This Week in Petroleum 11-7-07

Posted by Robert Rapier on November 7, 2007 - 10:15am

Updated Following Report Release

About 10 seconds after the report was released, I scanned down and found what I was looking for: U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) fell by 0.8 million barrels compared to the previous week. I turned to the guy sitting next to me, as we had been talking about this today, and I said “$100 oil may have to wait for another day. The inventory draw was half what was expected.” We could still pop $100 today, but this inventory report doesn’t favor that. A higher expected draw was already factored in, so I don’t think this supports a quick move up from the current price level. But I wouldn't put $1,000 on it.

However, we are still close enough that it won’t take much volatility to push oil over $100. A single negative geopolitical event should do it. But in the absence of a brand new geopolitical or weather-related event, I will be very surprised if we don’t pull back a bit from $100 in the next couple of days.

So, why were oil inventories down less than expected? Because refinery utilization continues to languish. You can see that in the utilization numbers, and you can see it in the fact that gasoline had an unexpected draw. Imports were also up from the previous week, surprising given the situation in Mexico. The other big surprise? Gasoline demand is still almost 1% above last year’s level. (Don’t overlook the role of ethanol there. As ethanol is added to the fuel supply, volume demand will go up even if miles driven don’t. I have documented that here).

(those linking directly to this point, scroll up for the beginning of the post, please)

Here were the highlights:

U.S. crude oil refinery inputs averaged 14.9 million barrels per day during the week ending November 2, down 43,000 barrels per day from the previous week's average. Refineries operated at 86.2 percent of their operable capacity last week. Gasoline production fell compared to the previous week, averaging nearly 8.9 million barrels per day. Distillate fuel production rose last week, averaging nearly 4.2 million barrels per day.

U.S. crude oil imports averaged nearly 9.7 million barrels per day last week, up 275,000 barrels per day from the previous week. Over the last four weeks, crude oil imports have averaged 9.6 million barrels per day, or 461,000 barrels per day less than averaged over the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 1,131,000 barrels per day. Distillate fuel imports averaged 270,000 barrels per day last week.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) fell by 0.8 million barrels compared to the previous week. At 311.9 million barrels, U.S. crude oil inventories are in the upper half of the average range for this time of year. Total motor gasoline inventories decreased by 0.8 million barrels last week, and are at the lower end of the average range.

Both finished gasoline inventories and gasoline blending components fell last week. Distillate fuel inventories increased by 0.1 million barrels, and are at the upper limit of the average range for this time of year. Propane/propylene inventories decreased 0.4 million barrels last week. Total commercial petroleum inventories decreased by 0.9 million barrels last week, but are in the upper half of the average range for this time of year.

Total products supplied over the last four-week period has averaged nearly 20.7 million barrels per day, down by 0.4 percent compared to the similar period last year. Over the last four weeks, motor gasoline demand has averaged 9.3 million barrels per day, or 0.8 percent above the same period last year. Distillate fuel demand has averaged 4.2 million barrels per day over the last four weeks, down

2.4 percent compared to the same period last year. Jet fuel demand is down 1.2 percent over the last four weeks compared to the same four-week period last year.

$100 Edition? - to be updated following the release of the report

It seems that every bit of news lately favors higher oil prices. In the wake of a perfect storm of weather-related and geopolitical events, Tapis went through the $100 mark overnight, and WTI is knocking at the door. In case you have been asleep for a week, the Fed cut interest rates, Mexico’s oil-rich Tabasco region is underwater, and oil companies are evacuating platforms in some parts of the North Sea ahead of a fierce storm predicted to generate 35-foot waves. The wind is howling in Aberdeen already, and did so throughout the night. (One of my engineers is stuck offshore and may have to ride out the storm, forecast for Thursday.)

Predictions are for a 1.6 million barrel draw for crude oil stocks this week. That expectation is factored into the price, so if we see less than that, crude could quickly give up some ground to profit-taking. However, the predictions for a draw may be too conservative, in which case WTI should quickly pop over $100. Gasoline inventories are forecast to rise by 200,000 barrels, and distillate inventories are expected to fall by 500,000 barrels.

Consider that the draws of the past 3 weeks have been much larger than predicted. I think the primary reason for that is a variable that analysts haven’t factored in: Some refiners are drawing down stocks and trying to wait out these prices. Consider it from their perspective, and it makes perfect sense. You have filled your tanks with oil at $80. You believe that we are in a speculative bubble. Therefore, you will risk drawing down inventories somewhat, and hoping that prices correct soon. If you fill your tanks at $100, and the price corrects back to $85, you are going to sell gasoline at a loss for a while. The risk in that strategy is obvious. But I do have direct knowledge that some are employing such a strategy.

So, there is that factor to consider with respect to the crude draw down. But the situation in Mexico, a large provider of U.S. imports, may cause the draw to be much steeper. This event has gotten very little attention in the media, but Mexican President Felipe Calderon said that the oil industry there has been devastated, and exports have ground to a halt. If it is as bad as it sounds, we should see a much larger draw than anticipated.

The final factor that may contribute to a larger than anticipated draw is the one that analysts have factored in: Refineries will be coming out of turnarounds. However, utilization rates have been lower than expected, primarily due to low margins. As I have mentioned before, if margins are poor, you aren’t exactly scrambling to process as many barrels as you can. So the utilization patterns of the past couple of years may not be a good guide for this year’s utilization pattern. Utilization should come up, which would lead to downward pressure on inventories, but it's not a sure thing.

My prediction? While I have made it through 85% of the year, I think I will lose my $1,000 bet within 24 hours. However, I don’t expect oil to stay there for very long. I think it will return to $100 - probably to stay - in 2008, but I believe it has gotten ahead of itself at the moment.

There were two scenarios that I foresaw as potentially causing me to lose the bet. One, Saudi production could continue to decline, and I would surely lose it. That did not happen. In fact, indications are that Saudi is increasing production, although just how much spare capacity they have is debatable. Two, a series of unfortunate events, which I identified as "a bad hurricane season in the Gulf of Mexico, combined with terrorist attacks or pipeline problems (or any number of things)" could cause me to lose it. Well, we have had saber-rattling and finally sanctions with Iran, storms in Mexico, storms in the North Sea, a collapsing dollar, and growing demand combined with flat production. I think that qualifies as a series of unfortunate events. If that happens, I will have a post dedicated to the bet, including a bit of information about my mystery betting partner.

Do you have a link to the assertion that "Mexican President Felipe Calderon said that the oil industry there has been devastated"?

Bunyonhead, its not an assertion that the oil industry will be devastated by these floods. Mexico lands the oil with pipelines from the offshore fields, then puts it in storage tanks and then loads it in tankers that mainly come to the Houston through Lousiana refinery and petrochemical area.

The workers mostly live in the areas which are having flood problems. They are likely to have road problems because of the high water, and people tend to stay home to take care of their personal damage problems rather than come to work.

The Golden Lane fields in Tobasco onshore produce about 30% of the Mexican total oil production if my recollection is correct, and the wells will be isolated and shut in until the water goes down and Pemex assesses how much damage has happened. Its likely fairly large, the oil in pipelines moves through electrical pumps on the pipelines and the storage tanks. Dirt roads to oil wells and berms protecting the wells are subject to washing out, and so are pipeline crossings of creeks and rivers.

At any rate, its likely to be a big mess and nobody can do much until the water goes down, well within a politician's right to call it devastation.

Bob Ebersole

Do you have a link to the assertion that "Mexican President Felipe Calderon said that the oil industry there has been devastated"?

Mexican President Calderon: Floods Cripple Mexico's Oil Industry

I suspect the Mexican flood situation will show up in next week's inventory report. This week was a bit too soon, as you have to account for barrels arriving at U.S. ports as of last Friday.

Hi Robert,

I, like a lot of others I'm sure, thought of taking the bet during the several hours that it was open. I let it go becauseyou are generally a better oil price prognosticator than I, especially where it comes to actual fundemental problems. However, people have a real propensity for testing limits. There are always some little kids that will , when told that something is hot and will burn them, stand as close as possible and stick out one finger just to see if the limit is real.

Applied to the $100 a barrel limit, I believe we will hit a top shortly past $100, then fall back a little below $100, about $95 or so, then stick one finger out for a while looking for the next limit to test. My guess is the limit is seeing if $4 gasoline causes demand destruction or a huge recession. Bob Ebersole

The problem is that inventory is still dropping.

If the price drops like "everyone" is calling for,

how does inventory not fall more.

Do you folks think that someone is holding back here

and will flood the market once their hand is forced?

From the EIA Report:

"U.S. crude oil imports averaged nearly 9.7 million barrels per day last week,

up 275,000 barrels per day from the previous week."

So Mexico had absolutely zero impact.

I don't believe it.

If so, we need to import Mexicans to help with our Gulf Coast outages, not the other way round.

Arkansaw of Samuel L Clemens

I seem to recall reading that Mexico started cutting back (production? shipments?) on Oct 28th. It must take at least a couple of days for a tanker to make it from Tabasco to Houston or LOOP. Maybe more like 3 or 4. Perhaps as little as one day's production cutback was factored into this report. If it was production only that was cut back that first day or two, but shipments continued, they could probably continue loading tankers from storage, and we would see zero impact in this report.

Tanker traffic was definitely stopped for a few days. I think that will ALL be in next week's report. Perhaps an extra 5 million barrels, or thereabouts. If we don't hit $100 this week, that should be enough to do it.

If you look at the data for Gulf Coast stockpiles and imports in the report you'll see that crude stocks have been dropping by 3.3-3.5 million barrels per week for the past 4 weeks, and the weekly draw to last Friday was bang in that range - which suggests that there has, thus far, been no impact from the loss of Mexican production.

The import data for the Gulf Coast shows a slight increase over the two prior weeks which, again, suggests that there has been no impact yet.

Yes, it seemed that the impact of the floods really hit on Friday as well as I can tell, and only represents one day (maybe two) of the relevant week. Beyond that, shipments would have been in progress from several days before and continued to arrive in US. It always seemed to me that it will be next week's report that will really show the Mexican impact.

Next week's report is going to be very interesting. Not only will the full impact of Mexico be felt, but there was a story a couple weeks ago that the ship watchers were saying OPEC deliveries for 11/1 - 11/15 were running behind October's levels.

And do you know WHY this is the case? Most OPEC countries increased their production in October AHEAD of the scheduled start to do so on November 1st. Remember, the total increase was ONLY supposed to be 500,000. Then we add in that PESKY maintenance from UAE which took 600,000 BPD off the market for 4-6 weeks, and suddenly your production is actually down 100,000 bpd.

Naturally your shipments will be lower. Naturally WT touts this to his hearts content :P

PartyGuy,

I feel your pain. It must really be distressing you that westexas is right most of the time and that people respect his opinion for both his good manners and clear exposition of his ideas, but its value as being predictve about the amounts of oil available in the future in the US market place from imports. (sarcanol alert) Bob Ebersole

I never said WT was wrong. Have I commented that he repeats himself endlessly with the same cut/pastes post, of course. My main grip is that he likes to ignore the 'dog legs up' and cherry pick his data, and I am not the only one who has told him this in public or privately.

Then what are we discussing?

And what part of the post-1990 Saudi production data did Khebab ignore in the following article?

Texas and the Lower 48 as a Model for Saudi Arabia and the World (May, 2006)

http://www.energybulletin.net/16459.html

BTW, anyone else find it ironic that I seem to be constantly replying to allegations that we "ignored and cherry-picked" data, and then I am accused of being repetitive when I defend our work?

Westexas,

ELM is your theory so it falls to you to defend it. It is scary and depressing. People are going to complain that your data is bad, that your conclusions go too far or don't go too far enough. And, years from now when you are proven correct to a greater or lesser degree nobody is going to be happy about it.

Sorry man, it is a rough job you have.

Tim Morrison

When this whole global energy problem winds down and people are back to worrying about sports I'll buy you a beer.

I talked to Matt Simmons at ASPO-USA and told him that I started looking at net export capacity because of some of his prior work. Matt said that he took no comfort from apparently being right about so many aspects of Peak Oil/Peak Exports. I feel the same way.

The 'cherry picked' data is the fact that you are relying on the HL for KSA without taking into consideration how unstable it is. The URR has increased by 25% in the last half a decade alone. Therefore it is impossible to assign a realistic depletion rate to KSA at the present time. Stating that they are 58.1% depleted as of 2005, when they could just as easily be 40% depleted is highly misleading.

And I am not attacking your ELM. Any rational person understands it, though you must also take into account the oil exporting countries controlling their demand to make a completely accurate prediction. The recent events in Iran in which they increased the cost of their oil should be a red flag for you, but its not.

Your picking on the wrong guy I think. WT made some valid observations that the doglegs may just represent increased drilling activity and thus URR estimates that include them may be inflated. The technology and drilling program used for a field and especially changes in the program will result in new URR estimates how much of that is real and how much of it is just faster extraction is open for debate. I'm the dogleg guy.

And I think that its valid to question HL results. But so far they have both been fairly accurate and lower than all other methods. And if HL is wrong its wrong on the high side and given that the HL predictions are already fairly sobering I don't think thats a huge issue.

Time will tell but its reasonable to consider that global oil production will not be symmetric i.e past performance does not insure future results. I myself find the doglegs very worrying since they imply a significant overestimation of remaining URR using HL maybe up to 50% in some cases.

For example I'm pretty convinced that KSA remaining reserves are between 40-60GB only by aggressively adopting the latest technologies have they managed to maintain production. This does not bode well for the future.

But WT is not the person presenting this argument his insight about the possible implications of the dogleg provided the basis for the argument that HL URR's may be inflated.

But as far as I know I'm the only one thats saying that we have used technology to dramatically increase extraction rates over the last 20 years leading to high HL estimates so I expect decline rates to be fairly steep soon.

So bash the right guy but the implications of the doglegs scares the piss out of me.

You bring up a good point. SA boosted prod with their new project as expected and starting in oct, so with 21 day lag we probably are now seeing this arrive in port. UAE supposedly began cutting nov 1, not confirmed that this has begun. If so, we will see lack of shipments in last week of nov. So, current boost is now depressing price, dec cut has not yet boosted it. Stocks at end of year probably not good and declining, just as xmas and winter arrives.

Note that Gulf Coast inventories dropped by 3.3 mb, and Cushing dropped by 1.7 mb, partially offset by gains elsewhere.

mcgowanmc

it takes a day for a tanker to load at the dock in Mexico, then a two day trip across the Gulf to the refineries, wait in line for the dock, and then offload. Its at least a four day process, and mostly longer. So inventory problems won't show up for at least a week. Bob Ebersole

I, like a lot of others I'm sure, thought of taking the bet during the several hours that it was open.

I know you did, but as I have written in my yet to be published essay on the bet, if you felt strongly that oil would reach $100, you want something better than even odds on it. If you put that $1,000 in the commodities market, you make more than 10 times your money.

Some people forget that I am very bullish on oil, I just recognized that this would be an unprecedented price move. In the words of my good friend Nate Hagens, who used to do this for a living, "I have been very bullish on oil but even I would have made the bet you did - no brainer - the option vol gave that about 1 in 12 chance of happening when you made bet..."

Robert, you and Nate are definitely right, its just that the psychology of the bettors, I mean commodity traders doesn't follow any real supply and demand indicators. That's why I'm afraid to bet that way-there are about 30 times more contacts for oil floating around the data banks than there are physical barrels of oil out in the world. Its so divorced from reality that I'm scared to gamble.

At least if I loose money in a poker game I can see where the money is going, but this is more like slots.

If I were King of the Federal Reserve Bank, I'd set the margin rate on crude contracts at 50%. That would sure cut the speculation back to reasonable levels. I suspect that if this all becomes unwrapped on oil futures like the subprime mortgage money market, it would show that the real price of oil demand and production is maybe $30 or $40 a barrel, but that the difference is being sucked up by the guys controlling the production from national oil companies. I doubt seriously that its going in the national treasuries of Mexico, Venezuela, Russia, ect. Since the Saud family owns Aramco, that may be going in the right pockets already. But, thats just my hunch-it seems to be too much money to not steal it. But I bet we find out pretty soon. So hang on to your Confederate money boys, the South will rise again! Bob Ebersole

Bob, with no spare capacity, inventories running down, production in apparent decline [admittedly in a small way to date] since mid 2005 and with the dollar so intrinsically valuable that a cup of coffee at Starbucks complete with its own deluxe paper cup sells for $5, tell me again why oil should be selling for $30 bucks per barrel?

The tar sands is a big money loser with oil selling for $30 US a barrel.

I would imagine a new issue of slave labor would coincide with lesser oil and thus the southerly winds blowing up yer ass? Really, it wood be rather nice if the nation of states cood help one another with their traded assets...

Do not presume a stance based on bullshit fiat,

Takecare

With oil falling back to $95 territory the bet looks safe for another week.

It does seem strange that so many are looking forward to $100 oil, kinda like the crowd willing the ledge stander to jump.

I was thinking about this!

I have been willing oil prices up to 100 for 2 reasons:

1. because bursting the bubble now will hurt less than later. i.e. the further on we go with BAU (Business As Usual) the less mitigating oil we will have when we really need it.

2. to bring the debate into the public sphere ( so I get to say "Look, this is what I have been talking about!" ) We can get past defining whether there is a problem in public, most people do not about PO, and get on with expalining that it is permanent fundamental and accelerating, not caused by gouging, taxes, speculators, lack of refineries etc.

Carbon, Coventry, UK

I have been thinking about this a lot. The entire world "knows" that oil is about to break $100. One thing about it, though. Just as soon as everyone "knows" they have it figured out, the market surprises them.

I think the bet is safe for another week, unless a major geopolitical event takes place. If it is a quiet week, we will probably drift a bit lower from here. Interestingly, the December WTI contract also expires the end of next week, which should add a lot of volatility. I think with that, and the looming OPEC meeting, investors will be cautious for a little while.

I agree with Robert but my reasoning is different. This is really the first time that the market has in a sense explored the fact that once we are really post peak their is no limit on oil prices until we see real demand destruction in the OECD countries. I posted a similar statement in another thread. We are not quite their yet and won't be in my opinion till this summer.

I fully expect prices to not rise much over 100 then pull back to 70-80 later this winter/spring.

I think whats important about the current price run up is it indicates that the market will eventually discover peak oil on its own regardless of what people say. Sooner or later it will realize that only significant demand destruction will cause prices to lower and then .....

Like any market prices are set at the margin when we finally reach the point that desperate buyers are forced to pay the spot price because they need oil then the real price run up will begin. I have to think that has to occur in the summer with next summer being the first time. After this I think it goes bimodal with a big rise in fall/winter for heating oil and agricultural diesel. But I don't think we will break out this winter.

Since everybody's pulling out their crystal balls for oil price, I'll give my comments. You can draw a trendline on a monthly chart of WTIC (West Texas Intermediate Crude) starting in late 2002. This trendline was honored for 4.5 years, until the big selloff in 2006. At $95 oil, we are only now getting back on course with that trendline. So the question now is, has the trend broken and the oil price will rise slower than it has historically over the last 6 years? That is what people are implying by saying oil prices won't hold $100+ in 2008.

I'm not making any $1000 bets, but I think we will get back in front of the trend and continue on it. That means $100 will soon be the new low price.

I think GreyZone's footer quote is appropriate here:

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

But their is still a lot of uncertainty in the oil markets.

Peak oil is not yet priced into the equation. So I really think we will see one last pull back later this winter/spring during the spring lull. Demand rises and falls on cycles throughout the year the current highs are in a large part from drawing down inventories all summer but we will I think be able to rebuild inventories and have demand lessen one more time. We start the elevator ride in prices when maximum capacity cannot meet the low in demand that in my opinion starts next summer.

We will still have price cycles but the low each year will then be higher then the highest high of the year previous.

I just don't think we are there yet. OPEC has not quite been forced into admitting they have no more oil although its getting close and its reasonable to expect a small surge some temporary some real over the winter. If I where them I'd do it when demand was lowest to get the biggest artificial price decrease. So I think we have one more drop.

If prices hit say 110 and we drop back to 70/80 thats a pretty big downward swing. On the production side I think it means we need to lose close to another 500kbp 1mbpd to ensure we have this rising floor in prices. They are only going to go zooming when OECD countries are forced to curtail demand via demand destruction. I just don't see that we are at that point. We have not yet seen a drop in US gasoline imports for example.

The first time we have really seen a peak oil effect is admittedly a bit scary but we are still very early in the post peak decline.

The OPEC meeting will probably make or break your bet for the rest of the year. If OPEC is firmly against any further production increase, you may be in trouble. If OPEC speaks with a forked tongue and tries to supply the market with wiggle room, you may get by if weather stays nice and nothing else triggers a spike.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

But what happens if OPEC is unable to supply even the extra 520 kb/d they have promised?

That, my friend, would be a bombshell!

Ron Patterson

The question is how much sustainable capacity do they have.

I'm sure they can make brief surges of say 3 months or so but I don't think they have much sustainable capacity.

memmel,

Changing the subject: my lousy memory tells you predicted last spring that there would be a price spike in the Fall? If so, good job.

Yeah that was from my simple pond model treating oil prices as waves. The prediction was that when peak oil hits we move to 3 price peak a year fall deep winter and summer with two low periods spring and end summer.

This continues with basically last years highs representing the next years lows. It does not really say how high the highs go each year.

It does not address how high the highs can go but given that the troughs are fairly well pinned I can't imagine price increase greater than 100% a year.

The observation is that oil production seems to have about a 3-4 month time scale built in from the time its pumped until its used in the final product.

This includes storage before shipping shipping refinery storage pipeline transits etc. So the natural cycle if for increasing prices to increase production but this pretty much finally shows up during the down periods. And we really have only two natural down times.

Thanks we will see how it goes next year I think thats going to be the big test. I'm more concerned about my current ideas.

I found a very interesting number here.

http://globalpublicmedia.com/an_open_letter_to_cera_from_chris_skrebowski

This is a very important number since it shows that the technical impact of EOR is very low. Given the uncertainty of oil production its effectively in the noise.

On the other hand I do believe that the technology of oil extraction itself has made significant strides. Anyone reading about oil extraction technology cannot fail but be impressed with how far we have come. Although I've not found any hard numbers on the effect of technical enhancements we can consider the follwing.

Using a simple compound interest model and assuming that we would extract 100 barrels of oil using a constant technical level and then that technology enhancements result in a 2% increase in extraction rates compounded annually we end after 20 years with 148 or 50% more oil extracted. At 30 years we end with 181 so close to doubling in 30 years.

At 3% growth from technology we have. 242% at the end of the year.

Lets assume that technology has allowed us to about double the rate of extraction. We know we burned 1 trillion barrels of oil for physical reasons I think its clear that we probably are close to the peak as far as technology that increases extraction rates go. The will still increase somewhat as the latest technology still is not widely deployed but for political reasons we can figure that it may never be widely deployed are at least not any time soon.

The end result is that this 2-3% technical boost has just recently gone to zero in fact looking at the history books the widespread deployment of MRC and horizontal drilling has only resulted in a slowly declining plateau as underlying geologic decline and slowing technical progress has met.

Also this shows that we probably passed the 50% URR mark back in the 1990's with technical improvements in extraction providing basically all of the increased production since.

Given all this we have in my opinion about 500GB of extractable reserves left and about 200GB that will be extracted at a high rate. Given we extract about 18GB a year this means less than 5 years before serious declines are obvious probably close to 7-8% anually. Assuming a geometric increase in decline rates and a peak end 2005 so starting 2006 we have.

Start 35GB

2006-2007 1% 34.65

2006-2007 2% 33.95

2007-2008 4% 32.6

2008-2009 8% 30

2009-2010 16% 25.2

2010-2011 32% 17

Or about 139 GB by 2011.

This is a level last seen back in the 60's 70's and at the height of the Iran/Iraq war. But with 40 years of population increase in between. My prediction looks like a cliff on the graph.

Even if I'm off by 50% in my estimate the world as we know it effectively comes to a end 2011-2012. Export land probably has the same geometric decrease in exports. So mistakes here are made up in export land.

Now you see why I think 2009 is the pivotal year its the last year we have a functional oil based economy probably in a fairly deep depression at this point but functional. It when I plan on making my move either back with my parents or buying a place outright. Also I'll know if I'm employable still at this point I work on mobile phones and my experience in third world countries leads me to believe that wireless technologies will remain viable and hopefully I'll have a job. But in any case I have to move to my safe house in 2009 and be able to raise a garden. This gives me 2-3 years too get a viable personal food supply going.

I know I'm pushing it but its senseless now to move to a small farm and have a mortgage its too late. I'm assuming that assets like homes in the country will be at rock bottom prices in 2009 so I'm going to have to gamble and can afford too since my parents have a nice 20 acre farm ten miles outside of Little Rock AR as my plan B. I really want to move to northern California/Oregon mainly because I like seafood cheese and good wine :)

I'm hoping to have 200-300k to invest and I really believe that right before things get really bad a good small farm in Oregon will be selling in this range if not lower. In any case I'm not going to make a move until we are obviously in a deep depression and I have determined if I have a stable income.

Consider this.

globalhouseprices.blogspot.com

We should see a 50% drop to get back to normal than a further 30% drop as we enter the depression for a total of 80% price reduction off of current prices.

So given that many decent small farms are at 500k now this gives about 100-200k for a nice farm by 2009-2010 assuming that your savings are invested in a mix of euros and gold.

No telling what the actual dollar price will be.

What interesting is this is in inadvertently predicting about a 40% drop in home prices next year which I really cant see happening. This is very pessimistic so I could easily be ahead by a year or two. But assuming the economy closely tracks oil supply we are looking at a crash that dwarfs the great depression by a order of magnitude within two years. I find this result a bit amazing myself but at best I can only convince myself I'm off by a year or so.

My gut tells me this analysis seems to be too pessimistic but since it does not include export land or geopolitical issues even if I'm off these could easily pull things back inline. If President Bush believes a similar sort of analysis then going to war with Iran makes sense since it really does not change things all that much given the above we could actually afford to lose the oil production from Iran and have the gulf production slowed and halted it really only pushes things forward by a year or two. Basically things are going bad so fast losing Iran is not a big deal. I've got things accelerated a bit on the time scale. But I think I can be 50% wrong and geopolitics and exportland will make up the difference. So to repeat myself but if we are really facing geometric increasing declines in exports if not production at least then mistakes are not important.

I find that a bit scary but I have to be fundamentally wrong about geometric decline for this to not be basically true.

Actually, I'd pin the make-or-break on the next Fed meeting, not the next OPEC meeting. My read of recent crude prices is that they've been more influenced by dollar valuation than oil fundamentals. But of course, I could be wrong...anybody with good numbers chops want to tackle that one? E.g., attempt to correlate the price increases with, say, inventory and production levels, vs dollar valuation levels?

--C

Energy consultant, writer, blogger www.getreallist.com

Every news paper in the world will run a story when oil hits $100. That's an excellent time to contact them about peak oil. They will be looking for an angle to differentiate themselves from every other story about $100 oil.

See an earlier post here.

Tim Morrison

Peak oil, global warming, and economic collapse are not the problems, they are the result of the problem. The problem is a collective action problem and an inability to make good long term plans.

The Irish Times $ quote:

"Since, most of the production remains shut down, it would mean that Mexico's output would drop by 2.6 million barrels a day."

It's not right.

Arkansaw of Samuel L Clemens

http://politics.reddit.com/info/601qn/comments/

Thanks for your support.

In the post-announcement chatter on CNBC this morning, the much maligned Mark Haines said to Erin Burnett that he is beginning to wonder about the Hummers he sees on the highway - consuming gas that is needed elsewhere. Then Erin challenges Mark, saying "Don't you drive a Tahoe?". Mark replies that his buick gets 25 MPG although he has a big vehicle that he uses to hall the kids around. Finally Mark trumps Erin by stating that he has ordered two 17 $K Smart Cars for spring delivery.

Erin mentions peak oil.

I suspect the biggest factor in the loss of your bet, if indeed you lose it, will be the dollar weakness. You may have judged the oil fundamentals correctly, but it was an issue not directly related to the oil that did you in.

Bingo.

--C

Looks like it was a smaller than expected draw. Above average imports and demand below expected levels help minimize the bad news. We might have to wait another week for $100. Of course, the dollar is down sharply today and GM posted a $39 billion loss. If the dollar goes down enough we might see $100 anyway.

Absolutely, profit taking is going to be contained by other economic factors. The media is primed now for bad news about oil supply, so there will always be something coming up to serve as an excuse for upward price pressure.

What are the potential sources for good supply news? "Inventory draw less than expected." That's about it.

What are the potential sources for good supply news? "Inventory draw less than expected." That's about it.

Not really. Good news will be a return to normalcy. North Sea mans back up. Mexico starts to get back to normal. Those kinds of things can shave a few dollars off of where prices are now, since those events added a few dollars on. But it seems that lately, what goes up never comes down, even when you remove some of the news that made it go up.

That seems right to me, but I think part of the issue is a news/media atmosphere that does not lend itself to a sense of "return to normalcy" right now. The media is circling for downside supply news, and there is always bad weather, sabotage, unrest, refinery outage, etc., somewhere.

Not surprisingly, profit taking is going on now. Oil is now down $1, and it was up $1 prior to the release of the report.

I think everyone feels that $100 is a sure thing, but some people are still skeptical. From a story today in CNN:

Yep, but think about what "normal" means right now - $80-$85 per barrel give or take a few bucks. Try imagining if you had told someone in 2002 that oil would be trading normally at $80 per barrel in 2007, with spikes near $100 per barrel. That's mind boggling and an astronomic price rise over the short time period under consideration. Yet there are still people who argue that we have not yet seen "high prices" for oil and wonder where the effects are!

Further, consider that crude oil inventories have been at very high levels until we passed about $85 per barrel. This means that refiners believe that it was cheaper to buy and hold than buy later and that has certainly been true up to about $85 per barrel. That also means the refiners believed that the trend line, at least up to $85 was up. That, to me, supports a view that supplies are very constrained. So yes, now we are drawing down inventories to ride out this assumed spike, but the real story is what constitutes "normal" today versus just a few years ago. And to me, the best answer to what is driving that is either the recent peaking or near (short term upcoming) peaking of global crude oil production.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

Amen.

STOCKS (MILLION BARRELS)

Cushing, Oklahoma 18.4 18.2 15.1 13.4

Anyone know what's going on at Cushing? Why is that number down 50% since the start of the year? Does it matter?

Backwardation-where actuals cost more than the outlier months.

It costs more to store than sell now.

In other words, show me the oil.

And keep it up until inventory rises/demand slackens.

Arkansaw of Samuel L Clemens

I've updated some of my charts:

http://www.theoildrum.com/node/3170

We are below 2005 stock levels now but still in the middle of the historical range:

Although unusually the current trend appears to be down, in the past it appears the trend has been up this time of year.

You're right, maybe because crude oil imports have been below expectations for a while now (see Fig. 2b).

100 oil with a perfect calm.

No hurricanes in the oil patch...

Less consumption in US...

Less consumption in Europe...

Less consumption in africa...

More output from opec, as previously announced...

No new middle east war...

No major act of terrorism in oil producing regions excluding the usual pipelines, even Iraq output up...

No filling of china's SPR...

What do we have? A couple of storms, one with massive human damage but, to date, little info re: mexico's oil exports, and another where platforms are being evacuated temporarily... Pretty modest negatives considering the above list.

A falling dollar does have an effect on oil, but a much larger effect on gold; pretty hard for those wishing to divest away from the dollar to store oil in the back yard... and China, which can, is so far not doing so because oil too high. Those buying oil futures to divest from the dollar are the minority... Don't blame the specs, they've been selling futures all year, getting burned as the sold month rolls to front and they buy to cover... specs are bucking the rising tide, not pushing it.

When people are fearful they buy and store to guard against supply disruption, just as individuals drained gas stations in the 70's to maintain full tanks; refiners allowing stocks to falll are not much worried. The market is perfectly fearless, fear premium is 0 and has been for over a year.

Rising oil can be easily explained; supply has been falling for years, Asian/exporter consumption is up enough to make up for other declines. Expecting oil to fall is expecting either new supply or less consumption or both. Funny how announcers in this most capitalist of countries blame the specs rather than boring old supply and demand.

It's the speculators! Yeah, yeah, that's the ticket!

http://www.counterpunch.org/nader11062007.html

This will be the reasoning grabbed by the masses.

They're retiring the (greed of) speculators as the reason for the increase. Now it's a "perception" problem. On NBC News last night, Marie Baritomo (sp?) said crude was overpriced because of the perception of various threats to disrupt supply. No problem with the actual supply (which I gather from her report are these huge spigots in various Middle Eastern countries which get turned on and off). Just that there is the perception of an above-ground threat (not an actual threat) that might possibly turn off the aforementioned spigot.

The other thing that drove me nuts was the follow up report -- stock footage of people moaning and groaning while filling up the tank. In it they said price of oil is causing all sorts of things to go up -- even mass transit. Of course they didn't say how much mass transit was going up, where, whether it was due to energy costs, nor the relative increases in fares compared to gasoline.

Iron Triangle indeed!

jskissing,

Chinese imports are up over 18% from last year, more than enough to cover demand destruction in other parts of the world. So, the difference is demand.

Up until a couple of years ago producers would fill onshore tank farms then look to sell the oil, now are scrambling for the crude to fill their orders. The market has become demand driven so any little disruption is magnified rather than smoothed out by the over supply. The blame game is not productive. It really doesn't matter if the blame belongs to the commodity speculators, the multinational oil companies, the nationalist politicians or the SUV drivers making US demand inelastic when its all of those causes plus the real root cause, population growth and desire for a materially prosperous life

Bob Ebersole

"No new middle east war..."

Not yet.

Oh the dancing continues, the hair-splitting continues apace, the rationalization that serves as a replacement for action rules the day.

Oh, yes, mission control, we have mediocrity.

No need to question the basic assumptions. No need to challenge the very foundations, because this is the best civilization we can ever have. We just need to apply a never-ending series of techno-tweaks until this machine really starts humming and then we can all sit back and live in splendid isolation from nature, watching the Survivor Irony Show and its twin, Dancing With the Retarded.

My friends, the axe, it is a'coming. It is swift. It is sharp. And it brooks no rationalization, no specious justification. It will come as you stand by your pie charts and calipers with laser pointer in hand. It will whistle through the air in the middle of your tired powerpoint. You will not feel it slice through your neck because you are already numb from your daily, nay hourly, dance with the minutiae of the obvious, your speculation about what kind of steel is in the axe, how fast it is traveling, whether the handle is clear-coated or raw, what brand of gloves is the executioner wearing, and just who is that hooded fellow is dating, why does he use the Leftkowitz stance to administer the fatal blow when clearly the Harbin-Oscheler stance is so much better, etc. etc. etc. ad nauseum, ad infinitum, ad absurdium.

I suggest that everyone here buy the film, "What a Way to Go: Life at the End of Empire.

Not that it can change the mind of the life-long caged animal who does not know he or she is caged, but at least it will stop the caged, for two hours, from beating this long dead horse into neutrinos.

http://www.populistamerica.com/stop_calling_me_a_doomer

Your eloquence appears to exceed your intelligence. This whole trip is an opportunity to make money (or lose money).

I, for one, enjoy's Cherenkov's commentary. Keep up the good writing, friend. It's not going to solve the world's problems, but at least we can enjoy the dark humor while our civilization circles the drain.

regards,

Oz

If all goes well and the center holds, then yes this is a great opportunity to make money. If things go poorly and the world falls down, then money isn't going to amount to much. I wish I could tell you which it will be.

Tim Morrison

Peak oil, global warming, and economic collapse are not the problems, they are the result of the problem. The problem is a collective action problem and an inability to make good long term plans.

Cherenkov

Thank you for writing the pieces you do. (I read every one you post that I see).

Great Prose, Great Content. A great example of the Teaspoon,Cup,Bucket/Bathtub experiment from UrbanSurvival today(mentioned in today's drumbeat).

http://www.urbansurvival.com/week.htm

BrianT has given you the capitalist's utilitarian response. Selling shovels to all of us who are digging our own graves so to speak.

BTW, Did you read Joe Bagneant's piece on the media.

Take a few minutes, I think you may enjoy it.

The Great American Media Mind Warp

http://www.joebageant.com/joe/2007/08/the-great-ameri.html

You Can Lead A Man To Knowledge, But You Can't Make Him Think.

John

Good one, Cherenkov. Go for it...at least until the metaphor police show up.

--C

Energy consultant, writer, blogger www.getreallist.com

One thing that might help lower the price of crude in the next couple of weeks is the Novemeber OPEC meeting. If there is any spare capacity in OPEC (and Saudi Arabia specifically) then perhaps they will raise output even it it is another token amount. This could help stabilize prices.

OPEC is dead. Maybe heads are there for the funeral.

IMO, OPEC continues to exhibit an ability to moderate price declines (so far).

Watch for OPEC to mention the environment more and more as the issue of oil use and supply continues to fester. "We really shouldn't raise output as it will further harm the environment.

In 1998 oil breifly dropped below $9.00. Does a 1000%+ increase in 9 years sound like it would be caused by speculation, to anybody with a brain?

Does anyone think $9 oil was the right price.

The KSA hammered the price down to punish quota cheaters. In doing so they permanently took out [IIRC] about a million barrels a day of stripper well production in North American as an added bonus.

BTW, the "Awash in Oil" magazine cover [The Economist?] came at a time when inventories in the U.S. were only about 10 milion barrels higher than they had been with $20 oil. The perception of sea of oil looking for a buyer drove the price. This perception has changed. 10 to 15 million in unused capacity then. Little if any now.

Where did the capacity go? Look to the North Sea. Look to demand in China and India and the absence of new super giant discoveries.

Was oil a bargain at $9? Of course. Is oil at $90 plus a speculative bubble? Price alone might lead some to that conclusion, but in my estimation the fundamentals have changed. Dig a little deeper and you may surprised by your answer.

Has anyone read this article:

http://www.gulfnews.com/opinion/columns/world/10165702.html

"Six years ago Saudi Arabia discovered giant oil reserves in the Shibam depression in the vast desert known as The Empty Quarter. According to estimates the new fields could produce up to 2.2 million barrels a day for another 50 years. Iraq is also sitting on an ocean of oil. As for Iran, less than 10 per cent of its territory has so far been prospected for oil. Given adequate investment and technological modernisation, Iran could more than double its present production levels to eight million barrels a day, a capacity it had in the early 1970s."

I have not read about any recent discoveries in Saudi Arabia, nor have I heard the statement - Iraq is sitting on an ocean of oil.

Someone debunk this with facts please.

Interesting, but I believe this is an opinion piece and as near as I can tell unsupported by facts. I did a quick google search and saw nothing other than this article to suggest a new super giant had been found in the empty quarter.

Debunking? Western Iraq is where the under exploration has occurred. Take a straight edge. Lay it across the prolific fields of the KSA, Kuwait, Iraq and Iran. Look at where Western Iraq is located relative to this unmistakable trend.

Western Iraq might have oil, but if you want to speculate about undiscovered reserves look to oil production of Syria for what may be the most appropriate application of closeology.

Iran? Hard to say for certain, but in asserting the need for new technology and higher investment, the author is probably poking holes in [his own?] theory that if you drill a hole anywhere in the Gulf Region the oil will flow. It just ain't so.

That statement was said by Pearl as an excuse for the invasion, I think around 2004.

If there were oil in the west of Iraq, you'd think the Sunnis would have developed it during the entire time they were in power, since that is the region dominated by them historically (who knows what's happening now). My understanding is that is half the problem in Iraq is that the Sunnis have no oil but the Shia and the Kurds do. Look at the oil fields here and then at the ethnicity chart on the bottom of here.

--

Gentlemen! You can't fight in here, this is the war room!

RE: Shibam

Shibam was located in Yemen.

If Saudi Arabia has an ocean of oil, they are selling it by the barrel. Some of their fields began production more than 50 years ago. The Alaskan Prudhoe Bay field was one of the largest oil fields in the U.S. and began production in 1977 after the pipeline was completed. Oil production from Prudhoe peaked by 1990. The field is now in decline, some nearby satellite fields were produced to make the decline less severe, yet the North Slope produces about half of what it did in the late 80's. U.S. oil production is greater today than it was this time last year, but not a full percent greater. Imports of oil and petroleum products increased 1.7% YOY.

Iran has explored much of its land; yet not all of the Caspian Sea. A retired Iranian national oil executive estimated they might have 40 billion barrels of proven reserves. OPEC nations' internal oil/petroleum products consumption was growing and this was adversely affecting export supply availble for seaborn transport. Iraq was thought to have enough discovered oil to raise their production to more than 4 million barrels a day, yet such has not occurred.

They are talking about Shabah, the oilfield in the Shibam depression. It was discovered in 1968 but because of its very remote location Saudi did not bring it on stream until 1998. It is currently producing about 900,000 barrels per day. It will not produce at this rate for very long because it is being produced with "superstraws" or MRC wells and high pressure water injection, which pushes oil out much faster

Shabah was Sauid's last giant oilfield and it was discovered 39 years ago.

Ron Patterson

Robert

You know more about this than I do, but virtually all of the US oil & gas companies are on the LIFO inventory for both book & tax, and they are on a calendar year end. That means, that on 12/31/07 they will want to have on hand at least as much inventory as last year - crude, products, etc. If they have less, then they "eat" into a LIFO layer based upon last year end price, or less. Which means 40% federal & state taxes on, e.g., oil priced around $55. This also raises their "book" income, as reported to the public (selling $55 oil for $100) and causes them a public relations problem. Note: the Democrats want to raise taxes on the oil & gas industry by taking LIFO away from them.

The point of the above is that, as we near year end, we could see some oil companies "paying up" for oil & products to raise their inventory levels to a level that ensures that they will not eat into a lower priced LIFO inventory level.

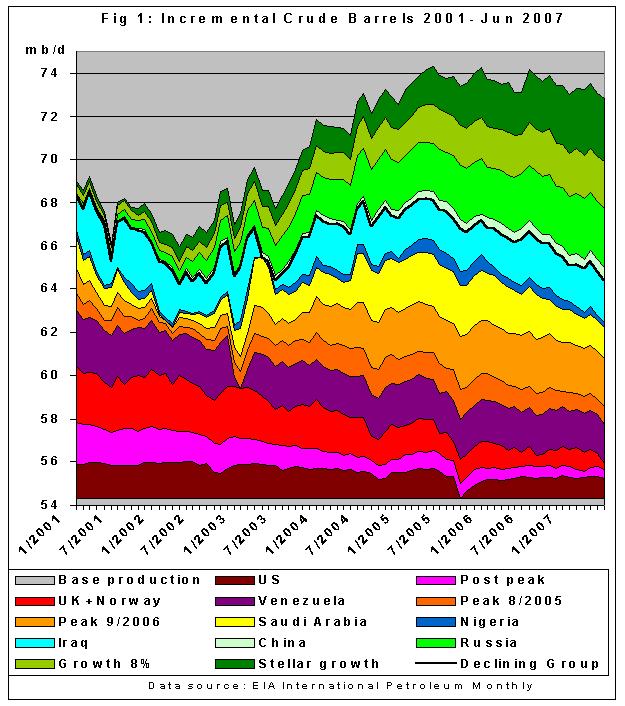

No one has mentioned here that the underlying root cause for high oil prices is the continuous decline of crude oil production since its peak in May 2005. As per latest EIA (International Petroleum Monthly) data published on Nov. 5th and covering the period up to August this year, total global crude production is down now by almost 1.8 mb/d.

Please refer to Gail's oildrum post:

"Did Katrina Hide the Real Peak in World Oil Production? And Other Oil Supply Insights"

http://www.theoildrum.com/node/3052

with following graph:

The August 2007 update of this graph will follow soon

This is Matt's August 2007 graph:

The decline looks even more pronounced than in the June graph above.

I do not understand this chart as all. How can you mix "Growth 8%" or "Post peak" with countriel like China or the US? Or especially UK - Norway, both which are definitely post peak? And exactly what is "Stellar Growth"? How does that differ from "Growth 8%". If 8% growth is not stellar then I don't know what is.

Ron Patterson

Incremental production is not mixed but stacked separately and the color scheme goes from different types of red (terminal decline) to dark green for high growth. "Stellar growth" means incremental production for this growth group since the 5/2005 peak went up 33% pa against 8% pa of the other growth group. You can clearly see from the shape of the different growth wedges sitting on top of the decline to which extent the decline is being offset.

The reason why incremental production is shown is that it is more visible what happens. If you stack total production profiles, the slope is so small you don't see the trends.

The worry is now that the growth in the stellar group has practically stalled in the last 5 months

It looked even more pronounced from 2000 to 2002 :P

Goldman Sachs are saying the price is likely to retreat to $80 a barrel by April. Given the fact they called this perfectly months ago, I am tempted to believe them.

It would make sense, and has been predicted by some (e.g. RR) that Spring 2008 would be a low point in yearly crude prices, since this is normal for Spring, but it would be a 'higher low' than usual and we would go up from there.

We had, IIRC, ~$50/bbl spring '07 so ~$80/bbl in spring '08 might translate into $120-$150/bbl by fall. This is nonsensical predicting, of course, given the volatility that will result with a much more pronounced and noticeable shortage of crude on world markets. I'll stick my neck out here in a Jean Laherrere fashion and predict crude price between $50/bbl and $300/bbl for 2008, anyone wanna bet? :->

I agree 100% with RR we will see a low in the 70/80 range this spring. Real peak runaway prices starts summer of 2008 when demand destruction in the OECD is required because of limited supplies. So this super doomer is not yet freaking out :)

I'll let you know when its time for the paranoid to consider freaking gettin close.

World oil exports are how much? 38 Mbpd? If a serious conflict breaks out in the Middle East during 2008 and leads to the closing of the Straits of HoHo, or to Iran sending some big fireworks into Kuwait/Iraq/Saudi/UAE Oil loading facilites, either or both of which could lead to the cessation of say 13 Mbpd of M.E. exports for a while. (This is IMO the extreme worse case event the world currently faces, with respect to the availiblity and price of oil.) In this case, I cant see oil below $500 per barrel, to pluck a number out of thin air. If $95pb = $3 per gallon, then $500 would be what? Triple? $9 gallon?

What is often overlooked by posters here is that the US is still a growing country! More people are in the US than a year ago, which must be accounted for if you are expecting demand to decrease.

A little off topic but, what do people think of this little video?

http://youtube.com/watch?v=CMovXzVOzc4

A new method of hydrolysis?

Sorry, has this been debunked already? If so, I'd really like to see the specifics. If not...what are your thoughts?

Same thoughts as any of these schemes brings up. Isolate the system, carefully measure all inputs and outputs including the embodied energy of any 'special' catalysts or materials that make the process work that themselves need energy to produce.

Chances that he has overturned ye olde 2nd law are zero to none.

According to ExxonMobil's The Outlook for Energy A View to 2030, petroleum stocks are sure to start increasing again soon, as oil production is forecast to increase to 116 mbd.(sarcasm intended)

http://home.businesswire.com/portal/site/exxonmobil/index.jsp?ndmViewId=...

November 5, 2007

Here's ExxonMobil's forecast

click to enlarge

ExxonMobil's overoptimistic forecast is made by first forecasting the demand and then assuming that the supply forecast naively equals the demand forecast. This assumption is justified by ExxonMobil because of the overoptimistic resource estimates made by CERA and the US Geological Survey who say that there are over 3 trillion barrels left!

http://globalpublicmedia.com/an_open_letter_to_cera_from_chris_skrebowski

(billions of barrels)

Skrebowski comments about the table from the link above

"I am afraid the table can only be described as a motley collection of the known, the unknown, the possible and the plain unlikely. More prosaically, it appears to be a collection of apples and pears along with a couple of lemons."

Ah, Skrebowski...killin' me! That's some funny shit!

The main problem in using the USGS assessment is that their estimates are neither on recoverable resources (URR) or resource in place (OOIP). I quote the USGS:

I really don't understand how you can forecast reserve additions and don't want to talk about recoverability in the same time! doesn't make any sense to me.

From the sounds of it, they are talking about recoverability, they're just not talking about ultimate recoverability.

If "ultimately recoverable resource" means "all that can ever be extracted", then giving URRs now means, essentially, "I can predict what all future technological developments will do for oil recoverability." Which, of course, is false. What the USGS appears to be doing instead is to say "I'm predicting what technology will mean for oil recovery in the next 30 years, but things could change after that."

So if you're willing to define URR as being able to change - Provisional-URR, let's say - then from the looks of it the USGS is using the difference between their estimate of Provisional-URR in 30 years' time and current Provisional-URR as the potential for additional reserves to be added. In essence:

additional reserves = P-URR(2037) - P-URR(2007)

Or that's how I read the passage you quoted, at least, and based on that interpretation their approach seems to make sense (semantically, at least - one could certainly say their approach doesn't make policy sense).