The 2008 IEA WEO - Renewable Energy

Posted by Robert Rapier on December 3, 2008 - 10:16am

As I read through the 2008 International Energy Agency (IEA) World Energy Outlook, I had the distinct impression that I was reading contributions from people with completely opposite points of view. The pessimist warned that we are facing a supply crunch and much higher prices. The optimist in the report said that oil production won't peak before 2030.

This trend held in the section on renewable energy. The optimist noted that renewable energy is expected to "expand rapidly." The pessimist noted that biofuels are predicted to only supply 5% of our road transport fuel in 2030. And so the report goes, part rampant optimism and part rampant pessimism.

I guess the good news then is that there is something in there that will appeal to everyone, regardless of your outlook. The bad news? The claims that are directly opposed to your views will have you questioning the credibility of the report. And if you are like me--and note that between last year's report and this year's report they dropped their 2030 oil demand forecast by 10 million bpd--you are left wondering whether there is any credibility at all in forecasts that far out.

But for what's worth, here's what the IEA had to say about renewable energy.

Report Highlights

World energy demand is forecast to grow from 11,730 Mtoe (million metric tons of oil equivalents) in 2006 to 17,010 Mtoe in 2030. Fossil fuels, with oil as the primary source, will account for 80% of energy used in 2030.

China and India will be responsible for over half of the increased energy demand between now and 2030. Global demand for oil (excluding biofuels) is forecast to rise from 85 million bpd in 2007 to 106 million bpd in 2030. This forecast was revised downward by 10 million bpd since last year’s forecast.

World demand for electricity is forecast to rise from 15,665 TWh in 2006 to 28,141 TWh in 2030. Renewable energy will displace gas to become the second largest producer of electrical energy by 2015, but will still lag far behind coal. For OECD countries, the increase in renewable electricity is greater than the increase in electricity from fossil fuels and nuclear. The share of nuclear power in the world energy mix falls from 6% in 2008 to 5% in 2030.

Electricity generation from PV and CSP in 2030 is forecast to be 245 TWh and 107 TWh, respectively. Solar PV will continue to have the highest investment cost of all commercially deployed renewable energy sources.

Geothermal and wave technologies are forecast to produce 180 TWh and 14 TWh of electricity in 2030. Over 860 TWh of electricity from biomass is forecast to be produced in 2030. Present conversion of biomass to electricity is at 20% efficiency.

Global output of wind power is forecast to grow from 130 TWh in 2006 to more than 660 TWh in 2015 to 1,490 TWh in 2030. It will become the 2nd largest source of renewable electricity (after hydropower) by 2010. Potential for hydropower in non-OECD countries is still large. Most good sites in OECD countries have been utilized.

Energy storage is rarely the cheapest way of dealing with variability of wind and solar power, but several next generation storage technologies are under development. These include ultracapacitors, superconducting magnetic systems, and vanadium redox batteries. Electrolysis to produce hydrogen, later used in fuel cells on demand is an option, but the overall efficiency is only 40%.

Carbon dioxide emissions from coal combustion are forecast to rise from 11.7 billion metric tons in 2006 to 18.6 billion metric tons in 2030. The ability of carbon sequestration to limit carbon dioxide emissions by 2030 is limited.

The reference scenario presumes that by 2030, the U.S. will only meet 40% of the biofuel mandate set in 2007. In Brazil, biofuels are projected to account for 28% of road-transport fuel demand by 2030. The present amount supplied is equivalent to 13% of road-transport fuel demand. Demand for biodiesel is expected to grow faster than demand for ethanol.

Biofuels in 2006 provided the equivalent of 0.6 million bpd, representing around 1.5% of global road transport fuel demand. The United States is the largest user of biofuels, and most of the recent growth has been in the U.S.

The share of biofuels in road transport fuels is forecast to grow from 1.5% in 2006 to 5% (3.2 million bpd) in 2030. Second generation biofuels based on lignocellulosic biomass, converted via enzyme hydrolysis or biomass gasification (BTL) are expected to become commercially viable. However, the contribution will be minor, and not until after 2020. Capital costs for cellulosic ethanol are "significantly more" than sugarcane or grain-based facilities. As a result, full commercialization hinges on "major cost reductions."

The United States and Brazil both export soybean biodiesel to the EU. (The fact that the U.S. exports any biodiesel is very surprising to me, given the high demand/prices for diesel in the U.S.) Some countries are beginning to scale back their biofuel policies due to concerns about environmental sustainability. Shortages of water availability will be a potential constraint for further expansion of biofuels.

Most biomass will still come from agricultural and forestry residues in 2030, but a growing portion will come from biomass farmed for biofuels. A growing share of biomass is also projected to fuel combined heat and power (CHP) plants.

There is considerable room for growth of solar water heating (water heating consumes 20% of all residential energy consumption). China currently has 60% of the world's installed solar water heating capacity. Solar water and space heating projected to grow from 7.6 Mtoe in 2006 to 45 Mtoe in 2030.

Hybrid vehicles are commercially viable today; electric vehicles have yet to gain traction. Electric vehicle technology is advancing rapidly, but further improvements in storage technology are needed for efficiency and cost improvements. Long term, electric hybrids, fully electric vehicles, and fuel cell vehicles have the most potential for minimizing the need for oil-based fuels. In the very long term--projecting out to 2050--fuel cell vehicles are forecast to make up 33% to 50% of new vehicle sales in the OECD.

Cumulative investment in renewable energy between 2007 and 2030 is projected to be $5.5 trillion, with 60% of that for electricity generation.

Commentary

The report reiterates the points I have argued on numerous occasions: Biofuels will not scale up to produce more than a small fraction of our fuel demand, and even then with potentially serious consequences. While the report spreads the blame for higher food prices on a combination of competition with biofuels, higher energy prices, poor harvests, and various agricultural policies, it correctly identifies water as a (highly underrated) issue in the future scaling of biofuels. On the other hand, the report identifies Latin America and Africa as regions with the potential for boosting biomass production by modernizing farming techniques.

I think the report correctly identifies renewable electricity and renewable heating (especially solar water heating) as areas poised for growth. However, it also predicts that carbon dioxide emissions will continue to rise. This was a controversial issue I tackled earlier in the year, when I predicted "we won't collectively do anything that will reduce worldwide greenhouse gas emissions." I don't think emissions are going to start falling substantially until nature does it for us.

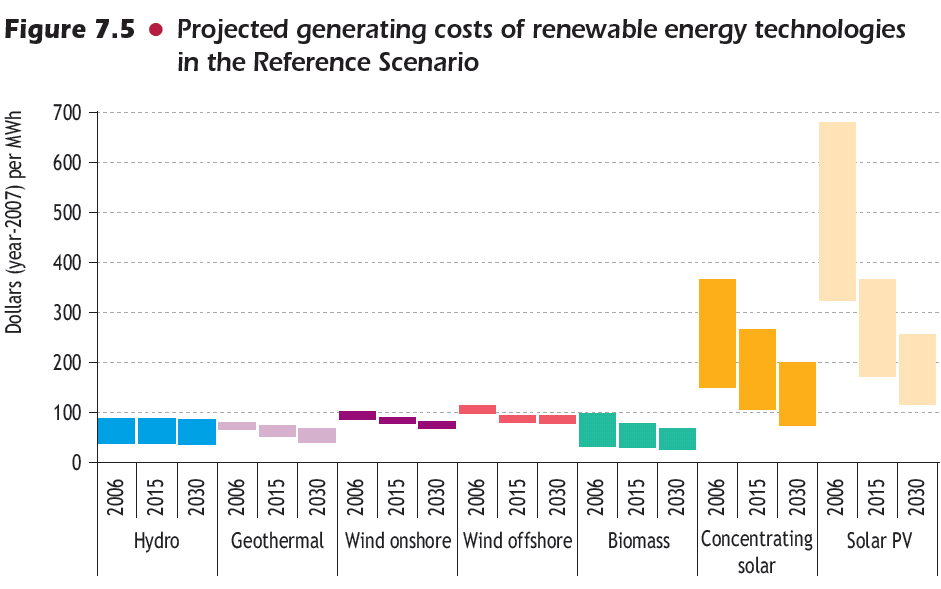

The following figure was very interesting to me:

Source: 2008 IEA WEO

This figure suggests that by 2030, the cost for solar PV and CSP will still be higher than all other renewable technologies are today. And not just a little higher: solar PV is predicted to be twice as expensive in 2030 as hydro and onshore wind are today. So much for Moore's Law applying to solar PV.

However the nagging issue for me is the credibility of the predictions. How much stock can I put into the renewable energy predictions from an agency that thinks oil production won't peak until 2030, and that demand will exceed 100 million bpd (contrary to the opinions of two Big Oil executives)?

Conclusions

The renewable energy portion was a tale of two technologies: Renewable electricity and renewable biofuels. Renewable electricity is forecast to grow rapidly, and make up an increasing portion of electricity supplies. The share of nuclear power falls, but coal usage is projected to rise 60% by 2030 (with 90% of that increase in non-OECD countries). The expected increase in coal usage helps explain why greenhouse gas emissions are forecast to continue rising.

Renewable biofuels, by contrast, are forecast to still make a very small contribution to overall road transport fuel by 2030. Cellulosic ethanol will be slow to be commercialized, and the contribution to fuel supplies by 2030 is expected to be small. Concerns about negative externalities will grow, and the impact of biofuel production on water supplies will be hotly debated.

What a strange world we live in! I follow the TOD and read books about energy and climate simply to help my family make practical decisions for the future. One thing I know for certain: a shortage of energy supply will profoundly affect our daily lives in a very unpleasant manner. However, trying to make sense of this is very frustrating. From my reading, it seems that fossil fuels will peak sometime in the next 10 years and 2 degrees of global warming are very likely to occur in 20 years or so with some nasty consequences. And yet, we have this prestigious energy agency talking about 2030 in terms that contradict almost everything I’ve read about the subject. No wonder we cannot get any kind of consensus or take any kind of meaningful government action.

Consider reading Greer's "Long Descent" and Kunstler's "The world made by hand". I've started thinking how the Dakohta native Americans lived in the state where I grew up. Buffalo skins and underground like bunkers (exhibit at Mitchell S. Dak.) with stores of corn etc. And not so many of them as our current population. If we are lucky, maybe my grandson will be able to have a life that my grand father had in South Dakota. Leaving out the fact that the Indians had to be rounded up and put on reservations, they had a life style that only needed money for coal, sugar and coffee.

You have to remember that many of the views here on TOD are seen as 'fringe' by the majority. The consensus between 5% and 95% is going to be weighted very heavily towards the 95% view which is IEA BAU.

If something bad has a percentage probability of occuring -say breaking your leg while skiing or a house fire- you usually hedge against it/costs of it happening by buying insurance.

This is the way I am viewing the PO situation -I aim to 'hedge' against the possibility of it occuring...

Different people will have different ways and extent of doing this depending on:

a) the strenght of their belief in the probability

b) the extent of the impact

c) their view on the best 'hedge' mechanism

-So their hedge/insurance is going to vary from simply keeping up to date and hoping to spot early signs then "do something" to hunkering down with some of Chimps canned tucker in a forest hut and praying the four horsemen ride on by...

I suspect even the majority of people that read TOD fall in the former catagory -continuing BAU with some limited hedging (buying some Gold, some energy stocks perhaps, learning a bit about growing your own food, considering buying a PHEV, etc.)

Nick.

I guess I fall into your "former" category also - maybe a bit more active. In the seventies we were building a cabin in the north woods and elected to use some passive solar ideas - worked well but lacked thermal mass. When we built a regular house about 15 years later we incorporated lots of southern exposure glazing and lots of therma mass. It's a great house and a real joy to have that sun stream in on cold January day. This was an idea that was gained from a group like this and it has not only paid off in monetary terms, but more importantly in having a really practical house that is fun to live in.

I also bicycle about 4,000 miles a year - mostly for fun with some of my other old retired buddies. However, if there were gas shortages, I could do 80% of my daily transportation on a bike.

I find the TOD to be a place where this brand of critical thinking can lead to practical suggestions that may not only be a "hedge", as you suggest, but also bring a degree of fun and satisfaction to one's immediate life.

However, not all is joy and happiness like a sunny home and a cool bicycle, for me there is a dark side also: some of my 401K decisions have been the result of drinking to much Kool-Aid here. When investing in the energy sector, I tried to stick with solid, dividend paying energy stocks and ETFs - along with alternate energy ETFs. All of the above have been sliced in half or worse. Hopefully, they will come back - but that does not ease the pain of knowing what they could be bought for today. My mental stumbling block was, as you say, the "strenght of belief" that $40 oil would never return. I guess the only saving grace here is the mystery of how this whole story unfolds over the next few years - assuming one likes mystery stories.

I'd like to comment a bit on your investment troubles. Understand that a transition to real post peak pricing i.e ever shrinking economy and ever higher commodity prices is a big jump from where we are today.

Think about it every year everyone is going to have to allocate more and more of their income to just effectively staying alive. This is something that only really happens during economic collapse and war. But in our future this will be the normal economy. Sure renewable energy and all kinds of other schemes with various probabilities of success will be suggested and tried but at some point we will face the fact that for a long time we will be poorer every year.

Thats the near term big picture and its the only one you can be fairly sure of if you believe in peak oil.

It makes sense that the transition will be bumpy and the one thing you cannot do using fundamentals is time the market.

I know since I do my bet to do exactly that. However it does mean that a position that goes agianst the fundamentals is temporary i.e eventually the market will be forced if required to follow fundamentals. A great example is the stock market its been in lala land for decades. Technically economic growth in the US should have been minimal since the 1980's. However oil is consumed every day its not stored for long. So there are real physical limits on how long oil prices will not fall back to fundamentals which simply means that oil sells for more than it costs to produce and demand exists for oil at that price.

Now I will tell you what I see right now for the market as best I can. Oil has a very high probability of hitting 30 a barrel over the next few weeks and it still has a high probability of hitting 160 by the end of the year. There is a chance that the 160 target may move out to Feb or March it really just depends on when oil really bottoms out.

But I will say my fundamental analysis with everything I can put together points toward a breathtaking move soon.

Now you can try and trade on that potential volatility if you want but good luck.

The reason is the only way oil can go to 200 or more a barrel is simply if no one believes the move is long term.

That may sound weird but markets are actually fantastic computers. For the market to make the move it needs to make to transition society into the real post peak spiral it has to literally fake out all the participants.

This means it has to tell a whopper of a lie once everyone except a few fringe fanatics believe the lie then the market will move. If that means going to 30 so it can go to 200 then thats what it will do.

Underlying all of this is in my opinion the fact that most of the remaining oil to be extracted actually has a real negative EROEI. High prices resulted in less energy making it out of the oil industry not more. Projects like the tar sands where consuming more then they where producing for example. The only way out was for the energy industry to stop spending money on projects which where net negative. This means in had to begin shrinking.

A way to think about this is that the rest of the economy was the real driver of energy use and once the energy industry began consuming more then it was producing the rest of the economy had no choice but to force the energy industry to shrink since it was no longer increasing the net available energy. The pie is now shrinking but the energy industry must take less and less of the pie if you will.

The way this could happen or this signal become transmitted is practically infinite. I actually expected that the route would be the energy industry would be nationalized and stripped of its profits and the exporters forced to deal with the governments of the importing countries. I.e no free market for oil. I'm pretty sure Nate Hagens also expects this to happen and it may very well eventually happen.

If you recall the obscene profits of the energy companies brought this possibility up. But whats important is that fundamentals require the energy industry to stop growing. It says nothing about the route this takes. In the post peak world the price signal needs to maximize the amount of energy used by the rest of the economy outside the energy industry. Generally this means starving the energy industry even if it means some marginal barrels will not be extracted.

The path it actually takes is pure guesswork but the oil industry itself had to begin shrinking as we entered the post peak regime. Think of it like this you have a land initially full of trees and you have logged most of them. At first you employed 1000 loggers but eventually as you get to the bottom you have no choice but to fire some of them you simply don't need them. And yes you may end up leaving a few trees but tough.

The fact that the market decided to take the route of a price crash is interesting and not unlike what happened when the US oil industry became unsustainable post US peak so it as precedent.

But this is what fundamentals are telling me. This price event is very temporary and its simply the route the market took to force the oil industry to shrink.

Once we transition then I suspect we won't see this approach used all that much i.e I suspect we won't see a crashing price used to maximize the amount of energy used by the non-energy industry. I suspect we will see what we though would happen in the first place which is more and more of the energy market socialized. Exactly what happens probably depends on if the energy industry took the hint and will produce the most oil it can for the lowest price it can. If this means it effectively does zero reinvestment fine. Its a balance but you can be sure the moment the Energy industry tries to grow in the future this growth will be smashed somehow.

"However, not all is joy and happiness like a sunny home and a cool bicycle, for me there is a dark side also: some of my 401K decisions have been the result of drinking to much Kool-Aid here. When investing in the energy sector, I tried to stick with solid, dividend paying energy stocks and ETFs - along with alternate energy ETFs. All of the above have been sliced in half or worse. Hopefully, they will come back - but that does not ease the pain of knowing what they could be bought for today. My mental stumbling block was, as you say, the "strenght of belief" that $40 oil would never return."

You need to use BOTH fundamental analysis (belief?) AND technical analysis to trade?

Fundamentally you believed that oil would continue to stay high...but technical timing would have gotten you out in order to save some of your gains.

Buy and hold is a kind of trading...where you simply....don't have an exit plan? But all in life is CYCLICAL?

Many share your pain for sure?

Right now energy is one of the sectors showing good relative strength...so it will be back.

The stock market has fallen a lot. Have your stocks fallen farther?

Using fundamentals at all to try and time market trades makes technical analysis look like a hard science.

The one thing fundamentals cannot do well is tell you time. You can get close on volumes the shape of the curve trends etc but the absolute time is 100% hidden. Thats because of the math behind the problem.

In my opinion using fundamentals to predict time is not just a black art its shear magic. I know I try to do it.

They only way you can get it right is if you guess right on the hidden variables.

In my case I believe I'm 100% right that the Saudi surges this summer consisted of stored light Arab grades and not real oil this played a large role in smashing the oil price.

But thats not information you can get from brute force public fundamental information you have to piece it together from a myriad of sources and its the key to future oil prices.

Like I said I'd not even call it art at best its at the level of some sort of crime investigation and your trying to piece together the truth with fragments of information of dubious quality.

This single most important piece of information for me for example was the lack of asphalt from Saudi Arabia.

Like a single hair in a crime scene this was the key piece of info.

Saudi Arabia was redirecting light oil to export or storage and drawing down its strategic finished product supplies.

Edited bad year for link:

Very interesting. I'm wondering whether the cost comparisons for, say, wind versus concentrated solar are comparisons of installed cost or operating cost over time. It seems as though the tendency is to headline the installation costs and ignore the maintenance and operating expenses and the service life.

Solar hot water heating might as well just be a mandatory requirement on any new construction, with some sort of tax incentive to do retrofits. This is a nice labor intensive employment scheme; maybe GM et al could make panels and tanks - water tanks, that is.

Making predictions for next year is very difficult. Let alone 20 years from now.

It seems that the economic predictions made just a few short months ago do not hold anymore.

How then can anyone predict what the world will look like in 20 years?

World will have to change a lot before any predictions made that far out will have any significance.

At the very least there should be some margins of error reported for far out predictions.

You can't, and you're spot on, it's one of the things the IEA doesn't get. Don't ask for a full sensitivity analysis from the IEA, such rigorous scientific methods are beyond them. The problem is, if the IEA did sensitivity analysis, they could not make any scenarios and would realise the future is extremely uncertain. So they do highly limited sensitivity analysis, on only one or two variables, so they can jump to conclusions. The IEA has radically altered their predictions/scenarios/projections from a few years ago as they couldn't predict even short term development in energy markets. The 2030 scenario is a good laugh at best. I wouldn't be surprised if they'll radically change their 'business as usual' scenarios next year and this prediction will again be way off.

Levelised cost of electricity estimates are also highly dubious; again no sensitivity analysis whatsoever. Already the cost vary greatly with geography even today. Concentrating solar? Amateuristic nomenclature.

We cannot predict the future with any reasonable accuracy or credibility. However, we can help invent the future. The IEA should put their energy into how best to do that, rather than these highly unusual 'business as usual' scenarios.

I found the following IEA comment rather odd "Energy storage is rarely the cheapest way of dealing with variability of wind and solar power"; I wonder what they believe the cheapest way is?

Burning natural gas.

DaveMart say's burning NG. I say, demand management :turning off/down low value-added-per KWhr uses when the power isn't available.

I was simply saying that the low cost alternative referred to in the report will be burning natural gas, and that is what is used at the moment instead of storage, in large part, although it is supplemented somewhat by pumped storage and so on, and extensively in some countries such as Sweden by hydropower.

Ugo Bardi has informed us that in Italy usage per house is limited to 3kw at any one time, and in practice around 2kw.

Your both right, of course, though it seems natural gas generation is the most widely used trough-filler at the moment where hydro isn't available. I'm a major supporter of demand side management, energy storage, renewables, etc as a part of a national smart grid infrastructure upgrade.

Dave,

It seems to trouble people to think that NG would be backing up renewable energy. Even now many NG peak plants are only used at <10% capacity, so we may have a situation with expanding NG peak capacity but less NG being used for both heating and electricity generation. Some coal fired electricity rather than being retired may also be kept in reserve as back-up for example for peak summer demand.

Any realistic transition roadmap would read just so. For example, in the US Southeast, little renewable energy is available in the summer when A/C is running flat out, so while some renewable can be shipped in, coal plants would likely be needed unless supplanted by nuclear.

Of course there is: plenty of sunshine.

Especially during noon peak hours this may produce plenty of photovoltaic electricity. Or the solar heat may be converted directly to cold for air conditioning using sorption technology.

The problem is not the technology - nor the economical viability as soon as prices went down due to mass production. The problem is the same that the IEA is complaining about oil production: lacking investment.

Of course there is: plenty of sunshine.

Especially during noon peak hours this may produce plenty of photovoltaic electricity. Or the solar heat may be converted directly to cold for air conditioning using sorption technology.

The problem is not the technology - nor the economical viability as soon as prices went down due to mass production. The problem is the same that the IEA is complaining about oil production: lacking investment.

Biogas?

For places that have summer peaking, the cheapest way to deal with solar power variability is to ignore it. It works in your favor. For solar power <10% total power.

Places with winter peaking are not good solar sites but government subsidies can distort the market.

It says dealing with..

and potentially that could be one of the following or even other options

1) Direct storage in some energy storage system such as pumped hydro or compressed air

2) Production of replacement power if there is a shortfall using such things as Natural Gass

3) Transmission by cables over loooooong distances. Say the winds slacks down on location X, then often the wind will pick up on location Y wich is 500 km away. So it could be a matter of just sending power back and forth across electric cables so that areas with temporary surplus can supply energy to areas with temporary shortfalls.

I found the following IEA comment rather odd "Energy storage is rarely the cheapest way of dealing with variability of wind and solar power"; I wonder what they believe the cheapest way is?

I think they are saying it is cheaper to increase electricity generation from other means to make up for the wind/solar down times.

I think the answer is simple:

As far as I know the IEA they are not really the best experts in renewables nor in energy efficiency measures. Until recently they more or less dismissed renewables, now they are inertly switching to the learning mode. So you shouldn't take them too seriously when they talk about alternative solutions.

The report (or at least the summary here) did not have much to say about nuclear energy. I would like to see an essay here with the title "The Case Against The Liquid Flouride Thorium Reactor". The case for this technology is presented at a very interesting site: http://thoriumenergy.blogspot.com/ . It would be interesting to read a critique.

There is also no mention of resource potential. Solar exceeds wind and geothermal by two to three orders of magnitude, while thorium, although finite, is sufficient for many thousands of years. The economics of scale, mass production, and standard design will eventually work in favour of these options, but maybe not for a few decades.

The 160 trillion tonnes of it in the crust would last several million years if you're burning it as fast as possible without melting the planet. There just isn't any point to talking about fuel limits for thorium. Its like talking about running out of aluminium.

I realize that RR is being a little flippant, but no one in the semiconductor industry would have expected that PV would follow Moore's Law. ML is all about cost reduction through increasing miniaturization (the number of transistors per unit area would double every 18 months) and reducing PV costs has nothing to do with that. Any reduction in PV costs would have to come from the usual manufacturing cost reductions: moving up the learning curve, increased yields, higher volumes, lower cost materials, etc.

It is interesting that Moore's Law has finally run out of gas now that the transistors are so small the the insulating layer in the gate of a MOSFET is now only several atoms thick.

It is hard to reduce that much further...

We don't know if Moore's law has finally run out of gas. They say that every generation.

Yeah, but like the Malthus rule, the Shrinkage (or growth) is going to Hit The Fan (SHTF) some day real soon and it won't be a happy sunny day when it comes.

_________________________

"They" also said a Great Depression would never happen again because this time we really know what we're doing. We got everything under control.

Why are you so negative about the ability to produce a substantial volume of biofuels from cellulosic sources? I am more convinced than ever that the 36 billion gallon goal/requirement layed out in the Energy Independance and Security Act will be met by 2022. There are many different technologies being explored and some of them are very promising.

I saw from a previous piece that you made an assessment of Coskata, and while you could not dispute the claim that they could make ethanol cheaply, you seem to remain skeptical. It seems that the technology is viable, what remains uncertain though, is whether they can actually produce ethanol for $1 per gallon or not, and this determination will only be made once they build a demonstration plant.

I am really excited about another process which produces diesel fuel from cellulose, and they are now starting up a 20 million gallon per year plant. The plant's capital costs are only 1/4 (maybe 1/8) of that of other cellulosic plants, and the process does not use any water. It seems too good to be true, but it is happening.

Retsel

Remember the 'biofuels are causing food riots' meme?

It turns out that speculators were responsible for food prices, not biofuels.

ANALYSIS-Ethanol no longer seen as big driver of food price

Just repeating what I have read here on TOD MANY times;

There is no rene-wable

(just having a little fun with the word, kind of like the cat playing with the mouse before killing it)

way to capture, store, or distribute so called renewable energy.

The absurdity I see is that PV will be a much larger source of electricity than CSP even though PV is more expensive. CSP has a big cost advantage when it comes to storage since all you need is a big insulated tank full of cheap material.

CSP is really only do-able in the desert Southwest US as you need unobstructed sunlight while you can get a fair amount of PV anywhere in the US.

PV works even on partly cloudy days.

http://www.eia.doe.gov/cneaf/solar.renewables/ilands/fig12.html

Amorphous silicon and thin film technologies do even better than crystalline silicon in overcast conditions, although of course a certain amount of light is still blocked out.

The World (technology) is moving Way Too Fast to put too much store (or money) in "studies" like this.

They're mildly interesting, but Not investable.

PV's form gives it a notable advantage over CSP, while I'm sure both will and should grow significantly. But PV has no moving parts and requires essentially no ongoing labor aside from the periodic washdown that could be done by a window washer in terms of required skills.

I think those are actually enormous advantages.

Still, How much is going to be invested in either probably won't become clear until we've solidly seen that oil is truly post-peak and our various societies start to see how few substitutes we really have available to us..

Oh, yeah.. the other 'form' advantage is that it's Flat, Weatherproof and UV-tropic (Loves sunlight..), so it could be and sometimes is a substitute roofing material as well as a power-supply. Simplicity in all these ways makes it a very useful item with a foolishly short instruction manual.

RR - a couple of comments:

PVs: I suspect that most people will eventually come around to my conclusion - it is never (during my lifetime, at least) going to be economically feasible or cost-effective for me to install sufficient PV capacity on my rooftop to enable me to power everything I have today (BAU). What I have concluded, though, is that it might be feasible to eventually install some PV capacity in an incremental fashion,using it just to power the highest priority devices (e.g.: furnace and water heater electronics, refrigerators & frezers). This won't necessarilly be a money saver, but it will reduce our vulnerability as grid supply becomes more unreliable, especially if an investment in battery storage is included. I suspect that this issue of grid unreliability, rather than EROI or cost payback, will actually become the main driver for much residential PV deployment.

Solar thermal: You favorably mentioned solar water heating. Yes, that is one solar technology that does appear to make good sense for many people. I expect to see a massive deployment of solar water and space heating over the next couple of decades, simply because these will be more within the range of affordability for many people, they have better paybacks, and they might even be possible DIY projects (especially space heating). Since these have the potential to substitute for at least some heating oil & propane presently being consumed for domestic space and water heating, these do have the potential of actually reducing demand for oil and oil products to some extent.

Biofuels: The "forgotten" biomass resource that I keep having to remind people about is biogas (methane). This is an established, proven technology, already widely deployed worldwide. There must be a huge amount of agricultural and municipal wastes that could become feedstocks for anaerobic generators, resulting in a very much needed renewable replacement for fossil NG. This might have an impact on "all liquids" petroleum supply as well, supposing that GTL schemes are deployed, or if gas is substituted for some liquids. Biogas development also have the highly desirable effect of reducing the methane - a very potent GHG - being released into the atmosphere. This alone should be sufficient reason to make biogas development as top global priority. More attention should be given in this direction.

You've arbitrarily discounted optical rectenna solar->electrical. Just google it. Only holdup at present is figuring out how to make the rectifier diodes fast enough (eg. small enough). Should be a Manhattan project, NOW.

Once that gets figured out, you can expect 92% efficient solar cells fabricated in plastic sheets with a few grams of carbon nanotube antenae and a few grams of silicon/etc. diode and some conductor material being automatically built into every building cladding material sold, automatically, at no cost. Your only decision will be how much inverter to buy, and how much solar generation to simply leave shorted out.

You then arrange with the smart grid to ship the generated power from your home to charge your grid-wise EV car at work during the day, and at night the car in your garage powers your home and supplies excess avalable, at market price, to your neighbours who's home may have no auto at home at the moment.

First thing I got when I googled it was an NREL report from 2002 stating that they didnt' even reach 1% conversion efficiency on their experiments.. They suggested lots of thingst that could be improved.. but to me it sounded like this technology was very early.

Do you know about the state of the art of optical rectennas research?

Infrared nano-antennas. Don't bother with nanotubes, just use conducting metal (silver,gold,copper,aluminum)

https://inlportal.inl.gov/portal/server.pt?open=514&objID=1269&mode=2&fe...

The trick remains conversion to useable frequencies. The tech is massively promising, considering they could be very cheap and applicable to the brunt of thermal sources. Vehicles, ships, planes, thermal powerplants, efficient thermal storage. Potentially world changing, but it's a bit early in development still.

WNC,

the model whereby people put solar on their rooftops is not the most cost effective way of doing things, except for residential solar thermal.

Much better to put them on the ground, in 2-10MW units so that installation and maintenance are both easy.

Power would not need transmitting a long way, and would not even need stepping down.

Nanosolar support this approach and are building their first project:

http://www.nanosolar.com/pr11.htm

http://www.nanosolar.com/blog3/?p=11

For areas with reasonable sunshine then this should be an economic way of providing daytime power.

By 2015 or so then this should be very economic, and it is getting close now.

What I find strange is that many seem determined to do things the hard way.

For baseload if you don't want to destroy West Virginia and emit huge amounts of CO2 and pollutants, then nuclear power in just the same number of sites that the US has today but with modern sized reactors would provide plenty of power.

In some areas with a good geological resource geothermal may do nicely for baseload.

For winter peaking wind should do fine, as in the cold north it is at it's maximum then.

Biogas is way more efficient than ethanol, and can help out in a lot of places.

If everything is just used where it is most effective then most of the problems disappear.

Decent building standards and appliance standards which are realistic for the climate they are in, together with the encouragement of air source heat pumps, rail and EV cars can take care of the rest.

You are right that rooftop PV is not all that efficient or cost effective. As I said in my original post, I am looking at this more from a grid reliability perspective. Our local service is already not all that reliable; between storms passing through and dropping tree branches on lines, transformers blowing, and other causes, we do tend to lose power quite frequently around here. When Ivan passed through in 2004 we were without power for several days. This is during the good times, when the power company has money in the bank, the banks are operating, so are manufacturers, and so are truckers to deliver parts. I don't expect the grid to fail forever anytime soon, but it does appear quite likely that the outages might become both more frequent and of longer duration. Thus, I want to eventually get myself set up with at least a few PV panels, some batteries, and control circuitry so that I can power at least a few devices even if the grid is down for a week or more. Having enough self-generated power to keep a frezer running when one's neighbors have no power at all can be a big deal.

I agree that for off grid use solar has it's points.

Another alternative if you have the space and are in an area with good wind resources is a wind turbine.

I was moderately impressed with the 'windspire' design, which although it is horrendously expensive for the actual power per year you are likely to get out, at least they seem to be honestly telling you as opposed to trying to bamboozle their customers:

http://mariahpower.com/test_data.html

Of course, what this is telling us is that unless you live on the Cape of Good Hope or the surface of Saturn, your $5000 1.2 kw installation is likely to generate less than 800kwh/year:

http://www.awea.org/faq/usresource.html

This is for sea level though - if it were I, I would try to get the thing mounted on an additional pole, so to get above some of the surface effect which hits wind power.

It's not cheap, but might be better than solar in your area.

Another alternative might be to have a go at building your own turbine from scrap, if you are handy:

http://www.treehugger.com/files/2008/08/cheap-diy-wind-turbine.php

And:

http://www.bullnet.co.uk/shops/test/wind.htm

(Bottom item)

You won't get much power, but then again it won't cost much....

EDIT: Being an inveterate bodger, I've been noodling this.

There are shroud designs for windturbines, but the expense of building them doesn't work out for the big ones.

Looking at the windspire design though, it looks idea to build a shroud for, as it is close to the ground and you would not be suspending a large weight high up.

It would have to be pretty robust, and a way would have to be figured out to alter it according to the direction of the wind, but a circular rail should do much of the job and some kind of rotor should move it to the right position.

My mathematics aren't good enough to work out how big a shroud would produce what effect, but suppose from the windspire link that you normally got a 7mph average wind speed, if you could build that up to 14mph you would increase the 500kwh/year to around 2800kwh/year.

As a pure guess, increasing the effective area to 3 times the original might produce this sort of increase.

The point is the shroud ought to be well within DIY capabilities, although the rotor to get the direction right might need a bit of doing.

The KISS way of doing this in an area with reasonably constant wind direction would be to build a brick wall and put the turbine in a gap in it - I'd put a lip on the top of the wall to keep the air going sideways rather than up.

You'll need battery back-up anyway so occasionally missing out when the wind shifts direction would be OK as long as you up the average wind speed significantly.

The other side of the wall would be a good place for some plants which like sheltered conditions.

WNC Observer -

There already is a fair amount of biogas being generated from i) the anaerobic digestion of sludge from municipal sewage treatment plants and large livestock operations, and ii) municipal landfills. It certainly makes sense where you already have a readily biodegradable waste at hand and need to reduce its volume and render it more stable.

However, one thing to keep in mind is that most anaerobic digesters typically convert no more than roughly 60 to 70% of the biodegradable organic matter to biogas. The remaining residue is a mixture of solid and soluble matter that must be disposed of. If one is in or near an agricultural area, this can be used as fertilizer, but it has a relatively weak nutrient content compared to synthetic fertilizers, and thus cannot be economically utilized too far from the point of origin.

Another consideration is that anaerobic digesters must be kept warm (80 to 120 degrees F) if they are to be operated at a high rate. As such, many anaerobic digesters at sewage treatment plants in cold climates wind up using a significant fraction of the biogas generated just to keep the digesters warm, thus producing not a whole lot of net energy.

The economics of biogas generation become quite unfavorable once one tries to get beyond these limited waste disposal applications and actually have to secure organic feedstock for the digesters. (Cellulosic material generally does not undergo anaerobic digestion very well.)

In summary, I would say that almost every livestock operation above a certain size should digest its waste to produce biogas, most of which would be used for onsite energy needs (thus displacing fossil fuel). A large fraction of the larger municipal sewage treatment plants already practice sludge digestion. Many of the larger municipal landfills already collect landfill gas. So, while there is certainly room for expanding these applications, I don't see it as being a potential major new source of energy.

The Germans appear to be more hopeful for it's potential:

http://www.biomassmagazine.com/article.jsp?article_id=1156&q=&page=all

See also:

http://www.renewableenergyworld.com/rea/news/story?id=53075

They reckon they can get around 20% of their natural gas supplies from biogas by 2020.

I had hoped that methane could be made thermochemically from biomass via the syngas (CO, H2 mixtures)--> catalytic methanation route. Gasification approaches include airless retorting, molten metal baths and plasma torches. So far even large plant shows low net energy giving little hope of it being localised.

It would be great to have a universal fuel gas with a heating value if I recall of at least 20 MJ/m3 at 1 bar. If it was mainly methane but low on CO2 etc it could be switched with natgas and biogas for all kinds of applications such as automotive, CHP and so on.

They use biogas reactor in Vietnam, even on tiny farms (a dozen pigs and a buffalo). Its simply a brick or polyethylene structure, which costs less than $US100 (farmers in Vietnam are not very rich): http://www.mekarn.org/procbiod/chinh.htm

The farmers collect the pig manure, place it in the reactor and then use the gas for cooking/heating. What's left in the reactors is used on fields/fish ponds.

It works well, because most farms in Vietnam are mixed (a bit of rice, a bit of vegetables, a few pigs and chickens, sometimes buffaloes), so the farmers can fertilize their own fields, so there isn't any transportation cost.

The main incentive is to use less wood or fossil fuels for the farmer's needs, as deforestation is a big problem, and fossil fuels are expensive. In less than in 4 years, the bioreactor is paid for.

Vietnam is not really a cold country, so I don't think that they have to heat them. Just to say that you can have biogas on small farms. Not sure if there are any small farms left in North America.

After your PV powers your furnace, water heater, refrigerator, and freezer, what's left besides lights?:)

(Sorry, could not resist;)

Are the projections for coal usage based on anything other than projected demand? On what basis is the size of the coal reource established? Does the report contain any comments about the energy quality of the remaining resource?

thanks to RR for the post and for any additional information. If anyone else has the report and can answer these questions, please do.

To get a take on the plausibility of these numbers I assume the 2006 energy mix was 95% fossil 5% renewable. The report predicts 80%:20% for 2030. If total energy use is rounded to billions of tonnes of oil equivalent we have

2006 11.7 btoe = 11.1 dirty + 0.6 clean

2030 17.0 btoe = 13.6 dirty + 3.4 clean

giving Δdirty = 2.5 btoe, Δclean = 2.9 btoe. Thus renewables increase on par with fossil energy, not actually displacing it. Other figures suggest a 60% increase in CO2 emissions yet as we speak bureaucrats are talking of cuts of the order of 40% for this period.

I think we will be mining some fairly crappy sort of coal by 2030 to make this amount. The tar sands regions will look like a giant moon crater. On the other hand the renewables list some pie-in-the-sky ideas that may never happen. I suggest that both energy sources may be less than predicted ie we are heading to a fairly major powerdown like it or not.

Coal quality varies with where it is being mined, and how much it is cleaned before being used. Cleaning coal has, however, a different meaning in the trade than getting rid of the carbon dioxide. Generally it means the separation of the coal from shale and other rock that may have been interlayered with the coal when it was formed. Some European countries have already used up all their high quality coal, and if they had to go back to much of a coal based economy would be reduced to the poor quality stuff you refer to. Other countries still have a fair resource size that will still be available at higher quality in this time frame. It all depends on what the price might be. Remember that one of the reasons that there are a fair number of Chinese in Botswana is that they have very large, sensibly untapped, coal deposits.

Oh, and in regard to the "Moon crater" in Alberta, when you take the oil from the sand the volume of the sand doesn't really change that much and ends up being put back in the hole (albeit there is a time lapse while the mine is operating there). From what I have seen of the environmental professionalism of the Canadian and Albertan authorities I suspect that the companies will be required to return the sites to a more natural setting when they are done.

Can copies of the IEA reports from 1986-1993 be referenced and checked for any accuracy ?

Online they seem to go back to 1994

http://www.worldenergyoutlook.org/older.asp

http://www.iea.org/textbase/nppdf/free/1990/weo1994.pdf

the 1994 reference case is based on $17/barrel oil rising to $28 in 2005 and then remaining flat.

This was not a bad scenario up until the beginning of 2005

http://en.wikipedia.org/wiki/Oil_price_increases_of_2004-2006

http://en.wikipedia.org/wiki/Image:Oil_price_chronology-june2007.gif

China expands at 7.9% per year GDP until 2010. China performed better.

Page 42 had the world oil supply chart

page 251, 257 has electricity generation by source

The actual experience

http://www.investis.com/bp_acc_ia/stat_review_06/htdocs/reports/report_1...

Nuclear went from 495 MTOE in 1994 up to 635 MTOE.

Some of the more recent world outlook reports 2001 etc... seem to be more inaccurate for oil projections because of greater optimism prior 2002-2006.

Certain projections are easier because of the long lead time to build things or to change demographic and other trends.

The World Outlook seems to be how long will current identified trends and imagined mainstream scenarios hold. While they do then these are the likely range of results.

The IEA is a political agency, not an independent agency It is funded by the oil producing nations. IEA's mission is to manipulate public opinion toward believing that all is well.

Here is what an independent agency says about alternatives. The Energy Watch Group (funded by the German Parliament) concludes in a current report titled: “Peak Oil Could Trigger Meltdown of Society:”

http://www.globaliamagazine.com/?id=482

Cheers,

Cliff Wirth

Cliff,

Going to your link, it,s not clear what you mean by "dramatically".

"Production will start to decline at a rate of several percent per year. By 2020, and even more by 2030, global oil supply will be dramatically lower."

This could be a 50% decline or do you mean even more by 2030?. The authors then go on to conclude:

"This will create a supply gap which can hardly be closed by growing contributions from other fossil, nuclear or alternative energy sources in this time frame."

Since oil accounts for 35% of world energy, replacing half would require additional 18% coming from NG, coal, nuclear and renewable sources. Since many governments are planing to generate 20% of energy from renewable sources by 2020 replacing half or more oil use by 2030 doesn't seem an impossible objective, especially if conservation, and the 1.3% gain in energy efficiency that OECD countries have had in last 40 years continues for the next 20.

Replacing most car and light trucks with PHEV and EV vehicles would give us a 50% saving in oil use.

We are not talking about replacing all FF's, just some of the oil.

Hi Neil1947,

The data you request are available in the previous Energy Watch Group study, which you should be familiar with, as it is standard reading in the area of declining oil production:

http://www.energywatchgroup.org/Oil-report.32+M5d637b1e38d.0.html

And similar studies have been posted on TOD in recent days:

http://www.theoildrum.com/node/4792

You wrote:

What governments have announced about subsidizing alternatives is not what they will be able to do. The current economic credit crunch shows the reality of what happens to energy projects when credit is tight >> governments and industry cut back on energy production:

http://www.theoildrum.com/node/4805

Long before 2020, governments will be using all of their meager available revenues (due to declining incomes and declining income taxes; declining sales and declining sales taxes [including gasoline taxes]; and declining property values and declining property taxes) in order to subsidize:

(1) food, (2) oil, natural gas, and tar sands production (3) home heating oil, natural gas, and electric power so people don't freeze to death in their homes, (4) unemployment pay checks, and (5) highway maintenance.

The impacts of Peak Oil are here, we are living in a different environment.

The Hirsch Report concludes:

http://www.netl.doe.gov/publications/others/pdf/Oil_Peaking_NETL.pdf

But the Peak is 2006 to 2010, according to most independent oil production studies.

With the assistance of a panel of 13 energy scientists of the National Academy of Sciences, the U.S. Government Accountability Office (GAO) recently examined the issue of declining oil production in “Crude Oil: Uncertainty about the Future Oil Supply Makes it Important to Develop a Strategy for Addressing a Peak and Decline in Oil Production” (2007). This study concludes:

http://www.gao.gov/products/GAO-07-283

Finally, alternatives provide electric power, which is not what we need: liquid fuels for tractors/combines, heavy trucks, trains, and ships and oil and natural gas for home heating.

And a longer explanation is available here: http://www.theoildrum.com/node/4805#comment-439802

Regards,

Cliff Wirth

Cliff,

Please read the links you provide.

For example the Energy Watch Outlook for renewable energy study is projecting 17-29% of the the energy demand based on IEA's 2006 projected demand. This study excludes increases in today's largest renewable energy, hydro electricity because they did not have sufficient data.

The link to projected oil and NG liquids is showing a possible decline from 82 million barrels to 72 million by 2020.

(http://www.theoildrum.com/node/4792)

A 12% decline in oil is challenging, but in today's environment not dramatic, considering that most renewable energy sources are generating electricity which is used x3-4 times more efficiently than oil, and oil accounts for 35% of energy use.

Doubling the fuel efficiency of cars and light trucks is probably going to give >20% decline in oil use. Replacing all oil for heating with NG, or electric heat pumps, is also a very realistic objective(if oil demand and prices don't decline).

Your world view doesn't add up; if we have a prolonged depression we won't need all of a declining oil supply, if we have a recession and then moderate growth we will have the means to replace declines in oil with renewable energy as fast as they occur.

(I am still waiting for your best estimate of how much oil is required to keep the 250,000 km high voltage US electricity grid functioning.)

Hi Neil,

The Land Export Model, which has been explained often on TOD, means that the US will experience a far greater decline in oil supplies than you have indicated:

http://www.theoildrum.com/node/2767

As I discussed above, in times of tight credit the capital is simply not there for the development of renewables.

More important, as the recession deepens into a major depression, we will have spare electric power. Plazas, commercial centers, factories and offices are closing as the economy collapses. It makes no sense that we waste oil/liquid fuels to manufacture devices to get electric power.

There will be no major change over to more fuel efficient cars. When people are unemployed and the trade in value of the old gas guzzler is very low, the sales of new cars will plummet.

Most important, conservation measures will not help much. As soon as global oil production begins to decline, demand will always be higher supply, as it is today. Economic development in China, India, the Middle East and elsewhere means that demand will always exceed supply.

No matter how bad the economy, oil will be used in the U.S. for heating, food production, and transportation, at least until total collapse.

Only if there were massive conservation across the globe would conservation help. But even so, the further down the production slope we go, the higher relative demand will be.

So, terminal oil depletion would be delayed for some time under massive global conservation, but it is still terminal.

It would be wise to use the oil that we can still buy to focus on risk management, which is what the U.S. General Accountability Office, Energy Watch Group, and others seem to be suggesting.

Time marches on, and collapse draws closer everyday, inevitably and inexorably.

Cheers,

Cliff Wirth

Vanadium batteries research is falling victim to the credit crisis:

VRB Power Curtails Operations

batteries cost as much as a coal power plant but are needed

caes is stored power by compressed air

Nagoya, July 28, 2008 (Jiji Press) - Japan's NGK Insulators Ltd. <5333> said Monday that it will expand its annual production capacity for high-volume sodium-sulfur (NAS) batteries from 90 megawatts to 150 megawatts.

The company will spend 11.3 billion yen to build a new assembly plant in Komaki, Aichi Prefecture, aiming to start operations there in June 2010.

NAS batteries, which consist of sodium at the negative electrode and sulfur at the positive one, have about three times the energy density of existing lead storage batteries.

NGK Insulators jointly developed the NAS battery with Tokyo Electric Power Co. <9501>, and is the world's only manufacturer.

The NAS battery was originally created for storing off-peak power at night and discharging it in the daytime, in order to level off daily electricity loads.

Such batteries are increasingly in demand for the stable supply of new energies, such as wind-generated electricity and solar photovoltaic energy, both at home and abroad.

NGK Insulators plans to increase its annual sales of the battery from 13.3 billion yen in fiscal 2007 to 35 billion yen in fiscal 2010, company officials said.

1st UHV transmission line starts pilot run in December

(Zoomchina.com.cn, Dec 03, 2008) In the end of November of 2008, Southeast Shanxi-Nangyang-Jingmen 1,000 kv UHV transmission line project was basically completed and was conducting preliminary work for formal operation.

The world's politicians and citizens of the world have yet another IEA report that effectively causes paralysis. Our cup is half full and half empty at the same time. I wish there was a independent source of energy information that was peer reviewed by the best minds in the energy industry (many who contribute to this site); a source so respected that politicians and citizens would be able to see a clear vision of the future and put forth the enormous effort we immediately need.

Maybe I'll write Santa:(

Hey PriorityX,

That source is the National Academy of Sciences. The last time they were commissioned to do a comprehensive study of energy policy was in the 1970s.

This tells us much about out "leaders."

They don't even have the sense to keep an eye on the fuel gauge.

Geeeeeeeeeeeze.

To the romantic we are star dust, to the cynic we are nuclear waste.

A beautiful open cluster emerging from it's nursery. Which is it?

Thanks for the image. Here you see it:

There are certainly HUGE (undiscovered hypothetical) amounts of oil around us. So we really don't have to worry.

Just wait and see. All will be fine.

Maybe it is even time to ask why the IEA hasn't added a few gazillion barrels to their resource assessment from the ENF (Extraterrestrial New Frontier).

The CHP/biomass stuff is pretty exciting. Still, it's not the biggest way CHP can be used. I'm actually associated with a CHP company -- Recycled Energy Development -- which turns manufacturers' waste heat into clean power. And there's plenty of opportunity on that front. EPA and DOE estimates suggest that more CHP could cut greenhouse emissions by 20%, which is as much as if we pulled every car off the road. So let's look at it beyond biomass and potentially as a way of improving efficiency across the board.

I just got back from a trip to Central America where lower oil prices are greatly appreciated. In fact, the Costa Rica colon is actually appreciating against the greenback quite a bit. Peak tropical fruit? The roads are jam packed with traffic of course.

We had CNBC and Fox keeping us company most of the way with their sophomoric approach to resource economics. Don't worry too much. They are just cheerleaders for Cheney's famous "US lifestyle" which is not of course negotiable. Wasn't GW a cheerleader in a previous life? Oil consumption means making actual money NOW.

Anyway, lots of other people want a piece of that pie and cheerleaders are not analysts, more like are BAU "creationists". Like the IEA said in about half its latest report, if we need more oil it can simply be created. Better that such thinking only occupied half the report this year, I suppose. Everybody gets a prize. Perfect for the new PC DC.

I bought the recent Forbes energy edition to keep my dander up on the plane. Young Forbes is perhaps the anti-peak oil crowd's head cheerleader (is there an outfit?). Leader of the smug. Anyway, there's a decent piece about lithium including some quite even-handed discussion (I thought) about resource scarcity.

As far as TOD's mandate is concerned, the most interesting article by far is Forbes' cornucopian version of the ARAMCO story, quite a long fawning article complete with some stats for new fields, Ghawar choke/watering policies etc... all leading to the usual conclusion "What? Why should Forbes worry about any US energy policy when we have honest and true friends like the KSA and geniuses like Malcolm and GW in the red white and blue corner?" Cheney, I'm not too sure which corner he's really in...

Anyway, this piece would seem to be ideal material for a blast or two from some of the great critics at TOD. Maybe even from some of the less talented! Forbes even included a gratuitous slight against Matt Simmons - he's apparently a "gadfly" - along with the usual casual dismissal of all things peak. I don't have the web reference and Forbes no doubt charges for the privilege but I bet TOD could key a really good critique on what seemed to me a very slick puff piece on the USA's key partner in energy blindness.

Anyway, can TOD let fly a rebuttal if only to defend Matt Simmons' honour against the supercilious Mr. Malcolm and his cohorts? Matt deserves better and TOD has the proper mandate and skill sets. OK, I'd just like to see them get firmly thwacked for yellow journalism and hear TOD's take on how ARAMCO pulls its yarn to block the view. But, can they ever do a number on the energy market!

BTW, up-arrow inflation on TOD is increasing while the oil price is decreasing. I saw a +20 for the first time on my return. It's kind of interesting how that seems to track. Any stats?

The failure of the gas pipeline to Western Australia provoked a senate enquiry, down here. I listened to some of the debate which supported the tabled report from both sides of the parliament. Most noteable of the recommendations of the report was that Western Australia should move rapidly to a broadbased renewable energy future in order to obtain a secure inflation proofed energy supply. The enquiry found that renewable energy (solar) delivery would be very well matched to energy consumption patterns, failures would have only a minimal impact on the system, and the cost of the energy would stay stable over time. Gas would be better used to balance the system once it was fully developed as this would extend the life of the overall system many fold.

If developments like this are repeated around the world then "Peak Oil" may well become "Purch Oil". That is, oil consumption may well reduce to a level that balances supply over a reasonably long period, before the plunge finally becomes a reality, leaving the "are we there yet" Peak Oil question an open one for some time to come.

See my post above to Neil.

Hey Cliff, you're getting a little bit carried away there. I have been around for the last four crash cycles, and non of what you anticipate in your comment to Neil occurred. Even though this crash is somewhat deeper, the world population is larger, and the recovery forces are stronger. What you suggest is only possible if people actually disappear on mass. But they don't. Sitting at home watching TV waiting for the job market to rise again they are still using power, they are still driving their cars to and from the employment centres, they are still eating, drinking, consuming and making babies. Consumption will be down a little, but not a massive amount.

But more importantly, while those people are sitting at home waiting for the job phone to ring, they are imagining how much better it would be if their electricity was generated on their own roof. People are now keyed into the idea of solar power, keyed into the idea of fueling their vehicles from the wall socket in the garage for just a few bucks, and keyed into the idea of building a cleaner future. That is irreversible now.

Infinia ( www.infiniacorp.com ) have shown that practical electricity can be generated on every property with just a small amount of space, and Aptera ( www.aptera.com ) have shown that comfortable vehicles can be made from a third of the material for commuting at a fraction of the cost of running conventional vehicles. It will take fifty years, but you can count on an all electric future, with just a little bit of oil thrown in for smooth running. And on that last point try googling "liquid crystal lubricants".

I report on scientific and independent government agency studies. That is not exactly getting "carried away."

Your ideas here do not concur with these studies, and as the Hirsch and GAO reports indicate, Peak Oil is different from other crashes, as it will be permanent and ever-worsening.

Cheers,

Cliff Wirth

OK, if your focus is peak oil, I suggest that peak oil is just that. A "peak", not a brick wall. We have seen in recent weeks what a little global panic can achieve. Unprecedented global cooperation and money appearing from nowhere in huge quantities. An actual real decline in oil availabilty will have, I believe, a similar effect. Only it will be a much more drawn out affair as we are talking about a slow run down rather than a sudden stop of deliverable oil. Frankly I would rather that it was under way now. I have no stake in oil and I by far prefer the alternatives.

For many reasons that have been published at TOD, the curve is much steeper than just the projected oil produced.

Much of this is summarized here: http://www.theoildrum.com/node/4805#comment-439802