Drumbeat: November 12, 2009

Posted by Leanan on November 12, 2009 - 9:49am

U.S. Adviser to Kurds Stands to Reap Oil Profits

OSLO — Peter W. Galbraith, an influential former American ambassador, is a powerful voice on Iraq who helped shape the views of policy makers like Joseph R. Biden Jr. and John Kerry. In the summer of 2005, he was also an adviser to the Kurdish regional government as Iraq wrote its Constitution — tough and sensitive talks not least because of issues like how Iraq would divide its vast oil wealth.Now Mr. Galbraith, 58, son of the renowned economist John Kenneth Galbraith, stands to earn perhaps a hundred million or more dollars as a result of his closeness to the Kurds, his relations with a Norwegian oil company and constitutional provisions he helped the Kurds extract.

IEA criticism is further blow to oil benchmark

The reign of the West Texas Intermediate as the world’s top oil benchmark “looks increasingly precarious”, the International Energy Agency said on Thursday, after Saudi Arabia dropped last month the yardstick as its reference for US sales.

Given the clear decline in new discoveries, it seems foolish to dismiss the whistleblower's claims out of hand. Especially when you consider the rising demand on flagging reserves resulting from improving economic conditions in China, India, and other developing countries. For less obvious support for the whistleblower’s case, I might also point to the invasion of Iraq, which makes absolutely no sense, other than in the context of an oil grab.Does this suggest the imminent emergence of a dystopian world, a world where Mad Max would feel entirely at home? Hardly. If for no other reason than that the U.S. has an abundance of natural gas – and so do many other countries, once they begin applying the newest gas extraction technologies – and that natural gas can be efficiently converted to liquids.

How many Mexicans does it take to drill an oil well?

More than 140,000, and even then they’re not very good at it. For this, now acute, problem, blame the politicians.

Why Poland Upped Its Reliance on Gazprom

Poland wants to diversify its energy supply, but a recent deal with Gazprom only increases its dependence on the Russian gas giant. Folly—or smart move?

Gazprom Ups 2010 Investment to $28M

Gazprom will increase its investment program next year by 5 percent to 802 billion rubles ($27.94 billion), a source close to the company said on Thursday.

Electric cars need government support: Nissan-Renault CEO

Electric cars could help China and other countries reduce their dependency on oil but the government must provide incentive to make the shift, Nissan and Renault CEO Carlos Ghosn said Thursday.Car makers need backing as they respond to the growing consensus among consumers that zero-emission vehicles are necessary to cope with the environmental crisis, Ghosn told an auto forum in Shanghai.

Oil heavyweight ponders fast changing landscape

The kingdom - home to the world's largest proven oil reserves - recently raised its production capacity to 12.5m barrels per day following a $100bn development programme.That gives Saudi Arabia spare capacity of around 4m barrels, reaffirming its unrivalled position as the world's key swing producer.

Still, the global economic crisis has forced Aramco, to slash its upstream maintenance budget from around $7bn a year to between $4bn-$5bn.

The cut was "to respond to the fact that we are sitting on significant spare capacity and our production declined by more than 1.5m barrels", Mr Falih says.

As for new capacity development, "there is nothing in the plans today," he says.

Steve Andrews: Umbrage in the Gas Patch

Last week, two remarkable events at World Oil magazine raised the decibel level about shale gas. First, WO columnist Art Berman’s latest shale piece, intended for the November issue, was yanked prior to publication. Berman immediately resigned. Berman and WO editor Perry Fischer issued on-line statements, saying the column was axed due to pressure applied by one or two natural gas companies on the president of Gulf Publishing. Fischer, the magazine’s editor for 11 years, reports that he fought the column’s cancellation, then took two days off. “When I returned I was fired,” Fischer relates. “I wasn’t told why, but neither was I surprised.”If you’re keeping score, this isn’t the first blood to be spilled over shale gas production, nor will it be the last.

Chris Martenson - "It's Really Bad" - Oil Supplies Intentionally Overstated

If this is true, and if it needs to be confirmed, it means that all models of stocks and bonds that rely on long-term cash flow models are wrong. It means that our primary assumption of petroleum fueled growth is wrong.It means that we are several decades late in responding. It means that we do not have time to slowly modify our fleet to carbon-fiber electric cars or any other fantasy technology.

It means that we've squandered (and continue to squander) our most valuable resource of them all - time.

MMS: More Than 30% of Gulf Oil Production Still Shut-In

Offshore oil and gas operators in the Gulf of Mexico are reboarding platforms and rigs and restoring production following Tropical Storm Ida. The Minerals Management Service's Continuity of Operations Plan team is monitoring the operators’ activities. This team will be activated until operations return to normal.Based on data from offshore operator reports submitted as of 11:30 a.m. CST today, personnel have been evacuated from a total of 17 production platforms, equivalent to 2.45% of the 694 manned platforms in the Gulf of Mexico. Production platforms are the structures located offshore from which oil and natural gas are produced. These structures remain in the same location throughout a project’s duration unlike drilling rigs which typically move from location to location.

Petrobras Workers Approve Possible Strike in Vote Ending Today

(Bloomberg) -- Petroleo Brasileiro SA workers voted in favor of a possible strike, a union spokeswoman said.Workers in a unanimous vote approved giving the national oil-workers’ federation the power to call a strike should talks with the state-controlled oil producer fail, said the spokeswoman, who declined to be identified because of the group’s policy.

Cuba orders extreme measures to cut energy use

HAVANA (Reuters) - Cuba has ordered all state enterprises to adopt "extreme measures" to cut energy usage through the end of the year in hopes of avoiding the dreaded blackouts that plagued the country following the 1991 collapse of its then-top ally, the Soviet Union.In documents seen by Reuters, government officials have been warned that the island is facing a "critical" energy shortage that requires the closing of non-essential factories and workshops and the shutting down of air conditioners and refrigerators not needed to preserve food and medicine.

Cuba has cut government spending and slashed imports after being hit hard by the global financial crisis and the cost of recovering from three hurricanes that struck last year.

Malawi continues to experience a paralyzing fuel shortage that authorities blame on technical problems at the Mozambique's Beira Port.

The Philippines: Palace to scrap oil price freeze order

MANILA - Giving into the clamor of the business community, Malacañang announced on Thursday it would lift the cap on oil prices in Luzon.Justice Secretary Agnes Devanadera confirmed to ABS-CBN News that Malacañang is set to scrap the controversial Executive Order 839, which mandated oil companies to bring down fuel prices to the October 15 level in the aftermath of the recent typhoons.

But she denied that Malacañang was pressured by threats of an oil supply shortage.

Al Gore's Inconvenient Truth sequel stresses spiritual argument on climate

Al's Gore's much-anticipated sequel to An Inconvenent Truth is published today, with an admission that facts alone will not persuade Americans to act on global warming and that appealing to their spiritual side is the way forward.In his latest book, Our Choice: A Plan to Solve the Climate Crisis, the man who won a Nobel prize in 2007 for his touring slideshow on disappearing polar ice and other consequences of climate change, concludes: "Simply laying out the facts won't work."

Food: Is Monsanto the answer or the problem?

ST. LOUIS (Reuters) - Norman Borlaug, the father of the Green Revolution of the 1960s and 1970s, had only months to live when he received a visit from an old friend, Rob Fraley, chief of technology for Monsanto Co.Borlaug, who won the Nobel Peace Prize in 1970 for his work increasing food production in starving areas of the globe, welcomed Fraley to his Dallas home, where the two men sipped coffee and tea and discussed a subject dear to their hearts: the future of agriculture and the latest challenges of feeding the human race.

Is the world awash in oil? - Not if you ask the folks who pump it

To read the most recent WEO, released this week, you would think the planet is swimming in oil CL-FT. So fear not - the "peak oil" mob is wrong. The peakists argue that the world will soon reach maximum-possible oil production, and may have already, after which humanity will begin a slow but sure descent into bedlam and bankruptcy. That's because oil consumption and GDP growth are directly linked. Cut the first and the second can only follow.The WEO authors don't buy into the peakist theory, never have and probably never will. The WEO expects oil production to reach about 105 million barrels a day by 2030, up from last year's 85 million. The production estimate is essentially unchanged from last year. So forget the pokey little hybrid - buy that V8-powered truck you've been dreaming about.

But the WEO team, led by chief economist Fatih Birol, is increasingly finding itself on the defensive. A small but growing number of scientists and oil executives think the WEO is out of touch with reality, that it is a creating false - and highly dangerous - sense of confidence.

Shale gas transforms energy picture

It may be hard to remember now, but it is less than five years since the Hirsch Report, prepared for the U.S. Department of Energy, warned that previous optimism about gas supplies "turns out to have been misplaced" and "supply difficulties are almost certain for at least the remainder of the decade.""Gas production in the United States now appears to be in permanent decline," according to senior analysts cited in the report. Hirsch urged policymakers to learn lessons from "peak gas" and be ready to deal with the disruption caused by "peak oil."

Instead, dry gas production has soared from 18.5 trillion cubic feet (tcf) in 2005 to 20.4 tcf in 2008, and is on course to hit 21 tcf in 2009 (the highest since 1973-74).

Oil Demand Returns to Growth In Q4 - IEA

LONDON (Reuters) - The world will use more fuel in the fourth quarter of 2009, marking the first time global oil demand has risen since the second quarter of 2008, the International Energy Agency said on Thursday.After a year-on-year contraction in demand for the first three quarters, its monthly report found fuel consumption was edging higher in the final three months of the year.

Higher oil seen threatening recovery

Rising oil prices could imperil a modest increase in crude demand and the recovery of the global economy, the International Energy Agency said Thursday as it raised its outlook for oil demand this year.“The recent price spike, if further extended, risks derailing the recovery,” the IEA said. “Not only that, but oil demand itself would rebound much more slowly were the price rally sustained into 2010.”

Medvedev Demands End to ‘Humiliating’ Oil Dependence

(Bloomberg) -- President Dmitry Medvedev renewed his demand for economic modernization and an end to Russia’s “humiliating” dependence on commodities even as rising oil prices eased the steepest contraction on record.“We shouldn’t look for the guilty only outside the country,” Medvedev said in his annual state-of-the-union address in the Kremlin today. “We haven’t freed ourselves from the primitive structure of the economy. It’s a question of our country’s survival in the modern world.”

Russia’s Economic Decline Eases on Commodities Demand

(Bloomberg) -- Russia’s economic decline eased last quarter from a record slump in the previous three months as oil, gas and metals prices rebounded and stimulus measures helped offset the impact of the global recession.Output of the world’s biggest energy exporter shrank 8.9 percent in the third quarter from a year earlier, after contracting a record 10.9 percent in the previous period, the State Statistics Service said in a preliminary estimate on its Web site today. From the second quarter, output grew a non- seasonally adjusted 13.9 percent. The office didn’t give a breakdown of the figures.

'Norway players tighten purse strings'

Investment by Norway's oil and gas industry should fall to about Nkr118 billion ($21.11 billion) next year, down from this year's record spend of Nkr129 billion, the country's Oil Industry Association, the OLF, said today.In September, Statistics Norway (SSB) estimated that investments on the Norwegian Continental Shelf would rise to Nkr145.4 billion next year, slightly up from its 2009 estimate of Nkr143.5 billion , and up from last year's Nkr123.9 billion spend.

Mexico's Pemex to invest $12.1 bln in new pipelines, upkeep

MONTERREY, Mexico (Reuters) - Mexico's state run oil company said it will invest $12.1 billion in new pipeline projects and maintenance of its existing facilities over the next 10 years in a bid to boost flagging output.Over the next 5 years, Pemex will spend $5.5 billion to build new pipelines, pumps and storage facilities, Juan Jose Suarez, Pemex's chief executive, told a business forum in northern Mexico.

Kazakhstan boosts output by 7.8%

Kazakhstan, Central Asia's largest oil producer, raised oil and gas condensate output by 7.8% year-on-year in the January to October period to 63 million tonnes, its State Statistics Agency said today.

Repsol Profit Drops on Lower Prices, Refining Margins

(Bloomberg) -- Repsol YPF SA, Spain’s largest oil producer, said third-quarter profit fell 61 percent as oil and natural-gas prices declined and refining margins narrowed.

Fears raised about Brazil infrastructure

Analysts said the blackout shows Brazil's lack of investment in the power system at a time when Latin America's largest economy is booming and the country is preparing to host the 2014 World Cup and 2016 Olympics.The Brazilian Olympic Committee would not comment on the power failure. But among guarantees made to the International Olympic Committee is that Rio, as the host city in 2016, will be isolated from the nation's power system - to avoid future problems. The city will have its own direct energy feed during the Games.

Brazil Agency Says Power Grid Vulnerable to Outages

(Bloomberg) -- Brazil’s integrated electricity grid leaves it vulnerable to the types of outages that occurred this week, when 40 percent of the country was plunged into darkness, according to a government energy research agency.“Brazil has the largest integrated power grid in the world; it’s fantastic because it facilitates electricity transmission between regions, but the domino effect that happens when we have a problem is a major inconvenience,” said Mauricio Tolmasquim, president of Brazil’s Energy Research Agency.

D.O.E. Hires V.C. to Run Loan Programs

The Department of Energy tapped a venture capitalist to run its ts loan guarantee and green auto loan programs.The D.O.E. said Wednesday that it had named Jonathan Silver, a former managing general partner at Washington D.C.-based Core Capital Partners, to head the loan programs, which Earth2Tech notes have doled out millions in loans and guarantees to venture-backed companies like Tesla Motors and Fisker Automotive.

On the road to electric vehicles, bumps remain

Nashville is one of a handful of cities in the U.S. targeted to become an early focal point for electric vehicles, as Nissan plans to start production of a battery-powered car in Smyrna by 2012 and a program is launched to build a network of recharging stations.But getting to the point where electric vehicles are common will take time and work, said Joe Hoagland, TVA's vice president for environmental policy, science and technology.

"If everyone of us had a car or two in the garage that was charging every night, could that be handled?" Hoagland asked. "I'm not sure."

Switching to electric cars could actually speed climate change

The idea that a wholesale switch to electric cars would automatically reduce CO2 emissions and dependence on oil is one of a number of myths dispelled by a major new report conducted on behalf of the Environmental Transport Association (ETA).The report found that whilst there were significant potential environmental benefits to be had from a switch to electric vehicles, these were wholly dependent on changes in the way electricity was generated, energy taxed and CO2 emissions regulated.

Plants Burning Garbage May Plug U.K. Power Supply Gap

(Bloomberg) -- U.K. trash collectors, fighting rising landfill taxes, plan to burn enough rubbish to fuel power stations with the capacity of two nuclear reactors.The U.K. may be able to incinerate about 15 million metric tons of waste a year, producing between 2,000 and 3,500 megawatts of power and heat, according to Pennon Group Plc’s Viridor unit and Montagu Private Equity LLP’s Biffa Ltd., which are building energy-from-waste generators. The plants would be able to satisfy about 5 percent of peak electricity demand, or 4.5 million homes.

"Clean coal will work:" IEA boss

One of the world's top energy experts says that despite climate change, there is a strong future for the backbone of the Australian economy - coal.Nobuo Tanaka, the executive director of the International Energy Agency (IEA), gave an upbeat assessment of the prospects for new technologies to make coal more climate-friendly.

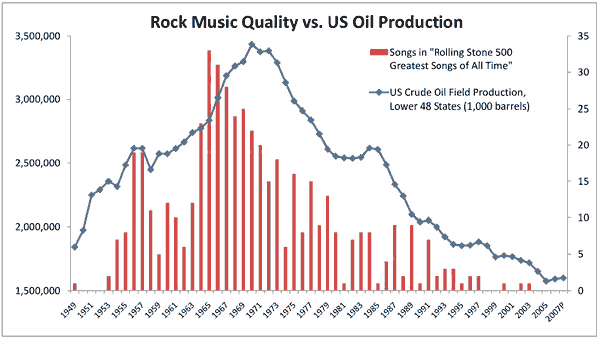

The Hubbert Peak Theory of Rock, or, Why We’re All Out of Good Songs

The decline in U.S. oil production* is explained by the Hubbert Peak Theory, which states that “the amount of oil under the ground in any region is finite, therefore the rate of discovery which initially increases quickly must reach a maximum and decline.” Makes sense, right? The same theory can apply to anything of a finite quantity that is discovered and quickly exploited with maximum effort.Including, it would seem, rock & roll. I know, the RS 500 list is not without its faults, but it does allow for some attempt at quantifying a highly subjective and controversial topic and for plotting the number of “greatest songs” over time. Notice that after the birth of rock & roll in the 1950’s, the production of “great songs” peaked in the 60’s, remained strong in the 70’s, but drastically fell in the subsequent decades. It would seem that, like oil, the supply of great musical ideas is finite. By the end of the 70’s, The Beatles, Led Zeppelin, Black Sabbath, the Motown greats, and other genre innovators quickly extracted the best their respective genres** had to offer, leaving little supply for future musicians.

Chris Saliba reviews Crude World: The Violent Twilight of Oil, by Peter Maass

The main thesis of the book is that oil creates volatility and havoc at all levels. For poor African nations like Nigeria and Equatorial Guinea, plundering US oil concerns are happy to work with dictators and strongmen. The money that should go to the impoverished people of these countries is funnelled back to corrupt leaders who lead the sort of lavish lifestyles that would make Marie Antoinette blush.Other countries, like Ecuador, find their environment despoiled by marauding oil companies. The unhappy histories of the Middle East are well known. War in Iraq and Kuwait, US meddling in Iran. Saudi Arabia is an unusual case all of its own. Its massive oil endowment has created a lopsided economy, completely captive to the vicissitudes of the global oil market. (90 per cent of the country's exports are oil, bringing in 75 per cent of the country’s revenues.)

We need to go cold turkey to kick our addiction to oil

Forget "green growth". Judging by the hard numbers, only two economic factors produce reliably good environmental outcomes: high energy prices and recession. During the era of soaring oil prices, which peaked at just over $140 a barrel in June 2008, people began to do all the things greens have been badgering them about for years: driving less and cutting back on flights, for example.

Stephen Schork: More Upside in Oil

Crigger: There's a lot of discussion lately on this idea of peak oil, and how that affects supply and demand for oil. What are your thoughts?Schork: I don't believe in it at all.

Another classic CNBC quote: “Dollar back to normal pre-crisis levels”

Do these pump monkeys have short memories? Why was oil at $147 in 2008?? It is simply because the dollar broke below 72 and looked like it had no support and people PILED into every ANTI-dollar trade. Sorry peak oil folks, this is what I strongly believe. Why is oil over $80 now even though we have ran out of places to store it in the U.S. and demand is next to nothing? Because the dollar is at 75 and people are piling into the SAME ANTI-DOLLAR trades.

The Global Oil Scam: 50 Times Bigger than Madoff

$2.5 Trillion - That’s the size of the global oil scam.It’s a number so large that, to put it in perspective, we will now begin measuring the damage done to the global economy in "Madoff Units" ($50Bn rip-offs). That’s right - $2.5Tn is 50 TIMES the amount of money that Bernie Madoff scammed from investors in his lifetime, yet it is also LESS than the MONTHLY EXCESS price the global population is being manipulated into paying for a barrel of oil.

Crude Oil Is ‘Coiled’ to Spring to $85: Technical Analysis

(Bloomberg) -- Crude oil is “coiled” to spring to $85 a barrel before the end of the year, according to a technical analysis by Auerbach Grayson, a brokerage in New York.The range that crude oil has traded in has narrowed since futures broke though resistance at $76.50 a barrel on Oct. 15 and reached a one-year high of $82 on Oct. 21, according to Richard Ross, an analyst at Auerbach Grayson. This pattern is setting up the market to rise, he said.

“A coil has formed since Oct. 15 as the range has got narrower and narrower,” Ross said in a telephone interview. “We’re seeing the lows get higher and the highs get lower.”

OPEC Supply May Rise From Nine-Month High, IEA Says

(Bloomberg) -- OPEC crude oil production rose in October to the highest level since January and the group may increase it further at a meeting next month in Angola if oil prices keep rising, the International Energy Agency said.Production from 11 members excluding Iraq rose by 150,000 barrels a day from September, to 26.48 million barrels a day, as Gulf members allowed more oil to flow to Asia. Compliance with output cutbacks agreed late last year by the Organization of Petroleum Exporting Countries slipped to 61 percent in October, from 64 percent in September, the Paris-based IEA estimated in its monthly report today.

BLM now collecting higher drilling application fee

CHEYENNE, Wyo. (AP) -- A huge increase in the application fee for oil and gas companies to drill on federal land is unfair and won't speed up review of drilling permits, industry officials said Wednesday.The $6,500-per-well fee was part of the Interior Department appropriations bill passed by Congress and signed into law by President Obama on Oct. 30. The new fee amounts to a 62 percent increase over the previous $4,000 fee.

The threat of nuclear meltdown: The government says nuclear power is safe, but others say an airplane hit or frontal assault would be big trouble

"The protection level at nuclear power reactors is not anywhere near that required," said Frank von Hippel, a nuclear physicist, Princeton professor, and former assistant director for national security in the White House Office of Science and Technology. "The utilities are unwilling to spend the money and the Nuclear Regulatory Commission, which is basically under the thumb of the utilities, is not willing to make them."

Bad weather blamed in blackout for 60M in Brazil

RIO DE JANEIRO – Heavy rain and strong wind caused blackouts that left nearly a third of Brazilians — 60 million people — in the dark, officials said Wednesday as they scrambled to restore confidence in the country's infrastructure before soccer's 2014 World Cup and the 2016 Olympics.The weather made transformers on a vital high-voltage transmission line short-circuit, Brazil's energy minister said. Two other transmission lines also went down as part of an automatic safety mechanism.

PSE&G cleared for additional NJ solar projects

NEWARK, N.J. – New Jersey's largest utility has received permission from state regulators to finance another 51 megawatts of solar power — enough energy for more than 45,000 homes.The Garden State is second only to California, with 100 megawatts of installed solar generating capacity.

Study seeks steady supply for Mich. ethanol plant

KINROSS TOWNSHIP, Mich. – Researchers from Michigan State and Michigan Technological universities are seeking to ensure a steady and sustainable supply of material for the state's first wood-based ethanol plant.

Wis. agency: Utility project jeopardizes lizard

MADISON, Wis. – Wisconsin environmental experts say the rebuilding of an electrical transmission line in Waushara County could cause some lizards on the state's endangered species list to be killed.The Department of Natural Resources says a permit it would issue to American Transmission Co. for the work would allow the "incidental taking" of the slender glass lizard. But the agency says any losses would not put its overall population at risk.

Peru slum goes cutting edge as 'fog catcher'

LIMA (AFP) – Many of Peru's grittiest slums can only dream of access to water. But thanks to a German NGO, simple technology and hard work, some humble homes are the first to use plastic netting to harvest water from the fog cloaking the night sky.

Climate sceptics are wrong - episode 4,356

So, oil is back above $80 again and officially the International Energy Agency (IEA) is warning that deep cuts in emissions are needed not just to tackle climate change but to avoid a doubling of energy bills by 2030, while unofficially a whistleblower at the agency thinks we are already in the "peak oil zone" and only behind the scenes lobbying stops government's admitting as much.There are many reasons why climate change scepticism and a refusal to accept the need for urgent reductions in greenhouse gas emissions is a sure fire indicator of a mind deep in the throes of intellectual atrophy - the inability to discern between one off data points and long term trends, the support for theories that have been comprehensively debunked, the unedifying victim mentality - but now we can add peak oil to the list.

China seeks 'fair' climate deal

SINGAPORE (AFP) – China said Thursday it would seek a "fair and reasonable" result at world climate talks next month but insisted rich nations must bear most of the burden for tackling global warming.

Bangla PM says failure not acceptable in Copenhagen

"We cannot accept the failure of the Copenhagen summit," Hasina told the conference."The most vulnerable countries and the least developed countries are worried that their legitimate demands are being sidelined by the disagreements in climate change negotiations between the developed and developing countries."

She urged rich nations to help climate-hit, poor nations such as Bangladesh in the same way they bailed out economies damaged by the global recession.

Climate Summit May Bring ‘Political Declaration,’ Further Talks

(Bloomberg) -- The United Nations climate summit next month may bring a “strong political declaration” followed by another round of technical negotiations to forge a new global treaty, Poland said.The UN will host almost 200 countries in Copenhagen on Dec. 7 to Dec. 18, seeking an accord on greenhouse-gas emission reductions that would succeed the Kyoto Protocol after it expires at the end of 2012. Two years of talks have stalled as developing countries call on richer nations to cut output first.

Major Asian cities face climate disaster: WWF

SINGAPORE (AFP) – Low-lying and impoverished Asian coastal cities such as Dhaka, Manila and Jakarta are vulnerable to "brutal" damage from climate change without global action, environmental group WWF warned Thursday.Energy consumption and greenhouse gas emissions must be curtailed in "mega-cities" where global warming will affect everything from national security to health and water availability, the influential campaign group said.

To understand peak rock songs:

http://xkcd.com/552/

It's got nothing at all to do with peak oil. It has everything in the world to do with that substance mentioned in the song Dr. Robert (by the Beatles during the mid 60's).

Video was the main driver behind the decline in quality of popular music.

Yes, video did indeed kill the radio star.

http://www.youtube.com/watch?v=XWtHEmVjVw8

I think there may be a connection, but it's not the one they think. Rock is baby boomer music. And it may not be a coincidence that the largest, wealthiest generation in the US has lived roughly parallel with the age of oil.

However, I think that graph is probably not good for the peak oil cause. People are going to look at it and think, "Well, we'll never be short of music. All it takes is human creativity." And they'll assume that applies to oil as well.

I would bet that the music data has a better correlation with the age demographic of Rolling Stone's readership than with oil production - offset by about 15 years.

indeed, there was an item on here a few months ago claiming(literally) that: "oil is found in the minds of men"

I suppose the Glenn Miller 500 would show a similar peak, just offset by a couple decades, but I do think an actual correlation is possible, as the Rolling Stone 500 is (to me) an expression of the Baby Boom, which in turn is an expression of the birthrate made possible by last century's brilliant energy supply.

I think Roger Conner had a good post on it, but I've been thinking a lot lately about how the peak of the Rock and Hippie years corresponded with a world that had this apex of power at its fingertips, so that even the tablescraps, landing amongst the outcasts enabled all sorts of volume from the expressions of challenge and disenchantment with the very system that fed it. Opposite, if not always equal reactions.

'What have the Romans Ever done for us?!!'

That piece was published last year - seem to recall bookmarking it even earlier.

Here's another good 'un: Bush Approval Vs Gas Price Index. These socionomic indicators are fascinating. I always wondered if these unrelated markers couldn't give insight into the macro story, as evidenced by things like GPI. Who's to say this isn't causation? Disco imbues drillers with despair, they can't concentrate on their work as a result, all these distractions like the Streak and SNL sketches; production suffers as a result.

What about the tenor of music as well? Stoneleigh says Bob Prechter has quantified this to an extant - that social mood can be a leading indicator of market sentiment. I asked her about this, having read here that Bob writes about things such as Michael Jordan's career or Trump's publishing schedule like they're the auspices of the S&P 500, thus suggesting he's dispatching from the land of crackpots; she gave me a rather more nuanced answer, having a fair deal of respect for his work.

I've also been uneasy about the length of time we've been leaning on 'classic rock', where it no longer fills the role it did when it came out. There has been new music, but I'm not sure we've been grabbed by a new idea. (Yet. .. and may the world of HipHop be kind in their rebuttals. 'Grunge' was still rock.)

Maybe Rock and Roll will never die, but I think it probably needs to, this unnatural sustain, like the ending of the Beatles 'A day in the life' strikes me as just as telling as those 50/50 votes during the Bush years. It's all fingernails, clinging desperately to the walls of the slippery pit.

I know it seems strange to older folk, but young adults feel just as attached to and nostalgic about rap as boomers do about rock.

I'm sure that's true.. maybe it's just a numbers game, and that the Boomer's demographic will assure that many radio stations are going to keep playing their (our) tunes for as long as the great milking remains possible.

I wince to remember a series of Electronics ads a few years back that used the Beatles' 'GETTING BETTER' to nail home the obvious advantages of your big new Phillips flat screen TV, without apparently compromising on your quirky and revolutionary spirit.

Obey your thirst.

We need to take classic rock, and drown it.

Enough!

I just drove through the central valley of California, and besides the bible banger, Mexican polka music, rap and hip hp, wingnut talk radio, classic rock was a major part of the mix.

Finally just turned the radio off, although I was able to access kpfa out of Fresno for a while.

Good luck with that.

Already, with the NPR dressy 'Motown Gala Evenings', it's not too hard to see that the Beatles and Eagles will be handed to either the Concert Halls or the Musicology Anthropologists, and will probably be more revered than ever..

I don't know what they'll do with the Permed Hair Bands.

'Oz never did give nuthin to the Tin Man, that he didn't -didn't already have' -America

'So often times it happens, that we live our lives in chains, and never even know we have the key..' -Eagles

- Life is high school.

Classic Rock will never die http://www.youtube.com/watch?v=8U25nYpiXYc

http://www.youtube.com/watch?v=tY5x8pF512k

I'm here to tell you that 200 years from now, almost all of that "classic rock" will only ever be heard as background for historical documentaries of the mid-late 20th century - if there is any media still existing that allows these to be made. People will, however, still be performing and listening to Beethoven, Bach, Chopin, etc.

The difference is that the artistry in the latter was in the composing, while the artistry in the former was mostly in the performing. Compositions last, performances don't.

Or, as a bumper sticker commented recently:

I find myself attending live performed music, by interesting singer song writers who would never be promoted with the pabulum based popular culture, and find these venues as alive as ever.

Radio and other broadcast media are a wasteland of mediocracy, with a few exceptions.

Fwiw,I agree with the bumper sticker.

Actually I think about 98 or 99 percent of all music sucks-I don't listen much to anything anymore but since we have electronic access we need to listen to only the very best-it costs no more o hear great music from any genre than trash that will be entirely forgotten in a few weeks.

I haven't been able to bring myself to listen to any rap yet-but I suppose there must already be a few really good rap compositions that people will want to hear in fifty years.

We get to thinking that the blues or some other era's music was all great-that's because we have the great stuff in our libraries actually being played -the junk has been forgotten, if it was even recorded.

Somewhere sometime I read an essay by a serious student of music who contends that there really are only so many really great combinations possible of all the various elements of music in a given environment-meaning the instruments and possible subject matter mostly (free expression is the exception rather than the historical norm).

His contention is that once these relatively few pieces are composed early in the game, it's overas far as more truly great pieces are concerned.Thus we should never expect anyone to match Beethoven because Beethoven has already explored the possibilities and siezed the best of them.

I don't really have any idea if this is plausible, but otoh the record according to many music fans seems to support it.

Personally all I am sure of is that I like a little of everything, but only a little.

If I live another twenty years I may hear a rap song that I like-mostly only the good stuff will survive that long and I 'll take a chance instead of hitting the channel button.

Almost any live music played in a satisfactory setting by musicians having a good time is good music and well worth listening to.

I listen to music all day; either my favorites with Windows Media Player or other favorites I don't have on Songza.fm. Songza is a fantastic web site. Searching by date will find great stuff from the '20s and up. At the moment I'm listening to Bessy Smith's "After You've Gone." It helps to know the names of the greats of the day.

I was born into the swing era of the early forties. Maybe that's why I love the old stuff. And Songza has it. I only listen to the best stuff and nothing new except for Beyonce. Life is too short to waste on trash music and it grinds on my ears.

http://songza.fm/

Thanks X for songza. It's life enhancing data like that that makes TOD so great.

One Man with one acoustic guitar.

Remember this?

http://www.youtube.com/watch?v=JeHgNqbdBKs

Magnus, xkcd provides a link for embedding their comics in a comment...

Image URL (for hotlinking/embedding): http://imgs.xkcd.com/comics/correlation.png

Absolutely love it! Thanks man, that's a keeper.

Link up top: Stephen Schork: More Upside in Oil

Who is Stephen Schork? Stephen Schork is the editor and visionary behind The Schork Report (http://www.SchorkReport.com), the leading market intelligence resource for technical and fundamental analysis of the energy markets.

And you can receive The Schork Report for only $1,500 per year. He is a true visionary in the energy market. He knows that, in exploring for oil, we have scratched only 1/15 billionth of the earth surface. That is one fifteenth of one billionth!

I have just have that newsletter, it will be the best $1,500 I ever spent.

Ron P.

Ron - I had exactly the same thoughts. What he appears to have done is calculate the surface area of the Earth directly above known oil fields (1/15th of a billionth) and then concluded that that is the total amount of surface are that has been explored. This guy is a salesman, pumping his newsletter to idiots who are prepared to pay silly money to someone who is prepared to tell them what they want to hear.

"the leading market intelligence resource for technical and fundamental analysis of the energy markets". Well given that statement he is obviously a 'jack of all trades'.

It never ceases to amaze me how much fluff there is out there getting in the way of proper fact-based research.

Taken from his website:

There was I thinking he was a geologist. He appears never to have gone within a country mile of an oil field. But he has got over 17 years experience in "physical commodity and derivatives trading, risk systems modeling and structured commodity finance".

"Mr. Schork initiated a successful cross-commodity trading book that realized annual gross profit goals by the end of the second month of execution"... in other words, he got lucky. This is meaningless crap. How did it do for the other ten months? I assume the model has been running for more than two months so why not tell us how well it has done in total? Tell me you have got it right consistently over ten years and I may take your 'mathematical models' seriously.

What a joke! Think we can safely ignore what he has to say on the subject.

There needs to be some sort of law: "Given a sufficient number of people making bets, at any given moment there are going to be a few who have just happened to hit a lucky streak and have been on a roll. At a later given moment, these will be replaced by a different set of people, and so on."

Maybe we should call it "The Dumb Luck Law".

Speaking of bets and the ones made by the British govt in regards to cutting emissions and going renewable:

There is a front page piece on todays Gaurdian under the auspices of the Institute of Mechanical Engineers ( the m e professional society of the country's engineers I presume ) which says it is physically impossible to meet the goals.

They won't even achieve a fifth of the needed cuts.

We all knew this of course but maybe it throws a little light on why our leglisators are less likely to vote such goals;they probably fear American voters haver longer memories in this respect.

There's an old gambler's law: You have to let the suckers win once in a while, or they won't keep playing the game.

Stephen Schork: More Upside in Oil 2 comments

November 12, 2009

Crigger: There's a lot of discussion lately on this idea of peak oil. What are your thoughts?

Schork: I don't believe in it at all. Well, I believe there's political peak oil. I believe there may not be the will to extract. But as far as actually extracting the oil from the ground - look, if you incorporate the entire mass of the Earth, we've scratched 1/15 billionth of its surface.

What an idiot! As if the entire mass of the earth contains a uniform density of oil everywhere. He even tool the 80% mass of the water into account!

Sadly enough HC that's exactly how the USGS estimated remaining US reserves about 35 yo. They calculated how much of the US had been drilled vs. not drilled and used that ratio to establish the future guess. And this is the number they supplied Congress at that time so those folks could plan our future.

It's like saying that there's a bunch of gold nuggets buried in my backyard, but I don't really have the will to shovel them out.

If you take the earths diameter at 12472 km (Wikipedia), this is a surface area of 510064471 sq km. 1/15 of 1 billionth of this is 34000 sq m. Although I am from Alberta, I know nothing about oil wells. Wikipedia says a well drills a hole 5 to 36 inches in diam. So I picked a middle value of 20" (or 50 cm). These wells would then have a surface area of about 0.2 sq m. So, in that 1/15 of 1 billionth of the earth's surface we could have drilled about 167000 wells.

for what it's worth. Probably as much as Schork's opinion.

Don

well done. Good maths!

I have absolutely no idea how he comes up with the statement that we have only explored 1/15th of one billionth of the surface of the Earth, but suffice it to say that it is daft. He is saying that only 34,000 square meters of the surface of the earth have ever heard the ping of a seismograph? Whatever, he is a loony tune.

For a suitably restrictive definition of "explored". I think his definition might only include rock within 12 inches or so of a drill hole. Anything further away form that and we are just guessing. If we've seen it with seismic, but not actually sampled it, there is a finite probably we missed some. Of course if the odds of your random (throw a dart at a map) wildcat drill are likely to be financially dissapointing, thats your tough luck.

Linked on Drudge, a town with almost a 50% unemployment rate:

http://cbs2chicago.com/local/pembroke.illinois.poorest.2.1307100.html

Poorest Town In Illinois Suffers In Recession

Pembroke is the poorest town in Illinois, with an unemployment rate of 46 percent.

Amazing. I'm trying to play "City of New Orleans" on my guitar. One of the verses mentions Kankakee.

Great song. Good luck! I play it in D. My friend even requested I play it at his wedding and I got through it pretty well that night, but I have to say, it's a toughie. I think I've only played it perfectly twice in all my years. Do you sing the lyrics too? Contact me (profile) if you want some pointers.

Lots of economic news today. Wal-Mart's results were mixed. Better profits than expected, but a drop in the all-important same-store sales, and disappointing guidance. Jobless claims came in the lowest since January. There's horrible news on state budgets - but we're assured that state budgets always lag the turnaround by a couple of years.

Perhaps most interesting is this story from yesterday:

China's record debt has economists worried

The strong Chinese economy might be an illusion.

humbly

what is guidance?

What the company reasonably thinks it will achieve in the short-term future

"Guidance" is when they talk about what they're predicting for the future. Wal-Mart is not expecting good sales for the holiday season. People were expecting a more upbeat forecast than they got.

thanks to both

Someone made that comment recently and it's very appropriate.

I can't believe that anybody still believes in Obama's "green

shitsshoots" anymore. Except for Goldman Sachs employees whose average salary of $149,000 per year over the last 8 years will balloon to almost $800,000 average this year, all on the backs of "profits" that came directly from about $52 billion in US taxpayer bailout money. After all, Goldman's CEO has declared that he's doing "God's work" as he privatizes the profits and socializes the losses.Oh yeah, Leanan... how exactly is China's debt supposed to be bad but our massive, much larger debt is supposed to be good? The talking heads at CNN don't want to cover that, do they?

Actually, the argument I'm hearing is not that our debt is good, but that China has just as much debt as we have. So it's not that we're good and they're bad...it's "They're just as bad as we are!"

But their debt is borrowed from within the country (I don't know that for a fact, but it must be the case). So it represents some Chinese owing other Chinese money. A purely internal matter. Debt by itself is not bad. Debt that is supported by shaky assets poses risks, but debt that is connected to real producing assets is just another form of ownership.

The great financial crisis was caused by too much savings chasing not enough good borrowers. So they found pretended bad borrowers were good ones and loaned to them as well. The other problem was the regional disparities in saving and borrowing, asia was saving, and muricans (Iris, Spanish, UKers...) were doing the borrowing.

China's debt is secured by $2 trillion in foreign exchange reserves, including $800 billion (and shrinking for the last few months) of US dollar reserves. China's debt is only a problem if their FOREX reserves are junk. Is the Euro junk? Is the yen? Is the dollar? Oops... yeah maybe China is in trouble after all.

Of course this compares to the US whose debt is secured by... um... more debt! Yeah! That's the ticket! We'll borrow our way out of debt, just like the prez says!

Con artists, all of them.

I don't think it matters. If you borrow more than your economy lets you pay back, it's not sustainable, and a crash is coming.

Well, let's give credit where credit is due. Obama had nothing to do with the recent use of the phrase "green shoots". In fact I don't think he has ever used the phrase. The phrase actually goes back almost 20 years. It was first use to announce sprouts of economic recovery back in 1991 according to Wikipedia. But the first one to use it concerning this recession was Bernanke, a Bush appointee. Bernanke sees 'green shoots' of US recovery

I just hate to see people blame everything on Obama, the man who inherited two wars and the worst financial crisis in history from his Republican predecessor.

Ron P.

Obama inherited it and had the opportunity to break with the past, Ron. Instead he chose to continue the policies of George Bush with regards to lying about insolvent banks, spending taxpayer money that was not legislatively allocated, and covering up for the very people (bankers) who created the economic disaster in the first place. As soon as he decided to do the same things as Bush, he owned it. If he had decided to be honest, point out that unemployment is really closer to 22%, and that we were going to both have to cut spending and raise taxes, I'd have some respect for him. Instead he's the $1 billion whore owned by Wall Street.

Cut spending and raise taxes? Oh yeah! That is what Obama should have done -- home prices would already be down 90%, we wouldn't even have to wait a year or two. It was too late when he walked, hell, it might have been too late a long time ago.

Damn that Bush: Sending 30,000 more troops to the plains of Afganistan for not much of a good reason.

"When you're wounded and left on Afghanistan's plains,

And the women come out to cut up what remains,

Jest roll to your rifle and blow out your brains

An' go to your Gawd like a soldier."

Kipling (about 130 years ago)

The Young British Soldier

Barrack Room Ballards and Other Verses.

Rudyard Kipling. 1892

Cut spending and raise taxes? Oh yeah!

If the whole military adventure had been a 'pay as you go' effort I doubt it would have had the support.

The tax law and tax system is a stick to beat you with, not raise funds to cover spending.

Ditto and up +10

That basically sounds like the Hoover solution in 29:32. He's following (mostly) the advice of his economists. IMO a year back we were on course for a repeat of the great depression. These actions have managed to change that to a mere great recession. Of course bailing out the financial players has definte moral risk, but the alternative was considered to be catastrophic. With all of the deficit mania, I expect to see a repeat of the recession of 1937, for all the same reasons (political pressure over deficits cause stimulus to be removed too early). Despite 70 plus years of experience we seem to have learned nothing, and will likely repeat that experience.

This economic crisis is not over yet by a long shot. Unemployment continues to rise. Bankruptcies continue to rise. Loans continue to go sour at increasing rates. That's not a recovery except in some perverted Orwellian sense. "Extend and pretend" just extends the pain.

On Localizing:

I'm just curious, anybody shopping locally for the gift-giving season?

I've gotten a few bottles of wine produced by small wineries within 50 miles.

Some cheeses produced within 250 miles. (Almost had one this year within 50 miles but am told that the (one young free-ranging cow) wasn't cooperating.)

"Old-fashioned" home crafts kits; assembled within 20 miles.

Locally produced condiments (preserves, jams, jellies, honey, etc.), made within 12-to-300 miles.

Hand-operated tools (sold at flea market) 15 miles away.

I did last year. I am trying to wean friends and family off the commercial aspect of Christmas, so I usually don't give gifts, aside from small consumable items. I bought things like gourmet vinegars, homemade soaps, jams, and sauces from a nearby monastery. They also have a program that teaches local college students sustainable farming.

I take the bus to a local bookstore and buy books for the nieces. Support your local book seller!

My six-year old declared herself a Woodworker yesterday. "I'm working.. with wood. I'm woodworking!"

Girl's getting some of her own tools.. but we've got generations' worth to re-gift. Not much coming from the stores. Anyway, the tools from the 30's and before are MUCH cooler than anything I could buy her new. She may get some new wood and fasteners, though. (Though Dad's jars are yielding up some really sweet Brass parts that will shine up nicely!)

Bravo Jokuhl: It is a Post Peak occupation she can grow in. I am working with my 12 yo grandson. He built his own full sized bed with 6 base drawers in Birch and Walnut last summer with a little help of course.

One of the great 'woodworkers' of all time (Sam Maloof) died a couple months ago at 90+. A great loss to all of us. He too called himself just a woodworker though he was an artist in wood.

http://www.amazon.com/Sam-Maloof-Woodworker/dp/0870119109/ref=sr_1_1?ie=...

Read to her the classic "A Cabinet Worker's Notebook" by James Krenov. You both will learn a lot about woodworking and life.

http://www.amazon.com/Cabinetmakers-Notebook-Woodworkers-Library-Fresno/...

Cheers, Lynford

Thanks, Lynford.

I actually remembered your mention of teaching toolcrafts to some younger people. This girl has artist written all over her.. won't even be a question of 'which medium', but how much of each, if her habits and her forebears are any indication.

Definitely. We've all agreed not to buy fancy holiday/birthday/any other gifts - it's been in place for about 3 years.

I generally fill a basket with home-made or locally made items if I'm going somewhere for a holiday meal. We'll usually all pitch in with the cooking and cleaning up.

Absolutely. 100% of all Christmas money will go to the local food bank, just like last year.

I like your idea as well, if you're in to the gift thing.

jt

Another gem by Greer.

http://thearchdruidreport.blogspot.com/

Post the link to the article you are talking about, rather than to the front page. Some blogs update several times a day, and it becomes difficult to tell what post you are referring to.

I assume it's this one:

http://thearchdruidreport.blogspot.com/2009/11/gesture-from-invisible-ha...

OK sorry.

It will never happen again.

Should I also post a small excerpt from the article?

You don't have to, especially with a writer as well-known here as Greer is. In general, a brief excerpt or a short description of what the link is about is considered good form.

I agree with Greer's observation about wealth flowing more into the abstract realms of economics. People are so focused on that view that I find it hard to believe we'll ever work out an energy policy that deals with reality... at least not with the current policy makers, maybe with the next generation if they come with different mindsets and perspectives.

Does Greer read TOD or what ?

I believe he at least did, in the past. Whether he continues to do so now, I have no idea.

If by that you mean in his writings one can detect some common themes from this site then I agree he must.

All the people that share this mindset see the same things but Greer writes with such eloquence and unique style that it just sounds better coming from him.

Michael C Lynch on IEA and blown whistles: The Peak Oil Secret is Revealed! — MasterResource

Those are your poster children? We've documented all that rot anyway, he doesn't have any data on production in surplus of decline, or increased consumption in these producing nations - ELM.

So you have plays on paper, Brazil's forecast of exporting perhaps 500 kb/d extra around 2015, the dribble that's coming out of the Bakken, and a fuel source which isn't part of the transportation sector except in custom vehicles. Really weak stuff this time out.

AGW promises to bring hurricanes to the South American coast as well - but of course the good folks at Master Resource reassure us that global warming is nothing but a scam, and even if it had any validity we'd be able to think our way around it as their high priest Julian Simon promised.

Says it all really. Yippee! The free-market will boff those nasty resource limits, flow rates and Laws of Thermodynamics on the nose and we will all be swimming in oil for ever!

On Fantasy Island, where Michael C. Lynch lives with unicorns, elves, fairies and other mythical creatures, oil fields don't deplete.

RE: Julian Simon

"Population growth has long term benefits"

"The world's food supply is improving"

"Natural resources and energy are getting less scarce"

ROFLMFHO !!!!

"Natural resources...pollution...world's food supply .. pressures of population growth

Every trend in material human welfare has been improving - and promises to continue to do so indefinitely"

Please! That's enough! Call a doctor! Help! My sides are actually splitting!

"Every trend in material human welfare has been improving" - yeah, tell that to the +billion people at the bottom of the pile. The economic miracles of population growth and rampant free-market greed have really improved their welfare.

What a grade-A plonker.

And then there is:

"...on a cleaner planet" - Oh just SHUT UP!

Where do these people get the gall?

Simon's book: The Ultimate Resource II: People, Materials, and Environment is available, at this link, on the web.

Of course those are just a very few of the absurdities in the book. But then Simon was an economist so what could we expect?

And on: The Improving State of the World:

Publisher: Cato Institute (January 19, 2007)

Nuff said.

Ron P.

I always found it interesting that Simon, Huber, et al believe that the sum of the output of discrete depleting oil wells results in a virtually infinite rate of increase in oil production. This is what I characterized as a "Huber/Lynch" type oil field, one where discrete wells peak and decline, but the total field production--the sum of the output of discrete, depleting wells--increases forever.

But if discrete regions have clearly peaked and declined, doesn't that defeat the Infinite Oil model? When I debated Michael C. Lynch, et al, I hammered him with the Texas & North Sea case histories, and he essentially adopted the "Pretend They Don't Exist" defense, i.e., he basically asserted that Texas and the North Sea--which accounted for about 9% of total cumulative world oil production through 2005--were not places where he would choose to drill.

But again boys and girls, the Peak Oilers are ones generally considered to be the nutcases.

This sounds like Simon believes the story about Achilles and the tortoise.

I forget, but who's the ancient Greek mathematician who said that you can never get to the end of a finite distance... that when you get to the mid-point of that distance you will always need to get to the (next) mid-point of the remaining distance.

Mathematical humor can be dangerous.

8-o

That would be Zeno of Elea and the paradox is called "Achilles and the tortoise".

"We now have in our hands—really, in our libraries—the technology to feed, clothe, and supply energy to an ever-growing population for the next seven billion years." (Simon along The State of Humanity: Steadily Improving 1995

There's not really much to say on this is there? Except perhaps to ask how exactly did this chap manage to become a professor at the University of Maryland?

Oh yeah, that's why! Because he was the professor of "business administration" - that well respected science department specializing in geology, physics and ecology.

Dear oh Dear.

Contrast that thoroughly insane quote with what Mike's saying:

He must be a Beta Minus, or Outer Party member.

One day late, because of the holiday...

Summary of Weekly Petroleum Data for the Week Ending November 6, 2009

Oil Extends Drop After Crude Supplies Rise More Than Forecast

So I am seeing crude imports down week over week. refinery utilization down week over week. And gasoline production down week over week.

But gasoline invetories are up 2.5% week over week? As did all other inventories?

So either a lot more imports of finished gasoline and distillates or demand is way down week over week. Which maybe makes sense after 30+ days of price increases starting in September.

Can anyone make the numbers add up?

Oil falls below $77 after US supply report

A careful of EIA weekly information indicates that they made some 'adjustments' to the numbers, basically they added about 500,000 bpd of various oil and oil product inventories (3.5 million for the week).

I presume, as I stated in another thread just today, that those adjustments either are correcting prior weeks errors and/or are estimates made about final inventories (somewhat ignoring actual refinery output).

It can take up to two months for the EIA to catch up with reporting errors, but by then, new errors can be made. Or in other words, total inventories in each category could be regularly be off by up to about 1.5% in either direction (based upon a review of last year's revisions).

The mother of a little girl who was kidnapped and murdered walking home from school is getting hate mail from people for letting her kids walk 0.9 miles to school.

Boy, am I glad I don't have any TV reception. I followed your link above, and that took me quickly to the woman who was Mauled by the Chimp in CT.. man, what a constant link to the most addicted and irrational parts of our Psyches. No wonder ADHD is so prominent.

Those that drive their children to school should be prosecuted for child abuse !

The early deaths from childhood obesity and it's consequences will dwarf, by a million to one, the deaths from stranger abductions.

Best Hopes for Walking and Bicycling to School,

Alan

http://www.dailymail.co.uk/news/article-1227188/Mother-fined-75-feeding-...

Britain really is fast becoming a fascist state. No kidding. This sort of thing would have been unthinkable only ten years ago. What was the point of all those brave soldiers storming the beaches on D-Day to liberate Europe from the Nazis? We are now dictated to by mini-hitlers with a uniform for doing nothing more radical than feeding the ducks. FFS, I give up.

Have you seen Children of Men? Absolutely farking brilliant.

We are now dictated to by mini-hitlers...

And yet, and yet. As I've observed before, lots of people around here want to vastly expand the powers of already bloated, meddlesome, bullying, overbearing government...

The planet is warming up, and if we just give enough cash to Goldman Sachs (or Al Gore) the planet will keep on warming up, but at least we can feel superior to those stupid "denialists". What is most important is the symbolism of our efforts which will be admired by Bejing-they can show their admiration by buying up anything of value here after the grifters are finished with the fire sale.

+1

So, is peddling despair the new tactic of denialists?

Len: Sure, Goldman is doing GOD`S work-it is a private equity partnership http://www.youtube.com/watch?v=9xvwhHOK8Rk

No, that's my job: Desdemona Despair: Blogging the End of the World™.

Tinkering Makes Comeback Amid Crisis

This may be one of the more hopeful bits of news I have seen in a while.

Hopeful in what way? That a species that has dug itself into an ecological hole deeper than Dante's 7th level of hell is going to somehow muddle through and come out smelling all roses on the other side?

No, not smelling all roses. We are definitely going to at least decline, maybe crash. The hopefulness is that maybe the descent can be a bit less swift and painful. Doomers, I know think that impossible, or maybe even undesirable. Sorry, I'm a declinist, not a doomer - for now, anyway, and probably for as long as I see a few glimmers of hope like this every now and then.

I was wondering if anybody has read the Aftershock by Robert and David Wiedemere? I just finished reading it and, except for a few minor issues needing clarifications, I found the book very convincing about the fact that we are by no means out of this economic chaos we are in. If his predictions come true (as his predictions in 2006 did) we are in deep trouble i.e. oil going to as low as $20 p/b or gas going to as high as $15 p/g. Scary stuff.

New article from The Guardian:

http://www.guardian.co.uk/business/2009/nov/12/oil-shortage-uppsala-alek...

It looks like the main stream media has finally come on board the peak oil debate in big way. My guess is that the Uppsala report will put the IEA on the defensive, at least for a while. They have a lot of explaining to do.

Has TOD extended a hand out to this "whistleblower"? It would be great fun to have him/her post her at TOD. He/she could be almost totally anonymous except to the TOD staff. What do ya say WB? Come aboard and give us some excitement.

In regard to the story on the use of large fog collectors to provide water in Peru, this was introduced into Nepal back in 2000, and it is good that it is now being used for a demonstration project in Peru, but I wasn't able to find much information showing that the idea caught on very much after the original sites had been set up in Nepal.

A somewhat surprising article in E&P, an oil & gas trade magazine (longer excerpt on Sam's post):

http://www.epmag.com/Magazine/2009/11/item47352.php

The most recent economic downturn is a peak oil recession

That guy's a peak oiler. He was at ASPO.

http://www.energybulletin.net/node/50109

This is an excellent read and brings up points that have been discussed before here at TOD. I, as well, think it particular impactful being published in a trade journal. Are more and more folks in the industry starting to face the facts instead of the rhetoric? If so, that is an important step.

No Dragon...it's not an important step. At the risk of boring all the TODers that have already listened to my rant many times before, the industry has undertood PO for decades. You shouldn't confuse the press releases from the CEO's of public companies with what virtually everyone in the oil patch has known for a very long time. Think about it for a second: we are the one's tasked daily with going out and finding more. Who would know better then us how little there is left and how expensive those reserves will be developed.

The real impact will be when those CEO's start sending out press releases supporting PO. It might not be too long before it happens. When the day comes that prices spike again, and hold for a significant period of time, the public will demand an explanation why the industry isn't devloping all those reserves the CEO's implied were out there. IMHO you'll see the mother of all flip flops as they explain how they've just discoverd the true limitations and have no choice but to sit back and charge those high prices. I've worked with public company management for over 34 years. They are as predcitable as the sun coming up tomoorow morning.

ROCKMAN...oh...don't get me wrong...I know about manager and CEO mentalities and it is no different in any company. But, don't you think a CEO was aware this article would be published and allowed it to be published?

That's a good point Dragon. I didn't want to get too wordy but I did think about what negative feedback might be generated by publishing that article. But I don't think the public companies spend as much ad $'s as the service companies. I would suspect ad revenue would be a motivation to not mke someone mad. But I think the service companies would favor any piece that might panic the public a little: they make their money by drilling activity as a rule. The CEO's are always worried about share price gains. And I would imagine they get a little conflicted at times: tell the public they won't be able to increase reserves endlessly or conversely, we're running out of oil/NG so what we have in the ground today will sell for a lot more down the road. From my experience public CEO's would rather stick a fork in their eye before they would ever admit any potential future difficulty in replacing their reserve base.

OTOH, that journal's owners might not care what anyone thinks and just published what they thought was worth doing.

The lights shine a little brighter in Nova Scotia tonight:

NS Power and OpenHydro successfully deploy in-stream tidal turbine

See: http://www.nspower.ca/en/home/aboutnspi/mediacentre/NewsRelease/2009/suc...

No more coal-fired power plants !

Cheers,

Paul

Interesting that today T. Boone Pickens was interviewed on Canada's business news cable network BNN (11:00AM). In the interview when the interviewer raised the issue of the IEA forcast of production 2030 of 120 (??) mmbpd, he explicitly stated his belief that world oil production "will never exceed the present record of 86(??) mmbpd. Price set by OPEC will be the limiter, soaring well above $200 / bbl very shortly." He went on to discuss China being in a much stronger position to compete on world markets, therefore N America "had better figure out how to do with a LOT less imported oil very shortly".

Nothing on their website yet. http://www.bnn.ca/index.html