Drumbeat: August 21, 2009

Posted by Leanan on August 21, 2009 - 10:07am

Mexico oil output falls 7.8 pct yr/yr in July -Pemex

MEXICO CITY (Reuters) - Mexican oil output fell 7.8 percent in July compared to the same month a year ago as the its efforts to replace production capacity lost at the Cantarell field continued to lag the giant's natural decline.State oil monopoly Pemex said on Friday it produced 2.561 million barrels per day of crude oil in July, an increase on June of 42,500 bpd. Output in June was affected by planned maintenance at its two largest oil fields, the Cantarell and Ku Maloob Zaap offshore deposits.

Pemex expects to raise oil production to 2.65 million bpd by the end of the year by adding new wells at its Chicontepec project. But analysts are skeptical that the company has mastered the technical and logistical challenges of developing the unconventional crude there.

Exxon Evacuates Nova Scotia Gas Platforms Ahead of Bill

ExxonMobil Canada said it is evacuating personnel from production facilities at five natural gas fields it operates off the coast of Nova Scotia, ahead of Hurricane Bill's expected arrival on Sunday."ExxonMobil is closely monitoring the progress of Hurricane Bill," spokeswoman Margot Bruce-O'Connell said Thursday. "Based on the current predictions of the storm's severity and with the safety of our work force as our first priority, ExxonMobil has decided to evacuate all personnel from the Sable facilities."

Dresdner/Commerzbank blames oil speculators

Wow, the commods analysts at Dresdner/Commerzbank have taken a rather bold — if slightly self-congratulatory — stand on oil speculators.In a note published on Thursday, analysts Eugen Weinberg, Barbara Lambrecht and Carsten Fritsch, are very clear: oil speculators have driven up oil prices, and pending an imminent clampdown by the CFTC, those oil prices will now be going down — closer to their fundamentals.

When governments fail, the public must set the agenda

The consequences of a lack of vision are not trivial. There is no need to detail the impoverished mess which is public transport in Sydney, or the daily inconveniences suffered by passengers obliged to use it. With every day that Sydney wallows in its conceptual chaos, the city is less and less prepared for great challenges which are rapidly approaching. Climate change. Peak oil. The epidemic of lifestyle diseases linked to urban design. All these will fall - are now falling - more heavily on this city because it lacks the vision to plan its transport and the will to act on its plan.The failure has already cost the state dearly. It led earlier this year to an astonishing public shaming of the State Government by its federal counterpart - of one Labor government by another. Canberra had billions to allocate in the last budget for infrastructure spending; NSW received virtually nothing for its capital city, Australia's global city.

A few generations from now our descendants will wonder, “What took them so long to figure out that we’d reached the limits to growth?” The answer, of course, is that growth is the core of the myth holding the American psyche together. If it’s false, what’s the meaning of “life, the universe, everything?”

Always the basic mechanism is the same ... Free Market exuberance!

It is probable, or at least possible Learsy himself takes seriously what he claims as facts in this "trenchant" piece. Basically he asserts the IEA or International Energy Agency has been taken over by dark forces which inject the world's media, and politicians heads with dangerous, or at least wrongheaded propaganda to drive up oil prices.The Learsy IEA is a friend of oil speculators who cynically and greedily manipulate oil prices, usually upward, before they implode their hedge funds, investment banks or other dark nests of dubious financial deeds and run to governments for generous bailouts. The same Learsy IEA, for the same reason also credibilizes peak oil pranksters, like Matt Simmons who can double any peak oil price forecast you would care, or dare to make.

Fuel oil prices surge 20% as supply tightens

Dubai: Middle East fuel oil prices jumped 20 per cent this week on tight supplies due to peak summer demand for power generation and strong requirements for marine transport fuel.Premiums for 180-centistoke (cst) fuel oil rose $1.50 (Dh5.5) to $9 a tonne versus levels seen the previous week, as the region continued to grapple with limited supplies.

Bolivians look to ancient farming

Poor farmers in the heart of Bolivia's Amazon are being encouraged to embrace the annual floods - by using a centuries-old irrigation system for their crops.They are experimenting with a sustainable way of growing food crops that their ancestors used.

It could provide them with better protection against the extremes of climate change, reduce deforestation, improve food security and even promise a better diet.

Pakistan needs energy help from Iran

ISLAMABAD, Pakistan (UPI) -- Tehran and Islamabad should move in harmony to expand bilateral energy relations as Pakistan struggles to overcome a looming energy crisis, officials say.Islamabad and Tehran in June signed a bilateral deal for the proposed 1,724-mile Iran-Pakistan-India natural gas pipeline. Pakistan would receive 750 million cubic feet per day from the South Pars gas field in Iran to generate electricity under the terms of a 25-year deal.

Oil industry giants: Saudi Aramco

No country is more synonymous with oil than Saudi Arabia and no company is as synonymous with its home country than Saudi Aramco.From its headquarters in Dhahran, Saudi Aramco is responsible for the management of 99% of the KSA’s oil assets of 259 billion barrels — about 25% of the world’s total conventional oil reserves.

While Saudi Aramco does have the world’s largest hydrocarbons reserves to draw upon, it still sets the benchmark for how a national oil company (NOC) should be run. The company starting life as a subsidiary of Chevron has helped Aramco to recognise the benefits of operating commercially while still retaining the responsibilities associated with being a state-run entity.

Number of active rigs climbs by 17

HOUSTON (AP) -- The number of rigs actively exploring for oil and natural gas in the United States rose by 17 this week to 985.Houston-based Baker Hughes Inc. reported Friday that of the rigs running nationwide, 695 were exploring for natural gas and 280 for oil. Ten were listed as miscellaneous.

A year ago, when oil and gas prices were much higher, the rig count stood at 1,998.

NEW YORK (CNNMoney.com) -- Oil prices soared on Friday to their highest level since October as investors grow hopeful that a recovery of the world economy is in sight.On Friday, the price of oil for October delivery rose as high as $74.15, after settling the day before at $72.42. The price of oil hasn't traded that high since Oct. 20, 2008, when it reached an intra-day peak of $76.12.

Iran announces massive oil find

TEHRAN (UPI) -- Though declining to specify exactly where, the outgoing Iranian oil minister announced the discovery of a giant oil field as a new government takes shape.Iranian Oil Minister Gholamhossein Nozari announced the discovery of the field, which the semiofficial Fars news agency reports has in-place reserves of more than "20,000 billion barrels."

"The relevant information on the exact location and volume of reserves of this oil field will be declared in coming days," Nozari added.

Kiev to slash Russia gas imports

Ukraine, one of the largest buyers of gas from Russia's export monopoly Gazprom, plans to cut imports by a quarter next year, Prime Minister Yulia Tymoshenko was quoted as saying today.Ukraine's imports of gas burden its finances, but provide vital revenues to Russia. The two ex-Soviet states often row over prices and supplies and one dispute led to a New Year gas cut-off for weeks, affecting consumers across central Europe.

"Given that we have bought 33 billion cubic metres of Russian gas this year, next year we will take 25 billion cubic metres," local news agencies quoted her as saying in the western city of Lviv.

PARIS - America's convoluted, Alice-in-Wonderland interpretation of this summer's top political show - the "free expression of the people" in the Afghanistan election - reads like an opium dream. In fact, it is actually a pipe dream - as in Pipelineistan. With the added twist that no one's saying a word about the pipe that's delivering the opium dream.As in an opium dream, delusion reigns. The chances of United States President Barack Obama actually elaborating what his AfPak strategy really is are as likely as having his super-envoy Richard Holbrooke share a pipe with explosive uber-guerrilla warlord Gulbuddin Hekmatyar.

Venezuela economy shrinks for first time in 5 years

CARACAS (Reuters) - Venezuela's economy shrunk for the first time in over five years in the second quarter, after a government-driven consumer boom petered out and the global recession finally bit South America's biggest oil exporter.High public spending by President Hugo Chavez during an oil bonanza meant even the poor had some money to burn, spurring a long shopping spree defined by double-digit growth. But the boom ended abruptly in the April-June period.

Venezuela's finances were hard hit when oil prices started a free fall late last year, while a string of nationalizations has dampened the private sector's appetite for investment.

Cash for clunkers to end Monday night

DETROIT — Let the national closeout sale begin: Car dealers and consumers have just four days to take advantage of Uncle Sam's $4,500 cash-for-clunkers rebate before it expires.The government is ending the program as of 8 p.m. ET Monday, giving dealers and customers time to close pending deals and get the paperwork processed before the $3 billion program runs out of money.

Uranium mine called ‘World’s worst practice’

Uranium mining in the far north of South Australia at the Beverley location near Arkaroola Wilderness Resort is being openly challenged by Aboriginal Traditional Owner Mrs Enice Marsh.She is concerned that the new Beverly Four Mile uranium mine is destroying sacred sites, polluting the environment unnecessarily, and promoting a culture of bullying.

Ethanol Producers Warily Eye Algae's Bloom

It's been the summer of algae-based fuels, with new technical advances, investments and legislative proposals appearing at regular intervals.After years of quietly building steam, the algae industry has recently received major, attention-grabbing investments from Exxon Mobil Corp. and Dow Chemical Co. And the industry is starting to find support in Congress with proposals that would provide it tax credits and other incentives gaining bipartisan support.

So you can't blame ethanol producers for being a little defensive.

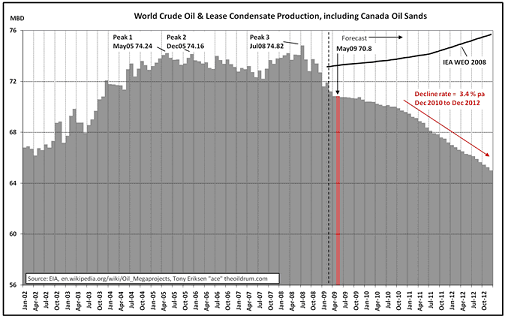

Still not convinced about ‘Peak Oil’? Then review Figure 2 which charts the expected combined flow rates for crude oil, lease condensates and Canadian Oil Sands. As you can see from the grey shaded area, production is about to decline by roughly 5 million barrels per day by 2012.Ironically, Figure 2 also plots the optimistic (almost laughable) forecast made by the International Energy Agency (IEA) in its “World Energy Outlook 2008”. Interestingly, in last year’s “World Energy Outlook”, the IEA stated that in order to fulfill its optimistic projections, the world had to install 64 million barrels per day of new supply by 2030 or the equivalent of six times the Saudi Arabian output! Furthermore, the IEA declared that the energy industry had to invest hundreds of billions of dollars every year to achieve this favourable outcome.

Oil hits 2009 high above $74, eyes Fed speech

LONDON (Reuters) - Oil touched a high for this year above $74 a barrel on Friday ahead of further pointers on the economic health of the United States and as the dollar flagged against a stronger euro.By 1145 GMT (7:45 a.m. EDT), the new front month U.S. crude futures contract for October delivery was up $1.04 at $73.94 a barrel, after briefly touching $74.05, its highest of the year. London Brent crude for October was up 99 cents at $74.32.

Oil is on track for a 7.3 percent gain this week, and was last at this level on October 21, 2008 when it closed at $75.22 a barrel on its way down from a record peak above $147.

Is Iran gas ban a step toward war?

As the Barack Obama administration struggles to devise a strategy for dealing with Iran's intransigence on the uranium-enrichment issue, it appears to be gravitating toward the imposition of an international embargo on gasoline sales to that country.Such a ban would be enacted if Iranian officials fail to come up with an acceptable negotiating plan by the time the United Nations General Assembly meets in late September - the deadline given by the White House for a constructive Iranian move.

Iran, of course, is a major oil producer, pumping out some 4.3 million barrels per day in 2008. But it is also a major petroleum consumer. Its oil industry has a significant structural weakness: its refinery capacity is too constricted to satisfy the nation's gasoline requirements. As a result, Iran must import about 40% of the refined products it requires. Government officials are attempting to reduce this dependency through rationing and other measures, but the country remains highly vulnerable to any cutoff in gasoline imports.

US Coast Guard steels for role in Arctic as exploration increases

Anchorage (Platts)- The US Coast Guard is strengthening its presence in US Arctic regions, testing equipment and operating strategies for the third summer season, to ensure safety as oil and gas exploration and commercial shipping in the area increases, the agency's commandant told a US Senate subcommittee Thursday.Climate change and the retreating polar icepack makes the Arctic more accessible, and the Coast Guard must have emergency search and rescue and oil spill responses and be able to provide security in regions with virtually no infrastructure, Coast Guard Commandant Admiral Thad Allen told the Homeland Security subcommittee.

Russia hosts international meeting on Arctic security

An international conference on Arctic security attended by several of the region's neighbours including the United States opened in Russia on Wednesday, Russia's ministry for emergency situations said.Canada, Denmark, Finland and Sweden are also taking part in the three-day conference in Anadyr, capital of the far eastern region of Chukotka, an unnamed ministry spokesman said.

Construction to begin on Minn. oil pipeline

MINNEAPOLIS – The U.S. State Department issued a permit Thursday allowing construction of a pipeline that will bring crude oil to the U.S. from Canada's oil sands, where environmental groups say extraction and refinement methods are contributing to global warming.With the permit in hand, Enbridge Inc. plans to start construction work on the Alberta Clipper pipeline, which will run through Minnesota and the northeastern corner of North Dakota from Superior, Wis., to Hardisty, Alberta.

Oil Sands May Get Cleaner as Shell, Exxon Bubble Tar to Froth

(Bloomberg) -- Royal Dutch Shell Plc and Exxon Mobil Corp., the world’s biggest energy companies, are rolling out technology intended to eliminate the environmental disadvantage of Canadian oil sands.A new process known as high-temperature froth treatment cuts carbon emissions from extracting crude from sand and mud by 10 to 15 percent, said Brad Komishke, a Shell chemist who leads 50 scientists developing new oil-sands techniques in Calgary.

Petrobank and Tristar become PetroBakken

They are showing that they can upgrade thick heavy oil (8-12 API) to light crude quality (36 API) using underground THAI/CAPRI technology. (Underground upgrading of oil). If successful and scaled up THAI/CAPRI could revolutionize the recovery and economics of heavy oil and oilsands reserves. The Canadian oilsands which is an amount of oil several times Saudi Arabian oil reserves could become cheaper and cleaner to develop and basically push off peak oil for a decade or two.

Australia gas deal to get green light 'within week'

SYDNEY (AFP) – Australia will decide "in the next week" whether to grant environmental approval to a project that will supply natural gas to China under Canberra's biggest ever trade deal, a minister said Friday.

Gazprom Seeks East Siberia Tax Break, Yakutia Permits

(Bloomberg) -- OAO Gazprom Chief Executive Officer Alexei Miller called for tax holidays for natural-gas production in eastern Siberia and urged the government to grant new licenses, after cutting output targets at a field in the region.Projects should be tax-exempt during their “payback period,” while export duties on gas from eastern Siberia and Russia’s Far East should be reduced or canceled, Miller said today at a meeting chaired by Prime Minister Vladimir Putin. Gazprom’s Chayanda field in Yakutia will pump less gas than planned, Miller said, without giving a forecast.

Gas producers in Russia, fighting a decline in energy demand, are pushing for tax breaks as a drop in prices for the fuel curbs revenue and output from older fields dwindles.

Asia's coal seam gas projects charge ahead, China leads

SINGAPORE (Reuters) - Projects to exploit coal-bed methane, once the bane of miners, are surging in Asia, with China out front as it strives to find ways of satisfying its prodigious appetite for energy.Industry players gathered at a conference in Singapore this week to explore opportunities in a region where CBM is in its infancy, except for Australia, whose coal seam gas industry has flourished over the past decade.

While some CBM projects in the United States have shut down, discouraged by very low gas prices, in Asia, the focus is on conversion of CBM to LNG and it will be priced using traditional Asian LNG formulas linked to oil, Tony Regan, a consultant with Tri-Zen International, said.

China coal-electricity project to increase coal output

BEIJING (Xinhua) -- China's first large coal-electricity joint project, Huaneng Yimin Coal Electricity Corp. aims to increase its annual coal output to 20 million tones this year, reported Friday's China Daily.

Militants claim Russia dam disaster

MOSCOW (AFP) – An Islamist group Friday claimed it carried out deadly attacks on the same day this week against Russia's biggest hydroelectric power station and a police station in the Caucasus that left dozens dead.Russian investigators strongly denied the claim by Riyadus Salikhiin, a militant group with roots in Chechnya, that it had hit the power station as part of a new campaign of "economic war" in Russia.

Putin orders probe of creaking infrastructure

MOSCOW (Reuters) – Prime Minister Vladimir Putin called for a sweeping probe of Russia's creaking Soviet-era infrastructure on Thursday after a disaster at its largest hydroelectric power station.A water surge caused aging turbines to explode at a 31-year-old Siberian dam on Monday, starting a chain reaction that sent a cascade of water into a 100-meter (yard) turbine hall and the four floors below it, and dumped 45 tons of fuel oil into the Yenisei River below.

Russian PM Putin wants electricity prices regulated

CHERYOMUSHKI, Russia, Aug 21 (Reuters) - Russian Prime Minister Vladimir Putin on Friday ordered his government to prepare a draft decree on the temporary regulation of wholesale electricity prices after a disaster at a hydro dam this week.

North Dakota: Flares burn a third of natural gas

Enough natural gas to heat every home in North Dakota through at least two brutal winters was burned off as an unmarketable byproduct in the state's oil patch in 2008, government and industry officials say.North Dakota produced a record 62.8 million barrels of oil last year, up nearly 18 million barrels from 2007. Natural gas, a byproduct of oil production, was pegged at 86 billion cubic feet, of which 26 billion cubic feet was "flared" because of the lack of collecting systems and pipelines needed to move it to market, said Lynn Helms, director of the state Department of Mineral Resources.

"Although natural gas creates much less revenue than oil, there is still a lot of value there," Helms said. "We don't want to see it go up in smoke."

NKorea-US talks shift to clean energy

SANTA FE, New Mexico (AFP) – A North Korean delegation held talks Thursday on renewable energy in New Mexico after pushing hard in earlier discussions for one-on-one nuclear talks with the United States.A spokesman for New Mexico state Governor Bill Richardson, who has been hosting the two North Korean diplomats at his sprawling hacienda overlooking Santa Fe, said meetings were shifting to focus on renewable energy.

Wisconsin's gas markup law gets new life

MADISON—Wisconsin's controversial minimum markup law for gasoline isn't dead yet.The 7th U.S. Circuit Court of Appeals said Thursday that it would allow a business group to appeal a February ruling that struck down the law, which critics say needlessly drives up the price of gas.

Utility sweats over bills when air's off

The news that electricity use in the state is down is good on many fronts. People are conserving energy and reducing the output of greenhouse gas and other pollutants from power plants.But the change is also a symptom of the downturn in the economy. And for Public Service of New Hampshire, the state's largest electric utility, it's a blow to the bottom line.

PSNH is asking the state to change the way the company is required to collect money from its ratepayers to make it less vulnerable to such dips in energy use.

The proposed change relates to what customers see on their bills as delivery charges, which address the cost of maintaining the infrastructure - such as poles and wires - used to deliver electricity to homes and businesses, as opposed to the cost of the energy itself.

Global Economy: This Ain't No Crisis

Well, I think it is entirely misleading to describe the current state of affairs as a "crisis". The term denotes a sharp, but short-lived condition leaving behind an aural after-taste that everything will be OK pretty soon. Particularly when combined with talk about massive doses of monetary and fiscal sauce being poured over the cooked goose of the economy.Instead, we should be using a terms like Stagnation or "The Long Emergency" (note: I am NOT fond of Mr. Kunstler's tirades and expletive-laden tent-revival style. But this book is not half bad).

Getting Real About the High Price of Cheap Food

But we don't have the luxury of philosophizing about food. With the exhaustion of the soil, the impact of global warming and the inevitably rising price of oil — which will affect everything from fertilizer to supermarket electricity bills — our industrial style of food production will end sooner or later. As the developing world grows richer, hundreds of millions of people will want to shift to the same calorie-heavy, protein-rich diet that has made Americans so unhealthy — demand for meat and poultry worldwide is set to rise 25% by 2015 — but the earth can no longer deliver. Unless Americans radically rethink the way they grow and consume food, they face a future of eroded farmland, hollowed-out countryside, scarier germs, higher health costs — and bland taste. Sustainable food has an élitist reputation, but each of us depends on the soil, animals and plants — and as every farmer knows, if you don't take care of your land, it can't take care of you.

Tim Halbur on sprawl, propaganda, and Obama’s approach to urban issues

The picture of cities being dirty, violent, and poor is where I think the propaganda aspect of the films kicks in. Cities were certainly dirty with pollution through the period of the 1930s-‘60s, which these films cover. And health issues were a reasonable concern with crowded conditions in big cities back in the early 20th century. But I believe these films were edited to make things look much worse, and again, the solutions they proposed were well-intentioned, but wrong. The issue of cities being “clean” led to the creation of those depressing housing projects with empty stretches of grass around them, where residents would supposedly enjoy being surrounded by a healthier atmosphere. Today we know better.As to being able to enjoy the advantages of a large city without paying the penalties, I think in some ways yes: we’ve learned more about how to make downtown urban areas work well. But I also believe that there are always tradeoffs. As David Sucher, who wrote a book called City Comforts, put it, people today want an “urban village.” And those terms are in many ways contradictory. Urbanity means accepting some chaos, anonymity and proximity to strangers. Village life is about stability and community. You can work to bring aspects of both to city life, but city living is really a choice to embrace vibrancy, which includes a little chaos and grit.

Are You Prepared for Transition Time?

Our industry is in the midst of some wrenching changes, but a much deeper transition is just over the horizon.You could be forgiven for thinking the economic crash was bad enough. The next big shift will affect the way we grow our food, manage our buildings, and transport ourselves and the products we use every day. We’ve reached the end of cheap oil, and the effects were captured in this short video, aired at MPI’s 2009 World Education Conference by panelists Elizabeth Valestuk Henderson and Fiona Pelham.

Cynicism springs eternal, offers little but wasted time

Like Al Gore, Gwynne Dyer and other dour prognosticators, McKeag brings up the oil crisis, that we’ve reached “peak oil” and have about 30 years left before everything — including food production — grinds to a halt.What they all fail to consider is that long before oil runs out, it will become so expensive that even the most outlandish hippie pipe dream of alternative energy will look good, and just watch the money roll in if you’re in solar panels.

As galling as it could be for some doom-mongers, the free market may solve the oil problem.

Moving on, why do the modern Nostradamuses think that because climate change is caused by humans, it can’t be solved by humans?

They’re not being creative enough.

The next big investment bubble - obscure metals

I notice in recent weeks that one entire sector has gone ballistic – lithium. Just about every company that is exploring for this reactive silvery-white metal has seen its stock price double. Why?

2nd lead poisoning case hits China, 1,300 sick

BEIJING – China has detained two factory officials after 1,300 children were poisoned by pollution from a manganese processing plant, days after emissions from a lead smelter in another province sickened hundreds.Both cases have sparked unrest and come amid growing anger in China over public safety scandals in which children have been the main victims. Tainted infant formula milk and the mass collapse of schools in a huge earthquake last year have also provoked widespread dissent.

Election likely to reset Japan climate target

TOKYO (AFP) – When Japan elects its next government this month, climate change campaigners will be watching closely to see which party takes the levers of power in the world's second-largest economy.

Seattle mayor fighting to hold onto his job

SEATTLE – Seattle Mayor Greg Nickels has been hailed as a visionary and a leader on environmental issues, helping persuade nearly 1,000 mayors around the country to abide by the standards of the Kyoto Protocol on global warming.But an environmental issue of a more basic sort — the city's inability to clear streets during paralyzing snowstorms last winter — might have set the stage for his political undoing.

B.C. must curb new gas plant emissions

A proposed $500-million natural-gas-processing plant in northeast British Columbia will become the province's single-largest source of carbon dioxide unless the government tightens the rules for greenhouse gas emissions, the Pembina Institute said yesterday.

Agency warns current climate proposals won't work

BRUSSELS – Reversing global warming will cost up to $185 billion (euro130 billion) a year before 2020 and require more action by world governments than currently pledged, an international environmental analysis group said Thursday.ClimateWorks Foundation said U.N. climate change talks would fail to reach a meaningful agreement with the proposals made so far, and that a new approach was needed.

"Climate change is a solvable problem, and the solution presents a major opportunity in terms of both economic growth and global development," said a report by the foundation's European branch. But it warned that "current commitments and actions are insufficient" to ensure deep cuts by 2050 in carbon dioxide emissions.

Poor Farmers Biggest Losers From Warming Planet, Study Says

(Bloomberg) -- Farmers in sub-Saharan Africa and similarly poor nations have the most to lose as the Earth gets warmer, highlighting the need to supply them with drought- resistant seeds and more effective water irrigation.A study by Danish professor Bjoern Lomborg showed that faltering crops may cut as much as 4 percent of gross domestic production in southern Asia by 2050. It also said climate change will impact other sectors including health and energy less.

A net-benefit greenhouse gas plan

In the beginning, the science of climate change was emphatically apocalyptic, with its images of starving multitudes, global plagues and civilizations lost, like Atlantis, to the relentless rising of seas and oceans. Although the beginning wasn't all that long ago (roughly dated to the 1980s), the scientific consensus is already more muted.Now, increasingly, science advises people to turn off the alarms. The question arises: Why are so many people still going berserk? Richard S.J. Tol, a distinguished climate scientist, remarked on this phenomenon in a paper published last week. "Projections of ... future climate change have become less severe over time," he observes, "even though public discourse has become shriller."

Re the top article on 5 MBD decline by 2012

we are already down 5 MBD since the peak last year - see Rembrandt's monthly report

also the IEA did forcast that the world would be shipping 68MBD on Jan 1 2010

that is, down 6 MBD

this was in Khebab's reconstruction of the data they published last fall

so the actuals in the top graphic are correct

the forcast is the graphic is too rosy

The graph shows an expected decline rate 2010-2012 of 3.4 %. Disturbingly optimistic.

I don't really think it is all that optimistic. While non-OPEC will continue to decline slowly, OPEC still has enough spare capacity to make up for any non-OPEC decline between now and 2012. I see world oil production pretty flat until the decline in non-OPEC production eats up OPEC spare capacity. That point should be reached sometime around 2012.

Ron P.

Let's hope so, Ron. You are much more into number crunching than I am.

But what's the use of spare capacity if you can't get oil out fast enough? IOW to what extend can it actually be utilised for EXTRA production, so not for off-setting declining production in the old fields? Would appreciate any and all comments.

I see Tony Eriksen's graph as the upper bound for decline.

It is ultimately finances that determine what is pulled out of the ground.

Peak oil -> peak credit -> declining investment.

None of this is likely to work out well, or as we expect. With less credit, there are fewer people buying houses and cars, and more people laid off from work. One would expect a continuation of the recession we have now, and getting worse. Less demand.

With less credit, there are also less funds for investment in new oil production (and building more cars, and building more houses).

Both oil supply and demand can be expected to drop, with the price of the day determined by which is ahead in the race to the bottom--supply or demand. Investment drops as well, so production is likely to go down faster than models would predict.

Where was this spare capacity during July 06 to October 07?... Before the mad rush to get every workable rig working?

Hey, I am not saying OPEC had spare capacity when they all were producing flat out. I am saying they have spare capacity NOW! OPEC is currently producing three million barrels per day less than they were producing in July of 2008. Are you trying to say that the sudden drop off in production last fall and winter was due to depletion?

And to answer Paulus' question, OPEC can ramp up to full production is about 30 days. But they will not have to do that because non-OPEC production will not fall off a cliff, it will decline rather slowly, far slower than it takes OPEC to ramp up.

I have also observed that non-OPEC nations put every possible rig in the field in 2007 and 2008 as the price of crude started to skyrocket. The sudden burst of production early this year was partly the result of that. Also hurricane season last year along with sour gas leaks in Azerbaijan, caused a huge dip in non-OPEC production in the second half of 2008. That is why non-OPEC production this year will be greater than last year, but less than every other year since 2004.

Ron P.

I certainly wouldn't dismiss the possibility out of hand.

I would definitely dismiss that possibility out of hand. In October of 2008 OPEC ordered massive cuts in production. During the next four months every OPEC nation except Iraq, which is not subject to quotas, cut production by an average of 9.5%. The largest cut was made by Saudi Arabia who cut production by 14.5% and the smallest percentage cut was made by Ecuador which cut production by 4.6%.

Okay, OPEC orders deep cuts then OPEC production in every OPEC nation subject to quotas suddenly drops off a cliff. I would absolutely dismiss out of hand that this was due to a sudden rise in depletion and that this depletion suddenly stopped as OPEC neared its new lower quota level.

Ron P.

Well put, but we don't now know how much of that voluntary reduction hid a reduction in production capacity, do we?

If they were hitting the limits of production in the period just prior, presumably some would in fact be facing the other side of the curve by now.

To me, it just adds to the unknowns.

Not that I am saying you are wrong, but Saudi Arabia is by far the biggest OPEC exporter, and made the biggest cuts. The rest put together don't come to that much. If SA was to crash (very improbable) the rest of OPEC between them couldn't do much about it.

It is more true than ever, when Saudi Arabia peaks, so does the world.

Saudi Arabia currently produces 28% of OPEC production. Saudi cut production over the first four months of cuts by 1,291,000 barrels per day. The remaining OPEC nations, less Iraq, cut production by 1,683,000 barrels per day. So Saudi is by far the giant among OPEC nations but you can count all the others as well.

Russia is now the world's largest oil producer. They have recently increased production to near their peak of 2007 but according to Russian watchers their production will fall next year.

I believe the peak in crude oil production was in 2005. If every OPEC nation suddenly began to produce flat out in 2010, then I think world production might be slightly higher in 2010 than in 2005, but only marginally so. But I think that has only a miniscule chance of happening.

Peak oil was in 2005.

Ron P.

You're probably correct but consider this: If production was going into decline due to depletion, what better way to disguise this fact from the importer nations than to announce a voluntary production cut? The motive for this deception would be to dissuade rationing or other conservation efforts & development of alternatives by buyers, ensuring continued demand for as long as possible. It's probably true that production cuts are in response to reduction in demand caused by economic recession but we don't have good enough information to dismiss the possibility that these cuts don't come on top of production declines due to depletion. If prices were still as high as they were last summer, mean OPEC cuts might be less than 9.5% but production might still be in decline. The new quota levels might be just about the best they can do.

No, he's wrong, and you know it. You're just being polite about it. Good job.

Your supposition above is exactly the case. When the economy attempts to rebound whenever, and oil demand picks up, OPEC expects to be able to tell its member countries to increase their quotas, because they recently decreased their quotas in advance of geological depletion rates. "See, we have plenty of spare capacity! Peak oil is a myth!"

It would have troubled me in the past that this is not more obvious to most people even on TOD. But even here most people aren't really paying attention.

I must be slipping. My reputation will be ruined if I'm caught being polite!

Thanks for these insights, d. Great to have people around with this level of knowledge about what's going on.

If anything like the graph plays out, it looks like a smoothed out curve would place peak in 2006. Shouldn't peak be based on such an averaged curve rather than on the individual month with highest production, as seems to be common here?

If you use an 'averaged' curve to smooth out the blips in the noisy data, as Darwinian says, 2005 is peak year - use your computer to put a line through the raw data to convince yourself.

Don't forget that the official monthly data is extremely untrustworty.

IMO the world's economy couldn't afford the price of early 2005 oil in order to purchase a bigger volume than the year before, so reaching that price anytime is likely to stop our economies growing again - if the marginal cost of new profitable production is above that price economic growth is likely to be over.

If we are post final-peak expect ALL oil companies, not just OPEC, to slow flow rates to keep the price up, preserve reserves and maximise their shareprice and profits in the long term - if there's no new profitable oil they don't have jobs.

It wasn't the $147 that caused the shutting in of production, it was the $34 that came a few months later.

If OPEC hadn't cut back the price would have dropped further.

Are the producers depleting? Of course, how could they not be depleting? Cutting back the rate of depletion either by voluntarily shutting in production can allow a field to recover. On the other hand, if a field is at the end of its life, as a result of physical depletion (flooding/water cut, etc.) shutting in parts of it won't change anything.

Unless you believe in abiotic oil squirting upwards from the depths.

How to tell peak:

- By cash price; the lowest price measures the greatest availability in the oil market. Measured by price the peak took place in 1998 (measured by EIA monthly prices).

- By the ability of cash investments to increase production. At some point increasing money investment in oil recovery fails to increase production. David Murphy examined this in a previous Oil Drum article; he quotes a New York TImes article:

This would give an inflection point somewhere around 2001.

- By easurement of actual production and adding/subracting unconventional sources. Matt Simmons and others here submit 2005 as the peak.

What can be taken away from this it there are several indicators that the peak in production has been reached, not just one. There is concurrance. If the peak is a few years earlier or later, it doesn't matter as much as the understanding that the amount of oil available will steadily decline over time, regardless of the tactics of producers. While there may indeed be several more Saudi Arabias out there just waiting for us, it is unlikely that these have escaped the scrutiny of the oil prospectors. By the time these fields are produced - presuming they exist at all - their effect against declines everyehere else will not matter very much.

Keep in mind, in a deflation, the oil price has held up very well. Take away the spike last summer and the following washout and the trend price has been steadily upward. There is also the possibility of another spike. With oil + $74, the resistance level appears to be $75 - $80. If it passes that price, there are technical reasons for a return to + $140.

Or more.

Thanks for the cheery news, guys : -|

I agree with some others that the 1998 price minimum marked the approximate date of the peak in Total Extractable Energy From Oil. We may now be down to high single or low double digit percentages for the amount of TEEFO left.

One would expect a decline in production recently. OPEC has cut production to maintain prices in face of the World depression, which has reduced demand.

July 06 to October 07.

Ignorant, that is not even a sentence. What is it supposed to mean? Please put a little more dialogue with your dates.

Ron P.

"July 06 to October 07.

that is not even a sentence."

Sure it is

Tiger Attack Victim Gets 16-Month Prison Sentence

http://m.news10.net/news.jsp?key=126782

Re Is Iran gas ban a step toward war?

"President Obama’s ultimatum that Iran must start talks and quickly "or else" may be based on the belief that pressuring the government in Tehran will produce a positive result. If that is the judgment, it is wrong"

Written by former CIA officer Philip Geraldi.

http://original.antiwar.com/giraldi/2009/08/12/wag-the-dog-again/

From Barry Ritholz' blog "The Big Picture":

Andy Xie: New Bubble Threatens a V-Shaped Rebound

(my emphasis)

I've got to say that I agree with the highlighted sentence.

And, therefore, price has lost all real-world, wet-barrel meaning, if it ever had any.

Fortunately there are a lot of other statistics we can use: production and stocks numbers, E&D numbers, oil companies buying back their own stock, ...

The point here is that any arguments about oil supply that are based solely on price movements can safely be ignored, saving time.

Behind a paywall, but viewable if you go in through Google:

Will China Light a Fire Under Coal Price?

EIA net coal exports from China, based on BTU's, through 2007:

Their 2001-2007 net coal export decline rate, -24%/year, looks similar to their 1985-1992 net oil export decline rate, -17%/year.

After hitting net oil importer status in 1993, Chinese net oil imports increased at +28%/year from 1993 to 2008 (doubling about every 31 months):

Sayano-Shushenskaya dam, 6400 MW

Photos of generator units from #1 to #10 (640MW each):

http://forums.drom.ru/hakasiya/t1151239745-p169.html

#2 is the source of the disaster and, for all practical purposes, is gone.

#7 and #9, despite being far from the source, went wild and damaged themselves badly.

#6 was out on maintenance and reported to be less damaged than any.

Those pictures really tell the story even if I can't understand four words of Russian.

Amazing the things that can go wrong, even in a hydro plant. This is a perfect illustration of the energy involved - no matter what the source of the energy is, any generator that "produces" so much power must have a an enormous source of energy available which is to be changed in state to something more useful. There isn't any way to do this without impact or in total safety. There is always the possibility for something to go very badly wrong.

Incredible pictures, thanks for the link.

It can be difficult to comprehend how long this may take to repair. There are very few companies capable of producing these kinds of systems (not to mention the unknown potential damage to the penstocks and other inner workings of the dam). Based on previous experience evaluating the time it would take to repair something similar in the US, this will take years before it's brought back online at 100%. The generator units will probably need to be purchased from South Korea or China, which may take years for delivery. Depending on what kind of repairs or inspections are required at the dam, intakes, etc., the reservoir may need to be drained a significant amount, which could reduce generation for years more.

Just for a little perspective, this is the equivalent of taking 200,000 barrels/day of oil production offline indefinitely (assuming 5000 MW actual generation and using a straight 1.64 MWh per barrel--very rough figures).

The units were built in St. Petersburg and they will be repaired by the same company without doubt. As for completely lost units, the company already anounces that they'll be replaced by more efficient 750MW generators. The company is Power Machines, 25% of which belongs to Siemens.

Blog post about the dam, current and past construction work. In Russian, but with lots of pictures, like this one.

Couldn't happen with a nuke plant. Those things are inherently safe, right?

http://upload.wikimedia.org/wikipedia/en/1/1b/Chernobyl_Disaster.jpg

Nothing's safe. But a badly designed plant that had all the safety limitations taken offline deliberately at the orders of a political hack is probably not a good example of potential problems. And it still killed far fewer people than coal does every year.

I would disagree. In a global nuclear economy, a significant fraction of nuke plants would operate under just such a situation (Somalia, Zimbabwe, Libya,etc.?) with much greater potential consquences than would result from mismanagement of a CSP plant or a wind farm. But of course in the nuclear proponents' dream world, such messy complications never occur.

Given Somalia, Zimbabwe, and Libya are out of my jurisdiction, theres not a thing I can do one way or another about that. I suppose I could go to war with them, but I think I'll be content just to say I told you so when they screw up.

Life's not perfect. Too bad.

'Life's not perfect. Too Bad.'

..that being the other natural rejoinder we get from Nuclear Proponents when the many dangers of operating reactors are pointed out.

With a worsening economy and energy predicaments spreading into formerly stable countries, we can only expect those Desperate Rule-loosenings to spread. Remember the announced reopening of once-shuttered reactors in the East Bloc last winter as Gas Supplies were held out of Europe?

Careful who you contentedly say 'I told you so' to..

Nuclear opponents bring up how badly the Russians and Chinese run nuclear plants in opposition to US and European nuclear plants.

Perhaps if we build (built?) fail-safe nuclear plant when there is enough energy surplus to do so we won't be as tempted to cut corners on the construction when we need the power urgently.

If it becomes a choice between building cheap, unsafe nukes or letting people freeze in the dark I think that nuclear safety will lose.

This seems like a solvable problem. Do not build nukes in Somalia, Zimbabwe, Libya, and several other places.

I also would recommend not building a large assortment of other plants and factories in a number of countries prominently including Somalia and Zimbabwe.

I think what people are worrying about is that in the future, the US will be Somalia or Zimbabwe. It's possible that the post-peak future will not be either Ecotopia or The Road, but simply the First World slowly turning into the Third World.

That is something I consider when evaluating silver BBs. How gracefully do they fail, if the time comes when we no longer have the capability to maintain them?

Leanan,

At least in developed countries I do not see Peak Oil as the reason why nukes could suddenly become unattended (to disastrous results). A more plausible scenario: A Carrington Event. If we had nukes in 1859 we would have been in trouble.

I also wonder what would happen if a VEI 7 or above volcanic eruption happened close enough to a nuke to prevent humans from tending to the nuke.

Of course, a VEI 8 or VEI 9 eruption would probably make solar panels far less useful.

Having plenty of electricity makes it less likely that a region will turn into a political mess.

But we are fucked if we dont use our brains and work hard with a long term view.

Well, modern PWRs are.

If you want to make a bomb that boils water like an RBMK, you might have problems however.

One can question the tradition of having all turbines in an unpartitioned turbine hall. Its cheaper, looks neat and makes maintainance easier but if one fails badly all of them can obviously be taken down.

Been there, saw that. Didn't get a t-shirt.

http://www.panoramio.com/photo/529547

Scanned the article looking for estimates of flow rates (BPD) and nothing significant jumped out at me. When will these people get it? If you're used to satisfying your thirst by siphoning off water from a Olympic size swimming pool with a 2 inch diameter hose, even Lake Superior isn't much help if all you've got is a tube the size of a drinking straw.

Alan from the islands

If they prove the superior economics of their process and higher recovery rates then all the other oil firms license the technology and then you have ten of thousands of straws (because the alberta oilsands are the size of Florida.) Plus the THAI/CAPRI techniques are applicable to heavy oil in Sask, South America and other places and the CAPRI process is converting the heavy oil to about the API quality of Saudi light oil. this upgrading is happening underground and does not require waiting for more refineries.

BTW: nextbigfuture is my website. I have updated the article and linked and added some information from my older articles which describe more about the projects and methods and the importance and economics of higher API.

Oilweek on THAI/CAPRI

http://www.oilweek.com/articles.asp?ID=601

One catch with Canada is that it depends on imports, in order to have enough petroleum to send us as exports. This is the forecast I made of future oil supply in a post last week. It is possible that production could ramp up more with new methods, but generally it takes as while to get them in place.

Under the above scenario, US imports would likely fall, if Canada's consumption is increasing, and if its conventional production and overseas imports are declining:

Canada's exports won't necessarily go to the US, though, especially if we have concerns about the CO2 generated. Canada is already working on a system of rail transport to its West coast, so they can export to China (and potentially make more money than exporting to the US).

http://network.nationalpost.com/np/blogs/francis/archive/2009/04/09/cn-s...

http://network.nationalpost.com/np/blogs/francis/archive/2009/04/15/oils...

A Canadian guy I talked to told me that in his opinion the whole THAI thing is a bunch of smoke and mirrors designed to drive Petrobank's stock price higher, so that they could use the appreciated stock to buy proven conventional reserves (his opinion; I don't know). What I do find interesting is that their current THAI production is only about 200 bpd or so.

I don't think THAI is a bunch of smoke and mirrors. It is just a very new technology that they are trying to shake the bugs out, and figure out if they can scale up. This takes a long time. No one expected that they would have their production up very far yet. One works on a very small scale initially. They have filed plans for a 100,000 barrel a day facility.

But there are a bunch of competing technologies out there as well. One is an electro-thermal approach, which hopes to work in some areas where others technologies don't work. See here and here.

Even if these things work, they will take quite a while to scale up.

Of course, a cynic might think that they have played the THAI thing for all it's worth, and they are on to their next attempt to hype the price of the stock. From the link uptop:

In any case, it just seems to me that when we look at actual production, and not projections, the amount of attention given this THAI/CAPRI thing is far more than is warranted. Maybe when, or if, they are producing tens of thousands of barrels of oil from their THAI/CAPRI process we should pay more attention.

There are a bunch of approaches out there--it is not clear whether THAI will be a winner. Some approaches are just trying to incrementally fix mining, like the post Leanan showed this morning. Others are looking at using petrochemicals as solvents, to dissolve the bitumen out.

Efficiency is gradually getting better, but Oil Sands are still high cost relative to many existing kinds of production, and relative to what people are able to pay for oil.

One question about the THAI process which sticks in my craw is the problem of venting the gases which are produced. The cartoons from Petrobank show indicate no pipes for exhaust gases to exit the tar sands. Are they pumping O2 into the ground to fuel the combustion? The resulting CO2 would be a good solvent for hydrocarbons if liquified, but that would require high pressures. The liquid CO2 would exit along with the other hydrocarbons in this scenario.

Anyone have thoughts on this?

E. Swanson

Previous articles referenced on Drumbeat have described THAI problems with emissions. CO2 is simply vented to atmosphere. And since air (not O2) is supplied, oxides of nitrogen are produced. These must be further combusted using CH4 to prevent these very polluting & ozone forming compounds from being released. So the THAI is not without its complications or extra costs.

Another problem is that 20% to 30% of hydrocarbon is not extracted from the sands as THAI process burns it as a heat source and further some is simply bypassed by the flame front and left behind. So the recovery rate is much less than conventional tar sands mining.

The initial article (above) says CAPRI process uses catalysts in drain pipes for in ground upgrading of bitumen. This leaves a lot of unanswered questions about cost of the process and efficiency of the process. CAPRI is supposed to upgrade bitumen to refinery ready oil, but only a percentage of extracted oil is fully upgraded (cracked into shorter hydrocarbon chains). My concern is the ability of this to work in such a dirty underground environment of sand, steam, oxides of nitrogen, etc. coming through catalyst pipe along with bitumen and hoping the catalyst can do its job. Economically viable? I doubt it.

Gail, what about the devastating impacts on environment ? Some time ago I read on Drumbeat that the government was considering to prohibit new tarsand projects. Also the amount of gas and water is mentioned in several reports as being a limiting factor.

I've said it before and I'll say it again, with OPEC managing supply and demand having recently crashed by almost 3 million b/d, this type of supply analysis does not tell us anything about peak oil. Now if this chart was one of productive capacity, then it would certainly tell us something, but it isn't.

You can interpret production data in any number of ways. OPEC may have added 10 million b/d of capacity which is currently shut-in, or they may have lost 5 million b/d of capacity and have zero in the tank. We can't tell from merely charting actual production.

If demand continued to decline as much as it has this year, we could also say that the spare capacity buffer is set to improve over the forecast period. Now I'm not saying that it will at all, but simply pointing out that only a complete analysis of productive capacity plus liquids demand will provide evidence, or any kind of indication, of whether we are approaching an imminent problem or not.

The big question is still what is happening at Gahwar (sp?).

On of these days/months/years it is going to go into serious decline like Cantarell in Mexico. When that happens things may go down hill quickly?

Maybe before the end of the year it might be helpful if some of the gurus could update the info on their take on the status of Saudi oil fields?

Due to the nature of the Saudi oil production strategy over the last several decades they will decline rather rapidly.

Production efficiency yields a faster and steeper decline.

They have stuck more "Super Straws" into the sand that simply extract more oil out faster in order to do two things; keep up with demand and (more importantly for the Saudis) give the appearance of possessing an ability to produce a certain amount of crude oil per day.

They keep saying that they have so much spare "processing" capacity. Processing capacity is not Crude oil production. They are referring to oil and water separation, which is occurring at a horrendous rate over there. They are trying to keep up but it will only get worse over time.

Good luck getting the Saudis to agree to data transparency. The people that run the Kingdom know full well how short they will be and how soon. They simply don't care because by the time that happens they will probably be dead. They can collect their riches NOW.

King Abdul Aziz Al Saud would be sad to see this turn of events. I am sure that he and other leaders of his time acted in a much more honest and open way. Honor was big back then. Plus, they were proud that they acted in that manner. Anything else was not tolerated.

Chicken, OPEC production capacity is a question but it is not that large a question. We do have OPEC megaprojects scheduled to come on line and we also have a guess at depletion rates. All OPEC nations, save Saudi Arabia, have, since last summer, put on less new projects than they have declined in production. Saudi fields are declining by from between 500,000 and 1,000,000 barrels per year. In the last year Saudi has put on more production than that.

In the last year Saudi has added production capacity while all other nations have lost production capacity. So it is pretty much a wash. If we assume that OPEC was producing flat out last summer, and I believe they were, then OPEC has spare capacity of about the amount equal to their recent cuts, or about 3 million barrels per day.

There is one caveat, Nigeria. Ecuador, Venezuela, Nigeria and Iraq are currently producing flat out. Ecuador and Venezuela have recently increased production to their former levels, or to the point where their decline trendline would put them at maximum production. Iraq is always producing flat out. But Nigeria could possibly produce about a million or more barrels per day than they are producing right now... if peace were suddenly to break out in that country.

Ron P.

Who knows if Khurais field can produce the announced 1.2 mbd ? Maybe only 800 kbd or even less.

It's a good point, and as I have pointed out several times, the Texas Railroad Commission has restricted oil production in Texas for 37 years because of a lack of demand for Texas oil, "Even our light, sweet oil." In the alternative, some people blame the decline in Texas oil production on the little known Midland, Texas based Communist takeover of Texas oil fields. The secretive West Texas Politburo meetings were held in the Petroleum Club in Midland.

In any case, if we can implement the same type of technological improvements that the Saudis are talking about (approaching a trillion barrels of recoverable reserves in Saudi Arabia), I see no reason why Texas can't ultimately produce another 200 to 300 Gb of oil.

Of course, some nutcases attribute the Texas and North Sea declines to natural depletion and to the inability to fully offset the declines from older, larger fields. These people are clearly insane and should be institutionalized.

Aw shucks, sure 'nuff can. The Saudis may have their Gharwar, but Texas has Spraberry!!!!

(sic)

:) yep !

RE: Cynicism Springs Eternal article topside

That would be fine, were it not for the fact that a declining economy tends not to generate a lot of that money that is supposed to be rolling in.

In a declining economy, for that money to roll in for solar panels, it has to have rolled out of something else. It is a zero-sum game, see? Once our economy is in long term decline, investing in anything that makes the pain a little less worse in the long term is going to require sacrificing something that is going to increase the pain in the short term.

That is very hard for people to do, although it has been done a few times in a few places. When I look at the political culture of the US though, I find it very hard to see how we can do that.

Maybe the money can come from the treasury.

A huge percentage of these treasuries are being purchased by the Fed because others are cutting their purchases way back. This purchasing program will end at about $300 billion in October. What then? The very least that can be expected is a dramatic rise in interest paid on these instruments in order to attract more buyers.

Fed Treasury Buying to Slow Before Ending in October

Notice the words "as the recession eases". Is than not being a little presumptuous?

Ron P.

"as the recession eases" presumptuous Ron, where is your cynic hat? well that depends how you define a recession, e.g. the definition of GDP bears little relationship to the real world of increasing unemployment and one in eight US mortgaged properties being in foreclosure or at least one month outstanding.

An example, here in Yuroop government cash revenues are significantly falling mostly due to lower corporate tax revenues but economic indicators are saying GDP has risen or will rise, WTF !! We get the usual seasonal improvement in housing and suddenly the media are claiming housing is OK but conveniently forgetting that prices always rise in the summer and seasonally adjusted are still falling.

This latest US borrowing binge comes two weeks after a similarly sized auction (which i commented on here that the Fed were buying it back to give the impression that longer term bonds had a good market) so 400b+ in the last month. I wonder how long they can keep that up? I suppose they will keep it going until the foreigners stop buying, run out of money or we get a black swan (any suggestions?).

Since it requires two consecutive quarters of negative change in GDP to be officially in a recession, but only one positive quarter to be officially out of it, they can lie with statistics for a good long while.

The US Treasury/Fed can create money, but what they can't create is value. If the economy is producing less and less of value, then you can "run the printing presses" (figuratively, that is) all you want, and all you will do is produce money that is worth-less.

As of June, China held $776 billion in treasury bills, Japan held $712 billion, the U.K. held $214 billion, "Oil Exporters" held $191 billion, and "Caribbean Banking Centers" held $190 billion, according to the U.S. treasury (www.treas.gov).

Now, doesn't this strike you as the U.S. Gummitup as owing a lot of money to people who are mostly interesting in making money and not much interested in helping the working (and formerly working) poor of America?

Tick these people off, and they'll call their loans. This is what the Chinese refer to as their "nuclear option". You have to play nice with them or they'll pick up their marbles and go home.

Most of the American financial bailout is being done with borrowed money from foreign sources. The U.S. has to pay this off eventually or join the ranks of Argentina, Mexico, Venezuela, Russia, etc. It's going to hit Americans in their pocketbooks, so they should start getting ready for it.

And there is no way we can ever pay it off - we cannot even stop borrowing. And everyone knows this. So what is the end game, where does it lead?

It is not possible for us to accumulate increasing debit forever.

Eventually, something must happen, some change must occur. What will it be?

Wrong question Twilight. We know what will happen, total economic collapse with the dollar inflating to near nothing. The correct question to ask is WHEN?

Ron P.

Yes, I know that, and when would be nice to know. I guess. But there may well be other things associated with the end game - wars would be a likely outcome too. Empires don't usually collapse without upheaval.

Not being gifted with god-like prognisticating power, I DON"T know what will happen.

But some alternative futures I can imagine:

1) Increasing tax rates on rich people in the US closer to historical levels reduces debt/deficit to manageable levels over decades (this has happened in economies with higher debt/GNP ratios than current US). Maximum US income tax rates in 1970 were 70%, 94% in 1944, versus 39% today.

http://www.truthandpolitics.org/top-rates.php

2) War and revolution replaces the dollar with another currency.

3) Aliens land and dis-inflate the dollar.

4) New technologies invigorate the economy, increase tax revenue, and balance the budget.

If you seriously think you can predict the future with certainty, stop wasting time on the Oil Drum and start picking stocks or hiring out as a psychic.

This is the only possible alternative. New technologies won't replace the energy from oil and gas to keep the economy on the growing path.

Not only that, but these incredible sums are being borrowed and largely pissed away (i.e. the Pentagon paying $500 for a hammer, billions transferred to Goldman). All this money lent to the Treasury CANNOT BE LENT to productive businesses-the overall economy is being starved of real productive investment capital. So much for plans to deal with oil depletion.

Your memes could use some updating, but I have neither the time nor the inclination to do your googling for you.

Government contracts can specify reimbursement of R&D costs in one of two ways: either through a dedicated IRAD contract, or by distributing the cost across all the deliverable hardware. That "$500 hammer" of yesteryear was of the latter type, so it embodied a fraction of contract R&D that was designated by the government, paying for lots more than a hammer.

To be sure, I have seen my share of waste and cronyism in government contracts, but this hammer/toilet seat/fill-in-the-blank story from the 70's is IMO more an example of MSM shortcomings than of abuse by contractors.

Your attention to detail is very impressive, but you miss the forest for the trees. All this money being borrowed by the guv squeezes out productive borrowing, unless you figure everyone an either work for the guv or work for a frim supplying the guv. Who is supposed to actually support all this overhead?

If government borrowing was truly squeezing out productive borrowing, then logically the supply/demand imbalance would produce high interest rates.

Of course, the opposite is true, with interest rates at historical lows, making your hypothesis quite unlikely.

Sorry Tommyvee but you are simply wrong. The only thing that is keeping interest rates low is the fact that the Fed is buying up a huge amount of the Tresuaries being auctioned. That is about to change as the Fed stops buying next month when it has bought about 300 billion of the debt.

If you doubt the effect the massive borrowing is having on commercial borrowing as well as the value of the dollar then just take a look at the chart on this page.

Foreign Purchases of Long Term Domestic Securties

A good write up on this can be found here: Monetization of USTreasurys In Isolation

Ron P.

No, tommy, I agree with Brian: Productive borrowing is toast already, but it won't show up in bond rates until the government printing & borrowing finally overwhelm the ongoing massive credit contraction, at which time the interest rates will catapult and the economy will go into full arrest.

I was only pointing out that, inefficient as it is, the aerospace industry actually produces stuff, unlike Gold-in-Sacks, that "great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money."

Thanks to Mr. Taibbi for the quote of the year.

The Chinese (or anyone else with gigabuck balances) can't really exercise the full "nuclear option" for the simple reason that there is nobody around who would buy that many US Treasuries. There aren't even enough buyers around to absorb all of the new ones being issued, which is why the Fed is having to buy so many. The best the Chinese can do is to quietly and slowly start slacking off on their buying of new issues (which is exactly what they are doing), and to quietly and slowly start exchanging some of their stash for commodities, equipment, infrastructure, and overseas investments (which is exactly what they are doing). In the long run, this might actually do the US more ultimate harm than a sudden fit of pique (which would hurt them as much or more than it would hurt us).

Short term USTs are money, long term USTs are wistful dreams of Unicorns.

Chinese may use their "nuclear option" but then their regime will fall because they will have to deal with 300 million unemployed. I don't think they want (or can afford) that. So, until they develop their domestic market, it is a mutually beneficial relationship--for a while anyway.

How to turn seawater into jet fuel

Just add money.

So what's the EROEI?

"But to make a jet fuel that is properly "green", the energy-intensive electrolysis that produces the hydrogen will need to use a carbon-neutral energy source; and the complex multi-step process will always consume significantly more energy than the fuel it produces could yield. In addition, each step in the process is likely to add cost and problems"

That's from the link. At least it's admitted.

Less than unity, of course. That doesn't mean you wouldn't do it, as it is rather hard to run a jet fighter on electricity. But you probably wouldn't want burn coal (or anything) to make electricity to make hydrogen to run a FT reaction on the CO2 in seawater to make jet fuel.

Unless the military pays you to do it, of course.

Well why not just use the nuke reactor on the aircraft carriers? Thay way you could just suck in sea water and hose out jet fuel straight into the planes. And then they can carry on bombing the sh!t out of unfriendly regimes who won't share their oil. Simple, joined up thinking ;)

The Fischer-Tropsch process requires a lot less energy than does making hydrogen from seawater. But it also requires a lot of natural gas or syngas made from coal. So if you are going to make your hydrogen from seawater you would probably need to at least triple the size of your power plant.

Ron P.

No Durable Recovery

I wonder how long it will take for the model to change. My guess is that they'll string us along for years. Prosperity will always be just around the corner.

I read yesterday the Phoenix is also losing population.

In Florida, your guess is quite right for now. We've seen quite a few schemes for 'restarting' growth already (getting rid of impact fees, arbitrary reductions in fees, expedited permitting, looser growth management laws, and a new law that allows approved permits to be extended 2 years, just for starters) and you can be sure more will be forthcoming with the news that we're actually losing people.

Halfway decent/interesting opinion article:

http://www.orlandosentinel.com/news/local/orl-mike-thomas-growth-082009,...

The difference between us and Detroit is Detroit made cars, we made homes. A little oversimplified, but not too much. So I think we here in Florida have an interesting view on how much people want to beleive (and will continue to believe) in continued growth, because down here we've built a bit of a ponzi scheme, depending on new arrivals for both jobs (building homes and taking care of old people) and money (people moving into the state pay much higher property taxes than those who have lived here for years). And when growth doesn't return, we can always find a scapegoat-high taxes, too liberal, too conservative, too many rules, no mass transit, not enough roads, whatever, depending on your politics.

And don't even ask what will happen if there is a big hurricane soon, because the state has decided to pick up most of the tab.

Perhaps related...

Rise of the Super-Rich Hits a Sobering Wall

I have known people who understood, at least on some level, that big problems were coming, but they believed they would make it far enough up the ladder that they would be OK. I always thought that there would be too few chairs when the music stopped - I expect I will be poor.

Last year as the economic crisis was picking up momentum I found myself holding an extremely poor hand. I had the bulk of my estate (in my case a modest one) invested in Commercial Real Estate Developments in Las Vegas. Since then one has been foreclosed upon and the other two are waiting for the Reaper. We have one commercial space that has an anchor tenant that hasn't paid his lease for over a year. The courts are backed up and besides...if we managed to get an eviction we don't have another back-up tenant.

It's hopeless...but my partners were in much deeper than I and therefore had a great deal more to lose. One partner died in March from a massive coronary. He had been ill for a while but the prospect of being old, sick and broke was too much for him.

I have to admit...I didn't see it coming but once the collapse began I could see crystal clear where it was going. But my wife and I see this as an opportunity to recalibrate our lives according to what is truly valuable. I still have some small assets that will ensure that at least we won't be homeless. That's more than a lot of other people might hope for. I'll be taking some courses in Horticulture starting next week. I want to learn something useful.

Good luck to you Twilight.

Joe

Thank you, joe, for sharing this tale. I admire your acceptance of your circumstance, apparently without blamestorming or futile rage. All we can do is press on, but it seems like many won't have your gumption to do so.

Like Gail says, everybody loses in a Depression, and all we can hope to do is hold on and not slide off the bottom into homelessness and destitution. That kind of mere survival will become the new "winning."

Thanks Joe, and good luck to you as well. At the moment I'm doing fine, but I have an annuity and a mortgage and no prospect of paying it all off soon. As long as the annuity and the job hold out, everything is OK, but the odds of that are very low long term.

We've been very conservative in the debt we took on relative to others - we just refinanced to a 4.5% 30yr fixed, and still have 50% equity at the present market value in this area. My job involves designing products for the electric utility industry, and I bought into the company a year and a half ago. This seems like it would put me in a pretty good position, but I don't really believe it will be enough. The storm that is coming will reveal that what once seemed like prudence was in fact a serious risk. Still, it is a very good place to try to survive, and if we can hang on to it will make a good asset to pass on to our kids - so we're going to try to keep it. So much is dependent on timing and chance.

Joe,Twilight

I suggest that you look into buying a small place in the foothills of the mountians in Va or NC withyour remaining assets if you are considering a move.Property off the ridges and main roads is cheap.Good luck.

If you are healthy and able to do some heavy duty gardening,burn wood,etc,you can actually live ok on a ss check if your place is paid for-no luxuries of course,but ample frre time in a decent environment. If tshtf for real ,I don't think you can find a better place.

Right now I expect you could get a long term lease on a sound smallish house with a huge garden spot, sheds,a landlord willing to throw in plowing the plowing,no water or sewer bill ,very low personal property taxes,etc, for less than half the going rent on apartments in most cities.

Firewood is dirt cheap and there are plenty of small farms where you can buy all sorts of stuff for anywhere from ten cents to forty cents on the dollar of super market prices in season.

But for gods sake please don't put this in any links to the msm. have enough of the wrong kind of new citizens as it is.

Just when the swine flu news was rather boring.

Chile confirms swine flu in turkeys

"Distinguished climate scientist" Richard Tol is no such thing. As the rest of the article and a quick search shows, he is an economist (and from his photo looks more extinguished than distinguished).

http://www.mi.uni-hamburg.de/Prof-Dr-Richard-S-J-Tol.5725.0.html

Are we surprised that an economist thinks that gw is no big deal?

Two economists are are sitting having a drink in a bar when one says to the other:

"You worried about man-made global warming?"

the other replies:

"Naw, once the price goes higher we'll just make more".

Oh, that photo is priceless!

He looks more lit than extinguished to me ;-)

I figure we're now on the decendency to a general lower standard of living where more of our income will be consumed by neccesities and more of our time consumed in labour.

Preparation is pretty much useless unless the whole of society is on board.

So I'm going to party on over that cliff edge. One last blowout. Screw the planet i'm going to fly all over the place on the last exotic holidays i'll probably ever get and purchase a big engined car while there is still some drivable tarmac on the road. Just got me a big plasma screen and fifty billion channel sound. Lots of red meat and wine. Yummie. Any other ideas about enjoying it while it lasts?!!

Marco.

Yea! I got myself a Honda Magna V65 to ride over the cliff! =D

Sure.

Be careful about gloating. It could backfire.

Krugman has an amusing column today where he uses the analogy of the election of Obama as America being "punked" http://www.nytimes.com/2009/08/21/opinion/21krugman.html?_r=1