Open Thread for "Peak Oil is 'A Waste of Energy'" NYTimes Article

Posted by nate hagens on August 25, 2009 - 10:55am

Today the NYTimes ran an Op-ed by Michael Lynch once again pointing out the "fallacious thinking behind the concept of Peak Oil."

TheOilDrum staff is considering a rebuttal to this article, though if we go point by point to Mr. Lynch it will be a bit like Monty Python skit, "The Argument Clinic", given he didn't posit many facts. Below the fold are some brief points followed by an open thread for you to deposit your own.

Here are some points to rebut Lynch:

1)Peak Oil has never been about the amount of hydrocarbon molecules that exist, but flow rates, timing and costs.

This post from 2007 gives a general overview of the differences between those concerned about a near term oil peak, and the unconcerned.

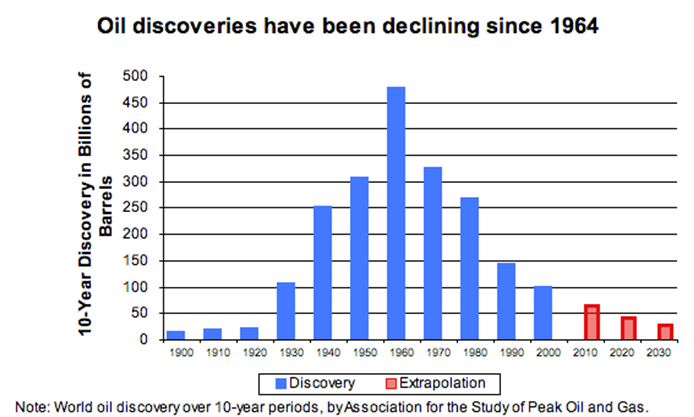

2)Reserves additions are backdated to date of discovery - even with that global discoveries peaked in 1960s and have declined every decade -we need to find oil before we produce it. Onshore oil production peaked in 1980 -all growth since then has come from offshore. 30 of the worlds 54 oil producing countries are past peak, with 10 flat or declining and only 12 increasing. etc.

Graphic by Gail Tverberg, Data from Exxon, Source: Tsoskounoglou, M.; Ayerides, G.; Tritopoulou, E. The End of Cheap Oil: Current Status and

Prospects. Energy Policy 2008, 36, 10, 3797-3806

3)New, better technology generally allows us to maintain current oil flow rate at cost of higher future decline, (which then requires more discoveries, etc.). Look at the example of Cantarell - stagnant production until 1999 when they introduced nitrogen injection - then horizontal drilling in 2002 -production increased for a few years but is now crashing - (yesterday Mexico announced they are buying oil from Brazil, which means USA is buying oil from Brazil indirectly)

4)Lynch and most other natural resource optimists completely ignore net energy analysis - the fact that energy and other natural resource inputs are requirements of oil extraction. Dollars are only an abstract marker for real biophysical costs. The energy return on energy invested on oil in USA has gone from 100:1 (1930s) to 30 to 1 (1970s) to 11:1 (2000) and anecdotally (we don't have the data) is lower now - additionally how much energy and natural resources will it take to rebuild the massive oil/gas infrastructure around the world with 40+ year average life? That isn't even included in those energy profit figures quoted above.

5)Nobody I know is blaming politics for declining discoveries -more expensive exploration and production, or increasing depletion rates. Mr Lynch tries to tie the current debate to the oil embargoes from 40 years ago - but tellingly doesn't mention one person today.

6) His final argument about total resources available being enormous mentions "some geologists". Again, he tellingly doesn't mention one name or organization to substantiate his claims.

7) If the mountain of credit/debt relative to physical resource continues to unwind, the market price signal will cause new investments to stagnate, and the observed decline rate will approach natural decline rate.

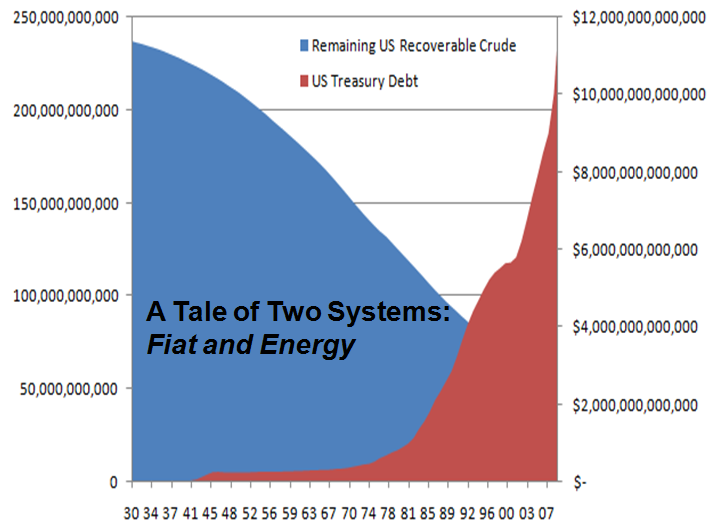

8)There was no mention of oil as the lynchpin of economic growth and that we need growth to pay back debt. We import 2/3 of our oil, yet are paying for it with fiat markers. Just today the Obama administration revised the 10 year deficit to $9 trillion. US Oil production and debt creation, are going in opposite directions. Lynch and others don't seem to understand that energy and natural resources are what we have to spend - dollars are just who controls these resources in the current system (or maybe they do understand?)

US lower 48 remaining recoverable oil (based on HL) vs. US Treasury Debt

Please add additional points with relevant charts, data, links, below.

Lets not say "anecdotally" when refering to supporting information. if it is anecdotal - leave it out. we dont want to fuel his fire - after all he did say all our supporting data is anecdotal.

To add to point #5 you made. It doesnt matter if there are 10 trillion barrels of oil left - it if takes 9.9 trillion barrels of oil to recover it. Lets add some data about the increasing marginal costs associated with recovering the kind of oil that is left.

Is it possible that Mr Mike Lynch (pic below) is a shill for the oil industry and is paid to keep the horses calm and not panicked into changing to other forms of energy?

About 4 years ago, Michael Lynch was quite active on the PeakOil.com message board and posted under the moniker Spike. The mammoth "Michael Lynch - Disputing Peak Oil" thread has been inactive for awhile though.

http://peakoil.com/peak-oil-discussion/michael-lynch-disputing-peak-oil-...

In a way its good to know he is still active, as his arguments are slick yet very straightforward to cut apart. His primary approach has always been an attack on "conclusions on poor analyses of data and misinterpretations of technical material" as he states in the OpEd. What has changed since a few years ago is the wealth of novel analysis techniques that have appeared on TOD and elsewhere. Lynch simply has no counterarguments to these analysis techniques, and will likely try to ignore them for as long as he can.

Lynch:

The reserve growth argument in particular has always been an analysis Lynch spins to good effect for the cornucopian side. With a good model for reserve growth based on dispersive search, we can easily accommodate upward projections and gain a better understanding of what is actually happening. That is the key to how Lynch operates: he looks for weaknesses in a peak oil analyst's heuristics and attacks any holes that he finds. Admittedly, the reserve growth heuristics have been an obvious weakness on the PO side as no one has created a sufficiently strong first-principles derivation to describe its temporal dynamics. Lynch has sensed this and decided to attack this soft spot, and has held his ground because no one has adequately countered his assertions.

But Lynch's own weakness is that he is not a high-caliber mathematician or statistician and would retreat if faced with some reallly solid analysis. ... That is, IF he has any scientific integrity, which is debatable. As I said, he does seem to point out the weak spots, but where he would go beyond this is not clear. If he was indeed an industry shill, he would likely start making stuff up. We have to get him to that point, as he still owns the upper hand on some of these arguments.

IIRC on that thread he argued that data pointing towards "peak now" wasn't what it was presented as by the "peakoilers"

he was asked what sorts of effects and data he would expect to see if oil was peaking..

when he failed to produce examples of such markers he answered that such information was a commercial secret he charged for...

glorified argument from authority.. "only i have the arcane formula"

no wonder he never stepped up and guest posted here.

Joseph Romm has the history on Lynch's bogus price predictions back in 1996 and he lowers the boom with a public challenge. Good stuff:

http://climateprogress.org/2009/08/26/michael-lynch-peak-oil-bet/

Is that true? In the chart of oil discoveries that Nate posted, didn't he say that the discovery sizes were back-adjusted for reserve growth? The declining discoveries for the '70s, '80s, and '90s are all pretty old by now. How much more reserve growth could be expected for them?

Not only that. Someone who says that oil from deep sea off Africa and South-America will bring back oil to 30 dollar cannot be taken serious. Oil can only go to $30/barrel because of a deepening recession.

It is a waste of energy and time to think much about his article.

From the facts above is most telling that onshore oil production peaked in 1980.

After that the fact that more than 40 years elapsed since peak discovery.

The Cornucopians know better. They are mere tools of delusional or desparate expansionists. They declined our $100K wager in 2007 on production estimates and have repeatedly rebuffed our invitations to debate at ASPO conferences. Dan Yergin called for a "civil dialog" at the same time his crony Peter Jackson called peak oil theory "garbage". And now Lynch calls peak oil watchers "Chicken Littles". They are university-trained, highly-experienced and well-paid dissemblers. But maybe, just maybe, if we keep reaching out to them in a bi-partisan manner they will come to our upcoming Town Hall Meeting (ASPO Conference, Oct.11-13)so we can have an honest conversation and learn from each other. I just hope they don't come with their weapons. HAWR!

I'm certain that Lynch is useful for what I call the "fiduciary conumdrum" facing the big boys in the oil industry. I've discussed this privately with a couple of heavy hitters, and they agree. If you are in senior management of a large publicly-traded oil company, admitting peak oil exists harms your shareholders and makes you subject to huge lawsuits for breach of fiduciary duty. In other words, if you make the stock go down, the lawyers can take all your money away.

If you admit peak oil is here, you immediately signal that you are willing to pay a scarcity premium for things like acquisitions of reserves or other companies, key employees, and specialized service providers. In short, all you do is increase your company's costs, while doing nothing to increase revenues. I seem to remember from school that declining earnings make a stock go down.

Some lawyers and pension fund consultants would have a field day picking apart the management teams that admit this. If you were in their position, and faced possible financial ruin, or at least a severe financial and legal cost for just saying you're not sure, then you bet you'd welcome the help that Michael Lynch and CERA provide in confusing this issue.

Sorry, I don't see that. If the admission of peak oil raises costs for the operating companies, then it should also raise prices for what they produce.

I'm not about to suggest that the oil business operates on anything like a "cost plus" basis, where increases in production costs are passed through directly in the form of increased prices. Costs to operating companies and prices to oil consumers are both determined by market dynamics. They're only coupled indirectly. So the situation you describe is possible in principle. But I don't see any reason it would work out that way in practice.

In saying that admitting peak oil will raise costs for the operating companies, you're implying that an expectation of scarcity will change the psychology of those that hold reserves in a manner that will increase costs to the operators -- which I think is quite true. But in saying that it won't increase revenues, you're implying that the same does not apply to the prices that the operators can get for the oil they produce. There you lose me.

The question of who gains from denial of peak oil seems to me rather complex. To the extent that it succeeds in influencing market opinions, it obviously serves to lower both costs and prices over what they'd otherwise be. That's short term. It also forestalls and undercuts market flight to alternatives, which could benefit producers in the longer term. But it puzzles me, because I don't see how it can be effective for any significant length of time. We're rather late in the game, in my opinion, and reality is already knocking at the door.

Perhaps what we're seeing is a last-ditch effort for those in acquisition mode to hold prices as low as possible while they're locking up everything they can get their hands on. It's hard to see it as an honest opinion, given the weight of recent evidence.

People like him deny the issue through stupidity; deny it due to emotional hindrance; deny it due to conflict of interests. They are essentially the bane of our efforts to spread the word about Peak Oil. Therefore, it is essential that we rebuke them as efficiently as is possible. And is it just my psychology, or do all deniers actually look as ugly as he does? (Assuming that is his likeness!)

Lynch is right. negative people who ignore economic history, only see gloom.

are historically and hysterically wrong.

In 1858- Titusville PA, oil was 20$. that 20$ incited production technology and brought on SUPPLY!! Oil has been going down in price ever since.

20$ is $400 in today’s prices.

FACT All commodities Go down in price in REAL terms,, since caveman days!!

By 1863 when the FUNK well came on at 3k barrels / day,

Oil went to 10 cents a barrel.

N-gas is 2.60, 160 in the Rockies- because there is TOOOOO much,, industry can help itself,, it barfed and over produced.

Over time rewards go to those who “see”,, not to it’s a disaster gloom-doom types.

Titusvilleman

To infinity, and beyond!

I'm glad you have started a seperate thread for this -I was just gonna post a comment in Drumbeat that said "remember this guy (Michael Lynch) and make sure he is the first to get crucified when the SHTF..."

-I'm sure your rebuttal will be much more diplomatic/informed.

Nick.

A minor nit: how about including the word "global" in point #1. Sure, we all know this refers to global discoveries, etc. But, someone who isn't familiar with the issues might think it refers to the US.

Todd

Bud, bubble spec nutcase cdue was 150..

it went to 30$ in 6 months//

TSHTF ,,,it was a joke.

75$ is a joke.

there is plentitude//

70$ makes THINGS hapoen, the industry acts!!

we will see 40 by Nov.

place you bets//

Bud, bubble spec nutcase cdue was 150..

it went to 30$ in 6 months//

TSHTF ,,,it was a joke.

75$ is a joke.

there is plentitude//

70$ makes THINGS hapoen, the industry acts!!

we will see 40 by Nov.

place you bets//

Is this titusville-man some out-of-control C++ automatic source code generator?

// This is a gratuitous comment

No, it is a complete idiot who doesn't know that drilling wells past peak only slows the decline.

What, no abiotic oil? No mining the asteroids? No endless supply of goose oil?

//This comment intentionally left blank

Nice shot web.

Almost all of my shallow knowledge about peak oil has either come directly from reading The Oil Drum or something on TOD sparking enough interest to cause me to look more deeply into a topic via other sources. At any rate, I'm far,far from an expert in geology, petroleum engineering, refinery practices, and energy marketing. I'm a natural born Malthusian though and can imagine very few if any at all things that will not eventually run out. So when I saw the gentleman's article in the NY Times I thought, it must be a sarcastic piece by a peak oil believer, but damned if the guy wasn't serious. I then decided to read it again and see just exactly what it was the man said and came to the conclusion that it amounted to little more than, “Is not”. He's not even particularly clever. Take this snippet:

“When a new field is found, it is given a size estimate that indicates how much is thought to be recoverable at that point in time. But as years pass, the estimate is almost always revised upward, either because more pockets of oil are found in the field or because new technology makes it possible to extract oil that was previously unreachable.”

Now that's somewhat true. But what he does not emphasize is that some of the increased estimates may be based on the potential ( but not yet demonstrated ) of a new approach to extracting oil, and he does not bother to mention that the pressure to up the estimates is often and, perhaps mostly as time goes on, marketing positioning and I believe that has been thrashed out rather thoroughly here on TOD.

Another bit reads “A careful examination of the facts shows that most arguments about peak oil are based on anecdotal information, vague references and ignorance of how the oil industry goes about finding fields and extracting petroleum.”

I think that the bit about based on anecdotal information may be sometimes true, but I'll bet that any number of TOD experts would love to be relieved of using anecdotal information by having access to actual data. I've seen enough on TOD to assure me that the statement “ignorance of how the oil industry goes about finding fields and extracting petroleum.” is not a credible assertion.

So I was left wondering why he'd write such a facile piece. It must be just to provoke.

If pressed, both Peter Huber and Michael Lynch will admit that discrete regions like the Texas and the North Sea peak and decline, but both of them are basically making the argument that the sum of the output of a group of producing regions that peak and decline will show increasing production for the indefinite future, practically forever apparently.

As I noted on the DB thread, this led me to define a "Huber/Lynch" type oil field as one whose individual wells ultimately decline, but the total field production--the sum of the output of discrete wells that peak and decline--increases forever.

Although most people probably don't think about it that much, the "Huber/Lynch" model is the operating premise that most people have in regard to natural resources.

Mathematically speaking, Lynch appears to be saying that even though the first derivative of production at individual wells is negative, the sum of all those negatives is a positive. (In other words, the whole is the opposite of the sum of its parts.)

We have to be careful as we might give Lynch some ideas. If Lynch doesn't know this already, there is the somewhat famous "Simpson's Paradox", where the sums are not always what they seem.

http://en.wikipedia.org/wiki/Simpson%27s_paradox

I would agree that if they were all negative, then we can make the obvious inference and trust that the aggregate would decline, but the trick is that they are not all negative.

Good insight though.

I think that Lynch's argument is simply an updated version of Zeno, and so he can argue that his math has thousands of years of support behind it. IIRC, Achilles never caught the tortoise, and thus we will never run out of oil from any well (but wait, there's more!).

More exactly, the theory is that there will be more (and/or bigger) wells that are still ramping up their production to counteract for the older declining wells. The underlying assumption in this theory is that as the industry develops, there will be more and more (or bigger) discoveries, and newer/better production methods that increase available flow rates. Obviously both assumptions can be tested by observing the facts about oil discoveries over time and about production technology wrt production rates.

I don't think that's right. If the number of individual wells is increasing (which it is)then total production could be increasing, even if production at each individual well were declining from the moment it came on line (which it pretty much does). It depends on which is bigger -- the total decline rate for existing wells, or the rate at which new production is brought on line.

From what I've seen here and elsewhere, the data seem conclusive that the total decline rate is already nearly equal to if not greater than production additions. There's every reason to believe that the decline rate will increase, and the rate of additions will fall as we move forward. But it's a matter of data collection and interpretation, not any funny math (as far as I can see).

Re: "Dollars are only an abstract marker for real biophysical costs."

Let me get this straight: Dollars are abstractions and energy is real.

In my world energy is abstract since its characteristics are undefined. Energy could be any of its various forms: solar, wind, geothermal, electricity, oil, coal, etc.. Each form has its own individual characteristics that are unique. Energy does not exist outside of its various forms. When EROEI/Net Energy is calculated without defining the form of input and output, it is invalid unless the forms happen to be the same.

Dollars are concrete at least for a moment in time. Energy is an abstraction like grain and metal. Until this is admitted and the wide variability in energy characteristics are taken into account, there can be no progress in dealing with the Peak Oil dilemma IMO. All alternatives will be deemed unacceptable because they fail the fallaciously measured EROEI when compared to oil.

Oil is non renewable and should be given a big minus for that characteristic somewhere in the calculations. Also imported oil is diffinitely a big energy return negative from the point of view of the oil importer. It has to be since no oil exporter would sell it for less than its energy value. When imported oil is refined and consumed no energy is produced. It is consumed. Since most of American oil is now imported, it should be obvious that the energy return on oil in the current American experience is very negative, not positive as implied.

That is part of the reason we are now experiencing the Great Recession as the economy struggles to make enough economic profit from imported oil to pay for importing more of the stuff. It is a vicious circle especially with the other drains on th economic profits of imported oil like fiscal and trade deficits, wars for oil security and bailouts of banks, auto companies and such.

I think you misunderstand by what I meant by 'abstract'.

Money can by created by penstroke, rule changes, etc. Energy cannot.

I think you squarely hit that one on the head. Money is imaginary, Energy is real. Money requires faith ("in God we trust")and more can ALWAYS be conjured up whereas easily accessed, transported and processed liquid petroleum is finite.

"Dollars are concrete at least for a moment in time.", yet "Energy is an abstraction like grain and metal." ?! WTF?

That is why I flagged this as inappropriate.

That, and the fact that your post has nothing to do with the topic at hand.

If you want to post this kind of reasoning (and I use the term loosely) in the Drumbeat, go for it.

That stupid inappropriate flag function was never intended to censor discussion based on ideas-it was set up to keep out cursing, insults, shoutfests, etc. So now you have this small band of morons flagging everything they disagree with.

Priceless!

It is funny, and he should not have used the word "moron" in his reply post, but his point still stands, in the post flagged as inappropriate there was no cursing, insults, etc. The flag unappropriate was for a post simply because the replier disagreed with it.

RC

The flag is not just for cursing and insults. It can also be used if a comment is inappropriate for the thread. Off-topic, etc.

FWIW, I have seen no evidence that anyone is "flagging everything they disagree with." If anything, people aren't using the flags enough.

The setup of this forum has always been a problem I find. Remember the red and green flags? and now this system is being abused.

This combined with having to search through an entire thread to answer replies to your own posts means the oildrum forum is the worst I have come across in 15 years of internet use.

Its about time we had a major overhaul of this forum and made it more user friendly.

Well, I like it. The format is easy for me to use -- if you want to find your own posts just use CtrlF.

And inappropriate content is way down compared to any other forum I read

One of the sweet features of the Chrome browser, is cntrl+f search results are also indexed as colored lines on the vertical scroll bar. It's easy to find things even in a long forum.

The comment system is a real pain in the backside. When there are 100+ comments it takes forever to get to the ones you wish to view and reply to. I have resorted to using the 'find' function with either my screen name or '[new]' to quickly locate posts.

I did email the editors a few days ago recommending a general forum is set up so we can start our own thread outside of conversations directly relating to a main article. This would be a plus for TOD.

You can also click on My Account.

Then click on Comments.

That will link you to all the comments you recently made and to responses that other TOD'ders may have posted.

This used to work better as you could easily tell if there were "replyed-to" comments. I think this was implemented when TOD used a pre-Scoop blogger configuration.

I've read this little diatribe so many times, it's starting to feel like those emails you get to purchase English bulldog puppies from Zimbabwe...

Energy is not abstract. It is totally definable and quantifiable. That it has various forms does not mean we can not quantify it. Does the fact that there are right, obtuse and acute triangles make "triangles" as a whole "abstract"? Yes there are different forms like coal, oil, gas, but they each have different eroei. THere are also different oil fields... but they each have their own quanitfiable eroei (that declines over time) and any group (or total) of fields will have an averageable eroei.

Your last parapgraphs seem to be constradicting your first few. eroei is abstract and fake... and yet it is what is causing us to go broke? Huh?

Grain and metal are abstracts? Wtf does that mean? Last time I checked, I could touch my box of cereal and weight it. Ditto on a pound of steel.

No one said that alternatives are unnacceotable JUST because of having ereoi lower than oil. (Indeed, I think they are quite acceptable.)

Why should oil get a lower eroei for being nonrenewable? Yes this is a disadvantage, but it has nothing to do with how much energy it takes to produce it right now. Me thinks you don't understand what eroei really means...

Hello Andrew in Texas,

Your quote: "Energy is not abstract."

Yep, this is a true statement! If there are any doubters seeking scientific self-proof: Please come to my Blazing Asphaltistan.

I will gladly provide you with comfortable A/C-cooled transport far & deep into my incredibly lethal, scorching Sonoran desert. Then you can pursue on-foot mirages into the ever receding horizon. You will have just a few hours of life left in the 115f heat, but to energy-doubters and energy-deniers: that is just 'too abstract' a concept to be concerned about. The buzzards, fly-maggots, and other desert biota will NOT consider the energy embedded in your corpse to be ABSTRACT at all.

YMMV based upon rate of dehydration and onset of heatstroke!

EDIT: those on a tight budget [you can't afford the plane fare] can find self-proof by tightly tying a cellophane bag over their heads.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

The Sonoran desert is beautiful and awful. I moved out of Tucson recently. Loved my two years of grad school there, awesome culture, but I don't really think we should be building cities in the desert, though not so much because of energy issues (the desert would be a great place to use local solar to pump heat/air condition) as water issues, which are quite harder to work around.

I think I might take Kunstler to bat on his "Suburbia is the biggest misallocation or resources in history" by challenging him with Phoenix. Of course, there's always Scottsdale... that we could both agree on.. :)

Thxs for your reply. I am doing all I can to dissuade people from moving anywhere [that already has plentiful water] to the naturally parched Southwest [CA,AZ,NV,NM..]. IMO, it will be a nightmare beyond belief when most of Mexico + SW US goes into water shortages.

I have invented a way to dehydrate water so that it can be shipped economically from Western Oregon, where we have plenty of it, to places like the Sonoran desert, where it can easily be re-hydrated with some abstract water that you can just find lying around on the sand.

The process is proprietary, of course, but I will gladly share it with a well-heeled investor of sufficient mental deficiency.

Hey! Not so fast you're it sounds like you're infringing on my "Instant Solar Water" patent pending circa 1999.

I had invented a solar destillation process to do exactly what you propose.

I had succeeded in producing 99.9999% pure instant water through my unique process. It came in a package with very precise measuring devices and instructions so that the end user, could, by very carefully following the instructions and adding a precise predetermined volume of highly purified distilled H20, measured in cubic centimeters then converted to mililiters, to the contents of the packaged Instant Solar Water, thereby instantly reconstituting the purest of waters, rivaling even the most exquisite of designer bottled waters.

I think you will be hearing from my attorneys shortly.

BTW my process doesn't depend on any fancy schmancy virtual water. My Instant water is the "REAL DEAL"!

Energy and grain and most commodities ARE abstract. Well it's all quantifiable right, so much as the energy in a super solar flare hitting our planet and burning off all of it's atmosphere within the next 10 million years would be quantifiable. Yes, that would be quantifiable and a pound of grain would be a pound of grain and 20 million barrels of oil a day would be just that. BUT when you get right down to it, that's all very abstract to any individual seeing only one small part of reality.

There's no need to brow beat individuals that sympathize with your world view. Maybe only two percent of people in the United States are directly involved in farming and I'm beginning to believe that hardly more than that have even a layman's understanding of what the peak oil argument is all about. To most people the dwindling forms of energy that sustain our civilization are very abstract.

I wish more people would take the time to make energy consumption less of an abstract, but hell, I wish more people knew what a space elevator was and understood the costs of war on a personal level. Our goal here is to find the best way to communicate our world view to the masses to which have an abstract idea of what energy is and to help TOD counter Michael Lynch twisted Op-ed.

Let's all save the brow beating for the Mr. Lynches and offer our rationale explanations to the rest of the folk.

This issue or "relationship" is one that interests me most.

** So has anyone found any discussions by economists or better yet...economists and those in the energy field about this subject? **

The amount the US spends on oil and the wars in the ME speak volumes? And we borrow and print $ to do these things.

"That is part of the reason we are now experiencing the Great Recession as the economy struggles to make enough economic profit from imported oil to pay for importing more of the stuff. It is a vicious circle especially with the other drains on th economic profits of imported oil like fiscal and trade deficits, wars for oil security and bailouts of banks, auto companies and such."

Check out The Automatic Earth at http://theautomaticearth.blogspot.com/

There is a primary on renewable energy at http://theautomaticearth.blogspot.com/2009/07/july-1-2009-renewable-powe...

Careful- it is as addicting at TOD.

Oil is not capital, but rent, if you believe Ricardo or Marx.

Of course, this is still economics, a Alice in Wonderland place that everyone believes is real.

Light bulb moment, oil is peaking because were are not printing enough money.

That's clearly silly. Oil is peaking because we are not paying bankers big enough bonuses.

Well, youre both wrong. Oil is peaking because of those crazy environmentalists keeping us from drilling!

You really ought to read your own stuff before you post it.

An interesting exercise would be to examine that issue of the NY Times fully and attempt to estimate what % of the articles written would be considered total BS (to the average reasonably aware reader). I would be surprised if this silly article stands out when that exercise is completed. Newspapers are meant to entertain, not inform.

This article is typical a New York Times opinion/op- ed piece. The Times de- coupled from reality a long time ago:

- Economics is 'examined' by Paul Krugman twice a week. Paul has the recession technically over but needing endless stimulus. Ilargi points out that Krugman cannot know what he doesn't know, and he cannot predict the unpredictable.

- The Times' Tom Friedman (along with the editorial staff and that of the Washington Post) was a front- runner/cheerleader for the Iraq invasion.

- The Times itself is a relentless spammer for the auto industry as well as for various luxury consumables; luxury clothing, luxury real estate, luxury vacations. These advertisements are constantly cloaked as 'news' content rather than what it really is. It is hard to craft an editorial policy of restraint and limits ... when big business advertising is picking up the check.

By the way, Steve, I've noticed and enjoyed a few of your comments on various NYTimes columns. Completely agree with your assessment of the nation's so-called "paper of record." The fact that they continue to give hacks like Lynch a forum speaks volumes.

I agree that the NY Times publishes a lot of this crap. But a big newspaper is a mosaic of different things and it is not all black and white. Some NY Times editors, unlike the majority who must be out of touch with reality to give such a prominent voice to mental midgets like Lynch and Friedman, may have different views. I base this on the fact that The NY Times also publishes articles by Micheal Pollan--a tireless advocate for local, unprocessed food and sane agriculture. Do you really think the NY Times editors/publishers are conscious propaganda tools for big business, or could it be they are just out of touch with reality? By publishing Michael Pollan they are kicking poison producers of high fructose corn syrup and hydrogenated oils, Archer Daniels Midland, Cargil, and all fast food big business right in the balls. At least they are not concerned about that advertising revenue.

Producers of foods with fructose corn syrup and hydrogenated oils don't advertise much in the NYT. The demographic, for the consumers of these products, would more likely find Rupert Murdoch's New York Post more to their liking.

They claim to be "the newspaper of record". That is reason enough to try and set the record straight.

I agree, and sometimes (unfortunately) bad press is better than no press. Lynch's cornucopian blather raises the issue one more time and allows people in the know the opportunity to rationally set the record straight one more time. I love when one of the big networks does an optimistic expose on peak oil related events because it get's people thinking, "why are they talking about this if it's not an issue." I know I'm pretty cynical and jaded to think like this, but you can see this reveals that I'm also pretty hopeful and optimistic too.

Telegraphing the real message

It may be helpful to highlight the real message behind Mr. Lynch's OpEd piece. He clearly states it: "We can’t let the false threat of disappearing oil lead the government to throw money away on harebrained renewable energy schemes or impose unnecessary and expensive conservation measures".

It is impossible to ignore the parallel with Prince Turki al-Faisal recent Foreign Affairs article where the Prince declares: "U.S. politicians must muster the courage to scrap the fable of energy independence once and for all."

The more effectively the real purpose is highlighted the more effective the rebuttal will be. Mr. Lynch and Prince al-Faisal are concerned about the economic impact of decreasing our dependence on fossil fuels, particularly imported oil. And the real cost of imported oil is much dearer than we generally acknowledge given the sizeable commitments in blood and treasure we've made to protect "our" supply.

razrmon,

you said, "Mr. Lynch and Prince al-Faisal are concerned about the economic impact of decreasing our dependence on fossil fuels, particularly imported oil."

I think you have called it exactly right. They are concerned about the economic impact ON THE PRODUCERS.

For them, it doesn't matter whether the decrease in oil usage occurs because of decreased supply or decreased demand, it is still a catastrope for the producers! The need to extract the billions spent in the infrastructure to get, refine and move oil.

Frankly, we have it in our power to break the back of the producers in the next decade if that is the goal. I do not see it as the goal. The idea would be that the oil producers will begin to transition themselves away from dependence on oil just as the consumers do. But they must be willing to take that path.

RC

Actually it matters very much to them. If the decrease is because of a demand reduction the price collapses, and the producers are screwed. If the decrease is due to supply constraints, then the price goes very high, and the producers can make a killing, even though they are selling less. The whole motivation for misdirecting people about the prospects of future supply problems, is to make sure that that is the way it goes down. Anti-peakers whether witting or unwitting are tools of the producers.

I think this is the core of the argument - and one that needs to be put back into the NYT by someone able to write that op-ed.

Hi e.o.s.

re: "If the decrease is due to supply constraints, then the price goes very high, and the producers can make a killing, even though they are selling less."

This doesn't last for long, though, does it? If it's the case that price volatility increases with "peak."

It would also matter how the periods of high price compare to the periods of low price and the cost of the ups and downs (to the producers).

Anyway, the illusion is that anyone's boat can float in this environment, as the situation worsens. We'll see, I suppose.

I had a journalist propose to me today that pek oilers were in the pocket of oil companies as this would allow oil companies to jack up prices when everyone was convinced that peak oil was real. I fear that is going to be the general belief which will hold up any meaningful mitigation until it is too late.

I've see a variant of that theme over on counterpunch.org. Elsewhere in the article I mention, the author writes:

Very well said. This has always struck me as the geopolitical nut that underlies all of the machinations we have seen thus far...

I have to say, I think its worthwhile reconsidering the general approach here, and what might be the best direction to take.

This little op-ed is basically just the same as all the rest, designed to push a particular policy direction by rubbishing the threat. We've seen its twins many times before. The bigger question is what is driving it?

Now I'd love it to be Opt2, but given the woeful backbone demonstrated over the past six months, Opt1 is quite a possibility. You must also take into consideration that if commercial property doesn't tank, people are being to stare down the possibility of another oil price spike as recovery sets in.

In either case, the field of play is politics and policy. These are set by emotions and emotions derived from faux facts. You want to answer that call with graphs and point by point rebuttals? You're bringing the wrong weapons to the fight.

I'd suggest that in answering it you give short shrift to the words, dismissing them quickly as tired repeats of distortions and lies that were trumpeted in 2006 - saying oil was going down to $12 a barrel. A link to a factual statement of the position on oil on this site can be given as an aside.

Instead move on to the policy battleground described above. Outline the failure of action that has dogged policy since OPEC first demonstrated the weakness of the US situation in 1973, 36 years ago. Paint a picture of the year 2012 if policy failure continues; the never ending recession as any green shoots of recovery are stomped on by oil price spike, the continued growth of China as its currency reserves allow it to buy up oil contracts around the world, Mexico falling apart as oil revenues disappear, the collapse of the dollar in the face of reality. Reference the words of Fatih Birol about failure to invest currently and need for much more government attention.

Then say the hour is getting late, action needs to be strong, swift and certain if that picture is not to be made real. Snivelling vested interests (like Mr Lynch) need to be 'strung up high' if the US is not to slouch towards its personal and international apocalypse.

I'd guess that some would catch the Yeats imagery, but the important thing is NOT to fight with numbers, but to fight with ideas. The facts are there to back up assertions, not to lead with. You are interested in decisive actions, not in if the peak was 2005 or will be 2011. Above all, its not really the readers you are interested in, its the government policy and it going down the Opt2 rather than Opt1 path.

garyp:

I fear your Option 1 is what is really behind this. My suspicions are that the Obama administration was so backed into a corner that they had to cut a backroom deal with some oil state Blue Dogs in order to get their support for the health plan. The deal is that the green energy initiatives get "postponed indefinitely" (i.e., for the remainder of Obama's term of office), with the public explanation being that the brakes need to be applied to the spending. The real back room explanation is that that is the price paid for the votes. Part of the deal was probably to delay the announcement of this for a while, in order to start in to play the machinations with the media that would lay the groundwork and condition public opinion to accept this policy change without too much opposition. Thus the appearance of Lynch's piece at this time. Look for others like it, in other venues (e.g., Samuelson's hit piece on passenger rail in yesterday's WaPo).

This is a testable hypothesis. If this initial salvo becomes a flood tide in the media of things like this, followed by a public announcement that "we just can't afford to move forward with green energy right now", then that will be confirmation.

Following that logic - that oil is plentiful - there is no reason for the government to throw away money on subsidising oil producers, either.

Interesting you see those two statements as synonymous because I see them very differently -- Lynch's is absurd, while the Saudi guy's observation is absolutely true. Nearly everything done in the US in the name of "energy independence" has been a disaster --- biofuels, oil shale, synfuels, you name it. A country with 1-2% of reserves and 5% global population that consumes 25% of the world's resources MUST get over the fantasy of energy independence and start trying to figure out how to live and play well with others.

Reducing consumption (or population) is the only long term solution. Similar to being unable to solve the credit crisis by increasing debt/credit, we can't solve an energy dependency problem by becoming more dependent on energy.

Only if you actually believe energy dependancy is a problem.

Seriously; Global human energy use is some 16 terawatts today. Its going to go up to hundreds of terawatts over the next century as global civilization continues industrialization. That this is 'bad' is a matter of perspective.

Have you thought about the non-energy inputs (in particular water, and metals for infrastructure) that accompany that fantastical prediction? How about externalities and social equity? Will we appropriate more or less than the 30-50% of net primary productivity we already pull into human systems? All other inputs and outputs magically stand still while we harness nuclear hmm? You are off by an order of magnitude, and quite likely two (meaning we are down to 1.6 from 16 by then). There is a non-zero possibility you're off by 3 orders of magnitude (.16 terawatts in 2109).

But lets say youre right. Nuclear is the only logical move up the energy density scale, and there is lots of it. How does that answer the fiat/liquid fuel/social equity crises of the next decade? Where is it addressing the real time problem?

Sometimes I think I'm on another planet. The only thing I agree with you on is that 'bad' is a matter of perspective.

It doesn't; I never claimed it does. Over the next decade price signals will bring forward the usual suspects of coal liquefaction, tar sands, ultra deep water, and so on.

Coal use will continue to go up, especially in India and China. But over the next 30-40 years there will be a transition to nuclear, wind, etcetera, and energy demand will continue to rise to feed ever larger industrial demands.

That statement is so outrageous it is difficult to know how to reply. Energy consumption is going up, not to one hundred terawatts but to hundreds of terawatts from the present sixteen terawatts.

After thinking about it for a couple of minutes, such a statement could only be made by someone who is totally delusional, totally out of touch with reality. Such people are best ignored.

Ron P.

To be fair, I think he's counting the watts from all the bombs we'll be dropping.

(Bred in his benign fleet of reactionary reactors)

Seriously; Global human energy use is going down to zero over the next century. That this is 'bad' is a matter of perspective.

Both wrong. Thanks for playing "See the extremes!"

LoveSalem:

Then the amount of exports available from producing countries drops to zero, then consuming countries like the US WILL be energy independent. It will happen, absolutely. And if the ELM hypothesis is true, then it may happen far sooner than most people realize.

razrmon:

Here, here! Thanks for saying this, otherwise I would have had to say the same thing. You are absolutely right, the real point and the real purpose of Lynch's article comes right at the end. I suggest that what we really need to do is think in terms of starting at the end and working our way backwards. Point out right at the beginning that Lynch works for the oilcos, and that both he and they have an obvious interest in derailing both renewables and energy efficiency. THEN make the case for why that is a terribly bad idea, and catastrophic for the US, by showing what the real state of affairs is wrt energy in general and oil in particular.

The big challenge: Someone like Lynch can throw out lies by the sentence, but refuting them requires facts by the paragraph. It is going to take a lot of good writing and editing to distill our arguments down to something concise enough to fit within the constraints of what the NYT will be willing to print. I would gently suggest to those putting this together that you not be too concerned about refuting each and every little thing that Lynch wrote. Focus on the most important things, and be more concerned about making our own case than about cutting down his. Focus the heavy artillery on the most strategic points - that's how you win a battle.

That's the theory? Who doesn't believe that? The only debate I've seen or heard of is about when. The peakers say it is imminent or here. The extreme optimists say it's decades off. This is the first time I've heard someone suggest the oil age won't end. There's massive confusion (or something) right there at the door.

More confusion. So most "previous predictions" were for peak in 20 years? Most who? Peakers? No. Those are the optimists. So again, the issue for anyone is when, not whether, with the optimists putting peak 20 years or more ahead. Well, if oil were known to be peaking in 20 years, that would be a serious problem deserving of attention NOW. But this guy is very, very relaxed about even that. What WOULD make him nervous?

I think #2 is a very important point. When I heard him say that reserve additions were not counted as discoveries, I worried that Ace's chart (my personal favorite) of discoveries vs. production was not telling the whole story.

The other major graph to include would be WT's favorite of Texas & North Sea. Between those two charts, you can make a pretty convincing argument.

Jin Baldauf invites Michael C. Lynch to an ASPO meeting.

http://tech.groups.yahoo.com/group/energyresources/message/105081

What? No Cornucopian apologists for Mr. Lynch? How can you have a debate with no voice representing the mainstream view ('mainstream' in the U.S. anyway). Ok, this isn't my specialty, but since there's no one else around to do it, I'll give it a whack.

Mr Lynch is 100% correct --more power to him for sticking it to those eco-weenie Doomers! There is no shortage of oil in the world, and not likely to be any shortages in the foreseaable future. Cheap oil, just like so called "endangered" plants, fish, mammals, etc. are replenished abiotically by Corporate Jeebus. Corporate Jeebus *wants* us Chosen Ones to be rich (and by 'Chosen Ones' I mean "belonging to an evangelical/pentacostal branch of Protestantism that supports laissez-faire unfettered capitalism, environmental deregulation, and an agenda of globalist pro-growth labor arbitrage", of course). To be rich all we need to do is "drill, baby, drill!" and grow ourselves into permanent prosperity. It's the Growth, stupid!

If you're *not* personally benefitting from His Unlimited Bounty, here's some practical advice: pray harder. And donate to the Republican Party, 700 Club, AEI and Heritage Foundation. Oh, and for you Ehrlich/Kunstler die-hard L-I-B-E-R-A-L-S, stop hating America!

/end rant

Ok, how'd I do?

+10

You did pretty good, but I could almost hear the sarcasm in the typing! lol

(1) The net energy analysis (#4) is strong. Has anyone done any economic analysis of the economic impact to the global economy of going from 100:1 EROI to 11:1 EROI or how much this will cost the economy to re-engineer its systems to accommodate (continue to create new economic wealth) lower EROI's? I just keep wondering how much of the current financial system meltdown (and destruction of ~$50,000 billion in asset prices) is a harbinger of future corrections left to occur as we slide down the EROI curve.

(2) Would Michael Lynch agree that oil today comes in at 11:1 EROI or would he claim that this number is also a figment of someone’s imagination?

(3) But, whether there are trillions of more barrels of oil left in the ground salvageable at today's 11:1 EROI is beside the point, if CO2 needs to be kept below 350 ppm to avoid runaway abrupt climate change. If conservation is driven primarily by the cost of energy inputs, there should be a cogent economic argument that higher energy input prices (at least for fossil fuel sources) are desirable. Again, there is an economic argument to be made if the cost of avoiding the triggering of runaway abrupt climate change (my estimate to achieve 350 ppm is $20,000 billion in current dollars; slightly more than 'fixing' the present financial system crisis) is less than the cost of an outcome without managing CO2 concentrations (e.g. the wholesale destruction of the global economy, loss of ecosystems, morbidity of large portions of the human population and loss of biologic life, etc.).

(4) I am intrigued by the NYT Op-Ed editorial policies. Would they publish an op-ed by an MIT professor who claimed that the earth was flat or that quantum physics was all ‘smoke and mirrors’? Is there really that much controversy over the ‘peak oil’ theory today? How does the NYT publish something w/ so little vetting? Is this an opportune time for the Oil Drum to publish a NYT op-ed to set the record straight, to provide an alternative view?

As to (1)

So long as EROEI is >1, the amount of net energy available for consumption is what matters. Let's say in 1950 (theoretical numbers follow) a country consumed 10 gigajoules (net) and all of this energy comes from oil with an EROEI of 100:1 said country would have produced (pumped) 10.1 gigajoules of primary energy out of the ground. Now let's say in 2050, the same country consumes 10 gigajoules of energy (net) and all of this energy comes from oil with an EROEI of 10:1 said country would have produced (pumped) 11 gigajoules of primary energy out of the ground. In both cases, the same amount of energy is available for planting, fertilizing, harvesting, and transporting crops as well as other goods thus the welfare of society is the same. The only real hole in my argument is that the country in 2050 would have more wells, drilling rigs, and associated environmental destruction.

Some insight into the NYT policies which gave rise to the Op-Ed on peak oil by Michael Lynch is provided on the front page of the print version of the paper (today):

(three inch ad across entire bottom of front page with a graphic of a car made from brown and green dots)

"- fuel for thought -

Energy from Algae.

The energy from algae holds potential as an economically viable, low emission transportation fuel. ExxonMobil is partnering with Synthetic Genomics Inc., as part of a major long-term research and development program aimed at developing algae as a viable fuel source. And because they consume CO2, algae could help reduce greenhouse gases.

To learn more, go to www.exxonmobil.com.

ExxonMobil

Taking on the world's toughest energy challenges."

I like the New York Times for many reasons. However, on the subject of peak oil it is blinded by loyalty to one of its principal advertisers.

4)I am intrigued by the NYT Op-Ed editorial policies. Would they publish an op-ed by an MIT professor who claimed that the earth was flat or that quantum physics was all ‘smoke and mirrors’? Is there really that much controversy over the ‘peak oil’ theory today? How does the NYT publish something w/ so little vetting? Is this an opportune time for the Oil Drum to publish a NYT op-ed to set the record straight, to provide an alternative view?

They would not publish a flat earth article, but they would also not be able to explain WHY they believe the earth is round. Editing a newspaper is not a job for people with a science education.

A few points for Nate from a non-expert:

1. Classic: Majority of nations have peaked

2. Classic: Hubbert predicted U.S. peak

3. Classic: Hubbert predicted world peak

4. Classic: exponential extraction cannot be sustained

5. Classic: We are going offshore and to Alberta because we have used up all the good stuff.

6. Political: Wars in Iraq and Afghanistan are about securing the last major oil reserves

7. Fallacy: Cherry picking one arguably irrelevant term by Matt Simmons proves nothing about Peak Oil

8. Fallacy: Cherry picking one so-called failed prediction of Peak Oil by founder of ASPO does not disprove Peak Oil.

9. Fallacy: Claiming that there are 10 trillion barrels of oil in the ground is completely inconsistent with publicly available production data applied to the integrated logistic equation.

10. Poor research: Lynch has obviously not been looking at the data as well as Matt Simmons has: "The Last Nail in the Coffin of Peak Oil."

Another point you could add is the low-hanging fruit premise. Countries/companies produced their best fields first and bring lesser fields on line as time goes on (e.g. Saudi Aramco producing Ghawar first and recently bringing on Khurias). I'm surprised no one has mentioned the fact that ALL fields peak on an individual basis which means that oil production in the aggregate will also peak.

Seems to be boost the "Recovery" Tuesday.

I emailed this through to ASPO ~ 15 hours ago.

The message seems to be you don't have to worry until 2030...

Demand without supply i.e. look no Peak at the BBC.

Thought this might be of passing interest given its potential audience size.

There is a Energy data graphic derived from World Energy Outlook © OECD/IEA, 2008, figure 2.2, p. 81 and modified by BBC News.

http://news.bbc.co.uk/1/hi/sci/tech/8213884.stm

Lynch writes:

Ask him to put his money where his mouth is. Here's my proposal: Make a public bet with him, spotting him $10 on his prediction of oil "closer" to $30 a barrel. At the end of each week between now and the end of 2015, TOD will pay Lynch the difference between $40 and the price of WTI if WTI is less than $40/barrel. In turn, Lynch will pay TOD the difference between $40 and the price of WTI if WTI is more than $40/barrel.

the problem with that is he might be right (for wrong reasons). We have built an enormous amount of slack into a system that decoupled from real assets for too long. Combine that with a market that prices at the marginal unit and we could very easily see $30 oil again, even with (and helping to cause) eventual near double digit decline rates. I wouldn't take that bet - depends how much central banks add - so far what theyve added is huge, but still small compared to the obligations/claims.

The argument (and the bet) would not be that oil absolutely won't get down to $30 (or rather, $40) at some point, but rather that it will average over $40 between now and 2015. If you are reluctant to make any kind of argument along those lines, then I think that in your response you really need to argue more or less what said -- that he might be right about oil prices, but for the wrong reason. That reason would obviously be that the economy has collapsed to the point that a significant recovery in petroleum demand might not occur for several years.

If his prediction of $30 a barrel comes true and you don't address why its coming true would not invalidate the broader argument for peak oil "soon," then he will have earned major prophecy points that will enhance his future credibility.

Starting to sound more and more like an economist, Nate. Haha. Just don't forget that what the central bank giveth defaults taketh away. One has to ask "What is happening faster: private de-leveraging or public leveraging?" I suppose only the Fed and money center banks truly know the answer...

At this point, public leveraging. TPTB are doing everything in their power (cash for trash, creative accounting) to avoid financial asset prices reflecting reality, and while consumers are paying down debt, they're only back to mid-2007 debt levels.

Nate, you are completely right that we don't know how the system may play out, but I would definitely take that bet. 5 year oil futures are currently trading at $85, if needs be I could just sell a bunch of futures and lock in the profit.

A better bet would be "The market reckons oil prices will be $85 in five years time, will it be more or less?"

I'm still a buyer at $85 though.

With a bet like that, you better have a lot of syrup to go with all the waffles you'll be receiving.

If I recall, Bakken is primarily dolomite. No? I know I'm preaching to the choir but Lynch overlooks the primary tenant of peak oil theory, flow rates, and the two physical attributes that dictate flow rates: porosity and permeability. There might very well be 60+ billion barrels in Bakken but getting it to flow out at more than 500,000bpd would take a miracle. Shame we can't have some one like Deffeyes to step in and give us a porosity comparison between Bakken and Ghawar.

Cornucopians such as Lynch never delve into actual science.

To be fair, one could make that same claim about doomers (many of them in any case)

A stock analyst friend of mine says there are some incredibly cheap reserves in Bakken - like $10 a barrel cost but all in with total acreage the play might produce 300-350 mil barrels URR, which is nice but chickens feet in scheme of things..

Continental Petroleum of Enid Oklahoma is the oil company developing the largest blocks of Bakken play. The President and CEO, a Mr H. Hamm, was interviewed by an Oklahoma newspaper about five or six months ago. He said that most companies developing the Bakken are losing money at the current price (then around $40/bbl) and to make money on that oil the price had to exceed $50/bbl. The fact that oil rig count in MT and ND has dropped from last year shows that even at current price of $70 per barrel the Bakken is not as attractive for oil production as when price was $100/bbl. Sorry I can't find the link.

Nate has a good point. In many of his articles, Lynch attacks the heuristics of PO advocates. He finds holes in the empirical arguments, and sits back confident that he won't get a counter-argument, since heuristics have no basis in any kind of model.

That is why I am so intent on coming up with solid models for oil depletion. A good model is Kryptonite to someone like Lynch, who knows enough math to know where the weaknesses are, but he would be clearly outmatched if he ran into a top-notch first-principles derivation for oil depletion.

I still think Lynch is a worthy Devil's Advocate as he seems to find the soft white underbelly of PO. The case of reserve growth he brings up in the OpEd is a good example.

Hi WebHubbleTelescope,

Could you please possibly explain this further? I don't see what you're getting at, though I'm sure I've missed previous discussions. (Thank you in advance for your patience.)

re: http://en.wikipedia.org/wiki/Heuristic

When you say, Lynch "attacks the heuristics of PO advocates", can you possibly give me an example?

When you say, "heuristics have no basis in any kind of model" - what model are you talking about? Do you mean models in general? Or, models WRT to some aspect of the production and consumption of oil?

re: oil depletion.

When you talk about "first principles," what do you mean?

My (admittedly naive) impression is that we've got a practical problem, namely, how to get the oil out of the ground; i.e., I guess we'd call it an engineering problem. And the engineering is brought to us by first principles, that, in a sense, no longer count (once we're in the engineering phase).

Next, my impression is that there are (must be) a finite number of ways to get the oil out, and the factors that make up these ways are well-known.

Then, there exist limitations regarding the factors that determine the amount that can be extracted. And these are well-known, as well, and there appear to be no big breakthroughs (in extraction techniques) on the horizon. (And the limitations exist WRT the characteristics of the fields and oil as well).

Then, backing up a bit (in order of things), the number of places from which one can extract oil are also finite and fairly well-known, and the combined production history (take the "giant oil fields" argument, for example) is also well-known.

Then, in the bigger picture, we have the different approaches to determining "peak of production", (please correct me: Hubbert/HL; megaprojects; and WRT KSA "Satellite O'er the desert" which goes with the "when Ghawar peaks the world has peaked" argument; I know I'm missing something - what?) and the even bigger picture of the idea that it's the "remorseless decline" on the other side of peak (as Campbell says) that's really "the issue."

So, I don't quite see the problem.

Just as a short example, there are really no accepted models that use a probability framework to understand peak oil. This would emerge as a first-principles formulation since it would consider physical quantities and stochastic processes to arrive at an outcome. Instead, the heuristics we use are mainly curve-fitting based on algebraic forms that we pull out of thin air. The way that most people use the Logistic is as a heuristic since no one has provided an acceptable derivation based on fundamental considerations. The classical derivation of the Logistic in terms of biological populations leads to a steady-state carrying capacity, and we know that oil doesn't reach a carrying capacity -- it just depletes.

So the techniques you describe are simply heuristics. Let me give a related example. Although its not quite so bad as this, but it would be like if we trusted global warming advocates who predicted temperature changes solely by tracking yearly temperature. Although predicting temperature tomprrow by using the temperature today is a fairly good heuristic, it doesn't explain anything in terms of why the trend occurs. This is compounded by the fact that the anti-AGW crowd uses this same heuristic any day that is cooler than normal to support their own argument. That would be Lynch's approach, attack the heuristics.

Bayes, Bayes, Bayes... (to be sung in the tone of the Swedish Chef)

A gentle reminder:

This isn't being written for Lynch. He's done, and couldn't care less. It is really being written for the general public. The point is to inform and convince the general public. Brush Lynch to one side and write for the general public.

Well, here's one of Mike's papers kneecapping Campbell and Co in the heuristic: CRYING WOLF : Warnings about oil supply. Amusingly enough Mike's own call for future production of C+C looks to have seriously overshot reality; here is his final graph of forecasts:

I've added bars for delineations of 10 mb/d and 2008/09, to see things better. Actual for 2008 was 73791.24 mb/d. Colin wins, despite being a bit under; next best is the World Bank, which looks to be ca. 79 mb/d. According to another diehard cornucopian, Freddy Hutter, Jean Laherrère made the best call for 2008 liquids, back around the time of Lynch's paper. For 2010 FH has also added the team denoted most accurate forecaster for 2008 by this site, Duncan & Youngquist's 1999 paper.

So that's 3 spot on calls 10 years out from peak oilers, leaving the big agencies and cornucopians thoroughly in the shade. You were saying, Mr Lynch?

uprated.

You misspelled "misinform".

"Oil remains abundant, and the price will likely come down closer to the historical level of $30 a barrel as new supplies come forward in the deep waters off West Africa and Latin America, in East Africa, and perhaps in the Bakken oil shale fields of Montana and North Dakota."

Utterly contradictory. If oil were really so abundant, then no one would be giving much attention to such exotic sources of fossil fuels. Moreover, a price of $30 is insufficient to support production in such regions. We know that such a prices is far too low to maintain, let alone expand, production from the oil sands of Alberta.

In a rebuttal to Lynch, it's worth emphasizing indisputable empirical facts: irreversible peaking of production has occurred already in some of the most important oil producing regions of the world.

IMO, it's also worth emphasizing the empirical observation that peaking occurs when about half of the oil reserves of a region are extracted. We are consuming oil at such a rapid rate (30 billion barrels / year) that if we could add an enormous 600 billion barrels to existing world reserves, representing more than two new Saudi Arabias, peaking would be postponed by a mere ten years. It's hardly a reassuring situation.

"In a rebuttal to Lynch, it's worth emphasizing indisputable empiricalfacts: irreversible peaking of production has occurred already in some of the most important oil producing regions of the world."

Just use Westexas' argument, and look at the examples of Texas and the North Sea. This is still the most compelling argument that all the money and the talent in the world cannot bring more oil out of the ground past a certain point of no return. The North Sea and Texas are still the most compelling arguments for REAL geological peak, not peak based on logistical issues. Go To Westexas string of posts over the years for ammo. :-)

RC

Joe Romm did it:

http://climateprogress.org/2009/08/26/michael-lynch-peak-oil-bet/

I imediatelly wrote a letter to the NYT on this POS op ed piece. The fact that he calls himself an "energy expert" and calls shale oil "synthetic" is laughable. Its not "synthesized". Its naturally occuring but requires additional steps in retrieving and purifying to crude.

How in God's name can this guy be an "energy consultant" when he ignores what are basic facts. I mean, let's forget "Peak Oil". How about the future price of oil being "$30"???? Its at $74 right now and we are experiencing a global recession! How about the decline in production in Mexico, UK, Russia??

MIT has lost a lot of credibility with me if that idiot works there. As a previous poster has suggested, we should next have an MIT moron discuss that the sun revolved around the earth, because "I said so."

Oy Vey!

What else would you come to expect, from a school that invented the SMOOT unit of measurement.

WIKI --- "One smoot is equal to Oliver Smoot's height at the time of the prank (five feet and seven inches ~1.70 m).[1] The bridge's length was measured to be 364.4 smoots (620.1 m) plus or minus one ear, with the "plus or minus" intended to express uncertainty of measurement.[2] Over the years the "or minus" portion has gone astray in many citations, including the commemorative plaque and markings at the site itself."

Ahem.

Michael Lynch was in the management wing of MIT (the business, economics and poli sci departments).

They're in a ghetto on the east side of campus and their antics should not be taken to reflect on the whole school.

Q: Could the 'no peak oil' argument be a smokescreen, a feint, to gain traction for abundant 'clean' coal and 'non-carbon' nuclear energy as the peak-oil and climate enthusiasts convince Congress and the public beyond a shadow of a doubt that 'peak oil' is near or has arrived?

I suggest that arguments that refute Lynch's propositions and assertions should not lead one to imagine that either 'clean' coal or 'non-carbon' nuclear are reasonable alternatives or 'solutions' to the peak-oil 'problem' or that Congress must ride to the rescue of 'bailing out' a beleaguered oil industry. My guess is that this is where this conversation is meant to lead. The oil industry makes more profits as prices rise. From the industry's perspective, they want higher prices and less government interference that leads to greater profits. The op-ed is not an intellectual exercise. It is to influence policy, either something on the table today such as climate legislation, or something that is still in Committee.

you are probably right -but all we can do here is show facts - the politics are beyond our reach. And no one in politics is going to win popularity by saying we need to use less energy and cannot be energy dependent.

I disagree. The argument is highly political. Lynch's op-ed was wholly political. The response should be factual, but, ultimately will carry the day by its political undertones and strategy. That said, my experience is that telling the truth carries further than framing arguments from the perspective of imagining what you think someone else wants to hear or what is PC at the moment. Understanding who Lynch is talking to (not us or the public) is important so that we can craft a response that is also heard by Lynch's audience.

BTW: sometimes NY Times Op-eds are designed to reach just a couple of key decision makers. These folks need to be our audience.

Actually it is a rather common political refrain, one I have been hearing since 1975 or so.

ur darn tootin they understand. Lynch has been putting out the same crap for what seems like years now. The guy is as big a hack as they come. He ignores every time he is exposed as a fraud and simply continues parroting the same nonsense. His articles read like a talking point memo. Each paragraph contains multiple logical fallacies and precious little hard evidence of any kind. And the best part is that he actually has the audacity to respond to idiotic strawman comments on his articles, usually with even more fallacious garbage if not outright lies. All the while ignoring the comments that actually disprove his garbage. Seriously, he literally will ignore a post that proves him wrong, then respond to the very next post written by some idiot. I think he does this just to rub in the fact that he's a hack.

The people who pay Lynch's paycheck do so out of a need to deceive humanity while they herd us like bison off a cliff. They are as cold blooded as can be. I look forward to the day when Lynch realizes he will not rest easy when he tries to retire on the paltry profits he has made by willfully participating in a mass extermination event.

I've actually met many people like that - and if so he is just guilty of Self-deception. Believes his own story to point of blindness. Either that or its as some have suggested - there is some greater political prize for the content/timing of this piece.

Top salespeople have the ability to allow themselves to believe anything that will further their agenda. When a guy can sell ice to Eskimos, it is not because he has determined that on a reasoned and intellectual basis Eskimos need ice-the top salesperson starts from a point where he determines what belief or set of beliefs will further his agenda and then allows himself to internalize those beliefs-you have to sell yourself the BS first before attempting to sell it to others.

Some other stories posted on the subject of boosting oil today ;¬):

http://www.dailymail.co.uk/money/article-1208774/G4S-benefits-guarding-I...

http://www.timesonline.co.uk/tol/news/uk/scotland/article6808436.ece

http://online.wsj.com/article/BT-CO-20090825-702966.html

http://www.google.com/hostednews/afp/article/ALeqM5geWULDXXrwfpI5mB-PPqB...

http://news.bbc.co.uk/1/hi/business/8219861.stm

http://www.forbes.com/feeds/afx/2009/08/25/afx6811606.html

http://news.bbc.co.uk/1/hi/england/nottinghamshire/8219753.stm

http://in.reuters.com/article/oilRpt/idINLP51028920090825

Also, look at the text book small rise in oil market caused by news created sentiment to buy.

If it was orchestrated anyone in the know could have banked on a rise for the first few hours of trading - a quid pro quo perhaps.

What makes most sense to me (just your average observer) is that Lynch was paid to play down the need for climate change/sustainable energy legislation that will give big business a hard time (in the short term). There was another article on DB about how worried big business is about climate change legislation and its deleterious effect on the ability to turn a profit.

Also, I think the thrust of most of what I have been hearing (on NPR) and reading lately (Yahoo News) is that we are coming out of the recession. Even the fourth or fifth derivative of the unemployment rate is improving, you know?

If I am convinced of something, it is that it is in way too many people's interest to inspire Americans to get back to spending and being optimistic. We have read several articles recently on DB that detail the ways in which we are still completely dependent on the consumer economy and there is absolutely no interest in changing that mode (perhaps smarter folks than I have determined steady-state economics can NEVER work).

Hell, my friends all believe they cannot retire unless their money grows as it sits in retirement accounts, and NO ONE is willing to work until they drop dead. So we are all in agreement - the economy MUST grow, so consumer spending MUST resume, so Americans MUST be optimistic about the future, so we MUST stop planning for a low-oil, climate-changed future. Unfortunately we can't do that unless we discredit Peak Oil and undermine Transition Towns.

On the other hand, the result of publishing the Lynch piece is a couple of hundred doomer comments, with nary a one supporting Lynch. Might that have been the intent? DId someone at NYT want to show that might be too late for the Cornucopian Economic Recovery?

Well hell, all we need to do is let Lynch stop deceiving himself with Cornucopian delusions. I suggest a very brief summer vacation to the very middle of this:

http://www.flickr.com/photos/97946617@N00/391103181

-------------------

Got Sand?

-----------------

Since Lynch is so confident about finding very deep crude, I am sure that he is a 100 more times confident about finding very shallow aquifer water. He most positively thinks it would be a easy & simple task for him to hand-dig through a hundred feet of sand, then another hundred feet of rock-hard caliche, to then take a thirst-quenching, very satisfying sip....

EDIT: I am sure that we could get enough TOD donations to totally soak the sand in his chosen digging area with 1,000 gallons of gasoline. He can then extract this very close-at-hand fuel any way he desires to ease his hand-digging task, but he will have to work much faster in the few hours remaining.

Toto: Are you writing for Bill Maher now? http://www.youtube.com/watch?v=VDSXUevzsF0

LOL! I wish, as I sure could use the income. IMO, if he ever has Tiger Woods or Justin Timberlake on his show, Bill out to reuse those golf jokes and facts. It would be fun to watch their reactions.

So I just want to get this perfectly clear. The graph above under point 2 includes backdated reserves growth? And ace's graph does the same?

I think these graphics are among the best, starkest illustrations that peak is coming in the near future, which is why I want to be sure I understand them. And to do so, I think it should also be clear how much reserves growth gets added through backdating per decade. (E.g., what is the difference between cumulative discoveries through, say, 1990, as of 1990, and cumulative discoveries through 1990 as of 2009?)

Fact: Oil discovery peaked in the USA in the 1930s and production peaked in the 1970s. I call it the 40 year factor that Hubbert discovered back in the 1950s.

Fact: Global oil discovery peaked in the 1960s or roughly 40 years ago.

Conclusion: World oil production peaked sometime between 2000 and 2010.

Fact: 85% of US offshore is banned from oil production.

Fact: Federal lands (ANWR etc.) are also off limits.

Conclusion: If the US doesn't have the political will to produce oil, it will be left behind by economic growth nations.

Is the CNPC in decline?

Fact: US production peaked in 1970 and NOTHING, not the North Slope, not technological improvements, not ANYTHING has changed that fact - so your point is that there are a few areas without proven reserves that are not open to drilling means what - we are fine? Oil will never run out?