Peak Oil, IHS Data and The Broken Clock

Posted by nate hagens on February 17, 2008 - 11:01am

We have been writing for almost 3 years on this site about the privatization of energy data by IHS Energy and the negative impact the lack of accuracy that CERA's historically optimistic claims are having on energy policy. The rebuttals and counteranalysis at TOD to CERAs assertions are too numerous to list. Today at the IHS Energy Conference in Houston, the CEO of IHS Energy, parent of CERA and other energy information agencies, asserted that Peak Oilers don't have the data to support their claims. This post is a brief rebuttal to this 'news' coming out of Houston, and a plea to refocus the questions to what is relevant and probable, not on what is irrelevant and unlikely.

Source - various - detailed here by G. Morton(Click to enlarge)

Well right off the bat I should point out, with a track record like the one above, I'm not sure we want the data that IHS refers to**, but here are some excerpts from the Bloomberg story this afternoon. I should also state that it's not CERA's fault that the traditional media still seems to fawn over their every assurance.

`Peak Oil' Backers Don't Have Data to Support Claims, IHS Says

By Edward Klump

Feb. 13 (Bloomberg) -- IHS Inc., owner of Cambridge Energy Research Associates, said those who espouse the theory that the world's oil production has already peaked lack evidence to support their claims. "The only thing that's relevant is our data," Jerre Stead, chief executive officer at Englewood, Colorado-based IHS, said today in an interview in Houston. Believers in the so-called Peal Oil theory "don't have our data".Stead made his comments at an industry conference hosted by Cambridge Energy Research Associates, which is headed by Daniel Yergin, the energy researcher whose Pulitzer Prize-winning book was touted as a bible of the petroleum industry. Yergin has said supposed oil shortages historically have eased as breakthroughs unlock new sources of crude.

U.S. oil futures jumped 57 percent last year on the way to topping $100 a barrel for the first time in January. Peak Oil supporters include billionaire hedge-fund manager Boone Pickens and Houston investment banker Matthew Simmons. Stead said some supporters of Peak Oil are interested in being consultants. IHS is standing by the facts, he said. "The Peak Oil discussion is useful in terms of trying to enlighten or shine a light on the discussion about where are the reserves today and what's the production capacity from them", Ron Mobed, IHS's co-president, said today in an interview.

`Above-Ground Issues'

He said political concerns in places such as Nigeria present larger problems than getting oil out of the ground. "The production capacity compared to actual production is moderated much more today by what we call above-ground issues than below-ground issues", Mobed said.

Cambridge Energy Research Associates last month said worldwide oil production from established fields was declining at a slower rate than estimated by Peak Oil proponents. Global production capacity for crude oil and condensate could climb from 91 million barrels a day in 2007 to as much as 112 million barrels a day by 2017, when demand will be 101 million barrels, the firm said.

As a former (and current) stock trader, this all strikes me as a stubborn adherence to a fundamental theme, while the technical signals are pointing to the fact that there are some new underlying drivers to the market dynamics that the old school analysts haven't figured out yet. I long ago gave up relying solely on fundamental analysis and now combine it with the 'trend is our friend'. The relevant trend in question is the 800%+ increase in oil prices over the past 8 years. Something fundamental has changed in this period in the relationship between oil supply to oil demand-perhaps we don't know precisely what is it is yet, but we do have some clues.

Our own government data, in an EIA release earlier this week, announced downward revisions in Crude + Condensate oil production for November 2007, confirming (for now) that 2005 is still the standing peak for oil production. World production through the first 11 months of 2007 averaged 73,223,000 bpd which is 594,000 bpd below the average for 2005. November 2007 production is still 582,000 bp/d below the record month of May 2005.

I do not know if this date will remain the peak for all time (because I am not privy to the IHS database, of course), but since the record of the analysts writing here at theoildrum has been quite accurate for the last couple years, I would put the odds considerably higher than zero that 2005-6 was the peak for conventional crude oil. Of course, it's quite possible we may continue to expand the definition of what is "oil" to include algal biodiesel, used french fry drippings, oil extracted from garbage dumps, etc. adding on to the already inclusive crude, condensate, ethanol, NGPL, coal-to-liquids, processed tar sand bitumen, etc. In any case, what is more important than the date of oils maximum production, is that neither the numbers by CERA, nor most data from the EIA show how much this oil costs to extract - the tone of the interview and comments is such that 112 million barrels in 2017 will still mean society can grow, function, etc. without diverting all its resources and natural capital to the endeavor. Though this graphic from the EIA (from the EIA report "Performance Profile of Major Energy Producers"), shows that finding and production costs, at least as of 2006, were increasing much faster than the price of oil. In short, what really matters is how much per barrel a globally interconnected complex society can afford.

Here is the actual (public/ free) data from EIA graphically represented:

Chart by Matt Mushalik using EIA data showing incremental world oil production since 2001 (thanks Gail)

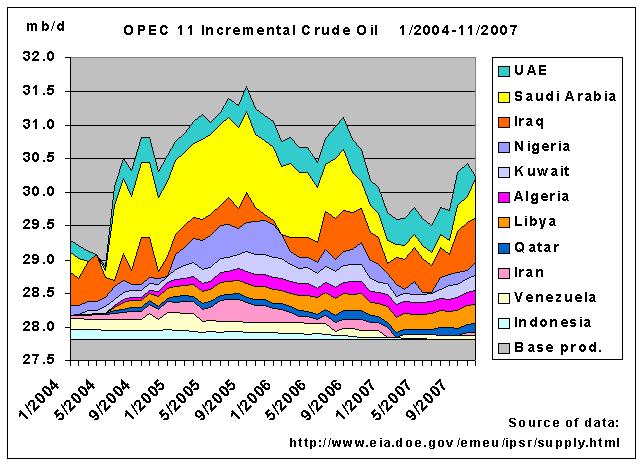

Chart by Matt Mushalik using EIA data showing incremental OPEC oil production since 2001 (thanks Gail))

The above graphs take the minimum monthly production for each country for the period 2001-November 2007 and subtracts this minimum from each monthly production to arrive at an incremental production relative to the minimum. For example, for the United States, the incremental oil production is the area in dark red in the top graph. The advantage of this approach it gives a clearer view of how production has been changing recently. -Note recent peak is well below prior 2005 peak for OPEC.

A Broken Clock is Right Twice a Day

"One shouldn't be investing with the mindset that oil's going to be $100 forever...A recession could change that pretty quickly"

This same logic may have precluded nations, regions and individuals from investing in long duration energy assets 2,3..6 years ago when energy was still cheap - that's one of the biggest losses in all of this - the energy costs of lost opportunities. Regarding Mr. Yergin's recession comment, the one event that may finally make one of his price forecasts come true is a recession or depression in OECD nations, which will reduce demand and the ability to pay for oil, especially considering the leveraged - aka supercharged in both directions - nature of our monetary/financial system. While at that point the broken clock may appear to again be working, the disincentives to invest, potential lack of financing available to new energy projects, (both oil and alternative), and a retracement in revenues while costs remain high, brought about by the lower oil prices may cement 2005 as the global peak. In other words, be careful in wishing to be right.

Here are some questions I respectfully offer to IHS Energy and CERA:

IHS Energy and CERA and their other subsidiaries are undoubtedly experts on the worlds oil fields. But does field by field analysis of production capacity give us the answers that we need in todays complex and rapidly changing world? Here are some of the issues, from a birds eye view, that I believe the answers to which are very important:

1) At each tranche of predicted future oil production, how much will it cost to obtain those barrels? Please respond in:

*a) dollar units (2008 inflation adjusted)

*b) energy terms (dollars being limited by political will and paper but energy being finite and requiring energy to procure)

*c) environmental terms (the planet being a place we not only procure energy from but also need to live on)

2) What is the shortfall risk if your data continues to give erroneous predictions of oil price and supply, as it has generally done, at least via your CERA subsidiary so far this century? Is the risk losing clients and money, or is the risk something greater?

3) If below ground factors have informed us we have plenty of spare capacity, but we have plateaued for 2.5 years already in an environment of rapidly rising prices, at what point do you start to hire analysts who are experts on 'above ground factors'? (Said differently, do the rules that governed the first half of oil supply apply equally to the era we have now entered?)

4) What does the oil field data suggest the impact of a recession and credit contraction have on the future of supply? (e.g. since oil is priced at the marginal unit, some of the more expensive oil may not profitably come to market. Also, some marginal production players may have higher financing costs or find credit unavailable, thus highlighting a key difference between production capacity and actual production.) What impact will OECD's 'borrowing from the future' via 40 years in a row of debt increasing more than GDP have on the future affordability of oil (and everything else) and thus your forecasts?

5) How should society best invest its remaining high quality energy stocks so future generations, including many living today, have reliable flows of energy?

6) To best serve your clients interests (which would then trickle down to energy policy), would you be willing to add interdisciplinary systems analysts to your mensa research staff, and look deeper at the interplay of the many different variables impacting oil availability, beyond just productive capacity?

Here are some questions for long time theoildrum readers:

1) How can analysis and facts trump sound-bites and rhetoric about the urgency of the planetary energy and resource situation, before events themselves precipitate response?

2) Should there be something similar to Sarbanes-Oxley with respect to energy analysis companies charging fees? What is the shortfall if IHS/CERA are wrong, or wrong by an order of magnitude (e.g. peak is now as opposed to in 30 years+)?

3) If IHS forecasts for 100 mbpd+ somehow are correct, how can society shift from using this energy bounty on short term novelty that has become conspicuous consumption,to something more meaningful?

4) How do we get the traditional media, like Bloomberg and CNN, to start asking questions and writing more like scientists?

**Note regarding data: In all seriousness, the group of people I interact with at TOD are some smart cookies, and volunteer their time to work on thorny issues related to society's energy future because there has been little market incentive for others to do so- so any credible data sent our way is welcomed - especially the expensive kind). (A few of the TOD crew are currently working on an independent TOD megaprojects analysis).

It would be among my top wishes that the smart folks at IHS/CERA are correct in their oil production and price forecasts. I will gladly eat crow in exchange for a more stable progressive world that has more time to turn an energy crisis into an energy transition.

I think that it is useful to look at the cumulative shortfall between what the world would have produced at the 5/05 rate and what we actually produced--on the order of 770 mb (EIA, C+C) through 11/07--despite oil prices trading in the highest nominal range in history, all while Daniel Yergin has constantly been assuring us that oil prices would be coming down, because of a flood of new oil production.

Also, insofar as I know the Yergin crowd is pretty much ignoring the Net Export aspect. Consider our "What If" scenario for Saudi Arabia. What if they maintained their 2005 production rate of about 11 mbpd (Total Liquids)? At their 2005 to 2006 rate of increase in consumption, their net exports would approach zero around 2036.

The costs to find and procure energy (liquids) are going up faster than the consumer demand for oil. A meaningful % of internal Saud oil and gas demand must go towards finding and developing oil projects. If this trend continues 2036 will be optimist. In other words, your Net Export theory doesn't explicitly address the continuing trend of depletion trumping technology.

Of course, Khebab's middle case is that Saudi Arabia approaches zero net exports in 2031, within a time frame from 2024 to 2037.

I estimate that if the Saudis wanted, and were able, to match their 2005 net export rate, they would have to kick their 2008 total liquids production up to about 11.7 mbpd in 2008, versus about 11 mbpd in 2005.

The flat line Saudi graph illustrates what could plausibly happen to net exports even under the Economist Magazine's assertion that Saudi Arabia could maintain their 2005 rate of production for 70 years.

Black Friday

March 7 2008 11:30 am ( NY time )

BOOM

You aren't being completely frank about the track record of both sides. I'm not going to do it today, but I too could trot out an extensive laundry list of bad predictions by Campbell, Simmons, Kunstler, Pickens, Deffeyes and others.

If you want to have a rational discussion, you have to come clean about the failures of peak oil advocates, as well as the failures of CERA. You're creating the impression that CERA is the only one who ever gets it wrong, and that's plainly deceitful.

I only referred to our group of analysts here at theoildrum. I said nothing about anyone else other than CERA and TOD - though Deffeyes thanksgiving 2005 prediction isn't looking too shabby at the moment. It is true that in the early days, pioneers like Colin Campbell made predictions of peak date, using incomplete data that have since been adjusted. But he has always been in the peak oil sooner than later camp and we better do something about it. Still others like Duncan and Youngquist performed analyses using 1999 data showing 2007 to be the peak year - whether that is ultimately right or not given the current circumstances its alot closer than the cornucopian camp was in 1998-9 when the IEA still used demand forecast for oil to create their supply estimates.....If you read back in the archives of this site, the general track record of our analysis, using free data for the most part, has been pretty darn accurate.

But thats not what this post is about. We are being told, specifically by an entity that has been very wrong for 7+years, why 'we' in the Peak Oil community are currently wrong about the Peak being 2005. Personally, I have never committed to May 05 being the peak - but I think its certainly possible. More to the point is Peak isn't that far off - if its within next 5-7 years we have huge problems. If its 2035, and all the oil from now until then can be pumped at a high energy gain (and therefore dollar gain), then we have time to party on for a while.

This isn't like a hedge fund having poor returns and giving their clients their remaining money back. The stakes are much higher. I suspect that Mr Yergin WILL be correct and oil prices will decline this year, but again, not because of increased capacity but due to decreased demand.

Still others like Duncan and Youngquist performed analyses using 1999 data showing 2007 to be the peak year - whether that is ultimately right or not given the current circumstances its alot closer than the cornucopian camp was in 1998-9 when the IEA still used demand forecast for oil to create their supply estimates...

At that same website, we find that Duncan also performed analyses showing worldwide permanent electric blackouts in 2007:

Source

I think the readers of this site deserve something better than filtered one-sided information. You're cherry picking the successes, and conveniently dumping the failures down the memory hole. It's a form of polemics/deceit, not a basis for honest discussion.

The people at CERA predict oil production for a living, Kunstler and the like do it as a hobby.

Two men make a prediction about my health at different times, and each turns out to be wrong. One is a doctor, the other is a former boy scout who took lots of first aid classes. Which one should I have the most scorn for?

you're kiddin, right? Kunstler is a teacher and teaches his ideology to his students. If that is not "professional", then I wonder how incompetent he is, daring to teach such "hobbyistic" stupiddity and horror to the kids as some kind of an atheist form of apocalypse, an atheist version of coming hell.

Can we distinguish between the predictions of Petroleum Geologists themselves and those who have taken one set of predictions or another to then make judgements about future practices?

Kunstler is a journalist, and a number of other PO figures mentioned are also not geologists. They have made a choice to believe the analysis of one set of geological predictions, much, for example, as those who run the US government have chosen to believe another (manifestly). In fact, nearly everyone in the rich world has chosen to believe one set of predictions or another, whether cornucopian (most) or depletionist (a growing number). We prove those beliefs when we live our lives as though the party is going to end or continue.

But saying that Kunstler, or George W. Bush or JimBob down at the Diner have chosen to make larger societal predictions based on geological analysis was inaccurate in their predictions about petroleum geology is ridiculous - they don't make any. The predicate their assumptions on one set of scientists or another, and postulate from there. But that's not the same thing as comparing two sets of scientists of similar qualifications and comparing *their* analysis.

So anyone who attempts to bring popular writers into the mix and point to them as "inaccurate" is simply raising a distracting red herring, and not a very compelling one.

Sharon

That's false. If Kunstler is a journalist, he is an incompetent one. He doesn't "predicate [his] assumptions on one set of scientists or another, and postulate from there", he simply has dictated that the end is nigh, and only thereafter he goes on to chose his preferred method of how it gonna happen, nitpicking the worst of the worst from his own set of choices...

But then again, who cares?

Wrong, luisdias. Kunstler is a muckraker, not an oil analyst, stock market analyst, or even a teacher. There is a long tradition of muckraking in the U.S., and he is brilliant at it. He has probably done more than anyone else to get info out to the masses about peak oil, and he's definitely more right than wrong on this issue.

Not only that, but he's an incredibly entertaining writer.

Exactly. He's an incredibly perceptive intellectual in the best tradition of American writing. I like to read his rants out loud to the family.

With respect to the Olduvai Gorge thing, the daily blog I put together does seem to suggest that there are some major energy issues throughout the world: systemic problems related to economic growth (China, South Africa), political problems, and tactical issues (like today's Aleutian islands story). Regardless of the reason, they suggest a world balanced on an energy "knife edge" (and that's taken from a story today from New Zealand where a dry spell has seriously compromised hydro power).

I don't think Duncan is too far off and I would suggest that there are, right now, sustained blackouts in many areas of the world.

So he is not a teacher. Who fired him? You?

And there's the obvious question hanging: why is a "muckraker" really needed?

If he is nothing than entertainment, though, then you've just put the sad fellow under the same bag as his long time nemesis, nascar and superbowl. How ironic!

Are you serious? Given the endless stream of happy talk from the Iron Triangle (not to mention people like you), we have a desperate need for people to rake through the muck to try to get a glimpse of what is really going on.

But what Kunstler really is is a prophet, in the old Biblical sense of the word. And the thing about prophets is that they only have to be right once to be vindicated. And it is waaaay to early to say Kunstler has been wrong. Whereas the anti-phrophets need to be right continually for years.

That's just the nature of the of predicting discontinuities. It is nearly impossible to predict the extact time of a discontinuity, even though it is possible to predict that a discontinuity will occur. People who predict them are basically right if the discontinuity occurs, even if they miss the exact date.

TPTB, the happy talkers, the optimists are always caught with their pants down when the discontinuities hit. It is because they can't imagine anything but BAU, or they are so invested in the status quo that they'll defend it to their (perhaps literal) dying days.

Kunstler is a catalyst that got many of us thinking about peak oil, its consequences, and the appropriate response to it.

Kunstler generally takes the view that it is a mistake to believe that all the variously touted technologies like hydrogen cars, etc. are going to get us out of this mess. He may be wrong but that view certainly must be respected and dealt with. Yes, he is entertaining but a little entertainment goes a long way to gets people's attention and makes things a bit more interesting. Entertainment is often a necesssary ingredient to invoke discussion, thought, and even action.

Regardless of one's view of Kunstler, most people here would acknowledge that a rational society should be planning and acting now based upon the reasonable conclusion that we will not be able simply carry on before. What outrages Kunstler and me, for that matter, is that people and governments won't at least plan based upon a scenario that says we are going to have a lot less oil in the future than we have now, hardly an outrageous assumption. And, instead of simply assuming technology will save us, a rational planning exercise would include the assumption that technology might help and other energy sources might help but maybe we ought to consider a change in our lifestyles, our housing patterns, and the way we get around.

Perhaps we won't see the end of suburbia but that doesn't mean that suburbs and cities shouldn't be planning how they are going to survive and prosper based on very different circumstances.

There is a town near me that is almost completely dependent upon tourists and long distance commuters for its existence. Almost every decision is about how they get more money from more tourists who must come a long way by automobile to get here. Their vision of the future doesn't even acknowledge the possibility that happy motoring will either end or be cut way back. I am part of a group that is trying to raise consciousness and cause change. Boring discussions about the future of peak oil doesn't really cut it. We need people like Kunstler to get people's attention. For various reasons, the grass roots are starting to get it even if the town politicos and real estate developers are still making their plans based upon $2.00 gasoline.

I've no idea what Kunstler does for a living, I just know that it's not forecasting oil production. But if you read what he writes you'll see that it's generally hysterical. After September 11th he wanted to drive the populations out of and destroy the cities of Damascus, Baghdad, Kabul, Tripoli and so on. When Pol Pot drove people out of the cities into the countryside we called it a "crime against humanity" and in fact "genocide". Now, everyone gets upset and says crazy things from time to time - but Kunstler has never recanted his advocacy for genocide.

So if you take him seriously then you really need to widen your range of reading.

The key issue is that when someone does something for a living, they're held to higher standards than when someone does not. I'm a chef these days - you expect decent food from me. If I kept giving you burned beans on toast you'd be more annoyed than if your buddy Joe the mechanic did it.

Kunstler majored in Theater at college and has no formal training in the fields in which he prognosticates.

Sometimes I wonder if Kunstler's rants are just that- theater.

Did you read Nate's response?

This post was a response to CERA's statement that Peak Oilers don't have the data to support their claims.

I'm happy to hear the other side of the argument - but we never seem to get evidence from the Cornucopians, just trolling.

Ya know, I would really like for CERA to be correct this time, as the predictions here from Nate have given me some nights of poor sleep. If wishing was profitable I would continue doing that.

Unfortunately I see around me the raw facts that everything requires energy, and that the prices of everything that requires energy is going higher.

Let me know when I should expect the price of fertilizer to come down.

The Oil Drum has been pretty accurate in its predictions.

Well then, what's the current TOD prediction for supply and price over the next 5 years? We can't expect policy makers to make decisions based on the TOD forecast if TOD doesn't actually have an explicit forecast. You guys are bristling with confidence. Get off the pot, and post the TOD forecast on the sidebar, where policy makers can make use of it.

JD,

CERA is a mouthpiece for Oil companies. CERA will say whatever it takes to keep alternative sources from coming online. Peak oil is obviously here. We have had 3 years of record setting prices and conventional crude extraction has not increased. There have been plenty of forecasts published on this site but I am guessing you know that.

That has started to happen, according to Tom Whipple's Jan. 17 column in the Falls Church paper that goes out to Washington, D.C. bureaucrats:

The Peak Oil Crisis: We Are Starting To Dim

I would like to know if some satellites regularly measure the amount of artificial illumination generated on Earth, and if the measurements have started to show a net decline.

In one sense Duncan's prediction was right, he just got the flow of blackouts backward. Countries like Nepal, Tajikistan, Zimbabwe, etc are experiencing blackouts due to unaffordability of fuel. Many TOD posts have consistently predicted the worst aspects of Peak Oil will strike the poor first and as prices rise more and more nations will go down. It is also needs to be kept in mind that Duncan was writing at a time when rolling blackouts due to Enron's criminality was at its height in California.

Ummm: I don't mean to be rude, but I don't think the blackouts in Zimbabwe are peak-oil related.

Well, they're related to unaffordability of fuel, and presumably on the downside of the oil production curve fuel will become less affordable, so...

Peak oil means the end of cheap oil for 'net importing' countries - some people won't be able to afford it - for whatever reason.

Zimbabwe, as an extreme current example, would be able to afford more oil if it were still $10 a barrel.

The effects of peak oil won't be evenly felt, some countries will do very well out of it for quite some time to come.

The people with the most to fear economically from peak oil are those who import a lot of it and import ~100% of their needs - most European states are in this vunerable category (or very soon will be).

Most countrys of the world now fall into the category of net-importing.

In Australia we pay world parity pricing even for our own oil so it doesn't really make muh difference whether we are net importers or not.

No, you pay what the local market will bear - which may or may not be the 'world' price, and also which may or may not make a profit in the short term for the people supplying whatever part of a barrel of crude consumers actually buy.

Also, it does matter if you are importing most of the oil that you consume since you must export (a lot of) something else to pay for it.

92 Regions and Territories now experiencing energy challenges.

See: http://energyshortage.blogspot.com/

talk about moving goalposts - are you kidding with the blackout thing? Nate is discussing CERA's terrible record of predicting OIL prices based on their "top secret, the rest-of-you-don't-have-it" data - not electricity generation.

your point is useless - it's like saying that Duncan predicted peak oil just fine, but he blew it on his Superbowl pick - who cares (in the context of THIS thread) about Duncan's prediction of electrical blackouts?

and since you bring it up - have you noticed the problems South Africa's mines are having with blackouts? - and the effects on the worldwide cost of platinum? So Duncan didn't identify the location correctly, but interestingly enough, Africa IS experiencing blackouts increasingly - as are other nations around the world - but this is just an aside - let's come back to the point -which is, despite a huge increase in the price of oil, the peak of crude production so far is May 2005 - so either the market has completely stopped working or something else is going on - and CERA tells us everything is fine and the price will drop any day now with lots and lots of cheap oil on the way?

Sorry to be tardy, and I've only skimmed the comments, but there's one highly relevant fact that doesn't seem to be recognized: Actually we, the Peak Oil concerned, do have the IHS data!

Before referring to details, it may be useful to set this fact into relief by means of the following quotes from the discussion:

"The only thing that's relevant is our data," Jerre Stead, chief executive officer at Englewood, Colorado-based IHS, said today in an interview in Houston. Believers in the so-called Peal Oil theory "don't have our data". (Bloomberg 2/13/2007)

"Well right off the bat I should point out, with a track record like the one above, I'm not sure we want the data that IHS refers to" (Nate Hagens)

"Nate is discussing CERA's terrible record of predicting OIL prices based on their "top secret, the rest-of-you-don't-have-it" data" (MacDuff)

“Are Yergin, Russia, OPEC, et al, ready to open their databases to all interested parties?” (Bob Shaw)

“I am still to see a comprehensive data report about the state of oil fields around the world…” (Luis Dias)

“I imagine I am being very naive but if Cera can make this statement, Believers in the so-called Peal Oil theory "don't have our data" then they should make that data available, otherwise they could well be using chicken entrails in their auguries much as a former, collapsed, civilization made it's forecasts.”

(ChrystalRadio)

The fact is that an evidently very knowledgeable industry professional has done a Daniel Ellsberg-like service by putting much of the IHS data into the public domain - over at the InvestorVillage, Clayton Williams Energy Inc., Message Board - along with his critical evaluations.

In "OPEC reserves and revised estimates IMO," (Msg. # 56151, 5/7/2007) the source refers by number to twelve previous country-by-country posts, giving IHS field-by-field data on the 144 oil fields which have accounted for 75.5 percent of OPEC's cumulative production. An additional post referred to reviews specifically the case of Shaybah and how its alleged reserves have escalated enormously over the years.

Messages 74013 and 74021 (9/20/2007) review the data for the 50 largest natural gas fields, as ranked by IHS:

Very big gas field part 1

Very big gas fields part 2

Message # 71577 introduces the gas field posts and mentions his previous posts on IHS OPEC and Russian oil fields data. I have not been able to locate the Russian posts, however, since I don't know the subject heading or message numbers. Anyone out there able to come by them?

Take that, Jerre Stead!

Duncan updated his prediction since 2001.

http://moralequivalentofwar.wordpress.com/2007/02/10/olduvai-theory-update/

You are cherry picking the failures.

Given above ground economic conditions and other factors such as technical advances. A prediction of peak oil from anytime about the 1990's on is valid.

Given this and the uncertainties in the data we have been at peak production capacity for almost two decades now. Actual peak production could have happened as early as 1990-2000 if we had produced at maximum capacity and been more aggressive at applying new technology and political factors had not limited extraction in various regions.

Until recently we have had at least a 10mbpd cushion of production that could created and brought online within 10 years given demand.

Given this and the technical advances I don't see that any of the peak oil predictions are actually "wrong". In my opinion the combination of political/economic factors and technical advances has allowed us to keep production capacity and now actual production high well past the point we should have declined given a simple symmetric production profile.

Hello JD,

That is fair enough, I agree that both sides should display their dirty laundry so that the whole world can finally understand thru Universal Peak Outreach just how damn difficult it truly is to 'see' the remaining FFs underneath our feet and plan for optimum extraction for now and future generations with full ecologic costing of above & below ground factors.

Then the global cry would be overwhelming for CERA/IHS to freely share their proprietary database, and Matt Simmons' request for all global FF production to be audited would be a quickly done deal.

Are Yergin, Russia, OPEC, et al, ready to open their databases to all interested parties?

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

This post is not about Kunstler, Simmons, Campbell, etc. This post is about CERA and how wrong CERA is yet continues to claim that they are right and that others are wrong. Regardless of whether those others are right or wrong, CERA itself is clearly wrong, JD. Every time they claim they are right, they are perpetrating a lie, a flat out complete and utter lie.

Take the NFL, for example. It doesn't matter if the St. Louis Rams were 3-13. We're not discussing the St. Louis Rams. We are discussing the 1-15 Miami Dolphins of crude oil forecasting. We're discussing CERA. Now if you want to go post on your blog (from which you've repeatedly "retired" only to spring to life again like a bad zit on a teenager's face), then go for it, dude. But the topic here is CERA and CERA's continuing failures while calling everyone else around them worse than themselves. I've got news for you, CERA is the 2007 Miami Dolphins of the crude forecasting business over the last several years. And pointing at the failures of others does not detract one bit from the fact that CERA is a flop, a humiliating, disastrous, pathetic flop. And anyone who invested in oil futures based on CERA's advice would have lost huge amounts of money over this most recent several years.

I don't have to compare the Miami Dolphins to the New England Patriots or the New York Giants if I choose to write about them, do I? I can focus on Miami's failures, mistakes, and pathetic performance without having to drag in the St. Louis Rams, the Atlanta Falcons or the New York Jets. I don't have to compare the Miami Dolphins to the Pittsburgh Steelers, the Green Bay Packers, or the Dallas Cowboys. In fact, I don't have to compare them to anything else at all, do I?

So what the hell is this call for "balance" from you? It's obfuscation. It's an attempt to detract from Nate's work by implicitly discrediting Nate. It's an attempt to underhandedly defend CERA when CERA cannot be defended.

Now, do you want to return to the topic at hand, or should we all ignore you again?

That Put-Down is almost poetic GZ, I feel almost humiliated on behalf of the recipient.

I for one am massively fed up with the pronouncements that CERA produce. They make being wrong into some kind of art form and have the brass neck to continually ignore their on-going predictive failures. Post 2012 (my own specific time point beyond which the s___ will have hit the fan) I believe CERA will be seen as almost having had criminal intent in their inaccuracy.

andyh said,

"That Put-Down is almost poetic GZ, I feel almost humiliated on behalf of the recipient."

Now, now, don't feel too sorry for the "recipient". Almost anyone who has displayed the intellectual fortitude to dare and question the holy writ here at TOD has been the "recipient" of GZ's "poetic" put downs, with such scientific refutations as "reappear like a zit on the face of a teenager." Now who can argue with that level of rhetorical skill, I ask you?

Yet JD has contributed his little effort, and will cause those who are not yet prone to accept pronouncements as facts, but instead are still willing to ask, "how do you know?", are you certain you can prove that?", "can you compare one set of 'predictions' to another and prove one set more valid?" and "has this been seen before, and were mistaken conclusions drawn then?"

CERA seems to have a cluster of disciples that will accept the holy writ of CERA no matter what. As much as GZ may be off put by it, the readers and posters at TOD still retain a bit more intellectual independence that the "followers" of the CERA camp. And to use GZ's briliant rhetorical flourish, we will continue to reappear like a zit on the face of a teenager to strive to increase the rigor of the peak argument until is virtually airtight. It's close now. We want it even tighter.

RC

Most of us, I'm sure, would welcome the day when peak oil arguments are airtight. Unfortunately, we will probably have to wait about ten years until that is the case. Even then, there will probably be a few who are predicting oil production over the previous peak.

Unfortunately, decisions are being made, and policy is being made now which will determine what our society will look like in the future. What is a politician or a policy maker to do? I would suggest that it would be prudent to take an approach that plans for a case approaching the worst, as opposed to an approach which plans for the best, especially if that best is touted by the likes of CERA.

Even if CERA is correct, and who here is willing to bet on that being the case, it would be profitable and enhance security to invest in a more efficient, and less energy intense society.

You too are obfuscating. The discussion here is about CERA's failed prediction history. Are you going to deny that too even in the face of clear evidence to the contrary, Roger?

By the way, Roger, I keep waiting for KSA to flood the market and drop oil to $10 per barrel the way you used to predict. I haven't heard you issue that one lately, probably because it is so embarrassing that you would rather people forget you made it. And it's funny how JD forgets such failed predictions by people like yourself, or CERA's $38 per barrel oil prediction, for example.

Wonderful! I am thrilled at the prospect of you providing us with JD's many questions to CERA, XOM, etc.!! I can hardly wait! The fortitude for him to ask CERA, "Why are you always **so fucking wrong** on oil prices, etc? And how do you know what you know? You WILL be showing us your database, given how important this issue is to the survival of civilization!"

Right?

;)

Cheers

andyh: "I for one am massively fed up with the pronouncements that CERA produce. They make being wrong into some kind of art form..."

CERA is the Baghdad Bob of the oil crowd.

Jon.

CERA can only be deliberatly manipulating the oil prices with their constantly wrong predictions. They are probably not in the buisness of getting things right but keeping things stable.

I agree with you that just like the agencies who issued the AAA ratings to all sort of toxic crap and are only just now comming into the spotlight CERA wont have to answer on anything until after things realy start to screw up.

Grautr: Yes. In the financial economy, incompetence is always the fall back excuse whenever corruption appears.

Yeah, he's so Macho! Because that is what is important isn't it? Which set of chimps can beat their chest louder?

The slick media savvy and sound-bites are mastered by the likes of CERA, and unfortunately, when TOD strays from data analysis into this area, it just makes a fool of itself. Debates over who made the most wrong predictions, and who is a bona fide spokesman for Peak Oil, are particularly futile.

CERA is the Moodys of the oil world. They are paid by their big oil clients to keep nations hooked on gas.

Their AAA ratings for the future of oil production, will only be modified after the charade can no longer be maintained, in the face of real shortages.

The same conflict of interests, that fraudulently inflated valuations, and has lead to systemic financial failure, misleads with claims of abundance, and will undermine the worlds ability to mitigate a nett energy crash.

Kunstler's genius was to make the connection between Peak Oil and the End of Suburbia. The DVD by that name was built around an interview with JHK.

I have used the "Sixth Sense" analogy (some ghosts don't know they are dead and only see what they want to see). For most of us, the auto centric suburban way of life is dead, but most of us don't know it and we only see what we want to see. What Yergin, et al are doing is enabling most Americans to keep seeing only what they want to see.

We really don't have a choice. We are facing a relentless transformation from an economy focused on meeting wants to one focused on meeting needs, and Yergin, et al's pronouncements are serving to postpone this necessary transformation, thus making the transition all the more painful.

Yes. Well said. It's the corporate positive feedback loop that is the problem. CERA wants to make money. They don't 'see' that the externalities of their actions and comments are setting us up for a greater shock once events catch up. They are acting in their own self-interests, which I understand. Believe me, if it was CERA saying the end of cheap oil is over, and theoildrum asserting we have 'data' showing new highs in oil production for decades to come, I'm sure the media (mostly owned by corporations, and make money by advertising and subscriptions) would gravitate to what we write. But the content here is not profitable to the average readers current life (unless you trade oil futures or disinvest in the stock market), nor is it easy on the mental palate. But its a quest for the truth in a situation that has no precedent. Smart people will figure it out. Probably too late though.

Hmmm... which is more likely true:

CERA is to Peak Oil as ExxonMobile is to Climate Change.

CERA is to Peak Oil as Al Gore is to Climate Change.

CERA is to Peak Oil as Chicken Little is to skies falling.

CERA is to Peak Oil as Chicken Little's neighbors are to skies falling.

CERA is to Peak Oil as Noah was to The Flood.

CERA is to Peak Oil as rain was to The Flood.

Multiple answers acceptable.

Cheers

Hi Nate,

Thanks for this valuable article.

I like your question number 4 (to CERA) above, as it focuses on what "we" need to do, regardless of the effort to put the truth (as we see it) in front of them.

re: "They don't 'see' that the externalities of their actions and comments are setting us up for a greater shock once events catch up."

This is the real kicker.

This is also where the opportunity lies for perhaps some connection and collaboration.

Are there specifics you/we can propose as things they might be willing to sign on to?

The courts of every declining and collapsing kingdom have always been filled with well-regarded wise men, seers and prophets proclaiming that a miraculous turnaround in their fortunes was just around the corner - all the way up to the moment when the enemy smashed through their gates and commenced the final massacre.

Suburbia is alive and well. I don't fall for your ideas. I live in a country full of suburbia, and you know what? It all started well before people drove massively their cars to the city. It started with trains and buses.

People will just eventually car-pool and go with buses and trains. The end of Suburbia is a complete illusion. The resource wasted in "wasting" the housing and infrastructure of Suburbia is so much greater than any shortcomings of transport crisis that such ideas are just an intellectual pain in the ass to still hear these days. To where would people go instead? Sleep under bridges nearer to their jobs? Sleep in the gutters? Like hell. Kunstler has been wrong for decades, because he is so close-minded about his own agenda (which is to kill Suburbia), and just takes whatever doom bullshit and uses it as his weapon to spread his idea. He couldn't care less about the truth or half truth of Y2k, GW, Housing crisis, or PO, as long it is believable, scary enough and usable to his diatribes, let's go, full speed.

Of course, as a person said here about CERA, even a broken clock can go right twice a day. Perhaps Kunstler is right and some "day" we will see massive crisis in america, paralleling the depression of the thirties. But will it end the "end of suburbia"?

Where's the evidence? The study of it? In my opinion, it's not even wrong.

I'm sure that you would find some willing sellers if you want to buy into some prime auto dependent American suburban real estate.

Did I hear deal?

I'm looking for investors in my new suburban strip mall dipped donut and bare-ass bronzing drive-thru franchise chain. By offering group discounts - one ass per window - cashback on purchases of 50 or more donuts purchased with our web-exclusive credit card - , and by maintaining wal-smart pricing by employing our patent solar redirection panels (using proprietory technology involving nitrate of silver, ammonia and sand)for both the bronzing and boiling operations, we are assured that postpeak car pooled customers will flock to our franchised facilities. If Kunstler understood the free enterprise system, he'd have a different take on things. Contact me at PTBarnum@suckerpersixty.caca

Yes, you would surely find SELLERS and not BUYERS, which means that if everybody is to sell suburbia, who's gonna buy it? And if no one's gonna buy it, is the owner going to simply waste his house? Are the million of owners simply waste their homes?

Ridiculous.

If they can't afford to keep the house, owners will be forced out or just walk away. As an historical example of structures being abandoned despite the cost, look to castles. Technology and circumstances made them obsolete, so the owners abandoned them to the elements. A more recent example would be the ghost towns of the Southwest.

When circumstances change, people can and will move on despite what they've invested into their living place. Sometimes, the cost of staying is just too high.

Actually, Americana are abandoning expensive suburban homes in droves. A discussion of the phenomenon:

http://globaleconomicanalysis.blogspot.com/2008/02/moral-obligations-of-...

When food stops moving, I wouldn't want to live in a city for anything. I see riots and people eating their rhetorical young. NY city when cut off will be the 'horror' genre's peak entertainment. I place my money (and life) on a bet of rural community. Next up the food chain would be the suburbs the furtherest away from the 'city'.

Yeah, like in New Orleans when all the people at the Superdome were raping and murdering each-other... wait, no, that never happened, excitable journalists made it up.

FEAR the masses! Or, you know, maybe not.

Peak oil is not a zombie movie.

NYC is a Harbortown, bro.. and it's at the mouth of the Hudson, and the junction of some of America's most economically stable Rail-lines. Your disaster scenario might make a great Movie Poster, but the actual City could be a lot more supportable than you think.

Some might say they don't WANT to support a big stomach like NYC, but ask that to a Hudson Valley farmer or a Long Island fisherman.

Bob

True, at least the trains part. The doomed suburbs are not any that lie outside a town or city, its the ones where expending large amounts of energy are required for survival. I live in a former streetcar suburb. They typically had everything the residents needed within walking distance (usually on a small 'main-street'). For many jobs and cultural persuits you took the streetcar into the city. Some suburbs could be fixed perhaps, but many are physically just too messed up to easily be converted to walkable suburbs. On the other hand, they will have to make do so we may see some interesting adaptations.

you have to just use your imagination. nobody listens to the HOA people when peak oil really hits. suburban homes are bought for 25 cents on the dollar. those who are still in the neighborhood set up restaurants and stores in their living rooms because people don't want to drive. fewer cars make the suburbs more walkable. families plant a garden in the front and raise chickens and everything else in the back. empty homes are used to grow food. the power is out but I share my neighbors solar panels and pay him with eggs and food from my garden.

That's kind of what I meant by 'interesting adaptations'. But still there is the period before people realize there is a permanent paradigm shift that requires drastic changes to or ignoring of HOA rules, zoning laws, building codes etc. The degree of angst over that shift in thinking will likely vary quite a bit from area to area.

yes. we might be surprised to find out what areas adapt well and which don't.

My guess is those "empty homes" WILL be our new businesses: restaurants, stores, churches, bed-n-breakfast, fix-it shops, etc.

I'll betcha restaurants will do well, given the labor intensivness - but economies of scale - of food preparation. My guess is the "meal of the day" where the chef will prepare a large quantity of several items like stews which can be served all day long.

Neighbors will gather around these homes for socials instead of going to some Starbucks or nightclub ten miles away. I expect to see the kids mingling in the bedrooms converted to game rooms - and having a ball.

The rest of the still occupied houses is where to get some sleep.

In a way, I look forward to it. I hope they don't serve alcohol in the neighborhoods.

Every experience I have had with that stuff has had bad endings.

Agree, there's a big difference between a streetcar suburb (8 to 15 housing units per acre) and automobile-based suburbs (1 to 4 units per acre). The former make much better use of land, reduce energy consumption, allow for a sense of community and keep mostly everything needed within walking distance. At least everything was within walking distance in these streetcar suburbs before the Walmartization of America, and hopefully someday this will be true again. I live in an old, small city of about 15000 that is still very walkable. Until WWII we had several streetcar lines as well as interurban lines. As recently as 60 years ago all children walked to school, almost all adults walked or took the streetcar to work and no one lived more than a mile and a half from downtown.

For anyone interested in the topic of urban vs. streetcar suburb vs. automobile suburbs, I'd recommend a book called "Crabgrass Frontier" by Kenneth Jackson.

US 26 barrels of oil per capita.

6.3 billion x 26 barrels = 163,800,000,000 barrels a year.

Remaining endowment: 1 - 4 trillion (all types and possibilites).

Time to total consumption: 6.1 to 24.4 years.

You're right. No problem.

"US 26 barrels of oil per capita.

6.3 billion x 26 barrels = 163,800,000,000 barrels a year.

Remaining endowment: 1 - 4 trillion (all types and possibilites).

Time to total consumption: 6.1 to 24.4 years.

You're right. No problem."

CCPO, that is a fantastic way to put it for illustrative purposes. The world uses 4.76 bbl/person/year. The most likely remaining reserves is 1 trillion meaning that we have 33 years. But, R/P is not the way to calculate when problems come. Problems come when production rates decline.

Illustrative, it was. Of an entire world like the U.S., it was. Your point understood and agreed with, it is. Props given, appreciated they are.

Cheers

Luisdias - I live in North County San diego and I am a Real estate Broker here (and I also have a license in Nevada and I own property there as well). In San Diego county we have seen drops in real values of homes over the last two years of 20 to 30%. In Las Vegas one in 20 homes are in foreclosure. The affordability index in San Diego is less than 8%.

People are not moving into dumpsters or under the freeway impasses but they are moving into the cities in mass numbers, buying up small condos and getting rid of a lot of "pack rat" garage clutter. The garage sales are truly amazing, showing that people in large are deciding to downsize for financial as well as practical reasons. Having more "keep up with the jones" stuff is so "not happening".

There is a recent article in the Atlantic Monthly detailing what the lifestyle wants of the new Gen-xer's are and the suburban model is out of fashion. What young people are looking for in Real Estate is places where they can catch a train to a job, walk to the movies or dinner and live in a upbeat cosmopolitan area. The sales in downtown areas and "walkable communities" are picking up while the areas in Poway and Escondido are being abandoned and the inventories continue to grow.

Who wants to live in a McMansion? is what you need to be asking rather than debating the sustainablilty of suburban estates. In Southern CA even the auctions for these "boxes" are generating very little interest. I daresay that 25 years from now we will be plowing a lot of these poorly thought out communities under.

I'm sorry that you might be upset because the loss in value has hurt you or people you know personally but guess what? We all bought into it.

But in the long run you really have to take a deep sigh and say:

Good riddance!

I would call that Kunstler's obsession, not genius.

He made much the same arguments about Y2K that he's making about peak oil; based on that, it seems likely that he has a pre-determined conclusion (suburbia will end) that he's trying desperately to find a rationale for.

It's like he's got a three step plan:

The details of step #2 are irrelevant so long as they let him plausibly argue his way to the conclusion he wants to reach. Y2K turned out to be a non-issue, so he latched onto something that would make his conclusion make sense. If peak oil turns out to be a non-issue, I'd bet he'll rapidly latch onto the next "crisis" as the "real" reason that suburbia is doomed.

It might be doomed. Peak oil might be the thing that dooms it. But Kunstler's arguments are too circular to be taken as any kind of support for that proposition.

Considering the rapidly increasing level of investment in oil (e.g., oil sands) and alternatives (e.g., wind, solar, batteries, electric cars), I'm not convinced that CERA's word carries an enormous amount of weight. I daresay the companies pouring tens of billions into the oil sands over the last several years didn't pay much attention to "oil prices will be in high 20s to low 30s through 2005".

You're quite right that they haven't done a good job predicting prices the last few years, no question about that; the question is whether their errors are actually causing substantial harm, or whether they're just as much background noise as, say, Pickens' errors, or even the errors here regarding a Nosedive Towards the Desert.

Basically, if nobody's paying much attention to him, I don't see why it's worth our time or stress to do so either.

It's interesting to see how the auto, housing and finance industries have fared since "End of Suburbia: Oil Depletion & the Collapse of the American Dream" came out, versus skyrocketing food & energy prices.

I was going to say the same thing. We have thousands of acres of suburbia in Vegas right now that are sitting completely empty. The prices for these houses are down 44% year over year (http://www.realtor.org/Research.nsf/files/STATES.pdf/$FILE/STATES.pdf).

The "garden suburbs" luisdias is talking about were developed around commuter train routes. The new suburbs were plunked down all over the place. There is no way to organize a viable system of commuter train routes for this mess in a time of increasing energy scarcity.

If you're living in one of the older garden suburbs built early in this century, you're probably okay. If you're living in one of the more recent plunked-down suburbs, things don't look so good.

things don't look good right now. 5 years or 10 years may be a different story.

"things don't look good right now. 5 years or 10 years may be a different story."

agreed - they will probably look a lot worse

The end of suburbia is a moot point, when the end of coastal cities is a forgone conclusion.

I've read probably a dozen books on climate change and the latest (With Speed and Violence, Why Scientists Fear Tipping Points In Climate Change: Fred Pearce 2007) has scared me the most.

There is so much I didn't realize about, frozen tundra, the Amazon, Borneo and the release of methane.

It's not that it might happen, it's happening now. Really I should say I was aware of the stored greenhouse gasses, I just didn't believe that the process of decay had already begun.

We are already heading down the slide.......and gathering speed.

Worrying about how much fossil fuel there is left to burn is not a concern, when compared with the many billions of tons of co2 and methane just waiting for more thawing and drought.

Reading this http://www.aip.org/history/climate/rapid.htm would have saved you the price of the book!

;)

Cheers

I live a couple of miles from the Pacific Ocean. But since mountains come out near to the coast I'd still be above water if the polar ice caps melted. What, me worry?

"Always look on the bright side of life" - Monty Python, Life of Brian.

Stratospheric sulphate particulates can compensate for global warming very cheaply and work quickly. There's a bunch of serious drawbacks, but if global warming turns out to be worse than expected we almost certainly will do it.

Things look great for prospective buyers.

Look, the declining real estate prices are not a crisis. When prices fall that is good for buyers. You can take the position of putting the interests of current owners first. But speaking as a non-owner this all sounds very good indeed.

I'm waiting for a mansion to cost $100k. Can we count on the news to get that "bad"? I hope so.

Unless there's a depression and the buyers have not much money because of job losses...

"Mansion! Only $100k!"

"Yes but I only earn $7k at Burger King..."

In Colorado, there was a guy with no income who bought and flipped three houses from freaking prison. America. What a great country.

The pundits and politicians tend to focus on the millions of homeowners who are being foreclosed upon and will have to move. It is proposed that we give them a grace period to work their financial problems out, as if they were United Airlines, or something. They are not going to work their problems out because they had a problem before they bought the house and will continue to have a problem, that problem being insufficient income.

The real crisis as perceived by the powers that be is that wealthy individuals in the financial community are being hurt by this and the problem has filtered over into the stock market.

For quite awhile now, many of us have wondered how house prices can be so high given the incomes in the communities in which these prices are high. The income to house price ratio simply does not compute and those outside the market simply have had no prayer of getting in the market. Well, as we have found out, those with insufficient incomes' prayers were answered by no income required subprime loans which defied all previous tenets of fiscal prudence.

Those who still cannot afford houses or refuse to get into a high debt to income situation will benefit if house prices come down to a level which they can afford. Those who are staying in cash and not in stocks will also benefit as this crisis further causes the deterioration of the stock market. There will be many losers but also some winners in the guise of those who want to buy a house in heretofore ridiculous markets like California.

But, do we simply prolong this crisis and perhaps make it even worse by continuing to pretend that we can make it possible for people to afford houses they had no business buying in the first place? Yes, there will be suffering. But aren't those currently outside the market suffering a bit by the fact that they cannot afford a house even with a median or higher income.

I still see real estate shows on TV where young couples are buying $500,000 houses without a clue as to how they will meet their zero down loans where they have two loans, one of which is to pay the down payment. I wonder how shiny and happy their faces will be in a few years where they find out they simply cannot go one paying their two mortgages.

I have always bought way less house than I can afford because of simple financial prudence. No doubt there are many who have been scammed but I have to believe that many of these people knew exactly what they were doing and chose to roll the dice. Some got lucky and had their incomes increase; others weren't so lucky.

The sooner we let this whole thing play out, the sooner we can get back to a rational, maybe even a more affordable real estate market. And, what is wrong with that?

The problem is that the "rapidly increasing level of investment" is not increasing at anywhere near the rate that the problem is increasing.

From 2005 to 2006 we added about 5% in renewable energy to our overall electricity production (http://www.eia.doe.gov/cneaf/solar.renewables/page/prelim_trends/rea_pre...). (I'm not counting biofuels as renewable, because I consider them basically a conversion of oil into another form without significant gain.) But that's 5% of a dinky amount, which means we added roughly 0.2% in renewables in terms of our overall energy needs. (We did virtually nothing to increase the energy efficiency of our transportation system.)

So, we have oil production declining at a minimum of about a 2% rate, and we have renewables increasing at roughly a 0.2% rate (and that is an optimistic figure--I think it's significantly less than that in reality).

Now we're trying to increase our investment in alternative energy at a time when we have much less energy to do so. The reason we're in this sorry state is, as Nate correctly points out, because of the influence of the bad predictions of organizations like the IHS and CERA.

Kunstler actually quotes Daniel Yergin extensively in The Long Emergency and gives Yergin credit where it is due.

CERA is funded by the oil business and it may be that CERA doesn't need to be right about oil prices, just right enough.

Not sure at what price oil sands become profitable but maybe low 30s from CERA was a strong enough signal to invest anyway. CERA may be ultra conservative on price which gives oil companies a margin of comfort.

On Kunstlers efforts to kill suburbia, I fail to see some sort of deluded conspiracy on his part. I work in real estate and I can gurantee you that towns with streets laid out pre automobiles are far more highly valued than tract suburban lots. The markets speaks pretty loudly. What is amazing is why developers and planning authorities only produce the crap that people don't want and refuse to build anymore of the 'old' style towns that peopale actually want to live in.

Kunstler is a social critic who is not content to stay within some narrow confine of journalistic constraints imposed by labels and qualifications. I have found his books, if not his blogs, well researched and considered, drawing in all the threads together and weaving the cloth to suit his message that I believe he has come to through his own journey of discovery, much like any of us here at TOD.

I would hardly call the end of suburbia a circular argument. Rather I think it is quite linear. Rise and Fall of the Suburban Empire. Not sure what his Y2K argument is but if you have some links to old quotes of his I'd be very interested.

BTW Y2K should be seen as a model for preparing for a coming, known event. The potential ramifications were indefinable but scary enough to prompt action on a large scale. The trigger point weas very well defined by nature. The preparation was huge and because many of the critical systems had been fixed years before, nothing happened when the trigger point came. But Y2K was never going to end suburbia (unless the nukes escaped). A right proper clusterfuck could have occurred if power went down for any significant period but that was recoverable, eventually. Peak Oil has no recovery and will not be a sudden, anticipated and well bookended emergency. It will be the Long Emergency that Kunstler has coined and it will kill the car suburbs very slowly but inexorably.

his genius was to move from Y2k to peak oil.

I personally did a lot of work to make sure Y2k wasn't a disaster - the reason things mostly continued to work was because we took hugely expensive remedial action.

There is little evidence that simmilar things are happening with regard to peak oil, and even less with Anthropogenic Dangerous Climate Change - CERA (just for one)is predicting massively more CO2, not less, it seems climate change is not a consideration as we must have growth!

Too true about Y2K. In the 18-24 months leading up to it it was the top priority for virtually every sizeable IT dept (I was working in IT for a major Oil Industry supply company at the time). Two years prior to Y2K most major companies systems really were nowhere near in shape to handle the transition but senior management understood just in time and virtually unlimited budgets were allocated to solve the problem. I wish I could say the same was happening with Peak Oil.

It is true that a lot of companies spent a lot of money on Y2K work, which was a bonanza for the IT industry and highly paid freelancers such as myself. However, a lot of that work was probably not necessary, given that some companies, and some countries, spent next to no money on Y2K and suffered no ill-effects. I think most of the "we prevented Y2k!" is merely self-justification by the IT sector.

Sure Y2k caused some bugs, but IT departments deal with dozens of bugs every week. There has never been an IT system without some bugs which the users workaround.

Certainly all the talk about embedded systems crashing (e.g traffic lights) was pure BS, I knew because I work in embedded systems. 95% of the Y2K scare was hype.

First off, I believe you are correct about embedded systems - they were the least of our problems. But do you honestly believe that Fortune 100 companies embarked on major upgrades blind? We knew exactly what we needed to fix and exactly what would happen if we didn't - simply because we tested and found things badly broken in many places. Where they weren't badly broken we often found that underlying software (databases mainly) could not be certified for Y2K and we couldn't take a chance (in one case the database ran fine but the backup/restore functions were broken post 2000). Yes there was a lot of small businesses conned into upgrading simple systems which were perfectly ok but that was most certainly not the case with large, complex and (mostly) ageing MRP/ERP business systems running most of the world's production.

Having worked in an IT department in a University, I can say that the amount of work invested in Y2K was justified. However, the media hype around ATM's spouting money and traffic lights going haywire was just that: media hype. To my knowledge no one in the IT industry said anything like that. Then, on 1/1/00, the media was disappointed that they didn't get their 100pt apocalyptic headline. Of course, then we got to hear about 'those IT people and their non event.'

Those who can, do. Those who can't, propagandize.

Jon.

Wrong, GZ. That's just wrong. This post is an attempt of a rebbutal to CERA's claims that "Peak oilers" don't have the data to support their analysis. Surprisingly enough, they aren't lying. I am still to see a comprehensive data report about the state of oil fields around the world, and the real failures and incapacities of TOD (despite some amnesia that seems to be spreading below JD's repply), where South Arabia doom-porn cliffing event were almost a settled truth, just to give a small example, are the direct result of the absence of such data.

I am not here to bash TOD. Given the small ammount of data available, I've seen incredible mathematical effort to try to understand and fill the huge data gaps. But this is an handicap and a correct criticism of Peak Oilers (Not only TOD, as some people suggested) by CERA.

Of course, it's all too easy to just repply:

Are you fooking joking with us, CERA? You, the utter failure are pin-pointing PO's handicaps?!?

But then again, isn't it all just politics? CERA is only a facade of society's cornucopianism. They will never tell the bad news, and they will always FUD the non-believers of their faith (it is a faith, they never tell us the evidences, we have to believe in them, cause you know, they have white suits and glasses, doesn't that count?) until, of course, the cartel decides to give up the game and just confess to us all their shortcomings.

Luis: One can criticize TOD for a doom-like tone, but the oil supply forecasts have been outstanding overall. I would hate to be your money manager if you feel that TOD has been incompetent in forecasting oil supply.

The oil supply forecasts?!? *What* oil *forecasts*? I only get to see reports, not *forecasts". It is too early to tell if the long-time forecasts are right or not. And like Campbell says, you only know it with precision in hindsight, which, btw, doesn't count as a "forecast". And if the oil megaprojects that are scheduled to come on stream do come on stream, we will hit new records of oil production.

Which puts an end to all the thousands of posts and comments concerning we-are-already-past-the-peak euphoria.

The only problem I see at it, is that it will only be put to rest until the next euphoria.

Funny, it reminds me a bit about the cyclical bubble and bust of capitalist societies.

Whatever.

Ah, so now those "scenarios" which happened to turn out close to the mark are now claimed as "forecasts".

Are we claiming TOD writers or other Peak Oil advocates are 100% correct? No. Because we understand that the data available is incomplete and sometimes incorrect (and obviously personal biases play a part in everyone's view of the world). CERA can point to the fact the some PO predictions have been wrong all they like. It is just obfuscation - misleading, pure-and-simple - considering PO advocates, on the whole, predict reality more closely than organisations like CERA and EXXON.

In jumping off the top of the mountain of peak oil, part of the problem is the way the prediction is stated. "We will hit the ground in 2 minutes."

Three minutes later, we're still sailing through the air. "See, you doomers! You were wrong, everything's peachy!"

The prediction is not that we will hit the ground at a certain time, the prediction is that we will hit the ground, period.

We don't need to know exactly when the blizzard hits next winter to start chopping wood now. We don't need to know exactly when we will get hungry to plant or buy food now. We don't need to know exactly when we will get thirsty to dig a well now.

The problem comes from the illusory belief that we will never hit the ground, and this is somehow acceptable.

But if someone were to say that we will never be cold, thirsty, or hungry, we would readily classify them as deeply disturbed or dysfunctionally neurotic.

We tend to be awed by a narcissistic fascination of our accomplishments that leads us to believe in immortality of the system that produces these works, our current system of civilization.

It was well put by someone here on TOD - I wish I could remember who - when they said, "if your doctor told you that continuing to drink booze and eat burgers would kill you, would you refuse to believe him unless he could give you the exact date of the heart attack?"

I would certainly demand some information. After all, no one lives forever. If the probable date were so far in the future that I would be certain to be dead of something else anyhow, then it might possibly be more productive to worry about that something else instead.

After all, if I panicked every time yet another hyperventilating yellow journalist breathlessly quoted yet another fearmonger with a "precautionary" ax to grind, there'd be absolutely zero time in which simply to live life. You use a medical metaphor, so, for example, the endless parade of statistically insignificant "studies" claiming coffee is bad for you, no it's not, yes it is, just makes the eyes roll. It boggles the mind how many people, even professionals, are supremely cocksure on opposite sides of a great variety of subjects, on the basis of nothing more than half a standard deviation of nearly pure noise. Like it or not, the skepticism that sort of thing invites is the societal background against which energy discussions occur.

While some have predicted peak oil too soon, it is clear from my chart that CERA hasn't figured out that the game has changed in the energy markets. If I had listened to Yergin and cronies, I would have missed a very nice investment opportunity. But it is the why energy has been such an investment opportunity that is the important issue. Basically things which become scarce in relation to demand see their prices go up. Yergin and cronies seems not to understand this fundamental fact.

I am glad they don't have much to do with coal. I made a big coal investment about a year ago. A couple of days ago the Wall Street Journal had an interesting article on the impact CHina is about to have on coal. It too is now getting scarce in relation to demand. Some coal company stocks were up 7% yesterday. All of this shows that the game has changed in the energy markets. Yergin and cronies are still diddling in the 1990s.

And because of their influence on governmental policies and the huge downside risk if they are wrong, they should have a wee bit less hubris about their abilities. This is especially true in light of their past record

Note that China, faced with a sudden increase in domestic demand for coal, did the same thing that Iran did to Turkey (regarding natural gas)--the middle finger salute to energy importers, which caused coal prices to spike, i.e., it caused importers to bid for declining coal exports. The irony of course is that China is a huge oil importer.

Your sequence is wrong. It was Turkmenistan that gave Iran the middle finger first and Iran had no spare capacity of its own to feed to Turkey where the Turkmen gas was directed to in the first place. Focusing on Iran as if it was the instigator smacks of neocon propaganda (not that you are guilty of it).

Of course, as you go down the line, Turkey cut off gas exports to Greece.

Regardless of country or ideology, food and energy exporters tend to look after the home team first. Do you want to cut off food and energy from the guy across the street from you, or from the guy 5,000 miles away?

Whether or not the subject is coal or oil, it is in the interests of the oil and coal companies to continue business as usual. As long as coal or oil are perceived as plentiful for the foreseeable (what a joke) future, the defenders of the status quo will always argue that we should not be alarmed and there is no urgency is transferring our capital away from fossil fuels into renewables. This is the same reason why it is in the interest of the Saudis to continue to argue that they and OPEC can ramp up production when they feel it is necessary.

If somone has been shown to be consistently wrong and it is in their interest to distort the future, then we should be highly suspicious of their analysis.

When I was a director of technology for a mid-sized oil company I took a hard look at alterntive energy. It simply wasn't going to work until AFTER oil prices rise through the roof. Even today, I am looking for renewable energy for my ranch. To generate 1/4 of the electrical needs of a modern home, I would need to invest between $50-70,000 for solar. Wind is far more respectable at $15k. Price is the ultimate moderator of what people will do. When renewables are cheaper, everyone will do renewables. Until then, they will do oil.

It simply wasn't going to work until AFTER oil prices rise through the roof.

And the problem there, Glenn, is the receding horizons issue. At today’s price, alternative energy looks good at X + $30 (or whatever). But X is a moving target, and thus the break even for alternative energy (or GTL or CTL) is as well.

If someone built a GTL plant 10 years ago when oil prices were very low (but also labor, equipment, etc. was much lower) then they looked stupid. But they are probably making money now, because they locked in most of their investment at, say $20/bbl. Once oil rose above $50, they were making money. If an energy company knew for certain that oil prices over the next 5 years would average $150 or so, they would make a lot of investments they aren’t currently making.

You are absolutely correct about the receding horizon. My father was a reservoir engineer in the oil business. I remember him saying that if oil would get to $4/bbl oil shale would be profitable. The horizon has constantly receded.