Looking in the Rear View Mirror

Posted by Phil Hart on May 18, 2011 - 2:29pm

It has often been said that we would only be able to see peak oil by looking in the rear view mirror. It's well past time for a head-check, so this post provides a quick look back at production over the last five years and at some of the predictions I and others have made.

The Early Days

While the peak oil theory traces its roots back to M. King Hubbert in 1956, I think the contemporary peak oil movement can pin its origins on the Scientific American paper “The End of Cheap Oil” by Colin Campbell and Jean Laherrere in 1998. At some point those authors deserve a medal for the prescience of their work, and the rest of the world a slap in the face for ignoring it at a time when we could have usefully started the transition away from said cheap oil.

It was not until 2004 though, when oil prices began to move firmly above their long-term trading range that awareness began to grow at all significantly. I started work in the oil industry in the UK in 2001 but first heard about ‘peak oil’ from an outside source and joined the growing numbers following peak oil websites in October 2004. The Oil Drum was one of those sites I followed, soon after it was launched in March 2005.

February 2006

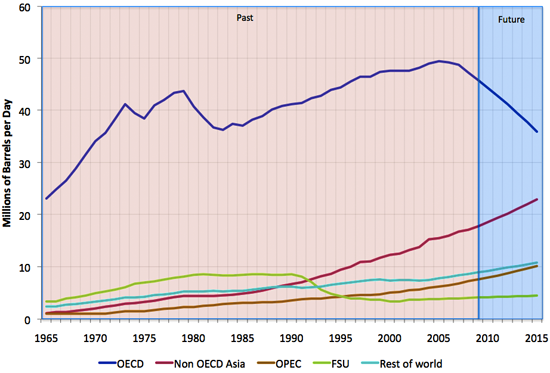

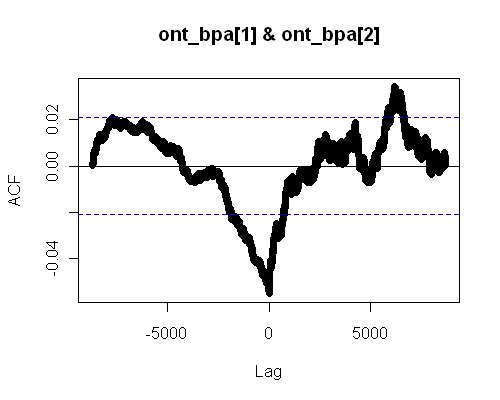

Stuart Staniford’s plateau updates were a feature of The Oil Drum and I, like others, followed them closely. Charts like that above made it seem obvious that we’d hit the ceiling for oil production and it was just a question of when decline would begin.

While Stuart didn't take much of a position in writing the statistical updates, he did frequently include curve fits to the data. Although he explicitly stated they weren't forecasts, seeing those curves dropping below 0% growth rate was strongly suggestive to those looking for evidence that peak oil was near at hand.

Very shortly after Stuart's February 2006 post, Dr Deffeyes defined a date for peak oil:

I predicted that world oil production would peak on Thanksgiving Day, November 24, 2005. In hindsight, that prediction was in error by three weeks. An update using the 2005 data shows that we passed the peak on December 16, 2005. . . . . . By 2025, we're going to be back in the Stone Age.

That's it. I can now refer to the world oil peak in the past tense. My career as a prophet is over. I'm now an historian.

I was considerably less certain about the timing than Mr Deffeyes, but at the end of February 2006, summarising Chris Skrebowski’s Megaprojects analysis, I stated in a submission to an Australian Government Senate Inquiry that:

These industry figures indicate that new production coming online before 2008 will probably be insufficient to offset decline in existing fields, and that falling total global oil production will be self-evident by 2010.

Clearly that hasn't happened and I thought I was being conservative at the time. Somewhat more cautiously, in describing Colin Campbell’s model, I also said:

The ASPO scenario forecasts a peak in 2010, with significant uncertainty on either side of this date. We can only state with reasonable confidence that peak liquid production will occur at any time between now and 2015.

November 2007

It was quite some time before the ever cautious (and I think remarkably objective) Stuart came to a conclusion that peak oil might be near at hand, in his post "Is the Decline of Base Production Accelerating?"

Overall, while there remains a lot of uncertainty, seeing this acceleration of base declines makes me lean a little further in the direction that the Russian situation of slowing production increases in the face of greatly increased rig counts also hinted at. Specifically, it suggests that perhaps by sometime in 2008 we will have unambiguous declines in total liquids production, rather than continued plateau. I'm not certain at this point, but that's the direction I lean.

Many Oil Drum readers would have been more pessimistic than Stuart at the time, and with less caveats on their position. I think it’s fair to say many of us did not think crude oil or total liquids production could be higher, however slightly, in 2011 than ever before.

The International Energy Agency

While I think some of us may have slightly over-stretched in the timing or confidence of our peak oil predictions, it’s clear that we have been very close to the mark overall in raising awareness of this critical issue, one that more than five years later is still getting little more than zero response from Government.

So there is room for improvement in the accuracy of our forecasts. Some other important people really did miss the boat entirely, though.

In their 2004 World Energy Outlook, the IEA included the key chart below, with a forecast in their reference scenario of 121 million barrels per day in 2030. Every report since, they have been revising that peak figure down by as much as 5 million barrels a day each time, which has made for several fairly dramatic downward revisions in a row.

What I now find amazing is that Fatih Birol at the IEA has the gall to say recently that ‘I think it would have been better if the governments had started to work on it at least 10 years ago’. This despite his organisation arguing against the need to be concerned about peak oil more recently than that. The IEA has radically changed its tune now, which is welcome, but admonishing Governments for not taking earlier action should come with a significant ‘mea culpa’ of their own, since the IEA were the ones supposed to be providing the best advice.

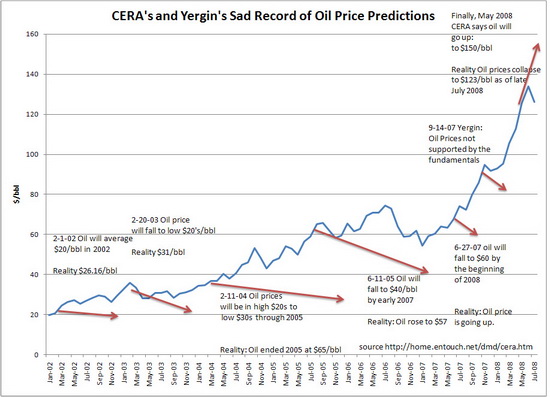

Of course, the only people further from the mark have been CERA. This chart is still priceless:

Where Are We Now?

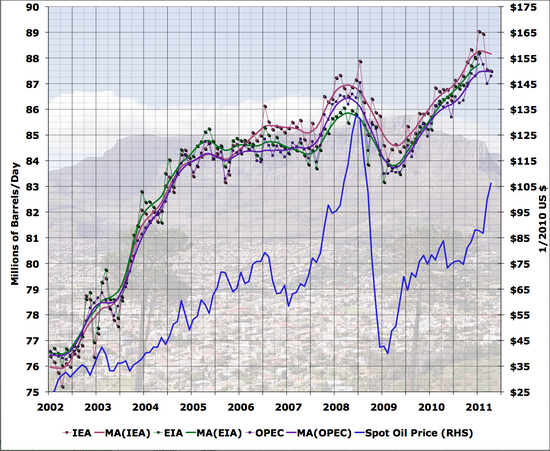

On his blog ‘Early Warning’, Stuart has updates again for the plateau following tragics among us. The chart above is from his April 2011 update (currently offline). Gail in her latest update has this view as well:

Compared to total production, the difference between 2011 and 2008 is marginal, but this is not ‘self evident’ decline, which is what I wrote five years ago in that Senate Inquiry submission about where I thought we would be now. (The one fairly weak caveat is that if there had been no financial crisis, and oil demand had remained strong, then we may be seeing decline now from a slightly higher level in between).

I think there are two main reasons why production capacity now can still be holding above its previous peaks:

1 – The high oil price environment up to 2008 spurred a frantic response from oil companies to develop previously marginal economic fields, with those decisions now bringing a delayed last gasp production increase.

2 – Actual decline rates for fields in production are at the lower end of expectations.

Likely it is a combination of both, but moderate decline rates must play a large part. If the worst case assumptions about decline rates from 2006 were correct, it would not have been possible to have production at this level in 2011, given the volume of new projects delivered since then.

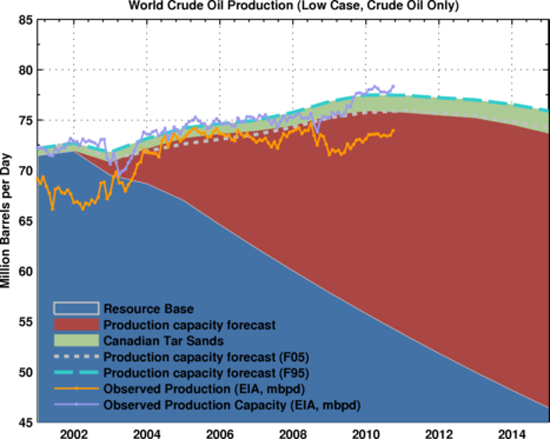

In an impressive piece of recent analysis here, Sam Foucher & J. Michael Bodell have made their own comprehensive estimate of decline rates in 'Crude Oil and Liquids Capacity Additions: 2011-2015':

In matching our production capacity forecast with available production capacity history for conventional oil, the implied world decline rate for the resource base is between 3.4 and 3.6 percent. This decline range is at the low end of values used in the literature but it is consistent with the short-term decline rate used by the IEA (World Energy Outlook, 2010).

In many ways, that is good news, as although decline rates are likely to increase (slowly), they may be more moderate than most expected, which increases the chances that we can adapt on the way down.

Future Supply

Remarkably, we are now in a situation where some of the most thorough peak oil forecasts are closer to the IEA forecasts than to more pessimistic peak oil views. The 2008 Outlook from Kjell Aleklett’s group at Uppsala University in Sweden looks positively optimistic, although there are many caveats:

Sam and Michael's comprehensive post above also portrays a pretty moderate situation, even in their low case (shown) over the next five years. Their high case has production capacity still increasing a little to 2015.

Meanwhile, the IEA has effectively called the top on crude oil production, making them look almost pessimistic by comparison. How things have changed!

IEA World Energy Outlook 2010

Global oil production reaches 96 mb/d in the New Policies Scenario, the balance of 3 mb/d coming from processing gains. Crude oil output reaches a plateau of around 68-69 mb/d by 2020 — marginally below the all-time peak of about 70 mb/d reached in 2006, while production of natural gas liquids and unconventional oil grows strongly.

The IEA has wiped more than 20 million barrels per day off their 2030 forecast over the last five years, while some of the more comprehensive peak oil forecasts now see a plateau or no more than moderate declines for some time yet, bringing the two views closer together than seemed possible five years ago.

Rather more questionably the IEA do still see total liquids growing, albeit slightly, all the way to 2030. Equally, there are many here who would see the Uppsala Group and Sam's forecast as optimistic, but we should look carefully at what has happened over the last five years and understand how that has been possible before being too confident in such a view.

My view now is that resources in the ground may be sufficient to allow for global capacity to continue on this ‘undulating plateau’ a little longer, or for decline rates to at least be moderate in the short-term. But the geopolitics of the major oil producers, and Iraq in particular, could mean that actual production capacity falls (just a little) short of what resources in the ground might otherwise sustain. But it is only a hypothetical world where resource limits do not interact with geopolitics and such above-ground factors only become a concern when you're near the below-the-ground limits.

Who Gets the Oil?

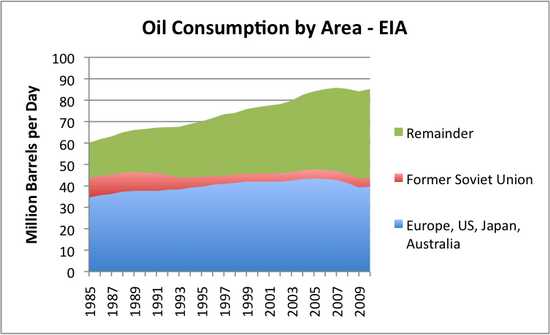

It would be wrong to take much comfort from these forecasts though. Even by the IEA’s own analysis, the growth in demand from developing countries leaves OECD countries with declining oil consumption from this point forward (see 'IEA Calls Peak on OECD Demand'). That message has barely been heard, let alone accepted and acted upon by any OECD Government, despite the evidence already showing that trend in play for many OECD countries (as in this chart also from Gail):

In "Oil Supply Constraints on US Recovery", Stuart also explored this theme. The following chart of his extrapolates trends in oil consumption assuming that total global oil supply remains flat to 2015. The growth in demand from developing Asian countries and the oil exporting countries leaves the OECD facing pretty stark declines, even before global peak oil.

So the first phase of the financial crisis has already delivered a transfer of 3-4 million barrels per day of consumption from developed to developing countries. OECD countries are not likely to ever see that production back again and it's hard to see how imminent further OECD declines can be avoided. That realisation, which is yet to come, will be a shock on its own.

Future Demand?

In many ways, the supply side of the equation looks clearer now than it did five years ago. The demand side, on the other hand, is decidedly uncertain.

If the global economy, or China and some of its developing nation colleagues should find a way to steam ahead momentarily despite the extraordinary debt deleveraging that is underway globally, then resource limits will quickly put a cap on such growth. The timing is impossible to predict, but a continuing volatile cycle of firm demand and high prices followed by periods of demand destruction and collapsing oil prices seems all but inevitable now.

Oil Prices and Market Uncertainty

Oil prices will be unpredictable, and at times could be surprisingly low. Oil companies are their are own worst enemies and will keep producing flat-out until prices fall below the marginal cost of production for any given field. It's the future investment decisions which take the biggest hit and that impact on supply is not felt for years. The short-term market can easily be flooded by even a small drop in demand.

Such volatile oil prices seriously handicap commercial incentives to respond to peak oil. Without certainty on the minimum oil price, investors can get burned if the result of their extended product development arrives on the market at the wrong time, even though the long-term average price may be high. The extension of this argument is that we need the equivalent of an electricity feed-in-tariff for oil prices - government's need to set an oil price floor which gives investors some certainty. Government's can take the gap between their floor and the market price as a tax, which could be used to ameliorate the higher price spikes. I'm not naive about the chances of such a policy being implemented though.

Summary

Predicting the future has not gotten any easier. Here at The Oil Drum, we picked up early on one of the great themes of the 21st century. Others denied the evidence until well after it was staring them in the face. But it is much harder to see where things go from here.

The second half of the 20th century was defined by remarkable growth in oil consumption, population, credit and debt, and all manner of other things. Neo-liberal economists have become accustomed to getting out their rulers to make predictions of the future and holding all spell-bound with their macro-economic prescriptions. I think those days of extrapolating the past as a useful guide to the future are over, and the sooner we develop a new economic paradigm the better. The future is likely to be one of discontinuities and sharp transitions and our rudimentary models and bureaucratic systems will not be up to the job.

If deleveraging of the record amounts of debt in every corner of the global economy is not already enough to start a downward spiral (still unexpected by the mainstream), then a ceiling on oil supply and the inevitable price response to force declines primarily in OECD countries will trip us up anyway. That forced transition to declining consumption for OECD countries could feel pretty painful rather soon, even before global oil supply decline sets in.

The good news is that resource decline rates look lower than feared a few years ago, and the plateau may continue (certainly not to 2030 though!). In an engineering sense, we may be able to adapt at the pace required, but whether we can adapt our economies and credit money system in particular is a different question.

Looking ahead, the only thing I can say with any confidence is that the years and even decades to come are likely to be characterised by much greater volatility than we are accustomed to. It could be a very bumpy ride.

Thanks a lot for this update. I have some questions.

First, it seems that there is a difference between peak conventional oil

and peak all liquids. The former seems to have happened around 2006 the

latter is still in question. At least this is what I was able to read off

the data. Second, even if oil production stays level in terms of barrels

there is the question of how much net energy that means. If unconventional

oil is on the rise it may be an indicator of peak net-energy from oil

at 2006 (I vaguely remember a post by Ugo Bardi on this difference).

Recall the study by Patzeck and Croft about peak coal. They say that 2011

is the year of peak energy-from-coal (not to mention peak net-energy-from-

coal). While tonnage may rise quality goes down to the extent that energy

goes down as well.

It would be profitable to highlight the net-energy questions as it is the

only number that really counts for us (as users).

-- Marcus

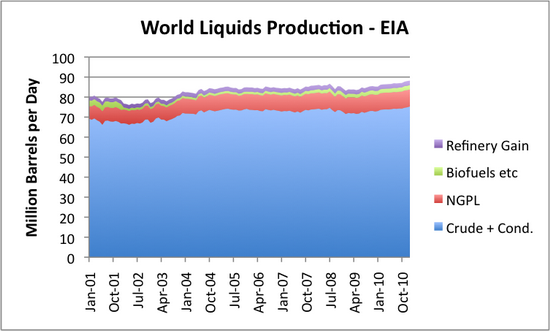

I think this chart gives a good picture of the changing composition of total oil production:

Most sources now show even crude oil at or just slightly above the level of 2006, although this does include tar sands which was not necessarily included in some of the 'conventional oil' models from earlier years. So it's not just alternative liquids that have held up the curve.

As regards net energy, I agree this is an important topic, but I think the composition of global oil production is only changing slowly (see the chart above) and so the net energy equation has also not changed dramatically over the last five years. Sure it will be getting very slightly worse each year, but it will be a slow squeeze too.

Net exports on the other hand, ie crude oil available to OECD countries, is already getting seriously squashed. It looks like it is going to bite hard relatively soon (a small number of years at most) and that could be the trigger for the next downward phase of the debt crisis.

Onshore conventional have been basically flat for around 35 years. The peak for onshore conventional actually happened 1979 unless something start to change.

I totally agree with your idea about net exports-

What is critical is the amount of fuel available for purchase on the world market, not the amount of global production.

Has peak net export happened yet?

It would be very interesting to see a chart of total monetary value expended for oil vs time (for USA at least).

This would reflect things like the amount of fuel available for purchase, the strength of the US dollar (or weakness), and the elasticity of the market.

Probably over time it will turn out that the onshore unconventional should be the "top" line, as is is the part that has growth potential still. Overall growth past 1975 or so has been a function of new sources of oil. How far will tar sands take us? Oil shales?

I'm not sure it matters, as with each new source there are new costs, and the price is related to the marginal cost of the last, most expensive barrel. I personally won't be surprised if there will still be a graph like that above in another 30 years, with another bar or two added, still percolating along at 40 or 60 or 80 mbpd, but with oil at $250 today-dollars per barrel. And, eveb that means significant changes. Most likely to the American way of life.

It may also be added that offshore conventional depends on very expensive production rigs, wich in turn depends on a high flow. Wich means they go out of production sooner than the rest. There will probably still be some nicking donkeys back over at Kern or any other real old super giant field when most of all offshore wells are plugged.

Great graph Phil! It tells a quick visual quantitative and historical story of how things are evolving in the direction of deep offshore and unconventional, we all knew was going on, but (I for one) had not seen before.

2005 was clearly an inflection point, since global crude oil (C+C) production effectively stopped increasing. Based on the HL models, global conventional crude oil production in 2005 was at about the same stage of depletion at which the US Lower 48 peaked in 1970 and at which the North Sea peaked in 1999.

I suspect that the primary reason for a global plateau, instead of the initial slow decline that we saw in the Lower 48 and North Sea, is a slowly increasing contribution from unconventional production globally, which was not a material factor in the Lower 48 and North Sea peaks. An additional factor may be increased depletion rates globally, because of increased use of techniques like horizontal drilling (which would boost short term production, but perhaps not materially increase recovery factors*).

EIA crude + condensate, rounded off to nearest one mbpd & Annual US spot crude oil prices:

2002: 67 mbpd & $26

2003: 69 mbpd & $31

2004: 72 mbpd & $42

2005: 74 mbpd & $57

2006: 73 mbpd & $66

2007: 73 mbpd & $72

2008: 74 mbpd & $100

2009: 72 mbpd & $62

2010: 74 mbpd & $79

There was a clear price signal from 2002 to 2005, as oil prices rose from $26 to $57. In response, global crude oil production increased by about 7 mbpd, a 3%/year rate of increase. If global C+C (crude + condensate) production had continued increasing at this rate, global production in 2010 would have averaged 86 mbpd, but lets look at what actually happened.

Annual oil prices from 2006 to 2010 inclusive have all exceeded the $57 level, and four of the five years have shown year over year increases in annual oil prices. In response, global annual crude oil production has so far not materially exceeded the 2005 level, and in fact we have seen a large cumulative shortfall between what we would have produced at the 2005 rate and what was actually produced.

But net oil exports are far more important to the oil importing countries, and we have seen a measurable decline in both Global Net Exports (GNE) and Available Net Exports (ANE). I define ANE as GNE less Chindia's combined net oil imports. ANE fell from about 41 mbpd in 2005 to 38 mbpd in 2008 and then down to 36 mbpd in 2009 (total petroleum liquids).

We don't have the 2010 data yet, but a plausible estimate is that ANE will be down to 27 to 30 mbpd by 2015. Given the above numbers, what is truly bizarre is the widespread conventional wisdom belief that generally rising oil prices are not related in any way to supply issues.

For more info, do a Google Search for: Peak Oil Versus Peak Exports.

*2004 article on this topic:

http://www.nytimes.com/2004/04/08/business/oman-s-oil-yield-long-in-decl...

(2005) Top Five Net Exports Update

I took the EIA data for total petroleum liquids for 2010 and then extrapolated the 2005 to 2009 rate of increase in consumption for Saudi Arabia, Russia, Norway, Iran and the UAE to come up with estimated (2005) top five production of 29.8 mbpd and consumption of about 8.0 mbpd, resulting in estimated 2010 net exports of 21.8 mbpd.

Here are the BP (2005) top five net exports data for 2005 to 2009, and the 2010 estimate:

2005: 23.8 mbpd

2006: 23.6

2007: 22.9

2008: 22.8

2009: 19.3

2010: 21.8*

*Estimated

Note that at the 2002 to 2005 rate of increase in net exports for the top five (6.3%/year), they would have been (net) exporting 32.6 mbpd in 2010, versus the estimated net export rate of 21.8 mbpd. The top five data continue to fall between Sam Foucher's middle case and high case. The wild card continues to be Russia, the only country where the production data are currently falling at the upper limit of Sam's projections.

Sam's most optimistic projection is that by the end of 2014, the (2005) top five will have (net) exported about half of their post-2005 CNE (Cumulative Net Exports).

Here are the detailed data for Global Net Exports (GNE) and Chindia's net imports for 2005 to 2009:

http://i1095.photobucket.com/albums/i475/westexas/Slide3-1.jpg

I estimate that 2010 GNE were around 44 mbpd and that Chindia's combined 2010 net oil imports were about 8 mbpd, which is probably a conservative estimate. In any case, a rough estimate would be that 2010 ANE (Available Net Exports), which I define as GNE less Chindia's net imports, were around 36 mbpd, versus 41 mbpd in 2005.

Here's a remark I made on those EIA crude numbers in April. See

http://www.theoildrum.com/node/7817/794815

Phil,

Thanks for the insightful update. If I understand your numbers you are looking at total liquids, regardless of source type. If correct in that assumption, I would like to ask people to think about this from a slightly different perspective. What is the amount of exergy in an average barrel of oil (taking into account the different finished products and their delivery to points of use)? What does not seem to be factored into this analysis is the effect of declining EROI as more non-conventional sources are exploited. The delivered exergy is becoming more costly due to declining EROI.

I submit that the potential impacts of a failing financial system (monetary and debt) that threaten production rates are actually a result of that declining EROI. The system is effectively moribund as the reliance on more unconventional liquids grows while the energetic cost of extraction and conversion of those liquids also grows. The floor to the price of oil must, in the end, reflect the total costs of extraction. The costs of finished products must reflect the cost involved in conversion (refining). These can never go down, except perhaps temporarily if a new technology is introduced - but that possibility has its limits too. Among those costs are the capital costs (monetary) of increasing production. Somewhere along this trajectory, the marginal costs of producing the next unit of raw liquid is simply too high to deem it a worthy investment to drill more. Then we could easily see a drastic decline rate in raw liquid production.

Unfortunately we do not have good data on net energy flows. Our only way to get at the metrics is by factoring gross by EROI ratios. And, more unfortunately, we have very little data on the latter. I think a number of researchers like Charlie Hall, Cutler Cleveland, et al have done a tremendous job getting some initial estimates, with continued refinements here and there. But we need what amounts to a cost accounting system measuring input joules at each stage in the supply chain to finally get some truer sense of just what the cost of exergy is. As I said above, my fear is it is already too late and the patient is moribund.

George

Question Everything

You've popped down the wrong tunnel. Go back to the sign reading "Conversion (refining)" and then squedaddle between the carrots and lettuce until you see the sign reading "Conversion (all)". This route deals with all the conversion issues, including such things as the amount of oil product needed to optimize the functioning of any given economic activity.

One of the more interesting stops along the way provides a picture of the benefit of scarce oil in terms of the reduction of congestion costs in those places where most people live and work. Rising fuel prices leads drivers, at the margins, to seek alternatives.

Consider the benefits accruing from those motivated by price to seek an alternative to driving. Some choose public transport, others walking or cycling, and many to move from behind the steering wheel to the passenger seat, a move made easier by the greatly reduced cost of communications characteristic of our times.

In the North American context, and elsewhere as well, the flow of goods and services is enhanced by the presence of fewer vehicles on the roads and from this increased productivity, the higher cost of fuel, of which less is required, is paid.

It is perfectly conceivable in this example that the higher refining costs of lower quality oil (i.e. lower eroi) is overcome by the benefit of a changed consumption pattern caused by higher retail pricing.

Bugs,

You are right to look at things from a whole systems perspective. But don't be too sure you know which tunnel I'm headed down from one abbreviated posting. I provided the link to QE so that those who haven't read much of my work could, if they so chose.

What I learned from Elmer Fudd:

1. Outcomes depend on more than physical inputs.

2. Outcomes may be enhanced by reducing physical inputs.

Bugs, you're a little ahead of yourself.

Your points have their place, but don't really address what George is getting at. He's in the very particular area of evaluating the supply, while this does not in any way show that he's blind to the issues you are interested in talking about.. but here today, this topic is looking at Oil Supply in particular.

I am also interested in seeing how EROIE and Oil Quality would affect the charts above.. and also would suggest that for completenes, this charting should also have a line that gives the deviation of oil production against population growth.

Admittedly, it's all somewhat academic. But that's not consequently a bad or unnecessary thing, is it? We're trying to find good, well reasoned information here.

Sincerely,

WWI Ace Snoopy.. (aka Joe Cool, or Jokuhl.. my old FlightSim Pilots Name)

i don't think I'm getting ahead of myself.

Consider these words:

The price the consumer is willing and able to pay will determine the worthiness of the investment, not the production costs. The capacity of the consumer to pay will depend on the productivity of the economy. Economic productivity depends among other things on efficient transportation of goods and workers. A higher oil price supports efficient transportation and thus bodes well for the economy.

Supply only takes on economic meaning in the presence of demand.

I don't see how anyone can speculate on the economic implications of the declining quality and quantity of oil on the basis of an idea, supply, that is meaningless in itself.

"A higher oil price supports efficient transportation and thus bodes well for the economy."

I think that statement carries some very rosy assumptions, and some stretched logic. It's built on some big IFs.

Beyond that, as George speaks about the selling price justifying the lifting costs, I think it's clear that he knows this doesn't happen in a vacuum. Efficiencies or no, there will be some harsh repercussions on the refineries, shipping co's and wells if there is a domino of crashing demand. I'm very pro Mass Transit and all the efficiencies we can muster, but that's no guarantee that the transition to these things might be trying to happen 15 feet out past the cliff edge.

Let's hope the great Animator is in a kindly and magical mood that day.

It would be nice if it worked that way, but it doesn't. Instead, those in the margins are pushed from the job market. No car = No Job. That's how it's been in just about every job interview I've ever been in. They don't want you to call in because you can't get a ride, and they want you available to come in if some one else calls in.

It doesn't make sense to own a car if you can't afford fuel cost. You would have to pay insurance and licencing for nothing. It's not impossible to get rides from people, but there is no stability. You can't count on some one else to get you to work every day.

In the city you can get away with using public transportation. In the rest of the country [USA] public transport is either non-existent or only operates a limited scheduled. I ride the bus as much as possible, but I still have to drive to the bus stop most days. It's a little too far to walk, and I refuse to ride my bike around traffic. [learned that one the hard way]

There is a bus stop right across the street from my apartment, but the bus only stops there a couple times a day and there are no stops after 6:00. My last class gets over at 7:30, so I ride the bus to a different stop and drive home. If I weren't able to afford a car, I wouldn't be able to take the class [calculus]. It's only offered at that time slot.

Just be careful not to confuse what is conceivable and what is actual, or even probable.

Some laws are immutable, such as the one which states that price changes lead to behavior changes. From the New York Times today:

http://www.nytimes.com/2011/05/18/business/18gasoline.html

I think it ironic that market rules are in effect imposing a depletion protocol on the major importing nations. Those that thought oil depletion required some sort of centrally planned response now find themselves in a world where the market may be producing something close in effect to the ASPO depletion protocol!

OTOH its somewhat strange for market advocates to find themselves in a world where their world view is producing a form of rationing as opposed to creating some new paradigm where market forces unleash human ingenuity and nuclear fusion for the masses

a form of rationing as opposed to creating some new paradigm where market forces unleash human ingenuity

Short term, vs long term...

there is a famine so food prices go up.

is that a solution? yes if you accept we live in a world where avoidance is impossible..... here is the interesting thing Long term means sustainable management of resources no matter what ideology is used to achieve it?

thats the thing so often these discussions get bogged down by some sort of ingrained ideology... sometimes subtilely.

I got seriously interested 2005/2006.

Thanks very much for this timely review - a bookmark for me.

Sophisticated financial instruments anybody? 'Tried and trusted methods'? hmmn ...

In the old days when British agriculture was crucial to national security and we had only just emerged from 'austerity Britain', we used to have 'Marketing Boards' to iron out the rapid boom and bust cycles for potatoes, milk and eggs. They worked, roughly. Somebody must have done the economics for them. Your suggestion might not be beyond the wit of international OECD bodies?

phil - "...government's need to set an oil price floor...". And we'll this recommendation will be coming out of Congress at the same time they're grilling the industry over price gouging? LOL. I've said it before and I still think many don't believe me but if 30 to 40 years ago the govt offered the industry a fixed price for oil, even if it were significantly below current prices, it would have jumped at the deal. There's already enough geological/engineering uncertainly in the process. Add the need to calculate the return on a $billion investment by projecting the price of oil accurately for the first 10 years of that project can almost seems delusionary. The big flush of cash during the price peaks doesn't come close to making up for the pain of the price valleys. Can anyone imagine the govt requiring consumers to pay an extra $10/bbl in 1986 when oil fell to less than $10/bbl? The world was trying to recover from a deep recession resulting from the oil price spike of the late 70's and desperately needed those low prices. But the low prices also led to less drilling which led to less supply and higher prices down the road. This cycle has always existed in the oil patch. But instead of cycling every 15 years or so now it seems to flip in a 5 year span or so. The recent boom/bust of the SG plays and NG prices is a great example. In the spring of '08 NG gets close to $13/mcf and then during the following winter it drops well below $5/mcf and broke the financial backs of many companies heavily invested in the fractured shale reservoirs. And now some folks expect the oil patch will rush back into the SG plays with checkbook in hand once prices start moving north again? It's very easy to remember past events when they're only a few years old. The oil patch readily remembers the slaughter at Chesapeake, Devon and et al. More importantly so do the capex sources.

If the U.S. government agreed to buy all the oil on the market at 150 dollars per barrel, we would be awash with oil. There is nothing quite like a government subsidy to create surpluses.

The oil industry would love this deal. Consumers could live with it, albeit with no economic growth.

Don - I'll counter your proposal on behalf of the oil patch: fix the price of oil at $75/bbl for the next 30 years. This would be a huge benefit for us in calculating our economic models for drilling investments. BTW: that's the price I use today doing my forecasts. I don't know of any company using prices anywhere close to current levels in their analysis. We've all be burned too many times by using the high end.

And, IMHO, $150/bbl might not lead us to being awash in oil. At least not conventional oil. When oil prices jumped in the late 70's it led to billions of $'s being wasted on prospects that had little chance of success but looked great when $35/bbl was run in the economics. I know it sounds simplistically stupid but it's still true: can't make a profit on a dry hole regardless of high the price of a bbl may be. As I mentioned in another post if the govt' wants to do something for the oil patch and the consumers they can put a floor on NG prices. Say $8/mcf for the next 10 years. Of course that would almost double the current price. But down the road when prices go above $8/mcf the govt could tax that at 100%. Trust me: the industry would be more than glad to trade that higher income for the minimum expectations. For one thing the SG players would go back into a drilling frenzy IMHO.

I agree Rockman.. oil companies are using a price way lower than current market price as their screening value for new projects, and it took them a long time into the last upward cycle to increase their old screening values from the old $15-20/barrel. For projects with a quick return, they do occasionally use much higher values (maybe even as high as $70-80 during the middle of the boom in some cases but only where return was fast). But now everybody can see risk again, and we've just proven how quickly prices can drop to $40 or less, so screening values are pretty low again and not likely to shift easily.

The question is, how much more oil could be produced if they had a guaranteed price of $75/barrel?

geology rules

+ entropy

minnie - If I get your drift: how much more oil would the oil patch produce if we up our price expectation to, let's say $90/bbl? IMHO not as much as many folks would think. It would allow us to drill for smaller and riskier propects. But folks need to remember: they are smaller and riskier which means we won't find as many (the riskier part) and there will be less oil discovered/$ spent (the smaller part). I use to have an old report that's long lost now. But it clearly showed much higher profits are generated from drilling efforts during low price times than high price times. The high prices for oil in the late 70's led to a boom in drilling that found relatvely little oil and eventually put hndreds of companies out of business. I've mentioned it before: we had 4,600+ drilling rigs running at the time and half those wells had little chance of commercial chance. Greed easily overwhelemd common sense back then. I know it sounds contradictory but the best rate of return I ever generated for a client was in the bust of the mid 80's when I as selling NG for 25% of the low price it's selling for today. NG prices were lower but drilling costs were even much lower. A well I ould drill and complete for $40,000 in 1986 could cost $600,000 today.

Rockman,

It is great that you are sort of opening up about the oil business and relaying oil business truths and telling good stories.

"fix the price of oil at $75/bbl for the next 30 years"

I've got a brother still in the oil patch (Schlumberger 30+ years now ThruBit) and he has been saying the same thing for decades. The dollar figure varies, but it is a common expression in the patch that a stable price is a good price.

"And, IMHO, $150/bbl might not lead us to being awash in oil. At least not conventional oil."

I agree. Raising the price has increased the rate of exploration in the past, but I think it's been a fractional exponent relationship for decades. Its been shown on this blog numerous times that rate of discovery has not matched increasing rates of exploration, going back to the sixties. Maybe WHT has a graph handy to show this.

Having formerly worked for Halliburton logging wells across the western U.S., I still talk to a few folks out there as well as interested folks in this part of the world. I'm constantly surprised (well, not so much anymore) by the lack of understanding of the scale, of the volumes we're dealing with, by almost everyone. I have had to explain to numerous people over the last year or two, that yes while the Bakken and associated Williston Basin discoveries are fabulous and have allowed ND to brag that it is the only state in the Union with a solid governmental budget, it just really doesn't do much to satisfy the demand of the U.S. as a whole. Sometimes I then get a response that oil shales are out there just waiting to be produced if only the government would allow it. Or the environmentalists. So then I usually just describe evidence that "the end of cheap oil is here." And ELM is great - most people get that concept quickly.

And yeah, geology does rule. I trust that no giant basin or field is able to hide from modern technology (WHT will also back that one), thus what we have already found is close to what we will get. Cornucopians abound but reality bites. It is blindingly apparent to you and me and many on this blog that what we used to called conventional crude production has peaked and that the demand difference is being made up using the uglier and more expensive petroleum hydrocarbons. But obviously not to all and that's why I think it is important to identify the portion of C+C that is the second C.

BTW, in the for what it's worth department, I've seen a couple of media mentions recently that have pegged the value of ethanol to the price of gasoline at over a dollar a gallon. It has been stated by one of our Minnesota U.S. Senators that if ethanol production was halted, the price of gasoline would rise by $1.50.

Basin discoveries are fabulous and have allowed ND to brag that it is the only state in the Union with a solid governmental budget,

AK's budget is still running in the black but our oil output is in decline so projections don't look near as rosy for us as they do for ND. We still are shipping quite a bit more crude than ND, but I think that is supposed to change pretty soon--less than a doubling of ND production knocks us one more spot down the list of top oil producing states.

But then from another perspective ND production has to increase six fold to match what we were shipping out of Alaska a couple decades ago or so--I never get replies from people proclaiming ND oil will save the day when I mention that last point.

I'm not sure I would say that ND will save the day, but I've seen projections of 2M bpd! I have no idea if that's possible, but I've seen projections of 1M bpd from mainstream folks.

And of course, there are 4-5 other areas like Williston/Bakken in the US...

The steep decline seen on the top portion of this chart shows the scary thing about the oil shale play--the color bands for individual wells can hold near the same width for a while at the top, indicating the best wells aren't falling off that fast but when all the declines are stacked one atop the other you get the precipitous fall. Three years of Brigham's prodution, they must be putting one heck of a lot of steel in the ground.

a bit over one million barrel a day look to be the shipping plans

The thing is, even if "consumers" could live with it, they would never tolerate it. At times of flush supply it would look like (and function as) subsidies to the rich. And we can't have that, except of course when we can.

It wouldn't be like, say, subsidizing agriculture to the hilt: unlike oil, agriculture is highly romanticized by a large cohort of fools who affect to aspire to the horse-and-buggy days. Big ag manages quite nicely to tuck itself under that halo. (And not just here, Europe is worse, most of all England with its mindless sentimentalism for a countryside that by law must forever remain embalmed as a dessicated corpse, not one iota of change permitted. Hence a lovely, classic old house I have in mind, having a small but ugly 1950s-era addition which the owners cannot remove because doing so would constitute change, requiring, these days, a level of planning permission and endless form-filling that an ordinary mortal can no longer hope to find the time or money to cope with.)

Nor would it be like subsidizing ballplayers and their owners with great gouts of public money, which also seems perfectly OK. Maybe this one is seen as working towards the spirit of the ADA, a sop to those too stupid to find anything to do with a spare Monday evening but drool over images of steroidally bloated and remanufactured beast-men cavorting about on a plastic rug. Be that is it may, it's certainly in the spirit of our contemplation of the tolerances and intolerances of "consumers" - namely morons with no conceivable duties or responsibilities.

It's all arbitrarily selective, and the sillier the social case might be for subsidizing a particular subset of rich folks, the easier it seems to be actually to do so. It just seems utterly futile to tilt at it.

paul - All true but if we didn't have futility to snuggle with how would we stay warm and protected from the boggeyman under the bed.

OK, its not a total price floor, but it's the thin end of the wedge on the way there. Does the US even index link its fuel tax?

http://www.thisismoney.co.uk/bargains-and-rip-offs/motoring/article.html...

I Think a price floor could work very well, the government would start to buy if oil fell below a given price, say $80. They could start to sell at say $110, they have massive stocks and could use this as a price stabilizer. May even pay off some of the national debt. They could sell to any country which cannot afford to have a stockpile.

ROFLMAO. They'd find a way to buy high and sell low. Guaranteed.

Agreed. Will they have a surplus, they will never use it to pay of debt. They will spend it. To the last dime. We have that situation in Sweden now.

Paul - Interesting. So I take it you've worked with govt contracts before? LOL. I know it's unfair and a cheap shot but in the oil patch one of the scariest phrases is still: "We're from the govt and we're here to help you".

Not just in the oil patch. I've heard that one from farmers too. It is a cheap shot in a way, but we've got so many arbitrary rules now that we've made our very own American 'Licence Raj'. It's a wonder anything gets made or sold any more... oh wait a minute, it doesn't any more, it almost all gets made overseas...

Rockman - I've said it before and I still think many don't believe me but if 30 to 40 years ago the govt offered the industry a fixed price for oil, even if it were significantly below current prices, it would have jumped at the deal.

If this is the case then is that not what the futures market was originally designed for, i.e. for producers to lock in a future sale price that at least ensures they can sell for a profit? With futures above $100 it should be possible for pretty much all producers to secure profitability down the line. Or am I missing something?

TW

watcher - A producer buying a futures contract doesn't guarentee a profit. It minimizes his potential loses. If I buy a futures contract for $100/bb and oil is selling for $90 at that time then I make $10/bbl on the futures but lose $10/bbl from what I had expected to sell my oil ($100/bbl). If oil is selling for $110/bbl then I lose $10/bbl on my futures contract but make an extra $10/bbl on my actual oil sales. But futuers contracts aren't free...you pay a commision. But there are more complicated hedges most oil/NG sellers actually use. The best way to think of it is as insurance: you don't make money if you house burns down but you don't lose that much either...if you're insured.

Bottom line: when oil/NG prices collapse companies lose cash flow and stop investing because they don't have the income to re-invest. A good example is Chesapeake: when NG prices collapsed. They were able to hang on better because they sold a large volume of NG in future contract sales. But they weren't futures...just contracted sales. So when Devon was selling their NG for $4/mcf CHK was selling much of theirs for $10/mcf. The folks who were buying the CHK hopefully had NG futures backing up their purchases. If they didn't then they got skinned alive.

Rockman - as a producer you wouldn't buy futures contracts but sell them. This way you would be able to lock in a certain price for future delivery of your oil. E.g. if the Dec 2011 contract is selling for $100 then by selling this you gaurentee $100 for your oil delivered in that month. Unlike producers, speculators are gambling because by and large they have no oil for delivery. But as long as you are producing at below $100 then you must profit from the trade. You could in theory sell as many contracts out along the futures curve as you deemed prudent to maintain profitability (as long as you can accurately forecast your production costs in the future). Yes there is a commission for this but worth paying when it's your business at stake if the spot price collapses and you have no hedge in place?

I guess in practice there might be a problem for the bigger players trying to lock in a price for all their future deliveries simply because of their size and therefore ability to find reliable counter-parties and not influence the price unduly. But in principle with a market as big as the oil one it shouldn't be a problem for most producers.

TW

watcher - I don't follow you. You can't sell a futures contract unless you have one that you bought. Maybe we're mixing apples and lemons. I can contract to sell my oil for the next 12 months at a certain price. That isn't a futures contract. It's a contract to sell my oil in the future. Let's say I'm selling 100,000 bbls of oil per month at some contracted price. ..say $90/bbl. So I buy a 100,000 bbls of oil futures at $90/bbl. So when my contract matures and oil is selling for $100/bbl I lose $1 million ($10 X 100,000 bbls). My futures contract is to deliver 100,000 bbls of at a price of $90/bbl. That's what a futures contract is: an obligation to deliver that volume of oil at that particular price. So I have to sell someone 100,000 bbls of oil for $90/bbl. That means I have to pay someone else $100/bbl for that oil. In reality the futures traders just pay a cash settlement: I write a check for $1 million. Now if 'm a producer I can sell my 100,000 bbls of oil for at $100/bbl and make that $10/bbl extra above the $90/bbl futures contract. So it's a break even less the commission.

Now go the other way. Oil is selling for $80/bbl. So now I buy 100,000 bbls of oil for $80/bbl and settle my futures contract for $90/bbl so I make $1 million. But the oil I do sell at $80/bbl generates $1 million less income than I would have gotten from selling my physical oil if oil for $90/bbl. I realities oil producers use a different system. I'll cut a deal with an oil buyer to sell my oil for $80/bbl for the next 12 months. But if oil goes above $80/bbl I get 20% of the difference. So the buyer gets 80% of the gain. But if it ends up selling for $70/bbl I still get my $80/bbl. This is commonly called a "floor trade". It sets the minimum price (the "floor") I'll get for my oil. And what usually happens is that my oil buyer will buy matching futures contracts to minimize his risk. And what I just described is a relatively simple deal compared to how many are structured.

You need to remember what a futures contract basically is: it's a bet on the future price of oil. Something like 99%+ of all the oil future volumes do not consist of physical oil...it's all "paper bbls" that don't exist in the real world. The analogy would be a football game: there is only one real game but you might have 1 million folks make a bet on that game. Thus you've generated a million "paper games". Only one game will be played but for the betters it's the same as a million games being played. There are literally billions of bbls/day traded in the futures market when there's actually less than 90 million bbl/day of oil sold. Buying a futures contract, whether you an actual oil seller or not, is a gamble. For every one making a $1 on a contract someone losses a $1. There is no such thing as a guaranteed profit on a futures contract. And it isn't a zero sum game because even if you win you still pay a commission. There's always a little more money lost then won because of the commissions. Actual oil sellers use the futures market to limit their down side but do it at the cost of not making as much on the upside.

I'm not really the best person to explain future trades. I know enough just to be dangerous. But we do have a few former traders floating around TOD so hopefully one might shed more light on the subject for you.

I can contract to sell my oil for the next 12 months at a certain price. That isn't a futures contract.

Yes, it is. That's exactly what it is. That was the original purpose of a "futures contract", not gambling.

"thewatcher" is talking about what Chesapeake did: locked in their pricing with futures contracts.

So, why don't more producers do that? They could go out 7 years - that's pretty good security.

Nick - CHK didn't lock in prices with future contracts. They sold their future production on a contract fixed price. I know that sounds like double speak. CHK agreed to sella volume of physical NG to a buyer for $X/mcf for a period of time. It was paper NG...it was the real thing. That's not a futures contract. Essentially they pre-sold much of the production at $10/mcf. Now the buyer who agreed to pay CHK that money might have bought NG future contracts to protect their position. That's a whole different game then CHK selling their NG under specific contract terms. CHK may have also bought NG future contracts. They might have made or lost money on that gamble...I don't know.

Rockman,

The original purpose of a "future contract" was exactly that: to have "sold their future production on a contract fixed price.". It still can be done, and many, many producers do just that.

Really, it's true. Hedging and speculating are byproducts.

Now, it's possible that CHK bypassed the commodities trading markets and wrote direct contracts, but they did the same thing.

Unlike an option, both parties of a futures contract must fulfill the contract on the delivery date. The seller delivers the underlying asset to the buyer, or, if it is a cash-settled futures contract, then cash is transferred from the futures trader who sustained a loss to the one who made a profit.

http://en.wikipedia.org/wiki/Futures_contract

Nick - I think we're agreeing to a degree but are talking around each other. I've had a lot of NG sold into the future based on specific contract terms. That had nothing to do with the NG futures market. And I know dozens of folks who have traded tens of millions of $'s in NG futures and never sold a cubic foot of NG. These are two different universes.

What CHK did was exactly that: they presold their NG to a buyer for $10/mcf and that deal had nothing to do with the futures market. Those buyers may have bought future contracts and CHk may have bought some also. But what saved CHK's butt was finding someone foolish eonough to agree to pay twice as much for some of there NG as it would eventually be worth. The buyers lost their butts...plain and simple. They only question is whether they had NG future contracts in place to ease the pain some.

Rockman,

I'm still not sure what you mean. Do you agree that someone can sell NG into the future using the futures market?

This conversation is a fine example of why foriegn language speakers find English so hard to learn.

As you move from one area of discussion to another, be the subject business, medicine , art, or whatever, you find that words which mean one thing to the general public are often defined in far narrower and sometimes VERY DIFFERENT ways by people within an indudtry or profession.

Sometimes the members of a particular profession or group of allied professions manage to more or less hijack certain words and redefine them in a way suited to thier own needs, thereby gaining control of a controversy by controlling the terms of the debate.

In economics, inflation is such a word-it means something considerably different to the man on the street than it does to an economist.

Another such word is "instinctive";the social scientists have managed , for the most part, to maintain the fiction of the blank slate mind , at least among themselves, by defining the word so narrowly that they can claim, among themselves, and those willing to allow them to control the debate, that humans display no instinctive behaviors-a position that I personally consider utterly absurd, as to me "instinctive" as an adjective to behavior means partly or mostly influenced by genetics, which is a far broader and more comprehensive definition.

We will just have to wait for those who sit in positions of influence and believe that all human behavior is culturally determined to die before there can be any serious debate within the social sciences in respect to this matter.

But a lot of them, happily, are dead already-anyone who is truly interested in this matter should read EO Wilson and Stephen Pinker to start.

Wilson is at Harvard and Pinker is at MIT.

You are way out of date here Mac. Pinker has been at Harvard since 2003.

Steven Pinker

Ron P.

Hi Darwinian,

Better late than never, at least I am up to date within a decade or so in keeping up with my reading in this area-I went with what is on the book jackets of my personal copies of thier work.;-)

Shoulda checked, of course.

As someone who taught English as a second language to groups of students from varied professional backgrounds, back when I was a college student in Brazil, I got a good chuckle out of that! So true dat...

Imagine being tasked with finding a way to get a conversation going with non native speakers of English when the class is composed of lawyers, doctors, engineers of various backgrounds, scientists, sociologists, economists etc... I sure learned a lot about both the English language and people in general. Too bad I didn't know about peak oil back then, it would have been a great topic for conversation.

CHK uses swaps, puts and calls to hedge themselves. the swaps are likely at least in part over the counter, although it is possible to clear them on ICE in certain circumstances.

http://services.corporate-ir.net/SEC.Enhanced/SecCapsule.aspx?c=104617&f...

(click the "entire filing" link and then CTRL+F and search for hedge. I think the bulk of the actual hedging program in on page 8).

My guess is that the reason why they go OTC and use options is the very limited liquidity in forward contracts in the futures market. I am 99.99% sure that the swaps are done with 2 of the large NYC investment banking firms.

Rgds

WeekendPeak

edit:

if you want to see the entire hedging program go to page 59. It gives you quantity, price and year of the hedges. good stuff. It makes it pretty clear that if you want to bet on the price of NG increasing buying CHK may not be the best way to get exposure....

Nick - Virtually no oil/NG are sold or bought in the futures market. As been reported by others 99.7% of the oil volume traded in the futures market doesn't exist. They are paper bbls. I've not sure of the numbers for NG but I suspect they are comparable.

Folks: you keep mixing apples and lemons in this conversation. Selling future oil/NG production on a long term contract is not a futures contract. If I sign a contract to sell 100,000 bbls of my oil production for $100/bbl then I will receive $10 million in future income whether future oil prices are $120/bbl or $70/bbl. If I buy 100,000 bbls of oil future contracts at $100/bbl and oil is selling for $120/bbl at settlement time I make $20 million less commission. If oil is selling for $70/bbl I lose $30 million plus commission. That is trading in oil futures. It is not selling future oil production under a long term contract.

And guess what? I can do both transactions at the same time. So in the two scenarios above I either net $30 million (20 + 10) or lose $10 million (10 – 20). Now get imaginative. You agree to buy my 100,000 at $100/bbl. But if you’re planning to resell my oil you’ve exposed yourself to a big potential gain or loss depending on future oil prices. If you pay me $100/bbl and the actual market price at the time of transfer is $120/bbl you make a profit. If it’s less than $100/bbl you lose money. So how do you minimize that volatility? You buy 100,000 bbls of future contracts at $80/bbl. So if oil ends up selling for $120/bbl you make $20 million on my contracted oil but you lose $20 million on your future contracts. So you end up flush on the transactions. But if oil eventually sells for $80 /bbl you loss $20 million on my contracted oil but you can sell your future contracts to someone who has 100,000 bbls of future contracts at $100/bbl. So you make $20 million on that trade. And again, you break even (less commission, of course). Remember virtually no oil exchanges hands in oil future trades…folks are just trading the paper bbls represented by the futures contracts.

This sort of split transaction is what refiners often do. I’m not an oil trader so I can just offer a generalized view of the game. But in reality the trades are much more complicated then what I just described. There are floor and ceiling trades, trades index to WTI. There are trades indexed to the prime rate or Liborg. Trades indexed

to a companies stock price, etc ,etc, etc. And a lot of combination trades of various angles. And guess what: we'll never see any details offered by the folks trading with each other. These deal structures are kept very secret. Oil trading is extremely competitive.

Again, oil trading is far from my area of expertise so all I can do is make generalizations.

Rockman,

Again, let me ask:

1)do you agree that someone can sell NG into the future using the futures market?

And,

2) if they plan to sell on the spot market at the market price, but they sell a futures contract at the price they want, what's the difference? Either way, they're protected against fluctuations in the price. In effect, they've locked in their price. Right?

Yes you can, assuming you are a credible counterparty with the ability to receive and deliver NG as well as have the finacial capabilities to do so.

The size you can actually execute on in futures is going to be quite limited. The reason why there is a curve - either backwardation or contago - in futures is because of the cost of carry versus cost of finance. So whether you make or lose money in a trade like that depends on if you can correctly predict storage costs as well as interest rates.

Rgds

WeekendPeak

If I buy 100,000 bbls of oil future contracts at $100/bbl and oil is selling for $120/bbl at settlement time I make $20 million less commission.

minor math goof, assuming 18 million is minor. (or maybe your broker is involved in money laundering) But great explanation, as usual.

No, you are a little confused here. Hedging is selling your product at a future price. The speculator takes the opposite side of the hedge. If you sell your product in the future via the futures market then you are hedging!

Well this is true but not too clear. The seller or the buyer can, if he wishes, insist on a cash settlement! No one must deliver or take delivery of the physical product. But it really doesn't matter. The hedger who sells his oil, or whatever, via a futures contract, can simply take the cash, if he made money, and sell his product at a loss, but the cash from his futures contract will make up the difference. If he lost money on his futures contract because the price of the physical went up, then he can take his profit from the physical and pay his debt on the futures contract. That is called hedging.

Ron P.

A minor (at least from a practical point of view) refinement:

Basic settlement of NG futures is physical.

http://www.cmegroup.com/trading/energy/files/EN-197.1_DeliveredNatGas_FC...

That is, if you have the right account for that. Most futures brokers who cater to retail will not give you the option to settle physically but that is a broker rule, not an exchange rule. Both CME and ICE are physical settle for a certain quantity of NG. Settlement on EEX is for a specific number of MWh: on normal days it is 24MWh, on dailight savings in the spring it is 23, in the fall it is 25. (or do I have that backwards?).

In reality there is much more liquidity and flexibility in swaps than there is in futures so more and more traded volume is no longer on exchanges where commoners like myself can easily see it.

/nitpicking.

Rgds

WeekendPeak

That is my point. Settling physically is an option, not a rule. You always have the option of a cash settlement.

The margin requirement is, on average, about 5 percent of the physical price. What would happen if you had bought a contract by putting down 5 percent of the price of the physical but had no more money?

It happens at on every expiration day, thousands of contracts expire without being closed. After all, things happen that might prevent you from closing a contract that you had every intention of closing before expiration. It happens. And thousands of speculators have no intention of buying or delivering the physical. They settle for cash. That is their option.

Ron P.

Margin rates are slightly different for hedgers vs speculators:

http://www.cmegroup.com/wrappedpages/clearing/pbrates/performancebond.ht... GAS&type=OutrightRates&h=2&reporttype=marginrate

Assuming 2,000 maintance margin it is about 41,870/2,000= 4.8% (yet another nitpick!). interestingly enough interproduct spreads (like being long June and short Sep) were changed about an hour ago. the CME increased those margins by about 33%.

Rgds

WP

Yes I know. I made that very point on Drumbeat a few days ago.

Well I said about 5%. I have seen it that low many times. It varies from time to time depending on volatility. Right now volatility is quite high and margins are about 8.5% while maintenance margins are about 6.25%. Well that is if oil is at $100 a barrel. Margins are a fixed dollar amount while oil, as you know, goes up and down. They have just been raised 25% because of high volatility.

The Meaning Of CME’s Margin Hikes On Oil And Silver

Ron P.

I'm just trying to add information to the collective.

Sigh.....

Rgds

WP

Hedging is selling your product at a future price.

Sure, and I should have used a better word or phrase. I had in mind the more complex maneuvers described here:

"A hedge financial term denoting is an investment position intended to offset potential losses that may be incurred by a companion investment.

Possible vehicles for a hedge investment include stocks, ETFs, insurance, forward contracts, swaps, options, many types of over-the-counter and derivative products, futures contracts. Public futures markets were established in the 19th century to allow transparent, standardized, and efficient hedging of agricultural commodity prices; they have since expanded to include futures contracts for hedging the values of energy, precious metals, foreign currency, and interest rate fluctuations."

http://en.wikipedia.org/wiki/Hedge_%28finance%29

Rockman - You can't sell a futures contract unless you have one that you bought

I think this is where you might be going wrong. You absolutely can sell futures contracts without buying them first. In fact this is pretty much how the market operates - lots of people wanting to buy and a matching number (matching done by the time-honoured tradition of price) wanting to sell. In a small way I trade these contracts myself by placing either up or down bets on the future price of oil.

Settlement of the sale of a futures contracts can be either by buying back the contract or physical delivery. As you rightly say the paper market is much bigger than the physical one and most trades are settled in cash.

The difference between speculators and producers/consumers using the futures market is purely motivation. The former are basically looking to make money by getting the price action right whilst the latter are looking to gaurentee either their profit margin (producers) or cost-base (consumers). A bit similar to the differecnce between people writing naked vs covered options - but maybe best we don't go there ;-)

Bottom line though you can sell futures contracts without buying them first.

And, sorry to disagree again, but contracting to sell your oil at a given price in the next 12 months is a futures contract! Even if you strip out the market makers/brokers etc and deal directly with an end user. The huge and complex futures market is really only an extension of this original innovation.

TW

Rockman has it right. The futures contracts that are listed are financial instruments used by risk traders (i.e. speculators) between themselves. The sorts of contract between risk traders and producers are different. (For the good reasons that Rockman has already given)

And, sorry to disagree again, but contracting to sell your oil at a given price in the next 12 months is a futures contract

This is where you are getting confused. This is just a contract. Every contract refers to the future. Futures contracts are a specialised type of contract, not any contract that involves something in the future. If I am paying you now, to do something now, that doesn't need a contract. If I am agreeing now, to do something later, for which you will pay me later, that is a contract.

I think this is where you might be going wrong. You absolutely can sell futures contracts without buying them first.

This depends on how much risk the regulator of the market wants to allow the speculators to take. While it is always possible in theory, it may be illegal in practice. I am pretty sure that Rockman has it right, and that it is illegal in the oil futures market. The volume of oil futures is just too large compared to the physical trade to permit it.

The one thing I remembered from the first oil crisis in the 70's was

"oil drives inflation and inflation drives gold"

I bet the farm (ok the suburban house) in 2005 and it has paid off well.

The price of gold crashed down in 1980, and the price of oil crashed down a few years later and then stayed cheap for years.

When the prime rate went up to 18%, nobody wanted to hold on to gold bullion and earn no interest. I used to get over 16% interest on my money market account, and I would borrow money at 12% on my credit card, then deposit it to earn the 16% on the money market account--a perfect way to make money without having any capital tied up.

I've seen long-term mortgage rates at 16 to 18% interest too, in the early eighties, and if inflation ever gets out of hand we'll see these high interest rates once again. The late seventies and early eighties were a crazy time for finance, crazier than anything seen during the last few years.

I think my best pull was a one-time offer from Citicard for a 1.99% cash loan for the life of the balance. After making sure I wasn't reading it wrong (usually, a cash advance is charged 18+%), I cashed it for 20K, and paid it back, faithfully, until it was gone. As you can imagine, there were one or two days of panic when realizing the banks weren't going to be open Monday, the due date, due to some stupid Federal Holiday and it's getting late on Friday ... but made it! I'm paying off my used truck still I bought with a credit card, at a nice 3.99%. Better to have the title in-hand than at some dumb bank.

Another scam, more recently, involves the presidential gold dollars - buy the maximum (per order)amount on a credit card that generates air miles, several timees over; the mint would even deliver them free (though no signature confirmation required!!!), and of course, the credit card has a 30-day grace period so it was free trips for everyone.

At the peak of the credit craze, I was able to get several large credit card cash advances (by check) for zero %!!

They relied on most of their customers not realizing that all future payments were applied to the cash advance, while high interest rate purchase balances were piling up.

Now, of course, they've caught on and they're charging a 3.99% up front fee.

One used to be able to buy US series I bonds 30k per person per year; we'd get 'em on mileage credit cards and each get enough for a RT ticket as a bonus.

More recently (last year), the government was selling $1000 boxes of dollar coins from the mint, free shipping, and taking credit cards. I used one with 5% back. Yes, I was buying cash at a discount, gotta love this country. Plus, a wooden chest full of the new dollar coins looks a bit like gold dubloons; you can put on a pirate hat and run your fingers through it saying "Arrrrr, what a fine treasure this be...".

Dopamine is where you find it, I reckon.

"It could be a very bumpy ride."

Could be.... That's the only prediction I make with certainty. It will be (already is).

Since I read Campbell and Laherrere in '99 I've taken any specific predictions for a "peak" with several grains of salt; the uncertainties are many (and the definitions of "peak" variable). Peak crude? C+C, unconventionals, EROEI, demand, other economic considerations, political unrest and military intervention, technology utilization, substitution, ELM, climate considerations, fickle populations, new discoveries, etc. ,,,,, all of these things affect production. Trying to nail down volumes and dates is an excercise in frustration, though I applaud all of those who make serious attempts to define and predict "peak oil".

What matters is the overall benefit to economies, total usable energy derived from all inputs, and how societies react to increasing constraints on energy and resource availablility. What matters most is how humans adjust their expectations. Perceptions trump Peak Oil.

Great point. I think most of us TODers have struggled with these issues over the years. We have become board with the simplistic realization of the "Hubbert Curve". We moved on to realize that real world conditions would cause a plateau, then in even more detail, the undulating plateau, the "ELM" effect, etc.

In the end, we are, and always will be, a small group who has the time or attention span to follow the reasons behind each undulation at the top.

The majority of the public will only be willing to "get it" when we are five years down the destructive decline, and there will not be anything they can do at that point.

Somehow I don't think that five years will be enough. The belief in the current economic system is so strong that most people will not make the connection between the disruptions to their lives with declines in oil production (or any other resource shortage type issue). The unemployed will continue to believe that their lives will get better once they find a job. The vast majority of middle and lower income types will continue to believe that they just need to work hard to get ahead.

Any new recessions, big bumps in inflation, lines at the gas station, shortages at the home depot, etc., will be blamed on the guy in the white house, the congress, the banks, China, terrorists, or whatever.

vast majority of middle and lower income types will continue to believe that they just need to work hard to get ahead

agreed, if only the government would *let* them work hard.

It seems that an increasing number believe they will get ahead if we just build a border fence and stop protecting smelt in the delta. If only we didn't have a socialist president, gas would be below $2/gallon and everyone could get a high paying job....etc.

I share the request for a conversion of the latest forecasts to the net energy view. My guess is that we are clearly off the plateau already.

If Iraq can ramp up fairly quickly the all liquids plateau will most likely extend to 2015 at a 4% decline rate for current production, or 2016 at 3.6%.

The wild card might be watering out of Ghawar north, which could be imminent.

While determining net energy will be nigh impossible, it may be useful to create an adjusted energy content curve. Hypothetically, if ethanol has an EROEI of 1 to 1 then it could be removed from the mix: no net benefit (inclusion only skews the numbers). Equating sands oil or kerogen to WTI doesn't make sense either. Adjusting for the pecentage of heavy/sour crude to light/sweet may not be accurate, but could be interesting to determining available energy trends. Of couse, good data is everything. Without it, predictions are really prophecies.

Wouldn't that be something to watch the talking heads trying to explain away a "Cantarell" scenario in the land of Saud.

eAstie - true but when have we heard the talking heads try to explain away the Cantarell scenario in Mexico?

Right. Is there any evidence that the talking heads know what or where Cantarell is, much less its depletion curve?

Somewhere, I have a "Ghawar Is Dying" button someone sent me. A few times, I've worn it for a day. Nobody (other than friends who have suffered my lectures since 1998) has ever had any clue what it means.

So I guess I'm still wondering if this is a reasonable summary of what the future might hold:

Peak all liquids: 2011-2014

Post-peak all-liquids decline rate: 1%

Post-peak crude decline rate: 2%

Post-peak available net exports of crude decline rate: 4%

If you've got it right we should be fine. We can adjust to a 2% annual crude decline.

The real discussion, IMHO, should not be about the date on which we passed/will pass peak but our adjustment strategies.

I think the more important number for the US is the 4% export decline and I would guess exports to the US will decline more like 6% due to China and India.

We can not manage 6% decline gracefully.

Time to build lots of nuclear reactors in ships at sea to make synthetic methanol to "export" to the US. Place the ships above a deep trench and if one goes bad sink the ship. A fleet of 3000 ships will give us all the energy we need.

We can not manage 6% decline gracefully.

That's not hard at all. The US has reduced it's net imports by 25% in the last 3 years.

OK, so that's 8% of imports per year, or 4% of consumption, very roughly.

And the US only had to have 4% of its working-age population leave the work force, and nearly double the unemployment rate of those who are still counted as being in the work force. Yeah, easy.

How easy will the next 25% of imports be? And the next?