CFTC Report on High Oil Prices - "Speculation My A$$"

Posted by nate hagens on July 23, 2008 - 12:00pm

| With a pending Senate vote on the "Stop Excessive Energy Speculation Act", it seems that we (not the TOD 'we', but the collective society 'we') continue the ongoing witch hunt to pinpoint any 'explanation' for our high oil and gas prices that is not related to finite geologic flow limits or Malthusian themes (i.e. benign). Greedy oil companies, dastardly OPEC plots, and off-limits drilling of the Arctic National Wildlife Reserve and Outer Continental Shelf are among the reasons oft floated in the conventional media for why oil has risen in price over 10 fold in the last decade. Yesterday, a report from a credible institution was released detailing why at least one of the high oil price bogeymen, 'the speculators', are not to blame. In this report, the Commodity Futures Trading Commission (CFTC), threw cold water on the recent rhetoric in Congressional testimonies and television commentary that high oil prices are primarily caused by investment speculators. |

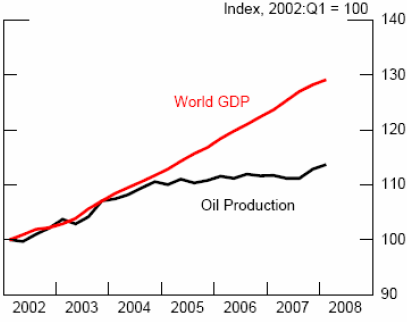

Excerpt from Figure 1 from CFTC Interim Report on Crude Oil - Click to Enlarge

This is a long and detailed report, with many graphs and data supportive of a)the tightness in global supply and demand for oil and b)the lack of correlation between speculative positioning and price increase. It is worth a complete read for those interested in this issue (which has seemed front and center in many CNBC debates on oil speculation). Below are some excerpts of the main findings of the report (italics/bold added).

From the Executive Summary:

The Task Force’s preliminary assessment is that current oil prices and the increase in oil prices between January 2003 and June 2008 are largely due to fundamental supply and demand factors. During this same period, activity on the crude oil futures market – as measured by the number of contracts outstanding, trading activity, and the number of traders – has increased significantly. While these increases broadly coincided with the run-up in crude oil prices, the Task Force’s preliminary analysis to date does not support the proposition that speculative activity has systematically driven changes in oil prices.

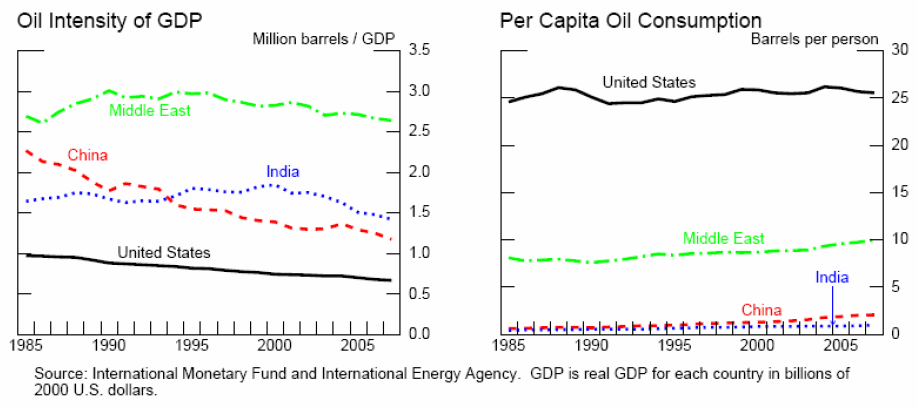

Figure 2 - Oil Intensity and Use by Country Click to Enlarge

The world economy has expanded at its fastest pace in decades, and that strong growth has translated into substantial increases in the demand for oil, particularly from emerging market countries. On the supply side, the production of oil has responded sluggishly, compounded by production shortfalls associated with geopolitical unrest in countries with large oil reserves. As it is very difficult to rely on substitutes for oil in the short term, very large price increases have occurred as the market balances supply and demand.

If a group of market participants has systematically driven prices, detailed daily position data should show that that group’s position changes preceded price changes. The Task Force’s preliminary analysis, based on the evidence available to date, suggests that changes in futures market participation by speculators have not systematically preceded price changes. On the contrary, most speculative traders typically alter their positions following price changes, suggesting that they are responding to new information – just as one would expect in an efficiently operating market.

This conclusion was discussed here in a post on Peak Oil and Reflexivity following George Soros and Michael Masters testimonies before Congress. In effect, at the end of trending cycles the tail eventually wags the dog. This can be seen in real time in energy stocks (down already 30% from their highs in the last month with oil still 'only' at $126).

More from the CFTC report:

On the demand side, world economic activity has expanded at close to 5 percent per year since 2004, marking the strongest performance in two decades. Between 2004 and 2007, global oil consumption grew by 3.9 percent, driven largely by rising demand in emerging markets that are both growing rapidly and shifting toward oil-intensive activities. Moreover, some of the fastest growing nations also rely on price subsidies that hold down the prices of oil and refined products such as gasoline, which further boosts oil consumption.

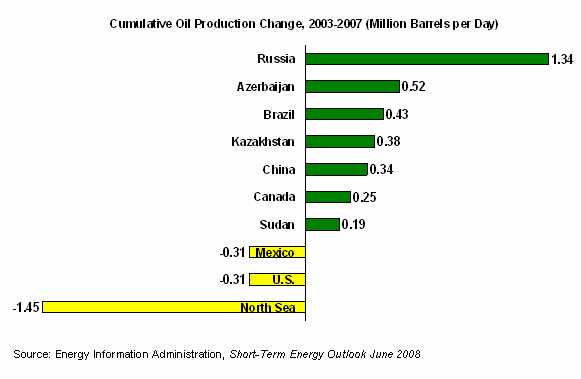

Figure 1 Click to Enlarge

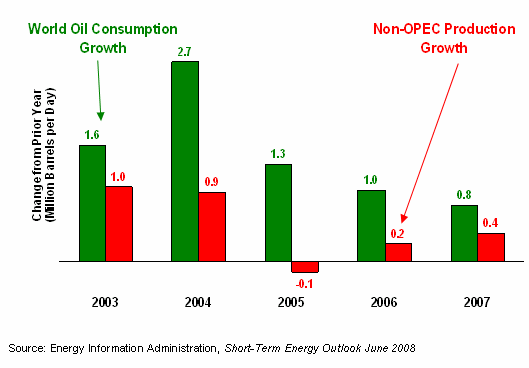

While global demand has proven strong, oil production growth has not kept pace. In the past three years, non-OPEC production growth has slowed to levels well below historical averages, and world surplus capacity has fallen below historical norms. Preliminary inventory data also shows that Organisation for Economic Co-operation and Development (OECD) stocks have fallen below 1996-2002 levels. Moreover, supply disruptions have adversely affected both world oil production and exports.

Figure 5 - Non-OPEC Oil Supply Growth

The imbalance between scarce supply and growing demand, and expectations that this imbalance will persist in the future, have led to upward pressure on oil prices and greater market reactions to any actual or perceived disruptions in available supply. Under such tight market conditions, it is often the case that only large price increases can re-establish equilibrium between supply and demand. Consequently, large or rapid movements in oil prices are not inconsistent with the fundamentals of supply and demand; such price movements, by themselves, do not indicate that prices have become divorced from fundamentals. Moreover, if speculative positions, rather than fundamentals, were pushing prices upward, then inventories would be expected to rise. To date, there is no evidence of such an accumulation; in fact, known inventory levels actually have declined.

Figure 6 - Increasing Reliance on OPEC Production

Activity in crude oil futures and options contracts has been increasing since 2004. During that period, the number of contracts outstanding (known as “open interest”) has more than tripled, and the number of traders has almost doubled. The fastest growth in open interest has been recorded among non-commercial traders – often called “speculators” – holding spread positions combining long positions in one month with short positions in another month. Thus, while the long positions of non-commercial traders have increased, the short positions of non-commercial traders also have increased. Additionally, although the net long positions of non-commercial traders have increased somewhat since 2004 – which some market observers have hypothesized has pushed prices up – the proportion of those positions has been relatively constant as a share of open interest over the last few years, undercutting that hypothesis.

Much of the attention related to participants in futures markets has focused on the role of commodity index investment funds and the commodity swap dealers that often act as their intermediaries. During the period studied, January 2003 through June 2008, pension funds and other investors have increasingly used index funds as vehicles to participate in commodity markets. Some observers have suggested that this rapid inflow of investments through index funds has been a cause of oil price increases. The CFTC has issued Special Calls for data about this activity, but only partial responses have been received as of the date of publication of this interim report. An analysis of the data from these Special Calls will be made available in September.

The data currently at hand – which incorporates non-public surveillance information – includes positions held by commodity swap dealers. Commodity swap dealers offer institutional investors contracts whose returns are linked to a variety of commodity indices. Broadly speaking, after netting their index fund clients’ positions against the positions of their other clients, these dealers use futures contracts to hedge the risk remaining from this business. Thus, the activity of commodity index participants should become evident in the position changes of commodity swap dealers.

Non-public CFTC trading data shows that commodity swap dealers have held roughly balanced long and short positions in the crude oil markets over the last year and actually held a net short position over the first five months of 2008 – that is, swap dealers’ futures positions would have benefited more from price decreases than from price increases like the ones experienced in the last few months. Moreover, any pressure exerted by the long positions of swap dealers’ commodity index clients has largely been offset by the short positions of the dealers’ other clients.

The Task Force’s preliminary analysis also suggests that changes in the positions of swap dealers and non-commercial traders most often followed price changes. This result does not support the hypothesis that the activity of these groups is driving prices higher. The Task Force has found that the activity of market participants often described as “speculators” has not resulted in systematic changes in price over the last five and a half years. On the contrary, most speculative traders typically alter their positions following price changes, suggesting that they are responding to new information – just as one would expect in an efficiently operating market. In particular, the positions of hedge funds appear to have moved inversely with the preceding price changes, suggesting instead that their positions might have provided a buffer against volatility-inducing shocks.

From the reports concluding remarks:

Observed increases in the speculative activity and the number of traders in the crude oil futures market do not appear to have systematically affected prices. Moreover, if speculative activity has pushed oil prices above the levels consistent with physical supply and demand, increases in inventories should emerge as higher prices reduce consumption and investment in productive capacity is encouraged. Although this process may take time to unfold, inventories of crude oil and petroleum products, according to available data, have declined significantly over the past year. The view that financial investors have pushed prices above fundamental values is also difficult to square with the fact that prices for other commodities that do not trade on established futures markets (such as coal, steel, and onions) have risen sharply as well.

OK, at least based on this preliminary report, speculators are not the primary culprit behind high oil prices. Clearly SOME % of oils rise is due to speculators, in the same vein that some rise in corn, live hogs and SP500 is due to speculation - in the intermediate term fundamentals will always win. The year of production peak is largely irrelevant - what matters is cheap and abundant liquid fuels to power the economic system the world has become dependent upon - for all practical purposes we are already past this point. We are likely going to continue to witness denial of this obvious but threatening theme from the Wall Street -government-OPEC trifecta. Investment analysts will claim demand destruction, governments will blame speculators and OPEC will posit that the markets remain well supplied. There will be no end to how long these parties continue to use these arguments. Every year there will be a normal 20+% correction in oil prices and confident authority figures will say that peak oil is a myth.

What is it going to take?

As a public service to the oil trader types, I have, from time to time, offered my interpretation of Yerginisms, and I coined the term "The Yergin Indicator," which suggests that oil prices will trade at about twice Yergin's predicted index price, within one to two years of his prediction. For example, about a year ago Yergin said that oil prices in (barring a geopolitical event) would be back down to $60 in 2008 (for more info, do a Google Search for Daniel Yergin Day).

Yergin has been noticeably reticent of late regarding prices, depriving traders of a critically important price trend indicator, so we have to go with secondary sources. Three talking heads were just on CNBC, and in their collective opinion, they agreed that we should be back down to $100 by the end of the year. So, I have designated a new indicator, the CNBC Consensus. While it will probably not be as powerful as the Yergin Indicator, it is probably a decent predictive tool. So, IMO, the CNBC Consensus suggests that oil prices will be closer to $200 than $100 by the end of the year.

WT, sometimes you make me laugh so hard my wife wonders.

$100 by the end of the year. That reminds me of the cartoon that you see in offices on the wall next to the photocopy machine with the guy laughing so hard he is holding his gut, saying "you want it finished by when?"

$200 per barrel if all goes well, higher if not. What was that guy Murphy saying about if something can go wrong it will. In this case there are many things that can go wrong.

We could easily be back at $100, or lower at the end of the year, and it would not invalidate any of the concepts we discuss here. We could also be at $200. Prices, as people must realize by now, have short term elasticity completely separate from long term fundamentals.

(btw, the implied vol in crude oil options suggests that seeing $100 again before year end is more likely to happen than to not happen)

I agree, Nate. I think it is good to keep in mind that most feel one of the symptoms/results of Peak is/will be extreme price volatility, as you pointed out. We need to keep in mind that demand destruction is occurring, though not yet net globally. Also, these ARE the peak production years according to Megaprojects. In late '07 some (many?) people here, including myself, were expecting some softness in price during the period through '09 or '10, no? (Of course, that was pre-Russian peak when they were responsible for something like 60 or 70% of net yearly gain in non-OPEC production.) Then there is the supposed 12.5 by '11 the KSA is claiming they'll have. Those not on board with the inevitable upward trend will take some of these things very seriously, and prices will be volatile.

Drinking the KoolAid, even if one's own (peakers), is always a bit of Russian Roulette, I think.

Cheers

I agree Nate, many of us peak-oiler's get a bit too excited when seeing price trends validate our personal models of PO. In reality, I think we will see an undulating plateau of supply with erratic price swings for several years. I view the whole price/volume system as very chaotic (in the true mathematical sense): it is extremely sensitive to minor changes and is wildly non-linear.

Has anyone considered mapping oil price as a chaotic system? I wonder if there is a strange attractor underneath this?

Lemme see.

1. The oil-producing nations would rather have higher than lower prices. 2. The oil-producing nations have huge mountains of money (sovereign funds) and expert financial advisors, and thousands of financial minion-quislings at their disposal. 3. Oil demand is inelastic in the short-run, meaning if speculators game the price up, demand does not wither for several years. 4. Any financial market can be gamed, and they have been gamed many, many times in the past.

But, oh no! No one ever manipulated the NYMEX! Never! Impossible!

Please. If I ran an oil-producing nation -- and our only real source of income was oil -- of course I would try to game the price higher. It would be a violation of fiduciary duty to my fellow citizens to NOT game the price higher.

So, we can assume oil-producing nations are gaming the price higher, through financial quislings. The gaming worked, as demand is inelastic in the short-run, defined as five years or less.

The gaming worked -- but the game has run its course. Demand is withering, in the medium-term, which we are reaching now. Automakers switching over fleets etc. Now, global demand will likely sink for several years. If prices hold long enough, then the long-term, and much greater elasticity begins to set in, bringing huge, decreases in demand.

What is fascinating is the OPEC-killer lurking in the wings. The death-ray for speculators. The GM Volt.

If such a car works commercially, it is game over for the oil boys and their minion-weenies. Who will need oil then? The world will be able to prosper at 40 mbd or less. Cities will be quieter and have cleaner air.

Tell me the downside in this, because I can't see it.

I agree that all the money sloshing around in our economic system is contributing to price volatility. But I completely disagree with any notion of a vast conspiracy or some "puppet master" that is pulling strings to consciously run up prices. The whole oil price system has lots of drivers from oil-producing states waking up to the real value of what they have in the ground, to worried investors who are starting to comprehend the house of cards that is the US economy. People in this system are like cellular automata's who are following their own interests. I think the influence by global actors like government, KSA, or even Exon Mobile is quite muted. As in calculus, all the little dx's add up, but you need to understand the underlying trends in order to add them up and make any sense of it.

As I see it, all this energy, fear, and money are racing around trying to find some stability point, yet they can't because it is a chaotic system. It keeps oscillating and chasing any hope for answers and stability... but there are no easy answers or safe havens. Climbing out of this peak oil hole will not happen easily or naturally, unless you are betting on Malthusian outcomes.

You're much more optimistic than I about the impact of the GM-Volt. I sure hope is has an impact, but I see it as too little, too late. By 2010 we're going to be in a vastly different world if we continue on current trend lines.

By 2010? Demand is falling now, but global production of liquid fuels is hitting records highs every months. Sellers of sour crude have no markets. Oil is plunging, and it may turn into a rout.

And conservation methors are just getting started.

Hi all,

Noticed a report in the Independant this morning that Nigerian "freedom fighters" were annoyed that a $6M pay off - sent by the Nigerian government had gone to criminal gangs instead of them. They promised to renew attacks on pipelines within the next 30 days as a result. I also note that the recent Iran / Eu "talks" have produced little of substance and that the US 2 week deadline to "think again" about their (Iranian) negotiating position expires shortly.

I'm sure both issues will exert some influence on fluctuating prices over the coming weeks.

I found my 6/28/07 post on The Yergin Indicator:

Jeff

Whilst we are in a creative mood i had a thought (dangerous). I thought we could improve the situation by creating a new acronym, WSD to describe an oil fields reserves, A WSD is "a World Supply Day". This has major advantages.

1/ Its is understandable by anyone, we all know what a day is, 1 billion barrels on the other hand has absolutely no 'meaning' to the general public.

2/ As consumption increases, Reserve Values Drop! 1 Billion barrels is currently 11.8 WSD, should consumption increase to 100mbpd then the reserve is 10 WSD

Imagine the press relese "ANWAR possibly contains 58.8 World Supply Days of crude!"

Its got to be better than POTUS or WOMD (Which I always confused with WOMAD)

Neven

Good Morning.

Um, this is for people like me, yes? Doesn't "WSD" sound a bit like "WMD"? But yes, I do like the idea, even though it would probably only appear on page 58 of the local rag, buried beneath the "Touched By The (Road) Toll" figures.

People don't service their washing machine; they just keep using it until it breaks down, curse it when it does and finally phone someone for help. I'm still crossing my fingers and toes that the "energy man" will have some answers for us when the time comes. I think that's the way it'll go.

Regards, Matt B

WT,

Yep...sometimes stochastics are better than knowledge. I have noticed that when folks are carrying umbrellas it's almost always causes it to rain. Let's hope Y does have a sudden philosophical shift.

I may self have just developed a great fondness for future traders. I've been wanting to buy one particular oil stock for a while but it's been priced high like most oils. Thanks to the pessimism of the future traders all the oil have quickly taker a dip. My target stock is now down 25%...and all the analysts liked it when it was at the top. Even when you're not a wolf it's fun to sit on the hill top and watch the sheeple run this way and then that way.

"the CNBC Consensus [indicator] suggests that oil prices will be closer to $200 than $100 by the end of the year."

You could be right, but currently oil prices are still trending down and I'm glad I sold out. Admittedly I wouldn't short into a rally to $136 any longer.

The speculators can affect the price in the short term, the front month contract doesn't close for another 3 weeks or so. So there's several weeks left for the speculators to squeeze out the overly leveraged longs, before supply/demand considerations come into play.

Question for all of you oil experts out there -- If we were to ramp up ethanol production tomorrow to full capacity, how far would the price of oil drop?

We can't get rid of oil overnight, but if we invest in clean, renewable fuels like ethanol, we can take a big step in solving this energy crisis. Count me in for American-made ethanol.

Ethanol would have virtually no effect on the price of oil. Diesel is what's driving the price right now.

In recent weeks, we've had a build in diesel inventory in the U.S., despite diesel shortages in China, India, South America, and even Saudi Arabia, in addition to a slew of smaller countries. It's the build in diesel inventory that is driving down oil prices here. (Plus a determination to cut oil inventories to the bare bones minimum.)

Meanwhile, most of the places with diesel shortages continue to refrain from buying due to price controls.

Essentially, much of the rest of the world (the part of the world with the largest demand growth) has started de facto rationing (many to "control inflation") even at the expense of their own economic growth. China, for example, recently organized its aluminum producers to cut production by 10% until after the grain harvest.

I think a huge part of the price volatility in the markets is coming from government interference in the markets, both in the U.S. (the spec witch hunt and threats to start emptying the SPR) and elsewhere (China's price controls, etc.)

The markets are becoming a place where, instead of betting on supply and demand, you're forced to place bets on the whims of politicians. It truly is becoming a poker game rather than a market, so governments are achieving exactly the opposite of what they'd want to achieve if they were smart. There's no way to get accurate price signals when you're betting on the moods of a handful of powerful people.

Without accurate price signals, oil producers can't plan risky production, and consumers can't make rational investments in efficiency.

A number of people around here have predicted that free markets would be an early casualty of the energy crisis. I think they're being proved correct.

I doubt very much that this CFTC report will change anything, since everything they said in this report has already been said in other recent CFTC reports.

I agree Muskie - ethanol production is a good start to ensure that we don't depend forever on foreign oil - it may not the be sole solution, but investing in biofuels and alternative energies are the way to go in this time of energy uncertainty.

Ethanol does not scale to the level necessary. Ethanol may play a very small place in stabilizing our energy future but we will not be able to continue the "happy motoring utopia" in which we have all grown up by using ethanol.

Change is coming whether we like it or not. We can either adapt to that change by choosing from the available paths to us or nature will select one path for us, whether we like it or not.

At least link to something to back up your slogan.

A billion tons of biomass would cover 30% of all US energy in 2030.

http://www.eesi.org/publications/Fact%20Sheets/EC_Fact_Sheets/Factoid1.pdf

A billion tons of ethanol stock would replace 50% (80 million gallons) of current US gasoline(150 million gallons).

http://www.ethanolproducer.com/article.jsp?article_id=3096

BTW..did you forget...neither does crude oil, foreign or domestic?

Some possible effects of new limitations on speculative participants, in oil futures markets. (People have already talked about a number of these).

First, my view is that speculators play the role of information aggregators. The CEO's of free market oil companies, the National Oil companies, government and institutional users--none of these are able to spend all their time aggregating information about global oil supply and demand. Prices are always imperfect. But, price is information. Less information, means the price is even more imperfect. So, if a good portion of speculators are driven from the US based oil markets I see the following coming to pass:

1. The marketing and trading departments of the large global integrateds will have a field day, because their firepower will no longer have an offset. They will use their new influence in a lower volume, lower liquidity environment, to gain advantages. That's not exactly a bad thing. But it will create choppy pricing. There is a good story of what Shell traders were able to do, about two years ago, when they squeezed the heck out of some players in the heavy-light spreads. Shell pounded the market with purchases of heavy sour stuff. Then they fed out the extra back onto the market after the price had spiked, and kept the rest. Again, this story shows how trading in front month is both fundamental but trading-influenced. Shell saw that the sour was underpriced, and they wanted some. But they also saw where players were positioned. So the markets will see more of this.

2. Commercial users will get hosed. Airlines, municipalities, and other commercials users who hedge usually by hiring a hedger will find that their activity is no longer passing through as much liquidity. The market will see them coming, and I would expect over time their purchases will more often go off at premiums. I would also expect expiry each month to get more volatile. Most importantly, there will be less liquidity out the curve. That will be terrible for commercial-users.

3. Small producers will find it more difficult to hedge out along the curve, thus making it harder to fund their expansion. We know the large integrateds don't trade as much out the curve. But all the smaller producers do. And it's the smaller producers who are actually successful at finding more supply. We might see a side-market develop between commercial-users and small producers, both looking to trade supply as a reference price point out 2-3 years. They could still record the trade at the NYMEX. But, neither would have liquid price action along the strip as a reference.

Finally, there's no question that trading would migrate elsewhere, to other exchanges. I could see Brent, and Arab Sour, and maybe even a Russian grade becoming new benchmarks. In fact, I would wager that Russia would love to host a new global oil exchange.

Gregor

Bonus comment for the day: https://twitter.com/gregormacdonald/statuses/866158163

Second bonus comment for the day: after I heard Michael Master's testimony, I did an SEC search for his investment fund, and was delighted to learn he was very long Airlines, Truckers, and Consumer Discretionary.

My sense is that Gregor is spot on here.

The rhetoric surrounding this issue suggests that the futures market sets price. But it only really reflects price, given that the cash market sets its contracts at a discount or premium to some futures benchmark. If it gets too out of whack with prices consistent with supply and demand, the cash market would deepen discounts so much that the futures contracts would no longer serve as a useful hedge.

It's pretty simple math, though, to see why it would be reasonable for people hedging against future prices to ask for the prices of the last half year. If there is war with Iran, there would not be any spare production capacity whatsoever. Any sizable disruption, from Nigeria or a hurricane or what have you, would mean a real shortage.

I suspect that on balance the market has decided that war with Iran will not happened. That Nigeria appears to be a little more serious about its problems. That many subsidizing nations are beginning to abandon or at least reduce subsidies--such as Nigeria. That even Chavez appears to think that historical determinants aren't with him at this very moment. And that Iraq's production levels are back at pre-war levels.

I too agree that Gregor's post is spot on.

The government murder of the markets will not be good for consumers or for rational solutions to the energy crisis.

Here was another of the 20 graphics from the CFTC report, showing term structure of crude oil futures primarily being in backwardation (long dated prices lower than spot prices) during the past 5 years. Expectations of higher prices in the future are generally viewed as a signal to build up physical inventories, which has basically not occured - hence higher price trends have been the rule.

There have only been a few occasions in this bull market when the full curve has gone into contango. As I am sure you are aware, a full length contango is very hard to maintain. It immediately attracts sellers in the distant months, who then buy the front months, in order to store. The sell pressure on the back end and the buy pressure on the front usually is its own undoing. And we have seen that at least two times in this bull market, possibly three times. Each time, the contango has dissipated as quickly as it appeared

This is why I have said that when and if we reach a point when a full length contango appears, and is sustained, it will "likely" mean that enough information has finally, finally been aggregated to determine with confidence that the chances of future supply growth are then falling rapidly, toward zero.

As we know that will indeed happen someday, it would be rather trite of me to say I think we are getting much closer now, to seeing a sustained full-length contango. But, I'll go ahead and say it anyway.

Gregor

What this demonstrates more than anything is the complete inanity of our political system and our ability to discuss much less do anything about any problem.

First, I'd like to point to a nice piece by the Financial Times, "Speculation must be defined before its blamed." Secondly, I'll define every investor as a speculator, we're all putting in money thinking it's going to grow, that is speculation.

Now, the report itself says:

In the last week, we saw the price of oil drop more than $20 a barrel or 15%, in a few days, that should speak for itself. Nothing nefarious, this is how the system presently works, it is in fact how prices are set.

Now a better word for Wall Street jumping on the bandwagon, the oil companies and various national governments reaping obscene profits from a problem with an essential commodity would be - PROFITEERING. But since the ascendence of neo-laissez faire in the last two decades, profiteering is no longer a societal taboo, it's just good business.

Now the oil industry has always been a rather primitive market at best, and for those who believe we are near peak, instead of arguing over semantics and beliefs, it would seem most appropriate to say that both our economic and political systems have failed in very fundamental ways.

Joe said, "What this demonstrates more than anything is the complete inanity of our political system and our ability to discuss much less do anything about any problem."

It should come as no surprise that government is incapable of solving problems. First, it was only delegated the power to secure rights (life, liberty, property), and govern those who consent. Second, the farqed up price system is partly due to the Federal Reserve Note (no par value). Third, government makes nothing but more government. Gives nothing but that which was taken from someone else. Until the "solution" creates more government and a mandate to expropriate more money and power, government will appear impotent.

Cynical, am I?

Certainly...

If you combine Fig 11 and Fig 10 you find that 50% of the WTI contracts were held by commercial swappers and 25% were held by hedge funds. Both these groups are speculators IMO.

If Southwest airlines buys contracts to offset the price of oil that's speculation too(they could have bought gold,etc.).

Notice how little of the WTI commodity market comprises producers and manufacturers--which is the traditional (agriculture)commodities market.

Yet the authors indicate the supply and demand is the real cause. They must believe we can't read their report.

GDP(PPP) numbers don't make a lot of sense.

http://en.wikipedia.org/wiki/List_of_countries_by_future_GDP_estimates_%...

If the US is 18% of the world at 3% growth( non-PPP have much more like 1-2% over the last 3 years and the EU is 20% of the world and grew at 3.2% and the whole world grew at 4.5%, that means the non-US,EU world grew at an impossible 5.5%, so Fig 1 looks wrong. Besides, such a high growth rate always means high inflation which drives up the prices of commodities--i.e. Fig 1 isn't telling us anything about a real shortage.

http://www.data360.org/graph_group.aspx?Graph_Group_Id=149

Looks like the whole thing is a PR stunt to give their employers, the commodities speculators, cover.

I think you have a fundamental misunderstanding of how futures markets work. High percentage of speculators are desirable because they add liquidity to the market. Can they bid the price up in the short term? Absolutely. Are they then stuck with an enforceable contract? Absolutely. So, unless they can find an actual end consumer to take delivery of the commodity at that price, they eat the difference--it becomes a self-correcting phenomenon with natural selection weeding out those who tend to bid up contracts higher than they can sell to end consumers. Likewise, they can bid down contracts too far, but then if it isn't worth it to the marginal producer to produce at that price, they will reduce production and supply and demand will find a new equilibrium--again, with the speculator eating the difference. The "problem" is that consumers are willing to pay these higher prices. That's the market definition of price--the equilibrium point where a producer is willing to sell and a consumer is willing to buy. Unless speculators are influencing one of these two points (such as buy physically hoarding oil), they are only creating short-term perturbations in price which will be resolved by market participation of producers and consumers.

Aside from that fundamental argument, I also disagree that there is a conspiracy to knowingly misrepresent the situation to the public. Is the CFTC to some degree structurally vetted to prefer more trading? Yes. Are they going to intentionally lie to that end? I certainly don't think so, but reasonable people can disagree on that point. A simpler, and more likely explanation in my opinion, is that they have the fundamental understanding explained above, and their report simply reflects that.

I thought I knew how commodity markets were supposed to work.

The example given is usually a farmer creates a contract with a 'speculator' selling his crop at a given price or a manufactures contracting with a 'speculator' to purchase his required raw materials at a given price. The immediate risk is transfered to the speculator, serving the interests of society by keeping the farmer or manufacturer up and running. That's fine.

But today's meta-speculators have turned an insurance policy into an insurance fraud.

Remember 'Double Indemnity'?

http://en.wikipedia.org/wiki/Double_Indemnity_(film)

You can never buy too much insurance, right?

A speculator may create a contract with another speculator, neither having anything to do with the farmer. In fact, as I understand it, there is no limit to the number of paper contracts that may be created on a given base of real product. All are 'side bets' (as long as the contract is speculator to speculator) as to how the real (spot) price is going to go.

Yes, there are scapegoats: Ben Bernanke and Masaaki Shirakawa. Hang them first!

The CFTC is not a neutral party. They have an interest, now that institutional investors have arrived with lots of money @ the commodities exchanges for the first time.

http://www.calpers.ca.gov/index.jsp?bc=/about/press/pr-2006/nov/pilot-co...

Whether these entities are 'speculators' or 'investors', I'll leave to others. At some point of perspective, the two concepts merge.

I find this particular story most appropriate:

http://www.economist.com/world/britain/displayStory.cfm?source=hptextfea...

The Bank of England is constrained by rising prices which would call for rise in short term interest rates. At the same time, the productive economy is stumbling which calls for an easing of rates. What will Mervyn King do?

He'll keep rates at 5%. Will it work ... and take Great Britain out of its 'Lesser Britain' funk? No!

Why, you ask? Because financial institutions are now international and can borrow American dollar funds (2.25%) or Yen funds (.5%). King can't close the barn door to keep the cows in or the foxes out because the door has been removed from its hinges!

According to Doug Noland's weekly update on the US money supply:

"M2 (narrow) “money” supply jumped $24.5bn to $7.699 TN (week of 7/7). Narrow “money” has expanded $236bn y-t-d, or 6.1% annualized, with a y-o-y rise of $442bn, or 6.1% ..."

http://www.prudentbear.com/index.php/CreditBubbleBulletinHome

With our economy growing at less than 1% where does that excess money go? The US just finished distributing $130 billion in subsidy (stimulus package). Where did THAT money go?

Oil, baby! Gold, too ... and into agricultural products and other commodities. America faces a second 'Great Depression'. Do you think people standing at the edge of a financial precipice are bidding up the price of something that they have been dependent on for their entire lives?

Think about it. The markets (did) reflect consumer participation more directly than stock or bond markets do. Why would broke people bid up oil to twice what it was last year? The reason is they didn't. The new intermediaries are not financially strapped, CalPERS has billions to throw around and can cause the price of anything to jump just by bidding in an exchange. From a yield standpoint, commodities are the only game in town. Stocks, bonds, and real estate are in bear markets. Direct investment in commercial enterprises requires a long term commitment, special expertise and a willingness to compete directly with (low wage) China and India. CalPERs isn't going to build a copper wire factory somewhere, they'll have their in-house brokers go long in commodities ... and give the brokers $500 million to do it with.

The runup in oil prices is similar to the runup in real estate prices here in the US from 1992- 2005. The rationalizations by both groups, real estate and oil investors are almost identical; "Prices will only go up because they always have. They aren't making any more (land/oil). 'Conditions are different now." The same crookedness and manipulations (and massive subsidies for highways, mortgages and house investments) kept prices rising even while the supply of houses expanded massively. The subsidies for petroleum are its tax- favored status and the depletion allowance. Well, you know ... house prices DO go down ... and the collateral damage is crushing!

To get prices under control, the US's and Japan's have to set short term interest rates in line with the ECB and the BOE. This will end the carry trade in petroleum and other commodities. Prices will fall in line with production, refining and distribution costs. Oil production currently is dirt cheap; less than $10 a barrel in the Middle East. YES, the cheap oil is maturing out of existance and replacement will will cost more than $70 a barrel, but that is a problem for the future. Resolution of the money/currency/interest rate imabalances will make it easier to fund solutions to the longer term supply and conservation issues.

According to Doug Noland's weekly update on the US money supply:

"M2 (narrow) “money” supply jumped $24.5bn to $7.699 TN (week of 7/7). Narrow “money” has expanded $236bn y-t-d, or 6.1% annualized, with a y-o-y rise of $442bn, or 6.1% ...

But let us not forget that the national debt is 9.4 Trillion. Ever wonder how one can pay 9.4 trillions with only 7.7 T?

Can you spell "K A P U T"?

"B A N K R U P T"?

What about all those outstanding mortgages, private sector debt and account holders?

Where's the "Beef"?

And, NO, the government can't just "print up more FRNs". Pursuant to Title 12 USC Sec. 411, each note is an obligation (debt) of the U.S. to pay lawful money. In order to authorize more FRNs, the Congress has to authorize MORE DEBT (Now you know why they just LUV that red ink...)

It's much worse - - - the national debt is denominated in lawful money (gold or silver coin). It would take a sum of gold bullion 85 times as much as the whole world's supply of above ground bullion to pay off that absurd debt. *(Silver is even worse - takes 17 times more silver than gold).

And you thought impossible contracts were illegal, immoral and just plain stupid!

Never underestimate the U.S. Congress, when it comes to Gross Stupidity...

NYT: Speculators Aren’t Driving Up Oil Prices, Report Says

More at article.

Giddaye Prof (are you really a professor?).

As a "taking an interest in behind-the-scenes stuff" newbie, I'm still not seeing headlines like, "Cheap Oil Hard To Find", or, "Current Energy Consumption Unsustainable". Instead, the talk on Aussie radio this morning is about, "Why don't fuel stations pass on cheaper pump prices more quickly".

There still seems to be the idea, "just increase the flow and all will be well" and I simply don't understand why we Average Joes and Janes aren't (or can't be) forcably made aware that crude oil is a finite resource. Then again, there's still plenty who believe a mystical being snapped some poor fella's rib off and morphed a chicky-babe from it (did she ever learn to speak, by the way?).

Regards, Matt B

No Matt, the one that does the speaking in that fairy tale is the long slithery creature with the forked tongue and the miraculous everlasting free energy apple. Then I think the oil runs out in the garden of Eden or something like that and they have survive by the sweat of their brows.

Matt--if you really want to know, you can look up in the staff bios section...

Sorry Prof, I keep forgetting about all those extra mouse-clicks available.

Regards, Matt B

PS. I read at the start of the year somewhere that the Big Boys are spending 100 million (or was it billion?) on exploration. How're they going with that? Any new North Seas out there?

http://www.financialweek.com/apps/pbcs.dll/article?AID=/20080723/REG/613...

While I don't entirely disagree with the premise, it should be clearly stated that the CFTC is an interested party with a bias towards more trading and not less trading.

Their facts and figures should be scrutinized at a level consistent with an Enron Annual Report.

That oil has dropped 20 bucks in a week, with a hurricane hitting Texas, should at least prompt consideration that non-geological forces can and do affect the price. Or, maybe 14% more supply came online since Thursday.

My take is that there was at least 20 dollars worth of speculation in the market price since nothing material has changed in the last two weeks with regards to supply and demand. And if one can concede 20 dollars, then perhaps 30 dollars is also possible, and so on.

I agree with your assessment about the bias in the study. Also, it seems that at least one supporting reason that the price of oil is being affected by nonsupply issues is the price of all commodities. Why is the price of gold (and corn and metals...) so high??? It is because investers cannot invest in the U.S. housing market, and no one wants to hold onto the sinking dollar so they invest in commodities, such as oil. To me this is pretty obvious. I believe that of the recent runup in oil prices, this investment/spectulation plays an important role.

The fact that inventories are low could be because that if the price of crude oil is high, why stock up, especially if you think that the price will soon drop.

When Bernenke eventually increases interest rates, which he eventually must do, we will see what happens with the price of oil - how much of the price is due to supply issues vs investors.

Retsel

I wouldn't be surprised to see the CFTC dismissed as a bunch of compromised Bush appointees as well.

Tom Whipple has written of no less than 90 nations experiencing energy shortages in the last few months. There's your additional supply.

http://energyshortage.org/

$20 to $30 of speculation in current price agrees quite closely with my estimates. But then what do I know?

You're incorrect--something material has indeed changed.

Prices have dropped because we keep building up diesel inventory.

Prices are dropping because in the past two weeks diesel inventory has gone over the 5-year average, after being below the 5-year average for many weeks.

Specifically, we added 2.4 million barrels of inventory last week. If any of the places with diesel shortages, like China, India, and even Saudi Arabia, would start buying, we'd see our inventories holding steady and oil prices holding steady too.

But they're not buying. They're essentially rationing through price controls. As a result, U.S. refineries are going to be cutting back production to prevent further builds. That means a serious reduction in oil demand. Part of this reduction will get taken care of through the decline rate. The rest means a price fall.

and so on, all the way to perhaps $120.

We all know Crude is an infinitely renewable resource on a ten-year timeframe. These high prices are just The Cabal squeezing consumers so they can fund their exponentionally-increasing porcelain figurine collections.

Kevin Drum over at Washington Monthly agrees with Da Sasquatch:

Also a good discussion of the speculation legislation that passed the Senate yesterday 94-0 that I somehow completely missed...and I am a political science geek.

More on the legislation:

CNN: Partisanship threatens Senate efforts to lower gas prices

And here's a link to the Senate legislation itself.

Nate,

Thank you for this. I love this site, and other sites that discuss these issues. This type of open discussion, with everyone allowed to voice their opinion, no matter how crazy it may seem I think is a huge driver to understanding, learning, enjoyment, and information needed to make decisions.

I wanted to comment on the drop in energy shares. I think that is for two reasons 1) energy shares get "marked to market" continuously based on the value of their reserves which is directly a function of the spot price of oil which is generally a reflection of supply and demand and money supply of course with some short-term variation as you discussed and 2) as the earning multiples of stocks contract in a bear market no stock is immune.

I do believe the real supply/demand issues are at the base. As the spot price goes down, the value of reserves go down and the energy stock price goes down.

The earning multiples of stocks are contracting because (1) debt to banks can no longer be serviced as more money supply is going to oil crushing banking stocks and (2) price increases in oil increases the price of consumables and products (i.e. price inflation not money supply inflation) and bond holders start demanding higher rates to preserve the value of their lending for future purchases of products. As rates go higher, one can get a good rate of return on bonds vs. earnings on equities and money flows into bonds instead of stocks lowering multiples. Case in point, in 1979 stock market multiples were about 6.5 and bond rates were very high.

Why speculate on likely poor earnings due to less money for goods & services since more is going to oil when you can get a pretty solid rate from a bond that likely will be higher than the earnings?

Pure speculation, but perhaps oil company stockholders forsee the future of oil prices and are taking profits?

Good points. But they would argue for energy shares (down 30% in last month) to outperform financial shares (BKX up 54% from bottom) going forward. Would you rather own ConocoPhilips at 6x forward earnings in an energy constrained world or JPMorgan at 12x forward earnings in a credit constrained world?

Nate,

You are spot on! I think energy stocks will outperform the rest of the market, but that doesn't mean that equities as a whole are not overvalued right now. Particularly financials.

But perhaps now is time to take profits at COP at 12X earnings and buy back these true value stocks (if you are a peaknik)when they drop to 6X earnings?

One of the best traders I know has always said that markets are completely irrational in the short term, and that's where quick profit can be made, but in the long term they are generally rational.

How many smart people are buying "oil is just speculators?" How many smart people think that the Treasury backstopping the housing market will stop the decline in the price of housing and turn the market around? How many smart people got fleeced in the April-May rally thinking the Fed could completely solve these problems? How much of this wealth is in Baby Boomer's hands who have "muscle memory" to buy on the dips since that has worked well for the last 25 years?

In my opinion, the housing bill will just increase rates on long term bonds making mortgages more expensive continuing to push housing prices down as the Treasury adds more debt & interest payments to its balance sheet. Tightening of rates is deflation in money supply to counter price inflation based on market conditions--like Volcker did when US hit PO in the 1970's and the US had not yet convinced Saudi to pump like mad in the 1980s.

Japan did government bailout of banks and they got a decade of deflation in asset prices--and a big cratering in the Nikkei with tons of bankruptcies at the end.

This is what I think Soros is talking about with the super-bubble. The super-bubble is the giant debt creation enabled by the suppression in oil and food prices for 20 years allowing people to afford to service more debt. Once oil and food prices rise, there is no longer money for this debt and the super-bubble must deflate as we are beginning to witness.

These are just observations, it will be interesting to see what happens for the rest of the year, and once the data comes in we can try and come to a better understanding of these things.

But perhaps now is time to take profits at COP at 12X earnings and buy back these true value stocks (if you are a peaknik)when they drop to 6X earnings?

COP is at 6X earnings. That's what Nate was saying. The PE based on the median estimate for 2008 is 6.6. To me, that looks incredibly cheap given their market cap is $126 billion, and they have reserves worth well over a trillion dollars.

Disclosure: Long COP for the past 6 years.

Robert,

Google is telling me different. It is saying current PE's are 10.57 and forward PEs are 8.70:

http://finance.google.com/finance?client=ob&q=NYSE:COP

Perhaps these numbers are bad, I don't know. They are what I use.

I'm not saying COP isn't a good stock. The company is outperforming every other major oil company in my opinion. If we have an equity cratering it will hold up better than probably any other stock. Warren Buffet is no fool. Warren bought when they were trading at 6, so did I.

The problem was the market wasn't pricing in future oil price increases at that time and therefore while selling at 6 and looking cheap, they thought the oil price would drop and so would the value of their reserves and so nobody was buying. Well I bought and so did Warren.

Now I think we have the opposite--trading at higher multiples because more money has moved into the stock. If oil prices shoot up, I think overall stock market money will go to bonds, and multiples will be lower but reserves will be worth more. So I don't think the stock can plummet like others, but I think it can still go down.

I've been long COP for the past two years myself and I just sold about a month ago. I think forward PEs were much higher then, so you might be right, they might be a better buy now.

Robert, with the time you have devoted to trying get the word out I'm glad you've had a pretty good past 6 years :). Hope you used some of it on your compost bin.

Down 30% in last month vs up 54% in last four days. Interesting apples and something else comparison.

Unless you feel we are at peak money, I would go with JPM for the long haul. After all, the premise of TOD is that COP will no have oil to sell at any price. Like the dot.com slogan, no S no E implies, COP is ultimately out of business. If oil really is peaking, people will see that, and maybe are seeing that.

If COP has no oil to sell at any price, clearly there is no JP Morgan.

Nice

Clearly, I'm afraid I still don't see the connection. JPM was around long before COP, or oil in general. The company is over 200 years old. I can see it now at the first board meeting. "What should we do?" "Sit around for another 50 or 60 years until someone finds oil".

http://www.jpmorgan.com/pages/jpmorgan/about/heritage

Life will go on, there will still be rich people, and there will still be some form of money, long after COP is gone. The world did exist before oil. A quick look at the left side of the peak from time to time wouldn't hurt. You'd see it goes on for some time back.

But hey, you may right! Everyone else seems to think so.

Here, 100 companies still in business, most of which existed hundreds of years before oil.

http://www.bizaims.com/Articles/Business+-+Economy/The+100+Oldest+Compan...

My favorites

6. Barovier & Toso – founded in 1295

Get that? 1295 and they have a website!!!!

http://www.barovier.com/

32. Zildjian Cymbal Co.

Cymbals

Based in Norwell, Mass.

Founded in 1623

14th generation

JPM and all modern banks worldwide are based on fractional reserve banking, i.e. lending the money deposited in them for an interest.

The existence of safe interest-bearing investments requires that the money supply grows at a similar rate. (*)

If REAL GDP does not grow at that rate, money supply growth just causes inflation.

Peak Oil and Peak Everything implies no more economic growth. Actually, it implies a decline in output until stabilizing at a really sustainable level. So, even a Steady State Economy cannot be achieved at the current economic output levels.

The banking system most appropriate for a Steady State Economy (as explained here) is 100% reserve banking, first proposed by Simons (1934) and Fisher (1935).

(*) which is only possible with fiat money. Hence the bibilical prohibition of interest when a precious metals-based monetary system was in effect. Explained at length here,

Nate,

Just a follow up. Long post please excuse.

Simply because its supply/demand + money supply doesn't mean that price won't move around like crazy. Here are some factors to consider as we move in Q4 2008:

Assumption: Diesel is driving the price

Facts in Support of Assumption: Diesel stocks are the only stocks that are at a decent level right now in US. Oil keeps coming down off inventory and diesel stays constant. Most stories about shortages talk about diesel shortages.

Still might be bad assumption.

Distillate Factors for 4Q 2008:

1) How cold of a winter will this be? I think this is the largest factor as diesel and heating oil compete for a barrel. Part of this depends on how much $4 heating oil from last winter caused people to change--I would think not too much since overhauling a heating system is very capital expensive especially for older bigger buildings.

2) When will the Jamnagar refinery come on line and how fast can it ramp up? This refinery is scheduled to come on December 2008 as of now with a 580,000 barrel per day capacity. This refinery is designed to take an API grade 24 feed which is on the heavier end of the spectrum. I believe Saudi does have spare capacity but it is of this heavier grades and is standing idle right now--once there is refining for these heavier grades they can increase output for this winter.

This refinery can process 12.5 MMPTA of diesel which is about 250,000 barrels per day in extra diesel. This would help the diesel situation a lot and so when this starts and how fast is an influence.

http://www.pakoil-gas.com/P2007/Day%202/Parallel%20Session%202%20(A)/Ashok%20Dhar_Islamabad.pdf

3) China. I think a big part of this drop is the Olympics will be over and the subsidization of prices was reduced.

4) Iraq. Last winter Iraq behaved like a swing producer. What might it do this year?

As far as the financial discussion here is my take on the whole situation. Of course this is all rampant speculation and I have no clue about any of it--it's just my attempt to make sense of events. It's probably all wrong, but here goes:

Last winter, when oil began its upward climb, it became clear to the bankers that there would not be money to service debt going foward especially when OPEC didn't pump enough to keep it down. The quick increase in the oil price was highly deflationary to assets like houses since people couldn't make their payments and it was clear that the value of those assets would fall quickly and therefore there would have to be huge writeoffs in the value of those debts.

Left unchecked this would create a quick and powerful deflationary collapse in the money supply. The Term Lending Facility was created as a quick stop gap but they knew they needed to be able to increase the money supply more. Bear Stearns didn't help out with the Long Term Capital Management bail out and therefore wasn't liked on the Street.

http://dealbreaker.com/2008/05/the_wall_street_big_wig_lunch.php

Bear has a lot of exposure to mortgages and was counterparty to JP Morgan on a bunch of derivative trades. Bear was selected for a takeunder and used as an excuse to create the Primary Dealer Lending Facility straining the authority of the Fed under the Federal Reserve Act. This allowed the Fed to re-inflate the money supply through the investment banks on top of the Term Lending Facility for the commercial banks.

Everybody was happy for a while. Then it became clear that the Fed's balance sheet wasn't unlimited and eventually it started to run dry. Lehman comes out with a note on Monday saying Freddie Mac and Fannie Mae are under water for 75 billion. They weren't the first ones to say that--many had been saying it for a while. Everybody sells off Fannie & Freddie stock. Friday things are looking grim for Freddie and Fannie and close to the end of the day a rumor is floated that Fed would open discount window to GSEs and Paulson talks about his plan to lend from Treasury.

I think that was a trial balloon sent out to test the bond market. The bond market jumped like a frog and the credit default swaps on US debt doubled in an instant. Bond market no likey.

Interestingly, the question arises: why does the Federal Reserve need to give the GSEs access to the discount window if they can borrow from the Treasury? Treasury can raise lots of money so why would they need to access the Fed? In my opinion, the GSEs become the conduit between the Treasury and the Fed to allow the Fed to increase its balance sheet with T-bills and agency paper to prop up the banks like the Japanese did. Basically complete nationalization of the banking system because the whole thing is leaning on the Treasury now.

Over the weekend Paulson and Ben talk to the other central bankers, particularly the Asian central bankers, and talk about thier plan. Some type of agreement was reached where the Asian bankers agreed to buy bonds at a crappy rate and eat the loss in purchasing power over time (they have already been doing this for a long time if you believe the CPI is understated--why do they agree? technology transfer, a consumer market while they build their industrial base). Maybe they offered to try free up oil for them too, who knows? Now, of course, they won't suck up these losses forever and rates will have to go up sometime. How soon or quick? Who knows.

Particularly, here is the answer to the question for bailing out the housing market of where will all the money come from? Asian central bankers. They have a ton of reserves of US T-bills. They will start to dump T-bills and buy agency securities. Rates on T-bills will go up, and so housing will keep going down but in a more controlled fashion, but Asian bankers get securities backed by real assets whatever their value is.

As some here have said, in a resource constrained world fiat loses its value. Issuing more doesn't create a Keynesian stimulus to go out and develop more resources to back that fiat so it holds value because there simply isn't more resources to develop--all it would do is result in more claims on goods and no more goods. We saw that with the check drop--all it did was increase the money supply and therefore the notional price of food and oil went up and it did diddly squat.

Securities without backing by real assets will continously lose their value in real terms as the amount of money supply(claim on goods) becomes much larger than the goods produced. So the Asian central bankers (and the Fed) gets to exchange fiat reserves T-bills for reserves backed by real estate which is likely to better hold its real value even if notionally the prices of houses are dropping--the income stream will be the same on the mortgage. $300,000 house at 6% = $1,800/month. $220,000 house at 9% = $1,800/month. Thus, they become our landlords in effect.

What do we get in exchange? Our multinationals get access to sell to a country of people who really want toasters, cars, etc. and are willing to work much harder for them than the US. The US is a low growth country now--moving on to greener pastures. Also, they enforce IP rights so we can sit back and collect royalties on the brands.

In my mind, the whole key to PO and its consequences is the decline rate and shape of the curve after peak. If 3% or more starting soon then its big problems time--I'm in the doomer camp. If its a plataeu or gentle decline like Stuart said in "slow squeeze" then we will have more time to adapt, implement alternative energy, and I think Leanan's view is correct--basically things are similar but we are poorer.

Anyways, like I said this is rampant speculation. And my opinions will probably change as more data comes in. It simply is just my attempt to make sense of the events of this past year. But I think the connection between oil and our financial problems is understated. The big debt bubble was enabled by cheap oil, and the big debt bubble will deflate as oil gets more expensive.

Interesting and insightful big pic. My main objection to bailing out the housing market is to the extent that it can provide financing for building new homes of the current variety. I don't object to paying out current Agency debt, I object to creating new Agency debt. No new Agency debt would certainly mean very few new mortgages which would cause a sharp drop in new home construction. Which, from a Hubbert's Peak-aware perspective, is exactly what the doctor orders.

Because construction of more suburban and exurban McMansions is just digging further in the already deep hole most of the US population is in, as higher fuel prices will turn those homes into traps for their occupants. The US would be WAY better if labor and (ever more scarce) resources were employed in a massive wind farm construction plan like Al Gore proposed recently.

Related to this, IMV the cars-on-natural-gas part of T. Boone Pickens plan is nonsense. Cars should go electric or at least PHEV (that's why the US needs so much wind power). Natural gas is too important for cooking and heating.

Beach Boy,

They don't need new houses to issue new agency debt. They simply need to package and sell the insane amount of mortgages they already hold on their balance sheet (they are levered 60 to 1) into agency securities and sell to foreign investors. A wind down of Freddie and Fannie into smaller beasts.

Here is how I envision it working. Foreign central bank sells T-bill on open market to raise cash--this pushes price down of T-bill and therefore raises the rate. Fannie & Freddie package those mortgages on their balance sheets (and new ones the banks dump into Fannie & Freddie per this bill) into agency securities--delever.

The time of levering up like we had for the past 25 years is over--because one can't service more and more debt when basic costs are going up.

Agency security is exchanged for cash from foreign bank. Cash is repaid to the Treasury on Freddie & Fannie's line of credit. Treasury lends that cash back out to foreign investors at higher rates of interest. Higher taxes finance this operation and these higher rates of interest.

Note the US has passed an exit tax--if you try to leave the US and renounce citizenship and you have over $600,000 then you will be forced to pay all taxes on wealth immediately upon exit. In my mind, this is a glaring signal that taxes will be higher for the wealthy and probably everyone else too.

This ensures the wealthy can't evade the coming higher taxes and ensures there will be tax funds to finance the debt windown. Plus, Obama intends to raise taxes and he appears to be the probable president.

For the last 25 years we have created a debt super-bubble as Soros, Ilargi, and Stoneleigh have noted based on cheap food and oil because of Saudi flooding the market allowing the amount of debt to be serviced to be greater and greater.

As we are moving out of this cheap oil phase, all of this "paper value" needs to be destroyed otherwise we have a huge amount of claims on goods and no more increases in goods. Such insanely rising prices would literally kill the poor--not that I think there are a lot of bleeding hearts caring about the poor, but they do care about riots and revolution. There are a lot more poor people than rich.

In my opinion, and like I said its pure speculation, is that the value of central bank holdings in T-bills will slowly be destroyed. As T-bill rates rise, the value of a 5% 30-year T-bill will continue to go down and down. Bill Gross, the billionaire bond manager, is hugely short T-Bills.

The foreign central banks would not accept this destruction of their wealth with nothing in return, so they can exchange their T-bill holdings for agency paper. In a resource constrained world, paper backed by real estate is much more likely to hold its value than pure fiat paper.

I've already read a lot of articles saying that these banks are already buying this paper.

Basically de-lever Fannie & Freddie by creating agency debt for sale to foreign central banks or for transfer to the US banking system (mainly the primary dealers and selected large commerical banks)through the Fed window.

Note the primary dealers who are connected to the Fed through the primary dealer lending facility now include foreign banks like BNP Paribas. It seems they are already extended to Europe and will be handled similarly. Fed has already floated the idea of accepting foreign collateral onto their balance sheet.

There is no need to build a bunch of houses. Plenty of mortgages right on the ol' balance sheet of Fannie & Freddie.

Pat,

I guess that's why they have horse races. I may self have just developed a great fondness for future traders. I've been wanting to buy one particular oil stock for a while but it's been priced high like most oils. Thanks to the pessimism of the future traders all the oil have quickly taker a dip. My target stock is now down 25%...and all the analysts liked it when it was at the top. Even when you're not a wolf it's fun to sit on the hill top and watch the sheeple run this way and then that way. I hope I'm running with the right herd.

I am a long time oil and gas investor and I sold 20% of my holdings last week. I was so far ahead that I had to take some profits. You do this long enough and you start to feel stupid if you miss the top.

Also I think you are right about interest rates and risk. When the Fed really starts to raise rates, watch oil prices drop.

I think it's starting to turn right now. Higher interest rates will cause the world economy will decline even further and it will require less oil.

Investors who have been forced into commodities by low interest rates will see new higher interest rates and make the jump to the lower risk bonds. If they made 30% in commodity speculation in the first part of the year, they will be tempted take profits and be happy to sit on low risk bonds for rest of the year and end with an easy 35% to 40%. Do this long enough and you know sometimes you have to take your money and run. I think this is happening now.

All those discussions about Chinese and Indian demand, will matter less as those countries have benifited greatly from selling goods to America. Demand from other countries will not make up for the decline in demand from America. The American consumer is tapped out from the housing crisis.

Jeff Rubin from CIBC is probably right that increased shipping costs will further reduce global trade. With reduced trade, Chinese workers will have trouble buying their first car.

Long-term oil will rise much as predicted, but there will be some choppy ups and downs for the next few years. Hang on, it will be a bumpy ride.

I am sorry that events on the ground

are confounding your cherished beliefs.

If it walks like a duck,

And swims like a duck,

And quacks like a duck - -

Then possibly, very possibly,

It is a duck.

http://www.dailykos.com/storyonly/2008/7/15/131157/509/631/545500

Now I know that I was just lucky in my timing with this.

I had been writing it for about a week,

And just happened to post it the morning prices broke.

So I don't claim Whoopi Goldberg's psychic powers.

Yeah - I know -

Go ahead and troll-rate.

Because it is plainly obvious that you are unwilling to consider the possibility that the price of oil will NOT go to $200 this year or any time soon. The sad thing is that people who hold to faith mantras - regardless of whether these are on the left or right, religious or secular - cause more harm to the causes that they purport to endorse.

I am laughing my arse off at present as oil continues to drop. Below $125 today. Consumption continues to drop. Additional production will be coming online soon - conventional in Iraq, Oil Sands in Alberta, expensive tertiary recovery that will require return on capital.

But nooooooo - you can include things like "My A$$" in your title and that is funny, yet if I make reference to a duck it is troll-ratable. Truly pathetic.

http://www.eia.doe.gov/pub/oil_gas/petroleum/data_publications/weekly_pe...

You've been a member here for three hours. I am guessing that it's your attitude as to why you are being downmodded.

Many around here, including myself, have been arguing that oil would break for quite a while. How far we are yet to see.

Your argument is not new or novel, nor is it unexpected.

I understand your point, but to be fair to johnnygunn, a newcomer to this site might not get that impression.

For instance, in comments regarding the poll you posted today, you said that in the last poll over 60% of responses thought oil would rise vs. oil 9% thinking it would fall from what were record levels. Those numbers say a lot.

The other point I'd like to make is that newcomers here (especially those who do not make a show of agreeing with the "oldtimers") seem to be treated quite poorly.

These seems to be this underlying notion that you shouldn't be commenting unless you have read and studied everything ever posted here. And if you might have gotten some first impressions by only reading say the last two days' worth of posts and comments - hey! that's your problem.

What difference does it make if he's been a member for three hours? Maybe we should put everybody's date of birth next to their name.

In fact, below, we already have "ccpo" making a weightless, unsubstantiated attack on the commenter rather than his statements.

Apparently breaking the rules is a privilege reserved for those with at least 32 weeks under their belts.

JAS, I fully agree with you. I've read JD's blog post and it is thoroughful and credible, very much unlike this thread post itself, where speculation has been "proven false", just like 1929's, 2000's, 2007's, etc. I guess. People here put blinds on their eyes to the very things they don't want to simply believe.

The most hilarious graph I've ever seen is the front one. Have it occurred to the authors of the post that:

- You could have done a similar graph with the same values but aligning GDP growth with oil growth since 2005? You only have to scale them;

- Even if we take the graph for granted (which is disproven hilariously some graphs below, where the plot of GDP/barrel clearly shows that it is a quite moving "constant"), shouldn't it prove for once and for all that GDP growth is almost completely independent from the barrels of oil we use?

PS: Mr Goose, this website is turning itself unto a porn doomer thread series, despite many positive things in it. Yes, I know, I've been saying this for ages now, but you simply don't seem to listen. If you want to turn the tide, so to speak, you should:

a) Abandon the "vote" system, which is only a measure of the sheepnessless of any given commentary, and erases the motivation to bring different points of views from the main cattle point of view, which will only increase your initial problem (positive feedback), rendering your site the ultimate doom feast. (I predict a peak on doom in TOD by in about a year, where it has superseeded LATOC);

b) Treat well people who disagree with your theories. Treat bad people who agree with your theories but acts like a bully. Like your pal here, ccpo, who strikes me more of a troll than anyone else by asking everyone who disagrees with him to get the hell out of here (but alas! he is in agreement with the msm, so he is protected);

c) Acknowledge the finiteness not only of oil, but of knowledge itself, and if anyone brings in more knowledge, even if you "heard of it before", perhaps many more people didn't, so you should welcome it. Or are you treating this site as useful to you only?

And ccpo, grow up.

luisdias,

I don't visit DailyKos, so don't known this new feller. And it wouldn't matter if I did. His post was churlish, childish and inappropriate. If he posts like a troll, he should expect to be treated like one. The good professor had the same reaction I did, so I consider that support that my perception is defensible. There was nothing childish in my post, but let me join you now in your childish response:

Mind your own business. Your perceptions are yours, mine are mine. I still call troll.

Cheers

ccpo,

Troll, from wikipedia means:

In JD's comment, I don't see an irrelevant off-topic message, I see disagreement and a link connecting to a comprehensive blog post explaining his position. Too much work just to "bait other users into an emotional response", if you ask me. I also can't see where it is "off-topic".

ccpo's reply?

Uncalled insult, false accusations without any evidence whatsoever, and failure to recognize a simple truth: that people may not register the exact moment that they discover the site. Many visitors are simply lurkers who will only register past several months.

From the moment you have posted this on an internet forum, and considering you are not a moderator nor anything like it, consider your wish automatically not fulfilled. Don't like it? My bad.

It the same troll re-joining over and over and offering his/her drive-by insults, almost certainly. Just joined, but claims familiarity with the overall consensus on these boards?

Go away JD, or whomever you are.

Cheers

johnnygunn has been an extremely active and popular diarist at DailyKos for over two years. I hope that he ignores this type of nonsense and continues to post here. I also hope JD continues to post on TOD as his comments provide a sometimes very useful counter-balance to ideas that often become dangerous doctrine.

(And no, that wasn't me that gave you the -1 rating.)

If Mr. Gunn should choose to post like an adult and not a 12 year-old, I'd agree. Thus far, the evidence is against. As for JD, I've read his site. He uses circular logic, non-science and non-scientists to support an agenda, nothing more. He serves no purpose because he is not applying the science to the situation, but is pursuing his agenda.

Cheers

Surely, the ability to guess other people's ages in internet comments is not your strength. Your accusation of "anti-science" is laughable, from a man who can only babble infamous rants against TPTB et al, if he is some kind of a troll, then what are you?

A super troll?

johnnygunn "I am laughing my arse off at present as oil continues to drop."

Prof. Goose "Many around here, including myself, have been arguing that oil would break for quite a while."