Another thought on coal supply

Posted by Heading Out on June 28, 2007 - 9:19am

The National Research Council, as Leanan reported earlier, has just issued a report Coal: Research and Development to Support National Energy Policy dealing with both current reserves and needed research. While I haven’t had a chance to read it in detail yet, there was one paragraph I thought worth mentioning before I write a longer review, and it is this one.

Despite significant uncertainties in existing reserve estimates, it is clear that there is sufficient coal at current levels of production to meet anticipated needs through 2030. Looking further into the future, there is probably sufficient coal to meet the nation’s needs for more than 100 years at current rates of consumption. However it is not possible to confirm the often-quoted assertion that there is a sufficient supply of coal for the next 250 years.

I had written in the non-too-distant past about why coal reserves can be smaller than those anticipated. There is, however, a current part of the in-situ deposits that are not considered, and to illustrate what I mean, I thought I would use the example of the Prairie State Energy Campus that is being developed in Southern Illinois. This is a 1,600 megawatt power plant that will serve customers in Illinois, Missouri, Indiana and Kentucky. It will be served by a dedicated adjacent underground coal mine. It is one aspect of this mine that I thought I would address here.

The mine is planned to produce 5.9 Mt/year (pdf) of coal for the power station, and given that it will be in operation with a planned life of 30 years, this will mean that the mine will need a current reserve of some 180 Mt. However, the coal is to be extracted by Room and Pillar Mining with five continuous miners working Super Sections, and leaving pillars of coal to hold up the roof, with the pillars measuring either 18.3 or 21.3 m on a side (60 to 70 ft). The 2.1 m (7 ft) seam is between 60 and 90 m (2-300 ft) below the surface at this point.

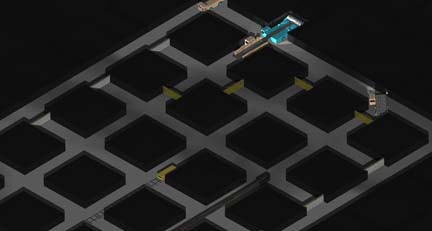

As currently planned there will be no secondary recovery, which means that the company will not go back, after the area has been mined to the boundary, to try and recover any of the coal left in these pillars. I have explained how Room and Pillar Mining works in an earlier post, but let me just revisit one illustration from that to get to my point. The view looks down on the working area in the coal seam, with the overlying rock layers removed.

As you can see, and this is just one of the working sections of the mine (not including the additional equipment for the Super Section), the pillars are larger than the entries and cross-cuts. While I don’t have these dimensions for the mine, a reasonable size would be 6 m (20 ft). Now if you are defining a 60 ft pillar with a passage 20 ft wide around it, then the relative amount of coal you are removing is ((80x80) – (60x60))/(80x80) or 43% of the coal. In fact there will be larger pillars left in strategic places around the mine, and I have used the smaller, rather than the larger pillar sizes to give the greatest percentage extracted.

In other words, of the coal that is in place, less than 50% will be mined, while the rest will be left in place. Typically, after an area has been mined in this way, the coal that is left is considered lost, since the area that is abandoned may fill with water, or noxious gases, or the roof may, with time, collapse. However there are mines that have been entered many years later where the conditions have remained good.

So the countable reserve for that seam of coal, being won this way, is for less than half the coal in place. Now that does not mean that there are not other ways to mine the coal. However, given how shallow it is, and the need to ensure that the surface remains undisturbed, this, at present is how the mine is planned to be operated.

Now it could be argued that leaving more than half the coal in place is depriving our children of a resource that they might need. However I didn’t want to get into that discussion today, rather I wanted to point out that there are resources not currently considered as reserves, which perhaps might be as the need becomes more apparent.

I am going to try and get hold of a copy of the NRC report this week, and will try and tie this into a greater discussion of what is and is not the state-of-the-world in regard to reserves. But in part that discussion revolves around methods used to extract the coal, and the innovations and creative new techniques that can be developed to do this safely, and with a higher extraction ratio. Unfortunately that is not likely to happen soon. As the report notes:

Over $538 million was spent by federal government agencies for coal-related research and technology development in 2005. Of this, more than 90% (~$492 million) was directed towards “downstream” aspects of coal use, mostly coal utilization technology development and transmission research funded through the Department of Energy (DOE). Federal support for R&D activities related to all “upstream” aspects of the coal fuel cycle – i.e. mine worker safety and health, resource and reserve assessments, coal mining and processing and environmental protection and reclamation- accounted for less than 10% of the total federal investment in coal-related R&D. Federal funding in 2005 for individual components of upstream activities ranged from $24.4 million (4.5%) for mine worker safety and health R&D to $1.3 million (0.2%) for coal mining and processing R&D.

UPDATE

I wrote the above part of the post on Sunday after coming back from some time off (and for those curious, having the wonderful Fathers’ Day gift of seeing the Engineer be hooded). Thinking to catch up I had read posts up through the Drumbeat that I had cited, and hadn’t seen Dr. Rutledge’s post when I prepared it. It gave me some several hundred additional pages to read, of which Jevon’s book on British Coal is proving to be one of the more fascinating. (Yes it is that Jevons, and he does write about the paradox in the book).

Jevons points out, for example, that the British population was seeing a growth rate of between 18 and 11% for the ten year intervals from 1800 (thereby going from 9 million to 20 million people) but that the rate was decreasing, while the rate of marriage was increasing. At the time that he wrote the mines were producing some 84 million tons of coal a year, which was largely mined by hand. The treatise has many parts that relate to the NRC report, and it may therefore be interesting to see how things have changed over the past hundred and forty years. However I will keep that comparison to another time, because I would like to correct an impression that I picked up from the piece by Dr. Rutledge who writes as follows:

Jevons wrote that even though the reserves-to-production (R/P) ratio was around 1,000 years, exponential growth would exhaust British coal in the 20th century. Jevons was right. In his time, there were more than 3,000 coal mines. Now the British are down to six major underground mines, with the last Welsh mine, the Tower Colliery, due to finish off its last seam next year. Figure 3 shows a Hubbert linearization for British coal. There is a good trend line, and the very first point in 1854 is near the line. We will see that the quality of the trend is in contrast to the reserves, which badly over-estimate remaining production throughout.

This, unfortunately, leaves the clear impression that there is no coal left in the United Kingdom. So I went to The Coalfields of Great Britain by Sir Arthur Trueman. Because the British Geological Survey has access to the core sections recovered from coal exploration across the country and that there was a fairly comprehensive evaluation done at the time that the industry was nationalized in 1947 the estimates of coal reserves in the various fields of the UK have some measure of validity. The book divides the country into 11 coalfields, and generally assumes that coal will only be mined at thicknesses above 2 ft, and at depths above 4,000 ft. (In which regard there was a comment a couple of weeks ago about mining a 12-inch seam in West Virginia, and in Ukraine they have gone down to 4,500ft).

Let me cite information from just a few of these fields. I quote, first for South Wales:

Reserves (a) In seams 24 inches and upwards, in existing colliery leases, and in those colliery leases projected by the Regional Valuation Board: 6,475 million tons, of which 3,300 million tons will be worked in the next 100 years.Reserves (b) In seams 24 inches thick and upwards in areas not at present leased and which occur at a depth not exceeding 4,000 ft from surface: 3,000 million tons.

Total reserves 9,500 million tons approximately. The output of raised and weighed coal was 46 million tons in 1930, and declined to 25 million tons in 1944. The output of anthracite 5.5 million tons in 1930 declined to 3 million tons in 1944. For the sake of discussion I am assuming that the production in 1930 represented the peak (this was just before the Depression) and you may note that at that rate of production South Wales had 206 years worth of coal left – under the conditions defined.

The depth limitation of 4,000 ft is artificial and its influence can be seen, for example in considering the Somerset and Gloucestershire coalfields, where there is roughly 3 billion tons of coal at depths below 3,000 ft in the fields, which lie within an area of some 270 sq miles.

There is also relatively little account taken of coal seams that run out to sea. In the Kent coalfield, for example, the 2,200 million tons of reserves did not count the possibility, considered good, that the coal continued under the English Channel. (Kent at the time mined about 2 million tons a year).In even the oldest of coal fields, Northumberland and Durham (commercially developed since 1239, though likely also used by the Romans). The reserves in 1945 were estimated at 2,100 million tons for Northumberland and 3,000 million tons for Durham.

It may not be widely recognized but the Coal Measures can extend up to more than 4,000 ft thick, and contain, in N&D, for example, 21 named seams of varying thicknesses. Many of these seams, for varying reasons, have not yet been worked. This illustration, for example, shows the named seams in South Wales. I have colored them red, so as to provide contrast, and the original image is some 6.5 inches tall in regards to the scale.

(Source Trueman - Coalfields of Great Britain)There are a significant number of reasons why the coal industry of the United Kingdom has sensibly disappeared, but, as the above figures illustrate, it is not because the UK ran out of coal. It is more that there were alternative, cheaper, and cleaner fuels coming in from the North Sea in large part. The coal is still there, it has just been too expensive to mine, and the question perhaps becomes when will that change?

And I suddenly realize that there will have to be at least a couple more posts in this series – the first of which will likely compare Jevons and the NRC’s views on coal – with some 140 years between them, and then I’ll try and give some numbers for the rest of the world. Better dig out my colliery brass band CD’s.

HO - I wish you'd been around to comment on Dave Rutledge's post. It was hard work trying to convince certain folks that UK coal mines were closed for economic and political reasons and not because they were empty of coal.

I posted some stuff on UK trade balance and on that basis will bet (yes another pint of Guinness) that we hear about plans to expand deep coal mining in the UK within a couple of years. Quite simply, the UK will be importing oil, gas and coal - and the trade balance which is already shot to Hell will be heading down the toilet. I think we will see a drive to produce as much indigenous energy as possible. Poiliticians will mumble about clean coal technology - if we are lucky that may involve SO2 scrubbers - but I think we can forget CO2 sequestration. Economics of deep UK coal can be modified by subsidies and employing E European miners perhaps.

If you get a chance to do so, I'd really apprecaite an authoratitive review of UK coal - resources, reserves, produced, economics - with maps and data tables - if that's not too mauch to ask:-)

I was down a coal mine once - beneath the Firth of Forth I seem to recall - and there they were alowing the roof to collapse behind the work face. The strata were dipping at some 30 degrees and it was scary as Hell to pear into the abyss that lay beyond the line of roof supports. Room and pillar is clearly not that efficient on the recovery front and you have to feel that this is selected on grounds of safety and operational efficiency. If there was a feeling that the resource was scarce - I'm sure they'd find another way.

How many times have we said "Peak Oil is not running out of oil, but running out of cheap oil"?

Peak Coal is not running out of coal, it is running out of cheap coal. The politics of coal in the UK is a red herring, it is like saying Peak Oil is about geopolitics. Politics is not going to change the EROEI of coal extraction in the UK. Call EROEI "economics" if you wish. At the time the pits were closed, extraction was becoming commercially unviable.

Even if we could produce more coal, CCS would make the econmoics worse, and we don't want coal without CCS. UK coal is dead and buried. Get over it! Surely we have better things to discuss, rather than trying to revive a dead industry.

I do not see an argument on why it can't be that the UK has used other sources of energy (Oil and NG) when these have been cheap and now will return to coal? What is cheap coal?

I guess the world economy would not like a trippling in the price of coal, but if that will double the coal reserves of the world, we are going to burn more coal, simply because other alternatives are even dearer. A worse eroei is not a problem as long as the kwh is cheeper than the alternatives.

A negavtive eroei would of cource stop exploration, but how do you know that a little bit deeper coal seams would give us that?

Comrade Bob, I thinks its time you started posting you're eroei data comparing UK deep coal with surface mined S African and Australian coal, including transportation costs to the UK but ignoring the differnt sulphur contents.

I have no problem accepting that the eroei for surface mined coal may be higher - but is this deterministic? I'm equally sure that the eroei of ME oil is much higher than N Sea oil - and yet we still produce N Sea oil - strange isn't it?

I think one of the main reasons UK coal is not favoured is high sulphur content. And so, like Safaniyah crude, it is unpopular with the market for so long as alternatives exist. But it sure as hell still exists and will be burned one day - that is UK coal and Safaniyah crude.

Why do you keep repeating this nonsense? Please refer me to any study prior to 1984 that mentions the energy required to extract and transport coal in the UK. Informed opinion in the UK coal industry was aware of « Peak Oil » in the early 1960s. I quote Dr Schumacher again, Economic Advisor the National Coal Board from his article « European Coal in the year 2000 » from the German revue « Schlågel und Eisen » February 1963

« According to all the conclusions of a careful investigation of the future, one must accept that the world is approaching a period of energy shortage that will be tied to lasting price increases for all imported fuels. This will not occur immediately…The need for a careful, responsible policy of conservation of the European coal industry should no longer be in doubt. It is clear that that not only the position in the world but the very existence of Western Europe would be seriously endangered if she were faced with an unfillable energy gap. Such a situation does not need to last long before it shakes the political and economic institutions to their foundations. »

Despite the now obvious correctness of Schumacher’s argument, the Thatcher Government sterilised some 6000 million tons of easily extracted, concentrated carbon. If it were true that UK reserves are down to 200 million tons, this must rank as one of the largest acts of vandalism ever by a Government. Fortunately, I suspect it is not true: that there is a lot more coal still down there. It will require a minimum of 10 years to construct new collieries and I was told this morning that Meridian Television (a UK digital channel ) had a program about a month ago about an feasibility study that a private company was undertaking to reopen Betteshanger colliery. I will try to get a video. BTW the private company is Chinese.

Whatever. Lap up what the National Coal Board says. Blame the right wing government. Of course, we believe what KSA says about it's oil reserves, why would they lie? Peak Oil? Nah, it's just lack of investment and politics. Why, there are trillions of barrels of oil yet to be produced.

When annual UK coal production shows a year on year increase, get back to me. Otherwise don't bother.

Again, could we have some evidence please rather than a stupid rant.

It's not up to me to prove the negative. The case for renewed investment is your claim, it's up to you to show some convincing reasons why anyone should put their money into coal mining.

The facts speak for themselves. UK annual coal production has declined since the peak in 1910, and that trend shows no sign of changing. More pits are closing than opening. If this trend reverses, then maybe you have something.

The former Betteshanger colliery has been redeveloped at a cost of £18 million to office, light industrial and leisure use. I guess the Chinese deal fell through.

Instead of looking back to past glories, we need to be investing in less polluting energy sources like wind and solar.

Straw man - nobody's asking you to prove a negative. Nobody's even asking you to prove anything.

What they appear to be asking is that you provide evidence for your apparent claim that UK coal production's decline is irreversible; i.e., that UK coal production is low for geological and EROEI reasons rather than for political or economic reasons. Large coal deposits are known and located in the UK; you are asserting that they are not being mined due to physical constraints. That is a positive assertion, and requires evidence to back it up.

In response, you've provided only semi-coherent rants. Those aren't evidence, no matter how strongly you believe them.

WTF does "not" mean? Hey, is that a negative? "irreversible" is also a negative. You ARE asking me to prove a negative, so don't lie.

Anyway, I am not arguing there is no longer coal down there, nor am asserting there are physical limits. Those are YOUR strawmen, so another lie.

I agree! It is for economic reasons. The "political" decision that was made was to stop subsidising a loss-making industry. QED.

If you think that the economic or political stance will change in the future, it is up to you to provide evidence for that.

Thanks for poking your nose in, but your objections are not even semi-coherent!

You'll have to excuse Pitt. He often confuses posters on this board for the demons in his head.

The system where the roof is allowed to collapse behind the miners is called longwall mining. Obviously, it increases the recovery enormously. Equally obviously, it means that the land above the mine will sink.

My Dad was a mining engineer and worked briefly in a Welsh coal mine around 1938 when he was a student - the rest of his mining career was spent in Africa. I studied some of these things as a civil engineer as we did geology and soil mechanics and so on.

I really don't know why it is still deemed necessary to have humans at the cutting face. It would seem to me that if you can control a drone from the Pentagon that is shooting at cars in the Empty Quarter of Arabia, then you should be able to control mining machinery from above ground - a few miles away. I mean, no one sends divers down to great depths any more - that is a job for ROV's (Remote Operated Vehicles).

Once there are no people below, the safety margins can be redefined. Ventilation can be dispensed with. Escape shafts dispensed with and so on. In many mines, for example the gold mines of South Africa, the miners spend most of their time either being taken to or returning from the Face. Ridiculous and very dangerous and unpleasant.

Just think of it. A highly redundant communications system to the machinery (e.g. Internet Protocol). I guess if some of the money being wasted on "clean coal" went in this direction, it could be done.

Alfred:

A couple of points, first it is actually not necessary to have the ground sink. Sometimes (as when mining under Duisburg) it is something that is wanted, other times, such as mining under the aircraft plants in Coventry, it was not. In the latter case they blew washery waste into the hole left as the supports moved forward, back filling the hole, so that the ground moved imperceptibly. (The story I was told was that the precision lathes were only stopped for recalibration once, and off-line for a day).

In regard to automation of mining, the Remote Operation of Longwall Mining Project ran in 1964. All the equipment on the face was automated, with no-one there. There were some teething troubles, but in the end it was closed because of union opposition (local Union said it was fine, National Union said it was fine, Area level union said no dice, as I heard the story), rather than because of technical show stoppers.

Bear in mind that many of the mines were kept open after Nationalization as part of the social compact and that coal could be purchased more cheaply from abroad by the time of the 60's. With a typical mine employing more than a thousand folk, the transition had to be handled somewhat carefully to allow the development of alternate jobs. Which arrangement went by the wayside during the Thatcher years.

HO,

Thanks for the information. I guess it should be much easier to automate now.

BTW, I was a fan of Thatcher at the time - when all my friends detested her. Now, I am not so sure.

I guess the sudden wealth of her son has something to do with the reluctance of Blair and co. to allow a proper investigation of BAE over the Al Yamamah deal. If he were to allow her scandals to be exposed just think what some future conservative prime minister might do to him!

An easy answer: never.

EROEI will not change. Law of Receding Horizons.

BobCousins,

The costs were labor costs rather than energy recovered being less than energy expended. If the general standard of living is reduced enough a whole lot more can be recovered.

Is the British way of life as non-negotiable as the American, or do you intend to have east european surfs as suggested above?

With coal the transition from good to bad economics can be instant - though predictable. Coal is 'easy' until you reach a fault line, then there is a step change in ROI. AFAIK, there is a lot of faulted UK coal fields left, sub North sea etc. The days of easy open cast or drift mines are long gone

Clearly an issue. The shape of resource peaks of any type depend on how price for the commodity rises. If price starts to rise exponentially this will extend the time to peak.

I would have thought that the break year was '29 with the General Strike. A local mine closed then and never re-opened, were there others?

An easy answer: never.

I doubt it. Coal production there will never attain pre ww2 levels, and domestic coal will undoubtedly never again play such a significant role in the UK's energy mix. But why declare that no further efforts to mine UK coal can possibly have a positive energy return?

Willfull ignorance. Not letting facts get in the way of preconcieved notions-its not limited to cornucopians.

If the width of the pillars is 60ft, and the width of the mined area on both the horizontal and vertical side of the pillars is 20ft, then surely the percentage of coal-in-place which is mined is (70^2-60^2)/70^2 = 1300/4900 =approx 26.5%. This is because if you take 80^2 - 60^2 surely you're double counting all the horizontal and vertical strips (they're included both in the pillar above them and the pillar below, if you can see what I mean). Is the width of the mined passages actually 40ft?

Cuchulainn:

Assuming:

1) all the passages (removed coal) in both directions are the same width

2) all the pillars (coal left in place) are 60' X 60' squares

3) the level of the mine extends to infinity (which of course is not the real world case, but lets assume that it does)

Then:

Each pillar should be "assigned" 1/2 of the passage width on each side of it to create a basic module that can be perfectly packed to fill the level.

Thus:

For 20' passages: 10+60+10= 80' squared = 6400 sq ft per module. Area left behind = 60'X 60'= 3600 sq ft.

This gives 43.75% extracted and 56.25% left behind.

Your query about 40' passages would give:

20'+60'+20' = 100' squared = 10000 square feet per module or 74% extracted and 36% left behind, assuming the pillars are still 60' on a side.

You're correct.........

But if I wanted to nit-pick I'd point out that 74%+36% = 110%........

:-)

Cuchulainn

Ooops, that shoud have been 64% not 74% Between the two of us we will get that scuttle filled in time to cook dinner yes?

Interesting data HO, thanks for your take on Coal, I’ll be looking forward for the ensuing posts.

Although the graphs built by Dave Rutledge are quite convincing I accept perfectly that Coal isn’t finished in Britain. Now what I’d like to ask you (and Euan) is why can’t we see in the trends the mines closed down by political action, what we usually call “above ground factors”. The thing is that we are used to see these interferences quite markedly on Oil production trends (eg Venezuela, Iran, Iraq, …).

What boggles me is that we can’t see any evidence of above ground factors interference on the trend, it just keep trolling its way down along the line. And the politics are well known and documented especially during Thatcher’s early days when the great leap forward on Nuclear was make in order to tame the miners influence.

It is possible that a new Coal cycle may emerge in Britain, but maybe, just maybe, the current cycle is too huge (~ 80 years half life) to be visibly disturbed by such “above ground factors”.

I would compare UK coal to Lower 48 oil.

In the Lower 48, we are still finding small--but profitable--oil fields, and therefore flattening the HL plot, but this is occurring as the long term decline continues. So the question is, are the smaller fields material, i.e., can they bring production back to, or close to, peak level?

In fact, this is the whole question for any post-peak region. We can profitably find and produce smaller deposits, but our post-peak case histories suggest that we can't meaningfully reverse the long term declines.

But it does suggest that we will see an absolute, desperate across the board effort to bring additional energy supplies on line.

Luis:

The problem in looking for "above ground factors" is that there were so many interacting, over such a long period that it is hard to identify the impact of just one.

Firstly there was the transition from manual winning of the coal to machine extraction (a change that was not completed until the '60's). Then there was the transition from the independent mines to a Nationalized industry, with the limited investment available as the government realized that the owners had, in large measure, not been doing the development work needed to sustain production as nationalization approached (to simplify a complex story).

There were also alternating demands from those who wanted house coal (nothing smaller than 2 inches please) to those who wanted to burn it in a power plant (nothing bigger than half-an-inch please). Not quite that bad but on that order.

There were also the increased demands for cleaning more from the coal and when put together over an overlapping time frame, all contributed their part.

Does anyone have EROEI figures, in Britain or elsewhere? This would seem to have a bearing on the amount that can reasonably be mined, if other fuels becomes very expensive.

I asked the question once before, and recall getting answers around 8 to 10 in some US mines. For some reason, when I went back to that post later, the relevant comments were missing. Someone once cited this post showing an EROEI of 25, but the comment at the side of the table where it is shown says "suspect figure".

Obviously EROEI will vary a lot, depending on the technology used and whether the coal is high quality or very low quality. It can also change rapidly as a mine reaches physical barriers to continued expansion.

Charles Hall, et al., presented "EROI: The Key Variable in Assessing Alternative Energy Futures?" at ASPO-5 in 2005. Slide 12 of their presentation gives an overall 80:1 EROEI for coal. (I don't know how to paste it in here.)

Gail:

I am going to have a couple more posts, now that this one is out. The first is going to try and explain (as I have tried in the past) what one counts as a reserve. This is based, in part, on what the cost is to recover the fuel, and that is a function of how you extract the fuel, and both the energy and financial cost thereof.

However I am going to have to work a bit harder on the next one since there is this misperception that EROI is an absolute number. It is generally not, and so I will work up a couple of examples to explain why not, and why it can be lowered quite a bit from current values underground.

The figure for coal reserves conflicts with the one published in that report cited by Heinberg (Ref: COAL: RESOURCES AND FUTURE PRODUCTION EWG-Paper No. 1/07). In table A-1 which it labels as: "History of bituminous and anthracite reserve assessments as published informer editions of the BP statistical review of world energy. These statistics are based on assessments of the World Energy Council (WEC).", it gives historic estimates of reserves for various countries including the UK. Here's some of the figures:

Year Uk (Mt)

1987 9,000

1988 9,000

1989 9,000

1990 8,602

1991 8,602

1992 3,300

1993 3,300

1994 2,000

1995 2,000

1996 2,000 and as low as 220 for the 2005 estimate.

(Just found link for this report. It is http://www.energywatchgroup.org/files/Coalreport.pdf )

I believe this is the document that predicts Peak Coal to be much sooner than was realized. If the figures above in this main article are correct, then it makes one wonder about the validity of the newer estimates of Peak Coal and reserves.

One other point, surely all this talk about mining this stuff again, because if it was done in any serious way, the same would apply for all other countries with similar reserves and it would just tip the climate into castrophic change. As it is and the reports are coming in every day, climate change is alot worse than we imagined and is happening much quicker.

Just recently James Hanson et al, produced this paper "Climate Change and Trace Gas" suggesting we are at the threshold of a flip over. (See http://pubs.giss.nasa.gov/docs/2007/2007_Hansen_etal_2.pdf/ )

The document you cite gets its figures from from the World Energy Council. Going to their web site on coal, we find:

"The world is not going to run out of physically-available supplies of coal.

Any limit on coal use will not be imposed by a limit on the availability of physical resources of coal"

My understanding of Rutlidge is that prior reserve 'estimates' are happy talk and not to be believed. I think he makes a pretty good case for his position from the historical record of these estimates. He may be wrong, but citing one point on the record is hardly a rational refutation of his work.

Sounds like the World Energy Council are more folks who don't understand the exponential function or peak theory, or at least choose not to speak about it....

They talk about "200 years of supply at present rates of consumption" and stop there. Yikes!

If we were to start with 2% growth just from population increase, add another couple or more from fuel switching due to Oil & NGas peaking, then lay a Hubbert curve over it you tell me... Peak coal in 40 years or so?

Some time ago I converted all the stated reserves of coal, natural gas and oil into BTU equvalents and got these numbers

Growth Rate Years

Remaining

0% 90.4

2% 52.1

4% 39.0

Sorry for the ugly format. It looked good when I posted it???

World population growth is currently 1.2% per year and dropping - it's projected to average 0.75% over the next 40 years (link).

If peak coal is in 40 years, that still puts it decades after most estimates for peak oil, meaning that not only can coal be effectively used to mitigate peak oil, when coal peaks we'll have experience dealing with energy resource peaks.

So there's a huge difference between "peak coal in 40 years" and "peak coal in 5 years".

My highlighting. Note how the last sentence doesn't include a phrase like "at current levels"? Even though the last sentence isn't intended to encourage optimism in the longevity of coal, the lack of that qualifying phrase may leave the casual reader with the impression that the preceding sentence doesn't include the phrase either, or at least lowers its importance.

The qualifying phrase nearly always seems to be a throwaway phrase, for its unreality is hardly ever examined in resource reports. What these reports should examine is projected rates of consumption, not current rates. That would make them far more realistic. And with impending oil shortages, the projected rates for coal should be enhanced. Clearly, the growth in consumption cannot be maintained for anywhere near the periods mentioned.

Naively, it seems that it would be possible to fill in the entries and cross-cuts and mine more of the pillars. Is this at all engineering feasible? Or does the volume of concrete required for this tactic cost more than the recovered coal?

North to Alaska

Alaska contained big coal reserves along the northern slope to the west of Point Barrow.Perhaps more than a hundred billion tons. Not likely to beat the Powder River Basin for some time to come.

http://pubs.usgs.gov/of/1995/of95-631/PLATE1/map.htm

If one could figure a way to mine coal under the sea, then one might make a fortune. The North Sea contained thick beds of coal beneath the sea floor. Three trillion tons of coal for anyone wise enough to get it out at a profit. Underwater mine robots to pulverize coal, mix it with water, and use submersible pumps to pipe it out?

http://www.energybulletin.net/11901.html

Three trillon tons might be enough to last the U.S. for 3,000 years.

How much to design, build, maintain and test deploy the robots?

Robots that can work under sea pressure?

There are a number of ways of getting more coal out, which can include taking coal from the pillars as you move back (retreat) from the boundaries of the property. However there are a number of consequences, particularly if this causes the mine roof to collapse, since this can affect the ability to mine adjacent seams.

Pumping waste underground to stow it is becoming quite expensive, but in some metal mines it is the only way to stabilize the operation.

Perhaps the Rutledge warming simulations should be rerun using different recovery factors. That might produce a graph that says 30% recovery 2C warming, 50% recovery 4C warming or whatever. One recovery method not mentioned is insitu gasification by partial burning, which has problems. Similarly the massive new coal-to-liquids plant in Inner Mongolia seems to be taking water from the starving locals. Australian electricity generators say they want assurances regarding future carbon taxation. All is not well with accelerated coal use.

Nonethless 4% (BP yearbook) annual growth continues so that political rhetoric on warming is obviously vapid. If the bounded warming theory is correct then early coal depletion might force some technology changes earlier without making the planet uninhabitable.

I wrote to the UK confederation of Coal Producers this week, from an email positing an oil/gas crisis and asking if deep mines could be reopened.

Here's their response;

So quite a confident position there.

DocScience

There were several coal mines in the area where I live.

They had closed the last coal mine that was operating in the area, in around 2002, not expecting to use coal again.

I had started studying the peak oil problem in 2004.

At that point, I was started telling people that I expected that they would start opening the coal mines in about 6 years.

I also said we needed to keep the rail link to the main line.

Well they took out the rail link, about 12 miles long, in 2005.

I think they sold it cheap, to China.

.

In 2006 they started proposals to reopen one of the coal mines.

They started the process of reopening up one of the mines in 2006

Several of the mines go out under the sea.

I think that they may have flooded the mine on purpose after closing, just for safety, to keep people out.

At the mine that they are opening up, they have been pumping out the water for several months.

It is expected to still take more time to finish pumping out the water.

They are not in any hurry to pump it out faster, at this time. I think that they are doing some water treatment or decontamination before emptying it back into the ocean.

They report the it will cost more then a million dollars a mile to put the rail link back.

Does anyone have any information on underground coal gasification and/or offshore reserves of coal? There isn't much information if one searches Google for the term "underground coal gasification" (no major co's appear to be pursuing it). Underground coal gasification would be a possible way to develop offshore coal reserves.

It is actually somewhat technically more difficult than it might, at first, appear.

DocScience

TheOilDrum has an article about -

“Burning coal in place or in-situ gasification”

http://www.theoildrum.com/story/2006/3/5/010/09681

.

Thanks!

This is pretty much the difference between reserves and resources. When we talk about peak coal, we are talking about reserves (economic coal) and not resources (economic coal plus uneconomic coal). There is a lot of coal left in Britain just like there is a lot of oil left in the U.S. and Mexico but it is the difficult to reach coal.

About the EROEI of coal, this is mentioned in the latest Thane Energy Report along with the relationship between price and net energy. It can be found at:

http://analyst.energy.googlepages.com/TERNumber6.pdf

and

http://analyst.energy.googlepages.com

This is a great initiative to develop sustainable energy. Technology buffs will be interested in how these turbines look like regular wind turbines.

With Peak Oil nearly upon us its time we all start working to develop this technology.

1.2 megawatt tidal turbine being built in Ireland’s Strangford Lough:

http://giftofireland.com/Siteblog/2007/06/29/worlds-largest-tidal-turbin...

Heading Out: Thanks for the research, I look forward to further chapters on coal.

I'm off to the library, there's a couple, at least, new books on coal. "Big Coal" I believe is one.

Maybe you could discuss a little the global distribution/export flowchart for coal into the future. IOW, who's going to be exporting it to who(m)?

In a cynical hedge against the future, I hope we don't burn it all, for the sake of the living status quo, but I've also invested a bit in AUS'n coal in case we do...