The JODI-EIA Divergence

Posted by Sam Foucher on May 23, 2011 - 9:31am

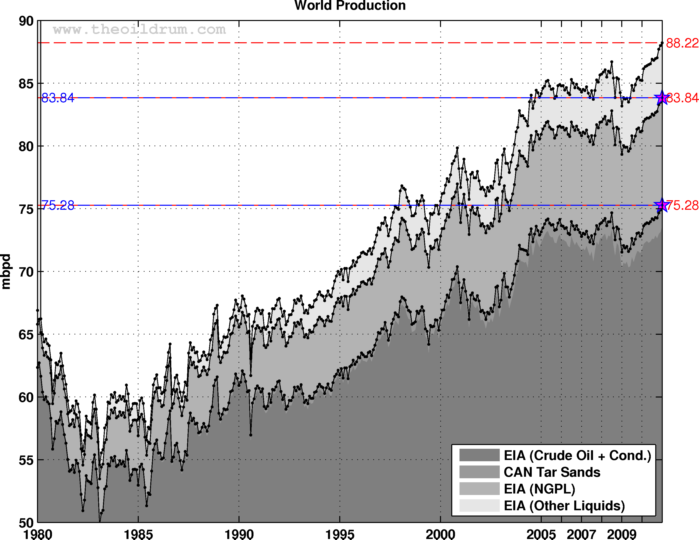

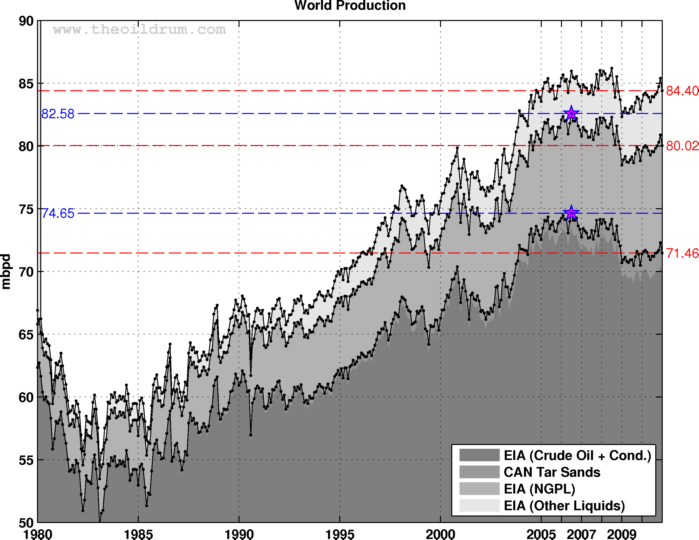

This is a follow-up on a discussion started by Darwinian (Ron) in the Drumbeat that I think is significant and deserving more eyes. Lately, looking at the EIA data we have seen new production records in all the categories (see post by Gail here for a discussion):

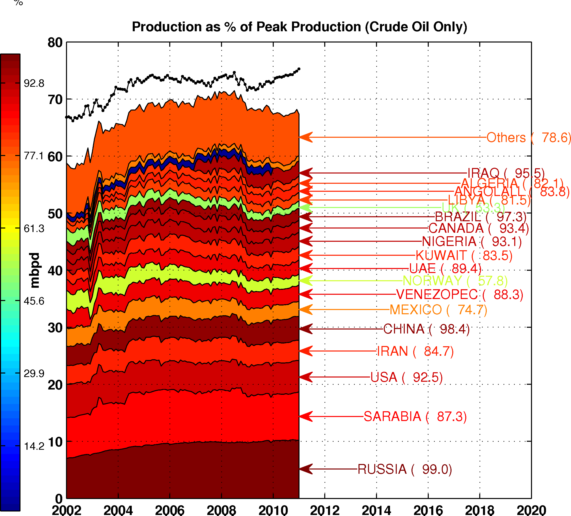

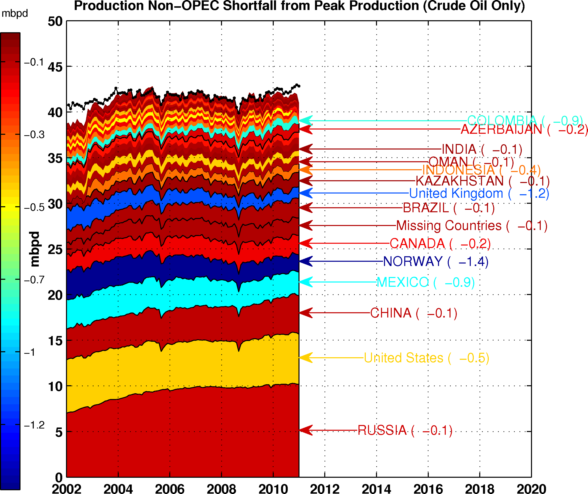

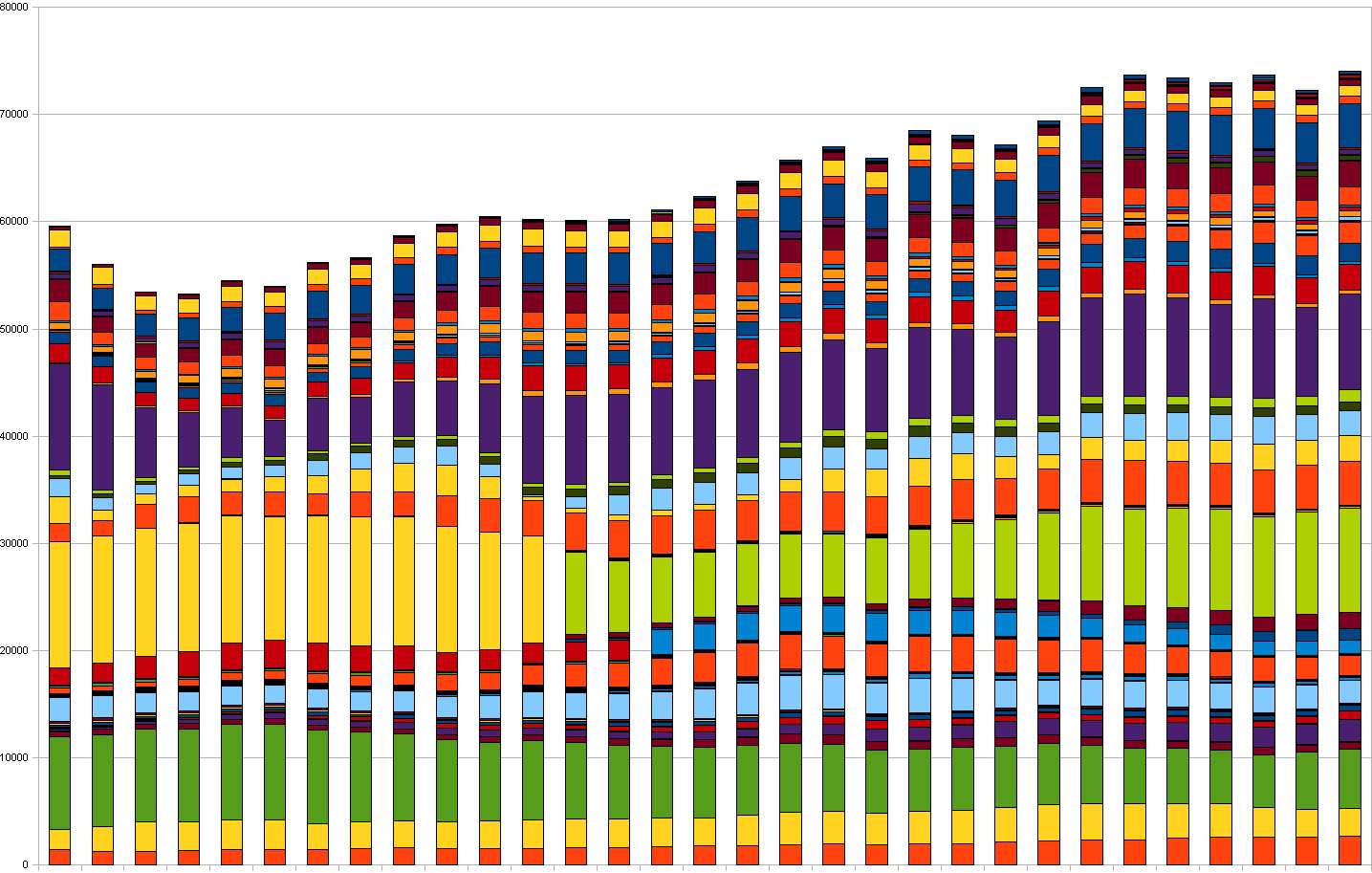

The public database JODI contains monthly data from more than 90 countries (90% of world production) but does not give a world production estimate, some countries are also missing or incomplete (about 20 countries), it gives something like this:

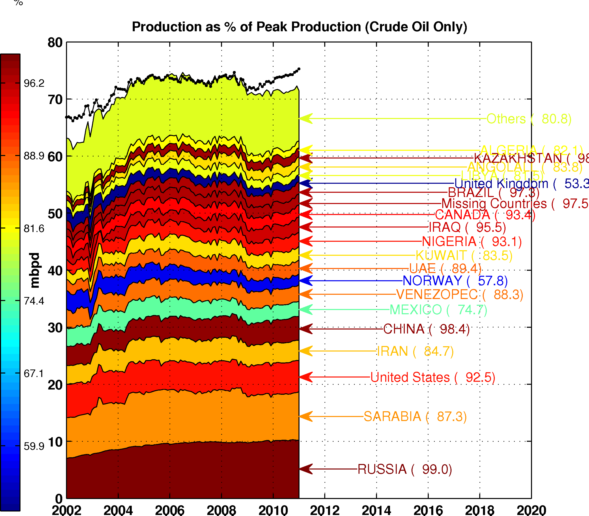

We can get the missing data from the EIA energy database, more precisely:

- Incomplete series: Iraq and Kazakhstan.

- Some Non-OPEC countries are not in the JODI database, we then get the data from the EIA (in total 124 small producing countries).

Once completed, we get the following chart:

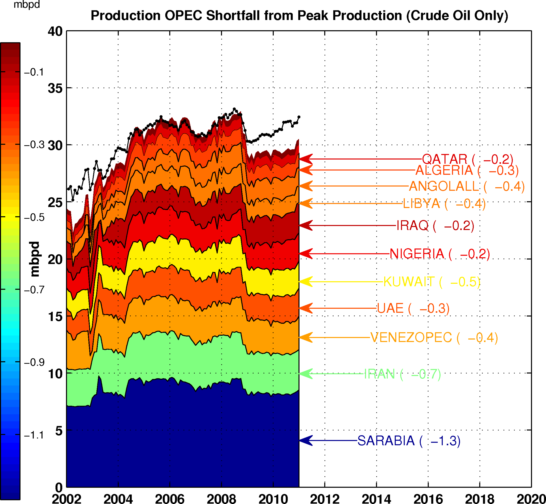

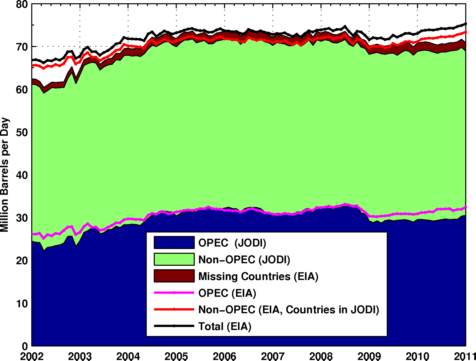

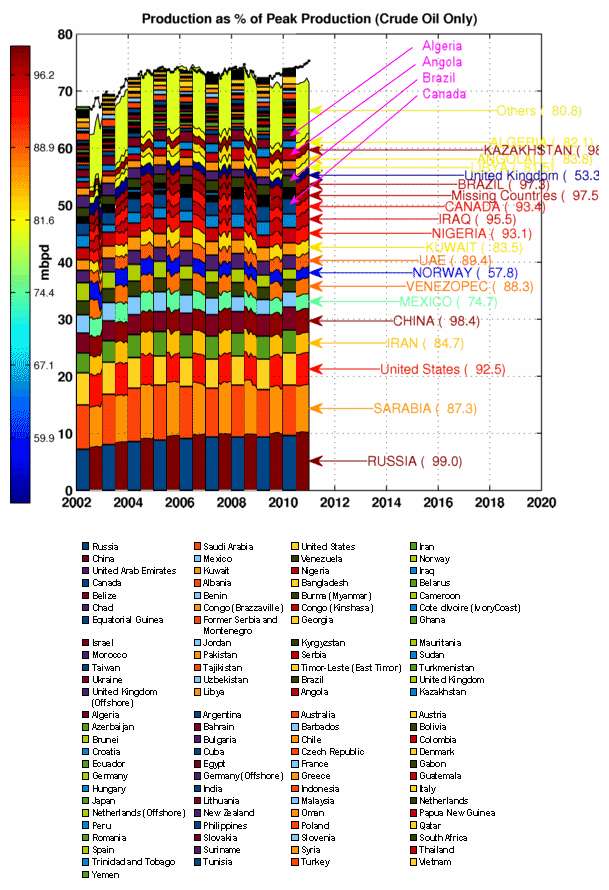

There is clearly a divergence since 2009 and also before 2005. The difference seems to originate both from OPEC and Non OPEC countries, OPEC production is significantly lower for JODI than for the EIA:

The chart below summarizes the difference between the two databases. We can see that even when adding the missing countries (the red area), we are not able to account for the difference with the EIA data.

We then add the EIA monthly estimates for NGL and other liquids to the JODI data past 2005 and we get a new version of Figure 1 shown below. The records for monthly supply are now back to 2006 for C+C and C+C+NGL.

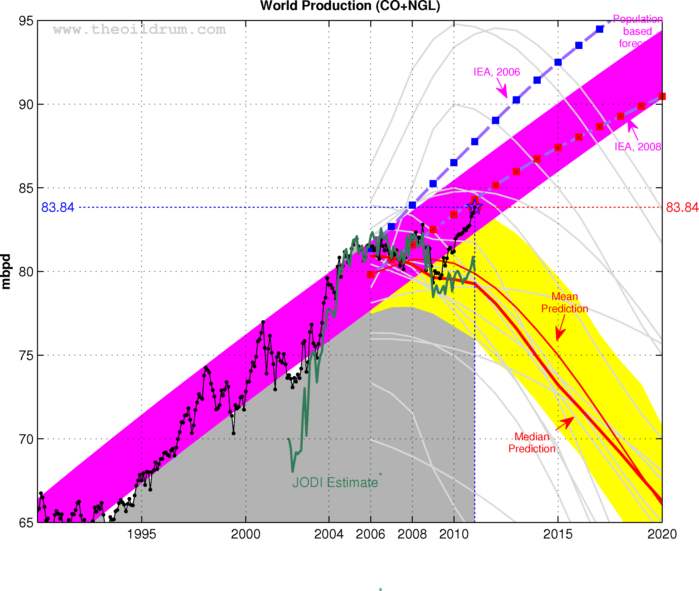

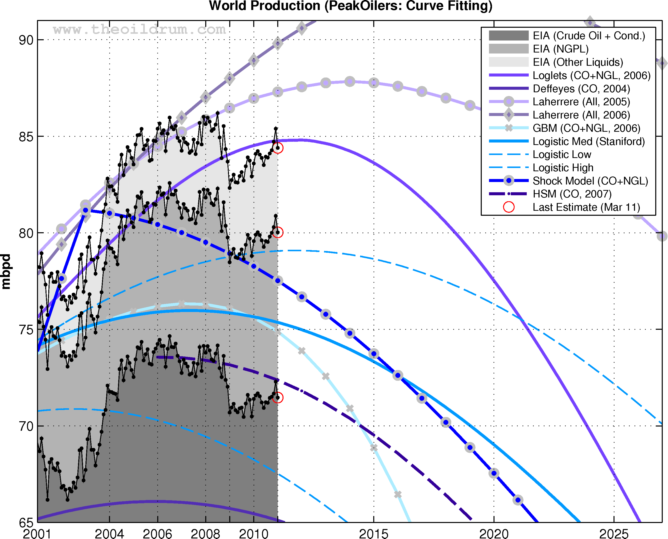

This is a significant divergence, in particular the drop in supply following the financial crisis in mid-2008 is more acute (~2 Mb/d lower) as shown on Figure 8 below. When looking at the EIA data only we can see that production levels have strongly increased since 2009 and are now close to the population based model (the magenta area) and the EIA 2008 forecast. However, this is not the case when using JODI estimate (shown as a green line), supply is much lower and it is following closely the average peak oil forecast (the red line).

I was struck by the fact that the JODI estimate is following the median forecast for crude oil and NGL whereas the EIA trajectory came back in the business as usual domain. The new production data based on JODI seems to follow closely most peak oil forecasts:

It remains to be seen what will happen in the next few months with respect to updates and corrections for both JODI and the EIA. Production levels were lower before 2005 and were never corrected to match the EIA data. If anything, it shows the large uncertainty surrounding production data coming from OPEC, the reason why OPEC members would report lower production data to JODI is unclear.

The way the production data is collected vastly differ between the EIA and JODI, for JODI the data is collected using a 42 key oil data points questionnaire. The data is then revised twice a year:

Jodi is a voluntary activity. Participating countries complete a standard data table (see table on page 2) every month for the two most recent months (M-1 and M-2) and submit it to the Jodi partner organisation(s) of which it is a member. The respective organisation compiles the data and forwards it to the IEF Secretariat which is responsible for the JodiOil World Database.

The EIA does not collect international production data but apparently pays IHS for the data (at least until the recent budget cuts).

Update:I've added the spreadsheet showing the EIA and JODI data for the period 2002 to 2011 after corrections for incomplete series. Common countries are in the same order (non OPEC first then OPEC), only the total volume is shown for missing countries.

And of course, the EIA recently posted some sizable and fairly unusual upward revisions in production data. If the EIA is relying on IHS for data, that may explain a lot.

In any case, what this excercise shows, especially as the global production data base becomes more unreliable, is that at best we may only have two significant figures of semi-reliable data. In practical terms, for most countries this means semi-accurate data to 0.1 mbpd and to one mbpd for global production.

What (if any) is the relationship between IHS and CERA?

So is IHS just a branch of CERA?

The other way around.

dohboi - No relationship...they are not seperate entities. IHS CERA is a company owned by the IHS corporation. There are about a half dozen more IHS divisions.

Thanks. I see I got it backwards above--not unusual '-)

IHS, Inc. (nee Information Handling Systems) bought:

Petroconsultants S.A. in 1996

http://en.wikipedia.org/wiki/Petroconsultants

(didn't know Colin Campbell worked for them...)

Cambridge Energy Research Associates (CERA) in 2004

http://en.wikipedia.org/wiki/Cambridge_Energy_Research_Associates

Jane’s Information Group. (e.g. Jane's Defense) in 2007

a bunch of other names...

http://www.ihs.com/about/glance/history.aspx

Westexas, you make some good points here, and I do applaud your rounding the annual figures to the nearest mbd, as this is a clear attempt to deal with the problem of error.

In terms of available oil extraction data, there are many, many issues. As exemplified by the article above, few, if any of the charts posted on The Oil Drum contain error bars. Without error indicated, the presentations are not scientifically rigorous. Before any claims of a "peak" in the monthly or annual data can be made, error has to be known. This is basic science. Without error indicated, the person presenting the data only has a weak argument. Especially in a case of claiming a new "peak" that is only a tiny amount higher than previous upward excursions.

The best one can probably say is that world oil extraction rates are still on plateau in the case of maximums that are very close in magnitude (e.g. 75.2 mbd vs. 74.8 mbd). Even this claim, without error demonstrated, can not be made with a high degree of confidence. My suspicion is that error in the monthly oil production figures is in the range of 2-4% (for 2 σ), if not higher, and maybe somewhat less for annual averages. The pronounced difference between the EIA and JODI numbers provide some indication of how much error can exist in the data: 75.3 mbd vs. 71.5 mbd equals a 3.8 mbd difference on the monthly figures. This is a difference of about 5%. This suggests that a difference of even a million barrels per day in the monthly data series is not meaningful. There is also the question of bias in the measurement, which is an additional complication.

An actual determination of error and bias for world oil extraction rates would be very difficult to do--maybe impossible as it would require a different and reliable measuring system outside the one(s) being used to make a good calibration check. Nevertheless, even with error determination quite difficult, it does not mean that error does not exist. On the contrary, error is present in all systems of measure. Error is inescapable. And in the complex and convoluted human world of oil extraction, which takes place in many different countries/cultures, it is a safe bet that error in the reported figures for extracted volumes is probably quite high.

Futhermore, in longer data-series, there is the problem of changes in methodology for determining oil extraction volumes (e.g. how were oil volumes determined in 1970 vs. say 2000?). Inflections in extraction rates could simply be due to changes in the way oil production in measured. As with error, very large swings, for example the climb in crude+condensate extraction rates from about 55 mbd in 1985 to 67 mbd in 2000, are likely real. However, small changes, such as the claimed ~2 mbd drop during the Great Recession are not strongly supported by the available data, partly due to the large error (a 2 mbd change is probably not large enough to be meaningful) and the potential for changes in the methodology used in acquiring the numbers in the first place. To fully understand a given data-series, methodologies for the acquisition of data over the duration of the time interval being explored have to be documented and discussed openly. Without this, any claims about particular small (say ≤ 5 mbd ΔQ/t) “downturns” or “upturns” in a series cannot be made with a high degree of confidence.

http://earlywarn.blogspot.com/2011/03/iea-confirms-new-highs-of-fuel.htm...

This chart from Stuart is a version of one that I and others have made showing correlation between oil price and production. Towards the end of last year the data wandered out of the historic data cloud suggesting perhaps that high price had led to increased production capacity and a new trend relationship.

It struck me from Sam's analysis that if production is actually around 85 mmbpd that we are still in the middle of the historic data cloud.

What the hell is going on at the EIA is anyone's guess - is there a conspiracy to cover up peak oil?

might even be simpler. there have been lots of budget cuts at EIA? I think with everything else going on in the world, I seriously doubt there is any conspiracy at EIA, especially given IEAs stark warnings.

I don't want to sidetrack Sams thread, but do continue to wonder at the real elephant in the room: what would your price/production envelope look like without debt extravaganza of last 2 decades (culminating in huge govt. debt replacing private/corp/etc. during last 24 months). I would hypothesize that with a tethered currency (i.e. something with physical grounding -not digitally leverageable), that max global oil production would have been over a decade ago, and decline rates would be less steep. Probably not easy to model but the fact that debt in reality (as opposed to textbooks) is not a neutral transfer between parties and that it has been used as a larger and larger crutch to keep things socially stable by borrowing from future affordability, certainly impacts oil discovery/production curves. Ergo, Keynesian endgame is gonna muck up oil production figures bigtime.

So IF Hubbert had anticipated the Steroid-like monetary stimuli, his model might have predicted a drawn out peak period? Hubbert didn't anticipate the affect of financial doping ? Hubbert didn't anticipate the Lance Armstrong Effect.

And one of the more horrendous side-effects of the monetary steroid/doping was hypertrophy of the dysfunctional financial system.

Next stop, 'Roid-Rage and Crash?

Hubbert anticipated a growth curve that was significantly higher than the one we ended up with. Seems like at it's peak it was somewhere between 43 and 45 GB/year before falling off. Looking at the area under his curve from years ago (giving you "total production" of crude oil over the duration of the curve), you would have reached the peak somewhere in the last several years rather than the late 1990's or 2000.

Over the past few years, depending upon what data you use, oil production/consumption would finally total the quantity that Hubbert anticipated at the peak (YMMV).

The US curve (both lower 48 and the additions from Alaska and deeper water GOM) are instructive in that the lower 48 (minus GOM and Alaska) seems to follow a fairly symmetrical curve with an extended tail. The additions from the other sources as a result of other exploration and production extends or flattens the tail off, but eventually it falls off.

We know that the "other side" of the curve is waiting for us.

There is no doubt that creating debt has caused energy use. If we had had to work for the money we would likely spend it more wisely or save some of it. Its Gregors comment that is more relevant to this post though.

tethered?

to what?

Basically similar data, with crude oil (C+C) data on horizontal axes with oil prices on vertical axes, for the Texas and North Sea peaks. IMO, once conventional production peaks in a given region, there is probably not a realistic oil price that will keep conventional crude oil production on an upward slope.

If we look at slightly rounded off annual global crude oil (C+C) data, so far we have not materially exceeded the annual rate of about 74 mbpd that we saw in 2005 (EIA). But of course the real story is the 2005 inflection point. At the 2002 to 2005 rate of increase in crude oil production, we would have been at 86 mbpd in 2010.

If Saudi crude oil production had kept increasing at their 2002 to 2005 rate of increase (when they went from 7.6 mbpd to 9.6 mbpd), they would have been at about 14 mbpd in 2010, versus the 8.9 mbpd that the EIA currently shows for Saudi crude production in 2010.

The cornucopians of the 1980s probably argued that vast oil supplies were reachable in Texas if only a) regulators would get off their backs (known today as 'drill baby drill') and b) oil prices would go higher. I wonder how much oil they thought they could get if prices would only just go to $50/bbl and stay there for a while!

And maybe, to be fair, they wouldn't have been entirely wrong. With prices consistently exceeding $90/bbl since 2008 (which is a lot like $50/bbl in 1985), Texas production has grown 2.3% per year. Would that be liquids from shale, primarily?

It would be great if Texas could keep growing production at these prices. At this rate, the state will be back to early-80s production levels in a scant 30 years. :)

steve - I don't have the hard numbers but if your 2.3% growth includes all liquids and not just crude oil it would be readily explained by the big increase in drilling NG reservoirs that have a high NGL yield. Such a play has been going strong for several years in SE Texas. The Barnett Shale may also get some of the credit. The hot Eagle Ford Shale play in S Texas wouldn't: it's too new to have added much yet. But with current drilling activity it should start showing up in a year or two. But with a 70%+ decline rate those wells won't hang in long. Only an ever increasing completion rate will get it done.

Thanks Rock. I'm just looking at a page from the EIA:

http://www.eia.doe.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=mcrfptx1&f=a

"Field Production of Crude Oil" -- I guess that would imply that it does not include NGLs, although I hate to read too much into a table header.

You're on that, right? ;)

steve - Thanks for the links. Does seem to indicate crude only. Actually a rather dramatic change in the trend given the long standing decline rate. I'm going to guess it's the fractured shale plays like the Barnett but the timing doesn't quite fit. Just a feeling. There really haven't been any other new oil trends developed in Texas for a long time.

Are we into the fracturred oil shales? Not at all. They don't generate a sufficient rate of return for us. We make a better profit drilling deep conventional NG even at current low prices. We're privately owned so we don't have a stock to hype. The public companies can't do what we're doing. There just aren't enough conventional wells to be drilled to satisfy Wall Street's demand for ever increasing reserve base for public companies. Just my WAG but if it weren't for the various shale plays the public oil stocks wouldn't be worth half of what they are today.

Similar developments have been taking place in western Oklahoma and the Texas panhandle. Horizontal drilling in tight, condensate rich gas reservoirs in the Granite Wash, Tonkawa, Cleveland, etc formations has produced a large amount of new condensate production since about 2004.

Thanks for a very informative post. It's remarkable that numbers from the two sources agree for a while but then diverge. The EIA data is saying total liquids production is increasing twice as fast as JODI says.

A couple of questions come to mind: how long after the fact are revisions made? and, Was this analysis done during a period when the two data sets agreed (ca 2006), and was the agreement apparent at that time?

thanks again.

Data are revised often, JODI has also a bi-annual assessment, I'm not too familliar with JODI and their documentation is rather minimal but it seems to have improved over time.

Here is a chart showing the EIA-JODI difference over time:

The data series here isn't long enough to confirm it, but on the surface it looks like the EIA and JODI series diverge coming out of recessions. Now, I have no idea what would explain that. Is there some dynamic in the measurement systems that causes one to overestimate and the other to underestimate as the economy turns up? For instance, if one was taking the most recent number and the other was using a rolling average, you would see something like this, but in that case you would expect to see the inverse occur when the economy turned down at the top. That doesn't seem to happen as the two track closely before and during the recession.

Probably just coincidental, but it would be nice to have a longer comparison and include recession bands.

Doesn't it take time to clean up JODI data? Aren't more current JODI records less reliable?

Also JODI data comes with a numeric code which indicates the level of reliability declared. Has Sam Foucher taken that into account?

Indeed, you are correct, it is less reliable, and some monthly estimates are revised. JODI is usually 2 months ahead of the EIA (it shows March already, EIA stops in January).

I have not taken into account the code, it is much more work, this is a quick post.

Thanks for clarifying these points.

Actually the EIA February data is out. International Energy Statistics

They have world C+C down by 789,000 bp/d in February. Of that decline OPEC was down 419,000 bp/d while non-OPEC was down 370,000 barrels per day.

World All Liquids was down 1,041,000 barrels per day. I did not break out the OPEC, non-OPEC share of All Liquids.

Ron P.

The upward revisions to the 2010 EIA Crude Oil Only data is the largest swing I have ever seen, in following EIA data since 2004. The revisions added nearly 750K-800K bbls to each month of 2010.

Notably, however, the overwhelming direction of revisions in EIA data the past 7 years has been down. Not only the short-term revisions which come in on a rolling basis from month to month--but also the big multi-year revisions which come every year or two. Would love to see a separate tracking chart on just revisions, with their direction and size plotted inside/outside normal ranges.

With the 2010 revisions, the annual average of C+C production has now just poked above the all time high year of 2005, when the total stood at 73.712 mbpd. Now 2010 stands at 74.047 mbpd. I really look forward to seeing what happens with subsequent revisions.

Updated Global Average Annual Crude Oil Production 2001-2011 (hosted at my site)

Finally, nota bene that EIA did produce updated International data this month, even though I was informed by an EIA rep that the data halt(s) would take place immediately. I assume this month therefore is the last international oil production data we will receive.

Update: I have been on the phone with EIA again today, and they confirm that updating to International Energy Stats is indeed due to be discontinued. It's just unclear when the shutdown will actually occur. Could be anytime from here going forward.

G

Gregor, are you saying that EIA are going to stop following international energy stats? A strange irony infone casualty of PO is our ability to follow story via "reliable" data. IEA next to go with spending cuts? And then BP gets taken over by XOM who see little merit in keeping their global energy stats charity going.

Gregor and Stuart both posted on the EIA budget cuts; Heading Out as well I think. Gregor was first to mention it. Other bloggers harrumphed about it as well but primarily over concerns regarding GHGs etc. Not much outcry about our not keeping track of world oil production - yawn...

There Goes the Data: Major Cuts at EIA Washington

http://gregor.us/eia/there-goes-the-data-major-cuts-at-eia-washington/

G

Over the past month, as I've shared the EIA announcement and Gregor's assessment ("bad news") with energy-aware associates who, mostly, don't read TOD, the nearly-universal reaction has been, "Are you kidding? Whose idea was that?"

Talk about fodder for conspiracy theorists...

I'm astounded at how counter-productive many of these government actions are in the US. Oil prices skyrocket, so the federal government cuts funding at the EIA so they have less information about what is going on. Local governments suffer a decline in tax revenues because fuel prices are higher and people are abandoning their houses in the far-flung suburbs, so they cut public transit to prevent the newly-deprived from going anywhere.

It's all very counter-productive. I think it's a subconscious desire by Americans to see a full-on, welcome-to-Hell collapse of society rather than a slow and painful decline into third-world status. But that's just an unscientific guess.

Nah, it's just a combination of real resource limits, ignorance and the focus on short term personal gain for those making decisions. It's what collapse looks like.

I agree with you Twi. Especially when you consider that the primary short term gain for most politicians is to get re-elected. A good dose of technical ignorance mixed with self serving political interest seems best to explain "our" reaction to PO. really quit logical and predictive IMHO.

The cuts in funding for the EIA are not about them having less information, it's about you having less information.

I'm sure the 'world crude and condensate' data will still be collected by some branch of government, the issue here is that the public may no longer have access to this information.

Thanks G, next thing to go GDP, borrowing and inflation statistics? Its amazingly short sighted.

I would guess that there was a brief, high level meeting where a political appointee asked a representative from DOE

"How can you save money - what's low priority - what can you drop?", and the DOE rep said

"Well, we keep statistics for world oil production, but that duplicates what the IEA gathers.". The political appointee said

"What, we're doing their job for them? It's duplicate data?!?!? Let them be responsible - this is a waste of money. Discontinue work on that immediately.".

Agreed. But its still pretty startling that world's largest economy can no longer afford to track international energy statistics.

It can afford to. It's choosing not to, because the congressional representatives of legacy industries (e.g., Koch brothers) are "starving the beast" as part of their drive to reduce the democratic process they fear.

This is not a matter of energy type power resources, it's a matter of political power.

The proof: the fact that only spending cuts are on the table, and not revenue increases. US taxes are at a record low. US taxes aren't low because the US can't afford to pay for government.

Sam,

Your figure 8 is titled Crude + NGL. You include the JODI line from figure 3, which is crude + condensate. Therefore, in figure 8, aren't you comparing EIA apples to JODI oranges ?

(And, your figure 3 is titled "crude oil only" but then below the graph you seem to imply JODI numbers are crude + condensate)?

see in the text:

"We then add the EIA monthly estimates for NGL and other liquids to the JODI data past 2005 and we get a new version of Figure 1 shown below"

What JODI calls "crude" is in fact crude oil plus condensates.

If these figures are correct, would you not expect data like this to be showing the opposite of what it is?

http://www.trend-news.com/default.asp?newsid=9604

http://uk.reuters.com/article/2011/03/11/china-autos-idUKN1129734320110311

All this fuel has to come from somewhere and biofuels is far from sufficient

Sam

Instead of wasting your time on an obviously flawed data set you need to do a complete study of ALL the top 50 oil producing countries.

It is a given that oil exports from past peak countries are falling but what about the other half of the story. The 22 significant oil producing countries that are increasing in production?

Unless you provide this full picture then the half you do provide will be seen as misleading.

If you cannot be bothered, tell me which data set you use and I will do it.

If its JODI don't bother.

Even the EIA has net oil exports peaking in 2005 and that includes all exporting countries. Below is a graph of Net Oil Exports for all countries in thousands of barrels per day. That is exports minus imports of crude oil. The data is derived from the EIA's International Energy Statistics, annual exports of all exporting nations minus the annual imports of all those nations.

Just curious but whatever gave you the very silly idea that folks on this list were only posting export data from countries that were past peak?

I would just love a list of those 22 significant oil producing countries that are still increasing production. I can count only 9 or 10 and several of them are importing nations.

Ron P.

Darwinian

Could you tell us all EXACTLY how you produced this graph.

With shortcuts to relevant page. The link above is of zero use.

I think we are just about to see another hole being dug by yourself, don't worry I got a very long ladder :-)

In your never-ending efforts to calculate production down to meaningless decimal points, you continue to overlook the big picture, which is that all of the C+C data bases and net export data bases are showing a major inflection point in 2005. Crude production effectively stopped growing in 2005, and net exports appear to have peaked in 2005/2006, with Chindia taking an ever greater share of what is net exported.

Arguing over extraneous decimal points in various data bases is akin to a couple of engineers standing on the stern of the Titanic arguing over who had the best estimate of when the ship would sink.

Westexas

The above graph produced by Darwinian is highly questionable, when he provides us with his data set I will explain why it is so.

Regardless of the merits of his approach, note the rapid increase from 2002 to the 2005 inflection point. Whatever the merits of his methodology, it was consistent, and it shows an inflection point.

This is the same pattern that we showed in our analysis. We looked at net exporters with 100,000 bpd or more of net exports in 2005 and primarily relied on the BP data base, with EIA data used for some minor countries. We subtracted domestic consumption from domestic production to derive net exports.

Global Net Oil Exports Less Chindia’s Combined Net Oil Imports = Available Net Exports (ANE)

(BP + Minor EIA data, mbpd):

2002: 39 - 3.5* = 35.5 (ANE)

2003: 42 - 4.0 = 37.4

2004: 45 - 5.1 = 39.9

2005: 46 - 5.2 = 40.8

2006: 46 - 5.5 = 40.5

2007: 45 - 6.1 = 38.9

2008: 45 - 6.6 = 38.4

2009: 43 - 7.3 = 35.7

2010: 44 - 8 = 36**

*Chindia's combined net oil imports

**Estimated

If global net exports had continued to show the 5%/year rate of increase that we saw from 2002 to 2005, global net exports in 2010 would have been about 59 mbpd, versus my estimate of about 44 mbpd, with Chindia taking an estimated 8 mbpd of that 44 mbpd.

No. C'mon, jaz, just stop it.

westexas is right: Darwinian's charts are designed to reveal and demonstrate trends, and trends are the most important things we need to know about oil production.

Nitpicking infinitesimally-small details, over and over, isn't adding to the value of the exercise and discussion.

kalliergo

The differences are not that small, 3 million barrels a day and the difference between a not inconsiderable fall and a slight rise.

This makes a massive difference in what we can expect in the next few years as it will take Iraq a few years to ramp up production. That is if they stop killing each other long enough to build the infrastructure.

Also the data for imports and exports of refined products makes a large difference and needs research.

Okay go to the link I posted then mouse over "petroleum". Then slide your mouse down to "exports" and click. Then you change the date to 2000 thru 2009 and change the "product" to "crude oil exports". Download to Excel. Copy and paste the data on a blank spreadsheet.

Then repeat the process except with imports. (Imports, unlike exports, are given as either monthly/quarterly of annual. Choose annual.) Then download to Excel. Copy and paste this data to the same spreadsheet. Then you must sort the data to pull out all exporting nations. I chose all nations with any net crude exports in either 2005 or 2009. (All nations except Brazil and Indonesia had net exports in both years. Indonesia had exports in 2005 was an importer by 2009. Brazil was an importer in 2005 but an exporter in 2009. I included both these nations in my data. All nations with any net crude oil exports were:

Then you take the crude oil imports of these 42 countries and subtract them from their crude oil exports. That gives the graph I displayed. Also I had to do the subtraction before sorting the net exports. Many net importers export some crude but just import a lot more than they export.

Important: A chart of only exports from these nations would give a chart very similar to the net exports chart except it would be a little more pronounced, down slightly more than net exports. The 42 listed nations above account for 100% of all net oil exports that I can ascertain.

Also I have read reports that Brazil became a net importer of crude oil again in 2010. However excluding both Brazil and Indonesia from the chart that would not change it significantly.

I have not dug any holes here Jaz. The data is what it is.

Edit: Also, very important. The EIA only gives net exports of refined products thru 2007. But net exporting nations show an even greater percentage drop in their exports of refined products 2005 thru 2007 than they do crude oil. If we include exports of refined products the drop, I suspect, would show a much higher decline than the 3 mb/d of crude. At least that's what the 2005 thru 2007 data indicates. The actual drop in exports of refined petroleum products, from the nations above that actually had exports of refined petroleum products 2005 thru 2007, was half a million barrels per day. (4,986,000 bp/d in 2005 to 4,480,000 bp/d in 2007.)

Ron P.

Darwinian.

I take it you except this EIA data set Then?

and there is the hole

I assume you meant accept not except.

The EIA has no motivation to show net oil exports declining at such an alarming rate. If anything they would play down the numbers. If they were inclined to fudge they would have obviously fudged the numbes in the other direction. So yes I accept the EIA data for what it is. I know it must have been hard of them to admit that oil exports were declining at such an alarming rate. They would not want to set off any kind of panic. Perhaps they thought no one would notice. And very few did notice. There was Sam, WT, myself and a few others, otherwise their data has been totally ignored.

What I am saying is that I accept the EIA numbers when they are being very pessimistic. It is when I sense that they may be fudging the numbers, trying to be very optimistic, that is when I get suspicious. I do so because I think the EIA is going overboard to be very optimistic. When they report numbers that show oil exports are in serious decline, I take them seriously.

But I am very disappointed in you Jaz. I surely thought you would have come up with a better rabbit hole than that. ;-) I really think you thought you would find a serious flaw in my data or my method of calculating net oil exports. You did not so you just picked the only thing you could think of, that the EIA data is unreliable.

Make no mistake, no data available anywhere is 100% reliable. Such data just does not exist. So we must make do with what we have. And folks who say we should just not do any calculating at all are out to lunch. We make do with what we have and that is all we can do. Those who do not accept any data because of possible flaws should just go somewhere else. Well that is my humble opinion anyway.

If we think the data is flawed we should express our opinion, and explain why we suspect the data, then use it anyway. We simply have no other choice.

Ron P.

Darwinian

Your entire argument in this post has been peak oil was in 2006, EIA Data clearly says not. Both for C&C and total liquids.

http://www.eia.gov/cfapps/ipdbproject/IEDIndex3.cfm?tid=50&pid=53&aid=1

You cannot use this data set to prove peak exports 5 years ago and then say it is flawed when it suits you.

My two external links show that for the countries I highlighted the EIA data was accurate and JODI was not, you really do not know when you are beat.

This is an obvious hole you have dug for yourself. So I could not resist it.

The point I was going to make is some oil producing and exporting countries have recently built or are building extra refining capacity. So any calculations of exports which does not include refined products will be seriously out.

http://www.bbc.co.uk/news/10527308

http://www.presstv.ir/detail/135551.html

http://www.terradaily.com/reports/Iran_To_Build_Oil_Refinery_In_Venezuel...

http://economictimes.indiatimes.com/articleshow/3238921.cms

http://www.cacianalyst.org/?q=node/5505

For example the UK imports crude and exports crude but it also imports refined products but exports even more refined products. Other countries refined products has grown considerably in recent years.

e.g.

http://uk.reuters.com/article/2007/04/17/energy-russia-refining-idUKL174...

so simply saying exports peaked in 2006 is too simplistic and without refined data cannot be proved.

You are correct. If Platts, JODI, the OMR or anyone else publishes net export data then we will use that.

But you miss the point completely! The EIA says Peak oil, so far, was in 2010. But the same EIA says net oil exports peaked in 2005. YOU Jaz, cannot use EIA data for peak oil production and ignore their data for net oil exports!

I have no problem with the EIA data except for their vast OPEC divergence beginning in late 2008 and their vast revisions of OPEC data in 2010. I simply cannot understand why JODI, Platts, the OPEC Oil Market Report and various news reports that I follow, disagrees so greatly with the EIA OPEC data.

You are correct that the net oil export data should include exports of refined products. The latest 2007 data shows net exports of refined petroleum products down half a million barrels per day from the 2005 data. This is understandable since the increased consumption in exporting nations is primarily that of refined petroleum products. They need to build even more refineries to keep up with this ever increasing domestic consumption.

However if you have any evidence that exports of refined petroleum products have made a dramatic turn around since 2007 I would gladly put that in my calculations. But you cannot claim that the absence of data since 2007 means that that all other data is invalid. On the other hand the trend in net exports of refined petroleum products was clearly down in the latest data we have. Therefore the burden of proof would be on the one arguing that this trend has been reversed. Not just reversed but reversed to the tune of 3 million barrels per day since 2007. That is just silly.

Ron P.

I think the burden of proof lies with all of us here.

Now if you look at the available data for refined products.

http://www.eia.gov/cfapps/ipdbproject/IEDIndex3.cfm?tid=5&pid=54&aid=4

You will see several countries increasing exports of these products. The large number of new refineries being built have a dual purpose refined products for internal consumption but also to gain export value.

So it will take a lot of digging country by country to get a true picture.

The only thing the price rise tells us is demand is increasing faster than supply but to what extent is open to debate.

Yes you do. They are Germany, Japan, Greece, the United States and several others. You will notice that they are all net importers. They are importing crude and exporting refined products, a wash. We are concerned here with nations that were listed as net oil exporters. That is they were exporting some of their production as refined petroleum products. Of those a quick look sees Canada, down slightly and Mexico, up slightly in exports of refined products. None of the other major net oil exporters show exports of refined petroleum products beyond 2007.

Soooo.....

Net crude oil exports clearly peaked in 2005. Exports of refined petroleum products can only change that data slightly. And that change, up until 2007 was down. It remains to be seen how much their exports of refined petroleum products were up or down since then. Even if they do reverse direction and go up they will have to increase by half a million barrels per day just to get back to where they were in 2005. To suggest that they might increase by another three million barrels per day is just reaching a bit too far.

Ron P.

Even if they do reverse direction and go up they will have to increase by half a million barrels per day just to get back to where they were in 2005. To suggest that they might increase by another three million barrels per day is just reaching a bit too far.

Darwinian

Remember this...

That being said, September 2010 C+C production was 73,596,000 barrels per day. July 2008 was 74,686,000 barrels per day or 1,090,000 barrels above September production. It just ain't blood likely that we are going to surpass that this year.

I think you will understand if I do not take your assumptions to seriously, the data for trade in refined products is three years out of date. This is exactly the period of time many countries have adopted the policy of increasing exports of these products. So your oil export figures are way out and need updating. 74,831,732 :-)

Jaz said:

You are really all over the map. One moment you are complaining about people suggesting that world production is dropping, and the next you are suggesting that it won't go above July 2008. You really have to get your story straight if you want to make a coherent argument.

You should probably learn how to use blockquotes. Gooogle html blockquote if you need some instructions. Barring that, the use of quote marks "" would help.

Jaz, yes I remember that. You should learn to use blockquotes, or at least italics to indicate when you are quoting and folks would not get confused. It's really not that hard to do.

Yes it was not bloody likely and without those massive revisions in the 2010 EIA data it would not have happened. The OPEC OMR did not make those revisions and no one else I know of made those revisions, only the EIA. According to JODI, according to to the Fatih Briol and the IEA, peak oil was in 2006.

So yes I remember that and I was correct.

Ron P.

Darwinian

Actually the original figures were sufficient.

Record number of cars and vehicles built in 2010 and 2011

http://www.globalgiants.com/archives/2011/02/global_light-ve.html

http://www.ipmd.net/news/001137.html

http://www.thejakartaglobe.com/bisindonesia/record-car-sales-overtaking-...

Record number of flight miles and passengers

http://www.centreforaviation.com/news/2011/02/15/worldwide-capacity-incr...

http://sydney.checkintoday.ws/blog/impact-of-low-cost-airlines-results-i...

All this ties in with an increase in production, what do you think all this is running on angel dust?

Don't say increased efficiency and bio fuels, leave yourself some dignity.

[edit]

The US consumed, during 2010, 1,654,000 fewer barrels of petroleum products per day than we did in 2005. During the first three months of 2011 we consumed 1,567,000 fewer barrels per day than we did in 2005.

Go to Table 3.1 Petroleum Overview and you will find the following data.

Here is a graph of US Petroleum Products Consumed in thousands of barrels per day, 1998 thru the 2011. The last point on the graph represents the average of the first three months of 2011.

As you can see consumption peaked in 2005 right at the point net oil exports peaked. We recovered a very tiny bit in 2010 and are still recovering but at a very slow pace. Our consumption of crude oil and all other forms of petroleum products clearly peaked in 2005. And so did the rest of the world. We are still not back to 1999 levels.

In my opinion we will never return to the 2005 level. Crude oil production peaked in 2006 and peak oil exports peaked in 2005. There is a slim possibility that crude oil production will surpass the 2006 level but there is no chance that net oil exports will ever surpass the 2005 export level.

Ron P.

[edit]

Anyway I was talking global consumption, I am well aware that consumption in the US has gone down, or rather the production of ethanol has gone up since 2005. Globally biofuels cannot explain the increase in road and aviation.

This is why i am happy with the EIA data, it simply matches the facts.

During 2008/2009 global oil production was down due to the recession and air transport and vehicle production and freight were all down.

Now globally they are above levels of 2007, you can believe in fairy dust if you want, I will use logic. Does it not occur to you that global Production could be increasing even though exports are in decline?

Well that disagrees with what you were suggesting when you wrote this:

Nevertheless... the International Petroleum Monthly, which suspended publication with the January edition has OECD consumption peaking in 2005 as well. Yes, that matches the facts as you suggest.

OECD consumption in thousands of barrels per day.

Imagine that! OECD countries consumed over 4 million barrels per day more oil in 2005, the year exports peaked, than they did in the first nine months of 2010! And consumption is still below 1997 levels!

Yeah, the vast majority of the time I like the EIA data as well. It is only the late OPEC data, since about October 2008, that I have a problem with. That was the point where their OPEC data suddenly started to diverge with what everyone else in the world was reporting.

I especially like their data that says net oil exports peaked in 2005. And all their consumption data confirms that.

Ron P.

Darwinian

I have no problem with OECD consumption falling, the EIA data shows that quite plainly. However I see it in the context of Global oil production having increased over that time as EIA data infers.

The increase in consumption from OPEC and non OECD countries is greater than OECD decline in consumption. As the recent quarterly and annual report shows.

http://www.eia.doe.gov/ipm/demand.html

If oil production had fallen over this period of time then non OECD consumption could not have increased more than the fall in OECD consumption could it?

I will know when global oil production starts to fall we will see $300 oil and all hell break loose.

I take it that you mean to say that when oil hits $300/bbl and all hell breaks loose, you will be convinced that global oil production has started to fall.

Or that demand is decreasing more slowly than supply. Or that supply is decreasing while demand is stagnant.

It is useful to have actual production/consumption data.

Thank-you to those who dig the data mines.

The simple definition of net exports as domestic production less domestic consumption (of total petroleum liquids) covers the export of refined products.

Here is an explanation that I have used before:

Let's assume two countries, Production Land (P) and Refinery Land (R).

Each country consumes one mbpd of refined petroleum product.

P has production of two mbpd of crude oil, but no refineries.

R has two mbpd of refining capacity, but no production.

Let's ignore refinery gains (the volume of refined product exceeds the crude oil volumetric input).

P ships two mbpd of crude oil to R. R refines the crude oil and ships one mbpd to P, while R consumes one mbpd.

So, P's net exports are two mbpd of production less one mbpd of consumption = one mbpd of net exports

And R's net imports are zero production less one mbpd of consumption = one mbpd of net imports

P's gross exports are two mbpd, and R's gross imports are two mbpd.

Funny. I have a world export graph on my computer showing EIA data. While the graph has the same profile, it peaks at 47 millin barrels a day. This graph peaks at 40 millions. What explains that differense?

I really don't understand where you are getting your data Jedi. If you just look at total crude oil exports and forget about subtracting imports, the peak was 44,415,000 bp/d in 2005.

The above data is copied directly from the EIA web page. This is world data and includes all crude oil exports from all nation, not just those of exporting nations only, as my data does. So I really don't understand how you are getting a higher number.

Check it out at: International Energy Statistics: Crude Oil Exports

Ron P.

I got it here on TOD. Some article about world exports a while ago. It's in the archives somewhere.

http://images.staticjw.com/fil/9218/figure01.jpg

The divergence between EIA and JODI is striking not only for its size but also for its consistency -- the gap widens over time which would not happen with random differences. There is some systematic cause for the divergence.

So who is correct? I don't know if that can be determined, but it does appear that the JODI methodology is less opaque than the IHS. I'm not sure that it should, but it gives me more confidence in JODI.

Conspiracy Theory #1: EIA decided to shut down international reporting after discovering consistent and unexplainable reporting anomolies from IHS. The budget cut is just a cover story to avoid embarrassment.

In any case, it appears that JODI will be the only game in town for monthly data from here on out.

Conspiracy theories aren't required. It is oddly similar to the Fed canceling M3 just before the housing bubble and consequent meltdown. The explanation is simple and straight forward:

PS Someone on TOD coined this gem but I forget who.

So IEA/JODI data has become reliable and EIA data is fixed because

IEA believes in Peak Oil and EIA seems to follow 'projections'.

Talk about circular reasoning.

If you average the CO+NGL JOD 80mpd and EIA 83.84 mbpd you get the same value today 2011 than the high point in 2008 which is surprising given the 2009 decline in OPEC from 33 mbpd to 30 mbpd.

And immediately we see HL graphs showing the precipitous decline into the abyss. [edit]

What's your point? I didn't read anything to say that JODI has become reliable. The only thing I read pertaining to reliability is "... at best we may only have two significant figures of semi-reliable data." That's a long way from saying JODI is reliable.

[edit]

I don't understand either of your guys arguments. JODI tells you that their data is not completely reliable. They even color code it for reliability. And we know that they report only what is reported to them, if they are lucky enough to get a report.

The point is that the JODI data is consistent. That is their 2006 data carries the same reliability that their 2010 data carries. I think it is the best data we have. And soon it will be the only data we have for monthly international oil production.

Ron P.

Does Occam's provide some clarity here? Yergin is always wrong --> Yergin = IHS --> IHS data = EIA data --> EIA data is wrong.

Not Conspiracy Theory, with capital letters, but more conspiracy theory as in a real conspiracy. We had a whistle blower claim the IEA, e.g., was telling us what the US wanted them to tell us. The EIA is a gov't agency, so why would it do this less so? We had confirmation from Birol that peak is Nigh not many months ago, but, golly, there's a recovery to keep going. And, that recovery, by pretty much all accounts isn't really happening much beyond the financial sector.

JODI has no reason to lie that we know of, IHS might. Besides, all the claims of huge energy consumption rises have never squared with reality while JODI does.

I'm going with JODI until better info is there to be had.

So am I.

Ron P.

Darwinian

Where do JODI get their Data from?

I thought you said it was from the horses mouth, so to speak.

http://www.upstreamonline.com/live/article230527.ece

Obviously not, if the Angolan Oil Minister admitted to exceeding oil quota, considering the animosity that causes in OPEC, then that figure should be accepted, you saying they know better than him?

JODI is 200,000 to 300,000 barrels a day out and their figure for Angola for October is ZERO how ridiculous it that.

Also you claim that their data is consistent, this is nonsense, they reported on Kazakhstan until December 2009 and then nothing.

At the time they put Kazakh production at 1.3 when good sources reported it at 1.6.

http://kazcham.com/?p=332

http://www.reportsnreports.com/reports/21356-kazakhstan-oil-and-gas-repo...

This clearly shows how unreliable JODI data is.

OPEC's "secondary sources" in their Oil Market Report report Angola producing remarkably close to what JODI publishes. Apparently you are looking at JODI all liquids, not C+C.

However OPEC's Oil Market Report does not accept any data from their own producing countries so why should they ask Angola? It is a matter of principle for OPEC to accept "secondary sources" for the data they publish. However nothing prevents any country from telling other sources what they actually produce. And of course nothing prevents a country, (Venezuela), from inflating the numbers they report to JODI.

Also, JODI reports zero if a country does not report for a month. If they later report then report the data. I clearly stated that in a previous post that Sam linked to up top. No, that is not ridiculous, if they don't have the data they don't publish it.

They put Kazakhstan figures at exactly what Kazakhstan stated they were until Kazakhstan stopped reporting. So JODI stopped reporting Kazakhstan when Kazakhstan stopped reporting to JODI.

JODI data is only as reliable as the countries reporting. They report what is reported to them.

Ron P.

So the missing month for Angola, Do you just lick your finger and stick it in the air?

In fact you go to the data set which has proved you wrong otherwise your figures would be even more meaningless.

What has suddenly happened to Cuba did it sink?

What happened to Vietnam Oct Nov Dec 2009?

What happened to South Africa between Dec 2009 and Jan 2010?

The more I look at this data set the more I realize why you use it, if you think this furthers the message of PEAK OIL you are greatly mistaken.

Obviously you did not read the link posted by Sam above at the very top of his post. MY post: Peak oil in the Rear View Mirror

As I explained when a zero is inserted by JODI I carry the previous months data forward. This will not be completely accurate but it is as close as possible. And also as I explained in that post, the JODI data is not complete. There are several nations that do not report at all. In those nations, if they are large producers, I use the EIA data. But very small producing nations like Cuba the data is just omitted. That is why I say the data is only 98 to 99 percent complete.

I use the JODI data because after the EIA discontinues their reporting it is the only monthly data, reported every month, that is available. If there were other data I would use it.

Ron P.

There is a presidential election coming up. If the incumbent has to run with government data showing oil production down the incumbent will be blamed. But if the last available data from the government sponsored data provider shows an upward trend then the incumbent was successful as a president and should be re-elected.

They are not suspending the US data, only the international data. I really don't think anyone is going to blame the US president for what happens to Saudi oil production, or what Venezuela does or even what Mexico does. Anyway the average Joe has no idea what oil production is anyway. He only knows what the price of gasoline is at the pump. And the EIA has no control over that.

Ron P.

Oh, sure they will, for all three, at least. If the price of gasoline is a significant issue in next year's election, some opponent of the incumbent, or an "independent expenditure" entity of some sort, is certain to claim that part of the problem is that Obama is soft on "fellow Commie" Chavez, or some similarly goofy argument. And some depressingly-large segment of the population will believe it.

I'd be surprised (but not astounded) to learn that the EIA international data is being "disappeared" for simple, crass political reasons, but it's such a good conspiracy theory that you can count on several versions circulating.

Killiergo, you miss my point altogether. Sure they will blame the president for high gas prices but I really don't think they will connect him with Chavez. And of course there will be a lot of goofy arguments but those making them will be in such a minority that no one will pay any attention to them.

The data is disappearing because of budget cuts. Let's not get overly dramatic here. There is no conspiracy. The problem is that the people directing the budget cuts have no sense of priority. They have no idea what is going on with the world oil's supply. They simply believe, like every other fool in the nation, that the oil will always be there so there is no need to track who is producing what.

"The fault, dear Brutus, is not in our stars,

But in ourselves, that we are underlings."

The fault is not in our politicians but in our pure ignorance of what is really happening in the world. Not one in one hundred seems to have a clue.

Ron P.

No, I didn't miss your point, Ron. I think you misread mine.

We agree that brain-dead prioritization in the face of budget cuts is the reason for the EIA cutbacks (although we can't be entirely certain that morons in Congress and/or the administration don't have some twisted political agenda).

We only disagree as to the extent to which politicians (and their masters) might be willing to use international O/G production as a weapon against their opponents, and the possibility that significant portions of the population might buy into some nonsensical story.

I fully expect that, if gasoline prices remain at the forefront of what passes for political awareness in America, during next year's election campaign, the opposition will use almost any tactic, concoct almost any story, to blame the incumbent for high prices. Whether it's charging him with blocking domestic production or failing to conduct foreign policy in a manner that insures the flow of affordable product from KSA or Venezuela, I would be astonished if they don't use anything they can cook up.

Likewise, I would be amazed if many Americans don't uncritically accept whatever idiocy they are fed.

Remember the endless nonsense we've seen, for years, over Obama's birth certificate?

Also, please don't forget that, last summer, polling showed that nearly one in five Americans thought he was a Muslim.

Growing Number of Americans Say Obama is a Muslim

Trust me, nothing is too outlandish for opponents to use as a bludgeon, and nothing is too ridiculous for Americans to believe. That's just how it is, here in the world's greatest democracy.

So what does IHS use for its international production figures? I don't see JODI being less reliable than anything that IHS can produce. If we are awash in oil output higher than 2008 with a big chunk of the world economy still in a state of recession why are crude prices over $100 per barrel?

Libya doesn't explain it since a 1 million bpd market supply difference is less than the measurement noise in the global production. It is also less than the EIA claimed increase.

A few points to consider tossing in to the ring:

1. As is typical, the truth could be somewhere in between the curves.

2. The possibility of double counting or improper accounting of liquids. As cheap oil becomes more scarce more of the alternatives come on the market and get mixed up with crude.

3. EIA counts "underground" production, not associated with countries.

4. Accounting issues at refineries, i.e. could get double-counted again.

The head-scratching part of this exercise is that EIA is used to fill in the missing gaps in the JODI database, yet I don't see a similar stacking of just the EIA numbers. I would think the stacking of the EIA country data would quickly reveal where the possible overcounting exists.

The seems kind of an obvious thing to do. The countries are here:

http://tonto.eia.doe.gov/cfapps/ipdbproject/iedindex3.cfm?tid=5&pid=57&a...

One could do this on a country-by-country case just as well. That is what redundant data is good for -- statistical forensics studies.

Regarding 2: Is it possible EIA but not JODI have "refinery gains" in their statistics?

Good point, small but every bit counts when doing accounting.

Here is a start at stacking the EIA numbers. I will clean this up with labels and proper ordering after work.

EDIT:

Completed reconstruction further down the thread ->

http://www.theoildrum.com/node/7949#comment-806233

A bit problematic to explain the convergence and then divergence between JODI and EIA using refinery gains.

I think the sudden introduction of the JODI database into discussions here on the oil drum stinks. I have been reading most posts on TOD for the last 4 years and the JODI numbers have scarcely every been mentioned. "Everybody" has accepted and argued their points based on the EIA, IEA and BP statistics numbers.

Now that the EIA, IEA and BP are consistently showing rising production - contrary to the doomers predictions - the doomers have suddenly started jumping up and down about the JODI numbers as they are the only ones that vaguely support their extreme predictions.

It is important to the note that the EIA, IEA and BP use their vast resources to estimate the real production around the world whereas JODI simply takes the data countries chose to give it. Then, as I understand it - the people arguing against using EIA data simply add the data from the EIA where it is missing (suddently trusting it) from JODI and come up with the curves above. This is the lowest quality data-use I have ever seen on TOD and borders on the ridiculous. Self-reporting to JODI CANNOT be taken as reliable under any circumstance and all OPEC countries have an INCENTIVE to under report to JODI.

BP numbers will be out in June and we can compare. We can also compare with IEA.

Come on! This is cherry-picking of the very worst kind.

I must say, I have to agree with this. The one possibility not considered in the post is that production actually went up.

Instead of complaining, what you have to do is take the data and show that it is correct or incorrect.

As I said right above, there is enough redundancy in the data sets that you can do some forensics on the trends and figure out the questionable areas.

[edit]

My argument is very clear: IEA, EIA, BP - who all have the time AND the skills show increasing crude and condensate AND all liquids producition. Isn't it then slightly more likely that they are all right rather than assuming that the JODI database is right?

Taking the JODI numbers and adding the numbers from the EIA where there are blanks does not take any skill whatsoever - merely time. :-)

To have such self-belief that you really believe that you can show that the data from EIA, IEA and BP is wrong (probably a conspiracy I assume?) seeems to be stretching it a bit to put it mildly.

It's really not that hard and is nothing more than a statistical bean-counting exercise. Get a few countries up or down and the curves will start to diverge, and then you can point to the questionable nations. If the fluctuations are equally weighted up or down then the curves will likely align, as they did in 2008.

Do what I did. Make a hypothesis and then go get the data and run some tests on it. After discovering the fact that only a few countries are responsible for the diverging data, I wouldn't be surprised that a better statistical estimate can be made by taking the average of the two curves.

This is a bit harsh I think. Sam has simply brought an observation to everyone's attention. I think you may find that EIA, IEA and BP all get their information from a common source, and so agreement between these data sets may be self fulfilling. JODI at least has some autonomy from these other sources, but since the data are incomplete (which is why this is not a favoured source), it is perfectly legitimate IMO to try and fill in gaps from other sources.

The real question is to try and understand why there is divergence. I don't think anyone is prejudging that JODI is correct or superior - just giving a different result.

In Twilight, Matt Simmons claimed that ME OPEC data was compiled by counting tanker traffic to and from Gulf ports. But is seems they do also report to JODI? I'd feel more inclined to believe official government returns than numbers from some Geneva based tanker counting outfit.

Euan, I agree with you! And I wasn't actually trying to criticise Sam, but rather Darwinian who suddenly introduced JODI in the "Rear View Mirror" post a few days ago. Immediately WHT and a few others jumped onto the bandwagon and within seconds I had the feeling that "all" TOD posters were suddenly aligned that JODI was the new mesiah and everybody else was useless.

Also: I work in the oil field, producing oil, and I have to say that there are currently a hell of a lot of oil fields being discovered and there are still many of the mega-projects to be developed. As you yourself have argued earlier there is no obvious reason why oil produdction should fall any time soon (based on the mega-projects data-base). Add to that the fact that in 2010 RECORD reserves were discovered around the world and the prospect of an ACE-like collapse seem highly unlikely.

I think it's great that Sam wrote this post: But let's not just suddenly all say JODI is great and everybody else is useless - just because JODI shows Peak Oil in the rear-view mirror.

Nordic, I must point out that the data in question is primarily OPEC data, not non-OPEC. JODI and the EIA pretty much agree on non-OPEC data, though there is a slight divergence.

We have several sources of data for OPEC data that are simply not there for non-OPEC data. We have Platts, we had MEES but I haven't been able to find their data lately. And we have OPEC's own "secondary sources" published in their Monthly Oil Market Report. All this data tracks pretty close to the JODI numbers! (With the exception of Venezuela of course.) All this data tends to agree with JODI but disagrees with the EIA's OPEC numbers. And of course the EIA, without explanation, dramatically revised their 2010 OPEC production numbers. This made the divergence between the EIA and everyone else increase to about 2 million barrels per day by 2010.

So no one is picking JODI over everyone else, I am simply saying that the EIA data has diverged just since late 2008, from ever other major OPEC reporting agency! And that divergence reached 2 million barrels per day for several months during 2010.

You think that stinks? So do I.

The chart below shows that JODI agreed almost completely with the EIA data up until late 2008. OPEC's OMR data was slightly lower because it is crude only while JODI and the EIA are both C+C. Then in late 2008 the EIA data suddenly diverged greatly with JODI and the OMR. JODI and the OMR continued to track each other however. Yes this stinks!

The above is monthly data from January 2002 thru March 2011. Thru February for EIA.

(I don't gather data from BP or the IEA so I don't know how much JODI, Platts, the OPEC OMR and others diverge from BP and the IEA, you will have to figure that one out yourself.)

Ron P.

Nordic Mist says:

I've been utilizing JODI data and posting comments here about the results for years. There was an early TOD post about the divergences between the various data sources. Jon Callahan set up a JODI databrowser. I like JODI, their numbers are published ahead of others and easily obtained, unlike IEA/OPEC. Stuart Staniford posts on his blog about the latest production numbers using all available sources, too, if you want more detail. BP I only use for a few applications such as refinery capacity; their production is given as C+C plus NGLs with no biofuels which yields a number inbetween the usual C+C and AL that isn't of much utility anymore. Also they only provide annual figures, which are handy as they go back 46 years, unlike the EIA who start in 1980 in most cases. You can flesh out EIA using Annual Energy Review data though.

Until this post I had no idea JODI numbers showed any downtick. Excellent work, Sam, btw. And thanks for doing a grand job of going head on with these people in the comments, Ron.

JODI is slowly improving, It's not the easiest database to use and the documentation is a little bit short, it took me a while to be able to access it from Matlab also.

Yes, many thanks to Ron for providing very good answers.

Here's that post I alluded to, from November 23, 2005: The Oil Drum | JODI Hall of Shame. One of Stuart's comparing JODI and numbers from the Oil & Gas Journal - EIA weren't online at that point?

I notice you can access old versions of the OPEC site at the Internet Archive Wayback Machine, which may be true of these other sites - TOD and peakoil.com are archived there, I've checked 'em out. May be of interest in anyone wanting to relive the good old days, such as they were. All that untested water, 8% decline rates for the world etc. Of course we know so much more now...

I was looking at the old versions of the OPEC site to see if their published numbers were different then, btw - a more utilitarian use for the WM.

I forgot about this post, looking at the last chart, JODI had only 40 countries at the time, now it's around 90.

Ron, this is great sleuthing. I for one have had a large number of doubts raised in my mind. From your chart here I'd note that JODI agreed well with EIA up to around month 80, and then it shifted to agree better with OMR. The offset between OMR and Jodi accounting for condensate does not stay constant. I imagine that many countries actually have problems compiling stats. Arab accountants / engineers wondering whether to classify some production as C or C?

I agree that 2 mmbpd surplus in EIA data does stink a bit.

Thanks Euan. The stinky thing is not language I would normally use. It was in response to Nordic Mist's statement: I think the sudden introduction of the JODI database into discussions here on the oil drum stinks.

I think we would be neglectant if we ignored any source of data.

Ron P.

Ron, thanks for that chart, it's very telling, what would be interesting to check is past revisions for OPEC in the EIA IPMs and see if downward corrections by 1 mbpd and plus have occured in the past.

Nordic – You have in numerous posts reminded readers of the big discoveries in Brazil and record finds in 2010, and from that drawn the conclusion that oil production is not likely to decline anytime soon. But of course you know that those big finds will take some time to turn into significant production flows, and in the meantime many existing fields elsewhere will indeed suffer declines. So it seems that the central issue regarding the likelihood of a near-term peak in overall production seems to come down to a comparison of two rates – (a) the rate at which big new discoveries can be turned into production flows, versus (b) the rate at which existing fields will decline over that same time period. As somewhat of a “dissenting voice” here on the TOD with respect to a near-term production peak, why don’t you take a stab giving us your best quantitative estimates for (a) versus (b)? Perhaps you could use historical precedents of past mega discoveries and the actual time it took to bring them up to substantial production as a basis for estimating (a) within your analysis? Since most of the big new discoveries are offshore, maybe you could restrict your historical precedents to offshore mega-projects in the past.

Others here on TOD have attempted different variations on the above analysis and arrived at a conclusion opposite yours. It would be interesting to see you put some real numbers to your qualitative assessment of the situation, so we can see your basis for arriving at a different conclusion. IMO, differing viewpoints promote a healthy debate, and it would be interesting to see a quantitative analysis from someone with a dissenting view.

Nordic_mist, could you elaborate on the "record reserves" that were discovered in 2010? Are you saying that more recoverable oil was discovered last year than in the mid 60s, or than the discovery of giant field in the Middle East? Do you have links?

I believe they may actually have been higher. I'll post a full reply when then the BP Statistical Review data is out in June.

But even if the reserves added in 2010 constitute some new record, that still doesn't answer the fundamental question: "What is the rate at which these new reserves will be converted into production flows, and how does that compare to the rate at which existing fields will decline in the meantime?" Reserves additions - in an of themselves - don't really mean much until they are converted into production flows. And it is the rate at which that takes place, minus the rate at which existing fields decline, that will determine the net production profile.

You also have to be careful to differentiate between oil and gas. the term boe is misleading.

http://www.offshore-mag.com/index/article-display/7580142997/articles/of...

However 2008, 2009, 2010 were good years, but nowhere near the record discovery years of the 1950s,60s and 70s.

Are you quoting someone again?

I am confused because a minute ago you were slamming Ron for making a peak oil production prediction. Now you are quoting or claiming peak discovery long ago. In case you haven't noticed, discovery and production numbers are fundamentally tied together.

You really need to have a consistent story, or otherwise it looks like you are just arguing for the sake of arguing.

Could it be that Jaz has just seen the light?

Discovery of Giant fields. Discovery of Oil

What might have happened is that Jaz did a lot of googling trying to find an article that proved his point but alas... he found the truth instead.

Ron P.

I agree with Jaz’s point about the importance of distinguishing between actual crude and boe. Your table above is also pretty compelling. However, I do believe that the pre-salt Brazilian discoveries will ultimately be ranked in the top 100, maybe even fairly high up on that list. So looking at the areas where massive reserves exist that might be brought on line in the relatively near term, I can see Iraq, the Caspian and Brazil.

When you look at the political and logistical challenges in Iraq, and the geologic complexity and cost of developing production in the Caspian and ultra deepwater, sub-salt Brazil, it seems to me that the rate of production increases from those areas might very well be slower than it was for the mega, super and gigantic fields of the past. The track record so far in the Caspian has not been good, and the other two remain to be seen. That’s why I think reserves additions alone don’t tell the whole story on the likelihood of a near-term drop in production.

The rate at which current reserves can be turned into production flows will be influenced by geologic complexity, political stability, world financial stability (availability of credit) and of course the price of oil relative to the cost of production. Except for geologic complexity, all of the other factors are impossible to predict with any accuracy. But I would nevertheless like to see some proposed rates for production increases from people who have an optimistic assessment of near-term production increases over the next 5-15 years.

Except for the minor detail that they keep downgrading them as more information comes to light.

http://www.bloomberg.com/news/2011-05-26/brazil-s-libra-field-likely-has...

"Brazil’s oil regulator reduced its estimate for the Libra field after conducting a drilling program at the site, director Magda Chambriard said."

Considering the possibility of an oil shortage and its effect, maybe, the supply/demand balance should be considered more important than the actual level of production. Now, we can see that production statistics are far from perfect. Probably consumption/demand statistics are even worse.

Statistics on stock will show the net effect of the production/consumption (im)balance. Such statistics are also far from perfect, but probably OECD data on stocks give a reasonable picture how OECD-stocks have changed. Obviously, this excludes changes in stocks of non-OECD countries and thus gives a far from perfect view of global production/consumption balances. Still, I have the notion that non-OECD countries in general have much less capacity for storing crude and product than OECD-countries. Though, it appears that China is striving to increase its capacity. Still if the major part of stocks are in OECD-countries these statistics would be highly interesting for judging the production/consumption balance. If I am incorrect in the assumption that OECD-stocks are outweighing non-OECD stocks I would be happy to get some data on the relationship between stocks in the different areas.

As can be seem from a chart produced by IEA, OECD stocks from February 2009 to February 2011 are trending downwards. The amount compared to 5-year average has decreased

In addition stocks in floating storage as reported by IEA have also declined. (My own compilation of data presented in the OMR:s).

Alot depends on whether one is a passive consumer of this data, even here at TOD, or if one is an active user and analyst of this data. My experience is in the latter category, as I've been wading through EIA, BP, IEA for years--since 2004.

Volatility in Crude Oil only data from EIA Washington, throughout the entirety of 2010, was among the highest I have ever seen. Indeed, 2010 is shaping up to be a very unusual year for EIA data. The year started out with repeated reports on a monthly basis of very high crude oil production--which were successively revised downward by 350-600K bbls each month. My personal data sets and the charts within them were bucking up and down all year. Finally, the revisions died down and we had what appeared to be a pretty good series for all 12 months of 2010. Until the the last revision, which put back 600K-800K bbls into each month. Never seen that before.

Backgrounded here was a website overhaul at EIA Washington, and reorganization of International Petroleum data sets and presentation. We've even seen TOD-ers placing calls this year to EIA on the occurrence of having completely left out some data. Never seen that before either. And finally we get a budget cut that will kill the production of this data altogether. Like I said, one's interest in this post of Sam's has a lot to do with how much time one has spent spelunking in the caves of this data.

Most of the data divers here know all about the holes in the JODI set. So, we're likely to see this comparative post for what it is: worth knowing, and worth pondering.

G

G - As a casual observer of this effort I'm thankful for all the work you and others put in. Especially since my nature is to not put much faith into anything the various "official sources" sources put out. I use production data for Texas and La. and have very high confidence for two very good reasons. First, multiple confirmation. The various working interest owners as well as the royalty owners will audit the production data for accuracy...tens of $millions on the line. Second, all this data is submitted to state agencies that have the power to fine and, in extreme cases, imprison false reporters of production data. And they don't even need a warrent to show up and check matters out. A TRRC inspector, with perhaps a Texas Ranger at his side, can walk in and you'll open your records up or they shut you down on the spot.

I see nothing close to this level of confidence from production reports from the vast majority of countries especially those in the ME. To be honest I don't even bother to pay attention to all those reports. But I do pay attention to what our investigators on TOD offer. And am very grateful for those efforts.

Interesting quote in a front page article in today's WSJ:

http://www.theoildrum.com/node/7961#comment-805953

"have pumped more than half their oil — the point at which production traditionally begins to decline". Don't have the hard number handy but this isn't even close to true. Perhaps he's just being loose with his terminology. Most oil fields begin their decline slope (after all development drilling has been completed) within the first 10-20% of recovery. Many fields, especially water drive reservoirs like Ghawar, recover the great majority of the URR after they've started heading down their decline curve. I can point to hundreds of fields/wells in Texas that have recovered 90% of the URR long after decline set in. In fact I can't recall a single Texas field that hadn't been down it's decline path for a long while by the time it hit 50% of it's URR.