Why Oil Shortages May Cause Price Decreases, Rather than Increases

Posted by Gail the Actuary on May 18, 2009 - 10:15am

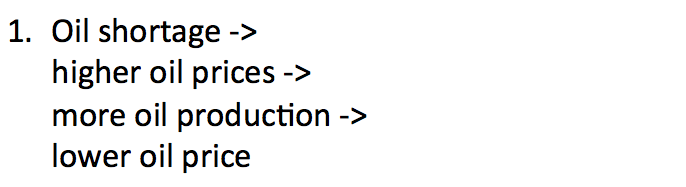

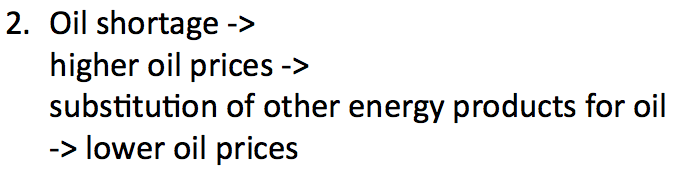

A lot of people think peak oil is no longer a problem because prices are no longer in the stratosphere. It seems to me that standard economic models start breaking down when production for a commodity like oil starts becoming difficult to expand and there are no good substitutes. We have been taught:

and

As long as production of oil can be expanded easily, relationship (1) holds. But once oil production can no longer be easily expanded, the relationship doesn't work. Relationship (2) would work, if there were a good, cheap, easily expanded substitute for oil, but there really isn't, so it doesn't hold either.

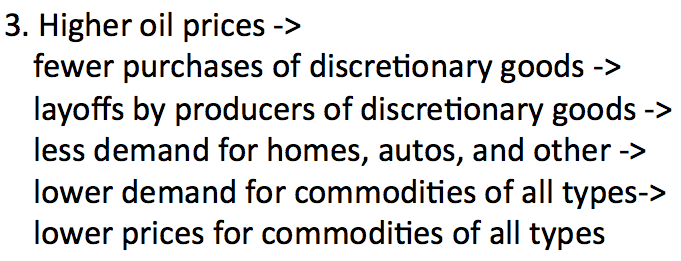

When these relationships don't hold, there are several other relationships that become more important. It seems to me that these relationships help explain our current price situation.

Once the price of oil started going up, one type of feedback loop looked like this:

Another looked like this:

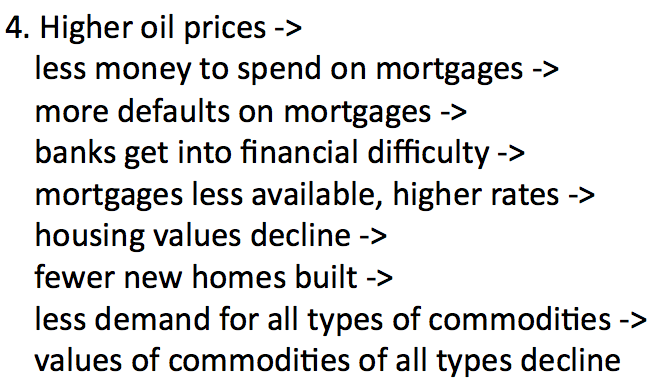

Steve from Virginia pointed out, through his analysis of the minutes of the Federal Reserve Open Market Committee, that there was also a feedback loop that looked like this:

All of these feedback loops led to reductions in demand for commodities of all types, including oil. With lower demand, prices dropped, not only for oil, but for natural gas, coal, uranium, and most metals.

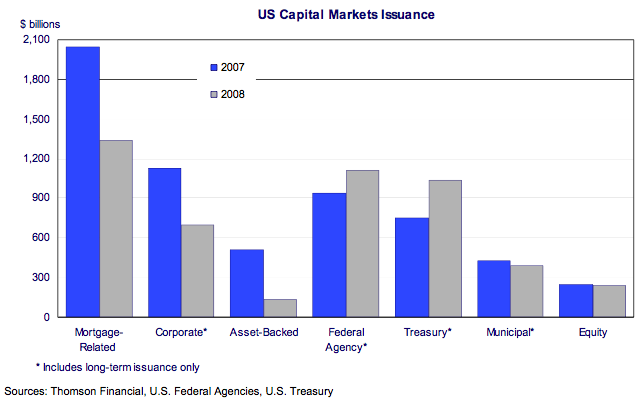

Feedback loops 4 and 5 led to damage to the lending system. One problem was that banks were less able to lend because of reduction in capital because of defaults and because of fear that new loans would default as well. Another was that structured securities became much more difficult to sell, because it became clear that the system was not set up to handle large numbers of defaults. These changes popped the "debt bubble".

As a result, the total amount of credit began to fall--not just bank issued debt, but credit from other sources as well:

Once the credit markets were damaged, there was a very significant impact on demand for oil, because credit is used at many points in building new products. Manufacturers often use credit to expand their factories; suppliers need credit to buy their raw materials; and purchasers of end products (like homes and automobiles) often use credit. A reduction in available credit could therefore result in a steep drop in demand.

It was not difficult to damage the capacity of credit markets, because the amount of debt had been expanding completely out of proportion to the amount of underlying assets (fed by cheap credit, aimed at keeping this expansion up, so no one would notice the lack of real growth). Also, credit markets needed economic growth in order for default rates to stay low. Once oil production flattened, default rates rose because of slower economic growth and higher oil prices. Without growth in oil production, economic growth couldn't continue, default rates rose, and the unwinding debt cycle took on a life of its own. The feedback loop looked something like this:

Note that with this feed-back loop, there is no longer a need for high oil prices to drive the credit unwind. The credit unwind is now self-reinforcing, and it seems to me that it is the driving force behind the current reduction in demand for oil and other commodities. The debt unwind has been hidden for a while now by all of the bailout activity, but will soon back from hiding, as it becomes impossible to cover up the extent of the continuing defaults. I expect the impact of the debt unwind on oil prices will continue to be generally negative for quite some time as the unwind continues.

Besides the debt unwind, there are other factors that can be expected to have an impact on the price of oil. One is how well the purchasing power of the dollar holds up. If the purchasing value of the dollar drops, the price of oil could rise, whether or not demand rises.

Availability of storage for oil is another factor that may affect oil prices in the future. Rune Lickvern wrote a post about the possibility of inadequate storage capacity suddenly causing a drop in oil prices.

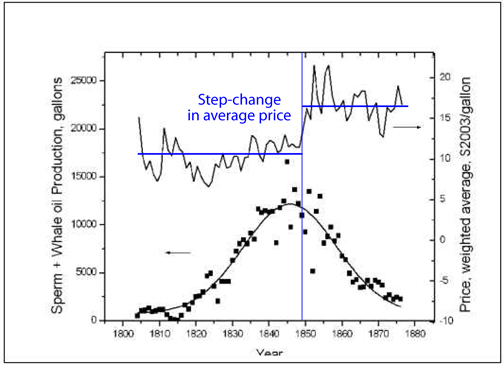

We cannot know precisely what path oil prices will take in the future, but one past example that is somewhat similar showed widely fluctuating prices. When whale oil (used for lamps) became scarce at the end of the 19th century, its prices fluctuated widely. The average price was higher than prior to the peak in production, but there was considerable variation:

Oil prices are likely to follow path that is somewhat different from those of whale oil, because the circumstances are different now (no available substitute, widespread economic impact). The whale oil model gives further evidence, though, that the price path isn't just upward. Other feedback loops besides those postulated by classical economists can also be important.

How has recent oil consumption fared compared with consumption of commodities of all other types? Seems that global oil use has not gone down as much as, say, timber or steel. Is it helpful to include oil with all commodities when anticipating the price impact of declining demand for new homes, cars, and other durable goods?

Edit: here's some numbers...Feb 2009 steel consumption down 44% from 2008; Brazil's timber exports down 22% to 66% March 2008 to 2009. Oil use, in contrast, appears to be flat.

Timber data: http://www.itto.int/en/mis_detail/

Steel data (pdf):

http://hq-web03.ita.doc.gov/License/Surge.nsf/webfiles/SteelMillDevelopments/$file/May09%20exec%20summ.pdf?openelement

First of all, thatks Gail for an interesting and informative article! There is a lot to discuss here, probably more than can be digested in a short comment.

Some commodities such as metals (gold, platinum, copper and palladium)and energy have increased while those such as lumber and out-of-fashion metals such as zinc have swooned. What does this indicate? Why doesn't zinc get any love?

There are several basic questions about the current state of the economy that are still controvercial, such as:

- Are we experiencing inflation or deflation?

- Will there be growth or more recession?

- Will energy prices go up or down?

- What energy price level causes damage to the overall economy ... and ...

- What energy price level causes changes in behavior?

Even after two years of contraction there is no consensus about whether there is a background of inflation or deflation. Increase in some commodieties prices indicates inflation as investors (who have all the money, now) seek to swap devalueing currencies for assets that hold value over time such as gold.

Ordinarily, real estate would fall into this 'inflation hedge' category - and the central banks both here and abroad would also like this to happen - but massive overbuilding and the consequent narrowing of real estate's particular usefulness by the development process leaves real estate with a lot more room to fall in relative price. By particular usefulness I mean that a bit of real estate turned into a strip mall can only be easily used as a strip mall, not as a factory or a wheat field, for instance. This being the case and the large increases worldwide in unemployment must be taken together as deflationary.

- Are we experiencing inflation or deflation? ANSWER; Both.

One thing that has changed is how commodities such as oil relate to the overall cost structure of the economy as a whole. Not that long ago, the issue of energy production was one of maintaining profitable price levels - of managing very large surpluses. The strategy was to hold capacity off the market as was done in Iraq and Saudi Arabia during the late 1980s and early 1990s so that the cheaper oil did not cut into (national) energy company profits. Understand that the economic infrastructure we inherit has been built with exceptionally cheap inputs. Cheap energy is just one item at the foundation of the productivity pyramid. These inputs included near- free water, $10 oil, $.03 kiloatt/hour electricity, cheap farmland to develop, and cheap highway and utility construction costs, cheap 'tools' such as cars and trucks and free air and rivers and streams to dump the waste into. That paradigm ended in the late 1990's and from that point no energy source was held off the market except for margnal percentages such as are taking place with OPEC producers cutting production slightly to iron out price fluctuations. What defines capacity is the overall rate of depletion relative to the the discovery and exploitation of large fields such as those in Central Asia and off the coasts of Brazil and Cuba (?). The $64 trillion question is whether the new fields can provide sufficient oil to offet depletion. This fundamental and the second derivative relationship to overall demand is now the factor which determines not just a few of the relative price levels within the world's economies but most and soon all the relative price levels.

The last ten years or so are therefor a period providing entirely new ground rules that governments, banks, consumers and investors, worldwide are currently only becoming dimly aware of.

- Will there be growth or more recession? ANSWER; a longer and deeper recession. This suggests lower commodity prices ... but ain't necessarily so!

Another way to look at this is that previous dramatic oil price increases have had exogenous causes that removed spare capacity from the market - the 1973 Yom Kippur war, the Iranian revolution in 1979, the Iran - Iraq war from 1980- 1988, the Iraqi invasion of Kuwait in 1991, hurricanes in the Gulf of Mexico in 2005 and last year - the situation after 1998 with steadily rising prices culminating with a large and painful 'spike' has largely an endogenous cause. Increasing demand along with natural depletion - rather than politics or weather - has in effect removed spare capacity. Neither finance nor inflation increased capacity. While the mechanics of constrained supply v. depletion and increased demand are no news here, the surprise is that this fundamental has been priced by the market beginning over ten years ago.

As such this represents a sea- change or even a tectonic change; one which places us 'users' of the modern world squarely in the middle of a process that started a long time ago. In other words, the Peak Oil phenomenon is not something that can be considered later. It has already begun and the economic fallout has also begun. Experts have said that the peak will only be seen from a perspective looking into the past. Look at the rear- view. The economic peak is there ... in 1998.

From here out, the foundation of all other value relationships must rest on the energy supply/demand fundamental. Exogenous price inputs have not disappeared, these will be added on top of the fundamental. All the differences between currencies and between interest rates and between convenience rates will be piled on top of the energy fundamental.

Price trends are not continuous. Rising interest rates - triggered by rising energy prices - caused a breakdown in finance in 2003-2005. Commodity prices along with oil decoupled from other asset prices such as real estate or bonds. Energy prices spiked because investors looking to 'park' cash or trying to offset credit losses flooded into 'can't miss' commodities across the board. When prices became unsustainable both at the cash level - because of recession and bottoming demand - as well as at the exchanges level - because of government threats to curb speculation - commodity prices collapsed. Now, energy prices have returned to the mark that existed more or less in line before the 2008 spike.

- Will energy prices go up or down? ANSWER; In the long term and relative to everyhing else, energy will become more costly.

If the government had allowed the financial sector to fail and set about to reconstruct a replacement sector (presumeably one without the defects and corruption of the current sector) energy prices would probably reflect very small demand - the country and perhaps most of the world would be in a very deep and serious recession. In such a scenario, it would be realistic to consider that most demand would not increase until the new finance structre was up and running and legacy debts and insolvencies cleared away by bankruptcy. This probably wouldn't have taken place before 2011. In such a scenario, a re-thinking of the exponential growth model would cause demand for crude - worldwide? - to moderate, keeping the fundamental supply vs. demand influence on relative prices under restraint.

This choice was not made by ANY government or finance sector and vast sums of liquidity have been shoveled at finance in an attempt to keep it afloat. While the original shock of deflationary collapse held prices low for a brief period (and Brad DeLong has a model that indicated a certain momentum oscillator effect taking place) the basic supply v. demand relationship has recovered its fundamental position at the bottom of the economic productivity pyramid. Partly, this is because the OPEC producers did indeed make marginal cuts in production to keep prices from falling further than $35/bbl.

The average yearly price of oil after 2003 has been over $42 a barrel with some fluctuation. This represents a 'stairstep' increase of almost 100%, from slightly over/under $21 a barrel for the period from 1986 - 2002 with very low prices ending in 1998 to early 1999 (see below).

(EIA data)

(Graph modified by me)

The 'support level' indicates prices overall trending upward from the lowest price in 1998-99. This 'trend line' was not broken even during the sharp commodity sell- off in 2008. Since neither finance nor governments (or central banks) have changed their approach to managing the world economy, nor has finance increased capacity ... there is nothing to alter the fundamental, bottom- of- the- pyramid relationship of supply versus demand. This suggests a fairly long- termed 'Bull Market' for crude.

A lot has changed since the beginning of 2007. Credit formation in the finance sector has shifted to credit formation directly by central banks. Since the crisis began in 2007 the various central banks have cut interest rates, injected trillions of dollars,yen, yuan and euros into finance in an effort to keep finance and world economies from out and out collapse. Clearly this effort has worked in that the markets still appear to function - in a zombie sort of way. Previously, credit was leveraged from bank deposits (in any currency into the same currency or into derivatives or securities and thence into other currencies) and amplified by velocity. (See the 'Quantity Theory of Money') This has changed with the crisis.

With the current difficulties in banking there is small increase in credit by fractional reserve mechanisms and velocity is constrained. A reason for small velocity and low credit creation is because there is little public participation - no 'Boom' to buy into and few valuable assets to swap back and forth. What little attempts to create some velocity in both equity and the energy markets is done by large institutions, trading is done with central bank credit. A consequence of this economic 'stimulus' is inflating (as in inflation) prices of stocks and oil ... this market constrained inflation is added to and amplifies the supply v. demand fundamental. Oil prices have gone up and so have prices at the pump.

Prices will likely continue to increase as long as the central banks keep printing money. The short term end of price increases will be when the high energy costs bankrupt enough businesses to trigger the next round of deleveraging and deflation. This in turn will constrain demand and oil prices will dive. After a bottoming out, the relentless fundamental will take hold again and the cycle will repeat. It will continue to repeat until everyone is clear on the fundamental relationship and steps are taken ... or until all businesses in the country have shut down.

- What energy price level causes damage to the overall economy ... and ...

- What energy price level causes changes in behavior? ANSWER; This remains to be seen but it probably isn't all that high.

What makes this final set of questions so hard to answer is that damage energy prices do to the economy lies at the economic margins rather than at more visible levels. People look at pump prices and say, "$2.30 a gallon, that's not so expensive!" Such a price may not effect individual consumers that much but similar price increases embedded at every step of the product supply chain amplify increases at other links. The cumulative effect makes products either unprofitable or unaffordable.

Loss of profits ->

Business failures ->

Increased unemployment ->

Cuts in consumer spending ...

Business profits are spent on petroleum. Petroleum prices shoulder aside investment needs. Speculative investment 'opportunities' are created to replace ordinary productive business rendered less- or unprofitable by increased input prices. That is, financial 'Home Runs' are sought to offest increasing unprofitablity elsewhere. The effests ricochet overseas. This is what is being seen currently despite massive stimulus and monetary easing; widespread business failures, high and increasing prices for some goods such as food, fertilizer and hardware, and large and widespread unemployment against a background of almost desperate financial speculation! Prices can decline over shorter terms because of deflationary episoces and temporary overcapacity ... but the long term trend appears to be UP.

Welcome to Peak Oil ... 1998!

Thanks for your ideas!

I think the effect will be continuing recession/depression, regardless of whether we have inflation or deflation.

It seems like there will be some type of change in the not too distant future that will suddenly make things worse--the temporary optimism will go away, and the fact that we cannot meet our promises will become more clear to our creditors. I don't think we can just extrapolate from where were are now.

Yes, the 'Powers That Be' have simply bought a little time ... with trillions of dollars.

Excuse me while I go outside and see if I can find some temporary optimism!

:)

Yes, nice work. We seem to have gotten two great articles for the price of one, here.

On your graph of the price of imported crude, what would you say the "economic peak" corresponds to? Is it mostly an accident of over production in the '90's? Or could that point represent peak available energy?

I was rummaging through the different peak oil websites a few months ago and came across an interveiw; I don't recall at the moment whether it was Matt Simmons or M. Hubbert ... it may have been Hubbert because he gave a lot of talks and presentations to energy company executives and engineers, particularly during the early 1970's. I recall the speaker was recollecting a conversation explaining the mechanism of peak oil to an executive; how the US oil production at the time was headed for a relentless and irreversable decline.

The executive declared this to be impossible! He pointed to the fact that the country was 'awash' in oil, that is was cheaper than it had ever been. There couldn't possibly be a decline in production. As Hubbert traveled the country - as Matt Simmons does now - explaining depletion and its effects, his listeners had never entertained the concept of general depletion. They were surprised, angry and in denial ... and these were energy company professionals!

Later on, the speaker, I actually believe it was Hubbert (I'll find it at some point) reflected that at the peak in production, oil would be most plentiful and prices would be lowest.

At that point I simply started looking at prices. The remarks made absolute, perfect sense. Conventionally, the measure of peak is a matter of physical production measured in barrels of liquid at either the wellhead, the shipping terminal or the refinery. The amounts are totaled and changes in physical production are measured against the 'Hubbert Curve'.

This is an excellent method to measure depletion. It has the benefit of removing production rates from the realm of conjecture and into that of data. It's hard to argue against physics. The 'bottom line' of peak production is rate of change; actual physical decline. A problem with measuring physical production is the demand dynamic is in the background. In the ambit of physical production, oil out of the ground will be used eventually. Demand doesn't effect production unless if declines to where it constrains that production - that is producers choose to leave oil in the ground because they cannot sell it. (NOTE: The opposite dynamic is also true!)

From the physical standpoint demand is static. A barrel produced will be consumed. Consumption makes use of all production. Storage relative to the production stream is small. Consumers can buy some oil and set it aside, but eventually all oil becomes atmospheric waste.

Market price measures the dynamic relationship of supply to consumption. The aim is to locate a change in trend, where the supply - demand dynamic changes from favoring the consumer to favoring the producer. In the market the intensity of demand is measurable. Consumption is auctioned. Marginal utility allows for consumers to bid prices higher than physical fundamentals might otherwise indicate. Markets calculate many sets of conditions. The price falls if the rate of consumption falls faster than the rate of supply, even if that rate is also falling. If the rate of production increases and exceeds the rate of consumption - even if the consumption rate is increasing - the price still falls. When the consumption rate rises faster than the rate of supply - even if the rate of supply is rising - the price rises. If supply declines and demand is steady or that rate falls slower than the decline of production, the price will also rise. The first set of conditions favors the consumer, the second set favors the producer.

Since every barrel of oil is bought and sold the price is an a accurate measure of the dynamic supply - demand relationship.

The rate of supply was very great and increasing relative to the (increasing) rate of consumption from 1985 until the late 1990's, During that period the the price declined. Afterwards, the rate of consumption increased faster than the rate of (increasing) production. Prices were bid higher. The 'inflection point' - where prices declined to the lowest point and then rose - was Economic Peak Oil, where supply was greatest relative to damand as measured in money within the marketplace. Prior to that point prices favored consumers, after that point prices favored producers.

The production rate exceeding the rate of consumption required a very low price to 'clear the market' Increased demand relative to increasing supply was reflected in steadily increasing prices. The price trend was exactly the same as if physical production declined!

Within the dynamic supply-demand relationship it does not matter if supply increases. Prices will increase if demand increases faster.

Many experts including Hubbert himself have stated that the real peak could only be determined long after the fact. As seen through the prism of price the largest supply relative to demand was at the end of 1998 until the first months of 1999. To my mind, this was 'peak oil'. From that point forward up until this minute the rate of consumption has outstripped to the rate of production allowing demand to bid up the price of relatively diminishing supply. The plentiful oil of 1998 and the cheap price of 25 cents a gallon of crude is likely never to be seen again. In this context, it doens't matter whether physical production increases of decreases; it's irrelevant. What matters is that consumption has unbalanced the pricing mechanism and tilted it in favor of production.

At the end of 2008 with prices plummeting and the overhang of 80 millions bpd of production overhanging the market, prior to any OPEC production cuts ... with the possible price of $5 a barrel looming over the horizon ... the price never fell below the longer termed trend line! The support level held; at $35 a barrel. Compared to prices of $11 a barrel ten years previous, the difference is a 3X increase! Now, prices have almost doubled again from that level.

A couple of things to consider ...

Peak Oil to the man in the street is a matter of price. The economic measure is more useful to people than is physical production. One person cannot grasp world fuel production, it's an abstract. Physical depletion is simply too big and too complex - and awful - to easily grasp. Even professionals have difficulties with the concept, as Hubbert and Simmons can both attest.

Consideration must be given to the state of production and demand. Both must be mature, that is supply and demand at high rates without distractions in the marketplace such as wars, embargoes or financial bubbles. Measuring supply v. demand by dollars in 1968 would have been pointless since US production was peaking and world demand was slight. During the period 1985 - 2002 there were few disruptions other than Saddam's adventure in Kuwait. both production and demand worldwide were mature and huge. Production levels were similar to those current; the interening years have not brought to light exponential increases in available oil. There are no new 'Super- giant' oil fields to replace those now producing in Saudi Arabia and Mexico.

Peak oil taking place in the past explains a lot of current problems and government strategies. Peak oil means basic, energy intensive manufacturing becomes less profitable over time. Better to send it to China and let them attempt to make use of it with cheaper labor ... or fail. Peak oil means that abstract speculation in financial securities - rather than making things in factories - is the only way for America to grow at a rate that allows our current standard of living. Under the circumstances, supporting finance and credit becomes a life or death political issue. Many of the credit and business disruptions of the past two years (and the follies leading up to them) are reasonable in a post- peak context.

Ten years into Peak Oil also explains the frenzy of capitalists worldwide to 'cash out'. Forward looking investors cannot afford to wait until the very end ... when bits and pieces of the current status quo will be worthless? What use is a private jet when fuel cannot be found for it? May as well ditch in now when it can gain a good price than wait. The manipulations taking place on Wall Street and other markets reflect this acknowledgement. Traders might not articulate the idea that 'Peak Oil happened at the end of the 1990's' but they can trade it and rationalize, later.

Ten years post- peak also means that time is running short (if it hasn't run out already). Exponential demand growth will consume remaining - harder to get - fuels in a staggeringly short time. In five years the full weight of out and out permanent shortages will fall with smashing weight upon the world's industrial economies. There is not sufficient time remaining to deploy the reactors, windmills, solar cells or electric cars ... particularly when there is no urgency to effect the change. The task is to replace the built world ... constructed over the past 60 years.

Unbelievable!

I like the idea that the peak in availability of oil occurred when the price was lowest, back in the late 1990s.

Now, with all of these funny interactions going on, the price situation is very confusing for the lay person. Certainly there can't be any problem. Prices are relatively low.

I am not sure that it is possible to replace the built world, with declining energy supplies. I wish someone would come up with a model comparing the amount of available energy prospectively, and how much of this energy would be required for replacing built infrastructure. Of course some of the energy is solar and wind, and continues to be added to earth's resources--but the infrastructure to capture it has to be manufactured has to be manufactured, and provides limits on the amount available to society.

I'll find that interview. It might even be over here, somewhere.

The problem with replacing the built world is there is no consensus about how world should be. There are lots of tentative inquiries which are steps in the right direction. I tell people they hae to figure out how to live in the nineteenth century otherwise they will wind up in the fourteenth century!

I like peak availability. It's like my chlid! The big complaint I have with it in the 1990's means the time to effectively act is past - the opportunity to take appropriate action 'come and gone' before anyone noticed there was a problem! This indicates another level of problem or 'Probleme' (for problem and meme) beyond the level of the 'Wicked Problem'. to that of the 'Hyper- wicked Problem'.

A Hyper- wicked problem is one whose existence isn't even discovered until after the opportunity to address it has passed. This kind of hyper- wicked problems are wrapped in existential paradoxes ... like the discussion I had here a little with aangel about the oil price level that would finance new production or energy alternatives being far above the price level that causes fatal destruction to the economy itself. I suspect a lot of these kinds of 'Problemes' will be turning up like bad pennies in the very near future.

There is no rule book for the situation we find ourselves in right now, frankly.

Oil needs to be used to manage the transition and keep people fed. Another problem is 'ramping up' alternatives is more energy wasteful with the goal or intent of increased alternatives not guaranteed. Throwing money (energy) at fusion or hydrogen - for instance - or at wave power might not return anything on the investments and the time and invested energy would be lost. This is itself another wicked problem, as the risk attached to an investment might be greater than any return yet discovering this requires the investment. This gears into your remark about replacing infrastucture.

I think your question could be better answered if people had a more comprehensive collection of skills. Creative skills are a good substitute for the brute force and mechanical leverage of cheap energy. Having gone in the one direction, it's been easy to unlearn the skills needed to go the other direction. This makes creating your model very difficult. People can grasp the need but cannot calculate the next step ...

This is all very interesting stuff -but possibly not the general thought of concept of "Peak Oil" (which I assume most people take to mean the point of maximum production). Your explanation of Economic Peak -if I am correct- is the point at which additional incremental barrel costs beging their inevitable rise after years of decline. And this occured at the end of the 90s. Very interesting.

It would also explain the rise in commodity prices since then... Any comments on the interelationship between Commodities and Oil 'PEPO' (Post Economic PO)

Nick.

"I wish someone would come up with a model comparing the amount of available energy prospectively"

Shortonoil over at the PO forums has an energy availability model according to which we are now at about 12% (as I recall) of remaining energy out of the original total of available recoverable energy we started with. This is a pretty grim picture of where we are, even for people used to the grimness of peak oil.

I don't think there is any remote posibility of "replacing built infrastructure." We will be learning to live (and die) without a lot of things we took for granted. Presumably the energy required to replace the built infrastructure would be comprable to the amount needed to build it in the first place. And if shortonoil is right, it presumably took much of the 88% of originally available energy we have used so far to build it.

Not bloody likely that we can do the same job with the 12% we have left.

Perfect post Steve !

Gail I actually don't see this in the short term believe it or not I think we have a year or two where we deal with our current bogey men.

With this said I'd not be surprised to see Goldman Sachs take over a major bank my best guess is BofA. And I think this will the start of consolidation and break up of some banks.

This Stress test was a game and the Banks actually failed they declared themselves solvent and now the Government is in a position to start nationalizing "a few bad apples".

I think Citi will also be broken up before finally swallowed. The real winner banks GS and MS will slowly digest their kill.

But this won't be seen as a bad thing but a return to stability and the market will respond positively to this. And technically it is positive. Eliminating BofA will send a message that the US is cleaning up its house and you can trust it.

Beyond this we will simply be dealing with falling home values steady credit defaults and high unemployment. CRE will of course start failing in a big way but its more of the same.

In a weird kind of way our economy has already adjusted to this we have already absorbed most of the economic fallout. Not that there is not a lot more to absorb but by simply being more of the same it won't have a jarring economic effect.

Even if oil hits 150 or 200 people will think its just another temporary spike.

I believe we will sort of muddle through like this for 1-2 years. I think that the monetary inflation will send oil price to the 200 mark but I think that people initially won't care.

Now depending on when prices cross 150 a barrel to new highs at that point if they remain over 150 for a year then and only then will this muddle along situation start to break down.

We are in a lot of ways entering what you can think of as the python squeezing stage where the economy continues to function it just gets squeezed.

I think that bottom calling and green shoots will be present this year and next. Obviously companies that have cut to the bone and finally been forced to actually try and operate efficiently will probably be able to turn out small profits even with rising energy prices.

On this blog we often discuss the energy waste in the system but the structural waste in most companies is orders of magnitude worse. We have plenty of room to streamline business practices. Those that do will survive those that don't will die.

And of course we have at least 20 years of inflation induced equity gains in the housing market that can be rolled back.

So I just overall see this literally taking time to happen at at every step of the way from now on out people will be calling a bottom ever more stridently.

Now I think we will have more regional Detroits obviously most of the rest of the cities that are into auto manufacturing are joining Detroit in becoming dysfunctional. But these will be dismissed. I think for example Oregon will get hammered. But these will be seen as regional issues or industrial shifts not as the start of a widespread collapse. And I think we probably will see riots in at least one major US city over the next two years.

Not until 2011 will these regional collapses begin to spread and expand into social collapse.

I'm guessing that we will end 2009 with unemployment at 12% and oil over 100. 2010 will I think see oil go over 200 and unemployment inch up to 14% or even decline back to 10% but with more and more Americans taking any job they can get so underemployment will be huge.

Only in 2011 when the collapse of housing markets becomes effectively national and its obvious that things are getting worse will wide social disturbances become a problem.

Also I think that cities and states will hold out through most of 2009 and into 2010 before finally seriously cutting spending. The problem of course is its too little and to late and of course they will probably drastically cut police forces to scare the tax payers. Well this will begin to backfire in 2011 when cities find they are calling in the National Guard to deal with civil disturbances. And this scenario could easily take longer than this we could sort of stabilize in 2010-2011 and then finally fall apart in 2012-2013.

Its just going to take time for the structural failures to build up and finally collapse this is not a fast process. We still have a long way to fall before the system finally begins to break down for real. And I really don't see that the forces driving the situation are any different from today its just more of the same just a bit worse month by month and year by year.

And yes once oil prices are sky high for some time we will see energy conservation start and a belated attempt to deal with the energy crisis but all this will do is work to slow the collapse rate say for a year or two.

The problem is by the time we finally decide to change the social network will be to far gone to prevent widespread collapse. Still its simply going to take time. A lot has to happen and most of the forces are slow. Real Estate is intrinsically illiquid so it takes time to collapse. The continued support for the banking system will ensure it fails slowly.

Rising energy costs will be seen as temporary. Socially we will hold out for hope far longer than we should. But because the system will last longer than it probably technically should when it finally does crumble I think we will find that it had truly become a house of cards and topples easily.

So in a sense I disagree I think we can indeed extrapolate where we are today out for at least two if not four years. However in doing so it ensures that when what your saying finally does happen it will be decisive our creditors will not just turn away but flee.

In a sense you could even see that we are given one last chance to change. And I of course believe we simply won't but will try to get back the old ways and fail. So in this sense only after America's attempt at recovery has obviously failed will we finally see the current system break down. Until we have tried to recover and then failed the world will be willing to give us a chance.

I think the next two years will see on fake recovery after another and only near the end will the confidence really be lost.

Memmel

I could not agree more with your predictions for the near term future. We have simply left it too late to make any significant changes to the energy depleted world we face.

I have recently undertaken an exercise in forecasting the conversion of the Australian economy onto a completly renewable base. The figures are sobering to say the least. It works out to be around 370% of GDP. I don't imagine that the US numbers would be greatly different.

Making a sizable dent in this is just not possible while we continue with a paradigm of exponential growth and BAU. The probable scenario of rapid, cyclical oil price spikes followed by crashes will further discourage private investment in alternatives. Governments will continue to use the funds they can either borrow or print to try to prop up the financial sector because of both, the influence from this sector and the fact that it now represents the largest employer in most western economies. It is a bit hard to see any path forward without there first being a major social discontinuity.

370% of GDP! That is amazing.

It sounds like a discussion of that calculation would make an interesting post. Write to me if you are interested at GailTverberg at comcast dot net.

Steve, I like your post even though it takes some 'getting your head round'. I would ask if you have any proof that newly created money is finding its way into stocks and oil (and not just 'parked' money from the way down...)?

Also any thoughts on assets likely to do well (I have my list!)

I have sought the 'non-discretional' ones I associate with PO -Oil, Gas, certain minerals and companies likely to do well + of course Gold .

Nick.

wisco,

There are going to be differences with different commodities, both in the amount of reduction in demand and the impact on prices. And this will change over time.

If there are fewer houses built, there will need to be less lumber transported to construction sites, and less of all the things that go into the house - insulation, wiring, appliances, plumbing. Oil will be used in production and transportation of all of these things. So will natural gas. Very small changes in demand of energy products can have a big impact on prices, so this may have as big impact as a larger cut in say, steel production.

Gail,

a better analogy may be that of whale BONE. Whale Oil found a substitute but whale bone didn't -I wonder whether the expense of a corset was a major reason it went out of fashion? :o)

Nick.

Hello Noutram,

Thxs for that chart!

There are No Substitutes to the Elements NPK for photosynthesis so unless we ramp O-NPK recycling bigtime, we should expect I-NPK to get increasingly unaffordable. Bill Doyle, POT's Topdog, is already on record that he is worried about farmers curtailing total acreage and also reducing the amount of I-NPK applied per acre. See my posting in yesterday's DB. This could be a cascading blowback of the worst kind.

"There are No Substitutes to the Elements NPK for photosynthesis"

Well, actually there is. It's commonly called shit and piss.

We are pouring so much animal and human manure into the streams and rivers that they choke to death from over fertilization while at the same time we claim there is no fertilizer! Oh, did I mention that as a side effect we let enough methane vapor off into the atmosphere to provide power for a hundred cities (that's a guess, it is probably more)...but as long as fertilizer and methane are viewed as more expensive to retain than producing new energy and fertilizer is, that's the way it will go...there's plenty of room for thought on this stuff because the room sure isn't crowded with any...

RC

It's a another question of scale as to how to concentrate widespread dilute sources of NPK into usable materials for broadacre application. How much will it cost to collect at municiapl sewerage treatment plants and distribute back to farmers? Can it be conentrated enough so that the bulk of materials being transported is sufficiently dense to justify trucking it? How much energy will it use? Can the methane from the the same STP be used to run it all? OR should we all jsut piss in a bottle and shit in our composting toilets and use the produce to fertilise local gardens and small scale nearby farms? I don't really mind eating food fertilised with this stuff as long as we eliminate all pharmaceuticals from the stream.

What one really needs to do is move people out of the cities to the land, and recycle waste of the local people on the land locally. I am afraid that ultimately composting will need to be done by nature.

I don't about what one does with all the waste products of the cows, pigs and chickens. Perhaps if we ate less meat, we would not need as much grain and wouldn't need to recycle as much.

I agree about eating less meat, being a vegetarian myself. But really the problems with cow and chicken manure are more from mass contained production more than from small, well managed, free range operations.

Chickens let out into the garden will eat harmful bugs even while they provide the soil with nitrogen from their scat.

Michael Pallen in Omnivor's Dilemma has an interesting chapter on a farmer who pastures his cows in one field, then lets the cow pies sit for just enough time for the maggot to start to breed. Then he lets his chickens out in the same field and they go after the maggots and in the process scatter the cow pies into the grass, adding their own rich scat into the mix in the process. The grass then gets greener, and so he then lets the cows back out to feed... Quite ingenious, really.

Pigs produce so much sh*t that I think only quite small operations can avoid enormous stench, pollution and other problems.

And of course Jenkins book on humanure should become a bible in every household.

In regard to the recycling of fertilizer please visit a company I am exited about.

http://www.vermitech.com/

Thousands of tonnes of sewerage turned into $50/a kilo black gold for people who grow "Tomatoes"

http://en.wikipedia.org/wiki/Whale_bone

Buggy whip demand also dropped off early in the 20th Century.

What are the chances of getting a whale and an oil well in the same view? Low, but not impossible.

Disappointing, there was no giant squid to fight the whale ;-)

Noutram,

Regarding whale bones, as you say, corsets ultimately went out of fashion. So did chrome bumpers on cars, for the same reason.

In a way, there was a substitution here as well--different fashion.

The catch with oil is that we don't have good scalable alternatives. It makes the situation much more difficult.

The bone was substituted by sprung steel ribs in the corsets but woven quills, cane or plastics have been used. So probably not the bast example either.

While these feed back loops might be true for the U.S., they may not apply to the oil market which is global. A lot of countries did more or less the same thing as the Americans, but to a lessor extent.

But some did not such as China and it is becoming more important in oil and commodity pricing. It is going around the world buying up commodity suppliers and locking in supplies.

Clearly China is not having the same feed back loop(s) as the U.S.. They are suffering the effects of the American debacle but for different reasons. Car sales are still booming in China and I read oil imports were up 14% in April.

The U.S. is not the world and things we experience may not affect the oil price since oil is an international market. If China expands usage, as is currently happening, oil prices may rise no matter the decline in the U.S..

This also applies to other commodities like soybeans. To say that certain loops will result in all commodities declining is false. There are other factors such as reduced crop in South America and large exports to China which are now driving soybean prices up even though we are in recession.

The world is a complex place. Over simplification sometimes helps understand what is going on, but can not be trusted to explain complex systems. The economy is a very, very complex system and the world economy which is an amalgamation of differing complex systems is exponentially more complex.

Beware of simple answers in complex systems analysis.

Note that compared to the conventional wisdom systems "analysis", the above is more a "complification" than a simplification. The point on the inability to assume that the US productive sector is roughly equivalent to the global productive sector is well taken ... but given that it is a critique of a view that is even more oversimplified, it is at least a step in the right direction.

When bringing it outside the parochial US view, there is also the feedback loop:

(1) Increase price of oil

(2) Increase in US current account deficit

(3) Slowdown in US economic activity

(4) Reduced ability of US to attract capital inflows

(5) Drop in US$ exchange rate

(6) Increase price of oil

And unlike the negative feedback loops from the increase in oil prices, this one is a positive feedback loop, for oil prices within the US, although it suggests that the hammering of the vulnerable US economy will offer respite for the international oil price if viewed in, for instance, a trade weighted basket of Euros and Yen.

And of course, that raises a further feedback loop:

(1) Perceived greater instability of oil prices in US$ compared to € and/or ¥

(2) Greater reliance on €|¥ as international reserve currency by nations with pegged exchange rates

(3) Increase sovereign demand for €|¥, and reduced sovereign demand for US$

(4) Decline in US$ relative to €|¥.

(5) Greater instability of oil prices in US$ compared to €|¥.

Gail's feedback loops have become visible in retrospect, but I didn't see anyone predicting these types of relationships ahead of time. I certainly never envisioned these relationships emerging.

Bruce's loops are, I think, good predictions of what lies ahead. I would have added "US gov and Federal REserve engage in massive 'quantitative easing' (i.e. money-printing) to replace foreign capital flows".

My understanding of Nassim Taleb's Black Swan is that we have an inate propensity to join the dots even when it is inapropriate. Such as making figures out of the random scattering of the stars, for example.

However that is not an excuse that impresses Mr Darwin. We have to peer out of the windscreen no matter how foggy the road ahead.

I suggest that we make the machine slow down, just like the Report to the Club of Rome suggests.

Bruce,

I like your feedback loops. I was kind of thinking of the first one, when I mentioned the level of the dollar. The special place of the US$ seems like it has to go away--reversion to the mean, if nothing else.

Do I have it right that another consequence would be increased mortgage rates (I'm vague on this as any financial issues are very new to me - but something about bond auctions determining fixed mortgage rates??)?

"Beware of simple answers in complex systems analysis."

Oh the wisdom in those words. Simple answers can be very dangerous, or as Albert Camus said of WWII, "but for a few distinctions, a thousand cities were lost."

RC

Beware of simple answers in complex systems analysis.

Interestingly, Stephen Wolfram, author of A New Kind of Science and developer of the recently released alpha of a computational (re)search engine called Wolfram/Alpha says exactly the opposite: Beware thinking that because the thing looks complex that there must be a complex function underlying it, which is exactly opposite to your maxim.

x

You are right--this is really a US centric view.

What I have written needs further refinement to better reflect the world situation, but that was really outside of my first pass at this approach. What readers add is helpful.

Interesting post Gail.

In addition to the absolute price level, the rate of change of prices has a big effect on price evolution.

The shock effect of sudden oil price increases has in the past created swift changes in efficiency behaviour (people consolidate trips etc) which are then subsequently reinforced by structural efficiency (people buy more efficient vehicles).

These shock effects occured in 1973-74, in the early 1980s and in 2008.

However, if prices crawl higher slowly but steadily then oil consumption behaviour and efficiency may not change much.

As the saying goes: A frog placed in boiling water will jump out. A frog placed in cold water that is slowly heated will ultimately be cooked.

In summary, if supply shortages occur suddenly then the subsequent price spike will be followed by a price collapse. If supply shortages occur more gradually then price increases become more sticky.

As oil prices moved higher on average by $1.05/month from $17 to $77 over the 57 months from November 2001 to July 2006, demand grew steadily both in the US and globally. Then prices moved higher by an average of $2.92/month over the following 24 months up to $147 in July 2008. This faster price increase contributed to the consumer shock, change in consumption behaviour, reduction in demand and price collapse.

And yet, there are supposedly serious advocates for serious policies to reduce the severity of climate chaos through policies to establish a fee for fuels for CO2 emissions ... who treat volatility of prices as a bad thing.

Reflecting the real world uncertainty as to what price will be required to meet a given target into the market system is one of the positive things a carbon fee can do ... especially when switching to non-carbon emitting alternatives eliminates the uncertainty.

Buster,

I agree with you. The quick run-up in prices had a significant impact. I think the impact was perhaps just as significant on businesses, who had no time to readjust budgets and plan for the change. Instead, they needed to take ad hoc steps to get the system "righted", even if it meant laying off people or shortening hours on a short-term basis. It may also have affected the amount that companies needed to borrow for undertake new project, and cash flow available for paying back old debt.

Gail, I have this sense that soon the *price* of oil will be less relevant than the actual *availability*. Once there are absolute shortages, price can do what it will, be more oil won't appear, and the physical effects of actual shortage will begin to bite regardless.

I wonder if you have any source of information for absolute demand? I don't know where to start for this question, but I have an idea that the whole global economy has become so dependent on the paradigm of abundant and cheap oil fuels, and an ever-rising production curve, that even the most non-discretionary functions of life will soon be impacted severely by the just-beginning contraction of supply.

Depressions depress demand -- up to a point. But a heavily oil-dependent civilisation can't depress its demand too far before it's beginning to compromise its essential life-support. Have you -- or has anyone -- any clear idea of how little the global production figures can shrink before we enter that death zone? Not much, I intuit. And the now-commencing fall-off will take us there terrifyingly quickly, I suspect.

One thing to look into in this regard is Nitrogen fertilizer. At present, most nitrogen fertilizer is produced using Natural Gas, which tend to track oil price shocks. Indeed, there was a reduction in nitrogen fertilizer use in the US Midwest in last year's growing season, with the predictable impacts on yields and, for wheat in particular, protein levels as well.

Protein levels in cereal grains may not be seen as a big issue in the US at present, but given that we are producing and, even more, consuming an ecological unsustainable quantity of animal protein per capita, it may become one over the decade or two ahead. It is already a serious issue in places like Egypt, where a substantial quantity of protein consumed by the a large share of the population is wheat protein complemented by legumes.

...consuming an ecological unsustainable quantity of animal protein per capita

I disagree. It is not the consumption of animal protein that is the problem, it it current population levels. Given a planet with 7+ billion humans beings (+net 70 million more added each year), the current rate of consumption of practically *every* natural resource is "ecological unsustainable". Given a planet of, say, 1 billion (or even better --less), not so much.

I have a problem with advocating we all switch to a vegan-only diet, given the negative health effects of a high-carbohydrate diet that we are already seeing throughout the industrialised world --including obesity and adult-onset diabetes. Like it or not, for the vast majority of the existence of the human species, we have been primarily hunter-gatherers who ate, among other things, animals. Granted, vegan diet does not = high fructose corn syrup, but eliminating *all* animal protein from one's diet does not sound like a recipe for overall good health to me.

Hi Harm,

I support your disagreement. I cringe every time I hear someone advocate that we can support a larger human population by eating less animal - more veggie diet. The last thing this planet needs is a larger human population. Feeding humans is not the first priority for sustaining the biosphere of the planet - upon which humans are totally dependant.

Also, regarding human health (again I agree with your comments) there is a great book titled "Good Calories, Bad Calories" that provides an excellent analysis of how we got to this FDA stance regarding fat. This is not a fad diet book, it is more an analysis of the scientific and political process for how the US came to advocate certain diet recommendations.

I think the discussion is not about increasing population from current levels. Instead, it is about reducing the amount of starvation in the years ahead of people who are here in the world right now.

I don't know that people are talking about vegan diets. There is certainly a large amount of cutting back on meat that could be done. The could also be a lot of cutting back on processed carbohydrates as well.

Here's a thought for doomer meat eaters such as HARM: if you think vegan diets are unhealthy, and you want to decrease the planet's population, why not advocate we all adopt a vegan diet?

Seriously, look up the vegan diet, and articles on whether vegans and vegetarians are healthier or sicker than the average American meat eater, and on the role of "refined carbs" in a vegan diet, and draw your own conclusions. If you really believe we will all sicken and die if we stop eating meat, then you just need more facts and less hearsay.

After all, in a low energy society, where the present cornucopia of medications and bypass surgery disappears, while Africa experiences massive starvation, we will need to know the truth about what diet is best.

I personally eat very little meat. I do eat some fish and a small amount of dairy products. This combination has worked well for me, and would use a lot less resources than the current American diet.

@Paranoid,

I don't think *all* vegan diets are necessarily "unhealthy", though depending upon specifically what you eat, "your mileage may vary". I also think you are offering up a false dichotomy of choice here, implying that our dietary choices are roughly split between:

(a) typical American diet of mostly highly-refined carbs (crap) + red meat

or...

(b) extreme no-animal-protein-ever vegan diet

Are these really our only two choices? How about an Atkins or South Beach/Meditteranean diet? Or any diet that emphasizes fresh, whole foods over HFCS and heavily processed junk? That approach has worked out rather well for me.

Hi Gail,

I guess it's easy to get a bit off-topic, but I think a huge problem is growing population. Back in the 70s, when I read the "poulation bomb", I was convinced that the world population would never get anywhere near today's level. I just did not appreciate the level of misery that people would tolerate just to breed more humans. Your concern about potential starvation is certainly valid, but the question is how many people will be starving - today's 6.8 billion, tomorrow's 8 billion? Or would it not be more sensible to advocate a massive family planning program to reduce the number of people in the first place? The Bush administration is an example of totally misguided policy - the general refusal to support family planning programs that conflicted somehow with faith based thinking. Harm (if I may speak for him) and I are just trying to point out that an intelligent approach to human population reduction could be one of the best ways to mitigate many "peak" problems. I readily admit that I don't know if it is too late - but certainly too late if we don't even recognize the population issue.

No doubt in my mind that processed carbohydrates is another example of a great delusion we harbor - 80% of my supermarket is devoted to this stuff and 90% of the customers don't think this is a problem.

@bicycle dave,

You may indeed speak for me --I completely agree :-).

I doubt such a thing exists as "absolute demand" for oil. It is not a necessity in the same way as food is. Nitrogen is a bad example. Even given all efficiencies, we need a certain amount of nitrogen to produce enough caloires to feed everyone. But do I need an SUV rather than a motor assisted bike? Do I need the motor at all? Do we need 5-day work weeks?

There is, no doubt, a base level of energy need to do basic things like food production, but that level is probably much lower than anyting we are looking at soon.

Andrew, no doubt the human population of the world could survive on food produced with a lot less energy. However that is only part of the problem. When the energy supply stopped growing in 2005 it was only a matter of time before employment stopped growing.

A growing energy supply is needed in order for us to have near full employment. As the energy supply drops, growth drops, employment drops. It simply does not matter how many calories it takes to support the world's population, if they cannot afford to buy those calories they will starve.

Ron P.

I wish somebody else but me would take up the job of endlessly emphasizing the obvious- that much- very much- of what people in countries like the US do is WORTHLESS AND WORSE and should not be done at all, regardless of how much energy there is available. The contents of any store, any catalog, any example of daily activity, shows this over and over for anyone to see who will look, and it's criminal that we keep doing this stupid stuff, wasting our one and only planet forever.

Energy shortage hell! The real shortage is ethics, brains and foresight.

I think it is difficult for us to understand how the financial system (including the credit system) is tied in with everything else.

If there are shortages, they may show up through the financial system, in places we don't expect. It seems like the way peak oil and limits to growth may ultimately show up is through products not being available to most of the population, because they are unaffordable.

What is the "death zone"? Could you, please, define it. And could you tell us how we, too, can intuit this. And how is an alleged "fall-off" taking us to the death zone? And how quick is quick? Just yesterday, for example, on another post on this site it was suggested that we could slowly decline for the next 100 years until we reached a sustainable, and much lower, level of existence, while other people have suggested 2017 as the "date" of collapse. Is collapse the same as death zone?

Rhisiart,

It seems like underlying demand very much depends on built infrastructure. There is a certain amount of contraction that can be done within a particular level of infrastructure (car pooling, moving together into more conveniently located houses), but, after a point, the system starts breaking down. In general, manufacturing can theoretically temporarily disappear, but this leads to huge problems as well--people without jobs, decline in asset values because people's incomes are lower reducing demand, and more defaults on debt.

I think different systems start breaking down at different times. The debt repayment system seems to me to be the most vulnerable, long before there are physical shortages of oil. I worry that the breakdown of the debt repayment system will spiral into a more general breakdown of the international financial system except for trade between trusted partners, and trade on more of a barter basis. If this should happen, there could be a very sudden drop in imports, to below the amount that is needed for essential life support.

I agree in general this is probably whats going to take us out.

However I'd suggest the fact that interest rates being kept artificially low in and effort to slow the default rate on existing debt is causing as much harm as good.

I suspect that the government will soon have little choice but to allow interest rates to rise to reflect the real risk in lending. Also of course same for the housing market its being kept artificially buoyed in the US with a combination of FHA loans and a 8000 dollar cash back scheme that effectively gives you something close to the zero down subprime loan.

Once these artificial constraints are finally forced off the financial system will begin to correct and although defaults will increase structurally it will be sounder.

I don't think the governments can prevent this from happing and its simply to basic a force to be stopped.

However this will only work to delay the end. Correcting the financial system does nothing because the intrinsic problem is simple most of the debt in the world is tied into infrastructure spending for Real Estate and we simply have to much of it. And commodity prices are increasing.

So even as the system finally starts to stabilize on the financial side the intrinsic growth required for fiat monetary systems is failing.

As with the subprime fiasco its another case of closing the barn doors after the horse has bolted.

I'm honestly not really sure what happens then tough lending standards mean nothing if 20% of the houses in town are empty and the value of the homes are then effectively zero.

I'd suggest the system will then be basically dysfunctional and monetary policy is almost irrelevant. I think your right in a sense we will move to more of a barter system so by the time they conceded defeat and institute sound fiscal policies the system would have started giving up on using fiat currencies.

Note that bills of lading serve as the barter equivalent of currency. Assuming we have computer networks I'd suggest that ad hoc currencies based on something like a futures market are possible. Using computers to create a functional barter system is a bit interesting but doable :)

Obviously such a move is really more about tax evasion and or avoiding hyperinflation.

But no intrinsic reason esp with computers that you can't reject traditional monetary systems and create a elegant easy to use barter network.

I'm tempted to build one but the IRS would come down on it like no tomorrow.

I think we've just hit the first stair step down of collapse. High oil prices have caused an economic collapse as GDP shrinks to a level that drops oil lower. Supplies will shrink to catch up to lower demand, prices will spike (maybe higher next time?), economic collapse to a lower GDP, higher unemployment, etc. In 20 years, oil may very well be $50 a barrel but we'll be using 50% of our current amount because 50% of the population is unemployed, etc.

I'm sorry, but total oil use (the physical measure of demand) does not appear to have shrunken by much at all, despite global economic contraction. Am I missing something here?

Okay, how about "oversupply will shrink to catch up with flat demand"?

At least for this stairstep down. Who knows about the next one.

Above ground storage both of crude and products - not all the barrels being produced/demanded are actually being consumed.

and

Untrustworthy statistics.

The shipping prices should tell you something about whether demand is down.

Because oil is such inconvenient stuff to store, supply always equals demand within a tiny margin*, so this line is a trueism anyway. Consumption has fallen about 3.5% from the March'08 peak.

G.

* recently estimated by Rune Likvern to be about 2 Bbbl, or about 3 weeks supply.

Agreed. Inflation and deflationary cycles seem likely to me.

However, what will these newly laid-off people do? Will they die? Will NONE of them ever find ANY work ever again? Seems doubtful.

Seems like they might move to high-density slums or something. And get bikes. And engage in the underground economy for as long as they have to. They may work together to form communities. They may be put to work for a scraping-by wage by the government to build wind turbines and a new grid and houses they can afford to heat/cool or to pour concrete for new nuke plants. They will do a number of things.

What people forget is that the beginning of an energy transition pretty much must look like the beginning of collapse, b/c they are the same thing initially. People won't change until they have to. Few are going to give up their SUV and McMansion until they are forced. Proving that Peak Oil caused the economic meltdown (I believe it directly did) is not the same thing as proving imminent, irreversible collapse. Both sceneraios, THE END and CHANGE will likely look exaclty the same at the get go.

Gail, thanks for another great analysis. However as you have explained in previous threads what really did happen.

Numbers 1 and 2 did not happen. More oil was not produced and no meaningful substitutes came on the market. Number 3 did not happen because commodity prices were quite high, like oil, as the crisis was developing. Number 5 did not happen because interest rates were quite low and were lowered considerably last year as the crisis was developing. I am not sure about Number 6 as some of those things were definitely happening but commodity prices were quite high, not low, as the crisis was developing.

That leaves number 3 as the culprit. But no, that is not correct either because you say: Lower demand for commodities of all types. Lower prices for commodities of all types. That simply did not happen. Other commodity prices peaked at almost exactly the same time as oil prices peaked.

Historical Commodity Prices

There were actually two crashes. Oil and all other commodity prices crashed in July of 2008. Though the stock marked peaked in 2007 the banks, along with the rest of the economy, crashed in September of 2008 along with the largest stock market drop in years. And during the whole scenario, interest rates, that is the cost of money, remained at historical lows.

Edit: Make that three crashes. The Housing Bubble burst in early 2006.

Here are graphs of inflation-adjusted, historical home prices.

This thing simply needs to be rethought.

Ron P.

Ron, that's just what I was thinking too, but you described it with far more eloquence than what I would have done.

A core assumption in Gail's article is that the oil price spike caused the recent crash(es). I don't think this can be taken as a given. The frenetic explosion in easy credit & mass leveraging of debt well beyond an ability to service the debt by both consumers and large companies was already hitting its limits and was well & truly due for an unwind. Sure, the oil spike could have expedited the economic meltdown, but the real problem was and is excessive debt, and the crash would have occurred if oil hadn't spiked.

Unfortunately this makes it hard for me to accept any of the feedback loops in the article. In theory they look ok, but imho its wrong to say that oil prices caused the current recession.

Commuter, it was not my intention to imply that the very high price of oil in 2008 did not cause the current recession. I do not believe it was the entire cause but it certainly contributed to it. And it will indeed be the cause of the non-recovery. The energy supply must grow if the economy is to grow. And in a debt based economy such as ours, if the economy does not grow it will collapse. And collapse is exactly what we are experiencing right now.

Ron P.

Oil prices have been rising over a period of time, exerting squeezes on the economy. Different things happen at different times. Why is that hard to understand? Subprime debt was among the most vulnerable, and got squeezed first. Some of the other changes came later, affecting more and more debt markets. Why is it a problem to have changes at different times?

You say "Number 3 did not happen, because commodity prices, like oil, were quite high as the crisis was developing". I am talking about a long period, roughly 2003 to 2008. Commodity prices were rising during that period. You must be thinking about a much shorter recent period.

Regarding Number 5, did you read Steve from Virginia's article. We are talking about the time period leading up to the housing crash, 2003 to 2006, and the minutes of the Federal Reserve Open Market Committee are very clear that the interest rates were being raised in response to rises in oil prices. The damage credit system was already done by the time of the sub-prime crash. We are living with the continuing

We live in a world where actual resources extracted from the earth have not been growing rapidly for several years now--since around 2000. Debt was growing a lot more rapidly, thanks to very low interest rates and the availability of "structured securities", put in place to give the illusion of growth. The combination was a system that was ripe for collapse. While one can argue that the system would have collapsed anyhow, the whole reason it was ripe for collapse was because the expansion of debt was simulating growth, when the underlying resources were growing very slowly. One can say that the collapse is not the fault of the underlying resources not growing rapidly; instead, it is the fault of politicians and economists thought they could create the illusion of a growing economy, even when resources were not growing. Aren't we splitting hairs?

"In 20 years, oil may very well be $50 a barrel but we'll be using 50% of our current amount because 50% of the population is unemployed, etc."

And also the average wage may be a few dollars an hour, so $50 oil will be the same as $147 oil last year.

Instead of putting my oil royalty cheques in the bank, I have begun cashing them and buying physical gold for my safe-deposit box. I will be in my 70s twenty years from now and my oil wells will probably be dry, but the gold will still be worth something. Remember that twenty years ago, General Motors was a blue-chip stock for widows and orphans.

You might want to think long and hard about banks and deposit boxes,although I am sure that for the time being your gold is reasonably safe there.

"You might want to think long and hard about banks and deposit boxes,although I am sure that for the time being your gold is reasonably safe there."

Different situation in Canada. My day-to-day chequing and savings accounts are in a credit union and the Alberta Treasury Branch (deposits 100% guaranteed). Canada never seized gold or closed banks as the USA did during the Great Depression, so safe-deposit boxes are secure.

No Canadian banks have failed since 1923. Unlike the American banking system, there are only a few dozen Canadian banks, viz, the Big Five, various trust companies, and a few smaller banks. There are hundreds of credit unions but they are all part of a national federation. The Big Five are Royal Bank of Canada, Toronto Dominion, Bank of Montreal, Bank of Nova Scotia, and National Bank of Canada. ATB is part of the Alberta provincial government, not a chartered bank, and is probably unique in the world in that it cannot fail unless the provincial government itself fails. Fortunately there is no danger of Alberta becoming another California; the oil didn't go away just because Wall Street banksters were caught out.

Precisely why you can't even be sure whether or not gold will still have value. Based on past experience you might be willing to make that bet and you may be right. You might also end up with an awful lot of very heavy shiny yellow paper weights. Not saying that that will happen just saying that times they are a changing. What may seem to be an absolutely sure thing may turn out not to be.

Maybe skills, hand tools or the means and access to fresh water and food, that should still be worth something.

Good Luck!

"Maybe skills, hand tools or the means and access to fresh water and food, that should still be worth something."

True, and I agree with you, but 5,000 years of human history has demonstrated that gold will always be a useful commodity.

Check back with me twenty years from now and I'll let you know how it turned out!

Recent human history extends back at least 200,000 years, so 5,000 years is a mere fad.

Let's see, gold has had value for over 5,000 years. It takes an enormous amount of fossil-fuel energy to produce gold (crushing tons of rock, for instance), and that's never going to be cheap or get cheaper. Silver is even more energy intensive. I think I'll stick with my precious metals, thanks.

...buying physical gold for my safe-deposit box.

The contents of SDBs are not insured, so if your bank burns down or gets looted, there goes the gold. Same for if the government devalues gold or confiscates it.

Then again, when you come to me with your gold in exchange for a can of beans, do you think I'm going to make the exchange?

Please note that canny investor John Paulson, who made a mint out of the Global Financial Collapse, has just recently sunk billions into gold. Maybe he knows something you don't?

I believe that the best indicator of future oil prices is still the value of the US dollar, although there should be an interesting case of the future inflated dollar versus falling global demand.

Eric T. @ http://www.jazdoilandgas.com

Welcome to economics, and the reason why we card carrying economists are legally entitled to use the phrase, "On the other hand...".

A big part of our current mess is market psychology, which is, in turn, heavily influenced by timing and the magnitude of changes. Right now, a lot of consumers are just plain shell shocked. Housing, the stock market (and therefore their 401Ks), banking, the price of gasoline and home heating fuel, and the auto sector have all delivered pretty painful shocks to the consumer in the last year. Many people are still feeling a major reduction in their perceived personal wealth (house value plus savings, more or less), and are very hesitant to spend on what they consider to be luxuries or non-essentials. Add to that the uncertainty about new legislation to curtail CO2 emissions and all the competing plans and proposals (like Pickens') they hear about to get us off oil or achieve some other large goal, and it's a wonder they're not all hiding under their bed.

In terms of oil this will likely keep prices from taking off and help us tread water for a while on a production plateau (world wide production will be less than capacity for another year, maybe longer). Beyond that, it gets gratuitously interesting.