Perception Management -- CERA and IHS Energy

Posted by Dave Cohen on August 12, 2006 - 7:46pm

[editor's note, by Dave Cohen] This is Part 1 of what I hope will be a 2 part series. The second installment is tentatively titled Getting to Know Daniel Yergin. Enjoy and remember what's at stake.

Yet another recent CERA press release World Oil & Liquids Production Capacity to Grow Significantly through At Least 2015 denies that peak oil is a concern.

Based on the report's extensive field-by-field analysis, [Peter] Jackson and [Robert] Esser conclude that the data reinforce CERA's view that the specter of "peak oil" is not imminent, nor is the start of an "undulating plateau" pattern of supply capacity.This latest cornucopian summary has been commented upon here at TOD and criticized directly by Kjell Aleklett, President of ASPO in CERA's report is over-optimistic courtesy of the Energy Bulletin.

This story's aim is to investigate the CERA method, provide background for these latest statements and round out Aleklett's critique. The view here is that CERA, which is wholly owned by IHS Energy, is misleading the public and our elected representatives. These two organizations are managing perceptions as they cast aspersions on the peak oil view of reality and present misleading or incomplete analysis to the media.

These half-truths have gone on long enough. A bit more in-depth analysis is required to reveal this charade for what it is. Our future energy need is put in ever greater jeopardy the longer the world waits to mitigate the crisis. One step toward changing perceptions to create a call to action is to refute deceptions, whether they are intentional or not.

A Note on the Latest Press Release

TOD contributor Khebab recently posted this graph.

Figure 1 -- Click to Enlarge

From the latest CERA press release.

CERA's examination of actual activity and production data covered existing fields and 360 new projects -- 250 new non-OPEC and 110 new OPEC development projects -- expected to start production by 2010. The analysis points to global productive capacity rising from 88.7 mbd in 2006 to 110 mbd in 2015 (Figure 1). CERA's "reference case" analysis projects strong potential growth in both the OPEC (7.6 mbd) and non-OPEC (5.7 mbd) sectors to 2010, with continued expansion of OPEC capacity by 5.3 mbd between 2010 and 2015. Non-OPEC growth is projected to be 2.7 mbd in the 2010 to 2015 time frame, lower than recent high expansion rates.It is easy to ridicule the 88.7/mbd number until one realizes that CERA is talking about productive capacity, not actual production. In a recent TOD comment, sunshine said

think CERA is doing something like this:in response to some comments by the author. Only a slight correction is necessary. According to the EIA, the Saudi spare capacity is estimated at somewhere between 1.3/mbd and 1.8/mbd. The term productive capacity is defined by the EIA link just above as84.4 (EIA) + 2.3 (disruptions) + 2.0 (Saudi spare capacity)

= 88.7 total current capacity

"Capacity" refers to maximum sustainable production capacity, defined as the maximum amount of production that: 1) could be brought online within a period of 30 days; and 2) sustained for at least 90 days.The small correction is this: 84.4/mbd (actual) + 2.5/mbd (disrupted, includes Prudhoe Bay) + 1.8 (maximum Saudi spare capacity) = 88.7/mbd. Why is CERA talking about capacity and not production? Never make something more complicated than it is. The main reason is so they can inflate the numbers. Note the use of the high-end Saudi spare capacity number. Do readers think that NPR's Robert Siegel, talking with Daniel Yergin, knows what production capacity is? No, of course not. Only aficionados will know the difference, not members of Congress, the media or the public.

However, there is a deeper reason. CERA uses at least two scenarios, a baseline "reference" case using capacity as presented in the press release and a "above-the-ground disruption" case which pertains in the real world. This latter also includes production delays for new fields or insufficient investment by IOCs or NOCs who should be but are not producing as much as they could (cf. many OPEC countries, Russia). Disruptions are presumably mostly accounted for by the troubles in Iraq and Nigeria. Could lost Iraqi production, for example, be brought onstream within a month and sustained for 3 months? Almost certainly not, even if "peace" should break out instead of incipient civil war. The EIA (link above) lists the OPEC 10 and separately, Iraq. What is Iraq's surplus capacity? It is zero just like that of every other OPEC country except Saudi Arabia. At this point, even the CERA "reference" case makes no sense. What do they mean by productive capacity?

By switching back and forth between these scenarios, CERA can "explain" tightness in the supply market and current high prices while simultaneously saying that production is not the problem. It is possible to have your cake and eat it too. As Aleklett discusses, this game can be projected into the future.

Figure 2 -- Click to Enlarge

Please read Aleklett's critique. It is certainly ironic, if not outright contradictory, that CERA employs a bottom-up analysis using the IHS database but ignores the current daily flow rates (all liquids) in their latest press release. The whole point of such databases (also see Skrebowski's Megaprojects) is to calculate such flows given a depletion rate—here, 5%—, new supply coming onstream and perhaps a disruption fudge factor. Speaking of the IHS database, let us now turn to that part of this analysis.

Robert Esser Testifies Before the House

There is a misperception, even among some of those who take peak oil seriously, that Daniel Yergin is the most important figure in the debate. He is a prominent person, especially in the media, but behind Yergin are two geologists, Peter Jackson and Robert Esser.With a combined 70 years of experience in the oil fields, report authors Robert Esser and Peter Jackson bring extensive knowledge of petroleum geology to this study. Trained as geologists, both spent many years in the oil industry, analyzing projects, drilling oil wells, and conducting geological studies before coming to CERA.

Jackson (left) and Esser

It is illuminating to focus on Esser's testimony before the House Energy and Air Quality Subcommitee in December of 2005. PG wrote up a summary at the time. Here's the part which will be examined.

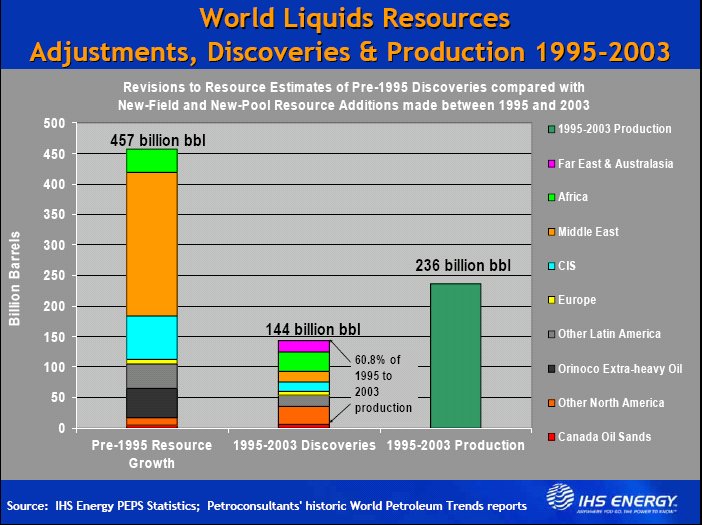

The Committee has asked us to address the question of Peak Oil. In our view, this is not a very helpful concept, nor one that provides much descriptive power. Rather than an imminent "peak," we envision an "undulating plateau" two to four decades away....Where do the numbers come from in the bolded text? Behind Jackson and Esser is the IHS database. The 236 Gb of oil produced and consumed in the 1995 - 2003 period as well as the 144 Gb discovered appear in IHS Energy presentations. Look at this graphic from Pete Stark of IHS entitled Role of Mature Fields in Meeting the Global O&G Supply Problem (pdf).Canada. Major expansion is expected. The main story is the oil sands projects, where capacity is expected to increase from 1.2 mbd in 2005 to 2.4 mbd by 2010 and 3.4 mbd by 2015. Conventional crude capacity of 2.3 mbd will decline to 1.9 mbd by 2015.

The question of a worldwide peak in oil production continues to stimulate debate. Our outlook shows no evidence of a peak in worldwide oil production before 2020. It is true that total annual global production has not been replaced by exploration success in recent years, but production has been more than replaced by exploration plus field reserve upgrades. In 1995-2003 global production of 236 billion barrels was more than compensated by exploration success and field upgrades that collectively added 144 billion barrels and up to 175 billion barrels, respectively. Although oil is a finite resource, we still do not have an exact estimate of total reserves; meanwhile global resources should continue to expand. Many basins, even those producing significant volumes of oil, remain underexplored.

Figure 3 -- Click to Enlarge

As the slide reveals, the discoveries comprised only 60.8% of what was produced and consumed during the period. Nevertheless, Esser is able to reassure the House subcommittee that there was indeed a surplus of new oil. As he puts it: "Our views about the peak oil debate have been reinforced by a detailed new audit of our own analysis and also further evidence that has come to light concerning the enormous scale of field reserve upgrades of existing fields". Specifically, he is referring to the "at least 175 [Gb]" of field reserves upgrades.

Where does the 175 Gb number come from? No doubt some of you have guessed the likely answer because in 2002, the Oil & Gas Journal recognized the tar sands of Canada as reserves (pdf) and these were "booked" by OGJ as reserves in 2003.

In 2002, the Oil & Gas Journal accepted Canada's classification of 174 billion barrels of oil sands as established reserves and Canada became the second largest oil reserve-holding nation in the world after Saudi Arabia.To be exact, the reserves increase was 174.4 Gb. This rough equality seems to be more than happenstance. It is easy to contend that Esser's testimony is misleading, perhaps even deceptive, accounting on a number of grounds. Intentions are not considered here because they can not be known.

- There is the troubled status of the tar sands production itself, as the author has pointed out in Extreme Production Measures regarding economic and logistical problems in Alberta. Another story focusing on natural gas usage there was documented in Oh, Canada! -- Natural Gas and the Future of Tar Sands Production . Many other editors, contributors and commenters at TOD have added to our knowledge describing the problems at the tar sands. Although Esser is testifying at the end of 2005 whereas some tar sands problems arose only this year, one must ask where the realism of his assessment lies.

- The 175 Gb figure is cited without specifying the source. How could House committee members know the origin of the number?

- More misleading information involves the use of the 1995 - 2003 period, which appears to have been cherry picked to include the tar sands reserves increases—although the testimony was given on December 7th of 2005, Pearl Harbor Day.

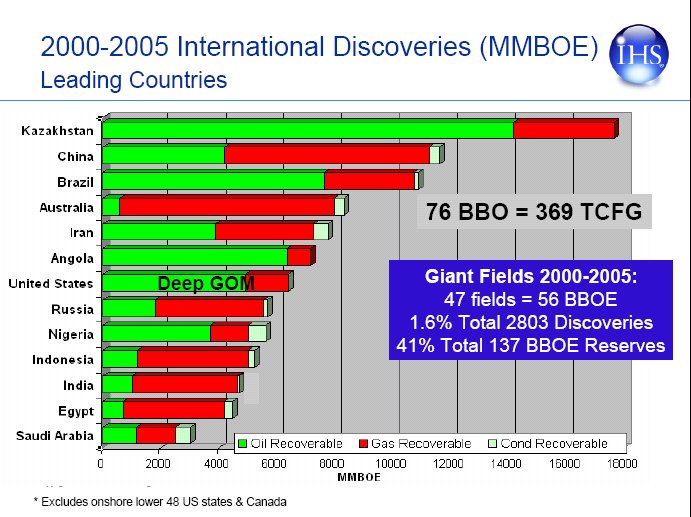

What was not shown was this graphic from this presentation New Frontiers -Where will Tomorrow's Oil & Gas Come From? (pdf) by Tim Zoba, IHS director of business development.

Figure 4 -- Click to Enlarge

According to Figure 4, less than 50 Gb of recoverable liquids were discovered in the 2001 - 2005 period (excluding onshore lower 48 & Canada). Figure 5 below lists the leading countries where discoveries were made but includes the year 2000 as well, thus including the biggest discovery of the last 6 years—Kashagan in Kazakhstan. The cited total is 76 Gb discovered.

Figure 5 -- Click to Enlarge

Using the EIA supply data, the amount of liquids produced between 2001 and 2005 inclusive was approximately 146 Gb. Astonishingly, when the 2000 production is added in, the tally becomes 175 Gb—the same amount as the entire OGJ tar sands reserves endowment all used up in 6 years! Perhaps one of us at TOD ought to testify before the House energy subcommittee.

CERA's Perception Management

This story has touched on a number of aspects of what was termed perception management. Instances of CERA promulgating misleading information have been documented above. Perhaps the most important problem, however, is cited by Aleklett.On August 8, 2006, CERA (Cambridge Energy Research Associates) released a new private report with the title "Expansion Set to Continue - Global Liquids Capacity to 2015". "Private report" means that CERA expects you to purchase the report for $2,500. The data files used in the report are also "private" rather than being audited or refereed like the data in normal scientific articles....In fact, the real debate ought to be whether it is worth the paper it is printed on. Lack of data transparency for oil production is one of the most serious problems in the oil industry. CERA offers their version of "transparency"—for a price. This privatization of E&P data based on the IHS database is understandable from a business point of view; to be sure, CERA is a corporation supporting a staff of about 250 people responsible for putting out misleading information. Yet, the lack of transparency is also reprehensible due to what is at stake in the world today. Now, it appears that attacking those concerned about peak oil is part of the business plan.More things can be said about the report, but it is obvious that it is not worth $2,500....

Rock Hammer

The author's mark

We see much of the lost ground being made up by 2010, along with an increase of about 4 mbd in our global estimate by 2015, with the inclusion of GTLs in the outlook along with new discoveries and existing field reserve upgrades in non-OPEC areas

I assume CTL will be included the next time oil production doesn't meet their expectations.

"During 2000, unconventional liquids represented 16% of global capacity, and by 2006 this had grown to 24% of the total," they write. "We expect this strong growth to continue to over one-third of total global capacity (38%) by 2015, especially if E&P companies believe that the oil price will remain high."

88.7 mbpd - 24% = 67.4 mbpd. This is close to the ASPO estimate for regular oil for 2005. Anyone know if CERA is using the same definition of conventional liquids, i.e. total liquids minus tar sands, deep water and natural gas liquids?

This is the military-industrial-media complex, and everything they do is based on "perception management." If they are successful, they make trillons of dollars and control the world's pipelines.

Matt Simmons is a member of the Council on Foreign Relations. Care to comment on what that means, Don?

Mr. Simmons, if you read TOD, then consider this to be a public request to break completely with your own class interest by someone who is very much an admirer of yours apart from what I have just said. (Because in fact I truly believe that you DO care deeply about humanity.)

He has repeatedly denied this associated. He has "advised" the Bush campaign on energy, but he was not part of the secret task force.

Not that I'm that much of a Simmons fan, however. He keeps saying Iraq was about WMD. I admire his energy analysis, but I would not enjoy being in the same room as he.

Overall, Simmons' connections to the power elite and their foreign policy machinations remain decidedly murky - at least to myself, and probably to most other people who hail him for his almost unheard-of forthrightness on energy issues for someone of his social background.

I think that Peak Oil advocates have been too quick to give Simmons a "free pass" with regard to his murky connections to foreign policy machinations on this account, though. For Simmons truly to live up to the hero-status that he has unquestioningly been accorded within the Peak-Oil crowd, he needs to divest himself of these morally compromising murky connections completely.

What is more damning of Yergin is his continued media prominence considering his track record. In the free market for subscription investment newsletters, economic feedback is swift and merciless. Investment gurus who repeatedly influence subscribers to lose money end up losing subscribers and going broke. Yergin has been disasterously wrong for years. Anyone who followed his advice is broke already. Yet Yergin has not vanished into oblivion, his star keeps rising. Therefore his paymasters are happy. Simmons has avered that CERA is employed by KSA. Yergin is a paid propagandist, and good at his job. Yergin's job is to baffle the masses with bullshit.

Excellent points! Dave, excellent keypost! As an increasingly upset taxpayer--I sure wish you could testify to Congress to offset CERA's misinformative testimony.

Khebab's graph says it all in regards to Yergin & CERA!

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Don't waste your time testifying. Remember, it's the "military-industrial-congressional-media" complex.

I've been finding the whole concept of 4th generation warfare - between the global elite and the rest of us suckers - particularly explanatory of late. Warfare extends in depth throughout all of society. Think Lebanon.

There is no end to which the global corpos will not go, said a relatively conservative member of Maine's Fair Trade Commission recently.

"We" just are not doing a good enough job competing, that's how the corpos would frame it. And if we are not matching the Yergins appropriately, well, it sucks to be us. We lose.

Lifeboats - the global corpos will smash them. Unless we build community defenses and use the states (at least here in US) to protect the communities. But testifying doesn't cut it, because you leave the decision making in the hands of those who profit by smashing your lifeboat. Via the Commerce Clause in US Constitution, WTO or GATS. And we need to get much more creative about taking the offense - best defense is a good offense. You might want to debate Yergin on the facts, but he is only one of the many points of attack on the cultural front. There's economicfare, legalfare and real warfare. And borders don't matter, because it's not state vs state, but class vs class. Oh, now I'm depressed.

cfm

....and you guys accused me of being a "conspiracy theorist"!!!!

:-)

Roger Conner known to you as ThatsItImout

Bilderberg Group. Follow the link to Daniel Yergin.

Danny Boy!

A nice smile, don't you think? I'm not a conspiracy theory kind of person myself but some things are just too much fun! A kind of stooge, kiss-ass, brown-nose, toady, sycophant, self-serving kind of smile! Oh my -- that could be construed as some kind of personal attack but really it was merely my first impression upon seeing the photograph.... So well-adapted, socially successful, financially well off ... I hope he's happy! I know I am!

== Dave

I don't know dude. Can you really write a post like that without damaging the credibility of your analysis in the article at the top?

BTW, I'm by no means unfriendly to the project of PO awareness. I just don't think this sort of thing helps.

Who is doing the damage here? Yergin or me? I stand by my statements. I don't express opinions in TOD articles that I write -- I stick to the facts and reasoned analysis. But I also have an opinion. If that damages the credibility of what I wrote in the article in your view, so be it.

1. confusing "oil" with anything (gas, coal, oil sands, corn, etc) that can be made into oil or into the same products that oil can be made into,

2. exagerating the number of new drilling projects available for exploitation, the speed at which new oil projects can be brought on stream, and the maximum productivity of such projects, and

3. possibly forgetting to project decline rates for the new projects they projecting to come on stream. Remember, some of these projects, may emulate a number of recent smaller and deep offshore projects that rise and fall rapidly, so have limited lifetimes. CERA seems to project them all to come on stream and to be productive at the "platau" rate for the duration of the period being projected, which is clearly an exageration for some projects.

So the bottom line is not that CERA ignores geology. Rather it is that CERA simply exagerates future exploitation opportunities.

Our problem in this corner of the galaxy may be that we have too many Shadows but not enough Vogons. No wait, those were the hyperspacial bypass engineers with the really bad poetry. Got plenty of them.

It''s certainly nice to hear from you again, JD. I must have touched a nerve.

Arrogant? You don't know the half of it -- but Oh, my, go on! Flattery will get you nowhere.

I'm a relatively new kid on the block, but I've read some of your articles on your old site. I'm glad there are optimists like you in this debate. I like to hear from both sides so I can come to my own conclusions. I would enjoy seeing you post on this forum to present your views.

On that note, I don't find this analysis derogatory or a waste of time. Both sides are simply presenting their perception based on the facts. Obviously, Dave's perception of the facts is that peak oil is imminent and it will be a huge problem. I think that perception is based in honesty, and if so, don't you think that he is justified in his anger that Cera is looking at these facts and presenting them optimistically to our Congress? Is it not at least a reasonable inference that somebody with the extensive knowledge that Cera SHOULD have be pointing out the holes that Dave has just pointed out--like all the non exploratory reserve growth is simply booking the sands as reserves?

Cera's perception of the facts is obviously optimistic and that peak is a long way away and will be a plateau. We all have no idea if that perception is baseed in honesty, but assuming it is, I think they are entitled to take shots at people like Colin Campbell and Matt Simmons as chicken littles. Mike Lynch has certainly put together some pieces blasting the credibility of Mr. Campbell.

I think the analysis is far from a waste of time JD. It is simply peer review. Dave has found holes in their analysis and has exposed them. Maybe they could come back (or you) and expose the holes in Dave's analysis. These critiques are important--maybe Roscoe Bartlett could use this information (somebody ought to email it to him)to testify to Congress about why Cera might be wrong, and hopefully, Congress could do something that might be beneficial like increase wind tax credits, increase CAFE standards, commission some urban rail, whatever.

Where you are absolutely right, however, is that nobody really knows and only time will tell. I think we all know we all will be waiting and checking to see where it goes.

Congressman Bartlett:

I do not live in your voting district, however, I know that you are an avid supporter of alternative energy and understand the concept of peak oil. I am a citizen who has become aware of the challenges posed by peak oil and therefore wanted to forward information that I have become aware of.

Cambridge Energy Research Associates (CERA) recently testified before the House Energy and Air Quality Subcommitee on December 2005. CERA painted a very optimistic picture of future oil production growth.

Below is a link to a critique of that testimony and the most recent CERA report.

http://www.theoildrum.com/story/2006/8/12/114231/281

The Oil Drum is a website dedicated to the exploration of energy issues particularly peak oil. I have found the analysis there solid and worth reviewing. The linked story shows that many holes exist in CERA's optimistic predictions. I forward this to you in the hope that Congress can hear another side of the story.

Very truly yours,

That sounds very reasonable!

And if it turns out that CERA is wrong and we hit the wall like a ripe tomato, and the disaster that analysts like Hubbert, Simmons, Westexas, and my old geology professor from Toledo have been trying to awaken us to for years actually happens--then I expect people like Yergin--and you, JD--to be hanged by the neck until you're dead.

I'm a 1976 UT grad with an MS in Geology. That wouldn't be Dr. R would it?

rockdoc76

See this pdf for further.

Could have been a very interesting chat you and he had, did he say much about how he sees things now or how they will pan out?

He did not! I tried to gather if he had any predictions to make, but he wouldn't go there. The most he said was, (to paraphrase) "It would be interesting to have a crystal ball, to see if the population curve moves downward with the oil depletion curve."

I was a little shocked at how OVER peak oil he is. In fact, the Hirsch report is news to him. It felt odd for me, an English teacher, to be informing him of later developments of an issue he began studying decades ag! This is a man who knows both Campbell and Deffeyes, but doesn't keep up with the latest.

I repeat: he is over it. "I got very angry in the 80s that no one was listening to these warnings, then in the 90s I realized it's too late to do anything about it."

I want to reemphasize that Prof Hatfield is a delightful and engaging man. For the last half hour of our talk, he was more interested in learning what it's like to live in Maine!

One doesn't need a crystal ball to see that the population will almost certainly follow the oil depletion curve down if that begins within the next decade. We have left it too late to avoid it.

There also should be a discount applied to oil sands production because of the heavy energy content of of the required refining process, whether that energy source is NG or the process of using part of the bichethane itself to refine the sands into crude. So I am guessing that 1 barrel of oil sands reserves = about .7 barrels of light sweet. Maybe less. No doubt someone else here would have a better guess.

This is a double standard to require Dave to apologize when Yergin does not.

How is it a waste of time? If this group is putting out misleading information then it should be exposed.

Rather that insulting Dave perhaps you should detail where this analysis is wrong and CERA is correct. When I saw a 24% rise projected in GTL I scoffed a bit. That would be interesting and not a waste of time.

You are correct that future production will answer the questions however by then the world's population will be in real trouble due to lack of liquid fuels and Daniel Yergin's backers will have made enough money to retreat to their own Green Zones with their own private security forces. Do you think that you or I will get an invite?

He's called me a "peak oil dead ender", Richard Heinbger "just another poser", Julian Darley and Colin Campbell "greened up fascists" said The Oil Drum was "swirling down the drain of doom" (classic one btw) and now he's accussing others of being deragotory!? too funny.

The worst part is that he wants us to wait and see, in other words not to act until its too late. I wonder if JD has insurance, or if he also wants to wait and see if something happens to him.

http://www.youtube.com/watch?v=ahv3VdknyZ4

But some can't see it:

"All this was inspired by the principle - which is quite true in itself - that in the big lie there is always a certain force of credibility; because the broad masses of a nation are always more easily corrupted in the deeper strata of their emotional nature than consciously or voluntarily; and thus in the primitive simplicity of their minds they more readily fall victims to the big lie than the small lie, since they themselves often tell small lies in little matters but would be ashamed to resort to large-scale falsehoods. It would never come into their heads to fabricate colossal untruths, and they would not believe that others could have the impudence to distort the truth so infamously. Even though the facts which prove this to be so may be brought clearly to their minds, they will still doubt and waver and will continue to think that there may be some other explanation. For the grossly impudent lie always leaves traces behind it, even after it has been nailed down, a fact which is known to all expert liars in this world and to all who conspire together in the art of lying. These people know only too well how to use falsehood for the basest purposes."

~Adolf Hitler "Mon Kempf"

Enter Zogby stage left:

http://www.zogby.com/Soundbites/ReadClips.dbm?ID=13475

The Government's 9/11 Facade is Crumbling

First things first:

Any time two or more people are knowingly involved in the commission of a crime, there is, by definition, a conspiracy. This is not a theory, folks. It's a stone-cold, undeniable fact. So the real question about 9/11 is not whether there was a conspiracy, but indeed exactly who the conspirators are.

<<END SNIP>>

Crunch the numbers on that TOD...

==AC

But I have made this point: the idea that conspiracy theories are "nuts" because people "can't keep secrets" is a damned lie, an awful lie, a killing lie.

Anyone who thinks people can't keep secrets: post your sexual indiscretions on the web now.

I believe this perception comes from watergate. Nixon and his people could not keep secrets, and they seemed a lot smarter than the current administration.

Between 1968 and 1975 we

- Went off the gold standard.

- Withdrew from Vietnam.

- Made peace with China.

- Stopped supporting Israel during the 1973 war.

- Put in quotas for racial and sexual integration.

- Established the EPA.

- Accepted inflation to pay the cost of Vietnam instead of increasing taxes on poor people.

- Allowed real wages in America to increase dramatically.

- Subsidised lower middle class kids going to college.

- Increased welfare payments and mandated states do same.

- Allowed the stock market to collapse without a plunge protection team to artificially prop it up.

- etc, etc, etc.

Think of him as a Republican version of Bill Clinton. No wonder the Democratic leadership hated him so much and he got impeached and resigned because he couldn't get Republican support.Re. <7) Accepted inflation to pay the cost of Vietnam instead of increasing taxes on poor people.>

Inflation is a tax that hits poor people the hardest. People that live from paycheck to paycheck and need that paycheck to cover expenses feel the pain of inflation first and are harmed most by it's bite.

It is especially harsh when a person on a fixed or low income has little prospects to increase their weekly wage but they see the cost of the things they need increasing in price.

Inflation has been called the cruelest tax of them all. Unfortunatly, it is also the preferred tax of politicians because they deny responsibility for it.

Regards

Great Post! Like Peakoil, we can only hope that people will care enough to do their own research, and ask the key questions like Lou Dobbs. I fear genetic lizard brain levels of misconceived political control and ineptitude is leading us inexorably on the '3 Days of the Condor' path versus slamming on the brakes to mitigate. My hope is that a scientifically based Foundation and widespread education could be a better solution. Time will tell.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

Another great post! Keep up the good work.

If you think Bush made the decisions to undertake the above mentioned decisions you need to brush up on how this government works. Bush is there to try to SELL the policies that are made by people much more important them him to the hapless proles. He admittedly does a horrible job of it.

The crime in NYC is FAR from perfect. It's astonishing obvious what happened once you take a serious look at the available evidence. What makes it seem like a perfect crime is the MSM complicity in covering up the events. Once again understand Bush himself most likely knew very little about the attacks or the plan to carry out the attacks. It was the job of the administration to cover it up and protect the secret government.

"IMO incompetence nearly always trumps conspiracy theories."

What exactly does this mean? 9/11 was without a doubt a conspiracy. More than one person colluded together to make 9/11 happen. It's a question of who the conspirators are. You can believe the OFFICIAL conspiracy theory that makes no practical sense whatsoever or you can go find the answers yourself. The latter is not the hallmark of a dumbed-down fattened up and fluoridated United States population.

"After all there are people in this world that would like nothing better than to kill Americans, I saw them dancing in the streets on 9/11."

Ya there was a lot of dancing;

http://www.commondreams.org/headlines02/0622-05.htm

==AC

Not being a member of the conspirator's inner circle, I can only look at the events following 9/11 to divine its purpose. It is crystal clear that the watershed event was used as an excuse to invade and occupy the middle east. Numerous sources have indicated that an attack against Iraq was "on the books" long before 9/11. These sources include former Bush administration insiders like ex-Treasury Secretary Paul O'Neill:

After 9/11, elected officials lied openly and frequently in linking Saddam to 9/11, and this flimsy pretext was utilized to go forward with the invasion.

IMO, 9/11 is inextricably linked to Peak Oil because the invasion and occupation was planned to initiate a chain of events which would ultimately place control of the regions oil resources in American hands. Witness the fact that the Iraqi Oil Ministry was virtually the only government entity that was actively protected in the initial stages of the invasion. The bottom line is that the elites wanted control over the oil spigots in the middle east and 9/11 gave them the excuse to go forward.

In a nutshell, that was the purpose of the 9/11 conspiracy. Its success in radicalizing enough of the American electorate to allow it to go forward with the Iraq attack is obvious. Strange as it may seem, to those who organized the invasion, Iraq has been a success. The military-industry complex has made money hand over foot and now have American "boots on the ground" in the very place that contains most of the world's oil. It isn't a coincidence.

I'm not going to get too deeply into this, so as not to offend the sensibilities of those who feel that this is all a "CT" and thus inappropriate for this board, but apparently the FBI doesn't agree with you because bin Laden has never been indicted for 9/11. From Wikipedia:

==AC

Pardon me for saying so, but that question makes no sense whatsoever. Leaving aside whether there really were any hijackers at all, just because individuals of a certain nationality were purportedly linked with the attack doesn't mean that it was officially sanctioned by the Saudi government. If an American commits a crime in a foreign country does that mean he or she did so with the blessing of the American government?

http://news.bbc.co.uk/1/hi/world/middle_east/1559151.stm

The supposed kingpin Mohamed Atta took a connecting flight from Portland to Boston. What would have happened if that flight got delayed? Doesn't sound like planning of top notch international terrorist.

==AC

Will you just tell me what actually happened. I don't care why. At least not right now. Just tell me exactly what happened. Who did it. The real time line. The actual events.

Just the basics. Whatever you can fit into 1000 words or less. No links, no videos, no cut-and-paste. Just tell us whatcha got.

I have read many of your post and it is evident you are very intelligent individual. I have absorbed a great deal of knowledge from your postings. I'm not sure if what you ask is serious or sort of a "ruse".

Either way I do not have time right now to type out an SA that could properly answer your question of "Just tell me exactly what happened". Not that I know, or anyone for that matter, knows exactly what happened. What I do know is that we can rip the "official conspiracy theory" to ribbons. Anybody could which makes you wonder why the MSM has remained conspicuously silent all this time. I have read dozens of books relating to 9/11 and books relating to how intelligence agencies work the government works etc. To ask me to sum it all up in a 1000 words is not reasonable. I'm not trying to dodge what you are asking but I fell it would be largely a waste of my time to reiterate what has been thoroughly covered by hundreds of other people that have published entire books on the subject.

==AC

I've not seen a conspiracy theory that I find sufficiently substantiated but nor is the 'official' story sufficiently credible. Things like why the towers collapsed, why WTO building 6 (or whatever it was called) came down, certain deliberate security compromises at the towers in the weeks prior, why high Sauds were the only ones allowed to fly out of US in the immediate aftermath, failure to intercept the planes, probable deliberate destruction of physical evidence immediately afterwards, the continued existence of several of the terrorists who were reportedly on the planes...

Maybe one day the truth will become known, maybe not. If some in the US govt were involved or complicit then I guess most of us will be seriously fucked before too long since they might do almost anything to acheive whatever it is they seek and one would be wise to presume they have the US 'democracy' (and perhaps more) pretty well sown up. I don't really want to know that the worst case conspiracy theories are true, even if they are, what should I do then? Join al Qaeda?

I really don't know. Currently I believe no one on this. A CERA statement would be helpful, then I'd know what not to believe. Danny boy, where are you when you're really needed?

I had this thought earlier, but couldn't phrase it like you did. As you see I haven't commented yet on this whole CERA thing. I do, however, have a bunch to say on the topic. Maybe tomorrow.

Maybe people are paying $5000 to hear what Yergin has to say, and making a ton of money on what they hear. You may have figured it out, Agric.

I'm too busy paying attention to the cease-fire. World War III is over! What shall we call it? VH Day? The Peace of August? August the 14th?

Can I just say - I'm in love with Hala Gorani.

...oh, wait, ok, hold on, this coming in live, we've got an incident...looks like, some, uh, well, some...fire...

Stay tuned, I guess.

I think this is a key statement. I think most that want to look deeper into 9/11 will have this feeling packed away somewhere in the back of their mind. It is sort of a subliminal switch that will always steer someone away from accepting the cold hard reality of 9/11. Nothing rings truer than what Hitler said in the Big Lie:

"Even though the facts which prove this to be so may be brought clearly to their minds, they will still doubt and waver and will continue to think that there may be some other explanation. For the grossly impudent lie always leaves traces behind it, even after it has been nailed down, a fact which is known to all expert liars in this world and to all who conspire together in the art of lying."

I have had so many people watch videos of tower 7 collapsing and went into great detail of 9/11 and even when confront with strong evidence of the deliberate implosion of WTC 7 most will come up with an idea that makes no sense at all even though "facts which prove this to be so may be brought clearly to their minds". "It just happened it was a fluke"," The foundation was weakened from the collapse of the other buildings", There was diesel fuel in the building", "The other towers fell on it", it goes on and on.

It reminds me of the movie the Matrix when Neo asks Morpheus why can't we just tell everyone what is really going on and he replies:

"The Matrix is a system... That system is our enemy. But when you're inside, you look around, what do you see? Businessmen, teachers, lawyers, carpenters. The very minds of the people we are trying to save. But until we do, these people are still a part of that system and that makes them our enemy. You have to understand, most of these people are not ready to be unplugged. And many of them are so inured, so hopelessly dependent on the system that they will fight to protect it."

~ Morpheus

That is what it boils down to. It is a denial mechanism similar to what most people do when confronted with peak oil. But peak oil is easier to "accept" because it implies that we are all equally at fault and it is a natural event that if we work collectively we may POSSIBLE soften the impact. 9/11 on the other hand destroys any notion about ones belief in the system they were raised to trust and love. It leaves you cold wet and all along shivering in the cold. It opens a Pandora's box of questions. How deep does the rabbit hole go? What else has been lies? What is left if everything you believed about this government, this country, its people, is all a collective illusion and you have been duped your entire life? What do you have left? What value does knowing these things add to your life? For most denial is the ONLY option.

"Nor did a prince ever lack legitimate reasons by which to color his bad faith. One could cite a host of modern examples and list the many peace treaties, the many promises that were made null and void by princes who broke faith, with the advantage going to the one who best knew how to play the fox. But one must know how to mask this nature skillfully and be a great dissembler. Men are so simple and so much inclined to obey immediate needs that a deceiver will never lack victims for his deceptions."

-- Niccolò Machiavelli

It has been pointed about many times before that we deceive ourselves about our origins to help us deceive others better. The truth generally doesn't increase your inclusive fitness:

"What modern evolution theory brings to Goffman's observation is an explanation of the practical function of self-deception: we deceive ourselves in order to deceive others better. In his foreword to Richard Dawkins' THE SELFISH GENE, Robert Trivers noted Dawkins' emphasis on the role of deception in animal life and added, in a much-cited passage, that if indeed "deceit is fundamental to animal communication, then there must be strong selection to spot deception and this ought, in turn, to select for a degree of self-deception, rendering some facts and motives unconscious so as not to betray -- by the subtle signs of self-knowledge -- the deception being practiced." Thus, "the conventional view that natural selection favors nervous systems which produce ever more accurate images of the world must be a very naive view of mental evolution."

http://tinyurl.com/cpb87

Does knowing the truth about 9/11 increase you fitness? No of course not, it actually decreases your chances of "moving on" your genes. One is genetically biased to not face up to harsh reality;

"Since we are genetically inclined to deceive ourselves into believing in gods -- just as a child believes in Santa Claus -- we naturally prefer to remain ignorant of our true natures. When confronted with "harsh reality", we demand scientific proof that Santa doesn't exist. Of course, it's impossible to prove that Santa doesn't exist. So we ignore the harsh reality and believe that Santa (either as "the market", or as some marvelous new "technology") will deliver the goods."

http://tinyurl.com/cpb87

Just like our species desperate want to believe in gods of all sorts to help us escape from the reality of life, people will do anything not to believe what really happiness on 9/11 to hold on to any quant notions that had about the system they live under.

"The war, therefore, if we judge it by the standards of previous wars, is merely an imposture. It is like the battles between certain ruminant animals whose horns are set at such an angle that they are incapable of hurting one another. But though it is unreal it is not meaningless. It eats up the surplus of consumable goods, and it helps to preserve the special mental atmosphere that a hierarchical society needs. War, it will be seen, is now a purely internal affair. In the past, the ruling groups of all countries, although they might recognize their common interest and therefore limit the destructiveness of war, did fight against one another, and the victor always plundered the vanquished. In our own day they are not fighting against one another at all. The war is waged by each ruling group against its own subjects, and the object of the war is not to make or prevent conquests of territory, but to keep the structure of society intact."

~George Orwell

http://www.youtube.com/v/AJ7uFA8RwpQ

==AC

You are asking us to accept an alternative reality which is substantially different to what the rest of us have been living through, these past five years. If you can't sum it up in 1000 words, after five years, then it isn't coherent, and deserves no credence.

For me, there are no show-stopping plausibility problems with the official version. On the other hand, what sort of narrative do you have to substitute for it?

Who, for example, flew the planes into the towers? Did the CIA (or whatever "deep" organisation organised the hijackings) have suicidal fanatics wired up to do it for them? In what world is that idea plausible?

I'm at work right now so please excuse me for being brief. It will get back tonight with more links on the topic.

It should come as no surprise to you that technology has existed for quite some time in commercial aircraft for the autopilot to fly the plane (with the exception of landing). How hard would it have been to take control of the flight computers and give them coordinates to fly into the buildings? The plane that struck the Pentagon did maneuvers that would challenge the best pilots in the world...

Home Run and Global Hawk

If the supposed pilots are impossible or unlikely prospects for flying a Boeing 757 or 767 through sharp turns and complex maneuvers, how COULD those airliners otherwise have been flown?

In an interview with the German newspaper Tagesspeigel on January 13, 2002, Andreas von Buelow, Minister of Technology for the united Germany in the early 1990s, a person who first worked in West Germany's Secretary of Defense 30 years ago, told about a technology by which airliners can be commanded through remote control.

The former Minister of Technology said: '"The Americans had developed a method in the 1970s, whereby they could rescue hijacked planes by intervening into the computer piloting."'

Andreas von Buelow said that this technology was named Home Run.

The German went on to give his Tagesspeigel interviewer his overall perspective of the 9/11/01 attacks: '"I can state: the planning of the attacks was technically and organizationally a master achievement. To hijack four huge airplanes within a few minutes and within one hour, to drive them into their targets, with complicated flight maneuvers! This is unthinkable, without years-long support from secret apparatuses of the state and industry¦. I have real difficulties, however, to imagine that all this all sprang out of the mind of an evil man in his cave"'

http://www.911review.com/articles/vonbuelow/tagesspiegel.html

<<SNIP>>

"Col. Donn de Grand Pre - former top US Pentagon arms salesman under the Ford and Carter administrations

A group of military and civilian US pilots, under the chairmanship of Colonel Donn de Grand, after deliberating non-stop for 72 hours, has concluded that the flight crews of the four passenger airliners, involved in the September 11th tragedy, had no control over their aircraft.

In a detailed press communiqué the inquiry stated: "The so-called terrorist attack was in fact a superbly executed military operation carried out against the USA, requiring the utmost professional military skill in command, communications and control. It was flawless in timing, in the choice of selected aircraft to be used as guided missiles and in the coordinated delivery of those missiles to their pre-selected targets."

The report seriously questions whether or not the suspect hijackers, supposedly trained on Cessna light aircraft, could have located a target dead-on 200 miles from take off point. It further throws into doubt their ability to master the intricacies of the instrument flight rules (IFR) in the 45 minutes from take off to the point of impact. Colonel de Grand said that it would be impossible for novices to have taken control of the four aircraft and orchestrated such a terrible act requiring military precision of the highest order.

A member of the inquiry team, a US Air Force officer who flew over 100 sorties during the Vietnam war, told the press conference: "Those birds (commercial airliners) either had a crack fighter pilot in the left seat, or they were being manoeuvred by remote control."

Further pilot comments: "I seriously question whether these novices could have located a target dead-on 200 miles removed from takeoff point...-- much less controlled the flight and mastered the intricacies of 11FR (instrument flight rules) -- and all accomplished in 45 minutes."

"If there was an AWACS on station over the targeted area, did it have a Global Hawk capability? I mean, could it convert the commercial jets to robotic flying missiles?

"The fact is, all the transponders were turned off on the doomed flights virtually at the same time." Look at their departure times -- two from Logan (Boston), one from Newark, another from Dulles (Washington DC) -- all between 8 am and 8:15."

"We were totally trained on the old type of hijack where you treat the hijacker cordially, punch a 4-digit code into your transponder to alert ground control you're being hijacked, and then get him where he wants to go, set the plane safely on the ground and let them deal with it on the ground. However, this is a totally new situation... Not one of the planes alerted ground control that they were being hijacked." Why?

"I became more convinced that the four commercial jets were choreographed by a "conductor" from a central source, namely an airborne warning and control system (AWACS). They have the electronic capability to engage several aircraft simultaneously, knock out their on-board flight controls by EMP (electro-magnetic pulsing) and assume command and remote control of these targeted aircraft"

Remote Control

Based upon the evidence, we can safely say that two airliners hit the World Trade Center. That part was filmed and/or witnessed by many people. There is, however, no footage of Flight 77's famed aerial maneuver just as there is no footage that shows an airliner actually hitting the Pentagon. The only thing ever produced was a film that showed the side of the Pentagon and then a large ball of flame.

Flight 77 remains the greatest unsolved mystery of 9/11 but that does not alter my belief in the guilt of the suspects.

What we have, however, is a feat of airplane driving that far exceeds the skills reportedly possessed by any of the alleged hijackers. In fact, the flying skill required for such a maneuver surpassed even those of commercial airline pilots."

==AC

~J. Edgar Hoover

Dipchip that would be too easy if I gave "the game" away to the "naive dumbed-down fattened up and fluoridated" 66% without them having to do some leg work. If you want to understand what the purpose of this conspiracy, and what was to be gained by its success you would need to understand the true power structure running the world. The above clip is one of their best "front men" telling you what they are trying to achieve. Watch the date Poppa Bush gave that famous speech, September 11, 1991.

Do you take the red or the blue, probably the only real choice you have left...

http://tinyurl.com/68k2z

"This means that terrorism is not something independent of world politics but simply an instrument, a means to install a unipolar world with a sole world headquarters, a pretext to erase national borders and to establish the rule of a new world elite. It is precisely this elite that constitutes the key element of world terrorism, its ideologist and its "godfather". The main target of the world elite is the historical, cultural, traditional and natural reality; the existing system of relations among states; the world national and state order of human civilization and national identity."

~General Leonid Ivashov http://tinyurl.com/d8zpr

==AC

BTW

Here is a nice little primer about the "secret government" by Bill Moyers. It was well done;

http://www.rinf.com/columnists/news/pbs-1987-the-secret-government

or

http://tinyurl.com/gdx24

When he discussing the US backed coup in Guatemala do not overlook the role that George H Bush's stake in United Fruit through Zapata Petroleum played...

If you've got to lead with conspiracy Chimp, go after ethanol.

Surely there's a money trail from ADM and Cargill to Congress. Surely Hillery Clinton is in the muck somewhere. I bet Tom Tomorrow has even done some revealing cartoons. Ethanol.org is getting money somewhere, flesh it out for us, if you will.

But stop with 9/11. I send friends and neighbors here and to Matt Simmon's site (for the powerpoint pdfs). We get nowhere real fast when they run into 9/11 rants or crude language. It's not helpful. And it taints the good posts about field depletion, extraction technology, and fossil fuel alternatives.

Your consideration would be appreciated.

I understand your concerns Will. We wouldn't want "friends and neighbors" who are just getting their first whiffs of the impending collapse and destruction of everything they hold near & dear in their lives to be exposed to something as "disturbing" as 9/11 truth. In the end you are of course correct because this is not the proper forum for this discussion, and for that, I apologize...

==AC

"Our lives begin to end the day we become silent about things that matter."

~Martin Luther King Jr.

But talking about 9/11 on a peak oil is similar to injecting gay marriage, birth control, or evolution into national politics.

It starts a big row and pressing issues: energy policy, health and Iraq get remaindered.

I kind of wonder if they have become bigger pessimists in private, but are conservatively moving their predictions just a little bit each year.

* - posted in a comment to a previous TOD article

Go figure.

I hope I'm not imagining that, and that someone else remembers the graph.

As far as who's pessimistic amongst the TOD editors, I wouldn't know how to call that. IMO it's a combinatino of how soon and how bad (global depletion rates). If Stuart things soon but shallow (again IIRC) ... that might not be so bad.

http://www.theoildrum.com/uploads/12/ieo_comparison.png

That's a comparison of the EIA's IEOs though.

- predict prices

- predict increase in capacity even after compensating for geopolitical events and hurricanes

Not to mention CERA in 2000 was thinking we will have so much natural gas to that they may have to pass a fine for passing gas.BTW anyone read the Economist article which printed sometime in april 2006? They have said that Deffeyes was wrong about the peak. I do not know how they made such a statement considering nobody really knows for sure.

They also make no provision for the decline of Ghawar, Burgan and Cantarell, all of which has been widely reported

As I mentioned in my first post here on TOD, my pseudonym was chosen as a reaction to a comment that Mathew Simmons made in Twilight in the Desert to the effect that, "only self-aggrandizing traders continue to promulgate the idea that oil is just another commodity."

I have stated that, from my point of view, oil has, in fact, continued to behave as, "just another commodity," seeing about an equal run-up, percentage wise, as the other commodities (gold, copper, etc.) during the first 3 or 4 years of this new commodities bull market.

Since oil hasn't shown me that it is anything other than, "just another commodity," I have continued to treat it as such, predicting a short term pullback (along with other commodities) to $57 by mid-November.

I have recieved some criticism for this prediction. Most people don't seem to agree with it (although when I floated this idea with AngryChimp yesterday, he seemed willing to entertain it) but I think there is some real room here for common ground.

After all wouldn't most of you agree with me that oil prices do not currenlty reflect PO? I think we can all agree that, if markets were forseeing PO in the near future, oil prices would probably be at least double what they are today.

Given that $75 a barrel does not reflect PO, it seems that there are only two possibilities as far as future oil prices are concerned.

- At some point in the future, markets will "realize" that PO is at hand, and oil prices will rise substantially.

- Oil prices will continue to be subject to the same up and down fluctuations of all other commodities.

For those who are convinced of PO, these two possibilities could be rewritten as a single, combined statement:"At some point in the future, markets will 'realize' that PO is at hand, and oil prices will rise substantially, but until this realization occurs, oil prices will continue to be subject to the same up and down fluctuations of all other commodities."

So, unless you've convinced yourself that the markets are on the verge of suddenly becoming "PO aware" during the very short period of time between now and mid-November, my prediction of $57 a barrel oil isn't so very absurd after all, now is it?

In fact, given the herd mentality and complacency which have invaded commodities markets in recent years (with every Tom, Dick, and Harry, grocery baggers, night watchmen, latecomers and amateurs of all makes and models, the people who pass out the "fly-in underwear" at airports, bed-ridden grannies acting on a tip they saw in the latest issue of Reader's Digest suddenly becoming convinced -- in mass, as if brainwashed -- as they typically do, that commodities have nowhere to go but up and, to top it off, that there's no risk involved!) I have half a mind to lower my target price to $56!

Why are commodities prices currently at record highs? Speculation, baby!

Why have we entered a new commodities bull market? Because of a longterm shift in sentiment.

Why has sentiment shifted? Nobody knows.

Will it shift again in the future? Yes.

Will commodities go up forever? No.

Within the context of longterm commodities bull markets, why do commodities periodically experience pronounced, sharp downturns? To shake out the latecomers and amateurs!

Why do the latecomers and amateurs need to be shaken out? It's a way of transfering wealth to the insiders and professionals.

Why do "markets" exist at all? It's a way of transferring wealth to the insiders and professionals (read: "to the rich").

AngryChimp, can I get an amen?

God help us when the markets realize peak oil. My guess is 2008-2009 there slow :)

Actually I suspect when the price of oil starts going through the roof the free market for oil will disappear. What it will be replaced with would be what I call the lead based market.

Depleted uranium might also become a big force in this new enlightened market.

For breeders or for amunitions?

Furthermore, the current "affordability" of oil is largely due to taxpayer subsidies for: oil companies, foreign aid to curry favor with oil exporters, military endeavors to secure foreign oil. The aggregate cost of these subsidies is staggering and may be one reason Simmons claims that the true market cost of oil should be much higher. Also, the real worth is masked by geopolitical maneuvering.

Barring massive demand destruction from a catastrophic event, it is hard to imagine the price of oil dropping substantially.

In the long view, when the massive debt of the U.S. finally deals a lethal blow to the "strong dollar policy" all bets will be off on the affordability equation.

I don't think this is important. Tom, Dick and Harry put all their dumb money into the housing bubble. For them to go out and invest in comodities they would have to put it on their credit cards, and even if they did they would most likely buy stocks in commodity companies not the commodities themself.

First, to your pseudonym, at the end of the day, we are ALL "self aggrandized traders" (imagine an investment banker using a hippie beatnik term like that!)

Now to your issue of price. It is fascinating to me that some here seem to think that people in the energy industry do not have any idea about what oil and gas is available a year or two down the road, when in many industries, they are having to plan and contract for it now! To this point, they seem to be showing no real sense of fear that the fuel for their business won't be there.

But some ask, "Well, if peak oil isn't real, what has caused the run up in price?

The other day, a poster on TOD asserted that "we know what has caused the price rise, thank you...", and became annoyed at anyone who would suggest "we" didn't. I suggested that I didn't "know", but I was becoming suspicious that a lot of people who thought they did in fact, did not know either.

But, what the helll, let's play out some possibilities:

*As you say, speculation. In the late 1990's, if a speculator had fished about for something that had been laying in the crapper, cheaper than dirt, he/she the enterprising soul would have ambled right into commodities in general and energy cmmodities in particular, at almost historic inflation adjusted lows, despite rising demand. Isn't that the definition of a great speculative play? It would have been just too juicy to pass up. Given the news since that time, we actually should have already went well over $100 to $120 a barrel for sustained periods. The fact that we have not is one of the first things that has caused me to re-question imminent peak oil. In a world of no transparency or valid information, the price signal is the only usable thing we have.

*Rising demand. Could it be that the liberalization and rapid expansion of two billion person economies has anything to do with it? China and India have opened their economies, and went to a policy of Western style market growth goal setting. With or with out "peak" per se, this, plus the opening of the Eastern European former Comcon economies should have sent the oil price through the roof. That it did exactly that is now seen as a major surprise (??)

*Needed investment. If the trucking industry drove it's trucks until they all but fell to pieces, and then had to replace the equipment across the industry with new, now even more expensive and high tech trucks, would it surprise anyone that the cost would be passed to the customer in higher prices? No it would not.

If the oil and gas industry spent two decades at inflation adjusted low prices for it's products, and then had to replace and expand it's wells, drills, exploration gear, transportation networks, pipelines, all at the same time mind you, thus driving prices up for metals, pumps, compressors, pipe, valves, water separators, on and on....would it surprise anyone that they would pass the cost on to their customers? It must have, because everyone seems surprised!!

*Geo-political issues. Yes, they do actually exist. No the CIA agent at the Algerian McDonalds does not create them all for his own amusement, some would exist without him. Having a terror attack (and I lay aside the Martians conspiring with the Dick Chaney to auto pilot the planes into the buildings just for the moment) of the greatest death toll in U.S. history come, maybe by coincidence from the minds of those reared in the world's lynchpin oil producer, followed by a bloody bog of a war right in the heart of the world oil patch, and a left leaning populist and fan of the Castro become leader of one of our most reliable oil suppliers over the years can have some effect. Throw on Nigieria, Angola, and the Ruskie nat gas spat....it is possible there is a geo-political premium on the price of oil right now. Just possible.

*Weather. Yep, there have been two record Gulf coast hurricane seasons. Could have had an effect. Nuf said.

So we see, that even without "impending peak oil", there are plenty of reasons for the price of oil to be greatly higher than it is. We also see that there is no assurance that if it was, demand would drop greatly. I have long held that the world can sustain $100 barrel oil, especially if we rise to it gradually, and it actually would have some very positive benefits (technology improvements on efficiency, alternatives beig competitive, and possible reduction in consumption to help on the CO2 front....not guaranteed, but possilble.

Does this mean, that like Danny Yergin, I would say "peak is not at hand"?

No, of course not. I cannot possibly know if peak is at hand. It could even be behind us. The information is so crapped up that any guess about that is just that, a pure guess. The most useful line by Dave Cohen was this:

"Lack of data transparency for oil production is one of the most serious problems in the oil industry."

But that knife cuts both ways. It makes attempting to prove impending doom just as fruitless as attempting to prove impending ongoing safety and security of energy. Both are equally suspect.

Blaming "peak" for the price increase in energy however, is not a provable argument either. Likewise, using "plateau" as a proof of peak cannot be accepted. Saudi Arabia has been in "plateau" for a decade at a time, and then, when the need arose, come rising out of it. This is where Yergin's point about "productive capacitiy" should not be so easily ridiculed. Many are saying that the world has "no spare capacity", without possibly being able to prove that this is true.

We are fast approaching winter, with our stockpiles of oil/gas in historically pretty fair shape. There is to this point no disruptions of fuel supply, and the price of crude oil has managed to hold a lower price to this point in the summer than the doomers expected.

It is fully possible for there to be a sizable drop in crude oil prices. How long it will last, I don't know, but I for one am hoping it does not occur. The economy has proven it can sustain the current oil price, in fact, still waste huge amounts of fuel at this price. A drop in price would only increase the waste and the environmental problem.

We need to be prepared for disruptions of any magnitude at any time. We need to "case harden" America and the world against fuel cutoff and extreme price swings in both directions. We need to increase energy diversity, and increase alternatives. Because peak or no peak, we are running completely blind at the mercy of those who may not have our best interests at heart.

In the meantime, look for the speculative opportunity that is cheap, and that everyone has forgotten and overlooked. Right now, oil and gas are certainly not it.

Roger Conner known to you as ThatsItImout

Unfortunately on the one below you are sure again ;-).

FWIW, I think the economy has maybe proved that it can take higher energy prices this long. Unproven is how much longer it can take them, or how much invisible damage is being baked in even now.

But I think high inventories and tight supply/demand are totally consistent. Remember, oil is a global market and the inventories cited are only US inventories. So what may be happening is that price is starting to allocate scarce supplies in poorer countries. Meanwhile in wealthy countries which can easily afford current oil prices like the US, knowledgeable users are building inventories against the very real possibility of a further supply crunch.

One example of this phenomenon that is clear to all: the national inventory buildups of SPR's in US, China, Japan, and probably other places.

All that said, futures markets are always subject to sharp counter-trend swings. So a fall in price to $59 would not shock me.

This is a very strange statement on many levels.

Frankly, I strongly disagree with the view that the hoi polloi are commodity aware. I saw that behaviour in 1979-1980, when every jerk in the disco was wearing a krugerrand, grandma was cleaning out the attic to find silver for the smelter, and the singer John Denver got in trouble in Aspen for trying to install a commercial sized gasoline storage tank at his house. We are nowhere near that point now. The public is still hanging on to real estate, the 401k, and Google - that would be those who actually have a positive net worth. The grocery baggers and night watchmen are debtors, not investors.

More importantly, it simply doesn't matter what the public thinks. Very few people have any way of playing in commodity markets, their assets are encumbered and they have no clue how to trade commodities. The ETFs have attracted a few early adopter smart individual investors and possibly have effected the very small silver market. But hardly anyone actually trades full sized crude oil contracts on the NYMEX. You can see that in the COT data. Most retail brokers don't even offer commodity trading accounts, they want to put people in stock mutual funds.

Full disclosure, while I felt there were some screaming buys in energy and metal commodities in November and June, I am personally neutral on most of the markets at the moment. I am only holding on to the long term energy plays as I had cheap entry points and can ride out any corrections. Agree with Jim Rogers that the only really cheap stuff left at the moment is some of the agricultural products. Maybe soybeans, wheat, cotton..?

Is The Last Sasquatch out there? How about a second opinion on this issue.

I would like to add that there are so many worthless "tally sticks" sloshing around in the system that like in housing excess liquidity is being funneled into the commodity market causing imbalances. TPTB need high oil prices right now to mop up the purchasing power of the proles to tame inflation. What goes up must come down.

Don't forget that the "dollar" is nothing more than a modern day "tally stick". The only thing maintaining the illusion is the demand created by taxation and legal tender laws.

From a previous post:

Below is a snip from Richard Kelly Hoskins' book "War Cycles Peace Cycles";

"When the crusaders first left their homelands in Europe for the crusade to the Holy Land, they took with them almost the entire circulating supply of gold and silver coins. This left western nations, England in particular, with no money.

In the year 1100 A.D. Henry I, 4th son of William the Conqueror, ascended the throne of England. Finding the treasury empty and his needs great, he cast about for a source of income. Having wise advisors he soon hit on a plan. The plan, with a few refinements, remained in effect for the next 726 years - and can be reinstated tomorrow. He issued "tallies".

A tally was a stick about nine inches or so long with each of the four sides about 1/2 inch wide. On two of the sides, the value of the "tally" was carved into the wood. On the other two sides, the amount was printed in ink.

The tally was then split in half lengthwise. One half remained in the treasury and the other half was given to soldiers for their pay, to farmers for wheat, to armorers for armor, and to laborers for their labor.

At tax time, taxpayers were required to bring in one half of a tally to pay their taxes. Woe unto the man who did not have the required number of tally sticks. As a consequence, these intrinsically worthless sticks of wood were in great demand. Gold and silver coins were fine if you traveled abroad for a crusade or something, but at home if you did not have your tax-tally at tax time - you were done.

Upon receipt of a tally the treasurer would immediately match the presented half with the half stored in the treasury. THEY HAD TO TALLY - which is what gave it the name. Counterfeiters lost their heads! Actually, it was practically impossible to counterfeit a tally. The wood grain had to match - the notches had to match - and the ink inscriptions had to match. This could only come about if both pieces came from the same split tally stick.

There you have it! An inexhaustible source of revenue for the government. The means were available to make tallies as long as there were trees. There was a demand as long as the government required the tallies for taxes. The system flourished as long as tax-evaders and counterfeiters were punished and they always were. For 726 years the system flourished."

Not only does taxation supports the currency due to the need to obtain the currency in order to pay the tax, it also supports it by creating an overall belief that the currency actually has some sort of "value". The government could very well just PRINT all the money it needs to operate the government without directly taxing the people. The problem there is that the proles would figure out rather quickly that money really is worthless and why should you work so hard for something the government can just produce in unlimited amounts at no cost to itself. It would destroy the illusion they have worked so hard to create. Direct taxation is just another part of the grand illusion....

==AC

Hope ours does as well, but our kings are not so good at controlling their urges... the price of a democracy, where we are all kings wanting more tallys.

;-)

==AC

I believe it all depends upon how close the markets are to aggregate Malthusian pressures on pricing. Consider the war for water ongoing in northern Sri Lanka-- its local water market has made a paradigm leap beyond a peaceful supply and demand negotiation curve to a lethal winner takes all competition. Water now has an infinite price until a new equilibrium of supply and demand is established.

Your projected mid-Nov $57/barrel is possible if adequate aggregate percerptions of extra supply and reduced demand permeate the market mindset. But from my viewpoint: increasing Malthusian pricing pressure tends to put a bottom floor to the energy market. Those countries seeking to build their own SPR is a new Malthusian response abnormal to past oilmarket pricing decisions when hoarding was not seen as required.

The 'fear premium' often discussed is directly due to rising Malthusian pressures. The fact that the US invaded Iraq for oil is just another Sri Lankan event writ large on a global scale. If our leaders decided that if we withdrew the US would be adequately supplied with FFs by the generosity of ME inhabitants, and no other countries sought control of ME oil, then we could easily see the price/bbl collapse to a new equilibrium as the fear premium was mentally extinguished. But this seems increasingly unlikely as ever more common Malthusian-level events unfold.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

<Why has sentiment shifted? Nobody knows>

Perhaps some do. Sentiment has shifted to commodities because they are a real asset that are not overpriced by historical standards. US Real estate and US equities are overpriced by most measures.

The movement of money from financial assets to real assets over the past 20 years is because the real interest rate (Fed Funds Rate- inflation) has been negative and declining.

When real interest rates are negative inflation is decreasing the future value of money and increasing the future cost of goods purchased with that money.

<Will it shift again in the future? Yes.>

Smart money will move away from real assets and into financial assets when the real interest rate turns positive. With + real interest rates investors can count on money increasing in value over time.

Do you believe the money you use to buy a Tbill at X% today will have more purchasing power when it is redeemed with the current interest available at it's redemption date?

I'd argue a lot of people don't believe these financial assets will increase in value, so they put their money in real assets whose price increases at least to match the current rate of real inflation.

Regards

It is hard (but not impossible) to imagine that the CERA bigwigs are sincerely mistaken. I tried to imagine what else except flat-out dishonesty could produce year after year of errors--systematic errors, all leaning in one direction. It is possible that self-deception has unintentionally caused the deception of the public. The self-deception (or "denial" or "wishful thinking") hypothesis is the only one that to me makes any sense--except for the alternative hypothesis of direct, well-thought-out, orchestrated and systematic lies. Because where there is any doubt at all, I prefer to give people the benefit of the doubt, I do not assert that those who glibly project no peak oil for twenty years are consciously lying. It is possible--perhaps plausible--that psychological processes of rationalization, repression, ego-defense-through-selective-blindness, and a desperate attempt to maintain self-esteem and the illusion of integrity mean that CERA spokespeople are not conciously lying.

I'd be interested to hear from psychologists and psychiatrists as to their opinions in regard to the plausibility of the self-deception hypothesis.

I don't see self-deception. I see someone in an important position who has been employed to ensure that world markets don't panic because oil depletion seems right over the horizon.

If Simmons gets on CNBC, he'll be followed up by Yergin saying everything's okay. Who do you think market traders want to believe?

Cera is behaving exactly as if they are being paid by SA/opec and/or the rest of oil patch. Maybe they are.

FWIW, I think the easiest way to produce this effect is to believe the schedules of all new projects. X barrels in Y years? Believe it, put it on the chart, and extrapolate from there.

When something less than X appears (just because we engineers have a poor record of hitting our schedules), move out X to Y+n years, and plot/extrapolate again.

That's a forumla for a happy graph, but one that shifts with time.

Your line of thinking would be plausible for the first or second time that such incorrect pronouncements might be made but to ignore your own errors and make the same kinds of predictions for years on end being wrong each time - wouldn't you eventually question your own methods?

I have to agree with Don here - they either believe the happy horse manure they are shoveling or they are being paid to shovel it regardless.

Pricing: I would expect price to rise at the same rate of CO depletion as margins get squeezed as higher cost unconventional production has to increase to mask CO depletion. If the price were to fall, those whose demand has been curtailed due to higher price will re-enter the market to buy on the dips, thus keeping upward pressure on price.