Of pipelines and the future

Posted by Heading Out on September 19, 2008 - 10:10am

Gail’s recent post on the fragility of the US distribution system and the shortages that will be imposed by refinery outages, is a reminder of our dependence on pipelines for supply. The dependence is not just in the US, though the debate over the reality of a new gas pipeline from Alaska to the lower 48 rumbles along as a part of the election debate.

Most of Europe also depends on pipelines, particularly natural gas ones, and it is because of that that I am going to take a somewhat nervous stance and disagree with a recent article by Jerome. Some considerable time ago we swopped comments about the likelihood of different pipelines being laid to exploit the natural gas in Turkmenistan, and so from that point, this post is an admission that his opinion at the time (that many of these pipes wouldn't happen) was correct. However part of the reason for this is the less than benevolent role that I see Russia is playing, and this is my disagreement with him.

My concern is emphasized by the difference in objectives of two recent trips around the periphery of Russia. First there was the trip by the Russian President, who, with Gazprom CEO Alexei Miller, toured oil and gas supplying countries such as Turkmenistan, Azerbaijan and Kazahkstan in July. Out of that came both an agreement for Russia to buy Turkmen gas but also for Gazprom to invest in the Turkmen gas infrastructure. (Quotes under fold)

Moscow’s base purchasing price for Turkmen gas in 2009 is projected in the range of $340 to $350 per 1,000 cubic meters at the Turkmen border. Gazprom had first made this offer in March 2008 (see EDM, March 17), which would more than double the existing purchase price. Gazprom has already raised the purchase price from $130 per 1,000 cubic meters in the first six months of 2008 to $150 in the second half of this year. Moscow’s price offer for 2009 is supposed to raise Turkmenistan’s earnings closer to the European netback level (sale price minus transportation costs).

The second agreement stipulates that Gazprom will finance and build gas transportation facilities and develop gas fields in Turkmenistan. Experts have estimated that Gazprom will finance Turkmen projects costing $4-6 billion. Gazprom chief Alexei Miller said, "We have reached agreement regarding Gazprom financing and building the new main gas pipelines from the east of the country, developing gas fields and boosting the capacity of the Turkmen sector of the Caspian gas pipeline to 30 billion cubic meters."

Which is interesting, given that the Chinese have, over the last year, been building a pipeline to carry gas from Eastern Turkmenistan to China.

The pipeline – China calls it Central Asia Gas Pipeline – will run some 7000 kilometers. It will have two branches, one going through Kazakhstan and the other through Uzbekistan.

Bagtyarlyk territory was leased to China in July this year. It contains some fields that are already productive such as Samandepe and Altyn Asyr. These two fields, after reconstruction, will provide 13 billion cubic meters per annum for the pipe. The remaining 17 billion cubic meters will come from development of new fields in the contract territory.

In addition to building the pipeline, the CNPC will provide financing and technical know-how for the gas processing and purification facilities, pumping and compression stations and boosters.

TurkmenGaz and CNPC have already signed gas sale-purchase agreement but the price has not been disclosed. Some reliable sources told that the price would be above US $ 100 per 1000 cubic meters.

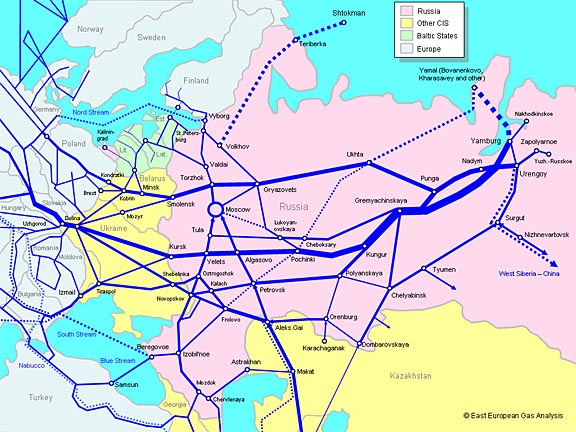

The likelihood of any additional pipelines being undertaken, such as that to India or feed to the Nabucco pipeline becomes even less likely given the management control of the gas infrastructure that the deals with China and Russia have delivered. Current and projected pipelines are shown below in a map that I borrowed from East European Gas Analysis where a higher quality version, and similar maps can be found.

from East European Gas Analysis

Optimism does, however, remain in the EU, particularly following a recent meeting in Slovakia of the Presidents of Poland, the Czech Republic, Slovakia and Hungary. But these players may be too late to the table.

Contrast that with Vice President Chaney’s recent tour of Azerbaijan, Georgia and Ukraine, with his message of “keep a stiff upper lip, chaps,” as though that will have much realistic impact. And this is where I disagree with Jerome, in that I rather suspect that the same sort of “infrastructure failures” that have led to Russia denying oil to places such as Lithuania.

The Druzhba-1 pipeline, which also feeds other facilities in the Baltic region, was shut down in July last year (2006) after a section of the Soviet-era duct ruptured in western Russia.

The halt in oil supplies came just weeks after Polish oil group PKN Orlen sealed a deal with Russian oil group Yukos to buy the Mazeikiu complex, apparently to the annoyance of Moscow which wanted the Baltic oil facility to be sold to a Russian company.

Not to mention gas supplies to Georgia (from 2006).

Explosions in southern Russia early Sunday severed the country's natural gas pipelines to Georgia, swiftly plunging Russia's neighbor into heat and electricity shortages and causing a sharp diplomatic flare-up between the two nations.

Two more explosions hours later severed one of Russia's main electricity cables to Georgia, increasing the electricity shortage even as the gas supply in Georgia dwindled.

Nor should we forget the intermittent arguments with Ukraine. (Not that they don’t have enough troubles of their own with their oil and gas company on the verge of going under). Shortages of gas threatened Italy at the time of the last Winter Olympics, and the EU recognizes that it needs to walk a little carefully .

Experts say the EU is also treading carefully on issues involving Russia, which supplies a quarter of Western Europe's natural gas. At an EU summit on the Georgian crisis earlier this month, European leaders refrained from considering tough measures such as sanctions against Moscow for not fully withdrawing from Georgian territory.

This "fingers around the neck" position was a point that Vice President Chaney made in Italy before his return to the US. Unfortunately, in pointing out the problem he did not admit that there is really not a lot that he can do about the situation. Nor, alas, will he likely have much impact on current Gazprom moves into Africa.

Gazprom signed a Memorandum of Understanding with Nigeria to develop gas and oil projects there. Gazprom is already in talks with Lybia where it is seeking to develop a gas pipeline to Sicily, and it opened an office in Algeria where is hoping to sign a deal with Sonatrach.(....) Obviously if Gazprom is successful in these deals it would reduce the European Union's leverage over Russia. It'd also change the balance of power between the US and Russia, since Europe would have to be more careful about provoking Russia with stupid offers of NATO membership for Georgia and Ukraine.

Thus, as the world comes to depend on a smaller number of suppliers, and the price that they are able to demand for their product, it becomes more critical that alternate sources and technologies be developed.

In that regard last Thursday Dr. Gene Whitney of the Energy section of the Congressional Research Service came to town to talk about Climate Change, Energy and Water issues. In his opening remarks he pointed out that the energy situation has become a real problem, rather than an issue, and stressed the fact that the time for implementation of new technologies is growing short. Basically he felt that the public was still unaware of the size of the problem, and of the speed with which it was approaching.

I took some of those comments and used them as a lead-in to a talk I gave at an algae workshop on Friday. There is an ongoing debate between a colleague and I as to whether it is better to justify investment in algal research as being a better way of helping solve the carbon dioxide problem, or as a source for bio-diesel. Encouraged by Dr. Whitney’s comments I took the energy need as my lead, but came away afterwards with the unwilling recognition that I had, at this time, probably made the wrong choice in emphasis. Given that there is some progress toward field trials of a system that will prototype that use, it is perhaps understandable. But the time we have left to develop the alternate use grows shorter, and I guess I will have to wait until "Panic" becomes a little more prevalent before I have a chance of winning that debate.

May I do my part to encourage "Panic"? I live in Western North Carolina and have not been able to obtain premimum fuel for my car for 22 days. The refining and distribution infrastructures are indeed fragile. One hopes that alternative energy advocates have recognized that it is desirable to have the energy produced locally.

Yep, we have an update coming on this here in a couple of hours. We have reports from NC, TN, and FL about some shortages, but haven't been able to figure out the scope of the shortages and their rate of increase yet.

Here in the raleigh NC area, it looks as though gasoline is being brought into the county from Greensboro a 100 mile trip. The other areas Smithfield and Apex are from what I have been told low on fuel from the Colonial pipeline. Many independent stations are out of gasoline or just have regular at 3.87 to 4.09 a gallon. If a station drops their price to 3.60 a gallon lines quickly form and they sell every last drop, funny like that price is any great shakes!!! ITS OVER 3.60 a gallon!!! Pipelines, how about local electric plants, nuclear plants wind, anything that makes electricity.

By the way how stupid is not having gasoline storage areas in the southeast part of the country, especially during HURRICANE season!!??

Enough of the NIMBY BS, if you want to run an economy on liquid transportation fuels you better make sure you have a minimum 30 day supply for situations like this. In addition, some type of rationing system should automatically go into place odd even etc when shortages occur. When I saw the idiot driving the hummer with 6 additional 5 gallon gasoline cans fill up in the Raleigh area last friday it made me want to hit the dumb arse.

Nashville is 85% out of gas.

http://www.tennessean.com/apps/pbcs.dll/article?AID=/2008091/NEWS/80919020

Lines two hours long and stretching six blocks around the few remaining stations. Eerie sight to drive by stations that are void of people and have blank signs, only to see cars backed up in every direction blocking all lanes of traffic at the stations which are still open.

"By the way how stupid is not having gasoline storage areas in the southeast part of the country, especially during HURRICANE season!!??"

Damn, I’m soo sorry you have been inconvenienced! I suppose some oil company could build enormous storage facilities. Let’s see, cost of the land, storage tanks, cost of inventory, the interest on that investment, insurance, and taxes on all that land, equipment, and inventory; they would undoubtedly have to charge more for their gasoline. Competition being what it is I am sure it would be easy to undercut the we-have-inventory-for-hurricane-oil company and the public would be more than willing to purchase the cheaper gasoline based on my experience.

The Gulf Coast doesn’t necessarily have hurricanes every year and by restricting where oil can be produced the government has effectively put a lot of eggs in one basket. If the US could produce oil off the Atlantic coast, Pacific coast, ANWAR, as well as the Eastern Gulf the effect of any one hurricane would be much less.

As far as the odd even day thing I’ve been there, done that. I was a wholesale distributor of fuel and lubricants during the Arab Oil Embargo. You still have lines and shortages and if it lasts long enough you get an extra benefit: Hoarding. There is a simple cure for what ails you; let the market determine the price. If you let prices be set by the market than there are no lines, no shortages, and no problems. You will, however, have to pay what they market will bear. Its simple and it works.

While the emergence of a "Gas OPEC" (a much cherished wish of both Algeria and Russia) is indeed nothing to laugh about, one should be careful with the IEA demand projections. I spoke about this with one of the writers of the recent Clingendael gas paper to find out where all this projected new natgas demand/dependence is coming from and it turns out that it hinges on the assumption that the UK and Germany, but mostly Eastern Europe will replace all their ageing nuclear and coal-fired power plants with gas-fired ones in the following decades. While that makes sense in their fundamentals analysis (purely on a exploration/transport cost basis, gas is potentially the cheapest/carbon-optimal option for Europe), this is a huge assumption if security of supply concerns start weighing more and Europe opts for nukes, coal or wind instead.

At the moment, the Russian gas molecules don't go any further than mid-Germany. If all the projected LNG terminals are built on the west coast of Europe, this point might even get pushed back further east. Now I don't know what is the less desirable option: a Russia that supplies natgas to a dependent Europe at will, or a pissed off Russia that invested billions in pipelines just to see no demand for it (and with little revenue flow at risk when it does pick a fight).

I still cannot figure why Russia with such vast amounts of energy, is not brought into the European western nation alliance. I mean the old soviet union is no more the wall is down and quite frankly more western than not. But our retoric and who knows what else makes little sense. I would not count on energy in the long term from Russia until nations decide to accept Russia as an EQUAL to the USA especially in that part of the world.

"If all the projected LNG terminals are built..."

I really don't understand the present LNG hype. Everybody believes that LNG can make Europe independent from Russia. But can anyone tell me which are the gas sources that can be delivered to Europe at a competitive price that are not already delivered by pipeline?

A few hints to shorten your list:

North Africa: already pipelined to Europe

Nigeria: pipeline planned (possibly co-financed by Russia)

Central Asia: pipelines via Russia, competing with new pipelines to Asia, so far no progress of pipeline plans to Indian Ocean

Malaysia etc.: much closer to the traditional (and well paying) east asian LNG markets

Americas: already short of gas

So which LNG exportation sources are left to bring down prices?

I bet: none.

In addition to the countries which hoped to increase supplies of LNG given in my link, Qatar is a major player:

http://www.tehrantimes.com/index_View.asp?code=175879

tehran times : LNG project delays may cut 100 million tons of supply

Form the link though it is clear that supplies will fall well short of previous projections by around 100 million tons by 2013, around the consumption of Japan and Korea combined.

The bottom line is that there will not be the LNG available to supply all the import terminals being built.

We are now in the reverse position from WW2: then we were an oil exporter whereas Germany and Japan were oil dependent. We (the US) appeared to be horrendous creatures to those regimes, blocking their access to resources needed by their industrial empires.

This time, our gov't in a bumpy collaboration with the EU and Japan has tried consolidate its hold on the ME and Afghanistan thru military means, simple aggression to put it bluntly. Russia has a lot of gas and oil (declining, yes), and wants to protect and exploit that advantage. The US and EU, ever since the fall of the SU, have been trying to weaken that advantage thru fomenting "revolutions" in the former Soviet states and satellites, not just leaving them neutral, but recruiting them into NATO, putting military bases there, and so on. Now, for the first time, Russia did not passively accept a provocation, but responded. Shock, shock,shock.

I'm no fan of Russia. But I'm even less a fan of the hypocrisy that prevails in the West where we see only one side. The "fingers around the neck" metaphor needs to be looked at from both ends.

What we ought be doing, rather than ramping up for Armageddon, is re-directing the funds now used for military adventures and bailing out the billionaires to rebuilding our society so that it can function on a radically reduced oil energy budget, i.e. build up small dense towns close to agriculture and small industry, and all the other obvious and natural steps.

Won't happen, of course, until we're more than halfway to hell. But without a vision, we'll make it all the way.

I'd like to concur in the thought that Russia has some justifiable concern about its position, and is likely to behave hostilely when threatened, even if we in the west think the threat is quite unreal. We after all know that we are good guys, one and all. But the Russians have historically been concerned about their access to ocean ports. This goes back to Czarist times and is not something that can be ignored. With each Cheneyist move on our side, they wonder what they could to counter a real escalation somewhere on their border. And what a real enemy, which Cheney surely is, could do to counter whatever they think they might do. It is chess master thinking. It does no good to say that we mean them no harm, if our actions continually move toward a situation in which doing them harm could less costly to us. This is not to say that we should simply let them do what they want, but we do need to work harder at diplomacy.

I belive that the G7 is acting out of desperation.

Japan has no energy resources.

Europe has depleted it's uranium and coal and north sea oil and gas is running out fast.

In the US net energy from coal peaked some time ago. Oil imports are very high. The Naturalgas cliff will soon arrive in north America. A north American natural gas shortage will end cannadian tarsands oil production.

Plus most of the exports that the west are depending on will not be forth coming.

Europe has not depleted all its coal, it has just chosen not to use it (whether on price or other concerns).

I'm not a fan of nuclear power but uranium comes from Canada, Australia, the United States. For a price, which is small compared to building the nuke in the first place, I can't see Europe not getting all the uranium they want.

The UK has enough nuclear waste if processed to run a number of reactors for 60 years.

Just a detail, but the 'waste' referred to is actually depleted uranium left over from the enrichment of natural uranium as fuel for the current generation of (thermal) nuclear reactors. Tens of thousands of tonnes sit in storage in rural Cheshire with no obvious place to go at the moment. A fast reactor, such as used to operate at Dounreay in the north of Scotland, can convert the depeleted uranium to plutonium which can be used to generate electricity (I know - I worked there).

For political and low oil and natural uranium price reasons, the project was cancelled in 1988 and the fast reactor shut down in 1994 as the Tory government of the day nailed its colours to the deregulated natural gas mast in respect of electricity generation. The result now is that about 35% of the UK's electricity is generated from natural gas, supplies from the North Sea are dwindling and it's getting less and less clear where long term stable supplies of any sort of energy are gong to come from in the future (but then we all know this anyway).

Sterling is doing an analysis of the potential of nuclear power to meet future world power needs - he has put the first part up here but was looking for collaborators.

You contribution could be very valuable, so if you feel that you would be prepared to help, please e-mail me and I will pass it on.

brittanicone2007 at yahoo dot co dot uk

There is also a webs site that some of us in the UK who are concerned about power shortages have set up:

http://uk.groups.yahoo.com/group/energysecurityuk/

Again, e-mail me if you would like to be a member.

Regards,

Do you work in the nuclear industry or own a company with interest in a nuke revival?

Nope. I am just interested in trying to stay warm in the winter, and am persuaded that for the UK at least there is no other practicable way.

We are probably going to get very cold and and thrown out ot work anyway, since the plan, insofar as there is one, is based on importing LNG.

Around 30GW of coal and nuclear out of a total of 75GW is coming off line in the next few years.

The planned increase in world LNG production has been scaled back in a number of countries, and now looks likely to be 100 million tons short by 2013, around the same as Japan and Korea use together.

Here is an analysis of the physical limitations of producing power with renewables in a crowded northern country:

http://www.withouthotair.com/

Sustainable Energy - Without the Hot Air (withouthotair.com)

This leaves out cost considerations. Solar PV in the UK produces only a tiny amount of power in the winter when it is most needed.

There are limited sites for wind on land, and off-shore wind costs around £3 million MW installed, not including connection, back-up and maintenance.

Allowing for intermittency you come out to around £9millionor so a MW - most of the poor, or indeed most people, could in no way afford that if it represented any substantial proportion of power, and would simply have to do without.

I should emphasise that the very first thing we should be doing is to insulate our houses properly, and to conserve wherever possible.

We need all sources of power which can be produced with anything like reasonable cost as soon as possible, but here the potential of renewables is nothing like as good as, say, in the Great plains of America with its huge on-shore resources.

It is going to take some time for a nuclear build to get going, and in the meantime we are going to get very cold in spite of conservation.

I do not appreciate the delay.

Ok, interesting.

Your offshore wind figures sound awfully expensive though. Are you sure they are correct? 9 billion pounds per GW? Isnt nuke about 1 billion dollars per GW? What would be the cost per kwh of offshore wind compared to nuke?

Darned if I can find the detailed break-down now, as I looked at the issue some time ago and a lot of my sources are now off line.

The problem is that you are shooting at a moving target, and unfortunately most of the costs are rapidly rising - this applies to nuclear as well as wind, although the inputs are rather different, as wind uses a lot more basic resources like steel but obviously not such sophisticated engineering, although the nacelle does involve precision engineering, and the equipment to install off-shore wind is certainly technologically advanced.

Here is the basic UK government report , but it is from 2006:

http://www.renewables-advisory-board.org.uk/vBulletin/showthread.php?t=13

Offshore Wind Cost Study (ODE Ltd) - RAB Forum

Here are some calculations I did at the time, and came out to a figure of around £45bn for 33GW nominal, which would come out to around £4bn for an actual MW

However, this was certainly, or at least is now, an under-estimate, and at one time a figure of £66bn was about, although that apparently did not include much of the needed connections, with some of the estimates to include connection being around £3bn/MW installed.

Since the Government report, Sterling has sunk by around 12% against many currencies for a start, and most of the costs are either in dollars or Euros.

I won't bother giving my links for the £99bn figure,a s most of them seem to be old now, and you have encouraged me to find a later figure:

http://findarticles.com/p/articles/mi_qn4158/is_/ai_n25141277

This comes out to £80bn, so using the Government's 30% utilisation figure from the report I quoted that is £8 million MW actual average output - this is April though, and Sterling is lower now.

I think I would be happier to use this figure, so apologies if I overstated the case - I really am happy for offshore wind to be built, it is only the cost that puts me off, so I don't have an axe ot grind.

It should also be noted that wind has an excellent load-following characteristic for the UK, being around 2.5 times stronger in mid-winter when it is most needed, as opposed to mid-summer when it is not.

http://www.eci.ox.ac.uk/publications/downloads/sinden05-dtiwindreport.pdf

sinden05-dtiwindreport.pdf

Nuclear costs are also a it as long as a piece of string, as if you take the costs the Chines have been building Westinghouse reactors for then you come out with a very low figure, whereas the new Areva reactor in Finland was the first of a kind, and they had to train the Finnish workforce and so may be high compared to series production.

However, I will use the highest estimate I can find - please note that it explicitly stated in the wind estimate that this was a conservative figure, so I am giving wind every chance to compete:

http://business.timesonline.co.uk/tol/business/industry_sectors/utilitie...

So you have £4.8bn for a 1.6GW plant, at a 90% capacity factor that is around £3.3 bn GW

Connection costs are far lower for nuclear, as they are mostly going to be built on existing sites, and anyway are not in the very remote locations of wind power.

Fuel costs are minor. Decomissioning is not included, or waste disposal, but OTOH my figures do not include maintenance in the case of off-shore wind, and that is going to be expensive.

The projected life-span of nuclear plants is at least 60 years, albeit with substantial refurbishment, whereas the wind build is going for 20years, although it should be noted that some of the foundations may be OK to put another rig atop.

It is easy to trip over decimal points, and go for a false precision, but from the figures we have come out at, £3.3million MW of average production for nuclear, and £8 million MW for off-shore wind, if we think in terms of at least double the cost for off-shore wind to nuclear we may be in the right ball-park.

Hope this helps - it was a good opportunity to update my figures.

BTW, you will see all sorts of costs per kwh quoted, high and low for both sources, and they are based on levelised costs.

Unfortunately, these figures are dependent on the assumptions fed into them, with interest rates being one critical factor, so unless you have full details of the assumptions and breakdown they are useless, and can be adjusted to taste by the people who compile them.

For renewables typically the quoted levelised cost will not include government subsidies.

Some of the figures for nuclear also may not include all the costs - I don't know I don't use levelised costs as they are too dodgy.

Another thing to watch out for is most of the quoted figures per MW in the press and from advocates for renewables do not allow for intermittency - rework my figures allowing 100% utilisation for wind and it is a bargain! :-)

EDIT: I just looked back at your comment - the figure of $1million per MW for nuclear is way too low- they might be able to get somewhere near that in China, in a few years with series production, but no-one can do anything like that now.

Pipelines are better than railways in a moderate to high volume scenario, but rail petroleum delivery is still viable and takes place in a big way in Russia. To a lesser degree, US refineries load railcars, usually to petrochemical plants with rail spur. This rail component is an important subject in meeting the challenges of the Oil Interregnum in America.

As various new sources of oil like algae, other crop formulations, come into volume production, rehab of the 1950's US railway network has one more 21st century rationale: liquid fuels delivery. The small percentage of people looking at the rail component in the Fossils Rollover solution set will benefit from Christopher C. Swan's "ELECTRIC WATER", a very comprehensive writing on localized power generation & renewables linked railways. See also ASPO Articles 374 & 1037 in the (peakoil.net) site.

The entire discussion of the Peaking Oil subject, whether agriculture, distribution, conservation or homeland/energy security; ALL need inclusion of rail savvy participants. Be one of those calm people in the room: study your respective locales' US Rail Map Atlas from (spv.co.uk) and help the people down at the County Planner's Bureau be knowledgeable about where the nearest rail corridor might be rehabbed.

Pipelines are the accepted ways and means to move oil & gas certainly, but in localization, "Societal & Commercial Cohesion" if you will, renewable powered railway is still a strategic requisite.

It is worth mentioning the under-the-radar news that China, Russia, the EU, Africa & South American rail features in the $Trillions are under way. USA investment mavens need to dust off the "Equipment Trust Certificate" methodology as collaterallized, tangible investment & annuity instruments. Gold can be recalled; FDR did it with no greater financial threat than we face now... Railway rolling stock, fixed plant and renewables infrastructure linked to rehabbed & expanded railways as Peaking Oil investments.

Luara Tyson & Austan Goolsby, are you reading this? Hmmm.

I am concerned about all this talk about making algae from coal fired chimney gas. Will this gas be scrubbed first to removed the ultrafine particles ( less than 10 micron ), heavy metals (attached to the ultrafines or in the gas stream), and other organics? Is this not just a move to continue using coal? Won´t those pollutants previously mentioned wind up in the algae and thus in the products? There are mountains of toxic coal ash laying about. Do we really need more? This material has been given a free ride for years.

Not sure what we disagree about...

My points are as follows:

- pipelines create a co-dependency, so it's not one-sided. But it certainly makes sense in any case to limit our gross dependence, even if the net relationship is not so unbalanced;

- Russia's apparently hostile behavior with some of its former satellites is often caused by shady deals - where the non-Russian side is often as corrupt as the Russians. Usually, it's private interests fighting it out and hijacking national "interests" along the way

- some pipelines that are being mooted are just unlikely to happen because they would be impossible to finance

- there's no escaping that the gas business is heavily infrastructure driven, and infrastructure (ie pipelines of LNG units) drive relationships more than the other way round.

Altogether, I think that resource depletion (in the medium to long term) is the biggest threat to Europe on the gas side, not political games in the meantime.