A. finds itself with a growing population becoming more and more unhappy with what it perceives is an unhealthy relationship with the infidel West. Falling employment rates, standards of living, water woes, and increasing radicalism all contribute to the fall of the Kingdom. With the royal family either dead or in exile, the kingdom and its infrastructure are doomed. What had been a marginally controlled collapse of exports becomes a freefall. The U.S. finds itself once again invading a country to save the oil. This time, the gloves are off. We do not have the inclination, nor time, to pretend that we are assisting the Saudi Arabians to find the guiding light of Democracy. Though we will hear little of it, the scorched earth method will cut down on pesky insurrectionists. Depending on how quickly the Royals are ousted or killed, and how angry the mobs are, me may arrive on the scene too late, discovering a smoking hole where the infrastructure used to be.

Here is where "above ground factors" get really nasty. This will be interesting.

I give this six years before total chaos in S.A. unless we do something really stupid like bomb, bomb, bomb Iran.

WT, how do you know the point at which increasing price can no longer compensate for decreasing volume?

Lots of variables--oil prices; war; domestic consumption; production decline rate, etc.

I did come up with some more numbers. If we assume a 5% net decline rate in production and current consumption of 2 mbpd (C+C), it looks like any increase in consumption of 2.4% or more per year would result in a 10% or greater annual decline rate in net oil exports. A 10% annual decline = a 50% decline in 7 years.

You are one of my favorite posters, so please don't take what I have to say as a criticism of you. I have been thinking that the big drawback to this site as far as popularizing it's views is that there is no way for the general public to get a swift idea of what the problem is. There are sites out there that pander to the public, in particular, the business crowd and talk of how reserves are replacing and exceeding production.

http://www.fullermoney.com/content/2006-08-11/MarketWatch200617-4-03-Dep...

On the surface they make simple and easily understandable presentations that seem quite reasonable and indicate everything looks if not just peachy, then fairly rosy.

In your post here you illustrate the difficulty that many have in understanding what the hell is being talked about, eyes glaze. The discussion is so far ranging and technical that I think many intelligent but teck challenged people just throw up their hands and wander off to the easy read sites.

A few ideas made simple would help, as in the thought that the oil that can be produced is the more important factor than the amount in reserve (other than discrepancies in reporting reserves). The tar sands might be a good example of great reserve but limited output. One could then move on to the idea that the situation is similar to the Saudi situation?

When Ace says: production decline rates will accelerate to ensure that depletion rate (rem) are kept below 5%.

It might be more generally readable in this form?

They will have to increasingly reduce the amount of oil pumped out of the ground to keep below 5% pumped a year to make sure that the bugger doesn't destroy itself.

I don't presume to suggest that Ace change his post, merely that I think there is a need here, from time to time, for someone with teck understanding as well as journalistic abilities.

If you find what I say so much rubbish, please don't hesitate to say so as I've got carrots to plant and a wood stove to install, much to do and so little time.

Well I'm pretty convinced that above ground factors will ensure the decline rate is much faster than that caused by peak oil alone. And people seem to at least think they understand above ground factors. I think presenting the combo makes peak oil a lot easier you show the problems then explain we have less oil every year making the problems worse decreasing the amount of oil ....

The focus is on explaining why above ground factors keep pushing us down. In reality its the reverse peak oil is what is allowing above ground issues to grow and fester but I think this is much harder to explain.

So focusing on the effects of peak oil and explaining the feedback loop goes a long way I think to getting people to understand. Global Warming for example has made positive feedback popular. People tend to understand that the warmer it gets the more the planet can warm further.

So a statement like the less oil we have the less oil we are able to pump is pretty simple. I know it removes the emphasis off of the peak but I think thats ok. Because the next statement is oil is declining. Then with that established you can talk about peak and why its declining.

Thanks pal, I'll save you a carrot.

Internal consumption would increase.

At 4% internal growth, by 15 years(from 2005) = 2MMBPD more... They consumed 2 MMBPD in 2005 (EIA here)

So you get, 3.6MMBPD. Close enough for me...one project ends early, etc.

Don't like 4% - how about a nice gradual 2% - then we get 2.7MMBPD - I am 1.3 MMBPD off. Still, getting close enough to be very worried. And that assumed everything is just dandy in KSA and they pump like mad for our pleasure.

Sorry I don't have the latest internal consumption growth numbers for KSA (and got to do some real work), so if you can find them I will plug them in for you. However, I do believe it was higher than 2% from memory.

And just in case you think that demand will be destroyed there, that would most likely be political/Royal Family suicide...in which case, this scenario is generous.

Re: Saudi Consumption

The latest EIA total liquids data, for 2004 to 2005, showed a 22% year over year increase in domestic consumption.

Ouch. Nowhere NEAR sustainable if KSA is at or near peak.. Could we see them go a crash course on electric cars, given the solar potential there?

Ouch. Nowhere NEAR sustainable if KSA is at or near peak.. Could we see them go a crash course on electric cars, given the solar potential there?

The REAL evidence for a peak would be

to see KSA go nuclear...

You said it!

http://www.nytimes.com/2007/04/15/world/middleeast/15sunnis.html

Touche.

Note that the article treats it primarily as a weapons issue (which it may very well be), but it's just as likely an energy issue for people who know the true status of their reserves and production capacity.

Because KSA isn't part of the "axis of evil," though, the weapons potential isn't getting hysterically hyped.

Thanks WT,

I don't think I need to plug in 22%.

That number is a nightmare!

Assuming 8.5 mbpd C+C for 2007, and 4.5 mbpd in 2020, suggests about a 5% net decline rate in production.

Currently, domestic consumption is probably about 2 mbpd (C+C).

So, net crude oil exports are probably about 6.5 mbpd.

For the sake of argument, if they reached zero net oil exports in 2020, this would suggest an annual increase in domestic consumption of only 6% per year, when the last available number showed 22% (Total Liquids).

Wow, want to do some scary math?

If we assume net oil exports of 6.5 mbpd in 2007 and 0.5 mbpd in 2019, this suggests a decline rate of about 21% per year in net oil exports. This assumes that consumption grows at about 6% per year.

If the Saudis show no increase in domestic consumption from 2007 to 2020, their net oil exports would still decline at about 7% per year (a 50% decline in 10 years), assuming a production rate of 4.5 mbpd in 2020.

Who was it that did a chart showing some net export declines?

22% is ridiculous -- probably reflects growing refining capacity and export of refined products rather than crude (solves the NIMBY problem) or export of other products with petroleum inputs (fertilizer, chemicals etc.)

Local petroleum subsidies won't likely remain 10yrs. If local prices match world prices, then decline in local consumption is likely to be in line with decline in world consumption = decline in world production.

I researched the numbers some in the past. KSA according to the old numbers had a per capita consumption less thant the US . At like .06 mbpd per million. While most of the ME that reported real numbers was at .11-.18 mbpd per million. The US uses around 20mbpd for 300 million giving a 0.67 mbd per million. Just using this for KSA gives for 24 million people

24*0.067 = 1.6 mpd.

using a ME number of 0.16.

Gives the more realistic figure of 3.83 mpd.

The ME countries that actually report usage correct tend to consume at twice the rate of the typical American today and near what it was in the US in the 50-60s when gas was cheap.

In these countries gas is dirt cheap so it makes no sense for them to have consumption patterns lower than the US.

This 22% hike probably has a lot more to do with corrected accounting for internal usage. I've never been able to find out how internal usage is actually reported. For example I think Russia is probably already in decline but inflating their internal usage numbers we have no real way as far as I know to verify these numbers but we do have good per capita numbers reported for the US and Kuwait for example and also lots of countries so its hard to lie to much about these numbers.

I sent several private emails to WT and posted them giving the case that KSA should have much higher internal consumption that reported. The systematic under reporting of internal use was probably easily hidden by pumping supposedly idled spare capacity to handle increases in the internal markets. Until they peaked it was not a issue just means they have probably pumped sever GB more than they have reported say 2-5GB. So consumption has probably been 40% higher than reported for a very long time. Lets say its 1mpd low this gives 0.36 GB a year so for 10 years its 3.6 GB in the past this was small change for KSA worst case its like 15GB total of "missing" oil thats already been pumped and went unreported. Generally its probably the best grades or was.

So overall I think that someone woke up and corrected the reported numbers since its now within the range we would expect. As you can see they make a real difference now.

KSA's population grew from roughly 7 million in 1980 to about 28 million today. Most of these are young. Do the math yourself.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

Any idea what proportion of Saudi domestic consumption the oil industry would be responsible for?

If we expect EROEI to decline in the future, isn't that the same as saying that we expect domestic consumption to become a larger and larger share of production, as the energy needs of the oil production infrastructure increase?

In other words, declining EROEI is manifested as declining exports, as the oil production process requires progressively more energy and thus drives increases in domestic consumption by the producing nations.

This in turn implies that most "domestic consumption" of crude is accounted for by refineries, which send the refined gasoline and diesel staight back to Aramco to help with the drilling and extraction.

Comments?

If we are to believe in things we cannot see or touch, how do we tell the true belief from the false belief?

This is one of the many feedback loops possible. Actually its a generic problem. The division between domestic and export is artificial except for the subsidy issues which aggravate the situation. The problem is once world peak production happens your left with a Pandora's box of positive feedback loops. Every where you look you see escalation that results in lower oil production not only are their positive feedback loops but they are intertwined. I gave and example like this in another post of the case where bunker fuel for ships was in short supply so tankers where allowed to fuel first. Unknown to the harbor master and the captain of a container ship it carried needed supplies for a refinery without them the refinery remained closed. The last of the fuel available for weeks went to the tanker which quickly sailed its cargo to the refinery which of course was closed because of the critical parts setting on a container ship waiting for the refined product.

Its a almost infinite number of situations like this that occur post world peak which will lead to a rapid breakdown in the oil supply chain production and eventually oil production itself. Post peak a large number of solvable problems go unsolved leading to a cascade of problems.

I'm beginning to understand why positive feedback is not welcome unless your building a atomic bomb.

Memmel, you are pre-supposing that there will be shortages post-peak. What will happen is that price will adjust upwards so that demand will be reduced to match the available supply.

Isolated shortages may occur due to unforeseen circumstances, but in general your scenario is unlikely to play out in great numbers.

One thing that is not seeing enough discussion is the slope of the production curve post-peak. If the yearly global reduction in supply post-peak turns out to be relatively mild, all the survivalists and ELP-preaching / implementing people are going to feel very foolish.

Oh, everything will be peachy keen, eh?

Look at 1979-1982 please. Go look very carefully. This was the last time the world saw serious declines in oil production year over year. Then tell me what happened. And that was only a couple of years. The economic growth reignited exactly at the same time that production turned up. Coincidence? I say absolutely not. Higher levels of energy have been the driving force behind economic growth for the last couple centuries. Declining energies will mean contraction, endlessly, year after year after year.

Yes, prices will get higher but what about those that find themselves priced out of the market? What happens in the 8th or 9th year of straight declines when you cannot get oil at all and your house is a 30 mile commute from work, you owe $350,000 on it and you've taken two salary reductions already just to stay employed? Ever heard of upside down mortgages? What happens when massive amounts of mortgage debt, which has been repackaged and sold as "securities", goes bad? Who else gets dragged down?

It is amazing that we see posts like what this every day yet people like you fail to take note of history. The US and world had plenty of resources, plenty of people who wanted to work and were willing and able, yet after the Great Depression began they could not work. They got thrown out of housing to live in shanty towns. No one could hire them because there was no medium of exchange that allowed for economic growth, and economic growth is the ultimate of Ponzi schemes, always dependent on increasing population and increasing consumption, actions which can be mathematically proven are unsustainable.

But go ahead and continue to believe in the fairy tale to which you cling. Once peak is reached and the downward spiral begins in earnest there will be no turning back. You know this, deep in your gut you know this, but you are terrified of it so you invoke every hoary superstitious image in your personal pantheon in an effort to keep the bogeyman at bay. I've got news for you, reality doesn't care what you believe.

Finally, let's take this gem:

Tell me - absent monetary inflation, exactly what is rising price except a shortage of goods in the market? Yes, that is exactly what rising price in response to less available goods means - a shortage.

Do you want to try this entire discussion again, this time with your eyes wide open?

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

Greyzone,

Agree with you completely. Although this is my first

post to TOD, I've been lurking for over a year or so, cutting my teeth with the dieoff, Energy Resources, etc.for the last five years.

I'm a retired mechanical engineer and rancher, vividly aware of peak oil for the last 20 years or so after listening to a eye opening lecture at CalTech which piqued my interest in finite energy sources.

Personally, I think the next five years are going to be real eyeopeners and will catch 99.99% of the population with their pants down.

Enjoy your posts.

Blair in Oregon

I think you missed my point. No knock against you GreyZone, but there are some people here who are so desperate to believe what they want to believe that they see what they want to see.

To reiterate, I said:

I stand by that statement. If the decline rate is mild, prices will go up, and we will respond by becoming more efficient. Yes, certain parts of the world will feel the pain more acutely, but there there is so much potential for efficiency improvements that the developed world will ride down the curve relatively unscathed.

Now, if the post-peak decline rate is extremely rapid? That's a whole other ball game.

This brings to mind some of what's missing from the peak oil discussion, things like an analysis of what decline rates might be post-peak, an analysis of how rapidly energy efficiency can increase due to price increase, etc. We have data points from the oil shocks of the 70's, and also more recently from the recent run-up in oil prices which has encouraged efficiency improvements world-wide. Quantifying some of those improvements and making some predictions based on them would be a very worthwhile endeavor.

Finally, I must address this quip:

I must disagree with this statement. The price of oil has more than tripled over the past few years. Do you see global shortages in oil right now? There are people out there who would buy more oil at $50/b than they would at $60. There are people who were buying when oil was $20/b and are not now at $60/b. Does that mean they are experiencing a "shortage?" Of course not. Price regulates the quantity demanded. As long as prices are allowed to increase (no arbitrary price controls) then there will not be extensive shortages, even post-peak.

You have got to be kidding me. No shortage right now? How do you think prices got this high? Just because YOU don't see the shortage directly does not mean it is not there. Indonesia has fuel riots, for gosh sakes. Other countries have completely stopped buying oil.

We have had increasing demand in the US, increasing demand in China, increasing demand in India, stable demand in Europe. In contrast, many third world nations are experiencing shortages. That's who the shortages affect first - the poor!

Yes I do see global shortages of oil. It is evident in Indonesia, China (KSA cutting contractual deliveries), India, throughout Africa, South America, even in places here in the US. If you don't see it then you are simply refusing to open your eyes.

My gosh... next you will tell me that these price increases are part of some oil company conspiracy!

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

GreyZone, it's difficult to have this conversation with you as it's clear that you have less background in understanding how global financial markets work. That's not a knock against you; we all bring different knowledge, talents and experience to the discussion. I just don't have time to write a lecture.

Some of our misunderstanding could be due to differences in terminology. Perhaps when you say 'shortage' you really mean excess capacity? If you say that excess capacity now is far less than it was a few years ago and this is one reason for the run-up in oil prices I would agree with you.

However, 'shortages' in the classic sense imply something else. Shortages imply consumers being turned away from gas stations due to lack of gasoline / diesel, oil tankers being turned away empty due to lack of oil, etc. This is just not happening on a global scale.

However, if one were to artificially prevent prices from fluctuating naturally by placing an arbitrary price cap on oil, then should demand increase or supply decrease then yes, one one see shortages. This is not what we are seeing, as the fluctuating price acts as a lever to ensure that demand always equals supply.

Ener Ji

I think I should sic memmel on you he will talk to you like a Dutch uncle and then you can come and grow carrots with me, okay?

Using GreyZone's term 'shortage' in your classic sense one may construe:

'Due to the reduction in excess oil production capacity there is a 'shortage' of homeless people on the street.'

I think your global financial markets are very good at marginalizing and then dismissing. As the pond shrinks life at the edge dies.

I once had my economics 100 teacher to the point of admitting that money is wealth using his own premises but, to the sound of much class laughter, he slipped away with a knaves trick of not answering. I think you are doing a similar thing in not considering the effects of 'reduction of production capacity' on those at ponds edge by not answering for the effects on them.

I have to agree that the rate of decline is the all important variable. It would nice to see a key post on this issue. A low rate of decline will allow western society to "mark time" - that is no growth while total energy supplies remain constant and oil is replaced by alternative supplies or conservation. I think that a decline rate of 3% should allow this - what is the logic of three percent. Simple: we have approx 3% growth in western societies at the moment and constant oil supplies (constant since 2005) - this implies energy efficiency/alternative supply is able to enable to provide for 3% growth. I think Stuart may have published something a while ago on TOD about the rate of substitution possible, anyone know the post?

Very high decline rates - 10% or so could cause near collapse of society - so I think it is pretty important to know what the decline rate is likely to be.

I don't think you have included, in your vision, the effect that increasing environmental degradation is having, of course the 'system' has no concern there, does it, in fact I imagine the New Orleans disaster works out to be a goodly part of that 3% growth factor. The hurricane's effect being merely an externality. Minus 10%,??? 0% and we wither and die.

We have built a house of cards predicated on an ever increasing energy supply and growth in 'wealth'. I think we have good reason to be nervous. I have been involved in the market as an investor for 20 years and have the same hollow feeling I had 6 months before the dot com. bubble began to pop. My broker, of that time, merely said 'tish tish avarice will provide'. I got out with half my skin that time I don't know what will happen tomorrow (do you Mr McGarrity?).

I don't see much comfort in your thoughts that our Cutthroat *hole Fridman Capitalistic World Corporate Growth (anyone know how to capitalize an asterisk?) may be extended using alternatives but I am going to take a look when I have time to see if there is that article by Stuart you mention, if the search on this site works as well as the rest of it does (kudos to Super G) it shouldn't take too long.

I think home growing of carrots will be a growth industry in the future economy.

Capitalism is a positive feedback system - think about it.

This may be one reason so many people who grasp this instinctively overreact.

But America is a very special case, where free market capitalism has also assumed the role of a religious totem for many, an answer to all wordly concerns. Even the term 'invisible hand' plays into this.

And yes, it has been my opinion since roughly 1981 that the U.S. has been following paths likely to lead to pain a magnitude greater than necessary, in part because the alternatives would seem to be contrary to the demands of a capitalist system, as understood in the American context. Small has never been beautiful in America, after all.

Hello WT, Darwinian, and other technical TODers,

I greatly appreciate your postings--hope it continues for a long time. But what worries me is a future TOD brain drain: as PO becomes more data obvious, Peakoil Outreach continues to spread, and resource shortages, blackouts, and violence keeps increasing in blowback force-- we will start to bail out from posting to direct our efforts to our own personal and family ELP-- perhaps TOD needs to help others prepare by encouraging libraries nationwide to archive TOD on CDs or print hardcopies for those that wish to inform themselves and others later. Obviously, the librarians would need to print out the weblinks too before they go offline forever from Olduvai Gorge.

Do you think we need to start an email campaign to our local libraries pleading for them to archive TOD, or do you think we still have plenty of time for them to download & printout TOD later?

My guess is that my local branch spends a lot of money for crappy 'Iron Triangle' copies of People magazine, Vogue, Yachting, and other pointless dead-tree info. They could easily stop these subscriptions, then divert these funds to archiving TOD for display. I think this would help spread Peakoil Outreach more rapidly potentially saving many future lives.

I asked about leaving Thermo/Gene handouts for free dispersal, but the librarian told me that this was not allowed on public property. Spreading Peakoil Outreach to newbies by one to one verbal facetime is frustratingly slow [but I must admit quite satisfying when I see them get that 'thousand yard stare' from the initial comprehension]. I got to 3 young adult newbies yesterday in a Mexican restaurant. =)

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Bob Shaw said:

"we will start to bail out from posting to direct our efforts to our own personal and family ELP-"

Yes Bob and that is one of the main reasons I no longer intend to do much if any further posting on TOD. Too busy, far too busy to listen to rants and raves by egoseekers who just put in time to preen their feathers and denigerate anyone who gets in their way.

I am extemely busy and will have basically very limited time to do other than lightly peruse this site now and in the future,if at all.

In the past I tried to post what I 'observed' out here in farming country BUT for most here is was so far from their understanding as to be a worthless attempt on my behalf as well as taking a lot of flak over what I portrayed as the farmers responses to the future crisis.

Once more then I will state it for the last time.

If anyone thinks they can just walk (or run) to the nearest farmers grain bin or to his fields where the animals graze and just blithly help themselves they are very very sadly mistaken. There will be NO National Guard robbing anyone for YOU. Your really not that important.

If you are not ready to provide for yourself in this future period then you surely must not expect others to do it for you and they simply will not. All the bs about Darwin will be seen as to its truth or not when this all gets started.

Wake up folks and smell the burndown.

Airdale-no need to answer,I likely won't be reading it.

Spring weather has put everyone way behind. If this is the makeit or breakit year then its not stacking up very well in AG. Thousands of dead acres being sprayed down, or bushogged and replanted. Just in time to later hit the pollen killing summer heat(for corn). Massive dieoffs of animals who need nuts and mast to survive and lay up for the winter. Bad peas all around. Bees get a double blow. No one here seems to really understand that FOOD is going to be all that matters.

Talk all you want but sustenance deals the joker and has all the hole cards.

Airdale,

I appreciated ALL of your posts and will miss them, but definitely understand what you are facing. I too am finding that I spend too much time on TOD, time that I should be putting into ELP. We've made lots of progress, but still have much more to go before I even begin to feel "okay"-- whatever "okay" means. Every time I read one of your posts, I realize just how much we still have to do.

I wish you the very best and hope that you will still post on occasion as your posts are very valuable to those of us trying to become self-sustaining when it comes to food (and survival).

All of the bad news about crops this year, combined with the bee problem and water problems should have everyone concerned. Instead, most people I talk to aren't even aware that they are problems.

Take care Airdale!!!

Cheryl

Airdale, sorry to see you go, I found your posts informative. I'm putting together my own small farm in France and the feedback from others doing similar things is invaluable.

We're receiving different type of weather here in Europe with temperatures over 20celsius (68 fahrenheit). Seems we went from mid winter to mid summer and skipped spring, everything is in bloom, but few bees around. Not sure what this means for the rest of the year, but its sent me into a frenzy of activity to catch up. Lack of rain means the ground is already drying and its only April, so I bought a 1000 litre water tank yesterday to ensure I can keep my beds watered.

I would think Europe will have a good early crop, but not sure about the rest of the year. When it comes to food, I think climate change poses the greater threat than PO. The combined effect of economic, energy and weather related problems may just be too much for agriculture to withstand.

Agriculture may well move on to horticulture on a massive scale in order to control environmental aspects. Wow! That would need lots of energy and money... opps!

What is to become of agriculture? Is this the really elephant in the room?

In the biggest norwegian farming magazine Bondebladet (literally "the farmermagazine") there used to be for many years an american correspondent writing, a monthly culoumn I think it was, about what was going on in american agriculture. For me atleast your posts give much the same insight, and I have appreciated them.

"I got to 3 young adult newbies yesterday in a Mexican restaurant. =)"

Just to sit in and listen to one of those conversations would be priceless.

-best,

Wolf

Hi Bob,

Just an idea: Are there any co-ops over there?

WT,

What would you estimate the threshold of demand destruction is from developing countries? ie. How much would likely be trimmed elsewhere before moving higher up the oil chain?

I ask because it could be predictive of when price/demand shocks will occur in each tier of world countries.

Typo ... and no edit left.

" = 2MMBPD" should read "= 1.6MMBPD"

That plus 2005 consumption of 2MMBPD = 3.6MMBPD.

This is probably saying the same things that you said Ener Ji, but I'll make this post anyway.

What I find interesting that just about everyone misses, at what point is a oil producing country going to stop exporting their products and keep what is left for them selves. How many years do you think they are going to keep in reserve? I bet that it will be in the GB numbers, so total reserves are still not a valid number when considering products for exporting. Just a thought ;).

Think of Russia at first.

Russia probably will go this route but they have a industry outside of oil/gas. But it makes more sense for them to simply keep producing and investing in their internal economy and let internal demand erode exports. Their is no real reason to cut exports that I can see. I could see them cut investment into expanding or maintaining which has the same effect of withholding oil. So what probably will happen is they will simply continually lower investment as oil gets more expensive driving production cost higher and over all this is what initiates a vicious cycle that leaves the oil in the ground. The effect is the same but I see no reason for a determined policy to conserve oil it will happen on its own accord.

Eventually of course since even Russia economy is primarily fueled by exports it will begin to collapse but at that point they would have blown all the money they should have spent on their energy infrastructure.

In general the oil exporting nations will probably fare worse after peak oil with the exception of Canada and Russia which both have other large resource reserves and a low population. On the intrinsic wealth/technology scale its probably.

Russia

Canada

US/Brazil

South Africa

Europe

Other South American countries

Africa

Western Asia not China

Central Asia

Middle East

China/India

Notice China and India vie for last place since their huge

population become a big problem when no one wants to buy cheap plastic junk and food exports collapse.

I am always surprised to read things like this:

What does make the US/Brazil better prepared than Europe? Is it Ethanol or is it the low EROI, rapid declining lower48 production?

I would presume that in a peak oil scenario the countries that could better cope with the declining oil imports would be the most energy efficient ones and with the lowest debt level per capita. To be honest with you I don't think the US fulfills either requirements.

The European Union original 15 countries produce 30% of electricity from nuclear (France 80%, Germany 40%), 16% from renewables (Austria 60%, Norway nearly 90%, Italy 30%) and the remaining 54% from Natural Gas and Coal.

Unlike North America the Natural Gas supply for Europe is not declining yet and it is very unlikely to reach its peak in the next two decades.

The EU relies on already existing pipelines for its gas imports from the FSU and North Africa. Most LNG regas projects are now underway to provide backup capacity rather than anything else (only the UK has serious NG import and storage infrastucture problems).

The oil consumption in Europe has been almost stagnant since the '90s. The average fuel efficiency of a european car is 38 MPG, roughly 50% of the car fleet is now made of direct injection diesels (with a mass of less than 1000kg) that can drive at 40-50 MPG. Some new diesel mini-cars can already reach 70 MPG and those are selling fast. In addition to this about 20% of taxis in Austria, Italy and Spain are already powered by Natural Gas.

It is now possible to travel by train from London to Paris in 2 and a half hours, from London to Rome (1800 miles circa) in less than 12 hours. Some projects already in advanced state of construction will further cut this time down to 8 hours. Italy alone has 16000Km (about 10000 Miles) of electrified railways covering a country the size of Florida; (France has 40000KM of electric railways).

London is buying 6000 diesel-electric in-series hybride double decker buses to backup a mass transport system of 14 underground lines already capable of commuting 9 milion people per day.

Or maybe I can tell you about the city of Leiden in the Netherlands where I have seen at least 10,000 bicycles parked in front of the local train station.

I can see the EU easily cutting its oil consumption by 50% in the next 15 years without a major breakdown in society.

But I am sorry I can't really say the same for the USA!

I've heard this logic before and can't say I agree

100%. The premise is that exporters will curtail

domestic consumption to make "money". That's such a big kettle of fish that it can't be addressed in a simple

post, but...why? To make dollars, an increasingly

empty paper promise?

The premise is that dollars are a store of value,

obviously dubious. Or a means of exchange-only if

you do so quickly, or with someone who doesn't otherwise

denominate their transactions in dollars(unless you

need to buy a big pile of weaponry quickly).

Same logic applies to euros, yen, etc., to a greater

or lesser degree. No?

Where the heck is Don Sailorman?

Unless you're running a closed economy, you need money to trade with outside nations. You need money purchase those things that you can't or don't produce domestically. For many oil-producing nations, their primary export is oil. If they wish to continue importing goods (think food, medicine, technology, consumer goods, etc.) then they will have to maintain oil exports so that they have something to trade with.

What seems to be missing from this discussion (and most peak oil discussions, unfortunately) is the impact of price. Prices will increase substantially post-peak, and the domestic consuming population of oil-producing countries will have the same incentives as the rest of the world to conserve and become more energy efficient. While it's true that many countries subsidize the cost of refined oil products for their domestic markets, as prices increase these subsidies will have to be reduced so as to 1) not bankrupt the government, and 2) send the appropriate price signals that the populations needs to conserve and become more efficient.

Any 'projection' of increased domestic oil usage post-peak are extremely flawed without analyzing how much oil prices may rise, the corresponding drain on state finances to maintain subsidies, and the long-term strategic imperative to reduce domestic consumption so that there is sufficient oil to export. Without sufficient oil to export, there will be no money to import.

As far as I can tell the plan seems to be to subsidize until your bankrupt. This seems to be what Iran is doing. They threaten to unwind subsidies but are unable to carry out the move. Indonesia

http://www.mises.org/story/1906

http://peakoildebunked.blogspot.com/2005/10/120-gasoline-subsidies.html

And recently.

http://english.people.com.cn/200611/09/eng20061109_319937.html

Understand Indonesia is no longer a net exporter of oil and they are having a hard time eliminating subsides I can't image trying to do it while you still have significant exports. No one has tried.

I posted a recent Iranian link already. They talk about it

often.

Venezuela is digging itself very deep into the subsidy grave.

Overall we have the example of Indonesia that only cut after they became a importer so any argument that a country will cut subsidies early would need at least one example.Mexico ?

This is an interesting discussion. Oil-producing countries face a dilemma when they peak: 1) cut subsidies to encourage efficiency and protect exports, or 2) maintain subsidies at great financial cost, reducing exports and ability to import goods and services that the population also demands.

Quite a dilemma! My prediction is that eventually they will have to unwind some of these subsidies, and that some of the later countries to peak will (perhaps) learn some lessons from the mistakes of the initial countries to go through this.

I suspect that TPTB in each country will simply keep subsidies up stop investments in infrastructure and bleed as much money as they can out of the country. When the crisis hits they bail. I'm pretty sure a lot more Saudi Royalty will be living overseas in the near future. We don't actually know what the Mullah's in Iran do with the money. Nigeria has been on this path from the beginning. I suspect Russia is the same way.

So It will be run it as long and as hard as you can and when you can't bleed the country then bail.

Very few of these governments have the popular support to do the right thing. Lets watch how Mexico handles it they will hit the wall first I think. I'm sure KSA will be doing the same.

Hi m,

re: "When the crisis hits they bail. I'm pretty sure a lot more Saudi Royalty will be living overseas in the near future. "

Q: Where do they go? And Why?

1) Is it a case of "away from home, no one will recognize you and you won't be a target" - ?

Or is it -

2) "Somewhere else is better/more livable...?", which seems a dubious premise.

A good chance the US or England or both. The own property all over the world. I'm not sure how much time the royal family outside the king spend in KSA today. People with that sort of wealth are simply beyond my understanding in the sense of where they live is a nebulous concept. As far as targets people with this much power are always targets for assignation so I'm not sure it changes the situation much for them.

Its loss of power and future earnings that they would have to deal with but once the excess revenue dries up future earning are bleak. I think a lot of people don't realize that the NOC are based on the concept of outrageous profit margins say 1000% profit from oil. As these margins drop even to what we consider ridiculous levels it has a big effect on the net cash flow from oil. The up front costs of extensive oil development projects is a problem for many if not all NOC's. Even KSA is suffering sticker shock these days. And of course internal needs are increasing exponentially and on top of this the real purchasing power of the dollar is falling off a cliff and most of these countries have large dollar reserves. Not only is the dollar dropping relative to other fiat currencies but all of them have had a insane about of monetary inflation recently.

And we have seen price pressure across the board.

The interaction of this debt based monetary inflation and negative growth with price inflation in perishable items and deflation in asset prices effects everyone we have a global economy the economies of oil produces and consumers are tightly intertwined. Rising oil prices ten to result in a slowing of the flow of money as it has to go for oil purchases then through the oil companies and governments before finally being reinvested. It does not change the absolute amount of money. I don't care if a Saudi or American gets the next billion dollars I do care that by routing the money back into KSA it takes a long time before its reinvested and the is "real money" not debt. So the net effect is to take a lot of cash out of the system by slowing the velocity of money. China reserves have a similar effect.

how 'bout the us model : subsidize consumption and print money and more money and drop money from helicopters to maintain consumption

Dear Ener,

I cannot recall even one nation that curtailed domestic consumtion BEFORE they had nothing left to export and instead started to import the oil.......

Roger From the Netherlands

Perhaps that's because most of the nations we've been tracking who have peaked have had relatively diversified economies and did not rely exclusively on oil? I'm not sure, just a thought. My feeling is that an economy that is wholly dependent on oil revenues will not allow domestic consumption to keep rising so as to maintain exports for as long as possible.

Mexico may be an interesting case study, although their economy is diversified enough that I wouldn't say they are wholly dependent on oil exports. I'm thinking primarily of the major producers in the Middle East. The smart ones are rapidly trying to diversify away from oil, but it's not an easy thing to do.

I'm visiting my happy place first two weeks of June. It's in the southern hemisphere.

Good luck, Matt. I hope it works out as you wish.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

Would it by chance be in Patagonia? I've been studying the map quite a lot, and I think that's where you're heading... Best of luck to you anyway!

Matt gave himself away a few months back when he posted a pic of the International Space Station! BYOB dude!

Hi Matt.

What's your take on St. George's island? I understand the British maintain a small garrison there. Could one at least visit if one were so inclined? You'd probably need to use sailboat transport to get there.

Oops.

I meant South Georgia Island (in the South Atlantic). And never mind.

The US Military should be clearing the way for you within the next couple weeks. Vios Con Dios.

Sweet.

Post pictures, GPS coordinates....:-P

Aren't happy places great! I'll be spending the better part of the next 4 months at mine.

Ace,

I have been waiting for this post

You state that Saleri says “Our typical depletion rate is about two percent” but he asserts this is only in the context of fields currently under production. Read http://www.saudi-us-relations.org/energy/saudi-energy-saleri.html to confirm this point. In other words, the “typical depletion rate of 2%” relates only to the initial reserves of those fields, not to the entire initial reserves of Saudi Arabia.

This means that he is specifically excluding fields which are not yet in production (eg Abu Hadriyah, Khursaniyah, Fadhili, Khurais, Manifa, Shaybah extensions, Nuayyim (and other Hawtah trend fields), etc).

By your reasoning, would this not mean Saudi is implying that the initial reserves of all fields currently in production is about 175 Gb, with remaining reserves from those fields of about 65 Gb?

On another note, Saleri clearly states in the above presentation that recently developed fields such as Shaybah and Haradh III have been developed with MRC smart wells, and that these wells can produce at much higher rates than they currently do. Though he doesn’t use the exact words, this implies to me that these wells are being deliberately choked back in order to maximise the long term production of reserves rather than to maximise production rates today. I have made this argument before here on TOD and been flamed for it, but I do think it is one worth exploring again.

Having said that, however, I ask myself why Saudi would go the expense of developing further Shaybah extension fields, if they could simply increase production by opening choke valves on the existing Shaybah field, where they claim they can produce 1 mm bpd, rather than the current 0.5 mm bpd. This is one for the reservoir guys out there to answer.

Since the original Shaybah field was developed with smart MRC wells, how much of a difference would it make to ultimately recoverable reserves if they produced the field at “full bore” rather than choked back? Intuition tells me that they would lose some production, but that this amount would be relatively limited by the technology of the smart MRCs. Isn’t it the point of smart MRCs that they can be shut off the moment that water becomes a problem, and thereby maximise the ultimate volume of oil recovered?

If this is the case, why not simply pump Shaybah at 1 mm bpd, and save the development of Shaybah extension (and other) fields to a later date?

As usual, I have more questions than answers, for which I apologise.

Not likely. However it doesn’t matter all that much. Historically 90 to 95 percent of Saudi production has come from those giant fields. Assuming he was talking only about those giant fields, then that would still mean that they were depleting at a rate of at least 1,8 to 1.9%.

Actually I think Saudi actually believes they have over 265 billion barrels of proven reserves with another 200 billion of probable reserves. If this is what they were talking about then 2% would be about 9.3 million barrels per day.

Ahh, but all those fields have previously been in production. Some, like Khurais, was closed down because of very poor production. Khurais was closed down after a massive gas injection program failed to increase production. A couple of others were closed down because of very heavy sour oil. At any rate none of them produced very much oil when they were shut down. Khurais, at its peak produced 144,000 barrels per day. And after the gas injection program, they were producing less than half that when it was closed down.

Indeed if that is truly the case then Saudi Arabia is in very deep doo-doo. All those other tiny fields just don’t have much oil in them. If their giants are down to 65 Gb, then all Saudi has less than 75, Gb.

A very good theory but there is absolutely no evidence to support it. In fact all the evidence suggests that, at least in the case of Haradh III, they are producing flat out.