The Case for the Australian Coal-to-Liquids Industry

Posted by Gail the Actuary on September 30, 2010 - 9:22am

This is a guest post by David Archibald, of Perth Australia. He has a degree in geology from Queensland University, and has worked in a number of fields, including oil exploration. He also makes a hobby of studying climate change. (I have removed the climate change slides from this presentation, however.) This is a link to David's personal website.

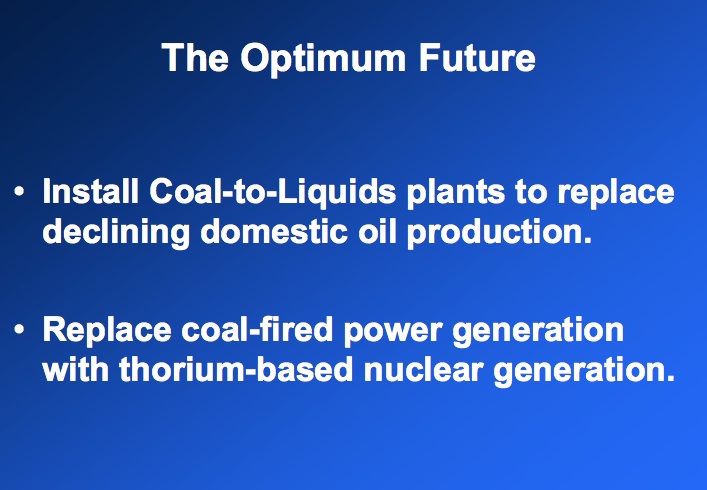

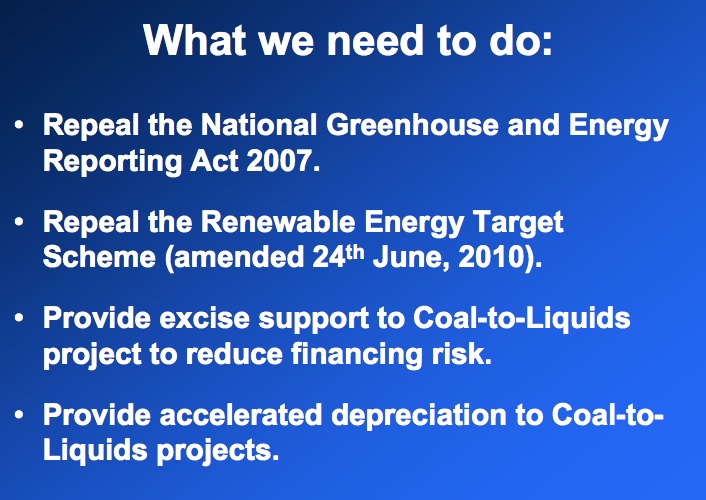

Below the fold is a presentation he made regarding why he thinks Australia should consider coal to liquids technology. It can also be found on the website of the Australia Coal-to-Liquids Association, or directly, at this link.

David Archibald provides the following additional information about costs:

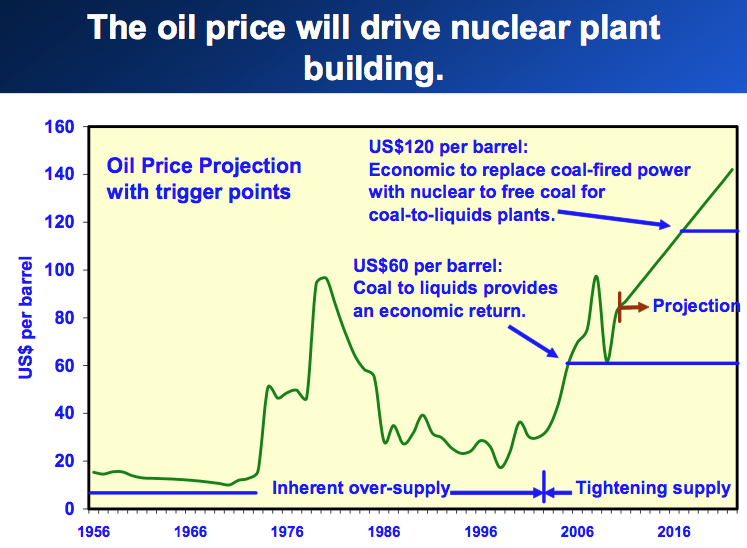

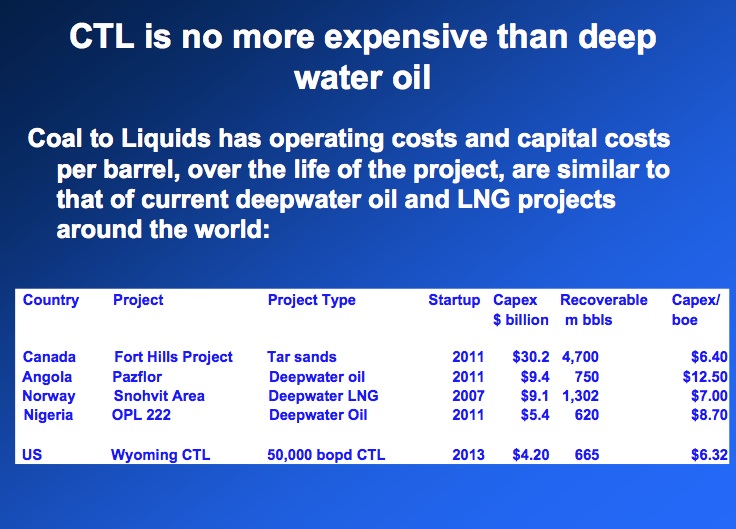

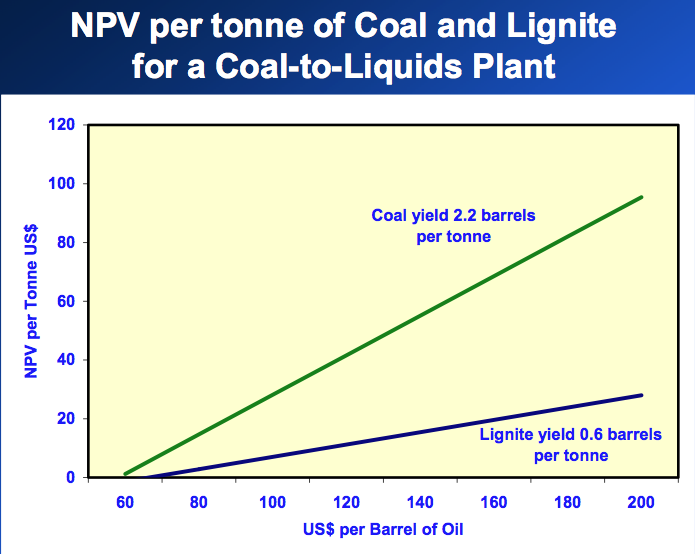

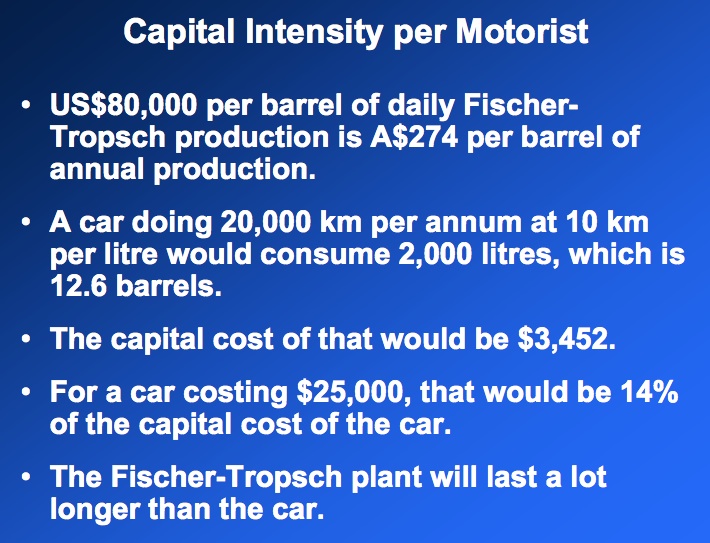

The cost of CTL is about $45 per bbl (opex and depreciation) at zero feedstock cost. That is based on the CCT process which saves on capital cost by not reforming the tail gas. The depreciation charge in that $45 is $14 per bbl. It could be $28 per bbl.

Assuming 2 bbls per tonne of coal, the coal cost component per bbl is half the cost of coal per tonne. So $40 per tonne coal would take it to $65 per bbl.

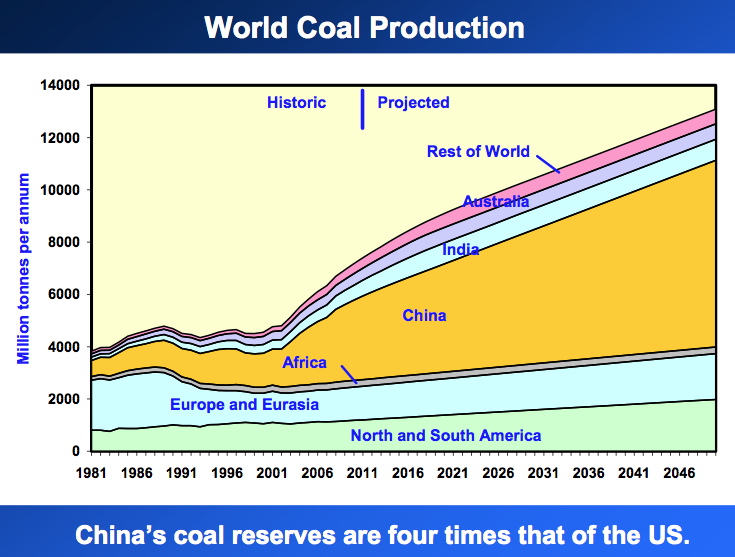

Note: The estimate of recoverable reserves for China used in Slide 28 is 1 trillion tonnes. According to this report on China's coal industry, China's recoverable reserves "exceed 1 trillion tonnes".

Thanks, David!

I know that there will be readers who find the whole idea of even thinking about coal-to-liquids objectionable. Whether or not we personally object to it, there are no doubt others who will be considering the issue, perhaps in a different part of the world, so it seems like we should at least be aware of the issue.

It seems like there is a possibility of a larger range of error coal-to-liquids, since there have been few recent projects, taking into account modern environmental standards on things such SOx and NOx and mercury emissions. So it seems like costs are only quite approximate.

I didn't notice anything about water requirements. This may be a limiting factor in many places also, I would expect.

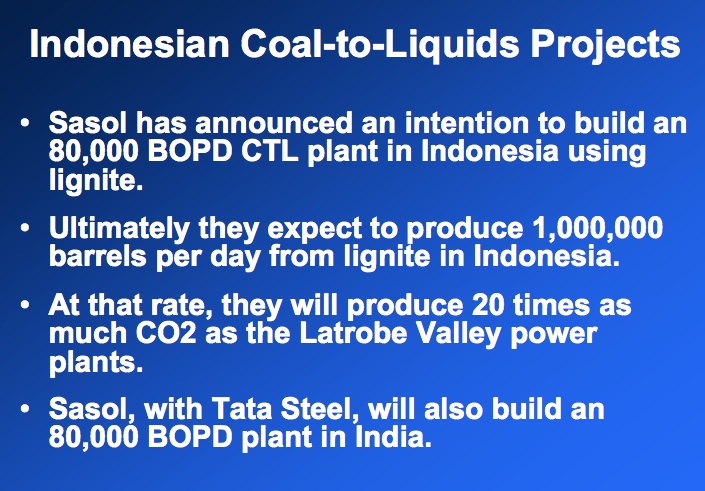

The Chinese have installed and planned capacity of 600,000 BOPD of CTL. Re SOx and NOx and so on, that is all cleaned up in the synthesis gas.

David, you've focused only on supply in this presentation, but have not even touched on demand. Hence, this is merely a BAU-extending proposal.

Australian vehicle fuel economy standards can be brought up to European standards, for example.

AUS has given a reduced import duty on 4WDs compared with passenger cars (after

all, they are commercial vehicles and only farmers or trades people would want one, right?).

Fortunately, this is scheduled to disappear this year.

AUS has also given tax breaks to people with a ‘company car’ according to how far they drive

it each year. Drive further, get a bigger tax deduction. In the UK they had a similar system

and found when they gave a flat rate based on fuel efficiency, people bought cars with better

fuel consumption and actually chose to drive less.

There are a number of recommendations that should be made to reduce demand first, instead of simply gutting environmental standards.

that is all cleaned up in the synthesis gas.

We would need more information than a simple handwave.

Other directions include going all nuclear and renewables, with a transition to electric transport (including rail), increased urban rail, buses, biking, telecommuting, and a number of other approaches that are working well in a number of European cities.

That's something you always see. What's a "progressive"'s answer to energy production problems are batteries, new windows, "saving".

Can you get a simple fact, true in nature, true in economics, and true everywhere through your head please ? It's an embarassingly old discovery, believing in "saving up" is only slightly better than believing in a flat earth and a vengeful god demanding stoning sacrifices.

It's called "Jevon's paradox".

Increases in efficiency lead to increases in total used fuel. Not decreases.

Additionally, equally trivial to see :

There is a (strong) tendency for new increases in efficiency to only be possible to develop if the total used energy used by society increases, because otherwise the energy needed to develop and test them represents a too great percentage of the total. Let's give the ultimate savings as an example : developing fusion requires maintaining the ability to generate the magnetic field needed by tokamaks. In electrical terms that means that any country that wishes to have a fusion plant needs to have multiple 5 GW (gigawatt) generation facilities ready at all times. This applies to less extreme cases too.

First, Jevon's Paradox is a proposition, not a fact.

Second, as mentioned countless times here at TOD, JP falls apart with a declining supply. Your assertion that efficiency can only be realized by a growing demand is simply that - an assertion.

That's something you always see. What's a "progressive"'s answer to energy production problems are batteries, new windows, "saving".

(sigh) I'm a moderate, but could just as easily throw partisan barbs and say that an ultra-conservative's answer to energy production is more oil wars, more oil spills, more GHG production, and more big cars/SUVs, because "The American Lifestyle is non-negotiable".

Two points:

First, Jevon's Paradox is nothing more than a special case of the Rebound Effect, which in turn is simply a special case of bog-standard supply and demand.

Improving fuel efficiency is an effective price decrease, which then leads to a demand increase; in some cases, that demand increase can be larger than the initial price decrease/efficiency increase. That's all Jevon was saying.

Second, you're absolutely right that it's not a fact or law. For example, Germany has reduced consumption of motor vehicle fuel since the mid-90s, despite (a) more German drivers, (b) each driving further. Fuel economy improved roughly 20% (Fig 1), but per capita miles driven only around 10% (Fig 2); note that a recent report from the Germand government confirms this, with a 5.6% decrease in motor vehicle fuel between 2000 and 2008, despite real per-capita GDP growth (in a manufacturing-heavy country) of 14% in the period.

Jevon's Paradox is not a law of nature, and in the real world it doesn't always happen.

Jevon's Paradox is not a law of nature, and in the real world it doesn't always happen.

And in mature industries or economies it almost never happens. It's a phenomenon of very early development, which is where coal was when Jevon was writing.

"the evidence does not suggest that improvements in energy efficiency routinely lead to economy-wide increases in energy consumption. At the same time the evidence suggests that economy-wide rebound effects will be at least 10% and often higher. Rebound effects therefore need to be factored into policy assessments.

• For household heating, household cooling and personal automotive transport in developed countries, the direct rebound effect is likely to be less than 30% and may

be closer to 10% for transport. Direct rebound effects for these energy services are

likely to decline in the future as demand saturates. Improvements in energy efficiency should therefore achieve 70% or more of the reduction in energy consumption projected using engineering principles. However, indirect effects mean that the economy-wide reduction in energy consumption will be less."

http://www.ukerc.ac.uk/Downloads/PDF/07/0710ReboundEffect/0710ReboundEff...

Thats and accounting charade so called mature economies have exported and enormous amount of manufacturing out to third world countries. Today you need to look at global aggregate demand which is following Jevons Paradox to a tee. And will continue to do so.

Next as far as what happens when the commons is shrinking I'd argue that this will simply result in growing percentage of the population unable to to access the commons. All that happens is the ranks of the poor grow. And this phenomena has also been occurring for some time. Per Capita incomes have been flat to declining in many parts of the world. As energy becomes more expensive these trends will accelerate.

Obviously the ranks of those in poverty can grow faster than supply falls at economic turning points. As long as housing prices rose housing was fine when the started to decline the economic impact was huge even though the relative price change was fairly small. In our economy the onset of deflation and contraction aka "negative" growth has a big impact initially but it decays fairly rapidly. Most of the money is lost at the turning point.

The critical factor which makes Jevons Paradox hold is this well or reserve of impoverished people who want to escape poverty. In his time coal consumption was growing working to reduce this reserve in our time energy is shrinking and the reserve is growing. However that does not matter its simply the existence of the well thats the problem and which generates the paradox.

And of course its obvious that until you address population nothing really works all that happens as the reserve of poor willing to do anything to be rich changes at the margin.

Thankyou, David! Since we rely on one depleting resource, obviously the only solution is to change to another depleting resource. This sort of solution is well-practiced by financially prudent people across the developed West, paying one credit card off with another.

Brilliant.

Looking at his website, we see that he's another climate change "sceptic". Specifically, warming is happening but it has nothing to do with carbon dioxide, it's the sun. No. His climate sceptic ideas are rather demolished here.

So if his ideas have no merit whatsoever, why would he express them? Perhaps because he makes a living exploring for oil in NW Australia. He also works with an astroturf group (described here) funded by BHP-Billiton, Western Mining, Monsanto, Phillip Morris and so on. And has been the director of several mineral and oil exploration companies.

In other words, a man who makes his living by finding stuff to dig up and burn, and represents a group funded by companies who make their living by finding stuff to dig up and burn, tells us that we should dig up more stuff and burn it, and no, it's harmless, honest.

No. We will not solve the problem of one depleting and polluting resource by switching to another depleting and polluting resource.

Time for my favorite quote!

"It is difficult to get a man to understand something when his salary depends on not understanding it." -- Upton Sinclair

But I wouldn't call his organization an astroturf group: it's more of a groupthink tank.

No. We will not solve the problem ... by switching to another depleting and polluting resource.

I think you mean "we should not". I have a feeling we will regardless.

He is right, even if he is wrong...

(I'm assuming that Coal to Liquid is viable at the price points he has stated, and it sounds about right).

As a transition option, for a country the size of Australia, it would work.

Hopefully it will be done with at least an understanding of why we are no longer able to get oil out of the ground.

The real reasons to not do CTL are:

1. Greenhouse gas emissions.

2. Denial of the problem. Coal supplies are infinte too, right?

But if we actually started to address these problems then using CTL would markedly reduce the pain that Australia would have to go through.

Not sure it would be so good if every country started doing it....

Michael

For a country the size of Australia, population wise, continued greenhouse gas emissions at current transportation fuel levels would be a very small percentage of world greenhouse gas emissions. They are too small to matter.

Then every little population unit (State, Province, town, etc) could say they are too small to matter. We all matter in the big picture.

http://en.wikipedia.org/wiki/List_of_countries_by_carbon_dioxide_emissions

Unless you have agreement among the big 4, (and possibly the main EU members) it is pointless for Australia to do anything.

States, provinces, cities are not sovereign nations.

The four countries you list produce roughly half of emissions. Other countries produce the other half. Both halves are equally important, and country is to some degree an arbitrary unit.

The 15 countries that are bigger greenhouse gas emitters produce 74.44% of greenhouse gas emissions.

Actually, if you include the EU as a whole instead of constituent countries, then over 80% of greenhouse gas emmisions are produced by bigger emitter than Australia.

Countries are not arbitrary units. Sovereign nations are the decision makers that can agree to be bound by treaty to specific levels of emissions. The only fuzziness is whether the EU bargains as a unit or as individual countries.

Nevertheless, what Austrailia does is just rounding error in the committments of big countries.

Merrill, I like to look at it on a per capita basis (hope the table looks OK):

rank country CO2/per person

1 China___________ 4.9

2 United States___ 18.8

3 India___________ 1.4

4 Russia__________ 10.8

16 Australia_______ 17.1

What source do you use?

Sorry about the formatting, I just did a cut and paste from recent assignment. Denmark figures are not relevant but Australian figures are.

Indicators

million

million

billion

per Capita

toe

toe

toe

electricity cons per capita kWh

kWh

kWh

kWh

/ TPES

/ Capita

Note 1:

http://www.iea.org/stats/indicators.asp?COUNTRY_CODE=DK

Note 2: http://www.iea.org/stats/indicators.asp?COUNTRY_CODE=AU

Note 3: http://www.iea.org/stats/indicators.asp?COUNTRY_CODE=29

Does the figure for Australia include all the exported coal? They may not be using it directly, but they are aiding and abetting its use in other countries, especially China. California is a state, for example, but is considered important enough that the oil companies have sponsored an initiative to kill its law to cut greenhouse emissions.

And what are you "aiding and abetting"? The demise of our financial future by preventing development of alternative fuels in the face of rapidly declining conventional light oil?

While the thrust of this comment is true. The detail show a lack of understanding of who produces, consumes and exports what.

Australia has exported very little coal to China. Test shipments in the tens of thousands of tonnes until the two years or so. The biggest amount in one years had been 3 million tonnes (<1% of Australia's production and about 0.125% of China's production). Historically both China and India have tried to be self sufficient in coal. Remember they are both in coals "Big 5".

It's only in the last two years that China has been actively securing commoditiy of all types outside it borders. In the coal arena, it seems to be trying to secure 'in-ground' coal reserves in another "Big 5" member, Russia and in emerging producer, Indonesia. China have struck deals in Australia, so expect FUTURE exports to China to be in the tens of millions of tonnes/annum, if the deals are followed through.

To give an idea of scale, Chinese coal production is about twice that of the US and six times that of Australia. Until the last couple of years, China had been a net coal exporter, but it only amounted to a few percent of total production (not seen recent Chinese export figures). Mainly in client state goods for goods deals, I understand.

That's what the US says, relative to China.

Australia has one of the highest life expectancies by world standards as well and yet we spend many billions of dollars each year trying to cure cancer? Climate change is environemtnal cancer, and while we may pat ourselves on the back for living a generally healthy lifestyle, we are going to be the hardest hit of the developed nations, simply by an accident of our geography.

The key issue for Australia is not how much GHG we produce ourselves, but how can we contribute meaningfully to the world solutions. Australia will be one of the worst hit developed countries if climate change accelerates in the genreal trend it is showing so we should be highly motivated to lead the world wide response. Unfortunately, TPTB are a buch of myopic, self interested superannuants, who put their own financial interests above those of future generations and use excuses like "Australia can't make a difference" to continue feathering their own nests, knowing they'll be safely dead in graves, long before the worst of the predictions could happen.

I'd say he should go back to school, but I don't think it would do any good. The whole idea of taking the carbon cost into consideration, a when not if, seems to have passed him by. Lignite FFS, how dirty can you get.

Not only that, but zeroing all imports would require 18 of his very big CTL plants, at a capital cost of $57bn, and that's without the cost of running them .... to produce oil at $300 per barrel - which is higher than an economy can run at. And that's with his rosy figures.

That's as opposed to efficiency measures and public transport which in the urban and suburban environment of Australia could cut usage extremely well.

There are reasons CTL is seen as a margin only extravagance - they seem to have passed Mr Archibald by.

I'd like to suggest that those of us who disagree with Archibald's assessment of climate change still consider what he has to say here: not as a message of hope, but as a warning.

There are two ways in which anthropogenic CO2 can be limited:

1) We choose to limit our use of fossil fuels

2) Increasing scarcity causes fossil fuels become too expensive to base our society on

I personally have my doubts that we'll be able to achieve option 1): too many greedy mouths sitting around the buffet: there will be no leftovers. I feel that CO2 levels will probably be limited by option 2).

But the point of this article is that coal-to-liquids projects are viable, cost-effective ways to produce vehicle fuel. Archibald doesn't intend it as such, but for us it's a warning: Option 2) above is unlikely. As oil grows scarce, we'll switch to coal and keep on burning.

If you'd like to do a truly terrifying calculation, work out the atmospheric CO2 concentration after all currently-known viable coal reserves are burned. Archibald's study is useful because it suggests that's not an unlikely scenario.

Or to put it another way: you may find coal-to-liquids technology personally repugnant, but if it's profitable and not prohibited, it *will* happen. So you'd best pay attention to its economics.

The costs seem in line with the CTL association's assertion

Leaving the climate change problem aside for the moment, I'm not convinced that the economics work out simply because of the enormous capital that is required for them in aggregate. I think only a few of these plants will get built before the world financial system struggles to provide capital for these sorts of projects. That's a good thing from the climate change perspective but it does seem to indicate that Australia (and the rest of us) are in a box. The obvious rejoinder would be that perhaps Australia could fund the projects from domestic funding sources but that seems a stretch.

So the next part of the analysis would be to determine where the funding would come from for the $57B someone else mentioned is required to replace all imports.

When looking at the whole picture, it really seems to me that Australia will experience what everyone else will experience: massive economic contraction. Initial estimates of the rate the world economy would contract as oil declines come in at roughly a 1 to 1 ratio (see Hirsch's paper "Mitigation of maximum world oil production: Shortage scenarios" at ScienceDirect). His conclusion is:

For more see my post Estimating the Economic Impacts of Peak Oil. Personally I think unity (i.e. 1 to 1 contraction) is the best case scenario. Cascading debt defaults will likely make it closer to 5 to 1. Of course a systemic financial failure brings it closer to 50 to 1 or thereabouts.

I will soon update that post with the latest work from Ayers and Warr "Evidence of causality between the quantity and quality of energy consumption and economic growth" also available at ScienceDirect plus the work of Dean Fantazzini after he publishes some interesting work that demonstrates the link between energy and the world economy.

So, let's not kid anyone here: the requisite number of CTL plants will not be built in Australia even if its citizenry understood the problem in time (which, if they are like the rest of the world, they don't) and the political will and financial resources could be mustered to build them.

Ergo, prepare for contraction.

aangel,

I wonder how firm the cost/time scale FAQ answer is. Do you (or anyone else here) have information about smaller scale plants? Have any been built to verify design assumptions? At what size? I'm sure there should be some economies of scale, but has there been any work on pilot plants?

Sorry, geek7, I don't have that information. You could call up the association and see what they say. Normally the people who work at these places are quite helpful and you would return with some good information to share with all of us.

It is best to avoid sweeping global presumptions, as countries will have widely differing finite affordable fuel tail managements.

If you want some REAL examples, of Coal to Fuels, look to South Africa.

http://english.peopledaily.com.cn/90001/90777/90855/7152354.html

South African petrochemical giant Sasol has set a world record after flying the world's maiden commercial passenger flight powered solely by the company's 100 percent synthetic jet fuel, which is made by converting coal into liquid fuel.

that already have mature displacement program:

For the past 10 years, 50 percent of the aircraft departing from Africa's busiest airport, Johannesburg's OR Tambo International Airport, use Sasol's 50 percent synthetic jet fuel.

Initial estimates of the rate the world economy would contract as oil declines come in at roughly a 1 to 1 ratio (see Hirsch's paper "Mitigation of maximum world oil production: Shortage scenarios"

This suggests that oil consumption is related to GDP in a 1:1 ratio - in other words, if oil consumption drops by 10%, GDP will as well. Here is what he said recently: "So then if one calculates a range of 2 to 5 percent, some people think the number may be larger, 2 to 5 percent per year increase in oil shortage, one comes up with a rather disastrous indication world GDP will decline by 2 to 5 percent a year in tandem with increasing oil shortages."

Is this realistic?

No. We can see this from economic history: in the US, oil consumption fell by 19% from 1978 to 1983, and yet GDP grew slightly. Similarly, world oil consumption has been flat for the last several years, but GDP growth was strong thourgh 2008 ( stronger than for the US (which itself grew 8% in the last 3 years up to that, with flat oil consumption), and has resumed growing.

Hirsch seems to have looked at the relationship between oil and GDP over the last 20 years, noticed that the ratio of oil increase to GDP increase has dropped from the previous 1:1 to roughly 1:2.5 (an analysis which he attributes to the DeutcheBank, but which can be derived straightforwardly from IEA statistics). In other words, in previous decades as the economy grew, oil consumption grew as quickly, while lately less oil has been needed. Hirsch drew the very strange inference that GDP has become more dependent on oil, rather than less.

An important and relevant researcher here is Robert Ayers . We see that he showed that GDP is related to applied energy (exergy), and only very loosely linked to primary energy consumption, let alone to oil consumption. The research indicates that BTU's only explain 14% of GDP,and that the source of those BTU's can change (coal to oil to wind, for instance). Both energy efficiency and energy intensity can change. Further, oil is only one source of BTU's. Oddly enough, many energy commentators seem to misunderstand Ayre's research, and think that it supports the idea of a strong causal connection between oil consumption and GDP.

US (and world) GDP could grow much more quickly than it's energy consumption (even including electricity). The best example of this is California, which has kept per capita electricity consumption flat over the last 25 years, while growing it's GDP relatively quickly.

Ayres used "exergy services", which are not "very close to BTU parity". Exergy services are work performed. So, for instance, a Prius performs the same work as a similar vehicle with half the MPG, but uses half the BTU's. Strictly speaking, a Prius can perform the same work as a Hummer (transporting people), and use 20% of the BTU's. An EV also does the same work as a Hummer, and uses about 1/3 of the BTU's as the Prius, and 1/15 of the Hummer's...and so on.

I agree that Ayre's work is important but it is consistently you who misunderstands what he and Warr are saying as well as the bigger picture as you fruitlessly try to demonstrate the notion that the world economy does not need energy to grow. From Ayres and Warr's latest paper Evidence of causality between the quantity and quality of energy consumption and economic growth:

Emphasis added.

In the abstract, he also notes:

In the conclusions of the paper, they go further:

Emphasis added.

Yes, it is possible for a while to find a country that grows its economy without energy usage increasing. This can happen as credit expands particularly the service sector while manufacturing moves outside the country. But the world as a whole does need energy for the economy to grow.

The Granger causality and cointegration tests Ayres performed in his latest paper demonstrate that. Plus Deanfa has done some innovative work that we will be publishing in a paper together next year.

Ayres and Warr are still missing some of the big picture even though they acknowledge peak oil in the paper because they fixate on efficiency:

Sure, make more net energy available and more growth is possible. But what happens when both gross and net energy availability declines? They don't go there.

I've heard of some quixotic quests, but yours, the goal of demonstrating that the economy doesn't need energy to grow, is definitely high on the list!

you fruitlessly try to demonstrate the notion that the world economy does not need energy to grow.

That's not what I've been saying. I'v been trying to tell you that the world economy doesn't need growth in oil consumption in order to have economic growth.

An increase in exergy supplied has both a short-run and long-run effect to increase output.

Note that he says "exergy". That's very different from "energy".

output growth is ‘driven’ by increased availability of energy and increased delivery of useful work to the economy.

Note the use of "useful work". Then note what I said above: "We see that he showed that GDP is related to applied energy (exergy), and only very loosely linked to primary energy consumption, let alone to oil consumption. "

See the difference? Ayres is showing that economic growth is related to "useful work", not primary energy or oil. We can see growth in "useful work", without seeing growth in primary energy, and certainly without growth in oil.

Yes, it is possible for a while to find a country that grows its economy without energy usage increasing. This can happen as credit expands particularly the service sector while manufacturing moves outside the country.

Look at the US from 1979 to 2009: it's GDP grew by 150%, and it's manufacturing grew by 50%, while oil consumption was flat.

I've heard of some quixotic quests, but yours, the goal of demonstrating that the economy doesn't need energy to grow, is definitely high on the list!

First, we can see quite clearly that it doesn't need oil to grow. 2nd, we can see that it doesn't need fossil fuels to grow. 3rd, we can see that it doesn't even need energy in general to grow, if it increases energy efficiency. He says so in his abstract: "We infer that output growth does not drive increased energy consumption and to sustain long-term growth it is necessary to either increase energy supplies or increase the efficiency of energy usage. "

Ayres is talking about "useful work". He's saying that we can use 50MPG Priuses, and transport 5 times as many people, for the same energy as is used by one car that gets 10MPG. And, we can use 12 EVs, and and transport 12 times as many people, for the same energy as is used by one car that gets 10MPG.

Do you see the difference?

There is no difference, Nick.

Oil comprises about 1/3 of the world's primary energy supply so when oil production declines the world's primary energy supply will decline, ergo the world economy will shrink.

It's the same thing as saying take one third of the supergiant oil fields out of production. Will world oil production decrease? Of course it will.

But the 1/3 ratio doesn't really capture the outsized role oil has in the world economy since it's primarily used for transportation and infrastructure construction and maintenance heavily depend on it. Impacting the cost of moving resources and goods and people to their jobs and all that has a disproportionate impact on the economy. Though oil makes up only 1/3 of the primary energy supply, its impact is more as though it were 2/3 or higher.

On this score, Dick Cheney got it exactly right about oil (emphasis added):

It's the same reason we have Oil Shock Simulations — precisely because of the role oil has in the world economy.

You seem to be one of the few people in the world who can't see this. Other people aren't having so much difficulty seeing the connection and regard the decline of oil with due seriousness:

Outcome Grim at Oil War Game

Former Officials Fail to Prevent Recession in Mock Energy Crisis

http://www.washingtonpost.com/wp-dyn/content/article/2005/06/23/AR200506...

Military Study Warns of a Potentially Drastic Oil Crisis

http://www.spiegel.de/international/germany/0,1518,715138,00.html

Oil comprises about 1/3 of the world's primary energy supply so when oil production declines the world's primary energy supply will decline

Maybe. Or other energy sources will grow faster.

ergo the world economy will shrink.

Are we agreed that's not what Ayres is saying?

Dick Cheney

You're going to quote Cheney? Really? Someone who's built a career on crony capitalism, and who is defending the interests of.....Haliburton??

I would agree that oil is a very important military asset, and an important competitive asset, especially in the short term. This is very different from whether it's necessary in the long run, especially from the point of view of the whole world.

It's the same reason we have Oil Shock Simulations

Oil shocks are important, but they're also temporary. Of course a sufficiently large oil shock can cause a recession, but recessions are temporary.

The German study wasn't an independent study, it was a literature search of oil-related risks. This was a preliminary, internal draft document. There's a reason it wasn't officially released.

Really? That's an astonishing statement and, in my view, demonstrates how poor your grasp is of the world energy and world financial systems.

I know, I know, we'll magically ramp up all the other sources "because we need to" while simultaneously replacing all the equipment that depends on oil to use these other energy sources.

Andre, and Nick,

Although you guys have genuine disagreements, you're also doing a lot of talking past each other in this particular thread, in my opinion. Even more than usual between you two.

Surely you can both agree that if oil declines, and no other energy sources "grows fast enough", then total primary energy will decline, and if those other sources do "grow fast enough", then primary energy would not decline. Your disagreements are about the possibilities for "fast enough."

Although I'm not familiar with Ayres work, from what both of you so far have shared regarding it, it does not seem to me that his work is by itself aimed at answering the question of whether alternative energy can "grow fast enough." It seems like it is more theoretical than that, aimed at answering what would happen in either scenario rather than predicting which will happen. You both seem to be reading him the same way and drawing different conclusions by adding other personal assumptions you are making about the future of energy supplies. You guys might as well stop using him in your arguments, I think.

JaggedBen,

You've almost got the problem we're discussing. The reason we are using Ayers and Warr's work is because Nick asserts that it is "unproven" that the world economy will contract as oil declines. Ayers' work directly addresses that because he connects our energy supply with world GDP.

I extend the connection by asserting that oil is a critical component of the world primary energy supply and thus when it declines the world economy will contract, thusly:

IF the size of the world economy depends on energy used

AND oil is a prime component of the global energy system

THEN as oil declines the world economy will contract.

This is important because preparing for a contracting world is very, very different from what Nick would have us do, which is basically ignore that little problem and rest all our plans on electric vehicles powered by wind. That's a simplification of his plan, but not by much.

You're right that Ayres does not address whether alternatives can ramp up in time. We can't even get to that place because to Nick the world economy won't contract as oil declines. He cherry picks moments in time to make the astonishing claim that as world oil production declines the economy will remain the same size and possibly even grow.

That's a fundamental misunderstanding of some fairly basic relationships, in my view, and it's no wonder we get nowhere in these exchanges.

Personally, I think there is a good chance that he is in the bargaining stage. When people bargain they assemble evidence that allows them to avoid confronting some particular outcome. They reason and make seemingly cogent arguments but their assumptions are marked by a pronounced optimism and they routinely give low probability outcomes a much higher chance of occurring than people not in the bargaining stage. Nick makes these sorts of overly optimistic assumptions all the time. Go back and review his projections for electric vehicle growth: they are significantly higher than any study we discussed. This sort of thinking is usually a very good indicator of bargaining.

In any case, I'm not in Nick's head so I could never say for sure. A trained psychologist might be able to tell but I think even then the only sure way of knowing is if he himself at some point in future says, "You know all those discussions we had? I can see now that I just didn't want to confront the gravity of the situation. I was spinning my wheels looking for any way to believe things wouldn't change."

In my experience studying this phenomenon, he won't even know if he's bargaining until that future point in time. The mind is a tricky thing. If it really is bargaining that is going on, our conversations are pointless because the bargainer can find an infinite number of reasons to avoid confronting the outcome. It does, hopefully, provide a service to others who are listening in, though.

Now, it's equally likely that he just hasn't made all the connections yet, which is where most people in the world are because the general level of energy education is quite low.

So I would never say with any certainty that Nick is bargaining. Only he will know and he may never share that insight with us here. (The other psychological factor to consider is that once we stake out a position we feel we have to defend it publicly even if we've actually changed our minds. That's a whole other issue.)

It's also possible that I'm completely wrong and I am seeing a connection that isn't there and that the world economy will not contract as oil declines, as I demonstrate in the slide below. Naturally, I think Nick hasn't connected the dots and he thinks I've connected dots that don't exist.

We are all going to encounter a lot of people in the bargaining stage so it's worth knowing something about it. Logic doesn't work — at all. That's why I went into some depth on the topic even if it doesn't apply to Nick.

In any system, if you can match the interface, then the system downstream of the interface won’t know the difference.

The main tenet of the post under discussion is that nuclear power creates the synthetic oil. Nuclear power is where the energy comes from.

If enough nuclear oil is manufactured, all will be well.

Yes, of course if enough of any or all the alternatives could be ramped up, then all will be well...except for all the other environmental problems we face that are right behind oil depletion (climate change, depleting aquifers, depleting metal and phosphorus ores, dramatic loss of biodiversity, fishery exhaustion, ocean acidification, etc.).

The only way you can say "all will be well" is if you ignore just about every other indicator that our ecosystems are deteriorating.

No, all will not be well. That's more wishful thinking or simple ignorance of the actual condition of the planet and our presence on it.

Andre,

Let me point out that I never say that "all will be well". In fact, I think climate change is an enormous problem, and I don't see any evidence that humanity is addressing it quickly enough. I think species extinction is also very important, and not being addressed adequately.

I do think it's important to clarify that we have technical solutions for both PO and AGW, and that those solutions are likely to be implemented quickly enough to make the transition from oil only medium painful (pain is, of course, relative).

Acknowledged.

Clearly Nick isn't disputing Ayers' connection of energy supply with world GDP. He's simply disputes the that oil will necessary decline faster than other sources can replace it. It's an argument about possible rates and timing, not about Ayers central conclusion.

Therein lies the problem with trying to use Ayers to convince Nick that alternatives can't ramp up in time, which is what you are trying to convince him of (or at least it's your major point of disagreement with him).

For the record, I'm on your side here, for the most part. It's fairly clear to me, if not to Nick, that over the next few decades decline in oil production is not going to be matched by growth from other sources, and that's going to mean economic contraction. However, I'm somewhat agnostic as to how significant growth from other sources will be. If they are significant enough, then economic contraction might not simply follow a line determined by declines in oil production. At some point, growth in alternatives may become more significant to the economy than decline of oil, in which case, according to Ayers, we would presumably see an economic turnaround. On the other hand, alternatives could be too weak to do much of anything, and there might be a threshold for their growth below which they would not survive in a contracting economy.

I like your slide (the title is exactly the pertinent question, in my opinion) but I think it's either a little mis-labled, or needs a little more explanation. As I would read it, the blue line wouldn't represent World GDP, but rather "GDP fueled by oil", or something like that. 'A' and 'B' represent possible curves for "GDP fueled by renewable energy". World GDP would be the sum of the two, and, remarkably since this slide comes from you, would be fairly flat (like Nick posits?) in the 'A' case.

jb,

Nick definitely is disputing the notion that when energy in general and oil in particular declines the economy will contract. He has been disputing this throughout the long-running conversation we have been having together. He points out that certain economies during certain periods have experienced growth even while their overall energy — and oil — usage have gone down. He then mistakenly applies that to the whole planet rather than recognizing it for what it is — a unique set of circumstances that cannot be extended to the planet as a whole.

He re-asserted a variant of that above when he made reference to California. He fundamentally disputes the connection between energy and the economy:

http://europe.theoildrum.com/node/6720#comment-685445

Somehow for Nick even with "declining energy in general and oil in particular" it's "highly unrealistic" that the world economy will contract.

I know, pretty odd, but that's his view.

Except it doesn't say that. Its been pointed out to Nick several times that it doesn't say that. Stoneleigh herself pointed that out to him.

The fact he continues to make that claim leads me to believe he's unreachable for whatever reason, or just playing some sort of stupid game with us.

If you could point out that conversation, I would appreciate it. I missed it the first time around.

In any case, I always thought that Nick was also saying that we could follow the blue line below in which so-called clean technologies come to the rescue. We can continue living our profligate ways with just the smallest decline in living standards before all those technologies rush to the rescue like a solar panel calvary.

In any case, I am definitely saying that as the primary energy supply decreases the economy will contract and was under the impression that Nicole thought the same thing. Thus peak oil == peak energy == peak economy, based on the connection between the economy and primary energy as distinguished by Ayers and Warr (and how large and important a component of the primary energy supply is comprised of oil).

Thus, the only thing in our control at this point is the slope of the green line. Basically, can we keep away from the orange line? If so, by how much?

Greer points out that the idea that we have any significant control over the slope of the line could be no more than an illusion — a view that definitely has some merit. I do think we have some control, though, and am working to influence that.

Sure, it starts here and goes on for some length.

http://www.theoildrum.com/node/6976#comment-723860

The salient quote by Stoneleigh is

I added the emphasis.

Ah, I did read that. I think Nicole's assessment of Nick's understanding is correct: he is missing very big pieces in his understanding of the financial system.

I would only slightly change what Nicole says. At this point in time, she is correct that the financial bubble is popping all on its own so energy is not the key driver, though I think it will accelerate the process for sure and definitely had a role to play in initiating the pop.

However, once this financial regime is gone and we've replaced our current set of currencies with whatever comes next, probably in the next decade or at most two, financial effects will play a lesser role and the economy will be tied more closely to how much net energy is available to it.

At that point as energy declines the economy will contract at nearly a 1 to 1 ratio. Until then, it will contract at a 5 to 1 ratio (or greater) because of all the debt defaults we will experience.

I'm pretty sure Nicole would be ok with distinguishing between these two time periods as I have done and would agree that, in the second period, energy and the size of the economy are highly and directly correlated. Until we enter that period, she is correct in asserting that ponzi dynamics rule the day with a good dollop of energy shocks to hurry things along. Still I don't want to speak for her but I think the logic is sound.

I want to careful no to put words in Stoneleigh's mouth.

But my interpretation of what she wrote is that the short time economic crisis will set us up for a medium/long term energy problem. But that problem isn't energy driven as much as it's capital driven. Ie it's the lack of capital/investment that's going to leave a lot of what used to be available energy in the ground.

I sort of envision a USSR/Russia type scenario. Russia had tons and tons of oil left in the ground but couldn't exploit it do to their economic crisis.

I think Nicole's assessment of Nick's understanding is correct: he is missing very big pieces in his understanding of the financial system.

Yes, I disagree with her assessments.

I've read quite a bit of it. I still can't see the basis, the fundamentals. Is she an Austrian? I can't tell. As best I can tell, she relies on two ideas: 1) deleveraging will cause massive deflation, and 2) diminishing investment in oil production, will accelerate Peak Oil, and declinging oil btu's won't allow a growing economy, and 2). If I'm missing something, please tell me. This writing contains many general assertions and predictions, but no supporting analysis, detail or supporting evidence.

She uses the phrase "excess claims on underlying real wealth". This implies a ratio of claims:wealth.

Are there too many claims? How do we know? In other words, what's the standard of "too many"? Elsewhere I've seen historical charts of credit as a ratio to GDP, and pyramids of different kinds of debt. But, this seems to be a kind of handwaving argument: "boy, that looks big!". What's the objective standard that says this is too high?

Or, is underlying wealth too small? As best I can tell she's saying that we're finding out that underlying wealth is too small (or won't grow as expected) due to energy limits, therefore there are too many claims.

Her theories don't seem to allow good predictions. Here's a prediction from November 2008: "We appear to be beginning a market rally at the moment, which should lead to precisely this set of trend reversals. Such a rally is only temporary relief however. It may last for a couple of months, but then the decline should resume with a vengeance." http://theautomaticearth.blogspot.com/2008/11/debt-rattle-november-29-20... . That was 22 months ago...

This is what I mean by re-interpreting her work to fit your narrow narrative.

She doesn't just postulate a hard oil ceiling. She postulates a hard energy ceiling. That includes all your wind, coal, nukes etc.

She's said it again and again, in many of her articles and lectures. That you continue to misrepresent what she says implies there is either something very wrong with your thought processes or you are playing a very strange game with everyone here.

She doesn't just postulate a hard oil ceiling. She postulates a hard energy ceiling. That includes all your wind, coal, nukes etc.

Oh, well, I'm, pefectly willing to admit that I probably missed that.

Perhaps it's because it makes very little sense: the world has an enormous amount of stuff that is burnable for electrical generation, and the US has an oversupply of generation. So, I was giving her the benefit of the doubt by assuming she was focusing on PO.

Words fail me.

You are either an ass or an idiot. Maybe both.

Yes, words fail you.

And, yes, we sharply disagree.

@Rethin

I think I would speak for many by saying that Nick should be ignored in this forum as he is basically a competitive sociopath whose main reason for being here is to feed his compulsion to win arguments. He lacks any emotional intelligence and does not understand when to drop a pointless argument, insisting on the last word even when it adds nothing but irritation to the conversation. This is a pity because he obviously has some knowledge on energy issues but confuses his own interpretation with holy gospel, taking a fundamentalist approach he feels compelled to constantly defend rather than re-examine. The only way to treat Nick is not engage in his childish arguments and choose more civil interlocutors who can at least acknowledge both the costs and benefits involved in any hypothesis.

I would bet money that Nick will not be able to refrain from interjecting here, but I won't be responding to him.

main reason for being here is to feed his compulsion to win arguments.

So you don't think TOD has any importance? You don't think anyone reads if to inform themselves, and make decisions? It's just an academic place, where we amuse ourselves conversationally? It's not important to figure out what makes sense?

insisting on the last word

I like to discuss things until we get to agreement, or as close as possible. I often acknowledge agreement with people. It's what I'm trying for.

a fundamentalist approach he feels compelled to constantly defend rather than re-examine.

Read the comments from those who disagree with me most sharply and persistently. Do you see indications they are re-examining their argument? Acknowledging mistakes, and learning from them? Both sides have to do that, for a discussion to make progress.

I won't be responding

I almost always encourage people who disagree with me to keep on responding until we reach agreement. But, given that your comment was entirely ad hominem, I won't this time.

As best I can tell, Nicole sees energy as a medium-term problem, not a short term problem (5 year window).

You insist on misinterpreting what she writes to fit your own narrative.

See my response above.

Huh??

How does what I said above conflict with what you wrote? Actually, if you read later in that older post where I debated with Nicole, you'd see I finetuned what I said.

Re: the graph, it's more two distinct measures plotted on the same graph. My goal is to show that the world economy will contract as fossil fuels decline until it reaches the energy level provided by alternatives. It's simplistic because it doesn't include nuclear etc. but it is meant to convey a concept, not to be representative of actual numbers.

It could also be expressed in the way you say...let me mull over which would get the idea across better.

Edit: I just realized you said that in this new graph the world economy line would stay flat...I wouldn't show that case. I see no possibility of the world economy staying anywhere near its current size. It will either contract a tremendous amount before renewables provide a backstop or it will contract a tremendous amount x2 before renewables can prop it up.

Andre, regarding the visual connotations of the graph, it seems to me that 'A' and 'B' correspond, respectively, to 'Cleantech stability' and 'Creative Descent' from your other graph. (Mad Max would be a flat line labeled 'C'.) I completely agree that the A curve, 'Cleantech stability' is highly unlikely. (Maybe I'd give it a 5% probability.) On the other hand, I do believe that cleantech has a role to play in "Creative Descent.' In a nutshell, I believe that 'B' is achievable if we put our minds to it.

Granting that your graph is conceptual rather than actually quantified, I think that to get across these two possibilities subjectively, I would make your current 'B' line the better case, and make the worse case a line halfway below it.

One thing that drives alternatives, is pain. So, the more economic pain, the more motivation to fund alternatives.

As the pain ramps, we could see things like rationing.

Also note that "economic contraction", is very selective.

In the last fuel price spike (before the recession), there was a lot MORE "economic migration", as large wealth transfers took place.

There is already signs of significant moves to Gas, which has a longer half-life than Oil, and even coal is on the radar, as the half life there is longer still. (this thread)

Good point, certainly a slide that shows GDP accelerating down to Zero, is not very well considered.

As the GDP Sum is only somewhat Oil dependent (given plenty of examples where GDP grew, as Oil declined), then perhaps the Graph needs MULTIPLE GDP contributors :

Smarter examples could be Oil+Gas+Coal+Renewable+Thrift+Elasticity+Discretionary.

Each of these would have a value, and a Change Weighting factor

Each one of those can change, independently, and a new total GDP results.

Some countries may even grow during the tail transition.

Clearly Nick isn't disputing Ayers' connection of energy supply with world GDP. He's simply disputes the that oil will necessary decline faster than other sources can replace it

My position is rather different. I think we have a liquid fuels problem, and a climate change problem.

We have plenty of coal, nat gas, wind, solar, etc to produce all the electricity we need. But, we're going to have a liquid fuel supply problem, which will have to be addressed by somewhat painful conservation if efficiency and substitutes don't ramp up quickly enough.

We have a climate change problem, that we need to ramp up wind, nuclear, solar, etc to deal with. We probably won't do that quickly enough, but we will do it quickly enough to extend FF supplies sufficiently that electrical supplies will never be fundamentally a problem.

To me, it still sounds like you believe "that oil will [not likely] decline faster than other sources can replace it." I'm not sure how your position is "rather different", except that perhaps you prefer not to frame the issue as one of economic growth or contraction.

To me, it still sounds like you believe "that oil will [not likely] decline faster than other sources can replace it."

Well, we have so much surplus energy of all sorts that conservation will play a large role: more important uses of oil will out-bid less important uses, like personal transportation.

So, other sources won't replace oil as quickly as it declines in the short-term, but it won't matter nearly as much as some are suggesting.

I don't think Nick's view is so different or that wildly cornucopian

basically he is saying we can muddle through despite fossil fuel depletion.. much the same as majoran really is also portrayed as outside the box..

everybody is getting into a bunch over not a lot....

I tend to think that is what will happen.. how much carnage does muddling entail?

the area I struggle with is "muddle through to where"

9 billion people with a annual global GDP growth rate of 4% in 2050.. BAU

I doubt that very much.. I just don't think its doable or even desirable

I think we have the resources to manage the problem but not the political will or psychological adaptation to settle for something sane as a goal. YET

I am not up for giga death scenarios.... we all muddle through together the best we can and we ration whats in the tank until some sustainable infrastructure is in place(one way or the other via the market or command economy I have no intrinsic bias as long as it is "just" as possible)

what comes next? .. there is a real failure by

politiciansthinkers everywhere to present the population with some sense of the futureThere are billions of lives at stake here

Contracting to zero?

50% of world energy goes to electricity which is not dependent on oil. Coal moved in trains wouldn't take a lot of oil(all trains probably use less than 1 quad of energy).

The amount of energy required to get produce and transport a ton of food is probably less than 50 GJ per ton. 11% of that would go to transportation/oil.

http://www.leopold.iastate.edu/pubs/staff/ppp/food_mil.pdf

The average (fat) american consumes 1.1 tons of food per year.

Therefore, 1.1 x 50 GJ? x 300E6/E18=~16.5 quads?.

Then food transport would be 1.8 quads of liquid fuels(11% of food).

BTW, the US produces 12.8 billion gallons of ethanol per year about 1 quad of energy. So if all ethanol was diverted to food transport it alone would cover half of food transport.

In the event of a sudden collapse of oil alone, it is certainly very possible to continue the basic functioning of society under wartime conditions would continue to produce fuel and electricity.

It's true that most people would no longer have jobs to commute to, but in countries like Haiti the unemployment rate is about 70-80%.

People would do a lot of telecommuting and local public works--maybe building electric trams.

In a society with 50-60% unemployment it's difficult to imagine businesses making much profit, but that isn't the end of the world.

Perhaps all this speculation is 'bargaining' but I haven't seen any figures 'proving' that a total oil embargo alone brought any country to total anarchy/collapse. In fact, such countries Germany and Japan WW2 survived surprisingly well.

Germany and Japan did not survive well, they were in the malnourished stage of decline when they lost their energy supplies and were utilizing slave labor to provide other resources. They were also at a much lower level of complexity that they are today with lower populations.

Personally, I think there is a good chance that he is in the bargaining stage.

That's ad hominem, and unproductive. In fact, as far as I can tell I know quite a bit more about energy than you do. But, that's irrelevant. I don't present myself as an authority: instead I present evidence.

Ayers' work directly addresses that because he connects our energy supply with world GDP.

This is so odd. That's not what Ayres says. He says in his abstract: "We infer that output growth does not drive increased energy consumption and to sustain long-term growth it is necessary to either increase energy supplies or increase the efficiency of energy usage. "

How much clearer can that be????

Ok, this is getting funny. Did you just completely skip over the first part of the sentence in your rush to find evidence for your point of view?

Ok, this is getting funny.

Or, very puzzling.

Did you miss the words either and or???

Nope...but it all starts with energy because you have to have it before you can use it more efficiently. Plus, as you know, my view is that there is no way we will replace all that equipment while the economy is contracting like a popping balloon.

there is no way we will replace all that equipment while the economy is contracting like a popping balloon.

Do you agree that both the US and world economies are now growing, (albeit not as strongly)?

US GDP (BEA):

07-q1 5.4%

q2 5.8%

q3 5.2%

q4 4.5%

08-q1 1.0%

q2 3.4%

q3 1.3%

q4 -5.5%

09-q1 -4.7%

q2 -0.8%

q3 2.6%

q4 5.9%

10-q1 3.8%

q2 1.7%

World GDP (World Bank PPP exchange rates):

2006 5.4%

2007 5.4%

2008 2%

2009 -1.9%

2010 3.4%

Irrelevant. More evidence that you still haven't gotten the big picture.

Do you see that growth can't continue with the fundamentally unsound financial system we've set up? That eventually debt repayment takes up too much of ongoing revenue and the process must slow, then contract?

Then, as we contract, do you believe we are going to pay back all the debt that we've incurred?

Irrelevant.

Surely we should try to agree on a few basics. Can we agree that the economy is not currently shrinking?

Do you see that growth can't continue with the fundamentally unsound financial system we've set up?

But, how is it fundamentally unsound? Because it's not based on a gold standard? Have you read the history of the gold standard, and how it perpetually created deflation and recessions/depressions?

Because there's too much leverage? By what standard do we decide how much leverage is too much? For instance, the US had as much leverage after WWII as it does now. Yes, other things have changed - but still, what's the quantitative measure? How do we decide?

That eventually debt repayment takes up too much of ongoing revenue and the process must slow, then contract?

Debt repayment right now is pretty cheap, with interest rates as low as they are.

I've seen that chart before. I note that it appears to be from a laywyer turned goldbug - someone who makes their living selling investments in gold and other commodities (I note that gold is called "power money"). Might there be a conflict of interest there?

The chart shows derivatives at the top. Where do "Shadow Derivative" numbers come from? How do the derivatives numbers change when you net out all of the transactions between matching counter-parties? IIRC, when Lehman's was liquidated, the derivative numbers started at $63billion, and after all transactions were netted out, they fell to about $7B.

jaggedben,

Maybe I can have a productive conversation with you, instead. Andre keeps reversing things, and just ignoring things. It's very, very odd.

Ayres says in his abstract (that Andre linked): "We infer that output growth does not drive increased energy consumption and to sustain long-term growth it is necessary to either increase energy supplies or increase the efficiency of energy usage. "

How much clearer can that be????

The emphasis is yours, I note. But I don't think it has the import you think it has. In the context of your disagreement with Andre, increasing efficiency is just a corollary to finding other sources of energy to replace oil. Efficiency gains (which will certainly have diminishing returns, btw) still have to outpace oil depletion to grow GDP. One can be optimistic or pessimistic about the prospects for increasing efficiency, as I believe you and Andre are, respectively.

Again, I don't think Ayers provides either you or Andre with the theoretical clincher that you both seem to believe it ought to. It is all your other assumptions that account for your disagreement.

I agree that Nick still doesn't get it but I disagree with your assessment that the paper does not demonstrate my point.

The exact nature of Ayres and Warr's work is to show the link between energy and the economy and they have been working on it for some time now. Granger-causality tests are designed for this sort of thing.

This is the best work they have done so far and directly addresses the confusion out there about causality. I request that you read this paragraph again carefully:

Also, as you point out, Nick completely misses the first part of this sentence:

Remember that Ayres and Warr have been grappling with connecting energy to the economy for a while now, that's a major focus of their work and is specifically what they are aiming to provide evidence for. Earlier attempts were not as comprehensive as this one but they have been getting closer each time.

Yes, Andre, you don't need to convince me that there is a link between energy and the economy. (Moreover, I'm actually interested and a bit relieved to see that they only identify causality in one direction. I would have thought that the link was even stronger, i.e. a feedback.) Moreover, I don't think that you need to convince Nick of it either. What you need to convince him of, if you want to change his outlook, is that declines in oil are going to mean declines in total energy no matter our best efforts with efficiency or other sources. As you said yourself upthread, Ayers work doesn't really address that.

BTW, hopefully someone will laugh if I put my own bold tags in the following sentence.

"to sustain long-term growth it is necessary to either increase energy supplies or increase the efficiency of energy usage."

It seems to me that both of you are overlooking those words.

Hi, jb.

I think Nick's feet are nailed to the floor and after many, many months of this conversation I don't think he is open to changing his mind. Recall that he thinks it "unrealistic" that the world economy will contract as energy OR oil decline (see his quote elsewhere).

And I'm not overlooking efficiency, I've just judged that there is no way for us to make our systems more efficient while the world financial system is imploding.

No matter, it makes little difference in the long run. I'll keep letting people know that we are headed for contraction and eventually we will be contracting so quickly it won't matter much what either of us say!

P.S. I did chuckle at your bolded words.

I think Nick's feet are nailed to the floor and after many, many months of this conversation I don't think he is open to changing his mind.

Again, that's subtly ad hominem. I'm entirely open to changing my mind, if shown something that makes sense.

I've been thinking about energy (and related questions) ever since I read the first Club of Rome's Limits to Growth more than 30 years ago. I was much more pessimistic then, but I spent decades gaining professional experience and learning about resource/energy problems. I carefully developed evidence-based ideas before I started asserting things on TOD. That's why I don't appear to change my mind much.

Recall that he thinks it "unrealistic" that the world economy will contract as energy OR oil decline (see his quote elsewhere).

Let's be clear: as a practical matter, oil is the only energy problem we have. For better or worse, we have a lot of things we can burn for electricity, and wind, nuclear and solar to extend them until renewables can take over completely.

GDP per unit of energy varies significantly between countries and between the United States and Europe. Greater efficiency has and will permit an increase in the amount of useful work per unit of energy expended. Goods production can be maintained or increased using less energy per unit of production.

Having said that, GDP cannot be increased indefinitely given a finite or decreasing energy supply. At some point, increased efficiency will not be adequate to compensate for decreased energy supply.

Further, even if the above is true, I don't think it is really worth arguing over whether or not GDP can increase for X number of years given a declining oil supply. Oil production is going to decrease, so what will be will be.

Regardless of whether or not one agrees with Nick or Aangel, other constraints such as air, water, food, soil, land, ocean acidity, and climate change will kick in to make us much less productive and much less viable. These constraints will force the earth's inhabitants to cut back on production. This decrease in production will be even more pronounced amongst those billions who experience dieoff.

There is too much reliance on GDP as a proxy for well being, not to mention happiness. If I ride my bicycle to work or the post office, it reduces fossil fuel consumption, saves me money, reduces my weight, increases my heart rate, improves my health and others' health, and improves my well being. If enough people do it, it improves the whole community's well being and does a little bit to help the planet's well being. If I walking or bicycling to work, it might even increase my productivity. It is my experience that this is true, personally.

If reduced energy use, regardless of the reason, increases quality of life and enhances the quality of the air, the soil, the water, and results in decreases in use of other resources, this seems like a good thing. If this also decreases GDP, so be it, especially considering the fact that GDP sucks as an indicator of progress or well being.

I don't know for certain if we will ramp up other sources. I suspect, however, that coal will be ramped up in a stupid attempt to keep our totally destructive transportation system going either through something like CTL or electric vehicles. We don't need to replace all or even most of the existing equipment if we accept an alternative path of making our cities capable of accommodating most people's needs within a short distance of their homes. That is what Portland, Oregon is trying to do. This may fail, also, but will be more successful than trying to completely change out all our existing vehicles.

If the intermittent nature of renewable sources can be overcome or accommodated, then we may be able to limp along for several decades or maybe even longer. GDP, such as it is, will probably be significantly reduced. The question, though, is what kinds of lives will people be really living.

Further, I would prefer a massive, voluntary reduction in population. That is not going to happen, of course, so we will have massive dieoff. Unfortunately, we will have killed off most of the planet's other species before human dieoff occurs. The human race is a plague that is killing itself.

This is what Ayres said in 2005 (quoted in David Strahan's The Last Oil Shock) about the impact of peak oil on global GDP:

Fairly clear in his views, so it seems.

Hmm. What page is that on? I'd be curious to verify that quote, as this is completely inconsistent with his research.

No it's not. You are completely inconsistent with his research because you have misinterpreted what he is saying, as we keep trying to point out to you.

It's actually quite remarkable how you can misinterpret an entire body of work with titles like:

The Economic Growth Engine: How Energy and Work Drive Material Prosperity, 2009

Energy and Economic Growth, 2008

Accounting for Growth: The Role of Physical Work, 2004

The quote is on p.123, btw.

There are two keys here:

Energy and "work" are not the same, and energy and oil are not the same.

Are you clear what "work" is? It's freight actually delivered, as opposed to the energy input. It's an activity, not an input. In a sense, Ayres has been measuring outputs, not inputs.

Now, I'd be curious to verify that Strahan is quoting Ayres correctly, and if it's correct to verify that Ayres opinion hasn't changed since. Because there's nothing in his research that fits with that quote.

Don't you think it's a hint that he is saying something in direct contradiction to what you think he has been saying that perhaps it is you who is misinterpreting his work, as several of us keep pointing out to you?

Of course. I can understand why that quote would seem to validate what you're saying.

Nevertheless, it's not supported by his research. He may have been misquoted. We're told it was made in 2005. World oil consumption has fallen since then, but the world economy has grown by 15%. This is fully consistent with his research, but not at all with this quote.

Let me say it again: this quote was completely wrong. And, that it would be wrong was predicted by Ayres' research!

Again, let's look at the last few lines of the abstract of his work that you described as his best:

"...to sustain long-term growth it is necessary to either increase energy supplies or increase the efficiency of energy usage. Faced with energy security concerns and the negative externalities of fossil fuel use the latter option is preferred."

He's clearly saying that economic growth does not require growth in primary energy supplies, such as oil.

Yes, he's saying that energy is important. But, he's not saying that oil is uniquely important, or that there is any kind of 1:1 ratio between primary energy and the economy. In fact, he's saying that the link can be broken, and should be.

The quote is from page 123. Maybe you should settle this argument simply by emailing Ayres and asking him what he thinks. Given your track record of misrepresenting the work of others, however, you should probably expect a similar reply to the one you had from Nicole Foss.

Maybe you should settle this argument simply by emailing Ayres and asking him what he thinks.

Not a bad idea. Thanks. He may have been misquoted, or had a chance to rethink that comment - we're told it was made in 2005. World oil consumption has fallen since then, but the world economy has grown by 15%. This is fully consistent with his research, but not at all with this quote.

Let me say it again: this quote was completely wrong. And, that it would be wrong was predicted by Ayres' research!

It doesn't seem that important to me, because I don't give much weight to the personal opinions of authority figures when they conflict with the published literature and data. But, others might benefit from a clarification.

Given your track record of misrepresenting the work of others

I did make a mistake: I thought she considered energy an important near-term factor. Frankly, it was the only explanation I could find for her unusual results.

Her theories don't seem to allow good predictions. Here's a prediction from November 2008: "We appear to be beginning a market rally at the moment, which should lead to precisely this set of trend reversals. Such a rally is only temporary relief however. It may last for a couple of months, but then the decline should resume with a vengeance." http://theautomaticearth.blogspot.com/2008/11/debt-rattle-november-29-20.... That was 22 months ago...

Unusual claims require unusual evidence. I asked Nicole for quantitative support, and she said numbers weren't useful ("There are far too many numbers in this world that are not worth the paper they're written on. I build logical models grounded in historical evidence." http://www.theoildrum.com/node/6976#comment-724950 )!!

How can you be certain that global oil production has already peaked? You are misrepresenting Ayres' words again.

I'm not suggesting that oil has peaked. Certainly, it reached a higher point in 2008, and it may mange to rise further to a higher peak in the next year or two.

But, in this case this is an unimportant distiction. In 2005 we reached something that very close to an absolute peak, something that has been called "peak lite", where production didn't rise quickly enough to meet demand, and therefore prices rose sharply.

That kind of shortage, and the resulting price rise, is what this quote is talking about: it says "When petroleum gets more expensive everything that depends on it gets more expensive...". This really isn't true (core inflation barely rose in the period 2004-2008, which means oil price inflation didn't break out of the direct effects of rising costs of basic energy products like gasoline).

I'm actually hoping that these are not Ayres' words. If Ayres said that, it means he committed a common error for an "expert", which is to stray outside the realm of one's expertise. I suppose that's possible, but I'm hoping that Strahan misquoted him.

------------------------------------------------------------------

Let me reassure you: I think we should move away from oil & FF ASAP. It's important to get things like this right because they support BAU by suggesting that without oil that our economy will collapse. The de facto message: drill, baby, drill, because without it we're going to hell in a handbasket. Corporate interests aren't afraid of people making apocalytic predictions about PO - they know they're unrealistic, and that in the long run we're going to move to effective substitutes. But, they're terrified of those substitutes, and they're delighted to have people out there discouraging any move away from FF as long as possible.

I have to agree with Andre here Nick. It's not surprising that someone whose research very robustly looks at the relationship between energy and economy would have such views. Note that scientific papers typically draw more conservative conclusions than the writer may express when interviewed in a less formal setting.

It's not surprising that someone whose research very robustly looks at the relationship between energy and economy would have such views.

Actually, it is. His research doesn't support it, as far as I can tell. He may have been misquoted. We're told it was made in 2005. World oil consumption has fallen since then, but the world economy has grown by 15%. This is fully consistent with his research, but not at all with this quote.

Let me say it again: this quote was completely wrong. And, that it would be wrong was predicted by Ayres' research!

Note that scientific papers typically draw more conservative conclusions than the writer may express when interviewed in a less formal setting.

There's a good reason for that. That's the purpose of peer review, and formal documentation. It prevents embarrassing mistakes like this.

World oil consumption has remained pretty level, statistically speaking, since 2005. It's still a matter of some guessing whether we've seen the all time peak or not. We have not seen a meaningful decline. As for world economic growth, I'll take your word for it.

The quote from Ayers, to be precise about it, states that the economy will likely peak when oil peaks. Since oil hasn't unequivocally peaked yet, the quote really can't be either verified or invalidated, yet. Neither is it clear what kind of time-correlation he is assuming.

Again, I haven't read Ayers work. But from what I've seen in abstract, his work looks robustly at the relationship between energy and economy. I do not see that it looks robustly at available energy supplies. Different assumptions about available alternatives to oil will lead to different conclusions about the practical implications of his work. Apparently, given the quote, Ayers own assumptions on energy supplies were pretty pessimistic regarding alternatives to oil back in 2005. (It's easy to criticize with hindsight.) Unless you can show me where Ayers actually predicted what has happened in the last 5 years, it seems to me that you are adding in your own point of view on available energy supplies when you say that his work predicted what has happened. Again (for the last time, may I hope?) let me say that I think you need to separate what you are getting from Ayers (the relationship of energy to the economy) from what you are getting from other places (ideas about available alternatives to oil). Your conclusions about the likely future of the economy are not based on Ayer's work alone.

Upthread, you said...