Canada's Oil Sands - Part 2

Posted by Gail the Actuary on September 1, 2009 - 10:06am

This is a follow-up to Part 1, which tells about my recent trip to Canada's oil sands, on a trip sponsored by the American Petroleum Institute (API).

In Part 2 of this post, I provide some additional thoughts to help the reader come to his / her own conclusions about the future of the oil sands. I talk a little about how Canada's oil sands production fits in with its other sources of supply, and how this in turn relates to Canada's exports. I also look a little at some political issues and how these fit in with environmental issues. A closely related post is this recent post.

How much will oil sands production expand in the future?

There is no doubt that there is a huge amount of resource in place - between 1.7 and 2.5 trillion barrels, according to the Oil Sands Discovery Centre's Oil Sands Story. Of this, 173 billion barrels (about 10%) is considered producible with current technology at 2006 prices ($66 barrel for WTI). Production to date has been relatively low, though--only 1.2 million barrels a day in 2008, according to Canadian Association of Petroleum Producers (CAPP).

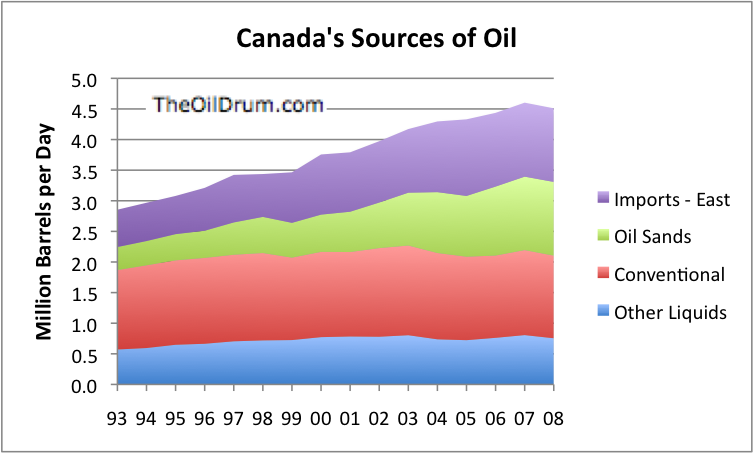

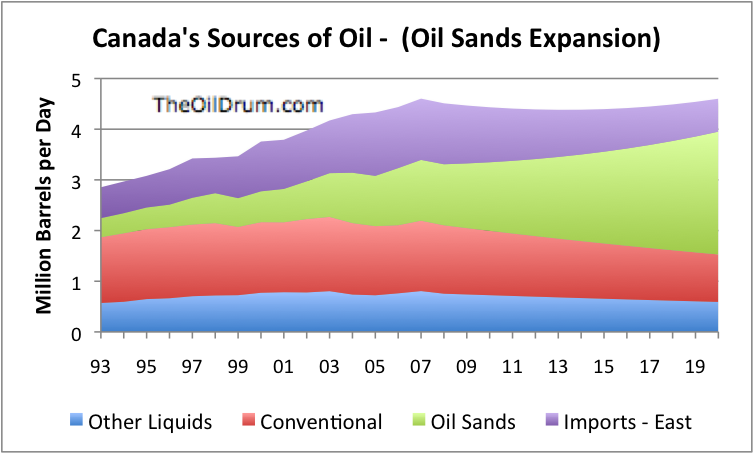

A big part of the reason that Canada can export oil to the United States is the fact that it is importing oil on its East Coast for its own use. When one looks at oil sands in relationship to its other oil sources (including imports), oil sands oil is only about one quarter of the total. The non-oil sands portion is expected to decrease in the future, so a significant increase in oil sands production is needed simply to offset expected decreases elsewhere. See my earlier post about this.

Unless oil prices rise above today's level, and stay higher, it seems unlikely that there will be a major increase in oil sands production. Don Thompson from the Oil Developers Group told us that in order to justify new development, the cost of West Texas Intermediate (WTI) crude must be at least $80 a barrel. CERA indicates in a new report (free with registration) that more than 70% of proposed Oil Sands expansion projects were postponed, after the drop in oil prices in 2008. CERA quotes a needed WTI price of $65 to $85 barrel to justify Oil Sands expansion--but based on a rate of return of 10%--which is probably not high enough.

Even beyond high oil prices, a major ramp up would also require a huge amount of investment funds. For example, if one wanted to add 1 million barrels a day of upgraded oil by adding new mines and upgraders, it would require an investment of roughly $126 billion dollars, based on a CERA estimate of $126,000 per flowing barrel. It would also require a huge amount of credit availability and a veritable army of workers.

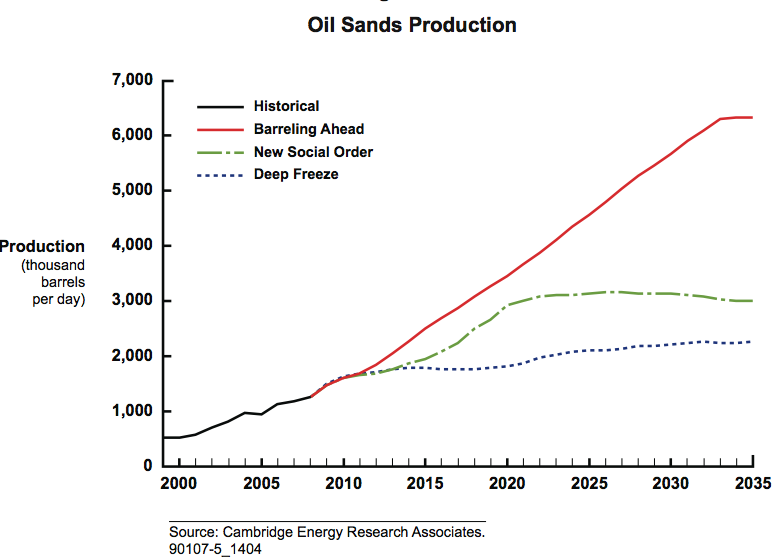

In the absence of a major improvement in technology (or perhaps even with one, since a big change in technology often takes a long time to implement), my estimate of the ramp up in oil sands production to 2020 is given below:

I am forecasting that oil sands production will approximately double by 2020 (from 1.2 million barrels per day in 2008, to 2.4 million barrels a day in 2020). This forecast, in part, reflects Tony Eriksen's ("ace's") calculation that projects already approved and in construction are expected to bring production up to 1.94 million bpd. Growth beyond that is expected to be constrained for a number of reasons, including difficulty in obtaining sufficient investment funds, need for a high price of oil to justify new construction, difficulty in obtaining enough diluent, and the possibility that royalties will be higher as governments discover that oil companies are among the few companies from whom higher taxes might be extracted.

Note that even with this increase in oil sands production, the total supply of oil available to Canada (including imports) dips somewhat, and exports are likely to decline. My forecast for oil sands production to 2020 is similar to the average of CERA's two lower production forecasts, taken from the new CERA report.

Even in CERA's "Barreling Ahead" forecast, the ramped up production will barely make a dent in the four or six Saudi Arabias of new oil production that Fatih Birol of the IEA has said will be needed if new production is to offset declines.

How much Canadian oil will the United States import?

Based on the forecast I made for oil sands production, the amount of imports to the United States are likely to drop somewhat, even if the United States continues to receive virtually all of Canada's oil exports.

Will oil actually be exported to the US?

But how likely is this scenario? When one reads Canadian material, it becomes clear that many Canadians would very much like to diversify the countries it exports to, even if currently nearly all pipelines lead from Canada to the United States. With the US as its only export partner, Canada has little leverage in bargaining over price. Also, there are details such as the US charging less for gasoline than Canada--why should Canadians be taxed to keep their consumption down, and the same time Americans can buy Canadian oil and sell it for less? NAFTA limits changes right now, but over the long term, that can be changed.

Canada is already working on an approach that will allow it to export oil in directions other than the US, to help diversify its exports. The approach is a rail link that acts like a pipeline, and can be implemented quite quickly. China and others with few environmental concerns are particularly favored as export partners. Canadian National (CN) also has tracks going East, so this approach could also be used to bring oil from western Canada to eastern Canada.

CN's revolutionary pipeline on rails

The Canadian National Railway has developed a transformative strategy it calls the “Pipeline on Rail” which can move oil sands production quickly and cheaply to markets in North America or Asia. . .

CN could gear up its capacity to ship by rail up to four million barrels a day of oil at less cost and more quickly, bypassing the need to finance huge pipelines. By the end of this year, the company will be shipping 10,000 barrels daily from producers whose reserves are now stranded.

Oils sands: Canada to China, Japan, India not US

This project, in its early stages, will eliminate three barriers to the development of Canada’s vast oil sands: the cost, delays and financial risks involved in building multi-billion dollar pipelines; the politics of obstruction south of the border from environmentalists and the danger of selling oil to monopoly buyers in the U.S. which has, in the past, resulted in contracts being ripped up when times were tough.

It also allows Canada to decouple from the American economy when it comes to its most important commodity which is oil products. This is because all the oil sands production can be routed to the west coast for shipment to Asia or anywhere, thus avoiding monopoly pricing and bullying by the Americans. Besides that advantage, oil sands are the national trump card in the future and the American economy, now sputtering, will never be as robust as before.

China is interested in investing in the oil sands. Just today we read that China is paying C$1.9 billion for an oil sands investment.

Alberta will ramp up oil sands, to the best of its ability

Alberta is very dependent on the oil sands industry, both for jobs and revenue. A report by Canadian Energy Research Institute (CERI) indicates

. . .every dollar spent on big oil projects stokes nearly $2.50 in further spending in Alberta, plus another roughly $2.50 in the rest of Canada. In other words, a $10-billion decrease in energy spending translates into about $60-billion in lost economic activity across the country.

These revenues translate to tax revenues as well, so I find it difficult to believe that Alberta will cut back oil sands production voluntarily, or even limit new production. If the US wants to cut back on imports because it is unhappy about CO2 or other environmental issues, I don't see that as a huge problem to Canada. Canada will sell its oil elsewhere.

Potential Impact of Loss of Oil Sands Production on US

From the US point of view, the potential loss of oil sands oil could be problematic. Pipelines that feed the oil sands oil feed directly to the Midwest. If oil sands oil is cut off, the ones likely to be hit the hardest hit are Midwestern American farmers. We know from experience that when there is a shortage of oil, it is the folks at the end of the pipeline that are hit. If the US decides it doesn't want Canadian oil, or if Canada cuts us off, it is likely the folks at the end of the pipelines, away from Chicago and the Midwest that would be hit most--places like North and South Dakota.

We could theoretically import more oil (perhaps from OPEC) to one of our coasts, and pipe it to the Midwest. This might or might not be successful. We don't have a rationing plan to work around shortages of diesel fuel in the Midwest at this point--maybe we should be thinking about such a plan.

How big an issue is environmental considerations?

Oil sands oil has a number of environmental issues. The one which is most obvious is the clearing of forests and taking up layers of overburden, storing them for many years, and then putting them back. This is an issue primarily with mining, rather than in place (in situ) production. Mining also tends to produce tailings ponds that are polluted with bitumen which is missed in the extraction process and with naphthenic acid. There is concern that water from this tailings water will escape, or will harm birds that happen to land in it. Companies use scarecrows and noise makers to attempt to keep birds away, but sometimes these precautions fail. There is also concern about the amount of water use, especially if production of bitumen from the oil sands should scale up.

There are other concerns with the extracted sulphur, and whether it gets into the air, as sulphur dioxide gas. As far as I know, the biggest issue with this is with upgrading operations, where the sulphur is separated out from the bitumen, such as that of Syncrude.

There are also metals that are found with the oil sands oil. This can be both good and bad. Bad because they could potentially be another source of pollution, and good, if they can be used as a source of rare earth minerals. We read:

It has been found that the tailings are a unique and rich source of titanium (5-10 % on solids), zirconium (2-5 %) and iron and rare earth minerals (8-12 %). These valuable minerals are at present not being recovered.

The quote relates to a patent for a method of extraction of these minerals, by applying centrifuge methods to tailings ponds. I expect we will see more centrifuge methods used in the future, both because of the possibility of financial gain, and because of a desire to reduce the amount of water stored in tailing ponds.

In situ production has much less direct environmental issues than mining, because it disturbs the soil much less, and because it leaves some of the potential pollutants underground. In situ results in far less tailings ponds. Most of the problems from in situ mining result simply from the fact that it is a low EROEI process, and uses a lot of natural gas in its production. As a result, its carbon footprint is quite high.

While there are quite a few environmental issues, I think that what we hear may be exaggerated.

Scale-up Confusion

I think the issue of "scale up" is a matter of huge confusion to environmental groups. How much worse will the environmental impact be, 10 or 20 years from now, if oil sands production continues to grow as forecast? Will the scale up have 20 times the current environmental impact of the worst company, or will the impact be quite small, as production is shifted more and more to in situ (in place) facilities, that don't disturb the ground except to lay underground pipelines to heat the bitumen, and as new environmental laws begin to have more impact?

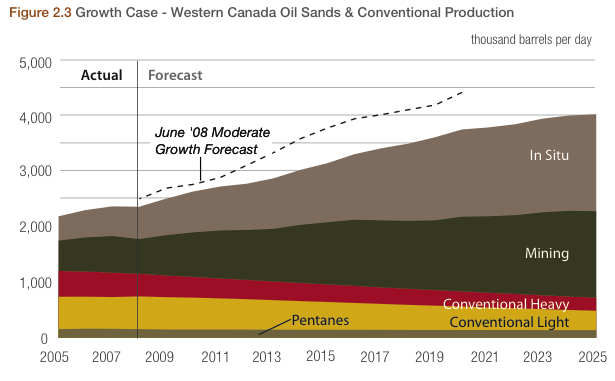

Suppose that production actually grows to the extent forecast by the Canadian Association of Petroleum Producers (CAPP) in its "growth case". (This is more of an increase than I am showing in my forecast earlier in the post.)

With this forecast, mining will roughly double between 2008 and 2025, and in place production will triple. Mining is the problematic one, in terms of land disturbance, water use, and tailing ponds. At worst, it would seem to me that there will be double the amount of pollution issues in 2025 that we have now, based on the forecast increase in mining. But even this estimate is high--companies will be getting rid of legacy technology that holds them back environmentally, and recent law changes (such as one passed in 2009 requiring much more rapid retirement of tailing ponds) will further reduce the impact of increased production.

The amount of surface area that is currently covered by oil sands mines amounts to about 200 square miles (518 square kilometers), according to the CERA report. This corresponds to a square 14 miles (23 kilometers) on its side, which is smaller than the footprint of many cities. What we are talking about, based on the CAPP mining forecasts, is, at worst, is doubling this footprint. The equivalent square would have an area of 400 square miles, so would measure 20 miles (32.2 kilometers) on a side.

Likely Area to be Disrupted by Mining

The confusion about scale up has led to very strange statements. For example, I recently got an e-mail from the Sierra Club that said (regarding the recent approval of the Alberta Clipper Pipeline):

This decision is deeply distressing because tar sands development in Alberta, Canada is creating an environmental catastrophe, with toxic tailings ponds so large they can be seen from space and plans to strip away the forests and peat lands in an area the size of Florida.

The entire area where oil sands deposits are located is the size of Florida. But the mines themselves are tiny in comparison--the size of a not very large city. Perhaps we are talking about doubling this by 2025. The tailing ponds are contained within this area. The percentage of this area covered by tailing ponds is now about 10%. This percentage may very well decrease, as new technology and new stricter laws are implemented.

When trees are cut, we were told that the trees are sold to the logging companies in the area, and thus offset other trees that would have been logged elsewhere. The peat moss is stored for later reuse, according to the Province of Alberta.

Carbon Dioxide Emissions

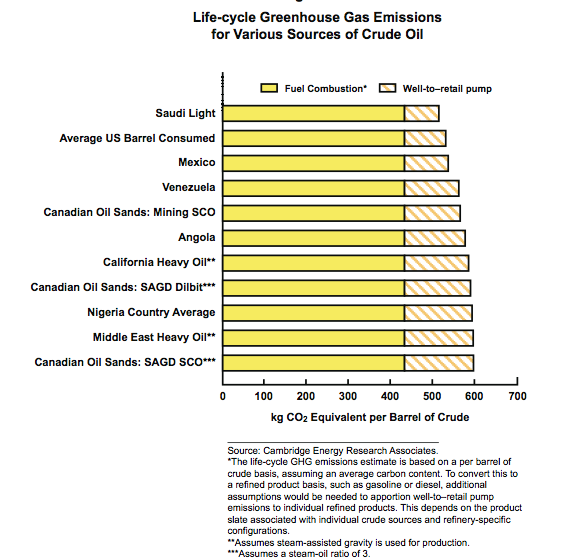

Another question is how to measure carbon emissions. Do you look at emissions during their whole life cycle, or only during extraction and refining? One would expect emissions to go up with the cost of producing oil (or decline in EROEI), and that is generally what a CERA study shows. The majority of the emissions relate to burning the oil that is produced, and these remain unchanged regardless of how low the EROEI of producing the oil is.

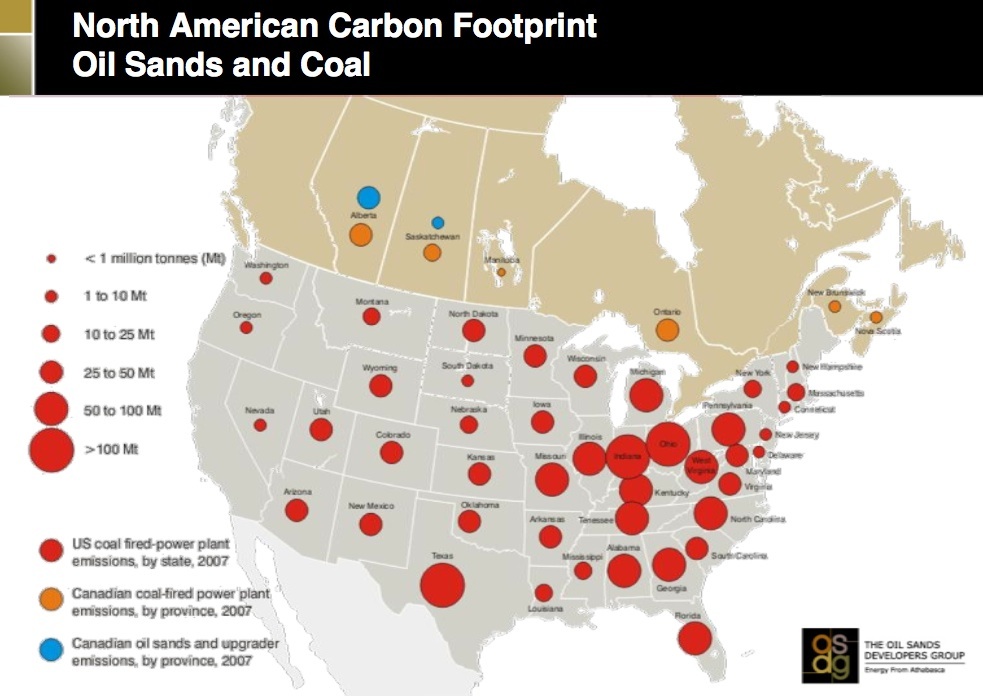

Also, in terms of absolute level, if one compares CO2 emissions from oil sands operations to those of coal fired power plants, the coal fired power plants seem to be a much bigger problem. If Alberta's oil sands emissions were doubled (as might possibly occur by 2025), they still would be less than the coal fired electricity emissions of many US states.

Athabasca River Pollution

Another source of confusion is pollution of the Athabasca River. The Athabasca River has been polluted for many years, and will continue to be polluted, because the river runs right through the oil sands area. In fact, the oil sands deposit was discovered because of water pollution.

The health of rivers in the area is being monitored by Regional Aquatics Monitoring Program (RAMP), a multi-stakeholder committee which includes representatives from oil companies, Ft. McMurray First Nation, Ft. McKay First Nation, Health Canada, Alberta Pacific Forest Industries, Fisheries and Oceans Canada, and many others.

Each year, RAMP issues a scientific report. The indications of these reports seem to show little problem with water pollution or overuse, except for a general mercury pollution problem, which I understand is quite widespread, extending throughout the US and Canada.

Air Pollution

With all of the pollution problems I had heard about, I assumed air pollution would be a real problem. Instead, the air was very clear. Don Thomson of the Oil Sands Developers Group told us the air in Ft. McMurray tests better than that in any other major city in Canada for air pollution, on almost any common pollutant. This may be in part because Ft. McMurray is several miles away from the mines.

I don't have many details on air pollution, except that this is one of the areas regulated by the province of Alberta. For example, Syncrude has undertaken a project called Syncrude's Emissions Reduction Project (SERP), designed to reduce stack emissions of sulphur compounds by 60% from current approved levels by 2011, under an agreement with the province.

Political Football Game

It seems to me that the Oil Sands are a huge political football game, and a good percentage of the environmental stories we hear are related to the posturing going on to win this football game.

Eastern Canada vs. Western Canada

First, Eastern Canada knows that it is likely to losing its imports from the East, due to peak oil. It needs the oil from Alberta, but as long as Alberta regulates the oil sands and exports the oil from the oil sands to the United States, (or to China), the East Coast is out of luck. So if Eastern Canada can show that Alberta is not doing a good enough job of regulating the oil sands, then it can perhaps get control through new Federal regulation of the oil sands. With that control, the Eastern part of Canada can be assured of getting oil. Also, if they want to raise taxes, it will be helpful to them. So we have reports like the one by Ecojustice, advocating additional Federal regulation.

US vs. Canada / China / Far East

Second, the US is the current recipient of the oil from the oil sands. If the United States can be convinced that we don't want it, because of environmental problems, that makes it all the easier for Eastern Canada to get it, or for Western Canada to export to China. Western Canada really would prefer not to sell to the United States, since the price it gets from the US is perceived to be not the best, and the US is viewed as a bully.

Consultants /Think Tanks / Environmental Reports

Because of the political situation, there is a big "market" for reports by consultants and think tanks that show huge environmental problems. There are also all kinds of ways one can legitimately show that there might be a problem. For example:

Undermining the Report Card: The Oil Sands Report Card by WWF and the Pembina Institute. This report compares the various oil sands projects against one another on a number of different variables, and makes statements such as, "If all companies had as low emissions as [lowest company], there would be a savings of __________ in emissions." That is interesting, but doesn't tell you whether there is a problem in the first place.

Statements like "Toxic tailing ponds filled with liquid mine wastes already cover more than 50 square kilometers," also from Oil Sands Report Card. Fifty square kilometers corresponds to a square a little over 7 kilometers (4.4 miles) on a side. Having so many tailings ponds is not great, but it is not as huge a problem as it is made out to be. In the future, the amount isn't likely to grow much, with more in-situ production, and with recent changes in regulations regarding tailing ponds that require much quicker ends to the ponds. Environmental Commissioner Renner told us that the oldest tailings pond (which is the one with by far the most leakage issues) is expected to be retired in 2010.

Photos with captions like, "Oil sands operations remove rivers, forests, and wetlands in order to access the oil sands beneath," also from Oil Sands Report Card. The angle of the picture makes it look like a huge area is involved, and the way the caption is worded makes it sound like there are no steps being taken to put the pieces back in place according to current views of best environmental practices.

Statements by aboriginal groups that they have some cancer above normal levels. Any of us who have studied probability know what the issue is here. There are all kinds of little aboriginal groups with population of around 1,000. So if you look at enough of these groups, some of the groups will have a handful of people with one or another kind of cancer. There is pollution in the area--there always has been, because the river naturally runs through the oil sands. The background pollution level may raise the probabilities of cancer a bit higher. But there doesn't seem to be any study showing an overall problem.

Not for Profit Issues

Not for Profit organizations are almost certainly under funding pressures. If they want donations, it is to their advantage to make things sound as dire as possible. If the leaders of the organizations truly don't understand the size of scale up issues, these organizations can easily make statements that inadvertently overstate how bad the future will be, relative to today.

Also, needless to say, their analyses are not of the nature of a cost/benefit analysis. They just tell you that there might be environmental costs involved, not that the oil eventually produced might provide benefits.

These organizations also don't tell you about the likely environmental consequences, if the replacement oil were extracted in a much more heavily populated area, such as one of the OPEC countries. The environmental impacts on the population would likely be worse--but a lot less reported, and a lot less regulated.

People trust Not for Profits. After all, they are "do good" organizations. A person might think that someone is looking over the shoulder of Not for Profits to see that what they say is adequately supported by facts, but I can't see that that is happening at all. This is complicated "stuff" to understand. If these organizations miss the boat, or slant things in a way to get more donations, no one is likely the wiser.

How the Politics Will Work Out

No one really knows the answer to this--but we certainly have a lot of people who are willing to take reports at face value, without considering the possibility that political maneuvering may be distorting what we see. Since peak oil is not in the newspapers, even Oil Drum readers assume "higher-ups" don't know about peak oil. That is simply not true. They know that imports may be declining in the future, and find Trojan horses in which to hide their causes.

There is one thing I am pretty sure of. No politician in Canada really has any intention of stopping oil sands production based on environmental concerns, although a few may want to make certain it doesn't grow too rapidly. Mostly what politicians want is the oil, or the profits from the oil, for themselves. If it takes an exaggeration or two about environmental issues to reach this end, so be it.

Note: Oil sands vs Tar sands. The province of Alberta and CAPP prefer oil sands, so that is the terminology I have used. Oil sands is also far more commonly used, according to Google.

Previous Oil Sands / Tar Sands articles.

Canada's Oil Sands - Part 1 - Gail the Actuary - Aug. 2009

World Oil Exports; US Oil Imports; and a Few Thoughts on Canada - Gail the Actuary - Aug. 2009

EROI Update: Preliminary Results using Toe-to-Heel Air Injection - Dave Murphy – March 2009

Unconventional Oil: Tar Sands and Shale Oil - EROI on the Web, Part 3 of 6- Charles Hall guest post – April 2008

Tar Sands: The Oil Junkie's Last Fix, Part 2 – Guest post by Chris Nelder – September 2007

Tar Sands: The Oil Junkie's Last Fix, Part 1 -

Guest post by Chris Nelder – August 2007

Extracting Heavy Oil: Using Toe to Heel Air Injection (THAI) – Gail the Actuary – August 2007

Canadian Oil Sands Production Update – Sam Foucher – Oct. 2006

Gail,

Thanks!

You do a great job of showing just how complicated the whole oil sands show really is.

Most people seem to think of such things in terms of black and white with at most a few gray areas.

This one may have more gray than any either black or white given the political situation you have outlined.

I for one know almost nothing about Canadian politics even though I have tons of reading time(stuck in the house for now)and follow the energy news regularly.

Give the fact that most of us,collectively ,know only that Canada is at the north pole and that the cops wear red uniforms and are all naned Dudley Doright and that Dastardly Boris and Natasha are

after Rocky and Bullwinckle ...

You have done the readers of this site a great service.

Here is a map of the various companies' tar (if it smells like a duck...) sands holdings:

and superimposed in Google Earth:

A square about 67 miles on a side, or 4500 square miles.

Of course, just because there are holdings doesn't mean that all that area will get plowed up. But it is misleading to taut the tar sands vast bounty without considering all the land covering said bounty.

Anyway, it's covered with snow most of the year, not? Glad that Albertans are willing to sacrifice to keep the rest of us in BAU.

Tar sands sounds more accurate than oil sands, the latter diminishes the complexity of the actual oil production process and basically make it sounder "cleaner". What are the implications of the use of natural gas?

It is a little fuzzy how much of a limiting factor natural gas is.

If one is doing mining with an upgrader (as Syncrude does), the upgrader produces natural gas and other gasses that can be used as part of the energy requirement of mining. With some fine-tuning, this process could probably be adjusted so that all of the energy requirement could be met with self-produced petroleum products.

Mining with an upgrader also produces coke that is quite polluted. At this point, this material is just buried. There may be some possibility of cleaning this up for use (but this would be a pretty carbon intensive fuel.)

In situ production as it is currently done uses natural gas, but other approaches are being explored. One approach is burning some of the bitumen itself to provide the heat for melting the bitumen, for example with Toe to Heel Air Injection, a method currently being evaluated. Another approach under development uses electrical induction.

Between these various approaches, it seems likely that natural gas is not as much of a limiting factor as we have thought it to be. Availability of capital may be a more important limiting factor.

It's only a limiting factor for those thinking inside the box. In reality, what they need is a source of process heat. They can get this from natural gas, they can get it from coal, they can get it by burning the heavy ends of the bitumen, or they can get it from nuclear reactors. The possibilities are many and diverse.

They burn natural gas because it's relatively cheap, easy to use, and available locally. If it ceases to be those things, they can switch (with a little difficulty) to something else.

Gail,

Natural gas is limiting only so far as the current economics make it. There are PLENTY of alternative approaches that would/could/will be used if the price of Natural Gas increases. It is also worth noting that there is natural gas produced from the bitumen when it is exposed to heat. The in-situ mining process generates a fair bit of it.

There is also the syngas approach using the petroleum coke that has been used in one form or another for a hundred years. (adding water to carbon and generating H2 and ultimately CH4 which can be added to the bitumen to produce lighter crudes or used directly as fuel). You are correct that they are "carbon-intensive", but when "people are freezing in the dark" through lack of access to fossil fuels, they will be happy to have these processes available!!

Unfortunately, I think you are all too correct in all of your other (excellent and prescient) statements about the politics of the oil sands. However, I think I should add that Albertans naturally feel a certain affinity for Americans as they tend to have a "cowboy culture" themselves. I would think that it would be very very difficult for Albertans to consider "cutting off" the Americans from access to the Oil Sands. Also, the political difficulties in "re-negotiating NAFTA" are HUGE. I have trouble imaging that any Canadian government would seriously consider that. The economies of the two countries are just TOO intertwined. Of course, Albertans are business people too and you can be sure that China will be given the choice of importing Alberta oil as well!! I am sure that they will gladly accept. I would expect that Albertans would gladly use that leverage (the Chinese importation) to get a better deal from the US.

Technology improvements are already available (e.g. "wet combustion") that would allow the tailing pond waters to be combusted and the napthenic acids with them. It is just the current economics and conservatism of the industry that prevents their adoption.

Ian

Thanks for your perspectives. In some future world, if one wanted to put together an area with both oil and food, it seems like an area extending from the plains states up to Alberta would work. So maybe there is potential for some long-term synergy.

In the meantime, I don't know what the real direction of trade/free trade will be. With the recession, there has been pressure for more buy local legislation, even in the presence of NAFTA. This is a recent article about US--Canada relations:

To the North, Grumbling Over Trade

I don't know whether there will be any renegotiation of NAFTA. It may just erode around the edges, or be ignored in some contexts.

Experience is that the US will definitely ignore it if that benefits them. However, I recal there being a provision in NAFTA which requires Canada to continue exporting oil and gas to the US at at minimum the same percentage of production that existed when NAFTA was signed, regardless of other developments. I'll bet that's one provision which will be enforced.

It is a little fuzzy how much of a limiting factor natural gas is.

If one is doing mining with an upgrader (as Syncrude does), the upgrader produces natural gas and other gasses that can be used as part of the energy requirement of mining. With some fine-tuning, this process could probably be adjusted so that all of the energy requirement could be met with self-produced petroleum products..

It's worth remembering that natural gas has two purposes, at least as I understand it. One is to produce heat - something they should be able to burn the bitumen or crude produced, if it's really a positive EROEI. The second is as a source of hydrogen. You need hydrogen to turn long carbon chains into short carbon chains. The hydrogen can be produced in a reaction with water and coke/bitumen/oil but it's very carbon intensive. It also reduces the EROEI equation even more.

In situ production as it is currently done uses natural gas, but other approaches are being explored. One approach is burning some of the bitumen itself to provide the heat for melting the bitumen, for example with Toe to Heel Air Injection, a method currently being evaluated. Another approach under development uses electrical induction.

I'm quite disappointed that no mention is made of EROEI for in-situ production. It would surprise me if it even reaches unity if one counts the energy lost to combustion in the ground; it's entirely possible that more than one barrel of bitumen is burned in order to coax a barrel of bitumen to drain out.

Whether this is profitable or not depends not on whether EROEI is negative or not, but on the fact that the one-plus barrel of oil being lost to production doesn't have to be produced itself. IE, if it's cheap enough to drill holes and pump in air and burn the stuff in the ground it will be produced unless there's a large enough price attached to releasing carbon in the air.

As for using electricity, that's about the most hideous mis-appropriation of resources I can imagine. Generate one of the most flexible, non-polluting, efficient forms of energy - indeed, a form that can even be multiplied by using it in a heat pump - and using it to heat one of the dirtiest forms of energy so that it can be used at 10% efficiency in the transportation sector.... It may make some perverse economic sense, but only if you have a "stranded" or otherwise very low cost source of electricity. Nuclear wouldn't seem to qualify.

David

With respect to the need for natural gas, you have a good point about the natural gas for upgrading. If the end product can be exported as bitumen, or mixed with a diluent so that it can be exported, the need for the natural gas can be put off to the end user, so it is not really an Alberta natural gas issue. But it is a natural gas issue, nevertheless.

The EROI of in situ processes will vary. The SAGD process I saw claimed an EROI of 6, but it left out so much that it was clearly lower. One reader wrote to me and suggested 3 was a better estimate. Part of the problem is that the energy used in the calculation was only the natural gas portion; another problem was that the end product was only bitumen. If one looks at the greenhouse gas calculations of CERA (as Jeff Vail did in another comment), it looks like the ratio is closer to 2.

If one burns part of the bitumen, the ratio will come out lower. But as you say, this could still be economic, if there is a low enough cost applied to CO2.

Alberta says that 2.4% of the area in which oil sands deposits are located are suitable for mining. So of the area the size of the state of Florida, only 2.4% could be mined, if there were adequate investment. Some of it would be put back into a condition vaguely like its original state by the time other areas are dug up, so it is unlikely one could get 2.4% dug up at the same time, under the worst circumstances.

Florida has an area of 67,000 square miles, so an equivalent footprint on Alberta is much much larger that I show above (it would cover a fourth of it). I would assume that the holdings are where the most accessible muck is, so it is not unreasonable to assume that most of that might be dug at some point.

Mining can only be done in specific locations, where the material is close enough to the surface, thick enough, and (as a practical matter) of a high enough grade--10% or more concentration of bitumen. Other places are going to be either passed by all together, or extracted with in situ methods.

I don't know what percentage of the company holdings are suitable for mining, but I would be willing to bet it is considerably less than 100%.

Here are some updated maps on the oilsands and operators and if it's Mining/SAGD.

Oil Sands Publications and Maps

http://www.energy.gov.ab.ca/OilSands/954.asp

Alberta’s Oil Sands Leased Area - PDF

http://www.energy.gov.ab.ca/OilSands/pdfs/OSAagreesStats_June2009vkb.pdf

Alberta's Current and Proposed Oil Sands Projects - PDF

http://www.energy.gov.ab.ca/OilSands/pdfs/projects_July2009_11x17.pdf

I notice there is a lot that is already under construction. That is why "ace" (Tony Eriksen) is seeing a fairly good increase, even without additional projects being approved, and I am following his lead in my forecast.

The mineable area is sort of a triangle, just north of Ft. McMurray (although even within that, some areas would be better than the rest). Otherwise, future production is expected to use some in situ approach.

Gail,

Excellent post by the way!! (as always). The number I have heard about the amount of bitumen accessible by mining is about 10% of the total that would be extractable by other means. So the in-situ method is definitely better.

I should mention that there is an excellent "hybrid" technology called "OSUM" (OIl Sands Underground Mining".

http://www.albertaoilmagazine.com/?p=443

It uses the stunningly easy idea of a hybrid between conventional coal mining and SAGD, already demonstrated in 1982 at AOSTRA (government test facility for oil sand technology). Basically:

1) Dig a coal mining type shaft at 15 degrees down below the oil sand deposit (e.g. 1000-2000 feet deep) - very cheap compared to conventional coal mining

2) Install a regular SAGD operation at the bitumen face with the steam being injected UP and the mobilized (low viscosity) bitumen flowing DOWN into a collection area

This has MANY advantages:

1) The footprint for environmental disturbance of the forest above is about 40 TIMES less than regular SAGD (and even less than Bitumen mining)

2) The amount of energy required (EROEI) to mobilize the bitumen is about 10-20% less

3) The temperature at the bottom of the inclined shaft (easy walk) is about 50 deg. F year round (shirtsleeve weather). As anyone who has worked in Northern Alberta during the winter can tell you, -40 F for months at a time is no picnic

4) It has the same advantages as regular SAGD in terms of leaving the heaviest bitumen in-place, but the environmental advantages are huge.

SO there are plenty of new approaches that would either completely eliminate the environmental concern (disturbance, not CO2) and have other advantages as well.

Ian

It seems like the big issue will be price. It has been my impression that for coal, underground mining is generally significantly more expensive than surface mining. The energy savings you refer to might fully offset this additional cost--so the new process might turn out to be cheaper.

Gail,

You are correct about coal mining, but the kind of the digging that we are talking about here is much simpler than the average coal mine with deep vertical shafts, horizontal shafts, elevators, etc. This is simply a gentle 15 degree sloped tunnel about a mile or less long to access the bitumen deposit from about 10-30 feet below the injection point of the steam. That is very cheap compared to a regular coal mine. Given that the amount of disturbed area is about 40 times less, there are some significant environmental advantages!

When the price of oil rises again, this technology will be very competitive indeed. Although initial capital will always be a problem.

Ian

Gail,

This article is a breath of fresh air. But just a couple of points.

1. The Opti Nexen Long Lake project is worth special study because they have gotten it as right as possible from an environmental and EROEI point of view. By gasifying the asphaltenes (15% of the bitumen) they get syngas for steam generation, hydrogen for their upgrader and electricity to power the site. They have a small footprint and yet are focused on ways to reduce CO2 emissions. This is capital intensive but with low operating costs per bbl of premium synthetic crude.

2. One gets most of the available bitumen/oil extracted by open cast mining. But that isn't a large part of the available resource Some 80% of the bitumen prone resource is only available by using in situ techniques but the SAGD and THAI methods cannot extract all the available bitumen - only a portion.

So if I beg or say "pretty please" could you possibly do a follow up article - or seek one from CAPP - on the way forward for environmentally responsible oil sands exploitation?

The greenies - unfortunately - tend to do more damage than good when they attack productive solutions.

Thanks again for a well-researched and well written article.

Yes but the proportion that SAGD can recover ranges up to 80%, according to some geologists I have talked to. It's extremely effective when used correctly.

They're still working on the technology, and it's getting better.

Thanks for the tip! I'll see what I can do--am not sure how much I can promise, though.

I am not sure what you mean by the term 'greenie'. If you mean someone who believes that the long term survival of the human race depends upon our learning to live within the limits of the ecological community of which we are a part, then I will have to raise my hand and plead 'guilty'. Strangely enough I am also a 'mathie' who believes that 2+2=4. Go figure.

The problem with tar sands is that they are not a solution to our problems. They are at best a tool which can help us transition to a sustainable economic infrastructure. Unfortunately you cannot create a sustainable economic infrastructure unless you actually intend to do so. I see very little sign of such an intention forming in our society even among people who label themselves as 'green'. Yes, fuel from tar sands will be used to transport food, medicine, and essential building materials, but it will also be used for driving SUVs, for jet airplane tourism, for transporting plasma screen TVs, etc.

If we were really serious about solving our problems we would be shutting down wasteful and unecessary forms of production and using the saved resources to create sustainable infrastructure. Unfortunately such a course of action is unthinkable in an economic system who end-all and be-all is maintaining the short term 'health' of capital markets.

You can make the argument that another decade or so of healthy capital markets will allow alternate energy technology to advance further, so that when we are finally forced to deal with limits to growth we will have a better set of tools at our disposal. But it is possible that such extended sucesss of capital markets will just dig us deeper into an ecological hole, and make the ultimate crash even worse than it would have been otherwise.

I am not in favor of shutting down the scientific enterprise, but we are going to need profound social changes and not just clever technology if we are going to save ourselves from the dilemma which we have created.

Let's add a bit of perspective to the numbers:

The total oil sands areas of Alberta are about 54,000 square miles, so when they compare it to Florida, they must be talking about the land area of Florida, and ignoring the water area.

By comparison, the coal deposits of Alberta are about twice the size of Florida, including water, but nobody expects anybody to open a coal mine half the size of Texas.

The mineable area is about 2100 square miles, which is about 1/3 the size of Metropolitan Edmonton. Keep in mind that our modern cities with their sprawling suburbs are extremely large in area (and Edmonton is built on some of the best farmland in Canada, whereas the oil sands are under peat bogs and second-grade forest.)

They wouldn't mine the entire oil sands area at once. They would be involved in a continual process of opening one area for mining while reclaiming the previous one, and moving on to the one after that. This would involve stripping the topsoil from an area, mining out the oil sand, putting the cleaned sand back, replacing the topsoil, and revegitating the area.

The rest of the oil sands would have to be developed using in-situ methods, usually using dual injection/production wells. This involves less surface area than you might think, since they typically directionally drill up to 20 horizontal wells off a single gravel pad in the interests of reducing costs.

2100 square miles is larger than the land area of the State of Delaware. How big, exactly, is Edmonton?

According to Wikipedia, the Edmonton Capital Region is 3,636 square miles.

However, it is part of StatsCan Census Division 11, which is 6,083 square miles in area. That's probably where they got the "1/3 the size of metropolitan Edmonton" ratio from.

The land area of poor little Delaware is 1,954 square miles, so yes, Edmonton is much bigger than Delaware.

On the other hand, metropolitan Houston is 10,062 sq. mi., which is bigger than the land area of 9 states and almost 5 times the mineable area of the oil sands.

When you're in oil country you've got to think big.

First, good article again, Gail. Thanks.

I might also add that IF that entire area of "tar" sands had its "oil" extracted, the resulting production (1.7 trillion bbl OIP) would be on the order of 1.5x the amount of oil which has ever been produced by all producers in all countries since the beginning of oil production in Petrolia, Ontario in the last century. It's a very long-term project even to arrive at the proposed 173 billion bbl economically extractable amount, over 170 years at eg. double present rates.

That really helps put it in context. Thanks. Do you have more information on the EROEI? I noticed your chart on the embodied CO2 for various oil resources, which is closely related. Do you think the ratio of CO2 produced in mining to the CO2 produced in finished product consumption is close how others would define the resource EROI?

I am sure you saw my comments in my first post about EROEI. Syncrude claims an EROI of 6:1. I would presume this ratio reflects the processes all the way to upgraded Synthetic Crude Oil (SCO), but I don't know how wide their boundaries in calculating the EROI is. Syncrude pays high salaries to its workers, but part of the reason for its high salaries is the fact that everything (food, clothing, cars, etc.) needs to be shipped from long distances.

Surmont also claimed a 6:1 EROI ratio, but that was only looking at their natural gas use for SAGD, and the end product was only bitumen which was then mixed with SCO to produce a salable product. It would seem like getting to a similar end product, and including other fuels, it would be lower.

Then the two data sets conflict, don't they? If the ratio of process to product CO2 is only ~4:1 and they claim an EROI of 6:1 someone is messing with one of the two sets of numbers and forgot to mess with the other, or something. EROI is such a complex calculation, and there are so many ways to define it. Isn't it surprising that the specific calculation method isn't generally mentioned when people claim EROI's for things?

I take it you are trying to use the CO2 amounts to approximate EROI. I thought it was interesting that using CO2, SAGD seems to have a lower EROI than mining, and that was the impression I got the from the quoted EROI numbers.

For mining, the 6:1 EROI is close to an EROI for making SCO. For Surmont using SAGD, the EROI I was given was 6:1 but only included the natural gas used to make bitumen. There was a double shortfall--other energy products and the additional processing to make the equivalent of SCO.

To get to gasoline or diesel, both would need to undergo additional steps, even beyond SCO. They would need to go to a refinery and have additional processing done. I would presume the CO2 calculation would include these extra steps.

But there are differences in the calculation too--even with these adjustments, it wouldn't match exactly.

Precisely, it's all a mishmash of different people calculating different things. So we clearly don't have or don't know about the definitions for EROI measures that would clear up the mess. I've tried very hard to contribute to that conversation, offering a simple whole system EROI strategy to include the energy equivalent for all the business and technology costs of resource extraction, taken to a comparable end use equivalence. I didn't get anyone to offer their suggestions so didn't go beyond concept. I'd be glad to help others working on the problem with the systems theory if you know of anyone.

Here's the reddit links for this post (we appreciate your helping us spread our work around, both in this post and any of our other work--if you want to submit something yourself to another site, etc., that isn't already here--feel free, just leave it as a reply to this comment, please so folks can find it.):

http://www.reddit.com/r/Economics/comments/9g89l/canadas_oil_sands_part_2/

http://www.reddit.com/r/energy/comments/9g89f/canadas_oil_sands_part_2/

http://www.reddit.com/r/business/comments/9g89i/canadas_oil_sands_part_2/

http://www.reddit.com/r/reddit.com/comments/9g8ek/canadas_oil_sands_part_2/

Find us on twitter:

http://twitter.com/theoildrum

http://friendfeed.com/theoildrum

Find us on facebook and linkedin as well:

http://www.facebook.com/group.php?gid=14778313964

http://www.linkedin.com/groups?gid=138274&trk=hb_side_g

Thanks again. Feel free to submit things yourself using the share this button on our articles as well to places like stumbleupon, metafilter, or other link farms yourself--we appreciate it!

Wow, that'd be my cue to leave. Provincial control of resources is an important and defining feature of the Canadian constitution, and people here get very, very upset when there is talk of increased federal powers. Alberta has its own office in Washington, apart from the Canadian embassy, and embarks on its own trade missions to Asia. Things would get ugly here pretty fast, and I can't say I'd want to stay.

The National Energy Program is not remembered fondly in Alberta, and I'm sure it would renew calls for separation if it were resurrected in any similar form.

I raised some of the Canadian issues in an earlier post and got quite a bit of feedback from Canadian readers. One reader said:

Funny how no-one ever mentions that from the beginning Ontario has always had to support all the regions at one time or another but w never hear a squeak of thanks. Newfoundland especially, what a joke.

All the regions except Alberta - and that's the crux of the problem: Ontario has never supported Alberta financially, especially not during the 1930's when the provincial government and most of the local governments went bankrupt, and the federal and Ontario governments refused to bail them out.

You can disagree, but the Alberta government has run the numbers to determine who was kidding whom, and it was Ontarioans kidding themselves.

In retrospect, it was probably a mistake not to bail Alberta out during the depression, but then nobody at the time realized Alberta had so much oil.

And now that Ontario is getting aid from the regions, the argument is starting to go over badly in other areas as well.

Ok, granted. Probably "never Alberta" as you say. But i'd suggest that if you were in charge of the Federal govt. in 1933 and took a look out at the dryland farm areas of the west, you'd probably have made the same decision, eg. it would be simply throwing scarce money away to provide farmers in those regions support which would keep them farming on land which simply didn't even appear to exist anymore. Better they should move elsewhere.

There's a lot more hatred toward Ontario in Alberta than any history can justify, and I've personally decided its a simple combination of jealousy and an inferiority complex. I have two brothers in Alberta with whom I've simply resolved to not discuss anything remotely political/economic/etc, else the discussion simply goes nuts. And they grew up in Ontario.

I'm not a Conservative or a particularly patriotic Albertan, but even I can see the animosity is deeper then trivial jealousy. There are serious issues with balance of power between the east and the west and no serious effort to correct them ever occurs. If tougher times are ahead, these must be resolved.

Let me put this East/West thing in perspective.

Let's say you have two brothers who are dirt farmers, and you own a Cadillac dealership. They come to you and say "Can you lend us some money to keep our farm going? The bank won't lend us any, but we'll pay you back when we can".

And you tell them, "No, that would just be throwing money away. You're wasting your time farming, but I'll tell you what - You leave the farm, and I'll give you jobs sweeping the floor of my Cadillac dealership, and a place to sleep next to the furnace".

But they say thanks, but they prefer farming. So they scrape by year after year, and every so often they ask for money to buy the kids shoes. But you remind them you don't give charity, but there's a job waiting for them sweeping the floor of your Cadillac dealership, and you'd pay them enough to buy shoes for maybe half the kids.

And then one day you read that there's been a massive oil strike, and most of it is under your brothers' farm. So you go to visit them, and they're standing in front of their new mansions, lighting big cigars with $100 bills.

So you tell them that it's disgusting the way they're throwing their wealth around, and they have a moral obligation to give you half of their money. They ask you why, and you say it's because you're their brother, it's unfair that they're now much richer than you, and you once offered to help them out by letting them sweep the floor of your Cadillac dealership.

Now, I don't know your brothers, but I'm betting their reaction would largely be in words of four letters, with numerous scatological and sexual references.

LOL!

Now isn't that a cutsey analogy. I'm sure if wasted two minutes i could come up with a similar one which would support the opposite view.

Fat chance, Dude.

I usually live on the west coast. A few years ago I cycled across Canada - In Alberta I started noticing 'I hate Ontario' bumper stickers, leaving Manitoba there is one 2 lane highway and a single track for about 100 km. Then two parallel roads for the next 1000km or so. I'm not aware of a pipeline, and didn't notice any power lines.

Around Sault St Maire we entered eastern civilization which was pretty consistent to New Brunswick. Nova Scotia and Newfoundland felt a bit different again.

My take on this - people in British Columbia know who the Canadian Prime Minister the same way we know the American guy, what's his name, and the Australian guy with the glasses. Frankly, it has no significant meaning to our lives day-to-day. Across the mountains the people of the prairie recognize the federal government but have been disgusted with it for the past 30 years (that I've been around).

Canada is a political entity, but there are significant physical boundaries at the Rockies, Lake Superior, and the Gulf of St Lawrence. These are already psychological divisions, and could easily become national.

Quebec is the obvious example - they've been pissed off since the Plains of Abraham thing. Every ten years they have a little hissy fit and say they're going to hold their breathe until they turn blue. I find it amusing that they never threaten to leave while the economy is down...

Well, as a simple conservative Ontario person who's never owned a bank (or Cadillac dealership) in my long life, I'm starting to appreciate the common sense reasonableness of our neighbors in Quebec more than most Albertans. Much better manners also, eg. I can't recall the last time anyone from Quebec stated on a public forum that they wished Toronto would drop off into Lake Ontario killing all citizens.

Here is a figure showing how the stuff makes it into the US:

How critical are the incoming (red) diluent pipelines to scaling?

I don't think the need for diluent is a huge issue in the long term.

If companies use mining with upgraders, the end product is Synthetic Crude Oil (SCO), which is the product other producers use to dilute their bitumen with. So with enough mining with upgraders, there theoretically would be no need for additional diluent from outside sources.

Another point that has been made is that diluent is only needed for pipeline transport. If bitumen is transported by rail cars, the cars can be heated (at least for loading /unloading). So there is no real need for diluent.

I don't think it is practical to add upgraders to in situ facilities, to eliminate the need for diluent. My impression is that in situ operations tend to be smaller. The Surmont facility was built in such a way that all the buildings and equipment could easily be moved to another location, when the bitumen had been steamed from the current location. Upgrading equipment would be less portable.

Looking at the EIA Company Level Imports data a bit closer I see something puzzling: overseas shipments of very small quantities, say 150 kb in March '08. Using the 7.5 bo = 1 DWT figure from Oil 101, this equates to a ship of 20 DWT, which is absurd; another shipment in the same month/port/company/API/sulfur content offloaded 240 kb, so these must have been batches from the one tanker. This makes things a bit confusing when trying to estimate how many ships are pulling into a state in a given month; or, in the case of WA, how much is from pipelines versus ships. I assume nothing enters WA state from Canada via ship but have no way of ascertaining this from the data; might have to call or email someone from BP.

Anyway, that big tanker shown delivering oil to California on the CAPP or CERA map above is just as much strictly on the drawing board as the pipeline on the BC coast exporting crude/importing Russian dilutent. This big boy would deliver VLCC loads to the Port of Long Beach, at least in theory. Certainly the crude will follow where the demand is. I'll look into this further but the only Canadian cargo of crude to enter CA in March '08 was 399 kb = Panamax tanker of 53.2 dwt. Maybe it was a larger boat that had multiple stops to make. On an annual basis Canada is behind Saudi Arabia, Iraq and Equador as a supplier of exports to PADD 5.

Perhaps the TMX pipeline can be yet again expanded if PNW demand is on the rise; or the Kitimat port can service the Pueget Sound area with smaller tankers, as well as exporting with VLCCs to the Far East. All of this is dependent on where demand is heading.

I'm wondering about the Russian diluent. It seems like it would be easier/cheaper to upgrade some of the bitumen in the area, and use it. Also, the long term supply would be better assured.

Russia has the biggest natural gas reserves in the world, so it follows that they would have the biggest production of condensate for diluent.

This sounds like something the Chinese would do: buy Russian diluent, ship it to the West Coast of Canada, pipeline it to the oil sands. Then, mix it with bitumen (dilbit), pipeline the dilbit to the West Coast, and ship it to China. Chinese refinery processes it and supplies gasoline and diesel to the Chinese market.

Makes sense to me. Keeps your tankers full both ways.

Russian diluent(oil) is a pipedream. Russia's Far East(Sakhalin) oil has a pipeline NOW, going to China.

More like Alaskan oil.

I see Sarah Palin's gas pipeline(from my house!)

Who draws these maps?

Canada tar sands will never produce that much by Hubbert's linearization; if tar sands have produced 5 Gb so far and there is 200 Gb and the parameter is say 9% then

P=Q*(1-Q/URR)*k or P=5*(1-5/200)*.09=.44 Gb per year(today) so

the peak production rate for tar sands will be P=100*(1-100/200)*.09= 4.5 Gb per year or 12.3 mbpd.

This is TERRIBLE news!

Tar sands cannot save Team America which guzzles 20.7 mbpd!

Time for plan B.

I enjoy you comments, and style, a great deal. Don't fade.....

We are down in New Zealand, so I might be able to see you from my house using ionospheric bounce.

At night, of course.

I gotta blog which is largely NZ topical, but you might empathise with....

powerdownkiwi.wordpress.com

cheers, Murray Grimwood

ps: if u r ever down this way, there's somewhere to stay (and the red wine is passable)

I am not convinced it necessarily follows the Hubbert curve. The limiting factor is probably investment capital (but could be something else). I would expect production to be closer to flat for a long period, as one might expect if not a lot of capital is being added.

The amount of production depends partly on technology and partly on how the world around the oil sands holds up after peak oil. If the rest of the world gets too disrupted (can't send enough food up to Ft. McMurray, for example), then production will stop.

Forget Alaskan oil. It's mostly gone. It's only a matter of time before they shut down the Trans-Alaska Pipeline and strand the remaining oil on the North Slope.

Plan A may not work for the U.S. but Canada has only 1/9 of the U.S. population.

12.3 million bpd is nearly 4.5 billion barrels per year. At $70/bbl, that would bring in $315 billion per year. Since Canada has 33 million people, that would be about $9,500 per Canadian. If the price doubled to $140/bbl (remember 2008), it would be $19,000 per year for every man, woman and child in the country. And thank you for buying Canadian.

However, the proven reserves of 173 billion barrels would last only 38 years at that rate, so most likely they'll keep it to a much lower level. I doubt they'll ever let production go over 5 million bpd.

So that's Plan A for Canada. The U.S. will have to find its Plan B somewhere else.

That's a Hubbert's Linearization so you'd see a 'bell' curve

peaking at 4.5 Gb in about 2070 and drying up completely around 2130.

I don't believe you will have a bell shaped curve. You'll have a quicker rise but post peak it will become a plateau before a symetrical decline. If the tar sand peak occurs in 2020 at 1.8 Gb/a(5 mbpd) then the plateau lasts +90 years.

The only partial US plan B I can see would be an oil shale crash program, with 20 years to ramp up to 1.8 Gb/a.? to last another +200 years.

But why would you Western Canadian sheikhs want to share your tar sand profits with Ontario? You could have over $250,000 for every West Canada man woman and child!

I am having a hard time seeing oil shale provide an EROI of more than 1.0.

Part of the problem is just the need for water. I contacted Shell recently, and they said that they thought they would need 3 barrels of water for each barrel of oil produced.

If they also use electricity, that will add a whole new set of problems. (Coal from Wyoming, etc.)

With an upgrader, they can perhaps use part of the oil produced instead of electricity, but how little will be left when the process is finished?

Shell says they need 12 GW power plants running 8760 hours per year to produce 1 mbpd or .365 Gb/year.

12GW x 8760h =105 Twh of electricity(.35 quads). If the electricity is supplied by inefficient(30%) coal or nuke plants then we need 1.2 quads of coal or nuke primary energy; .35/.3=1.2

You also don't include associated natural gas(1/3 of total energy released is combustible gas) that is created in Shell's method, which could be used to generate much if not most of the power.

The amount of coal required would be 52,500,000 tons. Wyoming currently mines 460 million tons of coal per year.

http://www.casperstartribune.net/articles/2009/01/10/news/wyoming/3ea901...

A barrel of oil is 5.8E6 Btus so 1 mbpd(.365Gb/yr) is 2.1 E15 Btus a year (2.1 quads).

So 2.1/1.2= a EROEI of 1.75, not 1.0.

Actually this is an IDEAL application for stranded wind. Wyoming has 900

Twh of wind energy potential according to the AWEA charts. I don't know if you've been to southern Wyoming but the area is has continuous strong winds thru South Pass very close to the Colorado oil shale deposits near Parachute.

Imagine the entire area being covered with 36000 1 MW wind turbines covering 4000 square miles. It would produce probably around 108 Twh of electricity with zero carbon emissions; 36000MW x 3000hr =108 Twh

Now it is true that wind is intermittent but the oil shale material is actually an ideal insulating material so electrically generated heat will not readily dissipate into the surrounding rocks.(Fire bricks are used to store heat in night-set back electric resistive furnaces).

So in this case the EROI would be be quite high probably around 10 if you believe that the EROI of wind is 18.

Basically, this is a no-brainer and if GHG legislation passes I believe that investors will happily invest $60 billion dollars($1M per MW wind plus transmission lines) to get carbon credits and a stake in the last great oil reserve on earth(600 Gb).

You say that 3 barrels of water will be needed per barrel of shale oil, so 3 x .365 Gb oil is 1.1 Gb of water is required or 46 G gallons of water or 6.1 billion cubic feet or 140,000 acre feet.

As I pointed out before the Glenn Canyon Dam/Lake Powell loses 700,000 acre feet per year in seepage and evaporation. It produces 3.2 Twh of electricity per year. Ecologists say it is ruining the Grand Canyon.

http://en.wikipedia.org/wiki/Risks_to_the_Glen_Canyon_Dam

I am suggesting that the dam should be removed and water better used for Colorado oil shale rather than be evaporated in Lake Powell so rich guys can motor about in a remote wilderness.

As far as I can see no upgrader is needed for shale oil( no upgraders existed in 1905 when oil shale was being mined and retorted in Scotland), where as it is obvious that a diluent is required to pump tar thru a pipeline.

I get the impression that the people at ASPO are either stupid or

deceitful on the topic of oil shale.

JMHO

Gail,

It IS practical to build upgraders for in-situ projects! There were several such projects in advanced planning stages when the bottom fell out of the credit markets. Upgraders can be simple affairs (just thermal cracking without hydrogen and dumping the pet coke) all the way up to full refineries with a full stream of petrochemicals being produced along with synthetic crude oil. Most of them were planned for the Edmonton area. A small pipeline from the in-situ site to Edmonton is sufficient to transfer the non-upgraded bitumen to Edmonton and then the full upgrading could occur there. A company could own the upgrader and in-situ facilities or just the upgrader.

It all boils down to capital. If Peak Oil is as bad as we think, there will be more upgraders built in the near future in Edmonton to augment the existing ones.

Ian

Thanks for the tip! I learn something new every day.

What's immediately obvious from this web page http://inform.energy.gov.ab.ca/Documents/Published/IL-2009-28.pdf (Alberta Govt. PAR prices by month) is that oil sands product is extremely sensitive to the monthly market price for light sweet crude. The oil sands producers are paid WTI light market price less 3 flat rate overhead costs (shipping from field to upgrader, upgrading, shipping from upgrader to market hub). The flat rate overheads don't change with market price, and are each significantly above Cdn$10/bbl meaning if the oil price drops below about US$35 to $40 / bbl, the extracters are making nothing to pay their costs of operation or investment (assuming they're producing Ultra Heavy grade).

I think the document you link to has to do with royalties, which are indeed linked to the price of crude.

Synthetic Crude Oil (SCO), which is a light sweet crude oil made by Syncrude and by other companies with upgraders is a traded commodity that sells for a price similar to that of West Texas Intermediate (WTI).

Bitumen can be diluted with various diluents. Surmont diluted their bitumen 50% /50% with SCO. The resulting heavy crude oil is marketed as Western Canadian Select Blend. The relativity of this product to WTI can vary. According to this recent article:

High prices for heavy oil defy logic

Elsewhere in the article, it says that the smaller discount is likely to persist, since there is a shortage of other heavy crude for various reasons (Mexican production declining, for example).

Those are actually the parameters for calculating Alberta government royalties. The government does not let producers calculate their own costs, but gives them a fixed number to use.

What it is really saying is that if the price drops below $35-$40/bbl, the royalty rates drop to zero. That affects the government more than it does the companies, many of whom are making money on the refining and marketing end of the business.

Hi Gail, interesting and important series.

A few comments:

I too would like a clarification on the EROEI numbers for oil from tar sands in Alberta. For a while numbers of as low as 3:1 were kicking around. Now the popular number seems to be 6:1 but keep in mind that this is official industry figure which could very well be short of reality. When you consider the incredible energy cost of surface mining, retorting and reclamation and the stated need of prices of 66 to 80 dollars a barrel needed to make profit, I wonder if the 6:1 EROEI is reasonable. Underground technology has got to be very expensive too because of the vast amounts of energy needed to heat large quantities of sand to a temperature needed to get the keratin to flow. I assume the 66 to 80 dollar figure is meant to apply to under surface extraction too as it is a given fact that the industry will switch more and more to the underground technique.

When I was a student at University of Alberta, gasoline was dirt cheap in Alberta with its local oil production. The University of Alberta had a surplus of about 200 million dollars in its coffers due to oil revenue. The federal government didn't think it fair that the east of Canada should pay much higher prices (even though Alberta had to put up with the environmental degradation, etc.) for gasoline and forced prices in Alberta to be essentially on par with the east.

Also when the national health plan was put in place (a very good thing for the nation and its people - take note America) they forced Alberta to take part. As background, Alberta already had an excellent "universal health plan" in place within the province paid for partly by oil proceeds. Albertan's were not very happy with that change either as it adversely affected their pocket books.

My point being that there is plenty of precedence for national government forcing major issues on provinces. Thus there is no question that the quoted action (above) must be taken seriously and that the "nationalization" of a province's out put could happen.

I don't think any federal government initiative has anything to do with fuel prices in Alberta, other than the GST universal value added tax. It's more likely to do with local refinery supply and demand issues. Fuel prices in Canada are not regulated AFAIK, and are set by the retailing and wholesaling companies in a theoretically competitive manner.

Did that plan you refer to precede T. C. Douglas's introduction of single-payer medical insurance in Saskatchewan? I'd like to learn more about the history of the Alberta plan. Have any references? I note from this website, http://albertadoctors.com/bcm/ama/ama-website.nsf/AllDoc/00707B190EE25FC487256F9D0072CB58/$File/FACT_SHEET.PDF?OpenElement

1935 - The Alberta Government supports and agrees to subsidize a prepayment

insurance program in 1935 and again in 1942

1948 – Alberta sets up Medical Services (Alberta) Incorporated (MSI) offering medical,

surgical and obstetrical services to subscribers

1969 – The Health Care Insurance Act passes introducing compulsory federal medicare

to the provinces - MSI ceases operations on June 30 - AMA and CPSA become independent of each other

Sounds like you're referring to MSI, but note "to subscribers" implies that there will be some group of people not covered, payments required, and perhaps procedures not covered by "medical, surgical and obstetrical services".

With respect to EROI, I think there are a couple of factors involved.

First is that the process is getting better over time. Canadians have been working on the process for 40 years. There is no issue of finding the material, at this point. The point is efficiently processing it, and processing is getting better. One booklet put out by the province of Alberta states, "Per barrel of oil, carbon dioxide emissions have been reduced by 45% since 1990." Companies are constantly looking for ways of doing things more efficiently. Also, if way of extracting "rare earths" from tailings is developed, there would be the possibility of getting two products for the effort of one. So it is not unreasonable for the EROI to go up over time--in fact, that is what one would expect.

The other side is that EROI leaves out a lot of indirect energy. People's salaries don't come into play, even though energy is quite a bit of what salaries go to pay for. It is necessary to borrow huge amount of money to fund these projects, and the borrowing costs are used to pay for the energy costs of a lot of financial executives, plus profits that eventually go to buy energy products for many of the recipients. But from an EROI point of view, this has no cost.

You expect the EROI to go up, but isn't that only possible while the highly concentrated pockets are being exploited? The EROI will move down as soon as lesser grade deposits have to be extracted. This is what is happening in the oil industry for some time already with ever deeper wells at more difficult locations, longer pipelines, heavy oil and the exploitation of the Canadian tar sands...

I am not sure how it will work out in practice. The total resource in place is huge, and the technology is evolving rapidly.

There are several variables that are important--resource concentration, depth of the resource, and thickness of the resource are ones I am aware of. The projects right now were probably chosen to be in as close to sweet spots as possible.

I would hope with the amount of the resource, we are not getting too close to the difficult to produce stuff very quickly. If the 173 billion barrel amount was picked to be easily producible, we could be looking at flat to increasing EROI for quite a while.

I certainly do NOT accept the 6:1 EROEI number!! The "standard" steam/oil ratio for SAGD is at least 3.0. That means the use of about 1.0MMBTU of natural gas just to heat and extract 1 BBL of bitumen from the ground. Since 1BBL of Bitumen has about 6.0 MMBTU of energy is 100% of the barrel were usable, that means about a 6:1 EROEI IF there were no other energy costs involved!!! (which is certainly NOT true). So in addition the energy cost of extracting the bitumen from the ground, there is the energy cost for upgrading (significant especially if you want high grades of oil with lots of hydrogen added, which costs MORE natural gas). Another energy cost is the pumping of the water, the cleaning of the water, the pumping of the upgraded bitumen and finally, the loss of the energy content from the "bottoms" of the bitumen barrel. There is too much carbon in bitumen (about 85%) compared to regular crude oil so you have to add hydrogen or get rid of carbon (pet coke) or both. Another way to look at it is that 15-20% of the barrel of bitumen (the high carbon, high molecular weight bottoms with most of the metals and the sulfur) is not usable, so that effectively gets rid of more EROEI. The most advanced schemes (like Nexen/Opti-Long Lake) are using the water shift reaction to add the hydrogen from water the "bottoms" and capturing most of that lost "bottoms". HOWEVER, there is another energy penalty and the net gain is mostly financial (producing more barrels of syncrude per unit time) and not EROEI. I would estimate a REAL EROEI of about 3:1 for the SAGD process. I am reasonably certain that the Bitumen mining operations are not more efficient.

I am NOT saying that the EROEI can never improve. It probably will because the SAGD process is being improved continually. However, the higher grade deposits are near the surface and the deeper, less concentrated deposits will require more steam and more steam losses, so the technology improvements will probably allow lower grade bitumen deposits (oil sand) to be accessed, but will probably not improve EROEI substantially (a well known Peak Oil phenomenon to anyone who reads TOD). I would strongly suggest that anyone citing an EROEI of 6:1 for the Oil sands is not including all of the losses, but just the extraction process itself.

Ian

Thanks for the in-dept look at oil sands, Gail.

I was struck by the implicit net-energy data in one of the graphics in your post:

No idea where they (CERA, the source listed in the caption) get their data, or what is included. However, if we *assume* it's accurate, then it seems like a decent proxy for EROEI: the energy required to produce given oil as a portion of the energy of that oil produced should be *roughly* comparable to the CO2 produced by each, no?

If that's accurate, then it looks like a rough net-energy of 4-5 for Saudi Light and less than 2 for Canadian oil sands. That seems like too little difference from Saudi Light to oil sands to me, but I'd be curious to hear others' thoughts (or if anyone has a report from CERA that discusses their methodology here)...

If all studies used same boundaries your estimate might be close, but:

a)much of saudi investment was made long ago, whereas tar sands needs to be built now - ergo there is the fixed vs marginal EROI issue again

b)measuring the CO2 alone wouldnt account for say 10x more metal and equipment (and the wide boundary emergy costs of that equipment) for the more industrial oil sources if it was only measuring emissions at the plant. I assume they (CERA) looked just at direct energy and didn't include the carbon sink loss from land use change - equivalent land in KSA wouldn't sequester much carbon - but I couldn't find the Sierra Club report.

Still your observation is interesting in that we have no EROI #s for Saudi (no data) - Charlie Hall has suggested it was at one time over 1,000:1 - we just don't know. What is relevant is what it is now, and going forward.

Here is similar GHG graphic for Coal-to-liquids:

It really makes me wonder where CERA got their numbers, and what methodology they used. Part of me thinks that this must be little more than conjectcure (especially since all the boundary issues with EROEI also appear here, and I doubt CERA magically solved them without telling us about it). Either way, I can't see how CERA would consciously publish something that implies a net energy of less than 2 for canadian oil sands--that's tantamount to an admission that oil sands are actually a means of converting other forms of energy to liquid fuel, not an energy source. Of course, as Gail points out below, we don't really know what other gasses they've included here that skew the calculations. Gail: was there a larger report where you found this graph that might explain the context better?