Tech Talk - North Dakota and the Bakken

Posted by Heading Out on August 14, 2011 - 5:32am

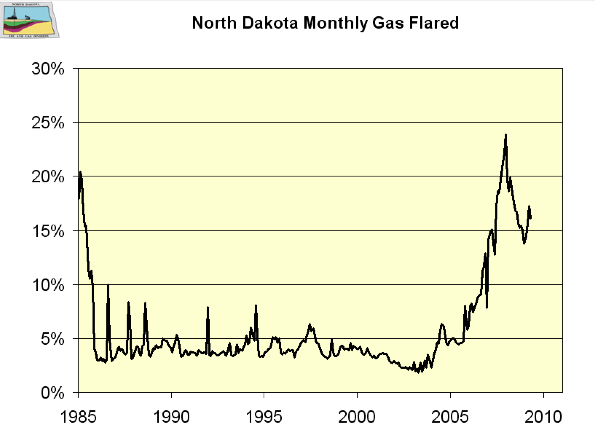

Nick has pointed out that the chart I used last time, in writing of the production in the deep waters of the Gulf, is out of date. North Dakota is heading for second place behind Texas, having passed Oklahoma, and has the ability to pass Alaska in a few years. In May, the state was averaging a production of 361 kbd of oil, and 361 bcf of natural gas, from a total of 5,570 wells (all three figures being all-time highs). Gas flaring, at the moment, is at around 29%. The current rig count is at 183 and also an all-time high. So where is all the excitement? It is not in shallow gas given that, as the Director of the Department of Mineral Resources has noted:

North Dakota Shallow gas exploration is not economic at the current price.

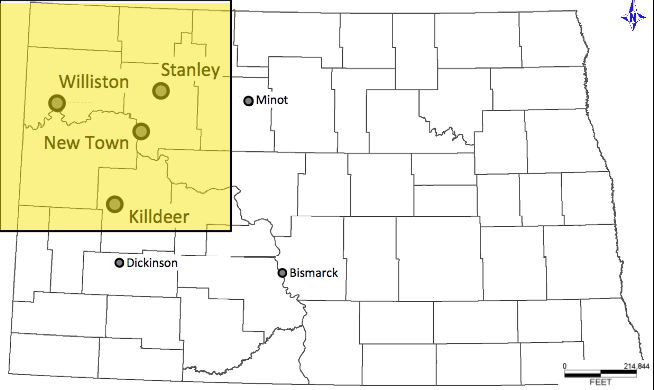

The answer lies in the Bakken and Three Forks with rigs that can drill more than 20,000 ft being the most actively employed. The Bakken has already been discussed in an earlier post at The Oil Drum and I don’t really want to repeat much of that information, and so this presentation will, perhaps, rely a little more on visuals. The Bakken and Three Forks partially lie in Western North Dakota, and the Department of Mineral Resources (DMR) for the state, has shown how the total Original Oil In Place (OOIP) estimates vary from county to county within that region.

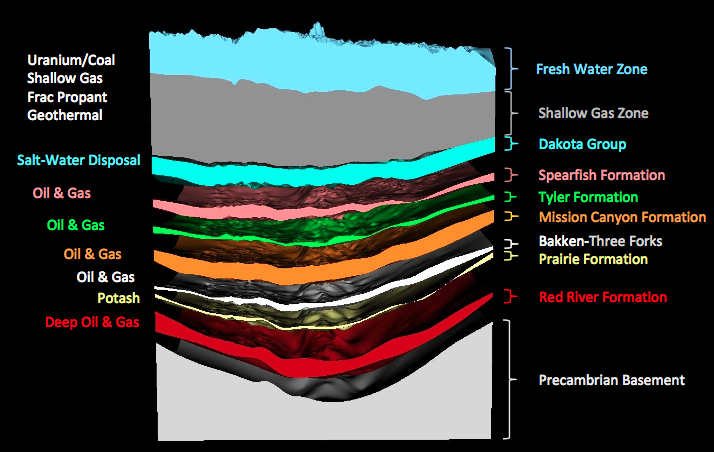

The state has also produced some three-dimensional models of the formations in the region around Williston, which is where some of the most productive wells are found.

By developing the model it is possible to look both at the section showing the location of the productive beds in the region. Since the Department covers other valuable minerals beside oil and gas, they are also shown in the section:

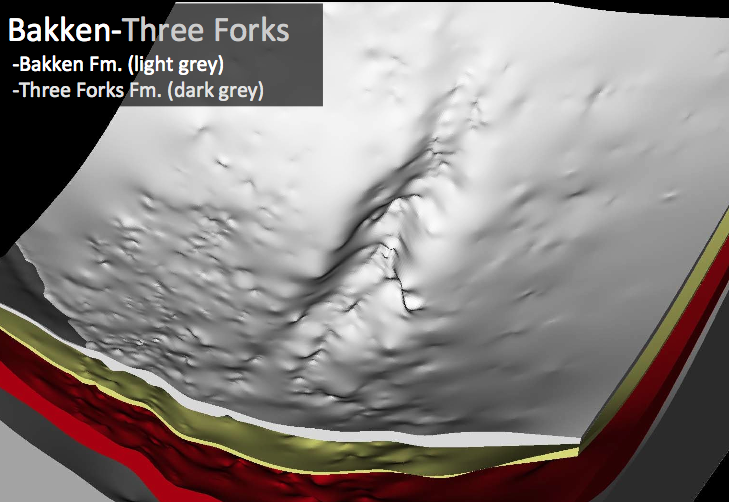

The Bakken lies at a depth of around 11,500 ft with the additional need for rigs to drill 20,000 ft coming from the use of horizontal drilling along the formation, which is typically only around 150 ft thick. One of the advantages of the model is that it can be used to generate a view of the Bakken itself, with the overlying ground removed. This also helps reveal that, while the above section shows the beds lying in a syncline, where oil might be expected to migrate out and up the sides away from the central dip, there is a central anticline where oil could be trapped, and the structure is not smooth. (Bear in mind also the scale of the model, so that small traps in the field are not picked up at this level.) The structure of the shale beds themselves also make it less sensitive to geological modifications which drive oil migration, though obviously not completely or else there would be little oil flow to the well.

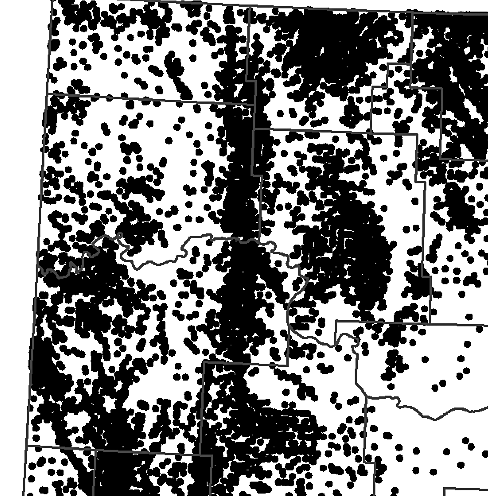

The dominant feature that runs relatively North-South through the center helps then explain the location of many wells drilling into the reservoir.

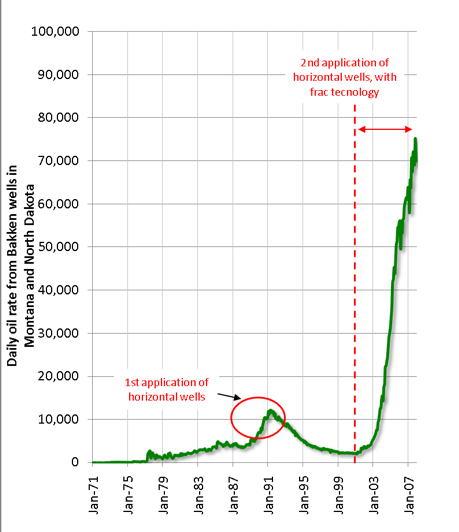

While the formations have been known for some time, it was only with the development of horizontal wells and fracking capabilities that the opportunities to extract the oil became viable. To borrow a picture from that earlier post by Piccolo (H/t Gail)

As the number of horizontal wells has grown, one finds, as I noted above, that 20,000 ft of drilling will include perhaps 9,000 ft of horizontal well in the formation itself. Such a well, for example, the Credo Petroleum well that is cited, may initially produce 1,267 bd of oil and 1.24 mcf/day of natural gas.

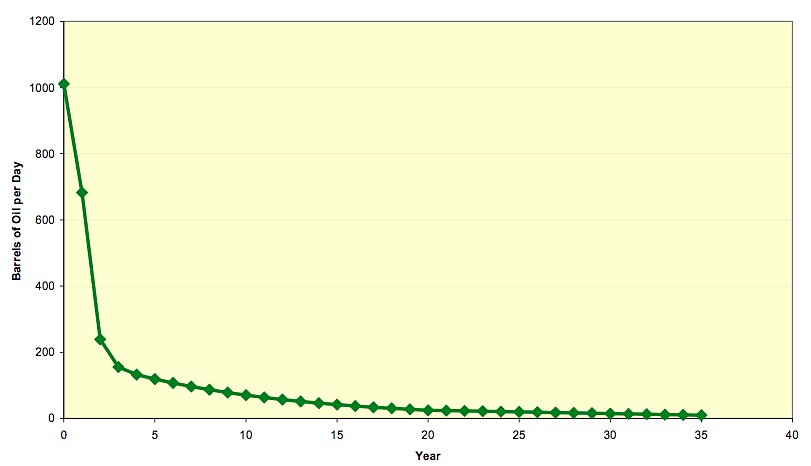

However, one of the concerns that has been expressed, both by Art Berman and later myself, has to do with the long-term production rate from long horizontal, frac’ed wells in shale, and it is therefore instructive to see the information that is now available on a typical well, which has been compiled by the ND DMR.

At the time of the presentation (last year), there was still a large proportion of the gas being flared.

Since then, as I noted at the start of the piece, the amount flared in May of this year has risen to 29%.

There is a more than adequate array of pipelines to handle the fuel that is being produced; at the moment, it is the oil that is the critical and valuable component. But even with a projection that the state will see about 2,000 wells a year being drilled over the next few years, with the expectation that the field will last some 20 years, the overall production is not expected to increase much beyond the levels that it is now attaining. This is because of the relatively rapid drop in well production, for which there is now a considerable data base. That doesn’t stop some from projecting, however, that the field can increase in production to levels as high as 1 mbd or so. That would, of course, include production from Montana and Canadian parts of the Bakken, which I have not discussed here.

One point that should be noted is that the lease rates for Bakken in North Dakota are quoted as being around $7,000 to $8,000 per acre, while those in Montana are reported to be considerably less. To date, there has not been that much activity in Montana, though with time this will change. Already permit numbers are rising, and there has been some success to equal that in North Dakota.

Brigham Exploration, one of the most aggressive in Montana, recently unveiled five wells there ranging from 909 boe/d to 2,962 boe/d, the latter volume a "record for the state," Pritchard said. The five wells averaged 1,579 boe/d.

At present, however, most of the rigs (170 to 10) remain on the North Dakota side of the border. That too will change, with time.

Overall, the Bakken is likely to see further increases in production as the areas being drilled expand, but with the relatively short life of the well at significant levels of production, it is harder to see the higher levels of production overall that others have cited, and one also has to remember that is often the sweetest spots that get drilled first.

FOR ALL Another meaty story by HO...mucho thanks. I've never worked this trend so have nothing to contribute in particular about it. But I want to point out to those who don't appreciate why this is an "unconventional" play. HO's general decline curve says it all. This is not a field in the conventional sense. It is a "play". Compare to the Mother of conventional fields: Ghawar. It is still producing a significant volume after many decades. But more important: many of the original wells are still producing. They have periodically drilled new wells to enhance recovery but the main reservoirs are still prodcing. HO’s decline curve clearly shows the Bakken is a very different animal. Original Ghawar wells came on at 5,000+ bopd and held there for decades. For the most part a Bakken well’s production becomes relatively insignificant after several years compared to thir imtial rate. There is some history of success re-frac’ng such wells but seldom as valuable as the initial completion.

No doubt the Bakken, Eagle Ford and similar unconventional plays will add significantly to our reserve base. But at a cost that requires higher oil prices. But it’s still important to remember there is an end to this road also. These are not the first major fractured oil reservoirs to be developed with frac’d horizontal wells. The Austin Chalk (a “limestone” shale) had it big day in Texas. Same big initial rates, same decline rate profile, same boost to oil production, same hype. And for the most part the play is dead even at current high oil prices. And for a simple reason: almost no more drill sites left to poke. In fact the current boom in Eagle Ford drilling is a result of the decline in AC drilling: it’s one of the few oil plays left in Texas. And in time it will be fully developed just as the Bakken will. And once most of the finite number of locations is drill the oil rates will drop off a cliff.

These plays can help give us some breathing room. But they don’t change the game significantly IMHO. Would be nice if we use this crutch to give us a little more time to make adjustments to PO. But I have my doubts.

An excellent article, thanks. Short of higher initial potentials in the Bakken than the Eagle Ford here in Texas, wells in both shale plays appear to decline like greased pigs sliding down an icy hill and the economics must be very similar. Well costs are about the same as are lease acquisition costs; I understand however those guys up there take a big hit on oil prices due to long trucking hauls, something in the order of WTI - $15.00? I don't know how it works in the long run with 3:1 EURS over 30 years but like Mr. Rock says, we sure need the oil, so more power to them.

Once induced energy from the frac is gone, solution gas I assume allows some brief period in the well's life for gas lift, then what happens the next 27 years? It appears to me these shale play folks are going to need lots of big pumping units and I think it may be time to buy shares of Lufkin.

Some perspective on total US C+C production. Four week running average US C+C production:

Note that US production has been between about 5.4 and 5.6 mbpd since the fourth quarter of 2009. And we are already running into pretty severe personnel and infrastructure problems, just tying to maintain flat production. I call it the "Whack-a-Mole" personnel and infrastructure game. As soon as we take care of one personnel or infrastructure problem, a new one pops up. Right now, we need tanker truck drivers, and I have heard of salaries starting in the six figure range, plus a signing bonus.

I have heard the same thing about truck drivers in your area, even that roughnecks making 65K a year are walking off the floor to become oil truck drivers. Who'd a ever thunk it. I have delayed my drilling program for the year because I am told in preparing my AFE's to add 3-4 days of rig time for circulating, waiting on loggers, another 3-4 days on cementers. Its crazy out there.

When I saw this chart from a Brigham Exploration Company report (Year End 2010 Conference Call February 25, 2011)

on TOD late last winter I had more than a strong inkling that the typical Bakken Shale oil well's decline curve was very steep. As you can see only three year in and the cumulative declines under the curve make all the colored slopes at the top of the production chart look steeper than a heliskier's typical downhill run. No doubt a conventional oil field the Bakken is not. Not that you need any backup from the me on that point ROCK but the chart colors are pretty ?- )

Regarding the 6:th graph I had an emediate reaction to the heavy production increse displayed there. Just west of Stockholm here in Sweden you find lots of old iron ore mines. Sweden once produced 1/3:rd of all iron ore in the world, and 25% of that was from the fields in Bergslagen, as the place is called. Those mines has been operational for about a milennia. But then came mechanisation. Production multiplied many times over. Then in the 1960'ies those old mines begun to underperform and was closed down one by one. Now they are all gone. Depleted.

With that heavy production explosion, wont the duration of the fields empty out very fast? I know it makes economical sense to produce it as fast as possible. But is it wise?

In that same spirit. If gas if being flared, we are already developing it too fast. You can say something similar if the oil is being used to fuel SUVs and speedboats.

JW - Good point. Latest rig count in the Eagle Ford is around 230. Can't run up much faster at this point...running out of rigs. But the drilling rate is picking up a bit as the learning curve improves. But just like your example of accelerated iron mining there's a finite number of B and EF drill site. The map of all those drilled (and now abandoned for the most part) Austin Chalk wells is amazing: one long horizontal well drilled right next to another next to another, etc, etc. And that map extends over 5+ MILLION ACES. A solid slash of black oil well symbols. And as long as oil prices stay high enough we'll continue rushing towards that future map filled with nearly depleted/abandoned Eagle Ford and Bakken wells.

Brings to mind the image of one abandoning the Titanic to a lifeboat with a hole in the bottom. The real question is will we make good use of this temporary stay of execution.

Is it good farmland? I can just imagine what the future generation would think if the fracking was not as safe as supposed. Basically they drilled huge areas full of evenly spaced holes and pumped them full with poison.

Is is mostly semi-arid brush country that will hardly sustain cattle. It does not matter. The Austin Chalk is a fractured carbonate with 8000-10000 feet of sediments stacked on top of it and propping those fractures open with sand and gelled water posed rare threat to shallow groundwater in the region. The so called "poison" that got left behind in those fractures from frac fluids was compatible with the bound formation water containing 80,000 ppm chlorides, saltier than sea water and othewise useless to mankind. By the way, we needed the crude oil back in those days and still do, last I looked. Folks everywhere, even back East, need the natural gas too.

I hope to see a TOD expert broach the topic of fracking soon and when that happens I trust all the emotional baggage about the issue will get checked at the door. If there is lack of supporting evidence to sustain an argument, from either side of the fence, then I hope we can at least look at the process from the standpoint of risk versus reward. The risks seem managable given the 65 years we have been fracking and isolated cases of failure, the reward will keep us off bicycles and wax candles a while longer.

karl - And that's the point I keep trying to beat into you folks: 100's of thousands of fracs in Texas and not one case where those deep fractures extended back up into the fresh water aquifers. And no...these weren't poor dirt farmers who couldn't hire lawyers. Many of these landowners were worth more than the companies drilling. And no...the regulators were looking the other way. They were issuing $millions in fines for other infractions and, in extreme cases, sent some folks to prison.

But, for the umtenth time, there has been documented instances of those nasty frac fluids polluting the environment in Texas. It was really bad decades ago before they changed the disposal regs. Now the nasties are injected into deep disposal wells. There are still some accidental/illegal dumping. No process is 100% safe...school buses and airplanes still crash and burn.

BTW:"More than 101 Texas counties have experienced some horizontal production (fig. 5). Statewide leases designated as "horizontal" (Dwights EnergyData) with the earliest production after 1987, have produced 188 MMBBL and 497 BCF (271 MMBOE). From http://gswindell.com/horizogj.htm.

And that's over $40 billion of oil/NG peoduction. And that with more than $10 billion going to those "poor dirt farmrs". And over $3 billion in production taxes going to the state and counties. And then there's the many, many $billions injected into local economies via salaries and infrastructure expansion. As Mikey says: risk to reward

I'm pretty sure you've read such post from me before karl. Either you think I'm lying and don't care to dig into the facts to prove me wrong or you have your own little hidden agenda. In either case it's probably time to cut you loose. Sorry about that, chief.

.

I believe you but for a totally different reason. If the wells leaked the fluid should not only spread over a large area but also over the entire volume up to the surface and the fluid would be far to dispersed. I may believe in small leaks but in such case farmland is probably far more destructive to the environment by the simple fact that farmland use incredible amounts of land. I guess the wildlife around Chernobyl have benefitted a lot just because the radioactivity keep people away.

It is just a feeling it simply does not feel like a good idea to drill a lot evenly spaced holes and pump them full with poisonous stuff.

Groundwater flow and dispersion is typically pretty slow. I don't know what Texas requires for monitoring, but with proper monitoring leaks should be detectable.

karl - OK but again I have to warn folks to read my words carefully. I've never said it wasn't possible for the nasties to leak out of those frac jobs into the fresh water column. Just that those fractures can't be propagated that shallow. But they can be pumped back up via a bad cement job in a well's annulus (the area between the earth and the casing) or the shallow casing rupturing. There have been a number of such incidents documented.

What's that failure rate? No data base to calculate. But from my knowledge base it's rare..probably a good bit less than 1%. And that's not because the oil patch struggles that hard to protect the environment: such an accident could harm the environment but it would also cost the company many millions of $'s. A well with a bad cement job or a ruptured casing can't be produced. So I might have I lost an $8 million investment and it might cost me more than $1 million to properly abandon this well. And yes...the state makes sure I do it properly...or else. And since the state documents the accident the civil lawsuit is a pretty easy win. Yes...the landowners are notified. This could cost the operator a lot more money.

The oil patch is very diligent in not causing such accidents because it's too freaking expensive. LOL. Even in the bad ole days 40+ years ago when the regulators and landowners didn't spank you so bad you still lost a multimillion $ investment. Most of us (especially those like me whose kids drink well water every day) don't want to mess the environment up. And we really don't want to be responsible for losing an $8 million investment...doesn't look good on your resume. The resume you'll update after getting fired after you screwed that well up.

As far as monitoring any problems with all those thousands of fracs in the Austin Chalk there were/are thousands of water wells dispersed around them. And monitoring these wells and going after any offending company is an active cottage industry here. It's very cheap to test those water wells. And there are problems detected from time to time. But rarely does it involve frac fluids. The very common offender is salt water. Same reason: bad cement jobs or a leak from corroded shallow casing. And once a problem is detected it's very easy to find the culprit via simple well test procedures required by the state.

Have no doubt there will be some environmental damage from the shale gas drilling in every state. Even in Texas with our very strict and enforced regs. Such is life. The questions for the LOCALS to decide IMHO is whether the risk to reward is acceptable. The gov of NY recently lifted the frac ban in his state. He decided for his citizens that the many $billion injected into his state's economy was worth the risk. If enough folks there disagree with that decision they can let him know on the next election day.

And the recommendation to my Yankee cousins still stands: copy the Texas regs and enforce them. And charge the compnies fees that cover this effort. Texas does and no company here has never stoped drilling because of it. And don't let the politcians slip those moneies into the general fund...keep the in the oil/NG enforcement effort. Do it right and it can be an easy win-win.

Farmland is, as you say,much worse for the enviornment than fracing. Farmers put their polutants on top of the soil, right where we grow food. Yes they do it in small ammounts, and it leaksaway with rain. But they do it every year. Where does that rain of chemicals end up? it leaks down to the ground water.

Take Denmark as example: In Denmark the ccletimeof the ground water is about 50-60 years. That is about the same amount of time they have used agro-toxics. So now they have topay the price; the toxics show up in drinking water. Every year they have to close down 2000-3000 wells due to illegaly high contamination grades. And they keep pouring those psticides on their farmland. Seems like a not so good plan.

Great post. Graph 7 is shocking. It would be nice to have a cumulative recovery curve. Eyeballing it, it looks like these well are half spent in 3 - 4 years! Mediocre politicians stay in power longer than that--Gov. Palin excluded.

Just FYI, the figures for June came out on Friday and ND oil production is up to 384,676 bpd (scroll to very bottom of PDF).

I think that the "MCF" units used in the Director's Cut are thousands of cubic feet; not millions of cf.

The total US consumption of Natural gas is about 22 trillion cf. If ND could produce 361 billion cf/day, they could produce the annual requirement for the US in about 2 months!

That's old information. Lynn Helms, director of the Oil and Gas Division of the NDIC, has more recently said:

The Oil Drum has been underestimating this thing for 3 years now. And they're continuing to do so even now.

In fact, now that I read over the original TOD article on the Bakken from April 2008, some of the statements and conclusions expressed there have become downright laughable! What's even funnier is that the analysis was written by a petroleum geologist! So much for expertise.

How about this doozey?

It's too bad TOD doesn't have smilies, because now would be an appropriate spot for a laughing one!

Oh, and about those per-well rates ... when Piccolo wrote that in April 2008, ND average oil per day rates were 40 barrels per day per well. They're now at 72 barrels per day. *inserts another laughing smiley* Once again, the numbers are here.

Oh, this just gets funnier and funnier!

Piccolo said in April 2008:

But the director of the ND Oil and Gas Division said in January:

*inserts yet another laughing smiley*

The amount of recoverable oil is dependent on two things and only two things:

1. Amount of original oil in place.

2. Profit margin on extracting each barrel of oil.

When oil fell to $38/barrel in early 2009, Harold Hamm, the chairman of Continental Resources (largest oil producer in the Bakken) said that oil price must remain above $50/barrel to be profitable in ND. With oil industry inflation running so high (20% typical) that break even price may now be $60/barrel.

Everything depends on price as far as Bakken max production goes. Until the last two weeks I believed the Bakken would get near 1 mm barrel/day. Now, that looks less likely. Price volatility is the enemy of the oil producer.

"starting to see indications that we could reasonably get..."

That's the same sort of language our politicians use to tell us things are getting better. Spoken by a political appointee right?

How about something from a *non*-political appointee?

Continental Resources CEO sez ...

As you say Seagatherer more weasel language: "...may be as high as 1,000,000 barrels a day... ". Not necessarily arguing his estimate is wrong but he's not confident enough to say IT WILL BE....

Consistently underestimating oil and gas resources goes hand in hand with the pessimistic wing of the resource scarcity movement. It takes many forms, dividing reserves by consumption and proclaiming the result to be "the end", not understanding what drives changes in recovery factor with respect to time, underestimating the speed with which resources can be converted to reserve and the size of the resource to begin with.

The Bakken hits on all cylinders in this type of debate, as does shale gas, tar sands, heavy oils, deepwater fields, etc etc. What better example is there than the United States, the largest natural gas consuming nation in the world, preparing to go off a cliff in 2005, and within 5 years completely reverses countrywide natural gas production rates, and increases country production to a new high?

It seems to me that just during the years this website has been in operation the presumption of pessimistic estimates of resources has been pretty thoroughly invalidated.

And the world price of oil has been >$100 a bbl for a while now and in 2007 it was at $147 a bbl at its peak. Those events occurred recently. You say that certain views are wrong, but you do not seem to have a very good explanation for the current facts. High oil prices and statistically flat oil production for about 6 years. If you can explain that all away using credible sources, then many would be relieved. Can you point on a map to some easy oil wells that have not been exploited, or are you going to say Deep water, shale oil, and tar sands are the new normal, and those flows will easily excede the flows generated prior to 2005? Moreover, oil supply will continue to grow exponentially at 3% a year annual growth.

Let us know when you find those sites to drill. Thanks.

Based on BP & EIA data, the volume of net oil exports available to importers other than China & India has declined at an average rate of one million barrels per day per year from 2005 to 2010, from about 40 mbpd to 35 mbpd.

The US is still one of the largest net natural gas importers in the world and the largest net oil importer in the world, and as noted up the thread, our crude oil production has basically been flat since the fourth quarter of 2009, at between 5.4 and 5.6 mbpd, versus the 1970 peak of 9.6 mbpd. For an excellent case history of deep water oil production to the rescue, take a look at the production chart for the main producing structure in the Thunder Horse project, BP's poster child for deep water exploration.

Regarding tar sands, Canada's net oil exports have increased at an average rate of about 50,000 bpd per year for the past five years, for a total increase of about 250,000 bpd, which doesn't even come close to offsetting Venezuela's net export decline over the same time frame of 600,000 bpd.

Oil companies can and will make money in selected areas in post peak regions, but the the cornucopian crowd is focusing on incremental increases in production in selected areas, while ignoring production declines elsewhere, and while generally ignoring depletion, and while ignoring the fact that the companies are not making a material difference in global oil production and in global net oil exports.

The North Sea is a perfect example of selected incremental increases in production. North Sea oil fields whose first full year of production was in 1999 or later showed a production peak of about one mbpd in 2005, but these post-peak fields only served to slow the overall North Sea decline rate to about 5%/year from 1999 to 2010.

In any case, this is not to argue that US production is not important; it is, especially since it provides real jobs, but it should be kept in perspective.

Spock - "during the years this website has been in operation the presumption of pessimistic estimates of resources has been pretty thoroughly invalidated." Not true in the least. Everyone of my projections have been remarkably accurate. And all the real TODsters would agree that I am, with 36 years of amazing success in the oil patch, the heart and soul of the tech side of this site. Of course, I must share a bit of that with westexas, HO and a few of the other little people.

I don't know whether to laugh or cry over these guys' assertions that rapidly depleting oil wells in fractured reservoirs are going to be our salvation. I sometimes think that the residents of Fantasy Island--where oil fields don't deplete, and where unicorns graze in the pastures--are happier than those of us who live in the real world of depleting oil fields.

IB crying.

It is imparative that the oil and natual gas industry, worldwide, keep a smiley face and tout unrealistic EUR's that cannot be supported, assure the world there is plenty of surplus capacity, 20,000 wells here, 45,000 there, 12 billion, 15 billion, oceans of natural gas; no need to worry, we got ya covered for the next 50 years. There is a method in that madness that keeps the world on the teet. If Hamm says its true, or McClendon, or the North Dakota chamber of commerce, well, its must be true. Ironically if the same crowd was equally reassuring about fracking, the public would cry self-serving foul. My wife refers to that as selective hearing.

I hope these shale liquids fellas can stay at it. We use 7 billion barrels of the nasty stuff every year in this country, the 2-3 years of annual US production they say they can deliver over the next 20 years, maybe, will sure come in handy.

Could you please reference one of these projections? I am not familiar with them.

Undoubtedly. But I did not make a statement about the technical aspects of drilling a well, or an explanation of how hydraulic fracturing works, or ask about the costs of installing and operating a ESP, or what landmen do for a living, or how much money a top drive system can save on drilling costs versus using a rotary table on a rig which can only pull singles.

Did you predict that the natural gas cliff in 2005 would be completely invalidated by the rise of unconventional production, prior to it actually happening? Did you offer some estimates of new field discoveries prior to their discovery, like in Brazil? Did you claim, in advance of it happening, that peak oil would be peak plateau instead, or better yet, would stop being peak oil and become growth again? If so, I would be interested in a pointer to the thread, blog, or writing where this happened.

Spock - "Did you predict that the natural gas cliff in 2005 would be completely invalidated by the rise of unconventional production, prior to it actually happening?: Yes. And not just by unconventional drilling but by the slow decline of our heritage production and gains from DW GOM (a couple of years ago the Independence DW GOM gas Hub brought 1 bcf/day on line in just a few weeks). Besides being a geologist I'm also a reservoir engineer and understand depletion dynamics quit well. BTW: I just spent over $300 million in the last 28 months drilling for conventional NG in the Gulf Coast. Helping maintain the NG plateau is what I do for a living 24/7.

"Did you offer some estimates of new field discoveries prior to their discovery, like in Brazil?" Not numerically but did offer that not only were they huge but easily discovered. Except for the water depth the geology is very smple compared to DW GOM. It's actually more comparable to onshore oil exploration in the US during the 1950's. BTW: I've worked DW Brazil wells for a short bit so my knowledge comes first hand. Professional ethics prevent me from offering details.

"Did you claim, in advance of it happening, that peak oil would be peak plateau instead, or better yet, would stop being peak oil and become growth again?" Yes...been preaching PP for a long time. In fact, I'm not sure but I may have been the one to coin "PP" on TOD. I make so many important contributions here I lose track...forgive me. And being a plateau there will be occasion, and relatively short lived, lows and highs. Which is, by my definition, is a plateau.

On rare occasions I've been inaccurate. In the archieves you can find many hundreds of my posts along with thousands of specific statements on most issues discussed on TOD. More than enough feedstock to catch my rare blunders. Also please note that many of my posts have a sarcastic edge to them. Note my previous post for example. LOL. Here's something else to chew on: I'm definately in the "drill, baby, drill" camp 100%. Not that I think it will have a significant effect on PO/PP other then to strecth it out a tad. But just because it's good business for the country. Folks on both sides of the debate get a tad confused over this position...as well as some of my other points of view. I would have to admit that's been my greatest failure on TOD: convincing folks that I'm almost always correct.

NG production in the US is not a plateau, it peaked as Hubbert predicted back in the 70's, and declined through the early and mid 80's. Then it increased for a few decades, and then it decreased going into 2005, and then rather than going off a cliff as some predicted, increased from 2005 to present. This was possible because of the development of unconventional type resources, if I recall my EIA figures correctly. This is one example of an obvious resource ignored in the rush to only use pessimistic estimates.

That aside, is there any particular prediction you are most proud of, in terms of accuracy? Did you call the increase in NG supplies prior to it happening? Perhaps the leveling off and even increase in domestic oil production in the past few years? Anything contemporaneous to the event itself?

You can understand why it has to be a contemporaneous prediction, during the event or after the effect it becomes nothing but Monday morning quarterbacking.

it peaked as Hubbert predicted back in the 70's

Kind've. Hubbert predicted that NG would fall off a cliff, not just peak a little.

Must be rolling over in his grave considering it stopped declining, reversed course, and began increasing again for a few decades, eh?

Well, better that these kinds of things come out after their primary advocate is dead and gone I suppose, than the alternative.

Spock - "...and began increasing again for a few decades". Not true: decreased for almost 20 years until it hit the low end of the current plateau in the late 80's. Check the curve.

http://www.eia.gov/energyexplained/index.cfm?page=natural_gas_where

NG peaked in the early 70's. All in the eye of the beholder but that's when the NG plateau began IMHO. Increased 400% from 1950 to that point. Since then production has varied y-o-y over a short range...typically less than 10%. And production has come up in the last couple of years. But still on the plateau IMHO. The combination of shale gas plays and DW GOM would appear to be the obvious cause. But so far we're only approached the high point in the plateau we saw 40 years ago. Looks like an obvious bumpy plateau to me and I suspect also to most who pull up the above chart.

From this point we can speculate all we want about the future: will we continue to bounce up and down along the plateau or are we at the verge of a long term climb? Everyone is free to make their guess because, in the end, it's only a guess. Mine is that we'll flatten out the increase just as we did around 2007. The boost in NG didn't come from the sudden discovery of the SG plays...they've been known for decades. I drilled and frac'd my first SG in the late 70's. And it didn't come from new horizontal frac'ng techniques...they've been around for over 15 years. What increased NG production was the increase in its price. The increases in production over the last couple of years represent the lag time from the beginning of a boom until it shows up. Likewise the drop in SG development will show up soon IMHO. And, as I said long ago, it won't be a cliff but rather a leveling off. IOW we'll still be on the plateau.

If someone wants to project an increase in NG as we saw before we hit the plateau in the 70's they're free to do so. But that would mean current production would have to increase from 20 tcf/year to 80 tcf/year. But they need to be prepared to defend their guess by also offering the number of typical SG wells and DW GOM fields that will be needed to achieve it. And that my friend will be staggering IMHO. And if that increase isn't practical then we'll keep bouncing along the plateau. Of course before they toss out that number they'll also have to project when NG prices will recover to spur such activity significantly. NG will eventually rebound to some degree. My company's biz plan counts on it happening. And that price increase will get the SG players drilling more than today. But note: today NG prices are about half of what they were when the SG plays kicked into high gear. And if/when the economy declines again so will NG prices and SG development. Just as happened a couple of years ago. And this is exactly why I feel long term accurate NG production predictions (either up or down) will be inherently inaccurate. To do so one must be able to predict this country's economic conditions well into the future. Have at it...good luck. LOL.

Of course many won't accept my view. But that's OK...doesn't hurt my feelings. Just like it didn't when some folks said I was wrong about the peak oil plateau long ago. Just looking at a few years of curve doesn't show much. The 60 year curve in the link above does a much better job of characterizing the situation IMHO.

Rockman,

FWIW, I think it's worth it to give a slightly more complex explanation. That doesn't look like a bumpy plateau to me, it looks like 3 different "regimes": strong growth to the peak, fairly strong decline to the mid-80's, and very slow growth from the mid-80's to the present.

I think it would be worth someone's time to develop the historical explanations for these different regimes: geology, technology, regulation, pricing, etc.

Nick - I agree with you. And if I didn't have to get up at 0430 I would point out some the geological and economic factors that generated the different phases you so astutely picked up on. Those dips and minipeaks do have clear causes. It's not statistical variations. Every point on that production curve is due to specific factors. I lived thru and survived everyone of them for the last 36 years. LOL.

Dr. Hirsch, he of the DOE 2005 report, defines a plateau as a band of perhaps 4% in size.

http://transitionnow.wordpress.com/2011/02/16/%E2%80%98peak-oil%E2%80%99...

Certainly the near 25% drop in US production after the 1970's and extending into the 80's was a decline by that standard. If global oil production had dropped that much since peak oil happened in 2005, the screaming from the resource scarcity advocates would be deafening. So I might disagree that a 25% drop would constitute any part of a plateau, remove 25% from someones paycheck and ask them if they are able to maintain their standard of living, them being on a monetary plateau and all.

But you are more satisfied that long term production predictions of oil are inherently more accurate? Even when oil prices can also vary by large amounts? You seem to be making a case to toss out Hubbert curves because they have no ability to incorporate the price component into their construction?

Spock - You deserve a more complete reponse but I'm tired. As far as Dr. Hirsch goes he can define "plateau" as the profile of his butt for all I care. LOL. The NG curve may be just a line on a graph to him. But as I just alluded to Nick I understand the causes behind every little wobble.

"...long term production predictions of oil are inherently more accurate?" Hell no! LOL. And I don't have to toss out the forward projections of Dr. Hubbert's curve...he did it himself decades ago. If you go back to his original work you'll find that he specifically says the shape of the backside of the curve can't be predicted with any great accuracy. Too many unpredictable variables I think he actually said. Remember the goal of his research: it was the production curve changes as exploration went forward. He spent little time discussing the depletion side. Lots of folks have offered their version of the depletion side of his curve. I never have: not smart enough to do it and not dumb enough to think I can. LOL

The wider you define a band for a plateau, the less meaningful the term is. Define it as 50% of the 1970's peak and you can say that we've been on a plateau for half a century, with another half a century to go.

I did use the paycheck analogy for a reason. You can declare plateau as the profile of your butt (well, maybe you can, I haven't seen your butt and certainly am not about to ask for a picture), but when it is reduced to terms everyone understands, like a 25% reduction in pay, it suddenly becomes obvious how un-plateau like a 25% reduction is.

Your understanding of why there was a 25% reduction (or other rate gyrations) notwithstanding, it is still Monday morning quarterbacking. Which is why I made my original supposition, that if these types of questions had been asked of someone with your experience back when you were a greenhorn, I am betting your answer would have been different. Just as they would have been if we had asked those questions recently, like when this website was created.

Spoke - I doubt most would be running around yelling about huge changes in the paycheck with less than a 10% y-o-y variance. Long haul: today I make 6 times what I made when I started...so what?. That doesn't mean I have a big pay raise in my future. Again, look at the growth in NG production from the 40's to the 70's: are you projecting such a potential increase in our future? I don't think so but correct me if I'm wrong.

"Your understanding of why there was a 25% reduction (or other rate gyrations) notwithstanding, it is still Monday morning quarterbacking." Not at all. And that's the point I'm having difficulty communicating. There are very specific and well defined reasons for every variation in the NG production curve. It is anything but random. Projecting future growth of NG production rates must be framed within the context of those factors. To project a significant increase in NG production over time requires a strict appreciation and DELINEATION of those facors to be crdible IMHO.

BTW: Sorry...I've lost track:"...that if these types of questions had been asked..." What specific questions? Thanks in advance.

I do not. Not because there is a lack of resource, but because increased efficiency of use is always creeping into the system and messing up the need for much more.

Yes. And you know what they are now, because it is Monday morning quarterbacking, you are looking back on them. Certainly those mistaken calling for a gas cliff in the USA in 2005 have been left with a little more than just egg on their face. Not assigning their poor predictions to you, just pointing out that you are correct when you say people don't predict the future very well.

My original supposition is that choosing the pessimistic resource numbers to proclaim resource scarcity is typical of people doing these sorts of forward looking statements. And they are often wrong because they do NOT examine the past for the sorts of changes you are familiar with, and which are obvious to anyone picking up a history book. Those who cannot learn from history are doomed to repeat it.

Spock - "those mistaken calling for a gas cliff in the USA in 2005 have been left with a little more than just egg on their face". I agree. Then those are the Monday morning quarterbacks you're referring to. The reason I didn't project a cliff is that I lived (and almost died LOL) on a day to day basis with all those factors we're talking about. And I think the biggest factor many pessimists don't appreciate is the driving force behind most public companies to increase their reserve base regardless of limited profits. Some companies may end up being net losers. But the reserves they bring into play are just as valuable to society as any other source.

I have no doubt we would have only a small fraction of SG activity going on today if it weren't for the drive by public companies to replace produced reserves. As I mentioned my owner has no interest in the SG plays: he can make a better profit easier in the commodity markets (those profits fund my ops). We drill deep conventional NG because it's much more profitable than the SG plays. But the conventional (not counting DW GOM NG) players like us won't bring as much NG to the market as the SG players.

Enjoyed the chat. Being challenged is a lot more interesting then agreement.

I think they don't appreciate alot more than that. Have you ever seen a resource pessimist say that the speed of resource to reserve conversion would be so strong as to completely reverse a Hubbertian decline? I believe this is the core point which Abundance is dancing around with more than a little (deserved) irony.

I did as well. As far as challenging, I agree that more is better. Such behavior is generally discouraged on the blogs of course, group cohesiveness takes precedence.

Thanks for this very pertinant information on the ND oil production in Bakken.

My first comment is regarding Harold Hamm of Continental Resources statement that Bakken (ND, MT and Saskatchewan) would require at least 20,000 wells to reach 1 millin barrels per day production (in seven or so years). At a well cost of $6 million each, this would be $120 billion over seven year period. Not sure who has the capital like that to get production up to 1 mm b/day, especially when oil drops to $60 (ND local price) from $80 in a matter of a month.

Second comment is the transportation issue. Too bad such a huge amount of nat. gas is being flared, but at less than $4/mm BTU the infrustructure to capture and transport the gas is not justified by the price. You can't go back for it later.

The producers want the oil so 1/3 of the gas will be wasted.

As far as moving the oil to higher priced market: Shipping oil by truck, then train to get it to distant refineries is defying logic. Rail rates are bery high (but less than by truck) and I have heard of two oil terminal project that will get the oil near the Gulf Coast refineries entirely by rail. Still means lower price for Bakken oil. This oil should be shipped by rail only as far as Souix City, Iowa where it can be put on barges (transload terminal already exists) then floated down Missouri and Mississippi Rivers to LA coastal refineries.

I'm the new guy here, but I follow many of TOD's topics with interest. I own trucks in the Bakken so I can validate some of the claims of the driver shortage and pay rates. Every one of my guys will make $90,000 this year, the best ones will make even more than that. That's what you have to pay to get guys to come up there. For the guys that come, it's the best money they've ever made as a driver and I'm proud to be able to provide these guys with a great job.

With regards to the logistics of Bakken crude, the rail is a blessing and a curse. Those who are stuck selling into WTI markets do indeed sell at at steep basis differential, but even the longest truck hauls in the market (250 miles or so) are no more than $5 or $6/bbl and 90% of the hauls out there are much closer to $3.00/bbl. Then you have LACT unit throughput, or rail transloading fees on top of that.

Those with the right logistics plays can sell Bakken crude into the higher paying Brent crude markets for a much greater premium than the extra freight and transloading costs of rail shipping. As long as the Brent-WTI spread stays wide you will continue to see this available. May continue for some time until the Keystone XL or some other pipeline eases congestion at Cushing and allows free product flow into the Gulf refining complex.

Thank you; that is great stuff. I stand corrected on the 15 dollar transportation deducts. You deserve to be proud.

The WTI price is pretty much irrelevant to oil consumers. WTI is really only relevant to Mid-Continent producers, who are getting much less than the global oil price, and to Mid-Continent refiners, who are making a killing.

What do you estimate that the transportation cost would be for a 350 mile haul (700 mile roundtrip) from West Central Texas to Corpus Christi?

Here is a decent link to see what the actual price postings are for various crude grades around the country. Bakken crude does trade at a steep discount to other grades despite it's quality. However, most of that is taken up by other factors besides truck freight.

http://crudeoilpostings.semgroupcorp.com/

A truck haul for 700 mile round trip in Texas would cost approximately $8-9/bbl. A truck in TX can carry about 180 bbl/load and those trucks need to make $1000/day or better in revenue plus the fuel surcharge.

Thanks for the info. We have a new shallow discovery that will produce about 90 BOPD per well, at 1,800', but it's 22 gravity crude, and our current purchaser is not interested in taking it. I seems likely that we can sell a barrel of 22 gravity crude in Corpus for more money that we get for a barrel of light, sweet crude in West Texas.

Congratulations on the new, bouncing little boy. A lot of mine is 22 gravity and very sweet, I can sell it for a slight premium to other stuff in the area because it is often blended with 42 gravity EF oil that has much higher sulfur contents.

I've heard that heavier oil is actually in demand in South Texas, because of the fairly high gravity of the Eagle Ford oil.

Incidentally, if you don't mind telling me, who is buying your 22 gravity oil?

Roger - You cheapskate...I hear west Texas truckers are getting $115,000/yr. LOL. Keep up the good work and thanks especially for first hand info.