Drumbeat: March 14, 2010

Posted by Leanan on March 14, 2010 - 9:47am

Gasoline refining lacks its spark, for now

NEW YORK (MarketWatch) -- While the cost of crude has risen in the past year much faster than the price of gasoline at the pump, Big Oil absorbed a huge body blow to the bottom line.After racking up sharp losses on their refining businesses in the last quarter of 2009, energy companies are facing a longer-term struggle even as the summer driving season approaches and the economy shows signs of life.

"There's been a fundamental shift in the U.S. demand and the price of gasoline," said Lynn Westfall, chief economist for Tesoro Corp., an independent refiner that posted a loss of $179 million in its latest quarterly report. "Growth in China and India are driving crude prices higher. But demand in the U.S. is weak and so you can't pass the higher costs along."

The Falklands: For Argentina, Oil Reopens Old Wounds

Argentines could be said to share three passions: soccer, the tango and their longstanding claim over Las Malvinas, which the British who control the island archipelago 300 miles off Argentina's coast call the Falklands. Even though Britain decisively beat back an Argentine invasion of the Falklands in 1982, the cry of "Las Malvinas son Argentinas!" (The Malvinas are Argentine!) still resonates in national politics. "It doesn't matter if you're from the left or the right, when you become President in Argentina, sooner or later you start beating your chest about the Malvinas," says writer Sylvia Walger, who is set to publish a book on current President Cristina Fernandez.That time has now come for Fernandez, who has begun vigorously asserting Argentina's rights to the Falklands after a British oil rig recently arrived to explore what may be vast crude reserves beneath the sea bed around the islands. Last month, Fernandez vowed to argue "one thousand and one times for [Argentina's] international rights" to the islands and the oil, and ordered all ships stopping at Argentine ports obtain a special government permit if they want to continue on to the Falklands. This month, during a visit by U.S. Secretary of State Hillary Clinton, she requested Washington's mediation in the dispute — and while Clinton declined to mediate, she appeared to endorse the principle that the dispute ought to be up for negotiation. "We would like to see Argentina and Great Britain sitting down to discuss this issue," she said.

Iran says no need to change OPEC output ceiling

TEHRAN (Reuters) - Iran said on Sunday there was no need to change OPEC's output ceiling at the oil producing cartel's meeting on March 17 in Vienna, the Iranian oil ministry's website SHANA reported."There is no need to change the output ceiling in the next OPEC meeting ... OPEC will insist on the members' quota compliance in the next meeting," Iran's representative to OPEC, Mohammad Ali Khatibi, was quoted as saying by SHANA.

Qatar minister sees no OPEC output change

KHOBAR, Saudi Arabia: OPEC is not expected to make any fundamental change in output at its next meeting, Qatar's oil minister was quoted yesterday as saying by Al-Hayat newspaper.Separately, the Saudi newspaper al-Riyadh quoted an unnamed senior OPEC official as saying the producers group is expected to maintain its production ceiling unchanged at the meeting.

Relax, there’s plenty of oil and gas

We are not staring soaring oil prices in the face. After crossing the then-record $120/bbl mark in May 2008, oil moved on to just shy of $150. By end 2008 the pricking of the financial bubble saw the price fall to $30/bbl and it has taken months to creep back to $80 or so. But, one argument goes, the millions of new cars expected on Chinese and Indian roads over the next decades will mean soaring demand and prices for oil. Perhaps.Daniel Yergin, founder of CERA (Cambridge Energy Research Associates), is not convinced. Demand in rich countries fell in 2008 as oil prices soared and affected economic activity. In the US, daily oil consumption fell by two million barrels last year, though motoring only accounted for 15% of the fall and slower economic activity and flying for the rest. Meanwhile, the world looks increasingly awash with crude.

“Not a single one of the 23 countries that derive most of their export earnings from oil and gas is a democracy today,” Diamond noted in an essay earlier this year. Especially in Arab countries, the fabulous riches that come from under the ground tend to create overbearing governments with apathetic citizens. “In these systems, the state is large, centralised, and repressive,” Diamond wrote.Societies are usually “intensely policed” because “there is plenty of money to lavish on a huge and active state-security apparatus,” and bureaucracies are “profoundly corrupt.” They tend to see the money that pours into state coffers as everybody’s and nobody’s, and therefore more or less free for the taking. The public pays no taxes in the richer states, and in the view of the entrenched potentates no taxation means no need for representation.

Delta Says Strategic Review Is in ‘Advanced Stages’

(Bloomberg) -- Delta Petroleum Corp., the money- losing U.S. energy producer whose largest shareholder is Kirk Kerkorian, said its review of strategic alternatives including a possible sale is in “advanced stages.”

Cnooc to Announce Information on Overseas Cooperation ‘Soon’

(Bloomberg) -- Cnooc Ltd., China’s biggest offshore oil explorer, may announce information about the progress of overseas cooperation “very soon,” said Chairman Fu Chengyu.“We have stressed our intention to intensify cooperation with foreign countries and companies since the crisis, and good progress has been made,” Fu said in an interview today in Beijing, where he’s attending parliamentary meetings.

Cnooc to Buy Half of Argentina’s Bridas for $3.1 Bln

(Bloomberg) -- Cnooc Ltd., China’s biggest offshore oil explorer, said it will buy half of Bridas Corporation from Carlos Bulgheroni for $3.1 billion, giving it a stake in Argentina’s largest oil exporter.

Nigeria's state-owned oil corporation to go private

Nigeria's state-owned National Petroleum Corporation (NNPC) has initiated talks with investment banks including Standard Chartered, JP Morgan, and Deutsche Bank to explore financing options as it changes into a fully privatised commercial company.

China Delivers Venezuela Jets For Anti - Drugs Fight

CARACAS (Reuters) - Venezuela on Saturday tested six training and light attack jets bought from China for defense and anti-drugs flights in a deal that dodges an embargo banning sales of U.S. weapons parts to oil exporter Venezuela.President Hugo Chavez ordered a total of 18 K-8 jets built by China after a plan to buy similar jets from Brazil's Embraer fell through, apparently because they include U.S. electrical systems.

Global hunt for phosphates is on

Are we facing a food disaster with catastrophic shortages of fertilisers? Will the world feed the three billion or so more people likely to be added, by 2050, to the six billion already on the planet?

Plunging price heats up ethanol

CHICAGO — Ethanol, the commodity that cost Bill Gates more than $44 million the last time prices collapsed, is poised to rally as much as 20 percent as the fastest drop since 2008 spurs demand.Falling corn prices and record ethanol supplies have driven the price down more than 17 percent in three months to $1.585 a gallon Friday, its worst run since 2008's fourth quarter. It will average $1.96 a gallon at the peak of the U.S. summer driving season as refiners from Valero Energy to Sunoco mix more into gasoline made from increasingly pricey oil, according to the median of 10 analyst estimates compiled by Bloomberg.

Taxpayer-subsidized manure digesters stimulate factory farm pollution

At the U.N. Climate Change Conference in Copenhagen last December, U.S. Department of Agriculture Secretary Tom Vilsack unveiled plans to promote manure digesters as a way to reduce U.S. greenhouse gas emissions by 25 percent. The trick is that you have to be a factory farm to qualify.

Renewable energy also needs to be sustainable energy

William "Bill" Ayres, business manager for the biomass division at R3 Sciences, has an idea that could dramatically increase the sustainability of the biodiesel industry. Ayres has been involved with biodiesel since 1990 and helped form the National Biodiesel Board."I did some research several years back and took some soybean oil and soy biodiesel, ran them through a catalytic reformer and converted them to hydrogen," Ayres said. "I did it just to show that it could be done."

Tokyo Electric Power planning trial of smart meters

TOKYO — Tokyo Electric Power Co said Thursday it will launch trials of smart meters for more efficient power consumption by October in a bid to start their full-fledged introduction in two or three years.

Operations normal at Japan nuke plants after quake

TOKYO (Reuters) - Operations at Tokyo Electric Power Co's Fukushima Daiichi and Daini nuclear power plants are as usual after a strong quake hit northern Japan on Sunday, a spokesman at the company said.

Health Costs of California Air Pollution

Filthy air in California cost federal, state and private health insurers $193 million in hospital costs, according to a RAND Corporation study released last week.The report is the first to show how California’s failure to meet federal clean air quality standards is increasing hospital expenses and its impact on insurers, said John Romley, the study’s lead author and a RAND economist.

China, Not UN, Controls Supply for CO2 Offsets, Stanford Says

(Bloomberg) -- China’s power to set prices for electricity from windfarms is dictating the supply of tradable emission credits in the UN carbon market, the world’s second biggest, according to a report from Stanford University.

State suing for responsible scientific conclusions

The Environmental Protection Agency recently concluded that man-made greenhouse gas emissions — including carbon dioxide — are harmful pollutants and must be regulated. The lawsuit I filed challenging that finding does not address the disputed science surrounding global warming. Instead, it focuses on the indisputable fact that the EPA relied on information that has been discredited, manipulated, lost or destroyed, and sometimes evaded peer review. The lawsuit does not attempt to show that the globe is not warming. It does, however, show that the process used by the EPA in deciding to regulate greenhouse gases is riddled with errors that render its conclusion untrustworthy.

Climate snapshot reveals things are heating up

THE nation's two leading scientific agencies will release a report today showing Australia has warmed up significantly over the past 50 years. It is a response to recent attacks on the science underpinning climate change.The ''State of the Climate'' snapshot, drawn together by the CSIRO and the Bureau of Meteorology, shows the mean temperature has increased 0.7 degrees since 1960.

The snapshot also finds average daily maximum temperatures have increased every decade for the past 50 years.

The report states temperature observations, among other indicators, ''clearly demonstrate climate change is real''.

Two really great videos were linked yesterday on Chris Martenson's blog: Daily Digest - March 13

One was "Harry Markopolos on The Daily Show with Jon Stewart" about the Madoff Ponzi Sheme. The other was "Ratigan And Spitzer Discuss Repo 105, Conclude "Civil Cases Will Be Brought" about the Lehman Brothers collapse.

Both will make you so angry you could chew nails.

Ron P.

Thanks for pointing those out.

I'm as interested in the item at the end:

The way Monsanto is operating right now has to stop. There are plenty of documentaries that discuss their monopolistic tactics (Food, Inc., for instance).

"The way Monsanto is operating right now has to stop."

Their not the only ones by far;

DuPont, Dow Chemical, Syngenta, BASF and Bayer CropScience are ALL just as bad and if you think big pharma is bad these guys can make them look like furry kittens.

Screw organics, this is where the battle field is and if it is not addressed organic will be irrelevant.

This is a no brainer. But will the Obama administration have the fortitude to see this through. What took them so long to start the process?

GMOs are enabling the likes of Monsanto to make dependent farmers thieir virtual slaves. The most egregious aspect of this is that Monsanto sues farmers who are not even planting their seeds. Even if they have a good case, Monsanto's overwhelming financial assets intimidate the farmer into settling with Monsanto.

And the conservatives should be all over this, not just us socialists out here. Monsanto has effectively killed free enterprise in the farming industry and should be resisted and prosecuted for anti trust at all costs and as soon as possible.

This was all made possible by the court decision that said it was acceptable to patent life.

How do we decide that a company is too big to allow to collapse? Apparently, Lehman was allowed to collapse but Bear-Stearns was not.

In 2007 Bear had 13,566 employees, while Lehman had 25,936.

The size of a firm is unstable with respect to the number of employees. If we try to model the size distribution, we see that the best interpretation leads to a situation where the average size of the firm will diverge if left to its own devices. Since we live in a world of finite constraints, this can't happen so something has to give.

If you integrate the following probability profile to obtain a mean firm size it will logarithmically diverge to infinity. It leads almost directly to a situation where one large monopolistic company will employ everyone on the planet. (It's a very slow process fortunately)

In the Lehman case, the people previously employed by Lehman (at least some fraction) will go to Goldman-Sachs and that will grow bigger. Some of the decisions made with the help of anti-monopolistic policies have to take this into account. I can imagine the difficulty in making these decisions because my arguments are all based on entropy and the only way you can fight entropy is by exercising some external control and maintaining that control.

I describe the situation in a recent blog post:

http://mobjectivist.blogspot.com/2010/03/firm-size-entroplet.html

Ron - I had seen the Harry Markopolos piece last week, but Spitzer with Ratigan was something new for me. The Enron comparison is perfectly valid.

I have a hard time believing that little Andy Fastow cooked up the giant Enron scheme all by himself. There were a lot of big players who knew perfectly well what was going on at Enron but were making such huge sums on the phony transactions that they turned a blind eye. Now an even bigger scheme with Lehman Brothers is coming to the surface and two years later there has yet to be a prosecution or any change to the financial regulations that allowed these Ponzi Schemes to prosper.

Personally I don't care if Elliot Spitzer had a harem of underage asian hookers living with him. I would like this hound of the Baskervilles unleashed on Wall St. He's right: "We need to start leading people away in handcuffs." Fat chance!

Joe

Joe, my sentiments exactly. No one at the SEC has been fired and no one involved in the Lehman Brothers scandal prosecuted. Damn shame, they should go to jail and those idiots at the SEC should all be fired.

Ron P.

The elephant in the room is political. The problem is political.

Until we decouple congress for the sewer flow of corporate "contributions" we are going to have meaningless regulation, meaningless prosecution, and a chronically sick economy.

Where the buck stops is not Dick Fuld, it's the chairman of the House Banking committee. If we fix congress, we can fix the rest of it.

Will - Fixing Congress? Please tell me something that is possible. Going after Dick Fuld and his confederates however is something that can create a shit-storm that will go all the way back to Washington.

Joe

Exactly no one at the Treasury or the Federal Reserve wants Dick's day in court to occur. Forget that shit-storm. Not gonna happen.

Now... We can fix Congress. All we gotta do is vote for the guy who tells us he won't take corporate money.

Of course, we gotta find that guy, or 535 of them rather. But it is a dead-easy campaign pledge to make. And we have to agree, as an electorate, and as a society, that it is the proverbial litmus test. We keep it very simple. We make it the defining issue. Once we do... that ball starts rolling.

All the rest of it: abortion, health care, war, all of that gets ignored. Focus on the money.

And when we find out he/she's lied to us, 2 or 4 years later, do it again? The problem is DC operates a certain way, and money is only one of the factors. I am sure many politicians have went there to buck the system and operate using their morals and constituents as their guide. They get absorbed, kicked out, or burnt out.

Many of these folks have money already, the pay to be a politician is nothing to sneeze at for most people.

The government needs a redo honestly, but the legal methods of doing this are almost as scary as the illegal. The people that have the power and skill to do this are exactly the people I don't want doing it. Lawyers and politicians.

Another point, the collective "We" need to quit saying "Lehman Brothers did..." "Citi caused.." Case in point the story goes "Bank of American repo's wrong house." NO BofA did not, some shill in the corporate entity that is BofA did, and that person should be fired, the tried for his crimes. Corporate people are allowing real people to hide behind their names and keep from being held accountable for their actions.

We use the old Persian system: put a satrap in each Congressional office.

We'd have to pay 535 watchers, so to speak, to keep elected hands from the grease. But that level of scrutiny would be the best investment we could possibly make.

Where we are today is pathetic.

And the guy who makes it gets one tenth the campaign donations, and one tenth the political advertising. The voters here a one sided story, and fall for it most of the time. So we are back where we started. As long as we are hung up on first amendment means all the government that money can buy, we won't get anywhere.

The govt. doesn't have to do anything about it. Depletion will re-shuffle the deck.

Of course depletion reshuffles the deck.

But our deteriorating economy is a lot more complicated than depletion.

We can live without cars. We can live without salad greens from California, wine from Chile, or goods from China.

But how much more mal-investment can we absorb?

We Californians still want our money back

Peak Minerals -- Phosphate, Potash

The Global hunt for phosphates is on article is the latest installment in a recurring theme. Phosphate is one of those minerals for which there is no replacement and global phosphate production will thus go through a geologically determined "peak" just like oil. From the article:

Let's do a quick review of the situation with graphics from the US Minerals Databrowser.

On the left we have US production, consumption and net exports/imports. Clearly, the US is past peak production and is now an importing nation for this most important commodity. On the right hand side we see world production with US production superimposed and an inflation adjusted price marker to show the relative cost of this mineral over time. If I had to describe the global situation the phrase "bumpy plateau" might come to mind.

The other mineral mentioned in the article was potash, the source of potassium in fertilizers -- the 'K' in of 'NPK'. Let's do the same review:

US production of potash peaked in the mid sixties and has since been in steady decline. We now import over 80% of the potash we use. And global production can again be described as a "bumpy plateau". But what's up with the price? What happened between 1914 and 1918 that made the price skyrocket?

Well, it turns out that German imports were the primary source of potash in North America from the 1860’s all the way up until World War I. The WWI embargo of German goods caused supplies to shrink and prices to skyrocket. The development of domestic US potash deposits began at this time in California, Utah, and Nebraska. (Interestingly, some potash deposits like the Carlsbad Potash Basin in New Mexico were discovered accidentally while drilling for oil.)

Are we at peak phosphate or peak potash? It's hard to know for sure. Undoubtedly there is still a lot of these minerals in the ground around the world.

Can we expect the price we pay for fertilizer to rise as we deplete the easy-to-find supplies of phosphate and potash? Without a doubt!

Best hopes for exploring the data and learning a little history along the way.

-- Jon

I would suggest that we have to distinguish between the origins of the specific material to figure out the potential depletion dynamics.

Concentrated phosphorus in the form of organically-derived phosphates goes through a Gompertz-like production life-cycle (not a Hubbert logistic). It is easy to extract and the extraction builds up exponentially as demand increases and then will follow a rapid crash.

http://www.energybulletin.net/node/46955

Distributed phosphorus and less accessible rock phosphate can be mined through various techniques so that will continue to contribute to the tails. That is closer to what happens with oil, since oil is not always easily accessible but as technology improves and it grows in value, the dispersed nature of discovery leads to a Logistic curve as opposed to a Gompertz. (See Dispersive Discovery on TOD to understand the difference)

I imagine, potash has a mix of the behaviors of phosphate and oil. The first step is to figure out which deposits were created as organically-derived and which have a dispersed origin. I realize that everyone understands this, but lifeforms can concentrate these materials into highly extractable forms, but this same efficiency leads to rapid depletion of the same resources if it all gets discovered at a single point in time.

Thanks WHT,

Your comment and link here helped me a lot by clarifying and simplifying a great deal of your thinking on Dispersive Discovery models.

I will admit to being a 'Show Me' state skeptic when it comes to modeling, but your distinction between bioconcentrated vs. dispersed deposts of different resources is one that has huge intuitive appeal.

Statistical models, Gompertz or Hubbert, can be useful in predicting production curves and utlimate recovery of a resource if one understands these differences. Their utility is limited, however, when human nature becomes involved in the form of politics, economics or warfare. Then all bets are off.

-- Jon

I agree on the human nature beyond a certain stage, yet the macro aspects of human economics can be modeled in a very similar fashion.

I have recently been on an econophysics kick and the field looks wide open because most of the research doesn't view or interpret the data in the same way I do.

Firm Size: http://mobjectivist.blogspot.com/2010/03/firm-size-entroplet.html

Income Disparity: http://mobjectivist.blogspot.com/2010/03/econophysics-and-sunk-costs.html

City Size: http://mobjectivist.blogspot.com/2010/03/entroplets-of-city-population.html

Investments: http://mobjectivist.blogspot.com/2010/03/volatile-investment-trap.html

I kind of know the boundaries of the general analysis and that has to do with scaling to the micro level. I stay at the macro level where all the individual game theoretic strategies cancel out and all that is left is entropy and disorder.

And these micro-features cancel out for the same reason that the specifics of the data for individual oil reservoirs (or any other constrained resource) cancel out when aggregated. In other words, beyond a certain point you no longer you need to know the detailed data, and the aggregate is good enough to make predictions or extrapolate the behavior. That is not to say that data collection is not important, as we need data to validate the models and to convince someone else that you can use a model as a proxy.

WHT,

Recently I've been thinking that some of what we hear about in financial circles seem like the eddies and whorls that form during turbulent flows. Something in the business environment today seems to be preventing the spreading of risk -- vehicles that at one time successfully mitigated individual risk (while raising overall costs modestly) seem to now be increasing systemic risk while maximizing third-party cash-out.

For example, in Florida the traditional insurers lost money in 2004/5, and pulled back. Rules were loosened to spur new investment in the insurance community, but the new companies are more like ponzi vehicles for investors than risk-spreading insurance. Small insurance companies spin out premium cash to shell companies, while their new re-insurance companies have no real assets to provide the supposed back-up. While the pseudo-insurance supports overly-expensive loans for housing, and all parties seem to be happy pretending that risk has been mitigated, if a hurricane hits it will all collapse. While it is obviously impossible to spread risk far enough in an overall risky environment, where there is more aggregate risk than aggregate mitigation funds, might such a situation be reached 'early' if the insurance process and industry becomes part of the risk itself?

Retirement funds (in Soc Sec or private funds) are likely in similar jeopardy. While an individual can plan for retirement, might the opportunities for everyone in aggregate be limited such that it's impossible for all who think they can retire to actually do so?

Is there a way to model such risk in a entropic manner? Is it piece and parcel of the same phenomena -- without continued specific effort nature (or human nature) creeps in and risk and losses/gains distribute themselves according to your heuristics?

Good question. Intuitively I'd expect it to be like modeling earthquakes, slides that occur as gravel is added to piles, or tomorrow afternoon's rainfall. As with those, you might be able to get a decent statistical feel while being unable to predict anything particularly useful. (The Weather Service will tell me, say, that there's a "30% chance" of rain, which is essentially useless for deciding whether to cancel tomorrow's picnic.)

I remember the analogy. The gravel or sandpile idea was due to the physicist Per Bak. Many of these physicists want to find the "critical behavior" phenomena that has a self-organizing character to it, ostensibly so they can discover some new laws of nature and therefore perhaps win a Nobel Prize.

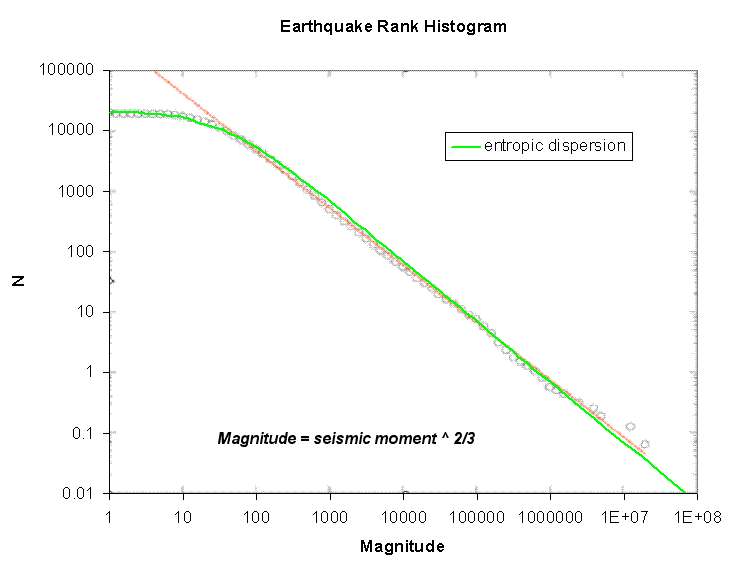

In actuality, the behavior can be explained by more mundane arguments. All it takes is a variation of fault strain release points and various stress rates in reaching those points. Then you get a graph that looks like this:

http://mobjectivist.blogspot.com/2010/02/quaking.html

So if you had an insurance policy against earthquakes, the insurance actuarian would consider this model quite useful. They couldn't tell you when the earthquake would happen, but they could reasonably predict the size in terms of a probability (essentially related the slope of the above curve).

Intriguing ideas Paleocon.

I had a post titled "Failure is the Complement of Success" in which I tried to point out that the path to success follows some of the same patterns as the path to failure. So I can use the entropic arguments to model reliability & risk arguably well: http://mobjectivist.blogspot.com/2009/10/failure-is-complement-of-succes...

So I can imagine dispersion in compounding investments may also provide some insight in how we can understand dispersion in risk mitigation strategies such as insurance policies. Dispersion in an aggregation of insurance policies consists of various probabilities of occurrence weighted against the potential payouts. I know that actuarians think in this way, but they treat all the possibilities as discrete or categorized events and then sum the aggregate. I don't know whether they would ever consider a continuous distribution of risks, which describes the entropic route. Gail might know (if she can figure out my abstract notions) and she did say this:

I think what you may be getting at is the dispersion of risk may push certain payouts well into the future. However since dispersion causes fat-tail effects, the continual buildup of these future payouts rise to such a high value that any adverse event may drain the insurance companies reserve. Yet I also think that this is exactly what the insurance companies want. They would gladly want to defer payouts as long as they can.

I will definitely look into this and I suspect it will lead to a pessimistic outlook, especially for certain outcomes such as Soc Sec.

Thanks for the feedback WHT. I recall enough college math to be able to follow your work, but I'd not be able to synthesize it myself!

Pushing risk into the future is an interesting concept -- if you can borrow or bank monetary risk like you can money itself then you could end up with situations where artificially low risk returns (calamities) would skew actuarial and regulatory views, only for the eventual risk to swamp the system. Perhaps, more generically, monetary risk is actually a component of debt, and the two are intertwined?

I'm not sure social security is any different than other debt or investment, except that the supposed savings have already been borrowed by the gov't and spent, so the "Where does the money come from?" question is more obvious.

In any long-term, society-wide investment mechanism I think it is a valid question to ask whether the scope of the investments sufficiency affects the market as to make the desired outcome uncertain. Similar questions could be asked about hedge funds, large investment funds/banks, and Fed actions -- as the players become few and large rather than many and small, does it affect the game significantly?

Back to your "corporate size" distribution model, if you add nation-states to the mix (with each gov't being a "company") does the distribution still fit the curve?

Fat-tails imply that the rare but large entity can sway things economically. Also, nation states are like big coprporations I would think.

Oh no!

The world needs to keep growing indefinitely. We need to increase consumption and population to keep our economy humming.

If need be, price signals will lead to substitutes. The invisible hand will care for us all, forever!

Depletion of fossil water, peak oil and natural gas, depletion of top soil, coal, and dieing oceans need not concern us. We must continue to plow ahead until God decides to pull the plug on judgement day.

Remember..., we have marching orders...,

We must be fruitful and multiply!

What exactly is phosphate used for and is it really necessary. Sorry for the dumb questions but I am not at all clued up on phosphate at all. Thanks

In the case of phosphate, a Google search doesn't immediately take you to the answers you want. The first link is to the wikipedia page has been take over by chemists. The second link is to a USGS page that itself contains numerous links. What you want is the US Minerals Yearbook section on phosphate. From that document:

Phosphate fertilizers were a key component of the Green Revolution that began after WWII.

-- Jon

Thanks Jon. Do you think that the world could be fed without fertilizers, using purely organic methods. I would imagine not. (btw I am talking about being technically possible from a pure yield basis, not taking into consideration logistics and politics.)

We'd all have to become much more familiar with Joe Jenkins and humanure.

NO THANKS!

I'd rather starve...!

One down. 6 billion to go!

LOL! I had exactly the same thought. Then again people are squeamish about things like even thinking of eating insects...

Unless you mean "natural-gas-and-nitrogen-based fertilizers," the idea that "organic" methods are fertilizer-free, i. e. "pure," is a myth.

Certified organic farmers regularly use mined materials, such as rock phosphate, lime, and greensand (and kaolin as a crop protectorant).

"Composting," if that's what you mean, does not require organic certification and is practiced by many farmers who have no interest in "organics."

I suspect even that is unsustainable. The materials in compost come largely from conventional farms.

We're not feeding 'the world' today even with fertilizers.

Distribution of food calories is highly inhomogeneous -- just look at the impoverished classes in India, Brazil, Central America, etc. or the entire nation of North Korea.

I believe that organic agriculture will be sufficient in many areas of the globe but not in others. I would be paying close attention to areas with the following characteristics:

However, I think it is important to realize that any shortages of phosphate or potash will appear as increasing commodity prices over several years or decades. We may be hearing increasing news about food riots from time to time as we did in 2008 but I'm not expecting any 'crash' in supplies of fertilizers or any severe food shortages in current food exporting nations.

Best Hopes for a compassionate distribution of food resources.

-- Jon

The fish catch rarely appears to get a mention.

Fish stocks and ocean catches are declining. Farmed fish requires protein mostly extracted from grain.

Fish supplements a good amount of our food supply. I think the logical conclusion is as the ocean catch declines there will be an inevitable growing reliance on farmed fish. Feeding the fish further intrudes into the grain supply. Feedbacks (excuse the pun).

To state the obvious I think we are in a wee bit of trouble.

http://www.worldwatch.org/node/5883

http://www.boston.com/lifestyle/green/greenblog/2009/09/as_farmed_fish_i...

If we started with a world like our own that looked like ours from say 1,000 BC. Without all the damage that people have bought on by clear cutting and what not. I would say if you limited the way people lived on the land, no over grazing, limited growth, parceling out about 5,000,000 square miles of land into 1/4 arce lots and giving them a lot of edible plants that would grow on each lot, not all of them native to their region, but able to grow in the climate of the plot of land. You could feed all the current world's population.

But that can't happen here on Earth, we have greed and hate for our fellow man to contend with. We have no known society that will allow itself to be limited in the fashion listed above.

With what we have have now, we can grow a lot of plants that are edible, using some animals to fill into the mix, Chickens, sheep, goats, rabbits, ducks, and several other small animals can be grown on small plots with some limitations. The problem is transtioning from what we do now to a new lifestyle is not as easy as people want it to be.

There are methods to grow food without mining rocks or FF to feed the plants, but you have to work closely with the Natural systems that are already there. Man has this nasty habit of trying to tame nature, beat it into the form we want, and that has been our down fall.

We took productive land that grew forests, or plains and tilled it until all we were growing was one kind of plant, or maybe several, but still the numbers of plants that were there before we arrived was a 100 fold or more. Farming even before the Green Revolution was hard on the land.

There are dozens of people out there that have proven you can live off the land a lot better than we do now. Methods of setting up growing systems that use what nature normally does, without us doing a lot beating nature into our ideals of monoculture. These methods don't allow for factory food production though, and we would need to change a lot of how we get our food to feed our tummies.

What you ask is possible, but what you point out is that politics and BAU will not allow it to happen in any way besides on a small scale within a small number of people.

People did feed themselves long before FF were part of the mix, but all that we have gained since their use does not have to be lost. We have a lot more knowledge about how the world works than we did even 50 years ago, we don't have to lose that knowledge base.

TOD does have a lot of Doomers reading and posting here, but as someone else said a lot of people read that don't post. So to those I say, look into growing food on your bit of world, look at the methods of Forest Gardening, Permaculture, Edible Landscapes, BioWebScape designs, and others that show you how to live within the means of the land you have working with nature and not trying to tame it.

It is true that plants need NPK but they got it just fine before we showed up on the scene, going back to that way of life is possible. Maybe not an easy trip from here to there, but a possible one.

Charles,

BioWebScape designs for a better fed future.

Hi, Charles. That is good advice. And we need to remind ourselves that survival will be individual. We could summarize all of the items we read on food production, and I submit we would find the following.

1. We are producting one heck of a lot of food by using commercial fertilizers and farming methods.

2. Certain organic farmers, using intensive farming and using sustainable methods are able to equal the production of the commercial fields, and keep it up indefinitely.

3. If everyone did that, we might be able to support about as many people as there are on earth today.

4. For # 3 to occur, land would have to be divided equally and into small plots for the organic farmers.

5. #4 is not likely to occur in this universe, on this planet.

6. Factory farms / commercial methods render the land less productive, and depend on every growing supplies of fertilizers.

7. These fertilizers are made from natural gas.

8. Factory farms use huge quantities of diesel fuel in various stages of production, packaging and distribution.

9. Diesel fuel will become scarce as Peak Oil occurs.

10. Natural gas will peak shortly after oil (after oil, NG use will increase, as will coal use - coal is another source of gas for fertilizer production).

11. When FF have all peaked and are declining, factory farming will first become extremely expensive, and then impossible.

12. When #11 occurs, it will be far too late to do anything about getting to #3.

13. All steps above could take place in a timeframe of from 10 to 50 years.

14. The shorter the time frame, the more uncomfortable the situation will be at the end.

15. The best we can do is to arrange for our own small parcel, sufficient to farm for ourselves and enough for trade as these steps take place.

16. We should thank those in TOD who have freely contributed their ideas and knowledge to this forum.

I would like to see a regular masthead on "Farming After the Peak", where all contributions could be archived and searched. Topics could include use of animals, tack for use with draft animals, preparing the soil, maintaining the soil, simple animal driven mechanical devices useful on small farms, etc. Also, how large a plot is needed to support a family of 2, 3, 4, ... n?

Craig

This is question-begging. What constitutes "organic" farming--strictly composting, or using mined materials such as rock phosphate? If composting, do the materials come from conventional farms or just from "organic" farms? If any compost comes from conventional farms, then the term "organic" has been compromised.

"Sustainable?" Does that mean "able to be maintained indefinitely without further harm to the environment," or is it being used as a buzzword? Which "organic" crops, under which conditions and climates, are "sustainable?" Does anyone really know?

Let's not forget that all farmers--conventional or "organic"--grow people.

Which is not sustainable.

My BioWebScape designs I don't call them Organic. That word has been used and abused to the point that it is no longer what it was meant to be, and some people who are organic farmers use methods that work against nature like tilling.

I work with what you have already on the parcel. If need be pruning or cutting down of some plant material is done, but all the material stays on site, and use of it is maximised.

If you have a lawn, I might look for places where weeds grow, some of them are edibles, others not. If I plant something be it a plant or a seed I mulch the area, using material on the site. Cutting grass down to the roots and using that, or leaves or even rocks. Building up from a lawn or barren site is the hardest, it'll take a few years of working to grow enough food to eat off most suburban lots, unless they have left some nature grow on them.

I try to stay away from tilling in my plans, though you can use raised beds if you have a lot of organic matter handy, or you can use compost or manure from human and animal sources. If I have to import organic material into the system I like to exchange it for organic material or food crops, keeping a balance in and balance out. Though given how erosion works and how the sun can change organic matter and all those other processes, some movement of organic inputs are okay, because the system is more in flux than we give it credit.

If I raise animals in a design, all the food for the animals needs to come from the parcel and not be imported from a grain crop somewhere, unless the grain crop is using the same methods as my design, but then the manure must be exchanged completing the cycle. The whole in and out cycling is still a work in progress, but the plan is to limit the use of foods from outside the parcel of land to get a better understanding of how long term it is and if the numbers really do work out like I think they can.

Basically the land use has to be sustainable for humans and for the animals we place on it, but then there is the animals that visit, how do you account for them? How do you account for things like houses already on site, do you only use rainfall and not the streams that flow over the land? Do you only use rainfall and not ground water? Do you use solar power via panels you brought at the store? I am still trying to work out the details of whether someone plopped down on a parcel of land can use it and only what is there for living, and not import anything else besides seeds and young plants from places which have a climate like the parcel does.

So yes, BioWebScape designs are a work in progress, and maybe in the long run I'll be the only one pracicing my own designs, but I hope to get enough information gathered, so that others can at least use it to plan out their niche in the world. With over 20,000 edible species of plants out there, there should be more than enough variety for everyone, whereever they live.

Just one acre of ground per person living today is about 11 million square miles if you use the high number of 7 billion people. That seems more than enough to feed them all, without fossil fuel inputs and only using the plant materials found on the land and with methods that do not distroy the land's ability to stay healthy.

Charles,

BioWebScape designs for a better fed future.

Have you seen any Mercury thermometers lately?

Have you seen any Mercury anything lately?

What ever happened to Merucry?

It's in our fish and our children's neurons. It is moving up the food chain in everything downstream/wind of a coal-fired power plant or a Nevada gold mine. Collateral damage in the march to a healthy economy

progress!!!

Just wait till the dioxins kick in when we burn the rubbish tips for heat..

Hi leduck,

The lighting industry, for one, is using a lot less mercury than in the past. Not long ago, a traditional F34 or F40T12 lamp contained up to 20 mg of Hg. These lamps have a rated service life of approximately 20,000 hours. Today, a replacement F32T8 contains as little as 1.7 mg and lasts up to 42,000 hours (e.g., http://www.nam.lighting.philips.com/us/ecatalog/catalogs/p-5569.pdf).

Older T12 lighting is being gradually phased out, but according to a recent article in LD+A, there are an estimated 500 million T12 lamps still in operation within the United States alone. The good news is that these lamps will no longer be manufactured or imported for sale as at July 1, 2012, so their days are numbered. Our firm, like many others, recycles every T12 lamp we remove from service and the Hg that is recovered can be reused to produce three, four or more T8s.

In addition to the Hg that's physically contained inside these lamps, converting from T12 to T8 will dramatically reduce the amount of Hg that is released into our environment through the burning of coal. For example, based on Nova Scotia Power's current generation mix, converting just ONE 4-lamp T12 troffer to T8 will prevent the release of some 47 mg of Hg over the life of the replacement lamps.

Edit #1: Seems I was a bit too conservative in my estimate of Hg content. According to the Philips brochure linked above, the average 4 ft. T12 manufactured in 1994 contained 22.9 mg of Hg (in years prior to this, the amount would have been presumably much higher as the industry has been steadily reducing its dousing for quite some time). It's also worth noting that Philip's Alto II lamps use 100 percent recycled/reclaimed mercury.

Edit #2: Yooza ! Seems I was even more shy of the mark than first thought. According to Osram Sylvania, the average 4 ft. lamp manufactured in 1990 contained an average of 43 mg.

Source: http://www.sylvania.com/cgi-bin/MsmGo.exe?grab_id=110&page_id=13894656&q...

Best hopes for more environmentally responsible firms like Philips (and Osram Sylvania)!

Cheers,

Paul

Paul,

Your comments are always a joy to read!

-- Jon

Thanks, Jon. I'd like to thank you in return for the graphic presentations and analysis you've shared with us; they add considerable clarity and richness to this data and much added value to the conversation.

Cheers,

Paul

Toxicity, primarily. Mercury is also bad news in contact with aluminium, or even steel.

At one time I looked into using mercury ballast instead of lead ballast, as the density is higher and the ability to cold-pour would have been useful. Unfortunately it needed a ceramic receptacle. And it was going to violate MARPOL.

Does Honeywell still make the classic round thermostat? Each one of them has/had a glob of mercury in the switch bulb that tilts up and down to cycle the HVAC. They work great and basically never fail but I cringe to think of how many of those end up in landfills. If they were recycled the mercury would be easy to recover.

Hi Walt,

I have three of those Honeywell classic round thermostats in our home and each reportedly contains some 3,000 mg of Hg (see: http://www.purdue.edu/envirosoft/mercbuild/src/devicepage.htm). In hindsight, I should have installed electronic/programmable units as I can't guarantee they'll be properly disposed after this home changes hands.

Also, many older homes are fitted with light switches that contain Hg (they were popular years ago because they're completely silent). Apparently, each contain approximately 2,000 mg of Hg.

Addendum: To put this into context, a 20-watt Philips SLS Marathon CFL contains 2.64 mg of Hg, so the mercury found inside just one of these silent wall switches would roughly equal 750 of these CFLs and a Honeywell round thermostat would exceed 1,100.

Cheers,

Paul

Thanks Paul. I had forgotten about all those silent mercury switches out there, even more likely to be disposed of casually rather than recycled. Of course from a purely technical standpoint mercury is an ideal contacting medium because the contacting surface is always in flux and so no degradation from arcing or wear. Solid metal OTOH provides a fixed contact surface which is subject to wear and degradation over time. It is encouraging to learn of the extent to which modern fluorescent lighting has reduced mercury content as well as increased efficiency.

Re: Relax, there’s plenty of oil and gas (uptop)

March 14, 2010

http://www.forbes.com/markets/free_forbes/2004/1101/041.html

Capitalism's Amazing Resilience

November 1, 2004

Incidentally, Yergin was dead wrong about the oil markets in late 2004. The price of oil went up to balance demand against flat to declining crude supply. But rest assured, "Yergin knows oil."

And Yergin's prediction--for a long term price ceiling of $38--was really remarkable. Based on 64 monthly data points, he nailed the price floor over this time period (11/04 to 2/10). The monthly spot price over the 64 month period ranged from a low of $39 in February, 2009 to a high of $134 in June, 2008, with a 64 month average price of $72, i.e., a little less than twice his predicted long term price:

Chris Nelder picked up on that theme a week or so ago and concluded that no economic recovery was possible given that we were "conserving oil" by shrinking our productive capacity. Awash in crude, indeed. Too bad we can't eat it.

We've seen businesses fail @ $30 a barrel, they couldn't make a profit unless oil cost less than $20. These were the most vulnerable: heavy, energy dependent manufacturing industries. The high worker pay plus higher aggregate energy costs ruined these companies' bottom line. While their input costs rose their returns declined as higher prices constrained sales volume; they sold at higher prices but lost money on declining sales. Result: factories closed and jobs sent to China and Mexico.

At $40 a barrel, businesses that couldn't make a profit unless oil cost less than $35 failed. These were businesses that had widespread customer bases such as light industry and real estate developers. Those who didn't flat out fail began to rely on credit as a substitute for top line returns. Again, input costs rose while returns declined as higher prices throttled sales volume; companies sold at higher prices but lost money on declining sales volume.

At $50 a barrel, the next level of vulnerable businesses failed. Now, house prices and other bits of exurbia were coming under price and interest rate pressure. The higher money cost plus higher aggregate energy costs rose while returns declined as higher prices throttled sales volume; companies sold at higher prices but margins shrank on declining sales volume.

At $60 a barrel, business failure had invaded the securitization markets.

At $80 a barrel the refining industry is now facing higher input costs while the increase is constraining overall demand. This time it is high sunk capital costs to expand capacity and accommodate increasingly sour feed-stocks added to increased energy costs themselves are ruining the refining industry's bottom line.

In every case the dynamic has been the same; increased costs destroying an industry segment profit margin as the cost to end users destroys demand and the input costs overtake cash flows.

Gasoline refining lacks its spark, for now

A few more refinery closings and there is going to be a real problem.

A nice summary Steve. oddly enough you and add the oil/NG industry to the group damaged by $100+ oil. Counterintuitive I know but the dynamics were there: "increased costs destroying an industry segment profit margin as the cost to end users destroys demand and the input costs overtake cash flows." As prices rose so did activity. This led to a very rapid inflation in leasing, drilling and completion costs. Consider the fate of Devon. During the summer of ‘08 they were leasing every drill rig available for their shale gas play regardless of the costs. Just 6 months later, with NG prices falling, they pay a $40 million penalty to drop 14 of the 18 rigs they had in the SG play. A few days ago they announced the sale of their Deep Water GOM and Brazil for $7 billion cash. Their future is unknown but I won’t be surprised to see them absorbed by another company within the year. Same thing is happening throughout the industry: Schlumberger acquiring Smith Industries. Most don’t realize but this is a huge consolidation. Don’t have the numbers but unemployment in the oil patch has been every significant. This isn’t a unique event. The oil boom of the late 70’s led to a boom in drilling. The subsequent price collapse and bust destroyed a very big segment of the industry.

This dynamic will have an impact as the effects of PO become more significant. A common assumption is that increasing prices will again spur more oil/NG development. Granted we could never drill ourselves out of PO but the industry is a major employer and source of tax revenue. We might not see an increase in activity with rising prices as we’ve seen in past periods. During recent time we’ve seen oil/NG prices more then adequate to spur conventional oil/NG development but it didn’t happen to degree it should have IMHO. This may be due to a combination of restricted capital availability and the very recent memory of huge losses suffered as the3 cycle swung back.

westexas:

Thanks for the perspective.

This is all so much propaganda. In a functioning society, guys like Yergin would be laughed off and would have to find a job in the circus.

I don't wish to sound too paranoid, but I sense things are starting to loosen up a bit. The maintream publications are getting more brazen with their BS, while people on the street fill up the tank and see the bill for themselves. The disconnect is surreal. Tread carefully and best of luck.

Yes. To correct anyone because they just plain got it wrong is considered to be elitist paternalism. They are instantly voted out of the debate for poor manners. So the people are becoming gloriously disconnected from truth. Especially with regards to any of the limits togrowth issues, all sorts of bizzare things like abiotic oil are being pushed. Its all political, any acknowledgement of the possibility of peak anything is assumed to help the pinko-liberal commies, and that just can't be permitted.

WT: Interesting that the "Relax" article was written by a guy named Jim Jones. He's definitely drinking the CERA Kool-Aid on this one.

And Yerginites, true believers in the Fantasy Island myth of non-depleting oil fields, will probably have, at least financially, the same reaction to the Kool-Aid that the unfortunate residents of Jonestown had.

and yet MSM keeps turning to yergin for predictions and forcasts.

Anybody hear David Brooks on NPR last week?

He was telling Washington to remember Wall Street, 'Where the smart people are..'

I'm getting ready to trade my pledge for a sledge.

wt, I find the most fascinating aspect of Yergin to be his moniker amongst the media top end publications, i.e. "The Most Knowledgable man about oil." That quote was not in that article, but I have seen words to that effect numerous times. Somehow they picked Yergin of all people for that title. I suppose he keeps the BAU crowd filled with hope for the same old stuff at a reasonable price, ad infinitum, and that has value to their wishful readers.

Yergin saying US oil demand dropped 2 million barrels last year is factually incorrect. It did drop about 2 million barrels from late summer 2007 until about late 2009. In recent weeks, the demand trends is decidely upward - so it appears the US oil demand downturn is finished for now.

While some say an $80 oil price is the highest it can go without pushing the US economy into recession, I think a price of $90 may be closer to a tipping point - and it may have to reach $100 to have a significant effect of gasoline demand.

But I do agree that US demand will be dropping later on at the same time Chindia will continue to demand more. And with their population about 8 or 9 times larger, a small drop in the US will be more than overcome by those countries.

Disagree on 90.

I've seen no convincing evidence to suggest that there is a top price for oil.

The crash in prices accepted.

I've seen plenty that suggests that the crash in prices was a very interesting event with a complex set of causes that had little to do with fundamental changes in demand.

A substantial amount of demand was deferred by the credit shock. We certainly saw a lot of valid and real economic activity that was viable simply stop because of problems in the financial world. The net result is the entire world basically took at least 1-2 days off of work. Of course this did not slow oil production and this breather if you will caused by the sharp onset of the credit crisis allowed a build in oil.

There is a lot more to it than that with the hurricanes also playing a big role but the point is that the shock itself along with the hurricanes resulted in deferred demand. The collapse of housing construction resulted in some real demand loss.

Further collapses in construction will have little impact on demand as its already very low a 50% further drop does not change much. As long as the economy continues to function the chances of even that level of drop are low as people still have money and many will continue to build. Albeit probably at and ever slower rate but it tails out pretty much from here.

I'd argue another credit shock is unlikely simply because we could not survive it.

If or more correctly when it happens our financial system will simply collapse this time.

The hurricanes are a act of nature and who knows.

Thus none of the key contributions to the drop are likely again and further more outside of housing in general they resulted in deferred demand.

The fact that it was not a decline in demand but deferred demand is what has been steadily driving up oil prices as real demand that was deferred resurfaced.

Thus the price collapse is useless as some sort of model for future prices its a one time event and its not predictive. Certainly we could have another set of events result in a price collapse but if so they would have their own unique signature and reasons.

There is absolutely nothing preventing another set of events to come together and result in a collapse of oil prices and if so just like the last time it has no predictive value nor can it be predicted.

Whats important is its not correct to use such a set of conditions as predictive of some top price for oil thats simply wrong. As the oil price could rise to any level. Think about it this way consider the events and its obvious that they could all have happened with the price of oil at 50,80,100,150,200,250.

We could have easily gone to 200 or 250 who knows. But more important all the arguments confidently predicting some peak price for oil would have been equally valid at 50,60,80 etc. Thus they have zero predictive value. If they had happened with oil at say 60 then everyone would have been claiming 60 was the magic price point and oil can't go over that value.

Now with that said rising oil prices certainly put tremendous stress on the system and play a contributing role in being initiators if you will of a potential shock.

Just like stress on a fault line contributes to and eventual earthquake.

Sure as price rise we will eventually see some sort of earthquake if you will in our economy but it can be anything from a price collapse to war to a total collapse of the system itself. Thus although there is no real bound to oil prices there are plenty of other constraints that can lead to any number of outcomes.

This just says that BAU becomes impossible and the system will make a probably dramatic shift to operate a different way.

I'd argue that this time around its far more likely to see outright currency collapse, global economic collapse and or war than to see a simple price collapse for oil. This is because the conditions which allowed a sharp financial turmoil and resulting deepest recession no longer apply. We are past that stage and it won't be repeated.

As far as to what the future holds right now it seems clear that we will see rising prices for oil. Next if we assume this is true the next issue is how fast they increase. This will become clearer over the next couple of months obviously the rate of increase itself plays a huge role. Going to 120 in two months is not the same as say being at 90-110 by December. Regardless of how prices move my feeling is what they do over the next few months will be important.

And of course depending on how they move you then have to watch the response. Its not predictable and there are simply to many possibilities.

My opinion is that we will see prices begin to increase sharply and people will find that demand is surprisingly resilient up to higher prices then most will believe. However if so then the entire economy is effectively dead over the short to longer term as the reason it can go high is its effectively using up its reserves. This sets up the mother of all events and the price of oil will quickly be the least of our problems more likely the willingness to accept the currencies we use now for oil at all will be a problem as exporting countries become unwilling to even accept the fiat currencies at any price. Thus there is no dollar price for oil simply because no one will sell it to you for dollars.

If this is true then its a good chance you see war before our currencies are completely rejected.

Who knows but If I'm right then we are headed towards this sort of fundamental crisis not a simple shock.

"I've seen no convincing evidence to suggest that there is a top price for oil."

Surely you jest. $1,000 a barrel would not be a top price? Then how about $2,000 a barrel? There is always a top price for absolutely everything. Even if you must pay for life over death, the limit of your funds becomes the top price for life.

"I'd argue another credit shock is unlikely simply because we could not survive it.

If or more correctly when it happens our financial system will simply collapse this time."

That's what a credit shock could cause, the collapse of our financial system. Simply because we could not survive it is no guarantee that it could not happen.

I do however believe our economy could survive $90 oil. It would keep us in this deep recession but it would not likely tip us into a depression. I think the tipping point would be somewhere between $100 and $200 a barrel. A price that high would throw the economy into a much deeper recession that would, within a few months, tip us right into another Great Depression. But there would be no recovery from this one.

Ron P.

Why should there be a limit ?

As I mentioned before and as you state the highest price you can pay is your life however thats not the limit on the price. What if we end up with nuclear war or biological war whats the price of that I'd argue greater than the loss of human life alone. Next of course you have to consider not only potential lives lost now but the effects on future generations of humans and of course the planet itself depending on what lengths we go to.

Consider Iraq sure there has been tremendous loss of life to date but what are the difficult to measure effects from both previous war and political jocking for oil and current issues one the future. Indeed Iraq itself exists because of meddling in the region for oil in preceding decades.

If this concept of a top price for oil was true then we would not be in Iraq right now. If one spend even a few moments considering simply the cost of maintaining the military industrial complex required to partly ensure oil supplies then what are we paying right now. Far more than the nominal price on a barrel thats for sure.

So I stand by what I say there is no top price for oil only the collapse of our oil based civilization will stop our insatiable demand for oil at any price no matter how great.

Like any drug addict we can certainly kill ourselves in our attempt to fulfill our needs and also like any drug addict we will continue to do whatever it takes to meet our needs until we eventually die trying.

If there was some real limit then we have had plenty of opportunities to kick the oil addiction and plenty of warning signs that suggest it could well prove fatal we have not therefore we won't. You have 100 years of history backing this and thousands of years of previous history of how humans have acted in the face of dwindling resources suggesting that the chances of change are slim and the chances of collapse almost certain.

Against this we have a period of less than one year of falling prices and a huge number of simplistic crackpot theories explaining why oil prices cannot go higher.

Most variants of the peak demand argument.

And whats really funny is the holders of these theories are so certain of their validity they don't even feel the need to justify them if someone points out that history suggests otherwise.

While my own theory suggests that this fanatical blindness is indeed one of the main reasons why there is no limit to the price of oil. This practically mass delusion with I swear only a hand full of people capable of recognizing it for what it is happens to be one of the critical factors ensuring that oil prices can rise without limit or to the point that the entire system self destructs.

All it is is the junkie rationalizing why he can get just one more fix and theres sure to be more drugs he can afford.

Prove it.

I'll make my argument.

Now again back to my own analysis I'd argue that as prices rose over 80 that recognition that the economy could no longer grow happened and as they rose higher this recognition turned to fear. This fear has nothing to do with oil itself but recognition that the massive amounts of outstanding debts we have would never be repayable in a high priced oil economy. Certain doom for our current banking system not necessarily unaffordable oil. Next the shutting down of Bear Stearns and Lehman was a deliberate act on the part of the US Government that obviously sparked the financial crisis. I'm not going to go into all the other facets but this alone is sufficient to question the chain of events. Regardless given the price of oil fell substantially as the world stood on the brink of collapse. One has to assume that a real oil surplus had to play a role in this also. Otherwise even this financial move could not have contained it. So during the price fall we have two reasonable facts. One that the financial crisis we deliberately started next that at the same time a physical oversupply of oil had to have developed or existed my full theory suggests that the required oil was probably stored up before the US made its financial move. The point is not the details of my theory but the claim its reasonable to assume that we managed to ensure the world was briefly well supplied with oil and that the initiation of the financial crisis was premeditated.

Now I suspect that although it was started on purpose that events did not unfold as expected I'd have to imagine that the original goal was simply to tame the economy tone it down a bit and let oil prices back off. I'd argue that initially one has to imagine that at worst most people expected this to simply slow the rate of growth not escalate as it did. I assume the reasoning was that the price was more than high enough for oil to spur further development and it was approaching dangerous levels.

Indeed we have seen the Saudi's repeatedly suggest that 70-80 was a fair price for oil and more than high enough to spur expansion of production and it fits well with everything I've seen concerning development costs. Fine I have no problem with that.

However I see no reason to not believe that the low prices where not the result of a chain of events which resulted in a brief surplus of oil. Indeed once oil hit its lows a massive contango existed and prices have risen steadily till now.

Certainly its fascinating and I have studied the time period extensively and come to my own conclusions. The most important to repeat myself is there is no indication that it was a fundamental event. Indeed the more I dug the more I become convinced it was and orchestrated event that got well out of hand.

In many ways a lot like the Japanese attack on Pearl Harbor. It succeeded far better than I suspect the Japanese thought it would and also history shows turned out to be a really really bad idea and it did not take long for this to become clear. And just like Pearl Harbor pundits claiming it was a fundamental event and ignoring the real basics will miss the truth.

Now although I did not give my full theory its rather obvious that underlying it are some fairly extraordinary claims. However my basic thesis is we are oil addicts and will do anything to keep our addiction going. If so then given this baseline the claims are not only not extraordinary they are fairly mild and represent the tip of the iceberg so to speak of what we could possibly do or more likely have already done if you bother to read up on some of the changes to US law.

Thus if I'm right the sad part is not that your wrong but that the horror's we will face in the future are difficult to imagine as we go to ever greater lengths to meet our addiction. But this utter revulsion is a common response when one views a drug addled addict mired in his own filth and delusion.

I hope I'm wrong but I see nothing that to justify a different conclusion.

Chilling yes but the human wreckage of addiction can readily be found on most downtown street corners the scale does not change the outcome.

Now you are just being silly. You know very well there is no way to prove an economic hypothesis before it happens. One can only rely on the logic of what is most likely to happen.

All but one of the recessions since the Great Depression has been brought on by high oil prices. And every incidence of very high oil prices has brought on a recession. Now you might insist that this was just a coincidence but most would not.

High oil prices are like a higher tax on everyone and every business. The higher this tax the the less they have to spend on other things and the greater the drag on the economy. There is a limit as to how high this tax can go before it drags the economy into a deep recession. No, I will not try to prove it, I will just insist that everyone use their common sense.

Ron Patterson

Careful, or you'll prove the case for lower taxation while you're at it.

Thats not the point the point is the claim that this leads to low oil prices or some sort of cap. I claim it does not. The impact of high oil prices is not uniform across industries regardless of the amount of oil they use. And obvious example is that the food industry and the nail salon industry both use differing amounts of oil however as oil prices increase one can expect the nail salon industry to take the brunt of the hit even though the food industry uses more oil.

If you read my scenarios they are full of contraction and destruction of equity and impoverishment however they are also simply suggesting that rising oil prices forces the economy steadily into a leaner and meaner form generally via reduction of debt almost universally via default on debt.

Its wrong to claim a general recession as the certain outcome in fact its fairly clear already that some business areas of suffered disproportionately to others. Housing and the Hotel industry are for example in the midst of a deep depression.

The key is to recognize that persistently high and rising oil prices do not trigger a traditional recession but trigger a economic evolution thats not captured with simple average like GDP.

Your wrong to call it a recession it is not is a fundamental and steady shift in the economy away from debt to increase daily cash flow. As oil prices increase certainly a lot of this cash flow will be diverted to oil but whats not used for oil food and shelter will be spent on a new mix of goods and services. Some might finally be saved as consumers loose access to all credit. The most wrenching aspect is of course the rejection of long term debt in the form of cars and homes.

But other than that its very much a shift in spending patterns. Some will benefit some will not. Exactly what consumers in general decide is important is unknown.

In general I expect them to keep the mobile phones, cars and cable tv and internet for example. Changes in housing I've discussed to the point it does not need repeating. Other shifts of interest is for example the rebound in restaurant traffic for example. I suspect to cheaper places and cheaper menu items but taking the family out to eat every now and then is a pleasure most can still afford and its one people will do. I've been unemployed for a while and I still take my kids to McDonalds certainly not as often but they enjoy it so I indulge them.

What I don't do is go to the high end restaurants that me and my wife like from time to time. I have no problem with this. I've been many times and don't need to go. My point is my own spending patterns have changed and will evolve overtime.

So far my oil usage has not changed one bit but I worked at home before. I.e I was already basically inelastic in my demand so I don't have any really easy way to conserve. I'm obviously using myself as a test subject but in general the evolution of my spending patterns fits well with the general situation. Massive pullback in large capitol outlays and retention of the smaller pleasures in life including driving.

Thus I stand by my claim you have proved nothing and your claims have no merit.

http://feeds.bignewsnetwork.com/?sid=592615

If you would actually try and seriously back your theory then I argue the facts speak for themselves and the pattern of economic transition is clear. Its not a recession and has nothing to do with a recession.

I have very little disagreement with almost all your points. Gasoline demand is down only 2% from its 2007 peak despite massive unemployment - and is on its way back up again. I was just referring to the statements made by many here that oil over $80 more or less automatically results in a US recession. To clarify, I do not see the economic balance tip into recession again until closer to $100.

I just posted a few days ago that it was my conclusion that $100 is what Iraq needs to develop its oil fields - the fields which are the last shining hope in the darkening world of post peak oil.

Although I think the oil is on a fast trend upward, there is a possibility of some combination of a dollar and bond market crash almost any time that will lead to a temporary panic liquidation of most everything.

Having said that, it looks like the US government will simply guarantee everything in a more traditional financial crisis like we saw in 2008 - 2009, and next time, I expect oil to soar in a purely financial crisis. Eventually the dollar will no longer be the benchmark by which we measure oil, but that will take a few more years or so to develop.

At some point its difficult to predict as the system itself comes unhinged and its like trying to measure using a ruler that on fire.

I think we both see this. Now as far as a US recession goes as oil prices go over 100 almost certainly indeed outside of dubious government numbers its not clear we even left the last recession. Certainly the rate of economic contraction slowed but other than believing the Chinese and US governments there is little to indicate we have not steadily seen the overall economy drift downward.

Next I seriously question the magnitude of the drop in US consumption secondary measures such as VMT and rail and truck data do not point to as large a sustained drop. I don't like the averages because they are very misleading we had a very intense negative spike in demand not just in the US but world wide at the hight of the financial crises followed by a fairly robust rebound as deferred demand returned.

I don't agree with averaging across such and event. In any case if one takes the negative demand spike from financial crisis and hurricanes as a one time event that generally resulted in deferred demand then the real demand drop is probably much closer to 0.5-1% with the collapse of housing construction making up the bulk of this. As far as data goes the EIA data is in general in my opinion not to be trusted especially claimed storage levels. Refinery utilization for example is suspicious not in its rate of change but in its basic level because the amount of capacity thats realistically usable is very questionable.

Assuming we are significantly post peak for production it makes sense that we will have a large amount of refining capacity that will never be used simply because the oil is not there to refine. As far as I can tell refinery capacity is overstated for a long time after it peaks. Real capacity is actually much lower.

So although I don't disagree with the changes reported by the EIA in refining levels I think the precentage of true usable capacity is much higher closer to 85-90% with 5% of claimed refining capacity remaining permanently shut in.

This is capacity that will never make sense to fire up in a world of high oil prices and overcapacity and thin refining margins. Its at best theoretically available if that consisting of inefficient units that will never be turned back on.