On being wrong - the falling price of home heating oil in Maine

Posted by Heading Out on October 31, 2008 - 9:54am

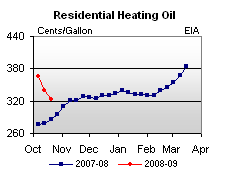

Sometimes, I have to admit, when predictions are made, I can be just wrong. Asked, early in the summer as to the wisdom of buying winter supplies of heating oil in the North East, I suggested that there would be a likely continued rise in price, and that with distributors having problems, that an early securing of supplies would pay off. Well it is not happening. Recent stories have shown that the price of heating oil in Maine has fallen from $4.71 in July to $3.08 last week. The national average heating oil price as shown by the EIA is steadily falling.

The underlying facts about world production potential have not changed, but the demand side of the equation has, at least temporarily, and with this change, the price has dropped. Winter still comes around (I look up at a tomato ripening on the window ledge as temperatures outside drop to freezing) and this winter has been predicted as being a bad one.

AccuWeather.com Chief Long-Range Forecaster Joe Bastardi today released his 2008–09 Winter Season Forecast addressing issues of average temperature and precipitation impacting the nation. His forecast calls for one of the coldest winters in several years across much of the East.

The core of cold was centered across the Great Plains last year but is expected to be farther east this year. Bastardi says the winter of 2008-2009 will be viewed as the hardest in several years. “It may be a shock to some when compared with the above-average temperatures of last year in the East. It will put some ‘brrrrrr’ in the saddle of folks who have not had to deal with such things for a while," he cautions.

The toughness of the winter will not be seen just by those who use the oil. Distributors, and the suppliers that provide it up the chain are now starting to see the fall-out from the credit freeze.

"A lot are starting to bounce checks," said a trader at a wholesale heating oil supplier, who requested anonymity to protect the supplier's standing in the physical fuel market. "Credit lines are definitely strained."

In the Northeast U.S., heating oil's biggest market, hundreds of dealers, ranging from single-truck operations to publicly traded corporations, bring the fuel to customers.

The fractured system, which stretches back decades and includes many multigenerational family owners, connects into a global market through the heating oil futures contract on the New York Mercantile Exchange, which in turn acts as a global benchmark for other products, including diesel and jet fuel.

But the story goes on to note that inventories are 25% lower than they were last year, and though the price drop has helped the financial stability of some distributors, the price is still higher than it was this time last year, and it won’t take much of a disruption to take it back up.

I have written in the past about the supply of natural gas into the North East, and the recent drop in price from $13.58 to $6.50 per million Btu, would initially suggest that there is nothing to worry about this year for that fuel either. However stocks are down a little over this time last year, when they were at record levels. If the cold weather is arriving a little earlier this may also reverse the decline in price, and depending on the winter’s severity may also remind folk that the cheaper supplies from the Rockies aren’t quite to Ohio yet, though the Rockies Express pipeline (REX) reached Missouri in May. Comments on an extension through Ohio (which it was scheduled to reach in June, 2009) close this week. This is later than had been intended, and with this delay in getting permits, the project completion has been set back about five months. (Interestingly there is some concern that this will hurt supplies to places such as Nevada.)

We have reached a time when production from the Marcellus shale in PA is now gearing up, so this supply may have an overall influence on price. However, given the relative cost of the wells, it will be interesting to see how the entire dynamic of price plays out with the two new competing sources of natural gas becoming available at around the same time. This may be especially interesting with the changes in the financial market.

At the other side of the country up in Alaska, one might have thought that supplies would have been more assured, given that the recent redistribution of oil revenue to the residents has been upped by some $1,200 per person. However, getting oil out to the more remote communities of the state continues to be a difficulty, and at an additional cost, so that prices away from the towns may well be at double that in the city. This is leading to concern from the Alaskan Federation of Natives, who considers that it is reaching emergency levels.

One of the impacts that this might have, is on the longer-term availability of natural gas from Alaska into the lower 48. The recent decision that TransCanada will run the pipeline the 1,715 miles from Prudhoe Bay to the Alberta Hub in Canada may face the same sort of objections from Native tribes that has caused problems for the McKenzie River project further East.

If the economic downturn reduces demand, with the concurrent increased availability of natural gas in the short term, then the economics of pipeline construction may not be as immediately pressing as they might have appeared even a year ago. Unfortunately putting off the construction planning and the other preliminary work that presages construction may mean that by the time that Arctic gas finally gets down to the lower 48, it will be considerably later than can do most good for the country.

Perhaps in recognition that it is no longer prudent to rely so heavily on external sources, Maine is now seeing construction of wood pellet plants, although there is currently a greater demand than supply. Part of the reason for the shortage is credited, in part, to the ability to buy larger volumes at a time, without the storage problem that arises with other forms of fuel. The pellets are selling for around $300 a ton, with one plant producing 60 – 70 tons a day during the summer. With demand increasing there are plans in place for expansion of the industry.

Which reminds me that it is time for the annual chimney sweeping, so if you will excuse me . . . . . . nothing like a face-full of soot to keep one humble.

Having to purchase petroleum products once or twice a year is a tough call for any homeowner to have to make.

This is a good reminder that "peak oil" does not mean "oil prices go one way - up" but rather it means "oil prices will be increasingly volatile."

Government should assist homeowners by (1) promoting energy efficiency to reduce demand (and exposure to price risk) and (2) establish some sort of hedging mechanism to smooth out prices for individual homeowners.

Essentially, the dealers and the homeowners are playing their own mini-hedge fund game. Neither of them have good information and the product is unstable. That's not a market; it's a casino.

It's way too early to say you are wrong.

Yes, the state should be doing a lot more to reduce demand. It should have been doing that for years now. And the state knew and did not. State energy policy is explicitly "Trust to the free market". Leaving aside the disaster that is for people who want to stay warm, it's also a really, really, really bad policy for a natural resources entity. Except for the people at the top who typically make out like the bandits they are - in this particular state FPL, Nestle, Casella come to mind. We're exporting low entropy and taking in crap. The heating season has hardly begun and one can smell wood smoke (and burning plastic) everywhere.

I'd be curious to see the EROEI on pellet manufacturing. The industry is no longer using waste wood, unless you expand the definition of waste wood to include forest where the size of trees is below what the paper industry wants. Mining the forest for wood pellets is no different than sucking oil out of the ground. King's Pines are not a renewable resource in any common sense.

I often hear people argue that forests now cover more of the North East than they did 150 years ago. True. But the trees are often weak scrubby things with much less emergy AND exergy. It won't take more than a few large pellet mills to mess up what's left of the forest industry. And of course, the wood is harvested, transported, milled and distributed courtesy of fossil energy on roads pounded to hell by ever-larger lumber trucks. Nor is there enough sunlight falling on Maine to cover much of the energy we use.

We need thinking along the lines of hard, enforceable, non-transferrable, carbon caps - caps that decline. The energy industries have to be redirected so that they are responsible for providing end results - eg cold milk, warm houses, transportation. Not simply sales of calories. I can dream, OK? Problem is, when I dream, that's not what I see; instead I see Easter Island.

cfm in Gray, ME

Pellet manufacturing is not an energy creation process. Its a process for making fuels easier to handel, transport and burn. In the case of wood you start with any wood with no sand and preferably little bark, mill it, dry it and press it into pellets. The drying is usualy done with energy from burning, bark and residue unsited as pellet raw material. The biomass dominats the raw materials but a fair ammount of electricity is also used.

EROEI on forestry is a better question since the input form the sun counts for free. The Swedish studies I have seen are A ok but I am too lazy to dig thru them for citations. All Swedish forestry and related transports could be run with fishcer-tropsch diesel from gasified biomass from a fraction of the yearly yield of renewable forest resource.

The local hardware store here in my Maine town says people are "panic buying" pellets. They can't keep enough bags in stock.

I expect he'll have a fire sale in the Spring (as it were).

Hi Mike,

Pretty much the story in Nova Scotia.

See: http://novascotiabusinessjournal.com/index.cfm?sid=183504&sc=107

Cheers,

Paul

Neither is drilling for oil. We still talk about energy return there. I'm particularly curious about how much energy goes into the drying.

And as usual, nature never gets paid. Not for the oil, not for the wood. But even solar energy is not free; it's being diverted from some other use. What was the number from the BBC recently, approx $7T per year "cost" to nature for what we are stripping from the forests? We're living off the built-up, stored concentrations of resources - stored by that solar energy and the forces it drives. It may only be a very small fraction, but we need to start thinking much more holistically.

cfm in Gray, ME

Or partly by train like here in sweden http://www.branschnyheter.se/article23869.php For the people how do not understand swedish, It is a terminal for transporting timber by train and they expect it to be profitable in three to four years.

The rail is electrified so it could be run on almost anything. Will it save energy? Probably not now! where was two sawmills in the small village until just a few years ago but they are both closed now.

But it could be used to produce energy from wood with good eroei, they just have to use it in another way.

I looked seriously about setting up A wood pellet plant 2 years ago using wet wood chip from a log mill. Pulled out about a month before ordering equipment. Due to the supply chain being totaly dependant on fossil fuel and high power requirment to run the Plant. Grinding dry 20mm softwood wood chip to >3mm and pelleting into 6mm takes about 85-100Kwh of electricity. Chipping logs this goes up to 120-140Kwh Drying 50% humidity wood down to 10% using waste wood/bark uses up approx 20-30% of orignal energy in wood. This does not include energy used in loging/forwarding/trucking.

Pelleting ony works as a way for sawmills to get rid of ther waste sawdust if the previously were dumping it.It is a good substatution for oil burners, saves oil for better uses.

Fitting a wood Gassifacation boilet to new house. 91% efficient, air dryed wood (no need for all the processing add can cut the wood myself With chainsaw,an axe if things get bad)

Hi Rib,

When you note that grinding and chipping softwood into pellets requires 85 to 100 kWh and 120 to 140 kWh, respectively, is this per 40 lb bag?

Around these parts, good quality pellets such as Shaw's Eastern Embers run between $5.50 and $6.00 per 40 lb. bag (that is, if you can find any). This puts the cost of pellet heat at about $0.075 per kWh; by comparison, off-peak electric heat in Nova Scotia is $0.054 per kWh.

Cheers,

Paul

"Government should assist homeowners by (1) promoting energy efficiency to reduce demand (and exposure to price risk) and (2) establish some sort of hedging mechanism to smooth out prices for individual homeowners."

Why? Chances that the government will screw it up worse are more likely. See Barney Franks et al promotion of low income housing for fiscal dropouts. Lets all subsidize corn growing for ethanol. That will get us mid-west politicians re-elected. On and on and on.

The government is NOT the answer to problems and is often-as-not the cause of same problems.

The government is NOT the answer to problems and is often-as-not the cause of same problems.

This gov't is totally beholden to corporate interests. The crisis we are in is not the result of gov't action, but of the workings of unbridled capitalism. When this leads to disaster and crisis, the gov't steps in to rescue the interests and corporations it is most beholden too -- and those parties have their people right there in the gov't overseeing their interests, whether it be Cheney or Paulson.

Gov't is not gov't. Gov't can be used to promote interests -- either private or public, common interests. There is no such thing as no gov't, or less gov't. That's not possible anymore, and has not been for a long time. What is possible is to have a gov't that tries to look ahead, tries to foresee and uses its power to protect the interests of the majority and ios responsive to that majority. That's not what we have -- but it is what we need. People should oppose THE gov't, but not oppose gov't in general -- they need to take it back from the private interests that control it now. To disavow gov't is too walk away from that and guarantee that gov't will continue to remain in the hands of those who control it now -- continuing disaster.

This government? BS I have seen US governments in action for the last 50 years and they are ALL beholding to business and special interests (farming etc.). The talk may differ but the walk is the same.

Why haven't we had an energy policy for 50 years? We knew of peak oil in 1968. This is nothing new.

All true, but doesn't address my point.

Gov't is not gov't. Gov't can be used to promote interests -- either private or public, common interests. There is no such thing as no gov't, or less gov't. That's not possible anymore, and has not been for a long time. What is possible is to have a gov't that tries to look ahead, tries to foresee and uses its power to protect the interests of the majority and ios responsive to that majority. That's not what we have -- but it is what we need. People should oppose THE gov't, but not oppose gov't in general -- they need to take it back from the private interests that control it now. To disavow gov't is too walk away from that and guarantee that gov't will continue to remain in the hands of those who control it now -- continuing disaster.

It's funny how on a site like this - which predicts that nothing will help except returning America to what it was in 1905 (although there are articles here stating more like 1800 or even 300.000 BC* ie without any humans) comments like these are to be found.

The intrest of the majority has the problem that there's a fucking lot of majority. The only thing the majority's interested in is watchin tv on the new 500 inch plasma, a new cell phone every week and daily restaurant visits.

In other words, let's reduce energy to 1930 levels is nice. And the current "oh-no-co2" campaign is convincing people it's wise. However me (and you), and the majority are going to scream bloody murder once supplies are cut.

Lots of people will realise that a 50% cut in petroleum supply is going to fucking hurt, and they will lynch whoever's in the white house (if this guy isn't hurt by it himself, both barack's and maccain's heating bills are enormous on a warm summer's eve), for that last second of delay.

We all know "increasing efficiency" has yielded it's greatest fruits already. It can maybe cut our usage 10%, perhaps even 20%. But no more. So that type of policies is out. So you need the government to force people to "save energy".

What would "mandatory saving" policies entail ? Letting people starve ? Letting poeple freeze ? Letting people be left behind in the dark ?

That's exactly what "saving" policies entail. How exactly is cutting energy supply, even partly, better than the engineered famines comitted by the Soviets ?

The Gummint "should" do a lot of things.

The Gummint "could" do something if only they hadn't spent $700+BILLION on the credit crisis debacle. (When the money is going into the banks and disappearing straight into the vaults, and screw the people who it was supposed to actually help. [The money didn't have the purpose stamped on the bills so of course the banks are doing the "prudent™®©" thing with it {unlike the shaky loans they made. (They're not going to repeat THAT again, No SIR-EE-BOB!)}])

The Gummint should do what we, the people, tell it to do AND NOTHING ELSE.

Its when they mine ideas on their own that we get the shaft.

I think you mean disappearing into year end bonuses.

Who could predict when the Mess That Greenspan (and the Bush administration) Made would impact?

The fall and heating season have just begun. Only time will tell if your prediction is wrong. One "event" related to oil supplies could drive the price of oil up to $500/barrel.

What is certain is that the price of oil will be too expensive to provide heating oil and diesel for highway maintenance. When?? Sooner than most think. There goes the transportation of food and the power grid, and with it the parts for anything mechanical. YIKES.

Time to invest in extra wood stoves, hand saws, hand sleds, and all of the stuff that you will need to farm without all of the stuff that comes in on the highways.

Cheers,

Cliff Wirth

People in Maine pay about $0.15/kWh for electricity so heating oil has to be above $4.50 a gallon to make electric space heaters less expensive than a 75% efficient oil furnace. On the other hand, if you are only keeping one or two rooms heated, you might do better than with using central heat.

Growing up, we always used wood heat as much as possible. That still sounds like a good option.

Chris

Hi Chris,

At current rates, electric resistance is not likely to be cost-effective for most New Englanders, other than for limited spot heating as you suggest. However, in a new, energy-efficient home, it may not be a bad way to go if oil is, for all intents and purposes, the only other alternative (i.e., lower initial cost; no ongoing service/maintenance costs; greater zoning capabilities; no living space lost to ductwork, furnaces or boilers, etc.); oil's extreme price volatility and ongoing concerns about supply are other key considerations as well. If your utility offers discounted off-peak or load management/interruptible rates, ETS (electric thermal storage) heating could be a good option. And, of course, a high efficiency ductless heat pump that can be easily and relatively inexpensively retrofitted in any home can provide heat at one-half to one-third the cost of electric resistance.

Cheers,

Paul

On the other hand, if you are only keeping one or two rooms heated, you might do better than with using central heat.

But if money is an issue, and it is for more and more people, why would one keep more than one or two more rooms heated? Especially on the coldest days. Let the house, apt or whatever, stay at 50 or 45, keep one room comfy, and even then wear a sweater. A small electric unit that blows on one's feet works very well. When sleeping, use electric blanket if needed and put the heater on low.

Same principle with lighting. CFL, but with a shade that directs light on what your reading. No need to keep everything all lit up.

Heat and light in a focused way. Big savings are possible right there. They'll soon be necessary.

Pipes. The reason you might have to heat at least to some level, the whole house is the piping system - most houses, especially old houses, of which there are a lot in New England and upstate NY and other heating oil using areas - are not piped in such a way that you can have running water in the house and allow all but a couple of rooms to fall below freezing. Replumbing the house is a possibility, of course, but not if you don't have the money, or are a renter.

Sharon

Yes, but note that I said 50 or 45 degrees, not no heat.

Hi Dave,

I have a hot water baseboard heating system and I use to turn my heat back at night, secure in my belief that "hot water can't freeze". What I soon discovered is that pipes running through exterior walls and along the sill plate are exposed to temperatures well below that of room temperature. If your setback thermostat is set at 10C/50F and the outdoor temperature is -20C/-4F, the temperature at the centre of the wall cavity, no matter how well insulated, will be well below freezing.

Cheers,

Paul

Valid point. One needs to be keenly aware of the pipes-freezing isssue.

"Yes, but note that I said 50 or 45 degrees, not no heat."

- that would help somewhat, but a lot of fuel will still be used. If it's 0 deg (F) outside and 50 inside you'd use about 2/3 of the fuel as you would if you kept it at 75 inside.

in the winter when i young (late 60's and early 70's) we had a space heater to keep us warm, but that was in south texas, and it was in one room. granted it isn't that cold, but to us it was cold enough.

however in the summer we had only one air conditioning window unit. with curtains drawn, the room was very cool room. other rooms only had fans.

one of the most frequent statements was:

shut the door, your letting the a/c out!

today the whole house is heated with central air. and cooled with central air. and i am beginning to think that this is just wasteful to heat or cool the whole house. the house we had was old (1910), yet compared with new houses today, the other rooms would gather mold if they didn't have conditioned air. especially in that very humid texas climate.

we have just become spoiled with ammenities over the decades, and it might be wise to revert to our older customs.

You're assuming that they don't just buy hydro-electricity from Québec.

The price of gasoline, and most other oil, has always shown a marked dip in an election season. (Remember the last one? Why is everybody always so surprised?)

That traditionally is followed by a steep and steady rise afterward.

Don't expect to pay the same price for a gallon of oil from one fuel tank full to the next.

And while the price may seem cheaper, its always a question of "One Step Forward, Two Steps Back."

I took the CMP standard offer of service and added their residential tariff. If there is is lower rate that most people are taking please let me know.

Chris

Over the last couple days I have had several people who I have talked about PO with, come in and site Exxons record profits and the falling gas prices as proof positive that there are no constraints and that its all just an evil plot by the Big Oil Cos.

I give up.

Now back to taking my frustration out on those mean old rounds of oak and fir with my trusty maul.

"I give up."

I don't blame you. Most people probably cannot understand PO and what it means for our civilization.

And most people will never know what hit us - just like the peoples of past collapses.

Archie The Druid's latest blog discusses these "Arguments from Ignorance."

http://thearchdruidreport.blogspot.com/2008/10/arguments-from-ignorance....

Ignorance might be bliss, but only until it starts to hurt.

Thanks HO. (which happens to be the futures symbol for Heating Oil...;-)

Heating oils price drop is completely a function of the ongoing global energy margin call: read: liquidations of hedge funds and participants in the market, and has virtually no bearing on long run scarcity/availability of actual product (other than worsening economy will reduce SOME demand for heating oil and for a short time this demand drop will offset supply drop).

Lots of people in Maine, NH and Vermont have switched to heating with wood. I expect this to continue, especially if they own their own 'stored sunlight' which is cheaper than 'ancient sunlight', though takes more time. I have written about this in

Home Heating Comparison of the United States: Forests vs Fossil Fuels

and a related post The Energy Return on Time (2nd half of post)

The "Forests vs Fossil Fuels" essay from last year was timely for this year, & the comments interesting. I live in New Mexico and heat exclusively with wood I harvest sustainably from 2 hectares of riparian bosque and the shelves above the river. I don't cut the native cottonwoods, just the Siberian elms, Russian olives & Tamarix. 3 - 4 cords per year heats the main part of the house, besides the bedrooms. I have a homemade steel fireplace insert that isn't very efficient but is more efficient than the open fireplace would be. If seasoned at least a year these "junk" species burn just fine. I use a chainsaw to harvest wood & up 'til a year ago used wedges & sledge hammer to split the rounds. I admit to buying a hydraulic log splitter last year, since I'm getting older & my sons are grown & on their own. I still bring wood up from down by the river in a wheelbarrow but am thinking of getting a pony or donkey to pull a cart.

While I burn very little softwood, many here in NM burn juniper & pinyon pine. Ignoring softwoods was a deficiency of the analysis. In Alaska, for instance, softwoods are burnt almost exclusively. A lot of loblolly slash gets burnt in the US Southeast, likewise.

Well, as I said in the post, the conclusions from using softwoods wouldn't have changed the major point - that we are already using our annual forest biomass interest and if we try to replace heating oil or natural gas by any meaningful % with wood, we are going to pretty quickly start a deforestation trend. A colleague and I are updating that analysis for peer review.

At school in Virginia, I was taught that loblolly will grow very quickly, in soil that is generally marginal at best. A good link is http://www.deq.state.va.us/vanaturally/guide/forests.html

There is no reason not to think that with some forethought and planning, wood could become a reasonable source of heating fuel - after all, it certainly is how German communities have been handling their forests for several centuries, basically.

And as noted above in terms of insulation, combining good insulation with an efficient woodstove actually makes a big difference in how much wood is needed to keep people warm.

Of course, if people really start to burn pines like loblolly or Virginia or white, the German standards for chimney sweeps becoming a regular part of a homeowner's maintenance would be necessary - pines can really deposit a lot of resin in a chimney - which is not the best place to have a fire.

When younger I used to work thinning contracts in the US Southwest & Rocky Mt. region during the summer, then plant trees in the South during the winter. Once I cut some some 7 - 8" dbh loblollies in Alabama, to make a lean-to. The trees were 4 yrs. old. Ponderosa the same diameter in NM would have been 40 yrs. old. Loblollys are grown for pulp and they do indeed grow fast. You may as well burn paper as loblollys, for all the BTU's per cord you get. Same goes for hybrid poplars. The slower the tree grows the denser its wood is.

This is one of the reasons that biofuels production is so tragic - in the end we're going to rely on biomass for at least some of our heating, maybe a lot - and so CPS land that was being moved into production is a disaster - that land needs to be forested if possible, grazed otherwise. The only way we're going to be able to handle the coming home heating crisis - and it will come - is with massive reforestation.

Sharon

After spending my teen years sawing through New Mexico juniper, I wince in pain at the classification of it as a softwood. It dulls saw blades quite well, but that might be due to sand which gets incorporated. It is 30% harder than ponderosa pine, though.

Here is an interesting pdf on wood hardness:

http://www.omni-test.com/publications/hardwood%20or%20Softwood.pdf

Like Yogi said, "Predictions are hard, especially when they involve the Future."

The decline in distillate stocks is even greater than the 25% drop would suggest, partly because the 25% figure refers to the entire East (not just the area that uses home heating oil in the winter), and partly because it includes oil in pipelines.

If one looks at the distillate portion of This week in petroleum, the stocks in New England are 8.2 million barrels, compared to 12.4 million barrels a year ago, a decline of 34%. November 1 is usually about the high point of the year, so one would expect something in the 12 to 14 million barrel range, based on history. 8.2 million barrels is very low. Only the year 2000 was lower.

Could some of this be a switch in where the stocks are held? Like people wanting more on-site storage than at regional storage tanks so they pay for extra deliveries? (much like if we have 200 million cars and everyone wanted to keep them full at one time that could be a several billion gallon draw...I will have to use the google for that - I wonder what the mean/mode of % full is for american automobile gas tanks. My guess is 25%.. (My hypothesis is if such a number exists, it will start to rise)

Nate -- I don't have any links handy but if Google back to the embargo days of the late 70's you might find what you're looking for. After the dust settled and the MSM found more interesting stories, the great gasoline shortage (remember the stories of tankers circling at seas so prices would ramp up?) was found to be caused by the same scenario you describe. I don't recall the exact numbers but the suddenly missing gasoline stocks fit exactly into the extra storage folks were carrying in their vehicles. Instead of filling up at a quarter tank or less like normal folks did so at a half tank or more. The mystery was solved but no one was interested by that point. I believe I just saw the same phenomenon here in Houston after Ike. Long lines and empty gas stations when folks started to keep their tanks full. We had plenty of gas on Houston…much more than normal thanks to transport problems to other areas of the country. But for 4 or 5 days I would pass many gas stations with 50 to 100 cars waiting. By the time my tank got low I could pull right up to a pump with a wait no longer then pre-hurricane. I wonder how much home heating oil storage was filled sooner than normal and if that volume might match the deficit Gail described.

With higher prices, I would think people would hold back on buying fuel from the winter, and it seems like that was what stories were saying this summer. If nothing else, some people could not afford the high prices being charged. It seems like demand would be higher now, for that reason.

Hi Gail,

This MPR story suggests this may be the case.

"Usually, people have fuel left over from the spring, but this year we're finding that many, many households are sitting with empty propane and fuel oil tanks," said Cummings. "That isn't normal. People virtually let themselves run dry last spring, and it was just because the prices were so high they couldn't afford to put anything in."

See: http://minnesota.publicradio.org/display/web/2008/10/29/coldweather/

Nate,

If we assume people only fill-up when almost empty and always fill-up, would expect the average tank to be 50% of capacity(a good assumption for smaller gas tank vehicle owners, but may not apply for old vehicles with large gas tanks owned by low income drivers). My vehicle gets 40mpg(6L/100km), so I just fill-up once a week whatever fuel level, so my tank is on average 75% full.

If the average tank has 20 gallon capacity that's ; 20x 0.5x220 million vehicles=2.2Billion gallons, 55Million boe, 3 days supply which sounds right if most people fill-up once a week.

Meanwhile, heating oil stocks in Singapore just rose to a record 13.5 mio barrels. Smart people taking advantage of low prices to build stocks for the coming winter, or victims of a game of musical chairs that left them forced to take deliveries of product that keeps on losing value every day? Depends on who you talk to...

Regarding the possibility of an upcoming cold winter in the Northeast, there has been a fair amount of discussion on the TOD contributors yahoo group about multiple forecasts for a cold winter. One concern is that something called the North Atlantic Oscillation may be turning negative. This could signal a series of very cold winters in years ahead.

The MDA Earthsat winter forecast was out earlier this week and Midwest looks to be much colder than average (.8F deep purple right over my head)

Also, one heres one datapoint on recent record cold temps.

Meanwhile here in Portland (OR) the locals say that the winters have been getting warmer and drier for the last two decades.

I'm not as concerned about these "in season" extremes- those records one might expect in that season. Then I'm not south either, where record cold in the winter throws a real monkey wrench around. It's the record highs or low in the spring temps, the record early fall anomalies, those that go against the grain of what things expect.

We had extreme lows early this fall that froze leaves green. No color here. Likewise, last spring was prolonged cold into May, followed by spikes to summer temps in a matter of days, then back cold. Buds that had been swelled, almost bursting for weeks, exploded overnight. It was ideal conditions for diseases rarely seen here.

Grin!

Having commented to some of the staff about the prediction for a colder winter, I was told that everyone around here already knew that, because of the spate of black woolly caterpillars all over the roads.

Nate,

I think what you are looking at is the change between two forecasts, not a forecast per se. What happened is that they are now thinking that Wisconsin will be colder relative to what they forecast earlier. You have to look at a different map to see the absolute level. I think it is the East coast that is expected to be worst off, and the Midwest somewhat less bad off.

Yes -you are correct Gail. I went back and read the pdf and mistakenly posted it as a change vs normal - it is a change vs the last report. (always good to have an actuary on staff....;-)

Nate-

What's with the bullseye over the state of Wisconsin? Are we just lucky? :)

That's where the asteroid is going to hit.

I think that the Midwest has some catching to do to in order to fulfill those forecasts. For fun I pulled up the heating degree days for Madison WI.

DEGREE DAYS HEATING

Looks like it is still warmer than normal.

I made the same predictions - I was very much concerned about those who couldn't afford heating oil facing price rises up to $6 per gallon. And frankly, I'm still concerned about heating affordability - this time simply because even lower prices are unaffordable as the economy cracks. The effect is very much the same for the millions of people in the northeast who face a real struggle to keep warm and keep eating.

Sharon

We can't predict what ecosystems will do when perturbed, we can't predict the weather, and we can't predict which way markets will trend. So it's useless to try. Chaotic dynamics are deterministic but they're also extremely sensitive to initial conditions. We don't know what those initial conditions are, all we have are distributions of probabilities. Chaos overlying stochasticity. Lots of luck in making predictions. That's all being right or wrong amounts to: luck.

There's no shame in being wrong but let it be a lesson to everyone so overly fond of models and projections. We know that fossil fuels are finite resources that are being depleted. We know that prices will go up in the long term, with tremendous volatility in the short & midterm. It's good to be getting ready, without fretting over shortterm noise. Yet I see that some haven't learned the lesson. There are charts purporting to predict this year's winter weather! Some people will never learn... :)

As pointed out by howleyj up top, there are at least meta-projections that can be made, and they're much the same whether we consider the weather, the Dow, or the WTI price. The rubber band is stretched so tightly now that inevitable small perturbations must result in large and unpredictable excursions.

I guess I'm agreeing with you in that the models are not to be trusted as the systems in question turn chaotic, but it looks to me like that result was predicted all along!

I agree on point 1. On point 2, there are many respected weather forecasters who have great long term track records. Doesn't mean they are 100% but "can't predict the weather" implies a 50/50 coin flip. MDS EarthSat is aggregate of weather forecasters and measures the 'change' from last month, which is now colder, based on new information. They are predicting coldest winter in US since 2003/4. We'll see.

As to your third point, actually we can:

1)in the short term, the recent 6 hours combined with recent 100 days has a better than 50% prediction rate. If both those agree, the odds are higher than 50% market will continue. Humans underestimate 4+ standard deviation events so markets tend to mean revert on short moves and go much further than anticipated on large moves. Hence, 'trend following' beats fundamentals.

2)In the long run (i.e. several years or more), markets will ALWAYS move in the opposite direction of levered money. Levered money was in energy and commodities earlier these past 2 years - the whipsaw reversal has been exacerbated by SEC/FED changing rules of right in the middle of the normal pendulum swing back, which made it a pendulum on steroids. Where will the next leverage be? Who knows? But I expect regulators will allow less leverage on all fronts going forward..

When I was in graduate school, I had a professor who was a well known theoretical ecologist. He often spoke of being approached by Wall Street firms, proposing that he apply the same models to the markets he applied to ecosystem dynamics. This professor said that if he could do even slightly better than chance at predicting the markets, he could make himself & the people who hired him very rich. He thot that perhaps he could do slightly better than chance but that he had better things to do. He was an ecologist.

I made some money investing during the '90s, not by attempting to model market trends but by investing in wood & paper product producers, pizza chains, and even banks. I stayed away from dot.com & biotech, even tho I was tempted. When I started losing money around Y2K I got out of the markets while still ahead. My point is that making money investing & being able to predict market trends aren't necessarily the same thing. In my case, lucky timing explained most or all of my (limited) success.

And as for the weather: I learned in a biocomplexity seminar that even if sensors recording temp., relative humidity, wind speed & direction, barometric pressure, irradiation, etc., existed in every cubic meter of the atmosphere continuously feeding data into supercomputers running weather predicting algorithms, weather conditions still couldn't be predicted any better than chance beyond a few days. I'd just as soon believe the Old Farmer's Almanac as the prognostications of MDS EarthSat. I'm no meteorologist but in my own field I know what happens: too many characters for too many taxa and the calculations explode factorially. Processing power may double or quadruple or increase by an order or two of magnitude. It makes no difference: Too many characters for too many taxa & the calculations increase by dozens or scores of orders. This is true of any Complex system and is a fundamental limiting factor to our power to predict - whether we be talking about phylogenetic algorithms, ecosystem dynamics, the weather or the markets.

I've just had a couple of good replies back from both Stoneleigh and Ilargi at TAE regarding the consequences of possible oil prices hikes vs depth of the recession. Hope it's useful to everyone else too.

Their take as I understand it is that demand reduction is, at present, a much more severe problem than supply reduction is ever likely to be.

Their replies are here (after my question "Can someone help me with this one?" about 2/3 way down.)

https://www.blogger.com/comment.g?blogID=4921988708619968880&postID=2762...

Just heard this definition: recession - you lose your job - depression - I lose mine...

Seems to be what us Brits call 'a bit of previous' between TOD and TAE? Am treading gingerly..

That joke is from way back. I first recall it from the 1980 US Pres campaign.

Reagan gave it a slight twist, saying a neighbor losing his job is recession, you losing your job is a depression and "recovery is when my opponent loses his."

Cute, but I think it was the sweater speech that did in Carter as much as anything. Don't want to conserve then, not now either.

Their take as I understand it is that demand reduction is, at present, a much more severe problem than supply reduction is ever likely to be.

The problem is with "ever likely to be", in particular "ever". They do acknowledge the ultimate rise in energy prices.

They also negate the role of energy prices in triggering this crisis. I'm not sure I completely agree, but they do have a point in that there have been previous crises -- and I would say crisis is endemic to capitalism. But whether it was the trigger or not, certainly peak oil greatly constrains the outcomes of this crisis. It means that that there can be no (major) growing our way out of this one. In the 30s it was possible to mortgage our future, because we had a resource base to mortgage. This time, no. So I venture that there wlll no real bottom (meaning no major upturn following) this time. IMO.

davebygolly,

Resources alone don't make a nation wealthy, compare Japan and most African states. Human capital, educated skilled workers, good government, commitment of entire population to pay fair share of taxes, are what made US the economic power. Why was oil first drilled in Pennsylvania, not Mexico, Nigeria, Iran, Iraq??

The US has had an 8 year hiccup, starting with tax reductions for the rich, etc etc. Just like in the 1930's, the US has the infrastructure, the human capital, they just need leadership, and recognition by the population that you can't have tax cuts and increased spending and increased consumer imports and massive trade deficits due to massive oil waste.

Excellent post Neil1947

Your sentence,

"The US has had an 8 year hiccup, starting with tax reductions for the rich" only begins to describe the catastrophe that was unleashed on our economy as we gave a massive tax cut to the rich just after we launched two expensive military expeditions and had to carry massively increased security costs after the 9-11 attacks.

Oh, to make things really come undone, we had stacked the deck for catastrophe in the economy in 1980 and 1999 by repealing the Glass Steagall Act, so that a breed of vultures the likes we had not seen since the robber baron days would be unleashed on the American victim..err, consumer.

Peak oil may or may not have occured, or may or may not occur in the near future. We do not need it to have an economic calamity, as we have experienced the true meaning of being hoisted on our own petard:

http://www.hinduonnet.com/thehindu/edu/2002/04/23/stories/20020423000301...

RC

I changed from Propane to a ground source heat pump this summer, and justified the purchase based on propane at $2.50/ gallon. And now it's going down.

I have no complaints, however. I love the heat pump, it takes half the energy to cool in the summer and 1/4 the cost to heat in the winter, it's quiet, etc. It makes "free" hot water. And while propane will be increasingly volatile in price, electricity here in Minnesota should be quite reliable and reasonable cost. (at least for the foreseeable future, however long that is...)

Dan

Hi, Dan

How did you lay it out, and could you share the anticipated pay-back period?

It cost about $12K to install. It's a 4 ton unit with a desuperheater. I use well water as the source and discharge it into a lake. No ground water depletion issues here--in another location you would probably want a closed loop, however it would have been an extra $8k, and sitting as I am between a very large wetland and a lake, with a 100' deep well, I should have no problem.

It takes 3.5 gal/min on "low" and 7 gpm on "high". It ran all summer without ever once needing to be on high cool, taking half the KWh of the old air conditioner. I'll share my winter experience when I'm further into it.

The desuperheater is set up with two hot water heaters. The first one (50 gallon cap) is heated by the heat pump and may be hot or not depending on if it is running. There is no other source of heat for the first one. The second one is fed by water from the first one and is thermostatically controlled at 135F. If the heat pump is running, that one is mostly off, but if the heat pump is off, the second water heater takes basically the same amount of energy as normal. The second one feeds the house hot water lines. I don't know how much this will save, but it was only a $350 option.

There is a 10KW resistance heater for backup situations or if it's incredibly cold. We'll see if it ever gets used, as the house is pretty tight.

As for paybacks, I normally used about 1000 gallons of propane to heat my 2155 square foot house for a winter. That makes it $2500 per year at $2.50/gal. If it now takes $600 of electric to do the same job, the payback should be about 6 years. It wasn't just about payback, tho...it was about energy security.

I did not install it on interruptible power, because there would have been extra expense to replace the dilapidated old propane furnace, and there wasn't adequate space for the backup system. If I had, it would have cost $4500 extra, but allowed an electric rate of half what I'm paying now.

Like I said, I'm pretty happy with it so far.

Dan

Thanks, sounds like a good system.

Hopefully you have a wood stove or something in case of a blackout?

No, but the propane furnace didn't run without electricity either, and that wasn't a problem over the *past* 20 years. I know, as they say on Wall Street, past performance is no guarantee of future results. There is actually a nice usable wood-stove flue pipe, and it wouldn't take too much doing to add in the stove. Call it plan B...

Dan

Do you have loading calculations that quantify 'pretty tight' ?

Hi Dan,

Do you have good quality ground water? For example, have you had any issues with fouling or scaling of the heat exchanges or iron bacteria contamination?

Cheers,

Paul

Edit: There's an interesting conversation in one of the news groups regarding the operation and maintenance of GSHPs in colder climates that can be viewed here:

http://groups.google.com/group/alt.energy.homepower/browse_thread/thread...

Well, don't be too depressed about predicting the future - in the last couple of weeks, German radio news was reporting that there was no way for fuel distributors to meet demand, so waiting anywhere from 4-8 weeks for a delivery was customary.

Which always leads to the interesting question - would you rather be cold but save money, or be warm and have spent more? When it is around freezing and raining (like now), I don't find that a hard question to answer at all.

The spike high in oil was a speculative phenomenon. It coincided with highs in many commodities. It was an echo bubble or the last bubble. Predicting it's demise was impossible. Your forecast was rooted in the supply demand balance. The fundamentals in other words.

Every bull market, especially in commodities, has a convincing fundamental story behind it. Usually the story is essentially true. Even as supplies remain tight however the price always reaches a spike high and then retreats. Typically a retest of the high occurs some month later. These price actions are the result of the relative positions of traders, which is seperate from the supply demand situation. As the price of a commodity begins to rise more speculators are attracted to it. More money in means higher prices, bringing in more speculators in a virtuous circle. (I am speaking mainly of prices in centralized auction markets. Futures markets where high leverage rules. The same applies to physical markets but there the action is slower. Think residential real estate.) Eventually the last buyer comes in. He like all late buyers is in a vulnerable position. When the price drops he might decide to sell his position to limit his loss. That sale leads prices lower. Other traders who are holding losing positions become desperate for prices to rise again. Some give up and sell. The virtuous circle has become a vicious one. For every long in a futures market there is a short. It's in their interest to see prices drop. Often large well capitalized traders have the largest short positions and work activly to start the price drop.

No commodity in history has ever had a consistently high price or a price much above the cost of production. Eventually oil might test that history. For oil is the first commodity which is fated to suffer an overall fall in supply while there is no apparent substitute available. Still that history is to be respected. For oil to avoid the fate of all other commodities and remain relatively low in price one of two things must happen. Either demand has to be substantially reduced or a new miracle supply or substitute must be found.

The latter seems impossible. The former could happen but the prospect seems freighting. It would appear to require an absolute fall in global economic output. The outsized correction/crash in the worlds financial markets and in most asset prices is coincident with the end of growth in economic output. A case about causality one way or the other can be made but that is probably not the best place to focus ones analysis. What is important is if the fall in financial markets and asset prices will lead to a depression like result where economic output dropped perhaps by 1/3. Such an outcome does not have to happen but our elites are so intent upon holding up asset prices that huge amounts of money are going into propping up those prices instead of using it to spur demand for real things. The result could be a self reinforcing contraction in the real economy.

That of course would supply the means to lower oil prices. That too could lead to significant to severe social problems, dislocation or even pockets of chaos. I'm not predicting such but just offering a possibility. An equitable economic solution which lowers energy usage is perfectly possilble in theory. However such a thing would greatly reduce the wealth and power of elites world wide and a more equitable distribution of wealth. They powerful will not surrender that peaceably.

Mr. Rapier:

It's likely, is it not, that on the far end of the ultimate spike, if you will, oil scales down and actually loses some its value per unit? Or at least the value grows more slowly? Especially if pipelines or tankers aren't filled adequately to transport the stuff? Not unlike now, there's almost nothing an individual can do with a barrel of oil without transport services and a refinery, right?

Complacency is what we don't want to be in spite of lower prices. Whether it's relatively cheap or expensive, it's a finite resource headed for peak or past peak on a classic bell curve. If we become complacent, it will bite us again like it did at 145 a barrel.

The U.S. needs to move towards less importation of oil with electric vehicles powered by solar from Texas to Calif. and wind from Texas to North Dakota, with CNG/LNG for trucking nationwide. Let's stop sending our bucks overseas and prepare in advance for peak oil.

Let's give China a great example to copy that will help them to become less oil dependent.

Anecdotaly, on the drive to work, I see piles of firewood in yards where I've never seen it before. Hopefully those chimneys are clean. Firewood dealers here are out of dry, fitted wood. Highest I saw was $300 a chord, fitted and dry, hard wood. It all went quick and early. Dealers I know are still doing a brisk business in green wood for next year. Someone mentioned storage in the thread, there is nothing like the feeling of looking at your next 2 years of heating just sitting in the yard. Try storing, that much fuel oil, or propane, or electricity on site. In these times, much, much better than money in the bank.

I suspect it is a reaction to last winter and the general news. Both Central Maine Power, and Bangor Hydro have never had so many accounts in arrears. I think it's after the November bill but it's law that the power companies cannot disconnect for non-payment during the coldest weather. I suspect quite a few people used the space heater option last winter, and are still paying for it. I wonder when it begins to impact the operation of the power companies. No money coming in but still have to provide service. Makes a nice hedge for the consumer, they can just stop paying the bill, and use the cash for something else, then in the spring arrange a payment program. On the other hand, propane dealers up here are now doing credit checks before filling the tank.

Winter up here is always cold, we deal with it. Once it gets below zero it's all pretty much the same. Wood splits some nicely then though. Grin !!

Don in Maine

"I suspect it is a reaction to last winter and the general news."

Exactly. A fuel price spike or crisis creates uncertainty. Many people see the low prices of oil and gasoline at the pump, but now have a vivid memory of how high oil can go in price, and this is a memory that will stay with them for awhile.

I have many friends who, when discussing the current ultra cheap price of gasoline, say "enjoy it while you can", in other words they don't believe it can last.

This is why I predict that oil may stay cheap for longer than some folks predict here on TOD, and may actually go lower in price before it bottoms out. People will be nervous for awhile, and cautious about going back to wasteful ways too quickly. People are hoarding money.

I once said here on TOD that I personally (and this is just me) would be glad to pay $90 to $100 per barrel for oil and $4.00 to $5.00 per gallon of gasoline if it would assure market stability and supply. I still stick with that. I think these boneheads wishing for $30 per barrel oil and $1.50 gasoline don't know what they are wishing for.

I was the one who begged people to be careful when oil was at it's top price, that the risk of a fast drop in price was real and it could be catastrophic, even more damaging that the high price. I was pretty much laughed off the block here. I also said that a sensible floor was probably around $90 to $100 per barrel. I still stick with that. The current price of oil is just too low, based on the cost of other living expenses in the economy and based on the cost of production.

I am sympathetic to Heading Out, the markets can change very very fast. I am watching a morning farm report as I type this that claims that food prices could drop very quickly and by large amounts. Farm land, which had skyrocketed in price throughout the midwest will surely begin to decline in price if this happens. Many farmers and agribusiness corporations took land under lease or purchased it at inflated prices recently and even speculators began to buy land that they themselves would never farm based on the idea of reselling it or sub leasing it at increased prices. They will be caught out badly if farm commodities prices drop quickly, but they will still have to make payments as owners or leasees of the property. It will be a type of margin call, as they pour money into farm land that cannot deliver enough return to break even.

Predictions? Go and try to find some old magazines from the period 1973 to 1982. They will pretty much tell the story.

As for me, I would be glad to buy all the oil and gasoline futures at current prices I could get my hands on if I had the money to do it. I can't, but I know the wealthy can, and are. After a bit of stall, the oil price should begin to come back up. My guess is that it will find it's correct market value somewhere around $100, but it may wallow around sideways for awhile (this coming spring?) before it gets there. Other commodities can then equalize around the new oil prices and other changed economic conditions, and we will see a sort of "stability" return. The wild cards are the Euro (which is no longer seen as some kind of omnipotent super currency) and...yep, Peak Oil. If peak turns out to be NOW and oil production begins dropping faster than even demand has and will drop, all bets are off, we are in a mess fast. The problem is, we don't know if that will happen next summer, or 10 or 15 summers from now. One day is as good as the next.

RC

Oil drummers: Obama wants to destroy the coal industry - our most abundant and cheapest energy source, that supplies over one half of our electricity. Stop the madness!!! This guy's energy policy is so far out of touch with reality, and what has given us the life we now enjoy, it is downright scary. Check his own quotes. This is more than the re-distribution of wealth he previously said he wanted. Stop him!!!

http://tinyurl.com/68oyz4

Hot off the press!!!!!!!

Okay, this is getting old, this is at least the fourth time you've posted the same link.

At LEAST give us a little variety, anyone with a computer can find dozens of stories about this.

Not the least of which is from the San Francisco Chronicle itself, who Palin said "hid" this interview, when in fact it has been posted on their web site (all 40 something minutes) since the day it came out and was heavily promoted by them, inciting pretty much a yawn by everyone (McCain camp included) until today.

Listen for yourself. Don't believe what the right wing news blogs would like for you to hear.

(and I can write without exclamation points. How 'bout you?)