Peak Oil Overview - March 2008 (Pdf and Powerpoint available)

Posted by Gail the Actuary on May 25, 2008 - 8:00am

Ed note: This is a repost of Gail's Peak Oil Overview with a new comment thread and node. It originally ran Mar 2008. We appreciate you spreading this around to anyone who needs to learn more about this topic.

Preliminary data regarding oil production through December 2007 is now available from the US Energy Information Administration, so it is a good time to put together an updated summary of where we are now with respect to peak oil. The major themes of this presentation are

• The US oil story

• The world oil story

• Five myths

I have put this summary together in the format of a PowerPoint presentation plus notes. In this format, it is a multi-purpose document. You can

1. Read the post yourself, with or without my comments.

2. Use the presentation (PDF) as a handout, to give to one or two of your friends. My comments are intended to give you some more background, so you can better explain the presentation and answer questions.

3. Use the presentation for a group, using the PowerPoint format.

The PDF version of this presentation is available here. The PowerPoint version is available here.

Peak Oil Overview - March '08 Gail Tverberg

TheOilDrum.com

Outline

• The US oil story

• The world oil story

• Five myths

2

The US Oil Story 3

The US Oil Story

4

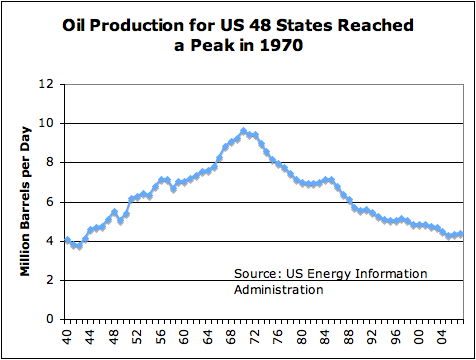

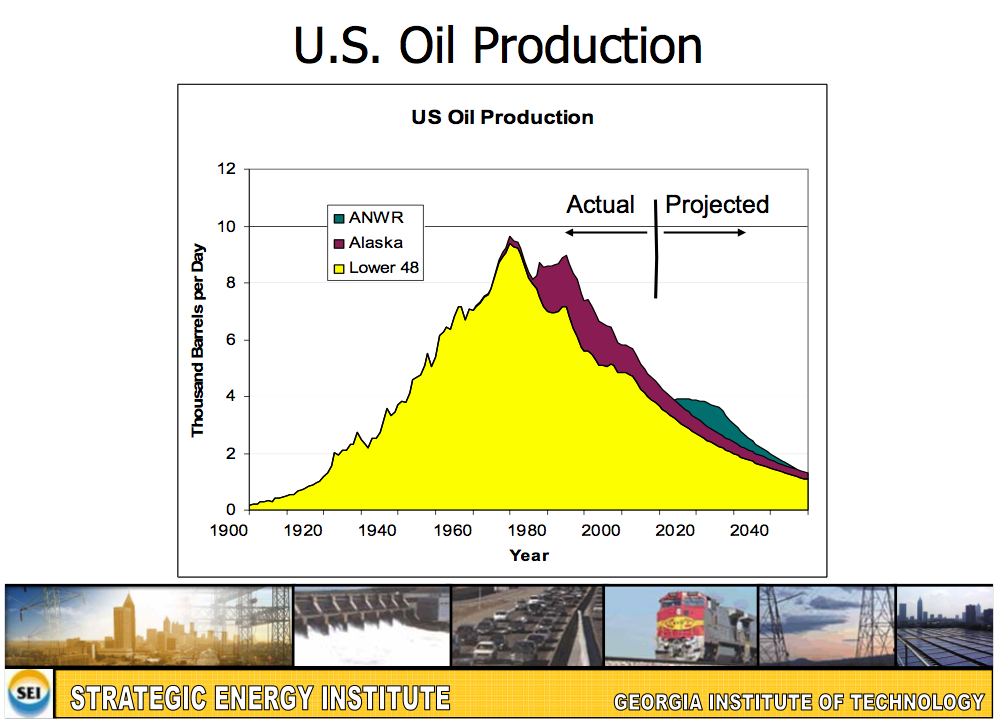

Comments: US oil production has been declining since 1970, in spite of technology advances and new drilling in the Gulf of Mexico. The recent dip and uptick reflects lower production in 2005 due to hurricane damage, followed by a bounce back in 2006 and 2007, as the damage was repaired.

US Peak in 1970 • US had been world's largest producer

• Peak came as a surprise to most

---Had been predicted by Hubbert in 1956• Precipitated a rush to find oil elsewhere

---Ramp up Saudi and Mexico production

---New production in Alaska and North Sea5

Comments: We were fortunate in 1970 to find other places in the world where oil was available, but had not yet been developed. There are still a few such sites available (for example, some US sites that have been placed off-limits for development), but they are much smaller in relationship to what was available in 1970.

M. King Hubbert had predicted in 1956 that the US production of oil would peak in 1970, but few believed him.

On page 22 of the same report, he predicts that world oil production will peak "about 2000". His prediction was made in 1956. As such, it did not reflect significant changes in the 1970s, including the significant recession of the 1973-1975 period, the switch to nuclear and natural gas instead of petroleum for electricity generation, and mileage improvements for cars. If these had been reflected, the predicted peak would have been several years later.

Saudi increases were quickest • Saudi oil company was run by Americans

---Able to ramp up quickly• OPEC embargo in 1973, however

---Oil shortages

---Huge oil price run-ups

---Lead to major recession 1973 - 756

Comments:

According to Wikipedia, Arabian American Oil Company (Aramco) was jointly owned by four US oil companies in 1970. In 1973, the Saudi Arabian government acquired 25% of the company. The percentage ownership was increased to 60% in 1974, and 100% in 1980.

OPEC began operation in 1965, but did not have pricing leverage until the United States could no longer produce the vast majority of its own oil, because of its decline in production. In October 1973, OPEC initiated an oil embargo against countries that supported Israel in the Yom Kippur War, particularly targeting the United States and Netherlands. The embargo lasted only a few months, until March 1974.

During this time, there was a sharp rise in oil prices, and a sharp drop in the stock market. In the United States, gasoline was rationed with people able to buy on odd or even days, depending on the last digit in their license plate number. According to Wikipedia, oil consumption in the United States dropped by 6.1% during this period.

The 1973-75 recession was the most severe recession since World War II. Merrill Lynch says it believes the current recession will be similar to that recession.

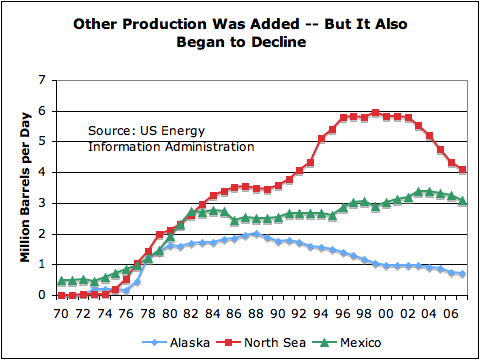

Other oil online by late 1970s

7

Comments: Even when an oil company wants to start new production quickly, it is difficult to do so. The ramp up in Alaska oil production had to wait until the Trans-Alaskan Pipeline System was completed in 1977.

It was known that oil was available in the North Sea prior to the oil embargo. It was not until the price run-up related to the embargo that it was economically feasible to drill there, however.

Production in all three of the areas shown is now declining. Alaskan production reached its peak in 1988; the North Sea peaked in 1999; and Mexico peaked in 2004. The shapes of the production curves vary for the different locations, depending on where the oil was located, and how it was produced.

Now the US is a major importer of oil

and a tiny user of newer renewables

8

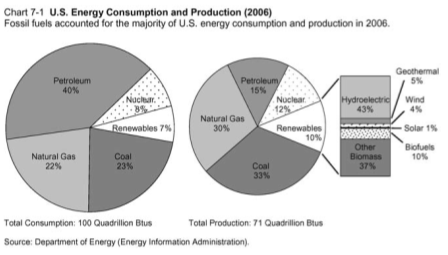

Comments: This figure is from Page 166 of the 2008 Economic Report of the President. The data shown are 2006 figures. Percentages for the newer renewables would be slightly higher for 2007.

The graphs are not as clear as I would like. The larger circle on the left represents consumption. It totals 100 quadrillion Btus. The smaller circle represents production. It totals 71 quadrillion Btus. Renewables are in the section pulled out. In total, renewables amount to 10% of production or 7% of consumption. The vast majority of renewables are hydroelectric and "other biomass" (wood used to heat homes and fuel some electric generating plants).

Reading Slide 8 • About two thirds of oil is imported

• Biofuels make up about 1.0% of energy production - a little less of use

• Wind comprises 0.4% of energy production

• Solar comprises 0.1% of energy production

9

Comments: We use a huge amount of oil and other fossil fuels. Even with big ramp up in alternatives, they are still tiny. If a cutback is made in fossil fuels, either because of shortages or because of a desire to reduce carbon dioxide, it seems clear that at least part of the response will have to be reduce total energy usage.

The World Oil Story 10

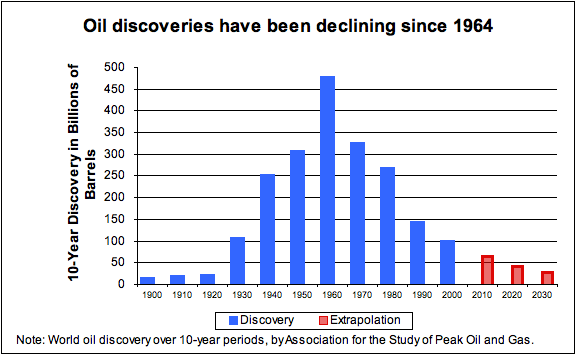

World Oil: Discoveries follow same pattern as US production

11

Comments: The discovery information is based on backdated information - what we now think old discoveries were worth. Some of the big oil fields in the Middle East were discovered about 1960. We are still discovering new fields, but they tend to be smaller and more difficult to extract. The discovery information includes only liquid oil, not oil in the form of tar or other solids.

The combination of discoveries which peaked many years ago, and oil extraction which tends to peak in individual areas, leads one to believe the eventually world oil production will peak. There will still be oil in the ground, but it will be difficult to extract. Eventually, we simply won't be able to keep extracting as much as we would like:

• As oil fields get older, the percentage of water extracted with the oil tends to increase. In some cases the water percentage exceeds 99%. Once an oil field's water production exceeds the installed water handling capability, production will need to be reduced. When the cost of additional water handling capability exceeds the cost of oil extracted, it stops making economic sense to extract the oil.

• Some of the oil will be mixed with toxic chemicals like poisonous hydrogen sulfide gas. Special techniques will be required to safely extract this oil. This process will be expensive and time consuming. A giant oil field discovered in Kazakhstan in 2000 has this problem and isn't expected to come on line until at least 2011.

• Some of the oil is found extremely deep beneath the sea. Special techniques need to be developed to deal with the high pressures and the temperature differentials encountered when drilling in these locations. Developing these new techniques takes time and is expensive. At some point, we will reach our limit on deep sea drilling.

• Some of the oil is very viscous, akin to tar. It can only be extracted by digging. Production requires inputs of fresh water and natural gas. Once limits on either of these are reached, production must stop. In some cases nuclear may be substituted for the natural gas, but this takes time, money, and agreement of the local population.

World oil production has stalled

12

Comments: Oil production on an "all liquids" basis was flat for the years 2005, 2006, and 2007. On an energy available basis, production actually declined. There are several reasons for this:

• The "All Liquids" summary includes lower energy products like ethanol and natural gas liquids. These have been growing, while crude oil production has tended to slightly decline since 2005.

• The oil produced requires more and more energy in extraction, because it is mixed with more and more water, and is found in deeper and deeper locations. More energy is required for extraction, leaving less for end users.

• If we look at oil available for imports, this has been declining since 2005. Part of the reason is the greater amount of oil used in extraction; part of the reason is that the standard of living in oil exporting nations is rising, so these nations are using more of the oil themselves, leaving less to export.

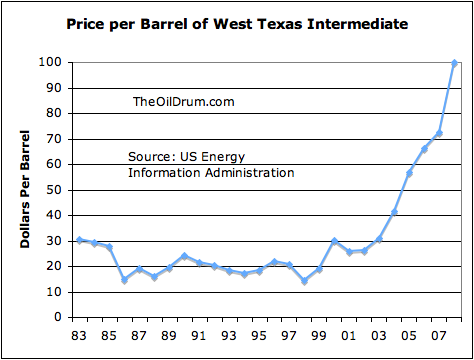

And prices are spiking

13

Comment: The fact that oil prices have been spiking since 2005 should come as no surprise. I show an estimated partial 2008 price on this graph, too, since we know the price spike has continued into 2008.

Given the shrinking supply and rising demand, the rise in prices was close to inevitable. Some of the poorer countries are being priced out of the market, and the use of coal is rising, particularly in China.

The higher prices have stimulated work on fields that were known, but not fully developed. Recent data compiled on oil megaprojects indicates that oil companies are now making a concerted effort to develop sites that may be available but have not yet been developed. Many of these projects are expected to begin production in 2008 and 2009.

It might be noted that in the 2000 to 2002 period, production stalled and even dropped a bit. Prices did not rise during this time period. They actually fell a bit. The reason for the decline during this period was lack of demand, due to recession. Now, many potential buyers are asking for more, but production does not seem to rise accordingly.

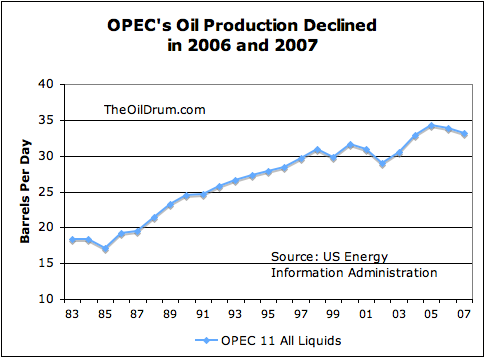

OPEC, particularly Saudi Arabia, has had

reduced oil production recently

14

Comment: The oil production of Saudi Arabia and OPEC has been sufficiently variable over time that it is difficult to make predictions, simply based on trends. OPEC's production, and in particular Saudi Arabia's production, is down in both 2006 and 2007. It is hard to know exactly what this means.

According to the US Energy Information Administration, Saudi Arabia's highest oil production was in 1980, when it produced 9.9 million barrels a day. Its recent peak was in 2005, when it produced 9.6 million barrels a day. In 2006, Saudi production dropped to an average of 9.2 million barrels a day. In 2007, production from February to August was only 8.6 million barrels a day.

When OPEC agreed to raise quotas near the end of 2007, Saudi Arabia did in fact raise its production. Its highest single month of production in 2007 was 9.1 million barrels a day, in December 2007. This represented a 500,000 barrel a day increase over its earlier low production of 8.6 million barrels a day, but still left production below both the 2006 average of 9.2 million barrels a day and the 2005 average of 9.6 million barrels a day.

One question too is whether this increase will continue, or if it is just temporary. It is sometimes possible to squeeze out a little extra production for a while, but then production drops back to a more normal level. Saudi Arabia originally planned to have an upgraded field (Khursaniyah) on line by late 2007, which was expected to produce an extra 500,000 barrels a day of oil. It may have thought it could make a spurt of extra production until this field came on line. Now the Khursaniyah field upgrade has been delayed until late 2008. Will Saudi Arabia be able to continue the increase, without the assistance of the Khursaniyah field?

Another question is why OPEC refused to raise its quota further on March 5, 2008. Is Saudi Arabia now really at the peak of what it can produce? It claims to have more production available in reserve. We know that Saudi Arabia has some poor quality oil off-line because the oil requires special processing which is not yet available in any refinery. Is this the only Saudi production off-line? Are other OPEC countries also unable to produce more?

OPEC's true reserves are unknown • Published reserves are unaudited

• Last Saudi reserve while US involved was 110 Gb in 1979 (perhaps 168 at "expected")

---Production to date 81 Gb, implying 29 to 87 Gb remaining; Saudi claims 264 Gb remaining• Kuwait published 96.5 Gb - Audit 24Gb

• GW Bush says regarding asking Saudi Arabia for more oil

---"It is hard to ask them to do something they may not be able to do."15

Comment: If one analyzes the reserves for OPEC countries, one very quickly comes to the conclusion that the published numbers are unreasonably high.

This is the story: In the early 1980s, OPEC oil countries were all vying for high quotas. To get those high quotas, they believed that publishing high reserves would be helpful. One by one, OPEC oil countries raised their reserve estimates, in an attempt to make it look like they had more oil, so deserved higher quotas. To further this illusion, they kept the reserve numbers at the new high level, even when oil had been pumped out, and no new oil had been found.

The practice has continued for years. OPEC leaders found that by overstating their reserves, they gained new respect, both within their own countries and abroad. They also found that the practice was very easy to do, since no one is auditing the reserve numbers they provide.

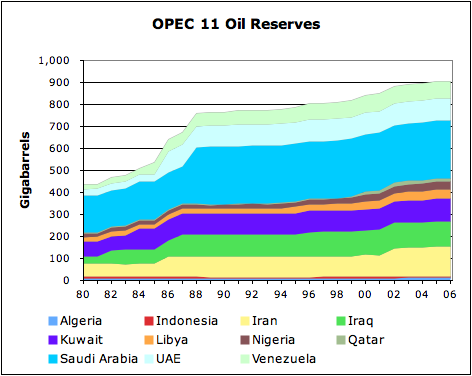

A graph of OPEC oil reserves over time is as follows:

There are many other ways this problem can be seen. For example, OPEC's oil production is unreasonably low in relationship to its reserves, unless the countries are inept at production or are misstating their reserve amounts. I discuss this issue further in my post The Disconnect Between Oil Reserves and Production. "Ace" has calculated some much lower reserve estimates, based on industry estimated recovery percentages.

Another insight can be gained by looking at Saudi oil reserves, when Americans were involved in setting reserves. According to Matt Simmons' "Twilight in the Desert", Saudi oil reserves were 110 Gigabarrels (Gb or billion barrels in US terminology) in 1979, back when Americans were still partial owners of Aramco. If we subtract the 81 Gb pumped out since then, this suggests remaining reserves of 29 Gb.

If is possible (even likely) that the 1979 American estimate was low. If, instead, we use the Saudi published estimate of 168 Gb in 1980, and subtract from it production of 81 Gb to date, we get an estimate of 87 Gb. This is less than a third of the 264.3 Gb that Saudi Arabia is currently reporting as reserves!

Kuwait is another country where we have an alternate estimate of the proven reserves available. An analysis by the Kuwait Oil Company as of December 31, 2001, showed proven reserves for the country of 24 Gb. Their published reserves were 96.5 as of December 31, 2001, moving up to 101.5 as of December 31, 2006!

President George W. Bush seems to be aware of Saudi Arabia's production/reserve problems. In an interview on ABC's Nightline, when asked why he didn't pressure the king for more oil, George Bush said

If they don't have a lot of additional oil to put on the market, it is hard to ask somebody to do something they may not be able to do.

Somehow, US textbooks and newspapers have not figured out the problem with OPEC reserves. They continue to quote huge "proven reserves" for most of the OPEC countries. The word proven adds credibility to the numbers, suggesting that somehow, the reserves have been proven to some authority, when nothing could be further from the truth.

The United States Geological Service (USGS) has added further to the confusion. It has taken the absurd reserves published by OPEC, and made calculations based on US development patterns suggesting that OPEC reserves may, in fact, be low. USGS publishes its even higher estimates, confusing the situation further.

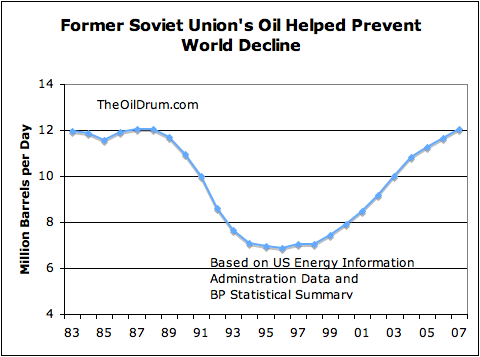

Fortunately, FSU production has increased recently

16

Comment: The Former Soviet Union saw a sharp decline in oil production in the late 1980s and early 1990s. With the adoption of modern extraction methods, they have been able to increase production again. There have even been some more recent discoveries brought on line.

Production going forward is uncertain • OPEC refuses to increase quotas

• Numerous reports say Russian production is likely to begin decreasing soon

• Little hope for US, North Sea, Mexico

• Canadian oil sands contribution is very small

• Recent discoveries have been small, relative to what is needed

• New production techniques can lead to sudden drop-offs

---Followed by small dribble for years from EOR17

Comments:We have problems almost everywhere we look. OPEC doesn't look like it is willing/able to increase production; Russia, which is the biggest part of the Former Soviet Union, looks like it is about to begin to decline; and there are a huge number of countries already post-peak, like the United States, Mexico, and the countries that make up North Sea production.

Even Canada, apart from the oil sands, is post peak. Canada depends on imports--heavily from Saudi Arabia--for its oil. While Canada has been exporting oil from the oil sands to the US, there are really two issues involved:

(1) The amount of oil from the oil sands is not likely to ramp up quickly.

(2) Canada is likely to need the oil itself, as its other production declines. This is especially the case if Saudi oil which it imports continues to decline. Under NAFTA, Canada is obligated to export a proportional share of its oil to the US, but this may be subject to renegotiation in the next few years.

There are really a couple of issues with newer technologies that are being used. One is that fancier and fancier extraction tools (such as horizontal wells and maximum reservoir contact wells) have been developed. These are able to suck out a greater percentage of the available oil, before production suddenly "hits a wall" when the layer of oil has been extracted, and the remaining oil is mixed with a huge amount of water and under little pressure. If this should happen on an enormous field like Ghawar in Saudi Arabia, we could very quickly see production drop by 2 million barrels a day, or more.

In recent years, quite a few "enhanced oil recovery" methods have been developed. Much of the impact of these methods is already reflected in the production data graphed. In some cases, like Mexico, it has permitted production to continue longer before the inevitable drop in oil production came. In others, it helps wells to continue to produce at a very low level after the vast majority of production is completed. It is doubtful that oil production will ever stop - a dribble that is nearly all water will continue indefinitely.

Projections of Future Production Vary Widely

18

Comment: The highest estimate in slide 18 is from the US Energy Information Administration. It is based solely on demand, under the assumption that OPEC can always provide additional oil if needed.

The next highest forecast is from the newsletter of the Association for the Study Peak Oil and Gas-Ireland, prepared by Colin Campbell. A link to it can be found here. It assumes that production will rise from its current level of 85 million barrels a day to a peak of 88 million barrels a day in 2010. After that, production will decline. (Update, May 08. The May newsletter now shows a 2007 peak, with a decline to 55 million barrels a day in 2030, so is closer to the other forecasts. The graph has not been updated to show the lower ASPO forecast.)

The next highest forecast is that of "Ace" of The Oil Drum staff. A link to his forecast can be found here. In this forecast, Ace considers the various Megaprojects, and when they are expected to go on line. He also considers expected decline rates on existing fields. He believes that we are on a plateau now that may last a few years. After that production will decline.

The remaining estimate is by Matt Simmons. In this interview, he mentions that he expects crude oil (not "total liquids") to drop to 65 million barrels a day by 2013. I have attempted to translate this comment into an equivalent projection, on a total liquids basis. It ends up being just a bit below Ace's projection.

World "All Liquids" Forecasts • "All Liquids" - Includes biofuels and "coal to liquid" fuels

• US EIA forecast - Based solely on demand

• ASPO Newsletter - Assoc. for the Study of Peak Oil and Gas Ireland, March '08

• "Ace"- Tony Eriksen, on The Oil Drum

• Simmons - Matt Simmons, recent interview on evworld.com

19

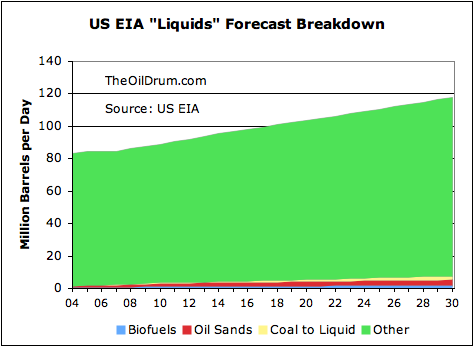

EIA expects biofuels, CTL,

and oil sands to remain small

20

Comment: The US Energy Information Administration's current projections suggest that it does not expect any of these fuels to grow to be significant between now and 2030.

Five Myths 21

Myth #1: OPEC could produce more if it used current techniques • International oil companies use same service companies US companies do

• Most are using up-to-date techniques

• Expenditures often are high

• Problem is very old fields

• Overstated reserves raise expectations

22

Comment: It is easy to see how this myth might arise, if people believe published reserves.

Update May 08: The International Energy Association (IEA) has indicated that it plans to sharply reduce its world oil supply forecasts, in its next set of forecasts to be published in November 2008.

Myth #2: Drilling in Arctic National Wildlife Refuge will save us 23

Comment: This slide is from a presentation of Dr. Sam Shelton of Georgia Tech. The oil from ANWR is expected to provide only a small upward "bump" to US production.

Quite a few of the other much-hyped solutions are expected to provide equivalently little benefit. We will likely need to reduce consumption to better match supply.

It might be noted that the Y scale on this graph should say million barrels a day, not thousand barrels a day. Since I did not make the graph, I can't fix it.

Myth #3: A small downturn can easily be made up with energy efficiency • The quickest impacts are financial

---Recession or depression

---Serious recession in 1973 - 75• Use of biofuels raises food prices

---Further increases recession risk• Don't need peak for recession

---Only need supply/demand shortfall

---Likely what we are experiencing now24

Comment: The connection between oil supply and the economy is not well understood by most. A shortage of oil very quickly leads to an increase in prices, and a cutback in the demand for other goods and services. The combination of these events tends to cause a recession. Cutting back on usage tends not to be sufficient to prevent the problem, because there are so many other users around the world, including in China and the developing world. They are likely to cause an increasing demand for oil, even if we try to cut back.

Myth #4: Canadian oil sands will save us • Hard to see this with current technology

---Technology known since 1920s

---Production slow and expensive• Requires huge amount of natural gas

---In limited supply• Most optimistic forecasts equal 5% of current world oil by 2030

---Even this exceeds available natural gas

25

Comment: There has been commercial development of the Canadian Oil Sands since 1967. Huge amounts have been spent, and there has been great damage to the environment. Even with this, production has remained small--only a little over 1% of world supply. Natural gas limitations suggest that we will never be able to greatly ramp up production.

It might be noted that a similar argument can be made as to why oil shale will not save us from peak oil. At this point, we don't even have an economic method of extracting oil shale. From what we know, extraction will require a large amount of water and considerable electricity. Finding adequate water for extraction is likely to be a problem. It is not clear that we will have extra electricity to spare either, for this large a project. Extraction is likely to be slow and expensive, since it will require moving large amounts of dirt around, plus heating and perhaps chilling the dirt. If we are able to extract oil shale, it will likely be in small quantities.

Myth #5: Biofuels will save us • Corn-based ethanol has many problems

---Raises food prices, not scalable, CO2 issues, depletes water supply• Cellulosic ethanol theoretically is better

---Still does not scale to more than 20% of need

---Competes with biomass for electric, home heat• Biofuel from algae might work

---Not perfected yet

26

Comment: Every study that has been done recently with respect to corn ethanol seems to come out with worse indications. Corn ethanol has virtually no benefits over petroleum. It uses huge amounts of fossil fuels as inputs, so it has most of the drawbacks of fossil fuels. It also has its own drawbacks, including raising prices, damage to the environment, high water usage, and possible CO2 and other global warming gas increases because of land use changes and nitrogen fertilizer use.

At this point, there aren't good alternatives to gasoline commercially available, however. Since there is great political appeal to growing our own fuel, corn ethanol is supported by most politicians, even if any reasonable analysis would say its benefit is very limited.

Longer term cellulosic ethanol may be a better solution, but at this time it is not commercially available. Even if we use wood and switchgrass as inputs, cellulosic ethanol will be difficult to scale up to provide more than a small share of the needed fuel.

Biofuel from algae looks to some like it might work. At this point, we do not have a commercial way of doing this and the cost would be extremely high.

Gail, spelling error in below paragraph on page 7:

got it. :) thanks.

I also cannot recommend enough Professor Mike Mills' site, which was just brought to our attention yesterday, "Evolutionary psychology and peak oil: A Malthusian inspired "heads up" for humanity.".

It is an amazing collection of sources, many of them from TOD. Make sure to take a look--I'm sure we'll also feature this in the future.

Gail,

I would suggest that on slide 23 and continuing with the comment below, you might insert something about how the IEA is preparing a sharp downward revision of it's oil-supply forecast in November 2008. (http://online.wsj.com/article/SB121139527250011387.html?mod=googlenews_wsj)

Thanks for the idea. I added a comment labelled May '08 about the expected change in IEA production, since this information was not known in March, when this was written.

Thanks for putting together this TOD "bible". It is an important piece of work that can be easily disseminated. You've done a great service.

I would like to make a request of the TOD staff. Would you consider posting this PO Overview at the top of TOD each day so that newcomers will see this first and then put the Drumbeats and featured articles below that?

Just a thought, since this article is an excellent read for newbies to TOD.

If a person happens to notice the "overview" rectangle at the top of the page when you log on to TOD, clicking on it will bring up this article. I'm not sure if people notice the rectangle, however.

I figured there was a way to get to this, but I think now, especially in light of recent media blitz, this needs to be MUCH more prominent and easy to get to when first getting on TOD.

My perspective.

I'll see what I can do. I think that was why it was re-run this week-end.

Gail,

This is awesome, dude.

Thanks!

By the way, I am a female dude. Gail is a name used by both men and women, so it is not very obvious.

With oil doubling in price over a 2 year period from 05-07, then doubling again in one year to the present, there is one glaring question at hand:

What will happen to the price of oil if the IEA in their November report adjusts OPEC reserve counts down to a much smaller percentage than current? Let's say the price of oil is between 140-180 in November, and IEA's adjusted reserve report reduces overall OPEC members reserves down 25-40%. What happens to price then? Does it suddenly rise to 250-300? Should the IEA consider not releasing that report for fear of what might happen to world markets, the price of food, cost of transportation, etc.? In other words is it better to maintain a certain level of uncertainty regarding how much oil is out there, versus a reality based worldwide panic that causes most countries to stop exporting oil?

Right now, production is not keeping up with demand (unless you use economists' definitions, in which case production always equals demand). People will start catching on to this. If production actually starts to fall, this will be even more alarming. One doesn't know precisely when the decline in production will begin, but it could start before November 2008.

I am not sure how much longer the IEA could keep the secret of this problem hidden if it wanted to. Even if the IEA stopped publishing figures, or kept figures artificially high, knowledge of the problem is going to become more and more widespread. I am sure that most of the major governments are already well aware of the problem. Publishing the lower number may cause some difficulties, but I expect they would be there in almost the same time frame regardless.

Over the last 24 hours listening to talk radio as well as colleagues here at work, oil is becoming a very hot topic indeed.

The blame is going in all directions, except in the one area that is accurate: supply and demand.

The most common seems to be: Crude reserves are way up but refineries are not producing at 100% capacity, thus gas prices are going up because the oil companies are holding back. This seems to be confusion between above ground crude reserves (which are actually down) and below ground crude reserves.

Another is that the dropping dollar is the cause. True the dollar's value has been cut in half vs. the Euro in the last 8 years, but at the same time oil prices have almost septupled. That only explains part of the increase.

America seems to be somewhere in the anger and denial stage.

I think you are right. It will take a few shocks for the message to fully sink in.

On Friday (I think) I saw the front page of the Independent was taken up with "Are we running on empty?" - followed by pages of commentators (along with the Wasteminster regime) reassuring us that it wasn't really a supply problem and peak oil is only a theory. Meanwhile on BBC Radio news Chris Skrebowski gave an excellent summary but which was "balanced" as customary by a more reassuring view which most listeners will have opted for. I guess we do need some sort of managed panic-escalation. The sooner those airlines all close down the better, but please allow me a few hours to get the last train out of this city first!

Peak oil requires such a big change in mind set that people can't believe it. If we knew for years that this would happen, why didn't our leaders say something?

I think the answer to this one is quite simple. How would you as a politician manage to not destroy your chances to become re-elected and simultaneously tell people that they will have to spend money on a huge infrastructural change, that they will have to cut their energy-wasting lifestyle and that they won't be richer tomorrow than they are today?

Change is easier to implement after a crash. A system that becomes too complex cannot be repaired without huge investments of both time and money.

Just out of interest, it is much easier to convince people that they are right, and simply got a few details wrong which they could not have known accurately, then to try to convince them that they were completely wrong.

For example, if an oil expert has predicted that we have at least 20-30 years before peak oil would have any practical significance, the optimum approach is to confirm that they were absolutely right to say that at some stage that supplies would run low, and then go on to casually remark that new data now to hand shows that reassessment makes it clear that it is earlier than could have been known before.

Never try to convince anyone that you are serious, about influencing that they were wrong - it is far easier to convince them that they said something totally different to what they actually said, and are now vindicated.

The slightest caveat they used can be utilised to create this effect.

It is child's play to convince, for instance, Yergin, that he has been trying to warn of peak oil for years.

Man is a rationalising animal, rather than rational.

There was a discussion about oil prices on the BBC's Dateline London this weekend. Goes out on BBC News Channel in the UK and BBC World everywhere else. The presenter Gavin Esler stated that some folk believe there is a con game going on and the middle east doesn't have all the oil it claims but they didn't really explore this much - perhaps another day...

Available for replay at http://www.bbc.co.uk/programmes/b00byk4z - oil discussion starts about 15 mins in.

Not sure if that link will work outside the UK. Probably will as it's an international programme.

Great work Gail.

Think you may have an error in the comments for slide 13:

"Now, many potential buyers are asking for more, but price does not seem to rise accordingly."

Not sure I understand this, did you mean production does not seem to rise accordingly?

Thanks - I fixed it.

Great post, Gail. If the data is available, could you add a graph after slide 12 showing World Liquid BTU Production? That might help illustrate the problem with including alternative liquids in total production.

Rick in WA, USA

I don't think there is anything readily available, but I could probably make an approximation.

I probably will do an update, and will think about adding one then.

Good presentation Gail

I think that the Export Land Model may be a useful addition to this. It is a critical nuance to the story and is actually the main driver of the international oil price.

Not only is a general understanding of PO important, the ELM, with its alarming implications, lends a sense of immediate urgency to the story.

I think that the problem is really a combination of the general Export Land problem, and our inability to pay for the huge amount of imports that we are consuming. It makes the result quite scary.

Great stuff, Gail.

Sorry I haven't been around for a while, but things just...

I wanted to ask if you or anyone else has thought about making or picking up a graph (I'm sure the oil companies should have some promotional kind of thing somewhere in a marketing file..) that shows the percentages of World Domestic Product or GDP per country that is dependent upon oil.

Then, extrapolate the exponential decay of those dollar figures relative to the exponential price of oil when supply doesn't meet demand on the speculative trading floors.

Just a thought. There is always talk about energy, food, etc., but the bottom line is that we have become Homo Petroleumus Economus, not just Homo Petroleumus. Petrodollars aren't just the dollars that are traded for oil, but all the dollars traded for all the things dependent upon oil, and all the dollars that can't be made without CHEAP oil. (A 'service economy' only works if you can drive to someone's house to 'service' them.) The housing bubble is a good example of just one bit: the availability of cheap credit is dependent upon an economy capable of paying back the money. If the economy is dependent upon something that is declining faster than the value of the economy can pay for it AND pay interest on the money borrowed to buy the gas to pay the oil companies to drill harder to get less oil...you see where I'm going, I'm sure.

Thanks for the good work.

Our current economy can be thought of as highly leveraged relative to oil. Oil cost is not as high a percentage of the economy as it once was, but it still just as important to the economy, or more so.

I worry about imports, because of our balance of payments situation, and our greater and greater debt. It is not surprising that the value of the dollar is dropping. If we start losing imports, because of either the balance of payment situation or because of "exportland" issues, there will be a huge multiplier impact on the US economy. A financial crash could easily be the outcome. I am not sure how I would make the graph -- it wouldn't be a pretty one.

Hello Gail

In Colin Campbell's latest ASPO newsletter he has adjusted his figures forward on his Base Model Graph which shows his Peak estimate at 84 mbpd in 2007.

The latest ASPO information came out after I put together this post. I can add an update note.

Gail,

Something of a structural point, so I doubt its addressable, but I thought I would make it anyway.

The key interest that the general public have is the price of gas at the pump. How it gets there tends to be indistinct for most people. Therefore leading off the presentation on Hubbert peaks doesn't grab interest and attention - its 'academic'. Sure the presentation gets round to prices by slide 13 - but that is squandering the biggest draw, and exchanging it for a historical based structuring. Better I'd suggest to lead with the 'sizzle' and use it as a basis to explain the 'why', go through the quick fixes and then conclude with the 'what next'.

If I ever get that mythical 'spare moment' I'll probably have a go at a presentation myself along these lines - but I know how difficult finding that moment is.

PS coal-to-liquids 'solution' needs further attention.

Garyp - I think you have a sound point in principle, but my impression is that it doesn't apply in this instance. Most people are currently wondering "why is the price going up?". Gail starts off with the key hushed-up facts about peaking production and so on, which will immediately switch on a light in the head of the reader at the pump, into thinking "so that's what's going on".

I think there is probably room for multiple versions of the story - some starting with the high gas price issue and some starting with the point about peak oil. If someone is hunting for an answer to the high gas price issue, they may be more open to an article of that type. I will keep the idea in mind for the future.

I could add something on coal to liquid as well. Coal to liquid will be very slow to produce much fuel, because one has to mine a huge amount of coal to get a much smaller quantity of oil substitute. It will take a long time (and capital) to build all of the equipment needed to increase the amount of coal mined, and also the equipment needed to make the coal into a liquid fuel. At the same time, there is huge concern that burning the coal may make global warming worse. You can see in my graph what a tiny share coal to liquid is currently. It is hard to see how it will ramp up very much, very quickly. I'll keep the idea in mind for my next update.

Slide 14 on OPEC production should be Million Barrels per Day on the y-axis. Otherwise excellent!

I know--but it is not my slide. It was put together by folks at the Georgia Tech Strategic Energy Institute. I will probably make my own slide next time, so it is properly labeled.

Great presentation, Gail. I am interested in knowing how you personally are preparing for the impact of peak oil? What preparations have you and your family made to adapt to the many changes that are coming? What do you think are the top three priorities? Thanks.

get out of debt

get a secure local job

tell others

I haven't made heroic efforts in this regard:

We have spent recent vacations visiting friends and family that it may be more difficult to visit in the future.

My health is good, and I try to stay in reasonable physical shape.

We live in an area where we could probably get along almost without heat or air conditioning (suburb of Atlanta). We live within walking distance of the university where my husband teaches. We bought two vacant lots near our house, so we can expand gardening if need be. I have only done a little gardening so far. I have more seeds and good intentions than anything else.

I have some food and water on hand, but not a huge amount. I also have some small swimming pools that I could catch rain water in, bleach for treating water, and filters. I also have a solar oven.

Our investments are sort of diversified. They include the vacant lots, TIPS, a little in stocks that may do well in the current environment, some CDs, and some gold and silver. I do not have a lot of confidence that this approach, or any approach, will do well. We do not have any long term care, life insurance or other similar policies.

We don't have any debt, but I don't see this as a necessity, except from a point of view of being less tied to one's possessions. I expect that banks will have a hard time collecting debt that is owed.

We stay in close contact with family, so we are not entirely on our own.

I am not sure that there is a good way to be prepared. I keep in mind that it is quite possible that we may have to move suddenly, and not be able to take much of anything we have with us. Because of this, it is good not to be too attached to whatever one has. It is also very possible that any paper investment will suddenly lose value. Friends and family are probably a person's most important assets.

"Myth #1: OPEC could produce more if it used current techniques."

You mention that "most are using up-to-date techniques." Do you have a reference for that point? Based on the vague or non-existent information that some oil exporting countries divulge, how can you be sure that they really are using the enhanced oil recovery methods? Enhanced methods can actually improve recovery from some wells by a significant amount, so I'd be interested to see a reference.

Thanks.

dangelo

You might try the Matthew Simmons web site for some details. The short answer is that Saudi has the most talented oil fild production specialists that money can buy. Because they have both the money and vested interest to do so. I've been a petroleum geologist for over 30 years and occasionally bump into the expats who have worked for Aramco. Since the Saudi's don't share their efforts with the world it's difficult to prove this fact. Don't let anyone convince you that the Saudi's are ignorant of modern production methods.

..wrong thread sorry