No peak oil yet? The limits of the Hubbert model

Posted by Ugo Bardi on January 17, 2011 - 10:42am

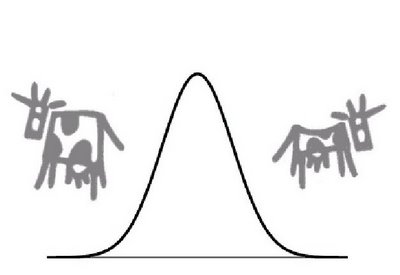

Fig 1. World production of conventional oil. Image from "Oilwatch Monthly"

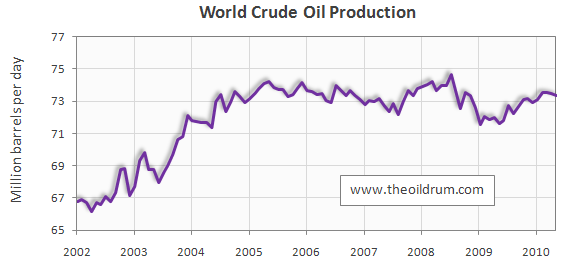

Fig. 2 World production of "all liquids." Image from "Oilwatch Monthly"

Nevertheless, what we are seeing is not what we would expect: we are not seeing a well defined peak, at least for the "all liquids" case. That raises a fundamental question: is the Hubbert model a valid tool for describing the future of oil production worldwide?

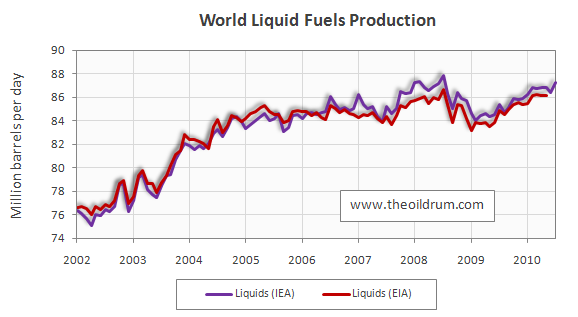

We know that the Hubbert model has worked in a number of regional cases, but not in all of them. One of the cases where the model failed is that of natural gas production in the US. Hubbert himself had calculated that it should have peaked around 1973. It did peak when predicted, but it did not significantly decline afterwards. Instead, it oscillated around a plateau and, in recent times, it has exceeded the 1973 peak. A completely different case is that of crude oil in the US, where the post-peak decline is compatible with the Hubbert model. Here is a comparison of the two cases (from EIA ). The scale is reported in terms of equivalent energy in Exajoules (EJ) with one cubic foot of gas equal to 1.1x10E+6 J and one barrel of oil equal to 6.1x10E+9 J.

Fig 3. Production of Natural Gas and Crude Oil in the USA

An interpretation of the Hubbert model is described in a post of mine that I titled Mind Sized Hubbert ." According to this view, the model is based on the concept of Energy Return for Energy Invested (EROEI). Oil is a form of energy, but extracting oil also requires energy; the EROEI is the ratio of these two energies. The core of the model lies in the assumption that the extractive industry reinvests an approximately constant fraction of the energy it produces into new extraction facilities. In this way, it can grow exponentially, at least for a while. However, the industry tends to extract first the, "easy", high EROEI, resources. With time, it must move to progressively more difficult (lower EROEI) resources. With less energy available for extraction, the growth of production slows down. Eventually, production peaks and then declines. If these considerations are set in mathematical form, the result is the bell shaped curve (see this article in "Energies" ).

An equivalent way to see this effect is in considering monetary costs. A lower EROEI means higher costs of extraction. As a consequence, profits go down and that reduces the capability of the industry to invest in new resources. Alternatively, the industry may attempt to increase prices in order to keep profits constant. But higher prices reduce demand and, as a consequence, production goes down - it is again the Hubbert curve.

This is a simplified view of the Hubbert model that sees it as an isolated subsection of the whole economy. However, that is an approximation, of course. The economy is more complex than that and the response of demand to price increases depends on a property that economist call "elasticity." Normally, higher prices reduce demand, but a commodity may be so crucially needed that demand remains high even for high prices. In this case, demand is said to be "inelastic." Crude oil and other fossil fuels are so vitally necessary to the economy that the vagaries of oil prices during the past few years have had only a small effect on the production curve. So, oil is a classic case of inelastic demand (within limits, of course).

The consequence of a nearly stable demand coupled with high prices is that the industry can maintain its profits and keep investing in new production facilities, even of high cost resources. In practice, the extractive sector takes energy and resources from other sectors of the economy and uses it to extract low EROEI resources. In this case, you can't expect to see a bell shaped production curve any longer.

These considerations explain the different behaviour of oil and gas in the US. Both are badly needed commodities for the economy and in both cases demand is basically inelastic. But there is a difference. Oil can be imported from overseas by tanker. Gas, instead, needs to be liquefied at low temperatures and that requires special facilities, it also requires special ships for transporting and more - all that is very expensive.

As a result, after the national peak, in 1971, the cheapest route for the US economy to obtain oil was to import it from overseas and, hence, there was no need of an effort to develop high cost resources within the national borders. Oil consumption did not decrease but imports grew gradually and today account for almost twice as much as the national production.

The opposite holds for natural gas, which was very expensive to import. As a consequence, it made sense to invest into developing new domestic resources, even expensive ones. That has been going on from 1973, the peak date for gas in the US. The last round of the process is the recent trend of exploiting the so called "fracture gas". The technology is not new, but it is being used now because all other sources are declining. And if it is used only now, it means that it is more expensive. But the US economy needs gas and - so far - it is willing to invest as much as needed in order to obtain it. As a result, the US domestic production of natural gas remains today almost ten times larger than imports.

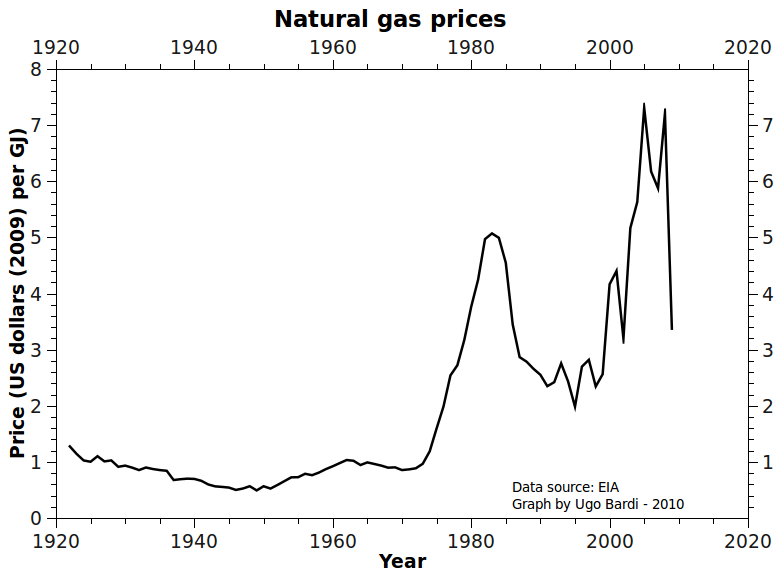

We see in the following figure the behaviour of gas prices in the US. The data are from EIA and are corrected for inflation using the data reported in usinflationcalculator .

Fig 4. Gas prices in the US

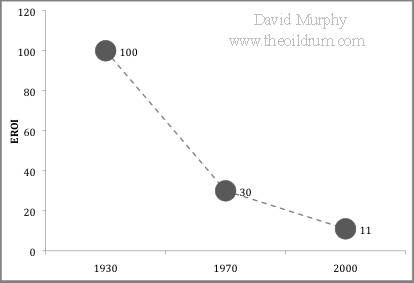

Now, let's see if we can apply these considerations to the case of crude oil worldwide. Oil EROEI has been plummeting in the past decades, as we can see in this well known graph by Cutler Cleveland, reported on The Oil Drum by David Murphy

Fig 5. Crude Oil EROEI in the US.

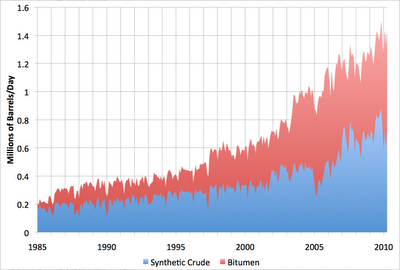

Fig 6. World production of liquid fuels from tar sands.

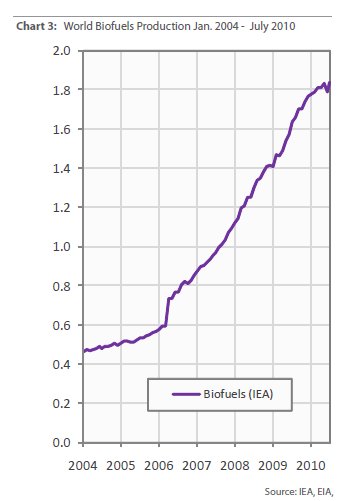

Fig 7. World production of biofuels (the vertical scale is in million barrels per day)

So, the world's economy is diverting resources in various forms to oil extraction in order to keep the vital supply of liquid fuels to the world. But that comes at a cost. Energy and resources needed to keep on producing from low EROEI sources must come from somewhere: some other sector of the world's economy must do without them. In other words, the net total energy available to the economy does not increase and may actually go down.

Biofuels are an interesting example of this phenomenon. The EROEI of a biofuel such as corn ethanol is low, around the value of one or little more. But you can use energy from coal to make ethanol from corn and, doing so, you are effectively transforming coal into a liquid fuel. But coal used in this way is not available to the economy for other purposes - the net energy available to society does not increase. This kind of phenomenon occurs also for other resources and the reduced availability of energy is a possible explanation for the world's economic troubles of recent times.

So, what is it going to happen in the future? We are moving, here, towards a completely uncharted territory. It has never happened in modern history that a crucial non-renewable commodity has been exploited to the "peaking point" worldwide, as it is happening now for fossil fuels. Surely, the mechanisms of the economy will try to maintain the production levels of a commodity which is indispensable for our society: liquid fuels. For this purpose, resources will continue to be removed from other sectors of the economy, from coal for instance, and used for boosting production of liquid fuels. That will go on as long as possible - but not forever: the economy is not infinitely large and the resources available are finite. We cannot say exactly when but, at some point, the production of liquid fuels will have to start declining. We cannot say with certainty which shape the decline will take, but some models such as those of The Limits to Growth that take into account the whole economy indicate that decline might be abrupt.

If you expect a model - any model - to be able to predict the future you are going to be sorely disappointed. The Hubbert model is no exception, but many models can tell you enough about the future that you may prepare for it. It doesn't matter if models are approximate and in some cases don't even work; it is the way one uses them that makes the difference. A feather falling in air does not mean that Newton's law of gravitation is wrong. It only shows that you must use the model understanding its limits. The same is true for Hubbert's model: the case of natural gas in the US doesn't mean that the model is wrong. It only shows that you must understand its limits. If you do, the Hubbert model can tell us a lot about what is happening and about the reasons for the troubles we are having. And that should tell us something about where we are heading to; there is still some time, not much, to get prepared.

References

A good historical account of the career and of the work of Marion King Hubbert can be found at this page by Ron Swenson

The March 1998 paper on Scientific American by Colin Campbell and Jean Laherrere can be found at

The paper by Ugo Bardi and Alessandro Lavacchi that describes the "mind sized" interpretation of Hubbert's model can be downloaded at this link at mdpi

About the EROEI of biofuels, there is a classic paper by Patzek and Pimentel . It has been contested many times, but the basic idea that corn based ethanol has a very low EROEI seems to remain valid.

A discussion of the concept of elasticity in economics can be found in this paper by Ron Cooke.

About the evolution of the ratio of net and gross energy available to society, see this document by Charles Hall

A description of the relation between "peak oil" and "The Limits to Growth" studies can be found in this post by Ugo Bardi

This kind of phenomenon occurs also for other resources and the reduced availability of energy is a possible explanation for the world's economic troubles of recent times.

I dont think it is valid to lump liquid fuels together with all energy. There are no immediate limitations to generating electrical energy, for either coal, nuclear or renewable resources. The problem for transportation is the present need for liquid fuels but with the exception of air transportation, most liquid fuels can be replaced by electricity, or coal or CNG. Its the time needed to make this transition not the absolute availability of energy that is going to be the issue once we have a more rapid decline in oil( and other liquid fuels).

I don't think it is valid to lump liquid fuels together with all energy.

Too true. To use units of volume like barrels and to combine fuels which contain different amounts of energy is to misrepresent what the volume can be used for. Those graphs of "volume total liquids over time" are showing exactly what in terms of energy when the parts of the volume which contain NGL have, say, 65% of the energy that the parts of the volume of oil they are being combined with?

Could you imagine a chart showing copper and lead production together with copper dwindling and lead increasing faster somehow being used to demonstrate that there's still increasing amount of copper being produced?

That's the issue I was trying to raise last week. Can someone with the know how show the projected production based on NET ENERGY. I would think it would affect the curve quite a bit.

Yes, I would like to see more fine grained data on what is included even under "crude oil" in figure 1.

I am betting that a lot of the stuff that is keeping it on the 'plateau' is unconventional, tar sands, deep water, and very heavy and sour stuff--all of which take considerably more energy and economic and environmentaly cost to produce and refine.

(And, by the way, does anyone have an up-dated version of that graph? Rembrandt?)

I'll bet that Rockman has a good idea about the difference in cost, both in energy and dollars, between offshore and land based oil extraction. My wild, unqualified, guess is that the difference isn't very significant to the price at the pump.

JJ – You lose the bet…pay up. LOL. I can’t give an answer in net energy. We just don’t think in those terms in the oil patch. At least not directly…our primary metrics are measured in dollars. Offshore vs. onshore LOE (lease operating expense) - Offshore LOE is much higher than onshore. OTOH offshore production is typically much higher so LOE per bbl/mcf doesn’t tend to look too bad. OTOH a lot of energy is used to abandon an offshore platform compared to plugging an onshore well. So convoluted I don’t think I would even offer a rough guess.

US oil production has two primary arenas: new DW production from the GOM that start at very high rates but decline to non-economic levels within 5 to 8 years. And very mature old onshore fields that typically have been undergoing EOR for decades and have rather slow decline rates and will hang on for many more years. But the LOE per bbl/mcf for these old fields is typically higher than the DW fields.

As difficult it is to make a generalization about US production we have a much more detailed data base to work with compared to the rest of the globe. As far as the price at the pump remember that oil isn’t priced based upon what it cost to drill or produce that well. It sells for what the market will bear. A bbl of oil from a high net energy cost will sell for the same price as a low net energy cost well. Of course what new wells get drilled, what EOR projects are implemented and what production is maintained will depend on cost factors at the time those decisions are made.

There you go: I’m sure my explanation is as clear as drilling mud. LOL.

JJ/Rockman

Can the dollar and energy costs be equated somehow?

Using a few approximations;

Oil accounts for 35% of the primary energy powering society.

If oil extraction had an EROEI of 1 then it would consume 35% gdp. Based on todays Global gdp numbers this would equate to a barrel cost of $580.

So can the barrel cost of extraction be equated to an EROEI by dividing it into 580. E.g. if DW oil extraction requires $70 to be profiatable then the EROEI for DW is 580/70 = 8.2.

Just a top-of-the-head thought, criticisms/comments welcome!

TW

Not really because dollars can be borrowed from the future and spent today. The net energy eventually available to pay of the loan occurs sometime later on in the future.

Even if a company in the oil patch runs a tight ship and only uses savings to fund investment that does not prevent their customers from borrowing to buy the product.

If EROEI is constant or increasing no big deal borrowing is unlikely to be impacted. I.e its simply funding the needed expansion.

However if EROEI is declining then borrowing will eventually be a real problem.

I think if you want to link money and EROEI then the linkage is through debt not money. If debt is expanding or defaulting at a high rate and you have reasonable data showing EROEI is falling the EROEI is one part of the problem with paying back debts.

Clearly a lot of other factors are at play but many of these can ultimately be traced back to EROEI problems.

For example China's willingness to exploit its vast coal reserves with little control introduced a cheap relatively high EROEI resource this allowed them to expand. Nations like the US that where unwilling or unable to match China showed rising debt loads.

EROEI and costs clearly play a role in the expanding debt. Thus the US clearly did not have any decent EROEI resources left to balance the trade between the two. This includes all kinds of low energy technical/service related possibilities. In short no low energy intensive route was possible.

I think its much easier to see when you consider relationships between countries that have bountiful cheap energy and those that don't. The debt is highly correlated with the lack of high EROEI resources.

And to be brutally honest the US will probably never pay for the energy its used in the last several years either embodied in goods or directly. The people that sold the energy to us will never get any value out of most of their electrons.

One has to imagine even it its too late that energy and goods producers will realize this and consider just what they will except as payment.

watcher - probably to some degree but I'm not sure how I would interpret such analysis. One example: the cost (in energy and $'s) in drilling a deep well. Even though the rig burns diesel (along with all the motor fuel used to transport the equipment to the drill site) overall this represents a rather small amount of cost in $'s. OTOH the daily rig rate tends to be the highest single expense. The next biggest chunk is the cost of the steel casing used in the well. But it took a lot of energy to build the drill rig and the steel that went into it. But that has to be amortized over hundreds if not thousands of wells drilled by the rig. And a lot of energy in making the steel as well as mining the ore needed to make the steel in the first place. But prices for all these parts can vary greatly over time. A rig might lease for $50,000/day right now but could go for $18,000/day two years down the road.

Even the relatively simple act of producing a well is difficult to run the calculation unless you have a lot of details. I.E. - two wells each making 100 bopd. But Well A also makes 10,000 bbls of water /day. So the production cost includes the energy to dispose of that water in an injection well. Well B thus has a much lower lifting cost than Well A. But the oil from Well B has to be trucked 100 miles to the oil buyers tanks: more motor fuel and vehicle costs. Well A's oil is pipelined to the buyer so very little monthly transport costs or energy. But the pipeline moving that oil had to be built with energy expensive steel and then buried by a lot of diesel burning machines.

I think you get the idea. Not that it can't be done (but requires a lot of assumptions) but to what end? Unless one includes a very detailed list of assumptions and calculations it would be difficult to put it all in perspective IMHO. Even just using $'s as a metric it would be difficult.

Lots of variables, thats for sure. Much of what you are dancing around is the embedded energy per unit of production. Nick had a couple decent links to work being done in that field a while back but I can't remember when, seems it was in spring but was that 2009 or 2010 or was it summer?- ) Its complex, compounded and more and there seems to have to be some sort of pratical limit to the number of cycles of the embedding process you go back as well.

Hey, RM:

Responding to the EROEI problem, it looks to me like much more investment capital is being used, and more energy resources as well, in extraction today. Isn't it the case that by going to super permiation, and by expanding production of low EROEI product, while the plateau may be extended, the slope on the downside of the graph is much, much steeper?

Do you know, or do you know anyone who knows, what exactly we should be looking for as an immediate precursor to the crash that is being constructed?

I don't mean to infer that post-peak means no more oil production. In fact, I would expect that for some purposes oil would not need to have a positive EROEI at all, and so there will be activity for a good long time. It just would appear that after the crash, burning it up would not be seen as a worthwhile thing to do.

Craig

The thing about low EROEI oil is that there are very large amounts of it available in the world. An example would be the Bakken Shale in North Dakota which has been known about since the 1930's, but hasn't been developed until recently.

Higher prices will pull this low EROEI oil onto the market, but it will be developed very slowly due to capital and labor constraints. So, what you might see is a steep initial decline after the peak (as the big Middle East oil fields go into steep decline), followed by a leveling off of the curve after a few decades (as the non-conventional ones slowly come on stream).

So, both the people who are expecting a sudden crash in production, and the people who are expecting non-conventional resources to prevent a peak from occurring at all are wrong. There will be a broad peak, followed by a steep decline, and then a leveling off of production at a considerably lower rate.

In fact, it will look like the US production curve, only bigger. It took 40 years for US production to drop to half its peak level, and you can expect the global curve to take even longer.

Hey... I just had a bit of an epiphany about the depletion curve... maybe it is nothing... maybe I am just really thinking about EROEI...

In terms of PO, I have always thought in terms of depletion rates of conventional oil overwhelming growth in non-conventional, initially creating a flatter peak/plateau and then a pronounced decline, partly due to 'natural depletion' and partly due economic factors. More or less a HL curve I guess in production.

I never really thought about what it means to use 'cheap' oil to produce 'expensive' oil. As you are at peak this is easy to do. It is BAU effectively with the result of producing oil to give you a nice plateau.

But as the depletion of cheap oil continues and the 'expensive' oil permeates your economy and industry, the viability of using 'expensive' oil to produce 'expensive' oil would have a feedback on itself and become non-viable very quickly? You would get your shocks as expensive oil increased, but once 'expensive' oil had sufficiently saturated the economy you would get a tipping point.

So I guess I am saying that perhaps BAU at the peak can create a plateau in oil production because oil is still relatively cheap, but would eventually expensive oil will choke the life out of the economy/industry/our ability to produce more expensive oil and oil production goes off a cliff.

Which is different (by my understanding) of the effect of depleting wells in the past. In the past as wells depleted, the curve was determined by technology and geology because production was being 'subsidised' by cheap oil being imported into the economy from elsewhere, and so you might get a long fat tail, gentle curve from that well/region - whatever. But this time there will be no subsidies.

Meh. Now that I have written it I am not sure of it's value... I'll post it in the hope that it has value... Be gentle :)

Those are definitely intriguing thoughts.

One of the problems in maintaining a plateau whereby they simply increase the extraction rate is that the oil producers will quickly run out of ways to accomplish that. Then the creative, market-driven solutions will rise to the surface. Your idea is as good as any and if it hasn't been thought of before, I wish I had.

I would file it as an interim or transitory substitutability regime.

This might have some basis as Goodhart's Law. The idea of putting incentives in place to use expensive alternatives has the perverse result of the market corrupting the intent. The great AzimuthProject website has an example of how this can come about:

http://www.azimuthproject.org/azimuth/show/Goodhart%27s+law

From the page at http://www.azimuthproject.org/azimuth/show/Goodhart%27s+law

The idea of a 'unreliable statistic' is used a lot in public discussion of public phenomena. But a statistic is merely a mathematical function that is intended to be evaluated on a body of data. It always has a clear mathematical definition as to how it should be evaluated, so it is really hard to see how it could be unreliable. What is really going on should be described as using a statistic as a proxy for some other, difficult to measure, or impossible to observe phenomenon. Thus, for instance, estimates of temperature in the geologic past are difficult(impossible) to measure in the here and now, so researchers look for various natural phenomena that depend of temperature to infer past temperature. Most commonly this involves slight shifts in isotope ratios in rocks.

But where the phenomenon that one wants to infer from the statistic is some form of human behavior and where the humans involved in actually doing the phenomenon know about the statistic and how it is being used as a proxy for actually assessing there work product, the logic justifying using the statistic as a proxy really breaks down. Ambulance companies, and CEOs of major, publicly traded corporations both start making decisions based on how they think the decision will affect the statistic and discounting how it will affect the real quality of their work. Basically, defining measurable goals and objectives can't work as a way to organize society. Flaws in this reasoning? I don't see any. But I also don't want to push it much, because I sense that I would not have much success.

Many of these laws are just different interpretations of game theory.

Goodhart's Law is very close to the efficient market hypothesis as well, whereby the market will automatically correct towards an equilibrium when they sense someone has an advantage.

I am just trying to place Calaf's idea on some other footing.

When I wrote the above, I was truly 'brain-dumping' as I was just catching up on TOD waiting for someone and then was meant to be leaving as the idea hit me - I was literally typing as the image of it was appearing in my mind as I was getting up to leave.

Having had a chance to get back to TOD and re-read it and actually reflect on it, I can see a mash of ideas, but one point did stick out that I am not sure that I have seen elsewhere; that being the global decline curve may not be like any well or region we have seen before. I think what I was descibing is effectively EROEI but from a market dynamics perspective.

(I am not authoritative and so I will just make the following statement in expectation of being corrected as needed)

All previous decline curves of any well or region were predominantly the result of geology and technology and the continued availability of cheap oil for industry/economy/production.

The continued availability of cheap oil (despite the decline in that particular well or region) fueled the ability for that well or region to produce a given decline curve.

With global peak oil there will be no substitution/imports of cheap oil from anywhere to allow technology and geology to produce the curves that we have seen in past. Using 'expensive oil' to create 'expensive oil' will change 'the equation' and create a new market dynamic that will shape the global decline curve.

I see money sitting on top of EROEI, and becoming a driver of the production curve. When oil is cheap the production curve process is in 'balance' between geology and technology to produce the curves we have seen before.

When oil is no longer cheap and permeates production/industry/economy the curve will be the result of a much different interplay between the production inputs and a different market dynamic. That is to say, the global decline for oil production should not look like any previous decline curve.

Edit: Now I remember...

and that is why a long plateau at peak GLOBAL production makes sense... there is no cheap oil substitute available like in all previous cases, but at global peak you still have a lot of cheap oil bubbling through production/industry/economy to allow oil production from almost any source, because these costs are still supported by the cheap oil underpinning the economy/industry/production.

Somebody might be able to produce oil from old tennis shoes at $90 a barrel, but once all the inputs to production - wages, food, spare nuts and bolts - begin using that $90 oil then... well I can't imagine how they can't re-price to accommodate the increase in the cost of oil and tennis shoe oil production must go up... I am not sure. But I do see how initially a plateau that supports 'expensive oil' is maintained at peak by cheap oil and continued demand.

Hope this has some value.

Cheers

@backcreek

Have you looked at primary energy consumption? BP measures it in million tonnes of oil equivalent. Admittedly consumption is not production but at least it uses a uniform unit of measurement for energy across diverse fuels.

Did folks predict that there will be _exactly_ one moment in history called 'Peak Oil'? The plateau is due to stealing from the future. It too, cannot go on forever. But yes, it may help continue BAU for longer at the cost of sharper decline rates when it is no longer possible to sustain the plateau.

Afterall, isn't the hubbert curve primarily about flow rates?

In the overall "Peak Oil message", I don't see how this post is anything but distracting the common man from the core message of urging them to nurture and adopt a different lifestyle. The underlying message(s) of "Peak Oil" as I take them are:

"The plateu is due to stealing from the future" - Well said. I completely agree and it is what I tried to say in the article.

It is simply not the case that the Hubbert model can be applied to nuclear energy for millions of years. First breeder technology would allow uranium and thorium at up to 300 times of the fuel efficiency of current nuclear technology. Secondly huge amounts of recoverable uranium and thorium are available in the earth's crust. Uranium can be recovered from sea water for a few hundred dollars per pound, and a pound of uranium is the energy equivalent of 15 tons of coal. Uranium in the seas is a virtual renewable resource as long as recovery does not exceed 32,000 tones a year. 32,000 tons uranium flow into the seas every year from rivers and other sources. 32,000 tons of uranium will power enough 32,000 1 GW reactors, enough to power the entire human population of the world at several times the energy consumption level of the United States. Once we start running out of uranium we can switch to thorium as an energy source. the thorium content in the earths crust is estimated to be 3 to 4 times greater than its uranium content. It will be a very long time before we reach peak thorium consumption.

this sounds rather like theoretical wishful thinking.

What about looking at the data? (too depressing for a nuclear energy believer?)

Uranium extraction peaked around 1980 (and is essentially terminated in many countries)

nuclear reactor grid connection/ year year peaked around 30 some 25 years ago

functioning prototype fast reactors (sometimes claimed to be breeders) peaked long ago

functioning thorium prototype reactors peaked even earlier

nuclear electric energy production so far peaked in 2006

fractional electric energy production from nuclear peaked some 10 years back

average nuclear power efficiency is flat or declines since a few years

you need more?

Uranium breeder reactors did not peak for resource reasons; in this country, my recollection is that we quit building them because of their use in producing plutonium.

Thorium reactors (which are proposed to be breeder reactors, not producing bomb precursors) did not peak for resource reasons.

And the point of using a breeder, is to get a lot more energy out of a given pile of input resources.

Am personally very encouraged about the old research performed in the 1950s into Molten Salt Reactors, and which I've only just stumbled upon.

Am trying to get a hold of 2nd hand copy of Alvin Weinberg's 'The First Nuclear Era':

http://tinyurl.com/6l55jcs

Unfortunately the libraries near me don't stock it. More's the pity!

I did not discuss any reason on why breeder prototypes etc peaked and why they are not being constructed right now.

I was just mentioning the unpleasant hard facts of reality for the believers in ``nuclear energy will save us".

It does not really matter for what reason things happened right now.

It might however matter to some extend for those who want to become realistic about fake alternatives for oil and gas.

But anyway, this post is about the Hubbert peak and not about the pros and cons of nuclear energy.

Perhaps we could just agree on the fact that humans are ``too stupid" to develop a sustainable nuclear energy system on our planet.

(the reason for being to stupid could be either because of false religious like believes or because nuclear energy technology is just to

complicated to be used correctly by our species or both.)

It does not really matter for what reason things happened right now.

I think it entirely does matter. Given finite supplies of increasingly expensive oil/gas/coal/whatever, eventually it becomes too expensive to be economical. That's not a reversible position. In contrast, we chose not to pursue uranium breeder tech because of arms proliferation/diversion concerns (roughly); that is a reversible position. I'm not sure why we chose not to pursue thorium reactors, but I've gone looking for information, and it appears to be purely a matter of choice -- there was no nail-in-the-coffin technical problem I could find. It may have been that the uranium reactors right then were a more mature technology, and faster to deploy, and the risks underestimated. So, again, a reversible position.

And there is the obvious retort that maybe we are underestimating the risks of thorium reactors, and maybe we are, but we could run quite a few prototypes before we had anything like a large risk. We accept all sorts of risks right now, all the time, and almost completely ignore them -- burning coal spews radioactive waste, driving cars kills tens of thousands of people every year, lifestyle choices (including driving cars, hence not exercising) kill hundreds of thousands.

I think, if you want to convince me that thorium reactors are a bad idea, you have to explain to me why I should expect them to be more deadly than, say, automobiles. I'm big on metrics, and I like to resolve safety issues by counting dead bodies, because otherwise people will spin fantastic stories. What's your thousands-killed, year-after-year, justification for not going nuclear, and in particular for not renewing R&D on thorium reactors? The clock is ticking, the longer we wait, the more time we waste.

I think the reason for not pursing thorium is just a matter of history. The first nuclear efforts were to produce a bomb and as I understand, thorium is not much good for that.

Well, lets first acknowledge the different nuclear energy peaks and consequences I mentioned.

second, lets acknowledge (or propose a hypothesis) that oil as an energy source will go down

and quantify the yearly % decline.

third for those who believe in the nuclear techno fix

propose a realistic scenario on how your way out can work and what it would imply

from the year you won heads and hearts and onwards. How many nukes and in what country

and how much uranium needs, how much reprocessing, etc.

just give it a try.

If not, well your ideas will not even be formulated. What a pity.

As I understand from Wikipedia, the liquid-salt thorium reactors reprocess continuously, on site; the game is to remove stuff from the salt as you are using it. Because it is low pressure, no incredible pressure containment vessel is needed. Because it is already melted, and because high temperatures retard the react, melt down is by-design not an issue.

I would not pursue uranium, both because of waste problems, proliferation problems, and because there is much less of it available.

And I would start immediately, as fast as possible, doing everything. Nukes, renewables, biofuels with positive ERoEI (oats!). Only an idiot puts all his eggs in one basket -- you are asking me, "show me how putting all my eggs in your basket will work", and I will give you no such guarantee. It is another basket, and the risks of testing it are low compared to the risks that we live with now. As far as I am concerned, the more baskets, the better, and we haven't scaled too many baskets up to size yet (we HAVE scaled uranium nukes up to size, we just don't like the costs, risks, and wastes).

The Netherlands have nicely shown us how to scale low-energy personal transportation up to size (bikes) in a wealthy nation, but that sells about as well as "nucular" in this country -- so far. We had a incredible pissing match here in Massachusetts over off-shore wind farms, not like we've got all the hearts and minds on that one yet, either. Geothermal in Northern California is stalled over earthquake concerns. A failure to win hearts and minds is not a technical problem, and we have to keep the two separate.

My assumption is that we not on track to halt global warming (never mind reversing it), and we need to be on that track, and we need to be trying everything.

The problem with this is approach is that there is a high probability that none of it will work, either to mitigate peak oil or climate change.

The alternative is to use the limited fossil energy that we have to make sensible adaptations so that 1). We don't need so much energy to go about our daily lives and 2). Even with expected climate change, we can be reasonably comfortable and well fed.

So we can throw money(which is really just a marker for energy demand) into a dubious nuclear R&D program or we could re-build our cities, residential and commercial buildings so as to require far less energy to run them in the future. Option 2 has much higher likelihood of success as we already have working examples and don't require technological breakthroughs. It is also going to be much easier to implement as it will engage a large proportion of the population who will see the immediate benefits.

Convincing people to eagerly hand over billions of dollars into energy projects that have a high likliehood of financial failure is going to be politically impossible. Just because you can get a positive EROEI in one technology does not mean you can scale it up to run all of modern society on. If you can't run BAU as it stands now then somethings got to change and it doesn'tnecessarily follow that it's going to be magic technology riding to the rescue.

We should do that too. I don't see adapting down to 20% of current as something that will be easy. The first, low-hanging gains will be easy, and like everything else (oil production, in particular) things get harder. It's really easy to replace 30% of car trips with bicycle trips. 80% for everyone, not just nuts like me, will require a bigger change. People are going to ask, "is this really necessary", and you'd better have a good answer for why we didn't try a lot of stuff.

Note, also, that a billion dollars ain't what it used to be. We spent 14 of them building tunnels for cars here near Boston; we were spending something like a billion a week for a while in the OIL war (Operation Iraqi Liberation, what did you think I meant :-); our excess medical spending compared to nearest-most expensive is in the ballpark of $1000 per capita, or $300 Billion. We can afford to gamble much more aggressively on all sorts of alternatives, and we should. $10 billion a year on bicycle infrastructure would roughly match Dutch per-capita spending, just for example. Amtrak loses about a billion a year; if we spent it intelligently, we could subsidize that more, too (the Acela runs full to near-full now; it needs rail improvements, it needs more trains, it needs to go faster south of NYC).

IMO, the biggest hurdle we face is the lack of reality. There is enough energy to power civilization as it stands, we just can't access it. There's far more sun energy than we could use, e.g., but we don't. And when we do, we waste most of it. The trick is to imagine how the world must be in the future, not how we want it to be.

The future must be not just carbon neutral, but for a period of 100 - 500 years, carbon negative. The future must be not only efficient, but must have fewer people in it. Not because of energy or food - we can get enough of both. Food, in fact, is easy. Energy, not so much. But the real issue is Liebig's Minimum, otherwise known as the weakest link in the chain. The problem is, we don't know what all of them are, necessarily. If we already have them all identified, then we need to deal with them. Some of them are water, phosphates, coal, oil, gas, fish, rain forests, sea ice. There are others. Essentially, we are talking about carrying capacity.

The most important Liebig's we face is time. The problem with nuclear, of any kind, is time. Time is why its contribution will be small in anything like a century or less time frame. Nuclear reactors simply can't be built fast enough nor be evenly distributed enough because of geography and economics. The time window is determined by climate. All the economic energy in the universe won't help if we are creating an unlivable, wet bulb planet.

We know from commentary out of Cancun that at least some climate scientists are building their own lifeboats. We know from direct quotes related to polls of climate scientists that only a small portion now consider less than 2C to be realistic. In other words, we've likely reached tipping points in the climate, so any debate about energy production needs to keep as the final requirement the immediate beginning of the process to draw down carbon, not just reduce emissions. Any net emissions is too much.

I agree with you completely. The effects of GW run-away-train will create itself escalating society, food production, security and health problems, in as few as about 15 years. This has been highly underestimated on this site.

The core message would be: Weaning away from coal completely within 10-15 years. Imagine Australia not exporting any more coal to China in order to prevent even more catastrophic consequences of GW as we can see now in these days.

Primarily this must be done by efficiency gains and reducing consumption, then replaced completely through renewables.

On the other hand, pri-de, IMO, the biggest hurdle we face is the lack of maturity. I think this is closer to the mark than a "lack of reality" can have manifold bases. It's not hard to profile the faults of society. We all do it. In the emotional/intellectual sense, the problem of wishing it so, is always a double edged sword. People on any cutting edge of technological revolution will always pass the gauntlet of skeptics, competitive lunatics with divergent solutions, doubters, name callers, shoot from the hippers, and other fanatics, or just the mistaken. If we are to succeed in saving the world people with different ideas need more respect insofar as the possibilities go. I feel the cuts taken on my system design are often ill informed, stupid, or blather based (which is to say based on a persons often deep seated sense of how they see a problem being defined and solved). My system (The Tripe System Report www.environmentalfisherman.com) is I feel a machine, a complex system, but a machine or system designed to do an energy job that isn't called for by the great unwashed techno masses. The Tripe does storage and transportation of energy. What is being called for hard core, with much emotional chortling and chanting, is the perfect easy replacement for FF to electric systems. Yes, this is not realistic thinking, but is it downright immature? I think it is. This is immature thinking, impure thought, because the time and hope people have invested is unmindful of other avenues. I say 95% of our hope is going in the wrong direction which is to say we are thinking with excessive amounts of tradition in mind. What is needed is a redesign of systems, not undue complimentary behaviors towards our current infrastructures. Unless you have a comprehensive sustainable energy system package to pedal, as I do, then you are in the hope someone will solve the energy crisis. This is field of thinking that usually entails hopes for grid constant solutions, which aren't likely. In other words there is mature hope and immature hope. 95% of us want a new power source for the electric grid, because we have that and it's a constant. And many want and need and new fuels for the cars we drive right now. 5% of us are smart and open minded enough to realize this may just be chasing a rainbow happy cake. I am with the 5%.

Required in new systems designs, energy and otherwise, that we must have, are new attitudes about what the problems actually are, and what the possible solutions actually could be. We are, in fact able to deal with such complexity. To say I just want ... and then describe what you want ... without connection of the dots to science-math-dollars so to speak is not a crime, but it may be the start to a feasible model. Sometimes to specify a theory as to how dots will get connected, pays off. But the catch is that maturity is a human attribute we don't have, that is, to see the need to see a machine that isn't yet here. Vision is a rarity.

To me the world must, must, be a place where we use the enormous energies available and apparent to the reasonable man. For this not to be impossible, we will need to transport and store the horsepower in question, and be able ship the horsepower in question, using conversions and re-conversions. Your list works. You have a gift for the synthesis of the problems. Your perspective is to me, spot on. Essentially (I agree) we have a carry capacity multi facetted complex problem. The supply of humans pushes the servicing yards capacity. There are too many people; but you think like it's a doable deal to work it out, and I agree that it is. My list for feasible sources in order are 1. Geothermal, 2. Wind and Wave (my own hybrid machines), 3. Solar, 4. Moon Tides, 5. Tidal Currents, 6. Oxen. All of these need the storage, conversion and re-conversion systems the tripe system provides. Let's go fools! Thanks Steve

removed double post

what uranium extraction peak ?

Are you talking about all the uranium that the US and Russia got for their weapons programs.

So that the US DOE has over 400,000 of uranium in the form of uranium hexaflouride sitting around ?

http://web.ead.anl.gov/uranium/faq/index.cfm

I am looking at a three for three sweep of our bets for 2010.

http://nextbigfuture.com/2010/12/reviewing-three-bets-on-uranium.html

Kazakstan at about 17800 tons for 2010, so I am looking very good for the 2011 portion of this bet

Brian Wang Dittmar Midpoint

2010 16500 tons 15000 tons 15750 tons

2011 18000 t or more 17,999.9 tons or less 18000 tons

There should be 3700 more tons of production in Kazakstan and 1000 more tons of production in Canada. Australian uranium production will be lower by close to 2000 tons.

World uranium production looks on track for 54,000-56,000 tons in 2010.

Big Husab mine could be open by 2014 in Namibia (5600 tons/year)

China is targeting 112 GWe of nuclear power in 2020.

Cameco in Canada is targeting doubling uranium production by 2018

China is going full speed toward large scale reprocessing and fast reactors

http://www.chinadaily.com.cn/usa/2011-01/18/content_11874184.htm

On generation.

The OECD is up almost 2% through October, Japan, USA numbers for november show continued

generation over 2009.

Ukraine, China, India and Russia all show well over 2009 through November.

http://nextbigfuture.com/2011/01/oecd-electricity-usage-from-jan-to-oct....

Japan is lowering the cost of uranium from seawater

http://nextbigfuture.com/2010/12/japan-could-use-old-cloth-dipped-in.html

BN 600* Beloyarsk 3 (D) fast reactor still operating since 1980 600 MWe

China CEFR (E) 65MWe started 2010

Under construction

BN-800 Beloyarsk 4 (C) 880MWe expected 2014

In 2009 two BN-800 reactors were sold to China, with construction due to start in 2011.

India 470 MWe fast breeder at Kalpakkam to start late in 2011 or in 2012, with 4 more to follow by 2020.

http://nextbigfuture.com/2010/05/indian-fast-breeder-on-track-for.html

A 1000 MWe Chinese prototype fast reactor (CDFR) based on CEFR is envisaged with construction start in 2017 and commissioning as the next step in CIAE's program. This will be a 3-loop 2500 MWt pool-type, use MOX fuel with average 66 GWd/t burn-up, run at 544°C, have breeding ratio 1.2, with 316 core fuel assemblies and 255 blanket ones, and a 40-year life. This is CIAE's "project one" CDFR. It will have active and passive shutdown systems and passive decay heat removal. This may be developed into a CCFR of about the same size by 2030, using MOX + actinide or metal + actinide fuel. MOX is seen only as an interim fuel, the target arrangement is metal fuel in closed cycle.

However, in October 2009 an agreement was signed with Russia's Atomstroyexport to start pre-project and design works for a commercial nuclear power plant with two BN-800 reactors in China, referred to by CIAE as 'project 2' Chinese Demonstration Fast Reactors (CDFR) - in China, with construction to start in 2013 and commissioning 2018-19. These would be similar to the OKBM Afrikantov design being built at Beloyarsk 4 and due to start up in 2012. In contrast to the intention in Russia, these will use ceramic MOX fuel pellets. The project is expected to lead to bilateral cooperation of fuel cycles for fast reactors.

The CIAE's CDFR 1000 is to be followed by a 1200 MWe CDFBR by about 2028, conforming to Gen IV criteria. This will have U-Pu-Zr fuel with 120 GWd/t burn-up and breeding ratio of 1.5, or less with minor actinide and long-lived fission product recycle.

Russia has experimented with several lead-cooled reactor designs, and has used lead-bismuth cooling for 40 years in reactors for its Alfa class submarines. Pb-208 (54% of naturally-occurring lead) is transparent to neutrons. A significant new Russian design from NIKIET is the BREST fast neutron reactor, of 300 MWe or more with lead as the primary coolant, at 540°C, and supercritical steam generators

A smaller and newer Russian design is the Lead-Bismuth Fast Reactor (SVBR) of 75-100 MWe. This is an integral design, with the steam generators sitting in the same Pb-Bi pool at 400-495°C as the reactor core, which could use a wide variety of fuels. The unit would be factory-made and shipped as a 4.5m diameter, 7.5m high module, then installed in a tank of water which gives passive heat removal and shielding. A power station with 16 such modules is expected to supply electricity at lower cost than any other new Russian technology as well as achieving inherent safety and high proliferation resistance. (Russia built 7 Alfa-class submarines, each powered by a compact 155 MWt Pb-Bi cooled reactor, and 70 reactor-years operational experience was acquired with these.) In 2008 Rosatom and the Russian Machines Co put together a joint venture to build a prototype 100 MWe SVBR reactor.

India and Russia signed a cooperation agreement to work together on breeders.

In India, research continues. At the Indira Gandhi Centre for Atomic Research a 40 MWt fast breeder test reactor (FBTR) has been operating since 1985. In addition, the tiny Kamini there is employed to explore the use of thorium as nuclear fuel, by breeding fissile U-233.

In 2002 the regulatory authority issued approval to start construction of a 500 MWe prototype fast breeder reactor (PFBR) at Kalpakkam and this is now under construction by BHAVINI. It is expected to be operating by 2012, fuelled with uranium-plutonium oxide (MOX - the reactor-grade Pu being from its existing PHWRs via Purex reprocessing) and with a thorium blanket to breed fissile U-233. The plutonium content will be 21% and 27% in two different regions of the core. Initial fuel will be MOX pellets, later vibropack fuel may be used.

The PFBR will take India's ambitious thorium program to stage 2, and set the scene for eventual full utilisation of the country's abundant thorium to fuel reactors. Four more such fast reactors have been announced for construction by 2020. Initial Indian FBRs will be have mixed oxide fuel but these will be followed by metallic-fuelled ones to enable shorter doubling time.

India is also developing mixed carbide fuels for FNRs (U-Pu-C-N-O). Carbide fuel in FBTR has reached 125,000 MWd/t burn-up without failure, and has been reprocessed at pilot scale. It envisages metal fuels after 2020.

Indian figures for PHWR reactors using unenriched uranium suggest 0.3% utilization, which is contrasted with 75% utilization expected for PFBR.

advancednano: First off let's not be supercritical of steam, because if you have ever enjoyed a good hot dog, ( I get so emotional) well I don't need to explain.

I have an oddball idea for a super-duper-critical steam nuke plant. The idea is to have a closed and pressurized chamber for the whole plant. This would include the water reservoirs, everything. The pressure will come to the plant in the form of 2-8,000 psi. This added air pressure will in theory turbo boost the steam provided by the reactor heat. I like the thought of using lead as coolant. Hat's off to the Russians SVBR 75-100 KWe systems. These it seems to me would be easily adapted to a high charge of compressed air.

My job is to make the CA off shore. Others can design nuke plants. I can easily give the nuke plant all the CA it would want. This is done with wind and wave machines. I can pipe it to the plants as well. The question I have is this: Could a plant be designed to run on the nuke fuels hybridized and adjustabily connected on the CA as well. Can this help to produce steam for base and peak needs. Just as a gas and CAES plant work can't the same deal be done for the nuke? Given X horspower or KW output of a standard say SVBR plant: What would the addition of 2-8,000 psi make in steam production? Would this not make for a super-duper-critical steam issue?

If we can make small nuke and compressed air hybrid systems work: one factor, not small in the grand scheme, could work in the favor of our getting off of FF: Heat co-gen systems may lend well to small portable nuke plants such as the SVBR model. With large scale rail systems, of my design, small nukes could easily locate, temporarily, to generate electricity, where the heat needs are. I can see a mini nuke CA turbo plant servicing a five to ten mile run. Lead heat sinks could work, iron, rock, mass of one form or another, giant iron bowling balls could easily be able to transfer heat, even to homes, but only if systems were designed to provide conduits for these diverse applications. I think this idea should be modeled up and thunk over.

I was not criticizing steam nuclear power plants, but showing that Michael Dittmar was ignoring the activity. I believe he is ignoring the activity because I told him about the breeders when he wrote his four part anti-nuclear articles last year.

We will see how well Michael Dittmar can claim to be a nuclear energy authority when he loses all three of the 2010 nuclear bets. I think when I have two years of shutouts with a follow up in 2011 (world uranium production, world nuclear generation and Kazakhstan uranium production) then it will start to get pretty apparent how wrong Dittmar was.

If France, Japan and the Ukraine get their nuclear plant operational act together, combined with the build up in China, India and Russia, the gaps between reality and Dittmar's prediction will be pretty laughable around 2014.

I also pointed out the large mistakes in Ugo's article about uranium from seawater in a post in the comments to this article.

Another incorrect oildrum prediction

Piccolo on the Bakken in 2008

Because of the highly variable nature of shale reservoirs, the characteristics of the historical Bakken production, and the fact that per-well rates seem to have peaked, it seems unlikely that total Bakken production will exceed 2x to 3x current rate of 75,000 BOPD.

http://www.theoildrum.com/node/3868

Piccolo on the Bakken in 2009

http://www.theoildrum.com/node/5928

My analysis of the Bakken is looking more correct

http://nextbigfuture.com/2009/11/north-dakota-oil-production-projected.html

Bakken oil production (Sask, ND, Montana) would be in the 500,000 barrel of oil per day range in 2011-2012 and onwards.

http://www.theoildrum.com/node/5969#comment-560860

http://www.theoildrum.com/node/5969#comment-560871

The 500,000 bpd is over 3 times what was coming from the Bakken two years ago and double the estimate of whether Bakken could move the needle for US production.

465,000 bpd from Montana and ND would be 14 million barrels of oil per month.

US production of oil is 162 million barrels per month.

So over 8% of US oil production.

The oil production technology for the Bakken is still improving and they are talking about possibly getting to 30% of the oil in place. 400 billion barrels of oil in place. That would be 120 billion barrels. So the 6-8 billion barrels of reserves talk is a snapshot.

167 billion barrels of oil in-place in the North Dakota portion of the Bakken and not including Three Forks Sanish oil.

North Dakota projecting 700,000 barrels per day in 2014-2017

http://nextbigfuture.com/2011/01/north-dakota-may-produce-700000-barrels...

Some predict one million barrels per day by 2020

http://nextbigfuture.com/2010/05/prediction-of-one-million-barrels-per.html

the horizontal multifrac drilling is unlocking more similar deposits in France, Australia, China and other places in North Dakota (spearfish and Tyler formations)

http://nextbigfuture.com/2010/09/paris-basin-shale-oil-could-have-more.html

http://nextbigfuture.com/2011/01/australia-has-shale-oil-field-with.html

http://nextbigfuture.com/2010/08/spearfish-oil-formation-could-be.html

http://nextbigfuture.com/2010/11/tyler-formation-could-be-one-third-to.html

``We will see how well Michael Dittmar can claim to be a nuclear energy authority when he loses all three of the 2010 nuclear bets. I think when I have two years of shutouts with a follow up in 2011 (world uranium production, world nuclear generation and Kazakhstan uranium production) then it will start to get pretty apparent how wrong Dittmar was."

Thanks for the honor. Lets see what will happen during the coming years.

1a) 2010 yeah, you might be right TWhe might be up to around 2008 values again.

Still much lower than the record year 2006 so far

But as was said when the bets were made:

the years when things really matter (and diverge) will be after 2013 (when the 10k tons natural uranium equivalent of russian uranium

to the USA will end). If more Megatons will be converted to Megawatts great, I am happy to loose thanks to this miracle.

2a and b) Concerning world uranium mining results

yes, true if the Kazakhstan numbers are correct for 2009 and 2010

I will loose my bet(s). Fine with me. Lets see how things evolve during the next few years when things become interesting

(the uranium price is already nervous and moving upwards).

However, can you explain why this is the only country which fulfills plans after plans,

while the other countries struggle even to keep their mines going?

My guess: The corrupt elite in this country found a way to add uranium, which was extracted during the Soviet Union times,

to the market. This would explain also why the former minister is now in prison.

But, perhaps we need to wait for wikileaks to find out eventually.

Before that I will for sure loose with Kazakhstan.

However, look into the 2009 Red Book about the uranium peak in Kazakhstan predicted already around 2015!

concerning your:

`` If France, Japan and the Ukraine get their nuclear plant operational act together, combined with the build up in China, India and Russia, the gaps between reality and Dittmar's prediction will be pretty laughable around 2014."

Well, may be they don't!

For

``I also pointed out the large mistakes in Ugo's article about uranium from seawater in a post in the comments to this article."

Concerning seawater uranium, may be I can recommend the story "the emperors new suit " enjoy

http://hca.gilead.org.il/emperor.html

original estimates for recoverable oil in the parshall field, the sweetest of the sweetspots, was generally under 10% of ooip. 4 years of production history has demonstrated that those estimates are overstated by a factor of 2. estimates from other areas are most likely overstated by a factor of 3 or more.

the problem is that most of that calculated ooip is traped in nanodarcy permeability rock. the spectacular 'early peak flowback' rates come from the natural fracture network in the bakken/three forks. what technology is going to increase recovery from 3 % of ooip to 30 % ?

three of the four largest bakken fields in north dakota have already reached their peak production.

many public traded companies are claiming that the three forks is a separate reservoir from the middle bakken. offset wells being frac'ed in one or the other zone keep getting filled up with frac sand. public traded companies are also claiming that 2 - 4 of each(tf and mb) can be drilled on a section of land. lalala.........lalala...a...lala.

helms refered to the 700kbpd forecast as a 'rosey' forcast:

http://www.youtube.com/watch?v=dzINc8fTDhE

Yeah, how about proof that you didn't pull all those stats out of your nether regions? Or proof that all of the above were not just caused by misguided attempts at 'environmental conservation' or attempts by the oil and coal industries to stifle competition? Or because uranium is well on its way toselling for cheaper than dirt with most major nuclear countries having more than enough just from dismantling old warheads?

With China having completed its research on fuel recycling and its fast buildout of new nuclear capacity we will probably power on to the 22nd century while you guys sit in the dark telling yourselves nuclear has peaked.

Although I have come around on nuclear technology especially the possibility of liquid fluoride thorium reactors, it is probably unwise to think we can rely on nuclear power to save us in our current situation. Build out of nuclear power has not occurred anywhere very quickly, certainly not quickly enough to cushion the decline in fossil fuel ERoEI. Current nuclear technology is not amenable to a fast build out nor does it seem to have a sufficiently high ERoEI. LFTR technology is still drawing board material as far as I can see. Until some are actually built to see their ERoEI, it is difficult to say if nuclear can save us. I am less concerned about energy production peaks as I am about ERoEI drops. Our societies have been built at highs for this value and failure to maintain them means a loss of complexity somewhere in the system.

We will of course fail if we dont try.

The global economy is still very rich and even the old indebted industrialized countries have vast capacities for doing stuff if they prioritize. We should be able to test almost every energy producing and energy saving idea in parallell including nuclear power ideas that almost worked with 40(!) year old technology.

This is true, of course, and I think we should keep working on it. As I said on today's DB, a little electricity on the way down would be very nice indeed.

However, building many complex nuclear plants on the cusp of a rapid simplification of our society many not be a wise idea.

I hope for a "shitload" of electricity on the way down and so far are manny corporations, interest groups and our government aligning to get post peak oil relevant investments done in Sweden and our closest neighbours Norway, Finland and Denmark have the same trends. I have no idea if it is being done due to peak oil but smart people everywhere know that peak oil is a slow acting fact of life and politicians who dont acknowlede reality sooner or later gets their pants pulled down. This is one of the factors currently pummeling the formerly dominating social democrates into pulp in last years election and the polls.

Ten reactors are running and nine of the originally twelve are being renovated wich in the short term is bad for their availability, new ones are being planned, wind power investments are currently being done at around 2 TWh/year, hydro powerplants are being renovated, industrial and district heating CHP is being built and both the high tension grid and the rural distribution grid is in the middle of a renewal program.

The per capita electricity production for the roughly 9,3 million population is around 15 000 kWh and I expect it to increase with around 10% keeping slightly ahead of migration. It would be possible to double it with new nuclear powerplants and lots of wind power but that would require massive electricity export or use of electrolysis hydrogen in oil refineries, possible but I do acknowledge that there is an economical limit.

It is about 25 years since we had a more or less complete technology base for nuclear powerplants. We have the waste handling in hand, maintainance fairly complete, an interest in recreating much of the newbuilding ability, fuel bundle fabrication but no isotope refining and no mines although there is lots of uranium ore and prospecting. I expect that Sweden will continue to be a solid place to run nuclear businesses and factories among other businesses and factories adding some resilence to the global supply web.

Personally am I starting to advocate developing small breeders for regional CHP plants as a long term plan to free up more biomass for fuel and biochemical production. It is also unwise to relie on garbage for long term district heating since the biogas production is expanding rapidly and can absord all of the biodegradable garbage within about 10 years, garbage plastic is valuble as a fuel synthesis feedstock and we will get depressions with lower personal consumption giving less garbage.

Keeping this running require no more then 1970:s level of technology, oil is not magical, its joules and hydrocarbons for chemical feedstock, we can go bio-nuclear. It should technology wise get easier with todays additional knowledge, electronics and biotechnology.

If a rough "simplification" gives a factor of ten hit in component size or CPU capacity it still leaves plenty for basic service including internet, PC:s and mobile phones, CAD, control systems, etc, no pocket size android phones though and we get to play Starcraft 2 on low graphics settings. ;-)

Another interpretation of simplification is simplification of government bueraucracy, military organization, etc. I think we have done enough of that during recssions and our failures of socialism to be able to triage our own government if the shit realy hits the fan.

But I dont know what to do in regions with lots of population, little biomass, a shaky technology base and and a shaky government. My overall solutions are for strong and competent governments pulled forward by specialists and large long term thinking minorities in the population.

Yep. And in Skåne we are way ahead of that game; we scrap and rebuild our hydroplants. Also as a side effect, we get to rebuild our downstream bridges as well!

EDIT: Funny howI forgot the link:

http://www.youtube.com/watch?v=rwFS2XeDHEs

I worked on reactor technology using Thorium over 30 years ago. Its funny reading about nuclear power seeing proposals for "new concepts" that I worked on or saw back then. But your point is the important one: Should we be investing in highly complex technologies when it is becoming so clear that we have already overshot what we can deal with as a species? I suspect we would all be happier and safer if we put that money and energy into simplifying our lives and our societies instead of upping the ante to make more and more of us dependent on things that might as well be magic, thereby reducing our self-sufficiency and sense of self-worth.

"How do you keep them down on the farm after they've seen Paree?"

As a species?

There are individuals and tribes with more or less efficient policies for interaction between individuals and this is often called culture.

Lots of things can be done, both sustainable and disasterous, this is proved by lots of such things being done. Everyone wont be doing long term good things and we will get disasters, I hope this will lead to cultural evolution and not die offs but I do not know.

Simplificaton is good as long as one does not simplifie away the ability to provide food etc for everybody or simplifie away the ability to understand nature in more then a self experienced spiritual way. I realy abhor the lets-all-get-back-to-natural-life idea since it would give a very large die off and make it much harder to understand physical reality. The key is "lets-all", if some do and relieve consumption preassure its fine, especially if they still pursue some intellectual goals and interact with society as you obviously do via internet.

I have no problem relying on things that might as well be magic as long as I can add something of value myself. We have allways relied on things we do not understand, the news is that a lot of our surroundings is understood but we only have time and intellect to understand a tiny bit of all available knowledge. Then we also create new stuff with this knowledge, I like that exept when the boxes are welded shut and the magic hidden away from possible understanding and copying.

I realy abhor the lets-all-get-back-to-natural-life idea since it would give a very large die off and make it much harder to understand physical reality.

Cite your sources, please, because you are unequivocally incorrect about this, but I want to understand what you believe the parameters and possibilities to be before responding.

I am a recent convert to pro-nuke thinking. I feel the next generation, 4th, can provide good clean energy. But if I'm wrong we're all dead, but we're all dead if we continue with the FF usage.

I like to think of the back to nature movement as a bio-common sense movement more so than as a societal bowel (bowl) movement towards the epoch of poisoned poop. We're just animals. Our crops aren't sacred, that's for sure. In Sweden they use their own urine to fertilize, works fine, so to me that is back to nature, even though such systems can be quite detailed and complex. There just ain't no either or: Natural Or High Technology, a true false dilemma if I ever saw one. Holistic, natural (deer) livestock husbandry combined with high tech organic can work better to feed more, I say, but why will we find out? How will we find out with such massive masochistic industrial farming subsidies? We don't know what we're eating.

We do such bantering as dogs chasing their tails on a constant basis on Fishfolk, an MIT chat for fisheries. With us it may be green fishing v industrial habitat destructive fishing. Back to nature can make more fish if you think back to nature means giving your habitat class of assets more clout than a fishing boats owner rights to harvest in his own personal way. If you think the cod fish are worth more in the sea as breeders than in the fishing boat owners hold, then this could be a back to nature movement. But ..... What the heck .... Let's talk balance sheets, efficiencies for whom, and why. Common Shmommon. We each hold some part of the whole and we each have our own balance sheets to look at too. Is it either or? Not to me.

The main problem is: we are way to many to feed ourself with natural methods. We have never proven we can feed 2 billion people without FF. And with all soil destruction, water depletion, ecosystems collapse, deforestation and climate change, the area to play with is much larger now. If we go back, we die.

We must stay on this path to keepeveryone alive. However this way we are doing nowis dependant on one use non renewable resources. When they are out, we die.

The road we are at now destroys the eco system, wich basicly is our life support system. If we stay here, we die.

This road leads to death, and we can't get off of it. Only way out is depopulation, and then hope we can manage as well as possible on the way down.

The path to keep everyone alive will just lead to a more rapid and more catastrophic crash and dieoff. We won't keep everyone alive and we never have.

Wich was my point. We are riding a tiger running for a cliff. If we stay on it we fall over with it, if we jump off, the tiger will eat us. And there are the odd chance we get tiered onf lose our grip before the cliff.

The main problem is: we are way to many to feed ourself with natural methods.

Says whom? We fed ourselves just fine before the advent of FF fertilizers. Asia didn't just become densely populated yesterday. There are multi-decade studies showing organic no-till ag outperforms FF ag. We also have examples of deserts being greened and rain forests being regrown. Growing enough food is among the least of our problems because we can build soils very quickly and sequester water very effectively.

Depopulation is certainly part of the answer, but that absent other societal changes will only lead back where we are today. We can build sustainable communities.

"Says whom? We fed ourselves just fine before the advent of FF fertilizers."

Peak population before the advent of FF was in 1800 at which time world pop. was 1 billion plus/minus about 100 million, which is much less the current world pop. I think it is irrational to believe that we can feed ourselves now, or in the future from biosphere resources alone, without a substantial crash in world pop. Maybe stablize at somewhat more than 1billion if we manage to preserve almost all of what is left of biosphere. But if we trash much more of the biosphere before the crash, world pop. will bottom out at much less than 1billion, IMHO.

edit: add mention of biosphere in stmnt. of what is irrational.

I'd go with pri-de. There is some reason to think that permaculture/bio-intensive organic methods can provide enough food but I also think that we may have to pull down borders in order to have people relocate to areas that can feed them using those methods. That isn't going to happen.

"There is some reason to think that ... "

Yes, but you agree that it's not enough reason to actually believe that ...

You offer opinion, I offer fact and experience. You need to balance this equation.

Regenerative Agriculture, longitudinal study

http://www.ifoam.org/growing_organic/1_arguments_for_oa/environmental_be...

Re-growing a rain forest, and community

http://www.youtube.com/watch?v=3vfuCPFb8wk

Mollison, growing food in drylands

http://video.google.com/videoplay?docid=8753613033531029453#

Growing food in Jordan

http://vimeo.com/7658282

A Nation of Farmers

http://www.amazon.com/Nation-Farmers-Defeating-Crisis-American/dp/086571...

Back in the day granpa' was a wee one, we had this problem we could not feed everybody. Then they invent something called the "green revolution". Everyone gets food, population tripple. Problem; it is all dependant on FFs.

Today we have destroyed alot of the bio-resources, I need not list all that again,plus we have an upcoming climte change ahead of us. We are 3+ times as many and about to lose the energy source that keeps the modern agriculture running.

But we have lost another criticl resource; knowledge. There was a day when 80% of population lived on a farm, and even more if you go further back. Today, less than 2%. And those who do know how to operate and repair a tractor, how a milking machine works and how to log on to the web site to order forms from the EU to apply for subsedies. But they don't know old school farming.

How are we going to feed ourself old school now when they couldn't do it 100 years ago before they trippled pop and destroyed all those values? Remeber the green revolution was invented SPECIFICLY because old school did not suffice any more.

Why would we want or need to return to "old scool farming"?

Running tractors on biogas needs less farmland then feeding horses and it is

a lot faster to retool diesel engines for biogas + ingnition diesel and then

change to new engines then to breed horses, make horse sized machines and train

horses and farmers.

Milking machines is an extremely good return on investment in labour,

running a motor for the milking machine vacuum pump and light bulbs were the key

resons for the original rural electrification back when we were quite poor.

You need on the order of 50 grams of rubber per cow and year for your milking

machines, a nice high value low volume trade item. The rubber used for one

tyre is probably enough for milking all the milk one human drinks or eats as

cheese etc during a lifetime.

And why should we run out of nitrous fertilizer? Phosphorous is more sensitive,

that loop needs to be closed within about two generations.

We have more knowledge now then we had back then and better means to access it and

learn how to use it.

But I do agree that EU can be dumb. The EU standard for ecological farming

specifically forbid use of human urine since too manny countries were afraid

of the icky factor. Thus is human urine only used for conventional farming...

The interesting fraction is the large volums from the sewage treatment plants,

it has taken about 20 years of bettering the quality but it is finally starting

to get accepted for farming in Sweden, another 10 years and it will probably be

standard procedure and no more of the valuble nutrients will end up in landfills.

There are very large regional problems with lack of water and soil erosion on

the globe but why should that lead to "old school farming"?

Everyone dies - eventually. Generally, we prefer death to come peacefully and at the end of a long, productive and fulfilling life, but it comes to all of us eventually. What we need to do as a species, if we want to continue the human experiment, is to avoid death coming abrubptly and to all of us at the same time.