Systemic Risk Arising from a Financial System that Requires Growth in a World with Limited Oil Supply

Posted by Gail the Actuary on September 21, 2010 - 10:45am

I received an e-mail from an actuarial group ( Joint Risk Management Section of the Society of Actuaries (SOA), the Casualty Actuarial Society (CAS), and the Canadian Institute of Actuaries (CIA) in collaboration with the SOA Investment Section, the International Network of Actuaries in Risk Management ("IN-ARM") and the Enterprise Risk Management Institute International ("ERM-II")) asking for essays relating to "Systemic Risk, Financial Reform, and Moving forward from the Financial Crisis."

Below the fold is the essay I submitted. It is called, "Systemic Risk Arising from a Financial System that Requires Growth in a World with Limited Oil Supply". Essays were limited to 1,500 words. The group calling for essays is made up of people who for the most part know very little about peak oil, or about oil in general. It is likely that actuaries who will eventually read the essays will be equally unknowledgeable. So the challenge was to describe the nature of the problem, starting from a knowledge level of close to zero, in as few words as possible.

The point I try to make in the essay is that the financial system requires economic growth, but oil supply seems to be flat, or even declining in the not too distant future. Because of the many benefits oil provides, this loss can be expected to constrain economic growth. If the economic system cannot grow, there are likely to be widespread debt defaults and other problems similar to the 2008 crisis. These problems can be expected to affect all types of financial institutions, including insurance companies.

Systemic Risk Arising from a Financial System that Requires Growth

in a World with Limited Oil Supply

In July of this year, Lloyds of London issued a white paper on the risks of peak oil, noting that we are headed toward a global supply crunch.1 In September, 2010, a paper was published in Energy Policy called “Global oil depletion: A review of the evidence.”2 It concludes, “A peak of conventional oil production before 2030 appears likely, and there is a significant risk of a peak in oil production before 2020.” In other words, the world’s conventional oil production may start declining in not too many years.

It seems to me that if we are in fact reaching limits with respect to oil supply, this should be of considerable concern. We have a financial system that demands economic growth, for reasons that will be discussed later in this paper. At the same time, as we approach limits with respect to oil production, the ability of the world’s economy to grow becomes constrained, because in order for economic growth to occur, we will need to do more and more, with less and less oil.

The conflict of these two forces – a need for economic growth in a world that can no longer provide growing oil supply – sets the financial system up for a systemic risk of collapse. Furthermore, there is significant evidence that the financial problems of 2008 were early signs of this systemic risk affecting the financial system. If oil supply should actually begin to decline in the future, we can expect financial problems of 2008 to return and worsen.

Oil’s Connection to the Economy

Oil is used for a huge number of purposes—transportation fuel, heating fuel, fuel for extracting minerals of all types, lubricant, and raw material for asphalt for road paving, plastics, synthetic cloth, medicines, fertilizer, pesticides, and herbicides, to name a few things. A declining oil supply, or even a level supply, should be a serious concern, with the world’s rising population.

In recent years, there have been many attempts to try to find substitutes for oil, but with very limited success. Ethanol from corn has probably been the biggest success, but in 2009, its use in the US amounted to only 660,000 barrels a day3, compared to total consumption of oil products of 18.8 million barrels a day4, or 3.5% of the total. Raising this percentage is proving difficult for several reasons: manufacturers’ warranties only permit the use of 10% ethanol in gasoline; ethanol tends to be more expensive than gasoline without subsides; and there are relatively few stations offering E-85 gasoline.

Other so-called replacements for oil are only very partial replacements, and are still very far away from being full-scale solutions. Biofuel from algae is being investigated, but it is still very expensive, and not yet scalable. Electric cars are being developed, but they still are many years from being ready to replace our huge fleet of cars with internal combustion engines.

It should noted that the problem with oil supply is really an economic one. There is a huge amount of oil theoretically available—in the oil sands in Canada, for example, and in the oil shale in the US west, and perhaps in the Middle East. But in order for this oil to be available now, huge investments would need to have been made starting at least 10 years ago. Also, in order to justify this investment, the cost of the finished oil products would need to be very high—high relative to the energy required to extract the oil, and high relative to people’s salaries. At some point, limits are reached in the amount people can afford to pay for oil, and we may already approaching those limits.5

Timing

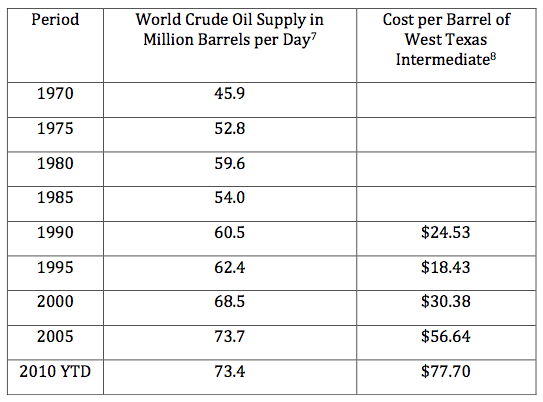

Many observers would like us to believe that limits on oil and other resources are still a long way off, but this is not really true. World crude oil production has already stopped rising. Oil production has been essentially flat from 2005 to 2010,6 meaning that more and more cars and trucks must compete for the same fuel supply.

Impacts

While crude oil supply has not yet begun declining, it had been essentially flat since 2005, and this lack of growth is putting tremendous pressure on the world’s financial system, since we now must do more and more with essentially the same oil supply. Oil prices have risen, and this is one source of financial problems, because higher oil prices have a disruptive impact on balance of payments, and can also cause a reduction in profits of companies.

But higher oil prices can also lead to recession and debt defaults. High oil prices don’t give ordinary citizens more salary to spend, so they have to cut back on something else. One possibility is a cutback in discretionary spending, which will tend to lead to recession. If the cutback is in buying new homes, the price of new homes can be expected to drop. James Hamilton wrote a paper called, “Causes and Consequences of the Oil Shock of 2007-2008” showing that the run up in oil prices in the years prior to 2008 was sufficient to cause the major recession we have recently experienced.9

If oil prices rise, they may also cause debt defaults. This occurs because people’s salaries don’t rise correspondingly, so they need to cut back somewhere, and some will default on debts. Businesses may also be more at risk of debt defaults, if their cash flow is declining. The lower values of homes may also play a role in increasing defaults.

While one cannot prove that the aforementioned problems were the only causes of the financial crisis of 2008, there is certainly a strong similarity between the expected problems and the types of problems we have recently seen.

It should be noted, too, that a seeming over-supply of oil should not be surprising. As higher prices give rise to recession, this causes a cutback in demand. Reduction in credit availability also tends to reduce demand. So the oil available may be more expensive than what individuals and businesses can afford. If the oil available were cheaper, the oversupply would disappear.

Economic System’s Need for Growth

Our current economic system includes a huge amount of debt. Money is loaned into existence. Debt is used to finance many business expansions. Governments rely heavily on debt.

The US economy has been growing for many years, with only brief interruptions, so nearly all of our experience with borrowing money, and paying it back with interest, has been during periods of economic growth.

Borrowing from the future is relatively easy when the economy is growing, because when the time comes to pay back the debt, the debtor’s economic condition is likely to be as good as it was when the loan was taken out, and may even be better. So defaults are relatively uncommon, and the growth in the economy between the time the loan was taken out and the time it is repaid provides some contribution toward the interest payments.

But what if we start encountering a very different kind of world, one with a decline in oil supplies? If oil resources constrain economic growth, debt defaults can be expected to rise, and the whole debt system underlying our financial system is at risk. Insurance companies are very much at risk too, because many of their assets are bonds. In the past, these bonds would have been repaid with interest, but in a world with little economic growth, and perhaps economic decline, the risk of default becomes much higher.

Even if we should discover a way around our problems—say a new technology, which permits more oil extraction at lower cost, or a better substitute for oil, financial institutions--including insurance companies--are still likely to encounter substantial systemic risk related to debt defaults in the next few years.

Notes

1Lloyds of London, Sustainable Energy Security: Strategic risks and opportunities for business, Chatham House, London. http://www.chathamhouse.org.uk/files/16720_0610_froggatt_lahn.pdf

2S Sorrel, J Spiers, R Bentley, A Brandt, and R Miller, Global Oil Depletion: A review of the evidence, Energy Policy, Vol 38, Issue 9, 5209-5295.

3US Energy Information Administration, refiners inputs of ethanol, http://www.eia.gov/dnav/pet/pet_pnp_inpt_dc_nus_mbblpd_a.htm

4US Energy Information Administration, product supplied, http://www.eia.gov/dnav/pet/pet_cons_psup_dc_nus_mbblpd_a.htm

5David Murphy, “Further Evidence of the Influence of Energy on the US Economy”, The Oil Drum, April16, 2009. http://netenergy.theoildrum.com/node/5304

6US Energy Information Administration, International Petroleum Monthly, Crude and Condensate from Table 1.1d. http://www.eia.doe.gov/ipm/supply.html

7US Energy Information Administration, International Petroleum Monthly, Crude and Condensate from Tables 1.1d and 4.1d. http://www.eia.doe.gov/ipm/supply.html

8US Energy Information Administration, Cushing , OK WTI spot price FOB. http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=rwtc&f=a

9James Hamilton, Causes and Consequences of the Oil Shock of 2007-2008, Brookings Papers on Economic Activity, 2009. http://www.brookings.edu/economics/bpea/~/media/Files/Programs/ES/BPEA/2...

Truly excellent essay Gail.

You present the situation in a way that newcomers can appreciate and invite them to consider the consequences rather than telling them exactly what they will be or how they will play out.

Here at TOD we don't always appreciate the effort you put in to communicating with professionals outside of science and engineering. And from the looks of it you are doing a fantastic job.

Regards,

Jon

There seem to be other actuaries following TOD, who send me e-mails alerting me to things I should respond to, and mentioning upcoming events. Someone sent me an e-mail about this, or I might have missed it.

I was asked by a TOD reader to submit a proposal for presentation at an actuarial conference next March in New Orleans. This was accepted, so I will be doing that as well.

Excellent essay, looks like Gail the Actuary was channeling M. King Hubbert himself.

Reaction of one of these unknowledgeable actuaries upon reading the essay...

Sheesh! What a doomer this Gail person must be, has she no faith in human ingenuity?! >;^)

That is a problem. I tried to bring in Lloyd's of London report, to give a little more credence that it wasn't just me. But it is a difficult view to overcome.

You could also reference the reports by the US Joint Forces Command and the German Ministry of Defense. I have also read references to a report by the US Army but I'm not sure that that isn't the report by Joint Forces Command.

I was running out of words.

Well, human ingenuity will have come into play in figuring out how to cope with a system designed for growth that has hit its limits.

You can't put a pint of beer in a 12 ounce glass.

Sure you can! Put 12 ounces in it, give it to me, I'll drink the 12 ounces hand you the empty glass, tell you put the remaining 4 ounces in my glass and to get few more pints because one pint ain't going to be enough >;^)

How ingenious!

American beer companies would simply define 12oz as a pint :(

NAOM

Actually, the redefinition is going to have to be in what kind of lifestyle is acceptable going on. The real problem is this pig-shit meme that "my children have to have a better life than I did", that was used to sell big houses, secondary education, and immigrant labor.

It's going to be a nasty job, but there are thousands of psychology manipulators studying cognitive science in the labs, studying how to tune and trim our opinion. There are peer-reviewed journals, costing $25/issue, about consumer psychology. I was reading one yesterday (the free, editorial section, asking for more and better papers.)

http://www.journals.uchicago.edu/toc/jcr/current

Human attitudes are mass attitudes and can be changed in a relative twinkling of Karl Rove's eye. Take the Tea Party, which is making Hitler look like an amateur.

Aren't consumer psychologist mostly trying to figure out how to convince people to consume even more so corps can make even more money from them?

Gail is a fear monger and has a very weak understanding of economics. She continues to attribute the last recession to rising oil prices and discounts the impact of the banking crisis. The banks made a lot of bad loans. No story about high oil prices is necessary to explain these loan writeoffs totalling over $2 trillion dollars. The real estate bubble and its subsequent collapse is why those loans will never be repaid.

There was no debt crisis in 1973 or 1980 despite a huge increase in oil prices.

Her case is very weak.

Moreover, the Apocalypse version of Peak Oil simply delays Peak Oil's acceptance by the mainstream.

Monolithic explanations of the business cycle (recessions are always caused by oil ...) are not convincing.

Gail is a fear monger and has a very weak understanding of economics

And who has a better "understanding" of economics? You?

Most economists have a weak understanding of economics. Why should Gail be any different? Most establishment economists are useless Pollyannas, spouting propaganda.

The current situation isn't 'either- or' it is 'this PLUS that'. Debt was a hedge against the effects of rising real energy costs on output. It also brought forward demand so as to continue inventory outflows: the ongoing challenge made by industrialization is the expansion of capacity relative to demand.

The effects of energy constraints on economies is well known and widely acknowledged. Efforts to mitigate these effects include conservation, increasing the efficiencies of both production and consumption and hedging. Hedges include currency unions, deregulation and wage suppression, lowering interest rates, creation of asset/debt 'bubbles' and unrestrained expansion of credit.

Countries that were unable to hedge against energy constraints such as the Soviet Union during the late 1980's ... collapsed as costs outran income.

Gail certainly understands that the finance economy has one foot in the real world that requires energy available at a price - that allows a profit. Not many economists acknowledge this which is why individuals outside the 'dismal science' such as the novelist James Howard Kunstler ascend in credibility while economists such as Ben Bernanke and Larry Summers fall on their faces.

Did I read that Summers is returning to the relative safety of academia?

Steve,

The point is that price of oil is not the sole factor driving the economy or causing business cycle fluctuations. People like yourself and Gail engage in monotheistic view of the world where 'God' has been relabeled 'Energy'.

The per capita economic growth of the 20th century was caused by multifactor productivity growth. It was Man's ability to improve the productivity of all inputs, including energy, labor, land, and capital, that was decisive.

Simply adding more energy input does make a country richer.

There are only two recessions where oil prices were the dominant factor: 73 and 80. The 82 recession was caused by the Fed pulling up the Feds Funds rate to historic level to kill inflationary expectations. The 2008 recession was triggered by the near collapse of the global banking system.

Monolithic explanations do not do justice to the facts. However, they do appeal to weak minds.

Roderick,

I asked you a simple question:

Is there a reason you have not answered the question?

No it wasn't. This statement is the perfect example as to why only those economists who are looking at the world through the prism of biophysical economics are the only ones who actually have any understanding of reality. The rest of the economists are no better than voodoo priests casting spells and studying goat entrails.

BTW, in physics, chemistry and biology 'Energy' is real, without it, nothing works, lives or grows... most certainly not any economy.

FMagyar, Thank you for pointing this out. A link to a video (in 8 parts) of Dr. Bartlett's teaching on exponential function, peak oil & coal, population growth, democracy and thinking. http://www.youtube.com/watch?v=F-QA2rkpBSY&p=6A1FD147A45EF50D&index=1

The basic math of compounding growth is all one needs to grasp... It was my bolt-of-lightning moment.

Cheers, Matt B

The per capita economic growth of the 20th century was caused by multifactor productivity growth. It was Man's ability to improve the productivity of all inputs, including energy, labor, land, and capital, that was decisive.

Think about human history.

What has supported technological development and increased wealth other the last few thousand years has been our ability to obtain and utilise new energy sources. We started off reliant on hunted and gathered food supplying the energy to our own muscles, then we developed agriculture, which gave us more food energy at a lesser cost (a higher EROI), then we utilised animal muscle, then wind to power ocean transport, then coal and in this century oil.

The foundation of developing civilisation has always been the ability to utilise ever richer sources of energy. The availability of that energy has enabled a diminishing fraction of the population to feed the rest of us. If farmers ability to fertiliser and harvest their crops was compromised by the removal their diesel supply, barring some alternative energy source (what alternative energy source??), the population could only be fed by replacing that energy with animal and human muscle, many more of us would have to become farmers again, that would have a flow on in reducing the brain power available to support other aspects of civilisation and without the energy from fossil fuels (or an alternative) people in those professions would also have their productivity greatly reduced.

Without high EROI energy supplies the whole lot unravels.

"they do appeal to weak minds"

Classic troll bait.

Acually, actuaries are a pretty smart bunch, so it must be the rest of us that you are referring to.

The growth in debt could be a substitution for real, productive growth which is now constrained by a lack of, wait for it, energy.

Back to square one, how to manage a growth challenged economy.

Which is what we're all trying to figure out how.

Somehow, my forecasts are holding up, but those of Larry Summers et al. are proving to be nonsense.

See Peak oil and the financial markets: A forecast for 2008 and Delusions of Finance: Where we are headed.

You got one forecast right (out of how many?) and now you claiming that constitutes evidence for your good judgement?

Have you ever heard of statistics? One observation does not carry a lot of weight.

Roubini also got one forecast right. And unfortunately, he's been wrong ever since ...

So you are completely unfazed in your confidence in economics by the fact that so very few economists saw the biggest downturn in economic activity since the Great Depression coming. Even "The Economist" magazine recognized this as a kind of crisis of confidence for the field. What rock have you been living under?

What rock have you been living under?

The rock that has him post about how Gail or Ugo sucks and keeps him deaf to others asking him straight forward questions.

You related to Glen?

Not to divert attention from Gail's astute topic . . .

. . . but I'm really tired of seeing this straw man dragged into discussions at every opportunity, no matter that the stuffing has been beaten out of it innumerable times:

* "Apocalypse" comes from the Greek apocalypsis. It means "unveiling" or "revelation." The term is reserved for biblical prophets who were (reputedly) vouchsafed a vision of the future from YHWH. There are no such prophets here. I, personally, have no truck whatsoever with persons who make glamorous and/or vivid predictions about future events. I prefer specific, scientific predictions--like about the approximate date oil extraction will max out globally.

* Apocalyptic visions are essentially messianic. All such biblical visions feature a "son of Man," or a "christos," coming on clouds of glory to restore Israel and usher in a new golden era. See Daniel and John the Revelator for details. That the current world will end is a mere signpost along the way. There are no such messianic visions here. In fact, the cornucopian economists and the technotopian visionaries are much, much more "apocalyptic" (i.e. messianic) than anyone on these boards.

* The world is not going to end. No mountain will be cast into the sea, no fire will rain from the skies. Even in the case of overshoot and die-back, the world will continue rotating merrily on.

Let me repeat that: the world is not going to end, no matter how hard you may wish for it.

@mikeB "Let me repeat that: the world is not going to end, no matter how hard you may wish for it."

You might consider this essay from a fairly knowledgeable source:

http://www.theamericanscholar.org/what-the-earth-knows/

Sorry if this has been discussed recently, no doubt it has. But I've been up in the hills for a while, cloud hidden, and just stumbled across it...

It does seem quite pertinent to this discussion.

Best to you all as always.

Panama, hope you can repost the link which didn't work for me.

This seems rather nitpicky. Context is everything. No one should be trotting out ideas of the end of the world in the style of some Biblical End of Days, but the idea that the Earth will keep turning and life will still exist on it is also entirely irrelevant to the situation at hand. The decimation of modern society and an ecological die-off of modern species (and mankind) most certainly would classify as a fairly important distinction here. To many, going from First World middle-class status to Third World ghetto status would fit the bill, and no amount of stating this isn't technically the end of reality will endear them to you either.

That's why I have the phrase, "no matter how hard you may wish for it."

This reply is rude and offensive. Several papers have been published linking the GFC to the 2008 spike in oil prices - at the very least as an important contributory factor. Mainstream economists, true to their faith based belief in the price mechanism, not only ignored the obvious links between oil production and the economy and the even more obvious problems in production since Q3, 2004, but failed to see the GFC until it hit them full in the face like a wet fish. I have zero respect for most economists that inhabit the corridors of government and corporate power. There are a few such as Herman Daly, Charles Hall, Jeff Rubin and Peter Schiff who I do respect; and I doubt they would criticise Gail in the way this offensive and shallow response did.

This is the standard economists response. Question the price mechanism and all of a sudden you don't understand. The faith based belief in the price mechanism is truly idiotic; and perhaps is even one of the foundations upon which this website is built. It ignores the countless cases of civilisational collapse that have occurred over the ages. Those peoples, as ingenious and clever as us; and most likely far more in tune with their environments, were not able to increase supply in the face of resource depletion, climate change, war, desease, counter productive cultural, religious and spiritual practices etc. Our knowledge and technology is obviously the greatest it has ever been, but so are our problems.

I have a lot of faith (to use your word) in the price mechanisms of the free market. I think where people go wrong is that, because it's the best system, they think it's the perfect system. In practice the market is only as good as the players in it, and those players, being human, can fall victim to ignorance - simply a lack of information - (and what are OPEC's true reserves anyway?) their own biases, rationalizing, blind greed and blind panic.

Governments typical response to problems that occur because of these human frailties is to regulate, to makes complex "safeguards" a subject Joseph Tainter likes to study.

So do I have faith in the price mechanism. But I also understand the concept of limits. Limits are not accepted by most mainstream economists. In other words there are goods that are vital where the supply of that good, or the utility it provides (substitution), cannot be increased because of price. In the case of energy a very broad understanding of energy is required to accept that. For oil the major components of that understanding include supply itself, the laws if thermodynamics, the concept of EROI and net energy among other things.

The price mechanism is hailed as a wonderful thing when it behaves as expected but as flawed when prices do something that is puzzling or not to your particular liking. The 2008 oil futures price was remarkable for its volatility and its inexplicable rise and fall. The mechanism was working fine, it was the information in the market that was not understood by all players that caused it to spike and then crash to $35. It didn't stay there long though, and has now recovered to an equilibrium point that appears reasonably stable for now. The price is a reflection of the available information which may not always be correct, but that is the judgement call that buyers and sellers have to make.

A peculiar vagueness once again entangles the discussion.

No one is ever precise about the subject that would seem to need it most in order to establish the veracity of the speakers.

I personally think that the economic world has been so long manipulated, in so many ways, that predicting price is like predicting the location of the ribbon in the center of a ten-way tug-of-war rope. Yeah, volume lowers price, unless there's price-fixing (32" LED TV's). Regulation increases cost, unless there's corporate regulatory capture (BP, anyone?).

The corporate golems, and their executives, have no concern for the conditions affecting the lower classes, now or then. Proof? Wars, to which their children rarely attend, diseases they don't get. Buddha's father tried to shield him. It won't work for them, either.

We're slaves, and they have overseers to buffer them from any empathyn they happened to have left. Until the pitchforks and torches come out.

/rant

+5

________________

But then again, remember this brother: In the land of the blind, the one-eyed man is a kook.

Saildog,

It's not rude at all. Fear mongering is what the Apocalypse Peak Oil movement is all about.

Gail has repeatedly treated oil as the primary cause of the business cycle when it is clear that business cycles are driven by many factors.

It strains credulity to ignore the $2 trillion hole punched in the global banking balance sheet. The debt defaults were guaranteed due to the lack of credit standards and the way the loans were structured.

No need to invoke gasoline prices to see why a crisis ensured.

By the way, you don't do your own credibility any good if you can't engage in a real argument and simply whine a like kid "I don't like economists'.

Roderick

Sorry, but I did find it rude. Energy is an enabling input - it is absolutely critical. Not just the availability of energy, but the availability of growing energy supply of the rights sorts and at the right price. The absence of growth in energy supplies will/does have impacts in our capital markets. I do not pretend to understand the linkages, they are very complex. The economy can get along fine without most commodities, there most likely is a substitute. The problem with energy is that there are no substitutes. My point on the faith based belief in the price mechanism is that in and of itself it will not necessarily lead to any more supply. Energy has to be constantly be procurable at a given (growing) rate in order for economic growth to occur under the current system.

The apocalyptic view is justified because we are reaching the limits of growth; and we have no idea about how to live in a steady state or declining economy. In addition our living arrangements, (particularly the US and Australia, where I live) have been built on the assumption that cheap energy will always be available. That is patently no longer true. We have huge investments to make in re-ordering our living arrangements just as our economies are faltering. In ecological terms we have exceeded the carrying capacity for humans on earth. I have no idea how the adjustment to the long term carrying capacity will play out, but I do have concerns for my kids lives.

It also strains credulity when Roderick fails to consider why all of that money went into real estate/housing investments leading up to 2008. The byzantine financial instruments known as derivatives helped to mask the fact that such investments were exceeding the value of underlying assets by unprecedented margins. But the root cause may have been the growing lack of attractive investment opportunities in traditional areas of the industrial economy. And the main problem with many such traditional investments has become their diminishing energy return on energy invested (ERoEI aka Net Energy) and manifestations thereof.

Saildog,

Show me where I invoked faith in market mechanisms. It's totally absent from my comments.

I believe like yourself in geological limits to natural resources like oil.

But I am sick and tired of monolithic explanations of the world, including the new energy paradigm advanced by the Apocalypse Crowd.

The massive economic growth of the last two centuries was due to productivity improvements. That includes improvements in the efficiency with which energy is used.

People on this board are making Energy into a False Idol.

If you look at household income, it has little with energy consumption. The highest paid people are not consuming or generating the most energy. Lawyers, doctors, accountants, investment bankers are valued for their human capital.

Lawyers, doctors, accountants, investment bankers are valued for their human capital.

Huh. And here I was thinking that every one of those are members of a government protected guild system. Some of the guilds are stronger and more protective than others - but with the membership of the guild, they then have the power to operate or operate with certain legal protections.

Say...when you gonna answer my direct question upthread? Or does naming names mean you'd have a harder time showing up to dis on Ugo/Gail?

This board (TOD) is about "oil", not about some nebulous notion of what "energy" is.

"Productivity" in our complex civilization is owed to the fact that your power lunch lawyer, doctor, accountant, investment banker, etc. has many barrels of oil working for him (or her); enabling the super-productive person (lawyer, banker, etc.) to utter magic words that cause fleets of diesel burning trucks to barrel at 70+ MPH down asphalt smoothed roadways and that cause fleets of kerosene burning planes to barrel at 300+ MPH across the skies so as to almost instantly bring to the power lunch personage the goods and services he/she has commanded by uttering the magic words ("oh, my charge card number is: 555-4444-321")

http://news.bbc.co.uk/2/hi/8410489.stm

Disclaimer: Since there are a couple of MDs in my extended family, my guess is that specialist doctors are probably a huge drain on the economy as well. We need more GPs and good nurses with an emphasis on preventive care.

Specialists in any field should be used as effectiveness multipliers for generalists working with them, so if they are working properly they should be a net positive.

I doubt they would criticise Gail in the way this offensive and shallow response did.

Look at Mr. Becks posting history. If Gail or Udo make a key post, he shows up and makes comments.

Answering a simple question about what economists display the understanding Beck claims Gail lacks - and nothing.

Perhaps Beck knows of some magical economist that *IS* better than others and is operating with no logical flaws. I understand there is an opening at the White House for an economist. I'm rather sure they can do worse than Gail. Lets see the names of these 'better' people Rodrick Beck thinks exist.

It appears to me that it is indeed Roderick Beck who has a very weak understanding of economics. Like many of the ignorati, he confounds economics with finance which is simply the scoreboard and does nothing to explain the course of, let alone the rules of, the game.

Whether the loans are repaid or not does not negate the fact that large amounts of oil were consumed to build this stuff in the first place and that once built, an even greater amount of oil is required to continue its habitation. The markers and bets that were then made on its subsequent value is a side issue. The economic analysis shows that building it was a gigantic waste of resources that could have been better employed and now that the energy to run it is no longer available at the price it was designed for, it's value declines - just as expected. Resetting the financial system will not change the underlying economics which Gail has so succinctly outlined.

The fact that oil was consumed in building these houses and apartments is essentially irrelevant. Labor, raw materials, and land were also consumed in large quantities.

And it is clearly wrong for you to claim that the operating cost of these homes were the key factor in the real estate collapse. The key factor was the buyers were not qualified to buy these properties in the first place and the reset interest rate triggers.

They were bad loans. The jump in oil prices did not turn good loans into bad loans.

Better luck next time ....

Good luck getting anything done without them and the roads that brung 'em.

The price of oil certainly contributed to the global contraction. It's not either/or it's both:

James Hamilton is not taken too seriously in the economics community.

First of all, in many business cycle models oil prices rise before recessions. Yet the increase in the oil price is not what triggers the recession. It is the Fed raising interest rates. Oil prices are the tail of the business cylce, not the head.

To illustrate further, imagine the economy is growing fast and inflation accelerates. Then the typical Federal Reserve is to raise the Fed funds rate, which in turn raises interests rates in general.

What do you see in such a world? Oil prices rises before recessions and then falling during them.

Sounds familiar?

In any conceivable business oil prices are procyclical. That suggests that oil prices are not driving the business cycle, but reflecting the economic growth.

The only recessions in which oil prices were an exogenous shock to the system were the 73 and 80 ones.

No one seriously believes that the 82 recession or the 92 or the 2001 were oil driven.

You can make a good argument that the the increase in oil prices in 2007/2008 was demand driven and hence not the primary cause.

No, the recession was not primarily due to oil prices. It was caused the banking crisis. It was the plunge in bank credit that sealed the economy's fate.

Thanks for trying ...

I too do not believe in single causes for events. Causality is mostly a trick of language, in my view, but that is a whole other topic.

In any case, it's unfortunate that you cannot see the link between energy and the economy. However many others can't either, so you are not alone. The mainstream economists are clearly part of that group. They may never see it in their lifetime. People thought the sun revolved around the Earth for many many decades (centuries?) even after it became clear that the reverse was true.

Energy is clearly a key component of any economy and this can be seen by a simple thought experiment.

Take away all the oil, instantly, and how much of the economy operates?

The answer is obviously "not much." Then we would see a cascading failure across all our systems until we reorganized at a lower level of activity.

To me, this is self-evident, which is why the Oil Shockwave simulations exists:

http://www.secureenergy.org/projects/oil-shockwave

It simulates the condition of a slight drop in oil availability and examines the consequences of that. The operating assumption is clearly that decreases in energy availability will impact the economy.

So, good luck with your worldview...I believe it is gravely incorrect but the world is a big place and people think all sorts of strange things. I once had a conversation with someone who believed that homo sapiens were on the cusp of turning into beings of light and this fellow — in his mind — had all the evidence for it.

Rod, you must also not see a link between oxygen and your ability to walk up a flight of stairs.

Yeah, interest rates made the price of oil go up. Look who is now making simplistic statements of cause and effect.

Of course it is all related. You should research Liebig's Law of the Minimum. Liebig's Law points out that the resource in shortest supply is the one that will cause problems first. We could have kept "extending and pretending" with our credit consumption, borrowing from future growth indefinitely, if only that continuous growth was possible. This growth was built into the system as a given. Once we hit some hard limits the system ceased to function correctly. There are many of these hard limits that we face, but oil is the "Minimum".

It is understandable that you are confused. The numbers in this matter are confusing. A lot of people have a lot of reasons to obscure them. The very nature of oil makes it hard to know exactly what is going on even without obstruction.

When the numbers are in doubt, don't look at the numbers, look at the behavior of the insiders.

We drill in deep water at high cost just because it is fun? We extract oil from Alberta sands at ~$40 per barrel and untold environmental damage because we like the challenge?

If your oxygen supply drops by 20% are you going to make it up that flight of stairs as quickly? What about 30%? 50%? 100%?

DD

Well, here's another little uninformed opinion for you.

Oil Price Feedback.

It's what will stop oil as a viable fuel source long before we ever get close to running out. Here's how it works.

At some point, oil prices start to increase due to an unchangeable factor (i.e. depletion combined with high demand).

Higher oil prices start working their way down the value chain, making all processes and products whose cost is dependent on oil to some degree, more expensive.

One of the processes that gets more expensive is the acquisition, extraction, and processing of oil and the distribution of petroleum products. This effectively starts to raise the price of oil, which makes oil more expensive, which raises the cost of getting oil, which makes oil more expensive, which raises the cost of getting oil, which...

You get the picture. By the way, since this is a recursive function, it's growth will be nonlinear. Expect a fast run up in prices.

Eventually, demand crashes, also suddenly. Oil prices decrease rapidly. We still have infrastructure and experts and so we start the process again until the next crash, and the next, and the next. The economic consequences are likely to be unpleasant.

Arguably, 2008 was the first part of this cycle, but I doubt it. Supply hadn't really started to get significantly out of kilter with demand yet, but inevitably, it will. The speculator driven pricing might have been the straw that broke the camel's back, however. We were, and are, in an economic system that is extremely sensitive to any kind of negative stress. High oil prices were undoubtedly one stressor.

This positive feedback loop sounds reminiscent of aangel's posts regarding the staircase collapse of the economy as a whole. I would expect that, as with the price spikes getting ever higher, but at a lower rate of increase, this same issue will affect this feedback, making such shocks occur more frequently and at lower price thresholds.

Perhaps 2008 wasn't the first true shock to the system, and maybe it was. Either way, we seem stuck in our own double helix with price of oil and demand circling up and bumping against one another until we all fall down back to some increasingly lower level of economic activity. The more obscure sources of oil or renewables, costing more to bring us less, won't help this I imagine.

That response suggests she should have explained the situation in such a manner that we can be comforted by some unknown answer to this dilemma by way of 'human ingenuity'. But because that answer isn't yet apparent, and might happen in time to avert the situation, yes, the prospect of declining oil in this economy is negative, or if you prefer doomerish. If you need everything sugar-coated then maybe you should watch Disney movies instead of reading the TOD.

Dearest sir,

It does no such thing and methinks you might really need to work on your reading comprehension a bit more.

ROFL! Have you ever read any of my comments? They are more often dipped in something slightly more corrosive than sugar.

I have written a list of 40 questions banks must answer before investing in toll-ways

21/9/2010

RTA fails to present business case for M2 widening (part 1)

http://www.crudeoilpeak.com/?p=1886

Gail is priceless.If I were able to delete the ill considered derogatory remarks concerning her posts put up by some members , I would do so.

Honest disagreement, respectfully or neutrally stated, is one thing and perfectly acceptable and needed of course; failure to show the respect due to anybody who does so much for us is something else altogether.

Fortunately we are afflicted with only a very few regulars who don't realize this simple fact.

Oldfamermac,

The level of sophistication on the message board is dismally low.

1. There was no debt crisis during the First Oil Crisis. Neither in 1973 nor 1980.

To claim as Gail does that the spike in oil prices caused the last recession (and yes, NBER ruled it ended in June 2009) and disregard the massive real estate bubble is simply not credible.

2. We have people conflating debt and capitalism whereas debt has existed as long as we have records and certainly proceeds the 19th century industrial revolution.

I give Gail credit for running an interesting and informative web site, but she has become a broken record. A broken clock is right twice a day.

I don't agree myself with all she has to say, but she says it well, and she sticks to her guns.My point is that without her (and Leanan's) hard work, the site would not be the best single blog around anywhere.

Incidentally , there are lots of capable people out there who agree with Gail that the oil shock precipitated or resulted in the bursting of the real estate bubble.

I am somewhat agnostic in respect to this question;I expect the real estate bubble would have popped anyway within a few more years, but I also believe that oil is a major root cause of our current economic problems, and that oil prices were intricately involved in the real estate crash..

It's not just the direct and obvious costs, either;it's also the cost of the MIC, deployed and fighting, the disruption and dislocation of the credit markets,the movement of money out of our country to our overseas suppliers as opposed to being spent domestically.......

And there is an additional argument to be made for the INDIRECT but primary reason for the oil crunch to have brought on the housing bust;the govt , in collusion with the FIRE cabal, deliberately overstimulated the housing market to offset and conceal the growing effects of rising oil prices on the economy.

I will give you a barely passing "d"in respect to civility to your referring to her work and posts as a broken record."Repetitious"would have served just as well.

Apparently you don't understand in a general way just how big an impact oil costs have on every good and service as they are passed on thru the economy, and the feedback loops involved; perhaps you should study her "broken record" comments more carefully, and with a more open mind.

You only have to move a very small amount of wieght from one side of a balance beam to the other to cause it to react suddenly and decisively in reversing its state of equilibrium.

Of course I work and live in an industry-agriculture- and a place-out in the country- where the effects of the rising costs of energy are painfully obvious, so perhaps I am more sympathetic to Gail's arguments than most people.

I myself make the occasional sarcastic comment, but I try to show respect where it is earned and due .

OFM Thank you, Gail is priceless. Her guidance on PO is awesome. This is another excellent post.

I do not understand how you can leave "Oil" & the Limits to Growth out of the current financial & jobs crisis.

Without the cheap oil subsidy we would not have suburbia, export of jobs due to globalisation & massive bubble economies due to cheap energy.

The link of PO to the actual GFC & the mortgage & housing crisis may not be primary. Yes it was caused by debt bubbles but the primary cause of massive economic and population and technological growth over the last 100 or so years is cheap liquid energy. Which is now running out. The party is ending.

Without cheap energy, economic regrowth will be almost impossible.

Gail Thank you

Good point. The slashing of the middle-class' purse includes this last effort.

And we're not going to get single payer either. And the boys aren't coming home.

Hope you weren't talking about me. I wouldn't want Gail to feel bad, but I do think she sometimes (perhaps from, as she says, lack of space) leaves out some elements in her disquisitions.

I give you a 'D' because you have a limited American view of the world. Yes, you Americans are addicted to oil and your system will come close to collapse. We living in Europe will not suffer as much and may actually benefit from our superior efficiency.

You guys are fundamentally cranks - you have taken a respectable point of view (Peak Oil) and it turned into a circus.

The world is not as energy dependent as Americans believe. Not everyone needs a car or travels ten minutes to the supermarket or 7 Eleven.

By the way, let me know when Gail gets her work published in Energy Economics ....

I won't be holding my breath ...

Really? Well, since you are, as you say in Europe, you obviously haven't got a care in the world...

http://scienceblogs.com/casaubonsbook/2010/09/leaked_german_military_rep...

Traveling by car to the supermarket isn't what you should be worrying about.

I'm working on a paper for an economics journal in Europe with colleagues from Uppsala University and Moscow University that will address exactly this topic. I'll be sure to post it when it is published (presuming that it is, which we do expect). We have some interesting statistical work we'll be presenting that demonstrates the link between energy and the economy.

In the meantime, you could look at all the papers that use Granger-causality tests that explore this topic. You seem to be very behind in the state of the art.

Why do you think the financial system is not in bed with the energy supply system? Bad loans are evidence that money is not being made on projecting growth. The financials lent the money to build homes. They had no other better options since growth has stymied. The reason we had the financial crisis in 2007 was the very high oil prices, which bankrupted individuals who are very overexposed to long driving distances. These homes are built in the 2nd collar suburbs. It makes sense to me that financial lending, housing and oil prices are connected.

Name a home building method that does not use a bunch of oil. I bet it involves slaves; hence our addiction to cheap chinese labor.

Believe what you like. LOL. Most Modern efficiency gains all trace back to oil.

The world is not as energy dependent as Americans believe. Not everyone needs a car or travels ten minutes to the supermarket or 7 Eleven.

Not that I expect Beck to nut up and defend his position - I'm posting this so others who may not have heard of the lack of food on the shelves in England during the truckers strike are made aware of what happens when the flow of energy stops.

http://www.thebadrash.com/2008/06/12/truckers-strike-causes-food-shortages/

http://english.aljazeera.net/news/europe/2008/06/20086150243821110.html

And the after analysis of the 2000 strike

http://www.iwar.org.uk/cip/resources/PSEPC/fuel-price-protests.htm

But didn't you get the memo? All Britons use the bus and train services and certainly never openly complain about fuel prices they have to pay. Why, I myself routinely use the bus to... oh wait, no I don't, because one can't bus to my workplace at all.

Beck could've saved us all the hassle and time of reading his posts by simply putting "I do not know anything about anything" in his profile rather than the roundabout way he went about giving us the same message in a tirade of postings readily debunked.

I'm calling it now: troll.

1974 was no picnic - a nasty recession with inflation left over, plenty of failure in the real estate business. 1980 was not terrible, but the oil price shock was very brief. All the leverage of the last decade amplified the effects of recent negative events, especially the general shortage of oil production growth after 2005.

I worked for two insurance companies during the 1974 time period. The smaller one went under. The larger one had its price per share drop to $2, and had to be bought out to prevent it failing.

It was my experience during the 1974 time period that alerted me to the likely impact of oil shortages on financial institutions now as well.

(I was pretty young at the time, but had gained standing by correctly identifying what was happening, before others saw it. I didn't make the connection with oil though--just with rising prices in general.)

Roderick,

That's a bit of an economist argument for the issue. They tend to look at history, find correlations, then expect the same thing to happen again and again (in their hubris they call them laws).

Reality is, this is a complex system. It doesn't repeat, but it does rhyme. Its the underlying connections that really inform things.

In previous oil run-ups the level of personal savings have been reasonable, and debt much lower. However the change in cultural outlook during the 80s and 90s (precipitated by the shift household control from those who had lived through bad times, to those that haven't) means that now households have much higher gearing. People have been living much more off 'tomorrow', meaning that slack in the system and ability to cope with the consequences of high oil prices is reduced.

Whereas in 1973 and 1980 higher prices depressed sales and raided savings, now individuals have no savings, are living hand to mouth, and thus have no slack to deal with price increases. At the same time, easy debt was curtailed; is it any wonder that debt repayments couldn't be serviced this time - we have clawed higher up the personal expenses chains of many more people this time.

It's generally wrong to say that large scale events can be attributed to individual causes. Each plays its part in straining the system and although one might break the donkey's back, it's the combination that does the damage. This time it was the rampant financial fraud in the system that was uncovered by oil prices straining repayment ability and bringing too many people into default. Next time it will probably be different; oil prices collapsing companies, bringing recession, then collapsing whole countries seems the most likely.

The whole point is that this wasn't the 'usual' boom'n'bust - since there was no real boom in western economies. It was more fundamental than that - a tremor in the foundations of our economies, a foreshock.

That whole post was great garyp and sizes up the situation very clearly.

Yes, very nice. Denying any role of oil prices and saying it is all because of debt and fraud is like saying a tiny pin can't possibly the cause of a balloon bursting--that was caused by too much air inside the balloon.

Hear. Hear. I am on the fence with respect to the degree to which oil caused the recession, but if people do not agree with that position, they should lay out their well considered arguments without claiming that the author is simply clueless or knows nothing about economics. No doubt most of the people here are thick skinned, but frankly I think it must hurt a little bit to put your heart and soul into a web site and then be subject to this mean spiritedness.

I have no great fondness for capitalism itself, and don't see any great need to preserve it further.

But I do wonder if debt (and so also growth), however important it is in our current arrangement, is absolutely necessary for capitalism to function.

It seems to me that private ownership is at the core of capitalism, and that even in a shrinking over-all economy, individuals and individual companies could make a profit in certain ventures, at least for a time.

(Of course, the most abstract levels of purely financial capitalism, investment banking, etc. have already taken a hit, and even Greenspan now sees that as the failure (and fraud) that it always was.)

But perhaps I'm missing something.

Capitalism has been very resilient, and has dove tailed with survival traits that brought fitness in our past (short term gain, discounting the future, thinking heuristically rather than critically, etc).

It's survival depends upon getting a greater exchange value over the user value, by owning the means of production, and getting surplus value from labor.

Capitalism is now bumping up against resource restraints, as Gail has pointed out, and will be very challenged to survive.

It had a good run.

Hightrekker,

No Marxist economist has successfully shown that the surplus value of labor theory can actually generate the prices in the markets.

It is dead end. Read Das Kapital.

Value is created all factors of production, not just labor or energy.

"Value is created all factors of production, not just labor or energy."

This sentance doesn't even make sense.

Obviously he inadvertently left out the word "by".

It should have said:

"Value is created by all factors of production, not just labor or energy."

(Whatever that means.)

But while we are on the subtopic of missing words, consider this statement:

The above is a good example for showing how framing in terms of "economics" speak warps our perceptions.

You are correct.

There is no noun such as "DeValues" in the econo-speak language.

(There is the verb form, to devalue, however.)

A "DeValue" in noun form would be the antithesis of a "value".

Economists conveniently leave out antithesis words such as "bads and disservices".

That's just the way they roll.

It's all very innocent. No one controls the econo-speak language and how it is used to frame the issues. It just "magically" happens all on its own.

Obviously he inadvertently left out the word "by".

Maybe his kids were jumping up and down on his head. Its a common problem for me. I've learned to double check everything I post when the kids are around now.

I have, at least Volume 1. We are talking where profit is extracted from the system, and it is always in the difference between the use and exchange value, the surplus value from labor.

This is not about prices. I suggest you take Harvey's course on Capital—

Your literacy would be increased.

The free market is the most efficient economic system for producing the goods and services that humans have ever come up with. It's that remarkable efficiency, the ability its given us to exploit otherwise inaccessible resources that's lead to the rapid economic and technological growth over the last couple of centuries which in turn has created the likelihood of a sudden onset of peak oil and its associated problems.

But if, or probably when, tshtf over the next decade, it's that economic and technological efficiency of the free market that's most likely to minimize the damage and lead us through, the only alternative I know of, the imposition of some form of central planning, would be a disaster on top of a disaster.

Your statement, while perhaps true, completely leaves out the fact that there are also human beings, other species, and the planet as a whole in the equation. You fear central planning, but China is kicking our ass. They have a free market, but only in the context of a command economy which has a direct influence over what will be produced, or not produced, and when. In China, the disaster may be that they are too good at producing "goods" and services. Many of these "goods" are, of course, producing bads in the form of pollution and resource depletion. Kind of like in the U.S. If we have a so called free market but,at the same time, are exporting most our good jobs, then efficiency isn't really worth much.

You can't eat efficiency. Ask those who got their jobs outsourced, jobs which will never return to the U.S. until our wages have been reduced to the level of the Chinese.

You fear central planning, but China is kicking our ass.

No, China has a faster growth rate than the US, I don't see how that is "kicking ass" you see it as inflicting pain on Americans? Perhaps with "are exporting most our good jobs," but it has actually been the less skilled jobs that have gone to China, and in return the types of goods produced by those that had those jobs in the US are now far, far cheaper, the average Americans spending power has actually increased through trade with China.

You can't eat efficiency.

People have starved to death though inefficiency in agriculture, usually as a result of central planning, so in practical terms I think you're wrong there.

Andrew - I suppose part of the answer depends on how you define "good jobs". If you're unskilled then any job you can get is a good job. Accepting your " less skilled jobs that have gone to China" then what are the 10's of low-skilled millions of workers in the US to do about supporting themselves. I work daily with one foot in a very high tech world and the other with folks near the bottom of the pyramide. I see more than a few who would have a difficult time doing some of those exported jobs. And the worst aspect IMHO is that many of the unskilled US workers are in the service industry that is very dependent upon folks spending their disposable income on $4 cups of coffee. As times get tougher folks will forego a lot of those perks. But they'll still buy their kids sneakers made in China.

Yeah, in talking about these lower paying jobs that we off-shored to free up people for "better jobs" we seem to forget that every population is made up of individuals with varying levels of important attributes such as "intelligence". The distribution of intelligence in a population is well-reflected in a bell curve. Half of the population is under the mean. Typically the less intelligent individuals get the lower paying jobs. These individuals in many cases are not even capable of filling the "better jobs." (I expect most of the folks commenting on this site are in at least the top 30% of the curve.)

This "better job" mantra is corporatist groupthink used to justify sending jobs to other countries without invoking protectionism. The corporations gutted our economy, and the government allowed it to happen.

So now that we don't have the lower paying jobs what do the lower intelligence individuals do for a living? For a while they could work in retail, but that is now shrinking as well. We could keep them on unemployment, but that is hard to sustain for long. Agriculture could be a good spot for them, but the "Green Revolution" closed that door, at least for now.

With all that free time they have I bet we could whip them up into a half-starving, fear-mongering horde! And they have guns!

Perhaps as the oil disappears we could send them to work in the coal mines.

DD

The law of comparative advantage, which means that it's profitable for countries to trade with each other, even when one country is, in absolute terms, better than the other at everything, means that a country is better off finding employment for the low skilled rather than leaving them unemployed.

Though I guess if the US has a huge surplus of really stupid people perhaps that could be a problem.

No, you're describing absolute advantage.

China is swallowing up every single job corporate america sends them. They even sell agricultural products like apple juice in our stores.

They don't care about 'profit', they care about providing employment to hundreds of millions of Chinese.

The really stupid people in the US are 'college educated'/brainwashed business school dopes who think they understand the system but instead don't understand their pockets are being picked.

No, you're describing absolute advantage.

No, comparative advantage means trade - within borders as well as across borders - is worth while for both parties even when one has an absolute advantage in all areas.

The two other parts of your comment sound like xenophobia against the Chinese, and hubris - a conviction that you know better than those who've studied the issue simply because of your relative ignorance.

In economics, principle of absolute advantage refers to the ability of a party (an individual, or firm, or country) to produce more of a good or service than competitors, using the same amount of resources. Adam Smith first described the principle of absolute advantage in the context of international trade, using labor as the only input.

http://en.wikipedia.org/wiki/Absolute_advantage

Yep, that's what absolute advantage means, that's not what I was describing in my earlier comment.

Baloney,

China sells $300 billion dollars worth of junk and buys $70 billion of US goods.

China sells the same stuff(~50%) the US makes(as corporations ship whole factories to China) but in far greater quantities. The Chinese already corner the market in apparel, toys, footware, and furniture. The US has niche markets in aircraft, paper, oil seed and organic chemicals which are by-products of the worlds largest oil refining system, but its a drop in the trade bucket.

http://www.uschina.org/statistics/tradetable.html

Comparative advantage means both economies grow by trading different commodities.

China is a jobs vampire.

http://en.wikipedia.org/wiki/Comparative_advantage

Another unworldly business theology graduate.

I'm at a loss to understand what point it is that you think you're making.

China and the US trade, as you point out they each tend to specialize in exporting the goods to the other in which they have a comparative advantage, the trade is worth billions and both countries have seen substantial economic growth over the period of that increasing trade.

The trade imbalance between the two countries has been supported by the US borrowing to feed Americans sweet tooth in comparison to recent Chinese industriousness.

The recent increase in unemployment in the US is a result of the financial crises, though I agree the increase in oil price was a trigger to the sub-prime collapse, the risky lending practices of the US sub-prime market made that market the weakest link in the American economy, those lending practices were entirely the result of poor decision making by Americans.

From what I can tell our primary export to China is all of our intellectual property.

DD

America is about to find out that she would have been far, far better off keeping all those low wage , lesser skilled jobs within her borders.

The globalization chickens are fast coming home to roost.

We are now faced with supporting these people in thier tens of m illions on welfare of one sort or another;ALL OF THE REST OF US, COLLECTIVELY, would have been far better off to have paid the higher prices needed to keep those jobs at home.

The welfare check route requires creating and mauintaining another layer of nonproductive bueracrats, another layer of nonproductive jailers and cops, another layer of non performing retraining schools.....

The welfare check route has created the conditions necessary for the rise of the Tea Party.

The really amazing thing about all this is that the TEA PARTY is the bastard child of conservative businessmen making whoopee with the laft/ environmental types.The businessmen temporarily got richer, faster, by offshoring, and the left /enviro types temporarily got a cleaner LOCAL environment.They also got to pat themselves on the back about getting rid of low paying, demeaning jobs no American should have to do.

It never occurs to them that "the free market" would take good care of these low skilled Americans to a very great extent if only were were not blessed with so many similarly low skilled immigrants willing to do the jobs "Americans won't do".

Those jobs would pay a lot better ,without the extra immigrant labor supply, and Americans would do them if doing them were a better deal than collecting welfare state benefits.

Offshoring merely offshored the pollution and environmental problems TEMPORARILY.All the smoke is still in the air, world wide.

Of course we are now in such a state that even a good portion of the immigrants can't find a job adequate to pay for shelter and food and are so heading home again.

If so they've got a very strange way of going about it. I don't know of anybody who wants to trade in North American living conditions for living conditions in China - although I suppose there's always one, somewhere. The immigration flows are still overwhelmingly in quite the opposite direction (as is often also the case with a variety of other places, in some cases exceedingly unpleasant ones, Cuba comes to mind, that get held up as exemplars for some reason.)

This reply goes to the heart of the problem. Garret Hardins "Tragedy of the Commons" demands a collective response as it was individual decisions that led us here in the first place. It is clear that collective action will always be corrupted, so our challenge is to devise a mechanism that restricts our access to FF (coal because of carbon, oil because of scarcity), but still encourages individual effort.

I have yet to read a cogent argument as to why the replacement of income, labour and sales based taxes on a dollar for dollar basis with carbon and an oil scarcity tax would do anything other than encourage a rapid switch to greater efficiency (using less) and substitutes. As taxes drive usage down the tax rate can be increased to maintain revenue, thereby further reducing our use of FF. In time as revenue flattens other "bads" could be taxed or income and sales taxes be reintroduced.

I agree that the introduction of FF taxes will be politically difficult, but isn't that what leadership is for?

I have yet to read that argument either.

I think that this is an example of "possession being 90% of the law", i.e. that the income and payroll taxes have the advantage of already being on the books.

I see you prefer the Red Kool Aid.

There are very few examples of completely free markets. Regulation is necessary at almost every point in the modern market trading system, even if it is agreement on weights and measures, or voltages, or which side of the road to drive on. Most economies in the world are an example of mixed economies where governments produce many of the things that the market would not provide. Even China now could hardly be described as being fully committed to central planning.

All systems are bumping up against resource constraints, but the real question is this. Is there something fundamental to capitalism that it becomes especially susceptible to dysfunctionality when it comes to resource constraints. I don't even know whether it is entirely appropriate to call the system in the U.S., for example, as capitalism. Certainly there are sectors, like the financial one, where corporate socialism might be a more appropriate term. If we were really devoted to capitalism in its pure or near term form, we would not be bailing out billionaires.

If we are content to allow high unemployment to fester even in the face of overall economic growth as measured by GDP, and if we are content to the increasing level of inequality of income and wealth, then whatever we have in the U.S. will continue its ride for quite a bit longer.

If, on the other hand, we have lost faith in capitalism's ability to provide growth, jobs, and a prosperous middle class, then we may decide to revisit the whole system under which we labor.

At this point, this is not what the upcoming election is about so we are not ready for a fundmental challenge to our quasi capitalistic system. The argument is over what model of captialism will provide growth primarily and jobs secondarily as a result of growth. Both parties share the same paradigm that growth is paramount and essential for well being and jobs. Neither party dare challenges the basic paradigm.

And I have not even mentioned how growth itself has and will continue to be unacceptable if the planet's health is a consideration. Sadly, we may already be past the tipping point.

Oil is an overlay to this whole problem and just feeds the fact that growth becomes increasingly difficult and less beneficial for the people at large. I don't pretend to know, however, to what extent peak oil is causing the result of slow and ineffective growth.

Nicely put.

It's not so much about "isms" like capitalism or some other abstractionism as it is about the difference between being "clever" and being "wise and humanitarian".

A "clever" person figures out how to maximize his own short term profit no matter what the damage to others or to long term prospects.

A "wise and humanitarian" person figures out how to obtain a livable profit while minimizing the damage to others and to long term prospects.

We have become a nation (no, make that a world) of very "clever" people.

I think the work you were looking for is "selfish".

One can be quite clever in applying wisdom for the betterment of others. Just look at Pres. Carter.

I have no great fondness for capitalism itself, and don't see any great need to preserve it further.

Like with most 'isms - is it capitalism that is the issue or is it the system you are observing that is labeled as capitalism by others that you see no reason to preserve?

private ownership is at the core of capitalism

But does actual private ownership of 'things' exist?

If you can loose the item via the non payment of taxes on the item - do you own it or are you under a twisted rental plan?

If your item can be taken 'for the common good' - did you own it?

Greenspan now sees that as the failure

At one time Greenspan wrote about how Gold is money, everything else was fake. And yet - when given the chance to serve the 'fake' system and be 'paid' well, Mr. Greenspan had a change of heart.

I'm not sure Mr. Greenspan is a reliable compass for guiding a person.

1) So how would you propose that a society might assemble the land deemed required for a road or rail right-of-way? Should a single property owner who "by chance (ha ha)" lucks into ownership of a critical series of plots which completely block a right-of-way be able to extract whatever price they wish from their fellow citizens? No limits? Please explain.

2) Is it your opinion that there are absolutely no public services required to operate a society? Therefore no taxes? Please enlighten us ;<)

dohboi,

I am not an economist or expert, but my take is that debt and growth are essential parts of capitalism. We could have a system where there was a pay as you go, and future operations, R&D, etc were funded by current profit. This would certainly limit the speed of growth to something sustainable. However if you have a competitive market, your competition which could obtain credit/incur debt could grow their business more quickly, and potentially out-compete your business. Their use of leverage would provide the competitive edge against your business and drive you out of that market space. To maintain your competitiveness, you would possibly need to leverage your assets and incur debt similarly. In order to pay off this debt, your business would have to grow, so growth becomes a condition of the system. At some point though, real world limits may limit possible growth so that the system can not continue. We may be close to that point now.

ej

I understand and believe our Debt Based Monetary System is unsustainable and will crumble due to peak oil. What I don’t understand is what that has to do with Capitalism and why it will come to an end. Why does Capitalism itself, require growth?

What does growth have to do with private ownership and operation of the means of production for profit? Allot of companies start out with a growth phase but then at some point, that growth kind of levels off and the company then enters a steady state. When a company develops a new product everyone must have, it grows, but then as everyone who can afford or who wants this product already has one, then the company is left with making replacements for those lost or broken products. At this point, the company may choose to periodically update its product to increase sales.

I always assumed most of our problems arise from the scale of what we do.

I guess I need to dummy version of the problems with Capitalism.

I agree with Les. I understand how our monetary system works--the central bank creates money from nothing and lends it out at interest. This creates a problem in that sooner or later the debts owed to the central bank become so large as to be unpayable. The central bank is owed an amount of money greater than all the assets that exist. The thing that keeps the system going is that the amount of money, and the amount of assets, keep growing, and hopefully you stay ahead of the point of gridlock.

So what about this system is specific to Capitalism? Don't Communist countries have a central bank? Don't those central banks lend out money at interest and expect repayment? Perhaps if someone had some specific knowledge of how money is created in a Communist system, we could all be enlightened.

A business must grow to survive.

Rising populations and energy costs assures that growth is a requirement to survive.

Costs rise..........Rent, insurance, wages, energy, credit, resources, technology and taxes.

The business can become more efficient to survive but efficiency if relied upon to remain afloat is doomed to failure, if costs continue to rise.

For instance airlines and hotels now are battling decreased patronage and rising costs. They are investing in technology and efficiencies, takeovers and mergers and asset selling to stay viable. They are increasing debt and waiting for the next airline or hotel to slide into bankruptcy to increase patronage. With growth decreasing that theme will become more common across the board.

Steady state means you are growing enough (by whatever means) to stay in business. Like a human body depending on how many calories one burns and how much fat is available, there is a threshold of calories needed to stay alive. If more energy is expended staying alive then the body needs to take in more calories. For a business that is growth....Increased sales or price hikes.