The IEA WEO 2008 - Objectivity of the International Energy Agency

Posted by Gail the Actuary on November 19, 2008 - 11:49am

Who is the International Energy Agency? According to its website:

The International Energy Agency (IEA) acts as energy policy advisor to 28 member countries in their effort to ensure reliable, affordable and clean energy for their citizens. Founded during the oil crisis of 1973-74, the IEA’s initial role was to co-ordinate measures in times of oil supply emergencies. As energy markets have changed, so has the IEA. Its mandate has broadened to incorporate the “Three E’s” of balanced energy policy making: energy security, economic development and environmental protection. Current work focuses on climate change policies, market reform, energy technology collaboration and outreach to the rest of the world, especially major consumers and producers of energy like China, India, Russia and the OPEC countries.

With a staff of around 190, mainly energy experts and statisticians from its 28 member countries, the IEA conducts a broad programme of energy research, data compilation, publications and public dissemination of the latest energy policy analysis and recommendations on good practices.

If the IEA acts as policy advisor, it is clearly involved in many matters of political importance. One question a person might ask is whether the IEA is able to separate its political role from its data analysis role. Is there an energy policy Chinese Wall? Also, there are many other tugs on anyone who provides forecasts to others (consistency with past forecasts, explainable changes due to outside causes, forecasts in line with what the clients want).

Given these issues, one might ask whether the IEA can really be expected to be objective. Is there any auditor looking over the IEA's shoulder? Is there any other outside independent agency looking out for the accuracy of the forecasts?

OECD and IEA

The Organisation for Economic Co-operation and Development (OECD) is an organization of 30 countries, based in Paris, that was formed in 1961. It is a large organization, with 2,500 employees. The 30 countries in the OECD are counties which are economically developed, and thus have the highest per-capita use of petroleum products. The OECD might be thought of as the "organization of petroleum importing countries".

According to a slide show from its web site, its missions are

• Support economic growth

• Boost employment

• Raise living standards

• Maintain financial stability

• Assist other countries' economic development

According to the same slide show, it is

• Committed to democracy and the market economy

• Provides economic and social data

• Analyzes and forecasts economic development

The IEA is a (supposedly) independent agency of the OECD. The countries making up the IEA seem to be slightly different from those of the OECD, but this could just be a matter of different dates--membership changes a bit from year to year. The IEA makes a point of its independence, while the OECD considers the IEA to be one of the ways it achieves its objectives, so one might suspect there is some internal tug of war.

The IEA is much smaller than the OECD, with only 190 employees. This seems to be up considerably from the recent past, when it only had 160 employees.

The IEA and OECD are both located in Paris, and seem to have some co-ordinated activities. For example, this job vacancies list is for both the IEA and OECD. Also, the copyright on the new IEA World Energy Outlook 2008 is "OECD/IEA".

IEA's Original Objectives

When the IEA was originally formed in 1974, countries using oil were dealing with a cut-back in oil supplies, as the result of an OPEC oil embargo. In its original charter, the purposes of the group were

(i) development of a common level of emergency self-sufficiency in oil supplies;

(ii) establishment of common demand restraint measures in an emergency;

(iii) establishment and implementation of measures for the allocation of available oil in time of emergency;

(iv) development of a system of information on the international oil market and a framework for consultation with international oil companies;

(v) development and implementation of a long-term co-operation programme to reduce dependence on imported oil, including: conservation of energy, development of alternative sources of energy, energy research and development, and supply of natural and enriched uranium;

(vi) promotion of co-operative relations with oil producing countries and with other oil consuming countries, particularly those of the developing world.

These goals were fairly limited, so there was little chance of conflict between data gathering and policy setting. Over the years, the goals have broadened, adding much more of a chance for conflict.

By 1979, these goals had changed, and the number one goal was reducing oil usage:

(i) co-operation among IEA participating countries to reduce excessive dependence on oil through energy conservation, development of alternative energy sources, and energy research and development.

One area where the IEA objectives have grown is in response to climate change concerns. The IEA now plays a leading role in attempting to reduce CO2 emissions. According to its web site, the IEA has formulated a plan for reducing global CO2 emissions by 8.2 gigatonnes by 2030. As part of its climate change efforts, the IEA has initiatives in the following areas: alternative energy; energy efficiency in buildings, appliances, transport and industry; cleaner fossil fuels; carbon capture and storage; renewable energy; and enhanced international co-operation.

IEA objectives have also grown in recognition of the fact that the world has changed since the time when the IEA was formed in 1974. When the IEA was founded, OECD countries accounted for nearly all of the oil demand. In recent years, China, India, and many other lesser developed countries have increased their oil use. These changes have altered the focus of the IEA toward more of a world-wide view. With more of a world-wide focus, the IEA has shifted toward more of a general growth objective, similar to the growth objective of the OECD organization.

The IEA's Current Objectives

Based on an Overview Presentation on its website, the current objectives of the IEA are

• Energy Security

• Environmental Protection

• Economic Growth

• Engagement Worldwide

Readers of this website know that economic growth and a long-term declining resource base are inherently in conflict, because it is not possible to have economic growth without sufficient energy resources. This has the potential to create conflict within the agency - cognitive dissonance written large. One can surmise that when economic growth was first added as an objective, no conflict was apparent, because there seemed to be plenty of oil for everyone and new energy sources (natural gas, nuclear, and other resources on the horizon). Now that resources are tighter, this fundamental conflict is starting to be manifest.

Environmental protection is now a major area of IEA's operations, but a review of the web site would suggest that the issues of concern are almost exclusively issues related to CO2 and climate change. Issues such as the shortages of fresh water and pollution do not appear to be a significant part of environmental protection.

Forecasts of future CO2 levels and future temperature levels are, in effect, an evaluation of whether IEA's decision to focus on CO2 levels and global warming was the correct one. While this may not bias IEA's thinking, many organizations in this position would tend to prepare reports that paint an unnecessarily gloomy picture of likely future global warming, thus validating their prior decision to focus on this problem.

Even engagement worldwide makes the IEA more vulnerable to conflict that when it began in 1974. When the IEA was just co-ordinating response to inadequate oil supply, the issues it dealt with were fairly limited. Now that there are many more users of its reports, including many non-OECD countries around the world, the IEA can come under pressure to make forecasts come out in the way these users would like to see them. Also, data quality related to these new users is likely less good.

Key areas of activity are listed as

• Emergency Preparedness

• Oil Markets

• Gas Markets

• Policy Analysis and Co-operation

• World Energy Outlook

• Global Energy Dialogue

• Energy Technology

• Energy Technology Network

• Energy Efficiency

• Energy and Environment

• Energy Statistics

Here again, we have potential for conflicts. Now that data is required from around the world, the IEA must obtain data from a wide variety of sources. It is nearly impossible to question the accuracy of information provided in good faith. As oil-producing companies and countries are pressured to "look good", there is increasing possibility of data of dubious quality being submitted. The IEA can do its best on quality control, but it is not clear that even these efforts will prove successful, whether with 190 employees, or 1,900.

The IEA has discretion in choosing who else to obtain data from. Besides data from individual countries, the IEA seems to put a great deal of reliance on data from IHS. The company IHS owns Cambridge Energy Research Associates (CERA), an organization that consuls for energy companies. CERA is known for its forecasts showing oil production continuing for many years without decline. IHS may be the best source of data available, but is it, in turn truly unbiased?

Because of the way the objectives of the IEA have been established, the same organization collects data, analyzes it, and makes policy. This combination of objectives sets the situation up for conflict. Furthermore, once a policy has been set, it might be difficult for the IEA (or any other organization with conflicting goals) to produce a forecast that indicates that the previous policy decisions were wrong.

If previous forecasts were wrong, or need to be changed, it is convenient to have some outside event that the changed forecasts can be blamed on. Global warming fits conveniently here. So does lack of investment by countries outside the OECD.

IEA Governance

The IEA and OECD seem to be set up in the same way, with three types of oversight:

• Council - Elected committee overseeing whole operation

• Committees - Large number of committees, set up for discussion and implementation

• Secretariat - In charge of analyses and proposals

It seems like it would be difficult to get much accomplished in such an arrangement, with so many bosses to please.

Who Pays? Who has the most votes?

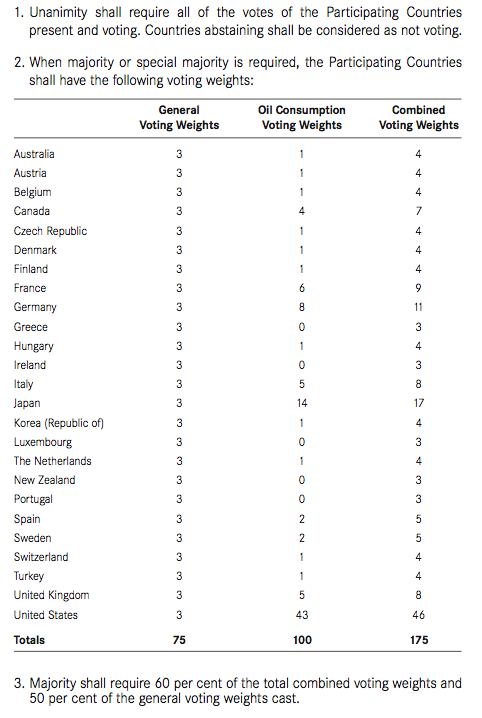

I didn't find current budgets and voting arrangements on the website, but I found information from 2003. When measures need to be voted on at the IEA, this is the weighting of votes:

Clearly the US has the biggest share of the votes (about 26%), and Japan is second. All of the other countries are much smaller.

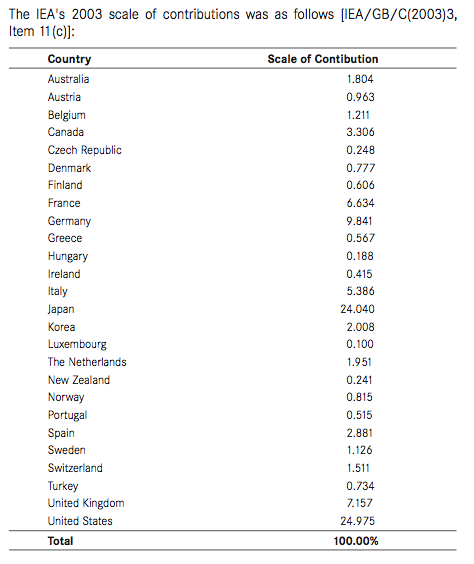

Regarding who pays, the 2003 allocation of assessments was as follows:

The US plus Japan pay 49% of the assessments, so one would suspect that if there is anything that the two of those countries object to, there could be some leverage brought to bear on the agency.

Funding

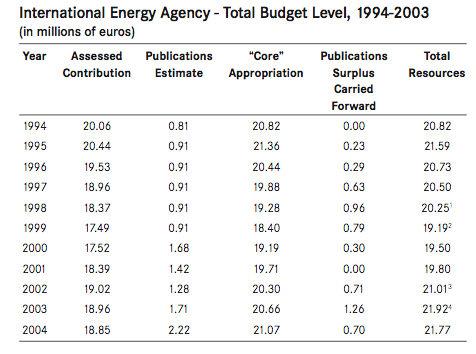

Getting adequate funding for the agency has been a problem over the years. Funding in real currency was flat for the entire period 1994 to 2003, meaning that the amount of services funded during this period declined. (This was true for the US EIA in the same time period. It was easy to get funding when there was a crisis back in the 1970s, but once the crisis went away, funding was left at a constant dollar amount.)

This exhibit shows a history of assessments for the 1994 to 2003 period:

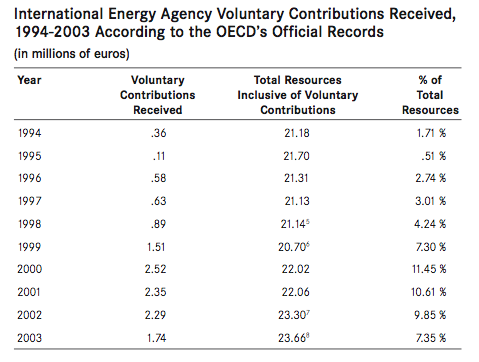

In order to make up for the deficient funding, some countries offered voluntary contributions. These grew over the time period in question. To the extent that the agency became dependent on these voluntary contributions, one might think that the countries making these contributions (whoever they were) might have been able to exert leverage with respect to issues of interest to those countries.

Funding for the IEA has probably increased somewhat since 2003, because the number of employees of the agency seems to have increased from 160 to 190. There has also been an increased emphasis on climate change. It is possible that the additional employees and costs related to the beefed up climate change aspects of the IEA.

Audits and Oversight

When I looked through the history document from which I took the budget and other exhibits, I could only find a few mentions of audits. Basically, there is an audit of funds spent, to see that they are spent for the intended purposes. In 1995, the OECD did an operational audit of the IEA, looking at the operations in detail. The fact that it could do such an audit would suggest that it has oversight over the IEA. The only other mentions of audits are in terms of those providing voluntary funding not being able to audit what the IEA is doing with their funds.

Who Is Depending On and Reviewing IEA's Numbers?

Clearly, all of the 28 countries belonging to the IEA are depending on the IEA's forecasts. Since its focus is worldwide, many of the lesser-developed countries are looking at these forecasts as well. In addition, the OECD is using the IEA's forecasts in its policy making, and the IEA is using its forecasts in its policy making.

Many of the bigger countries have their own data and forecasting arms. The US EIA is well known to most of us. Japan has the Institute of Energy Economics, which most of us are less familiar with.

The US EIA has in the past published high estimates of future oil production. One would think that this would put pressure on the IEA to be consistent with what the EIA is forecasting, especially since the US is a major contributor to IEA funding. The fact that the IEA has been willing to step out and make statements regarding oil depletion being an issue, when EIA has not be willing to make a similar statement, shows that the IEA is making a courageous (and more risky) effort to be objective, even if one might argue with the precise selection of the forecasted amounts.

Regarding who is reviewing the forecasts of the IEA for reasonableness, it is very difficult for anyone to review energy forecasts, so it is not clear if the OECD, or any other organization, could audit IEA's forecasts for accuracy if they wanted to. Data is often not very reliable. Many oil producers who could provide data are unwilling to disclose accurate estimates. The issue is also very complex, and because of this, there aren't many with sufficient technical expertise to review the accuracy of the forecasts if they chose to. But the data and conclusions presented by the IEA is much more important to the world's social system than quarterly reports by the likes of Microsoft, Caterpillar, and Exxon (and Enron), yet data and statements by these public companies must undergo scrutiny by outside auditors. Is IEA information either above the law, or not important enough to warrant outside scrutiny? At this point, The Oil Drum and a few members of various Association for the Study of Peak Oil (ASPO) organizations seem to be the only ones reviewing IEA's analysis in detail.

Conclusions

Given the current structure and objectives of the IEA, it seems like it would be very difficult for the IEA to be 100% objective, especially in making forecasts where there is a high degree of uncertainty. The objectives of IEA, and of its more-or-less parent OECD, are not consistent with declining energy availability, and declining growth. So in this context, Mssrs. Tanaka and Birol face considerable challenges.

The voting and funding structure are heavily weighted to the US and Japan. If either of them object to a particular view, it would seem more than possible to have this view not approved, or at least watered down. Also, with the complex governance structure, it would seem as though getting anything passed which potentially is in conflict with the views of some of the member nations would be an issue.

Consistency with past reports is something that any forecasting agency would consider important. This, by itself, will tend to inhibit big changes in forecasts. When one couples this issue with other issues of importance--such as the perceived need to maintain growth, and a concern about not causing panic, there would seem to be considerable pressure to keep forecasts as close to those in the past as possible. We would note, however, that the IEA has taken steps to indicate that there is a problem, even when other agencies have sidestepped this issue. In fact, the headline projections from this report are indeed a large departure from the recent past.

There really aren't other organizations, (other than previously mentioned), that are looking at the IEA report from a point of reasonableness of the forecasts compared to the indications of the underlying data. What would be the incentive? The Energy Information Agency could at least in theory, undertake this role, but it has at least an equally bad track record in forecasting. Theoretically, newspapers could be doing this, but they lack the staff and expertise to manage the technical details. This leaves The Oil Drum and the ASPO organizations as the only "watch dogs" of the supposed "watch dog" agency.

Excellent organizational overview, Gail.

Unfortunately, IEA's forecasting ability has been quite an embarrassment, even with relatively good data, such as in the case of the UK North Sea. And other embarrassments, such as Mexico (even as late as 2004), Argentina, etc only compound the perception of questionable competence. On top of that, the data secrecy of many national oil companies makes any global projection by the IEA a prisoner to questionable data.

So it doesn't pay to form one's opinion based on any petroleum or natural gas projection by the IEA.

My sentiments exactly. When you need to make several key assumptions for a model to work, and sensitivity analysis shows that varying all the assumptions leads to radically different results, you know it's time to stop basing conclusions - let alone policy - on these models. Even making 'business as usual' scenario's is dubious with this approach.

But the IEA just goes on and on and on, repeating the same mistakes from the past, without reflection.

You mean like this? (From page 3 of your link for the IEA's 2004 outlook.)

Mexico, total liquids, peaked in 2004 at 3.825 mb/d, the very year of that report. Last month their all liquids production was 3.080 mb/d. That is 1.12 mb/d less than the IEA's expected plateau in 2010. It should easily reach 2.8 mb/d in 2010 instead of 2030. That would mean their predictions are only 20 years off.

Ron Patterson

Gail - an excellent overview. Rarely get the chance to learn so much in such a short space of time.

Would you care to comment on why USA and Japan have such high voting weights - what does this mean, and does this matter? Also, why is Norway not listed?

In an earlier draft, I called IEA an organization of oil consuming nations. I later changed this to an organization of oil importing nations.

According to Rune Likvern, Norway is only an associate member of the IEA because it is oil exporter. It is listed as member of OECD, however. This collection of IEA graphs shows crude oil imports by OECD country.

Japan uses a disproportionate amount of oil, because natural gas can only be imported as LNG (which is very expensive) and it has little or no fossil fuels of its own (except a little offshore). A comparison of the scales on the graphs shows that the US imports about 10.5 million barrels a day and Japan about 4 million barrels a day. Other countries import much less.

I don't know why Japan has such a high assessment. It seems out of line with its oil imports or use.

Japan used to pay more towards various international 'good causes' as a compensation for it's inability to contribute militarily due to it's constitution limitations.

The habit has somewhat fallen by the wayside, as to a degree has observation of the constitution.

A little to add to the history. The IEA was initiated by Henry Kissinger. It's initial charge was to build up surplus reserves so OECD countries would not be as susceptible to oil embargoes/disruptions as they were in 73.

Gail -- Very interesting insight into the inner workings of the IEA. I’m sure more interesting tidbits will be ferreted out by this forum.

I’m personally torn between admonishing their effort and defending them. As you and others know I do such analysis of reserves for a living. We all recognize the lack of basic data available to them. This is not uncommon in such efforts. Though they are looking at a very large aggregate of results, the effort still reduces to evaluating individual fields. In my personal efforts I’ve done such analysis with less then complete data but could still offer a range of risked possibilities. But there have been times when there wasn’t sufficient info to do such an approximation. At that point I can only offer the client a simple answer: I DON’T KNOW. But beyond that conclusion I can also offer that any results offered by another party should be considered highly suspect. Not every client has appreciated such conclusions and some have insisted upon a certified answer. At that point my only option is to resign from the effort.

If the IEA charter implores them to produce an independent and accurate analysis of remaining global reserves and a production schedule of the same then, from your analysis and that of others here, their answer should be simply: WE DON’T KNOW. But it’s easy to imagine how poorly such a statement would be received by TPTB.

OTOH, perhaps their mandate allows the use of fuzzy and unaudited data to make crude and inherently inaccurate estimates. If so…such is life. But their true mortal sin would be to offer the world their results without such qualifications. From an ethical standpoint (yes…we do have an ethics code…see AAPG Code of Ethics) which clearly states that offering unsupported results is a violation of the higher order. But the staff at the IEA has mortgages to pay, kids to send to college, etc. For some it’s an easy choice. But that choice may not always represent the best in us.

Precisely.

I feel the same way. I think they are trying to steer the ship into the arena of concern. Its just the biggest ship that was ever built, so they are, by definition, limited. I hope they can succeed in pushing through data reform and adhering to the precautionary principle. "I don't know" should become a common response in science and industry, but our current culture frowns on such frankness. (I remember in my early days at Salomon Brothers, if I tried to BS my way through an answer, I would get bludgeoned by the senior employees until 'I don't know but I can find out', became an appropriate answer drilled in my head. Our future challenges would be better served if people adhered to that principle, but as I've pointed out before, energy is probably not our Liebigs limiting variable, but rather politics.

The reality is WE DON'T KNOW the future - none of us! ... I think all on TOD would agree with that.

The IEA is charged to see if there is enough reserves of oil in the world to continue economic growth for at least 30 years or so ... their answer is yes ... I think all on TOD would agree with that.

The IEA further says that if the oil exporting nations (mostly OPEC) don't invest enough then the flows will be inadequate, soon ... I think all on TOD would agree with that.

It looks like the only use for the IEA is planning for short term emergencies, not peak oil - so is it value for your tax dollar, probably not?

The political reality is that we collectively vote in democratic Governments to give us growth - so that is what they will attempt, adequate oil or not, and they will never tell us that the future can't be growth. But the reality also is that the IEA sponsors HAVE NO CONTROL over the investments made in the exporting countries.

Live with the reality that we don't know what the future WILL be and that the past most definitely is no guide to the future, but we do know what it can't be (with a high degree of certainty).

The uncertainty is just the timing of inevitable things such as peak oil, peak gas, peak coal, peak phosphorous, peak fresh water, peak food, peak humans, peak investment, failing fiat currencies, climate change etc etc.

What we consider normal is actually very, very abnormal in the ~4,500,000,000 year life of the earth - it will not last!

Enjoy life and try and have a flexible personal plan that can cope with rapid change, don't rely on the efforts of others, your life is what you make of it - some of the bad things will likely happen in the next 50 years or so (and judging by recent historical data, may even be happening now).

enough reserves of oil in the world to continue economic growth for at least 30 years or so?

But the IEA has made it a practice to predict production rates as well, so it isn't just reserves. If by economic growth you mean continuation of BAU, then I would say "no". Counting oil shale and even some tar sands must account for EROEI, so simple reserves won't be realistic.

The IEA's method of prediction seems to bring supply up to demand, by assuming price changes and additional investments to provide the needed supply. The increased prices slightly affect demand, so the process is iterative.

These are the words of the IEA on methodology:

The world has just completed a giant live experiment by trying to grow the economy against limited crude oil supplies at around 74 million barrels/day. Result: bank failures, company bankruptcies, airline closures, a car industry at its knees and many rescue packages which mean new debt. Assuming we come out of the current crisis, who would want to repeat that exercise? When will we repay debt at all?

Thanks for bringing up this excerpt. I had also to do with modelling in my earlier life. However these models dealt only with natural parameters, so it had a fairly narrow and "predictable" range of results.

But the IEA model has to deal with quite a few "unpredictable" parameters, e.g. politics, so they have a big array of srews they turn manually according to their personal assumptions. So simply depending on these manual adjustments the model can produce an huge array of results.

It is a pity that they don't provide more transparency by publishing all details (source code, data etc.) on the modelling process.

Thanks (as always), Gail and Hi Rockman,

re: "In my personal efforts I’ve done such analysis with less then complete data but could still offer a range of risked possibilities. But there have been times when there wasn’t sufficient info to do such an approximation. At that point I can only offer the client a simple answer: I DON’T KNOW."

And "But their true mortal sin would be to offer the world their results without such qualifications."

The second sentence I quote more or less sums up what I wanted to say about the first quote.

Given the enormity of the implications, it seems that it's crucial for the organization to:

1) Put the range of results in context.

2) Point out the implications for the specifics listed in the range.

This would be in economic terms, and physical terms, for example.

3) Assign some meaning to the risk and the ranges of risk, even if one cannot assign a specific risk.

4) It also seems that on the issue of the "bigger picture," "I don't know" is not really satisfactory. The "bigger picture" lends itself to other tools, doesn't it?

Just some thoughts.

Aniya,

"I don't know" might not be very satisfying but if it's true then that's the answer. As far as "other tools" go, yes....they are available and would generate a reasonable result. But there are no tools which can make up for the lack of basic data. The KSA has a very good estimate of their remaining reserves as well as future production rates. They've had some of the best (and most expensive) reservoir modelers working on Ghawar and its other fields for decades. But they are not willing to share those answers. If they were allow others to analyze the production histories we would all know the answer. But they won't. Compare that policy to those of US public corporations who are required by law to present independent third party audits of their reserves which must conform to very strict criteria.

Ranging the risk to any value is fine but one must have a credible baseline to work with. Making a wild and unsupported estimate and then assigning a heavy risk to your answer is deceptive. The MSM and the public will generally use your answer and then conveniently forget to mention the qualifying risk. With regards to the "big picture" the KSA won't even admit how much oil has been produced from its fields since production began or even how much each produced last month. Even if you magically knew how much oil was in Ghawar initially you couldn't even tell today if it were 40% depleted or 70%.

Exactly.

Of course the executives who want to base their decision on such studies want to hear more than "I don't know", otherwise they wouldn't have hired you. Finally they want to know if they shall drill/build/invest or not, so you should give them a clear answer. But normally even under big uncertainties I always could draw conclusions from my data. These could result in a range of values and perhaps an average, and if the client preferred for exaple a conservative statement he could chose the lowest value.

Of course there should never be inconsistencies like in the WEO's chapter of Saudi Arabia:

Classical maths says: 11 fields x 450 million = 4.95 billion.

If these data weren't mixed up by mistake then the report could have said something like this:

The exact reserves are unknown. 6.2 billion barrels of reserves are reported in (source a), however (source b) has 11 fields of 450 million barrels each. So we estimate the total resource is probably in a range between 4.95 and 6.2 billion barrels.

I think the whole bias thing is a little overdone. IEA may be slow, but the EIA has been on this.

As I mentioned in Joules's thread, the EIA first published a peak oil scenario in its International Energy Outlook 2006. (The high price case)

Nobody did an article on it at TOD.

Same with the their IEO 2008 that came out a couple of months ago (which was even more pessimistic and showed a peak in conventional liquids in 2010).

Yet TOD ignores this work.

Perhaps the watchdog of watchdogs needs a watchdog.

(Ruff! Ruff!)

The above post is about the IEA, not the EIA.

Yes we did. (two actually)

Here is the longer one:

A Critique of the 2006 International Energy Outlook

We have also referenced that report dozens of times in other posts.

Our watchdog is this community. Go read elsewhere if this isn't worth the price of admission.

There is no discussion of the high price case in those articles. They completely overlook the fact that in that scenario the EIA identified an early peak.

Granted it is hidden somewhat in 2006 by the fact that the EIA lumps NGLs with conventional oil in their conventional liquids category.

But in 2008, even conventional liquids is shown as peaking.

Not a peep about it at TOD.

You're on TOD and you're talking about it.

Wag the Watchdog :-)

What a load of BS and you know it Nate. One recent example was pointing out (factually)that Westexas has been changing which avg price (from daily avg, to monthly avg, and now seems to be pushing for yearly avg) to use for his oil price doubling model, but my post are repeatedly deleted in the drumbeat concerning this. So please Nate, save me the watchdog is the community crap.

Datamunger,

When it comes to making statements that the world will notice, words go a lot farther than "high price scenarios". What the IEA has done is put some words out there, that reporters can copy and use in their paper. Including words like needing "four Saudi Arabias" and "patently unsustainable" is very important.

What the EIA has done is try to prevent criticism by putting out a range of scenarios, and saying as little as possible about the likelihood of the high price scenario, and what it would mean for society. This way they can cling to BAU, and also show a lower indication for the few who might notice or care.

What EIA did appears to be a standard trick of bureaucrats: Sneak some new data or new analysis into an otherwise ho-hum periodic report, so that people who, in the future, are caught by surprise, are cut off at the ankles when they ask loudly why they weren't warned. "Well, we first mentioned that in our report of umpteen quarters ago. We're really sorry that you didn't notice."

I can see it now -- country delegates with votes spend all their time trying to get their respective countries to increase their oil consumption so they get an increased proportion of the "Oil Consumption voting weights".

2 of the biggest OECD members are Turkey and Mexico. I wouldn't call those developed countries. They are far from the level of the other member countries, so there's plenty of room for catch-up growh among them. I would say they are more similar to the BRIC countries than other OECD countries.

These are the member countries, and the dates at which they joined, from here. Many of the poorer countries were added recently. Turkey was added early, though.

AUSTRALIA: 7 June 1971

AUSTRIA: 29 September 1961

BELGIUM: 13 September 1961

CANADA: 10 April 1961

CZECH REPUBLIC: 21 December 1995

DENMARK: 30 May 1961

FINLAND: 28 January 1969

FRANCE: 7 August 1961

GERMANY: 27 September 1961

GREECE: 27 September 1961

HUNGARY: 7 May 1996

ICELAND: 5 June 1961

IRELAND: 17 August 1961

ITALY: 29 March 1962

JAPAN: 28 April 1964

KOREA: 12 December 1996

LUXEMBOURG: 7 December 1961

MEXICO: 18 May 1994

NETHERLANDS: 13 November 1961

NEW ZEALAND: 29 May 1973

NORWAY: 4 July 1961

POLAND: 22 November 1996

PORTUGAL: 4 August 1961

SLOVAK REPUBLIC: 14 December 2000

SPAIN: 3 August 1961

SWEDEN: 28 September 1961

SWITZERLAND: 28 September 1961

TURKEY: 2 August 1961

UNITED KINGDOM: 2 May 1961

UNITED STATES: 12 April 1961

Gail,

This is the list of OECD members, not of the signatories to the 1974 AGREEMENT ON AN INTERNATIONAL ENERGY PROGRAM creating the IEA. Only OECD members can join the AGREMENT. Some have elected not to. Mexico comes to mind.

Norway, for its own national interests, could not accept all the provisions of the AGREEMENT. Hence its different status. Canada, another oil exporter, did.

Hope this help.

Thanks for pointing this out. I labeled this OECD members. As you correctly point out, IEA members are a little different. I believe Iceland is also an OECD member that is not an IEA member.

I am awed by the ability of Gail and others here at TOD to collect, distill, analyze and present data on so many diverse aspects of the energy picture. And grateful.

Google works very well. Also, TOD members collaborate on a lot of things. The number of e-mails back and forth is just amazing in any given day.

I have had experience analyzing issues of various sorts, so have an idea which kind of documents might be good ones to check. I have also discovered the "Edit Find" function on particular documents works well. With a MacIntosh, you can even use the Edit Find function on scanned in documents, and "copy" information from scanned in or password protected documents.

Yeah, as Joe points out, the IEA was initiated by the Nixon Administration which probably goes a long way towards explaining why he U.S. is a major funder; probably an historical artifact, also the voting shares.

There's always a certain amount of politics involved, even in science. Peer reviews are often done (out of necessity) by cohorts with sympathetic interests and views.

One could ask the same question other organizations, one in particular based in the U.S. comes to mind.

The EIA seems to be trying to cover all bases by offering a high-price scenario with lower production, but it doesn't seem to be willing to point out the problem as other than a remote theoretical possibility.

Consulting firms have a similar problem, because they want to produce answers their clients will like (and pay them for).

The IEA report is a slap to the face of the Peak Oil movement, no matter how we may try to co-opt their statements. That's why we have this article, in which Gail tries to show why the report may be biased to the upside. Commenting here as an interested observer but a non-expert, I can testify that the nett effect of the current ~$50/b oil price — and now this IEA report, which shows heaps of new supply and yet-to-be-discovered supply — is to take the wind out of the sails of everything Peak Oil related. That's a simple fact that most concerned people on the periphery of this issue will recognize as true. I find this disquieting because I have invested financially and emotionally in the imminence of Peak Oil. A 2-decade delay in the onset of liquids energy decline would severely disrupt everything I have planned, and significantly change my life for the worse. Sorry if this is too personal, but I'm frustrated with the way things are going after basing so much of my planning on the opinions of "experts" like Campbell, Deffeyes and Simmons. I'd be very surprised if there are not a lot of lurkers who feel exactly the same way.

But why do you take either $50 oil or this report as solid evidence against peak oil. This report is actually a massive step in our direction, predicting substantially lower production and higher prices than the IEA ever did before. I'd say that's as much as you can hope for given that they're still working from OPEC's dubious reserve numbers and the increasingly discredited USGS discovery predictions.

And the $50 oil is because of an economic collapse and resulting demand reduction. Projects are already being deferred. This will make it harder to set new production records when demand rises again, raising the likelihood that July 2008, if not May 2005 was the all time peak.

I grant you that it sucks that the financial implosion is more exigent than running out of liquid fuels, but we're still running out of liquid fuels.

I think this is an unfair attack on the TOD leadership. The current drop in oil prices from their recent high of $140/b is clearly because of a world economic decline. If/When world economy is 'healthy' again, oil prices will be right back up there. Excepting, that the world can never go back to just what it was then.

It is reasonable to believe that the rapidly rising oil prices actually caused the economic collapse. Economic models, such as are used by all major investment houses and by the IEA, are untested and likely grossly wrong when subjected to such price shocks. Investment houses ACT on the predictions of their models, at least until their first few billions of loss. Then they go into institutional shock.

(Somewhat over simplified explanation. Bursting of the housing bubble might also have had some effect.)

Well, let's not overlook the causes o the world economic decline. The oil supply stopped growing in 2005. That meant that, after some delay, the world economy must stop growing as well. Combine that with oil prices over $100 a barrel and you are hitting the world economy with a double whammy.

The current world recession is a direct result of peak oil and the high oil prices that resulted from peak oil. The world economy will recover, and start growing again, when the world oil supply begins to grow again at pre 2005 rates. That is likely to never happen.

I expect the economy to feint recovery, due to lower oil prices. But it will not get very far because a tight oil supply will drive prices up again, and the economy down again, in a vicious cycle. Each economic peak will be lower than the last one and each economic dip also lower than the last one.

Ron Patterson

Mamba,

I think the problem a lot of people are having is that our current situation doesn't match their mental image of what peak oil would look like. A lot of people to think that because of peak oil, oil production would follow a nice up and down pattern, like that in the US, and that prices should increase as oil supply becomes more scarce.

My view all along has been quite different. I have been saying that one of the big effects of peak oil would be to "crash" the financial system, so that we would need to start over again with a different financial system, one which is debt plays only a minor role. I have been writing about this since I started writing about peak oil. (See for example this and this).

From my perspective, the economic problems were are seeing today is is exactly what I expected peak oil to look like, because once resources (such as oil production) stopped growing, people could not pay back their debt. There would be massive defaults on all types of debt, and the system would crash. (Also see my forecast for 2008.) We have started the financial crash now, and it is now happening in slow motion around us. This is scary to me, but people who only see the $1.80 gasoline don't see a problem.

After the crash, it is not clear exactly what will happen, but I expect oil consumption, and consumption of a lot of other goods, will be a lot lower. Thus, instead of having a nice smooth up and down pattern like US oil production, we will have much more of a drop off. It doesn't match what many people were looking for, but it is likely not far away. Exactly how this crash plays out is not clear--it is unlike anything any of us have experienced before. Low prices don't mean something good. They mean serious disruption of our economic system surrounds us.

Gail, I couldn't get your forecast link to work or spot it in your stories.

Perhaps if you have time you would fix it.

Thanks.

I think I fixed it. Thanks for pointing it out.

Cheers. Now can I please request a more cheerful forecast for 2009, even if it is as an 'outlier' in the small print, like the EIA high price alternative! :-)

Seriously, remarkable work, and regrettably prescient.

Hi Gail,

The second link still doesn't work (at least, for me).

Sorry. I fixed it. I need to look at these more closely before I put them up.

Gail,

I just wanted to thank you for your current and previous posts on how you see the financial situation playing out, and encourage you to keep writing.

If its any consolation if we actually had financial decline causing demand to decline faster than production then its probably the best solution.

I'd not worry to much about it. If you invest in anything you better be willing to lose all the money. If not your not and investor. Personally I'm down on my oil investments and yes they effect my dreams of buying a home outright but those are dreams not plans.

My plan is 20k for a trailer.

Next if its worth anything I expect you will see oil go up as fast as it went down i.e a V bottom or at worst a U. In general because the current price of oil is based on expectations that are unwarranted esp that we are entering the next great depression. We are not even close to that.

So make your own decisions but if you can't handle 50 oil then your not and investor. I bought a 90 December 09 crude option so double down baby !

Edit by Gail I removed the strange extra letters. There were extra spaces also.

Memmel

1)I suggest buying a new keyboard or trying decaf.

2)We are closer to depression than you think. Mortgage spreads blew out today. The fixed income market is in disarray. Shipping grinding to a halt, etc. In the intermediate term oil supply will drop like a stone vs demand. But the near term may seem like an awfully long time. I think we go back to $70-$90 pretty quick, but beyond that might be a long wait. And Simmons $500 totally out of question. Resource would be nationalized/futures stopped trading well before that level - equity breakdown in population would skew too fast for social stability. I would guess $200-$300 in a few years is all we will see, and that might be way more than $200-$300 in todays dollars.

Hi Nate,

Thanks for your second point, scary though it is.

I seem to recall (but am not going to look for it!) that Mike himself posted on the "end of the oil market" some time back.

Anyway, here's my question:

Something I’m curious about (I don’t know enough about how the oil market works).

Is it the case that when a country, such as China, negotiates an oil contract with Sudan, that this oil is still “fungible” and subject to market forces/prices? Or, not?

If not, then it might be possible (and interesting) to take a look at the percentage and type of resource base being subject to these kind of “alternative arrangements”, and also, at the resulting effect on the (hypothetical) lifetime of the oil market.

http://www.energybulletin.net/node/3753

Aniya

Second point is not rocket science. We not only need oil we need oil cheap enough that can give the illusion that everyone can get to the top. Once the prices rise over a certain threshold permanently what we 'predict' should be the correct price of oil based on normal supply demand dynamics won't be a valid paradigm anymore. So IF the supply/demand imbalance is such that $500 would be the market clearing price, secretaries, janitors, schoolteachers, plumbers, and the rank and file could not afford to live... before that would happen government would involve itself in the energy business so the higher 'costs' would not be seen (directly) by consumer.

Regarding long term contracts, they do impact prices in a way. Say China needs 10 million barrels a day. They buy this all on the open market. Then they sign a long term contract with Russia to provide them with 5 million barrels per day. If this is NEW oil heretofore not on the market, then Chinas demand just went from 10 mil down to 5 -they need to buy less on open market so prices will drop. But if this 5 mil bpd from Russia was previously being sold on open mkt and now taken off to sell directly to China, then mkt impact is neutral to slightly positive (world supply went down by 5 million and so did world demand, but now aggregate is smaller by 5 mil, so any 100,000+ disruption in oil supplies is now a greater % of world publicly traded demand.

At least thats how I see it. The bigger issues are world supply and world demand. What is private and public kind of washes out after you know total supply/demand.

Nate as far as 2 goes.

This is tough because given the current situation with the economy its really tough to gauge the value of the dollar vs oil. I think its a pretty safe to consider oil as a store of value vs all fiat currencies. As far as a upper bound price if you look at the possible alternative sources of liquid organic fuels and the volume they can provide i.e the demand that can be met and upper bound on the price for diesel or gasoline like fuels is in the range of 10-15 dollars a gallon. This balances demand destruction with supply. A lot of alternatives open up as you cross five dollars a gallon but volume supplied simply is not there so significant demand destruction is needed. I've figured this a lot of different ways for example looking at the prices of various vegetable oils today vs what they would be if food and fuel where in direct competition. And the need to cut demand by at least 60%.

The big factor seems to be decreasing demand by 60% assuming 3-4 dollars a gallon causes demand to flatten or decline a simple rough guess of about 30% off for each doubling results in a 60% decrease and a price range of 10-12 or basically my 10-15 for final fuel.

I'm saying final fuel because its not clear as you enter into these price ranges what the refining cost would be one would expect the price of oil to actually make up a larger percentage and the part that passed on refining costs to lower. But this is probably at least 400 dollars a barrel.

Note that prices in europe are in the bottom part of this range and yes a lot of that is taxes but still on a individual basis its pretty much a direct cost. And European demand is still quite robust. So although scary these prices are not unreasonable.

We have actually seen many people state that this price or that price was the highest oil can go for X reason. I'd suggest that the only real upper bound is when other sources of liquid fuels can balance remaining demand at some price. This is simple economics the price of oil will increase until valid substitution and demand destruction balance the supply and demand equation.

Like I said 10-15 dollars a gallon is fairly easy to come up with as a reasonable number it could be higher but its fairly difficult to justify a lower price. Think about it we reached 4 dollars a gallon and saw very little demand destruction. And next its not clear that this price hit anything but what I call leisure demand. I don't think it went high enough to impact core demand considerably.

This leads into how price would have to change to get us into a world where demand was low enough but robust enough to encourage substitution and at the same time life style changes sufficient to reduce demand enough for effective substitution. Four dollar a gallon starts the ball rolling by eight dollars a gallon it seems to make sense that substitutes would be viewed as viable and begin to reach a larger and larger precentage of demand even as demand is destroyed. And it makes sense that a final price of around 10-15 is enough to keep demand reducing to match the loss of oil and probably the limits of substitutes. The price could go higher but overall it seems that around that price range we would see basically a balance. Obviously liquid fuel in this price range would be used where they don't have easy substitutes.

You may not agree with the numbers I've come up with but I think its the best way to figure a real maximum price for liquid fuels and it correlates fairly well with oil at 400+ a barrel.

As far as resource nationalization goes I'm not convinced it will actually result in a low price for oil since what I'm suggesting is the price is bounded by substitution and remaining very inelastic demand nationalization does not seem to change this. I think it would simply increase the costs and in this case this number would be the black market price.

Now as far as futures contract I'd think given what I'm saying instead of the cessation of futures the oil contract would be expanded to include settling the contract with alternative fuels. Thus you would simply be allowed to settle the contract with ethanol or vegetable oil instead of rock oil. Thus they would simply be expanded to be liquid energy contracts with various discounts for alternatives. This is not a whole lot different from the current contract and is a simple expansion

and its quite sensible.

The reason I don't think the futures markets are gone now although for a long time I agreed is that as alternative fuels become more important we will be forced to continue to allow international trade just like with oil supply and demand will be geographically split and cross borders. Liquid fuel continues to be fungible and nationalization will fail. Now to some extent in some countries it may be the national government that takes control of the oil or liquid fuel trade in and out of the country but thats the case today and the markets function just fine with some of the participants being governments. It might get dicey if it was pure government trade but we will see.

Now on to Mortgage spreads and other financial turmoil. Whats happening right now are two things the withdrawal of long term credit offers to a large number of borrowers except at increasingly stringent terms and deleveraging. Its actually a fairly directed collapse. Primarly housing and commericial real estate and autos and of course the "financial" world. I qouted financial because I'm talking primarly about various financial contracts and associated leverage that don't have direct connection with any real business or assets. Most of the assets associated with the financial crisis are either not backed by any real collateral or are backed by collateral thats in one of the dead asset classes. Real Estate and autos. One more thats in the mix is of course consumer credit card debt.

Sure the financial turmoil is causing some collateral damage esp to letters of credit or other credit lines being withdrawn and commercial paper but this is indirect and for the most part it is being duct taped together. Same with money markets etc. These are not areas that have fundamental problems yet and it seems the Government has been reasonably successful at keeping these running.

Now on to housing in particular prices in costal regions are still well above historical norms for California coast of 4:1 this is median home price to salary most of the country its 3:1 they are about 6:1 to 8:1 understand that in California they hit 10:1 in a lot of areas. The bay area is just coming down to 10:1 I don't even know what it hit 15:1 to 20:1. The inland regions generally are historically at 3:1. Sacramento on of the poster children for collapse is basically at 3:1 now its just returned to sanity and sales are picking up sure it my overshoot.

My point is that this collapse is for a large part just a return to sanity not even for the most part an actual recession. Same for the stock market its now slightly undervalued vs historical norms vs being wildly overvalued until recently.

As far as shipping goes well if you have a worldwide housing bust and a slow down in auto's then your going to have a slow down in bulk shipping for all kinds of resources and drops in prices on those resource classes. Ore shipping etc. This will pretty much cross over into container shipping etc. And also if you take a look at shipping you will see that there has been significant expansion of fleets over the last few years so you have a bit of a bubble that formed in shipping. Same for the Baltic Index if you look it went up well above normal and of course oil prices play into the costs of shipping vs profit margins. I did some spot checks of shippers explicitly not involved in products that can be related to the housing industry and they seem to be doing well all where profitable.

Now to continue growth is highly concentrated in the construction industry i.e a growing economy builds stuff a stagnant economy does not. A cessation of growth esp if the growth itself was tied to the construction industry causes it to contract the fact that is was the source of the growth bubble itself.

At the end of the day right now we are really at the point that industries that require continuous growth are no longer viable and of course the financial bubble that built to support growth are popping. This is a move towards a stagnant economy not yet a move towards overall decline.

For oil what this implies is once supply matches demand minus what ever was being used by the growth industries we will be back in a tight supply demand situation. Now the housing industry has been falling for some time now basically since 2005 esp housing construction so the demand from these industries has actually been declining for some time even as oil prices rose. A stagnant economy implies stagnant demand and we still have some growth going on in the world. Globally the economy continued to grow this year and the onces that are negative are barely negative 0.3% for the US I believe.

Stagnation is in the bag with slow to small growth globally. This implies that oil demand will be stagnant to slowly growing. If supply is declining then this means supply probably cannot meet demand which means increasing prices.

All the economic indicators in my opinion point toward the cessation of growth and the end of the various bubbles they don't yet point towards further declines.

The point is you can make a very strong case for the world economy transiting to a world of zero growth this of course will continue obviously to impact our financial systems esp long term debt contracts but its not yet obviously headed downwards into deep depression/ recession.

It will eventually of course contract at some point the imbalance between oil supply and even stagnant demand will force prices up and this will eventually force further contraction.

The economic house of cards could actually collapse and this could force a depression.

But these are events that are yet to happen the current events result in stagnation with the exception of the effective death of growth industries such as housing.

However prices esp in the stock market are controlled by expectations about the future not the current state of the economy and its a safe bet that even the possibility of world wide economic collapse is sufficient to put a real damper on prices esp if you factor in all the unwind still taking places.

Back to oil this means oil prices are not responding to current demand at least the futures market is not its controlled by expectations you your self showed the tight correlation with the stock market.

However oil is consumable and despite all the bad news the real economy does not stop its still running along consuming oil. As best as I can tell global demand is either up slightly on the year stagnant or slightly lower by this its changed by less than 2mbd and probably be less than 1mbd.

We also still have a lot of production offline and continued declines in Mexico and other areas.

We have no indication that export land problems have stopped at best the growth rate has slowed.

Thus the rate of decrease in exports might have slowed but exports have still dropped.

So overall in the real world the supply/demand equation is actually very murky certainly at the global level we don't have a clear case that supply is definitely less than demand. And we don't know for sure what the price of oil would are should be or how it will move in a world of stagnant to slowly growing demand. Nobody really knows.

What we do know is before expectations changed price continued to decrease even as VMT was falling in the US. So we do have real world data that indicates at least falling demand in the worlds largest consumer was not sufficient to cause prices to decrease.

And last but not least the US was hit by two major hurricanes this year and outside the oildrum it seems that they went practically unnoticed. We really just recovered from these and got supplies stable to about 1/4 of the US which was experiencing serious shortages. This was like having France not buy any oil for a few months. Also of course prices have obviously decreased so if we had any demand suppression in the US we will see a rebound from this. This of course is balanced by some real declines in demand from a higher unemployment rate.

But again we end up more in a balanced demand situation not outright declines much beyond what we have been seeing since 2005. If we get a real cut of 1.5mbd from OPEC or even non OPEC because of the low prices we could well find out soon that supply may have not been adequate and the cuts could overshoot.

I'll just wrap this up we are now entering the stage where the worlds economy stagnates I expect we could set here for some time at least a year. I expect that given oil is a consumable that the real oil price will shortly begin to be determined as the actual supply and demand situation becomes clear and assuming that the world continues to avoid a real financial crash. As we enter into December we will reach a high oil demand season and thus it will quickly become clear what the real supply demand balance is regardless of overall market expectations. If we actually have a imbalance and supply does not meet demand I don't care if everyone thinks the world is going to end next year the price of oil will increase.

So agian sorry for the monster post but its tough to explain all of this. At some point the commodities markets will return to doing what they are supposed to do and arbitrate demand over the short term and allow long term bets of lesser importance. As the sky does not fall the world economy will adjust to no growth and it will muddle through. The financial and housing and auto's and credit card debt will continue to die they are not coming back effectively forever. However I think I'm one of the few people that noticed that if you rent instead of taking out a large mortgage and don't buy a new care every three years and keep the one thats paid for etc that you actually dramatically increase your cash flow. By not buying houses and cars people actually have higher cash flow for other stuff. Sure some of it will prudently be redirected into savings but overall your talking about a change in spending habits not necessarily a large contraction. A world without the strain of ever rising costs from a housing bubble and uneeded car purchases is actually a wealthier world not a poorer world.

Enough no one is going to read this far anyway :)

how about some new economic scenario no one has seen before?

thats my take on prediction... no one has yet convinced me they understand how this is going to play out in detail.

"...we reached 4 dollars a gallon and saw very little demand destruction."Since the financial crash I'm no more sure about this. Here the story in short:

I think that the price elasticity was distorted as in the US (and other countries) much of the consumption was based on loans. In fact the real income of poor Americans have been declining since decades, and especially since 2000 (I had posted this before), but people (didn't want to realize this? and) kept to increase their spendings. So private debt increased in order to buy commodities, cars, houses...

Since 2000 also the oil price went up and started to eat away from the people's purchase power. So maybe the rapid rise of oil and gas prices since 2007 was the straw that broke the camel's back.

Obviously the banks weren't aware of the growing risks and still dreamt of making money by selling tricky loans to have-nots. The end of this story is well known.

So the current new attitude of people refraining to take up new debts (or banks to give loans) probably reflects much better the real purchase power, and provides a more direct price elasticity feedback. With the financial crash price elasticity simply bounced down like a flipped rubber band. It is only now that we can see how many dollars per barrel the world economy really can bear.

Welcome in the real world!

Thanks Gail for the edit sometimes my two year old sneaks in and uses my computer and I don't catch it.

Try to find a password he still cannot crack ;-)

I admit that my comments to friends about "$4/gallon will look cheap in the near future" and my recent financial demise are now causing me a fair bit of grief. And I am sure that there are people around me who think that I am not only slightly crazy, but also somewhat pathetic when I say "yes...I still contend that PO is THE problem on the near horizon." As the markets and the price of gas have plummeted my e-mailed comments and links seem to be falling on deaf ears. A couple of months ago I was encouraged by people asking for more information, but now....silence. I agree with Gail's comment suggesting that when the only thing that people see is gasoline at $1.80 we've got trouble.

At least Obama agrees....he claims that we will reduce CO2 emissions by 80% by 2050. If only we could be sure that the 80% reduction went hand in hand with a 5,000% increase in renewables.

-dr

The most honest post I have read here in a long time.

Mamba, I think you will find that your preparations were good investments, they might just take a few more months to "mature" as the bankers would say. There are no guarantees in Life my freind except for one, Death. Please remain seated and cheerful where possible, the fun-ride has only just started.

Death and taxes, Lucifer. I hope you are right about all the rest.

Mamba,

I can appreciate your frustration. I work in the oil patch so the ups and downs affect me as much or more then most. Hey...it's a personal issue for all of us to some degree. I'll offer some unrequested advice: relax and tell yourself you reevaluate your plan 12 months from today. I'm pretty sure you find some reaffirmation of your efforts by then. This is not a situation that can be monitored on a day to day basis. It really doesn't suit itself to a yearly time table very well. For instance, if you understand the concept of a running average, the 18 month running average price of oil is at its all time highest (non-inflation adjusted). This statistic tends to minimize the effects of big price fluctuations as we've seen in the last few months.

Huh? ... Check the data ... I think you will find that world oil consumption has peaked and 'net exports' have peaked - they are now in decline. Also, the IEA has been wrong in their predictions for several years now - amazingly, somebody keeps paying their wages.

The IEA talks about reserves - they have nothing to do with the flow rates, they just tell you how much you have until the flow goes to zero.

Even at $50 a barrel oil is more costly and importantly less affordable than a year ago.

If there is no adequate alternative then Post-Peak-Oil means world economic contraction is inevitable and failure of systems that require growth such as interest on debt. Check the data, I think you will find the banks are struggling and economies are contracting - worldwide! I think you may find pension funds struggle as well. These are the symptoms of peak oil.

Oil is definitely more affordable than it was a year ago, even in the beginning of a depression. A year ago it was $90 or so this week in November. Now at $51. Prices in general economy have not dropped 44% (yet). Gasoline is so cheap that everyone (at least in US) can afford it first. Fill up gas tank first then start worrying about what else you can buy.

Is the world or even the US really using more oil than a year ago, that is the implication of saying it is more affordable now?

The weekly stocks reports has US oil consumption over the last four weeks 7 percent lower than last year, and crude inventories continuing to climb by 1.6 million barrels. Although gasoline demand is only down by 2.2 percent over last year, jet fuel demand now is down by an impressive 20 percent as airlines cut back flights and ground their inefficient aircraft.

Not exactly. By saying it is more affordable now I mean compared to other things in the average consumers basket.

My opinion is that the problems that Gail is highlighting show the natural problems that result from trying to watch a complex system when it is stressed when your unwilling to understand how it works.

The problem is that complex systems actually compute and they tend to lie about there actual condition when stressed. Thus they either appear better than they are or in some cases appear worse in order to look better later on. The point is that complex systems naturally game their external visible indicators by obscuring their internal state. Not to mention we have not even developed the mathematics of complex systems to the point of understanding their internal "virtual" world.

Simmons call for data transparency is even more powerful if you understand how these systems work.

The fact that people and thus politics are involved simply makes the task harder but the nature of failing complex systems is independent of the computational power of the nodes that make up the system they need only to have enough computational complexity to create a virtual world.

A perfect example is bacterial colonies or even concentration of minerals via natural processes the computational power of the nodes is pitifully small esp for rocks but the chemical and physical gradients are sufficient to create a computationally complex system. A simple example is a sand pile on the very of and avalanche. Its virtually impossible to predict the actual time of the avalanche without effectively perfectly modeling the internal complexity.

However given this we can expect that the EIA will consistently not tell the truth. Simply because they don't understand that by ignoring the internal state problem they are part of the system not and observer. I'm aware that this gets into concepts similar to quantum mechanics but this is because complex systems create their own uncertainty principal by effectively creating their own virtual internal physics. It seems that a even more basic truth that anything that can exhibit physics like behavior i.e complexity sufficient to force probabilistic treatment creates a uncertainty principle. This eventually causes the higher level problem of decoupling of the observer from the observable. For quantum mechanics this means the system and the observer must not have any strong overlap between wave functions. We express this often in law as impartial judges and juries so it not like we don't understand the concept.

Gail exposure of the inner workings of the EIA cast a high degree of doubt on its ability to act as and observer in fact its simply part of the machine if you will.

And last but not least we also have another phenomena associated with complex system although I don't quite understand its roots its fascinating. Whenever the consensus of the system is that the internal state is certain the consensus is assured to be 100% wrong. This is and expression of the complex systems uncertainty principle thus once its clear to everyone that your going a certain direction or the current conditions are at some value you know for a fact that this is false.

So you can see that the key to understanding complex systems is to understanding that the truth is that you can know that lies of various forms are being told. Now this does not mean that the right answer is always the exact opposite of the lie it just means you can eliminate the supposed truth as a probable outcome. When the lie is one of public consensus or internal agreement then you can make a very safe bet that the truth is probably 100% the other direction. Again this concept is well known and its intrinsic in the reason that ponzi schemes collapse once everyone is in the game the game is over.

What this means from a complex systems viewpoint is that the complex system is now going to move rapidly from its current position this you can pretty much take to the bank if they are still open.

So right now today we actually know a lot just by understanding how things work.

We know the EIA is wrong about future oil supplies. Next on the oildrum I feel like we have succesfully played the role of unconnected observer and we know that they are wrong because oil supplies will always be less then predicted by the EIA.

Next on the financial front we know that the public consensus is that we are entering into the worst depression in history or the next great depression well as I outlined above its a safe bet that the current consensus is wrong. Not that we won't eventually fall into a real depression in the near future but when we do it will be with the public perception that the worst is behind us and this is just a temporary hiccup on the road to recovery.

Now long term complex systems can and do implode and create new complex systems the actual death of one system and rise of another is outside the constraints of the virtual rules of the original system thus my above analysis does not apply you have to expand to the enclosing complex system that includes the original observers to again see what the heck is going on. You can look at the collapse of the Roman Empire and the evolution from that point forward for example and its pretty obvious that the interaction of the old Roman Empire with neighboring civilizations must be included to understand the fall. This is not just the barbarian invasions but also the rise of the Muslim world and its control of trade with China. Eventually you have interactions with the Americas. Hopefully you can see that you have to pull back to a higher level complex system when the one under observation actually enters its final collapse phase. To some extent whats happening is as it collapses it becomes unable to compute a internal state thus it effectively virally invades surrounding systems to recreate complexity. Thus a collapsing complex system tends to revert to simple viral mode and tries to infect other nearby complex systems that are loosely coupled.

This can be seen in evolution for example when the environment collapses species morph to infect niches that where held by other complex systems that became extinct. Better to keep a morphed genetic line vs losing entirely.

This is another important point since it indicates that we know the US is entering final collapse phase when it attempts to "infect" its neighbors. The web of debt we have woven that insures our collapse takes everyone out shows just how advanced the viral stage of the collapse of the US has progressed.

Finally what do you do ?

Well you act first and foremost as a impartial observer and collect as many facts as possible but you also must determine which of these facts is a truth or a lie. You literally are forced to reject some "facts" as bald faced lies. This rejection process is the one that causes the most problems since supposed objective observers that have not decoupled will deride you for making these filtering decision. In fact they have done so themselves and the "fact" that their viewpoint is generally in agreement with the public consensus is sufficient to ensure your detractors are wrong.

Understand this does not make you correct but knowing that they are wrong is important.

And last but not least if you use these methods you can reach a conclusion that you are either right or have selected a fact as truth thats actually a lie. This simply means you must always remain on your guard testing your facts and attempt to detect falsehoods. This brings up another inherent problems with complex systems its impossible for the impartial observer to prove he is impartial.

Given that he must detect falsehoods and this requires a belief system the observer himself can never determine if he has acted impartially because his belief system accepted a critical fact that was a lie.

Hopefully this is helpful to people this is how I study peak oil and the death of our complex civilization I believe I have the approach correct. I readily admit that it can result in me making a mistake or being wrong but unlike most people I at least understand why I can be wrong.

That alone is probably greater than anything you will ever get out of any of our government agencies they don't even understand what they are doing well enough to understand why and how they can be incorrect.

And last but not least hopefully since most people know I'm a super-doomer the fact that I'm predicting that right now is not the end of our civilization in fact we are not even close should bring some comfort. By close I mean within the next couple of years we are not entering the final depression yet its coming but not right now. I know a lot of people are worried and I could well be wrong but if I'm right be thankful that you still have several more years of relative stability before TSHTF for real. As far as I can tell at least 2-3 more years maybe as long as five and and less probable more. Understand we are pulling back from a insane economic bubble we are not close to actual economic collapse. Its the end of insanity not the end.

You always have interesting observations. Thanks!

With such complex systems as we have today, it is hard to know how things will work out. Our financial system is so complex, that it especially is uncertain. I don't think the fact that some folks are saying we are at the edge of a depression makes that outcome unlikely. A lot of other people are saying things will turn back up in a year so.

One of my major concerns is that it no longer makes sense to have anywhere the level of debt that people, businesses and governments have been carrying, simply because paying back the debt with interest will be too difficult in a society with declining resources. The discontinuity of going from our current debt level, to much, much less debt is going to be enormous.I don't see how we are going to be able to keep our complex system hanging together the way it has.

By the way, I think you meant IEA when you said EIA in your comment. (The EIA no doubt has its own set of challenges.)

Sorry your right IEA :)

Actually the fact that this is not the crash point is a real problem in and of itself.

A lot of people think we are having hard times right now. Not even close we are so far away from what I see coming that the concern about our current situation is cause for concern.

How is our society going to react when the real hard times hit ?

In many ways are country is screaming that the wolf is at the door the end is near.

Instead whats really going on is a big asset grab and socialization of losses by large companies

esp banks. Its simply a massive sucking of money out of the taxpayers under the guise that if we don't give them the money the boogey man will get us.

We are so gilded in our living that we simply rolled over and accepted it.

What it does however do as you recognize is ensure beyond a shadow of doubt that the US will default on its obligations the only question is how and when. By giving in we have in reality sealed our certain doom. The fear of collapse was sufficient to ensure collapse. The false flag event worked perfectly. The real answer of course is that Americans should have toughened up and taken our losses and allowed the excess to get cleaned out and a more solid economy form.