DrumBeat: January 17, 2008

Posted by Leanan on January 17, 2008 - 10:06am

Citgo cuts hundreds of Louisiana contractors - sources

Citgo Petroleum Corp cut more than 500 contract maintenance workers in late December at its Louisiana refinery as part of a program to increase returns to corporate parent Venezuelan state oil company PDVSA, according to sources familiar with the company's refinery operations.Between 500 and 700 contractors were let go at the 430,000-barrel-per-day (bpd) Lake Charles plant, which the U.S. government lists as the nation's third largest, the sources said. A Citgo spokesman declined to discuss operations at the Lake Charles refinery.

Drought-hit Brazil maxes out thermal energy

RIO DE JANEIRO (Reuters) - Brazil is trying to offset falling water levels at drought-hit hydroelectric reservoirs with more thermoelectric generation, including using pricey fuel oil, but officials deny risks of energy shortages.Outgoing acting Mines and Energy Minister Nelson Hubner said on Thursday the Cuiaba gas-fired plant, which stopped working last September after Bolivia reduced natural gas supplies, will go back on line, now running on fuel oil.

Oil falls on Bernanke comments

Oil futures fell Thursday after Federal Reserve Chairman Ben Bernanke said he expects slower growth in 2008, but no recession.Bernanke's comments added to the negative economic sentiment that has been the market's dominant driver in recent days, pushing prices down nearly $10 from their record over $100 a barrel two weeks ago. Despite Bernanke's comments, many investors fear a recession is imminent.

Mr. Yergin is a smart man. Mr. Bakhtiari was, too. Mr. Yergin’s undulating peak is immediately more reassuring - we have lots of time to change. Mr. Bakhtiari was more anxious, seeing change forced on the world much more quickly, in four stages, the first (right about now, he argued) seeing oil production slip almost imperceptibly. Then, in the second stage, it becomes clear oil production is not rising but in fact falling. Then, worsening in stage three, a “remarkable” decline begins, with stage four featuring a harrowing “rather steep” slide (and that could occur by 2020).

"We have grossly underestimated mankind’s ability to find new reserves of petroleum, as well as our capacity to raise recovery rates and tap fields once thought inaccessible or impossible to produce.” So said Abdallah S. Jum’ah, Saudi Aramco’s president and CEO, during his address at the 11th Congress of the World’s Energy Council in Rome last November.With the mass media focused on soaring oil prices and publishing a rash of peak oil stories, Jum’ah’s latest contribution to the peak oil debate has gone largely unreported. Remarking on the abysmal prediction record of peak oil alarmists through the years, Jum’ah countered it would be possible for the oil industry to produce at least 3 trillion barrels (over 1.3 trillion barrels more than usual estimates) from conventional recoverable and proven reserves in known fields over several decades. “Based on projections I’ve cited,” Jum’ah said, “the world seems to have over 3 trillion barrels of recoverable conventional and non-conventional liquid fuel resources if we opt for extra-conservative assumptions, and about 6 trillion barrels” if more liberal assumptions are used.

China and India's pressing energy crunch

By 2030, China will be importing the same amount of oil as US currently imports daily. And India's daily oil imports will have overtaken the European Union and Japan.Those figures are from the International Energy Agency (IEA), which advises governments around the world on energy issues.

"The oil markets will get tighter and tighter," says Fatih Birol, the IEA's chief economist.

Ukraine, Gazprom hold gas talks as fears mount

MOSCOW, Jan 17 (Reuters) Ukraine's energy executives today met the chief of Russian gas export monopoly Gazprom as Ukraine's new government seeks to revise the terms of gas agreements with Moscow amid mounting debt.Russia, which suplies one quarter of Europe's gas needs, ships four-fifths of its exports to Europe via Ukraine. Europe closely watches gas price disputes between Kiev and Moscow, as they can lead to transit supply cuts.

Deadline extension sought for Texas LNG terminal

Proponents of a liquefied natural gas import terminal near Corpus Christi, Texas, on Thursday asked U.S. regulators for a nearly three-year extension of the original deadline for putting it in operation, according to a filing....The letter cited market conditions in the LNG industry for the request to delay. The growth of the LNG trade has been hampered by uneven development of supply and demand, including delays in facilities overseas for liquefying natural gas for shipment.

Energy Tribune Speaks With Dave Pursell

I am not sure when oil production is going to peak, but since Colonel Drake discovered oil, everyone who has called the top of oil production has been wrong. The initial peak oil theory developed by M. King Hubbert, used to accurately predict the peak in U.S. Lower 48 onshore oil production, is reserve-based…one has to know the reserve picture to make a peak oil projection. I find it interesting that many peakoilers have also been very vocal about the lack of solid global reserve data.

Unconventional natural gas reservoir in Pennsylvania poised to dramatically increase US Production

Natural gas distributed throughout the Marcellus black shale in northern Appalachia could conservatively boost proven U.S. reserves by trillions of cubic feet if gas production companies employ horizontal drilling techniques, according to a Penn State and State University of New York, Fredonia, team.

BULGARIA: On To A New Nuclear Path

The European Commission (EC) has given a positive opinion on construction of a nuclear plant at Belene by Russian Atomstroiexport, controlled by Gazprom.Russian President Vladimir Putin, who is in Sofia to mark the beginning of the 'Year of Russia in Bulgaria', was set to bless the signing of this deal Friday.

Georgetown is one of those southern Ontario towns “near Toronto.” Like others in the area, it is rapidly expanding into the surrounding farmlands, blanketing some of Canada’s richest soil with a thick coat of concrete. Last year, around 3,000 hectares of farmland were transformed into pre-packaged suburbia – row upon row of identical houses, roads, and big box stores. This isn’t news: roughly the same amount of arable land has disappeared every year in the area for the last three decades.

CAMBRIDGE, Mass. — The missing link for understanding the future of world oil supply - a solidly based view of oil field decline rates - has now been filled by a new field-by-field analysis of production data by Cambridge Energy Research Associates (CERA) and IHS Inc.The aggregate global decline rate is 4.5 percent, rather than the 8 percent cited in many studies, based upon CERA's analysis of the production characteristics of 811 separate oil fields.

"Some of the more gloomy, pessimistic 'peak oil' views about the future of oil supplies that are current today result from an assumption of high decline rates," said CERA Oil Industry Activity Director Peter M. Jackson, author of the Finding the Critical Numbers report. "This new analysis provides the basis for more confidence about the future availability of oil.

"The absence of definitive, comprehensive analysis of production timelines and decline rates has led to widely differing estimates of the potential future availability of oil: an information vacuum that has contributed to the 'peak oil' theory of future liquids production capacity," he added. "We hope that this study will contribute to a more informed understanding of the issues, both below ground and above ground."

The Oil Price Rise - Timing Benchmarks Delineate Our Likely Advance to the Oil Peak

Back in 2001, I set out some timing benchmarks for energy developments that I saw coming towards us (“Nearing the Top of Hubbert’s Peak,” 8/1/01). These benchmarks have served me well over the succeeding six years in a general sense, but now I think that they need to be sharpened and tightened a bit. We are closing in on some of the dates cited for important defined events such as the peak of non-OPEC oil supply, projected then for 2010. I now believe that certain of these dates should be modified, in this case to 2008. The reasons here are more technical than fundamental.

World Oil Demand Up, Says IEA; OPEC Unwilling to Ease the Pressure

The International Energy Agency (IEA) has revised the 2007 world oil demand, increasing the estimate by 150 kb/d to 85.8 mb/d. The IEA states that demand forecasts for 2008 are slightly higher, yet the Organization of Petroleum Exporting Countries (OPEC) has refused to increase oil outputs despite pleas from IEA and world leaders.

James Howard Kunstler on the human habitat (audio)

Author James Howard Kunstler talks with Duncan Crary of the Institute for Humanist Studies about the tragedy/comedy of suburban sprawl, what makes a successful town, and the fantasy of alternative fuels. Kunstler also reads passages from his book, The Geography of Nowhere.

C-Realm Podcast: Cui Bono (audio)

In this episode, KMO concludes his conversation with James H. Kunstler, author of the Long Emergency: Surviving the Converging Catastrophes of the 21st Century. Later, we hear from Kathy McMahon, founder of PeakOilBlues.com about the range of psychological reactions which commonly manifest themselves in people who come to appreciate the implications of peak oil.

Petroleum industry leader urges better understanding by elected officials and public

Crude oil and gasoline prices underscore a major obstacle to addressing our nation’s energy challenges: the public’s lack of understanding about energy, particularly oil and natural gas. People are understandably concerned about energy prices. Unfortunately, however, they do not understand that price volatility is actually a symptom of the energy problems confronting our nation. We have massive energy resources here in the United States and worldwide; we have a wealth of energy information and analysis; and we have a wide array of energy studies and research. What we don’t have is public awareness and opinion-leader understanding of the need for energy and what it takes to find, develop and deliver affordable fuels reliably to customers.

Warming Climate Accelerated Greenland's Thaw, Scientists Report

Climate change led to accelerated melting of Greenland's ice sheet during the past half-century, scientists said in a study that adds to evidence suggesting sea levels will rise faster than expected.

Massachusetts: Senate offers a ‘GREEN’ solution to energy crisis

In last week’s column, I wrote about the Senate’s passage of the Regional Greenhouse Gas Initiative, a multi-state compact to reduce carbon dioxide emissions from larger power plants throughout New England and several bordering states by 10 percent over the next decade.This week, I will take a look at another statewide energy initiative: An Act to Generate Renewable Energy and Efficiency Now, which passed the Senate unanimously on Jan. 9.

Pakistan short of everything except crises

QUETTA, Pakistan - There is a crisis of crises facing Pakistan. While the political crisis centering on President Pervez Musharraf and the future of general elections scheduled for February 18 dominate the headlines, this country of 160-plus million people faces a tangle of escalating problems, extending from energy shortages to soaring wheat prices to a cotton industry facing meltdown.

Albania has been hit by a succession of severe energy crises in the last few years, due its total dependence on hydro-power for the generation of electricity, an obsolete distribution network and growing demand from an increasingly-prosperous population.

Bulgaria Stops Electricity Exports

Bulgaria has halted electricity exports for at least a week because of an emergency caused by an exceptionally cold spell at home.

There should be a report on the financial losses which the country suffered after the closure of 3rd and 4th reactor of Nuclear Power Plant Kozloduy, Bulgarian Prime Minister Sergey Stanishev said during a jointly press conference together with Minister of Economy and Energy Petar Dimitrov, FOCUS News Agency informs. Both of them discussed today the execution of the plan for extension of the period for work of 3rd and 4th reactor of NPP Kozloduy.

Mike Adams On His Personal Routine For Optimal Health

When the weather gets radical, the crops disappear, and then the population disappears. We are in what I call a food bubble and a population bubble. It's a food bubble because modern food production is only supported by non-renewable resources, oil and water. When peak oil is really realized and oil becomes scarce, and when the water tables around the world begin to run dry, we are very close to that in many regions now. The food production that we enjoy today will disappear and with that, the population must, unfortunately, follow.

Christians playing their part in sustainability

Traditionally, Christianity is concerned about caring for God’s creation. So you’d think we Christians would be out at the front when it comes to doing something about all the threats to the environment we are suddenly aware of. But not necessarily. ‘I just trust in God,’ one woman said, and presumably went on living in her old familiar creation-wasting way. (‘Poor God,’ some nuns said, when they heard that one.) A parish priest, who said the matter didn’t interest him, was asked what would happen when the seas rise and sweep over Ireland. ‘Ah, they can all go to America,’ was his simple solution.

The Peak Oil Crisis: We Are Starting To Dim

While waiting to see how the contest between a demand-killing recession and shrinking oil stockpiles plays out, it might be worthwhile to spend a little time reviewing the world’s electricity situation. If there is any form of energy that would be sorely missed by people who had once had it, electricity would be it.Private cars we could do without, but not our lights and appliances. Most of us here in America have been blessed to have an unlimited amount of electricity for all of our adult lives. There are very few left who can remember a time when it was not universally available.

Oil giant ordered to pay millions in damages over spill

IT WAS one of Europe's grimmest maritime oil spills, suffocating hundreds of kilometres of France's Atlantic coastline with a tide of black, toxic, heavy fuel and killing or injuring 300,000 sea birds.In a historic ruling, a Paris court on Wednesday held that the oil giant Total was responsible for the 1999 sinking of the ageing oil tanker Erika and must pay millions of euros in damages.

Analysis: Iraq oil flow actually lower

New reports on Iraq oil production find it flat, possibly decreasing, dampening expectations the sector was steadily advancing in the final months of 2007.The needs of Iraq's oil sector to continue and expand are not new. But the inability to exact levels of oil flow -- particularly the exports that bring in the tens of billions of dollars a year that support the federal budget -- highlight a troubling lack of transparency for Iraq and occupation powers.

Bush hopes OPEC will raise production

SHARM EL-SHEIK, Egypt - Saudi Arabia's King Abdullah told President Bush he was worried about the impact of high oil prices on the world economy, the White House said Wednesday. After their talks, Bush was hopeful that OPEC would authorize an increase in oil production.The White House did not say there was any commitment from the king about increasing oil output. The kingdom holds the world's largest oil supplies and is a major voice in decisions by OPEC.

PetroChina Longgang May Be Nation's Largest Gas Field

PetroChina Co.'s Longgang natural gas field may have twice the reserves of Puguang, the nation's largest gas field run by rival China Petroleum & Chemical Corp., a government official said. PetroChina's stock rose 3.9 percent.

Oil profits could spark some backlash - But expert says many lack understanding of industry

Historic oil prices and $3-a-gallon gasoline have been contributing to fears of a recession, but they've yet to cause the hue and cry that some might expect. Americans may simply be growing more accustomed to high fuel costs, analysts say.All that may change beginning Friday, when oilfield services giant Schlumberger Ltd. kicks off earnings season for the oil sector. Companies may not post record profits, but certainly may report big enough earnings to raise some eyebrows.

Energy experts to discuss threats to future (Rochester, MN)

You probably have heard more about climate change and energy supply issues in the last year than in the last 10. We have all noticed the increase in fuel prices and felt its effect on our budgets.This Friday you can get the latest information on climate change and energy, how they might affect communities and how to prepare for them.

Planning officials give OK to land rezoning for refinery company

ELK POINT, S.D. (AP) -- Union County planning officials late Wednesday voted to recommend that county commissioners approve a Texas company's request to turn 3,800 acres north of Elk Point into a planned development district for a $10 billion oil refinery.

UAE about to start building green city in desert

The United Arab Emirates plans to start building a multi-billion-dollar green city in the desert in the first quarter of this year, as the oil producer looks to become a pioneer of alternative energy.The zero-carbon, zero waste city -- actually a town of up to 15,000 residents -- is being steered by Masdar, an initiative set up by the Abu Dhabi government to develop sustainable and clean energy.

LONDON (AFP) - Prime Minister Gordon Brown heads to China and India Thursday for his first visit as prime minister, looking notably to get the world's two most populous countries on board for a new deal on climate change.

Texas is biggest carbon polluter

Everything's big in Texas — big pickup trucks, big SUVs and the state's big carbon footprint, too. Texans' fondness for large, manly vehicles has helped make the Lone Star State the biggest carbon polluter in the nation.

US calls January 30-31 climate talks

US President George W. Bush has called major world economies to a second round of climate change talks on January 30-31 in Hawaii, the White House's Council on Environmental Quality announced.

EU commission refuses to compromise on greenhouse plan

STRASBOURG (AFP) - European Commission chief Jose Manuel Barroso refused Wednesday to compromise on a plan for the 27-nation to cut emissions of the gases responsible for global warming."Do not expect us to compromise on European interests," he told members of the European Parliament. "Both our international credibility and credibility before European Union citizens depend on fulfilment of the targets."

Tories' fuel plan would cut vehicle emissions

While just everyone believes that a stimulus package is needed, some have pointed out that any package will unfortunately just contribute to an even more ridiculous deficit than we already have. I think most politicians, especially the conservative ones, are leaning towards a quick fix rebate. While this should stimulate the economy,much of this will bleed off to China as people use their rebates for more Chinese made trinkets.

We don't need more trinkets; as long as we think we need to stimulate the economy anyway, let's put those dollars into green energy. We need to ramp it up anyway so let's make this stimulus package into something that will help us in the long run,not simply fuel our debt ridden over consuming society. Besides, as I mentioned in paragraph one, how much "leakage" would there be from any tax cut. The vast majority of consumer goods are imported, especially from China. Maybe we should have China help us with the package; I notice there stock market isn't doing so well lately, either.

On CNBC this morning, one analyst said that most of the rebates would go to paying off credit card debt. Another analyst countered that as soon as some of the debt was paid off, the consumer would just drive their debt up again with consumption. This is kind of like providing more credit to a gambler in Vegas.

A better bet would be a voucher that could only be spent on an approved list of energy conservation items.

Yes, vouchers would be good as an addition, but not the sole method of investment. There are many large scale investments that should be made that would not be amenable to small scale things the individual consumer would be doing.

Roughly $135 to $175 billion, start construction within 12 to 36 months (we could put a 24 month deadline to start). Almost every $ stays here and they last a L-O-N-G time !

http://www.lightrailnow.org/features/f_lrt_2007-04a.htm

Best Hopes,

Alan.

Merrill takes US$14.1B writedown

Merril takes $16.7 Billion hit. Follow the magical growing write downs...

Fuel-laden tanker hijacked from Curtis Bay, emptied

A very high percentage of the Caltec Streaming Theater lectures recently have been on oil, energy, global warming or other related subjects. The very last one was on ”Sunlight to Fuels”. It describes how sunlight could be converted and stored as chemical fuel. I watched that one a couple of days ago. Highly technical but some really eye opening facts concerning biofuels and other renewables. That is the data presented gives us very little hope that biofuels will ever make very much difference worldwide.

Last night I watched another really great one. It is the ninth one down from the top:

A lot of things in this lecture will blow you away. Professor Rutledge applies the Hubbert Linearization method (or something very similar) to all fossil fuels combined, coal, gas and oil, as Tboe, (trillion barrels of oil equivalent) and comes to the conclusion that they will be 90% exhausted in 2076. We have a whole lot less recoverable coal than most people believe.

Near the end of the lecture there is a very good presentation on Solar Thermal power. Looks promising.

The lecture ends with a presentation on global warming. One point is that all coal consumption will raise the earth’s temperature by about .3 degrees centigrade. All fossil fuels raise it about 1.7 degrees C. And it does not matter when you burn this coal because it takes the world about 800 years to recover. That is it does not matter if you cut coal consumption in half, the end result will be the same if all available coal is eventually burned. The same is true for all fossil fuels, or any other type of carbon base fuel that is burned, it simply does not matter when it is burned it will eventually have the same effect.

Note, all opinions and data stated in this post are not mine but those of Professor David Rutledge.

Ron Patterson

Here is a working version of the link.

Rutledge is TOD member DaveR and the presentation in question was covered as a featured post earlier this year.

One point is that all coal consumption will raise the earth’s temperature by about .3 degrees centigrade. All fossil fuels raise it about 1.7 degrees C.

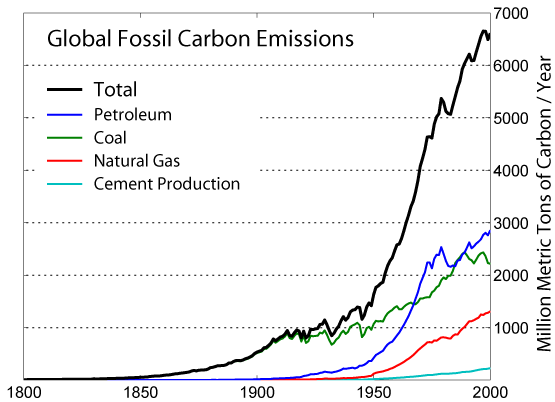

This can not be true. Even now coal accounts for about the same CO2 emissions as oil (and catching up) and roughly twice more than Natural Gas. Here is a nice graph illustrating this:

Coal price per BTU is many times lower than the other FFs and hence its usage rises much faster recently. What is more worrisome are the ultimate coal reserves:

1 trillion tonnes of coal will emit 7-800bln.tonnes of carbon, or more than 100 years worth of carbon emissions at current emission levels. A rough calculation: if 50 years of burning FFs at about half current emission levels on average brought us 0.6C temperature rise, 100 years, twice that emissions should bring 4 times, or 2.4 degrees C temperature rise (forgetting about feedback loops etc.).

Even if we are pessimistic and half of that coal turns out unrecoverable, this is still 1.2 degrees or 4 times what your source suggests.

Hi LevinK,

For coal, everyone use the World Energy Council surveys. They are at

http://www.worldenergy.org/

They were 847Gt in the 2007 survey. These have been reduced repeatedly since the 1992 Survey, when they were 1,039Gt. These have been dropping, as countries become more realistic about how much coal they will mine, like Germany, and switch from quoting coal in place to recoverable coal, like India. In the simulations I have run, which do include climate feedback to the carbon cycle, the contribution to the peak temperature rise from coal burning is roughly linear, with a proportionality constant of 0.0007 degrees C/Gt. Multiplying this by half the coal reserves, which is probably reasonable for mined coal, gives 0.3 degrees C rise.

There are slides and spreadsheets at

http://rutledge.caltech.edu/

Historically coal reserves have not been a good estimate of future production, just as oil and gas reserves have not been a good estimate of future production. However, while oil and gas reserves have been lower than future production, coal reserves have been higher than future production.

Dave

David Strahan has an article about coal on the EB, in which he discusses David Rutledge's work:

http://www.energybulletin.net/39236.html

All these discussions about coal reserves are completely academic. The limiting factor is not the coal reserve (resource side) but the absorption capacity of the atmosphere for CO2 (sink side). In fact, our atmosphere is already overflowing with CO2. Carbon dioxide concentrations are now much higher than they were in the warmest interglacial period during the last 500 k years when sea levels were several metres higher than now. So we are clearly in overshoot mode already.

Lessons from the Arctic summer sea ice melt in 2007:

www.carbonequity.info/PDFs/Arctic.pdf

NASA climatologist James Hansen is working on a new paper:

Remember This: 350 Parts Per Million

By Bill McKibben

http://www.washingtonpost.com/wp-dyn/content/article/2007/12/27/AR200712...

We are now at 383 ppm and rising.

Discussion of 2007 GISS global temperature analysis is posted at Solar and Southern Oscillations

http://www.columbia.edu/~jeh1/mailings/20080114_GISTEMP.pdf

The additional warming from increasing solar irradiance is 0.3 W/m2 over the next years.

When the Arctic summer sea ice is gone in a couple of years time, the whole weather and climate pattern of the Northern hemisphere will change. We have no idea what that will mean.

Causes of Changes in Arctic Sea Ice; by Wieslaw Maslowski (Naval Postgraduate School)

http://www.ametsoc.org/atmospolicy/documents/May032006_Dr.WieslawMaslows...

Hi Ron,

Thank you for your comments. The numbers get revised a bit from time to time. Here is how the various parts of the peak temperature rise break out. The reference year is 2005.

Future US coal 0.05 degrees C

World coal 0.3 degrees C

World fossil fuels 0.8 degrees C

Total 1.4 degrees C (largest additional components are CH4 and N20)

The slides and spreadsheets are at

http://rutledge.caltech.edu

and the plot for the simulated temperature rise is given below.

Dave

Caltech is apparently a hotbed of PO/GW hippies.

The Mechanical Universe guy appeared in a peak oil video a while back, it was linked from TOD but I've forgotten the name of it. It's nice to see he is still there; I loved his physics lectures on the PBS channel here a couple decades ago.

Hi DIYer,

That would be David Goodstein, who wrote the book "Out of Gas," which I recommend.

Dave

http://www.bloomberg.com/apps/news?pid=20602099&sid=aGvjUrCR0gds&refer=e...

At the meeting Peter Davies told us he didn’t believe in world ‘Peak Oil’ even though he knows individual wells and countries do indeed peak. He then spent twenty minutes showing us that apparently he doesn’t fully understand the concept of ‘Peak Oil’, and why BP is such a profitable company. But, most importantly, he explained the mechanism by which ‘Peak Oil’ will occur, even though he didn’t realise it.

Put simply ‘Peak Oil’ is the end of cheap oil, not the end of profitable oil. We all agree that there are still huge deposits of potential Fossil Fuels in the world but ‘Peak Oil’ is about adequately increasing flows of oil, enough to keep the world’s economy growing at about 1.5% per year – the 'size of the tap not the size of the barrel'.

By ‘cheap’ we mean in comparison with everything else we consume - clearly with ~900% increase in the price of oil in the last 10 years while general inflation has been a very small fraction of that and with flat production for three years or so, worldwide, we are approximately at ‘Peak’ now and many countries are already ‘post peak’. As the relative price for liquid fuels rises (and with no currently viable adequate alternatives to liquid fuels) BP (and I) can see possible ways of making liquid fuel at a profit from light sweet crude, heavy sour crude, corn, sugar cane, chicken guts, wood, natural gas, tar sands, coal, bitumen, and oil shale in turn.

BP, like every other company in the ‘free world’ exists to make a PROFIT for its shareholders – no profit for long enough leads to no company. Unfortunately the world market for oil is not totally ‘free’ – for example BP is only allowed increasingly limited areas of the world to extract oil and normal economic theory of supply and demand does not apply to cartels such as OPEC – or to protectionist governments like the US restricting what exporters can buy in the USA with their dollars! There is no such thing as a free lunch or a free market for oil!

In the real world of oil, supply, demand and the price which balances the two varies substantially in an unpredictable way – when prices go up marginal consumers are removed from the market and when prices go down marginal unprofitable production is removed.

The price of oil will ensure most of the companies producing oil post peak will still be producing at a profit, that may or may not include BP – nobody can predict what the future will be, but at those prices (relative to everything else in the economy) there is no reason at all to believe there will be enough oil supply/demand for the world to continue essential 'business as usual' growth of ~1.5% a year, as in the last three years or so for example, and that is what ‘Peak Oil’ is all about!

API Press Release I

NEWS EMBARGOED FOR RELEASE AT 10 AM, 01.17.08

1220 L Street, NW | Washington, DC 20005-4070 www.api.org

Karen Matusic | 202.682.8118|matusick@api.org

U.S. fuel production at record-high in 2007, demand flat - API

WASHINGTON –

U.S. fuel production reached a record high in 2007 as refinery capacity expanded for the 11th straight year, API data show. U.S. crude oil production also rose in 2007, the first annual increase since 1991, according to API’s year-end Monthly Statistical Report. The API statistics also showed that U.S. oil demand was flat in 2007, the third straight year of stagnant or lower oil demand in the world’s largest oil-consuming nation. “While much of the increase in crude oil production represents a recovery from 2006’s depressed levels, our latest drilling figures show tremendous industry efforts to develop additional supplies from those regions that are open to exploration.,” said Ron Planting, manager, information and analysis, for API. Given the higher domestic production and flat demand, total oil imports fell 1.9 percent from year-ago levels, though imports still cover about 65 percent of U.S. oil demand. “Despite high oil prices, the industry worked hard to meet the needs of consumers by producing record amounts of fuel,” said API Chief Economist John Felmy. “Consumers appear to be responding to the higher prices at the margin.”

Total U.S. petroleum deliveries, a proxy for demand, averaged 20.7 million barrels per day, the same level seen in 2006, following a decline of 0.6 percent in that year. In the fourth quarter alone, deliveries slumped 0.4 percent. Despite a one percent year-on-year increase in the first quarter, gasoline demand was lagging about half a percent below 2006 levels by the fourth quarter. On the other hand, distillate fuel oil demand rose 1.5 percent in the year amid rising diesel demand and higher home heating demand.

The demand data includes an increase in the amount of ethanol blended into gasoline, which averaged more than 400,000 barrels per day. Excluding ethanol, which accounted for nearly five percent of all gasoline sales during the year, total domestic oil deliveries in 2007 actually fell half a percent. An estimated 6.7 billon gallons of fuel ethanol were used by refiners in 2007, some two billion gallons more than the 4.7 billion gallons required by law but more than two billion gallons less than the recently-passed requirement for 2008.

Alan

I find this API press release confusing for two reasons:

1. When a person reads this press release, they have to understand that "demand" doesn't mean demand in the lay sense of the word. It means consumption, at whatever price happens to be in effect at that time. If this press release is intended for an audience of non-economists, I would have preferred that API had used the word "consumption" in each of the places where the word demand is used, since this is what they are measuring.

2. The title is "U.S. fuel production at record-high in 2007, demand flat". The first half of the title does not refer to the same thing as the second half of the title. The US fuel production statement relates to the fuel component of the output of US refineries. Based on the API Monthly Statistical report, this amounted to about 9.0 million barrels of gasoline, and 2.3 million barrels of distillate, or about 11.3 million barrels a day.

The demand = consumption is flat part of the title relates to the 20.7 million barrels per day of total petroleum products supplied. Besides what is included in the first half of the title, these petroleum products include:

- Output of US refineries other than fuels

- Imported refined petroleum products

- Inventory changes

One reason why the percentage changes are different (fuel up, total flat) is that refiners are trying to get every barrel of gasoline and diesel out of available crude oil as they can. Lower value products (such as bunker fuel and probably asphalt) are being squeezed out. Other reasons were that inventories were drawn down this year, and imports of finished products were lower.

If I had written the press release, I would have titled it, "Fuel production by US refineries reaches record levels in 2007; total US consumption of petroleum products was flat.

So what you are saying is that one has to be a trained Actuary in order to decode the news?

I guess history will show that tptb told us what was going on but we were all just too ignorant to understand.

California and Florida are, by some accounts, now in recession. Yesterday the local paper carried an article by Carl Hiaasen (columnist for Miami Daily Herald and author of several good novels) said that moving companies are reporting more moves out of Florida than into the state. I have been reporting this trend for some time but have encountered some doubters. The cheap dollar will help Florida with the Canadian 'snow birds' tourisim, if the Canadian economy holds up. Europeans, that used to journey to Florida in droves, are more reluctant to visit the US since the 9-11 event and subsequent tighter visa/passport and body search requirements. Yesterday the Fl insurance commisioner told Allstate that they could not write any more auto policies untill they turned over to the commission all pertinent documents concerning possible collusion among insurance companies writing storm coverage in Fl. From reading the paper it sounds like the courtroom scene was a shouting match. Meanwhile, the state gov cannot put together a tax reform package that a majority will except because of special interests and the budget shortfall continues to increase. Its a mess. (This article was originally behind a 'log-in' wall at FT but was picked up by MSNBC.)

'Recession looming in US housing-boom states'

http://www.msnbc.msn.com/id/22689098/

'California and Florida - the biggest and fourth biggest state economies in the US - are either in recession or on the brink, many economists now believe.

While state-level data are patchy, the available figures suggest that economic activity is probably contracting in Florida and may be declining in California as well.

With Nevada and Arizona, they represent a new group of housing boom-turned-bust states that could join the rust-belt states of Michigan and Ohio in recession even if the US as a whole escapes with only weak growth.'

California and Florida - the biggest and fourth biggest state economies in the US - are either in recession or on the brink, many economists now believe.

While state-level data are patchy, the available figures suggest that economic activity is probably contracting in Florida and may be declining in California as well.

With Nevada and Arizona, they represent a new group of housing boom-turned-bust states that could join the rust-belt states of Michigan and Ohio in recession even if the US as a whole escapes with only weak growth.'...snip...

'The signs of recession are even stronger in Florida, where retail sales tax receipts for November - a proxy for consumer spending - were down 5 per cent year on year, on a three-month rolling average basis.

John Robertson, senior economist at the Atlanta Federal Reserve, told the FT: "All the indicators in Florida are consistent with an economy that is contracting not growing"...snip...

CERA just published a new peak oil analysis:

http://www.centredaily.com/business/story/339147.html

What startles me the most is the description about the future prospects:

They claim that the overall decline is 4.5% p.a. When calculating that for a five year period (the period they refer when talking about the future projects), we arrive at (1 - 0.045)**5 == 0,79 - so a more than 20% decline.

Now, even starting from their estimated production capability of 91 mbd, in five years we are down to 91 * 0.79 = 72.3 mbd. This means that within five years, the potential output declines by almost 19 mbd.

They say that within five years 3 mbd from OPEC and 3.5 mbd from non-OPEC are added. In grant total, their calculation says that in five years we are at a production capability of 72.3 mbd + 6.5 mbd = 78.8 mbd.

This seems to be a blatant mismatch with their suggested production capability of 112 mbd by 2017.

So, either I got the numbers wrong here, or CERA's calculation are speaking what we are saying and their words say the complete opposite.

Any thoughts here?

I posted this reply yesterday to last weeks Article documenting all the bad predictions by CERA and Yergin. It's pretty timely given todays CERA report. Essentially what I have on my Tivo is Yergin saying 5 months ago that production is slowing due to shortages of Personnel and high costs. How does that square with todays rosy future output predictions??? Here is my post from yesterday:

If anyone is still reading this post, I Tivo'd an episode of Squawk Box from August 16, 2007. Yergin was on at 7:18 AM along with some guy in Port Arthur Texas. They were discussing Hurricane Dean which was just getting rev'd up and was projected to maybe hit the US Gulf.

Joe Kernan took the opportunity to ask Yergin about the price of oil. I saved the show because I couldn't believe what Yergin was spinning. Here is the transcript:

JK: Why is Oil down today? (It was down $1.91 to $71.42) Does $70 plus per barrel already factor in that there will be a storm or is it just supply + demand?

DY: No. I think that we would see the price go up higher if it was thought that the storm would hit the vast Gulf of Mexico energy complex.

JK: How tight is supply and demand? Have you changed any of your view

on what a fair price for a barrel of crude should be right now?

DY: No. We are still seeing this years price in the low $70's as long as there are no major disruptions and next year we think the price is several dollars lower. Perhaps mid $60's as the supply and demand balance looks different. But right now the question is what is going to happen to the overall economy? What's going to happen to overall oil demand and that's a changing picture.

JK: Dan, big picture, Where is the demand destruction ... where is the increased production because you can sell it for $70 per barrel, where are the normal things that happen when the price of oil quadruples in a short period of time? Why isn't it happening?

(That excellent question gets Dan stammering + stuttering)

DY: Uhhh, it's you know, it's sort of happening in a very slow motion because you're short of people, you're short of equipment, ummm, I was talking to one uhhh, one of the national oil companies who was trying to recruit in Venezuela to get some new people and the people they sent down there actually got arrested for 3 days. That, that's a particularly graphic example of how tight it is in terms of people. So delay is now the name of the game, rising costs, people estimate a new oil field would cost $800 million now will cost a couple billion, it get's postponed. So that's in the system right now. So it's a slow motion response Joe.

That was the end of the interview. According to Yergin 2008 should see $65 oil for the year. Even though according to him Oil projects are being postponed due to high costs and shortages of people + equipment. Forget the economy and how much increased demand there may or may not be. What about depletion? How can "slow motion" new production even keep up with depletion?

I wish I could simultaneously Tivo ALL news channels, and keep all the video for dozens of years, so that I could pull it out 12 years from now and look at wrong predictions, outright lies, and the downward spiral. Hopefully someone out there is doing something like this.

Could you please, please, please put that on YouTube? Every time the CERA points out 'the terrible record of peak oil predictions', I want to point to a good interview of Yergin botching things. That sounds perfect.

I don't see CERA pulling many punches, I don't see why we should.

On my list of things to do is to figure out how to chop up and move video from my Tivo to Youtube. I'll try to work on it soon. I agree that Yergin needs to be held accountable. That's why I saved the video in the first place. He was on Kudlow last night and Larry asked him about his new report noting that a lot of people don't agree that we can keep up with the decline rates. Yergin answered that he wasn't saying it would be easy but that it could be done.

BTW, SLB reported this morning and the stock is getting hammered. Good buying opportunity.

The World Bank says

http://web.worldbank.org/WBSITE/EXTERNAL/EXTDEC/EXTDECPROSPECTS/EXTGBLPR...

Are they one of Yergin's customers?

According to:

http://royaldutchshellplc.com/2008/01/17/the-wall-street-journal-new-fie...

"CERA has drawn fire among skeptics for being one of the most optimistic forecasters in the industry. The company predicted in June that world oil production, now at just above 85 million barrels a day, could hit 112 million barrels a day by 2017."

-snip

"CERA argues that nearly half of that output will come from nonconventional sources such as biofuels and natural-gas liquids."

Thanks for the WSJ story.

No one -- I mean no one -- outside the offices of Cambridge Energy Research Associates believes CERA's estimates. Not even the WSJ reporter Neil King. They have no credibility anymore.

I have of course seen the report in question and there is no specific field data for any of the 811 fields studied other than Ghawar. Where's the data? The numbers? Barrels per day month by month, year by year. Naturally, we can't see it. It is not credible that IHS Energy's database contains this kind of detail. Take Russia. Do you think IHS Energy has access to Rosneft's field production numbers? No way! What does Iran do, call up Peter Jackson every month and give him the field-by-field production scoop? Again, no way. Does he have a hot line to Venezuela? Maybe Yergin's got Hugo on speed dial.

But it doesn't matter. From the CERA press release:

The "8 percent" number is from Schlumberger CEO Andrew Gould. I have never seen a study that said the overall decline rate is 8%. This is dishonest. I myself use a 4% decline rate. CERA has used 5% in the past.

They're still selling water from the Fountain of Youth. The usual $1000/copy for their clients. The report shows Ghawar is still producing near peak levels. I have commented in private that if that's not true, and CERA is selling this report, then we have a major case of fraud going on here.

I have watched Brazil, Russia, various operators in the Gulf of Mexico, etc. struggle mightily to put an additional 100 or 200 thousand barrels on-stream. I have seen just how hard it is to do, how hard it is to sustain those production levels. This CERA report insults them all. How dare they sit there in their corporate ivory tower and put out this palliative nonsense! Shameless.

Have a good one,

Dave

Hello Dave Cohen,

Thxs for weighing in--your analysis is always very credible. I consider your ASPO texts [also featured on EnergyBulletin.net] a must read for expert and newbie TODers alike.

An earlier posting of mine suggested that the TopTODers and ASPO topdogs should join Simmons & Pickens in Yergin's upcoming CERAweak conference--it would be great fun to get inside and shake the place up with questions and counter arguments. Alternatively, the video footage of Simmons and Pickens being hustled out to the street curb by CERA security would play very well on CNBC and Youtube.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Alternatively, the video footage of Simmons and Pickens being hustled out to the street curb by CERA security would play very well on CNBC and Youtube.

I can see it now, "Don't Taz Me Bro, I Just Asked Where's Your Data"

The 8% is from Gould but it did not originate with him. He was asked a question about "declines in production in mature areas" by an analyst in the last SLB Earnings call which can be found here:

http://biz.yahoo.com/cc/0/85040.html

At 24:30 he answers:

"I've never given a public answwer to this question and I'm not going to. I use a figure that was used by a major customer a few years ago which is 8%. Now, you know whether that is excelerating or not overall is an open question, what I do think is that a lot of the forecasting agencies are still using decline rates that are inferior to that which is what leads to confusion"

I can't think of anyone who is in a better position than Gould to comment on depletion rates and he uses 8% but as he says, that's a number he got from a customer.

BTW, SLB reports earnings tomorrow AM and will have another conference call.

Some more points to add to this excellent discussion:

Gould can't give a number of his own, because he's servicing customers who have their own ideas about this, and he's not going to insert Schlumberger into that fuss, but he's not going to deliberately give a bad number. He could have given someone else's number, like CERA's, or he could have given no number. He chose which number to give, even though he assigned responsibility for it to someone else.

Another point about the incompetence of Yergin and the CERA organization is that they assume the decline rate is steady, when the decline rate is increasing due to the nature of projects coming online to replace the dying elephants. Offshore decline rates will be faster than the decline rates from the old traditional production. Memmel and others have also made the point that we can expect decline rates to increase sharply at some point, due to the technology we've been using, which extracts oil faster but doesn't increase ultimate total production from a field.

And Stuart Staniford provided an important post not too long ago addressing the points in the Megaprojects report. Essentially, if I remember this correctly, Staniford had been hearing from oil people that more new production had been coming online through the years than predicted by the Megaprojects reports. Yet, this extra new production had failed to increase overall production, leading Staniford to hypothesize that decline rates had to have been steeper than supposed.

And that customer was very probably KSA who uses the same number before EOR techniques are applied to reduce decline. After applying various techniques, KSA claims they can (for now) reduce decline in existing fields to 2%.

This is all documented stuff. Now, very clearly based on the US situation, IF KSA can remain politically stable THEN they can probably keep that decline rate around 2% for a long time. The US has done it for 30 years. But that requires political stability and constant reinvestment. KSA has the funds to reinvest but I am not sure I'd bet on their long term political stability. Likewise with Iran. Iran may be semi-stable but there appears to be a widening gap between needed investment and what is occurring. Venezuela is another example of lack of investment so the decline rate is going to be worse there.

Then there are all the offshore fields. Offshore fields deliberately have high decline rates, because the daily operating costs are so high. So the goal in the offshore world is to suck it as dry as possible as fast as possible then get out. They do that to maximize profits and it does but it does not give us a stable oil supply, especially as larger and larger portions of the daily total come from offshore sources. Light crude peaked a few years ago. Total crude may have peaked or is close to peaking. Offshore won't peak for a few more years yet but when it does, whooboy, look out below!

i think you are making a BIG assumption i.e. political stability = 2% decline. how about the geology ? the advancing w/o contact at ghawar has chased aramco to the very top of the reservoir. they may be able to hold out there for awhile, but what happens when the w/o contact hits the mrc ? i doubt a politically stable environment will be of much benifit.

the us has maintained their 2% decline by drilling thousands upon thousands of wells per year. drilling a well in texas is a whole lot easier than drilling one in the empty quarter. roads would help.

It should be pointed out that Schlumberger, because of the business they are in, do have incentive to exaggerate the aggregate decline rate while not embracing peak oil.

And isn't that what they do?

Hello Dave,

This is my commiseration post for the evening (and beyond).

re: "No one -- I mean no one -- outside the offices of Cambridge Energy Research Associates believes CERA's estimates. Not even the WSJ reporter Neil King. They have no credibility anymore."

If only this were true.

I just had the privilege of a brief, yet enlightening conversation with a successful investor, who, together with his (approximately one decade) older, presumably-more-successful colleague, had just wrapped up a talk to a roomful of eager, college-age biz/econ majors.

I'll edit to shorten:

"Have you heard of "Peak oil"?"

"I don't believe it."

"Have you read Matt Simmons?"

"Of course, and Deffeyes - I was at Princeton when he was teaching. I'm in the CERA/Yergin camp. When the price is high - they'll find more of it."

What I cannot convey is his sweetness, which came through despite the self-assured smile. The slight undertone of eagerness to befriend.

The more disturbing aspect was the small crowd of young persons who followed him (and his friend) out to for a beer - including (Alan? are you there?) a young woman from Louisiana (had lived in NO for a while, too...). A representation of the best and brightest.

Aniya: Possibly. Two points: 1. for every successful investor, there are probably 20 salesmen masquerading as such 2. if he managed to quietly convey his sweetness to you he is a hell of a salesmen, which means you should question his sincerity always. He might be honestly speaking his mind-he might not. Guys (or girls) like this will literally say anything they feel is useful to their agenda. Unless he is marketing a short fund, Peak Oil is considered a negative story and the last thing any salesman/grifter wants or needs is a negative story screwing with the enthusiasm of the flock.

Hi Brian,

Thanks for responding.

I didn't want to just come right out and name his company, but they are successful, that's why the club booked them. I mean, "successful"... so far.

I didn't say I was taken in by it, or that I thought one of his outstanding traits was depth of character. I did believe he was being honest about his views on "peak oil". It wasn't his field, he said - they have someone else in the company who works on oil - and on wind investments as well. "So," he said, "we have one foot in each camp."

I just got the idea that the oil guy (whoever he might be) back home wasn't clued in...yet. Either.

Boy, you paint a picture, Aniya.

The 'easy, total confidence of the true-believer'.. I'm sure it's a very alluring pitch. I wonder if he's right? (Don't worry, I'm still building my panels and winter-fridge and geothermal hdw.)

Bob

RUTH DEWITT BUKATER: SO THIS IS THE SHIP THEY SAY IS UNSINKABLE.

CALEDON HOCKLEY: IT IS UNSINKABLE. GOD HIMSELF COULD NOT SINK THIS SHIP.

Hi Bob,

Thanks. What I was trying to convey also was my sense of helplessness, being an "outsider" (I'd just dropped in) and all...and the difficulty of attempting to have a conversation where I might put across some counter-points. And the sad sight of all the students who were trying to soak up from their (ostensible) role models.

It seems what they've been taught is a - (we know it's sad) - form of fiction.

including (Alan? are you there?) a young woman from Louisiana (had lived in NO for a while, too...).

Are you in New Orleans ? Be glad to meet (and don't miss the Krewe du Vieux Saturday night. Old style traditional Mardi Gras parade, ribald & satirical).

Best Hopes of meeting you,

Alan

1. The price is already high, and "they" have not made the investments that "they" should have already made if there is to be any reality behind CERA's projections.

2. As the price goes higher, the economy goes lower, which means that "they" will likely have less of the investment capital needed to "find more of it".

3. "They" are having a hard time "finding more of it", because a couple of decades of too low prices have resulted in a shortage of drilling rigs, petroleum engineers, etc.

4. "They" will have a hard time "finding more of it" because there are fewer and fewer places left to look for it.

Hi WNC, and Alan,

Thanks for spelling it all out. Later I thought "Just like old-growth forest - when the price goes up, they find more."

Alan, I hope to meet you someday, too. And many other TODers. I'm not in NO. You're a great advertisement for the city.

And if they are sre shipping it through the US Postal Service, it's mail fraud.

I don't get where they get their 117 mbpd by 2017 either.

Their #'s don't add up, the leg they stand on is their 63% of existing fields at plateau or in buildup. Of these, the reader must infer that the unstated % of these in buildup must offset their 4.5% decline rate.

This time they do add the caveat they could be wrong and need to understand "evolving decline rates."

Quite a shift from last spring. Seems the central message they were trying to project here is don't worry, high offshore decline rates to 18% are averaged out.

Well a certain amount of this is just "handwaving" (ignore the man behind the curtain, I am the great Wizard of Oz).

Notice how it's cast, a 4.5% aggregate decline for fields in production. I guess we are to take that as all fields they included in their study. And the fields in decline represent 41% of production. If production in the other 59% was flat, would would be the decline rate of those 41% of the fields to give an apparent 4.5% decline? Answer: ~11%.

If the other 59% of production were growing, then the decline rate for those fields in decline would be even worse (than 11%) to give the aggregate 4.5% decline the CERA reports.

So the 8% that CERA is arguing against is actually optimistic compared to their own numbers, or at least the way they were reported in this article.

If the decline continues at this aggregated pace, then 15 years from now the production rate will be 50% of today's current level. Maybe declines don't equal peaks to CERA, they are just plateaus and "negative growth" (but it's still growth because they use the word 'growth').

The real thing to note is the use of the word "capacity" as they assert 91 MMBPD "capacity" for 2007. That's like asserting the remaining wells in the North Slope in Alaska have a "capacity" of more than 2 million barrels per day (neglecting the TAP limitations). The fact that the production has declined to .66 MMBPD is just a minor detail. The same could be said for the GOM which has a "capacity" approaching 3 million BPD. But production is only about 1.35 million BPD.

So, what CERA is really saying is that the CAPACITY will be 112 MMBPD in 2017 and the decline rate will mean that the production will be 45.7 MMBPD.

But look at all that "capacity!"

In other words in reality future production won't look anything like what we said it would but we will blame "geopolitics, investment patterns, rising costs, government decision-making, and environmental issues"

"Ah knew it, it's them dang treehuggers, and the gummint, and them ay-rabs whose fault this is all is, you betcha Billyjoebob...Ah say we just nuke 'em all ta glass..."

Federal Qualms Leave Dulles Rail at Risk

I have plenty of objections to the way that this project has reached the point where it is today. In particular no-bid contracts to Bechtel really stink, and Bechtel's record isn't exactly stellar in the area of completing projects anywhere close to the original cost estimates.

In addition, the agency has been reluctant to promote large-scale transit projects

The

reason !REAL

GWB and underlings have been trying everything, in EVERY way to stop any non-oil transportation from going forward.

Best Hopes for 369 Days from now,

Alan

I posted the comment (below) earlier, and nobody has replied to say that my logic is screwed up. Anyone? Come on, I'm in denial here, I need some support. Tell me I'm wrong.

(Actually, I feel the need for some feedback for a reality check.)

"A scary thought occurred to me last night... it was sort of an IMPORT Land Model. If the U.S. economy continues along its direction, oil consumption will decline and the "surplus" production will be taken up (rather quickly , I think) by growing economies. Less oil would lead to less economic activity, weaker dollar. Weaker dollar means less ability to buy foreign oil... if one can find any surplus in a market that's on the downward side of the production curve. Spiral that feeds on itself."

Exactly - that may be a problem for importing countries that can't pay with cash - human nature, and minimising risk, says somebody else with something of value to the exporter may outbid you.

This is why large exponentially increasing trade deficits are unsustainable - eventually even nations come up against a credit limit for international trade.

On a personal level, who would you deal with if you were selling something of importance, say, your house? - somebody who can pay the asking price with cash today (or goods to the value of the cash) or somebody who asks for credit and says he will pay you or your heirs with interest in 30 years?

BTW, I think we may be not just on a plateau with regard to 'net exports' but actually now declining - ELM is not just theory, it is happening now! I think this has serious implications for liquid fuel use as I am sure that some things, such as agriculture, will require more energy as the world population increases - that means they take a bigger percentage of the declining resource making a potentially bad situation worse.

Reserves don't mean Production

Production doesn't mean Export

Export doesn't mean Import

Import doesn't mean Availability

There's a chain with oil in the ground at one end and you at the other. A break at any point in the chain means you don't benefit from the oil.

The other detail is that you need growth to keep the financial system going. How are people going to pay back all of the loans, if suddenly there is long-term economic decline?

Less oil would lead to less economic activity, weaker dollar

Is the glass half full or half empty ?

Depends - are you pouring or drinking?

If we are proactive in adapting to a low energy future and find new ways/markets/technologies that are exportable then it may put a hole in your theory.

If a new regionalism does happen in the US then light exportable products may take some of the sting out of the spiral - Hollywood, software services ect...

But ya - it don't look good from this standpoint.

Hi Ignorant,

Thanks. The first "reality check" I can give is emotional support (best I'm able). This entire subject is sure a...well, let's call it a "character challenge." Logic, emotions, dealing with others, near and far...

1) Though there's more than plenty to be in shock about, it seems that the specifics of how other economies can grow, for how long...there's be some discussion here about that, w/out a 100% consensus conclusion AFAIK. (though I think you're in w. the clear majority). OTOH, the point made below about "cash" is relevant. As, of course, is Gail's point, which is in sync with yours.

2) You left out the factor of US military demand, and the issue of priorities. So, this could make your logic-steps worse (for the US) as well (if some oil is taken off the top of imports).

3) And, also as said...a positive policy could make a difference.

From the above top link; "No Evidence of Precipitous Fall on Horizon for World Oil Production".

Of course this does not square with a 4.5% decline rate but does when you consider that, they say, only 41% of all fields are in decline. So the overall decline rate is only 4.5% even though every individual field that is in decline is much higher. But of course that means that when all those fields do go into decline that the decline rate will be much higher than 4.5%.

But what I do not understand is that last sentence concerning the 12% decline for OPEC offshore fields compared to only 5% of non-OPEC offshore field decline. Hell, geology is geology, why should there be any difference at all? What is the difference in an OPEC offshore field and a non-OPEC offshore field? Is there some law of geology that looks at who owns the field? Of course not! What am I missing here?

Ron Patterson

OPEC's decline rates have to be lower so that their proven reserves stay constant, which appears to be each of their national policies.

EU threatens 50,000 jobs with CO2 plan: German steelmakers

If the issue is that steel will, therefore, be produced and bought elsewhere, like China, for example, the tariffs should be imposed reflecting the carbon generated from steel plants in other countries. Besides, just exporting the problem doesn't do anything to cut carbon emissions. We can't solve this problem within one country or one region or one continent, especially as we live in a globalized trading system. If addressing global warming requires bleeding off jobs to other countries, it will surely fail.

Top Post: "UAE about to start building green city in desert"

Green city in the desert is an oxymoron in itself. Still,

"Taking old cities from the Arab world as inspiration, the plans show narrow streets, squat buildings and no cars. Solar panels will act as awnings to shelter pedestrians from the sun."

Maybe Las Vegas could grab a page. No cars...pedestrians too.

Sarkozy attacks EU carbon targets

This just reinforces the fact that this problem cannot so solved in isolation. Any action that increases costs in one country must be offset with tariffs on products from those countries who are not cutting their carbon. Besides, if addressing global warming is shown to have a significant impact on jobs, it will make it all the more difficult to get political support.

Better off home owners in trouble?

http://www.reuters.com/article/newsOne/idUSN1530426720080117

What's wrong with the natural gas article? It's not posted yet and seems quite on topic.

It is posted. If you have anything insightful or thoughtful to add, feel free. But don't just post a link to a story that is already posted.

My bad, i'm having trouble with refreshing these pages or something. Does anyone know how many other old oil fields in the us could be used to exploit natural gas in a similar way mention in the article?

After reading the CERA article I did a little XL growth, depletion chart, to get some perspective of what is needed.

Column 1 is the year

Column 2 is 2% annual growth starting @ 91 Million B/D.

Column 3 is 4.5% depletion using previous year’s production capacity.

Column 4 is annual capacity increase.

Column 5 is annual depletion using previous year’s production capacity.

Column 6 is total new annual capacity required to maintain real annual growth shown in column 2.

IMO Most unlikly!

2008 -91.0 -91.0 -0.0 -0.0 -0.0

2009 -92.8 -86.9 -1.8 -4.1 -5.9

2010 -94.7 -88.6 -1.9 -4.2 -6.0

2011 -96.6 -90.4 -1.9 -4.3 -6.2

2012 -98.5 -92.2 -1.9 -4.3 -6.3

2013 100.5 -94.1 -2.0 -4.4 -6.4

2014 102.5 -96.0 -2.0 -4.5 -6.5

2015 104.5 -97.9 -2.0 -4.6 -6.7

2016 106.6 -99.8 -2.1 -4.7 -6.8

2017 108.8 101.8 -2.1 -4.8 -6.9

The sum of column 6 is 57.7 Million barrels per day of new capacity in the next 9 years.

When was the last year 6 to 7 million brl’s of new production was achieved?

Dow down over 300 points today. o_O

yeah, I've been watching Closing Bell and MSNBC. One of 'em had an interview with Nancy Pelosi. Here's what she said:

blah, blah, blah, American People, blah, blah, blah, in a bi-partisan way, blah, blah, blah, stimulus package, blah, blah, blah timely fashion, blah, blah, blah, increase consumer spending

Good grief, we're doomed. And I voted for her. I think all politicians are into some kind of substance abuse... they've got to be in order to OBFUSCATE the way they do day after day, week after week, year after year. I wish I had kept track of the number of times she said each of those and others. Very disappointing, not encouraging at all.

On Closing Bell what's-her-name was interviewing the head of Merrill - jeez, the guy even looks creepy. I couldn't believe the crap falling out of his mouth. I thought her questions were good. He danced around 'em and veered off into Wonder Land (as in "I wonder"). They all know what's coming and I think they're scared.

Merrill got stiffed by a bond insurer. I think it's ACA. The Monolines are in Big Trouble = Everyone is in big trouble.

Visting Argentina 6mos after they devalued a few years ago was an eye opener. Corregated Steel over all the banks windows, etc.

You could only withdraw 1000 a month regardless of your balance.

Look at the picture of the lines that were out front of Northern Rock a few months ago. Coming to a corner near you.

Americans will learn the hard way the fact that if you don't have your money in your hand, it doesn't matter what some electronic screen says you have. The banks are broke folks.

If it's electronic, You don't have it. Bank accounts, 401k's pensions, all "Virtual" money.

Real money hurts if you drop it on your toe.

One of the contributers over at Minyanville is predicting a "surprise" rate cut tomorrow.

http://www.minyanville.com/articles/index.php?a=15577

Something to keep in mind, is that the stock market crash of 1929 didn't happen in all in one day. It took a couple of years to run to the bottom.

This chart is kind of fun.

1927-1933 Chart of Pompous Prognosticators:

http://www.gold-eagle.com/editorials_01/seymour062001.html

I don't think the fun chart link goes where intended. Does it?

Yes.

It's a chart of the 1929 equivalent, of todays TV talking heads, explaining away the stock market crash.

Try http://bigpicture.typepad.com/comments/2006/11/19271933_chart_.html

Hello TODers,

When the banking runs start here in the US and it takes tremendous amounts of waiting to access your cash: will our cops and military force themselves to the front of the banking queues like in Zimbabwe?

http://www.zimdaily.com/news/117/ARTICLE/2316/2008-01-17.html

-----------------------------

HARARE - The cash crisis is set to worsen as it has emerged that banks are fast running out of cash with no solution in sight.

Long queues remain the order of the day with most depositors failing to access their money.

As the spectacle continues, soldiers who, this week, were given a “buy time boost” from government have invaded banks and are using their muscle to get cash before ordinary civilians.

“Soldiers came and demanded that they should not stand in the same queue as civilians but now have their own line that should be served first.

---------------------------

Hard to argue with guys holding guns. Yikes!

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Of course, if things get this bad: I would also expect the cops and military to queue jump the very long lines at Home Depot and Lowes to buy and hoard the remaining NPK, seeds, wheelbarrows, bicycles, and other permaculture essentials. NPK can grow more food than wrapping a seed with a worthless US dollar.

Where the Top 5 Winners usually are...

Really sums up what peak oil is about. No winners.

You just need to redefine what a "winner" is. A "winner" in the Newest World Order is the one the declines the least. The new game is not about gaining the most, it is about surviving. Who will be left after the dust settles.

As you've no doubt noticed, we are having serious technical difficulties today. SuperG is working on it. He may have to take the site offline tonight.

Hello TODers,

http://www.bloomberg.com/apps/news?pid=20601087&sid=a5AdCqFvvskU&refer=home

---------------------------------

Jan. 17 (Bloomberg) -- The Bush administration is close to completing an economic-stimulus proposal that will include $800 rebates for individuals and $1,600 for households as well as tax breaks for businesses, people familiar with the plan said.

-------------------------------------------

My guess is the $800 gift will be like vaporware--it won't do a damn thing to help the economy. Especially if people run out to buy big screen tvs with this money. Bush could help this country more by requiring that this $800 is redeemable only for biosolar goods such as NPK, wheelbarrows, bicycles, solar water heaters, seeds, handtools, etc.

Hey let them get those checks in the mail asap. I could get a new more energy efficient water heater and buy a little gold to boot. Go GW and Uncle Ben! John

And my guess is that it will stimulate the Chinese economy. :)

There's a definite whiff of panic in the air tonight. Bernanke wants everyone to run out and spend money...on American products. WTF? I thought Globalization was Good.

And CNN's Jack Cafferty went off on a rant. No one else could get a word in edgewise...and they tried. It almost sounded like he reads this site. He said we're heading for a long, deep recession. That we're in big trouble, that started with the '70s oil embargo, and that none of the presidential candidates has offered any solutions. He was practically foaming at the mouth, going on about how everyone's obsessed with stupid "wedge issues" like gay marriage and stem-cell research when we have such serious problems to worry about.

I've predicted the Meat Stick Media graph was going to move from fandango to forwardation and today might just be that day with Bush's gaffe (planned?) on peak oil.

So, no more dancing around the issue, and now they race to see who can make the gloomiest pronouncement without actually triggering a panic.

Me thinks the same. I just opened the NYTimes after reading the Chart of Pompous Prognosticators. These two headlines kinda jarred me. Particularly the words Plunges, Grim, Quick and Aid.

http://www.nytimes.com/2008/01/17/business/17cnd-stox.html?hp

http://www.nytimes.com/2008/01/17/business/17cnd-fed.html?hp

Not too late for a white russian.

...going on about how everyone's obsessed with stupid "wedge issues" like gay marriage and stem-cell research when we have such serious problems to worry about.

Did you ever wonder whether these guys get frustrated with the script? They know it's B.S..

The real issues are Wall Street, War, and our dysfunctional political environment ($$$ = representation). The Empire is tired.

Bernanke wants everyone to run out and spend money...on American products. WTF? I thought Globalization was Good.

Perhaps John15 will grace us with more on such a topic.

Brazil uses FFs to make up hydro shortfall.

This seems to be happening on several continents. Big users like aluminium smelters want contracts that say x megawatts 24/7 don't care where it comes from. Even if annual rainfall remains the same the shift to long dry spells interspersed with storms changes evaporation and runoff patterns. I also think increased cloud cover with or without rain will affect output from large scale solar.

Remedies include;

1) dams have to be at trigger levels before some users are supplied

2) carbon taxes so FFs are less attractive

3) working out how to get by with less.

Has Ug99 wheat blight reached Saudi Arabia?

Ug99 is the most probable reason for decline in wheat production in Saudi Arabia. Ug99 reached Yemen 1 yr ago and has no doubt crossed into Saudi Arabia.

http://environment.newscientist.com/channel/earth/mg19425983.700-billion...

http://www.globalrust.org/images/IR2007_002_GRI.pdf

http://www.sciencenews.org/articles/20050924/food.asp

http://voanews.com/english/archive/2007-04/2007-04-12-voa32.cfm?CFID=761...

When the story broke last April it was quashed immediately. It broke at an extremely inopportune time for the Ethanol lobby which was already under great pressure with regards to the food vs fuel debate.

http://www.reuters.com/article/latestCrisis/idUSL08699206

World Wheat Supply Threatened

Yue Jin, a plant pathologist at the Agricultural Research Service’s Cereal Disease Laboratory (CDL) in St. Paul, Minn., has confirmed that a new variant of the already virulent pathogen, Ug99, has occurred in Kenya, one that could broaden the disease’s reach to beyond the 80 percent of the world’s wheat already at risk.

All this is occurring at a low point in world wheat supplies. The Middle East and Asia’s 160-plus million acres of fields, which account for a quarter of the word’s annual wheat harvest, are in the direct path of the disease’s advance. And the spores of this fungal disease of plants could reach our continent sooner or later.

http://www.agriview.com/articles/2007/12/13/crop_news/crops09.txt

Oil Drum has been extremely slow since you got the animated ads in the sidebar. It's killing the site.

It's not the ads. SuperG says the database is corrupt. They're trying to fix it.

Did the database corrupt itself, or was it corrupted by someone? (Cue dark, sinister background music)

Maybe it was CERA and their evil minions!

PostgreSQL has never corrupted itself, but I've had to deal with database going FUBAR on MySQL 3 separate times on 3 separate systems.

The $599 a year license for MySQL and the non-open source nature of it - all the more reason for a pox on its house.

Is it MySQL TOD uses then? Note that Sun has just bought MySQL which is probably a good thing.

pnm distributed on Wednesday January 16, 2008 an infromative foil on cost of electrical energy generation by technology.

link

The amount of corn in the ethanol it takes to fill up an SUV would feed a person for a year:

http://www.caller.com/news/2007/dec/24/ethanol-demand-is-driving-up-grai...

World grain prices were exploding upward at spectacular rates after ignorant U.S. central planning required a switch to ethanol that is neither practical nor profitable for the nation or the world.

United States crude production up in 2007, imports down in 2007, stockpiles drawn down in 2007, high prices are decreasing oil demand in the U.S. (API):

http://www.pennenergy.com/display_article/317369/7/PRARC/none/GenIn/1/AP...

Hi rainsong,

Thanks for the really nice little comparison - it'll come in handy.